APRIL 17, 2018 Q1 2018 INTERIM REPORT Filing pursuant to Rule 425 under the Securities Act of 1933, as amended Filer: Com Hem Holding AB (publ) Subject Company: Com Hem Holding AB Commission File No.: 132-02882

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS This presentation includes forward-looking statements. Forward-looking statements can be identified by the use of forward-looking terminology, including words such as “believes,” “estimates,” “anticipates,” “expects,” “intends,” “may,” “will”, “could” or “should” or, in each case, their negative or other variations thereof or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this presentation and include statements regarding, or based upon, our Management’s current intentions, beliefs or expectations concerning, among other things, our future results of operations, financial condition, liquidity, prospects, growth, strategies, potential acquisitions, or developments in the industry in which we operate. Forward-looking statements are based upon assumptions and estimates about future events or circumstances, and are subject to risks and uncertainties. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations will materialise. Accordingly, our actual results may differ materially from those expressed or implied thereby. Unless otherwise specified, forward-looking statements herein speak only as of the date of this presentation. We undertake no obligation, and do not intend, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements referred to above. Readers are cautioned not to place undue reliance on any forward-looking statements. DISCLAIMER

TABLE OF CONTENT SUMMARY AND OUTLOOK OPERATIONAL UPDATE Group footprint expansion Com Hem Segment Boxer Segment Commercial update FINANCIAL PERFORMANCE Group financial performance Com Hem Segment Boxer Segment Group P&L Group cash flow and capital structure

SUMMARY Price adjustments implemented successfully for both Com Hem and Boxer during the quarter Largest price increase in Com Hem History, churn and net adds in-line with expectations Financial growth in-line with guidance Group revenue growth of 1.6% with a growth of 4.0% in the Com Hem Segment offset by a 5.9% decline in the Boxer segment Group underlying EBITDA growth of 3.6% with a growth of 5.2 % in the Com Hem Segment offset by a 8.1% decline in the Boxer segment Shareholder remuneration of SEK 740m in the quarter Continued progress on footprint expansion Group now connected to 2.9m addressable households Boxer operational results show large year-on-year improvement Decline in unique customers and RGUs almost half compared to Q1 2017 RGU neutrality in February Next two generations TV-products launched Award winning Tv Hub launched ComBo – our first boxless TV-subscription On track to DOCSIS 3.1 Network upgrades ongoing – 1+ Gbit/s expected H2 SUMMARY OF Q1 2018 COM HEM GROUP ON TRACK FOR FULL YEAR GUIDANCE

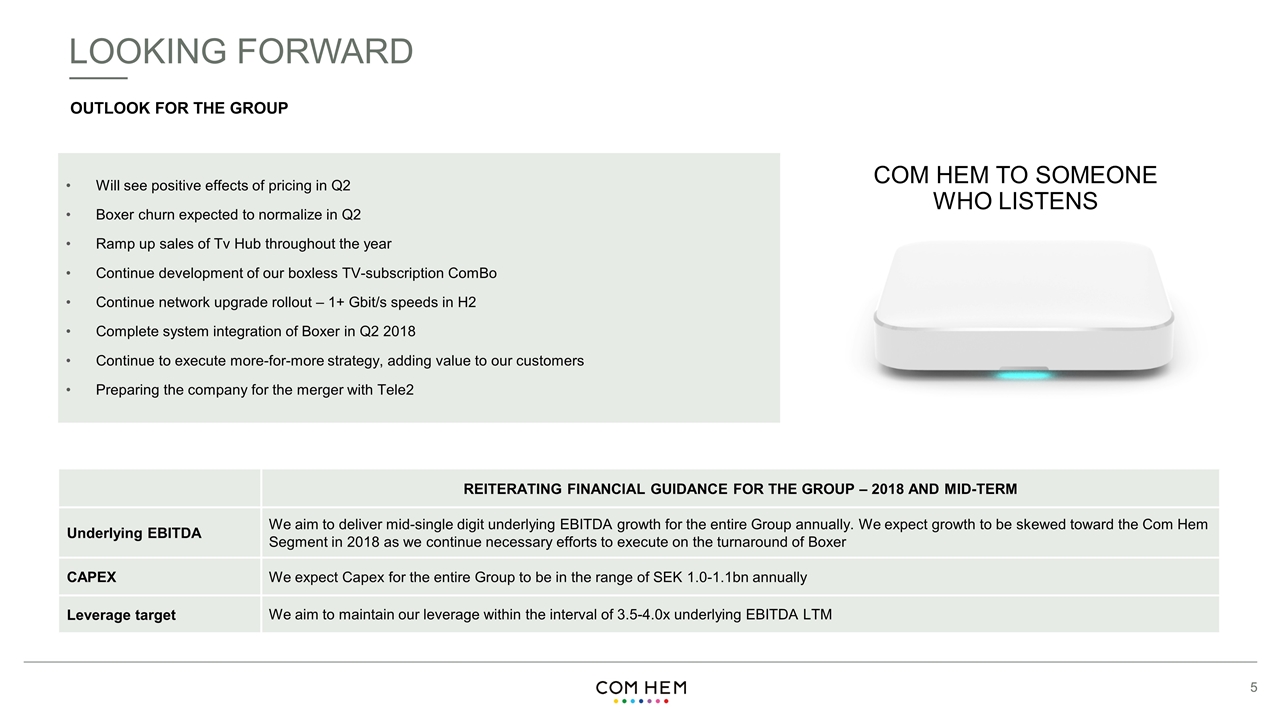

LOOKING FORWARD OUTLOOK FOR THE GROUP REITERATING FINANCIAL GUIDANCE FOR THE GROUP – 2018 AND MID-TERM Underlying EBITDA We aim to deliver mid-single digit underlying EBITDA growth for the entire Group annually. We expect growth to be skewed toward the Com Hem Segment in 2018 as we continue necessary efforts to execute on the turnaround of Boxer CAPEX We expect Capex for the entire Group to be in the range of SEK 1.0-1.1bn annually Leverage target We aim to maintain our leverage within the interval of 3.5-4.0x underlying EBITDA LTM Will see positive effects of pricing in Q2 Boxer churn expected to normalize in Q2 Ramp up sales of Tv Hub throughout the year Continue development of our boxless TV-subscription ComBo Continue network upgrade rollout – 1+ Gbit/s speeds in H2 Complete system integration of Boxer in Q2 2018 Continue to execute more-for-more strategy, adding value to our customers Preparing the company for the merger with Tele2 COM HEM TO SOMEONE WHO LISTENS

