UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 000-56276

Unicoin Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | | 47-4360035 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

228 Park Ave South 16065

New York, New York |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: (212) 216-0001

TransparentBusiness, Inc.

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | | None | | None |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| Emerging growth company | | ☒ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 28, 2022, there were 730,637,878 shares of the Registrant’s common stock outstanding.

Table of Contents

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

Some of the statements contained in this Quarterly Report on Form 10-Q of Unicoin Inc. (formerly known as TransparentBusiness, Inc. and hereinafter referred to as “Unicoin Inc.”, “we”, “our”, or the “Company”) discuss future expectations, contain projections of our plan of operation or financial condition or state other forward-looking information. In this Quarterly Report on Form 10-Q, forward-looking statements are generally identified by the words such as “anticipate”, “plan”, “believe”, “expect”, “estimate”, and the like. Forward-looking statements involve future risks and uncertainties, there are factors that could cause actual results or plans to differ materially from those expressed or implied. These statements are subject to known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on various factors and is derived using numerous assumptions. A reader, whether investing in the Company’s securities or not, should not place undue reliance on these forward-looking statements, which apply only as of the date of this Quarterly Report on Form 10-Q. Important factors that may cause actual results to differ from projections include, for example:

| | ● | the success or failure of Management’s efforts to implement the Company’s plan of operation; |

| | ● | the ability of the Company to fund its operating expenses; |

| | ● | the ability of the Company to compete with other companies that have a similar plan of operation; |

| | ● | the effect of changing economic conditions impacting our plan of operation; and |

| | ● | the ability of the Company to meet the other risks as may be described in future filings with the SEC. |

Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date hereof. We believe the information contained in this Quarterly Report on Form 10-Q to be accurate as of the date hereof. Changes may occur after that date. We will not update that information except as required by law in the normal course of our public disclosure practices.

Additionally, the following discussion regarding our financial condition and results of operations should be read in conjunction with the condensed consolidated financial statements and related notes included in this Quarterly Report on Form 10-Q.

PART I-FINANCIAL INFORMATION

Item 1. Financial Statements.

TRANSPARENTBUSINESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | |

| | | June 30, | | | December 31, | |

| | | 2022 | | | 2021 | |

| ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 1,844,286 | | | $ | 1,872,529 | |

| Accounts receivable, net | | | | | | | | |

| Trade receivables payable in cash | | | 2,328,028 | | | | 2,221,639 | |

| Unicorn Hunters non-cash receivables (Note 4) | | | 8,420,000 | | | | 4,281,000 | |

| Prepaid expenses and other current assets | | | 1,566,620 | | | | 214,633 | |

| Indemnification asset | | | 4,389,727 | | | | 4,389,727 | |

| TOTAL CURRENT ASSETS | | | 18,548,661 | | | | 12,979,528 | |

| Property and equipment, net | | | 54,583 | | | | 5,322 | |

| Goodwill | | | 3,865,695 | | | | 3,865,695 | |

| Intangible assets, net | | | 4,262,649 | | | | 3,634,679 | |

| TOTAL ASSETS | | $ | 26,731,588 | | | $ | 20,485,224 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | |

| Accounts payable | | $ | 1,762,693 | | | $ | 1,920,087 | |

| Income tax payable | | | 90 | | | | 90 | |

| Accrued expenses | | | 2,322,736 | | | | 2,374,258 | |

| Accrued payroll liabilities | | | 637,369 | | | | 417,300 | |

| Deferred revenue | | | 104,790 | | | | 51,030 | |

| ITSQuest tax liability | | | 4,389,727 | | | | 4,389,727 | |

| Short-term debt | | | 919,000 | | | | 1,216,000 | |

| Other current liabilities | | | 464,012 | | | | 898,298 | |

| TOTAL CURRENT LIABILITIES | | | 10,600,417 | | | | 11,266,790 | |

| Deferred income tax liability, net | | | 1,097,049 | | | | 1,097,049 | |

| Unicoin Rights financing obligation (Note 8) | | | 27,348,575 | | | | - | |

| TOTAL LIABILITIES | | | 39,046,041 | | | | 12,363,839 | |

| | | | | | | | | |

| STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | |

| Common stock, $0.001 par value; 1,000,000,000 authorized; 772,742,352 and 767,525,220 issued; 734,069,873 and 732,251,471 outstanding, net of treasury stock at June 30, 2022 and December 31 2021, respectively | | | 772,742 | | | | 767,525 | |

| Treasury stock, at cost; 38,672,479 and 35,273,749 shares at June 30, 2022 and December 31, 2021, respectively | | | (3,054,185 | ) | | | (2,714,312 | ) |

| Additional paid-in capital | | | 72,777,431 | | | | 71,041,101 | |

Accumulated deficit | | | (80,590,620 | ) | | | (59,946,592 | ) |

| TOTAL TRANSPARENTBUSINESS STOCKHOLDERS’ EQUITY (DEFICIT) | | | (10,094,632 | ) | | | 9,147,722 | |

| Noncontrolling interest | | | (2,219,821 | ) | | | (1,026,337 | ) |

| TOTAL STOCKHOLDERS’ EQUITY (DEFICIT) | | | (12,314,453 | ) | | | 8,121,385 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | $ | 26,731,588 | | | $ | 20,485,224 | |

See accompanying notes to the unaudited condensed consolidated financial statements

TRANSPARENTBUSINESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| | | | | | | | | | | | | | | | | |

| | | Three months ended

June 30, | | | Six months ended

June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

| REVENUES | | $ | 4,860,714 | | | $ | 3,900,032 | | | $ | 13,592,784 | | | $ | 6,950,463 | |

| COST OF REVENUES | | | 9,074,444 | | | | 7,942,606 | | | | 12,669,369 | | | | 10,205,209 | |

| GROSS PROFIT (LOSS) | | | (4,213,730 | ) | | | (4,042,574 | ) | | | 923,415 | | | | (3,254,746 | ) |

| OPERATING COSTS AND EXPENSES | | | | | | | | | | | | | | | | |

| General and administrative | | | 4,670,846 | | | | 4,847,114 | | | | 8,070,650 | | | | 8,792,819 | |

| Sales and marketing | | | 12,458,119 | | | | 2,764,345 | | | | 14,206,122 | | | | 9,617,300 | |

| Research and development | | | 126,703 | | | | 165,227 | | | | 249,401 | | | | 293,376 | |

| TOTAL OPERATING COSTS AND EXPENSES | | | 17,255,668 | | | | 7,776,686 | | | | 22,526,173 | | | | 18,703,495 | |

| LOSS FROM OPERATIONS | | | (21,469,398 | ) | | | (11,819,260 | ) | | | (21,602,758 | ) | | | (21,958,241 | ) |

| Interest income (expense), net | | | (57,386 | ) | | | 4,239 | | | | (118,845 | ) | | | 17,847 | |

| Other expense, net | | | (586 | ) | | | (870 | ) | | | (616 | ) | | | (1,287 | ) |

| Income tax benefit (expense) | | | 65,309 | | | | (7,996 | ) | | | (115,293 | ) | | | (8,920 | ) |

| NET LOSS AND COMPREHENSIVE LOSS | | $ | (21,462,061 | ) | | $ | (11,823,887 | ) | | $ | (21,837,512 | ) | | $ | (21,950,601 | ) |

| Less: net loss attributable to the noncontrolling interest | | | (2,173,258 | ) | | | (1,778,748 | ) | | | (1,193,484 | ) | | | (2,534,457 | ) |

| NET LOSS ATTRIBUTABLE TO TRANSPARENTBUSINESS | | $ | (19,288,803 | ) | | $ | (10,045,139 | ) | | $ | (20,644,028 | ) | | $ | (19,416,144 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss per share attributable to TransparentBusiness, basic and diluted | | $ | (0.03 | ) | | $ | (0.01 | ) | | $ | (0.03 | ) | | $ | (0.03 | ) |

| Weighted average common shares outstanding used to compute basic and diluted loss per share | | | 734,018,271 | | | | 726,375,940 | | | | 733,516,974 | | | | 726,742,756 | |

See accompanying notes to the unaudited condensed consolidated financial statements

TRANSPARENTBUSINESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | | Additional

Paid-In | | | Treasury Stock | | | Accumulated | | | Transparent

Business

Stockholders’

Equity | | | Transparent

Business

Noncontrolling | | | Total

Stockholders’

