united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered

management investment companies

Investment Company Act file number: 811-23328

Flat Rock Opportunity Fund

(Exact name of registrant as specified in charter)

Robert K. Grunewald,

Chief Executive Officer

680 S. Cache Street, Suite 100,

P.O. Box 7403,

Jackson, WY 83001

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Copy to:

Owen J. Pinkerton, Esq.

Krisztina Nadasdy, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, NW, Suite 700

Washington, DC 20001

(202) 383-0262

Registrant’s telephone number, including area code: (307) 500-5200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders.

(a)

Flat Rock Opportunity Fund | Shareholder Letter |

| | December 31, 2024 (Unaudited) |

Fellow FROPX Shareholders:

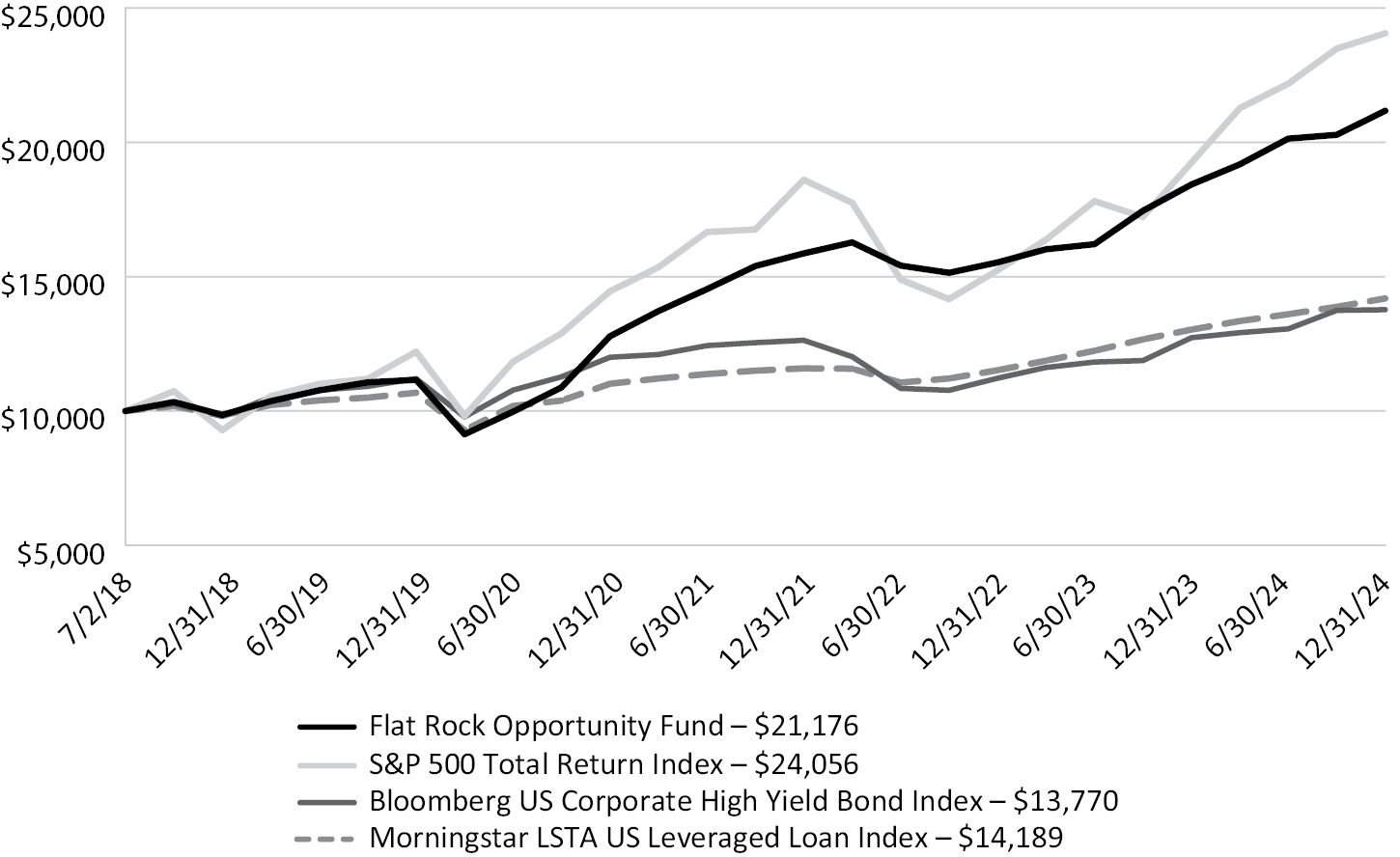

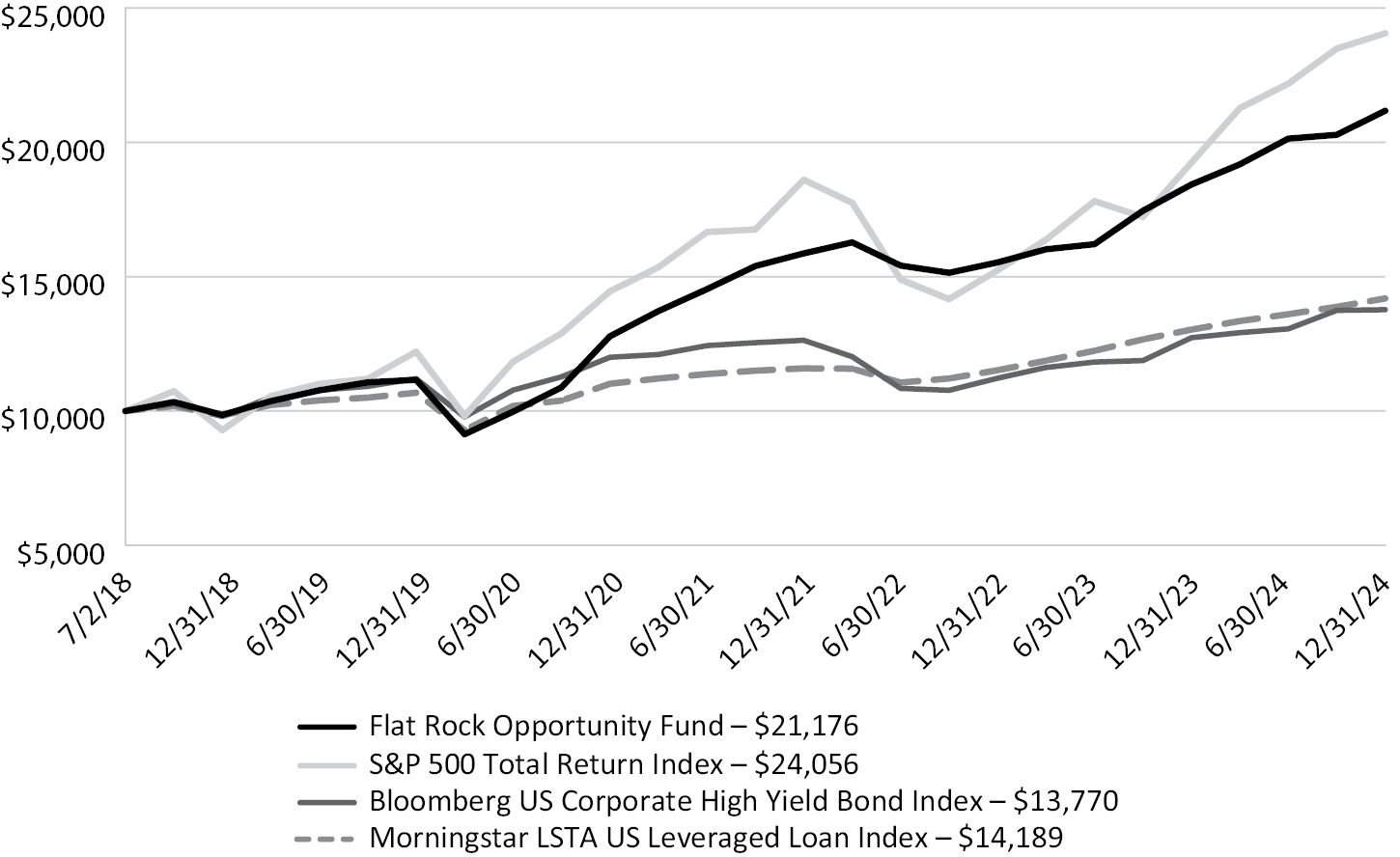

The Flat Rock Opportunity Fund (the “Fund”) had a solid performance in 2024 with an 14.91% return. Since inception in July of 2018, the Fund’s annualized return of 12.24% trailed the S&P 500, but with less than 1/3 of the volatility. The Fund has significantly outperformed the Bloomberg US Corporate High Yield Bond Index and the Morningstar LSTA US Leveraged Loan Index over that timeframe.

Fund Performance (Net)

Fund Performance | | 1-Year

Return | | 3-Year

Return | | 5-Year

Return | | Return

Since

Inception | | Standard

Deviation

Since

Inception |

Flat Rock Opportunity Fund | | 14.91% | | 10.10% | | 13.67% | | 12.24% | | 6.15% |

S&P 500 Index | | 25.02% | | 8.94% | | 14.53% | | 14.46% | | 19.96% |

Bloomberg US Corporate High Yield Bond Index | | 8.19% | | 2.92% | | 4.21% | | 5.05% | | 5.74% |

Morningstar LSTA US Leveraged Loan Index | | 8.93% | | 7.00% | | 5.85% | | 5.53% | | 3.42% |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance quoted above. Investment return and principal value will fluctuate, so that shares, when repurchased by the Fund, may be worth more or less than their original cost. Past performance is no guarantee of future results. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions.