OPERATIONAL UPDATE

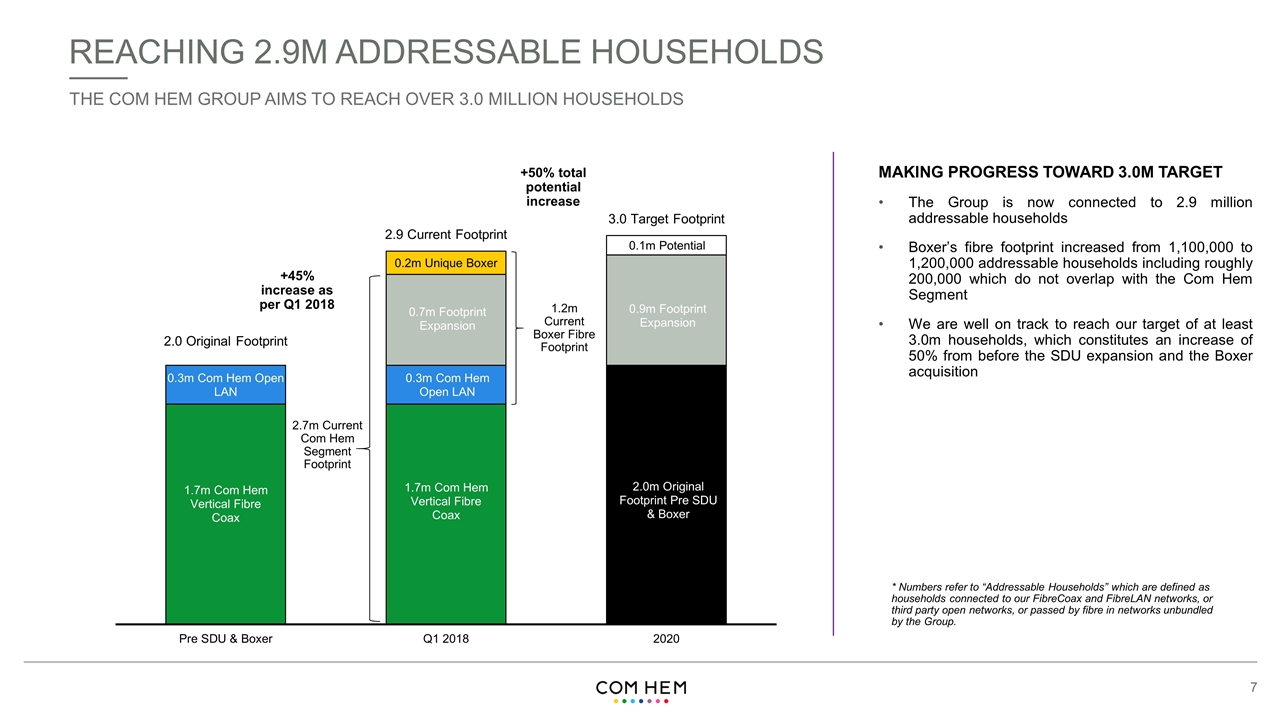

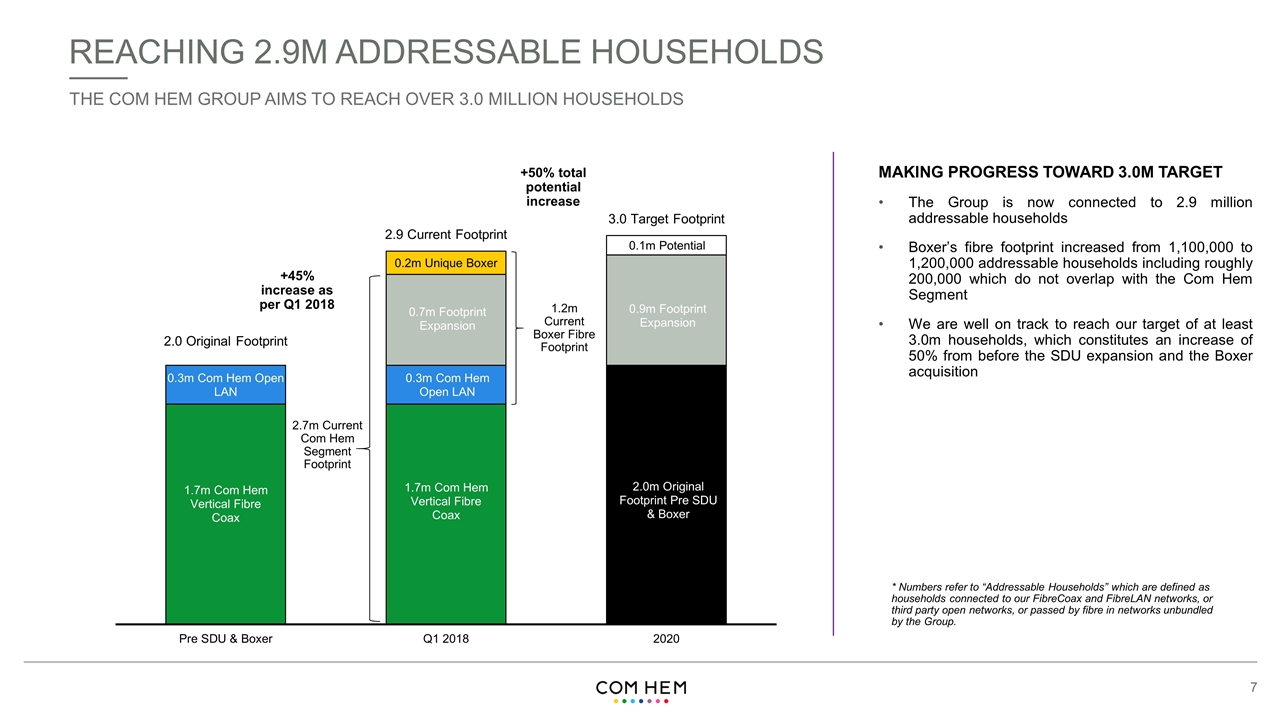

REACHING 2.9M ADDRESSABLE HOUSEHOLDS THE COM HEM GROUP AIMS TO REACH OVER 3.0 MILLION HOUSEHOLDS MAKING PROGRESS TOWARD 3.0M TARGET The Group is now connected to 2.9 million addressable households Boxer’s fibre footprint increased from 1,100,000 to 1,200,000 addressable households including roughly 200,000 which do not overlap with the Com Hem Segment We are well on track to reach our target of at least 3.0m households, which constitutes an increase of 50% from before the SDU expansion and the Boxer acquisition 1.2m Current Boxer Fibre Footprint +50% total potential increase 2.7m Current Com Hem Segment Footprint * Numbers refer to “Addressable Households” which are defined as households connected to our FibreCoax and FibreLAN networks, or third party open networks, or passed by fibre in networks unbundled by the Group. +45% increase as per Q1 2018

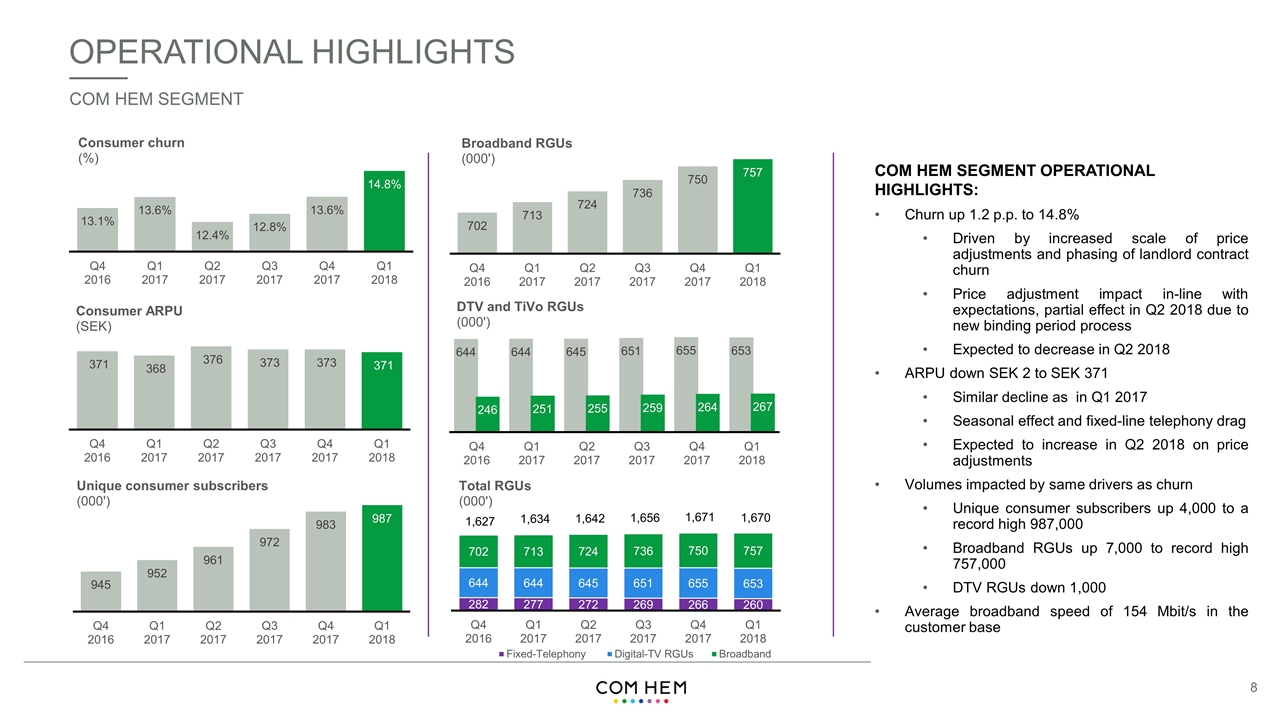

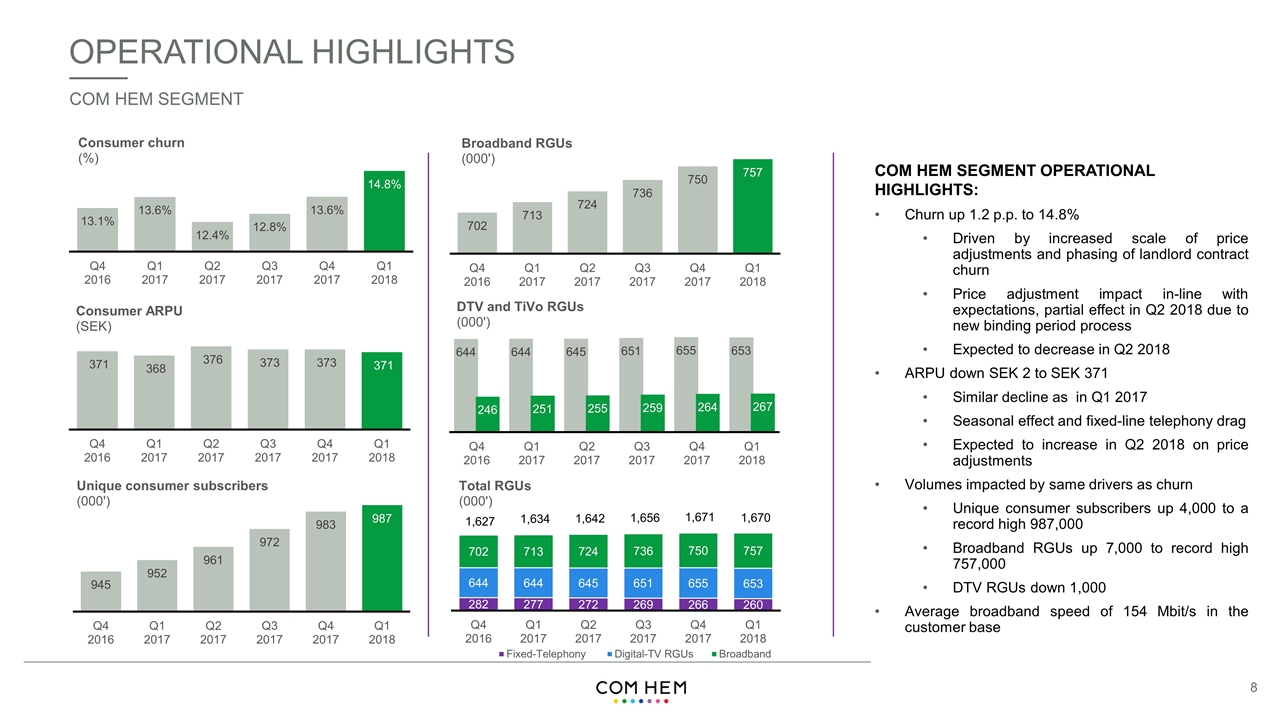

OPERATIONAL HIGHLIGHTS COM HEM SEGMENT COM HEM SEGMENT OPERATIONAL HIGHLIGHTS: Churn up 1.2 p.p. to 14.8% Driven by increased scale of price adjustments and phasing of landlord contract churn Price adjustment impact in-line with expectations, partial effect in Q2 2018 due to new binding period process Expected to decrease in Q2 2018 ARPU down SEK 2 to SEK 371 Similar decline as in Q1 2017 Seasonal effect and fixed-line telephony drag Expected to increase in Q2 2018 on price adjustments Volumes impacted by same drivers as churn Unique consumer subscribers up 4,000 to a record high 987,000 Broadband RGUs up 7,000 to record high 757,000 DTV RGUs down 1,000 Average broadband speed of 154 Mbit/s in the customer base