Equity | |

| | | Shares | | | Amount | | | Capital | | | Shares | | | Amount | | | Deficit | | | (Deficit) | | | Interest | | | (Deficit) | |

| Balance as of December 31, 2020 | | | 751,489,686 | | | $ | 751,489 | | | $ | 35,595,322 | | | | (26,379,012 | ) | | $ | (1,114,312 | ) | | $ | (20,981,710 | ) | | $ | 14,250,789 | | | $ | 3,679,513 | | | $ | 17,930,302 | |

| Issuance of common stock | | | 24,333 | | | | 24 | | | | 12,976 | | | | - | | | | - | | | | - | | | | 13,000 | | | | - | | | | 13,000 | |

| Stock-based compensation expense | | | - | | | | - | | | | 97,775 | | | | - | | | | - | | | | - | | | | 97,775 | | | | - | | | | 97,775 | |

| Exercise of stock options and warrants | | | 800,000 | | | | 800 | | | | (720 | ) | | | - | | | | - | | | | - | | | | 80 | | | | - | | | | 80 | |

| Common stock issued for services | | | 1,320,740 | | | | 1,321 | | | | (37,544 | ) | | | - | | | | - | | | | - | | | | (36,223 | ) | | | - | | | | (36,223 | ) |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (9,371,005 | ) | | | (9,371,005 | ) | | | (755,709 | ) | | | (10,126,714 | ) |

| Balance as of March 31, 2021 | | | 753,634,759 | | | $ | 753,634 | | | $ | 35,667,809 | | | | (26,379,012 | ) | | $ | (1,114,312 | ) | | $ | (30,352,715 | ) | | $ | 4,954,416 | | | $ | 2,923,804 | | | $ | 7,878,220 | |

| Issuance of common stock | | | 8,995,117 | | | | 8,995 | | | | 17,755,563 | | | | - | | | | - | | | | - | | | | 17,764,558 | | | | - | | | | 17,764,558 | |

| Stock-based compensation expense | | | - | | | | - | | | | 90,938 | | | | - | | | | - | | | | - | | | | 90,938 | | | | - | | | | 90,938 | |

| Repurchase of common stock (Note 15) | | | - | | | | - | | | | - | | | | (1,500,000 | ) | | | (285,000 | ) | | | - | | | | (285,000 | ) | | | - | | | | (285,000 | ) |

| Exercise of stock options and warrants | | | 108,330 | | | | 108 | | | | (98 | ) | | | - | | | | - | | | | - | | | | 10 | | | | - | | | | 10 | |

| Common stock issued for services | | | 32,246 | | | | 32 | | | | (65,205 | ) | | | - | | | | - | | | | - | | | | (65,173 | ) | | | - | | | | (65,173 | ) |

| Noncontrolling interest (Note 4) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,500 | | | | 2,500 | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (10,045,139 | ) | | | (10,045,139 | ) | | | (1,778,748 | ) | | | (11,823,887 | ) |

| Balance as of June 30, 2021 | | | 762,770,452 | | | | 762,769 | | | | 53,449,007 | | | | (27,879,012 | ) | | | (1,399,312 | ) | | | (40,397,854 | ) | | | 12,414,610 | | | | 1,147,556 | | | | 13,562,166 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2021 | | | 767,525,220 | | | $ | 767,525 | | | $ | 71,041,101 | | | | (35,273,749 | ) | | $ | (2,714,312 | ) | | $ | (59,946,592 | ) | | $ | 9,147,722 | | | $ | (1,026,337 | ) | | $ | 8,121,385 | |

| Issuance of common stock | | | 398,596 | | | | 399 | | | | 1,359,469 | | | | - | | | | - | | | | - | | | | 1,359,868 | | | | - | | | | 1,359,868 | |

| Stock-based compensation expense | | | - | | | | - | | | | 66,114 | | | | - | | | | - | | | | - | | | | 66,114 | | | | - | | | | 66,114 | |

| Repurchase of common stock | | | - | | | | - | | | | - | | | | (3,398,730 | ) | | | (339,873 | ) | | | - | | | | (339,873 | ) | | | - | | | | (339,873 | ) |

| Exercise of stock options and warrants | | | 4,478,730 | | | | 4,479 | | | | 1,524 | | | | - | | | | - | | | | - | | | | 6,003 | | | | - | | | | 6,003 | |

| Common stock issued for services | | | 273,702 | | | | 273 | | | | 197,348 | | | | - | | | | - | | | | - | | | | 197,621 | | | | - | | | | 197,621 | |

| Non-cash dividend (Note 9) | | | - | | | | - | | | | (68,510 | ) | | | - | | | | - | | | | - | | | | (68,510 | ) | | | - | | | | (68,510 | ) |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,355,225 | ) | | | (1,355,225 | ) | | | 979,774 | | | | (375,451 | ) |

| Balance as of March 31, 2022 | | | 772,676,248 | | | $ | 772,676 | | | $ | 72,597,046 | | | | (38,672,479 | ) | | $ | (3,054,185 | ) | | $ | (61,301,817 | ) | | $ | 9,013,720 | | | $ | (46,563 | ) | | $ | 8,967,157 | |

| Issuance of common stock | | | 66,104 | | | | 66 | | | | 133,935 | | | | - | | | | - | | | | - | | | | 134,001 | | | | - | | | | 134,001 | |

| Stock-based compensation expense | | | - | | | | - | | | | 50,990 | | | | - | | | | - | | | | - | | | | 50,990 | | | | - | | | | 50,990 | |

| Non-cash dividend (Note 9) | | | - | | | | - | | | | (4,540 | ) | | | - | | | | - | | | | - | | | | (4,540 | ) | | | - | | | | (4,540 | ) |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (19,288,803 | ) | | | (19,288,803 | ) | | | (2,173,258 | ) | | | (21,462,061 | ) |

| Balance as of June 30, 2022 | | | 772,742,352 | | | | 772,742 | | | | 72,777,431 | | | | (38,672,479 | ) | | | (3,054,185 | ) | | | (80,590,620 | ) | | | (10,094,632 | ) | | | (2,219,821 | ) | | | (12,314,453 | ) |

See accompanying notes to the unaudited condensed consolidated financial statements

TRANSPARENTBUSINESS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | |

| | | Six Months Ended

June 30, | |

| | | 2022 | | | 2021 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net loss | | $ | (21,837,512 | ) | | $ | (21,950,601 | ) |

| Adjustments to reconcile net loss to cash used in operating activities: | | | | | | | | |

| Stock-based compensation expense | | | 117,427 | | | | 123,540 | |

| Operating expenses paid with Unicoin Rights | | | 7,933,025 | | | | - | |

| Noncash consideration from customers of Unicorns, Inc. | | | (4,139,000 | ) | | | - | |

| Impairment of digital assets | | | 617,173 | | | | - | |

| Depreciation and amortization expense | | | 178,866 | | | | 177,367 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Trade receivables payable in cash | | | (106,389 | ) | | | (826,078 | ) |

| Receivables from affiliates | | | - | | | | 950 | |

| Prepaid expenses | | | (824,531 | ) | | | (2,204,518 | ) |

| Other assets | | | (527,456 | ) | | | 134,202 | |

| Accounts payable | | | (157,394 | ) | | | 1,078,963 | |

| Accrued expenses and payroll liabilities | | | 89,846 | | | | 4,318,978 | |

| Deferred revenue | | | 53,760 | | | | (2,183 | ) |

| Other liabilities | | | (434,286 | ) | | | 450,699 | |

| Net cash used in operating activities | | | (19,036,471 | ) | | | (18,698,681 | ) |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Repayment of related party promissory note | | | - | | | | 200,000 | |

| Purchase of property and equipment | | | (50,759 | ) | | | (2,995 | ) |

| Net cash provided by (used in) investing activities | | | (50,759 | ) | | | 197,005 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| Proceeds from issuance of private placement unsecured notes | | | 48,000 | | | | 349,846 | |

| Payment of short-term debt | | | (345,000 | ) | | | - | |

| Proceeds from sales of Unicoin Rights | | | 18,218,967 | | | | - | |

| Proceeds from sales of common stock | | | 1,470,890 | | | | 17,747,558 | |

| Repurchase of common stock | | | (339,873 | ) | | | - | |

| Proceeds from exercise of stock options and warrants | | | 6,003 | | | | 90 | |

| Net cash provided by financing activities | | | 19,058,987 | | | | 18,097,494 | |

| | | | | | | | | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | | $ | (28,243 | ) | | $ | (404,182 | ) |

| CASH AND CASH EQUIVALENTS—Beginning of period | | | 1,872,529 | | | | 9,961,817 | |

| CASH AND CASH EQUIVALENTS—End of period | | $ | 1,844,286 | | | $ | 9,557,635 | |

| | | | | | | | | |

| NONCASH INVESTING AND FINANCING ACTIVITIES: | | | | | | | | |

| Market value of digital assets received as proceeds from sales of common stock (Notes 5 and 9) | | $ | 22,980 | | | $ | 30,000 | |

| Market value of digital assets received as proceeds from sales of Unicoin Rights (Notes 5 and 8) | | | 1,399,530 | | | | - | |

| Common stock received in payment of related party promissory note (1,500,000 shares) (Note 15) | | | - | | | | 285,000 | |

| Non-cash dividend of Unicoin Rights (730,503,862 rights) (Notes 8 and 9) | | | 73,050 | | | | - | |

See accompanying notes to the unaudited condensed consolidated financial statements.

