UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23328

FLAT ROCK OPPORTUNITY FUND

(Exact name of registrant as specified in charter)

Robert K. Grunewald

Chief Executive Officer

680 S Cache Street, Suite 100

P.O. Box 7403

Jackson, WY 83001

(Address of principal executive offices) (Zip code)

(307) 500-5200

(Registrant’s telephone number, including area code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Copy to:

Owen J. Pinkerton, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, NW, Suite 700

Washington, DC 20001

(202) 383-0262

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1. Reports to Stockholders.

(a)

Table of Contents

| Flat Rock Opportunity Fund | Shareholder Letter |

December 31, 2021 (Unaudited)

March 1, 2022

Fellow FROPX Shareholders:

The Flat Rock Opportunity Fund (“the Fund”) finished up 24.30% for the year, our best annual return since inception in 2018. Fund returns were driven by cash flows from our CLO equity positions and realized and unrealized appreciation on our investments. While returns since inception have trailed the S&P 500 Index (“S&P 500”), our Fund’s standard deviation is approximately 1/3 of the S&P 500’s. The Fund started 2022 up 4.11% through February 11, 2022.

Fund Performance (Net)

| | | | | | | | | Average Annual | | | Standard | |

| | | | | | | | | Return from | | | Deviation from | |

| | | 2021 | | | 2020 | | | Inception on | | | Inception on | |

| Fund Performance (Net) | | Full Year | | | Full Year | | | 7/2/2018 | | | 7/2/2018 | |

| Flat Rock Opportunity Fund | | | 24.30 | % | | | 14.50 | % | | | 14.73 | % | | | 7.41 | % |

| S&P 500 Index | | | 28.71 | % | | | 18.40 | % | | | 16.42 | % | | | 21.79 | % |

| Bloomberg US High Yield Bond Index | | | 5.28 | % | | | 7.11 | % | | | 6.32 | % | | | 6.03 | % |

| S&P / LSTA Leveraged Loan Index | | | 5.20 | % | | | 3.12 | % | | | 4.42 | % | | | 4.38 | % |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions.

In recent months, the markets have been choppy with talk of coming rate hikes dominating headlines. In our CLOs, the loans are floating rates based on The London Inter-Bank Offered Rate (LIBOR) or Secured Overnight Financing Rate SOFR and the rate resets every one to six months. While the potential for higher rates is negative for equities and fixed income securities, over time we expect that CLO equity should benefit.

We believe the current market conditions for CLO equity are favorable. The below quote from JP Morgan’s February 2022 Default Monitor publication summarizes our current view of the loan market:

“Given improving credit fundamentals, few distressed candidates, and wide-open access to capital markets, we are forecasting high yield bond and loan default rates of only 0.75% in 2022 and 1.25% in 2023, or comfortably below the long-term average of 3.5% and 3.0%, respectively.”

It should be noted that a low default rate environment has the potential to materially increase CLO equity returns from our base-case projections, which assume a normalized loan default rate environment.

| Annual Report | December 31, 2021 | 1 |

| Flat Rock Opportunity Fund | Shareholder Letter |

December 31, 2021 (Unaudited)

Middle market CLOs represented 41.7% of our portfolio at the end of 2021. We believe we are one of the largest diversified third-party investors in middle market CLO equity positions. We think our Advisor is uniquely positioned to analyze these investments as a result of our expertise underwriting middle market debt for the Flat Rock Core Income Fund. In our experience, middle market CLOs have had lower volatility than broadly syndicated CLOs as a result of the stronger convenants associated with middle markets loans and generally lower leverage levels within these CLO structures.

The Fund has grown to over $230M of assets at fair market value on December 31, 2021. We think Fund growth has primarily been driven by investors seeking exposure to first lien, secured loans via CLO technology. However, we believe our investors also see merit in the interval fund structure. Our Fund offers investors a published daily Net Asset Value; SEC regulation and reporting; minimum 5% quarterly liquidity; and the ability to invest directly into a diversified fund using our ticker, FROPX.

As always, if you have any questions, feel free to reach out.

Sincerely,

Robert Grunewald

Chief Executive Officer and Founder

Glossary: Standard Deviation is measure that provides the dispersion around a mean. The S&P 500 Index or the Standard & Poor’s 500 Index is a market-capitalization- weighted index of the 500 largest U.S. publicly traded companies. The S&P LSTA Leveraged Loan Index is a market value weighted index designed to capture the performance of the U.S. leveraged loan market. The Bloomberg US High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. The index excludes bonds from emerging markets.

Consider the investment risks, charges, and expenses of the Fund carefully before investing. Other information about the Fund may be obtained at https://flatrockglobal.com/flat-rock-opportunity-fund/. This material must be preceded or accompanied by the prospectus.

The Fund is suitable for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment. Our shares have no history of public trading, nor is it intended that our shares will be listed on a national securities exchange at this time, if ever. No secondary market is expected to develop for our shares; liquidity for our shares will be provided only through quarterly repurchase offers for no less than 5% of and no more than 25% of our shares at net asset value, and there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. Due to these limited restrictions, an investor should consider an investment in the Fund to be of limited liquidity. Investing in our shares may be speculative and involves a high degree of risk, including the risks associated with leverage. Investing in the Fund involves risks, including the risk that shareholders may lose part or all of their investment. We intend to invest primarily in the equity and, to a lesser extent, in the junior debt tranches of CLOs that own a pool of senior secured loans. Our investments in the equity and junior debt tranches of CLOs are exposed to leveraged credit risk. Investments in the lowest tranches bear the highest level of risk. We may pay distributions in significant part from sources that may not be available in the future and that are unrelated to our performance, such as a returns of capital or borrowing. The amount of distributions that we may pay, if any, is uncertain. Alps Distributors Inc. serves as our principal underwriter, within the meaning of the 1940 Act, and will act as the distributor of our shares on a best efforts’ basis, subject to various condition.

| Flat Rock Opportunity Fund | Portfolio Update |

December 31, 2021 (Unaudited)

INVESTMENT OBJECTIVE

Flat Rock Opportunity Fund’s (“the Fund”) investment objective is to generate current income and, as a secondary objective, long-term capital appreciation.

PERFORMANCE OVERVIEW

For the year ended December 31, 2021, the Fund returned 24.30%. During that same period, the S&P BDC Total Return Index returned 37.40% and the S&P 500 Index returned 28.71%.

PERFORMANCE as of December 31, 2021

| | | | | | | | | Since | |

| | | 6 Month | | | 1 Year | | | Inception(1) | |

| Flat Rock Opportunity Fund(2) | | | 7.90 | % | | | 24.30 | % | | | 14.14 | % |

| S&P BDC Total Return Index(3) | | | 7.22 | % | | | 37.40 | % | | | 11.18 | % |

| S&P 500 Index(4) | | | 11.67 | % | | | 28.71 | % | | | 19.42 | % |

| (1) | The Fund commenced operations on July 2, 2018. |

| (2) | Performance returns are net of management fees and other Fund expenses. |

| (3) | The S&P BDC Total Return Index is designed to track leading business development companies (“BDCs”) that trade on major U.S. exchanges. BDCs are publicly traded private equity firms that invest equity and debt capital in small and mid-sized businesses, and make managerial assistance available to portfolio companies. Constituent companies are BDCs that meet minimum market capitalization and liquidity requirements. The index uses a capped market capitalization weighting scheme. Modifications are made to market cap weights, if required, to reflect available float, while applying single stock capping to the index constituents. |

| (4) | The Standard & Poor’s 500 Stock Index (S&P 500) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 large-capitalization stocks primarily traded on the New York Stock Exchange. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, if repurchased, may be worth more or less than their original cost. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

