UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

001-38875

(Commission file number)

Greenlane Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 83-0806637 | |||||||

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |||||||

| 1095 Broken Sound Parkway, | Suite 300 | |||||||||||||

| Boca Raton, | FL | 33487 | ||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

(877) 292-7660

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A Common Stock, $0.01 par value per share | GNLN | Nasdaq Global Market | ||||||||||||

Securities registered pursuant to Section 12 (g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No £

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | £ | Accelerated filer | £ | ||||||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | ||||||||

| Emerging growth company | ☒ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 28, 2019, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $95.0 million based upon the closing price reported for such date on the Nasdaq Global Select Market.

As of April 20, 2020, Greenlane Holdings, Inc. had 10,347,026 shares of Class A common stock outstanding, 5,814,630 shares of Class B common stock outstanding and 77,791,218 shares of Class C common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the 2020 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2019.

Greenlane Holdings, Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2019

TABLE OF CONTENTS

| Page | |||||||||||

| Item 1. | |||||||||||

| Item 1A. | |||||||||||

| Item 1B. | |||||||||||

| Item 2. | |||||||||||

| Item 3. | |||||||||||

| Item 4. | |||||||||||

| Item 5. | |||||||||||

| Item 6. | |||||||||||

| Item 7. | |||||||||||

| Item 7A. | |||||||||||

| Item 8. | |||||||||||

| Item 9. | |||||||||||

| Item 9A. | |||||||||||

| Item 9B. | |||||||||||

| PART III | |||||||||||

| Item 10. | |||||||||||

| Item 11. | |||||||||||

| Item 12. | |||||||||||

| Item 13. | |||||||||||

| Item 14. | |||||||||||

| PART IV | |||||||||||

| Item 15. | |||||||||||

| Item 16. | |||||||||||

| Signatures | |||||||||||

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Many of the forward-looking statements are located in Part, Item 7 of this Form 10-K under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations." Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could” and similar expressions. Examples of forward-looking statements include, without limitation:

•statements regarding our growth and other strategies, results of operations or liquidity;

•statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance;

•statements regarding our industry;

•statements of management’s goals and objectives;

•projections of revenue, earnings, capital structure and other financial items;

•assumptions underlying statements regarding us or our business; and

•other similar expressions concerning matters that are not historical facts.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those discussed in Part I, Item 1A of this Form 10-K under the heading “Risk Factors" and in other documents that we file from time to time with the Securities and Exchange Commission (the "SEC").

Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances, or achievements expressed or implied by the forward-looking statements. These risks include, but are not limited to, those listed below and those discussed in greater detail in Part I, Item 1A of this Form 10-K under the heading “Risk Factors."

•our strategy, outlook and growth prospects;

•general economic trends and trends in the industry and markets;

•public heath crises, including the novel coronavirus known as COVID-19 pandemic;

•our dependence on, and our ability to establish and maintain business relationships with, third-party suppliers and service suppliers;

•the competitive environment in which we operate;

•our vulnerability to third-party transportation risks;

•the impact of governmental laws and regulations and the outcomes of regulatory or agency proceedings;

•our ability to accurately estimate demand for our products and maintain our levels of inventory;

•our ability to maintain our operating margins and meet sales expectations;

•our ability to adapt to changes in consumer spending and general economic conditions;

•our ability to use or license certain trademarks;

1

•our ability to maintain a consumer brand recognition and loyalty of our products;

•our and our customers’ ability to establish or maintain banking relationships;

•fluctuations in U.S. federal, state, local and foreign tax obligation and changes in tariffs;

•our ability to address product defects;

•our exposure to potential various claims, lawsuits and administrative proceedings;

•contamination of, or damage to, our products;

•any unfavorable scientific studies on the long-term health risks of vaporizers, electronic cigarettes, e-liquids products or hemp-derived cannabidiol (“CBD”) products;

•failure of our information technology systems to support our current and growing business;

•our ability to prevent and recover from Internet security breaches;

•our ability to generate adequate cash from our existing business to support our growth;

•our ability to protect our intellectual property rights;

•our dependence on continued market acceptance by consumers;

•our sensitivity to global economic conditions and international trade issues;

•our ability to comply with certain environmental, health and safety regulations;

•our ability to successfully identify and complete strategic acquisitions;

•natural disasters, adverse weather conditions, operating hazards, environmental incidents and labor disputes;

•increased costs as a result of being a public company; and

•our failure to maintain adequate internal controls over financial reporting.

Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or operating results.

The forward-looking statements speak only as of the date on which they are made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Consequently, you should not place undue reliance on forward-looking statements.

PART I

ITEM 1. BUSINESS

General

We are one of the largest global sellers of premium cannabis accessories and liquid nicotine products in the world. We operate as a powerful house of brands, third party brand accelerator and distribution platform for consumption devices and lifestyle brands serving the global cannabis, hemp-derived CBD, and liquid nicotine markets with an expansive customer base of more than 11,000 retail locations, including licensed cannabis dispensaries and smoke and vape shops. We have an established track record of partnering with brands through all stages of product lifecycle.

We are the partner of choice for many of the industry’s leading players including PAX Labs, JUUL Labs, Grenco Science, Firefly, DaVinci, Omura, Eyce, Santa Cruz Shredder, Sentia Wellness, Bloom Farms, Cookies and dozens of others. In addition to our partner brands, we have set out to develop a world-class portfolio of our own proprietary brands that we believe will, over time, deliver higher margins and create long-term value. Our house brands are comprised of child-resistant packaging

2

innovator Pollen Gear; VIBES rolling papers; the Marley Natural accessory line; the K. Haring Glass Collection; Aerospaced & Groove grinders; and Higher Standards, an upscale product line of glass and premium care and maintenance products. We also own and operate Vapor.com, an industry leading e-commerce platform which offers convenient, flexible shopping solutions directly to consumers. We strive to provide exceptional customer support to complement our product offerings and help our customers operate and grow their businesses. We believe our market leadership, wide distribution network, broad product selection and extensive technical expertise provide us with significant competitive advantages and create a compelling value proposition for our customers and our suppliers.

We merchandise vaporizers and other products in the United States, Canada and Europe and we distribute to retailers through wholesale operations and to consumers through e-commerce activities and our retail stores. We currently operate four distribution centers in the United States, two distribution centers in Canada, and one distribution center in Europe. Effective March 2020, we began taking steps to optimize our distribution network in the coming months, transitioning to a more centralized model with fewer, larger, highly automated facilities in the U.S. and open a new, streamlined, centrally-located facility, which will help the us reduce costs going forward. This consolidation will require fewer distribution center employees while also driving business improvement in multiple areas including inventory management, sales operations, and customer experience.