TransparentBusiness, Inc. AND SUBSIDIARIES

NOTES TO CONDENSED Consolidated FINANCIAL STATEMENTS (UNAUDITED)

AS OF JUNE 30, 2022 AND DECEMBER 31, 2021 AND

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2022 AND 2021

NOTE 1 – ORGANIZATION AND OPERATIONS

Description of Business

TransparentBusiness, Inc. (“TransparentBusiness” or the “Company”) was incorporated in the state of Delaware on June 22, 2015. The SaaS (Software-as-a-Service) platform was developed in 2008 by KMGi Group, the predecessor to TransparentBusiness. The platform is designed to increase remote workers’ productivity, protect client budgets from overbilling, allow coordination and monitoring of their remote workforces and provide real-time information on the cost and status of all tasks and projects. The Company markets its services throughout the United States of America.

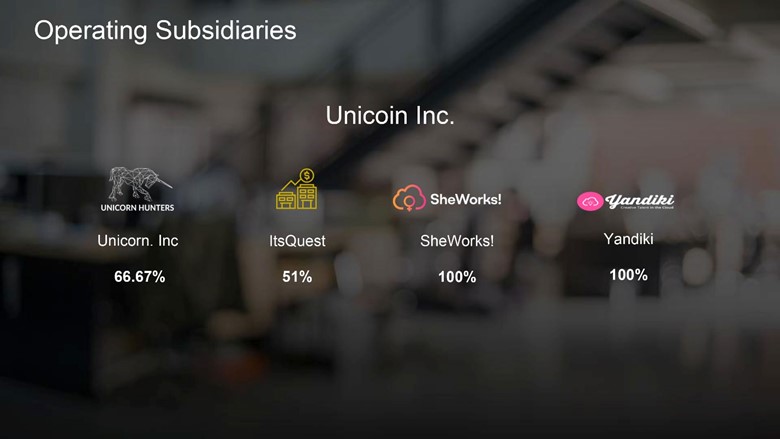

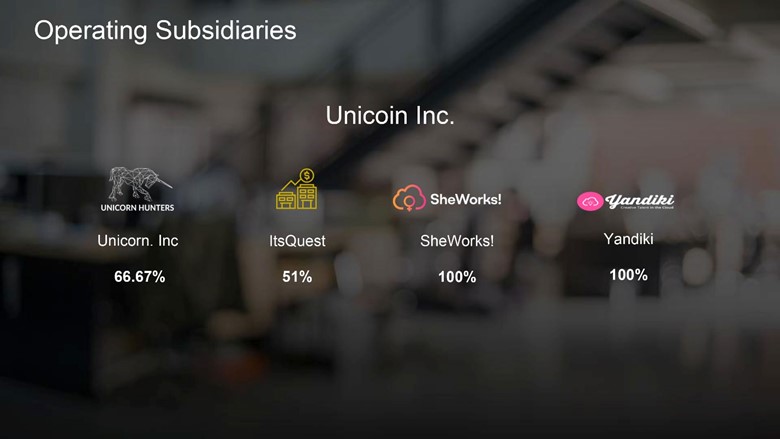

In addition to its original SaaS business the Company wholly owns two TaaS (Talent-as-a-Service) companies and platforms, SheWorks! and Yandiki, and holds a 51% majority ownership interests in ITSQuest, Inc, (“ITSQuest”) a regional staffing agency. SheWorks! is a talent exchange focused on connecting women seeking freelance or employment opportunities with companies looking for freelancers or employees to fill their needs. Yandiki is also a talent exchange and platform that connects freelance talent with companies looking for leaner, more transparent ways of conducting remote contractual work. ITSQuest, Inc is a regional staffing agency with twelve locations throughout New Mexico and Texas. Customers of ITSQuest are primarily governmental agencies.

As more fully discussed in Note 4 – Unicorns Acquisition, in April 2021 the Company acquired a 66.67% interest in Unicorns, Inc. (“Unicorns” or “Unicorn Hunters”). Unicorns produces a reality television/streaming show called Unicorn Hunters that showcases private companies seeking to obtain publicity for their private offerings by appearing on the show and attempting to raise capital by advertising their exempt offerings to a wide audience. As discussed in Note 4, the Company consolidated Unicorns prior to the acquisition because it was a Variable Interest Entity (“VIE”) under common control.

Going Concern

These consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) assuming the Company will continue as a going concern. The going concern assumption contemplates the realization of assets and satisfaction of liabilities in the normal course of business.

The Company has incurred net losses of ($21,838) thousand and ($21,951) thousand and used cash in operating activities of ($19,036) thousand and ($18,699) thousand for the six months ended June 30, 2022 and 2021 and has an accumulated deficit of ($80,591) thousand and ($59,947) thousand as of June 30, 2022 and December 31, 2021, respectively, and expects to incur future additional losses. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The Company’s long-term success is dependent upon its ability to successfully raise additional capital, market its existing services, increase revenues, and, ultimately, to achieve profitable operations.

The Company is evaluating strategies to obtain the required additional funding for future operations. These strategies may include, but are not limited to, obtaining equity financing, issuing debt, or entering other financing arrangements, and restructuring of operations to grow revenues and decrease expenses. However, in view of uncertainties in U.S. and global financial markets, the Company may be unable to access further equity or debt financing when needed. As such, there can be no assurance that the Company will be able to obtain additional liquidity when needed or under acceptable terms, if at all.

The consolidated financial statements do not include any adjustments to the carrying amounts and classification of assets, liabilities, and reported expenses that may be necessary if the Company were unable to continue as a going concern.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) and include the accounts of TransparentBusiness, Inc., its wholly owned subsidiaries, SheWorks! and Yandiki, as well as ITSQuest and Unicorns. These entities are consolidated in accordance with Accounting Standards Codification (“ASC”) 810, Consolidations (“ASC 810”). All significant intercompany accounts and transactions have been eliminated in consolidation. For ITSQuest which is 51% owned, the minority interest is reflected in the consolidated financial statements as non-controlling interest (“NCI”). As more fully discussed in Note 4 – Unicorns Acquisition, Unicorns was consolidated prior to it being acquired in April 2021 because it is a VIE under common control. The Unicorns NCI was 100% prior to the April acquisition and 33.33% subsequent to the April 2021 acquisition.

Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. Accordingly, these unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and accompanying notes for the years ended December 31, 2021 and 2020. The unaudited condensed consolidated balance sheet as of December 31, 2021, included herein, was derived from the audited consolidated balance sheet of the Company as of that date.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires us to make estimates and assumptions in the consolidated financial statements and accompanying notes. Significant estimates and assumptions made by the Company include: the valuation of Unicoins, valuation of non-cash consideration received from Unicorns customers, including accounts receivable and private company investments, and the associated revenue recognition; valuation of investments in private companies; valuation of Company’s common stock as a private company, valuation of the NCI in ITSQuest; valuation of the ITSQuest contingent divestiture; determination of the fair value of assets acquired and liabilities assumed in the business combination with ITSQuest; determination of the useful lives assigned to intangible assets; determination of the fair value of the ITSQuest indemnification asset and related tax liability; assessments for potential impairment of goodwill and intangible assets including digital assets; assessments of the recoverability of accounts receivable and determination of the fair value of certain stock awards issued. The Company bases these estimates on historical experience and on various other assumptions that management believes to be reasonable, the result of which forms the basis for making judgements about the carrying values of assets and liabilities. Actual results could differ materially from those estimates.

Risks and Uncertainties

The Company is subject to a number of risks that are similar to those which other companies of similar size in its industry are facing, including, but not limited to, the need for additional capital (or financing) to fund operations, competition from substitute products and services from larger companies, protection of proprietary technology, dependence on key customers, dependence on key individuals, and risks associated with changes in information technology.