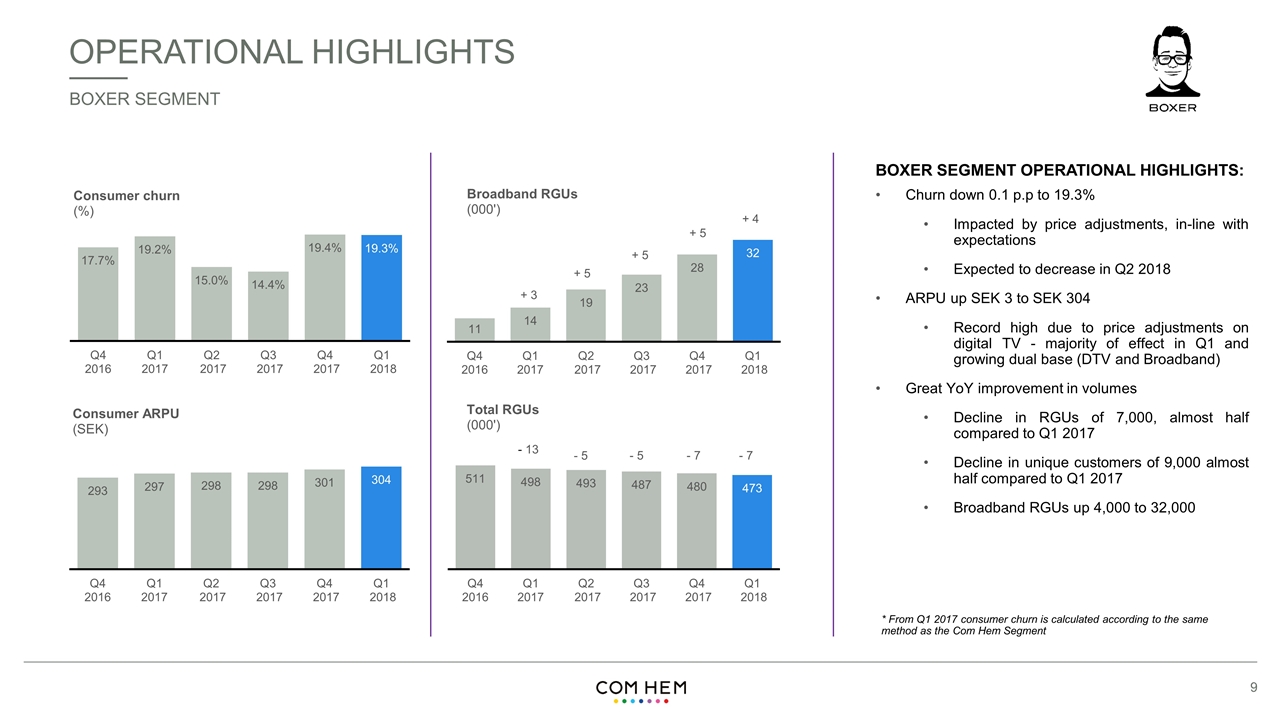

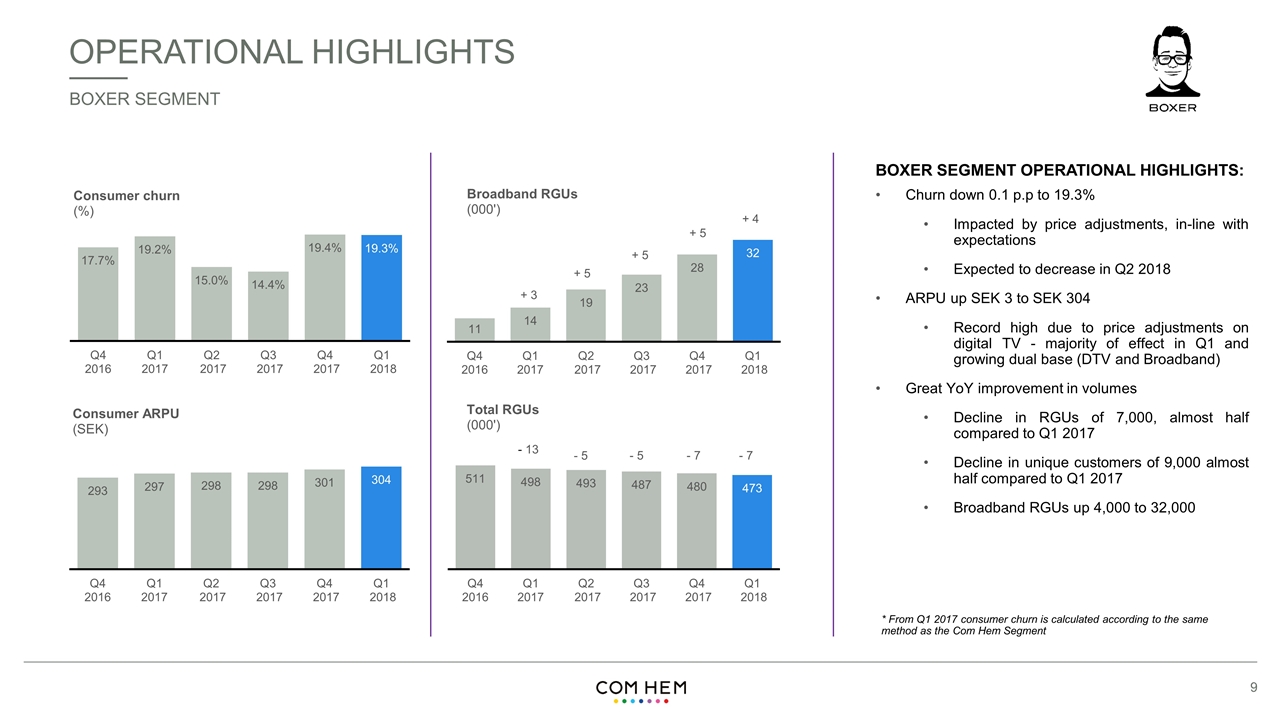

OPERATIONAL HIGHLIGHTS BOXER SEGMENT BOXER SEGMENT OPERATIONAL HIGHLIGHTS: Churn down 0.1 p.p to 19.3% Impacted by price adjustments, in-line with expectations Expected to decrease in Q2 2018 ARPU up SEK 3 to SEK 304 Record high due to price adjustments on digital TV - majority of effect in Q1 and growing dual base (DTV and Broadband) Great YoY improvement in volumes Decline in RGUs of 7,000, almost half compared to Q1 2017 Decline in unique customers of 9,000 almost half compared to Q1 2017 Broadband RGUs up 4,000 to 32,000 * From Q1 2017 consumer churn is calculated according to the same method as the Com Hem Segment