Flat Rock Opportunity Fund is a continuously offered, non-diversified, closed-end management investment company that is operated as an interval fund. The Fund is suitable only for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment. The Fund’s shares have no history of public trading, nor is it intended that our shares will be listed on a national securities exchange at this time, if ever. Investing in the Fund’s shares may be speculative and involves a high degree of risk, including the risks associated with leverage. Investing in the Fund involves risk, including the risk that shareholders may receive little or no return on their investment or that shareholders may lose part or all of their investment. The Fund intends to invest primarily in the equity and, to a lesser extent, in the junior debt tranches of CLOs that own a pool of senior secured loans made to companies whose debt is rated below investment grade or, in limited circumstances, unrated. The Fund’s investments in the equity and junior debt tranches of CLOs are exposed to leveraged credit risk. Investments in the lowest tranches bear the highest level of risk. The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to our performance, such as a return of capital or borrowings. The amount of distributions that the Fund may pay, if any, is uncertain.

| Annual Report | December 31, 2021 | 3 |

| Flat Rock Opportunity Fund | Portfolio Update |

December 31, 2021 (Unaudited)

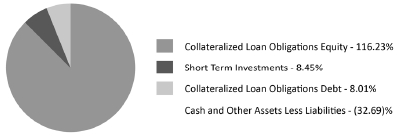

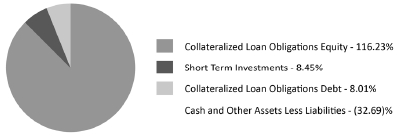

ASSET ALLOCATION as of December 31, 2021^

| ^ | Holdings are subject to change. |

Percentages are based on net assets of the Fund.

TOP TEN HOLDINGS* as of December 31, 2021

| | | % of Total Investments** | |

| Churchill Middle Market CLO III, Ltd. | | | 9.48 | % |

| Great Lakes CLO 2014-1, Ltd. | | | 8.83 | % |

| TCP Whitney CLO, Ltd. | | | 5.73 | % |

| New Mountain CLO 1, Ltd. | | | 4.61 | % |

| Dryden 92 CLO, Ltd. | | | 3.93 | % |

| Benefit Street Partners CLO XXV, Ltd. | | | 3.64 | % |

| Regatta XXII CLO Warehouse | | | 3.41 | % |

| Allegro CLO XIV, Ltd. | | | 3.32 | % |

| Oaktree CLO 2019-4, Ltd. | | | 3.26 | % |

| LCM 34, Ltd. | | | 3.21 | % |

| | | | 49.42 | % |

| * | Holdings are subject to change and exclude cash equivalents. |

| ** | Percentages are based on the fair value of total investments of the Fund. |

| Flat Rock Opportunity Fund | Portfolio Update |

December 31, 2021 (Unaudited)

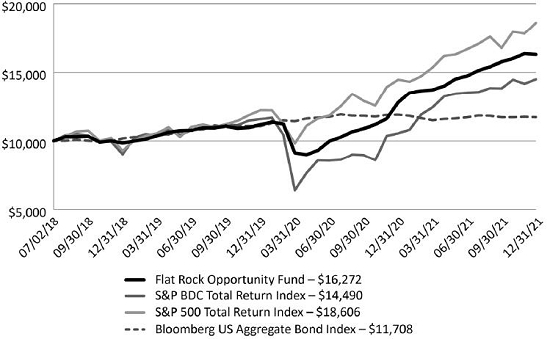

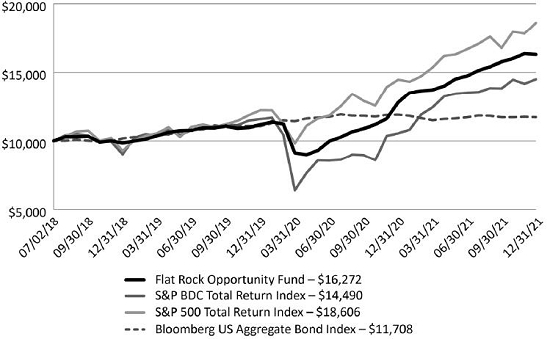

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares at the NAV of $20.00 on July 2, 2018 (commencement of operations) and tracking its progress through December 31, 2021.

| Annual Report | December 31, 2021 | 5 |

| Flat Rock Opportunity Fund | Schedule of Investments |

| | December 31, 2021 |

| | | | | | | | Principal | | | | |

| | | Rate | | | Maturity | | Amount | | | Value | |

| COLLATERALIZED LOAN OBLIGATIONS EQUITY(a)(b)(c)(d)(e)- 116.23% | | | | | | | | | | | | | | |

| Allegro CLO XIV, Ltd., Subordinated Notes | | | 18.29 | %(f) | | 10/15/2034 | | $ | 9,000,000 | | | $ | 7,290,000 | |

| ALM 2020, Ltd., Subordinated Notes | | | 15.04 | %(f) | | 10/15/2029 | | | 8,000,000 | | | | 6,429,509 | |

| Ares LIX CLO, Ltd., Subordinated Notes | | | 17.17 | %(f) | | 04/25/2034 | | | 8,000,000 | | | | 7,126,030 | |

| Bain Capital Credit CLO 2021-3, Ltd., Subordinated Notes | | | 14.57 | %(f) | | 07/24/2034 | | | 8,000,000 | | | | 6,558,085 | |

| Bain Capital Credit CLO 2021-3A, Ltd., Subordinated Notes Side Letter | | | 14.34 | %(f) | | 07/24/2034 | | | 300,000 | | | | 300,000 | |

| Barings Middle Market CLO Ltd 2021-I, Subordinated Notes | | | 16.52 | %(f) | | 07/20/2033 | | | 3,240,000 | | | | 3,223,801 | |

| Benefit Street Partners CLO XXV, Ltd., Subordinated Notes | | | 14.82 | %(f) | | 01/15/2035 | | | 9,246,257 | | | | 7,999,982 | |

| BlackRock Baker CLO 2021-1, Ltd., Class VDN | | | 23.01 | %(f) | | 01/15/2034 | | | 7,347,140 | | | | 2,204,074 | |

| BlackRock Elbert CLO V, Ltd., Subordinated Notes | | | 17.39 | %(f) | | 12/15/2031 | | | 6,500,000 | | | | 6,582,324 | |

| Churchill Middle Market CLO III, Ltd., Subordinated Notes | | | 17.30 | %(f) | | 10/24/2033 | | | 21,500,000 | | | | 20,855,000 | |

| Churchill Middle Market CLO IV, Ltd., Subordinated Notes | | | 13.93 | %(f) | | 01/23/2032 | | | 7,000,000 | | | | 5,194,987 | |

| CIFC Cobra Warehouse II, Ltd.(g) | | | 25.00 | %(f) | | 12/31/2049 | | | 625,000 | | | | 625,000 | |

| Dryden 33 Senior Loan Fund, Subordinated Notes | | | 31.29 | %(f) | | 04/15/2029 | | | 10,000,000 | | | | 5,078,506 | |

| Dryden 92 CLO, Ltd., Subordinated Notes | | | 15.38 | %(f) | | 11/20/2034 | | | 10,000,000 | | | | 8,639,828 | |

| Great Lakes CLO 2014-1, Ltd., Subordinated Notes | | | 16.17 | %(f) | | 10/15/2029 | | | 26,740,000 | | | | 19,423,498 | |

| KKR CLO 31, Ltd., Subordinated Notes | | | 18.22 | %(f) | | 04/20/2034 | | | 6,000,000 | | | | 5,088,024 | |

| LCM 32, Ltd., Subordinated Notes | | | 16.33 | %(f) | | 07/20/2034 | | | 6,000,000 | | | | 4,875,365 | |

| LCM 34, Ltd., Income Notes | | | 15.71 | %(f) | | 10/20/2034 | | | 8,696,000 | | | | 6,958,789 | |

| LCM 34, Ltd., Subordinated Notes, Class SUB2 | | | 15.79 | %(f) | | 10/20/2034 | | | 659,110 | | | | 94,054 | |

| Maranon Loan Funding 2021-3, Ltd., Subordinated Notes | | | 20.66 | %(f) | | 01/15/2034 | | | 10,000,000 | | | | 2,725,000 | |

| Marble Point CLO XVIII, Ltd., Income Notes | | | 14.39 | %(f) | | 10/15/2034 | | | 5,000,000 | | | | 4,091,476 | |

| Marble Point CLO XX, Ltd., Income Notes | | | 16.54 | %(f) | | 04/23/2034 | | | 6,000,000 | | | | 4,591,363 | |

| New Mountain CLO 1, Ltd., Subordinated Notes | | | 15.41 | %(f) | | 10/15/2034 | | | 10,520,364 | | | | 10,146,984 | |

| Oaktree CLO 2019-2, Ltd., Subordinated Notes | | | 24.16 | %(f) | | 04/15/2031 | | | 5,000,000 | | | | 3,016,927 | |