In January 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain of coronavirus (“COVID-19”) and the risks to the international community. In March 2020, WHO classified the COVID-19 outbreak as a pandemic based on the rapid increase in exposure globally. The outbreak of the COVID-19 pandemic has affected the United States and global economies and may affect the Company’s operations and those of third parties on which the Company relies. While the potential economic impact brought by, and the duration of, the COVID-19 pandemic is difficult to assess or predict, the impact of the COVID-19 pandemic on the global financial markets may reduce the Company’s ability to access capital, which could negatively impact the Company’s short-term and long-term liquidity. The ultimate impact of the COVID-19 pandemic is uncertain and subject to change. As of the date of this report, the Company’s efforts to respond to the challenges presented by the conditions described above have allowed the Company to minimize the impacts of these challenges to its business.

Financial instruments that potentially subject the Company to concentrations of credit risk consist of cash and cash equivalents and accounts receivables. The Company’s cash and cash equivalents are held in accounts with major financial institutions, and, at times, exceed federally insured limits. In addition, as more fully described above, the Company has non-cash receivables consisting of options and warrants to purchase common stock in small private companies. The Company also holds digital assets which are more fully described above and in Note 5. Digital asset market values are subject to significant fluctuations based on supply and demand for such digital assets and other factors. The Company’s digital assets are included in the consolidated balance sheets as intangible assets.

During the three months ended June 30, 2022 two customers accounted for 14% and 11% of the Company’s total revenue. These customers accounted for 5% and 6% of total customer receivables, as of June 30, 2022. During the three months ended June 30, 2021 two customers accounted for 11% and 16% of the Company’s total revenue. These customers accounted for 2% and 5% of total customer receivables as of December 31, 2021, respectively. During the six months ended June 30, 2022 two customers accounted for 29% and 10% of the Company’s total revenue. These customers accounted for 36% and 6% of total customer receivables, as of June 30, 2022. During the six months ended June 30, 2021 two customers accounted for 15% and 13% of the Company’s total revenue. These customers accounted for 2% and 5% of total customer receivables as of December 31, 2021, respectively.

The Share Exchange Agreement we entered into in order to acquire a majority stake in ITSQuest contains a contingent divestiture provision whereby if TransparentBusiness does not engage in a public offering of its securities at a price of at least $10 per share on or before December 31, 2022, then TransparentBusiness will be required to divest itself of the acquired ITSQuest equity by returning the same to the founders of ITSQuest, and such founders shall be entitled to retain the shares of TransparentBusiness received pursuant to the Exchange Agreement. Such an event would cause the loss of ITSQuest-associated revenue to TransparentBusiness while resulting in us having issued equity to the ITSQuest founders for only nominal consideration.

Significant Accounting Policies

There have been no material changes to the Company’s significant accounting policies that were disclosed in its audited consolidated financial statements for the years ended December 31, 2021 and 2020. However, the Company has expanded the description of its accounting policy for Unicorn Hunters Revenue and Non-Cash Receivables and Accounting for Investments in Private Companies in Note 4 - Unicorns Acquisition.

Lease Accounting

As more fully discussed in the Company’s audited financial statements for the years ended December 31, 2021 and 2020, in February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). Under ASU 2016-02, entities are required to recognize assets and liabilities for the rights and obligations created by leases on the entity’s consolidated balance sheets for both finance and operating leases. Topic 842 is effective for the Company beginning January 1, 2022 in connection with the issuance of its annual financial statements for the year ended December 31, 2022 and for interim periods beginning with its quarterly financial statements for the three months ended March 31, 2023. Because the standard is effective January 1, 2022, but is not required to be reflected in quarterly financial statements until the first quarter of 2023, the comparative financial statements for the first quarter of 2022 to be included with the financial statements for the first quarter of 2023 may differ from these financial statements as a result of recognition of assets and liabilities for the rights and obligations created by the Company’s leases.

Revenue Recognition

Revenue Sources

The Company primarily derives its revenues from three revenue streams:

| 1. | Subscription Revenue (Software-as-a-Service or “SaaS”) – which are comprised of subscription license fees from customers accessing the Company’s all-in-one cloud-based solution to manage remote workers (“software platform”). |

| 2. | Staffing Revenue (Talent-as-a-Service or “TaaS”) – whereby enterprise customers are connected to individuals who are able to assist them in projects. |

| 3. | Unicorns Revenue – which generally consists of the fair value of stock options or warrants received as consideration from companies presenting on the Unicorn Hunters show. |

Refer to Note 6 – Segment Information for disaggregated revenue information.

Deferred revenue

The Company had deferred revenue of $104.8 thousand and $51.0 thousand as of June 30, 2022 and December 2021, respectively. The amount of revenue recognized in the first half of fiscal 2022 and 2021, that was included in deferred revenue at the beginning of the periods, was $19.6 thousand and $2.2 thousand, respectively.

Reclassification of Operating Costs and Expenses:

During the three months ended June 30, 2022, the Company reclassified certain operating costs and expenses within the consolidated statements of operations and comprehensive loss. Prior-period amounts were revised to conform with the current presentation. These changes have no impact on the Company’s previously reported consolidated net loss, loss per share, total operating expenses, financial position, or cash flows. The reclassifications result from refinement of the Company’s approach to allocation of operating costs and expenses based on departments. This refined methodology resulted in a reduction of general and administrative expense and increases in sales and marketing expense and research and development.

The classification of Operating Cost and Expenses included in the Condensed Consolidated Statements of Operations and Comprehensive Loss for the three and six months ended June 30, 2022 and June 30, 2021 conforms to the refined methodology described above. However, since the reclassification affects amounts included in the consolidated statements of operations and comprehensive loss for the three months ended March 31, 2022 and 2021 respectively, which were previously reported in Form 10-12GA filed on August 13, 2022, the impact of those changes is presented below:

| Schedule of operating costs and expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31,

2022 | | | Three Months Ended

March 31,

2021 | |

| | | As

Previously

Reported | | | Adjustments | | | Reclassified | | | As

Previously

Reported | | | Adjustments | | | Reclassified | |

| Operating Costs and Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| General and administrative | | | 3,820,788 | | | | (420,984 | ) | | | 3,399,804 | | | | 3,494,813 | | | | 450,892 | | | | 3,945,705 | |

| Sales and marketing | | | 1,449,717 | | | | 298,286 | | | | 1,748,003 | | | | 7,312,996 | | | | (460,041 | ) | | | 6,852,955 | |

| Research and development | | | - | | | | 122,698 | | | | 122,698 | | | | 119,000 | | | | 9,149 | | | | 128,149 | |

| Total Operating Costs and Expenses | | | 5,270,505 | | | | - | | | | 5,270,505 | | | | 10,926,809 | | | | - | | | | 10,926,809 | |

NOTE 3 – FAIR VALUE MEASUREMENT

The Company measures the fair value of financial instruments in accordance with ASC 820. ASC 820 defines fair value, establishes a framework for measuring fair value in accordance with U.S. GAAP, and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements, ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels, as follows:

| Level 1 | Quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| | |

| Level 2 | Significant other inputs that are directly or indirectly observable in the marketplace. |

| | |

| Level 3 | Assets and liabilities whose significant value drivers are unobservable. |

Observable inputs are based on market data obtained from independent sources, while unobservable inputs are based on the Company’s market assumptions. Unobservable inputs require significant management judgment or estimation. In some cases, the inputs used to measure an asset or liability may fall into different levels of the fair value hierarchy. In those instances, the fair value measurement is required to be classified using the lowest level of input that is significant to the fair value measurement. Such determination requires significant management judgment.

The following table is a summary of financial assets and liabilities measured at fair value on a recurring basis and their classification within the fair value hierarchy:

As of June 30, 2022

| Schedule of fair value assets measured on recurring basis | | | | | | | | | | | | | | | | | | | | |

| | | Carrying Value | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| ASSETS | | | | | | | | | | | | | | | | | | | | |

| Cash held by financial institutions | | $ | 1,771,543 | | | $ | 1,771,543 | | | $ | - | | | $ | - | | | $ | 1,771,543 | |

| Money market funds | | | 72,743 | | | | 72,743 | | | | - | | | | - | | | | 72,743 | |

As of December 31, 2021

| | | Carrying Value | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| ASSETS | | | | | | | | | | | | | | | | | | | | |

| Cash held by financial institutions | | $ | 1,299,808 | | | $ | 1,299,808 | | | $ | - | | | $ | - | | | $ | 1,299,808 | |

| Money market funds | | | 572,721 | | | | 572,721 | | | | - | | | | - | | | | 572,721 | |

Assets Measured at Fair Value on a Non-Recurring Basis

As discussed in Note 2, consideration from Unicorns customers generally includes a commitment to issue stock options or warrants from customers who appear on the Unicorn Hunters show. This non-cash consideration is recognized in accounts receivable at the estimated fair values at or near the dates of contract inception using Level 3 inputs. The fair value of these commitments, as well as the options or warrants of private companies, held upon settlement of such receivables, as measured using Level 3 inputs, may fluctuate as discussed in the Company’s accounting policy for private company investments, which is included in Note 4 below. Certain other items such as goodwill, intangible assets, contingent divestiture and NCI resulting from the ITSQuest acquisition are recognized or disclosed at fair value on a non-recurring basis. The Company determines the fair value of these items using Level 3 inputs. There are inherent limitations when estimating the fair value of financial instruments, and the fair values reported are not necessarily indicative of the amounts that would be realized in current market transactions.