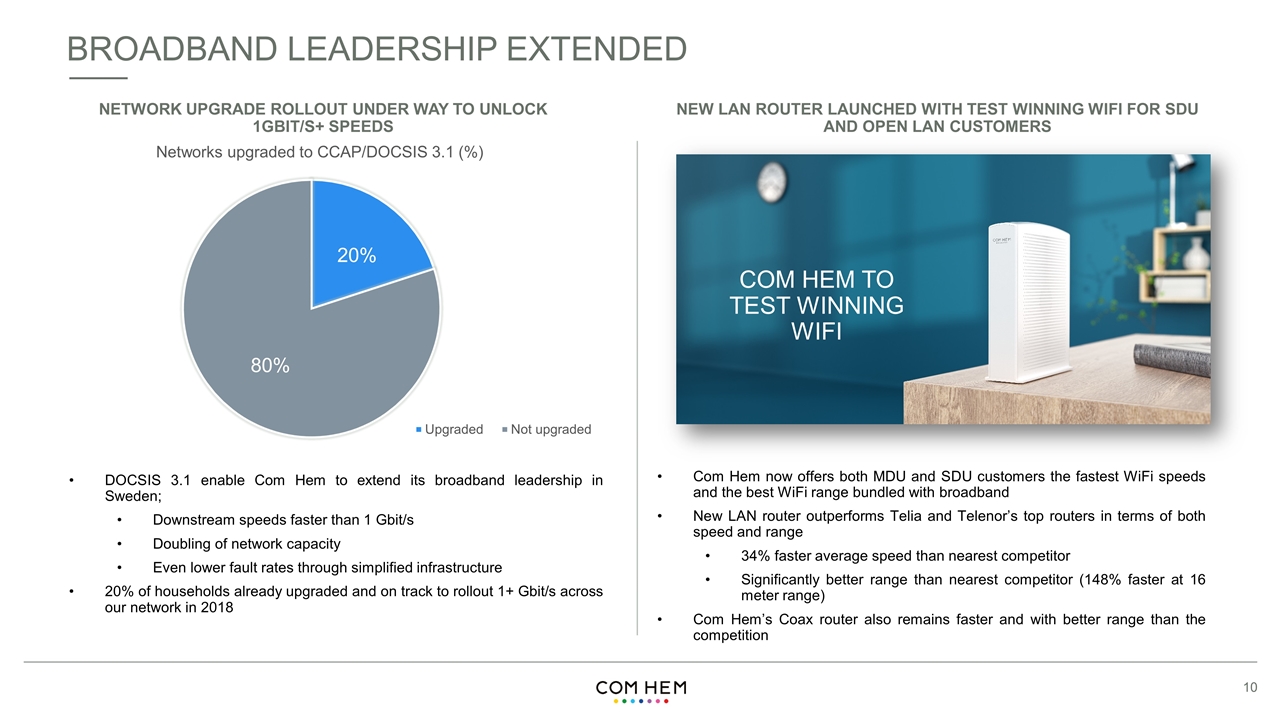

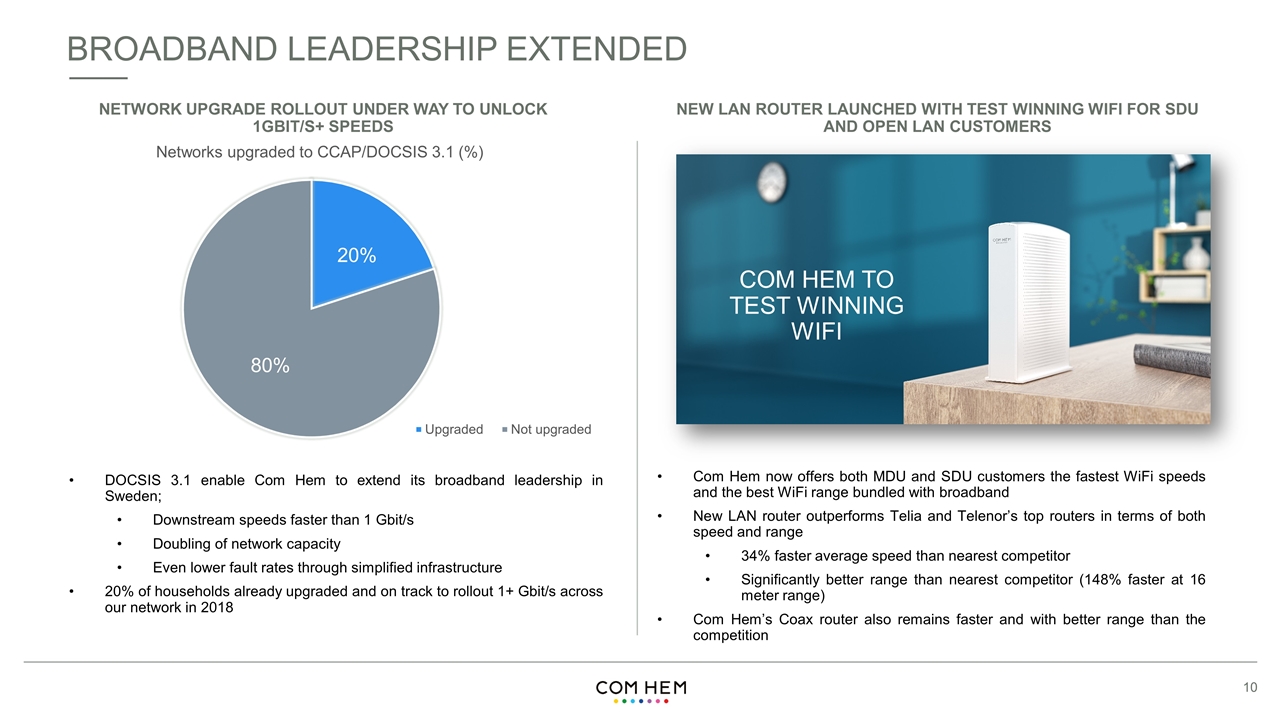

BROADBAND LEADERSHIP EXTENDED NETWORK UPGRADE ROLLOUT UNDER WAY TO UNLOCK 1GBIT/S+ SPEEDS NEW LAN ROUTER LAUNCHED WITH TEST WINNING WIFI FOR SDU AND OPEN LAN CUSTOMERS Com Hem now offers both MDU and SDU customers the fastest WiFi speeds and the best WiFi range bundled with broadband New LAN router outperforms Telia and Telenor’s top routers in terms of both speed and range 34% faster average speed than nearest competitor Significantly better range than nearest competitor (148% faster at 16 meter range) Com Hem’s Coax router also remains faster and with better range than the competition DOCSIS 3.1 enable Com Hem to extend its broadband leadership in Sweden; Downstream speeds faster than 1 Gbit/s Doubling of network capacity Even lower fault rates through simplified infrastructure 20% of households already upgraded and on track to rollout 1+ Gbit/s across our network in 2018 COM HEM TO TEST WINNING WI-FI 80% COM HEM TO TEST WINNING WIFI

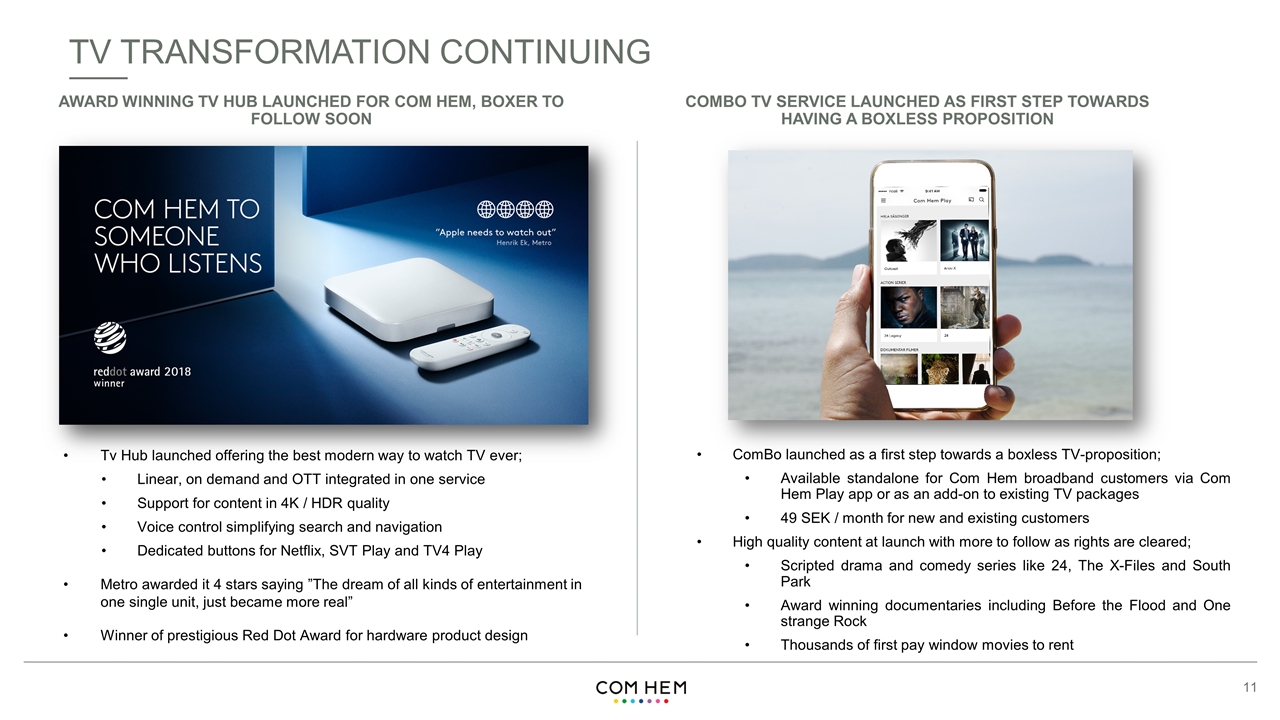

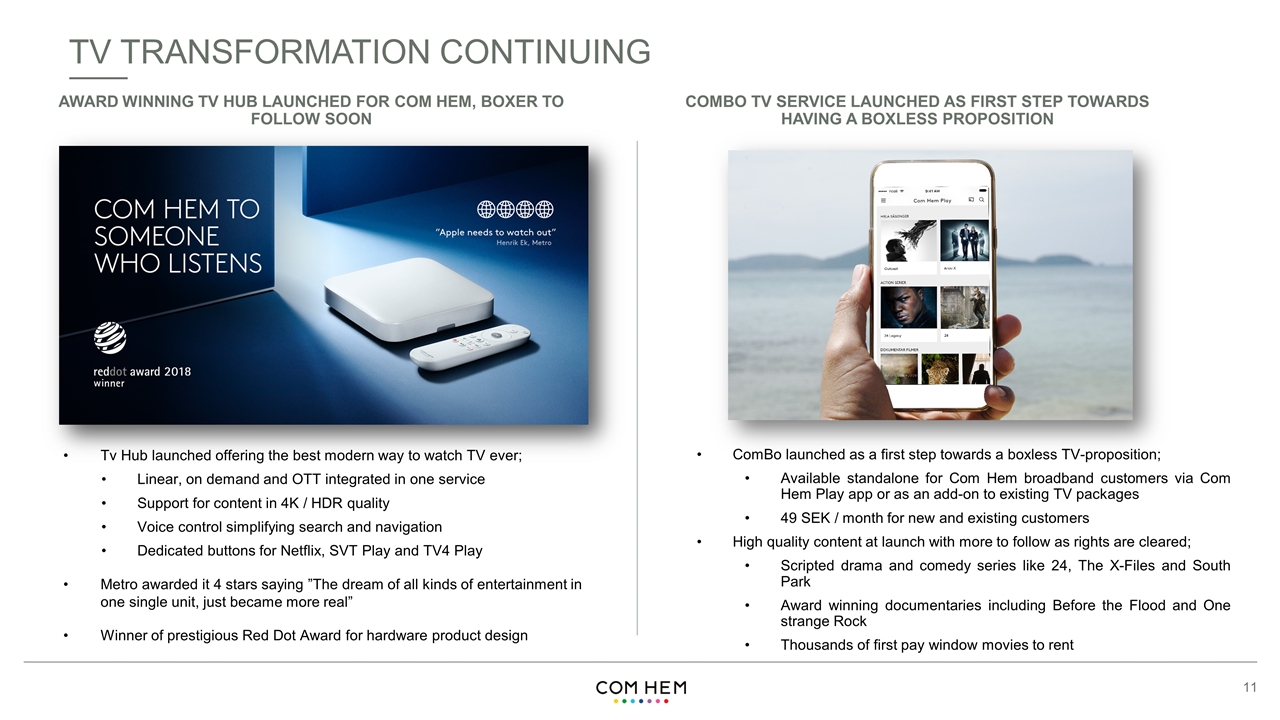

TV TRANSFORMATION CONTINUING AWARD WINNING TV HUB LAUNCHED FOR COM HEM, BOXER TO FOLLOW SOON Tv Hub launched offering the best modern way to watch TV ever; Linear, on demand and OTT integrated in one service Support for content in 4K / HDR quality Voice control simplifying search and navigation Dedicated buttons for Netflix, SVT Play and TV4 Play Metro awarded it 4 stars saying ”The dream of all kinds of entertainment in one single unit, just became more real” Winner of prestigious Red Dot Award for hardware product design ComBo launched as a first step towards a boxless TV-proposition; Available standalone for Com Hem broadband customers via Com Hem Play app or as an add-on to existing TV packages 49 SEK / month for new and existing customers High quality content at launch with more to follow as rights are cleared; Scripted drama and comedy series like 24, The X-Files and South Park Award winning documentaries including Before the Flood and One strange Rock Thousands of first pay window movies to rent COMBO TV SERVICE LAUNCHED AS FIRST STEP TOWARDS HAVING A BOXLESS PROPOSITION