The Fund ended the year with a distribution yield of 13.98%, which was covered by the Fund’s net investment income. Returns for the year were primarily composed of monthly distributions. We believe CLO equity securities are still priced at discounted levels and that there exists the potential for price appreciation in our portfolio.

When we model projected returns for our CLOs, we generally budget for 2.0% of the loans to default each year. During 2024, we saw the default rate of the loans in our CLOs increase from 1.0% to 2.3%. The higher default rate was negative for returns. Of course, the loan market default rate isn’t constant, and some years we would expect to be below 2.0% and some years above. In 2025, lower interest rates and a favorable economic backdrop have the potential to reverse this trend.

CLOs generally begin their lives with a two-year non-call period, during which the spreads on the CLO’s debt cannot be changed. After the non-call period, the CLO equity investors can refinance the CLO’s debt at lower rates and/or extend the life of the CLO. During 2022-2023, CLO financing costs were elevated and we were not able to refinance/extend any of our investments. During 2024, CLO financing costs declined and we were able to complete refinancings/extensions on 21% of our portfolio. These transactions

|

Annual Report | December 31, 2024 | 1 |

Flat Rock Opportunity Fund | Shareholder Letter |

| | December 31, 2024 (Unaudited) |

resulted in increased cash flows to CLO equity and increases in the fair market value of our investments, and played a valuable role in counteracting the effect of higher loan defaults. As we head into 2025, CLO financing costs have continued to decline and 42% of our portfolio is expected to be in-the-money for a refinancing by 3/31/2026, according to our calculations. That means that as non-call periods roll off, we would expect to refinance/extend the CLO, if CLO financing costs do not increase.

During the year, we saw compelling investment opportunities in middle market CLOs and our allocation to these investments increased from 60% to 68%. We believe our focus on middle market CLOs differentiates us from our peers, and that these investments often offer more favorable risk-adjusted returns than CLOs backed by broadly syndicated loans.

The Fund has grown to over $465 million of assets at fair value on December 31, 2024. We believe Fund growth has primarily been driven by investors seeking exposure to first lien, secured loans via CLO technology and the favorable risk-adjusted returns that the Fund achieved. Flat Rock Opportunity Fund offers investors a published daily net asset value, Securities and Exchange Commission regulation and reporting, minimum 5% quarterly liquidity, and the ability to invest directly into a diversified fund using a ticker, FROPX.

As always, if you have any questions, feel free to reach out.

Sincerely,

Robert Grunewald

Chief Executive Officer and Founder

Glossary: Standard Deviation is measure that provides the dispersion around a mean. The S&P 500 Index or the Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The Morningstar LSTA US Leveraged Loan Index is a market value weighted index designed to capture the performance of the U.S. leveraged loan market. The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. The index excludes bonds from emerging markets. Indexes are unmanaged, do not incur fees, expenses or taxes, and cannot be invested in directly.

Consider the investment risks, charges, and expenses of the Fund carefully before investing. Other information about the Fund may be obtained at https://flatrockglobal.com/flat-rock-opportunity-fund/. Please read it carefully.

The Fund is suitable for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment. Our shares have no history of public trading, nor is it intended that our shares will be listed on a national securities exchange at this time, if ever. No secondary market is expected to develop for our shares; liquidity for our shares will be provided only through quarterly repurchase offers for no less than 5% of and no more than 25% of our shares at net asset value, and there

Flat Rock Opportunity Fund | Shareholder Letter |

| | December 31, 2024 (Unaudited) |

is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. Due to these limited restrictions, an investor should consider an investment in the Fund to be of limited liquidity. Investing in our shares may be speculative and involves a high degree of risk, including the risks associated with leverage. Investing in the Fund involves risks, including the risk that shareholder may lose part or all of their investment. We intend to invest primarily in the equity and, to a lesser extent, in the junior debt tranches of CLOs that own a pool of senior secured loans. Our investments in the equity and junior debt tranches of CLOs are exposed to leveraged credit risk. Investments in the lowest tranches bear the highest level of risk. We may pay distributions in significant part from sources that may not be available in the future and that are unrelated to our performance, such as a returns of capital or borrowing. The amount of distributions that we may pay, if any, is uncertain. Ultimus Fund Distributors, LLC serves as our principal underwriter, within the meaning of the 1940 Act, and will act as the distributor of our shares on a best efforts’ basis, subject to various conditions. You can contact Ultimus Fund Distributors at (833) 415-1088.

|

Annual Report | December 31, 2024 | 3 |

Flat Rock Opportunity Fund | Portfolio Update |

| | December 31, 2024 (Unaudited) |

INVESTMENT OBJECTIVE

Flat Rock Opportunity Fund’s (the “Fund”) investment objective is to generate current income and, as a secondary objective, long-term capital appreciation.

PERFORMANCE as of December 31, 2024

| | 1 Year | | 3 Year | | 5 Year | | Since

Inception(1) |

Flat Rock Opportunity Fund(2)(6) | | 14.91% | | 10.10% | | 13.67% | | 12.24% |

S&P 500 Index(3) | | 25.02% | | 8.94% | | 14.53% | | 14.46% |

Bloomberg US Corporate High Yield Bond Index(4) | | 8.19% | | 2.92% | | 4.21% | | 5.05% |

Morningstar LSTA US Leveraged Loan Index(5) | | 8.93% | | 7.00% | | 5.85% | | 5.53% |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, if repurchased by the Fund, may be worth more or less than their original cost. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

The Fund is a continuously offered, non-diversified, closed-end management investment company that is operated as an interval fund. The Fund is suitable only for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment. The Fund’s shares have no history of public trading, nor is it intended that its shares will be listed on a national securities exchange at this time, if ever. Investing in the Fund’s shares may be speculative and involves a high degree of risk, including the risks associated with leverage. Investing in the Fund involves risk, including the risk that shareholders may receive little or no return on their investment or that shareholders may lose part or all of their investment. The Fund intends to invest primarily in the equity and, to a lesser extent, in the junior debt tranches of CLOs that own a pool of senior secured loans made to companies whose debt is rated below investment grade or, in limited circumstances, unrated. The Fund’s investments in the equity and junior debt tranches of CLOs are exposed to leveraged credit risk. Investments in the lowest tranches bear the highest

Flat Rock Opportunity Fund | Portfolio Update |

| | December 31, 2024 (Unaudited) |

level of risk. The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to its performance, such as a return of capital or borrowings. The amount of distributions that the Fund may pay, if any, is uncertain.

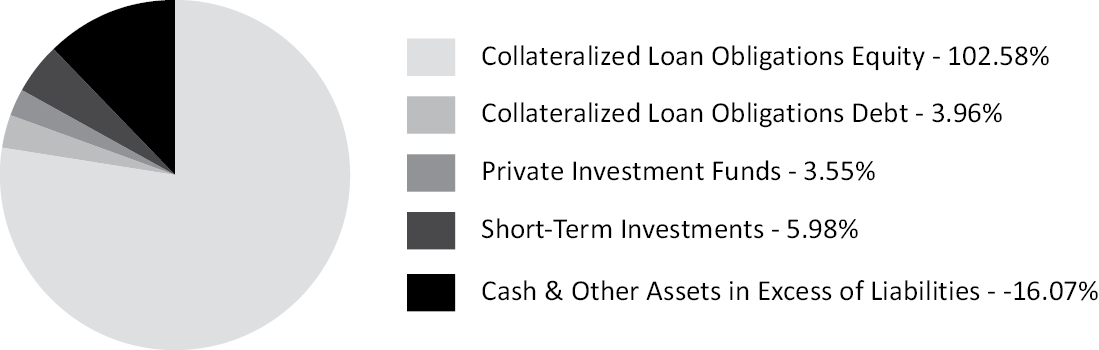

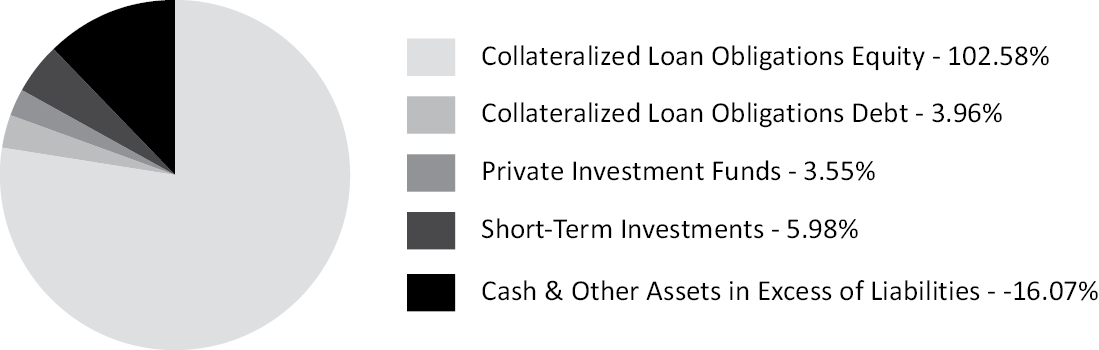

ASSET ALLOCATION as of December 31, 2024*

TOP TEN HOLDINGS* as of December 31, 2024

| | % of Net Assets |

Jefferies Credit Partners DL CLO 2024-II Ltd., Series 2A | | 8.00% |

Woodmont Trust, Series 2022-9A | | 6.09% |

Guggenheim MM CLO LLC, Series 2023-6A | | 5.02% |

Jefferies Credit Partners Direct Lending CLO Ltd., Series 2024-1A | | 4.94% |

Audax Senior Debt CLO 9 LLC, Series 2024-9A | | 4.43% |

Ivy Hill Middle Market Credit Fund XX Ltd., Series 20A | | 3.94% |

Barings Middle Market CLO Ltd., Series 2023-1A | | 3.90% |

Churchill Middle Market CLO III Ltd., Series 2021-1A | | 3.90% |

Great Lakes CLO Ltd., Series 2014-1A | | 3.86% |

TCW, Series 2024-2A | | 3.67% |

|

Annual Report | December 31, 2024 | 5 |

Flat Rock Opportunity Fund | Portfolio Update |

| | December 31, 2024 (Unaudited) |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares at the NAV of $20.00 on July 2, 2018 (commencement of operations) and tracking its progress through December 31, 2024.

