UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23336

Variant Alternative Income Fund

(Exact name of registrant as specified in charter)

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Terrance P. Gallagher

235 West Galena Street

Milwaukee, WI 53212

(Name and address of agent for service)

registrant's telephone number, including area code: (414) 299-2270

Date of fiscal year end: April 30

Date of reporting period: April 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) The Report to Shareholders is attached herewith.

VARIANT ALTERNATIVE INCOME FUND

Annual Report

For the Year Ended April 30, 2022

Variant Alternative Income Fund

Table of Contents

For the Year Ended April 30, 2022

| | |

Management Discussion of Fund Performance (Unaudited) | 2-3 |

Fund Performance (Unaudited) | 4 |

Report of Independent Registered Public Accounting Firm | 5 |

Schedule of Investments | 6-10 |

Portfolio Allocation (Unaudited) | 11 |

Statement of Assets and Liabilities | 12 |

Statement of Operations | 13 |

Statements of Changes in Shareholders’ Equity | 14-15 |

Statement of Cash Flows | 16 |

Financial Highlights | 17 |

Notes to Financial Statements | 18-34 |

Supplemental Information (Unaudited) | 35 |

Fund Management (Unaudited) | 36-38 |

Other Information (Unaudited) | 39-41 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Variant Alternative Income Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

1

Variant Alternative Income Fund

Management Discussion of Fund Performance (Unaudited)

Dear Shareholder,

Variant Investments, LLC (“Variant”) is pleased to provide the audited annual financial statements for the Variant Alternative Income Fund1 (the “Fund”) for the fiscal year that ended April 30, 2022.

This fiscal year included a period of heightened public market volatility generated by macroeconomic uncertainty and geopolitical tensions. We are pleased with the performance of the Fund during this challenging time.

Over the fiscal year, the institutional share class for the Fund (NICHX) delivered a net total return2 of +11.19%. The Fund’s performance benefited from broad diversification across varied underlying exposures. Investments in specialty finance, litigation finance and real estate equity had the greatest contribution to return over the fiscal year. There were some modest detractors to performance in individual months within trade finance and secondaries. We believe the performance compares favorably to many income-oriented risk assets over the same period. The Fund’s focus on private market niches with less economic sensitivity, as well as deal structures, which we believe have strong downside mitigation, supported investment results. We are also pleased with the Fund’s since inception track record3 which includes strong absolute returns, relatively low volatility and limited correlation4 or beta5 to public market indices.

During the fiscal year, the investor share class (UNIQX) was closed and shareholders were converted to the institutional share class on September 17, 2021.

Over the fiscal year, the Fund experienced strong growth in assets under management (“AUM”), increasing by $997 million to end the fiscal year at $1.844 billion. Also, the Fund was able to satisfy all quarterly redemption requests throughout the fiscal year without any proration. With both new and existing clients allocating to the Fund, the Fund’s investor base was further diversified.

New capital continued to be deployed into a wide variety of niche investment opportunities, further diversifying the Fund’s exposures. A complete listing of the Fund’s investments can be found in the Schedule of Investments.

On behalf of the entire Variant team, we thank you for your investment in the Fund. We are honored to be trusted stewards of your capital. We are excited about the year ahead and look forward to working with each of you.

Sincerely,

JB Hayes, Principal | Curt Fintel, Principal | Bob Elsasser, Principal |

1 | The Variant Alternative Income Fund (the “Fund”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified, closed-end management investment company. The Fund operates as an interval fund. The Fund operates under an Agreement and Declaration of Trust (“Declaration of Trust”) dated April 4, 2018 (the “Declaration of Trust”). Variant Investments, LLC serves as the investment adviser (the “Investment Manager”) of the Fund. The Investment Manager is an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended. The Fund has elected to be treated as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). |

2 | The net total return uses geometric returns and reflects the reinvestment of earnings. |

3 | Inception date is October 2, 2017. Between October 2017 and September 2018, the track record includes that of the Variant Alternative Income Fund LP, the predecessor private fund (the “Predecessor Fund”) that converted into the Fund. The Predecessor Fund was, in all material respects, equivalent to the interval fund. For purposes of performance reporting, the Predecessor Fund track record was adjusted to reflect the Fund’s estimated expenses and expense limitations. Specifically, it reflects a management fee of 0.95% and fund expenses capped at 0.50%. |

4 | “Correlation” is the performance relationship between the Fund and the reference indices on a monthly basis over the period. |

5 | “Beta” measures the volatility of the Fund relative to the reference indices over the period. |

2

Variant Alternative Income Fund

Management Discussion of Fund Performance (Unaudited)

(continued)

The Variant Alternative Income Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. There is no guarantee the Fund will achieve its objective. An investment in the Fund should only be made by investors who understand the risks involved, who are able to withstand the loss of the entire amount invested and who can bear the risks associated with the limited liquidity of Shares. A prospective investor must meet the definition of “accredited investor” under Regulation D under the Securities Act of 1933.

Important Risks: Shares are an illiquid investment. You should generally not expect to be able to sell your Shares (other than through the repurchase process), regardless of how the Fund performs. Although the Fund is required to implement a Share repurchase program only a limited number of Shares will be eligible for repurchase by the Fund.

An investment in the Fund is speculative, involves substantial risks, including the risk that the entire amount invested may be lost, and should not constitute a complete investment program. The Fund may leverage its investments by borrowing, use of swap agreements, options or other derivative instruments. The Fund is a non-diversified management investment company, meaning it may be more susceptible to any single economic or regulatory occurrence than a diversified investment company. In addition, the fund is subject to investment related risks of the underlying funds in which it invests, and general economic and market condition risk.

Alternative investments provide limited liquidity and include, among other things, the risks inherent in investing in securities, futures, commodities and derivatives, using leverage and engaging in short sales. The Fund’s investment performance depends, at least in part, on how its assets are allocated and reallocated among asset classes and strategies. Such allocation could result in the Fund holding asset classes or investments that perform poorly or underperform. Investments and investment transactions are subject to various counterparty risks. The counterparties to transactions in over the-counter or “inter-dealer” markets are typically subject to lesser credit evaluation and regulatory oversight compared to members of “exchange-based” markets. This may increase the risk that a counterparty will not settle a transaction because of a credit or liquidity problem, thus causing the Fund to suffer losses. The Fund and its service providers may be prone to operational and information security risks resulting from breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause the Fund to lose proprietary information, suffer data corruption, or lose operational capacity.

PANDEMIC RISK. The continuing spread of an infectious respiratory illness caused by a novel strain of coronavirus (known as COVID-19) has caused volatility, severe market dislocations and liquidity constraints in many markets, including securities the Fund holds, and may adversely affect the Fund’s investments and operations.

BEFORE INVESTING YOU SHOULD CAREFULLY CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES. THIS AND OTHER INFORMATION IS IN THE PROSPECTUS, A COPY OF WHICH MAY BE OBTAINED FROM (877) 770-7717 OR WWW.VARIANTINVESTMENTS.COM. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE YOU INVEST.

Foreside Fund Services, LLC, distributor.

3

Variant Alternative Income Fund

Fund Performance

April 30, 2022 (Unaudited)

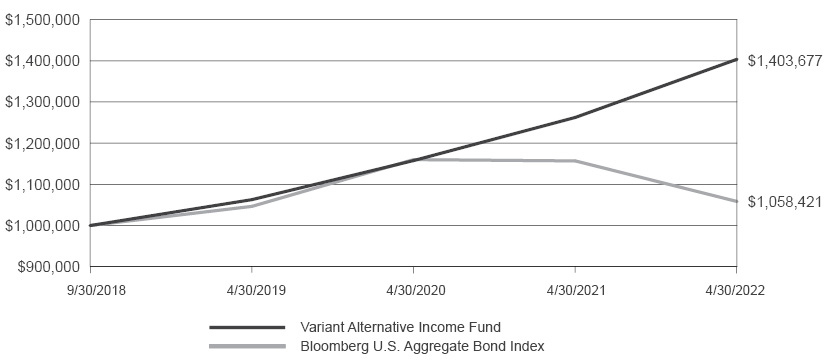

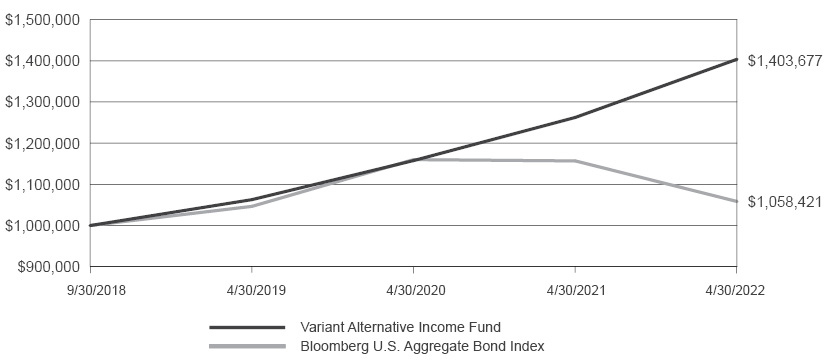

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Institutional Class Shares with a similar investment in the Bloomberg U.S. Aggregate Bond Index. Results include the reinvestment of all dividends and capital gains. The index does not reflect expenses, fees, or sales charges, which would lower performance.

The Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment grade, taxable, fixed income securities in the United States - including government, corporate and international dollar denominated bonds as well as mortgage-backed and asset-backed securities, all with maturities of less than one year. The index is unmanaged and it is not available for investment.

