UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23336

Variant Alternative Income Fund

(Exact name of registrant as specified in charter)

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Terrance P. Gallagher

235 West Galena Street

Milwaukee, WI 53212

(Name and address of agent for service)

registrant's telephone number, including area code: (414) 299-2270

Date of fiscal year end: April 30

Date of reporting period: April 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| (a) | The Report to Shareholders is attached herewith. |

VARIANT ALTERNATIVE INCOME FUND

Annual Report

For the Year Ended April 30, 2023

Variant Alternative Income Fund

Table of Contents

For the Year Ended April 30, 2023

| | |

Management Discussion of Fund Performance (Unaudited) | 2-3 |

Fund Performance (Unaudited) | 4 |

Report of Independent Registered Public Accounting Firm | 5 |

Schedule of Investments | 6-11 |

Portfolio Allocation (Unaudited) | 12 |

Statement of Assets and Liabilities | 13 |

Statement of Operations | 14 |

Statements of Changes in Shareholders’ Equity | 15-16 |

Statement of Cash Flows | 17 |

Financial Highlights | 18-19 |

Notes to Financial Statements | 20-37 |

Fund Management (Unaudited) | 38-40 |

Other Information (Unaudited) | 41-43 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Variant Alternative Income Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

1

Variant Alternative Income Fund

Management Discussion of Fund Performance (Unaudited)

Dear Shareholder,

Variant Investments, LLC (“Variant”) is pleased to provide the audited annual financial statements for the Variant Alternative Income Fund1 (the “Fund”) for the fiscal year that ended April 30, 2023.

The Fund celebrated its fifth anniversary this past October amid a relatively tumultuous macroeconomic climate. This fiscal year presented challenges that included the Federal Reserve rapidly hiking rates to combat persistent inflationary pressures, growing concerns about recessionary risk and a spate of historic bank failures. Despite these obstacles, we are happy with the performance of the Fund in this difficult environment.

Over the past fiscal year, the institutional share class for the Fund (NICHX) delivered a net total return2 of +8.51%. We believe the performance compares favorably to many income-oriented risk assets over the same period. The Fund’s performance, again, benefited from broad diversification across numerous unique underlying market segments. Investments in specialty finance and litigation finance led the way in contribution to return over the fiscal year, followed by meaningful performance contributions from investments in portfolio finance, royalties, and transportation finance. The Fund’s investment in trade finance was the sole, modest detractor. The Fund’s emphasis on private market niches with less economic sensitivity have helped yield favorable results. In the long run, the Fund’s track record has included an annualized net total return2 of 8.89% since inception3 as of April 30, 2023.

The Fund also experienced growth in assets under management (“AUM”) over the past fiscal year, expanding by $715 million to finish the fiscal year at $2,559 million. Additionally, the Fund was once again able to satisfy all quarterly redemption requests throughout the fiscal year without any proration.

Variant continues to deploy new capital into a wide array of niche investment opportunities, further diversifying the Fund’s exposures. Recent dislocations in the financial markets have widened the opportunity set for the Fund. For more information on the Fund’s activity the complete listing of the Fund’s investments can be found in the Schedule of Investments.

On behalf of everyone at Variant, we thank you for your investment in the Fund. We are honored to be trusted stewards of your capital. We are excited about the year ahead and look forward to working with each of you.

Sincerely,

JB Hayes, Principal Curt Fintel, Principal Bob Elsasser, Principal

1 | The Variant Alternative Income Fund (the “Fund”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified, closed-end management investment company. The Fund operates as an interval fund. The Fund operates under an Agreement and Declaration of Trust (“Declaration of Trust”) dated April 4, 2018 (the “Declaration of Trust”). Variant Investments, LLC serves as the investment adviser (the “Investment Manager”) of the Fund. The Investment Manager is an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended. The Fund has elected to be treated as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). |

2 | The net total return uses geometric returns and reflects the reinvestment of earnings. |

3 | Inception date is October 2, 2017. Between October 2017 and September 2018, the track record includes that of the Variant Alternative Income Fund LP, the predecessor private fund (the “Predecessor Fund”) that converted into the Fund. The Predecessor Fund was, in all material respects, equivalent to the interval fund. For purposes of performance reporting, the Predecessor Fund track record was adjusted to reflect the Fund’s estimated expenses and expense limitations. Specifically, it reflects a management fee of 0.95% and fund expenses capped at 0.50%. |

The accompanying notes are an integral part of these Financial Statements.

2

Variant Alternative Income Fund

Management Discussion of Fund Performance (Unaudited)

(continued)

Past performance is not indicative of future results.

The Variant Alternative Income Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. There is no guarantee the Fund will achieve its objective. An investment in the Fund should only be made by investors who understand the risks involved, who are able to withstand the loss of the entire amount invested and who can bear the risks associated with the limited liquidity of Shares. A prospective investor must meet the definition of “accredited investor” under Regulation D under the Securities Act of 1933.

Important Risks: Shares are an illiquid investment. You should generally not expect to be able to sell your Shares (other than through the repurchase process), regardless of how the Fund performs. Although the Fund is required to implement a Share repurchase program only a limited number of Shares will be eligible for repurchase by the Fund.

An investment in the Fund is speculative, involves substantial risks, including the risk that the entire amount invested may be lost, and should not constitute a complete investment program. The Fund may leverage its investments by borrowing, use of swap agreements, options or other derivative instruments. The Fund has no public trading of its shares. The Fund is a non-diversified management investment company, meaning it may be more susceptible to any single economic or regulatory occurrence than a diversified investment company. In addition, the fund is subject to investment related risks of the underlying funds, general economic and market condition risk.

Alternative investments provide limited liquidity and include, among other things, the risks inherent in investing in securities, futures, commodities and derivatives, using leverage and engaging in short sales. The Fund’s investment performance depends, at least in part, on how its assets are allocated and reallocated among asset classes and strategies. Such allocation could result in the Fund holding asset classes or investments that perform poorly or underperform. Investments and investment transactions are subject to various counterparty risks. The counterparties to transactions in over the-counter or “inter-dealer” markets are typically subject to lesser credit evaluation and regulatory oversight compared to members of “exchange-based” markets. This may increase the risk that a counterparty will not settle a transaction because of a credit or liquidity problem, thus causing the Fund to suffer losses. The Fund and its service providers may be prone to operational and information security risks resulting from breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause the Fund to lose proprietary information, suffer data corruption, or lose operational capacity.

Foreside Fund Services, LLC, distributor.

The accompanying notes are an integral part of these Financial Statements.

3

Variant Alternative Income Fund

Fund Performance

April 30, 2023 (Unaudited)

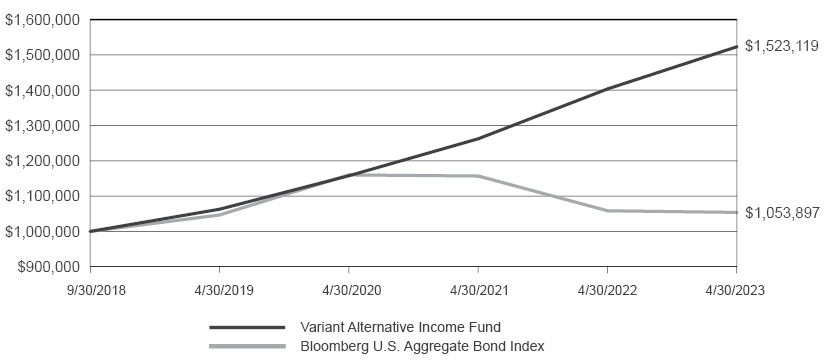

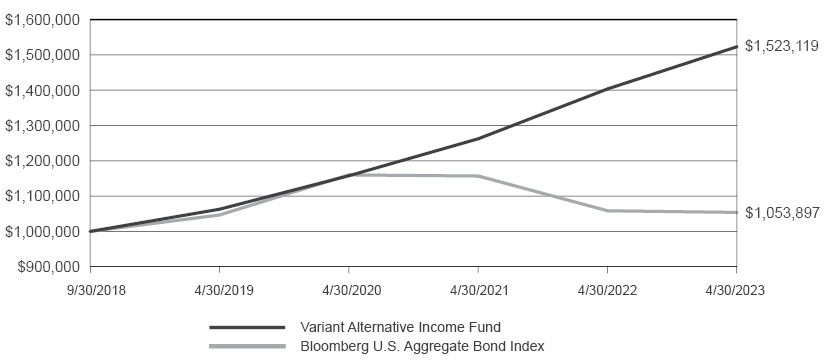

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Institutional Class Shares with a similar investment in the Bloomberg U.S. Aggregate Bond Index. Results include the reinvestment of all dividends and capital gains. The index does not reflect expenses, fees, or sales charges, which would lower performance.

The Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment grade, taxable, fixed income securities in the United States - including government, corporate and international dollar denominated bonds as well as mortgage-backed and asset-backed securities, all with maturities of less than one year. The index is unmanaged and it is not available for investment.

Average Annual Total Returns as of April 30, 2023 | | 1 Year | | | Since Inception | |

Variant Alternative Income Fund (Inception Date October 1, 2018) | | | 8.28 | % | | | 9.61 | % |

Bloomberg U.S. Aggregate Bond Index | | | -0.43 | % | | | 1.15 | % |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 1 (877) 770-7717.

Fund performance is shown net of fees.

For the Fund’s current expense ratios, please refer to the Financial Highlights Section of this report.

Performance results include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

4

Variant Alternative Income Fund

Report of Independent Registered Public Accounting Firm

For the Year Ended April 30, 2023

To the Shareholders and Board of Trustees of

Variant Alternative Income Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Variant Alternative Income Fund (the “Fund”) as of April 30, 2023, the related statements of operations and cash flows for the year then ended, the statements of changes in shareholders’ equity for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2023, the results of its operations and its cash flows for the year then ended, the changes in shareholders’ equity for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2023, by correspondence with the custodian, brokers, participating lenders, and underlying fund administrators or managers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Variant Investments, LLC since 2018.