The hypothetical $10,000 investment at inception includes changes due to share price and reinvestment of dividends and capital gains. The chart does not imply future performance. Indexes are unmanaged, do not incur fees, expenses or taxes, and cannot be invested in directly. Performance quoted does not include a deduction for taxes that a shareholder would pay on the repurchase of its shares by the Fund.

Flat Rock Opportunity Fund | Schedule of Investments |

| | December 31, 2024 |

| | Principal

Amount | | Fair Value |

COLLATERALIZED LOAN OBLIGATIONS EQUITY(a)(b)(c) - 102.58% | | | | | | |

Allegro CLO XIV Ltd., Series 2021-2A,

Subordinated Notes, 13.17%, 10/15/2034 | | $ | 11,800,000 | | $ | 6,542,582 |

ALM 2020 Ltd., Series 2020-1A,

Subordinated Notes, 0.00%, 10/15/2029 | | | 8,000,000 | | | 148,000 |

Audax Interests, Series 2023-8a,

14.07%, 10/20/2035 | | | 15,000,000 | | | 11,803,946 |

Audax Senior Debt CLO 9 LLC, Series 2024-9A,

Subordinated Notes, 16.57%, 4/20/2036 | | | 19,000,000 | | | 17,089,097 |

Bain Capital Credit CLO Ltd., Series 2021-3A,

Subordinated Notes, 12.86%, 7/24/2034 | | | 12,800,000 | | | 7,305,522 |

Barings Middle Market CLO Ltd., Series 2021-1,

Subordinated Notes, 18.34%, 7/20/2033 | | | 3,240,000 | | | 2,824,544 |

Barings Middle Market CLO Ltd., Series 2023-1A,

Subordinated Notes, 14.40%, 1/20/2036 | | | 17,000,000 | | | 15,061,545 |

Benefit Street Partners CLO XXV Ltd., Series 2021-25A,

Subordinated Notes, 13.64%, 1/15/2035 | | | 9,246,257 | | | 6,738,226 |

BlackRock Baker CLO Ltd., Series 2021-8A,

Class VDN, 8.68%, 1/15/2034 | | | 7,347,140 | | | 3,994,941 |

BlackRock Elbert CLO V, LLC, Series 5I,

Subordinated Notes, 5.95%, 6/15/2034 | | | 6,500,000 | | | 4,386,612 |

BlackRock Maroon Bells CLO XI, LLC, Series 1A,

Subordinated Notes, 5.92%, 10/15/2034 | | | 11,643,312 | | | 7,630,360 |

Blackrock Mt. Hood CLO X, LLC, Series 1A,

Class VDN, 13.61%, 4/20/2035 | | | 20,600,000 | | | 9,699,263 |

Brightwood Capital MM CLO Ltd., Series 2023-1,

Class E, 13.78%, 10/15/2035 | | | 14,945,879 | | | 11,284,549 |

Churchill Middle Market CLO III Ltd., Series 2021-1A,

Subordinated Notes, 12.42%, 10/24/2033 | | | 21,500,000 | | | 15,031,829 |

Churchill Middle Market CLO IV Ltd., Series 1I,

Subordinated Notes, 16.32%, 4/23/2036 | | | 7,000,000 | | | 4,869,276 |

Great Lakes CLO Ltd., Series 2014-1A,

Subordinated Notes, 4.59%, 10/15/2029 | | | 26,740,000 | | | 14,883,296 |

Guggenheim MM CLO LLC, Series 2023-6A,

Subordinated Notes, 12.26%, 1/25/2036 | | | 20,000,000 | | | 19,377,938 |

Ivy Hill Middle Market Credit Fund XX Ltd., Series 20A,

Subordinated Notes, 14.31%, 4/20/2035 | | | 18,000,000 | | | 15,217,262 |

See Notes to Financial Statements. |

Annual Report | December 31, 2024 | 7 |

Flat Rock Opportunity Fund | | Schedule of Investments |

| | | December 31, 2024 |

| | Principal

Amount | | Fair Value |

COLLATERALIZED LOAN OBLIGATIONS EQUITY(a)(b)(c) - 102.58% | | | | | | |

Jefferies Credit Partners Direct Lending CLO Ltd., Series 2024-1A,

Subordinated Notes, 17.79%, 7/25/2036 | | $ | 20,403,000 | | $ | 19,063,063 |

Jefferies Credit Partners DL CLO 2024-II Ltd, Series 2A,

Subordinated Notes, 0.00%, 1/20/2037(f) | | | 35,272,444 | | | 30,879,861 |

Lake Shore MM CLO II Ltd., Series 2X,

Subordinated Notes, 34.15%, 10/17/2031 | | | 1,700,000 | | | 472,472 |

Lake Shore MM CLO II Ltd., Series 2A,

Subordinated Notes, 34.15%, 10/17/2031 | | | 17,300,000 | | | 4,808,102 |

Lake Shore MM CLO V LLC, Series 1A,

Subordinated Notes, 15.97%, 10/15/2034 | | | 22,400,000 | | | 14,130,275 |

LCM Ltd., Series 34A,

Income Notes, 6.00%, 10/20/2034 | | | 8,696,000 | | | 2,996,153 |

Maranon Loan Funding Ltd., Series 3A,

Subordinated Notes, 33.04%, 1/15/2034 | | | 10,000,000 | | | 6,736,297 |

New Mountain CLO Ltd., Series 2A,

Subordinated Notes, 15.73%, 4/15/2034 | | | 8,250,000 | | | 5,449,904 |

New Mountain CLO Ltd., Series 1A,

Subordinated Notes, 16.24%, 10/15/2034 | | | 10,520,364 | | | 8,088,179 |

New Mountain CLO Ltd., Series 3A,

Subordinated Notes, 15.53%, 10/20/2034 | | | 10,000,000 | | | 6,911,899 |

New Mountain CLO Ltd., Series 4A,

Subordinated Notes, 11.05%, 4/20/2036 | | | 16,500,000 | | | 12,728,036 |

Oaktree CLO Ltd., Series 2019-2A,

Subordinated Notes, 27.86%, 4/15/2031 | | | 10,880,000 | | | 4,810,960 |

Oaktree CLO Ltd., Series 2019-4A,

Subordinated Notes, 22.04%, 10/20/2032 | | | 9,000,000 | | | 6,223,035 |

Oaktree CLO Ltd., Series 2022-1A,

Subordinated Notes, 11.97%, 5/15/2033 | | | 9,000,000 | | | 5,231,562 |

Oaktree CLO Ltd., Series 2019-3A,

Subordinated Notes, 18.44%, 10/20/2034 | | | 8,981,520 | | | 5,838,587 |

OCP CLO Ltd., Series 2020-20,

Subordinated Notes, 15.17%, 4/18/2037 | | | 6,000,000 | | | 4,278,254 |

Octagon 70 Alto Ltd., Series 1A,

Subordinated Notes, 14.97%, 10/20/2036 | | | 6,000,000 | | | 3,854,095 |

See Notes to Financial Statements. |

8 | www.flatrockglobal.com |

Flat Rock Opportunity Fund | Schedule of Investments |

| | December 31, 2024 |

| | Principal

Amount | | Fair Value |

COLLATERALIZED LOAN OBLIGATIONS EQUITY(a)(b)(c) - 102.58% | | | | | | |

Symphony CLO Ltd., Series 30A,

Subordinated Notes, 11.42%, 4/20/2037 | | $ | 9,227,500 | | $ | 5,736,459 |

Symphony CLO XXIV Ltd., Series 24X,

Subordinated Notes, 24.96%, 1/23/2032 | | | 5,000,000 | | | 2,488,745 |

TCP Whitney CLO Ltd., Series 1I,

Subordinated Notes, 8.92%, 8/20/2033 | | | 11,500,000 | | | 5,462,449 |

TCP Whitney CLO Ltd., Series 1A,

Class Subordinated Notes, 5.33%, 8/20/2033 | | | 3,575,763 | | | 2,179,447 |

TCW CLO Ltd., Series 2021-2A,

Subordinated Notes, 11.16%, 7/25/2034 | | | 8,125,000 | | | 4,027,126 |

TCW CLO Ltd., Series 2021-2A,

Income Notes, 11.22%, 7/25/2034 | | | 7,000,000 | | | 3,469,186 |

TCW CLO Ltd., Series 2024-2A,

Subordinated Notes, 15.60%, 7/17/2037 | | | 18,000,000 | | | 14,164,425 |

Voya CLO Ltd., Series 2021-1A,

Income Notes, 9.19%, 7/15/2034 | | | 6,960,000 | | | 3,824,472 |

Voya CLO Ltd., Series 2022-1A,

Subordinated Notes, 15.42%, 4/20/2035 | | | 8,000,000 | | | 5,651,025 |

Voya CLO Ltd., Series 2024-2A,

Subordinated Notes, 13.10%, 7/20/2037 | | | 10,500,000 | | | 8,972,505 |

Woodmont Trust, Series 2022-9A,

Subordinated Notes, 20.57%, 10/25/2036 | | | 24,084,000 | | | 23,488,457 |

TOTAL COLLATERALIZED LOAN OBLIGATIONS EQUITY

(Cost $413,098,294) | | | | | | 395,853,818 |

| | | | | | | |

COLLATERALIZED LOAN OBLIGATIONS DEBT(a)(c)(d) - 3.96% | | | | | | |

Brightwood Capital MM CLO Ltd., Series 2020-1,

Class ER, 13.38%, 1/15/2031 (3M US SOFR + 872 bps) | | | 6,500,000 | | | 6,458,260 |

Brightwood Capital MM CLO Ltd., Series 2023-1A,