Average Annual Total Returns as of April 30, 2022 | | 1 Year | | | Since Inception | |

Variant Alternative Income Fund (Inception Date October 1, 2018) | | | 11.19 | % | | | 9.92 | % |

Bloomberg U.S. Aggregate Bond Index | | | -8.51 | % | | | 1.60 | % |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 1 (877) 770-7717.

The Expense Limitation and Reimbursement Agreement is in effect until October 31, 2022 and will automatically renew for consecutive one-year terms thereafter. This Agreement, however, may be terminated at any time by the Fund’s Board of Trustees.

Fund performance is shown net of fees. For the Fund’s current expense ratios, please refer to the Financial Highlights Section of this report.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

4

Variant Alternative Income Fund

Report of Independent Registered Public Accounting Firm

For the Year Ended April 30, 2022

To the Shareholders and Board of Trustees of

Variant Alternative Income Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Variant Alternative Income Fund (the “Fund”) as of April 30, 2022, the related statements of operations and cash flows for the year then ended, the statements of changes in shareholders’ equity for each of the two years in the period then ended, the related notes, and the financial highlights for each of the four periods in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2022, the results of its operations and its cash flows for the year then ended, the changes in shareholders’ equity for each of the two years in the period then ended, and the financial highlights for each of the four periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2022, by correspondence with the custodian, brokers, participating lenders, and underlying fund administrators or managers; when replies were not received, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Variant Investments, LLC since 2018.

COHEN & COMPANY, LTD.

Chicago, Illinois

July 7, 2022

5

Variant Alternative Income Fund

Schedule of Investments

April 30, 2022

Investments in private investment companies — 27.0% | | Shares/

Units | | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percent of

Net

Assets | |

Litigation Finance | | | | | | | | | | | | | | | | | | | | |

Equal Access Justice Fund LP (a)(f)(g) | | | — | | | | 3/30/2021 | | | $ | 34,000,000 | | | $ | 35,255,854 | | | | 1.9 | % |

Series 4 - Virage Capital Partners LP (a)(f)(g) | | | — | | | | 9/1/2018 | | | | 1,119,449 | | | | 1,707,838 | | | | 0.1 | |

Series 6 - Virage Capital Partners LP (a)(f)(g) | | | — | | | | 10/31/2019 | | | | 16,000,000 | | | | 19,986,191 | | | | 1.1 | |

Virage Recovery Fund (Cayman) LP (a)(b)(i) | | | 3,828,921 | | | | 8/6/2019 | | | | 15,313,446 | | | | 35,587,842 | | | | 1.9 | |

| | | | | | | | | | | | 66,432,895 | | | | 92,537,725 | | | | 5.0 | |

Portfolio Finance | | | | | | | | | | | | | | | | | | | | |

Crestline Portfolio Financing Fund Offshore B, L.P. and Subsidiary (a)(f)(g) | | | — | | | | 4/25/2018 | | | | 662,077 | | | | 871,211 | | | | 0.0 | |

Crestline Portfolio Financing Fund II (US), L.P. (a)(f)(g) | | | — | | | | 8/26/2021 | | | | 1,602,860 | | | | 1,689,782 | | | | 0.1 | |

Crestline Praeter, L.P. - Zoom (a)(f)(g) | | | — | | | | 12/26/2019 | | | | 2,593,168 | | | | 3,036,552 | | | | 0.2 | |

| | | | | | | | | | | | 4,858,105 | | | | 5,597,545 | | | | 0.3 | |

Real Estate Debt | | | | | | | | | | | | | | | | | | | | |

Oak Harbor Capital NPL VII, LLC (a)(f)(g) | | | — | | | | 3/1/2019 | | | | 9,295,296 | | | | 11,878,590 | | | | 0.6 | |

Quiet Credit I LLC (a)(f)(g) | | | — | | | | 7/15/2021 | | | | 6,250,000 | | | | 6,250,000 | | | | 0.3 | |

Setpoint Residential Fintech Fund LP (a)(f)(g) | | | — | | | | 2/4/2022 | | | | 12,677,105 | | | | 12,777,365 | | | | 0.7 | |

| | | | | | | | | | | | 28,222,401 | | | | 30,905,955 | | | | 1.6 | |

Real Estate Equity | | | | | | | | | | | | | | | | | | | | |

ArrowMark Commercial Real Estate Partners, LLC (a)(f)(g) | | | — | | | | 12/20/2021 | | | | 10,000,000 | | | | 10,601,233 | | | | 0.6 | |

Montreux Healthcare Fund PLC (a)(g) | | | 48,220 | | | | 2/1/2018 | | | | 66,291,144 | | | | 75,203,111 | | | | 4.1 | |

Prime Storage Fund II (Cayman), LP (a)(f)(g) | | | — | | | | 11/20/2017 | | | | 996,147 | | | | 1,324,824 | | | | 0.1 | |

| | | | | | | | | | | | 77,287,291 | | | | 87,129,168 | | | | 4.8 | |

Royalties | | | | | | | | | | | | | | | | | | | | |

MEP Capital II LP (a)(f)(g) | | | — | | | | 11/27/2020 | | | | 8,499,826 | | | | 9,087,597 | | | | 0.5 | |

MEP Capital II LP - Co-investment Sound Royalties (a)(f)(g) | | | — | | | | 8/3/2021 | | | | 2,000,000 | | | | 2,183,355 | | | | 0.1 | |

MEP Capital III LP (a)(f)(g) | | | — | | | | 11/1/2021 | | | | 9,222,103 | | | | 9,451,388 | | | | 0.5 | |

MEP Capital III LP - Co-investment Culture Works (a)(f)(g) | | | — | | | | 11/3/2021 | | | | 2,000,000 | | | | 2,183,355 | | | | 0.1 | |

| | | | | | | | | | | | 21,721,929 | | | | 22,905,695 | | | | 1.2 | |

Secondaries | | | | | | | | | | | | | | | | | | | | |

Armadillo Financial Fund LP (a)(f)(g) | | | — | | | | 12/28/2018 | | | | 55,955 | | | | 8,424 | | | | 0.0 | |

CAMPBELL OPPORTUNITY TIMBER FUND-A, L.P. (a)(f)(g) | | | — | | | | 11/1/2021 | | | | 135,476 | | | | 1,206,836 | | | | 0.1 | |

North Haven Offshore Infrastructure Partners A L.P. (a)(f)(g) | | | — | | | | 7/18/2019 | | | | 1,566,729 | | | | 1,450,381 | | | | 0.1 | |

PWP Asset Based Income ASP Fund (a)(f)(g) | | | — | | | | 3/29/2019 | | | | 916,560 | | | | 1,098,230 | | | | 0.1 | |

Taiga Special Opportunities LP (a)(f)(g) | | | 26,646,784 | | | | 4/22/2022 | | | | 20,700,548 | | | | 26,170,929 | | | | 1.4 | |

Thor Urban Property Fund II Liquidating Trust (a)(g) | | | 35,695 | | | | 12/30/2019 | | | | 4,161,214 | | | | 315,514 | | | | 0.0 | |

| | | | | | | | | | | | 27,536,482 | | | | 29,698,342 | | | | 1.7 | |

Specialty Finance | | | | | | | | | | | | | | | | | | | | |

Blue Elephant Financing Fund I, L.P. (a)(f)(g) | | | — | | | | 3/29/2019 | | | | 926,461 | | | | 372,378 | | | | 0.0 | |

CoVenture - Amzn Credit Opportunities Fund LP (a)(f)(g) | | | — | | | | 3/11/2021 | | | | 30,573,720 | | | | 31,982,063 | | | | 1.7 | |

CoVenture Credit Opportunities Partners Fund LP (a)(f)(g) | | | — | | | | 2/28/2020 | | | | 20,000,000 | | | | 20,825,159 | | | | 1.1 | |

CoVenture - No1 Credit Opportunities Fund LLC (A-2 Series) (a)(f)(g) | | | — | | | | 2/5/2021 | | | | 3,000,000 | | | | 3,032,912 | | | | 0.2 | |

CoVenture - No1 Credit Opportunities Fund LLC (A-3 Series) (a)(f)(g) | | | — | | | | 7/12/2021 | | | | 7,500,000 | | | | 7,572,257 | | | | 0.4 | |

CoVenture - No1 Credit Opportunities Fund LLC (a)(f)(g) | | | — | | | | 12/12/2019 | | | | 1,000,000 | | | | 1,011,962 | | | | 0.1 | |

DelGatto Diamond Fund QP, LP (a)(f)(g) | | | — | | | | 10/3/2019 | | | | 18,750,000 | | | | 22,495,098 | | | | 1.2 | |

OHPC LP Founders Class Interest 1.25% (a)(f)(g) | | | — | | | | 5/27/2021 | | | | 8,170,203 | | | | 8,263,021 | | | | 0.4 | |

OHP II LP (a)(f)(g) | | | — | | | | 3/7/2019 | | | | 4,239,951 | | | | 4,284,609 | | | | 0.2 | |

Silverpeak Special Situations Lending Onshore Fund LP (a)(f)(g) | | | — | | | | 10/19/2021 | | | | 3,830,240 | | | | 4,202,065 | | | | 0.2 | |

Sound Point Discovery Fund LLC(a)(f)(g) | | | — | | | | 3/31/2022 | | | | 10,000,000 | | | | 10,105,233 | | | | 0.5 | |

Turning Rock Fund I LP (a)(f)(g) | | | — | | | | 11/29/2019 | | | | 6,764,750 | | | | 7,463,952 | | | | 0.4 | |

Turning Rock Fund II LP (a)(f)(g) | | | — | | | | 12/29/2021 | | | | 2,164,932 | | | | 2,182,597 | | | | 0.1 | |

| | | | | | | | | | | | 116,920,257 | | | | 123,793,306 | | | | 6.5 | |

The accompanying notes are an integral part of these Financial Statements.