COHEN & COMPANY, LTD.

Chicago, Illinois

June 30, 2023

5

Variant Alternative Income Fund

Schedule of Investments

April 30, 2023

Investments in private investment companies — 25.8% | | Shares/

Units | | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percent of

Net

Assets | |

Litigation Finance | | | | | | | | | | | | | | | | | | | | |

EAJF ESQ FUND LP (a)(e)(f) | | | — | | | | 5/26/2022 | | | $ | 35,000,000 | | | $ | 37,826,354 | | | | 1.5 | % |

Equal Access Justice Fund LP (a)(e)(f) | | | — | | | | 3/30/2021 | | | | 45,000,000 | | | | 51,273,116 | | | | 2.0 | |

Series 4 - Virage Capital Partners LP (a)(e)(f) | | | — | | | | 9/1/2018 | | | | 883,896 | | | | 1,682,503 | | | | 0.1 | |

Series 6 - Virage Capital Partners LP (a)(e)(f) | | | — | | | | 10/31/2019 | | | | 16,000,000 | | | | 21,479,377 | | | | 0.8 | |

Virage Recovery Fund (Cayman) LP (a)(b)(g)(f) | | | 3,814,489 | | | | 8/6/2019 | | | | 15,313,446 | | | | 23,278,198 | | | | 0.9 | |

| | | | | | | | | | | | 112,197,342 | | | | 135,539,548 | | | | 5.3 | |

Portfolio Finance | | | | | | | | | | | | | | | | | | | | |

C L Levi Co-Invest, L.P. (a)(e)(f) | | | — | | | | 6/27/2022 | | | | 11,853,832 | | | | 13,234,469 | | | | 0.5 | |

Crestline Portfolio Financing Fund II (US), L.P. (a)(e)(f) | | | — | | | | 8/26/2021 | | | | 1,602,932 | | | | 1,888,629 | | | | 0.1 | |

Crestline Portfolio Financing Fund Offshore B, L.P. and Subsidiary (a)(e)(f) | | | — | | | | 4/25/2018 | | | | 380,182 | | | | 632,610 | | | | 0.0 | |

Crestline Praeter, L.P. - Zoom (a)(e)(f) | | | — | | | | 12/26/2019 | | | | 2,826,366 | | | | 3,596,083 | | | | 0.1 | |

RIVER HORSE HOLDINGS II LP (a)(e)(f) | | | — | | | | 1/6/2023 | | | | 3,600,000 | | | | 4,032,000 | | | | 0.2 | |

| | | | | | | | | | | | 20,263,312 | | | | 23,383,791 | | | | 0.9 | |

Real Estate Debt | | | | | | | | | | | | | | | | | | | | |

Oak Harbor Capital NPL VII, LLC (a)(e)(f) | | | — | | | | 3/1/2019 | | | | 7,481,358 | | | | 9,494,753 | | | | 0.4 | |

Setpoint Residential Fintech Fund LP (a)(e)(f) | | | — | | | | 2/4/2022 | | | | 14,460,214 | | | | 14,300,330 | | | | 0.5 | |

| | | | | | | | | | | | 21,941,572 | | | | 23,795,083 | | | | 0.9 | |

Real Estate Equity | | | | | | | | | | | | | | | | | | | | |

Montreux Healthcare Fund PLC (a)(f) | | | 48,220 | | | | 2/1/2018 | | | | 63,438,713 | | | | 76,291,935 | | | | 3.0 | |

Prime Storage Fund II (Cayman), LP (a)(e)(f) | | | — | | | | 11/20/2017 | | | | 996,147 | | | | 1,649,695 | | | | 0.1 | |

| | | | | | | | | | | | 64,434,860 | | | | 77,941,630 | | | | 3.1 | |

Royalties | | | | | | | | | | | | | | | | | | | | |

MEP Capital II LP (a)(e)(f) | | | — | | | | 11/27/2020 | | | | 7,363,099 | | | | 8,362,918 | | | | 0.3 | |

MEP Capital II LP - Co-investment Sound Royalties (a)(e)(f) | | | — | | | | 8/3/2021 | | | | 2,000,000 | | | | 2,489,675 | | | | 0.1 | |

MEP Capital III LP (a)(e)(f) | | | — | | | | 11/1/2021 | | | | 19,693,881 | | | | 20,341,647 | | | | 0.8 | |

MEP Capital III LP - Co-investment Culture Works (a)(e)(f) | | | — | | | | 11/3/2021 | | | | 2,000,000 | | | | 2,207,053 | | | | 0.1 | |

MEP Capital III, L.P. - NGL (a)(e)(f) | | | — | | | | 3/24/2022 | | | | 7,750,000 | | | | 8,001,938 | | | | 0.3 | |

| | | | | | | | | | | | 38,806,980 | | | | 41,403,231 | | | | 1.6 | |

Secondaries | | | | | | | | | | | | | | | | | | | | |

Black Forest Structured Lending Fund (a)(f) | | | 4,028 | | | | 12/30/2022 | | | | 3,776,040 | | | | 5,300,525 | | | | 0.2 | |

CAMPBELL OPPORTUNITY TIMBER FUND-A, L.P. (a)(e)(f) | | | — | | | | 11/1/2021 | | | | 135,476 | | | | 746,995 | | | | 0.0 | |

North Haven Offshore Infrastructure Partners A LP (a)(e)(f) | | | — | | | | 7/18/2019 | | | | 1,566,729 | | | | 1,526,882 | | | | 0.1 | |

PWP Asset Based Income ASP Fund (a)(e)(f) | | | — | | | | 3/29/2019 | | | | 916,560 | | | | 931,164 | | | | 0.1 | |

Taiga Special Opportunities LP (a)(f) | | | 20,687,033 | | | | 4/22/2022 | | | | 14,465,781 | | | | 18,954,866 | | | | 0.7 | |

Thor Urban Property Fund II, Inc. (a)(f) | | | 35,695 | | | | 12/30/2019 | | | | 4,161,214 | | | | 296,699 | | | | 0.0 | |

| | | | | | | | | | | | 25,021,800 | | | | 27,757,131 | | | | 1.1 | |

Specialty Finance | | | | | | | | | | | | | | | | | | | | |

ACM JEEVES CO-INVEST VEHICLE LLC (a)(e)(f) | | | — | | | | 11/21/2022 | | | | 3,257,143 | | | | 3,561,753 | | | | 0.1 | |

ATALAYA EQUIPMENT LEASING FEEDER EVERGREEN LP (a)(e)(f) | | | — | | | | 5/23/2022 | | | | 25,375,000 | | | | 25,794,382 | | | | 1.0 | |

BSRF Tax-Exempt LLC (a)(e)(f) | | | — | | | | 5/17/2022 | | | | 20,000,000 | | | | 21,554,118 | | | | 0.8 | |

CoVenture - Amzn Credit Opportunities Fund LP (a)(e)(f) | | | — | | | | 3/11/2021 | | | | 30,573,720 | | | | 30,559,502 | | | | 1.2 | |

CoVenture - No1 Credit Opportunities Fund LLC (a)(e)(f) | | | — | | | | 12/12/2019 | | | | 1,000,000 | | | | 1,011,533 | | | | 0.0 | |

CoVenture - No1 Credit Opportunities Fund LLC (A-2 Series) (a)(e)(f) | | | — | | | | 2/5/2021 | | | | 3,000,000 | | | | 3,031,841 | | | | 0.1 | |

CoVenture - No1 Credit Opportunities Fund LLC (A-3 Series) (a)(e)(f) | | | — | | | | 7/12/2021 | | | | 7,500,000 | | | | 7,570,697 | | | | 0.3 | |

CoVenture Credit Opportunities Partners Fund LP (a)(e)(f) | | | — | | | | 2/28/2020 | | | | 20,000,000 | | | | 20,236,408 | | | | 0.8 | |

DelGatto Diamond Fund QP, LP (a)(e)(f) | | | — | | | | 10/3/2019 | | | | 18,750,000 | | | | 25,221,671 | | | | 1.0 | |

OHP II LP Class B (a)(e)(f) | | | — | | | | 3/7/2019 | | | | 1,560,368 | | | | 1,463,364 | | | | 0.1 | |

OHPC LP Founders Class Interest 1.25% (a)(e)(f) | | | — | | | | 5/27/2021 | | | | 11,206,083 | | | | 11,384,119 | | | | 0.5 | |

RIVONIA ROAD FUND LP (a)(e)(f) | | | — | | | | 7/29/2022 | | | | 10,000,000 | | | | 10,650,207 | | | | 0.4 | |

Silverview Special Situations Lending Onshore Fund LP (a)(e)(f) | | | — | | | | 10/19/2021 | | | | 6,175,287 | | | | 7,352,116 | | | | 0.3 | |

The accompanying notes are an integral part of these Financial Statements.