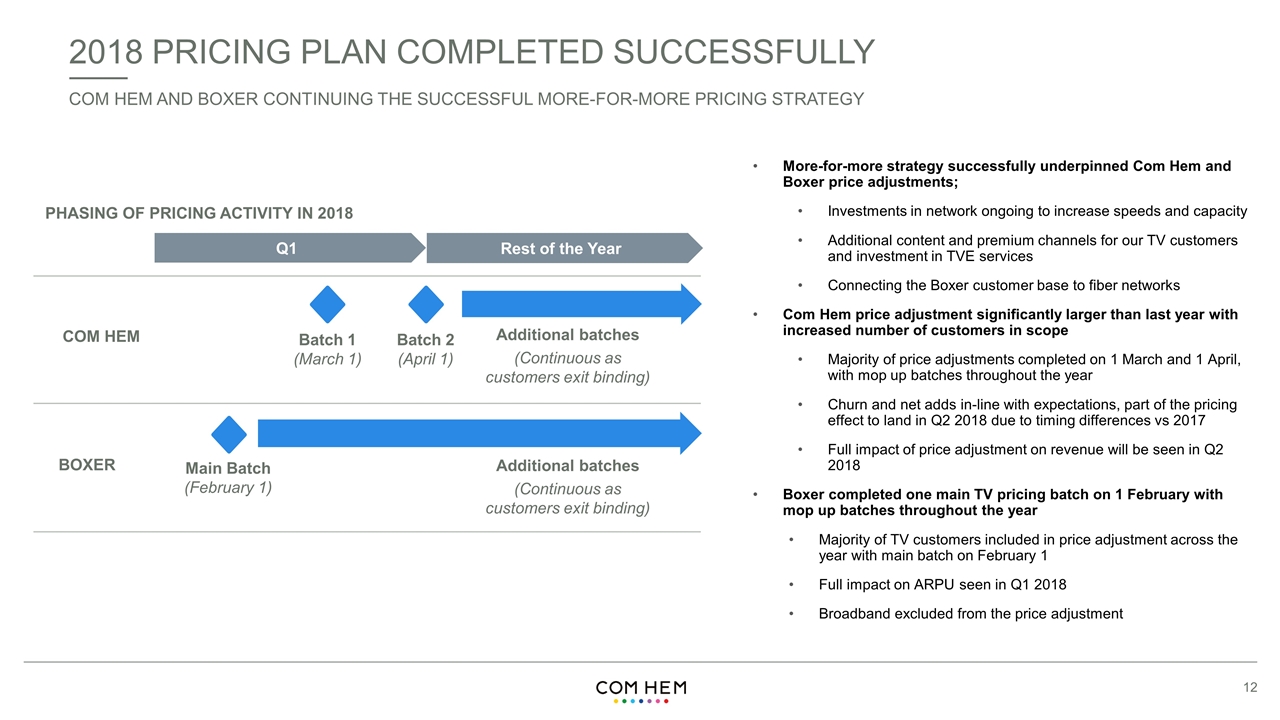

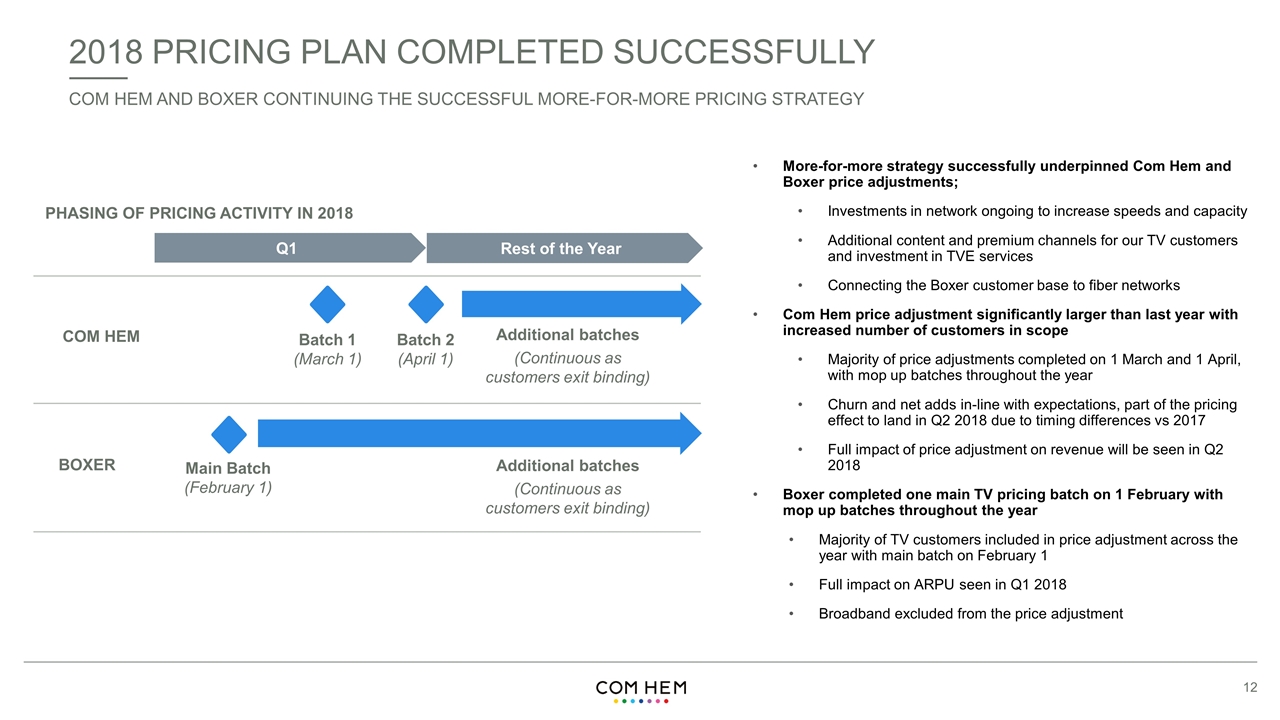

2018 PRICING PLAN COMPLETED SUCCESSFULLY More-for-more strategy successfully underpinned Com Hem and Boxer price adjustments; Investments in network ongoing to increase speeds and capacity Additional content and premium channels for our TV customers and investment in TVE services Connecting the Boxer customer base to fiber networks Com Hem price adjustment significantly larger than last year with increased number of customers in scope Majority of price adjustments completed on 1 March and 1 April, with mop up batches throughout the year Churn and net adds in-line with expectations, part of the pricing effect to land in Q2 2018 due to timing differences vs 2017 Full impact of price adjustment on revenue will be seen in Q2 2018 Boxer completed one main TV pricing batch on 1 February with mop up batches throughout the year Majority of TV customers included in price adjustment across the year with main batch on February 1 Full impact on ARPU seen in Q1 2018 Broadband excluded from the price adjustment COM HEM AND BOXER CONTINUING THE SUCCESSFUL MORE-FOR-MORE PRICING STRATEGY Additional batches (Continuous as customers exit binding) Q1 Batch 1 (March 1) Batch 2 (April 1) Rest of the Year Additional batches (Continuous as customers exit binding) Main Batch (February 1) BOXER COM HEM PHASING OF PRICING ACTIVITY IN 2018

FINANCIAL PERFORMANCE

15.3% 1.6% FIRST QUARTER FINANCIAL HIGHLIGHTS COM HEM GROUP ■ Com Hem ■ Boxer 3.6% 5.2% 3.8% -1.1% 16.8% 4.0% OUTCOME Q1 2018 ■ Com Hem ■ Boxer ■ Com Hem ■ Boxer ■ Com Hem ■ Boxer 1,784 1,757 410 436 Com Hem segment revenue grew by 4.0% to SEK 1,374m, as a result of continued broadband and DTV volume and price growth Boxer revenue decline continued due to DTT churn leading to Group revenue growth of 1.6% to SEK 1,784m for the quarter Underlying EBITDA growth of 5.2% for the Com Hem Segment and 3.6% for the Group explained by lower operating costs Slightly higher capex spend compared to Q1 2017 explained by higher capex for TV CPEs and Boxer system integration Com Hem segment OFCF growth of 3.8% explained by stable growth in underlying EBITDA Slightly lower OFCF for the group as Boxer reported temporarily higher capex due to system integration compared to Q1 last year