6

Variant Alternative Income Fund

Schedule of Investments

April 30, 2022 (continued)

Investments in private investment companies — 27.0% | | Shares/

Units | | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percent of

Net

Assets | |

Transportation Finance | | | | | | | | | | | | | | | | | | | | |

Aero Capital Solutions Fund, LP (a)(f)(g) | | | — | | | | 1/17/2019 | | | $ | 1,876,350 | | | $ | 1,966,050 | | | | 0.1 | % |

Aero Capital Solutions Fund II, LP (a)(f)(g) | | | — | | | | 9/16/2019 | | | | 40,196,149 | | | | 48,778,500 | | | | 2.6 | |

Aero Capital Solutions Feeder Fund III, LP (a)(f)(g) | | | — | | | | 9/13/2021 | | | | 29,559,738 | | | | 31,306,790 | | | | 1.7 | |

American Rivers Fund, LLC (a)(f)(g) | | | — | | | | 5/2/2019 | | | | 22,972,826 | | | | 26,381,797 | | | | 1.4 | |

Hudson Transport Real Asset Fund LP (a)(f)(g) | | | — | | | | 8/31/2018 | | | | 1,294,390 | | | | 1,593,284 | | | | 0.1 | |

| | | | | | | | | | | | 95,899,453 | | | | 110,026,421 | | | | 5.9 | |

Total investments in private investment companies | | | | | | | | | | | 438,878,813 | | | | 503,146,129 | | | | 27.0 | |

Investments in credit facilities — 51.2% | | | | | | Principal | | | | | | | | | |

Litigation Finance | | | | | | | | | | | | | | | | |

C CUBED CAPITAL PARTNERS LLC, 14.0%, due 4/30/2025 (a)(b) | | | 4/18/2022 | | | | 7,000,000 | | | | 7,000,000 | | | | 0.4 | |

Experity Ventures, LLC, 13.0%, due 11/4/2026 (a)(b) | | | 11/10/2021 | | | | 12,071,002 | | | | 12,071,002 | | | | 0.7 | |

Kerberos Capital Management and SPV I, 17.0%, due 8/16/2024 (a)(b) | | | 12/29/2018 | | | | 55,659,999 | | | | 55,659,999 | | | | 3.0 | |

Kerberos Capital Management and SPV - (Luckett), 19.0%, due 8/16/2024 (a)(b) | | | 1/29/2020 | | | | 8,282,200 | | | | 8,282,200 | | | | 0.5 | |

Kerberos Capital Management SPV I LLC (Pulvers), 20.0%, due 8/16/2024 (a)(b) | | | 11/19/2020 | | | | 10,729,963 | | | | 10,729,963 | | | | 0.6 | |

Legal Capital Products, LLC, 13.0%, due 10/7/2026 (a)(b) | | | 10/7/2021 | | | | 10,568,608 | | | | 10,568,608 | | | | 0.6 | |

| | | | | | | | 104,311,772 | | | | 104,311,772 | | | | 5.8 | |

Portfolio Finance | | | | | | | | | | | | | | | | |

BA Tech Master, LP, 19.5%, due 10/3/2023 (a)(b) | | | 10/2/2018 | | | | 4,915,670 | | | | 4,915,670 | | | | 0.3 | |

Cirrix Finance, LLC, 15.0%, due 11/4/2022 (a)(b) | | | 11/4/2021 | | | | 20,000,000 | | | | 20,000,000 | | | | 1.1 | |

Delgatto Diamond Finance Fund, L.P., 8.0%, due 5/26/2022 (a)(b) | | | 5/28/2021 | | | | 55,500,000 | | | | 55,500,000 | | | | 3.0 | |

Fairway America Fund (VII and VIIQP) LP, 7.0%, due 7/1/2023 (a)(b) | | | 11/29/2019 | | | | 7,500,000 | | | | 7,500,000 | | | | 0.4 | |

Stage Point Capital, LLC, 7.0%, due 5/1/2023 (a)(b) | | | 5/21/2019 | | | | 13,000,000 | | | | 13,000,000 | | | | 0.7 | |

Viscogliosi Brothers, LLC, 15.0%, due 10/31/2023 (a)(b) | | | 10/27/2021 | | | | 5,304,530 | | | | 5,304,530 | | | | 0.3 | |

| | | | | | | | 106,220,200 | | | | 106,220,200 | | | | 5.8 | |

Real Estate Debt | | | | | | | | | | | | | | | | |

Arctic Fox Joint Stock Company, 12.81% due 11/24/2023 (a)(b) | | | 11/24/2021 | | | | 720,000 | | | | 720,000 | | | | 0.0 | |

Drummond Ross Limited, 10.0%, due 8/10/2022 (a)(b) | | | 1/7/2022 | | | | 4,071,203 | | | | 3,800,186 | | | | 0.2 | |

Pier Asset Management (Series 5), 15.0%, due 7/14/2023 (a)(b) | | | 4/27/2021 | | | | 11,231,100 | | | | 11,231,100 | | | | 0.6 | |

TAILOR RIDGE CAPITAL MANAGEMENT, LLC, 9.0%, due 7/31/2023 (a)(b)(c) | | | 8/18/2021 | | | | 1,725,000 | | | | 1,725,000 | | | | 0.1 | |

| | | | | | | | 17,747,303 | | | | 17,476,286 | | | | 0.9 | |

Royalties | | | | | | | | | | | | | | | | |

ARC LPW I, LLC, 13.0%, due 11/30/2025 (a)(b) | | | 9/26/2019 | | | | 84,707,496 | | | | 84,707,496 | | | | 4.6 | |

Specialty Finance | | | | | | | | | | | | | | | | |

5 Core Capital LLC, 13.0%, due 9/30/2022 (a)(b) | | | 10/28/2020 | | | | 6,232,150 | | | | 6,232,150 | | | | 0.3 | |

ACMV Factor Finance SPV LLC, 12.0%, due 11/8/2023 (a)(b) | | | 11/24/2021 | | | | 8,485,000 | | | | 8,485,000 | | | | 0.5 | |

Advantech Servicios Financieros, 14.0%, due 8/13/2026 (a)(b) | | | 11/5/2020 | | | | 11,515,000 | | | | 11,515,000 | | | | 0.6 | |

Aion Acquisition, LLC, 0.0%, due 6/30/2022 (a)(b) | | | 3/31/2021 | | | | 1,283,622 | | | | 309,109 | | | | 0.0 | |

Aion Acquisition, LLC, 0.0%, due 3/31/2023 (a)(b) | | | 3/31/2021 | | | | 538,513 | | | | 359,863 | | | | 0.0 | |

Art Lending, Inc. (Dart Milano S.R.L), 9.5%, due 7/14/2022 (a)(b) | | | 4/14/2021 | | | | 12,154,496 | | | | 12,154,496 | | | | 0.7 | |

Art Lending, Inc. (Dart Milano S.R.L 2), 8.68%, due 12/20/2022 (a)(b) | | | 12/17/2021 | | | | 13,957,126 | | | | 13,957,126 | | | | 0.8 | |

Art Lending, Inc. (Procacini S.L. - 1), 10.0%, due 8/31/2022 (a)(b) | | | 8/26/2020 | | | | 2,430,956 | | | | 2,430,956 | | | | 0.1 | |

Art Lending, Inc. (Procacini S.L. - 2), 9.5%, due 7/14/2022 (a)(b) | | | 4/14/2021 | | | | 4,047,827 | | | | 4,047,827 | | | | 0.2 | |

Art Money International, Co., 8.0%, due 12/9/2023 (a)(b) | | | 12/9/2019 | | | | 435,000 | | | | 435,000 | | | | 0.0 | |

Art Money U.S., Inc., 12.0%, due 7/1/2023 (a)(b) | | | 6/12/2018 | | | | 3,500,000 | | | | 3,500,000 | | | | 0.2 | |

AVISTA COLOMBIA S.A.S, 12.59%, due 3/29/2023 (a)(b) | | | 3/29/2021 | | | | 5,600,000 | | | | 5,600,000 | | | | 0.3 | |

Bandon VAIF, LLC, 12.0%, due 1/31/2023 (a)(b) | | | 2/10/2020 | | | | 6,050,384 | | | | 3,647,939 | | | | 0.2 | |

Bandon VAIF, LLC, 15.0%, due 1/24/2024 (a)(b) | | | 2/15/2022 | | | | 52,000 | | | | 52,000 | | | | 0.0 | |

Bastion Funding IV LLC (Community Finance), 12.0%, due 12/31/2024 (a)(b) | | | 1/19/2022 | | | | 5,064,292 | | | | 5,064,292 | | | | 0.3 | |

The accompanying notes are an integral part of these Financial Statements.