NOTE 4 – UNICORNS ACQUISITION

Unicorns Acquisition

In April 2021, Alex Konanykhin, founder of Unicorns, a Nevada corporation, transferred 50,000,001 shares of common stock to TransparentBusiness out of the 75,000,000 shares it had issued to date. TransparentBusiness became a majority owner of Unicorns, obtaining a 66.67% interest. In addition to the Company’s 66.67% interest in Unicorns, 20,000,000 shares of Unicorns or 26.7% are held by officers and directors of the Company. This consists of 5,000,000 shares or 6.67% held by Alex Konanykhin, CEO of TransparentBusiness, 5,000,000 shares or 6.67% held by Silvina Moschini, President of TransparentBusiness, 2,500,000 shares or 3.33% held by Andrew Winn, CFO of TransparentBusiness and 7,500,000 shares or 10.00% held by Moe Vela, a TransparentBusiness director. The remaining 5,000,000 shares, or 6.67%, are held by Craig Plestis, Executive Producer of the Unicorn Hunters show. Because the same related party shareholder group owned a majority of the voting shares of both companies prior to and after the issuance of shares to TransparentBusiness, Unicorns and the Company are considered to be entities under common control.

Management evaluated whether Unicorns meets the criteria for classification as a VIE or as a voting interest entity (“VOE”) and concluded that Unicorns meets the criteria of a VIE. Management further concluded that the Company is the primary beneficiary of the Unicorns VIE because the Company has the power to direct the activities that most affect its economic performance and further has the obligation to absorb losses and the right to receive benefits that could be significant to the VIE. Accordingly, the Company is required to consolidate Unicorns as a VIE.

Unicorns was consolidated in the Company’s financial statements, prior to it being acquired in April 2021, as an entity under common control with the Company. The Unicorns NCI was 100% prior to the April 2021 acquisition because the Company didn’t own any shares of Unicorns stock. Subsequent to issuance of 66.67% of Unicorns shares to the Company in April 2021, the NCI decreased from 100% to 33.33%.

In accordance with ASC 810 – Consolidations, the Company initially measured the assets and liabilities of Unicorns, including the NCI, at their previous carrying amounts because Unicorns and the Company are under common control.

The Company’s consolidated balance sheets included the following assets and liabilities of Unicorns, after eliminations, as of June 30, 2022 and December 31, 2021, respectively.

| Schedule of consolidated balance sheet | | | | | | | | |

| | June 30,

2022 | | | December 31,

2021 | |

| Assets | | | | | | |

| Cash and cash equivalents | | $ | 253,757 | | | $ | 230,059 | |

| Accounts receivable, net | | | | | | | | |

| Trade receivables payable in cash | | | 6,000 | | | | - | |

| Unicorn Hunters non-cash receivables | | | 8,420,000 | | | | 4,281,000 | |

| Prepaid expenses and other current assets | | | 171,633 | | | | 46,273 | |

| Property and equipment, net | | | 48,082 | | | | - | |

| Total assets | | | 8,899,472 | | | | 4,557,332 | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Accounts payable | | $ | 66,404 | | | $ | - | |

| Accrued expenses | | | 62,099 | | | | 86,996 | |

| Total liabilities | | | 128,503 | | | | 86,996 | |

As part of the agreement in which the Company received 50,000,001 shares of Unicorns stock, the Company extended a line of credit to Unicorns in the amount of $10,000 thousand to fund production of the Unicorn Hunters show and related expenses. Further additional ongoing funding was provided by TransparentBusiness to Unicorns to fund the production related expenses of Unicorn Hunters show. This intercompany loan, which is eliminated in consolidation, totalled $25,345 thousand and $16,775 thousand as of June 30, 2022 and December 31, 2021, respectively.

As more fully discussed in Note 6 – Segment Information, Unicorns is a separate reportable segment for the Company. Refer to Note 6 for revenues, cost of revenues and gross profit related to Unicorns.

Unicorns NCI

The NCI of Unicorns as of June 30, 2021 was negative $2,491 thousand which consisted of 100% of the loss for the first quarter of 2021 and 33.33% of the net loss for the second quarter of 2021 plus $2.5 thousand which represents 33.33% of the $7.5 thousand par value of Unicorns common stock. The Unicorns net loss for the year ended December 31, 2021 was $12,336 thousand of which $4,608 thousand related to the NCI resulting in a negative NCI balance of $4,606 thousand as of December 31, 2021. The Unicorns net loss for the six months ended June 30, 2022 was $4,089 thousand of which $1,363 thousand related to the NCI resulting in a negative NCI balance of $5,969 thousand as of June 30, 2022.

Unicorn Hunters Revenue and Non-Cash Receivables

Revenue and accounts receivable for Unicorns generally consists of the fair value of stock options or warrants committed from companies that have appeared on the Unicorn Hunters show. The options or warrants underlying the commitments typically have a term of five to ten years and accounts receivable are recorded at the estimated fair value of such options or warrants as determined at contract inception. The estimated fair value of stock options and warrants, expected to be received as consideration, is dependent on the fair value of the underlying equity of each privately held presenting company.

The fair value of such underlying private company equity is determined based on (i) the valuation indicated in a recent round of financing (ii) a recent pre-existing third-party valuation report or (iii) a new third-party valuation report as of or near the date of contract inception. Third-party valuation reports consider factors such as recent financing rounds, third-party financing transactions, discounted cash flow analyses and market-based information, including comparable transactions, trading multiples and other factors based on facts and circumstances specific to each privately held presenting company. For non-cash consideration in the form of “stock options” or “warrants” of the presenting company, the Company, with assistance from third-party valuation advisors, determines the fair value of such consideration using the Black-Scholes option pricing model which, in addition to the fair value of underlying stock, considers the term of the stock options or warrants, exercise price, volatility, interest rate and dividend yield. These are Level 3 estimates under the fair value hierarchy because they involve significant unobservable inputs. The valuation of stock options or warrants committed by Unicorns customers requires management judgement due to the absence of an observable market price for those options or warrants.

Unicorns invoices customers for the number of committed options or warrants, and records the corresponding revenue and accounts receivable, when an episode is distributed for broadcast or streaming. Unicorns receivables are classified as current because the underlying option or warrant certificates are expected to be received within one year of invoicing. Subsequent to issuance of these option or warrant certificates to the Company, the related receivables will be reclassified to a long-term asset account representing investments in private company equity securities.

Accounting for Investments in Private Companies

In accordance with ASC 321 “Investments-Equity Securities” (“ASC 321”), equity securities for which the Company has no significant influence (generally less than a 20% ownership interest), and which do not have readily determinable fair values, are accounted for using the measurement alternative which is at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for identical or a similar investments of the same issuer. All gains and losses on investments in equity securities are recognized in the consolidated statements of operations.

The Company regularly reviews such equity securities for impairment based on a qualitative assessment which includes, but is not limited to (i) significant deterioration in the earnings performance, credit rating, asset quality or business prospects of the investee, (ii) significant adverse changes in the regulatory, economic or technological environment of the investee and (iii) significant adverse changes in the general market condition of either the geographical area or the industry in which the investee operates, (iv) a bona fide offer to purchase, an offer by the investee to sell, or a completed auction process for the same or similar investment for an amount less than the carrying amount of that investment, (v) factors that raise significant concerns about the investee’s ability to continue as a going concern such as negative cash flows from operations, working capital deficiencies, or non-compliance with statutory capital requirements or debt covenants. If an equity security is impaired, an impairment loss is recognized in the consolidated statements of operations equal to the difference between the fair value of the investment and its carrying amount. If such impairment is determined prior to receiving options or warrants to be received as consideration for Unicorns customer contracts, the related loss on impairment is reflected as bad debt expense. As of June 30, 2022, all such commitments to issue options or warrants remain classified in accounts receivable and no impairment or bad debt expense have been recorded to-date.