We have three distinct operating segments, which include our United States operations, our Canadian operations, and our European operations. These operating segments also represent our reportable segments. Refer to "Note 12— Segment Reporting", for more discussion regarding out segment reporting. Overall, total net sales generated by our United States operating segment accounted for approximately 86.6% and 91.7% of total consolidated net sales for the years ended December 31, 2019 and 2018, respectively. Total net sales generated by our Canadian operations accounted for approximately 12.0% and 8.3% of total consolidated net sales for the years ended December 31, 2019 and 2018, respectively. With our acquisition of Conscious Wholesale in September 2019 (see "Note 3—Business Acquisitions", under Item 8), we commenced operations of our European segment. Total net sales generated by this segment were 1.4% of total consolidated revenue in 2019. We expect revenue from this segment to increase within the next year as we continue to expand our foothold in Europe.

We market and sell our products in the business to business (“B2B”), supply and packaging (“S&P”), and business to consumer (“B2C”) areas of the marketplace. We have a diverse base of customers, and our top ten customers accounted for only 17.3% and 13.0% of our net sales for the years ended December 31, 2019 and 2018, respectively, with no single customer accounting for more than 3.0% of our net sales in both years. For each of the years ended December 31, 2019 and 2018, nine out of the top ten customers were categorized as B2B customers, with the other one being classified as an S&P customer. While we have recently commenced distribution of our products to a growing number of large national and regional retailers in Canada and Europe, our typical B2B customer is an independent retailer operating in a single market. Our sales teams interact regularly with customers as most of them have frequent restocking needs. We believe our high-touch customer service model strengthens relationships, builds loyalty and drives repeat business. In addition, we believe our premium product lines, broad product portfolio and strategic distribution network position us well to meet the needs of our customers and ensure timely delivery of products.

For the year ended December 31, 2019, our B2B revenues represented approximately 78.1% of our net sales, our B2C revenues represented approximately 5.9% of our net sales, our S&P revenues represented approximately 10.8% of our net sales, and channel and drop-ship revenues derived from the sales and shipment of our products to the customers of third-party website operators and providing other services to our customers represented approximately 5.2% of our net sales. For the year ended December 31, 2018, our B2B revenues represented approximately 79.5% of our net sales, our B2C revenues represented approximately 3.2% of our net sales, our S&P revenues represented approximately 9.9% of our net sales, and channel and drop-ship revenues derived from the sales and shipment of our products to the customers of third-party website operators and providing other services to our customers represented approximately 7.4% of our net sales.

Organization

Greenlane Holdings, Inc. (“Greenlane” and, collectively with the Operating Company (as defined below) and its consolidated subsidiaries, the “Company”, "we", "us" and "our") was formed as a Delaware corporation on May 2, 2018. We are a holding company that was formed for the purpose of completing an underwritten initial public offering (“IPO”) of shares of our Class A common stock on April 23, 2019 and other related transactions in order to carry on the business of Greenlane Holdings, LLC (the “Operating Company”). The Operating Company was organized under the laws of the state of Delaware on September 1, 2015, and is based in Boca Raton, Florida. Refer to "Note 1—Business Operations and Organizations" within Item 8 for further information on the Company's organization and the IPO and related transactions. We are the sole manager of the Operating Company and, as of December 31, 2019, owned a 23.5% interest in the Operating Company.

3

Our Business Relating to the Cannabis Industry

The information included below is based on the most recent information available to the Company and, except as expressly stated below, does not give effect to the impact of the expanding outbreak of the novel coronavirus known as COVID-19, the impacts of which remain uncertain as of the date of this Form 10-K.

While we do not cultivate, distribute or dispense marijuana as that term is defined by the Controlled Substances Act, several of the products we distribute, such as vaporizers, pipes, rolling papers and storage solutions, can be used with marijuana or marijuana derivatives, as well as several other legal substances.

We believe the global cannabis industry is experiencing a transformation from a state of prohibition toward a state of legalization. We expect the number of states, countries and other jurisdictions implementing legalization legislation to continue to increase, which will create numerous and sizable opportunities for market participants, including us.

Global Landscape

A June 2019 report of Arcview Market Research and BDS Analytics, leading market research firms in the cannabis industry, estimated that spending in the global legal cannabis market was approximately $11 billion in 2018 and was estimated to reach $14.9 billion in 2019, representing growth of approximately 36%. The report projects that by 2024, spending in the global legal cannabis market will reach $40 billion, representing a compound annual growth rate of approximately 24% over the six-year period from 2018. Our experience and awareness of the markets in which we operate lead us to believe that demand for the types of products we distribute will grow in tandem with the industry.

The North American Cannabis Landscape

United States and Territories. Thirty-four states and the District of Columbia have legalized medical cannabis in some form and have a formal cannabis program. Eleven of these states, including the District of Columbia, have legalized cannabis for non-medical adult use with additional states, including New Jersey and New York, actively considering the legalization of cannabis for non-medical adult use. Fourteen additional states have legalized high-cannabidiol ("CBD"), low tetrahydrocannabinol ("THC") oils for a limited class of patients. Only three states continue to prohibit cannabis entirely. Notwithstanding the continued trend toward further state legalization, cannabis continues to be categorized as a Schedule I controlled substance under the Federal Controlled Substances Act (the “CSA”) and, accordingly, the cultivation, processing, distribution, sale and possession of cannabis violate federal law in the United States as discussed further in Item 1A under the heading “Risk Factors". Our business depends partly on continued purchases by businesses and individuals selling or using cannabis pursuant to state laws in the United States or Canadian and provincial laws.

We believe support for cannabis legalization in the United States is gaining momentum. According to an October 2019 poll by Gallup, public support for the legalization of cannabis in the United States has increased from approximately 12% in 1969 to approximately 66% in 2019.

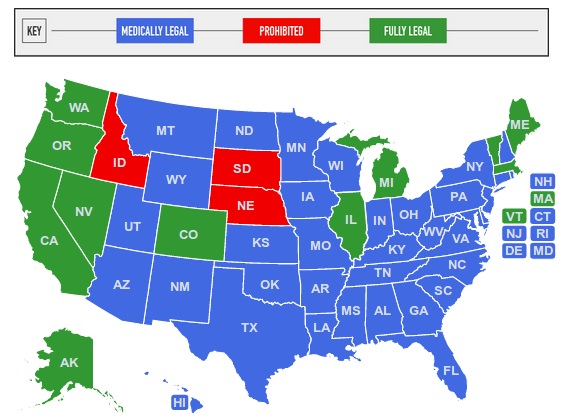

The following map illustrates states that have fully legalized cannabis (for medical and recreational purposes), states that have partially legalized cannabis (for medical purposes only, including states that have legalized only low-THC cannabis derivatives), and states that have not legalized cannabis for medical or recreational purposes (as of January 4, 2020).

4

U.S. CBD Landscape

In December 2018, the Farm Bill was signed into law in the United States which specifically removed hemp from the definition of “marijuana” under the Controlled Substances Act. In addition, the Farm Bill designated hemp as an agricultural commodity and permits the lawful cultivation of hemp in all states and territories of the United States. Federal and state laws and regulations concerning the cultivation and sale of hemp and hemp-derived products (including CBD) continue to evolve.