6

Variant Alternative Income Fund

Schedule of Investments

April 30, 2023 (continued)

Investments in private investment companies — 25.8% | | Shares/

Units | | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percent of

Net

Assets | |

Specialty Finance (continued) | | | | | | | | | | | | | | | | | | | | |

Sound Point Discovery Fund LLC (a)(e)(f) | | | — | | | | 3/31/2022 | | | $ | 10,000,000 | | | $ | 10,379,752 | | | | 0.4 | % |

SP TECHNOLOGY PAYMENTS II, LLC (a)(e)(f) | | | — | | | | 11/10/2022 | | | | 4,480,000 | | | | 4,588,099 | | | | 0.2 | |

Turning Rock Fund I LP (a)(e)(f) | | | — | | | | 11/29/2019 | | | | 4,279,369 | | | | 5,551,773 | | | | 0.2 | |

Turning Rock Fund II LP (a)(e)(f) | | | — | | | | 11/29/2021 | | | | 14,225,096 | | | | 14,742,375 | | | | 0.6 | |

Upper90 Fund III, LP (a)(e)(f) | | | — | | | | 7/28/2022 | | | | 977,702 | | | | 944,654 | | | | 0.0 | |

| | | | | | | | | | | | 192,359,768 | | | | 205,598,364 | | | | 8.0 | |

Transportation Finance | | | | | | | | | | | | | | | | | | | | |

Aero Capital Solutions Fund, LP (a)(e)(f) | | | — | | | | 1/17/2019 | | | | 1,306,934 | | | | 1,563,238 | | | | 0.1 | |

Aero Capital Solutions Fund II, LP (a)(e)(f) | | | — | | | | 9/16/2019 | | | | 28,201,497 | | | | 40,720,829 | | | | 1.6 | |

Aero Capital Solutions Feeder Fund III, LP (a)(e)(f) | | | — | | | | 9/13/2021 | | | | 35,000,000 | | | | 42,228,399 | | | | 1.6 | |

Hudson Transport Real Asset Fund LP (a)(e)(f) | | | — | | | | 8/31/2018 | | | | 908,558 | | | | 1,219,571 | | | | 0.0 | |

ITE Rail Fund, L.P. (a)(e)(f) | | | — | | | | 5/25/2022 | | | | 13,455,542 | | | | 13,687,223 | | | | 0.5 | |

American Rivers Fund, LLC (a)(e)(f) | | | — | | | | 5/2/2019 | | | | 22,972,826 | | | | 27,503,529 | | | | 1.1 | |

| | | | | | | | | | | | 101,845,357 | | | | 126,922,789 | | | | 4.9 | |

Total investments in private investment companies | | | | | | | | | | | 576,870,991 | | | | 662,341,567 | | | | 25.8 | |

| Investments in credit facilities — 54.9% | | | | | Principal | | | | | | | |

| Litigation Finance | | | | | | | | | | | | | | | | |

888 FUND I LLC, 14.00%, due 4/18/2025 (a)(b)(q) | | | 4/18/2022 | | | | 55,865,152 | | | | 55,865,152 | | | | 2.2 | |

Experity Ventures, LLC, Blended, due 11/10/2026 (a)(b)(h)(q) | | | 11/10/2021 | | | | 18,251,893 | | | | 18,251,893 | | | | 0.7 | |

Kerberos Capital Management SPV I LLC, 17.00%, due 8/16/2024 (a)(b)(q) | | | 10/7/2019 | | | | 53,836,611 | | | | 53,836,611 | | | | 2.1 | |

Kerberos Capital Management SPV I LLC (Luckett), 19.00%, due 8/16/2024 (a)(b)(q) | | | 1/29/2020 | | | | 8,282,200 | | | | 8,282,200 | | | | 0.3 | |

Kerberos Capital Management SPV I LLC (Pulvers), 12.00%, due 8/16/2024 (a)(b)(q) | | | 10/7/2019 | | | | 11,974,267 | | | | 11,974,267 | | | | 0.5 | |

KERBEROS CAPITAL MANAGEMENT SPV V, LLC, 15.00%, due 5/17/2026 (a)(b)(q) | | | 5/17/2022 | | | | 20,477,625 | | | | 20,477,625 | | | | 0.8 | |

Legal Capital Products, LLC, 13.00%, due 10/07/2026 (a)(b) | | | 10/7/2021 | | | | 21,591,831 | | | | 21,591,831 | | | | 0.8 | |

SCPFL I, LLC, 10.00%, due 12/16/2026 (a)(b)(q) | | | 4/21/2023 | | | | 56,985,308 | | | | 56,985,308 | | | | 2.2 | |

STENO AGENCY FUNDING I, LLC, 1 Month Term SOFR (3.00% Floor) + 11.00%, due 10/28/2024 (a)(b)(c)(o) | | | 11/12/2021 | | | | 3,647,165 | | | | 3,647,165 | | | | 0.2 | |

Stifel Syndicated Credit LLC, 20.00%, due 6/15/2026 (a)(b) | | | 8/15/2022 | | | | 4,000,000 | | | | 4,000,000 | | | | 0.2 | |

| | | | | | | | 254,912,052 | | | | 254,912,052 | | | | 10.0 | |

| Portfolio Finance | | | | | | | | | | | | | | | | |

BA Tech Master, LP, 19.50%, due 10/3/2023 (a)(b)(q) | | | 10/2/2018 | | | | 1,792,299 | | | | 1,792,299 | | | | 0.1 | |

Cirrix Finance, LLC, 15.00% (a)(b)(k)(q) | | | 11/4/2021 | | | | 22,365,416 | | | | 22,365,416 | | | | 0.9 | |

Delgatto Diamond Finance Fund, L.P., 10.50%, due 3/28/2025 (a)(b) | | | 5/28/2021 | | | | 67,340,000 | | | | 67,340,000 | | | | 2.6 | |

Fairway America Fund (VII and VIIQP) LP, 30 Day Avg. SOFR (2.00% Floor and 4.00% Ceiling) + 6.00%, due 7/1/2023 (a)(b)(c) | | | 8/7/2020 | | | | 7,500,000 | | | | 7,500,000 | | | | 0.3 | |

Stage Point Capital, LLC, 30 Day Avg. SOFR (2.00% Floor and a 4.00% Ceiling) + 6.00%, due 5/31/2023 (a)(b)(c) | | | 9/5/2019 | | | | 13,500,000 | | | | 13,500,000 | | | | 0.5 | |

Viscogliosi Brothers, LLC, 30 Day Avg. SOFR (1.00% Floor) + 14.00%, due 10/31/2023 (a)(b)(c)(q) | | | 10/27/2021 | | | | 6,322,885 | | | | 6,322,885 | | | | 0.2 | |

| | | | | | | | 118,820,600 | | | | 118,820,600 | | | | 4.6 | |

| Real Estate Debt | | | | | | | | | | | | | | | | |

Arctic Fox Joint Stock Company, 12.81%, due 6/22/2023 (a)(b)(p) | | | 11/24/2021 | | | | 720,000 | | | | 720,000 | | | | 0.0 | |

CDMX II Fund, LLC, 13.00%, due 11/30/2027 (a)(b) | | | 12/1/2022 | | | | 11,817,815 | | | | 11,817,815 | | | | 0.4 | |

Drummond Ross Limited, 10.00%, due 1/31/2024 (a)(b)(q) | | | 1/7/2022 | | | | 4,999,462 | | | | 4,906,015 | | | | 0.2 | |

Tailor Ridge REIT, LLC, 30 Day Avg. SOFR (2.00% Floor and a 4.00% Ceiling) + 6.00%, due 7/31/2023 (a)(b)(c) | | | 8/18/2021 | | | | 2,945,000 | | | | 2,945,000 | | | | 0.1 | |

TruNorth Star RTL Co-Invest, LLC, 13.00%, due 2/27/2026 (a)(b)(q) | | | 2/27/2023 | | | | 12,000,000 | | | | 12,000,000 | | | | 0.5 | |

| | | | | | | | 32,482,277 | | | | 32,388,830 | | | | 1.2 | |

The accompanying notes are an integral part of these Financial Statements.

7

Variant Alternative Income Fund

Schedule of Investments

April 30, 2023 (continued)

Investments in credit facilities — 54.9% | | First

Acquisition

Date | | | Principal | | | Fair Value | | | Percent of

Net

Assets | |

Royalties | | | | | | | | | | | | | | | | |

ARC LPW I, LLC, 13.00%, due 10/31/2025 (a)(b) | | | 9/26/2019 | | | $ | 53,461,883 | | | $ | 48,672,633 | | | | 1.9 | % |

BEATFUND II, LLC, 30 Day Avg. SOFR (1.00% Floor) + 10.00%, due 11/25/2025 (a)(b)(c) | | | 11/25/2022 | | | | 15,188,647 | | | | 15,188,647 | | | | 0.6 | |

CASCADE ENERGY GROUP, LLC, 30 Day Avg. SOFR (1.00% Floor and 4.00% Ceiling) + 10.75%, due 7/20/2025 (a)(b)(c) | | | 7/20/2022 | | | | 13,202,074 | | | | 13,202,074 | | | | 0.5 | |

Marine Street, L.P. blended (a)(b)(i)(l)(q) | | | 3/22/2022 | | | | 73,889,464 | | | | 73,889,464 | | | | 2.9 | |

| | | | | | | | 155,742,068 | | | | 150,952,818 | | | | 5.9 | |

Specialty Finance | | | | | | | | | | | | | | | | |

5 Core Capital LLC, 30 Day Avg. SOFR (1.00% Floor) + 9.75%, due 4/25/2026 (a)(b)(c) | | | 10/28/2020 | | | | 14,632,150 | | | | 14,632,150 | | | | 0.6 | |

ACMV Factor Finance SPV LLC, 12.00%, due 11/30/2023 (a)(b) | | | 11/24/2021 | | | | 27,223,673 | | | | 27,223,673 | | | | 1.1 | |

ADVANTECH SERVICIOS FINANCIEROS, SOCIEDAD ANÓNIMA PROMOTORA DE INVERSIÓN DE CAPITAL VARIABLE, 30 Day Avg. SOFR (1.00% Floor and a 3.50% Ceiling) + 8.00%, due 8/13/2026 (a)(b)(c) | | | 11/5/2020 | | | | 20,950,000 | | | | 20,950,000 | | | | 0.8 | |

Aion Acquisition, LLC (a)(b)(k) | | | 3/31/2021 | | | | 1,217,193 | | | | 267,676 | | | | 0.0 | |

Aion Acquisition, LLC (a)(b)(k) | | | 3/31/2021 | | | | 538,513 | | | | 141,079 | | | | 0.0 | |

App Academy Financial, LLC, 12.00%, due 2/23/2024 (a)(b) | | | 3/23/2021 | | | | 1,473,447 | | | | 1,473,447 | | | | 0.1 | |

Art Lending, Inc. (Dart Milano S.R.L 1), 9.50%, (a)(b)(k)(o) | | | 4/14/2021 | | | | 12,154,496 | | | | 11,790,358 | | | | 0.5 | |

