UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 000-56276

Unicoin Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | | 47-4360035 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

228 Park Ave South 16065

New York, New York

(Address of principal executive offices)

Registrant’s telephone number, including area code: (212) 216-0001

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | | None | | None |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 14, 2023, there were 733,507,964 shares of the Registrant’s common stock outstanding.

Table of Contents

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

Some of the statements contained in this Quarterly Report on Form 10-Q of Unicoin Inc. (formerly known as TransparentBusiness, Inc. and hereinafter referred to as “Unicoin Inc.”, “we”, “our”, or the “Company”) discuss future expectations, contain projections of our plan of operation or financial condition or state other forward-looking information. In this Quarterly Report on Form 10-Q, forward-looking statements are generally identified by the words such as “anticipate”, “plan”, “believe”, “expect”, “estimate”, and the like. Forward-looking statements involve future risks and uncertainties, there are factors that could cause actual results or plans to differ materially from those expressed or implied. These statements are subject to known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on various factors and is derived using numerous assumptions. A reader, whether investing in the Company’s securities or not, should not place undue reliance on these forward-looking statements, which apply only as of the date of this Quarterly Report on Form 10-Q. Important factors that may cause actual results to differ from projections include, for example:

| | ● | the success or failure of Management’s efforts to implement the Company’s plan of operation; |

| | ● | the ability of the Company to fund its operating expenses; |

| | ● | the ability of the Company to compete with other companies that have a similar plan of operation; |

| | ● | the effect of changing economic conditions impacting our plan of operation; and |

| | ● | the ability of the Company to meet the other risks as may be described in future filings with the SEC. |

Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date hereof. We believe the information contained in this Quarterly Report on Form 10-Q to be accurate as of the date hereof. Changes may occur after that date. We will not update that information except as required by law in the normal course of our public disclosure practices.

Additionally, the following discussion regarding our financial condition and results of operations should be read in conjunction with the condensed consolidated financial statements and related notes included in this Quarterly Report on Form 10-Q.

PART I-FINANCIAL INFORMATION

Item 1. Financial Statements.

UNICOIN INC. AND SUBSIDIARIES

(fORMERLY kNOWN AS TRANSPARENTBUSINESS, INC.)

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | |

| | | June 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

| ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 6,623,089 | | | $ | 1,522,069 | |

| Accounts receivable, net | | | | | | | | |

| Trade receivables payable in cash (Note 2) | | | 1,949,294 | | | | 2,418,773 | |

| Unicorn Hunters non-cash receivables (Note 4) | | | - | | | | 8,322,000 | |

| Prepaid expenses and other current assets (Note 2) | | | 707,502 | | | | 511,790 | |

| Indemnification asset | | | 4,785,455 | | | | 4,659,700 | |

| TOTAL CURRENT ASSETS | | | 14,065,340 | | | | 17,434,332 | |

| Property and equipment, net | | | 40,641 | | | | 46,032 | |

| Goodwill | | | 3,865,695 | | | | 3,865,695 | |

| Intangible assets, net | | | 2,883,386 | | | | 3,041,972 | |

| Investments in privately-held companies (Note 4) | | | 8,627,000 | | | | 298,000 | |

| Operating lease right-of-use assets | | | 270,406 | | | | 349,631 | |

| TOTAL ASSETS | | $ | 29,752,468 | | | $ | 25,035,662 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | |

| Accounts payable | | $ | 1,456,650 | | | $ | 2,159,677 | |

| Income tax payable | | | 24,467 | | | | 27,500 | |

| Accrued expenses | | | 2,316,899 | | | | 1,314,195 | |

| Accrued payroll liabilities | | | 680,172 | | | | 611,614 | |

| Deferred revenue | | | 25,116 | | | | 18,969 | |

| ITSQuest tax liability | | | 4,785,455 | | | | 4,659,700 | |

| Short-term debt | | | 570,300 | | | | 708,100 | |

| Loan from related party (Note 13) | | | 395,000 | | | | 645,000 | |

| Operating lease liabilities, current | | | 140,744 | | | | 149,802 | |

| Other current liabilities | | | 464,315 | | | | 823,876 | |

| TOTAL CURRENT LIABILITIES | | | 10,859,118 | | | | 11,118,433 | |

| Deferred income tax liability, net | | | 1,141,453 | | | | 1,141,453 | |

| Unicoin rights financing obligation (Note 7) | | | 48,359,967 | | | | 37,461,847 | |

| Operating lease liabilities, noncurrent | | | 132,636 | | | | 199,629 | |

| TOTAL LIABILITIES | | | 60,493,174 | | | | 49,921,362 | |

| | | | | | | | | |

| STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | |

| Common stock, $0.001 par value; 1,000,000,000 authorized; 773,030,006 and 772,938,415 issued; 733,507,964 and 733,427,768 outstanding, net of treasury stock as of June 30, 2023 and December 31, 2022, respectively | | | 773,030 | | | | 772,938 | |

| Treasury stock, at cost; 39,522,042 and 39,510,647 shares as of June 30, 2023 and December 31, 2022, respectively | | | (3,393,525 | ) | | | (3,389,446 | ) |

| Additional paid-in capital | | | 72,947,626 | | | | 72,831,056 | |

| Accumulated deficit | | | (98,622,983 | ) | | | (92,570,448 | ) |

| TOTAL UNICOIN INC. STOCKHOLDERS’ EQUITY (DEFICIT) | | | (28,295,852 | ) | | | (22,355,900 | ) |

| Noncontrolling interest | | | (2,444,854 | ) | | | (2,529,800 | ) |

| TOTAL STOCKHOLDERS’ DEFICIT | | | (30,740,706 | ) | | | (24,885,700 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | $ | 29,752,468 | | | $ | 25,035,662 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

UNICOIN INC. AND SUBSIDIARIES

(fORMERLY kNOWN AS TRANSPARENTBUSINESS, INC.)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | | Six Months Ended

June 30, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| REVENUES | | $ | 4,508,378 | | | $ | 4,860,714 | | | | 8,784,460 | | | $ | 13,592,784 | |

| COST OF REVENUES | | | 3,532,220 | | | | 9,074,444 | | | | 6,966,699 | | | | 12,669,369 | |

| GROSS PROFIT | | | 976,158 | | | | (4,213,730 | ) | | | 1,817,761 | | | | 923,415 | |

| OPERATING COSTS AND EXPENSES | | | | | | | | | | | | | | | | |

| General and administrative | | | 3,916,250 | | | | 4,670,846 | | | | 6,834,266 | | | | 8,070,650 | |

| Sales and marketing | | | 367,757 | | | | 12,458,119 | | | | 611,229 | | | | 14,206,122 | |

| Research and development | | | 56,242 | | | | 126,703 | | | | 114,607 | | | | 249,401 | |

| TOTAL OPERATING COSTS AND EXPENSES | | | 4,340,249 | | | | 17,255,668 | | | | 7,560,102 | | | | 22,526,173 | |

| LOSS FROM OPERATIONS | | | (3,364,091 | ) | | | (21,469,398 | ) | | | (5,742,341 | ) | | | (21,602,758 | ) |

| Interest income (expense), net | | | (44,186 | ) | | | (57,386 | ) | | | (117,406 | ) | | | (118,845 | ) |

| Other income (expense), net | | | 391 | | | | (586 | ) | | | - | | | | (616 | ) |

| Income tax benefit (expense) | | | (37,826 | ) | | | 65,309 | | | | (107,842 | ) | | | (115,293 | ) |

| NET LOSS AND COMPREHENSIVE LOSS | | | (3,445,712 | ) | | $ | (21,462,061 | ) | | | (5,967,589 | ) | | $ | (21,837,512 | ) |

| Less: net income/(loss) attributable to the noncontrolling interest | | | 22,934 | | | | (2,173,258 | ) | | | 84,946 | | | | (1,193,484 | ) |

| NET LOSS ATTRIBUTABLE TO UNICOIN INC. | | $ | (3,468,646 | ) | | $ | (19,288,803 | ) | | $ | (6,052,535 | ) | | $ | (20,644,028 | ) |

| Net loss per share attributable to Unicoin Inc., basic and diluted | | $ | (0.01 | ) | | | (0.03 | ) | | $ | (0.01 | ) | | $ | (0.03 | ) |

| Weighted average common shares outstanding used to compute basic and diluted loss per share | | | 733,485,437 | | | | 734,018,271 | | | | 733,469,733 | | | | 733,516,974 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

UNICOIN INC. AND SUBSIDIARIES

(fORMERLY kNOWN AS TRANSPARENTBUSINESS, INC.)

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Additional | | | | | | | | | | | | Unicoin Inc.