Canada.

Legal access to dried cannabis for medical purposes was first allowed in Canada in 1999. The Cannabis Act (the “Cannabis Act”) currently governs the production, sale and distribution of medical cannabis and related oil extracts in Canada.

On April 13, 2017, the Government of Canada introduced Bill C-45, which proposed the enactment of the Cannabis Act to legalize and regulate access to cannabis. The Cannabis Act proposed a strict legal framework for controlling the production, distribution, sale and possession of medical and recreational adult-use cannabis in Canada. On June 21, 2018, the Government of Canada announced that Bill C-45 received Royal Assent. On July 11, 2018, the Government of Canada published the Cannabis Regulations under the Cannabis Act. The Cannabis Regulations provide more detail on the medical and recreational regulatory regimes for cannabis, including regarding licensing, security clearances and physical security requirements, product practices, outdoor growing, security, packaging and labelling, cannabis-containing drugs, document retention requirements, reporting and disclosure requirements, the new access to cannabis for medical purposes regime and industrial hemp. The majority of the Cannabis Act and the Cannabis Regulations came into force on October 17, 2018.

While the Cannabis Act provides for the regulation by the federal government of, among other things, the commercial cultivation and processing of cannabis for recreational purposes, it provides the provinces and territories of Canada with the authority to regulate in respect of the other aspects of recreational cannabis, such as distribution, sale, minimum age requirements, places where cannabis can be consumed, and a range of other matters.

The governments of every Canadian province and territory have implemented regulatory regimes for the distribution and sale of cannabis for recreational purposes. Most provinces and territories have announced a minimum age of 19 years old, except for Québec and Alberta, where the minimum age will be 18. Certain provinces, such as Ontario, have legislation in place that restricts the packaging of vapor products and the manner in which vapor products are displayed or promoted in stores.

The European Cannabis Landscape

Europe’s population is larger than that of the U.S. and Canadian markets combined, suggesting the potential of a very significant market. Prohibition Partners, a London-based strategic consultancy firm, estimated in 2019 that the European legal

5

cannabis market would be worth $0.3 billion in 2020, growing to $2.5 billion in 2024, representing a 69% compound annual growth rate.

Currently, Germany, Italy, Austria, Czech Republic, Finland, Portugal, Poland, Spain, the Netherlands, Denmark, Greece, Croatia, Macedonia, Poland and Turkey, Malta, Luxembourg, Cyprus, France, the U.K and Ireland allow cannabis use for medicinal purposes, with some of those countries operating pilot programs. However, it has been widely reported that other countries are considering following suit.

Product Information

Consumers of cannabis, herbs, flavored compounds, aromatherapy oils and nicotine are likely going to require the types of products we distribute, including vaporizers, pipes, rolling papers and packaging. We believe we distribute the “picks & shovels” for these rapidly-growing industries.

Inhalation Delivery Methods

There are two prevalent types of inhalation methods for cannabis and nicotine: combustion and vaporization. Vaporizers are devices that heat materials to temperatures below the point of combustion, extracting the flavors, aromas and effects of dry herbs and concentrates in the form of vapor. Measured by revenue, vaporizers are our largest product category. During the years ended December 31, 2019 and 2018, the vaporizers and components category, which is comprised of desktops, portables and pens, and vaporizer parts and accessories, generated approximately 76.0% and 83.1%, respectively, of our net sales.

The Science and Popularity of Vaporization

Vaporizers have elements that are designed to quickly heat combustible material, which generates a vapor that is immediately inhaled through the mouthpiece on the device itself, or a hose, pipe or an inflatable bag. Vaporizers can heat a variety of dry materials, viscous liquids and waxes and provides a convenient way for users to consume the active ingredients. Common ingredients used in vaporizers include tobacco, nicotine extracts, legal herbs, hemp-derived CBD, aromatherapy oils, cannabis and propylene glycol and glycerin blends.

Vaporization Technology. Consumers have a wide array of vaporization devices at their disposal, which can be broadly categorized into two primary categories: desktop and portable vaporizers. Our vaporizer offering spans over 159 distinct products across 29 brands.

Desktop Vaporizers. Vaporizers were first developed as desktop models that were powered through traditional electric power sources. Desktop vaporizers are capable of heating the material to a more precise temperature choice determined by the consumer or as advised by a health practitioner. Some models dispense the vapor through a pipe or wand, and others into an inflatable bag in order to allow users to more accurately monitor their consumption.

Portable Vaporizers. With the development of lithium batteries, vaporizers have now become portable. Technological advances are resulting in lighter, sleeker and more visually-appealing units that are capable of quickly heating the material to the user’s desired temperature setting. The temperature setting can be fixed by the manufacturer or set manually by the consumer or via a Bluetooth connection to the consumer’s smartphone. Portable vaporizers, of which pens are a sub-set, are differentiated by many features, including output, battery life, recharge time, material, capacity and design.

Other Methods of Consumption. In addition to vaporizers, consumers have a wide array of methods of consumption at their disposal, including, among others, hand pipes, water pipes, rolling papers, and oral and topical delivery methods.

Hand and Water Pipes. We offer a diverse portfolio of approximately 219 products and fourteen brands, including our own proprietary Higher Standards brand. Many display iconic, licensed logos and artwork as pipes have grown into an artistic expression and are available in countless creative forms and functionality.

Hand pipes are small, portable and simple to use, and function by trapping the smoke produced from burning materials, which is then inhaled by the user. Water pipes include large table-top models, bubblers and rigs, and are more complex because they incorporate the cooling effects of water to the burning materials, before inhalation.

Rolling Papers. Rolling papers are a traditional consumption method used to smoke dried plant material in a “roll-your-own" application. Our rolling papers category is comprised of approximately 160 products across nine brands.

6

Our Competitive Strengths

We attribute our success to the following competitive strengths:

A Clear Market Leader in an Attractive Industry.

We are a leading North American distributor of premium vaporization products and consumption accessories, reaching over 11,000 retail locations and over 1,100 licensed cannabis cultivators, processors and dispensaries. We also own and operate one of the industry’s most visited North American direct-to-consumer e-commerce websites, Vapor.com. Vapor.com was launched in April 2019 when we consolidated our previously owned websites, Vapeworld.com and Vapornation.com, into one homogeneous website. The latter website, VaporNation, was acquired as part of our February 2019 purchase of Better Life Holdings, LLC.

Market Knowledge and Understanding.

Because of our experience and our extensive and long-term industry relationships, we believe we have a deep understanding of customer needs and desires in our B2B, B2C and S&P channels. This allows us to influence customer demand and the pipeline between product manufacturers, suppliers, advertisers and the marketplace.

Broadest Product Offering.

We believe we offer the industry’s most comprehensive portfolio of vaporization products and consumption accessories with over 5,100 SKUs ( stock-keeping unit ) from more than 180 suppliers. This broad product offering creates a “one-stop” shop for our customers and positively distinguishes us from our competitors. In addition, we have carefully cultivated a portfolio of well-known brands and premium products and have helped many of the brands we distribute to become established names in the industry.