NOTE 5 – DIGITAL ASSETS

As more fully discussed in the Company’s audited financial statements for the years ended December 31, 2021 and 2020, the Company records the initial cost basis of digital assets at then-current quoted market prices and presents all digital asset holdings as indefinite-lived intangible assets in accordance with ASC 350, Intangibles—Goodwill and Other. The Company performs an analysis each quarter to identify whether events or changes in circumstances, principally decreases in the quoted prices on active exchanges, indicate that it is more likely than not that our digital assets are impaired. In determining if an impairment has occurred, we consider the quoted price of the digital asset. If the then current carrying value of a digital asset exceeds the fair value so determined, an impairment loss has occurred with respect to those digital assets in the amount equal to the difference between their carrying values and the price determined.

During the three months ended June 30, 2022 and 2021, the Company received digital assets of $270 thousand and zero, respectively, as consideration from certain investors. During the six months ended June 30, 2022 and 2021, the Company received digital assets of $1,423 thousand and $30 thousand, respectively, as consideration from certain investors. These digital assets included Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dai (DAI), USD Coin (USDC) and Bitcoin Cash (BCH). As shown in the tables below, these digital assets were transferred to the Company in exchange for TransparentBusiness common stock or rights to purchase Unicoins issued by the Company. Unicoins are more fully discussed in Note 2 and Note 8.

During the three months ended June 30, 2022 and 2021, the Company recorded $613 thousand and zero, respectively, of impairment losses on digital assets. During the six months ended June 30, 2022 and 2021, the Company recorded $617 thousand and zero, respectively, of impairment losses on digital assets. Impairment losses are included in operating expenses in the consolidated statements of operations.

The table below summarizes the carrying values of the Company’s digital asset holdings as of June 30, 2022 and December 31, 2021:

| Schedule of digital assets | | | | | | | | |

| | | June 30,

2022 | | | December 31,

2021 | |

| Bitcoin (BTC) | | $ | 367,016 | | | $ | 167,795 | |

| Ethereum (ETH) | | | 128,150 | | | | 24,365 | |

| Litecoin (LTC) | | | 17,210 | | | | 3,482 | |

| USD Coin (USDC) | | | 508,587 | | | | 42,331 | |

| Dai (DAI) | | | 19,800 | | | | - | |

| Bitcoin Cash (BCH) | | | 2,547 | | | | - | |

| | | $ | 1,043,310 | | | $ | 237,973 | |

The table below summarizes the Company’s digital asset activity for the three and six months ended June 30, 2022 and 2021:

| Schedule of digital assets activity | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | | Six Months Ended

June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

| Beginning balance | | $ | 1,386,407 | | | $ | 30,000 | | | $ | 237,973 | | | $ | - | |

| Received as consideration in sales of common stock | | | - | | | | - | | | | 22,980 | | | | 30,000 | |

| Received as consideration in sales of Unicoin rights | | | 270,326 | | | | - | | | | 1,399,530 | | | | - | |

| Impairments recorded | | | (613,423 | ) | | | - | | | | (617,173 | ) | | | - | |

| Ending balance | | $ | 1,043,310 | | | $ | 30,000 | | | $ | 1,043,310 | | | $ | 30,000 | |

The market value of digital assets, based on quoted prices on active exchanges, was approximately $1,107 thousand and $373 thousand as of June 30, 2022 and December 31, 2021, respectively.

To date, the Company has not sold any digital assets, converted any into fiat currency nor used any as payment to vendors. The Company may use cryptocurrencies as payment to vendors for goods or services from time to time in the future. The Company’s policy is to compute resulting gains or losses by subtracting the then-current carrying value from the realized proceeds or the fair value of cryptocurrencies on the goods or services transaction date or the fair value of the goods or services received in exchange for cryptocurrencies, if more readily determinable. Any such transactions will be handled through Coinbase, the third-party custodian and exchange platform the Company utilizes to store its digital assets and facilitate transactions. The transfer of control and transaction date would be based on the transaction date as indicated in Coinbase exchange platform. The gain or loss will be determined for each digital asset purchase separately in accordance with first in first out (FIFO) method of accounting.

NOTE 6 – SEGMENT INFORMATION

Operating segments are defined as components of an enterprise for which separate financial information is evaluated regularly by the chief operating decision maker, or decision-making group in deciding how to allocate resources and in assessing performance. The Company evaluates operating results based on measures of performance, including revenues and profit (loss). The Company currently operates in the following three reporting segments: SaaS, TaaS and Unicorn Hunters.

Our reportable segments consist of SaaS, TaaS and Unicorn Hunters. We determine our operating segments based on how the chief operating decision makers (“CODM”) manage the business, allocates resources, makes operating decisions and evaluates operating performance. The chief operating decision makers (“CODM”) are the Chief Executive Officer and the President of the Company. Our chief operating decision makers review financial information presented on a consolidated basis accompanied by information about revenue and cost of revenue by services type along with gross profit for purposes of allocating resources and evaluating financial performance, as such we have disclosed segment information up to gross profit for each operating segment. Furthermore, our revenues are derived from the United States and foreign countries which includes the South American and Europeans regions (“Foreign countries”).

Historically the Company has operated in two segments – SaaS, which consists of operations relative to the Company’s fully integrated all-in-one cloud-based solution to manage remote workers and TaaS, which consists of operations relative to the Company’s staffing service offerings, where Customers are connected to individuals by the Company who are able to assist them in projects.

A third segment was added in 2021, upon acquisition of Unicorns, which consists of operations relative to production and streaming of the Unicorn Hunters show which provides publicity and exposure to customers through their appearances on the Unicorn Hunters show.

The following tables set forth certain reportable segment information relating to where the Company derived its revenue for the three and six months ended June 30, 2022, and 2021:

| Schedule of revenue from segments | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | |

| | | 2022 | | | 2021 | |

| | | United

States | | | Foreign

countries | | | Consolidated | | | United

States | | | Foreign

countries | | | Consolidated | |

| Staffing revenues | | $ | 4,463,870 | | | $ | 388,823 | | | $ | 4,852,693 | | | $ | 3,833,431 | | | $ | 15,773 | | | $ | 3,849,204 | |

| Subscription revenues | | | 494 | | | | 7,527 | | | | 8,021 | | | | 1,493 | | | | 49,335 | | | | 50,828 | |

| Unicorn Hunters | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total revenues | | $ | 4,464,364 | | | $ | 396,350 | | | $ | 4,860,714 | | | $ | 3,834,924 | | | $ | 65,108 | | | $ | 3,900,032 | |

| | | Six Months Ended June 30, | |

| | | 2022 | | | 2021 | |

| | | United

States | | | Foreign

countries | | | Consolidated | | | United

States | | | Foreign

countries | | | Consolidated | |

| Staffing revenues | | $ | 8,824,134 | | | $ | 617,786 | | | $ | 9,441,920 | | | $ | 6,831,956 | | | $ | 18,495 | | | $ | 6,850,451 | |

| Subscription revenues | | | 848 | | | | 11,016 | | | | 11,864 | | | | 3,650 | | | | 96,362 | | | | 100,012 | |

| Unicorn Hunters | | | - | | | | 4,139,000 | | | | 4,139,000 | | | | - | | | | - | | | | - | |

| Total revenues | | $ | 8,824,982 | | | $ | 4,767,802 | | | $ | 13,592,784 | | | $ | 6,835,606 | | | $ | 114,857 | | | $ | 6,950,463 | |

The following tables set forth certain reportable segment information relating to the Company’s operations for the three and six months ended June 30, 2022 and 2021:

| Schedule of operations from operations | | | | | | | | | | | | | | | | |

| | | Three months ended June 30, 2022 | |

| | | SaaS | | | TaaS | | | Unicorn

Hunters | | | Consolidated | |

| Revenues | | $ | 8,021 | | | $ | 4,852,693 | | | $ | - | | | $ | 4,860,714 | |

| Cost of revenues | | | 573 | | | | 3,703,279 | | | | 5,370,592 | | | | 9,074,444 | |

| Gross profit | | | 7,448 | | | | 1,149,414 | | | | (5,370,592 | ) | | | (4,213,730 | ) |

| | | | | | | | | | | | | | | | | |

| | | Three months ended June 30, 2021 | |

| | | SaaS | | | TaaS | | | Unicorn

Hunters | | | Consolidated | |

| Revenues | | $ | 50,828 | | | $ | 3,849,204 | | | $ | - | | | $ | 3,900,032 | |

| Cost of revenues | | | 27,852 | | | | 2,985,631 | | | | 4,929,123 | | | | 7,942,606 | |

| Gross profit | | | 22,976 | | | | 863,573 | | | | (4,929,123 | ) | | | (4,042,574 | ) |

| | | | | | | | | | | | | | | | | |

| | | Six months ended June 30, 2022 | |

| | | SaaS | | | TaaS | | | Unicorn

Hunters | | | Consolidated | |

| Revenues | | $ | 11,864 | | | $ | 9,441,920 | | | $ | 4,139,000 | | | $ | 13,592,784 | |

| Cost of revenues | | | 870 | | | | 7,286,086 | | | | 5,382,413 | | | | 12,669,369 | |

| Gross profit | | | 10,994 | | | | 2,155,834 | | | | (1,243,413 | ) | | | 923,415 | |

| | | | | | | | | | | | | | | | | |

| | | Six months ended June 30, 2021 | |

| | | SaaS | | | TaaS | | | Unicorn

Hunters | | | Consolidated | |

| Revenues | | $ | 100,012 | | | $ | 6,850,451 | | | $ | - | | | $ | 6,950,463 | |

| Cost of revenues | | | 44,773 | | | | 5,231,313 | | | | 4,929,123 | | | | 10,205,209 | |

| Gross profit | | | 55,239 | | | | 1,619,138 | | | | (4,929,123 | ) | | | (3,254,746 | ) |

There were no material transactions between reportable segments during the six months ended June 30, 2022 and 2021.