Stockholders’ | | | Unicoin Inc. | | | Total

Stockholders’ | |

| | | Common Stock | | | Paid-In | | | Treasury Stock | | | Accumulated | | | Equity | | | Noncontrolling | | | Equity | |

| | | Shares | | | Amount | | | Capital | | | Shares | | | Amount | | | Deficit | | | (Deficit) | | | Interest | | | (Deficit) | |

| Balance as of December 31, 2021 | | | 767,525,220 | | | $ | 767,525 | | | $ | 71,041,101 | | | | (35,273,749 | ) | | $ | (2,714,312 | ) | | $ | (59,946,592 | ) | | $ | 9,147,722 | | | $ | (1,026,337 | ) | | $ | 8,121,385 | |

| Issuance of common stock | | | 398,596 | | | | 399 | | | | 1,359,469 | | | | - | | | | - | | | | - | | | | 1,359,868 | | | | - | | | | 1,359,868 | |

| Stock-based compensation expense | | | - | | | | - | | | | 66,114 | | | | - | | | | - | | | | - | | | | 66,114 | | | | - | | | | 66,114 | |

| Repurchase of common stock (Note 8) | | | - | | | | - | | | | - | | | | (3,398,730 | ) | | | (339,873 | ) | | | - | | | | (339,873 | ) | | | - | | | | (339,873 | ) |

| Exercise of stock options and warrants | | | 4,478,730 | | | | 4,479 | | | | 1,524 | | | | - | | | | - | | | | - | | | | 6,003 | | | | - | | | | 6,003 | |

| Common stock issued for services | | | 273,702 | | | | 273 | | | | 197,348 | | | | - | | | | - | | | | - | | | | 197,621 | | | | - | | | | 197,621 | |

| Non-cash dividend (Note 7) | | | - | | | | - | | | | (68,510 | ) | | | - | | | | - | | | | - | | | | (68,510 | ) | | | - | | | | (68,510 | ) |

| Net Income (Loss) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,355,225 | ) | | | (1,355,225 | ) | | | 979,774 | | | | (375,451 | ) |

| Balance as of March 31, 2022 | | | 772,676,248 | | | $ | 772,676 | | | $ | 72,597,046 | | | | (38,672,479 | ) | | $ | (3,054,185 | ) | | $ | (61,301,817 | ) | | $ | 9,013,720 | | | $ | (46,563 | ) | | $ | 8,967,157 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock | | | 66,104 | | | | 66 | | | | 133,935 | | | | - | | | | - | | | | - | | | | 134,001 | | | | - | | | | 134,001 | |

| Stock-based compensation expense | | | - | | | | - | | | | 50,990 | | | | - | | | | - | | | | - | | | | 50,990 | | | | - | | | | 50,990 | |

| Non-cash dividend (Note 7) | | | - | | | | - | | | | (4,540 | ) | | | - | | | | - | | | | - | | | | (4,540 | ) | | | - | | | | (4,540 | ) |

| Net Income (Loss) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (19,288,803 | ) | | | (19,288,803 | ) | | | (2,173,258 | ) | | | (21,462,061 | ) |

| Balance as of June 30, 2022 | | | 772,742,352 | | | | 772,742 | | | | 72,777,431 | | | | (38,672,479 | ) | | | (3,054,185 | ) | | | (80,590,620 | ) | | | (10,094,632 | ) | | | (2,219,821 | ) | | | (12,314,453 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2022 | | | 772,938,415 | | | | 772,938 | | | | 72,831,056 | | | | (39,510,647 | ) | | | (3,389,446 | ) | | | (92,570,448 | ) | | | (22,355,900 | ) | | | (2,529,800 | ) | | | (24,885,700 | ) |

| Issuance of common stock | | | 12,445 | | | | 12 | | | | 33,988 | | | | - | | | | - | | | | - | | | | 34,000 | | | | - | | | | 34,000 | |

| Stock-based compensation expense | | | - | | | | - | | | | 38,523 | | | | - | | | | - | | | | - | | | | 38,523 | | | | - | | | | 38,523 | |

| Repurchase of common stock | | | - | | | | - | | | | - | | | | (6,185 | ) | | | (2,412 | ) | | | - | | | | (2,412 | ) | | | - | | | | (2,412 | ) |

| Common stock issued for services | | | 38,837 | | | | 40 | | | | (40 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Net Income (Loss) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,583,889 | ) | | | (2,583,889 | ) | | | 62,012 | | | | (2,521,877 | ) |

| Balance as of March 31, 2023 | | | 772,989,697 | | | | 772,990 | | | | 72,903,527 | | | | (39,516,832 | ) | | | (3,391,858 | ) | | | (95,154,337 | ) | | | (24,869,678 | ) | | | (2,467,788 | ) | | | (27,337,466 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock | | | 2,534 | | | | 2 | | | | 7,498 | | | | - | | | | - | | | | - | | | | 7,500 | | | | - | | | | 7,500 | |

| Stock-based compensation expense | | | - | | | | - | | | | 36,639 | | | | | | | | | | | | | | | | 36,639 | | | | | | | | 36,639 | |

| Repurchase of common stock | | | - | | | | - | | | | - | | | | (5,210 | ) | | | (1,667 | ) | | | - | | | | (1,667 | ) | | | - | | | | (1,667 | ) |

| Common stock issued for services | | | 37,775 | | | | 38 | | | | (38 | ) | | | - | | | | - | | | | - | | | | | | | | - | | | | | |

| Net Income (Loss) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (3,468,646 | ) | | | (3,468,646 | ) | | | 22,934 | | | | (3,445,712 | ) |

| Balance as of June 30, 2023 | | | 773,030,006 | | | $ | 773,030 | | | $ | 72,947,626 | | | | (39,522,042 | ) | | $ | (3,393,525 | ) | | $ | (98,622,983 | ) | | $ | (28,295,852 | ) | | $ | (2,444,854 | ) | | $ | (30,740,706 | ) |

See accompanying notes to the unaudited condensed consolidated financial statements.

UNICOIN INC. AND SUBSIDIARIES

(fORMERLY kNOWN AS TRANSPARENTBUSINESS, INC.)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | |

| | | Six Months Ended

June 30, | |

| | | 2023 | | | 2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net loss | | $ | (5,967,589 | ) | | $ | (21,837,512 | ) |

| Adjustments to reconcile net loss to cash used in operating activities: | | | | | | | | |

| Stock-based compensation expense | | | 75,162 | | | | 117,427 | |

| Operating expenses paid with Unicoin rights (Note 7) | | | 1,114,836 | | | | 7,933,025 | |

| Operating expenses paid with digital assets (Note 5) | | | 131,433 | | | | - | |

| Noncash consideration (Note 4) | | | (7,000 | ) | | | (4,139,000 | ) |

| Impairment of digital assets (Note 5) | | | - | | | | 617,173 | |

| Depreciation and amortization expense | | | 182,757 | | | | 178,866 | |

| Noncash operating lease expense (Notes 2 and 11) | | | 79,225 | | | | 68,927 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Trade receivables payable in cash (Note 2) | | | 469,479 | | | | (159,976 | ) |

| Prepaid expenses and other current assets (Note 2) | | | (196,725 | ) | | | (1,298,400 | ) |

| Accounts payable | | | (703,027 | ) | | | (157,394 | ) |

| Accrued expenses and payroll liabilities | | | 657,810 | | | | 89,846 | |

| Deferred revenue | | | 6,147 | | | | 53,760 | |

| Operating lease liability (Notes 2 and 11) | | | (76,051 | ) | | | (68,927 | ) |

| Other liabilities | | | (326,520) | | | | (434,286 | ) |

| Net cash used in operating activities | | | (4,560,063 | ) | | | (19,036,471 | ) |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Purchase of property and equipment | | | - | | | | (50,759 | ) |

| Net cash used in investing activities | | | - | | | | (50,759 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| Proceeds from issuance of private placement unsecured notes | | | 199,200 | | | | 48,000 | |

| Payment of short-term debt | | | (337,000 | ) | | | (345,000 | ) |

| Proceeds from sales of Unicoin rights (Note 7) | | | 10,011,464 | | | | 18,218,967 | |

| Proceeds from sales of common stock | | | 41,498 | | | | 1,470,890 | |

| Repurchase of common stock | | | (4,079 | ) | | | (339,873 | ) |

| Proceeds from exercise of stock options and warrants | | | - | | | | 6,003 | |

| Repayment of related party loan payable (Note 13) | | | (250,000 | ) | | | - | |

| Net cash provided by financing activities | | | 9,661,083 | | | | 19,058,987 | |

| | | | | | | | | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 5,101,020 | | | | (28,243 | ) |

| CASH AND CASH EQUIVALENTS—Beginning of period | | | 1,522,069 | | | | 1,872,529 | |

| CASH AND CASH EQUIVALENTS—End of period | | $ | 6,623,089 | | | $ | 1,844,286 | |

| | | | | | | | | |

| Supplemental Non-Cash Disclosures: | | | | | | | | |

| Market value of digital assets received as proceeds from sales of common stock (Notes 5 and 8) | | | - | | | | 22,980 | |

| Market value of digital assets received as proceeds from sales of Unicoin rights (Notes 5 and 7) | | | 149,200 | | | | 1,399,530 | |

| Receipt (i.e., “collection”) of private company equity securities (Note 4) | | | 8,329,000 | | | | - | |

| Recognition of operating lease right-of-use assets and operating lease liabilities upon adoption of ASC 842 (Note 2) | | | - | | | | 187,963 | |

| Non-cash dividend of Unicoin rights (730,503,862 rights) (Notes 8 and 9) | | | - | | | | 73,050 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

Unicoin Inc. AND SUBSIDIARIES

(fORMERLY kNOWN AS TRANSPARENTBUSINESS, INC.)