Art Lending, Inc. (Dart Milano S.R.L 2), 8.68%, (a)(b)(k)(o) | | | 12/17/2021 | | | | 13,748,021 | | | | 13,246,060 | | | | 0.5 | |

Art Lending, Inc. (Procacini S.L. - 1), 10.00% (a)(b)(k)(o) | | | 8/26/2020 | | | | 1,967,917 | | | | 1,967,917 | | | | 0.1 | |

Art Lending, Inc. (Procacini S.L. - 2), 9.50% (a)(b)(k)(o) | | | 4/14/2021 | | | | 4,047,827 | | | | 4,047,827 | | | | 0.2 | |

Art Money International, Co., 8.00%, due 12/9/2023 (a)(b) | | | 12/9/2019 | | | | 435,000 | | | | 435,000 | | | | 0.0 | |

Art Money International, Co., 30 Day Avg. SOFR (2.00% Floor) + 10.00%, due 7/1/2023 (a)(b)(c) | | | 6/12/2018 | | | | 5,500,000 | | | | 5,500,000 | | | | 0.2 | |

AVISTA COLOMBIA S.A.S, 14.00%, due 9/28/2025 (a)(b) | | | 3/29/2021 | | | | 7,200,000 | | | | 7,200,000 | | | | 0.3 | |

Bandon VAIF, LLC, 12.00% (a)(b)(k) | | | 2/10/2020 | | | | 4,626,533 | | | | 2,224,088 | | | | 0.1 | |

Bandon VAIF, LLC, 15.00%, due 1/24/2024 (a)(b) | | | 2/15/2022 | | | | 76,000 | | | | 76,000 | | | | 0.0 | |

BPIIHR HOLDCO, LLC, 12.00%, due 10/28/2026 (a)(b)(q) | | | 11/1/2021 | | | | 3,093,717 | | | | 3,093,717 | | | | 0.1 | |

BUNDLED UP LLC, 30 Day Avg. SOFR (1.00% Floor) + 10.50%, due 10/1/2025 (a)(b)(c) | | | 11/18/2022 | | | | 33,884,959 | | | | 33,884,959 | | | | 1.3 | |

CF Holdings II, LLC, CME 3 month SOFR (4.00% Ceiling) + 11.00%, due 12/9/2024 (a)(b)(c)(o) | | | 12/28/2021 | | | | 4,497,632 | | | | 4,497,632 | | | | 0.2 | |

CIBANCO, S.A. INSTITUCIÓN DE BANCA MÚLTIPLE, 14.55%, due 3/27/2027 (a)(b)(q) | | | 4/5/2023 | | | | 936,337 | | | | 936,337 | | | | 0.0 | |

Coromandel SPV LLC, 10.00%, due 7/1/2024 (a)(b) | | | 1/13/2020 | | | | 98,842,977 | | | | 98,842,977 | | | | 3.9 | |

ECG BOREAL FUNDING, LLC, blended due 8/29/2024 (a)(b)(c)(n)(o) | | | 12/28/2021 | | | | 8,153,846 | | | | 8,153,846 | | | | 0.3 | |

Envest (Canada) Holdings Corp., 12.00%, due 11/30/2024 (a)(b) | | | 11/30/2022 | | | | 19,048,000 | | | | 19,048,000 | | | | 0.7 | |

EQUITY LINK, S.A.P.I. DE C.V., SOFOM E.N.R., 30 Day Avg. SOFR (2.00% Floor) + 9.50%, due 7/28/2024 (a)(b)(c) | | | 4/29/2021 | | | | 10,530,000 | | | | 10,530,000 | | | | 0.4 | |

F88 Business JSC 11.00%, due 12/13/2023 (a)(b)(o) | | | 1/13/2023 | | | | 6,750,000 | | | | 6,750,000 | | | | 0.3 | |

FilmRise Acquisitions LLC, 13.50%, due 9/17/2025 (a)(b) | | | 9/14/2022 | | | | 6,818,523 | | | | 6,818,523 | | | | 0.3 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust, 11.25%, due 4/15/2024 (a)(b)(q) | | | 4/14/2021 | | | | 7,652,000 | | | | 6,687,683 | | | | 0.3 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust, 11.25%, due 1/18/2024 (a)(b)(q) | | | 1/20/2021 | | | | 10,000,000 | | | | 8,625,377 | | | | 0.3 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust, 12.00%, due 11/9/2023 (a)(b)(q) | | | 11/6/2020 | | | | 30,000,000 | | | | 27,530,364 | | | | 1.1 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust - B Class, 12.50%, due 9/8/2023 (a)(b)(q) | | | 9/7/2021 | | | | 10,000,000 | | | | 8,924,395 | | | | 0.3 | |

First Class Securities Pty Ltd as trustee for the Oceana Australian Fixed Income Trust - C Class, 12.00%, due 3/22/2024 (a)(b)(q) | | | 3/21/2022 | | | | 5,000,000 | | | | 4,457,375 | | | | 0.2 | |

Grupo Olinx, S.A.P.I. de C.V., SOFOM, E.N.R., 11.00%, due 8/12/2025 (a)(b) | | | 8/12/2021 | | | | 9,500,000 | | | | 9,500,000 | | | | 0.4 | |

KSPV 2, LLC, CME 3 month SOFR (2.50% Ceiling) + 12.50%, due 7/15/2024 (a)(b)(c)(o) | | | 12/28/2021 | | | | 6,000,000 | | | | 6,000,000 | | | | 0.2 | |

KY LAN ASSET FINANCE 1, 9.50%, due 1/26/2024 (a)(b) | | | 1/26/2022 | | | | 12,078,947 | | | | 12,078,947 | | | | 0.5 | |

LAMBDA SCHOOL III SPV LLC, 12.00%, due 9/28/2023 (a)(b) | | | 6/18/2021 | | | | 2,820,486 | | | | 2,820,486 | | | | 0.1 | |

The accompanying notes are an integral part of these Financial Statements.

8

Variant Alternative Income Fund

Schedule of Investments

April 30, 2023 (continued)

Investments in credit facilities — 54.9% | | First

Acquisition

Date | | | Principal | | | Fair Value | | | Percent of

Net

Assets | |

Specialty Finance(continued) | | | | | | | | | | | | | | | | |

LCA Crackpital, S.A.P.I. de C.V. SOFOM, E.N.R., 15.25%, (a)(b)(k) | | | 4/21/2021 | | | $ | 1,240,586 | | | $ | 1,240,586 | | | | 0.0 | % |

Lima Impact Fund Pte. Ltd, 11.00%, due 5/4/2023(a)(b)(o) | | | 11/15/2022 | | | | 4,000,000 | | | | 4,000,000 | | | | 0.2 | |

Payjoy Inc., 14.50%, due 11/25/2024 (a)(b)(o) | | | 1/13/2021 | | | | 5,000,000 | | | | 5,000,000 | | | | 0.2 | |

Pier Asset Management LLC (Series 6), SONIA (1.00% Floor) + 13.50%, due 2/10/2024 (a)(b)(c)(o) | | | 2/9/2022 | | | | 32,267,303 | | | | 32,267,303 | | | | 1.2 | |

Pier Asset Management LLC (Series 9), 1 Month Term SOFR (1.00% Floor and 5.00% Ceiling) + 14.00%, due 6/22/2024 (a)(b)(c)(o) | | | 12/23/2022 | | | | 7,113,000 | | | | 7,113,000 | | | | 0.3 | |

PT AWAN TUNAI INDONESIA, 5.00%, due 4/1/2024 (a)(b) | | | 9/9/2020 | | | | 22,500,200 | | | | 22,500,200 | | | | 0.9 | |

RAINFOREST LIFE PTE. LTD., blended, due 8/20/2024 (a)(b)(m) | | | 8/20/2021 | | | | 15,235,368 | | | | 15,235,368 | | | | 0.6 | |

RKB Bridge Solutions, LLC, 7.00%, due 5/31/2023 (a)(b)(p) | | | 12/13/2019 | | | | 439,000 | | | | 439,000 | | | | 0.0 | |

RKB BRIDGE SOLUTIONS, LLC, 30 Day Avg. SOFR (1.00% Floor and a 3.00% Ceiling) + 6.75%, due 3/31/2025 (a)(b)(c) | | | 4/21/2022 | | | | 2,191,500 | | | | 2,191,500 | | | | 0.1 | |

Salaryo Capital II LLC, 11.00% (a)(b)(k) | | | 1/30/2020 | | | | 8,500,000 | | | | 8,500,000 | | | | 0.3 | |

SEIA Purchasing LLC, 13.00%, due 10/12/2024 (a)(b) | | | 10/12/2022 | | | | 33,213,248 | | | | 33,213,248 | | | | 1.3 | |

SPV. Collections LLC, Prime (4.90% Floor) + 7.75%, due 11/10/2023 (a)(b)(c) | | | 10/31/2022 | | | | 22,098,365 | | | | 22,098,365 | | | | 0.8 | |

SQUARE KILOMETER CAPITAL SPV LLC, 30 Day Avg. SOFR + 11.00%, due 11/8/2024 (a)(b)(c) | | | 11/9/2022 | | | | 7,347,529 | | | | 7,347,529 | | | | 0.3 | |

SSC SPV No.1 LLC, 9.00%, due 1/24/2025 (a)(b) | | | 8/9/2019 | | | | 67,847,487 | | | | 67,847,487 | | | | 2.5 | |

SSL DB WEST LLC, 30 Day Avg. SOFR (2.00% Floor) + 10.00%, due 4/7/2026 (a)(b)(c) | | | 4/14/2023 | | | | 12,336,087 | | | | 12,336,087 | | | | 0.5 | |

Star Strong Funding LLC, 8.00%, due 12/31/2023 (a)(b)(q) | | | 2/4/2022 | | | | 753,211 | | | | 753,211 | | | | 0.0 | |