See Notes to Financial Statements.

| Flat Rock Opportunity Fund | Schedule of Investments |

| | December 31, 2021 |

| | | | | | | | Principal | | | | |

| | | Rate | | | Maturity | | Amount | | | Value | |

| Oaktree CLO 2019-4, Ltd., Subordinated Notes | | | 16.33 | %(f) | | 10/20/2032 | | $ | 9,000,000 | | | $ | 7,174,105 | |

| OCP CLO 2020-20, Ltd., Subordinated Notes | | | 16.74 | %(f) | | 10/09/2033 | | | 6,000,000 | | | | 5,224,698 | |

| Regatta XXII CLO, Ltd. CLO(g)(h) | | | 20.00 | %(f) | | 12/31/2049 | | | 7,500,000 | | | | 7,500,000 | |

| Symphony CLO XXX, Ltd. CLO(g)(h) | | | 20.00 | %(f) | | 12/31/2049 | | | 4,893,300 | | | | 4,893,300 | |

| TCP Whitney CLO, Ltd., Subordinated Notes | | | 23.62 | %(f) | | 08/20/2033 | | | 11,500,000 | | | | 9,412,900 | |

| TCP Whitney CLO, Ltd., Subordinated Notes, Class SUB2 | | | 17.41 | %(f) | | 08/20/2033 | | | 3,575,762 | | | | 3,195,049 | |

| Voya CLO 2021-1, Ltd., Income Notes | | | 15.13 | %(f) | | 07/15/2034 | | | 6,960,000 | | | | 6,090,000 | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS EQUITY

(Cost $187,782,890) | | | | | | | | | | | | $ | 192,608,658 | |

| | | | | | | | | | | | | | | |

| COLLATERALIZED LOAN OBLIGATIONS DEBT(b)(c)(d)(e)- 8.01% | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| BlackRock Baker CLO 2021-1, Ltd., Class E | | | 3M US L + 8.00 | % | | 01/15/2034 | | | 4,323,507 | | | | 4,323,507 | |

| Maranon Loan Funding 2021-3, Ltd., Class E | | | 3M US L + 8.00 | % | | 01/15/2034 | | | 6,100,000 | | | | 6,100,000 | |

| NewStar Fairfield Fund CLO, Ltd., Class DN | | | 3M US L + 7.38 | % | | 04/20/2030 | | | 3,000,000 | | | | 2,854,771 | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS DEBT

(Cost $13,193,948) | | | | | | | | | | | | $ | 13,278,278 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2021 | 7 |

| Flat Rock Opportunity Fund | | Schedule of Investments |

| | | December 31, 2021 |

| | | Rate | | Shares | | | Value | |

| SHORT TERM INVESTMENTS(b) - 8.45% | | | | | | | | |

| Money Market Fund - 8.45% | | | | | | | | |

| First American Government Obligations Fund | | (7 Day Yield 0.04%)

| | | 13,999,539 | | | $ | 13,999,539 | |

| | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | |

| (Cost $13,999,539) | | | | | | | | $ | 13,999,539 | |

| | | | | | | | | | | |

| TOTAL INVESTMENTS - 132.69% | | | | | | | | | | |

| (Cost $214,976,377) | | | | | | | | $ | 219,886,475 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (32.69)% | | | | | | | | | (54,172,424 | ) |

| NET ASSETS - 100.00% | | | | | | | | $ | 165,714,051 | |

| (a) | Collateralized Loan Obligations (“CLO”) equity positions are entitled to recurring distributions which are generally equal to the remaining cash flow of payments made by underlying securities less contractual payments to debt holders and fund expenses. The effective yield is estimated based upon the current projection of the amount and timing of these recurring distributions in addition to the estimated amount of terminal principal payment. Effective yields for the CLO equity positions are updated generally once a quarter or on a transaction such as an add-on purchase, refinancing or reset. The estimated yield and investment cost may ultimately not be realized. Total fair value of the securities is $192,608,658, which represents 115.83% of net assets as of December 31, 2021. |

| (b) | All or a portion of the security has been pledged as collateral in connection with the credit facility with certain funds and accounts managed by Eagle Point Credit Management, LLC (the “Credit Facility”). At December 31, 2021, the value of securities pledged amounted to $219,886,475, which represents approximately 132.23% of net assets. |

| (c) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at December 31, 2021. For securities based on a published reference rate and spread, the reference rate and spread are presented as the rate above. |

| (d) | The level 3 assets were a result of unavailable quoted prices from an active market or the unavailability of other significant observable inputs. |

| (e) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities are not restricted and may normally be sold to qualified institutional buyers in transactions exempt from registration. Total fair value of Rule 144A securities amounts to $166,299,919, which represents 100.01% of net assets as of December 31, 2021. |

| (g) | Positions represent investments in a warehouse facility, which is a financing structure intended to aggregate loans that may be used to form the basis of a CLO position. |

| (h) | As of December 31, 2021, the Fund has unfunded commitments related to its investment in this CLO (see Note 11). |

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

Reference Rates:

3M US L - 3 Month LIBOR as of December 31, 2021 was 0.21%

| See Notes to Financial Statements. |

| 8 | www.flatrockglobal.com |

| Flat Rock Opportunity Fund | Statement of Assets and Liabilities |

| | | December 31, 2021 |

| ASSETS: | | | |

| Investments, at fair value (Cost: $214,976,377) | | $ | 219,886,475 | |

| Interest receivable | | | 7,325,342 | |

| Receivable for fund shares sold | | | 2,543,743 | |

| Prepaid loan commitment fees | | | 603,847 | |

| Fee rebate | | | 109,604 | |

| Prepaid expenses and other assets | | | 40,252 | |

| Total Assets | | | 230,509,263 | |

| LIABILITIES: | | | | |

| Credit Facility, net (see Note 9) | | | 37,000,000 | |

| Accrued interest expense | | | 986,833 | |

| Incentive fee payable | | | 830,793 | |

| Payable for excise tax | | | 622,142 | |

| Payable to counter parties | | | 280,586 | |

| Management fee payable | | | 251,842 | |

| Distributions payable on redeemable preferred stock | | | 62,500 | |

| Payable for audit and tax service fees | | | 58,500 | |

| Accrued commitment fees on credit facility | | | 43,467 | |

| Payable for fund accounting and administration fees | | | 15,608 | |

| Payable to transfer agent | | | 9,718 | |

| Payable for custodian fees | | | 1,475 | |

| Payable to trustees and officers | | | 25 | |

| Other accrued expenses | | | 4,641 | |

| Mandatorily redeemable preferred stock (net of deferred financing costs of $372,918)(a) | | | 24,627,082 | |

| Total Liabilities | | | 64,795,212 | |

| Net Assets | | $ | 165,714,051 | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 151,153,387 | |

| Total distributable earnings | | | 14,560,664 | |

| Net Assets | | $ | 165,714,051 | |

| PRICING OF SHARES: | | | | |

| Net Assets | | $ | 165,714,051 | |

| Shares of beneficial interest outstanding | | | | |

| (Unlimited number of shares, at $0.001 par value per share) | | | 7,460,279 | |

| Net Asset Value Per Share and Offering Price Per Share | | $ | 22.21 | |

| (a) | $10,000 liquidation value per share. 1,000 shares authorized, issued and outstanding. |

See Notes to Financial Statements.