NOTES TO CONDENSED Consolidated FINANCIAL STATEMENTS

(UNAUDITED)

AS OF June 30, 2023 AND DECEMBER 31, 2022 AND

FOR THE THREE AND SIX MONTHS ENDED June 30, 2023 AND 2022

NOTE 1 – ORGANIZATION AND OPERATIONS

Name Change

On October 6, 2022, the Company filed an amendment to its Certificate of Incorporation with the Secretary of State of the State of Delaware changing its name from TransparentBusiness, Inc. to Unicoin Inc. (“Unicoin” or the “Company”). The name change was effective as of October 6, 2022.

Description of Business

Unicoin Inc. formerly known as TransparentBusiness, Inc. was incorporated in the state of Delaware on June 22, 2015. The Company’s SaaS (Software-as-a-Service) platform was developed in 2008 by KMGi Group, the predecessor to Unicoin as an internal tool for monitoring and managing computer-based work for the purpose of improving efficiency of both remote and on-site employees and eliminating overbilling of contractors. The TransparentBusiness platform has been in use since 2009, initially under the name TransparentBilling, Inc. serving KMGi Group’s internal operations. The Company markets its services throughout the United States of America.

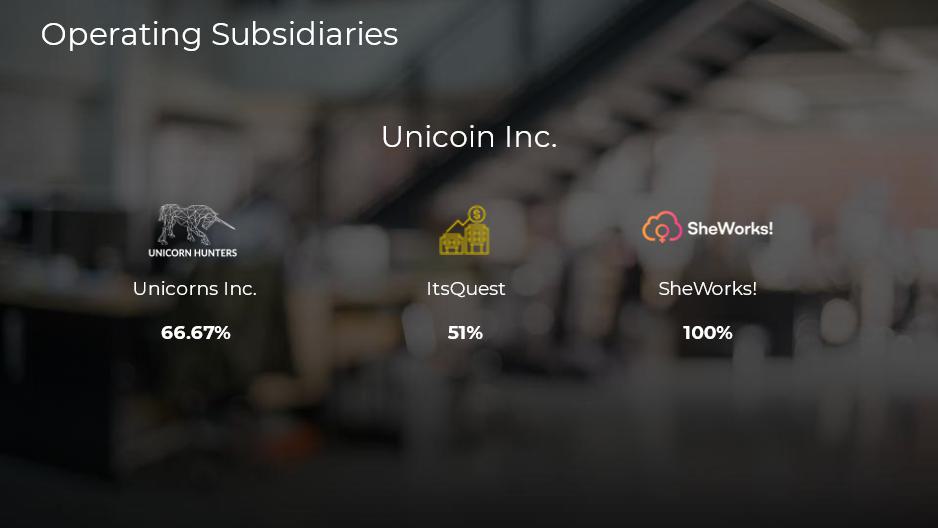

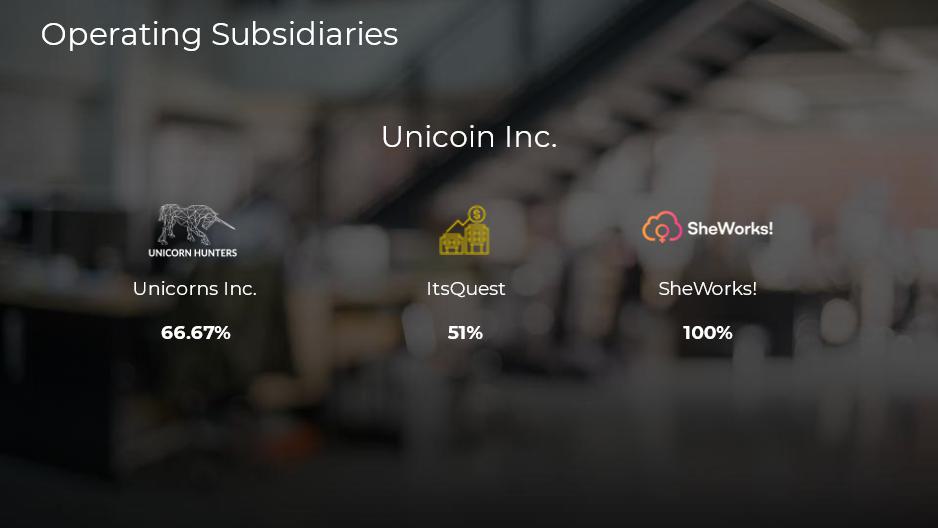

In addition to operating its original SaaS business, the Company wholly owns two TaaS (Talent-as-a-Service) companies and platforms, SheWorks! And Yandiki, and holds majority ownership interests in ITSQuest, Inc, (“ITSQuest”) a regional staffing agency, as well as Unicorns, Inc. (“Unicorns” or “Unicorn Hunters”) which produces reality television/streaming shows.

In June 2023, the Company merged two of its wholly owned subsidiaries, SheWorks! and Yandiki, into one operating entity. The surviving post-merger entity will operate under the name SheWorks!. SheWorks! is a talent exchange focused on connecting women seeking freelance or employment opportunities with companies looking for freelancers or employees to fill their needs.

In November 2020 the Company acquired a 51% ownership interest in ITSQuest, Inc which is a regional staffing agency with twelve locations throughout New Mexico and Texas. ITSQuest has significant contact with employers throughout the US Southwest and utilizes its sales force and contacts to promote and sell the Company’s SaaS and TaaS products. Customers of ITSQuest are primarily governmental agencies.

In April 2021, the Company acquired a 66.67% ownership interest in Unicorns, Inc. Unicorns produces a reality television/streaming show called Unicorn Hunters that showcases private companies seeking to obtain publicity for their private offerings by appearing on the show and attempting to raise capital by advertising their exempt offerings to a wide audience. Alex Konanykhin, CEO of the Company and founder of Unicorns, issued 50,000,001 shares of Unicorns common stock to Unicoin giving the Company a 66.67% majority interest in Unicorns. An additional 26.67% of Unicorns shares are held by officers and directors of the Company.

Going Concern

These financial statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) assuming the Company will continue as a going concern. The going concern assumption contemplates the realization of assets and satisfaction of liabilities in the normal course of business.

The Company has incurred net losses of ($5,968) thousand (5,967,589) and ($21,838) thousand (21,837,512) and used cash in operating activities of ($4,560) thousand and ($19,036) thousand for the six months ended June 30, 2023 and 2022, respectively, and has an accumulated deficit of ($98,623) thousand and ($92,570) thousand as of June 30, 2023 and December 31, 2022, respectively, and expects to incur future additional losses. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The Company’s long-term success is dependent upon its ability to successfully raise additional capital, market its existing services, increase revenues, and, ultimately, to achieve profitable operations.

The Company is evaluating strategies to obtain the required additional funding for future operations. These strategies may include, but are not limited to, issuing Unicoin rights, obtaining equity financing, issuing debt, or entering other financing arrangements, and restructuring of operations to grow revenues and decrease expenses. However, in view of uncertainties in U.S. and global financial markets, the Company may be unable to access further equity or debt financing when needed. As such, there can be no assurance that the Company will be able to obtain additional liquidity when needed or under acceptable terms, if at all.