Assets by reportable segment and operating costs by reportable segment are not presented as the Company does not allocate assets to its reportable segments, nor is such information used by management for purposes of assessing performance or allocating resources.

NOTE 7 – DEBT

As more fully described below, the Company’s short-term debt as of June 30, 2022 and December 31, 2021 totalled $919 thousand and $1,216 thousand, respectively. The Company did not hold any long-term debt as of June 30, 2022 or December 31, 2021.

Unsecured Notes

From June 3, 2021 through November 23, 2021 the Company issued 89 private placement unsecured promissory notes with aggregate principal amount of $1,216 thousand and interest of 20.0% per annum, payable at maturity (the “Unsecured Notes”) resulting in an outstanding balance of $1,216 thousand as of December 31, 2021.

During the six months ended June 30, 2022, additional five Unsecured Notes with aggregate principal amount of $48 thousand were issued and Unsecured Notes with aggregate principal amount of $345 thousand were redeemed resulting in an ending balance of $919 thousand as of June 30, 2022.

The Unsecured Notes mature one year from issuance unless the holder elects to extend the maturity for one additional year. Prepayment is not permitted. The Unsecured Notes generally rank pari-passu relative to other unsecured obligations. As of June 30, 2022, $871 thousand of Unsecured Notes are due and payable during the second half of 2022 and $48 thousand are due and payable during the first half of 2023, to the extent holders do not elect to extend one additional year.

Unsecured Notes interest expense of $57 thousand $119 thousand was incurred during the three and six months ended June 30, 2022 and was recorded as accrued expenses in the consolidated balance sheets. No interest was incurred during the six months ended June 30, 2021.

No significant third-party financing costs were incurred because the Company managed issuance of the Unsecured Notes internally, without use of an underwriter or trustee. Based on their short duration, the fair value of the Unsecured Notes as of June 30, 2022 and December 31, 2021 approximates the carrying amounts.

NOTE 8 – UNICOIN RIGHTS FINANCING OBLIGATION

The Company is developing a security token called Unicoin (“Unicoins” or “Tokens”) whose value is intended to be supported by equity positions purchased from Unicorn Hunters show participants, as well as equity positions acquired by non-show participants for other services. Such equity positions may be held in a to-be-created investment fund (the “Fund”), to facilitate proper management of the equity portfolio. The intention of the Company is that when equity positions held by the Fund are liquidated through a liquidity event, some or all of the resulting proceeds are to be distributed to holders of the Unicoins.

The Company is offering Unicoin Right Certificates with terms and conditions which are set forth in a confidential private placement memorandum dated March 2022 and subsequently updated in June 2022 (“the Offering”). The Offering is being conducted pursuant to an exemption from U.S. securities registration requirements provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506(c) thereunder. Each U.S. domiciled investor in Unicoin Rights must be an “accredited investor,” as defined in Rule 501 of the Securities Act.

During the six months ended June 30, 2022, the Company issued rights to acquire 2.7 billion Unicoins in exchange for $17,943 thousand in cash, $1,400 thousand in digital assets (Note 5), $7,894 thousand of services from vendors, $39 thousand of services from employees, contractors and directors and $73 thousand which was recorded as a dividend to company stockholders (Note 9).

As of June 30, 2022, the Company held approximately $276 thousand of cash deposits pursuant to completion of the due diligence process required before issuance of Unicoin Right certificates. This amount is included in accrued liabilities on the condensed consolidated balance sheet and in proceeds from sales of Unicoin Rights on the condensed consolidated statements of cash flows. As discussed in Note 16, additional rights to acquire Unicoins were issued subsequent to June 30, 2022.

The Company accounts for Unicoin Rights by recording a liability representing the amount that management believes the Company would be obligated to pay or refund (i.e., the amount holders have a right to claim and would likely be awarded in settlement) for fair value exchanged (i.e., in the form of cash or services) for rights to receive Unicoins in the future and in the event the Unicoin is never developed and launched. As of June 30, 2022 the outstanding financing obligation related to Unicoin Rights Issued was $27,349 thousand.

As of June 30, 2022 and through the date of filing, the Company has not developed or issued any Unicoins and there is no assurance as to whether, or at what amount, or on what terms, Unicoins will be available to be issued, if ever. As of June 30, 2022, as the Unicoins do not exist, and any amounts received for Unicoins are not considered equity or revenue, management determined that 100% of the obligation of $27,349 thousand is a liability to be settled by through the issuance of Unicoins, or through other means if Unicoins are never issued. The obligation to settle this liability through the exchange of a fixed number of Unicoins, when and if all contingencies are resolved and Unicoins are launched, represents an embedded feature that may result in additional charges to the Company’s consolidated statement of operations upon settlement.

NOTE 9 – COMMON STOCK

The Company is authorized to issue 1,000,000,000 shares with 772,742,352 shares and 767,525,220 shares of common stock issued and with 734,069,873 shares and 732,251,471 shares outstanding, net of treasury stock, as of June 30, 2022 and December 31, 2021, respectively. Stockholders are entitled to one vote for each share held of record on all matters to be voted on by stockholders. Stockholders have no conversion, pre-emptive, or other subscription rights and there are no sinking fund or redemption provisions applicable to the common stock.

Issuance of Common Stock

For the three months ended June 30, 2022 and 2021, the Company raised cash proceeds of $134 thousand and $17,765 thousand, respectively, through a series of equity funding rounds as follows:

| Schedule of issuance of common stock | | | | | | | | | | | | |

| | | Three Months Ended June 30,

2022 | |

| Series | | Shares | | | Weighted

Average

Price per

Share | | | Proceeds | |

| Plus: Stock issues - Round 3b | | | 2 | | | $ | 0.30 | | | $ | 1 | |

| Plus: Stock issues - Round 4a | | | 60,500 | | | | 2.00 | | | | 121,000 | |

| Plus: Stock issues - Round 4b | | | (3,000 | ) | | | 3.00 | | | | (9,000 | ) |

| Plus: Stock issues - Round 5 | | | 5,698 | | | | 3.86 | | | | 22,000 | |

| Total stock issues | | | 63,200 | | | | | | | $ | 134,001 | |

| | | Three Months Ended June 30,

2021 | |

| Series | | Shares | | | Weighted

Average

Price per

Share | | | Proceeds | |

| Plus: Stock issues - Round 3a | | | 95,000 | | | $ | 0.20 | | | $ | 19,000 | |

| Plus: Stock issues - Round 3d | | | 5,000 | | | $ | 1.00 | | | | 5,000 | |

| Plus: Stock issues - Round 4a | | | 8,870,279 | | | $ | 2.00 | | | | 17,740,558 | |

| Total stock issues | | | 8,970,279 | | | | | | | $ | 17,764,558 | |

For the six months ended June 30, 2022 and 2021, the Company raised $1,494 thousand and $17,778 thousand, respectively, through a series of equity funding rounds as presented below. Proceeds for the six months ended June 30, 2022 and 2021 included digital assets of $23 thousand and $30 thousand, respectively.

| | | Six Months Ended June 30,

2022 | |

| Series | | Shares | | | Weighted

Average

Price per

Share | | | Proceeds | |

| Plus: Stock issues - Round 3b | | | 2 | | | $ | 0.50 | | | $ | 1 | |

| Plus: Stock issues - Round 4a | | | 90,000 | | | | 2.00 | | | | 180,000 | |

| Plus: Stock issues - Round 4b | | | 24,001 | | | | 3.00 | | | | 72,000 | |

| Plus: Stock issues - Round 5 | | | 343,311 | | | | 3.62 | | | | 1,241,868 | |

| Total stock issues | | | 457,314 | | | | | | | $ | 1,493,869 | |

| | | Six Months Ended June 30,

2021 | |

| Series | | Shares | | | Weighted

Average

Price per

Share | | | Proceeds | |

| Plus: Stock issues - Round 3a | | | 95,000 | | | $ | 0.20 | | | $ | 19,000 | |

| Plus: Stock issues - Round 3b | | | 3,333 | | | | 0.30 | | | | 1,000 | |

| Plus: Stock issues - Round 3d | | | 25,000 | | | | 0.68 | | | | 17,000 | |

| Plus: Stock issues - Round 4a | | | 8,870,279 | | | | 2.00 | | | | 17,740,558 | |

| Total stock issues | | | 8,993,612 | | | | | | | $ | 17,777,558 | |

All shares were issued from the Company’s pool of authorized common stock, which rights and privileges are discussed above and were the same for all shares issued to date. Each funding round was available for a defined period with a specified price per share and did not overlap with other funding rounds. Investors that subscribed during a specific round, locked the pricing offered for that round and Company had a limited time to close on the issuance of shares. Once a funding round was fully subscribed and committed, management evaluated capital needs and determined the price for the following round.