| Annual Report | December 31, 2021 | 9 |

| Flat Rock Opportunity Fund | Statement of Operations |

| | For the Year Ended December 31, 2021 |

| INVESTMENT INCOME: | | | |

| Interest income | | $ | 25,037,918 | |

| Total Investment Income | | | 25,037,918 | |

| | | | | |

| EXPENSES: | | | | |

| Management fees | | | 2,131,037 | |

| Incentive fees | | | 2,855,243 | |

| Interest on credit facility | | | 2,089,246 | |

| Excise tax expenses | | | 622,142 | |

| Accounting and administration fees | | | 282,492 | |

| Distributions on redeemable preferred stock | | | 232,500 | |

| Transfer agent fees and expenses | | | 205,566 | |

| Loan issuance costs | | | 199,471 | |

| Audit and tax service fees | | | 79,215 | |

| Legal fees | | | 65,916 | |

| Printing expenses | | | 32,591 | |

| Registration expenses | | | 23,807 | |

| Custodian expenses | | | 13,781 | |

| Insurance expenses | | | 9,750 | |

| Amortization of deferred financing costs | | | 7,213 | |

| Trustee expenses | | | 7 | |

| Miscellaneous expenses | | | 7,372 | |

| Total Expenses | | | 8,857,349 | |

| Net Investment Income | | | 16,180,569 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/LOSS: | | | | |

| Net realized gain on: | | | | |

| Investments | | | 4,330,817 | |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | 1,745,564 | |

| Net Realized and Unrealized Gain on Investments | | | 6,076,381 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 22,256,950 | |

See Notes to Financial Statements.

| Flat Rock Opportunity Fund | Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31,

2021 | | | December 31,

2020 | |

| NET INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | |

| Net investment income | | $ | 16,180,569 | | | $ | 6,746,041 | |

| Net realized gain | | | 4,330,817 | | | | 251,154 | |

| Net change in unrealized appreciation | | | 1,745,564 | | | | 4,272,637 | |

| Net increase in net assets resulting from operations | | | 22,256,950 | | | | 11,269,832 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions paid | | | (11,698,681 | ) | | | (6,922,351 | ) |

| Decrease in net assets from distributions to shareholders | | | (11,698,681 | ) | | | (6,922,351 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 86,693,915 | | | | 34,825,541 | |

| Reinvestment of distributions | | | 3,491,481 | | | | 1,961,018 | |

| Cost of shares repurchased | | | (14,204,916 | ) | | | (6,965,811 | ) |

| Net increase in net assets from capital share transactions | | | 75,980,480 | | | | 29,820,748 | |

| | | | | | | | | |

| Net Increase in Net Assets | | | 86,538,749 | | | | 34,168,229 | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 79,175,302 | | | | 45,007,073 | |

| End of period | | $ | 165,714,051 | | | $ | 79,175,302 | |

| | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Shares sold | | | 3,930,278 | | | | 1,993,116 | |

| Shares issued in reinvestment of distributions | | | 158,927 | | | | 111,448 | |

| Shares repurchased | | | (648,727 | ) | | | (394,878 | ) |

| Net increase in shares outstanding | | | 3,440,478 | | | | 1,709,686 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2021 | 11 |

| Flat Rock Opportunity Fund | Statement of Cash Flows |

| | For the Year Ended December 31, 2021 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase in net assets from operations | | $ | 22,256,950 | |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

| Purchase of investment securities | | | (251,418,597 | ) |

| Proceeds from sale of investment securities | | | 143,553,577 | |

| Net purchase of short-term investment securities | | | (9,986,647 | ) |

| Amortization of premium and accretion of discount on investments, net | | | 4,509,929 | |

| Net realized (gain) on: | | | | |

| Investments | | | (4,330,817 | ) |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | (1,745,564 | ) |

| (Increase)/Decrease in assets: | | | | |

| Interest receivable | | | (5,500,882 | ) |

| Prepaid loan commitment fees | | | (603,847 | ) |

| Prepaid expenses and other assets | | | (32,578 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Unfunded loan commitments | | | 43,467 | |

| Accrued interest expense | | | 760,531 | |

| Incentive fee payable | | | 405,449 | |

| Payable to counter parties | | | 280,586 | |

| Management fee payable | | | 132,985 | |

| Payable for fund accounting and administration fees | | | (9,054 | ) |

| Payable for custodian fees | | | (1,531 | ) |

| Payable for audit and tax service fees | | | 18,500 | |

| Payable to transfer agent | | | (6,967 | ) |

| Distributions payable on mandatorily redeemable preferred stock | | | 62,500 | |

| Payable to trustees and officers | | | 7 | |

| Payable for excise tax | | | 619,644 | |

| Other accrued expenses | | | (24,586 | ) |

| Net cash used in operating activities | | | (101,016,945 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from shares sold | | | 84,389,327 | |

| Proceeds from issuance of mandatorily redeemable preferred stock (net of deferred financing costs of $372,918) | | | 24,627,082 | |

| Cost of shares repurchased | | | (14,204,916 | ) |

| Borrowings on credit facility | | | 39,700,000 | |

| Payments on credit facility | | | (25,200,000 | ) |

| Payments of debt issuance costs | | | 610,273 | |

| Cash distributions paid | | | (8,904,821 | ) |

| Net cash provided by financing activities | | | 101,016,945 | |

See Notes to Financial Statements.

| Flat Rock Opportunity Fund | Statement of Cash Flows |

| | For the Year Ended December 31, 2021 |

| Net increase in cash | | $ | – | |

| Cash, beginning of period | | $ | – | |

| Cash, end of period | | $ | – | |

| Non-cash financing activities not included herein consist of: | | | | |

| Reinvestment of dividends and distributions: | | $ | 3,491,481 | |

| Cash paid for interest on credit facility during the period: | | $ | 1,328,715 | |

| Cash paid for distributions to mandatorily redeemable preferred stock: | | $ | 170,000 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2021 | 13 |

| Flat Rock Opportunity Fund | Financial Highlights |

| For a share outstanding throughout the periods presented |

| | | | | | | | | | | | For the Period | |

| | | | | | | | | | | | July 2, 2018 | |

| | | For the | | | For the | | | For the | | | (Commencement | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | of Operations) to | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Net asset value - beginning of period | | $ | 19.70 | | | $ | 19.48 | | | $ | 19.06 | | | $ | 20.00 | |

| Income/(loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 3.03 | | | | 2.16 | | | | 2.16 | | | | 0.99 | |

| Net realized and unrealized gain/(loss) on investments | | | 1.61 | | | | 0.24 | | | | 0.26 | | | | (1.26 | ) |

| | | | | | | | | | | | | | | | | |

| Total income/(loss) from investment operations | | | 4.64 | | | | 2.40 | | | | 2.42 | | | | (0.27 | ) |

| Less distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | (2.12 | ) | | | (2.18 | ) | | | (2.00 | ) | | | (0.67 | ) |

| From net realized gain on investments | | | (0.01 | ) | | | – | | | | – | | | | – | |

| Total distributions | | | (2.13 | ) | | | (2.18 | ) | | | (2.00 | ) | | | (0.67 | ) |

| Net increase/(decrease) in net asset value | | | 2.51 | | | | 0.22 | | | | 0.42 | | | | (0.94 | ) |

| Net asset value - end of period | | $ | 22.21 | | | $ | 19.70 | | | $ | 19.48 | | | $ | 19.06 | |

| Total Return(b) | | | 24.30 | % | | | 14.50 | % | | | 13.24 | % | | | (1.44 | )%(c) |

| | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 165,714 | | | $ | 79,175 | | | $ | 45,007 | | | $ | 16,262 | |

| Ratios to Average Net Assets (including interest on credit facility and distributions on mandatorily redeemable preferred stock)(d) | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

| Flat Rock Opportunity Fund | Financial Highlights |

| For a share outstanding throughout the periods presented |

| | | | | | | | | | | | For the Period | |

| | | | | | | | | | | | July 2, 2018 | |

| | | For the | | | For the | | | For the | | | (Commencement | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | of Operations) to | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | | 7.62 | % | | | 5.23 | % | | | 3.67 | % | | | 0.89 | %(e) |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 7.62 | % | | | 5.37 | % | | | 4.93 | % | | | 7.51 | %(e) |

| Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 13.92 | % | | | 12.37 | % | | | 11.02 | % | | | 9.99 | %(e) |

| Ratio of net investment income to average net assets excluding fee waivers and reimbursements | | | 13.92 | % | | | 12.23 | % | | | 9.76 | % | | | 3.36 | %(e) |

| Ratios to Average Net Assets (excluding interest on credit facility and distributions on mandatorily redeemable preferred stock)(d) | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | | 5.61 | % | | | 4.53 | % | | | N/A | | | | N/A | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 5.61 | % | | | 4.67 | % | | | N/A | | | | N/A | |