The condensed consolidated financial statements do not include any adjustments to the carrying amounts and classification of assets, liabilities, and reported expenses that may be necessary if the Company were unable to continue as a going concern.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) and include the accounts of Unicoin Inc., its wholly owned subsidiary, SheWorks!, as well as ITSQuest and Unicorns. These entities are consolidated in accordance with Accounting Standards Codification (“ASC”) 810, Consolidations (“ASC 810”). All significant intercompany accounts and transactions have been eliminated in consolidation. For ITSQuest and Unicorns which are 51% and 66.67% owned, respectively, the minority interests are reflected in the condensed consolidated financial statements as non-controlling interests (“NCI”).

Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. Accordingly, these unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and accompanying notes for the years ended December 31, 2022 and 2021. The unaudited condensed consolidated balance sheet as of December 31, 2022, included herein, was derived from the audited consolidated balance sheet of the Company as of that date.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires us to make estimates and assumptions in the condensed consolidated financial statements and accompanying notes. Significant estimates and assumptions made by us include: the valuation of Unicoin rights and the related embedded feature, valuation of non-cash contract consideration received from certain investors in Unicoin rights, the valuation of non-cash consideration received from Unicorns customers and the associated revenue recognition; valuation of investments in private companies; valuation of the Company’s common stock as a private company, valuation of the NCI in ITSQuest; valuation of the ITSQuest contingent divestiture; determination of the fair value of assets acquired and liabilities assumed in the business combination with ITSQuest; determination of the useful lives assigned to intangible assets; determination of the fair value of the ITSQuest indemnification asset and related tax liability; assessments for potential impairment of goodwill and intangible assets including digital assets; assessments of the recoverability of accounts receivable and determination of the fair value of certain stock awards issued. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable, the result of which forms the basis for making judgements about the carrying values of assets and liabilities. Actual results could differ materially from those estimates.

Risks and Uncertainties

The Company is subject to a number of risks that are similar to those which other companies of similar size in its industry are facing, including, but not limited to, the need for additional capital (or financing) to fund operations, competition from substitute products and services from larger companies, protection of proprietary technology, dependence on key customers, dependence on key individuals, and risks associated with changes in information technology.

Financial instruments that potentially subject the Company to concentrations of credit risk consist of cash, cash equivalents and accounts receivable. The Company’s cash and cash equivalents are held in accounts with major financial institutions, and, at times, exceed federally insured limits. As of June 30, 2023 and December 31, 2022, respectively, the Company had $3,692 thousand and $700 thousand of cash in excess of the FDIC insured amounts. The bank at which the Company had deposits that exceed FDIC limits is not in receivership or under the control of the FDIC. The Company has not experienced any losses in such accounts.

In addition, as discussed in Note 4, as of December 31, 2022 the Company had non-cash receivables consisting of options and warrants to purchase common stock in small privately-held companies. The options and warrants underlying these non-cash receivables are subject to significant fluctuations in market values. As of June 30, 2023 all related option and warrant certificates have been received and these accounts receivable have been reclassified to investments in privately-held companies in the Company’s consolidated balance sheets.

As discussed in Note 5, the Company has accepted digital assets as consideration from certain investors in exchange for equity, debt or Unicoin rights issued by the Company. Digital asset market values are subject to significant fluctuations based on supply and demand for such digital assets and other factors. The Company can either hold, sell, or use digital assets as payment to vendors. Digital asset price risk could adversely affect future operating results including earnings, cash flows and the Company’s ability to meet its ongoing obligations.

During the three months ended June 30, 2023, the Company had one customer for which revenue accounted for 16% or more of total revenue. This customer accounted for 6% of total customer receivables as of June 30, 2023. During the three months ended June 30, 2022 two customers accounted for 14% and 11% of the Company’s total revenue. These customers accounted for 5% and 6% of total customer receivables, as of June 30, 2022. During the six months ended June 30, 2023 two customers accounted for 11% and 10% of the Company’s total revenue. These customers accounted for 6% and 12% of total customer receivables, respectively, as of June 30, 2022. During the six months ended June 30, 2022 two customers accounted for 29% and 10% of the Company’s total revenue. These customers accounted for 36% and 6% of total customer receivables, as of June 30, 2022.

The Share Exchange Agreement (“SEA”) that the Company entered into in order to acquire a majority stake in ITSQuest, as amended on December 28, 2022, contains a contingent divestiture provision whereby if by December 31, 2024, the Company does not either (i) engage in an initial public offering of its securities at a price of at least $10.00 per share or (ii) cause the Company’s proposed security tokens (Unicoins) to become tokenized and listed on a cryptocurrency exchange with a quoted price at or above $1.00 per token, then the Company will be required to divest itself of the acquired ITSQuest equity by returning the same to the founders of ITSQuest, and such founders shall be entitled to retain the shares of the Company received pursuant to the SEA. As of the filing date of this Quarterly Report on Form 10-Q, the Company cannot yet assess the likelihood or probability of achieving either of the two trigger events necessary to avoid divestiture of ITSQuest. However, if the Company is not able to achieve an initial offering of its Common Stock or an initial registration of its Unicoins, sufficient to meet the criteria outlined in the Amended SEA on or before December 31, 2024, the Company’s business, financial condition, results of operations and liquidity will be materially impacted.

ITSQuest represents Company assets of $10,215 thousand, revenues of $7,342 thousand, and generated gross margins of $1,401 thousand, respectively, as of and for the six months ended June 30, 2023, respectively.

In January 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain of coronavirus (“COVID-19”) and the risks to the international community. In March 2020, WHO classified the COVID-19 outbreak as a pandemic based on the rapid increase in exposure globally. The outbreak of the COVID-19 pandemic has affected the United States and global economies and may affect the Company’s operations and those of third parties on which the Company relies. While the potential economic impact brought by, and the duration of, the COVID-19 pandemic is difficult to assess or predict, the impact of the COVID-19 pandemic on the global financial markets may reduce the Company’s ability to access capital, which could negatively impact the Company’s short-term and long-term liquidity. The ultimate impact of the COVID-19 pandemic is uncertain and subject to change. As of the date of this report, the Company’s efforts to respond to the challenges presented by the conditions described above have allowed the Company to minimize the impacts of these challenges to its business.

Accounting Pronouncements Recently Adopted

Financial Instruments – Credit Losses

The Company adopted Accounting Standards Update (“ASU”) 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit losses on financial instruments later codified as Accounting Standard codification (“ASC”) 326 (“ASC 326”), effective January 1, 2023, using a modified retrospective approach. The guidance introduces a revised approach to the recognition and measurement of credit losses, emphasizing an updated model based on expected losses rather than incurred losses. There was no significant impact on the date of adoption of ASC 326.

Under ASC 326, Accounts receivable are recorded at the invoiced amount, net of allowance for expected credit losses. The Company’s primary allowance for credit losses is the allowance for doubtful accounts. The allowance for doubtful accounts reduces the Accounts receivable balance to the estimated net realizable value. The Company regularly reviews the adequacy of the allowance for credit losses based on a combination of factors. In establishing any required allowance, management considers historical losses adjusted for current market conditions, the Company’s customers’ financial condition, the amount of any receivables in dispute, the current receivables aging, current payment terms and expectations of forward-looking loss estimates.

All provisions for the allowance for doubtful accounts are included as a component of general and administrative expenses on the accompanying consolidated statements of operations and comprehensive loss. Accounts receivable deemed uncollectible are charged against the allowance for credit losses when identified. Subsequent recoveries of amounts previously written off are credited to earnings in the period recovered.

The allowance for doubtful accounts related to Unicorns non-cash receivables is subject to uncertainty because the fair value of the underlying private company options, warrants or shares could change subsequent to the initial determination of fair value and before receipt of the related option, warrant or share certificates. In addition, unforeseen circumstances could arise after contract inception which could impact the customer’s intent or ability to pay. Because the value of any one of the receivables associated with Unicorn’s contracts may be material, changes such as these could have a material effect on the Company’s future financial condition, results of operations and cash flows.

To date, the Company has recognized revenue in connection with six Unicorn Hunters agreements. The total revenue amount related to these agreements was $8,620 thousand to-date. As of June 30, 2023 and December 31, 2022, Unicorn Hunters non-cash receivables were $0 and $8,322 thousand, respectively and represented 0% and 77% of total receivables, respectively. In addition, these receivables represented 0% and 33% of total assets as of June 30, 2023 and December 31, 2022, respectively.

The Company reviews each outstanding customer’s non-cash receivable balance with management of the private company customer, and records an allowance for doubtful accounts if either of the following are noted:

| a. | A specific milestone, equity financing or other event has occurred that is a clear indication that there has been a material change in the enterprise value of the private company customer since the original recording of the Unicorns accounts receivable balance and before the Company has received the underlying stock option, warrants or shares certificates. |

The Company’s review identifies facts and circumstances that have substantially changed either the private company customers’ intent or its ability to issue the stock option, warrants or shares certificates due in satisfaction of their related accounts receivable balance.