Repurchases of Common Stock

During the six months ended June 30, 2022 the Company repurchased 3,398,730 shares in exchange for $340 thousand. Treasury stock is recorded on the consolidated balance sheets at cost and is reflected as an increase to stockholders’ deficit. The Company intends to resell the treasury stock which was held as of June 30, 2022.

Shares of common stock reserved for future issuance are as follows:

| Schedule of common stock reserved | | | | | | | | |

| | | June 30,

2022 | | | December 31,

2021 | |

| Stock options outstanding (Note 10) | | | 55,535,881 | | | | 58,737,070 | |

| Warrants for common stock (Note 11) | | | 10,310,000 | | | | 11,570,000 | |

| Restricted stock units (Note 10) | | | 529,697 | | | | 788,797 | |

Dividend of Unicoins

In connection with a February 10, 2022 board consent, the Company declared a non-cash dividend of one Unicoin Right per each common share of record held on February 10, 2022. A total of 730,503,862 Unicoin Rights were issued as non-cash dividends aggregating to $73 thousand, or $0.0001 per share and was recorded as a reduction of additional paid-in-capital and an increase to the Unicoin Rights liability in the Company’s consolidated balance sheet. The dividend was recorded as a reduction of additional paid-in-capital because the Company is in a retained deficit position.

Management believes the fair value of the Unicoin rights issued to its shareholders was de minimis given the following:

| ● | The legal terms and conditions (and therefore the rights and obligations of the Company and holders of Unicoins) have not yet been finalized. |

| ● | Certain regulatory and other approvals will have to be obtained before the Unicoin can be launched by the Company and the yet-to-be newly formed entity that will ultimately issue Unicoins will be required to go through Registration with the SEC or identify an appropriate exemption from Registration before Unicoins can be actively traded. Obtaining these approvals and achieving appropriate Registration or exemption status may be outside of the Company’s control. |

| ● | The underlying business and related private company investment holdings that are intended to support the underlying value of Unicoins is in the early stages of operation and has not yet realized any investment gains and is likely to experience volatility that may be significant. |

Future dividends of Unicoin Rights will depend upon factors to be determined as the Company further develops its plans for Unicoins. The Company has not paid any cash dividends to date and does not anticipate or contemplate paying cash dividends in the foreseeable future; management’s intention is to utilize all available funds for further development of the Company’s business.

NOTE 10 – STOCK-BASED COMPENSATION

Options to purchase common stock are granted at the discretion of the Board of Directors, a committee thereof or, subject to defined limitations, an executive officer of the Company to whom such authority has been delegated.

Non-Plan Equity Incentive Awards

The Company provides discretionary awards such as nonqualified stock options as well as stock awards, any or all of which may be made contingent upon the achievement of performance criteria. The Company at its discretion determines the terms and conditions of the option award, including the time or times at which an option may be exercised, the methods by which such exercise price may be paid, and the form of such payment. Options are generally granted with an exercise price ranging from $0.001 to $2. Upon exercise, the option exercise price may be paid in cash or by the delivery of previously owned shares of common stock, through an option exercise arrangement. The Administrator determines the terms relating to the exercise, cancellation, or other disposition of options and stock awards upon a termination of employment, whether by reason of disability, retirement, death, or any other reason.

Stock Options

The Company recorded zero and $7 thousand of stock-based compensation expense relating to stock option awards during the three months ended June 30, 2022 and 2021, respectively. The Company recorded $11 thousand and $89 thousand of stock-based compensation expense relating to stock option awards during the six months ended June 30, 2022 and 2021, respectively. The Company measures the expense using the Black-Scholes option-pricing model. The Black-Scholes option pricing model requires the use of a number of assumptions, including expected volatility, risk-free interest rate, expected dividends, and expected term. Management estimates the expected term of the award based on the contractual as well as the exercise price of the options. Expected volatility is based on the historic volatility of a basket of certain publicly traded comparable companies. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for the expected term of the unit.

The following is a summary of stock option activity for the six months ended June 30, 2022:

| Schedule of stock option activity | | | | | | | | | | | | | | | | |

| | | Number of Shares | | | Weighted

Average

Exercise Price | | | Weighted

Average

Remaining

Contractual

Term (Years) | | | Aggregate

Intrinsic Value | |

| Beginning balance January 1, 2022 | | | 58,737,070 | | | $ | 0.029 | | | | 7.58 | | | $ | 58,764,812 | |

| Granted | | | 17,541 | | | | 1.030 | | | | | | | | | |

| Exercised | | | (3,218,730 | ) | | | 0.002 | | | | | | | | 3,280,250 | |

| Ending balance June 30, 2022 | | | 55,535,881 | | | | 0.031 | | | | 7.11 | | | | 48,919,823 | |

| Vested and exercisable as of June 30, 2022 | | | 55,535,881 | | | $ | 0.031 | | | | 7.11 | | | $ | 48,919,823 | |

The assumptions used to determine stock-based compensation expense for the six months ended June 30, 2022 and 2021 were as follows:

| Schedule of assumptions used | | | | | | |

| | | June 30,

2022 | | | June 30,

2021 | |

| Fair value of common stock | | $0.91 - $0.94 | | | $0.39 - $0.52 | |

| Expected term (in years) | | 10 | | | 10 | |

| Volatility | | 58.00% - 59.00% | | | 52.40% - 57.70% | |

| Risk-free rate | | 2.30% - 2.90% | | | 1.47% - 1.75% | |

| Dividend yield | | - | | | - | |

Restricted Stock Units

RSU’s Classified as a Liability

Prior to July 2021 the Company issued Restricted Stock Units (“RSU’s”) in which the Company has an obligation to issue a variable number of shares that are based on a fixed monetary amount. These awards are classified as a liability. The Company measures the cost of employee services received in exchange for a liability classified award based on the fixed dollar value of the awards.

RSU’s Classified as Equity

During 2021, the Company amended certain employment agreements for some of its employees that enabled those employees to receive stock awards worth a fixed dollar amount, either: (i) at end of every month in certain instances; or (ii) on the first anniversary of their respective employments in other instances. The revised employment agreement specifies the maximum number of shares to be issued upon vesting to the respective employees. Equity-classified RSU’s have a grant-date fair value equal to the fair market value of the underlying stock on the grant date less present value of expected dividends. These awards vest immediately.

The following is a summary of RSU activity for the six months ended June 30, 2022:

| Schedule of liability and restricted stock units | | | | | | | | | | | | | | | | | |

| | | | Liability

Classified | | | Equity

Classified | | | Total | | | Weighted

Average

Grant Date

Fair Value | |

| Beginning balance - January 1, 2022 | | | | 172,247 | | | | 616,550 | | | | 788,797 | | | | | |

| Granted | | | | - | | | | 15,135 | | | | 15,135 | | | $ | 0.98 | |

| Vested | | | | (99,534 | ) | | | (174,168 | ) | | | (273,702 | ) | | | | |

| Forfeited | | | | - | | | | (533 | ) | | | (533 | ) | | | | |

| Ending balance - June 30, 2022 | | | | 72,713 | | | | 456,984 | | | | 529,697 | | | | | |

The Company recorded $52 thousand and $432 thousand of stock-based compensation expense relating to RSU’s during the three months ended June 30, 2022 and 2021, respectively. The Company recorded $106 thousand and $758 thousand of stock-based compensation expense relating to RSU’s during six months ended June 30, 2022 and 2021, respectively. During the three and six months ended June 30, 2022 and 2021 substantially all stock-based compensation expense was classified as general and administrative expense.

NOTE 11 – WARRANTS