STAT CAPITAL SPV LLC, 30 Day Avg. SOFR (1.00% Floor) + 9.75%, due 4/25/2026 (a)(b)(c) | | | 4/29/2022 | | | | 12,000,000 | | | | 12,000,000 | | | | 0.5 | |

STEEL RIVER SYSTEMS LLC, due 12/22/2024 (a)(b)(j) | | | 12/22/2022 | | | | 2,258,370 | | | | 2,258,370 | | | | 0.1 | |

STRIDE ALTERNATIVE EDUCATION FUND 1, 14.00%, due 6/10/2029 (a)(b) | | | 6/13/2022 | | | | 6,818,000 | | | | 6,818,000 | | | | 0.3 | |

TCM Produce LLC, 14.00%, due 6/30/2023 (a)(b)(o) | | | 5/19/2021 | | | | 10,295,000 | | | | 10,295,000 | | | | 0.4 | |

Terra Payment Services (Mauritius), 10.75%, due 12/26/2024 (a)(b)(o) | | | 1/10/2022 | | | | 5,000,000 | | | | 5,000,000 | | | | 0.2 | |

Vantage Borrower SPV I LLC, 12.00%, due 4/30/2024 (a)(b) | | | 9/11/2020 | | | | 3,000,000 | | | | 3,000,000 | | | | 0.1 | |

Wallace Management Co. LLC, 30 Day Avg. SOFR (1.00% Floor) + 13.00%, due 9/6/2023 (a)(b)(c) | | | 9/8/2022 | | | | 7,222,222 | | | | 7,222,222 | | | | 0.3 | |

Watu Holdings Ltd, 13.00%, due 5/7/2025 (a)(b)(o) | | | 4/11/2022 | | | | 10,000,000 | | | | 10,000,000 | | | | 0.4 | |

Zanifu Limited, 30 Day Avg. SOFR (2.00% Floor) + 13.00%, due 4/17/2026(a)(b)(c) | | | 4/18/2023 | | | | 170,854 | | | | 170,854 | | | | 0.0 | |

| | | | | | | | 700,245,524 | | | | 689,203,223 | | | | 26.9 | |

Trade Finance | | | | | | | | | | | | | | | | |

DRIP CAPITAL SPV VASCO LLC - Series 2022-X, 8.00%, due 6/15/2023 (a)(b) | | | 12/14/2022 | | | | 300,000 | | | | 300,000 | | | | 0.0 | |

DRIP CAPITAL SPV VASCO LLC - Series 2023-E, 8.00%, due 9/1/2023 (a)(b) | | | 1/31/2023 | | | | 625,000 | | | | 625,000 | | | | 0.0 | |

DRIP CAPITAL SPV VASCO LLC - Series 2023-L, 8.00%, due 8/3/2023 (a)(b) | | | 3/31/2023 | | | | 550,000 | | | | 550,000 | | | | 0.0 | |

MEDTRADE CAPITAL, LLC, due 7/31/2025(a)(b)(j)(q) | | | 4/30/2022 | | | | 128,238,152 | | | | 122,559,223 | | | | 4.6 | |

Octagon Asset Management, LLC - (Deal: Tru Grit 7) (a)(b)(j)(k)(q) | | | 3/9/2021 | | | | 21,705,421 | | | | 21,705,422 | | | | 0.9 | |

| | | | | | | | 151,418,573 | | | | 145,739,645 | | | | 5.5 | |

Transportation Finance | | | | | | | | | | | | | | | | |

Inclusion South Africa Proprietary Limited, 1 Month Term SOFR (1.00% Floor) + 12.50%, due 09/23/2025 (a)(b)(c)(o) | | | 9/27/2022 | | | | 16,139,800 | | | | 16,139,800 | | | | 0.7 | |

| | | | | | | | | | | | | | | | | |

Warehouse Facilities | | | | | | | | | | | | | | | | |

edly WH Investors 2019-1, LLC, 12.00%, due 12/7/2023 (a)(b) | | | 10/9/2019 | | | | 956,933 | | | | 956,933 | | | | 0.0 | |

Homelight Homes Real Estate, LLC, 13.50%, due 8/31/2024 (a)(b) | | | 10/8/2020 | | | | 2,266,205 | | | | 2,266,205 | | | | 0.1 | |

| | | | | | | | 3,223,138 | | | | 3,223,138 | | | | 0.1 | |

Total investments in credit facilities | | | | | | | 1,432,984,032 | | | | 1,411,380,106 | | | | 54.9 | |

The accompanying notes are an integral part of these Financial Statements.

9

Variant Alternative Income Fund

Schedule of Investments

April 30, 2023 (continued)

Investments in special purpose vehicles — 9.0% | | Shares/

Units | | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percent of

Net

Assets | |

Litigation Finance | | | | | | | | | | | | | | | | | | | | |

YS CF LawFF VII LLC (a)(b)(e)(f) | | | — | | | | 4/5/2018 | | | $ | 241,115 | | | $ | 351,197 | | | | 0.0 | % |

Real Estate Debt | | | | | | | | | | | | | | | | | | | | |

CDMX DEBT FUND, LLC (a)(b)(e) | | | — | | | | 4/25/2022 | | | | 14,069,482 | | | | 15,852,881 | | | | 0.6 | |

Monticello Funding, LLC Series BTH 48 (a)(e)(f) | | | — | | | | 7/23/2021 | | | | 2,250,000 | | | | 2,281,297 | | | | 0.1 | |

Monticello Funding, LLC Series BTH 49 (a)(e)(f) | | | — | | | | 8/16/2021 | | | | 828,948 | | | | 867,511 | | | | 0.0 | |

Monticello Funding, LLC Series BTH 54 (a)(e)(f) | | | — | | | | 12/17/2021 | | | | 1,990,161 | | | | 2,084,752 | | | | 0.1 | |

Monticello Funding, LLC Series BTH 55 (a)(e)(f) | | | — | | | | 12/17/2021 | | | | 2,500,000 | | | | 2,589,354 | | | | 0.1 | |

Monticello Funding, LLC Series BTH 56 (a)(e)(f) | | | — | | | | 12/17/2021 | | | | 7,155,449 | | | | 7,222,930 | | | | 0.3 | |

Monticello Structured Products, LLC Series SH—52 (a)(e)(f) | | | — | | | | 3/30/2022 | | | | 1,500,000 | | | | 1,578,319 | | | | 0.1 | |

Monticello Structured Products, LLC Series SH—62 (a)(e)(f) | | | — | | | | 5/6/2022 | | | | 800,000 | | | | 837,367 | | | | 0.0 | |

| | | | | | | | | | | | 31,094,040 | | | | 33,314,411 | | | | 1.3 | |

Real Estate Equity | | | | | | | | | | | | | | | | | | | | |

PHX Industrial Portfolio AMP SPV, LLC (a)(e)(f) | | | — | | | | 12/20/2021 | | | | 8,493,394 | | | | 10,901,720 | | | | 0.5 | |

CX LIVELY INDIGO RUN DEPOSITOR, LLC (a)(b)(e) | | | — | | | | 5/9/2022 | | | | 8,809,440 | | | | 8,809,440 | | | | 0.3 | |

CX Midwest Industrial Logistics Depositor, LLC (a)(b)(e) | | | — | | | | 6/24/2022 | | | | 10,000,000 | | | | 10,000,000 | | | | 0.4 | |

CX Mode at Hyattsville Depositor, LLC (a)(b)(e) | | | — | | | | 10/18/2022 | | | | 12,990,000 | | | | 12,990,000 | | | | 0.5 | |

CX Owings Mills Multifamily Depositor, LLC (a)(b)(e) | | | — | | | | 7/12/2022 | | | | 9,975,000 | | | | 9,975,000 | | | | 0.4 | |

CX Residences at Congressional Village Depositor, LLC (a)(b)(e) | | | — | | | | 6/27/2022 | | | | 10,000,000 | | | | 10,000,000 | | | | 0.4 | |

CX Station at Clift Farm Depositor, LLC (a)(b)(e) | | | — | | | | 12/27/2021 | | | | 11,269,000 | | | | 11,269,000 | | | | 0.4 | |

| | | | | | | | | | | | 71,536,834 | | | | 73,945,160 | | | | 2.9 | |

Royalties | | | | | | | | | | | | | | | | | | | | |

Round Hill Music Carlin Coinvest, LP (a)(d)(e)(f) | | | — | | | | 10/1/2017 | | | | 929,104 | | | | 1,243,100 | | | | 0.1 | |

Specialty Finance | | | | | | | | | | | | | | | | | | | | |

Cirrix Investments, LLC (a)(e)(f) | | | — | | | | 1/27/2022 | | | | 5,000,000 | | | | 5,993,401 | | | | 0.2 | |

CoVenture - Clearbanc Special Assets Fund LP (a)(e)(f) | | | — | | | | 3/12/2019 | | | | 598,509 | | | | 607,627 | | | | 0 | |

Lendable SPC (a)(e)(f) | | | — | | | | 7/31/2020 | | | | 102,900,000 | | | | 98,333,364 | | | | 3.9 | |

PSC US BADGER LLC (a)(e)(f) | | | — | | | | 10/20/2021 | | | | 15,493,998 | | | | 15,916,880 | | | | 0.6 | |

| | | | | | | | | | | | 123,992,507 | | | | 120,851,272 | | | | 4.7 | |

Transportation Finance | | | | | | | | | | | | | | | | | | | | |

YS Vessel Deconstruction I (a)(b)(e) | | | — | | | | 6/26/2018 | | | | 500,000 | | | | 200,000 | | | | 0.0 | |

Total investments in special purpose vehicles | | | | | | | | | | | 228,293,600 | | | | 229,905,140 | | | | 9.0 | |

Investments in direct equities — 0.3% | | | | | | | | | | | | | | | | | | | | |

Specialty Finance | | | | | | | | | | | | | | | | | | | | |

Aion Financial - Series 1 Preferred Stock (a)(b) | | | 219,220 | | | | 3/31/2021 | | | | 22 | | | | 34,913 | | | | 0.0 | |