To date, the Company has not recorded any bad debt expense or allowance for doubtful accounts related to Unicorn Hunters non-cash receivables and the Company has not experienced any fluctuations or significant matters that would require recording a material allowance for doubtful accounts in any period to date.

As of June 30, 2023 and December 31, 2022, the Company had an allowance for doubtful accounts balance of $35 thousand and $0, respectively. For the six months ended June 30, 2023 and 2022, the Company recorded bad debt expense of $35 thousand and $1 thousand, respectively. For the three months ended June 30, 2023 and 2022, the Company recorded bad debt expense of $0. These amounts were related to trade receivables payable in cash.

Leases

As discussed in the Company’s consolidated financial statements and accompanying notes for the years ended December 31, 2022 and 2021, the Company adopted ASU 2016-02, Leases (Topic 842) which was later codified as ASC 842 (“ASC 842”) effective January 1, 2022 using a modified retrospective approach. This guidance requires an entity to recognize operating lease liabilities and corresponding right-of-use (“ROU”) assets on its balance sheet.

The adoption of ASC 842 resulted in the recognition of $188 thousand of operating lease ROU assets and $188 thousand of operating lease liabilities on the condensed consolidated balance sheet as of January 1, 2022. Because the standard was effective January 1, 2022, but was not required to be reflected in quarterly financial statements until the first quarter of 2023, the comparative financial statements for the second quarter of 2022, included herein, differ from the financial statements included with the Company’s quarterly reports on Form 10-Q, for the six and three months ended June 30, 2022, as a result of recognition of assets and liabilities for the rights and obligations created by the Company’s leases. Refer to the Adjustment section below and Note 11 for further information.

Adjustments to Previously Reported Financial Information

Adoption of ASC 842

As noted above, the adoption of ASC 842 was effective January 1, 2022, which resulted in recognition of operating lease ROU assets and operating lease liabilities on the condensed consolidated balance sheet that were not reflected in the financial statements included with the Company’s Quarterly Report on Form 10-Q for the three and six months ended June 30, 2022.

The following table summarizes the ASC 842 related adjustments made to the Company’s previously reported financial information for the comparative financial statements included herein:

| Schedule of reclassification of operating costs and expenses | | | | | | | | | | | | |

| | | As of and for the

Six Months Ended

June 30, 2022 | |

| | | As

Previously

Reported | | | Adjustment for

ASC 842

Adoption | | | As

Adjusted | |

| Changes to the Consolidated Balance Sheet (not included herein) | | | | | | | | | | | | |

| Operating lease right of use assets | | $ | - | | | $ | 119,036 | | | $ | 119,036 | |

| Total assets | | | 26,731,588 | | | | 119,036 | | | | 26,850,624 | |

| Operating lease liabilities, current portion | | | - | | | | 106,499 | | | | 106,499 | |

| Current liabilities | | | 10,600,417 | | | | 106,499 | | | | 10,706,916 | |

| Operating lease liabilities, non-current | | | - | | | | 12,537 | | | | 12,537 | |

| Total liabilities | | | 39,046,041 | | | | 119,036 | | | | 39,165,077 | |

| Total stockholders’ equity | | | (12,314,453) | | | | - | | | | (12,314,453) | |

| Total liabilities and stockholders’ equity | | | 26,731,588 | | | | 119,036 | | | | 26,850,624 | |

| | | | | | | | | | | | | |

| Changes to the Consolidated Statement of Cash Flows | | | | | | | | | | | | |

| Noncash operating lease expense | | | - | | | | 68,927 | | | | 68,927 | |

| Operating lease liability change | | | - | | | | (68,927 | ) | | | (68,927 | ) |

| Net cash used in operating activities | | | (19,036,471 | ) | | | - | | | | (19,036,471 | ) |

Unbilled Receivables

In addition, in connection with the Company’s implementation of new ERP system during the six months ended June 30, 2023, the chart of accounts for ITSQuest was updated to be more consistent with that of other Company subsidiaries. As a result, ITSQuest unbilled receivables, which had previously been reported as other current assets were reclassified and reported as trade receivables payable in cash in the consolidated balance sheets.

This change was effective as of June 30, 2022 and previously reported amounts were adjusted to conform with current presentation as shown in the table below.

| Schedule of reclassification of assets and liabilities | | | | | | | | | | | | |

| | | As

Previously

Reported | | | Adjustment | | | As

Adjusted | |

| Changes to the Consolidated Balance Sheet as of December 31, 2022 | | | | | | | | | | | | |

| Trade receivables payable in cash | | $ | 2,179,586 | | | $ | 239,187 | | | $ | 2,418,773 | |

| Prepaid expenses and other current assets | | | 750,977 | | | | (239,187 | ) | | | 511,790 | |

| | | | | | | | | | | | | |

| Changes to the Consolidated Balance Sheet as of June 30, 2022 (not included herein) | | | | | | | | | | | | |

| Trade receivables payable in cash | | | 2,328,028 | | | | 53,587 | | | | 2,381,615 | |

| Prepaid expenses and other current assets | | | 1,566,620 | | | | (53,587 | ) | | | 1,513,033 | |

| | | | | | | | | | | | | |

| Changes to the Consolidated Statement of Cash Flows for the Six Months Ended June 30, 2022 | | | | | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | |

| Trade receivables payable in cash | | | (106,389 | ) | | | (53,587 | ) | | | (159,976 | ) |

| Prepaid expenses and other current assets | | | (1,351,987 | ) | | | 53,587 | | | | (1,298,400 | ) |

Note: the consolidated balance sheet as of December 31, 2021 was not impacted.

Significant Accounting Policies

During the six-month period ended June 30, 2023, there have been no material changes to the Company’s significant accounting policies disclosed in its audited condensed consolidated financial statements for the years ended December 31, 2022 and 2021.

Revenue Recognition

Revenue Sources

The Company primarily derives its revenues from three revenue streams:

| 1. | Subscription Revenue (Software-as-a-Service or “SaaS”) – which are comprised of subscription license fees from customers accessing the Company’s all-in-one cloud-based solution to manage remote workers (“software platform”). |

| 2. | Staffing Revenue (Talent-as-a-Service or “TaaS”) – whereby enterprise customers are connected to individuals who are able to assist them in projects. |

| 3. | Unicorns Revenue – which generally consists of the fair value of stock options or warrants received as consideration from companies presenting on the Unicorn Hunters show. |

Refer to Note 16 – Segment Information for disaggregated revenue information.

Deferred revenue

The Company had deferred revenue of $19 thousand and $51 thousand as of December 31, 2022 and December 2021, respectively. The amount of revenue recognized during the six months ended June 30, 2023 and 2022, respectively, that was included in deferred revenue at the beginning of each calendar year, was $17 thousand and $20 thousand, respectively. The amount of revenue recognized during the three months ended June 30, 2023 and 2022, respectively, that was included in deferred revenue at the beginning of each calendar year, was $6 thousand and $11 thousand, respectively.

NOTE 3 – FAIR VALUE MEASUREMENT

The Company measures the fair value for financial instruments under ASC 820. ASC 820 defines fair value, establishes a framework for measuring fair value in accordance with U.S. GAAP, and expands disclosures about fair value measurements.

To increase consistency and comparability in fair value measurements, ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels, as follows:

| | Level 1 | Quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| | | |

| | Level 2 | Significant other inputs that are directly or indirectly observable in the marketplace. |

| | | |

| | Level 3 | Assets and liabilities whose significant value drivers are unobservable. |

Observable inputs are based on market data obtained from independent sources, while unobservable inputs are based on the Company’s market assumptions. Unobservable inputs require significant management judgment or estimation. In some cases, the inputs used to measure an asset or liability may fall into different levels of the fair value hierarchy. In those instances, the fair value measurement is required to be classified using the lowest level of input that is significant to the fair value measurement. Such determination requires significant management judgment.

The Company has revised its Intangible Assets and Financial Assets accounting policies to acknowledge that USD Coin (“USDC”) meets the definition of financial assets and as such will be measured going forward at fair value. The Company previously reported USDC within Intangible assets, net, and will report USDC within the prepaid expenses and other current assets line item going forward. The Company had a balance of $0 USDC as of June 30, 2023 and December 31, 2022. Management assessed the balance of USDC in historical periods, noting the previously reported amounts were immaterial.