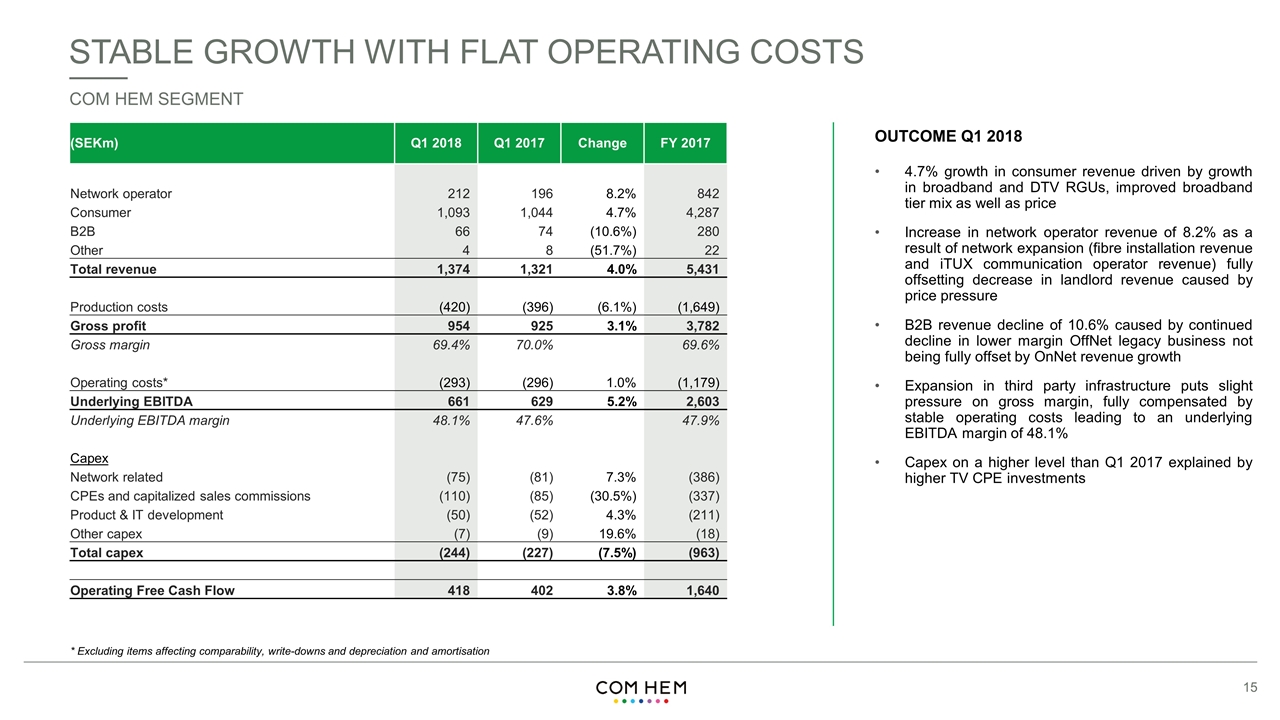

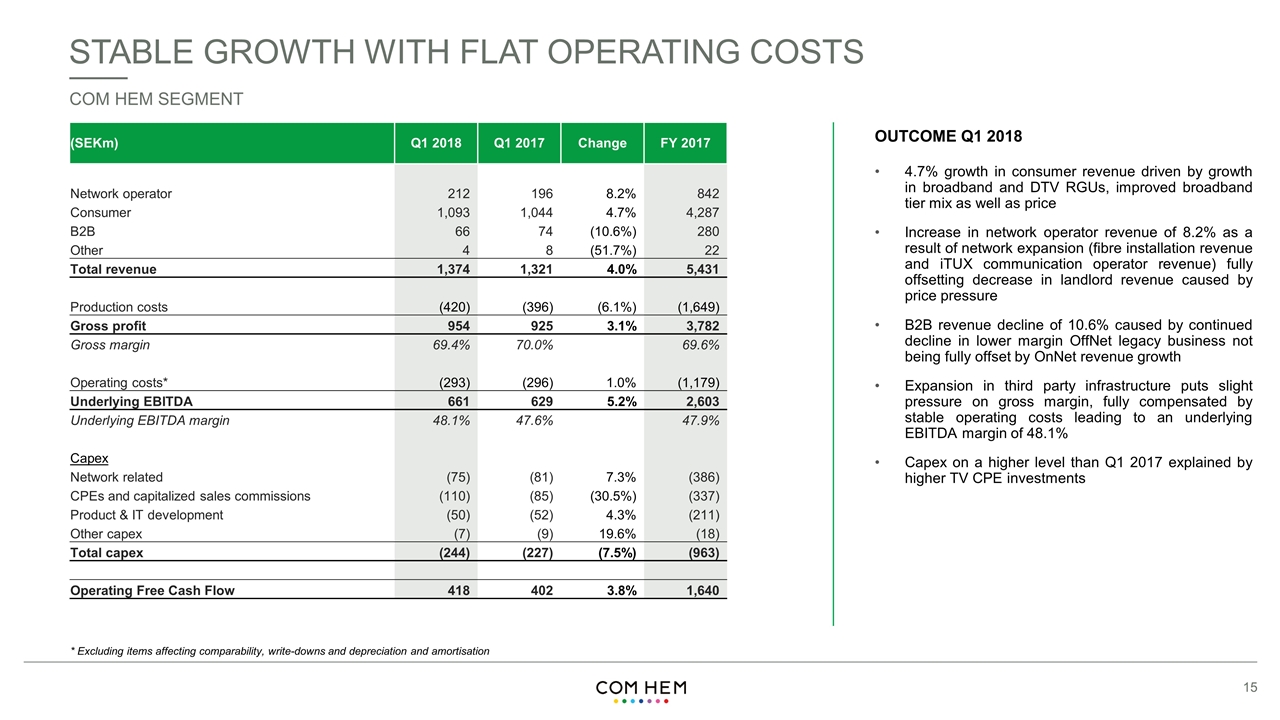

STABLE GROWTH WITH FLAT OPERATING COSTS COM HEM SEGMENT OUTCOME Q1 2018 * Excluding items affecting comparability, write-downs and depreciation and amortisation (SEKm) Q1 2018 Q1 2017 Change FY 2017 Network operator 212 196 8.2% 842 Consumer 1,093 1,044 4.7% 4,287 B2B 66 74 (10.6%) 280 Other 4 8 (51.7%) 22 Total revenue 1,374 1,321 4.0% 5,431 Production costs (420) (396) (6.1%) (1,649) Gross profit 954 925 3.1% 3,782 Gross margin 69.4% 70.0% 69.6% Operating costs* (293) (296) 1.0% (1,179) Underlying EBITDA 661 629 5.2% 2,603 Underlying EBITDA margin 48.1% 47.6% 47.9% Capex Network related (75) (81) 7.3% (386) CPEs and capitalized sales commissions (110) (85) (30.5%) (337) Product & IT development (50) (52) 4.3% (211) Other capex (7) (9) 19.6% (18) Total capex (244) (227) (7.5%) (963) Operating Free Cash Flow 418 402 3.8% 1,640 4.7% growth in consumer revenue driven by growth in broadband and DTV RGUs, improved broadband tier mix as well as price Increase in network operator revenue of 8.2% as a result of network expansion (fibre installation revenue and iTUX communication operator revenue) fully offsetting decrease in landlord revenue caused by price pressure B2B revenue decline of 10.6% caused by continued decline in lower margin OffNet legacy business not being fully offset by OnNet revenue growth Expansion in third party infrastructure puts slight pressure on gross margin, fully compensated by stable operating costs leading to an underlying EBITDA margin of 48.1% Capex on a higher level than Q1 2017 explained by higher TV CPE investments