Art Money International, Co. - Convertible Shares, (a)(b) | | | — | | | | 11/5/2021 | | | | 0 | | | | 59,661 | | | | 0.0 | |

Coromandel SPV LLC - Warrants, (a)(b) | | | — | | | | 9/8/2021 | | | | 0 | | | | 195,255 | | | | 0.0 | |

INTERNEX CAPITAL LLC Preferred A Shares (a)(b) | | | 359,701 | | | | 4/1/2022 | | | | 1,250,000 | | | | 1,250,000 | | | | 0.1 | |

Preteur Inc. Common Shares (a)(b) | | | 400,000 | | | | 3/28/2023 | | | | 0 | | | | 2,165,666 | | | | 0.1 | |

STAR STRONG FUNDING LLC Ownership Interest (a)(b) | | | — | | | | 4/27/2022 | | | | 348,000 | | | | 1,851,219 | | | | 0.1 | |

| | | | | | | | | | | | 1,598,022 | | | | 5,556,714 | | | | 0.3 | |

Transportation Finance | | | | | | | | | | | | | | | | | | | | |

Inclusion South Africa Proprietary Limited (a)(b)(s) | | | — | | | | 9/27/2022 | | | | 0 | | | | 57,574 | | | | 0.0 | |

Total investments in direct equities | | | | | | | | | | | 1,598,022 | | | | 5,614,288 | | | | 0.3 | |

The accompanying notes are an integral part of these Financial Statements.

10

Variant Alternative Income Fund

Schedule of Investments

April 30, 2023 (continued)

| Investments in warrants — 0.1% | | Shares | | | First

Acquisition

Date | | Cost | | | Fair Value | | | Percent of

Net

Assets | |

| Litigation Finance | | | | | | | | | | | | | | | | | | |

Kerberos Capital Management SPV V, LLC (a)(b)(t) | | | — | | | 5/17/2022 | | $ | — | | | $ | 2,845,599 | | | | 0.1 | |

| Specialty Finance | | | | | | | | | | | | | | | | | | |

RAINFOREST LIFE PTE. LTD. (a)(b)(u) | | | — | | | 8/20/2021 | | | — | | | | 106,200 | | | | — | |

Vantage Borrower SPV I LLC, (a)(b)(v) | | | 29,206 | | | 1/27/2021 | | | — | | | | 525,915 | | | | — | |

| | | | | | | | | | | | | | 632,115 | | | | | |

| Total investments in warrants | | | | | | | | | — | | | | 3,477,714 | | | | 0.1 | |

Investments in money market instruments — 7.5% | | | | | | | | | | | | | | | | | | | | |

GS Financial Square Government Fund, Institutional Shares, 4.76% (a)(r) | | | 192,807,584 | | | | | | | $ | 192,807,584 | | | $ | 192,807,584 | | | | 7.5 | |

Total investments in money market instruments | | | | | | | | | | | 192,807,584 | | | | 192,807,584 | | | | 7.5 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Investments (cost $2,432,554,229) | | | | | | | | | | | | | | $ | 2,505,526,399 | | | | 97.6 | |

Other assets less liabilities | | | | | | | | | | | | | | | 55,692,977 | | | | 2.4 | |

Net Assets | | | | | | | | | | | | | | $ | 2,561,219,376 | | | | 100.0 | |

The accompanying notes are an integral part of these Financial Statements.

11

Variant Alternative Income Fund

Schedule of Investments

April 30, 2023 (continued)

| | FUTURES CONTRACTS | | Expiration

Date | | Number of

Contracts

Long

(Short) | | | Notional

Value | | | Value at

April 30,

2023 | | | Unrealized

Appreciation

(Depreciation) | |

Foreign Exchange Futures | | | | | | | | | | | | | | | | | |

CME Australian Dollar | Jun 2023 | | | (899) | | | $ | (59,691,984 | ) | | $ | (59,590,215 | ) | | $ | 101,769 | |

CME British Pound | Jun 2023 | | | (120) | | | | (8,963,729 | ) | | | (9,434,250 | ) | | | (470,521 | ) |

CME Euro Dollar | Jun 2023 | | | (32) | | | | (4,255,677 | ) | | | (4,419,400 | ) | | | (163,723 | ) |

CME Mexican Peso | Jun 2023 | | | (570) | | | | (15,517,994 | ) | | | (15,689,250 | ) | | | (171,256 | ) |

TOTAL FUTURES CONTRACTS | | | | | | | $ | (88,429,384 | ) | | $ | (89,133,115 | ) | | $ | (703,731 | ) |

(a) | Security serves as collateral for the Fund’s revolving credit facility, when in use during the year. See Note 11. |

(b) | Value was determined using significant unobservable inputs. |

(c) | Variable rate security. |

(d) | 100% of this special purpose vehicle is invested in one music catalog. |

(e) | Private investment company or special purpose vehicle does not issue shares or units. |

(f) | Investment valued using net asset value per share (or its equivalent) as a practical expedient. See Note 13 for respective investment strategies, unfunded commitments and redemptive restrictions. |

(g) | Private investment company is part of the MSPR SPAC. The Fund’s valuation is made up of its share of the SPAC plus a preferred return. |

(h) | Security has a blended interest rate of 13.00% fixed for draws up to $15MM and 30 Day Avg. SOFR + 13.00% for draws above $15MM. |

(i) | Security has a blended interest rate of 8.50% and 9.00% based on underlying collateral. |

(j) | The security is structured as profit sharing agreement subject to a preferred return. |

(k) | Security is in wind down with no specific maturity date. |

(l) | Variable maturity dates maturing through 4/30/2024. |

(m) | Security has a blended interest rate of 14.00% for draws up to $13,000,500 and 12.70% for draws above $13,000,500. |

(n) | Security has a blended interest rate of CME 3 month SOFR + 10.00% for 85% advance rates and CME 3 month SOFR + 13.00% for 90% advance rates. |

(o) | This investment was made through a participation. Please see Note 2 for a description of loan participations. |

(p) | The security paid off in full subsequent to fiscal year end 4/30/2023. |

(q) | The security receives paid in kind interest. This indicates that interest accrued within a period may be capitalized into the principal balance of the security or interest is collected periodically with no specific terms. |

(r) | Rate listed is the 7-day effective yield at 4/30/2023. |

(s) | This investment is a grant. The grant can be exercised at 200 EUR when an equity investment is made by the participation through Rivonia Road Capital, LLC. |

(t) | This warrant’s expiration date is on the tenth anniversary of its date of issue (5/17/2022). The exercise price is $0.01. |

(u) | This warrant’s expiration date is on the tenth anniversary of its effective date (7/13/2021). The exercise price is $0.01. |

(v) | This warrant’s expiration date is on the tenth anniversary of its initial vest date (5/1/2020). The exercise price is $0.01. |

The accompanying notes are an integral part of these Financial Statements.

12

Variant Alternative Income Fund

Portfolio Allocation (Unaudited)

April 30, 2023

Investment Type as a percentage of Total Net Assets as follows

Security Type/Sector | | Percent of

Total

Net Assets | |

Credit Facilities | | | 54.9 | % |

Private Investment Companies | | | 25.8 | % |

Special Purpose Vehicles | | | 9.0 | % |

Short-Term Investments | | | 7.5 | % |

Direct Equities | | | 0.3 | % |

Warrants | | | 0.1 | % |

Total Investments | | | 97.6 | % |

Other assets less liabilities | | | 2.4 | % |

Total Net Assets | | | 100.0 | % |

The accompanying notes are an integral part of these Financial Statements.

13

Variant Alternative Income Fund

Statement of Assets and Liabilities

April 30, 2023

Assets | | | | |

Investments in securities, at fair value (cost $2,432,554,229) | | $ | 2,505,526,399 | |

Unrealized appreciation on open futures contract | | | 101,769 | |

Cash | | | 173,781 | |

Cash deposited with broker for futures contracts | | | 10,058,415 | |

Receivable for Fund shares sold | | | 1,234,772 | |

Receivable for investments sold | | | 451,435 | |

Interest receivable | | | 11,752,166 | |

Interest receivable on securities paid in kind | | | 34,698,934 | |

Prepaid expenses | | | 871,958 | |

Total Assets | | | 2,564,869,629 | |

| | | | | |

Liabilities | | | | |

Foreign currency due to broker, at value (proceeds $590) | | | 545 | |

Unrealized depreciation on open futures contracts | | | 805,500 | |

Due to Investment Manager | | | 1,992,107 | |

Audit fees payable | | | 252,000 | |

Legal fees payable | | | 50,001 | |

Accounting and administration fees payable | | | 300,637 | |

SEC fees payable | | | 77,000 | |

Custody fees payable | | | 35,328 | |

Other liabilities | | | 137,135 | |

Total Liabilities | | | 3,650,253 | |

| | | | | |

Net Assets | | $ | 2,561,219,376 | |

| | | | | |

Components of Net Assets: | | | | |

Paid-in Capital (par value of $0.01 with an unlimited amount of shares authorized) | | $ | 2,399,521,891 | |

Total distributable earnings | | | 161,697,485 | |

Net Assets | | $ | 2,561,219,376 | |

| | | | | |

Institutional Class Shares: | | | | |

Net assets applicable to shares outstanding | | $ | 2,561,219,376 | |

Shares of beneficial interest issued and outstanding | | | 88,517,680 | |

Net asset value per share | | $ | 28.93 | |

The accompanying notes are an integral part of these Financial Statements.