Entrepreneurial Culture.

We believe our entrepreneurial, results-driven culture fosters highly-dedicated employees who provide our customers with superior service. We invest in our talent by providing every sales representative with an extensive and ongoing education and have successfully developed programs that provide comprehensive product knowledge and the tools needed to have a unique understanding of our customers’ personalities and decision-making processes.

Unwavering Focus on Relationships and Superior Service. We aim to be the premier platform and partner of choice for our customers, suppliers and employees.

Customers. We believe we offer superior services and solutions due to our comprehensive product offering, proprietary industry data and analytics, product expertise and the quality of our service. We deliver products to our customers in a precise, safe and timely manner with complementary support from our dedicated sales and service teams.

Suppliers. Our industry knowledge, market reach and resources allow us to establish trusted professional relationships with many of our product suppliers. We generate substantially all of our net sales from products manufactured by others. We have strong relationships with many large, well-established suppliers, and seek to establish distribution relationships with smaller or more recently established manufacturers in our industry. While we purchase our products from over 180 suppliers, a significant percentage of our net sales is dependent on sales of products from a small number of key suppliers. We believe there is a trend of suppliers in our industry to consolidate their relationships to do more business with fewer distributors. We believe our ability to help maximize the value and extend the distribution of our suppliers’ products has allowed us to benefit from this trend. The efforts of our senior management team have been integral to our relationships with our suppliers.

Employees. We provide our employees with an entrepreneurial culture, a safe work environment, financial incentives and career development opportunities.

Experienced and Proven Management Team Driving Organic and Acquisition Growth.

We believe our management team is among the most experienced in the industry. Our senior management team brings experience in accounting, mergers and acquisitions, financial services, consumer packaged goods, retail operations, third-party

7

logistics, information technology, product development and specialty retail and an understanding of the cultural nuances of the sectors that we serve.

Our Operating Strategies

We intend to leverage our competitive strengths to increase shareholder value through the following core strategies:

Build Upon Strong Customer and Supplier Relationships to Expand Organically.

Our North American footprint and broad supplier relationships, combined with our regular interaction with our large and diverse customer base, provides us key insights and positions us to be a critical link in the supply chain for premium vaporization products and consumption accessories. Our suppliers benefit from access to more than 7,000 B2B customers and more than 320,000 B2C customers as we are a single point of contact for improved production, planning and efficiency. Our customers, in turn, benefit from our market leadership, talented sales associates, broad product offering, high inventory availability, timely delivery and exceptional customer services. We believe our strong customer and supplier relationships will enable us to expand and broaden our market share in the premium vaporization products and consumption accessories marketplace and expand into new categories. For example, in February 2019 we commenced distribution of premium products containing hemp-derived CBD.

Expand Our Operations Internationally.

We currently focus our marketing and sales efforts on the United States, Canada, and Europe, with the United States and Canada representing the two largest and most developed markets for our products. While we currently support and ship certain products to customers in Australia and parts of South America on a limited basis, we are aware of the growth opportunities in these markets. As we continue to expand our marketing, supplier relationships, sales bandwidth and expertise, we anticipate capturing market share in those regions by opening our own distribution centers, acquiring existing international distributors and partnering with local operators. In September 2019, we acquired Conscious Wholesale, a leading European wholesaler and retailer of consumption accessories, vaporizers, and other high-quality products. We assumed control of their existing warehouse facility located in Amsterdam, Netherlands, which is expected to facilitate the expansion of our European operations.

Expand our E-Commerce Reach and Capabilities.

We own and operate one of the leading direct-to-consumer e-commerce websites in our industry, Vapor.com. This site is one of the most visited within our industry according to SEMrush, a leading data analytics firm, and as of December 31, 2019, we ranked in the top five in approximately 46 Google key search terms and in the top ten in 84 Google key search terms. We intend to continue optimizing our e-commerce platform to improve conversion rates, increase average order values, and grow our margins.

Pursue Value-Enhancing Strategic Acquisitions.

Through our acquisitions of VaporNation (Better Life Holdings, LLC), Pollen Gear LLC and Conscious Wholesale, we have added new markets within the United States and Europe, new product lines, talented employees and operational best practices. We intend to continue pursuing strategic acquisitions to grow our market share and enhance leadership positions by taking advantage of our scale, operational experience and acquisition know-how to pursue and integrate attractive targets. We believe we have significant opportunities to add product categories through our knowledge of our industry and possible acquisition targets.

Enhance Our Operating Margins.

We expect to enhance our operating margins as our business expands through a combination of additional product purchasing discounts, reduced inbound and outbound shipping and handling rates, reduced transaction processing fees, increased operating efficiencies and realization of benefits through leveraging our existing assets and distribution facilities. Additionally, we expect that our operating margins will increase as our product mix continues to evolve to include a greater portion of our proprietary branded products. We are committed to supporting our proprietary brands, such as Higher Standards, VIBES and Pollen Gear, which offer significantly higher gross margins than supplier-branded products.

Developing A World-Class Portfolio of Proprietary Brands.

8

We intend to continue to develop a portfolio of our own proprietary brands, which over time has helped to improve our blended margins and create long-term value. Our brand development is based upon our proprietary industry intelligence that allows us to identify market opportunities for new brands and products. We leverage our distribution infrastructure and customer relationships to penetrate the market quickly with our proprietary brands and to gain placement in thousands of stores. Currently, we sell such products directly to consumers via the brand websites and our e-commerce properties. Our existing proprietary brands include our Higher Standards, Aerospaced, Groove, K.Haring Glass Collection, Marley Natural, VIBES, and Pollen Gear brands. In May 2018, we entered into an exclusive license agreement with Keith Haring Studio to manufacture and sell consumption accessory products that will incorporate certain artwork images created by the iconic artist Keith Haring, and in July 2018, we entered into a joint venture with an affiliate of Gilbert Milam, one of the most influential celebrities in the industry today, to create, develop and market a line of consumer products to be sold under the VIBES brand name, including rolling papers, clothing, and other smoking accessories. We launched these products in 2019. In addition to absorbing the Marley Natural accessory line as a house brand, we are making other strides to ensure we take full advantage of the opportunities given to us as a company. We will be extending the price points of the Higher Standards line to include a wider customer base, and in doing so, increase the presence of our house brands. To synergize with the direction of Higher Standards, Marley Natural, the K.Haring Glass Collection, and our upcoming brand Hew By Higher Standards, will all be under the Higher Standards brand umbrella. Taking this step will ensure the brands are not competing against each other, and that we maximize market penetration for all our brands. With all these changes comes expansion into new markets; we are taking steps to ensure that all our proprietary brands are prepared to enter new markets in Europe during the upcoming year. In creating, acquiring, and expanding our proprietary brands, we intend to stay mindful of our key supplier relationships and to identify opportunities within our product portfolio and in the market where we can introduce or acquire compelling products that do not directly compete with the products of our core suppliers.