See Notes to Financial Statements.

| Annual Report | December 31, 2021 | 15 |

| Flat Rock Opportunity Fund | Financial Highlights |

| For a share outstanding throughout the periods presented |

| | | For the

Year Ended

December 31,

2021 | | | For the

Year Ended

December 31,

2020 | | | For the

Year Ended

December 31,

2019 | | | For the Period

July 2, 2018

(Commencement

of Operations) to

December 31,

2018 | |

| Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 15.92 | % | | | 13.07 | % | | | N/A | | | | N/A | |

| Ratio of net investment income to average net excluding fee waivers and reimbursements | | | 15.92 | % | | | 12.93 | % | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 99 | % | | | 43 | % | | | 52 | % | | | 131 | %(c) |

| | | | | | | | | | | | | | | | | |

| Credit Facility: | | | | | | | | | | | | | | | | |

| Aggregate principal amount, end of period (000s): | | | 37,000 | | | | 21,890 | | | | – | | | | – | |

| Asset coverage, end of period per $1,000:(f) | | | 5,505 | | | | 4,627 | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | |

| Redeemable Preferred Stock: | | | | | | | | | | | | | | | | |

| Liquidation value, end of period (000s): | | | 25,000 | | | | – | | | | – | | | | – | |

| Asset coverage, end of period per $1,000:(g) | | | 3,690 | | | | – | | | | – | | | | – | |

| (a) | | Based on average shares outstanding during the period. |

| (b) | | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (c) | | Not annualized. |

| (d) | | Interest expense relates to the Fund’s Credit Facility (see Note 9) and includes amortization of debt issuance costs. |

| (e) | | Annualized. |

| (f) | | Calculated by subtracting the Fund’s total liabilities (excluding the Credit Facility and accumulated unpaid interest on Credit Facility) from the Fund’s total assets and dividing by the outstanding Credit Facility balance. |

| (g) | | Calculated by subtracting the Fund’s total liabilities (excluding the liquidation value of the Mandatorily Redeemable Preferred Stock including distributions payable on Mandatorily Redeemable Preferred Stock and the Credit Facility and accumulated unpaid interest on Credit Facility) from the Fund’s total assets and dividing by the liquidation value of the Mandatorily Redeemable Preferred Stock and the outstanding Credit Facility balance. |

See Notes to Financial Statements.

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

1. ORGANIZATION

Flat Rock Opportunity Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”) as a non-diversified, closed-end management investment company. The shares of beneficial interest of the Fund (the “Shares”) are continuously offered under Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”). The Fund operates as an interval fund pursuant to Rule 23c-3 under the 1940 Act, and has adopted a fundamental policy to conduct quarterly repurchase offers at net asset value (“NAV”).

The Fund’s investment objective is to generate current income and, as a secondary objective, long-term capital appreciation.

The Fund was formed as a Delaware statutory trust on February 12, 2018 and operates pursuant to an Amended and Restated Agreement and Declaration of Trust governed by and interpreted in accordance with the laws of the State of Delaware. The Fund had no operations from that date to July 2, 2018, other than those related to organizational matters and the registration of its shares under applicable securities laws.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund is an investment company under U.S. GAAP and follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946.

Use of Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of increases and decreases in net assets from operations during the period. Actual results could differ from these estimates.

Preferred Shares: In accordance with ASC 480-10-25, the Fund’s mandatorily redeemable preferred stock have been classified as debt on the Statement of Assets and Liabilities. Refer to “Note 10. Redeemable Preferred Stock” for further details.

Security Valuation: The Fund records its investments at fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used to determine fair value are further discussed below. The Fund determines the NAV of its shares daily as of the close of regular trading (normally, 4:00 p.m., Eastern time) on each day that the New York Stock Exchange (“NYSE”) is open for business.

Equity securities for which market quotations are available are generally valued at the last sale price or official closing price on the primary market or exchange on which they trade.

| Annual Report | December 31, 2021 | 17 |

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

Short-term debt securities having a remaining maturity of 60 days or less when purchased are valued at cost adjusted for amortization of premiums and accretion of discounts, which approximates fair value.

The Fund primarily invests in junior debt or equity tranches of CLOs. In valuing such investments, the Adviser considers the indicative prices provided by a recognized industry pricing service as a primary source for its CLO debt and equity positions, and the implied yield of such prices, supplemented by actual trades executed in the market at or around period-end, as well as the indicative prices provided by the broker who arranges transactions in such investment vehicles.

Additional factors include any available information on other relevant transactions, including firm bids and offers in the market and information resulting from bids-wanted-in-competition. In addition, the Adviser considers the operating metrics of the specific investment vehicle, including compliance with collateralization tests, defaulted and restructured securities, payment defaults, if any, and covenant cushions. In periods of illiquidity and volatility, the Adviser may rely more heavily on other qualities and metrics, including, but not limited to, the collateral manager, time left in the reinvestment period, and expected cash flows and overcollateralization ratios.

The Fund may invest directly in Senior Loans (either in the primary or secondary markets). For each Senior Loan, the Fund will obtain a valuation from a third-party valuation firm each quarter when it receives financial updates from portfolio companies. Valuations will be updated whenever material information is received from portfolio companies. As a proxy for discount rates and market comparables, the Adviser will look to the S&P/LSTA U.S. Leveraged Loan Index (the “LSTA Index”) for significant price movements. The LSTA Index is a market value-weighted index designed to track the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. The LSTA Index is comprised of senior secured loans denominated in U.S. dollars that meet certain selection criteria. If the LSTA index cumulative change is greater than 1% or less than -1% from the completion date of the most recent valuation, then the Adviser will adjust the value of the Senior Loan by 20% of the LSTA Index change. For example, if the LSTA Index trades down or up by 5%, then the Adviser will adjust the value of the Senior Loans by 1% to mirror the LSTA Index. Furthermore, if the LSTA Index moves another 1% (over 2% cumulative change) in either direction, then the Adviser will further adjust the value based on the aforementioned methodology.

In addition, the values of the Fund’s Senior Loans are adjusted daily based on the estimated total return that the asset will generate during the current quarter. The Adviser will monitor these estimates daily and update them as necessary if macro or individual changes warrant any adjustments. To the extent adjustments are necessary, the Senior Loans may be valued based on prices supplied by a pricing agent(s), based on broker or dealer supplied valuations, based on model pricing, or based on matrix pricing, which is a method of valuing securities or other assets by reference to the value of other securities or other assets with similar characteristics, such as rating, interest rate and maturity. At the end of the quarter, each Senior Loan’s value is adjusted based on the actual income and appreciation or depreciation realized by such loan when its quarterly valuations and income are reported. The Fund’s Senior Loans are valued without accrued interest, and accrued interest is reported as income in the Fund’s statement of operations.

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

All available information, including non-binding indicative bids which may not be considered reliable, typically will be considered by the Adviser in making its fair value determinations. In some instances, there may be limited trading activity in a security even though the market for the security is considered not active. In such cases the Adviser will consider the number of trades, the size and timing of each trade, and other circumstances around such trades, to the extent such information is available. The Fund will engage third-party valuation firms to provide assistance to the Board in valuing a substantial portion of the Fund’s investments. The Adviser expects to evaluate the impact of such additional information and factor it into its consideration of fair value.