15.69%, 10/15/2035 (3M US SOFR + 1036 bps) | | | 5,804,225 | | | 5,910,738 |

NewStar Fairfield Fund CLO Ltd., Series 2015-2A,

Class DN, 12.26%, 4/20/2030 (3M US SOFR + 764 bps) | | | 3,000,000 | | | 2,895,847 |

TOTAL COLLATERALIZED LOAN OBLIGATIONS DEBT

(Cost $14,651,772) | | | | | | 15,264,845 |

See Notes to Financial Statements. |

Annual Report | December 31, 2024 | 9 |

Flat Rock Opportunity Fund | | Schedule of Investments |

| | | December 31, 2024 |

| |

Shares

| |

Fair Value

|

PRIVATE INVESTMENT FUND - 3.55% | | | | | |

| | | | | | |

New Mountain Guardian IV Feeder III, Ltd.(g) | | 13,921,220 | | $ | 13,712,401 |

TOTAL PRIVATE INVESTMENT FUND

(Cost $13,712,503) | | | | | 13,712,401 |

| | | | | | |

SHORT-TERM INVESTMENT - 5.98% | | | | | |

| | | | | | |

MONEY MARKET FUND - 5.98% | | | | | |

First American Government Obligations Fund,

Class X, 4.38%(e) | | 23,092,314 | | | 23,092,314 |

TOTAL SHORT-TERM INVESTMENT

(Cost $23,092,314) | | | | | 23,092,314 |

TOTAL INVESTMENTS - 116.07%

(Cost $464,554,883) | | | | | 447,923,378 |

Liabilities in Excess of Other Assets - (16.07)% | | | | | (62,023,512) |

NET ASSETS - 100.00% | | | | $ | 385,899,866 |

SOFR - Secured Overnight Financing Rate

3M US SOFR - 3 Month US SOFR as of December 31, 2024 was 4.69%

See Notes to Financial Statements. |

10 | www.flatrockglobal.com |

Flat Rock Opportunity Fund | | Statement of Assets and Liabilities |

| | | December 31, 2024 |

Assets | |

Investments at fair value (cost $464,554,883) | $ 447,923,378 |

Interest receivable | 14,873,148 |

Fee Rebate | 1,621,972 |

Receivable for fund shares sold | 495,059 |

Dividends receivable | 85,554 |

Prepaid expenses and other assets | 420,117 |

Total assets | 465,419,228 |

Liabilities | |

Mandatorily redeemable preferred stock (net of deferred financing costs of $551,577(a) (see Note 10)) | $ 44,448,423 |

Payable for securities purchased | 31,095,294 |

Incentive fee payable | 2,162,437 |

Payable for excise tax | 690,915 |

Management fee payable | 504,698 |

Payable to transfer agent | 166,756 |

Dividends payable on redeemable preferred stock (see Note 10) | 126,083 |

Payable for audit and tax service fees | 116,750 |

Payable for loan commitment fees | 63,820 |

Payable for fund accounting and administration fees | 38,278 |

Payable for custodian fees | 10,558 |

Other accrued expenses | 95,350 |

Total liabilities | 79,519,362 |

Net Assets | $ 385,899,866 |

Commitments and Contingencies (see Note 12) | |

Net Assets Consist Of: | |

Paid-in capital | $ 402,424,078 |

Accumulated deficit | (16,524,212) |

Net Assets | $ 385,899,866 |

Pricing of Shares | |

Net Assets | 385,899,866 |

Shares of beneficial interest outstanding

(Unlimited number of shares, at $0.001 par value per share) | 20,472,130 |

Net asset value and offering price per share | $ 18.85 |

See accompanying notes which are an integral part of these financial statements. |

Annual Report | December 31, 2024 | 11 |

Flat Rock Opportunity Fund | Statement of Operations |

| | For the year ended December 31, 2024 |

Investment Income | |

Interest income | $ 63,304,563 |

Dividend income | 1,205,631 |

Total Investment Income | 64,510,194 |

Expenses | |

Incentive fees | 7,774,834 |

Management fees | 5,436,795 |

Dividends on redeemable preferred stock | 2,670,000 |

Interest on credit facility | 2,118,906 |

Transfer agent fees and expenses | 668,705 |

Accounting and administration fees | 397,219 |

Loan issuance costs | 368,299 |

Excise tax expenses | 954,396 |

Audit and tax service fees | 131,367 |

Amortization of deferred financing costs | 120,432 |

Printing expenses | 115,175 |

Legal fees | 71,096 |

Custodian expenses | 44,709 |

Compliance expenses | 30,000 |

Trustee expenses | 30,000 |

Insurance expenses | 28,906 |

Registration expenses | 23,665 |

Miscellaneous expenses | 192,930 |

Total expenses | 21,177,434 |

Fees waived by Adviser | (20,987) |

Net expenses | 21,156,447 |

Net Investment Income | 43,353,747 |

Realized and Change in Unrealized Gain/(Loss) from Investments | |

Net realized loss on sale of investments | (6,732,505) |

Net change in unrealized appreciation/(depreciation) from investments | 4,519,161 |

Net realized and change in unrealized loss from investments | (2,213,344) |

Net Increase in Net Assets Resulting from Operations | $ 41,140,403 |

See accompanying notes which are an integral part of these financial statements. |

12 | www.flatrockglobal.com |

Flat Rock Opportunity Fund | | Statements of Changes in Net Assets |

| | | |

| For The Year

Ended

December 31,

2024 | For The Year

Ended

December 31,

2023 |

Increase/(Decrease) In Net Assets Resulting From Operations | | |

Net investment income | $ 43,353,747 | $ 33,666,691 |

Net realized loss on sale of investments | (6,732,505) | (1,626,196) |

Net change in unrealized appreciation/(depreciation) from investments | 4,519,161 | 5,621,457 |

Net increase in net assets resulting from operations | 41,140,403 | 37,661,952 |

Distributions To Shareholders | | |

Distributions paid from earnings | (48,982,481) | (31,335,392) |

Decrease in net assets from distributions to shareholders | (48,982,481) | (31,335,392) |

Capital Share Transactions | | |

Proceeds from shares sold | 183,799,252 | 62,351,575 |

Reinvestment of distributions | 14,878,088 | 9,780,564 |

Cost of shares repurchased | (31,780,805) | (43,791,568) |

Net increase in net assets resulting from capital share transactions | 166,896,535 | 28,340,571 |

Net increase in net assets | 159,054,457 | 34,667,131 |

Net Assets | | |

Beginning of year | 226,845,409 | 192,178,278 |

End of year | $ 385,899,866 | $ 226,845,409 |

Share Transactions | | |

Shares sold | 9,529,247 | 3,334,784 |

Shares issued in reinvestment of distributions | 777,781 | 526,925 |

Shares repurchased | (1,642,435) | (2,320,653) |

Net increase in share transactions | 8,664,593 | 1,541,056 |

See accompanying notes which are an integral part of these financial statements. |

Annual Report | December 31, 2024 | 13 |

Flat Rock Opportunity Fund | | Statement of Cash Flows |

| | | For the year ended December 31, 2024 |

CASH FLOWS RESULTING FROM OPERATING ACTIVITIES: | | | |

Net increase in net assets resulting from operations | | $ | 41,140,403 |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | |

Purchase of investment securities | | | (202,484,678) |

Proceeds from sales of investment securities | | | 85,090,059 |

Net purchases of short-term investments securities | | | (9,593,307) |

Amortization of premium and accretion of discount on investments, net | | | 19,756,101 |