Execute on Identified Operational Initiatives.

We continue to evaluate operational initiatives to improve our profitability, enhance our supply chain efficiency, strengthen our pricing and category management capabilities, streamline and refine our marketing process and invest in more sophisticated information technology systems and data analytics. In addition, we continue to further automate our distribution facilities and improve our logistical capabilities. We are also taking steps to transition to a more centralized model with fewer, larger, highly automated facilities. We plan to gradually close our existing distribution facilities in the United States and open one new, streamlined centrally-located facility, which will reduce costs going forward. We believe we will continue to benefit from these and other operational improvements.

Be the Employer of Choice.

We believe our employees are the key drivers of our success, and we aim to recruit, train, promote and retain the most talented and success-driven personnel in the industry. Our size and scale enable us to offer structured training and career path opportunities for our employees, while in our sales and marketing teams, we have built a vibrant and entrepreneurial culture that rewards performance. We are committed to being the employer of choice in our industry.

Business Seasonality

While our B2B customers typically operate in highly-seasonal businesses, we have historically experienced only moderate seasonality in our business, particularly during the fourth quarter, which coincides with Cyber Monday (the first Monday after Thanksgiving, when online retailers typically offer holiday discounts), and as our customers build up their inventories in anticipation of the holiday season and we have related promotional marketing campaigns. However, the rapid growth we have experienced in recent years may have masked the full effects of seasonal factors on our business to date and, as a result, seasonality may have a greater effect on our results of operations in future periods.

Employees

As of December 31, 2019, we employed approximately 350 employees, substantially all of whom are full-time non-union employees.

Competition

Business-to-Business. We operate in an evolving industry in which the market and its participants remain highly fragmented. Although it is difficult to find reliable independent research, we believe there is a vast number of potential B2B customers in North America comprised of independent retail shops, specialty retailers, licensed cannabis dispensaries and regional retailer chains, the latter particularly in Canada. We currently serve over approximately 7,000 of these businesses. Our

9

B2B customers compete primarily on the basis of the breadth, style, quality, pricing and availability of merchandise, the level of customer service, brand recognition and loyalty. We successfully reach our B2B customers through our direct sales force and other marketing initiatives, and provide them with our strategically-curated mix of brands and products, merchandise planning strategies and exceptional customer service. Among vaporizer product distributors, we compete against both suppliers and other distributors. A number of suppliers choose to distribute directly in some sales channels and may also operate their own e-commerce platforms. We face competition from many small privately-owned regional distributors that carry a narrow range of products. We believe there are only a select few wholesale distributors carrying a complete line of premium vaporization products and consumption accessories. We believe our competitors include Phillips & King International, Windship Trading Co. and West Coast Gifts. Our principal competitors for the sale of supplies and packaging are KushCo Holdings, Inc., eBottles and large packaging companies, such as Berlin Packaging.

Business-to-Consumer. A number of suppliers of vaporizers and specialized consumption products and accessories operate their own e-commerce websites through which they sell their items directly to end consumers. Additionally, there are hundreds of websites that sell products similar to those we offer in North America, Europe, Australia and other parts of the world. We believe we compete effectively with other e-commerce websites. Further, we provide fulfillment services to the owners of some of these websites as they do not carry their own inventory, are not able to ship as efficiently as we do and are unable to meet certain regulatory requirements, such as sales tax collection. Our competitors’ websites rank in many search categories below our primary e-commerce website, Vapor.com, which has its own dedicated design, social media and search engine optimization ("SEO") teams. We believe our market knowledge, large product selection, relationships with vaporizer brands, in-house search engine optimization teams, social media focus and distribution facilities will enable us to remain a market leader in e-commerce.

Trademarks

We own a number of registered trademarks and service marks, including without limitation, Greenlane, Higher Standards, Vapor.com, VIBES, Aerospaced, Groove and Pollen GearTM. Solely for convenience, trademarks and trade names referred to in this Form 10-K may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. In addition, this Form 10-K contains trade names, trademarks and service marks of other companies that we do not own. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies. We believe our largest trademarks are widely recognized throughout the world and have considerable value. The duration of trademark registrations varies from country to country. However, trademarks are generally valid and may be renewed indefinitely as long as they are in use and/or their registrations are properly maintained.

Insurance

We carry a broad range of insurance coverages, including general liability, real and personal property, workers’ compensation, directors’ and officers’ liability and other coverages we believe are customary. Our exposure to loss for insurance claims is generally limited to the per-incident deductible under the related insurance policy. We do not expect the impact of any known casualty, property, environmental or other contingency to have a material impact on our financial conditions, results of operations or cash flows.

Our directors’ and officers’ liability insurance policy we chose to maintain covers only non-indemnifiable individual executive liability, often referred to as “Side A,” and does not provide individual or corporate reimbursement coverage, often referred to as “Side B” and “Side C,” respectively. The Side A policy covers directors and officers directly for loss, including defense costs, when corporate indemnification is unavailable. Side A-only coverage cannot be exhausted by payments to the Company, as the Company is not insured for any money it advances for defense costs or pays as indemnity to the insured directors and officers. As a result, we currently do not have insurance coverage for, and must directly self-fund with cash on hand, our litigation defense costs for actions like those described under "Item 3—Legal Proceedings".

Regulatory Developments

Our operating results and prospects will be impacted, directly and indirectly, by regulatory developments at the local, state, and federal levels. Certain changes in local, state, national, and international laws and regulations, such as increased legalization of cannabis, create significant opportunities for our business. However, other changes to laws and regulations result in restrictions on which products we are permitted to sell and the manner in which we market our products, increased taxation of our products, and negative changes to the public perceptions of our products, among other effects.

10

Recently, the identification of many cases of e-cigarette or vaping product use associated lung injury (“EVALI”) has led to significant scrutiny of e-cigarette and other vaporization products. As of February 18, 2020, the Center for Disease Control and Prevention (“CDC”) had identified 2,807 cases of EVALI nationwide, including 68 confirmed deaths. According to the CDC, most of the patients with EVALI reported a history of using vaporization products containing tetrahydrocannabinol ("THC"). The CDC has reported that products containing THC, particularly those obtained from informal sources (e.g., illicit dealers), are linked to most of the incidents involving EVALI. The CDC has recommended, among other things, that consumers not use vaping products containing THC and not purchase vaping products from unlicensed sellers. While the CDC has not definitively identified the cause(s) of EVALI, on November 5, 2019, it published findings that 48 of 51 fluid samples collected from the lungs of patients with EVALI contained vitamin E acetate. Although we do not sell vitamin E acetate or any products containing vitamin E acetate, recent incidence of EVALI, other public health concerns, and associated negative perceptions of vaping could lead consumers to avoid vaping products, which would materially and adversely affect our results of operations.