7

Variant Alternative Income Fund

Schedule of Investments

April 30, 2022 (continued)

Investments in credit facilities — 50.0% | | First

Acquisition

Date | | | Principal | | | Fair Value | | | Percent of

Net

Assets | |

Specialty Finance (Continued) | | | | | | | | | | | | | | | | |

Bastion Funding IV LLC (Expansion Capital Group), 11.00%, due 8/31/2024 (a)(b) | | | 1/19/2022 | | | $ | 9,400,000 | | | $ | 9,400,000 | | | | 0.5 | % |

Bastion Funding IV LLC (Kornerstone), 13.50%, due 7/15/2024 (a)(b) | | | 1/19/2022 | | | | 6,146,000 | | | | 6,146,000 | | | | 0.3 | |

BPIIHR HOLDCO, LLC, 16.0%, due 10/28/2026 (a)(b) | | | 11/1/2021 | | | | 2,020,000 | | | | 2,020,000 | | | | 0.1 | |

Byzfunder Funding, LLC, 13.50%, due 9/5/2023 (a)(b) | | | 10/22/2021 | | | | 4,915,605 | | | | 4,915,605 | | | | 0.3 | |

Coromandel Credit Facility, 9.0%, due 7/1/2023 (a)(b) | | | 1/13/2020 | | | | 44,846,000 | | | | 44,846,000 | | | | 2.4 | |

EDU Growth Capital Management PTE, Ltd., 12.5%, due 11/19/2023 (a)(b) | | | 4/27/2021 | | | | 2,527,660 | | | | 2,527,660 | | | | 0.1 | |

Equity Link, S.A.P.I. De C.V., 10.0%, due 4/12/2024 (a)(b) | | | 4/29/2021 | | | | 4,830,000 | | | | 4,830,000 | | | | 0.3 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust - 10.25%, due 4/15/2023 (a)(b) | | | 4/14/2021 | | | | 7,652,000 | | | | 7,205,010 | | | | 0.4 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust - 11.25%, due 1/19/2023 (a)(b) | | | 1/20/2021 | | | | 10,000,000 | | | | 9,337,293 | | | | 0.5 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust - 13.0%, due 11/9/2022 (a)(b) | | | 11/6/2020 | | | | 30,000,000 | | | | 29,828,094 | | | | 1.6 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust - 12.5%, due 9/6/22 (a)(b) | | | 9/7/2021 | | | | 10,000,000 | | | | 9,463,755 | | | | 0.5 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust - 12.0%, due 3/22/2024 (a)(b) | | | 3/21/2022 | | | | 5,000,000 | | | | 4,761,855 | | | | 0.3 | |

Grupo Olinx, S.A.P.I. de C.V., SOFOM, E.N.R., 12.11%, due 2/22/2025 (a)(b) | | | 8/12/2021 | | | | 9,500,000 | | | | 9,500,000 | | | | 0.5 | |

Hash Maps Labs, Inc., 12.0%, due 3/31/2024 (a)(b) | | | 3/23/2021 | | | | 2,474,447 | | | | 2,474,447 | | | | 0.1 | |

KY LAN ASSET FINANCE 1, 9.5%, due 1/26/2024 (a)(b) | | | 1/26/2022 | | | | 8,175,727 | | | | 8,175,727 | | | | 0.4 | |

Lambda School II SPV LLC, 12.0%, due 10/25/2025 (a)(b) | | | 10/19/2020 | | | | 457,473 | | | | 457,473 | | | | 0.0 | |

Lambda School III SPV LLC, 12.0%, due 5/17/2024 (a)(b) | | | 6/18/2021 | | | | 2,289,833 | | | | 2,289,833 | | | | 0.1 | |

LCA Crackpital, S.A.P.I. de C.V. SOFOM, E.N.R., 15.25%, due 4/21/2023 (a)(b) | | | 4/21/2021 | | | | 3,500,086 | | | | 3,500,086 | | | | 0.2 | |

Lendable Asset Management LLC (Payjoy), 14.5%, due 11/25/2024 (a)(b) | | | 1/13/2021 | | | | 5,000,000 | | | | 5,000,000 | | | | 0.3 | |

Lendable Asset Management LLC (Terrapay), 10.75%, due 12/26/2024 (a)(b) | | | 1/10/2022 | | | | 5,000,000 | | | | 5,000,000 | | | | 0.3 | |

MARINE STREET, L.P., 9.0%, due 1/31/2026 (a)(b) | | | 3/22/2022 | | | | 17,780,916 | | | | 17,780,916 | | | | 1.0 | |

Pier Asset Management LLC, (Series 6), 14.5%, due 2/17/2024 (a)(b) | | | 2/9/2022 | | | | 18,013,052 | | | | 18,013,052 | | | | 1.0 | |

PT Awan Tunai Indonesia, 11.93%, due 5/19/2023 (a)(b) | | | 9/9/2020 | | | | 11,500,200 | | | | 11,500,200 | | | | 0.6 | |

PT SOLUSI DIGITAL INTERASIA, 9.3%, due 10/23/2022 (a)(b) | | | 11/11/2020 | | | | 3,800,000 | | | | 3,800,000 | | | | 0.2 | |

RAINFOREST LIFE PTE. LTD., 14.0%, due 8/20/2024 (a)(b) | | | 8/20/2021 | | | | 12,337,793 | | | | 12,337,793 | | | | 0.7 | |

RIVONIA ROAD FUND LP, 11.0% + LIBOR (3% Floor), due 10/28/2023 (a)(b)(c) | | | 11/12/2021 | | | | 1,922,851 | | | | 1,922,851 | | | | 0.1 | |

RKB Bridge Solutions Credit Facility, SOFR + 6.75%, due 12/10/2022 (a)(b)(c) | | | 12/13/2019 | | | | 22,235,000 | | | | 22,235,000 | | | | 1.2 | |

RKB Bridge Solutions Credit Facility, 7.75%, due 3/31/2025 (a)(b) | | | 4/21/2022 | | | | 1,170,000 | | | | 1,170,000 | | | | 0.1 | |

Salaryo Credit Facility, 11.0%, due 4/15/2023 (a)(b) | | | 1/30/2020 | | | | 5,000,000 | | | | 5,000,000 | | | | 0.3 | |

Star Strong Capital, 9.0%, due 1/24/2025 (a)(b) | | | 8/9/2019 | | | | 73,996,207 | | | | 73,996,207 | | | | 4.0 | |

Star Strong Funding LLC, 8.0%, due 12/31/2023 (a)(b) | | | 2/4/2022 | | | | 697,418 | | | | 697,418 | | | | 0.0 | |

STAT CAPITAL SPV LLC, 10.75%, due 4/28/2026 (a)(b) | | | 4/29/2022 | | | | 2,000,000 | | | | 2,000,000 | | | | 0.1 | |

TCM Produce LLC, 16.0%, due 10/15/2022 (a)(b) | | | 5/19/2021 | | | | 10,295,000 | | | | 10,295,000 | | | | 0.6 | |

Vantage Borrower SPV I LLC, 12.0%, due 4/30/2024 (a)(b) | | | 9/11/2020 | | | | 3,000,000 | | | | 3,000,000 | | | | 0.2 | |

Wall St. Funding, 13.0%, due 8/18/2022 (a)(b) | | | 5/7/2021 | | | | 8,095,084 | | | | 8,095,084 | | | | 0.4 | |

Watu Holdings Ltd, 13.0%, due 5/7/2024 (a)(b) | | | 4/11/2022 | | | | 10,000,000 | | | | 10,000,000 | | | | 0.5 | |

| | | | | | | | 456,924,718 | | | | 451,313,117 | | | | 24.4 | |

Trade Finance | | | | | | | | | | | | | | | | |

Drip Trade Finance Series 2020-L, 7.0%, due 6/30/2022 (a)(b) | | | 7/30/2020 | | | | 1,000,000 | | | | 1,000,000 | | | | 0.1 | |

Drip Trade Finance Series 2020-P, 7.0%, due 8/28/2022 (a)(b) | | | 8/28/2020 | | | | 2,000,000 | | | | 2,000,000 | | | | 0.1 | |

Drip Trade Finance Series 2020-W, 7.0%, due 11/1/2022 (a)(b) | | | 10/30/2020 | | | | 1,000,000 | | | | 1,000,000 | | | | 0.1 | |

Drip Trade Finance Series 2022-D, 7.0%, due 8/15/2022 (a)(b) | | | 2/14/2022 | | | | 5,000,000 | | | | 5,000,000 | | | | 0.3 | |

MEDTRADE CAPITAL, LLC, 0.0%, due 7/31/2025(a)(b) | | | 4/30/2022 | | | | 93,172,534 | | | | 93,172,534 | | | | 5.0 | |

Octagon Asset Management, LLC - (Deal: Tru Grit 7), 24.0%, due 9/30/2022 (a)(b) | | | 3/9/2021 | | | | 20,714,501 | | | | 20,714,501 | | | | 1.1 | |

| | | | | | | | 122,887,035 | | | | 122,887,035 | | | | 6.7 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these Financial Statements.