Net realized (gain)/loss on: | | | |

Investments | | | 6,732,505 |

Net change in unrealized (appreciation)/depreciation on: | | | |

Investments | | | (4,519,161) |

(Increase)/Decrease in assets: | | | |

Interest receivable | | | (5,467,856) |

Dividends receivable | | | (85,554) |

Fee Rebate | | | (484,467) |

Prepaid loan commitment fees | | | 205,569 |

Prepaid expenses and other assets | | | (179,823) |

Increase/(Decrease) in liabilities: | | | |

Accrued interest expense | | | (603,891) |

Payable for loan commitment fees | | | 63,820 |

Payable for excise tax | | | 690,915 |

Management fee payable | | | 115,930 |

Payable to counterparty | | | (168,318) |

Payable for fund accounting and administration fees | | | (4,708) |

Payable to transfer agent | | | 116,922 |

Incentive fee payable | | | 573,312 |

Payable to trustees | | | (10,000) |

Payable for custodian fees | | | 6,472 |

Other accrued expenses | | | 55,016 |

Net cash used in operating activities | | | (69,054,739) |

See Notes to Financial Statements. |

14 | www.flatrockglobal.com |

Flat Rock Opportunity Fund | Statement of Cash Flows |

| | For the year ended December 31, 2024 |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

Proceeds from shares sold | | $ | 183,828,898 |

Cost of shares repurchased | | | (31,780,805) |

Distributions paid (net of reinvestments) | | | (34,104,393) |

Borrowings on credit facility | | | 17,750,000 |

Payments on credit facility | | | (66,750,000) |

Dividends payable on redeemable preferred stock | | | 607 |

Mandatorily redeemable preferred stock | | | 110,432 |

Net cash provided by financing activities | | | 69,054,739 |

Net increase/(decrease) in cash | | | — |

Cash, beginning of year | | $ | — |

Cash, end of year | | $ | — |

Non-cash financing activities not included herein consist of: | | | |

Reinvestment of dividends and distributions: | | $ | 14,878,088 |

Supplemental Disclosure of Cash Flow Information | | | |

Cash paid for interest on credit facility: | | $ | 2,722,797 |

Cash paid for dividends on mandatory redeemable preferred stock: | | $ | 2,669,393 |

See Notes to Financial Statements. |

Annual Report | December 31, 2024 | 15 |

Flat Rock Opportunity Fund | | Financial Highlights |

| | | |

| | For the Year

Ended

December 31,

2024* | | For the Year

Ended

December 31,

2023 | | For the Year

Ended

December 31,

2022 | | For the Year

Ended

December 31,

2021 | | For the Year

Ended

December 31,

2020 |

Per Share Operating Performance | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 19.21 | | $ | 18.72 | | $ | 22.21 | | $ | 19.70 | | $ | 19.48 |

Income/(loss) from investment operations: | | | | | | | | | | | | | | | |

Net investment income(a) | | | 2.68 | | | 2.94 | | | 3.05 | | | 3.03 | | | 2.16 |

Net realized and unrealized gains/(losses) from investments | | | (0.03) | | | 0.29 | | | (3.54) | | | 1.61 | | | 0.24 |

Total income/(loss) from investment operations | | | 2.65 | | | 3.23 | | | (0.49) | | | 4.64 | | | 2.40 |

Less distributions: | | | | | | | | | | | | | | | |

Net investment income | | | (3.01) | | | (2.74) | | | (2.92) | | | (2.12) | | | (2.18) |

Net realized gains | | | — | | | — | | | (0.08) | | | (0.01) | | | — |

Total distributions | | | (3.01) | | | (2.74) | | | (3.00) | | | (2.13) | | | (2.18) |

Net increase/(decrease) in net asset value | | | (0.36) | | | 0.49 | | | (3.49) | | | 2.51 | | | 0.22 |

Net asset value, end of year | | $ | 18.85 | | $ | 19.21 | | $ | 18.72 | | $ | 22.21 | | $ | 19.70 |

Total return(b) | | | 14.73% | | | 18.84% | | | (2.49)% | | | 24.30% | | | 14.50% |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (in thousands) | | $ | 385,900 | | $ | 226,845 | | $ | 192,178 | | $ | 165,714 | | $ | 79,175 |

Ratios To Average Net Assets (including interest on credit facility and dividends on redeemable preferred stock)(c) | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets including fee waivers and reimbursements | | | 6.78%(f) | | | 8.47% | | | 8.73% | | | 7.62% | | | 5.23% |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 6.79% | | | 8.47% | | | 8.73% | | | 7.62% | | | 5.37% |

Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 13.91% | | | 15.74% | | | 14.94% | | | 13.92% | | | 12.37% |

Ratio of net investment income to average net assets excluding fee waivers and reimbursements | | | 13.90% | | | 15.74% | | | 14.94% | | | 13.92% | | | 12.23% |

See accompanying notes which are an integral part of these financial statements. |

16 | www.flatrockglobal.com |

Flat Rock Opportunity Fund | Financial Highlights |

| | |

| | For the Year

Ended

December 31,

2024* | | For the Year

Ended

December 31,

2023 | | For the Year

Ended

December 31,

2022 | | For the Year

Ended

December 31,

2021 | | For the Year

Ended

December 31,

2020 |

Ratios To Average Net Assets (excluding interest on credit facility and distributions on redeemable preferred stock)(c) | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets including fee waivers and reimbursements | | | 5.20%(f) | | | 5.63% | | | 5.78% | | | 5.61% | | | 4.53% |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 5.21% | | | 5.63% | | | 5.78% | | | 5.61% | | | 4.67% |

Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 15.49% | | | 18.58% | | | 17.89% | | | 15.92% | | | 13.07% |

Ratio of net investment income to average net assets excluding fee waivers and reimbursements | | | 15.48% | | | 18.58% | | | 17.89% | | | 15.92% | | | 12.93% |

Portfolio turnover rate | | | 23% | | | 23% | | | 19% | | | 99% | | | 43% |

Credit Facility: | | | | | | | | | | | | | | | |

Aggregate principal amount, end of year (000s): | | $ | — | | $ | 49,000 | | $ | 49,000 | | $ | 37,000 | | $ | 21,890 |

Assets Coverage, end of year per $1,000:(d) | | | — | | | 5,642 | | | 4,932 | | | 5,505 | | | 4,627 |

Redeemable Preferred Stock: | | | | | | | | | | | | | | | |

Liquidation value, end of year (000s): | | $ | 45,000 | | $ | 45,000 | | $ | 45,000 | | $ | 25,000 | | $ | — |

Asset coverage, end of year per share:(e) | | | 43,103 | | | 27,197 | | | 23,730 | | | 19,078 | | | — |

See accompanying notes which are an integral part of these financial statements. |

Annual Report | December 31, 2024 | 17 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

Flat Rock Opportunity Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”) as a non-diversified, closed-end management investment company. The shares of beneficial interest of the Fund (the “Shares”) are continuously offered under Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”). The Fund operates as an interval fund pursuant to Rule 23c-3 under the 1940 Act and has adopted a fundamental policy to conduct quarterly repurchase offers at net asset value (“NAV”).

The Fund’s investment objective is to generate current income and, as a secondary objective, long-term capital appreciation.

The Fund was formed as a Delaware statutory trust on February 12, 2018 and operates pursuant to a Second Amended and Restated Agreement and Declaration of Trust governed by and interpreted in accordance with the laws of the State of Delaware. The Fund had no operations from that date to July 2, 2018, other than those related to organizational matters and the registration of its shares under applicable securities laws.

Regulatory Update — The Fund is deemed to be an individual reporting segment and is not part of a consolidated reporting entity. The objective and strategy of the Fund is used by the Adviser to make investment decisions, and the results of the operations, as shown in the Statements of Operations and the Financial Highlights is the information utilized for the day-to-day management of the Fund. The Fund is party to the expense agreements as disclosed in the notes to the financial statements and resources are not allocated to the Fund based on performance measurements. Due to the significance of oversight and their role, the Adviser is deemed to be the Chief Operating Decision Maker.

2. SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund is an investment company under U.S. GAAP and follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946.

Use of Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of increases and decreases in net assets from operations during the period. Actual results could differ from these estimates.

Preferred Shares: In accordance with ASC 480-10-25, the Fund’s mandatorily redeemable preferred stock have been classified as debt on the Statement of Assets and Liabilities. Refer to “Note 10. Mandatorily Redeemable Preferred Stock” for further details.

Security Valuation: The Fund determines the NAV of its shares daily as of the close of regular trading (normally, 4:00 p.m., Eastern time) on each day that the New York Stock Exchange (“NYSE”) is open for business.

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

The 1940 Act requires the Fund to determine the value of its portfolio securities using market quotations when “readily available,” and when market quotations are not readily available, portfolio securities must be valued at fair value, as determined in good faith by the Fund’s Board. As stated in Rule 2a-5 under the 1940 Act, determining fair value in good faith requires (i) assessment and management of risks, (ii) establishment of fair value methodologies, (iii) testing of fair value methodologies, and (iv) evaluation of pricing services. Under Rule 2a-5, a fund’s board may designate the fund’s adviser as “valuation designee” to perform fair value determinations. The Board, including a majority of the Trustees who are not “interested persons” of the Fund, as such term is defined in the 1940 Act, has designated the Adviser to perform fair value determinations and act as “valuation designee” for each Fund’s investments.

The Fund records its investments at fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used to determine fair value are further discussed below.

It is the policy of the Fund to value its portfolio securities using market quotations when readily available. For purposes of this policy, a market quotation is readily available only when that quotation is a quoted price (unadjusted) in active markets for identical investments that the Fund can access at the measurement date, provided that a quotation will not be readily available if it is not reliable. If market quotations are not readily available, securities or other assets will be valued at their fair market value as determined using the valuation methodologies approved by the Board.