The Fund’s Board of Trustees (the “Board”) is responsible for the valuation of the Fund’s portfolio investments for which market quotations are not readily available, as determined in good faith pursuant to the Fund’s valuation policy and consistently applied valuation process. The Board has delegated day-to-day responsibility for implementing the portfolio valuation process set forth in the valuation policy to Flat Rock Global, LLC (the “Adviser”), as its valuation designee.

The fair value of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level and supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; and (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the U.S. Treasury yield curve and credit quality.

The valuation designee has also engaged a third-party valuation firm to provide assistance in valuing certain of the Fund’s investments. All third-party pricing and valuation services are approved, monitored and evaluated by the Board and its valuation designee. The Board, in conjunction with its active oversight of the valuation designee, may evaluate the impact of such additional information, and factor it into its consideration of fair value.

Rule 2a-5 under the 1940 Act was recently adopted by the SEC and establishes requirements for determining fair value in good faith for purposes of the 1940 Act. The Fund is evaluating the impact of adopting Rule 2a-5 on the financial statements and intends to comply with the new rule’s requirements on or before the compliance date in September 2022.

Federal Income Taxes: The Fund has elected to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended. Accordingly, the Fund will generally not pay corporate-level U.S. federal income taxes on any net ordinary income or capital gains that are timely distributed to shareholders. To qualify as a RIC, the Fund must, among other things, meet certain source-of-income and asset diversification requirements and timely distribute at least 90% of its investment company taxable income each year to its shareholders.

As of and during the year ended December 31, 2021, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns.

| Annual Report | December 31, 2021 | 19 |

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expenses on the Statement of Operations. During the year ended December 31, 2021, the Fund did not incur any interest or penalties.

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex-dividend date. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the identified cost basis method for financial reporting purposes. Interest income from investments in the “equity” class of CLO funds is recorded based upon an estimate of an effective yield to expected maturity utilizing assumed cash flows.

Distributions to Shareholders: The Fund normally pays dividends, if any, monthly, and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and interest income the Fund receives from its investments, including short term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than one year.

3. FAIR VALUE MEASUREMENTS

The Fund utilizes various inputs to measure the fair value of its investments. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 - | Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access at the measurement date. |

| Level 2 - | Significant observable inputs (including quoted prices for the identical instrument on an inactive market, quoted prices for similar instruments, interest rates, prepayment spreads, credit risk, yield curves, default rates and similar data). |

| Level 3 - | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of the investments) to the extent relevant observable inputs are not available, for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used to value the Fund’s investments under the fair value hierarchy levels as of December 31, 2021:

| | | Valuation Inputs | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Collateralized Loan Obligations | | | | | | | | | | | | |

| Equity | | $ | – | | | $ | – | | | $ | 192,608,658 | | | $ | 192,608,658 | |

| Collateralized Loan Obligations | | | | | | | | | | | | | | | | |

| Debt | | | – | | | | – | | | | 13,278,278 | | | | 13,278,278 | |

| Short Term Investments | | | 13,999,539 | | | | – | | | | – | | | | 13,999,539 | |

| Total | | $ | 13,999,539 | | | $ | – | | | $ | 205,886,936 | | | $ | 219,886,475 | |

The following is a reconciliation of the fair value of investments for which the Fund has used Level 3 unobservable inputs in determining fair value as of December 31, 2021:

| | | Collateralized Loan | | | Collateralized Loan | | | | |

| | | Obligations Equity | | | Obligations Debt | | | Total | |

| Balance as of December 31, 2020 | | $ | 51,015,016 | | | $ | 44,909,660 | | | $ | 95,924,676 | |

| Accrued Discount/Premium | | | (7,042,221 | ) | | | 2,532,292 | | | | (4,509,929 | ) |

| Realized Gain/(Loss) | | | (361,763 | ) | | | 4,909,669 | | | | 4,547,906 | |

| Change in Unrealized Appreciation/(Depreciation) | | | 6,530,097 | | | | (4,784,533 | ) | | | 1,745,564 | |

| Purchases | | | 235,922,739 | | | | 15,495,858 | | | | 251,418,597 | |

| Sales Proceeds | | | (93,455,210 | ) | | | (49,784,668 | ) | | | (143,239,878 | ) |

| Transfer into Level 3 | | | – | | | | – | | | | – | |

| Transfer out of Level 3 | | | – | | | | – | | | | – | |

| Balance as of December 31, 2021 | | $ | 192,608,658 | | | $ | 13,278,278 | | | $ | 205,886,936 | |

| Net change in unrealized appreciation/(depreciation) attributable to Level 3 investments held at December 31, 2021 | | $ | 5,584,155 | | | $ | 300,935 | | | $ | 5,885,090 | |

| Annual Report | December 31, 2021 | 21 |

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

The following table summarizes the valuation techniques and significant unobservable inputs used for the Fund’s investments that are categorized in Level 3 of the fair value hierarchy as of December 31, 2021:

| Asset Class | | Fair Value | | | Valuation Technique(s) | | Unobservable

Input(s) | | Input

Value(s) |

| Collateralized Loan Obligations Equity | | $ | 110,321,635 | | | Third-party vendor pricing service | | Broker Quotes | | N/A |

| | | $ | 82,287,023 | | | Recent transaction | | Acquisition Cost | | N/A |

| Collateralized Loan Obligations Debt | | $ | 8,954,771 | | | Third-party vendor pricing service | | Broker Quotes | | N/A |

| | | $ | 4,323,507 | | | Recent transaction | | Acquisition Cost | | N/A |

4. INVESTMENT ADVISORY SERVICES AND OTHER AGREEMENTS

Flat Rock Global, LLC (the “Adviser”) serves as the investment adviser to the Fund pursuant to the terms of an investment advisory agreement (the “Advisory Agreement”). Under the terms of the Advisory Agreement, the Adviser provides the Fund such investment advice as it deems advisable and furnishes a continuous investment program for the Fund consistent with the Fund’s investment objective and strategies. As compensation for its management services, the Fund pays the Adviser a management fee of 1.375% (as a percentage of the average daily value of total assets), paid monthly in arrears, calculated based on the average daily value of total assets at the end of the two most recently completed quarters.

In addition to the management fee, the Adviser in entitled to an incentive fee. The incentive fee is calculated and payable quarterly in arrears in an amount equal to 15.0% of the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s “adjusted capital,” equal to 2.00% per quarter (or an annualized hurdle rate of 8.00%), subject to a “catch-up” feature, which allows the Adviser to recover foregone incentive fees that were previously limited by the hurdle rate. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser for any administrative services provided by the Adviser and any interest expense and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). “Adjusted capital” means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund’s distribution reinvestment plan), reduced by amounts paid in connection with purchases of the Fund’s shares pursuant to the Fund’s Repurchase Program.

The calculation of the incentive fee on pre-incentive fee net investment income for each quarter is as follows:

| ● | No incentive fee is payable in any calendar quarter in which the Fund’s pre-incentive fee net investment income does not exceed the hurdle rate of 2.00% per quarter (or an annualized rate of 8.00%); |

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

| ● | 100% of the Fund’s pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than or equal to 2.352%. This portion of the Fund’s pre-incentive fee net investment income (which exceeds the hurdle rate but is less than or equal to 2.352%) is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 15.0% on all of the Fund’s pre-incentive fee net investment income when its pre-incentive fee net investment income reaches 2.352% in any calendar quarter; and |

| ● | 15.0% of the amount of the Fund’s pre-incentive fee net investment income, if any, that exceeds 2.352% in any calendar quarter is payable to the Adviser once the hurdle rate is reached and the catch-up is achieved (15.0% of all pre-incentive fee net investment income thereafter will be allocated to the Adviser). |

ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s Administrator and Accounting Agent and receives customary fees from the Fund for such services.

DST Systems Inc., an affiliate of ALPS, serves as transfer, dividend paying and shareholder servicing agent for the Fund.

U.S. Bank N.A. serves as the Fund’s custodian.

The Fund has entered into a Distribution Agreement with ALPS Distributors, Inc. (the “Distributor”), an affiliate of ALPS, to provide distribution services to the Fund. The Distributor serves as principal underwriter/distributor of shares of the Fund.