In response to EVALI, as well as concerns about people under the age of eighteen using vaping products, several localities, states, and the federal government have enacted measures restricting the sale of certain types of vaping products. For example, on December 20, 2019, legislation was signed into law that raised the federal minimum age of sale for tobacco products from 18 to 21. As another example, on January 2, 2020, the United States Food and Drug Administration ("FDA") announced a new policy prioritizing enforcement against certain unauthorized flavored e-cigarette products that appeal to minors, including fruit and mint flavors. Starting in February 2020, the FDA will seek to prohibit sales of flavored, cartridge-based e-cigarettes, as well as of any other products that are targeted to minors. Additionally, some state and local governments have enacted or plan to enact laws and regulations that restrict the sale of certain types of vaping products. For example, several states and localities have implemented bans on certain flavored vaping products in an effort to reduce the appeal of such products to minors and some localities have banned the sale of nicotine vaping products entirely. These new vaping laws are rapidly shifting and, in some instances, have been repealed or narrowed as the result of successful legal challenges. The enactment of restrictions or bans on vaping products or other new laws or regulations related to vaping, particularly if they are enacted federally or in states or localities in which we derive significant revenues, could materially and adversely affect our revenues. The ultimate impact of these policy developments will depend upon, among other things, the types and quantities of products we sell that are encompassed by each ban, the success of legal challenges to the bans, our suppliers' actions to adapt to actual and potential regulatory changes, and our ability to provide alternative products. For example, on November 7, 2019, JUUL announced that it was ceasing sales of its mint-flavored products. While we believe consumers may switch from mint to flavors traditionally known to smokers, we expect JUUL's choice to cease sales of mint-flavored products may materially and adversely affect our results of operations.

Several states, including Texas, Ohio, and Nebraska have recently enacted laws permitting the sale of product containing hemp-derived CBD. As a result of these laws, we are now selling hemp-derived CBD products in markets where we previously did not. Texas and Ohio represent significant opportunities to grow our sales of hemp-derived CBD products, as those states accounted for 4.6% and 2.1%, respectively, of our net sales for the year ended December 31, 2019. The continued proliferation of state laws allowing the sale of products containing hemp-derived CBD would create additional opportunities for us to grow our sales of hemp-derived CBD products. Additionally, Illinois recently adopted the Cannabis Regulation and Taxation Act, becoming the first state to legalize a comprehensive adult-use cannabis market through its state legislature. Although we can provide no assurances, other states appear likely to legalize either medical or adult-use cannabis in 2020. We believe the continuing trend of states’ legalization of medicinal and adult-use cannabis is likely to contribute to an increase in the demand for many of our products.

In addition, 25 states and the District of Columbia have recently adopted laws imposing taxes on liquid nicotine. These laws have already taken effect in 18 states and the District of Columbia, with the remaining seven states’ taxes set to take effect by January 2021. Additionally, at least nine states have adopted laws imposing taxes on vaporizers. These laws have already taken effect in six states, with the remaining three states’ taxes set to take effect by January 2021. These taxes will result in increased prices to end consumers, which may adversely impact the demand for our products. We expect these taxes would impact our competitors similarly, assuming their compliance with applicable laws.

Trade policy also may impact our results of operations and prospects. For example, on September 25, 2019, a domestic party filed with the U.S. Department of Commerce and U.S. International Trade Commission an anti-dumping and countervailing duty petition related to certain glass containers imported from China. On March 2, 2020, U.S. Department of Commerce published a preliminary determination that countervailable subsidies are being provided to producers and exporters of these glass containers and imposed countervailing duties ranging from approximately 23% to 316% on such imports. These duties apply to certain of our manufacturers and products and may materially and adversely affect our revenues, particularly if we are unable to source these products from other locations at comparable prices.

Corporate Information

11

Our executive offices are located at 1095 Broken Sound Parkway, Suite 300, Boca Raton, Florida 33487. Our telephone number at our executive offices is (877) 292-7660.

Available Information

The Company’s Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the SEC. We are subject to the informational requirements of the Exchange Act and file or furnish reports, proxy statements and other information with the SEC. Such reports and other information filed by us with the SEC are available free of charge at investor.gnln.com/financial-information/sec-filings when such reports are available on the SEC’s website. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. We periodically provide other information for investors on our corporate website, www.gnln.com, and our investor relations website, investor.gnln.com. This includes press releases and other information about financial performance, information on corporate governance and details related to our annual meeting of shareholders. The information contained on the websites referenced in this Form 10-K is not incorporated by reference into this filing. Further, our references to website URLs are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

Our operations and financial results are subject to various risks and uncertainties, including but not limited to those described below, which could harm our business, reputation, financial condition, and operating results. The following is a description of what we consider the key challenges and material risks to our business and an investment in our Class A common stock.

Risks Related to Our Business and Industry

We have experienced rapid growth, both domestically and internationally, and expect continued future growth, including growth from additional acquisitions. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service or address competitive challenges adequately. Furthermore, our corporate culture has contributed to our success, and if we cannot maintain this culture as we grow, we could lose the innovation, creativity, and teamwork fostered by our culture, and our business may be harmed.

We intend to continue to grow our business. Our success will depend, in part, on our ability to manage this growth, both domestically and internationally. Any growth in, or expansion of, our business is likely to continue to place a strain on our management and administrative resources, infrastructure and systems. As with other growing businesses, we expect that we will need to further refine and expand our business development capabilities, our systems and processes and our access to financing sources. We will also need to hire, train, supervise, and manage new employees. These processes are time consuming and expensive and will increase management responsibilities and divert management attention. We cannot assure that we will be able to:

•expand our product offerings effectively or efficiently or in a timely manner, if at all;

•allocate our human resources optimally;

•meet our capital needs;

•identify and hire qualified employees or retain valued employees;

•effectively incorporate the components of any business or product line that we may acquire in our effort to achieve growth; or

•continue to grow our business.

Our inability or failure to manage our growth and expansion effectively could harm our business and materially adversely affect our operating results and financial condition. In addition, we believe that an important contributor to our success has been and will continue to be our corporate culture, which we believe fosters innovation, teamwork and a passion for our products and customers. As a result of our rapid growth, we may find it difficult to build and maintain our strong corporate culture, which could limit our ability to innovate and operate effectively. Any failure to preserve our culture could also negatively affect our ability to retain current and recruit new personnel, continue to perform at current levels or execute on our business strategy.

12

The market for vaporizer products and related items is a niche market, subject to a great deal of uncertainty and is still evolving.