Equity securities for which market quotations are available are generally valued at the last sale price or official closing price on the primary market or exchange on which they trade.

Short-term debt securities having a remaining maturity of 60 days or less when purchased are valued at cost adjusted for amortization of premiums and accretion of discounts, which approximates fair value.

The Fund primarily invests in the equity and, to a lesser extent, in the junior debt tranches of collateralized loan obligations (“CLOs”). In valuing such investments, the Adviser considers a number of factors, including: 1) the indicative prices provided by a recognized, independent third-party industry pricing service, and the implied yield of such prices; 2)recent trading prices for specific investments; 3) recent purchases and sales known to the Adviser in similar securities; 4) the indicative prices for specific investments and similar securities provided by the broker who arranges transactions in such CLOs; and 5) the Adviser’s own models, which will incorporate key inputs including, but not limited to, assumptions for future loan default rates, recovery rates, prepayment rates, and discount rates — all of which are determined by considering both observable and third-party market data and prevailing general market assumptions and conventions, as well as those of the Adviser. While the use of an independent third-party industry pricing service can be a source for valuing its CLO investments, the Adviser will not use the price provided by a third-party service if it believes that the price does not accurately reflect fair value and will instead utilize another methodology outlined above to make its own assessment of fair value.

The Fund may invest in interests or shares in private investment companies and/or funds (“Private Investment Funds”) where the net asset value is calculated and reported by respective unaffiliated investment managers on a monthly or quarterly basis. Unless the Adviser is aware of information that a value reported to the Fund by a portfolio, underlying manager, or administrator does not accurately reflect the value of the Fund’s interest in that Private Investment Fund, the Adviser will use the net asset value provided by the Private Investment Funds as a practical expedient to estimate the fair value of such interests.

|

Annual Report | December 31, 2024 | 19 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

The Fund may also invest directly in senior secured loans of U.S. middle-market companies (“Senior Loans”) (either in the primary or secondary markets). The Fund’s Senior Loans are valued without accrued interest, and accrued interest is reported as income in the Fund’s Statement of Operations.

Certain of the Senior Loans held by the Fund will be broadly syndicated loans. Broadly syndicated loans will be valued by using readily available market quotations or indicative market quotations provided by an independent, third-party pricing service.

For each Senior Loan held by the Fund, that is either: 1) not a broadly syndicated loan; or 2) is a broadly-syndicated loan but has limited liquidity such that the Adviser determines that readily available or indicative market quotations do not reflect fair value, the Adviser will employ the methodology it deems most appropriate to fair value the Senior Loan. For the period before such a Senior Loan begins providing quarterly financial updates, the Senior Loan’s fair value will usually be listed as the cost at which the Fund purchased the Senior Loan. For all other such Senior Loans, the Adviser will fair value each of these on a quarterly basis after the underlying portfolio company has reported its most recent quarterly financial update. These fair value calculations involve significant professional judgment by the Adviser in the application of both observable and unobservable attributes, and it is possible that the fair value determined for a Senior Loan may differ materially from the value that could be realized upon the sale of the Senior Loan. There is no single standard for determining the fair value of an investment. Accordingly, the methodologies the Adviser may use to fair value the Senior Loan may include: 1) fair values provided by an independent third-party valuation firm; 2) mark-to-model valuation techniques; and 3) matrix pricing.

For each Senior Loan that is either: 1) not a broadly syndicated loan; or 2) is a broadly-syndicated loan but has limited liquidity such that the Adviser determines that readily available or indicative market quotations do not reflect fair value, the Adviser may adjust the value of the Senior Loan between quarterly valuations based on changes in the capital markets. To do this, as a proxy for discount rates and market comparables, the Adviser may look to the Morningstar LSTA U.S. Leveraged Loan 100 Index (the “LSTA Index”). The LSTA Index is an equal value-weighted index designed to track the performance of the largest U.S. leveraged loan facilities. The LSTA Index is comprised of senior secured loans denominated in U.S. dollars that meet certain selection criteria. If there are significant moves in the LSTA Index, the Adviser may adjust the value of the Senior Loan using its discretion.

In addition, the values of the Fund’s Senior Loans may be adjusted daily based on changes to the estimated total return that the assets will generate. The Adviser will monitor these estimates and update them as necessary if macro or individual changes warrant any adjustments.

Federal Income Taxes: The Fund has elected to be treated for U.S. federal income tax purposes as a RIC under Subchapter M of the Code. Accordingly, the Fund will generally not pay corporate-level U.S. federal income taxes on any net ordinary income or capital gains that are timely distributed to shareholders. To qualify as a RIC, the Fund must, among other things, meet certain source-of-income and asset diversification requirements and timely distribute at least 90% of its investment company taxable income each year to its shareholders.

Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for the open tax years ended December 31, 2021 to December 31, 2023, or expected to be taken in the Fund’s December 31, 2024 year-end tax returns. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expenses on the Statement of Operations. During the year ended December 31, 2024, the Fund paid $954,396 in excise tax.

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex-dividend date. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the identified cost basis method for financial reporting purposes. Interest income from investments in the “equity” tranche of CLO funds is recorded based upon an estimate of an effective yield to expected maturity utilizing assumed cash flows in accordance with FASB ASC 325-40, Beneficial Interests in Securitized Financials Assets.

Distributions to Shareholders: The Fund normally pays dividends, if any, monthly, and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and interest income the Fund receives from its investments, including short term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than one year.

Cash and Cash Equivalents: Cash and cash equivalents (e.g., U.S. Treasury bills) may include demand deposits and highly liquid investments with original maturities of three months or less. Cash and cash equivalents are carried at cost, which approximates fair value. The Fund deposits its cash and cash equivalents with highly-rated banking corporations and, at times, may exceed the insured limits under applicable law.

3. FAIR VALUE MEASUREMENTS |

The Fund utilizes various inputs to measure the fair value of its investments. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | Level 1 | | - | | Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access at the measurement date. |

| | | Level 2 | | - | | Significant observable inputs (including quoted prices for the identical instrument on an inactive market, quoted prices for similar instruments, interest rates, prepayment spreads, credit risk, yield curves, default rates and similar data). |

| | | Level 3 | | - | | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of the investments) to the extent relevant observable inputs are not available, for the asset or liability at the measurement date. |

|

Annual Report | December 31, 2024 | 21 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used to value the Fund’s investments under the fair value hierarchy levels as of December 31, 2024:

| | Valuation Inputs | | |

Investments in Securities at Value | | Level 1 | | Level 2 | | Level 3 | | Total |

Collateralized Loan Obligations Equity | | $ | — | | $ | — | | $ | 395,853,818 | | $ | 395,853,818 |

Collateralized Loan Obligations Debt | | | — | | | — | | | 15,264,845 | | | 15,264,845 |

Private Investment Funds* | | | — | | | — | | | — | | | 13,712,401 |

Short-Term Investments | | | 23,092,314 | | | — | | | — | | | 23,092,314 |

Total | | $ | 23,092,314 | | $ | — | | $ | 411,118,663 | | $ | 447,923,378 |

The following is a reconciliation of the fair value of investments for which the Fund has used Level 3 unobservable inputs in determining fair value as of December 31, 2024:

| | Balance

as of

December 31,

2023 | | Realized

gain

(loss) | | Amortization/

Accretion | | Change in

unrealized

appreciation

(depreciation) | | Purchases | | Sales/

Paydown | | Transfer

in

Level 3 | | Transfer

out

Level 3 | | Balance

as of

December 31,

2024 |

Collateralized Loan Obligations Equity | | $ | 270,508,689 | | $ | (8,157,533) | | $ | (21,193,896) | | $ | 4,495,271 | | $ | 202,353,022 | | $ | (52,151,735) | | $ | — | | $ | — | | $ | 395,853,818 |

Collateralized Loan Obligations Debt | | | 45,251,907 | | | 1,553,028 | | | 1,437,795 | | | (39,561) | | | — | | | (32,938,324) | | | — | | | — | | | 15,264,845 |

Total | | $ | 315,760,596 | | $ | (6,604,505) | | $ | (19,756,101) | | $ | 4,455,710 | | $ | 202,353,022 | | $ | (85,090,059) | | $ | — | | $ | — | | $ | 411,118,663 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

| | Net Change in

Unrealized Appreciation/

(Depreciation) included

in Statements of

Operations attributable

to Level 3 investments

held at December 31,

2024 |

Collateralized Loan Obligations Equity | | $ | (2,594,816) |

Collateralized Loan Obligations Debt | | | 142,004 |

Total | | $ | (2,452,812) |

The following table summarizes the valuation techniques and significant unobservable inputs used for the Fund’s investments that are categorized in Level 3 of the fair value hierarchy as of December 31, 2024:

Assets | | Fair Value at

December 31,

2024 | | Valuation

Techniques/

Methodlogies | | Unobservable

Input | | Range/Weighted

Average(2) | | Valuation

from an

Increase in

Input(3) |

Collateralized Loan Obligations Equity | | $ | 345,079,115 | | Market Quotes | | NBIB(1) | | 29.62 – 106.25/

77.17 | | Increase |

| | | | 30,879,861 | | Recent Transaction | | Acquisition Cost | | 87.55 – 87.55/

87.55 | | Increase |

| | | | 19,746,842 | | Yield Analysis | | Internal Rate of Return | | 17.00% – 21.70%/

19.62% | | Decrease |

| | | | 148,000 | | Liquidation Net Asset Value | | Broker Quotes | | 1.85 – 1.85/1.85 | | Increase |

Collateralized Loan Obligations Debt | | | 15,264,845 | | Market Quotes | | NBIB(1) | | 96.53 – 101.84/

99.78 | | Increase |

|

Annual Report | December 31, 2024 | 23 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

4. INVESTMENT ADVISORY SERVICES AND OTHER AGREEMENTS |

Flat Rock Global, LLC serves as the investment adviser to the Fund pursuant to the terms of an investment advisory agreement (the “Advisory Agreement”). Under the terms of the Advisory Agreement, the Adviser provides the Fund such investment advice as it deems advisable and furnishes a continuous investment program for the Fund consistent with the Fund’s investment objective and strategies. As compensation for its management services, the Fund pays the Adviser a management fee of 1.375% (as a percentage of the average daily value of total assets), paid monthly in arrears, calculated based on the average daily value of total assets during such period.