8

Variant Alternative Income Fund

Schedule of Investments

April 30, 2022 (continued)

Investments in credit facilities — 51.2% | | First

Acquisition

Date | | | Principal | | | Fair Value | | | Percent of

Net

Assets | |

Warehouse Facilities | | | | | | | | | | | | | | | | |

Edly WH Investors 2019-1, LLC, 12.0%, due 12/4/2023 (a)(b)(d) | | | 10/9/2019 | | | $ | 2,454,423 | | | $ | 2,454,423 | | | | 0.1 | % |

Homelight Homes Real Estate, LLC, 12.0%, due 2/28/2023 (a)(b) | | | 10/8/2020 | | | | 37,801,382 | | | | 37,801,382 | | | | 2.0 | |

Rivonia Road Accept, LLC, 8.0%, due 11/12/2022 (a)(b) | | | 2/5/2021 | | | | 6,172,202 | | | | 6,172,202 | | | | 0.3 | |

| | | | | | | | 46,428,007 | | | | 46,428,007 | | | | 2.4 | |

Total investments in credit facilities | | | | | | | 939,226,532 | | | | 933,343,913 | | | | 51.2 | |

Investments in special purpose vehicles — 12.3% | | Shares/

Units | | | | | | | Cost | | | | | | | | | |

Litigation Finance | | | | | | | | | | | | | | | | | | | | |

YS CF LawFF VII LLC (a)(b) | | | — | | | | 4/5/2018 | | | | 500,000 | | | | 500,000 | | | | 0.0 | |

Real Estate Debt | | | | | | | | | | | | | | | | | | | | |

Monticello Funding, LLC Series BTH-3 (a)(f)(g) | | | — | | | | 6/29/2018 | | | | 619,612 | | | | 619,612 | | | | 0.0 | |

Monticello Funding, LLC Series BTH-31 (a)(f)(g) | | | — | | | | 5/29/2019 | | | | 664,422 | | | | 664,422 | | | | 0.0 | |

Monticello Funding, LLC Series BTH-47 (a)(f)(g) | | | — | | | | 12/22/2020 | | | | 3,000,000 | | | | 3,000,000 | | | | 0.2 | |

Monticello Funding, LLC Series BTH-48 (a)(f)(g) | | | — | | | | 7/23/2021 | | | | 2,250,000 | | | | 2,250,000 | | | | 0.1 | |

Monticello Funding, LLC Series BTH-49 (a)(f)(g) | | | — | | | | 8/16/2021 | | | | 592,105 | | | | 592,105 | | | | 0.0 | |

Monticello Funding, LLC Series BTH-54 (a)(f)(g) | | | — | | | | 12/17/2021 | | | | 1,990,161 | | | | 1,990,161 | | | | 0.1 | |

Monticello Funding, LLC Series BTH-55 (a)(f)(g) | | | — | | | | 12/17/2021 | | | | 2,500,000 | | | | 2,500,000 | | | | 0.1 | |

Monticello Funding, LLC Series BTH-56 (a)(f)(g) | | | — | | | | 12/17/2021 | | | | 7,333,857 | | | | 7,333,857 | | | | 0.4 | |

Monticello Structured Products, LLC Series MSP-17 (a)(f)(g) | | | — | | | | 12/13/2021 | | | | 2,000,000 | | | | 2,000,000 | | | | 0.1 | |

Monticello Structured Products, LLC Series SH-52 (a)(f)(g) | | | — | | | | 3/30/2022 | | | | 1,500,000 | | | | 1,498,864 | | | | 0.1 | |

| | | | | | | | | | | | 22,450,157 | | | | 22,449,021 | | | | 1.1 | |

Real Estate Equity | | | | | | | | | | | | | | | | | | | | |

CDMX DEBT FUND, LLC (a)(f)(g) | | | — | | | | 4/25/2022 | | | | 28,540,178 | | | | 28,406,286 | | | | 1.5 | |

CMF II Portfolio East Bridge, LLC (a)(f) | | | — | | | | 2/15/2022 | | | | 20,000,000 | | | | 20,893,151 | | | | 1.1 | |

CMF III Gates Portfolio, LLC (a)(f) | | | — | | | | 2/25/2022 | | | | 12,388,000 | | | | 12,527,299 | | | | 0.7 | |

CX Alexandria Depositor, LLC (a)(f) | | | — | | | | 10/22/2021 | | | | 125,250 | | | | 127,913 | | | | 0.0 | |

CX Cypress McKinney Falls Depositor, LLC (a)(f) | | | — | | | | 11/24/2021 | | | | 8,850,000 | | | | 9,480,896 | | | | 0.5 | |

CX Foundry Yards Depositor, LLC (a)(f) | | | — | | | | 2/11/2022 | | | | 4,413,500 | | | | 4,474,634 | | | | 0.2 | |

CX Heritage Depositor, LLC (a)(f) | | | — | | | | 9/15/2021 | | | | 225,000 | | | | 228,506 | | | | 0.0 | |

CX Ravella at Town Center Depositor, LLC (a)(f) | | | — | | | | 2/25/2022 | | | | 5,307,500 | | | | 5,358,546 | | | | 0.3 | |

CX Riverstone Depositor, LLC (a)(f) | | | — | | | | 9/15/2021 | | | | 260,000 | | | | 267,384 | | | | 0.0 | |

CX Station at Clift Farm Depositor, LLC (a)(f) | | | — | | | | 12/27/2021 | | | | 11,800,000 | | | | 12,520,931 | | | | 0.7 | |

| | | | | | | | | | | | 91,909,428 | | | | 94,285,546 | | | | 5.0 | |

Royalties | | | | | | | | | | | | | | | | | | | | |

Round Hill Music Carlin Coinvest, LP (e)(f)(g) | | | — | | | | 10/1/2017 | | | | 929,104 | | | | 1,113,152 | | | | 0.1 | |

Specialty Finance | | | | | | | | | | | | | | | | | | | | |

Cirrix Investments, LLC (a)(f)(g) | | | — | | | | 1/27/2022 | | | | 5,000,000 | | | | 5,237,265 | | | | 0.3 | |

CoVenture - Clearbanc Special Assets Fund LP (a)(f)(g) | | | — | | | | 3/12/2019 | | | | 1,500,000 | | | | 1,512,929 | | | | 0.1 | |

PSC US BADGER LLC (a)(f)(g) | | | — | | | | 10/20/2021 | | | | 14,241,078 | | | | 14,320,219 | | | | 0.8 | |

Segregated Investment Vehicle I, SP (a segregated portfolio of Lendable SPC), 12.18% (a)(f)(g) | | | — | | | | 7/31/2020 | | | | 90,286,853 | | | | 91,241,360 | | | | 4.9 | |

| | | | | | | | | | | | 111,027,931 | | | | 112,311,773 | | | | 6.1 | |

Transportation Finance | | | | | | | | | | | | | | | | | | | | |

YS Vessel Deconstruction I (a)(b) | | | — | | | | 8/26/2018 | | | | 500,000 | | | | 200,000 | | | | 0.0 | |

Total investments in special purpose vehicles | | | | | | | | | | | 227,316,621 | | | | 230,859,492 | | | | 12.3 | |

The accompanying notes are an integral part of these Financial Statements.

9

Variant Alternative Income Fund

Schedule of Investments

April 30, 2022 (continued)

Investments in direct equities — 0.2% | | Shares/

Units | | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percent of

Net

Assets | |

Royalties | | | | | | | | | | | | | | | | | | | |

ARC LPW I, LLC Warrants, due 3/31/2024 (a)(b) | | | 3,063 | | | | 10/3/2019 | | | $ | 0 | | $ | 22,358 | | | | 0.0 | % |

Specialty Finance | | | | | | | | | | | | | | | | | | | |

Aion Financial - Equity (a)(b) | | | 219,220 | | | | 3/31/2021 | | | | 22 | | | 349,125 | | | | 0.0 | |

Art Lending, Inc. (Dart Milano Profit Share), due 12/20/2022 (a)(b) | | | — | | | | 6/2/2021 | | | | 0 | | | 25,413 | | | | 0.0 | |

Art Lending, Inc. (Dart Milano 2 Profit Share), due 4/7/2023 (a)(b) | | | — | | | | 12/17/2021 | | | | 0 | | | 124,618 | | | | 0.0 | |

Art Lending, Inc. (Procacini S.L. - 1 Profit Share), due 8/31/2022 (a)(b) | | | — | | | | 8/26/2020 | | | | 0 | | | 227,848 | | | | 0.0 | |

Art Lending, Inc. (Procacini S.L. - 2 Profit Share), due 4/7/2023 (a)(b) | | | — | | | | 4/14/2021 | | | | 0 | | | 373,097 | | | | 0.0 | |

Art Money International, Co. - Convertible Shares, due 12/9/2023 (a)(b) | | | — | | | | 11/5/2021 | | | | 0 | | | 59,661 | | | | 0.0 | |

Coromandel SPV LLC - Warrants, due 7/30/2022 (a)(b) | | | — | | | | 9/8/2021 | | | | 0 | | | 107,553 | | | | 0.0 | |

INTERNEX CAPITAL LLC (a)(b) | | | 359,701 | | | | 4/1/2022 | | | | 1,250,000 | | | 1,250,000 | | | | 0.1 | |

RAINFOREST LIFE PTE. LTD. - Warrants (a)(b) | | | 61,370 | | | | 8/20/2021 | | | | 0 | | | 106,200 | | | | 0.0 | |

STAR STRONG FUNDING LLC (a)(b) | | | — | | | | 4/27/2022 | | | | 348,000 | | | 348,000 | | | | 0.0 | |

Vantage Borrower SPV I LLC Warrants, due 4/30/2024 (a)(b) | | | 29,207 | | | | 1/27/2021 | | | | 0 | | | 1,391,903 | | | | 0.1 | |

| | | | | | | | | | | | 1,598,022 | | | 4,363,418 | | | | 0.2 | |

Trade Finance | | | | | | | | | | | | | | | | | | | |

Octagon Asset Management, LLC - (Deal: Tru Grit 7) - Warrants, due 4/30/2022 (a)(b) | | | — | | | | 5/18/2021 | | | | 0 | | | 292,500 | | | | 0.0 | |