Vaporizer products comprise a significant portion of our product portfolio. Many of these products have only recently been introduced to the market and are at an early stage of development. These products represent core components of a niche market that is evolving rapidly, is characterized by a number of market participants and is subject to regulatory oversight and a potentially fluctuating regulatory framework. Rapid growth in the use of, and interest in, vaporizer products is recent, and may not continue on a lasting basis. The demand and market acceptance for these products is subject to a high level of uncertainty, including, but not limited to, changes in governmental regulation, developments in product technology, perceived safety and efficacy of our products, perceived advantages of competing products and sale and use of materials that can be vaporized, including in the expanding legal national and state cannabis markets. For example, recent concerns about EVALI and youth use of vaporizers have, by some metrics, negatively impacted demand for vaporizers and led to laws and regulations restricting the sale of certain products in different markets. Therefore, we are subject to many of the business risks associated with a new enterprise in a niche market. Continued technical evolution, market uncertainty, evolving regulation and the resulting risk of failure of our new and existing product offerings in this market could have a material adverse effect on our ability to build and maintain market share and on our business, results of operations and financial condition. Further, there can be no assurance that we will be able to continue to effectively compete in this marketplace.

We depend on third-party suppliers for our products and may experience unexpected supply shortages.

We depend on third-party suppliers for our vaporization products and consumption accessories product offerings. Our customers associate certain characteristics of our products, including the weight, feel, draw, flavor, packaging and other unique attributes, to the brands we market, distribute and sell. In the future, we may have difficulty obtaining the products we need from our suppliers as a result of unexpected demand or production difficulties that might extend lead times. Also, products may not be available to us in quantities sufficient to meet our customer demand. Any interruption in supply and/or consistency of these products may adversely impact our ability to deliver products to our customers, may harm our relationships and reputation with our customers, and may have a material adverse effect on our business, results of operations and financial condition. Interruptions in supply or consistency of products could arise for a number of reasons, including but not limited to economic and civil unrest, epidemics/pandemics, such as coronavirus (COVID-19), embargoes, and sanctions.

A significant percentage of our revenue is dependent on sales of products from a relatively small number of key suppliers, and a decline in sales of products from these suppliers could materially harm our business.

A significant percentage of our revenue is dependent on sales of products, primarily vaporizers and related components, that we purchase from a small number of key suppliers, including PAX Labs and JUUL Labs. For example, products manufactured by PAX Labs represented approximately 11.1% and 15.6% of our net sales in the years ended December 31, 2019 and 2018, respectively, and products manufactured by JUUL Labs represented approximately 38.7% and 36.5% of our net sales in the years ended December 31, 2019 and 2018, respectively. A decline in sales of any of our key suppliers’ products, whether due to decreases in supply of, or demand for, their products, termination of our agreements with them, regulatory actions or otherwise, could have a material adverse impact on our sales and earnings and adversely affect our business.

The FDA has expressed growing concern about the popularity among youth of the products of JUUL Labs and other manufactures of flavored ENDS products, and additional regulatory actions may further impact our ability to sell these products in the United States or online.

Any regulatory action by the FDA that adversely affects the sale or distribution of Electronic Nicotine Delivery Systems ("ENDS") products may have a material adverse effect on our business, results of operations and financial condition.

On April 24, 2018, the FDA issued a letter to JUUL Labs requesting documents relating to marketing practices and research on marketing, effects of product design, public health impact, and adverse experiences and complaints related to JUUL products. All information for this request was to be received by the FDA no later than June 19, 2018. FDA Commissioner Scott Gottlieb, M.D. issued an FDA statement on April 24, 2018 announcing that the FDA has been conducting a large-scale, undercover nationwide action to crack down on the sale of e-cigarettes, specifically JUUL products, to minors at both brick-and-mortar and online retailers. The FDA indicated that this action had already revealed numerous violations of the law, and that as a result of these and other identified instances of the sale of JUUL products to minors, the FDA was issuing warning letters and civil penalties and fines. The FDA also advised that it had contacted retailers such as 7-Eleven, Circle K, AM/PM Arco, Walgreens and other national or regional stores regarding concerns about the sale of these products to minors and to online retailers, such as eBay, regarding concerns over listings of JUUL products on its website.

13

In the largest coordinated enforcement effort in the FDA’s history, the agency subsequently issued more than 1,300 warning letters and civil fines to retailers who illegally sold JUUL and other e-cigarettes to minors during a nationwide, undercover blitz of brick-and mortar and online stores. It has been widely reported that in October 2018, the FDA seized more than a thousand pages of documents from JUUL Labs related to its sales and marketing practices. The FDA also stated that it could remove their products from the market if JUUL Labs and its manufacturers fail to halt sales to minors. It also raised the possibility of civil or criminal charges if companies, such as JUUL Labs or its distributors and re-sellers, are allowing bulk sales through websites and other online purchases.

On November 15, 2018, the FDA issued a statement in which it announced that it is pursuing actions aimed at addressing the trend of increased use of combustible cigarette use among middle and high school students and released, together with the Centers for Disease Control and Prevention, a national youth tobacco survey, a study that shows a significant increase in the use by teenage children of e-cigarettes and other ENDS, such as the vaporizers sold by JUUL, as alternatives to cigarettes. In such statement, the FDA announced that it is directing the FDA’s Center for Tobacco Products to revisit its compliance policy as it relates to ENDS products that are flavored, including all flavors other than tobacco, mint and menthol, and to implement changes that would protect teenagers by mandating that all flavored ENDS products (other than tobacco, mint and menthol) be sold only in age-restricted, in-person locations and, if sold on-line, only under heightened practices for age verification. In addition, it was announced that the FDA will pursue the removal from the market of those ENDS products that are marketed to children or are appealing to the youth market, including any products that use popular children’s cartoon or animated characters, or are names of products that are names of products favored by children, such as brands of candy or soda. The FDA also announced its intention to advance a notice of proposed rule making that would seek to ban menthol in combustible tobacco products, including cigarettes and cigars.

On November 14, 2018, JUUL Labs announced that, in furtherance of its common goal with the FDA to prevent youth from initiating the use of nicotine, and in anticipation of the above FDA announcement, JUUL Labs plans to eliminate some of its social media accounts, including its U.S. social media accounts on Facebook and Instagram, and it has halted most retail sales of its flavored products in the United States as part of a plan to restrict the access of its products to youth. As part of its plan, JUUL Labs indicated it would temporarily stop selling most of its flavored JUUL pods in all retail stores in the United States, including convenience stores and vape shops, and will restrict sales to adults 21 years of age and over on its secure website. Subsequently, JUUL Labs chose to discontinue sales of most of its flavored JUUL pods in the U.S. altogether.

On December 20, 2019, the President signed legislation to amend the Federal Food, Drug, and Cosmetic Act (“FFDCA”), and raise the federal minimum age of sale of tobacco products (including ENDS products) from 18 to 21 years. Although many states had already established a minimum age of 21 years, our sales could be adversely impacted by this change in federal law.

In January 2020, FDA issued a guidance document titled Enforcement Priorities for Electronic Nicotine Delivery Systems ("ENDS") and Other Deemed Products on the Market Without Premarket Authorization (“ENDS Enforcement Guidance”). According to the ENDS Enforcement Guidance, FDA intends to prioritize enforcement against (1) flavored, cartridge-based ENDS products (except tobacco or menthol flavored products), (2) all other ENDS products for which the manufacturer has or is failing to take adequate measures to prevent minors’ access, and (3) any ENDS product targeted to minors or whose marketing is likely to promote use by minors. FDA also intends to prioritize any ENDS product offered for sale after May 12, 2020 for which the manufacturer has not submitted a premarket application. As noted in the guidance, FDA is not necessarily bound by these enforcement priorities, and could take action against other products as warranted by changing circumstances.