In addition to the management fee, the Adviser in entitled to an incentive fee. The incentive fee is calculated and payable quarterly in arrears in an amount equal to 15.0% of the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s “adjusted capital,” equal to 2.00% per quarter (or an annualized hurdle rate of 8.00%), subject to a “catch-up” feature, which allows the Adviser to recover foregone incentive fees that were previously limited by the hurdle rate. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income (including any other fees such as commitment, origination, structuring, diligence and consulting fees or other fees that the Fund receives from portfolio companies) accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser for any administrative services provided by the Adviser and any interest expense and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with payment-in-kind interest and zero-coupon securities), accrued income that the Fund has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. “Adjusted capital” means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund’s distribution reinvestment plan), reduced by amounts paid in connection with purchases of the Fund’s shares pursuant to the Fund’s repurchase program.

The calculation of the incentive fee on pre-incentive fee net investment income for each quarter is as follows:

• No incentive fee is payable in any calendar quarter in which the Fund’s pre-incentive fee net investment income does not exceed the hurdle rate of 2.00% per quarter (or an annualized rate of 8.00%);

• 100% of the Fund’s pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than or equal to 2.352%. This portion of the Fund’s pre-incentive fee net investment income (which exceeds the hurdle rate but is less than or equal to 2.352%) is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 15.0% on all of the Fund’s pre-incentive fee net investment income when its pre-incentive fee net investment income reaches 2.352% in any calendar quarter; and

• 15.0% of the amount of the Fund’s pre-incentive fee net investment income, if any, that exceeds 2.352% in any calendar quarter is payable to the Adviser once the hurdle rate is reached and the catch-up is achieved (15.0% of all pre-incentive fee net investment income thereafter will be allocated to the Adviser).

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

For the year ended December 31, 2024, the Adviser earned $5,436,795 in management fees and $7,774,834 in incentive fees, and voluntarily waived $20,987 in fees. The fees waived by the Adviser are not subject to recoupment.

Effective July 22, 2024, Ultimus Fund Distributors, LLC (the “Distributor”) replaced ALPS Distributors, Inc., as the Fund’s distributor, and Ultimus Fund Solutions, LLC replaced ALPS Fund Services, Inc., as the Fund’s administrator and fund accountant and replaced DST Systems, Inc. as the Fund’s transfer agent.

U.S. Bank N.A. serves as the Fund’s custodian.

U.S. Bank N.A., and the Distributor are not considered affiliates, as defined under the 1940 Act, of the Fund.

The Fund conducts quarterly repurchase offers of 5% of the Fund’s outstanding shares. Repurchase offers in excess of 5% are made solely at the discretion of the Board and investors should not rely on any expectation of repurchase offers in excess of 5%. In the event that a repurchase offer is oversubscribed, shareholders may only be able to have a portion of their shares repurchased.

Quarterly repurchases occur in the months of March, June, September, and December. A repurchase offer notice will be sent to shareholders at least 21 calendar days before the repurchase request deadline. The repurchase price will be the Fund’s NAV determined on the repurchase pricing date, which is ordinarily expected to be the repurchase request deadline. Payment for all shares repurchased pursuant to these offers will be made not later than seven calendar days after the repurchase pricing date.

During the year ended December 31, 2024, the Fund completed four repurchase offers. In these offers, the Fund offered to repurchase no less than 5% of the number of its outstanding shares as of the repurchase pricing dates. The results of the repurchase offers were as follows:

| | Repurchase Offer

#1 | | Repurchase Offer

#2 |

Commencement Date | | February 1, 2024 | | May 2, 2024 |

Repurchase Request Deadline | | March 5, 2024 | | June 5, 2024 |

Repurchase Pricing Date | | March 5, 2024 | | June 5, 2024 |

Amount Repurchased | | $6,115,345 | | $4,961,593 |

Shares Repurchased | | 316,202 | | 250,586 |

|

Annual Report | December 31, 2024 | 25 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

| | Repurchase Offer

#3 | | Repurchase Offer

#4 |

Commencement Date | | August 1, 2024 | | November 4, 2024 |

Repurchase Request Deadline | | September 4, 2024 | | December 4, 2024 |

Repurchase Pricing Date | | September 4, 2024 | | December 4, 2024 |

Amount Repurchased | | $10,591,355 | | $10,112,512 |

Shares Repurchased | | 552,496 | | 523,151 |

Purchases and sales of securities for the year ended December 31, 2024, excluding short-term securities, were as follows:

| | Purchases of Securities | | Proceeds from Sales of Securities |

| | | $216,689,127 | | $85,090,059 |

Classification of Distributions

Distributions are determined in accordance with U.S. federal income tax regulations, which differ from U.S. GAAP, and therefore, may differ significantly in amount or character from net investment income and realized gains for financial statement purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The tax character of distributions paid by the Fund during the periods ended December 31, 2024 and 2023, were as follows:

| | 2024 | | 2023 |

Distributions paid from: | | | | | | |

Ordinary Income | | $ | 48,982,481 | | $ | 31,335,392 |

Long-Term Capital Gain | | | — | | | — |

Total | | $ | 48,982,481 | | $ | 31,335,392 |

Components of Distributable Earnings on a Tax Basis

Permanent book and tax differences, primarily attributable to the tax treatment of non-deductible expenses resulted in reclassifications for the year ended December 31, 2024, as follows:

| | Paid-in Capital | | Accumulated Deficit |

| | | $(690,986) | | $690,986 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

As of December 31, 2024, the components of accumulated earnings/(deficit) on a tax basis for the Fund were as follows:

Undistributed Ordinary Income | | $ | 44,479,737 |

Undistributed Long-Term Capital Gains | | | — |

Capital Loss Carry Forwards | | | (16,330,627) |

Unrealized Appreciation (Depreciation) | | | (44,673,322) |

Total | | $ | (16,524,212) |

Tax Basis of Investments

Net unrealized appreciation/(depreciation) of investments based on federal tax cost as of December 31, 2024, with differences primarily attributable to passive foreign investment companies and adjustments for partnerships, was as follows:

Gross Unrealized Appreciation | | $ | 11,786,699 |

Gross Unrealized Depreciation | | | (56,460,021) |

Net Unrealized Depreciation on Investments | | $ | (44,673,322) |

Tax Cost | | $ | 492,596,700 |

Capital losses

As of December 31, 2024, the Fund had capital loss carryforwards which may reduce the Fund’s taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code and thus may reduce the amount of the distributions to shareholders which would otherwise be necessary to relieve the fund of any liability for federal tax pursuant to the Code. The capital loss carryforwards may be carried forward indefinitely. At December 31, 2024, the Fund had capital loss carry forwards for federal income tax purposes available to offset future capital gains, along with capital loss carryforwards utilized as follows:

Non-Expiring

Short-Term | | Non-Expiring

Long-Term | | Total | | Capital Loss

Carry Forwards

Utilized |

$742,608 | | $15,588,019 | | $16,330,627 | | $— |

In the normal course of business, the Fund invests in financial instruments and enters into financial transactions where risk of potential loss exists due to such things as changes in the market (market risk) or failure or inability of the other party to a transaction to perform (credit and counterparty risk). See below for a detailed description of select principal risks. The following is not intended to be a comprehensive description of all of the potential risks associated with the Fund. The Fund’s prospectus provides a detailed discussion of the Fund’s risks.

|

Annual Report | December 31, 2024 | 27 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

CLO Risk. CLOs are securities backed by an underlying portfolio of loan obligations. CLOs issue classes or “tranches” that vary in risk and yield and may experience substantial losses due to actual defaults, decrease of market value due to collateral defaults and removal of subordinate tranches, market anticipation of defaults and investor aversion to CLO securities as a class. Investments in CLO securities may be riskier and less transparent than direct investments in the underlying loans and debt obligations. The risks of investing in CLOs depend largely on the tranche invested in and the type of the underlying loans in the tranche of the CLO in which the Fund invests. The tranches in a CLO vary substantially in their risk profile, and debt tranches are more senior than equity tranches. The senior tranches are relatively safer because they have first priority on the collateral in the event of default. As a result, the senior tranches of a CLO generally have a higher credit rating and offer lower coupon rates than the junior tranches, which offer higher coupon rates to compensate for their higher default risk. The Fund expects that it will primarily invest in the equity, and to a lesser extent, the junior debt tranches of CLOs. The CLOs in which the Fund may invest may incur, or may have already incurred, debt that is senior to the Fund’s investment. CLOs also carry risks including, but not limited to, interest rate risk and credit risk. Investments in CLOs may be subject to certain tax provisions that could result in the Fund incurring tax or recognizing income prior to receiving cash distributions related to such income. CLOs that fail to comply with certain U.S. tax disclosure requirements may be subject to withholding requirements that could adversely affect cash flows and investment results. Any unrealized losses the Fund experiences with respect to its CLO investments may be an indication of future realized losses. Equity tranches are unrated and equity investors receive no principal payments, if any, until all debt obligations are paid.