Total investments in direct equities | | | | | | | | | | | 1,598,022 | | | 4,678,276 | | | | 0.2 | |

| | | | | | | | | | | | | | | | | | | | |

Investments in money market instruments — 6.9% | | | | | | | | | | | | | | | | | | | |

GS Financial Square Government Fund, Institutional Shares, 0.29% (a)(h) | | | 128,750,098 | | | | | | | | 128,750,098 | | | 128,750,098 | | | | 6.9 | |

Total investments in money market instruments | | | | | | | | | | | 128,750,098 | | | 128,750,098 | | | | 6.9 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments (cost $1,735,770,085) | | | | | | | | | | | | | | 1,800,777,908 | | | | 97.6 | |

Other assets less liabilities | | | | | | | | | | | | | | 56,488,288 | | | | 2.4 | |

Net Assets | | | | | | | | | | | | | | $1,857,266,196 | | | | 100.0 | |

(a) | Security serves as collateral for the Fund’s revolving credit facility, when in use during the year. See Note 11. |

(b) | Value was determined using significant unobservable inputs. |

(c) | Variable rate security. |

(d) | Variable maturity dates maturing through 9/30/2023. |

(e) | 100% of this special purpose vehicle is invested in one music catalog. |

(f) | Private investment company or special purpose vehicle does not issue shares or units. |

(g) | Investment valued using net asset value per share (or its equivalent) as a practical expedient. See Note 13 for respective investment categories and redemptive restrictions. |

(h) | Rate listed is the 7-day effective yield at 4/30/2022. |

(i) | Private investment company is part of the MSPR SPAC. The Fund’s valuation is made up of its share of the SPAC plus a preferred return. |

| | FUTURES CONTRACTS | | Expiration

Date | | Number of

Contracts

Long

(Short) | | | Notional

Value | | | Value at

April 30,

2022 | | | Unrealized

Appreciation

(Depreciation) | |

Foreign Exchange Futures | | | | | | | | | | | | | | | | | |

CME Australian Dollar | June 2022 | | | (883) | | | $ | (65,032,932 | ) | | $ | (62,578,210 | ) | | $ | 2,454,722 | |

CME Euro Dollar | June 2022 | | | (30) | | | | (4,140,869 | ) | | | (3,970,875 | ) | | | 169,994 | |

CME Mexican Peso | June 2022 | | | (1,178) | | | | (28,856,935 | ) | | | (28,707,860 | ) | | | 149,075 | |

TOTAL FUTURES CONTRACTS | | | | | | | $ | (98,030,736 | ) | | $ | (95,256,945 | ) | | $ | 2,773,791 | |

The accompanying notes are an integral part of these Financial Statements.

10

Variant Alternative Income Fund

Portfolio Allocation (Unaudited)

April 30, 2022

Investment Type as a Percentage of Total Net Assets As Follows:

Security Type/Sector | | Percent of

Total

Net Assets | |

Credit Facilities | | | 51.2 | % |

Private Investment Companies | | | 27.0 | % |

Special Purpose Vehicles | | | 12.3 | % |

Direct Equities | | | 0.2 | % |

Short-Term Investments | | | 6.9 | % |

Total Investments | | | 97.6 | % |

Other assets less liabilities | | | 2.4 | % |

Total Net Assets | | | 100.0 | % |

The accompanying notes are an integral part of these Financial Statements.

11

Variant Alternative Income Fund

Statement of Assets and Liabilities

April 30, 2022

Assets | | | | |

Investments, at fair value (cost $1,735,770,085) | | $ | 1,800,777,908 | |

Unrealized appreciation on open futures contracts | | | 2,773,791 | |

Cash | | | 1,558,598 | |

Cash deposited with broker for futures contracts | | | 6,901,507 | |

Receivable for Fund shares sold | | | 8,765,496 | |

Receivable for investments sold | | | 6,210,025 | |

Contributions paid in advance | | | 14,418,631 | |

Interest receivable | | | 18,247,738 | |

Prepaid expenses | | | 637,900 | |

Total Assets | | | 1,860,291,594 | |

| | | | | |

Liabilities | | | | |

Foreign currency due to broker, at value (proceeds $590) | | | 563 | |

Due to Investment Manager | | | 1,393,416 | |

Audit fees payable | | | 176,905 | |

Accounting and administration fees payable | | | 109,918 | |

SEC fees payable | | | 54,471 | |

Custody fees payable | | | 12,332 | |

Interest received not yet earned | | | 1,251,040 | |

Other Liabilities | | | 26,753 | |

Total Liabilities | | | 3,025,398 | |

| | | | | |

Net Assets | | $ | 1,857,266,196 | |

| | | | | |

Components of Net Assets: | | | | |

Paid-in Capital (par value of $0.01 with an unlimited amount of shares authorized) | | $ | 1,758,050,843 | |

Total distributable earnings | | | 99,215,353 | |

Net Assets | | $ | 1,857,266,196 | |

| | | | | |

Institutional Class Shares: | | | | |

Net assets applicable to shares outstanding | | $ | 1,857,266,196 | |

Shares of beneficial interest issued and outstanding | | | 65,448,093 | |

Net asset value per share | | $ | 28.38 | |

The accompanying notes are an integral part of these Financial Statements.

12

Variant Alternative Income Fund

Statement of Operations

For the Year Ended April 30, 2022

Investment Income | | | | |

Interest (net of withholding taxes, $123,470) | | $ | 79,672,319 | |

Distributions from private investment funds and special purpose vehicles | | | 22,040,722 | |

Total Investment Income | | | 101,713,041 | |

| | | | | |

Expenses | | | | |

Investment management fees | | | 12,216,978 | |

Accounting and administration fees | | | 1,022,283 | |

Legal fees | | | 302,829 | |

Transfer Agent fees | | | 198,801 | |

Audit fees | | | 181,758 | |

Custody fees | | | 98,119 | |

Trustee fees | | | 63,250 | |

Blue sky fees | | | 62,388 | |

Insurance fees | | | 40,773 | |

Chief Compliance Officer fees | | | 26,210 | |

12b-1 fees | | | 3,262 | |

Other expenses | | | 292,338 | |

Total expenses | | | 14,508,989 | |

| | | | | |

Net Expenses, before revolving credit facility fees | | | 14,508,989 | |

Revolving credit facility fees | | | 267,019 | |

| | | | | |

Net Expenses | | | 14,776,008 | |

| | | | | |

Net Investment Income | | | 86,937,033 | |

| | | | | |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) on: | | | | |

Investments | | | 522,963 | |

Futures contracts | | | 2,887,599 | |

Foreign currency transactions | | | (239,690 | ) |

Capital gain distributions from private investment companies | | | 65,348 | |

Net realized gain | | | 3,236,220 | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 44,523,821 | |

Foreign currency translations | | | (118,795 | ) |

Futures contracts | | | 2,578,546 | |

Net change in unrealized appreciation (depreciation) | | | 46,983,572 | |

Net realized and unrealized gain (loss) | | | 50,219,792 | |

| | | | | |

Net Increase in Net Assets resulting from Operations | | $ | 137,156,825 | |

The accompanying notes are an integral part of these Financial Statements.

13

Variant Alternative Income Fund

Statements of Changes in Shareholders’ Equity

| | | For the

Year Ended

April 30, 2022 | | | For the

Year Ended

April 30, 2021 | |

Increase (decrease) in Net Assets from: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 86,937,033 | | | $ | 35,806,727 | |

Net realized gain (loss) | | | 3,236,220 | | | | (2,638,628 | ) |

Net change in unrealized appreciation (depreciation) | | | 46,983,572 | | | | 17,198,882 | |

Net increase in net assets resulting from operations | | | 137,156,825 | | | | 50,366,981 | |

| | | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

Distributions: | | | | | | | | |

Institutional Class | | | (67,629,289 | ) | | | (21,822,499 | ) |

Investor Class | | | (39,311 | ) | | | (86,089 | ) |

From return of capital: | | | | | | | | |

Institutional Class | | | (11,493,656 | ) | | | (13,246,095 | ) |

Investor Class | | | (6,681 | ) | | | (59,549 | ) |

Total distributions to shareholders | | | (79,168,937 | ) | | | (35,214,232 | ) |

| | | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Institutional Class Shares | | | | | | | | |

Net proceeds from shares sold: | | | 1,013,005,180 | | | | 500,962,754 | |

Exchange from Investor Class: | | | 4,086,999 | | | | — | |

Reinvestment of distributions: | | | 16,594,573 | | | | 6,201,223 | |

Cost of shares repurchased: | | | (80,846,791 | ) | | | (53,720,257 | ) |

Net increase in net assets from Institutional Class Shares capital transactions | | | 952,839,961 | | | | 453,443,720 | |

| | | | | | | | | |

Investor Class Shares 1 | | | | | | | | |

Net proceeds from shares sold: | | | 1,582,939 | | | | 1,023,041 | |

Exchange to Institutional Class | | | (4,086,999 | ) | | | — | |

Reinvestment of distributions: | | | 5,367 | | | | 19,289 | |

Cost of shares repurchased: | | | (291,152 | ) | | | (892,038 | ) |

Net increase (decrease) in net assets from Investor Class Shares capital transactions | | | (2,789,845 | ) | | | 150,292 | |

| | | | | | | | | |

Net increase in net assets resulting from capital transactions | | | 950,050,116 | | | | 453,594,012 | |

| | | | | | | | | |

Total increase in net assets | | | 1,008,038,004 | | | | 468,746,761 | |

| | | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of period | | | 849,228,192 | | | | 380,481,431 | |

End of period | | $ | 1,857,266,196 | | | $ | 849,228,192 | |

1 | On September 17, 2021, Investor Class Shares were converted into Institutional Class Shares, and Investor Class Shares as a class of Shares of the Fund was terminated. |

The accompanying notes are an integral part of these Financial Statements.