The ENDS Enforcement Guidance had the effect of prohibiting the sale of certain products we sell, including mint flavored products from JUUL Labs and other flavored ENDS. We expect that our sales will be adversely impacted by this prohibition. Products impacted by the ENDS Enforcement Guidance Labs represented approximately 17.8% and 25.6% of our net sales for the years ended December 31, 2019 and 2018, respectively.

In February 2020, FDA published a notice seeking data and information related to the use of vaping products associated with recent lung injuries. FDA seeks information relating to product design and ways to prevent consumers from modifying or adding substances to these products that are not intended by the manufacturers. The notice states that FDA may use the information in future rule making, review of premarket authorization applications, or other regulatory activity. The notice further states that FDA has not found one product or substance implicated in all of the cases of injury, and that FDA is following all potential leads and will take appropriate actions as additional facts emerge. The FDA's actions resulting from this request for information could adversely affect our sales of ENDS products and may have a material adverse effect on our business, results of operations and financial condition.

14

There is uncertainty related to the regulation of vaporization products and certain other consumption accessories. Increased regulatory compliance burdens could have a material adverse impact on our business development efforts and our operations.

United States

There is uncertainty regarding whether, in what circumstances, how and when the FDA will seek to enforce the tobacco-related provisions of the FFDCA relative to vaporizer hardware and accessories that can be used to vaporize cannabis and other material, including electronic cigarettes, rolling papers and glassware, in light of the potential for dual use with tobacco.

Through amendments to the FFDCA, the Tobacco Control Act established, by statute, that the FDA has oversight over specific types of tobacco products (cigarettes, cigarette tobacco, roll-your-own (“RYO”) tobacco, and smokeless tobacco) and granted the FDA the authority to “deem” other types of tobacco products as subject to the statutory requirements. In addition to establishing authority, defining key terminology, and setting adulteration and misbranding standards, the Tobacco Control Act established FDA’s authority over tobacco products in a number of areas such as: submission of health information to the FDA; registration with the FDA; premarket authorization requirements; good manufacturing practice requirements; tobacco product standards; notification, recall, corrections, and removals; records and reports; marketing considerations and restrictions; post-market surveillance and studies; labeling and warnings; and recordkeeping and tracking.

In December 2010, the U.S. Court of Appeals for the D.C. Circuit held that the FDA is permitted to regulate vaporizer devices containing tobacco-derived nicotine as “tobacco products” under the Tobacco Control Act.

In a final rule effective August 8, 2016 (“Deeming Rule”), the FDA deemed all products that meet the Tobacco Control Act’s definition of “tobacco product,” including components and parts but excluding accessories, to be subject to the tobacco control requirements of the FFDCA and the FDA’s implementing regulations. Accordingly, as of the Deeming Rule’s effective date, deemed tobacco products that are “new” (i.e., those that were not commercially marketed in the United States as of February 15, 2007) are subject to the premarket authorization requirements. Deemed new tobacco products that remain on the market without authorization are marketed unlawfully.

Deemed new tobacco products include, among other things: products such as electronic cigarettes, electronic cigars, electronic hookahs, vape pens, vaporizers and e-liquids and their components or parts (such as tanks, coils and batteries) (“ENDS”). The FDA’s interpretation of components and parts of a tobacco product includes any assembly of materials intended or reasonably expected to be used with or for the human consumption of a tobacco product. In a 2017 decision of the D.C. Circuit court, the court upheld the FDA’s authority to regulate ENDS even though they do not actually contain tobacco, and even if the products could be used with nicotine-free e-liquids.

The Tobacco Control Act and FDA’s implementation of regulations restrict the way tobacco product manufacturers, retailers, and distributors can advertise and promote tobacco products, including a prohibition against free samples or the use of vending machines, requirements for presentation of warning information, and age verification of purchasers.

Newly-deemed tobacco products are also subject to the other requirements of the Tobacco Control Act, such as that they not be adulterated or misbranded. The FDA has been directed under the Tobacco Control Act to establish specific good manufacturing practice (“GMP”) regulations for tobacco products, and could do so in the future, which could have a material adverse impact on the ability of some of our suppliers to manufacture, and the cost to manufacture, certain of our products. Even in the absence of specific GMP regulations, a facility’s failure to maintain sanitary conditions or to prevent contamination of products could result in the FDA deeming the products produced there adulterated.

In light of the laws noted above, we anticipate that premarket authorizations will be necessary for us to continue our distribution of certain vaporizer hardware and accessories that can be used to vaporize cannabis and other material. In the preamble to the Deeming Rule, FDA established compliance periods for the submission of premarket authorization applications and their review, during which FDA intended to defer enforcement. FDA subsequently extended those compliance periods. As the result of litigation challenging FDA’s compliance policies, FDA is now under court order to require that premarket authorization applications be submitted for all “new” tobacco products by May 12, 2020, with an additional year during which products with timely filed applications can remain on the market. Products on the market as of August 8, 2016, for which premarket authorization applications are not filed by May 12, 2020, are subject to FDA enforcement actions, in the FDA’s

15

discretion. Products entering the market after August 8, 2016 (the effective date of the Deeming Rule) are subject to enforcement at any time if marketed without authorization.

Our suppliers must timely file applications for the appropriate authorizations so that we may continue selling their products in the United States. We have no control over the content of those applications, and we have no assurances that the outcome of FDA’s review will result in authorization of the marketing of these products. If our suppliers do not timely file applications, or if the FDA establishes or applies review standards or processes that our suppliers are unable or unwilling to comply with, our business, results of operations, financial condition and prospects would be adversely affected.

The anticipated costs to our suppliers of complying with future FDA regulations will be dependent on the rules issued by the FDA (which have yet to be issued), the timing and clarity of any new rules or guidance documents accompanying these rules, the reliability and simplicity (or complexity) of the electronic systems utilized by the FDA for information and reports to be submitted, and the details required by the FDA for such information and reports with respect to each regulated product. Any failure to comply with existing or new FDA regulatory requirements could result in significant financial penalties to us or our suppliers, which could ultimately have a material adverse effect on our business, results of operations, financial condition and ability to market and sell our products. Compliance and related costs could be substantial and could significantly increase the costs of operating in the vaporization products and certain other consumption accessories markets.

In addition, failure to comply with the Tobacco Control Act and with FDA regulatory requirements could result in litigation, criminal convictions or significant financial penalties and could impair our ability to market and sell some of our vaporizer products. At present, we are not able to predict whether the Tobacco Control Act will impact our business to a greater degree than competitors in the industry, thus affecting our competitive position.