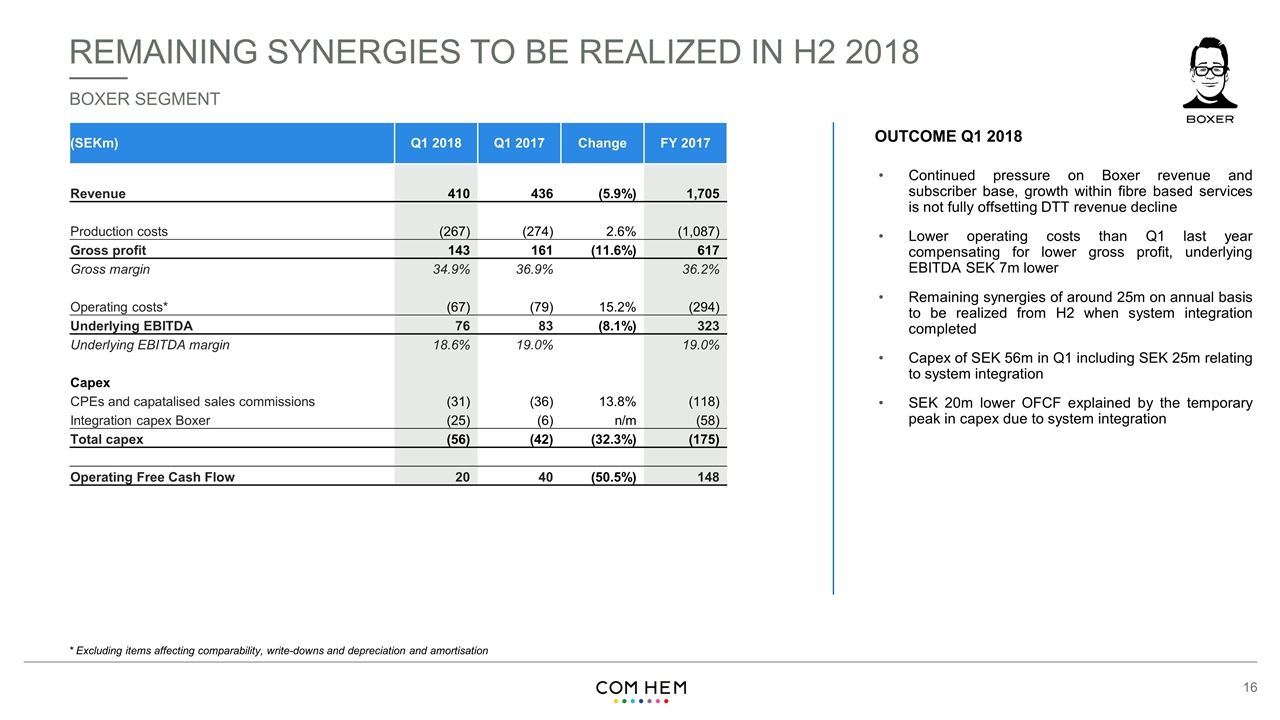

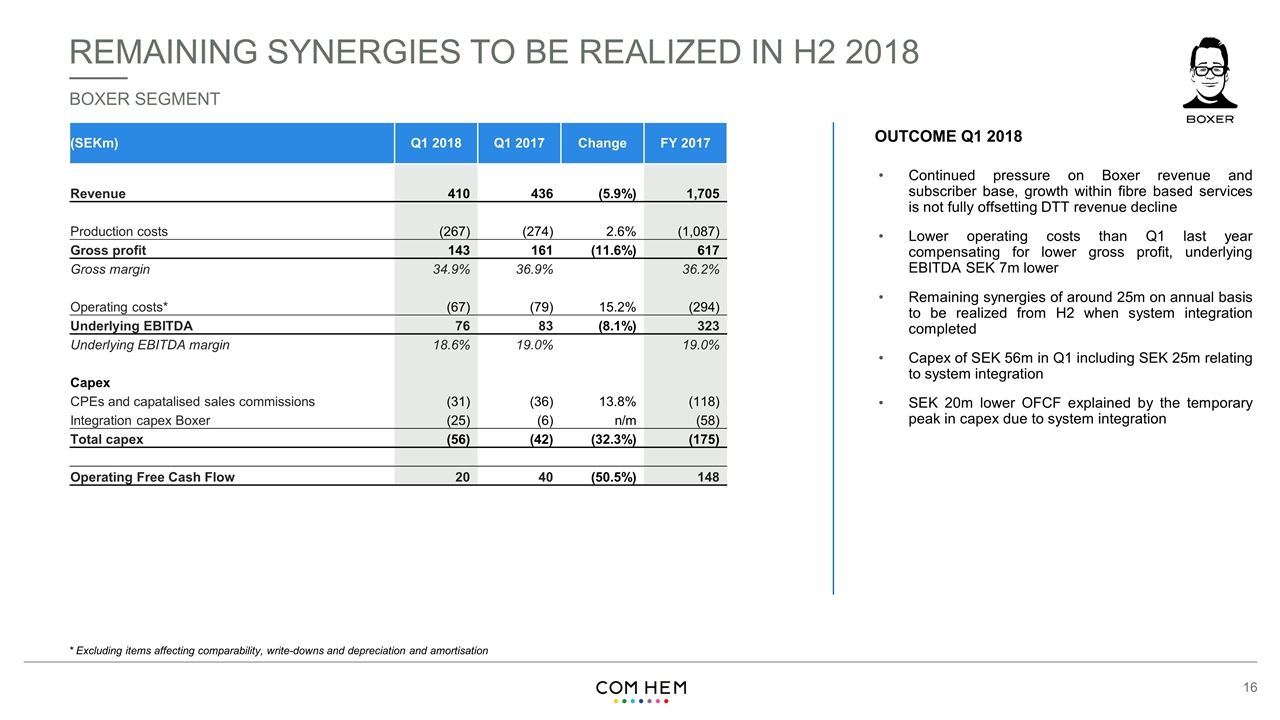

REMAINING SYNERGIES TO BE REALIZED IN H2 2018 BOXER SEGMENT * Excluding items affecting comparability, write-downs and depreciation and amortisation OUTCOME Q1 2018 (SEKm) Q1 2018 Q1 2017 Change FY 2017 Revenue 410 436 (5.9%) 1,705 Production costs (267) (274) 2.6% (1,087) Gross profit 143 161 (11.6%) 617 Gross margin 34.9% 36.9% 36.2% Operating costs* (67) (79) 15.2% (294) Underlying EBITDA 76 83 (8.1%) 323 Underlying EBITDA margin 18.6% 19.0% 19.0% Capex CPEs and capatalised sales commissions (31) (36) 13.8% (118) Integration capex Boxer (25) (6) n/m (58) Total capex (56) (42) (32.3%) (175) Operating Free Cash Flow 20 40 (50.5%) 148 Continued pressure on Boxer revenue and subscriber base, growth within fibre based services is not fully offsetting DTT revenue decline Lower operating costs than Q1 last year compensating for lower gross profit, underlying EBITDA SEK 7m lower Remaining synergies of around 25m on annual basis to be realized from H2 when system integration completed Capex of SEK 56m in Q1 including SEK 25m relating to system integration SEK 20m lower OFCF explained by the temporary peak in capex due to system integration

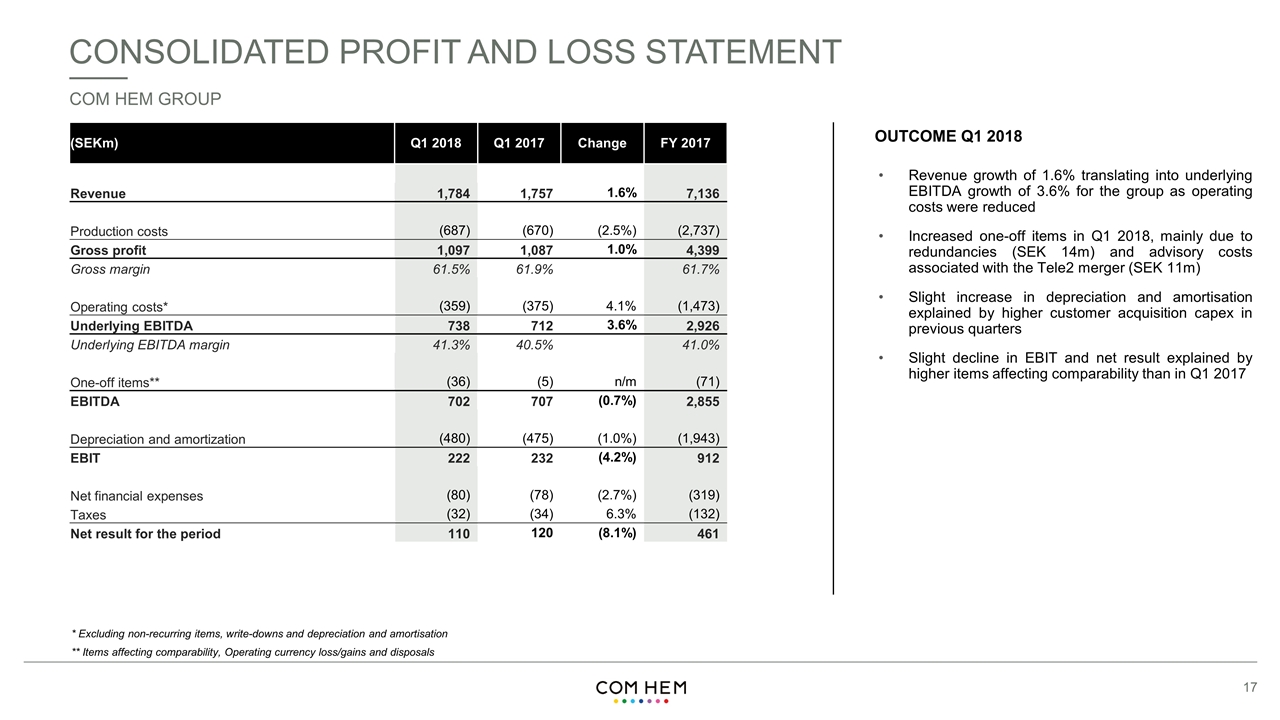

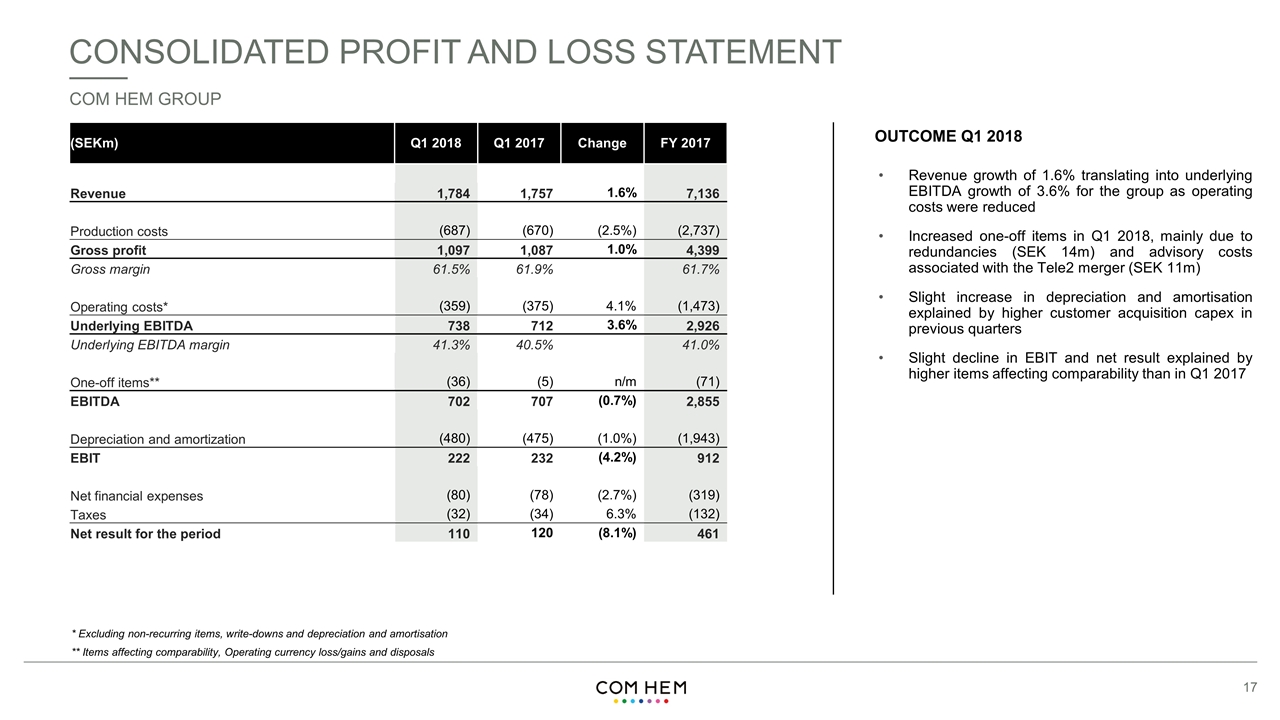

CONSOLIDATED PROFIT AND LOSS STATEMENT COM HEM GROUP OUTCOME Q1 2018 * Excluding non-recurring items, write-downs and depreciation and amortisation ** Items affecting comparability, Operating currency loss/gains and disposals (SEKm) Q1 2018 Q1 2017 Change FY 2017 Revenue 1,784 1,757 1.6% 7,136 Production costs (687) (670) (2.5%) (2,737) Gross profit 1,097 1,087 1.0% 4,399 Gross margin 61.5% 61.9% 61.7% Operating costs* (359) (375) 4.1% (1,473) Underlying EBITDA 738 712 3.6% 2,926 Underlying EBITDA margin 41.3% 40.5% 41.0% One-off items** (36) (5) n/m (71) EBITDA 702 707 (0.7%) 2,855 Depreciation and amortization (480) (475) (1.0%) (1,943) EBIT 222 232 (4.2%) 912 Net financial expenses (80) (78) (2.7%) (319) Taxes (32) (34) 6.3% (132) Net result for the period 110 120 (8.1%) 461 Revenue growth of 1.6% translating into underlying EBITDA growth of 3.6% for the group as operating costs were reduced Increased one-off items in Q1 2018, mainly due to redundancies (SEK 14m) and advisory costs associated with the Tele2 merger (SEK 11m) Slight increase in depreciation and amortisation explained by higher customer acquisition capex in previous quarters Slight decline in EBIT and net result explained by higher items affecting comparability than in Q1 2017