ALPS, DST Systems Inc., U.S. Bank N.A., and the Distributor are not considered affiliates, as defined under the 1940 Act, of the Fund.

5. REPURCHASE OFFERS

The Fund conducts quarterly repurchase offers of 5% of the Fund’s outstanding shares. Repurchase offers in excess of 5% are made solely at the discretion of the Board and investors should not rely on any expectation of repurchase offers in excess of 5%. In the event that a repurchase offer is oversubscribed, shareholders may only be able to have a portion of their shares repurchased.

Quarterly repurchases occur in the months of March, June, September and December. A Repurchase Offer Notice will be sent to shareholders at least 21 calendar days before the Repurchase Request Deadline, which is ordinarily on the third Friday of the month in which the repurchase occurs. The repurchase price will be the Fund’s NAV determined on the repurchase pricing date, which is ordinarily expected to be the Repurchase Request Deadline. Payment for all shares repurchased pursuant to these offers will be made not later than seven calendar days after the repurchase pricing date.

| Annual Report | December 31, 2021 | 23 |

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

During the year ended December 31, 2021, the Fund completed four quarterly repurchase offers. In these offers, the Fund offered to repurchase 5% of the number of its outstanding shares as of the Repurchase Pricing Dates. The result of the repurchase offers were as follows:

| | | Repurchase | | | Repurchase | | | Repurchase | | | Repurchase | |

| | | Offer #1 | | | Offer #2 | | | Offer #3 | | | Offer #4 | |

| Commencement Date | | | February 11, 2021 | | | | May 20, 2021 | | | | August 26, 2021 | | | | November 11, 2021 | |

| Repurchase Request Deadline | | | March 19, 2021 | | | | June 23, 2021 | | | | September 27, 2021 | | | | December 17, 2021 | |

| Repurchase Pricing Date | | | March 19, 2021 | | | | June 23, 2021 | | | | September 27, 2021 | | | | December 17, 2021 | |

| Amount Repurchased | | $ | 4,543,616 | | | $ | 1,473,718 | | | $ | 5,157,416 | | | $ | 3,030,166 | |

| Shares Repurchased | | | 219,286 | | | | 67,664 | | | | 228,407 | | | | 133,370 | |

6. PORTFOLIO INFORMATION

Purchases and sales of securities for the year ended December 31, 2021, excluding short-term securities, were as follows:

| Purchases of Securities | | | Proceeds from Sales of Securities | |

| $251,418,597 | | | | $143,239,879 | |

7. TAXES

Classification of Distributions

Distributions are determined in accordance with U.S. federal income tax regulations, which differ from U.S. GAAP, and therefore, may differ significantly in amount or character from net investment income and realized gains for financial statement purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The tax character of distributions paid by the Fund during the fiscal year ended December 31, 2021, was as follows:

| | | | | | | Distributions | | | | | | | |

| | | | | | | paid from | | | | | | | |

| Ordinary | | | Tax-Exempt | | | Long-Term | | | Return of | | | | |

| Income | | | Income | | | Capital Gain | | | Capital | | | Total | |

| $ | 11,698,681 | | | $ | – | | | $ | – | | | $ | – | | | $ | 11,698,681 | |

| Flat Rock Opportunity Fund | Notes to Financial Statements |

| December 31, 2021 |

The tax character of distributions paid by the Fund during the fiscal year ended December 31, 2020, was as follows:

| | | | | | | Distributions | | | | | | | |

| | | | | | | paid from | | | | | | | |

| Ordinary | | | Tax-Exempt | | | Long-Term | | | Return of | | | | |

| Income | | | Income | | | Capital Gain | | | Capital | | | Total | |

| $ | 6,922,351 | | | $ | – | | | $ | – | | | $ | – | | | $ | 6,922,351 | |

Components of Distributable Earnings on a Tax Basis

The tax components of distributable earnings are determined in accordance with income tax regulations which may differ from the composition of net assets reported under U.S. GAAP. The amount reclassified did not affect net assets. The reclassification related to non-deductible excise taxes paid was as follows:

| Paid-in Capital | | | Total Distributable Earnings | |

| $(622,142) | | | | $622,142 | |

At December 31, 2021, the components of distributable earnings on a tax basis for the Fund were as follows:

| | | | | | | Net Unrealized | | | Other Cumulative | | | | |

| Undistributed | | | Accumulated Capital | | | Appreciation/ | | | Effect of Timing | | | | |

| Ordinary Income | | | Gains/(Losses) | | | (Depreciation) | | | Differences | | | Total | |

| $ | 14,783,392 | | | $ | – | | | $ | (222,728 | ) | | $ | – | | | $ | 14,560,664 | |

Tax Basis of Investments

Net unrealized appreciation/(depreciation) of investments based on federal tax cost as of December 31, 2021, with differences related to passive foreign investment companies, controlled foreign corporations and partnership interests, was as follows:

| Gross Appreciation | | | Gross Depreciation | | | Net Unrealized | | | Cost of Investments

for Income Tax | |

| (excess of value over tax) | | | (excess of tax cost over value) | | | Appreciation/ (Depreciation) | | | Purposes | |

| $ | 3,644,409 | | | $ | (3,867,137 | ) | | $ | (222,728 | ) | | $ | 220,109,203 | |

8. RISK FACTORS

In the normal course of business, the Fund invests in financial instruments and enters into financial transactions where risk of potential loss exists due to such things as changes in the market (market risk) or failure or inability of the other party to a transaction to perform (credit and counterparty risk). See below for a detailed description of select principal risks. The following list is not intended to be a comprehensive listing of all of the potential risks associated with the Fund. The Fund’s prospectus provides a detailed discussion of the Fund’s risks and considerations.

| Annual Report | December 31, 2021 | 25 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

December 31, 2021

CLO Risk: Investments in CLOs carry additional risks, including, but not limited to (i) the possibility that distributions from collateral securities will not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; (iii) the possibility that the investments in CLOs are subordinate to other classes or tranches thereof; and (iv) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results. In addition, at the time of issuance, the CLO may not be fully invested. Until the CLO is fully invested, the debt service of the CLO may exceed the amount of interest earned from the CLO’s portfolio. Though not exclusively, the Fund will typically be in a first loss or subordinated position with respect to realized losses on the assets of the CLOs in which it is invested. The Fund may recognize phantom taxable income from its investments in the subordinated tranches of CLOs and structured notes.

Between the closing date and the effective date of a CLO, the CLO collateral manager will generally expect to purchase additional collateral obligations for the CLO. During this period, the price and availability of these collateral obligations may be adversely affected by a number of market factors, including price volatility and availability of investments suitable for the CLO, which could hamper the ability of the collateral manager to acquire a portfolio of collateral obligations that will satisfy specified concentration limitations and allow the CLO to reach the initial par amount of collateral prior to the effective date. An inability or delay in reaching the target initial par amount of collateral may adversely affect the timing and amount of interest or principal payments received by the holders of the CLO debt securities and distributions of the CLO on equity securities and could result in early redemptions which may cause CLO debt and equity investors to receive less than the face value of their investment.

The failure by a CLO in which the Fund invests to satisfy financial covenants, including with respect to adequate collateralization and/or interest coverage tests, could lead to a reduction in the CLO’s payments to the Fund. In the event that a CLO fails certain tests, holders of CLO senior debt may be entitled to additional payments that would, in turn, reduce the payments the Fund would otherwise be entitled to receive. Separately, the Fund may incur expenses to the extent necessary to seek recovery upon default or to negotiate new terms, which may include the waiver of certain financial covenants, with a defaulting CLO or any other investment the Fund may make. If any of these occur, it could adversely affect the Fund’s operating results and cash flows.

The Fund’s CLO investments are exposed to leveraged credit risk. If certain minimum collateral value ratios and/or interest coverage ratios are not met by a CLO, primarily due to senior secured loan defaults, then cash flow that otherwise would have been available to pay distributions to the Fund on its CLO investments may instead be used to redeem any senior notes or to purchase additional senior secured loans, until the ratios again exceed the minimum required levels or any senior notes are repaid in full. The Fund’s CLO investments and/or the underlying senior secured loans may prepay more quickly than expected, which could have an adverse impact on the Fund’s net assets.