The following table is a summary of financial assets measured at fair value on a recurring basis and their classification within the fair value hierarchy.

| Schedule of fair value assets measured on recurring basis | | | | | | | | | | | | | | | | | | | | |

| As of June 30, 2023 | | Carrying

Value | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| ASSETS | | | | | | | | | | | | | | | | | | | | |

| Money market funds | | $ | 2,102,045 | | | $ | 2,102,045 | | | $ | - | | | $ | - | | | $ | 2,102,045 | |

| As of December 31, 2022 | | Carrying

Value | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| ASSETS | | | | | | | | | | | | | | | | | | | | |

| Money market funds | | $ | 166,343 | | | $ | 166,343 | | | $ | - | | | $ | - | | | $ | 166,343 | |

Assets Measured at Fair Value on a Non-Recurring Basis

As discussed in Notes 2 and 5, consideration from Unicorns customers generally consists of commitments to issue stock options or warrants from customers which appear on the Unicorn Hunters show. This non-cash consideration is recognized in accounts receivable at the estimated fair values at or near the dates of contract inception using Level 3 inputs. The fair value of these commitments, as well as the options or warrants of private companies, held upon settlement of such receivables, as measured using Level 3 inputs, may fluctuate as discussed in the Company’s in Note 5. Certain other items such as goodwill, intangible assets, contingent divestiture and NCI resulting from the ITSQuest acquisition are recognized or disclosed at fair value on a non-recurring basis. The Company determines the fair value of these items using Level 3 inputs. There are inherent limitations when estimating the fair value of financial instruments, and the fair values reported are not necessarily indicative of the amounts that would be realized in current market transactions.

NOTE 4 – INVESTMENTS IN PRIVATELY-HELD COMPANIES

As discussed in Note 2, revenue and accounts receivable for Unicorns generally consist of the fair value of stock options or warrants committed from companies that have appeared on the Unicorn Hunters show. The options or warrants underlying the commitments typically have a term of five to ten years and accounts receivable are recorded at the estimated fair value of such options or warrants as determined at contract inception. Subsequent to issuance of the option or warrant certificates to the Company, the related receivables are reclassified to investments in privately-held companies, a long-term asset account representing investments in private company equity securities.

The Company’s non-cash receivables and the underlying investments in privately-held companies do not have readily determinable fair values. Their initial cost is subsequently adjusted to fair value on a nonrecurring basis based on observable price changes from orderly transactions of identical or similar securities of the same issuer or for impairment. These investments are classified within Level 3 of the fair value hierarchy as we estimate the value based on valuation methods using the observable transaction price at the transaction date and other significant unobservable inputs, such as volatility, rights and obligations related to these securities. These valuations require management judgment due to the absence of an observable market price and lack of liquidity.

As shown in the table below, no impairments or upward adjustments to estimated fair values have been recorded to-date because there have been no observable price changes related to the Company’s investments in privately held companies or non-cash receivables representing promises to issue such securities.

The following tables summarize the Company’s non-cash receivables and investments in privately held companies as of June 30, 2023 and December 31, 2022, respectively:

| Schedule of non-cash receivables and investments in privately held companies | | | | | | | | |

| | | June 30,

2023 | | | December 31,

2022 | |

| Non-cash receivables | | $ | - | | | $ | 8,322,000 | |

| Investments in privately-held companies | | | 8,627,000 | | | | 298,000 | |

| Carrying value of non-cash consideration | | $ | 8,627,000 | | | $ | 8,620,000 | |

| | | | | | | | | |

| | | June 30,

2023 | | | December 31,

2022 | |

| Cost of investments in privately-held companies | | $ | 8,627,000 | | | $ | 298,000 | |

| Cumulative impairments | | | - | | | | - | |

| Cumulative upward adjustments | | | - | | | | - | |

| Carrying value of investments in privately-held companies | | $ | 8,627,000 | | | $ | 298,000 | |

During the six months ended June 30, 2023, the Company received warrant certificates from five Unicorn Hunters customers with an aggregate carrying value, and estimated fair value, of $8,322 thousand. During the three months ended June 30, 2023, the Company received warrant certificates from four Unicorn Hunters customers with an aggregate carrying value, and estimated fair value, of $6,081 thousand. In addition, during the six months ended June 30, 2023, stock certificates with an aggregate carrying value, and estimated fair value, of $7 thousand were received from a TaaS customer. No such receipts took place during the three months ended June 30, 2022.

NOTE 5 – DIGITAL ASSETS

As more fully discussed in the Company’s financial statements for the years ended December 31, 2022 and 2021, the Company records the initial cost basis of digital assets at then-current quoted market prices and presents all digital asset holdings as indefinite-lived intangible assets in accordance with ASC 350, Intangibles—Goodwill and Other. The Company performs an analysis each quarter to identify whether events or changes in circumstances, principally decreases in the quoted prices on active exchanges, indicate that it is more likely than not that our digital assets are impaired. In determining if an impairment has occurred, we consider the quoted price of the digital asset. If the then current carrying value of a digital asset exceeds the fair value so determined, an impairment loss has occurred with respect to those digital assets in the amount equal to the difference between their carrying values and the prices determined.

The Company has revised its impairment loss assessment methodology for digital assets to record write-downs to the lowest market price of one unit of digital asset quoted on the active exchange since acquiring the digital asset. This revision would be consistent with the requirements of ASC 350-30-35-19, which indicates impairment exists whenever carrying value exceeds fair value. It also indicates that after an impairment loss is recognized, the adjusted carrying amount of the intangible asset shall be its new accounting basis. Management assessed the potential difference in impairment loss that would have resulted in prior periods if this impairment methodology had been applied retroactively, noting the amounts were immaterial.

During the three and six months ended June 30, 2023, the Company received $150 thousand of digital assets as consideration in sales of Unicoin rights. The Company utilized $130 thousand of its digital asset holdings for vendor payments during the three months and six months ended June 30, 2023. Remaining digital asset holdings as of June 30, 2023 amounted to $19 thousand.

During the three months ended June 30, 2022, the Company received $270 thousand of digital assets as consideration in sales of Unicoin rights and recorded impairment losses of $613 thousand. During the six months ended June 30, 2022, the Company received $23 thousand of digital assets as consideration in sales of common stock and $1,400 thousand of digital assets as consideration in sales of Unicoin rights. The Company utilized $0 thousand of its digital asset holdings for vendor payments during the three months and six months ended June 30, 2022. Therefore, the Company had ending digital asset holdings of $1,043 thousand as of June 30, 2022.

The digital assets received as consideration included Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and Tether (USDT). As shown in the table below, these digital assets were transferred to the Company as consideration for sale of Unicoin rights. Unicoin rights are more fully discussed in Note 7.

The table below summarizes the Company’s digital asset activity for the three months ended as of June 30, 2023 and 2022:

| Schedule of digital assets activity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Bitcoin | | | Bitcoin Cash | | | Ethereum | | | Litecoin | | | Dai | | | Tether | | | Three Months Ended

June 30, | |

| | | (BTC) | | | (BCH) | | | (ETH) | | | (LTC) | | | (DAI) | | | (USDT) | | | 2023 | | | 2022 | |

| Beginning balance | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 1,386,407 | |

| Received as consideration in sales of Unicoin rights | | | 23,728 | | | | 807 | | | | 18,233 | | | | 4,714 | | | | - | | | | 101,719 | | | | 149,200 | | | | 270,326 | |

| Vendor Payments | | | (21,757 | ) | | | - | | | | (12,500 | ) | | | - | | | | - | | | | (95,986 | ) | | | (130,243 | ) | | | - | |

| Fees and Other | | | (174 | ) | | | - | | | | (3,483 | ) | | | - | | | | - | | | | 3,481 | | | | (177 | ) | | | - | |

| Impairments | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (613,423 | ) |

| Ending balance | | $ | 1,797 | | | $ | 807 | | | $ | 2,249 | | | $ | 4,714 | | | $ | - | | | $ | 9,213 | | | $ | 18,780 | | | $ | 1,043,310 | |

The table below summarizes the Company’s digital asset activity for the six months ended as of June 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Bitcoin | | | Bitcoin Cash | | | Ethereum | | | Litecoin | | | Dai | | | Tether | | | Six Months Ended

June 30, | |

| | | (BTC) | | | (BCH) | | | (ETH) | | | (LTC) | | | (DAI) | | | (USDT) | | | 2023 | | | 2022 | |

| Beginning balance | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 237,973 | |

| Received as consideration in sales of common stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 22,980 | |

| Received as consideration in sales of Unicoin rights | | | 23,728 | | | | 807 | | | | 18,233 | | | | 4,714 | | | | - | | | | 101,719 | | | | 149,200 | | | | 1,399,530 | |

| Vendor Payments | | | (21,757 | ) | | | - | | | | (12,500 | ) | | | - | | | | - | | | | (95,986 | ) | | | (130,243 | ) | | | - | |

| Fees and Other | | | (174 | ) | | | - | | | | (3,483 | ) | | | - | | | | - | | | | 3,481 | | | | (177 | ) | | | - | |

| Impairments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (617,173 | ) |

| Ending balance | | $ | 1,797 | | | $ | 807 | | | $ | 2,249 | | | $ | 4,714 | | | $ | - | | | $ | 9,213 | | | $ | 18,780 | | | $ | 1,043,310 | |