14

Variant Alternative Income Fund

Statements of Changes in Shareholders’ Equity

(Continued)

| | | For the

Year Ended

April 30, 2022 | | | For the

Year Ended

April 30, 2021 | |

Share Transactions: | | | | | | | | |

Institutional Class Shares | | | | | | | | |

Issued | | | 36,317,834 | | | | 18,800,786 | |

Exchange from Investor Class | | | 145,429 | | | | — | |

Reinvested | | | 596,368 | | | | 234,266 | |

Repurchased | | | (2,863,603 | ) | | | (2,002,794 | ) |

Change in Institutional Class Shares | | | 34,196,028 | | | | 17,032,258 | |

Investor Class Shares 1 | | | | | | | | |

Issued | | | 57,269 | | | | 38,221 | |

Exchange to Institutional Class | | | (145,429 | ) | | | — | |

Reinvested | | | 196 | | | | 731 | |

Repurchased | | | (155,974 | ) | | | (33,184 | ) |

Change in Investor Class Shares | | | (243,938 | ) | | | 5,768 | |

1 | On September 17, 2021, Investor Class Shares were converted into Institutional Class Shares, and Investor Class Shares as a class of Shares of the Fund was terminated. |

The accompanying notes are an integral part of these Financial Statements.

15

Variant Alternative Income Fund

Statement of Cash Flows

For the Year Ended April 30, 2022

Cash flows from operating activities: | | | | |

Net Increase in net assets resulting from Operations | | $ | 137,156,825 | |

Adjustments to reconcile Net Increase in net assets resulting from | | | | |

Operations to net cash used in operating activities: | | | | |

Net realized (gain) loss on: | | | | |

Investments | | | (522,963 | ) |

Futures contracts | | | (2,887,599 | ) |

Capital gain distributions from private investment companies | | | (65,348 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (44,523,821 | ) |

Futures contracts | | | (2,578,546 | ) |

Purchases of long-term investments | | | (1,349,191,516 | ) |

Proceeds from long-term investments sold | | | 466,142,297 | |

Purchase of short-term investments, net | | | (56,845,927 | ) |

Changes in operating assets and liabilities: | | | | |

Interest receivable | | | (5,979,378 | ) |

Investments sold | | | (3,058,788 | ) |

Prepaid expenses | | | (514,413 | ) |

Due to Investment Manager | | | 753,799 | |

Audit fees payable | | | 19,905 | |

Legal fees payable | | | (74,138 | ) |

Accounting and administration fees payable | | | 55,012 | |

SEC fees | | | 54,471 | |

Custody fees payable | | | 3,295 | |

Chief Compliance Officer fees payable | | | (83 | ) |

Interest received not yet earned | | | (797,930 | ) |

Other liabilities | | | 8,050 | |

Net cash used in operating activities | | | (862,846,796 | ) |

| | | | | |

Cash flows from financing activities: | | | | |

Proceeds from shares sold, net of receivable for fund shares sold | | | 1,010,655,589 | |

Payments for shares repurchased | | | (81,137,943 | ) |

Distributions to shareholders, net of reinvestments | | | (62,568,997 | ) |

Net cash provided by financing activities | | | 866,948,649 | |

| | | | | |

Net Increase in Cash and Restricted Cash | | | 4,101,853 | |

| | | | | |

Cash and Restricted Cash: | | | | |

Beginning of period | | | 4,358,252 | |

End of period (a) | | $ | 8,460,105 | |

(a) | Cash and restricted cash include cash and cash deposited with broker for written options contracts and futures, as outlined further on the Statement of Assets and Liabilities. |

Supplemental disclosure of cash flow information:

Non-cash financing activities not included consist of reinvestment of dividends and distributions of $16,599,940.

The accompanying notes are an integral part of these Financial Statements.

16

Variant Alternative Income Fund

Financial Highlights

Institutional Class

Per share operating performance. For a capital share outstanding throughout each year/period. |

| | | For the

Year Ended

April 30, 2022 | | | For the

Year Ended

April 30, 2021 | | | For the

Year Ended

April 30, 2020 | | | For the

Period Ended

April 30, 2019 1 | |

Net asset value, beginning of year/period | | $ | 26.96 | | | $ | 26.32 | | | $ | 25.79 | | | $ | 25.00 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | |

Net investment income2 | | | 1.89 | | | | 1.66 | | | | 1.33 | | | | 0.97 | |

Net realized and unrealized gain (loss) | | | 1.21 | | | | 0.59 | | | | 0.79 | | | | 0.69 | |

Total from investment operations | | | 3.10 | | | | 2.25 | | | | 2.12 | | | | 1.66 | |

| | | | | | | | | | | | | | | | | |

Less Distributions: | | | | | | | | | | | | | | | | |

From net investment income | | | (1.43 | ) | | | (0.99 | ) | | | (1.59 | ) | | | (0.87 | ) |

From return of capital | | | (0.25 | ) | | | (0.62 | ) | | | — | | | | — | |

From net realized gains | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (1.68 | ) | | | (1.61 | ) | | | (1.59 | ) | | | (0.87 | ) |

| | | | | | | | | | | | | | | | | |

Net asset value, end of year/period | | $ | 28.38 | | | $ | 26.96 | | | $ | 26.32 | | | $ | 25.79 | |

| | | | | | | | | | | | | | | | | |

Total return 3 | | | 11.79 | % | | | 8.81 | % | | | 8.38 | % | | | 6.29 | %4 |

| | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 1,857,266 | | | $ | 846,571 | | | $ | 378,040 | | | $ | 62,603 | |

| | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | |

(including interest and revolving credit facility expense) | | | | | | | | | | | | | | | | |

Before fees waived/recovered 6 | | | 1.14 | % | | | 1.21 | % | | | 1.53 | % | | | 3.05 | %5 |

After fees waived/recovered 6 | | | 1.14 | % | | | 1.28 | % | | | 1.50 | % | | | 1.60 | %5 |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | |

(excluding interest and revolving credit facility expense) | | | | | | | | | | | | | | | | |

Before fees waived/recovered 6 | | | 1.12 | % | | | 1.20 | % | | | 1.48 | % | | | 2.90 | %5 |

After fees waived/recovered 6 | | | 1.12 | % | | | 1.27 | % | | | 1.45 | % | | | 1.45 | %5 |

| | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets: | | | | | | | | | | | | | | | | |

(including interest and revolving credit facility expense) | | | | | | | | | | | | | | | | |

Before fees waived/recovered 6 | | | 6.75 | % | | | 6.28 | % | | | 4.96 | % | | | 5.13 | %5 |

After fees waived/recovered 6 | | | 6.75 | % | | | 6.21 | % | | | 4.99 | % | | | 6.58 | %5 |

Ratio of net investment income to average net assets: | | | | | | | | | | | | | | | | |

(excluding interest and revolving credit facility expense) | | | | | | | | | | | | | | | | |

Before fees waived/recovered 6 | | | 6.77 | % | | | 6.29 | % | | | 5.01 | % | | | 5.28 | %5 |

After fees waived/recovered 6 | | | 6.77 | % | | | 6.22 | % | | | 5.04 | % | | | 6.73 | %5 |

| | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 42 | % | | | 52 | % | | | 21 | % | | | 21 | %4 |

| | | | | | | | | | | | | | | | | |

Senior Securities | | | | | | | | | | | | | | | | |

Total borrowings (000’s omitted) | | | — | | | | — | | | | — | | | | — | |

Asset coverage per $1,000 unit of senior indebtness 7 | | | — | | | | — | | | | — | | | | — | |

1 | For the period October 1, 2018 (commencement of operations) to April 30, 2019. See Note 12 “Reorganization Information” in the Notes to the Financial Statements. |

2 | Based on average shares outstanding for the period. |

3 | Total returns would have been lower had expenses not been waived by the Investment Manager. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

6 | The expenses and net investment loss ratios include income or expenses of the private investment companies and special purpose vehicles valued at practical expedient in which the Fund invests. |

7 | Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing this by the total number of senior indebtedness units, where one unit equals $1,000 of senior indebtedness. |

The accompanying notes are an integral part of these Financial Statements.

17

Variant Alternative Income Fund

Notes to Financial Statements

April 30, 2022

1. Organization

The Variant Alternative Income Fund (the “Fund”) is a closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and reorganized as a Delaware statutory trust at the close of business on September 28, 2018. Variant Investments, LLC serves as the investment adviser (the “Investment Manager”) of the Fund. The Fund operates as an interval fund pursuant to Rule 23c-3 under the Investment Company Act, and has adopted a fundamental policy to conduct quarterly repurchase offers at net asset value (“NAV”). The Fund commenced operations on October 1, 2018 with Institutional class shares. Investor class shares were offered at a later date and commenced operations on October 31, 2018. The Board of Trustees (“Board”) of the Fund approved the closure of the Fund’s Investor Class Shares to new investors effective August 27, 2021. On September 17, 2021, all Investor Class Shares of the Fund were converted into Institutional Class Shares, and Investor Class Shares as a class of Shares of the Fund was terminated.