14

Variant Alternative Income Fund

Statement of Operations

For the Year Ended April 30, 2023

Investment Income | | | | |

Interest (net of withholding taxes, $69,532) | | $ | 115,106,181 | |

Interest from securities paid in kind | | | 45,304,419 | |

Distributions from private investment funds and special purpose vehicles | | | 38,254,467 | |

Total Investment Income | | | 198,665,067 | |

| | | | | |

Expenses | | | | |

Investment management fees | | | 21,268,106 | |

Accounting and administration fees | | | 1,610,837 | |

Legal fees | | | 707,482 | |

Audit and tax compliance fees | | | 327,095 | |

Transfer Agent fees | | | 406,969 | |

Blue sky fees | | | 112,780 | |

Custody fees | | | 104,175 | |

Trustee fees | | | 95,192 | |

Insurance fees | | | 52,853 | |

Chief Compliance Officer fees | | | 59,240 | |

Other expenses | | | 372,279 | |

Total expenses before revolving credit facility fees and interest expense | | | 25,117,008 | |

| | | | | |

Revolving credit facility fees | | | 142,476 | |

Interest expense | | | 2,094,782 | |

| | | | | |

Total Expenses | | | 27,354,266 | |

| | | | | |

Net Investment Income | | | 171,310,801 | |

| | | | | |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) on: | | | | |

Investments in unaffiliated securities | | | (1,083,616 | ) |

Futures contracts | | | 3,132,681 | |

Foreign currency transactions | | | (15,253 | ) |

Capital gain distributions from private investment companies | | | 27,968 | |

Net realized gain | | | 2,061,780 | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments in issuers | | | 7,964,347 | |

Foreign currency translations | | | 30,767 | |

Futures contracts | | | (3,477,522 | ) |

Net change in unrealized appreciation (depreciation) | | | (3,477,522 | ) |

Net realized and unrealized gain (loss) | | | 6,579,372 | |

| | | | | |

Net Increase in Net Assets resulting from Operations | | $ | 177,890,173 | |

The accompanying notes are an integral part of these Financial Statements.

15

Variant Alternative Income Fund

Statements of Changes in Shareholders’ Equity

| | | For the

Year Ended

April 30, 2023 | | | For the

Year Ended

April 30, 2022 | |

Increase (decrease) in Net Assets from: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 171,310,801 | | | $ | 86,937,033 | |

Net realized gain (loss) | | | 2,061,780 | | | | 3,236,220 | |

Net change in unrealized appreciation (depreciation) | | | 4,517,592 | | | | 46,983,572 | |

Net increase in net assets resulting from operations | | | 177,890,173 | | | | 137,156,825 | |

| | | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

Distributions: | | | | | | | | |

Institutional Class | | | (117,696,281 | ) | | | (67,629,289 | ) |

Investor Class | | | — | | | | (39,311 | ) |

From return of capital: | | | | | | | | |

Institutional Class | | | (15,410,214 | ) | | | (11,493,656 | ) |

Investor Class | | | — | | | | (6,681 | ) |

Total distributions to shareholders | | | (133,106,495 | ) | | | (79,168,937 | ) |

| | | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Institutional Class Shares | | | | | | | | |

Net proceeds from shares sold | | | 904,881,803 | | | | 1,013,005,180 | |

Exchange from Investor Class | | | — | | | | 4,086,999 | |

Reinvestment of distributions | | | 31,500,940 | | | | 16,594,573 | |

Cost of shares repurchased | | | (277,213,241 | ) | | | (80,846,791 | ) |

Net increase (decrease) in net assets from Institutional Class Shares capital transactions | | | 659,169,502 | | | | 952,839,961 | |

| | | | | | | | | |

Investor Class Shares 1 | | | | | | | | |

Net proceeds from shares sold | | | — | | | | 1,582,939 | |

Exchange to Institutional Class | | | — | | | | (4,086,999 | ) |

Reinvestment of distributions | | | — | | | | 5,367 | |

Cost of shares repurchased: | | | — | | | | (291,152 | ) |

Net increase (decrease) in net assets from Investor Class Shares capital transactions | | | — | | | | (2,789,845 | ) |

| | | | | | | | | |

Net increase in net assets resulting from capital transactions | | | 659,169,502 | | | | 950,050,116 | |

| | | | | | | | | |

Total increase in net assets | | | 703,953,180 | | | | 1,008,038,004 | |

| | | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of year | | | 1,857,266,196 | | | | 849,228,192 | |

End of year | | $ | 2,561,219,376 | | | $ | 1,857,266,196 | |

The accompanying notes are an integral part of these Financial Statements.

16

Variant Alternative Income Fund

Statements of Changes in Shareholders’ Equity

(Continued)

| | | For the

Year Ended

April 30, 2023 | | | For the

Year Ended

April 30, 2022 | |

Share Transactions: | | | | | | | | |

Institutional Class Shares | | | | | | | | |

Issued | | | 31,576,941 | | | | 36,317,834 | |

Exchange from Investor Class | | | — | | | | 145,429 | |

Reinvested | | | 1,105,906 | | | | 596,368 | |

Repurchased | | | (9,613,260 | ) | | | (2,863,603 | ) |

Change in Institutional Class Shares | | | 23,069,587 | | | | 34,196,028 | |

Investor Class Shares 1 | | | | | | | | |

Issued | | | — | | | | 57,269 | |

Exchange to Institutional Class | | | — | | | | (145,429 | ) |

Reinvested | | | — | | | | 196 | |

Repurchased | | | — | | | | (155,974 | ) |

Change in Investor Class Shares | | | — | | | | (243,938 | ) |

| 1 | On September 17, 2021, Investor Class Shares were converted into Institutional Class Shares, and Investor Class Shares as a class of Shares of the Fund was terminated. |

The accompanying notes are an integral part of these Financial Statements.

17

Variant Alternative Income Fund

Statement of Cash Flows

For the Year Ended April 30, 2023

Cash flows from operating activities: | | | | |

Net increase in net assets resulting from operations | | $ | 177,652,050 | |

Adjustments to reconcile net increase in net assets resulting from | | | | |

operations to net cash used in operating activities: | | | | |

Net realized (gain) loss on: | | | | |

Investments | | | 1,083,616 | |

Futures contracts | | | (3,132,681 | ) |

Capital gain distributions from private investment companies | | | (27,968 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (7,964,347 | ) |

Futures contracts | | | 3,477,522 | |

Purchases of long-term investments | | | (1,218,257,716 | ) |

Proceeds from long-term investments sold | | | 542,541,777 | |

Purchase of short-term investments, net | | | (64,057,486 | ) |

Interest from securities paid in kind | | | 45,304,419 | |

Changes in operating assets and liabilities: | | | | |

Interest receivable | | | 6,495,572 | |

Interest receivable from securities paid in kind | | | (34,698,934 | ) |

Investments sold | | | 5,758,590 | |

Contributions paid in advance | | | 14,418,631 | |

Prepaid expenses | | | (234,058 | ) |

Due to Investment Manager | | | 598,691 | |

Audit fees payable | | | 75,095 | |

Legal fees payable | | | 50,001 | |

Accounting and administration fees payable | | | 190,719 | |

SEC fees payable | | | 22,529 | |

Custody fees payable | | | 22,996 | |

Interest received not yet earned | | | (1,251,040 | ) |

Other liabilities | | | 110,382 | |

Net cash used in operating activities | | | (531,821,640 | ) |

| | | | | |

Cash flows from financing activities: | | | | |

Proceeds from shares sold, net of receivable for fund shares sold | | | 912,412,527 | |

Payments for shares repurchased | | | (277,213,241 | ) |

Distributions to shareholders, net of reinvestments | | | (101,605,555 | ) |

Proceeds from revolving credit facility | | | (40,000,000 | ) |

Repayments on revolving credit facility | | | 40,000,000 | |

Net cash provided by financing activities | | | 533,593,731 | |

| | | | | |

Net Increase in Cash and Restricted Cash | | | 1,772,091 | |

| | | | | |

Cash and Restricted Cash: | | | | |

Beginning of period | | | 8,460,105 | |

End of period (a) | | $ | 10,232,196 | |

| (a) | Cash and restricted cash include cash and cash deposited with broker for futures, as outlined further on the Statement of Assets and Liabilities. |

Supplemental disclosure of cash flow information:

Non-cash financing activities not included consist of reinvestment of dividends and distributions of $31,500,940, and paid in kind income of $45,304,419.

The accompanying notes are an integral part of these Financial Statements.

18

Variant Alternative Income Fund

Financial Highlights

Institutional Class

Per share operating performance. For a capital share outstanding throughout each year/period. |

| | | For the

Year Ended

April 30, 2023 | | | For the

Year Ended

April 30, 2022 | | | For the

Year Ended

April 30, 2021 | | | For the

Year Ended

April 30, 2020 | | | For the

Period Ended

April 30, 2019 1 | |

Net asset value, beginning of year/period | | $ | 28.38 | | | $ | 26.96 | | | $ | 26.32 | | | $ | 25.79 | | | $ | 25.00 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 2.22 | | | | 1.89 | | | | 1.66 | | | | 1.33 | | | | 0.97 | |

Net realized and unrealized gain (loss) | | | 0.06 | | | | 1.21 | | | | 0.59 | | | | 0.79 | | | | 0.69 | |

Total from investment operations | | | 2.28 | | | | 3.10 | | | | 2.25 | | | | 2.12 | | | | 1.66 | |

| | | | | | | | | | | | | | | | | | | | | |

Less Distributions: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (1.53 | ) | | | (1.43 | ) | | | (0.99 | ) | | | (1.59 | ) | | | (0.87 | ) |

From return of capital | | | (0.20 | ) | | | (0.25 | ) | | | (0.62 | ) | | | – | | | | – | |

From net realized gains | | | – | | | | – | | | | – | | | | – | | | | – | |

Total distributions | | | (1.73 | ) | | | (1.68 | ) | | | (1.61 | ) | | | (1.59 | ) | | | (0.87 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year/period | | $ | 28.93 | | | $ | 28.38 | | | $ | 26.96 | | | $ | 26.32 | | | $ | 25.79 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return 3 | | | 8.28 | % | | | 11.79 | % | | | 8.81 | % | | | 8.38 | % | | | 6.29 | %4 |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 2,561,219 | | | $ | 1,857,266 | | | $ | 846,571 | | | $ | 378,040 | | | $ | 62,603 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