The table below summarizes the carrying values for the Company’s digital asset holdings as of June 30, 2023 and December 31, 2022:

| Schedule of digital assets holdings | | | | | | | | |

| | | June 30,

2023 | | | December 31,

2022 | |

| Bitcoin (BTC) | | $ | 1,797 | | | $ | - | |

| Bitcoin Cash (BCH) | | | 807 | | | | - | |

| Ethereum (ETH) | | | 2,249 | | | | - | |

| Litecoin (LTC) | | | 4,714 | | | | - | |

| Dai (DAI) | | | - | | | | - | |

| Tether (USDT) | | | 9,213 | | | | - | |

| Total | | $ | 18,780 | | | $ | - | |

The market value of the Company’s digital assets, based on quoted prices on active exchanges, was approximately $25 thousand and $0 as of June 30, 2023 and December 31, 2022, respectively.

As discussed in the Company’s financial statements for the years ended December 31, 2022 and 2021, during the second half of the year ended December 31, 2022 the Company identified an $851 thousand difference between certain reports provided by its digital asset custodian. The Company’s digital assets, as reported in the consolidated balance sheet as of December 31, 2022, presented the lower of the reported amounts and the $851 thousand difference was written off during the fourth quarter of 2022 pending resolution with the custodian. As of June 30, 2023, the Company completed its investigation of the matter and concluded that related digital assets were misappropriated by an unknown and unauthorized outside party that bypassed the Company’s security procedures and operational infrastructure. The Company is currently exploring its legal options; however, has determined it will not be able to recover those assets.

NOTE 6 – DEBT

The Company’s short-term debt as of June 30, 2023 and December 31, 2022 totaled $570 thousand and $708 thousand, respectively of unsecured promissory notes (the “Unsecured Notes”) at 20% annual interest rate. The Company issued $199 and $48 thousand, respectively of Unsecured Notes during the six months ended June 30, 2023 and 2022, respectively. The Company issued $199 and $0 thousand, respectively of Unsecured Notes during the three months ended June 30, 2023 and 2022, respectively. Unsecured Notes interest expense of $82 thousand and $119 thousand was incurred during the six months ended June 30, 2023 and 2022, respectively and was recorded as accrued expenses in the condensed consolidated balance sheets. Unsecured Notes interest expense of $45 thousand and $57 thousand was incurred during the three months ended June 30, 2023 and 2022, respectively and was recorded as accrued expenses in the condensed consolidated balance sheets.

The Unsecured Notes mature one year from issuance unless the holder elects to extend the maturity for one additional year. Prepayment is not permitted. The Unsecured Notes generally rank pari-passu relative to other unsecured obligations. No significant third-party financing costs were incurred because the Company managed issuance of the Unsecured Notes internally, without use of an underwriter or trustee. Based on their short duration, the fair value of the Unsecured Notes as of June 30, 2023 and December 31, 2022 approximates the carrying amounts. Substantially all of the Unsecured Notes are due and payable during the year ending December 31, 2023 to the extent holders do not elect to extend one additional year.

NOTE 7 – UNICOIN RIGHTS FINANCING OBLIGATION

The Company is developing a security token called Unicoin (“Unicoins” or “Tokens”) whose value is intended to be supported by the returns generated by equity positions purchased from Unicorn Hunters show participants, as well as the returns from equity positions acquired from non-show participants for other services. Such equity positions may be held in a to-be-created investment fund (the “Fund”), to facilitate proper management of the equity portfolio. The intention of the Company is that when equity positions held by the Fund are liquidated through a liquidity event, some or all of the realized gains are to be distributed to holders of the Unicoins.

The holders of Unicoins will only realize a gain in the event of a liquidity event of such equity positions. Unicoin rights do not represent an equity interest in the Company or any other entity, there are no voting rights granted to the holder of Unicoin rights, the Unicoin rights Certificate currently does not trade on any stock exchange or cryptocurrency exchange platform, and that Unicoins might never be developed or launched and that this investment could result in total loss of invested funds.

The Company is offering Unicoin Right Certificates (“Unicoin rights” or “Rights”) with terms and conditions which are set forth in a confidential private placement memorandum initially dated February 2022 (“the Offering”). The Offering is being conducted pursuant to an exemption from U.S. securities registration requirements provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506(c) thereunder. Each U.S. domiciled investor in Unicoin rights must be an “accredited investor,” as defined in Rule 501 of the Securities Act.

During the three months ended June 30, 2023 and 2022, the Company issued rights to acquire 0.3 billion and 0.4 billion Unicoins, respectively. During the six months ended June 30, 2023 and 2022, the Company issued rights to acquire 1.6 billion and 2.7 billion Unicoins, respectively. The Company accounts for Unicoin rights by recording a liability representing the amount that management believes the Company would be obligated to pay or refund (i.e., the amount holders have a right to claim and would likely be awarded in settlement) for fair value exchanged as consideration for Rights to receive Unicoins in the future and in the event the Unicoin is never developed and launched. The Company concluded that it has a legal or contractual obligation and recorded an amount necessary to refund the amount originally paid by investors if holders’ reasonable expectation to receive Unicoins is not achieved.

To date, the Company has begun exploring possible service providers and exchanges which can assist with the tokenization of Unicoins and eventual launch but has not yet begun actual technological development or coding of the tokens. The Company reasonably expects that technical development can happen in a relatively short time, assuming regulatory readiness for launch, and hopes to complete this process by the end of the 2023 calendar year. Neither the Unicoin rights nor the tokenized Unicoins will grant any intellectual property rights to holders. As of June 30, 2023 and through the filing date of this Quarterly Report on Form 10-Q, the Company has not developed or issued any Unicoins and there is no assurance as to whether, or at what amount, or on what terms, Unicoins will be available to be issued, if ever.

As of June 30, 2023 and December 31, 2022 the outstanding financing obligation related to Unicoin rights was $48,360 thousand and $37,462 thousand, respectively. The obligation to settle this liability through the exchange of a fixed number of Unicoins, when and if all contingencies are resolved and Unicoins are launched, represents an embedded feature that may result in additional charges to the Company’s condensed consolidated statements of operations and comprehensive loss upon settlement. Although the Company intends to do so, if it is unable to develop and launch the Unicoin, there can be no assurance that the Company can generate sufficient funds through operations, or through financing transactions on terms acceptable to the Company in order to settle the Unicoin rights financing obligation. Due to the currently undetermined rights of Unicoin holders, the significant nature of required regulatory approvals and the likely registration required prior to Unicoins achieving liquidity (all of which have aspects whose success is outside of the Company’s control), management initially concluded that the value of the embedded feature is de minimis and will likely remain de minimis until the Unicoin is probable of regulatory approval and launch. Accordingly, the embedded feature was initially valued at $0 and is not expected to fluctuate until the Unicoin is launched or probable of launch.

The fair value measurement of the Unicoin rights financing obligation was based on significant inputs not observable in the market and represent Level 3 measurements within the fair value measurement hierarchy. Level 3 fair market values were determined using a variety of information, including estimated future cash flows.