The Fund’s investment objective is to seek to provide a high level of current income by investing, directly or indirectly, a majority of its net assets (plus any borrowings for investment purposes) in alternative income generating investments. The Fund may allocate its assets through direct investments, and investments in a wide range of investment vehicles.

2. Accounting Policies

Basis of Preparation and Use of Estimates

The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies. The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Investment Transactions and Related Investment Income

Investment transactions are accounted for on a trade-date basis. Realized gains and losses on investment transactions are determined using cost calculated on a specific identification basis. Dividends are recorded on the ex-dividend date and interest is recognized on an accrual basis. Distributions from private investments that represent returns of capital in excess of cumulative profits and losses are credited to investment cost rather than investment income.

Distributions to Shareholders

Distributions are paid at least quarterly on the Shares in amounts representing substantially all of the Fund’s net investment income, if any, earned each year. The Fund determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses (including capital loss carryover); however, it may distribute any excess annually to its shareholders. Distributions to shareholders are recorded on the ex-dividend date.

The exact amount of distributable income for each fiscal year can only be determined at the end of the Fund’s tax year. Under Section 19 of the Investment Company Act, the Fund is required to indicate the sources of certain distributions to shareholders. The estimated distribution composition may vary from quarter to quarter because it may be materially impacted by future income, expenses and realized gains and losses on securities and fluctuations in the value of the currencies in which Fund assets are denominated.

Valuation of Investments

The Fund calculates its NAV as of the close of business on each business day and at such other times as the Board may determine, including in connection with repurchases of Shares, in accordance with the procedures described below or as may be determined from time to time in accordance with policies established by the Board.

The Board has approved valuation procedures for the Fund (the “Valuation Procedures”). The Valuation Procedures provide that the Fund will value its investments at fair value. The Board has delegated the day to day responsibility for determining these fair values in accordance with the policies it has approved to the Investment Manager. The Investment Manager’s Valuation Committee (the “Valuation Committee”) will oversee the valuation of the Fund’s investments on behalf of the Fund. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly.

18

Variant Alternative Income Fund

Notes to Financial Statements

April 30, 2022 (continued)

2. Accounting Policies (continued)

Short-term securities, including bonds, notes, debentures and other debt securities, such as certificates of deposit, commercial paper, bankers’ acceptances and obligations of domestic and foreign banks, with maturities of 60 days or less, for which reliable market quotations are readily available shall each be valued at current market quotations as provided by an independent pricing service or principal market maker. Money market funds will be valued at NAV.

For equity, equity related securities, and options that are freely tradable and listed on a securities exchange or over-the- counter market, the Fund fair values those securities at their last sale price on that exchange or over-the-counter market on the valuation date. If the security is listed on more than one exchange, the Fund will use the price from the exchange that it considers to be the principal exchange on which the security is traded. Securities listed on the NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or over-the-counter market on such day, the security will be valued at the mean between the last bid price and last ask price on such day.

Any direct equities held by the Fund in private investment or operating companies are valued using (a) readily available market quotations or (b) market value for securities with similar characteristics or (c) fair value methodologies approved by the Board in a manner that seeks to reflect the market value of the security on the valuation date based on considerations determined by the Valuation Committee.

Fixed income securities (other than the short-term securities as described above) shall be valued by (a) using readily available market quotations based upon the last updated sale price or a market value from an approved pricing service generated by a pricing matrix based upon yield data for securities with similar characteristics or (b) by obtaining a direct written broker- dealer quotation from a dealer who has made a market in the security. If no price is obtained for a security in accordance with the foregoing, because either an external price is not readily available or such external price is believed by the Investment Manager not to reflect the market value, the Valuation Committee will make a determination in good faith of the fair value of the security in accordance with the Valuation Procedures. The credit facilities the Fund invests in generally do not have a readily available external price. Under these circumstances, the Valuation Committee determines in good faith that cost is the best fair value for such securities. In general, fair value represents a good faith approximation of the current value of an asset and will be used when there is no public market or possibly no market at all for the asset. The fair values of one or more assets may not be the prices at which those assets are ultimately sold and the differences may be significant.

Prior to investing in any private investment companies or special purpose vehicles (“Underlying Fund(s)”), the Investment Manager will conduct an initial due diligence review of the valuation methodologies utilized by the Underlying Fund, which generally shall be based upon readily observable market values when available, and otherwise utilize principles of fair value that are reasonably consistent with those used by the Fund for valuing its own investments. Subsequent to investment in an Underlying Fund, the Investment Manager will monitor the valuation methodologies used by each Underlying Fund. The Fund values its interests in Underlying Funds using the NAV provided by the managers of the Underlying Funds and/or their agents. These valuations involve significant judgment by the managers of the Underlying Funds and may differ from their actual realizable value. Under certain circumstances, the Valuation Committee may modify the managers’ valuations based on updated information received since the last valuation date. The Valuation Committee may also modify valuations if the valuations are deemed to not fully reflect the fair value of the investment. Valuations will be provided to the Fund based on interim unaudited financial records of the Underlying Funds, and, therefore, will be estimates and may fluctuate as a result. The Board, the Investment Manager and the Valuation Committee may have limited ability to assess the accuracy of these valuations.

In circumstances in which market quotations are not readily available or are deemed unreliable, or in the case of the valuation of private, direct investments, such investments may be valued as determined in good faith using methodologies approved by the Board. In these circumstances, the Fund determines fair value in a manner that seeks to reflect the market value of the security on the valuation date based on consideration by the Valuation Committee of any information or factors deemed appropriate. The Valuation Committee may engage third party valuation consultants on an as-needed basis to assist in determining fair value.

Fair valuation involves subjective judgments, and there is no single standard for determining the fair value of an investment. The fair value determined for an investment may differ materially from the value that could be realized upon the sale of the investment. Fair values used to determine the Fund’s NAV may differ from quoted or published prices, or from prices that are used by others, for the same investment. Thus, fair valuation may have an unintended dilutive or accretive effect on the value of shareholders’ investments in the Fund. Information that becomes known to the Fund or its agents after the NAV has been calculated on a particular day will not be used to retroactively adjust the price of a security or the NAV determined

19

Variant Alternative Income Fund

Notes to Financial Statements

April 30, 2022 (continued)

2. Accounting Policies (continued)

earlier. Prospective investors should be aware that situations involving uncertainties as to the value of investments could have an adverse effect on the Fund’s NAV if the judgments of the Board or the Valuation Committee regarding appropriate valuations should prove incorrect.

Written Options

The Fund may write call and put options. Writing put options tends to increase the Fund’s exposure to the underlying instrument. Writing call options tends to decrease the Fund’s exposure to the underlying instrument. When the Fund writes a call or put option, an amount equal to the premium received is recorded as a liability and subsequently marked-to-market to reflect the current value of the option written. These liabilities are reflected as written options outstanding in the Schedule of Investments. Payments received or made, if any, from writing options with premiums to be determined on a future date are reflected as such in the Schedule of Investments. Premiums received from writing options that expire are treated as realized gains. Premiums received from writing options that are exercised or closed are added to the proceeds or offset against amounts paid on the underlying future, security or currency transaction to determine the realized gain or loss. The Fund, as a writer of an option, has no control over whether the underlying future, security or currency may be sold (call) or purchased (put) and, as a result, bears the market risk of an unfavorable change in the price of the security underlying the written option. The risk exists that the Fund may not be able to enter into a closing transaction because of an illiquid market.

Futures

The Fund may enter into futures contracts in U.S. domestic markets or on exchanges located outside the United States. Foreign markets may offer advantages such as trading opportunities or arbitrage possibilities not available in the United States. Foreign markets, however, may have greater risk potential than domestic markets. For example, some foreign exchanges are principal markets so that no common clearing facility exists and an investor may look only to the broker for performance of the contract. In addition, any profits that might be realized in trading could be eliminated by adverse changes in the exchange rate, or a loss could be incurred as a result of those changes. Transactions on foreign exchanges may include both commodities which are traded on domestic exchanges and those which are not. Unlike trading on domestic commodity exchanges, trading on foreign commodity exchanges is not regulated by the Commodity Futures Trading Commission.

Engaging in these transactions involves risk of loss, which could adversely affect the value of the Fund’s net assets. No assurance can be given that a liquid market will exist for any particular futures contract at any particular time. Many futures exchanges and boards of trade limit the amount of fluctuation permitted in futures contract prices during a single trading day. Once the daily limit has been reached in a particular contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the trading day. Futures contract prices could move to the limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of futures positions and potentially subjecting the Fund to substantial losses.

Federal Income Taxes

The Fund intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. The Fund utilizes a tax-year end of October 31 and the Fund’s income and federal excise tax returns and all financial records supporting the 2020 and 2021 returns are subject to examination by the federal and Delaware revenue authorities. If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required. Management of the Fund is required to determine whether a tax position taken by the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. Based on its analysis, there were no tax positions identified by management of the Fund which did not meet the “more likely than not” standard as of April 30, 2022.

3. Principal Risks

Indemnifications

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund, and therefore cannot be established; however, the risk of loss from such claims is considered remote.

20

Variant Alternative Income Fund

Notes to Financial Statements

April 30, 2022 (continued)

3. Principal Risks (continued)

Borrowing, Use of Leverage