Liquidity Risk: The securities issued by CLOs generally offer less liquidity than below investment grade or high-yield corporate debt, and are subject to certain transfer restrictions imposed on certain financial and other eligibility requirements on prospective transferees. Other investments the Fund may purchase through privately negotiated transactions may also be illiquid or subject to legal restrictions on their transfer. As a result of this illiquidity, the Fund’s ability to sell certain investments quickly, or at all, in response to changes in economic and other conditions and to receive a fair price when selling such investments may be limited, which could prevent the Fund from making sales to mitigate losses on such investments. In addition, CLOs are subject to the possibility of liquidation upon an event of default, which could result in full loss of value to the CLO equity and junior debt investors. CLO equity tranches are the most likely tranche to suffer a loss of all of their value in these circumstances.

Flat Rock Opportunity Fund | Notes to Financial Statements |

December 31, 2021

LIBOR Risk: Concerns have been publicized that some of the member banks surveyed by the British Bankers’ Association (“BBA”) in connection with the calculation of LIBOR across a range of maturities and currencies may have been under-reporting or otherwise manipulating the inter-bank lending rate applicable to them in order to profit on their derivatives positions or to avoid an appearance of capital insufficiency or adverse reputational or other consequences that may have resulted from reporting inter-bank lending rates higher than those they actually submitted. A number of BBA member banks have entered into settlements with their regulators and law enforcement agencies with respect to alleged manipulation of LIBOR, and investigations by regulators and governmental authorities in various jurisdictions are ongoing.

On July 27, 2017, the United Kingdom’s Financial Conduct Authority, which regulates LIBOR, announced that it intends to phase out LIBOR by the end of 2021. It is unclear if at that time whether or not LIBOR will cease to exist or if new methods of calculating LIBOR will be established such that it continues to exist after 2021. The U.S. Federal Reserve, in conjunction with the Alternative Reference Rates Committee, a steering committee comprised of large U.S. financial institutions, is considering replacing U.S. dollar LIBOR with a new index calculated by short-term repurchase agreements, backed by Treasury securities. The future of LIBOR at this time is uncertain. Potential changes, or uncertainty related to such potential changes, may adversely affect the market for LIBOR-based securities, including our portfolio of LIBOR-indexed, floating-rate debt securities. In addition, changes or reforms to the determination or supervision of LIBOR may result in a sudden or prolonged increase or decrease in reported LIBOR, which could have an adverse impact on the market for LIBOR-based securities, including the value of the LIBOR-indexed, floating-rate debt securities in our portfolio.

Global Markets Risk: The U.S. and global markets have, from time to time, experienced periods of disruption due to events such as terrorist attacks; acts of war; natural disasters, such as earthquakes, tsunamis, fires, floods or hurricanes; and outbreaks of epidemic, pandemic or contagious diseases. Such events have created, and continue to create, economic and political uncertainties and have contributed to recent global economic instability. In particular, outbreaks of epidemic, pandemic or contagious diseases may cause serious harm to our business, operating results and financial condition. Historically, disease pandemics such as the Ebola virus, Middle East Respiratory Syndrome, Severe Acute Respiratory Syndrome or the H1N1 virus, have diverted resources and priorities towards the treatment of such diseases. In December 2019, a strain of novel coronavirus causing respiratory illness, or COVID-19, emerged in the city of Wuhan in the Hubei province of China.

Any prolonged disruptions in the business of the portfolio companies underlying the CLOs in which we invest, including a disruption in their supply chains may adversely affect their ability to obtain the necessary raw materials or components to make their products or cause a decline in the demand for their products or services, leading to a negative impact on their operating results. In addition, such events may lead to restrictions on travel to and from the affected areas, making it more difficult for companies to conduct their businesses. As a result of pandemic outbreaks, including COVID-19, businesses can be shut down, supply chains can be interrupted, slowed, or rendered inoperable, and individuals can become ill, quarantined, or otherwise unable to work and/or travel due to health reasons or governmental restrictions. Governmental mandates may require forced shutdowns of companies’ facilities for extended or indefinite periods. In addition, these widespread outbreaks of illness, particularly in China, North America, Europe, or other locations significant to the operations of the portfolio companies underlying the CLOs in which we invest, could adversely affect their workforce, resulting in serious health issues and absenteeism, and may cause serious harm to our results of operations, business, or prospects.

| Annual Report | December 31, 2021 | 27 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

December 31, 2021

Furthermore, future terrorist activities, military or security operations, natural disasters, disease outbreaks, pandemics or other similar events could further weaken the domestic/global economies and create additional uncertainties, which may negatively impact our investments. During these periods of disruption, general economic conditions may deteriorate with material and adverse consequences for the broader financial and credit markets, and the availability of debt and equity capital for the market as a whole, and financial services firms in particular. Such economic adversity could impair companies’ financial positions and operating results and affect the industries in which we invest, which could, in turn, harm our operating results. These conditions may reoccur for a prolonged period of time or materially worsen in the future.

9. BORROWINGS

On September 18, 2020, the Fund entered into the Credit Facility Agreement with certain funds and accounts managed by Eagle Point Credit Management, LLC, pursuant to which the Lenders agreed to provide the Fund with a term loan of $25,000,000 and a revolver of $3,125,000. On August 16, 2021, the term loan borrowing limit was increased to $37,000,000 and the revolver was increased to $4,625,000. The maximum borrowing amount outstanding during the year was $41,625,000.

As of December 31, 2021, the Fund had drawn down $37,000,000 from the term loan. The Fund is charged an interest rate of 6.90% on the initial $28,125,000 tranche and 6.00% on the second $13,500,000 tranche, provided that the Fund maintains an investment grade credit rating from a nationally recognized statistical ratings organization, which was the case for each day for the year ended December 31, 2021. The Fund is charged a fee on the average daily unused balance of the Credit Facility of 0.75%. The average balance outstanding and weighted average interest rate for the year ended December 31, 2021 was $29,902,968 and 6.99%, respectively.

10. MANDATORILY REDEEMABLE PREFERRED STOCK

At December 31, 2021, the Fund had issued and outstanding 2,500 shares of Series A Term Preferred Shares, with a liquidation preference of $10,000 per share plus accrued and unpaid dividends (whether or not declared). The Fund issued 2,000 and 500 shares of Series A Term Preferred Shares on October 27, 2021 and December 3, 2021, respectively. The Series A Term Preferred Shares are entitled to a dividend at a rate of 6.00% per year based on the $10,000 liquidation preference before the common stock is entitled to receive any dividends. The Series A Term Preferred Shares are redeemable at $10,000 per share plus accrued and unpaid dividends (whether or not declared) exclusively at the Fund’s option commencing on October 27, 2022 for the initial 2,000 shares issued, and December 3, 2022 for the add-on 500 shares issued. Debt issuance costs related to Series A Preferred Shares of $380,131 are deferred and amortized over the period the Series A Term Preferred Shares are outstanding.

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2021 |

| | | | | Annual | | | | | | Aggregate | | | | |

| | | Mandatory | | Dividend | | | Shares | | | Liquidation | | | Estimated | |

| Series | | Redemption Date | | Rate | | | Outstanding | | | Preference | | | Fair Value | |

| Series A | | December 15, 2029 | | | 6.00 | % | | | 2,500 | | | $ | 25,000,000 | | | $ | 25,000,000 | |

11. COMMITMENTS

In the normal course of business, the Fund enters into contracts that may contain a variety of representations that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

The following table represents the Fund���s unfunded commitments on CLO’s held by the Fund as of December 31, 2021:

| | | Redemption Frequency/ Expiration Date | | As of December 31, 2021 | |

| Regatta XXII CLO, Ltd. | | N/A | | $ | 2,500,000 | |

| Symphony CLO XXX, Ltd. | | N/A | | | 5,100,000 | |

| | | | | $ | 7,600,000 | |