The following table summarizes the components of the Unicoin rights financing obligation recorded on the Company’s condensed consolidated balance sheet as of June 30, 2023 and December 31, 2022:

| Schedule of components of the unicoin rights financing obligation | | | | | | | | | | | | | | | | | | |

| | | | | Outstanding Unicoin Rights and

Related Financing Obligation | |

| Nature / Category of Unicoin Right Holder | | | | June 30,

2023 | | | December 31,

2022 | |

| | Form of Consideration | | Units | | | Amount | | | Units | | | Amount | |

| Accredited Investors | | Cash and Digital Assets | | | 1,675,905,941 | | | | 31,228,923 | | | | 1,532,851,167 | | | $ | 23,454,700 | |

| Unicoin Inc. Shareholders | | Non-Cash Dividends | | | 730,522,705 | | | | 73,052 | | | | 730,524,705 | | | | 73,052 | |

| Employee, Contractors, Directors | | Discretionary Compensation | | | 343,680,612 | | | | 34,368 | | | | 330,052,274 | | | | 361,119 | |

| Service Providers, Influencers and Employees | | Services and Employee Labor | | | 203,439,167 | | | | 12,499,681 | | | | 197,505,326 | | | | 11,058,094 | |

| Subtotal | | | | | 2,953,548,425 | | | | 43,836,024 | | | | 2,790,933,472 | | | $ | 34,946,965 | |

| ITSQuest Contingent Divestiture Amendment | | Contract Amendment | | | 20,000,000 | | | | 1,780,000 | | | | 20,000,000 | | | | 1,780,000 | |

| Five-Year Deferred Payment Plan | | Cash | | | 3,078,997,452 | | | | 972,663 | | | | 1,630,136,422 | | | | 297,882 | |

| Ten-Year Prepaid Plan | | Cash | | | 8,151,047 | | | | 1,771,280 | | | | 2,131,667 | | | | 437,000 | |

| Total | | | | | 6,060,696,924 | | | | 48,359,967 | | | | 4,443,201,561 | | | $ | 37,461,847 | |

Sales to Accredited Investors

As of June 30, 2023 and December 31, 2022, the Unicoin rights financing obligation associated with sales to Accredited Investors amounted to $31,229 thousand and $23,455 thousand, respectively. The cumulative amounts were received from completed cash and non-cash sales of Unicoin rights in the Company’s various financing rounds at prices ranging from $0.01 to $0.50. Although there are no stated legal rights requiring the Company to return amounts received from investors, management believes the holder of Unicoin rights has a reasonable right to either 1) receive the number of Unicoins specified in their Unicoin rights agreement upon the future development and launch of the Unicoin or 2) a refund of the amount invested in anticipation of the future development and launch of Unicoins. Therefore, all amounts received from sales to Accredited Investors have been recorded as a Unicoin rights financing obligation.

Dividend Issued to Shareholders

The Company declared and issued a non-cash dividend of Unicoin rights, on a pro-rata basis, to all shareholders of record as of the dividend declaration date of February 10, 2022. This non-cash dividend was the initial issuance of Unicoin rights, prior to finalizing any plan to market and sell Rights in connection with any of the Company’s financing rounds, and at the time of the pro-rata distribution, management and the Board had not yet ascribed a value to such Rights. As a result, the Company has ascribed a de minimis value to all Unicoin rights issued to shareholders on February 10, 2022. As of June 30, 2023 and December 31, 2022, the Unicoin rights financing obligation associated non-cash dividend of Unicoin rights amounted to $73 thousand.

Discretionary Payments to Employees, Contractors and Directors

The Company has issued Unicoin rights to certain employees, Board members and external contractors/consultants as discretionary awards. These Unicoin rights were issued on a discretionary basis and do not indicate that employees, Board members or contractors/consultants are being rewarded with a specific value attributable to past or future services rendered by such individuals. The Unicoin rights were also not issued as a replacement for, or in lieu of, cash or equity awards due under any type of pre-determined bonus or other incentive plan that quantifies a value that the holders are entitled to as a result of their services or performance. The Company believes that, because of the nature of these discretionary awards (i.e., nothing of specific value was exchanged to the Company in return), together with the legal disclaimer of any obligation to launch the Unicoin within the terms of the Unicoin rights agreement, on a per Unicoin Right basis, the amount that holders would be entitled to if the Unicoin is not ultimately launched is de minimis in relation to the actual fair value per Unicoin Right. As of June 30, 2023 and December 31, 2022, the Unicoin rights financing obligation associated with discretionary payments to employees, contractors and directors amounted to $34 thousand and $361 thousand, respectively.

Issued to Service Providers, Influencers and Employees

The Company has issued Unicoin rights in exchange for services from advertising agencies, marketing firms and other vendors. Also, the Company has issued Unicoin rights as part of the compensation package negotiated with certain employees. The related contracts for these third-party providers and employees specify the value provided, as negotiated by these parties, and the number of Unicoin rights accepted as compensation for the dollar value of those services.

Similar to Accredited Investors, service providers exchanged a specified, negotiated value in exchange for Unicoin rights and has rights to receive either 1) the negotiated number of Unicoins upon development or launch, or 2) payment of cash equivalent to the value of services provided. In addition, from time to time the Company engages Influencers to promote Unicoins and/or the Unicorn Hunters show in exchange for Unicoin rights. The form of Influencer engagement may include promoting Unicoin in a social media post, making brief reference in a speech, posting about Unicoin on a website or any other media form.

These contracts do not specify the value of services rendered by Influencer nor the specific format of engagement required. Because an “engagement” can represent something as simple as brief mention in a speaking engagement, or posting on a social media account, etc. management determined there is very little effort involved by the Influencer in order to perform services in a manner consistent with the contractual terms. As of June 30, 2023 and December 31, 2022, the Unicoin rights financing obligation associated with Unicoin rights issued to service providers, influencers and employees amounted to $12,500 thousand and $11,058 thousand, respectively.

Five-Year Deferred Payment Plan

In August 2022 the Company began offering a five-year deferred payment plan (the “deferred payment plan”) to investors in its ongoing Unicoin rights offering. The deferred payment plan permits investors to purchase Unicoin rights immediately and pay for such Unicoin rights in five equal annual installments, with the first installment due one year after the date of purchase. Purchases through the deferred payment plan requires that investors provide collateral to the Company having a value of up to 20% of the total purchase price of the purchased Unicoin rights. Collateral can be in the form of Company common stock owned by the investor, Unicoin rights already owned by the investor, cash, digital assets or other assets with a demonstrable value, at the Company’s discretion, if such assets can be transferred to the Company or a valid lien on such assets can be secured. Pursuant to the terms of the installment payment plan, both the pledged collateral and the Unicoin rights being purchased under the installment plan will be forfeited to the Company if the investor fails to make any of the five annual installment payments.

Because there is no history of collections under the deferred payment plan, as no annual installment have become due yet and because there is uncertainty regarding payment in the event that Unicoins have not been developed and launched by the time the first annual installments become due, the Company has not recorded a receivable and a corresponding Unicoin rights financing obligation for uncollected amounts. As of June 30, 2023 and December 31, 2022, the Company has recognized an asset and a corresponding Unicoin rights financing obligation of $973 thousand and $298 thousand, respectively, for cash collateral submitted by investors under the deferred payment plan. However, no asset will be recognized for the fair value of non-cash collateral unless and until one or more investors default on their payment obligation.

As of December 31, 2022, investors had signed contracts for the purchase of 1.63 billion Unicoin rights under the five-year deferred payment plan that may lead to proceeds of up to $170,418 thousand through the five-year period if the Unicoin is successfully developed and launched and the Company’s deferred payment installment sales are fully executed. Upon receiving the annual payments over the five-year term or upon having sufficient history and other positive information regarding collectability to record accounts or notes receivable for remaining amounts due under the deferred sale arrangements, the Company expects to record cash or notes receivable and a corresponding financing obligation, as it would through Sales to Accredited Investors as discussed above, until the point in time that the investment contracts are settled through issuance of Unicoins.

The following table summarizes the pledged collateral pursuant to the five-year deferred payment plan as of June 30, 2023 and December 31, 2022:

| Schedule of pledged collateral | | | | | | | | |

| | | Estimated Fair Value of

Collateral Received as of: | |

| Form of Collateral Received | | June 30,

2023 | | | December 31,

2022 | |

| Cash | | $ | 972,663 | | | $ | 297,882 | |

| Digital Assets | | | 131,841 | | | | 94,102 | |

| Non-Unicoin Inc. Stock | | | 1,771,180 | | | | - | |

| Unicoin Inc. Common Stock | | | 4,633,210 | | | | 1,931,116 | |

| Unicoin rights | | | 19,631,505 | | | | 8,175,000 | |

| Real Estate | | | 12,719,514 | | | | 2,300,000 | |

| Total | | $ | 39,859,913 | | | $ | 12,798,100 | |

The fair value of the collateral received by Company is determined as follows:

| | ○ | Cash – Based on the value of cash received. |

| | ○ | Digital Assets – Fair value is determined based on quoted prices on the active exchanges as of the balance sheet date for the reporting period. |

| | ○ | Non Unicoin Inc. Stock – Fair value is determined based on quoted prices on the active exchanges as of the balance sheet date for the reporting period. |

| | ○ | Unicoin Inc. Common Stock – Based on fair value of common stock, as of the balance sheet date for the reporting period, determined with the assistance of a third-party valuation firm. |

| | ○ | Unicoin rights – Based on fair value of Unicoin rights, as of the balance sheet date for the reporting period, determined with the assistance of a third-party valuation firm. |

| | ○ | Real Estate – Based on third-party appraisal as of or near the balance sheet date for the reporting period. |

Ten-Year Prepaid Plan