Liquidity Risk: The securities issued by CLOs generally offer less liquidity than below investment grade or high-yield corporate debt and are subject to certain transfer restrictions imposed on certain financial and other eligibility requirements on prospective transferees. Other investments the Fund may purchase through privately negotiated transactions may also be illiquid or subject to legal restrictions on their transfer. As a result of this illiquidity, the Fund’s ability to sell certain investments quickly, or at all, in response to changes in economic and other conditions and to receive a fair price when selling such investments may be limited, which could prevent the Fund from making sales to mitigate losses on such investments. In addition, CLOs are subject to the possibility of liquidation upon an event of default, which could result in full loss of value to the CLO equity and junior debt investors. CLO equity tranches are the most likely tranche to suffer a loss of all of their value in these circumstances.

Global Markets Risk: The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years may result in market volatility, and may have long term effects on both the U.S. and global financial markets. For example, Russia’s ongoing military interventions in Ukraine have led to, and may lead to additional sanctions being levied by the United States, European Union and other countries against Russia. Russia’s military incursion and the resulting sanctions could adversely affect global energy and financial markets and thus could affect the value of the Fund’s investments, even beyond any direct exposure the Fund may have to Russian issuers or the adjoining geographic regions. The extent and duration of the military action, sanctions and resulting market disruptions are impossible to predict, but could be substantial. Any such disruptions caused by Russian military action or resulting sanctions may magnify the impact of other risks. In addition, the Israel-Hamas conflict as well as the potential risk for a wider conflict could negatively affect financial markets. Geopolitical tensions introduce uncertainty into global markets.

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

This conflict could disrupt regional trade and supply chains, potentially affecting U.S. businesses with exposure to the region. Additionally, the Middle East plays a pivotal role in the global energy sector, and prolonged instability could impact oil prices, leading to increased costs for businesses and consumers. Furthermore, the U.S.’s diplomatic ties and commitments in the region mean that it might become more directly involved, either diplomatically or militarily, diverting attention and resources. These and any related events could significantly impact the Fund’s performance and the value of an investment in the Fund, even if the Fund does not have direct exposure. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

Credit Risk. The Fund is subject to the risk that the issuer or guarantor of an obligation, or the counterparty to a transaction, may fail, or become less able, to make timely payment of interest or principal or otherwise honor its obligations or default completely. The strategies utilized by the Adviser require accurate and detailed credit analysis of issuers, and there can be no assurance that its analysis will be accurate or complete. The Fund may be subject to substantial losses in the event of credit deterioration or bankruptcy of one or more issuers in its portfolio. Financial strength and solvency of an issuer are the primary factors influencing credit risk. The Fund could lose money if the issuer or guarantor of a debt security is unable or unwilling, or is perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or unwilling, to make timely principal and/or interest payments, or to otherwise honor its obligations.

Condition of the borrowers of the loans underlying the CLOs in which the Fund invests could deteriorate as a result of, among other factors, an adverse development in their business, a change in the competitive environment or an economic downturn. As a result, companies that the Adviser may have expected to be stable may operate, or expect to operate, at a loss or have significant variations in operating results, may require substantial additional capital to support their operations or maintain their competitive position, or may otherwise have a weak financial condition or be experiencing financial distress. In addition, inadequacy of collateral or credit enhancement for a debt obligation may affect its credit risk.

Although the Fund may invest in investments that the Adviser believes are secured by specific collateral, the value of which may exceed the principal amount of the investments at the time of initial investment, there can be no assurance that the liquidation of any such collateral would satisfy the borrower’s obligation in the event of non-payment of scheduled interest or principal payments with respect to such investment, or that such collateral could be readily liquidated. In addition, in the event of bankruptcy of a borrower, the Fund could experience delays or limitations with respect to its ability to realize the benefits of the collateral securing an investment. Under certain circumstances, collateral securing an investment may be released without the consent of the Fund.

Credit risk is typically greater for securities with ratings that are below investment grade (commonly referred to as “junk bonds”). Since the Fund can invest significantly in high-yield investments considered speculative in nature and unsecured investments, this risk may be substantial. The Fund’s right to payment and its security interest, if any, may be subordinated to the payment rights and security interests of more senior creditors. This risk may also be greater to the extent the Fund uses leverage in connection with the management of the Fund. Changes in the actual or perceived creditworthiness of an issuer, or a downgrade or default affecting any of the Fund’s securities, could affect the Fund’s performance.

|

Annual Report | December 31, 2024 | 29 |

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

Valuation Risk: Most of the Fund’s investments are not traded on national securities exchanges, and the Fund does not have the benefit of market quotations or other pricing data from such an exchange. Certain of the Fund’s investments will have the benefit of third-party bid-ask quotations. With respect to investments for which pricing data is not readily available or when such pricing data is deemed not to represent fair value, the Adviser determines fair value using the valuation procedures approved by the Board. There is no single standard for determining fair value in good faith. As a result, determining fair value requires that judgment be applied to the specific facts and circumstances of each portfolio investment while employing a consistently applied valuation process for the types of investments the Fund makes.

Interest Rate Risk: Interest rate sensitivity refers to the change in earnings that may result from changes in the level of interest rates. The Fund intends to fund portions of its investments with borrowings, and at such time, its net investment income will be affected by the difference between the rate at which it invests and the rate at which it borrows. Accordingly, the Fund cannot assure that a significant change in market interest risks will not have a material adverse effect on its net investment income.

The Fund entered into a Credit Agreement with certain funds and accounts managed by Eagle Point Credit Management, LLC, pursuant to which the Lenders agreed to provide the Fund with a term loan of $49,000,000 and a revolver of $6,125,000.

The maximum amount outstanding during the year was $55,125,000. The Fund is charged an interest rate of 6.90% on the initial $28,125,000 tranche and 6.00% on the second $27,000,000 tranche, provided that the Fund maintains an investment grade credit rating from a nationally recognized statistical ratings organization, which was the case for each day for the year ended December 31, 2024. The Credit Facility matured on September 18, 2024 and was not renewed. The Fund is charged a fee on the average daily unused balance of the Credit Facility of 0.75%. The average balance outstanding and weighted average interest rate for the year ended December 31, 2024 was $33,083,333 and 6.53%, respectively.

10. MANDATORILY REDEEMABLE PREFERRED STOCK |

At December 31, 2024, the Fund issued and had outstanding 2,500 shares of Series A Term Preferred Shares, and 2,000 shares of Series B Term Preferred Shares. Both the Series A and Series B Term Preferred shares have a liquidation preference of $10,000 per share plus accrued and unpaid dividends (whether or not declared). The Fund issued 2,000 and 500 shares of Series A Term Preferred Shares on October 27, 2021 and December 3, 2021, respectively. The Fund issued 2,000 shares of Series B Term Preferred Shares on January 28, 2022. The Series A Term Preferred Shares are entitled to a dividend at a rate of 6.00% per year based on the $10,000 liquidation preference before the common stock is entitled to receive any dividends. The Series B Term Preferred Shares are entitled to a dividend at a rate of 5.85% per year based on the $10,000 liquidation preference before the common stock is entitled to receive any dividends. The Series A Term Preferred Shares are redeemable at $10,000 per share plus accrued and unpaid dividends (whether or not declared) exclusively at the Fund’s option commencing on October 27, 2021, for the initial 2,000 shares issued, and December 3, 2021 for the add-on 500 shares issued. The Series B Term Preferred Shares are redeemable at $10,000 per share plus accrued and unpaid dividends (whether or not declared) exclusively at the Fund’s option commencing on January 28, 2022. Debt issuance costs related to Series A Preferred Shares of $380,131 are deferred and amortized over

Flat Rock Opportunity Fund | Notes to Financial Statements |

| | December 31, 2024 |

the period the Series A Term Preferred Shares are outstanding. Debt issuance costs related to Series B Preferred Shares of $510,000 are deferred and amortized over the period the Series B Term Preferred Shares are outstanding.

Series | | Mandatory

Redemption

Date | | Annual

Dividend

Rate | | Shares

Outstanding | | Aggregate

Liquidation

Preference | | Unamortized

Deferred

Issuance

Costs | | Carrying

Value of

Preferred

Shares | | Fair Value

as of

December 31,

2024 |

Series A | | December 15, 2029 | | 6.00% | | 2,500 | | $ | 25,000,000 | | $ | 310,703 | | $ | 24,689,297 | | $ | 23,341,904 |

Series B | | March 15, 2029 | | 5.85% | | 2,000 | | | 20,000,000 | | | 240,874 | | | 19,759,126 | | | 18,745,380 |

| | | | | | | | | $ | 45,000,000 | | $ | 551,577 | | $ | 44,448,423 | | $ | 42,087,284 |