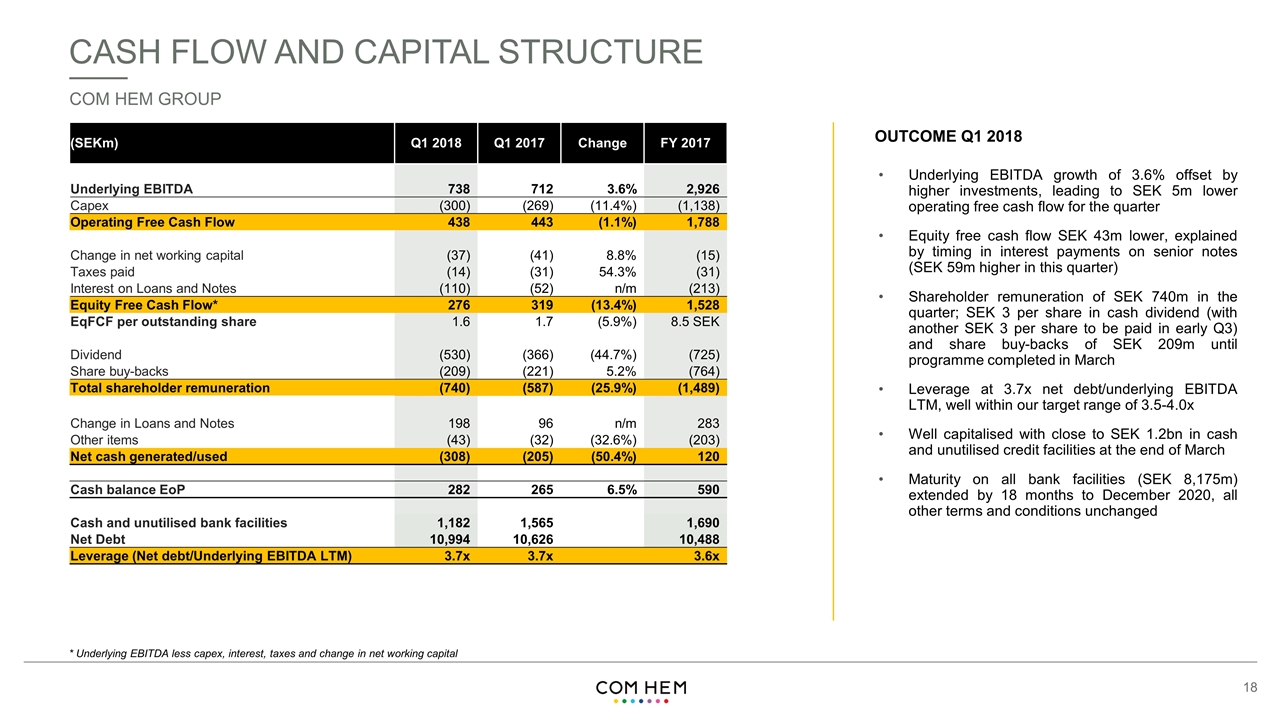

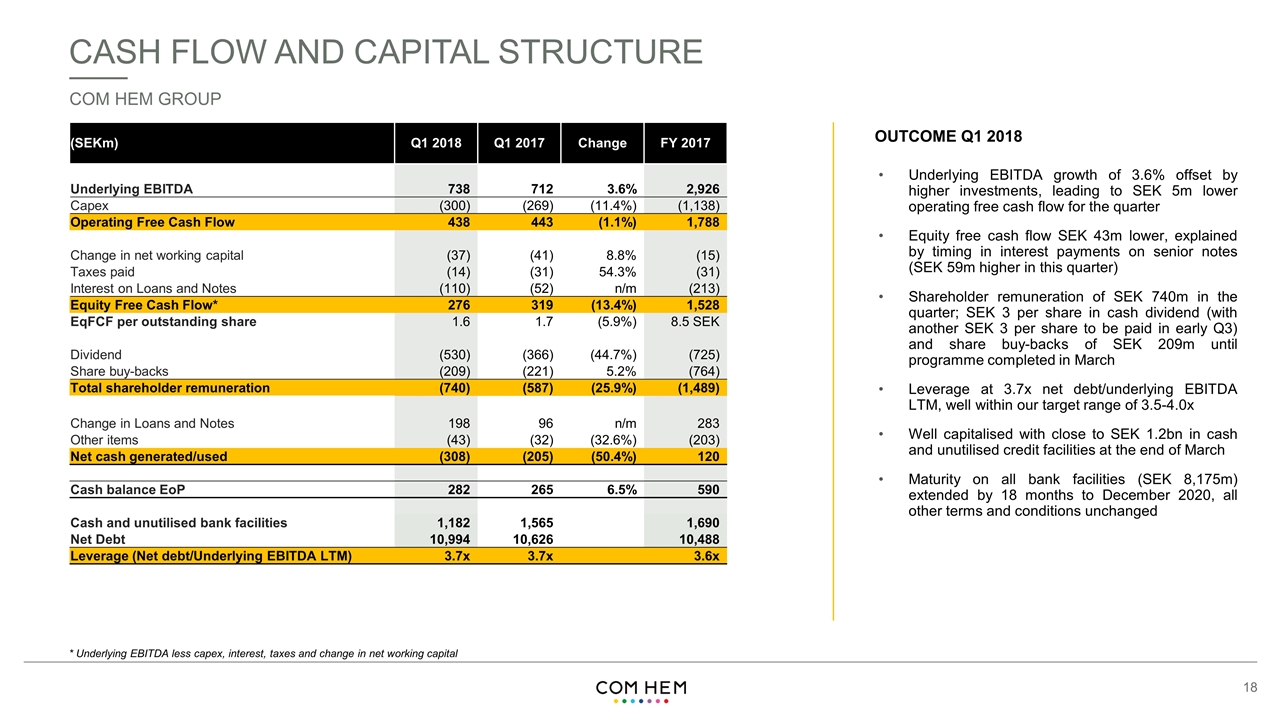

CASH FLOW AND CAPITAL STRUCTURE COM HEM GROUP * Underlying EBITDA less capex, interest, taxes and change in net working capital OUTCOME Q1 2018 Underlying EBITDA growth of 3.6% offset by higher investments, leading to SEK 5m lower operating free cash flow for the quarter Equity free cash flow SEK 43m lower, explained by timing in interest payments on senior notes (SEK 59m higher in this quarter) Shareholder remuneration of SEK 740m in the quarter; SEK 3 per share in cash dividend (with another SEK 3 per share to be paid in early Q3) and share buy-backs of SEK 209m until programme completed in March Leverage at 3.7x net debt/underlying EBITDA LTM, well within our target range of 3.5-4.0x Well capitalised with close to SEK 1.2bn in cash and unutilised credit facilities at the end of March Maturity on all bank facilities (SEK 8,175m) extended by 18 months to December 2020, all other terms and conditions unchanged (SEKm) Q1 2018 Q1 2017 Change FY 2017 Underlying EBITDA 738 712 3.6% 2,926 Capex (300) (269) (11.4%) (1,138) Operating Free Cash Flow 438 443 (1.1%) 1,788 Change in net working capital (37) (41) 8.8% (15) Taxes paid (14) (31) 54.3% (31) Interest on Loans and Notes (110) (52) n/m (213) Equity Free Cash Flow* 276 319 (13.4%) 1,528 EqFCF per outstanding share 1.6 1.7 (5.9%) 8.5 SEK Dividend (530) (366) (44.7%) (725) Share buy-backs (209) (221) 5.2% (764) Total shareholder remuneration (740) (587) (25.9%) (1,489) Change in Loans and Notes 198 96 n/m 283 Other items (43) (32) (32.6%) (203) Net cash generated/used (308) (205) (50.4%) 120 Cash balance EoP 282 265 6.5% 590 Cash and unutilised bank facilities 1,182 1,565 1,690 Net Debt 10,994 10,626 10,488 Leverage (Net debt/Underlying EBITDA LTM) 3.7x 3.7x 3.6x

IMPORTANT INFORMATION The information included in this document is provided for informational purposes only and is neither an offer to sell nor a solicitation of an offer to buy shares of Com Hem Holding AB (publ) (“COM HEM”) or Tele2 AB (publ) (“Tele2”). Tele2 is expected to file a registration statement on Form F-4 with the Securities and Exchange Commission (the “SEC”) in connection with the planned merger of COM HEM into Tele2 (“Transaction”). Tele2 is expected to mail a merger document, which is part of the registration statement on Form F-4, to security holders of COM HEM in connection with the transaction. This information is not a substitute for the registration statement, merger document or any other offering materials or other documents that Tele2 plans to file with the SEC or send to security holders of COM HEM in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF COM HEM ARE URGED TO READ the registration statement and THE MERGER DOCUMENT CAREFULLY WHEN IT BECOMES AVAILABLE. THE REGISTRATION STATEMENT AND THE MERGER DOCUMENT CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION INCLUDING CERTAIN RISKS RELATED TO THE TRANSACTION AND SHOULD BE READ BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TRANSACTION. When the registration statement and merger document become available, investors and security holders will be able to obtain free copies of it through the website maintained by the SEC at www.sec.gov. Free copies of the merger document may also be obtained from COM HEM, by directing a request to Mr. Marcus Lindberg, Head of Investor Relations, e-mail: marcus.lindberg@comhem.com, phone: +46 734 39 25 40 or from Tele2, by directing such request to Mr. Erik Strandin Pers, Head of Investor Relations, e-mail: erik.pers@tele2.com, phone: +46 733 41 41 88. In addition to the registration statement and merger document, COM HEM and Tele2 file annual, quarterly and special reports and other information with the Swedish Financial Supervisory Authority. You may read and copy any reports, statements or other information filed by COM HEM or Tele2 at: http://www.comhemgroup.se/en/investors/ and http://www.tele2.com/investors/, respectively. FORWARD LOOKING STATEMENTS The information in this document may contain forward-looking statements. By their nature, forward- looking statements involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of each respective company or the combined company. Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements. Although the management of COM HEM believes that the expectations reflected in any forward-looking statements are reasonable based on information currently available to them, no assurance is given that such forward-looking statements will prove to have been correct. You should not place undue reliance on forward-looking statements. They speak only as at the date thereof and COM HEM undertakes no obligation to update any forward-looking statements. Past performance of COM HEM or Tele2 does not guarantee or predict future performance of the combined company. Moreover, COM HEM, Tele2 and their respective affiliates and their respective officers, employees and agents do not undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of the presentation. Additionally, there can be no certainty that the Transaction will be completed in the manner and timeframe described in this document, or at all. NO SOLICITATION This communication does not constitute notice to an extraordinary general meeting or a merger document, nor shall it constitute an offer to sell or the solicitation or invitation of any offer to buy, acquire or subscribe for, any securities or an inducement to enter into investment activity, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Disclaimer