(including interest and revolving credit facility expense) | | | | | | | | | | | | | | | | | | | | |

Before fees waived/recovered 6 | | | 1.24 | % | | | 1.14 | % | | | 1.21 | % | | | 1.53 | % | | | 3.05 | %5 |

After fees waived/recovered 6 | | | 1.24 | % | | | 1.14 | % | | | 1.28 | % | | | 1.50 | % | | | 1.60 | %5 |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

(excluding interest and revolving credit facility expense) | | | | | | | | | | | | | | | | | | | | |

Before fees waived/recovered 6 | | | 1.14 | % | | | 1.12 | % | | | 1.20 | % | | | 1.48 | % | | | 2.90 | %5 |

After fees waived/recovered 6 | | | 1.14 | % | | | 1.12 | % | | | 1.27 | % | | | 1.45 | % | | | 1.45 | %5 |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets: | | | | | | | | | | | | | | | | | | | | |

(including interest and revolving credit facility expense) | | | | | | | | | | | | | | | | | | | | |

Before fees waived/recovered 6 | | | 7.75 | % | | | 6.75 | % | | | 6.28 | % | | | 4.96 | % | | | 5.13 | %5 |

After fees waived/recovered 6 | | | 7.75 | % | | | 6.75 | % | | | 6.21 | % | | | 4.99 | % | | | 6.58 | %5 |

Ratio of net investment income to average net assets: | | | | | | | | | | | | | | | | | | | | |

(excluding interest and revolving credit facility expense) | | | | | | | | | | | | | | | | | | | | |

Before fees waived/recovered 6 | | | 7.85 | % | | | 6.77 | % | | | 6.29 | % | | | 5.01 | % | | | 5.28 | %5 |

After fees waived/recovered 6 | | | 7.85 | % | | | 6.77 | % | | | 6.22 | % | | | 5.04 | % | | | 6.73 | %5 |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 27 | % | | | 42 | % | | | 52 | % | | | 21 | % | | | 21 | %4 |

| | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these Financial Statements.

19

Variant Alternative Income Fund

Financial Highlights

Institutional Class (continued)

| | | For the

Year Ended

April 30, 2023 | | | For the

Year Ended

April 30, 2022 | | | For the

Year Ended

April 30, 2021 | | | For the

Year Ended

April 30, 2020 | | | For the

Period Ended

April 30, 2019 1 | |

Senior Securities | | | | | | | | | | | | | | | | | | | | |

Total borrowings (000’s omitted) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Asset coverage per $1,000 unit of senior indebtness 7 | | | — | | | | — | | | | — | | | | — | | | | — | |

1 | For the period October 1, 2018 (commencement of operations) to April 30, 2019. See Note 12 “Reorganization Information” in the Notes to the Financial Statements. |

2 | Based on average shares outstanding for the period. |

3 | Total returns would have been lower had expenses not been waived by the Investment Manager. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

6 | The expenses and net investment loss ratios include income or expenses of the private investment companies and special purpose vehicles valued at practical expedient in which the Fund invests. |

7 | Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing this by the total number of senior indebtedness units, where one unit equals $1,000 of senior indebtedness. |

The accompanying notes are an integral part of these Financial Statements.

20

Variant Alternative Income Fund

Notes to Financial Statements

April 30, 2023

1. Organization

The Variant Alternative Income Fund (the “Fund”) is a closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and reorganized as a Delaware statutory trust at the close of business on September 28, 2018. Variant Investments, LLC serves as the investment adviser (the “Investment Manager”) of the Fund. The Fund operates as an interval fund pursuant to Rule 23c-3 under the Investment Company Act, and has adopted a fundamental policy to conduct quarterly repurchase offers at net asset value (“NAV”). The Fund commenced operations on October 1, 2018 with Institutional Class Shares. Investor Class Shares were offered at a later date and commenced operations on October 31, 2018. The Board of Trustees (“Board”) of the Fund approved the closure of the Fund’s Investor Class Shares effective August 27, 2021. On September 17, 2021, all of the Fund’s Investor Class Shares were converted into Institutional Class Shares and Investor Class Shares as a class of Shares of the Fund were terminated.

The Fund’s investment objective is to seek to provide a high level of current income by investing, directly or indirectly, a majority of its net assets (plus any borrowings for investment purposes) in alternative income generating investments. The Fund may allocate its assets through direct investments, and investments in a wide range of investment vehicles.

2. Accounting Policies

Basis of Preparation and Use of Estimates

The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies. The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Investment Transactions and Related Investment Income

Investment transactions are accounted for on a trade-date basis. Realized gains and losses on investment transactions are determined using cost calculated on a specific identification basis. Dividends are recorded on the ex-dividend date and interest is recognized on an accrual basis. Distributions from private investments that represent returns of capital in excess of cumulative profits and losses are credited to investment cost rather than investment income.

Distributions to Shareholders

Distributions are paid at least quarterly on the Shares in amounts representing substantially all of the Fund’s net investment income, if any, earned values each year. The Fund determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses (including capital loss carryover); however, it may distribute any excess annually to its shareholders. Distributions to shareholders are recorded on the ex-dividend date.

The exact amount of distributable income for each fiscal year can only be determined at the end of the Fund’s tax year. Under Section 19 of the Investment Company Act, the Fund is required to indicate the sources of certain distributions to shareholders. The estimated distribution composition may vary from quarter to quarter because it may be materially impacted by future income, expenses and realized gains and losses on securities and fluctuations in the value of the currencies in which Fund assets are denominated.

Valuation of Investments

The Fund calculates its NAV as of the close of business on each business day and at such other times as the Board may determine, including in connection with repurchases of Shares, in accordance with the procedures described below or as may be determined from time to time in accordance with policies established by the Board.

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good faith for purposes of the Investment Company Act. Rule 2a-5 permits fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the Investment Company Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the

21

Variant Alternative Income Fund

Notes to Financial Statements

April 30, 2023 (continued)

2. Accounting Policies (continued)

SEC also adopted related recordkeeping requirements and is rescinding previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. Effective September 8, 2022, and pursuant to the requirements of Rule 2a-5, the Board designated the Investment Manager as the Fund’s valuation designee (in this capacity, the “Valuation Designee”) to perform fair value determinations.

The Fund values its investments at fair value. The Board has approved valuation procedures for the Fund (the “Valuation Procedures”).The Board has delegated the day to day responsibility for fair value determinations in accordance with the Valuation Procedures and pricing to the Investment Manager (“Valuation Designee”), subject to oversight by the Board.

Short-term securities, including bonds, notes, debentures and other debt securities, such as certificates of deposit, commercial paper, bankers’ acceptances and obligations of domestic and foreign banks, with maturities of 60 days or less, for which reliable market quotations are readily available shall each be valued at current market quotations as provided by an independent pricing service or principal market maker. Money market funds will be valued at NAV.

For equity, equity related securities, and options that are freely tradable and listed on a securities exchange or over-the- counter market, the Fund fair values those securities at their last sale price on that exchange or over-the-counter market on the valuation date. If the security is listed on more than one exchange, the Fund will use the price from the exchange that it considers to be the principal exchange on which the security is traded. Securities listed on the NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or over-the-counter market on such day, the security will be valued at the mean between the last bid price and last ask price on such day.

Fixed income securities (i.e. credit facilities, other than the short-term securities as described above) shall be valued by (a) using readily available market quotations based upon the last updated sale price or a market value from an approved pricing service generated by a pricing matrix based upon yield data for securities with similar characteristics or (b) by obtaining a direct written broker- dealer quotation from a dealer who has made a market in the security. If no price is obtained for a security in accordance with the foregoing, because either an external price is not readily available or such external price is believed by the Investment Manager not to reflect the market value, the Valuation Committee will make a determination in good faith of the fair value of the security in accordance with the Valuation Procedures. In general, fair value represents a good faith approximation of the current value of an asset and will be used when there is no public market or possibly no market at all for the asset. The fair values of one or more assets may not be the prices at which those assets are ultimately sold and the differences may be significant.

The Fund may acquire interests in loans either directly (by way of original issuance, sale or assignment) or indirectly (by way of participation). The purchaser of an assignment typically succeeds to all the rights and obligations of the assigning institution and becomes a lender under the credit agreement with respect to the debt obligation; however, its rights can be more restricted than those of the assigning institution. Participation interests in a portion of a debt obligation typically result in a contractual relationship only with the institution participating in the interest, not with the borrower. In purchasing participations, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement, nor any rights of set-off against the borrower, and the Fund may not directly benefit from the collateral supporting the debt obligation in which it has purchased the participation. As a result, the Fund will assume the credit risk of both the borrower and the institution selling the participation.

Prior to investing in any private investment companies or special purpose vehicles (collectively, “Underlying Funds”), the Investment Manager will conduct an initial due diligence review of the valuation methodologies utilized by the Underlying Fund, which generally shall be based upon readily observable market values when available, and otherwise utilize principles of fair value that are reasonably consistent with those used by the Fund for valuing its own investments. Subsequent to investment in an Underlying Fund, the Investment Manager will monitor the valuation methodologies used by each Underlying Fund. The Fund values its interests in Underlying Funds using the NAV provided by the managers of the Underlying Funds and/or their agents. These valuations involve significant judgment by the managers of the Underlying Funds and may differ from their actual realizable value. Under certain circumstances, the Valuation Committee may modify the managers’ valuations based on updated information received since the last valuation date. The Valuation Committee may also modify valuations if the valuations are deemed to not fully reflect the fair value of the investment. Valuations will be provided to the Fund based on interim unaudited financial records of the Underlying Funds, and, therefore, will be estimates and may fluctuate as a result. The Board, the Investment Manager and the Valuation Committee may have limited ability to assess the accuracy of these valuations.

22

Variant Alternative Income Fund

Notes to Financial Statements

April 30, 2023 (continued)

2. Accounting Policies (continued)