Exhibit 99.2

and July 2020 Investor Presentation

Page 2 | Disclaimer This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist intereste d p arties in making their own evaluation with respect to a potential business combination between Velodyne Lidar , Inc. (“ Velodyne ” or the “Company”) and Graf Industrial Corp. (“Graf”) and related transactions (the “Proposed Business Combination”) and for no o the r purpose. No representations or warranties, express or implied are given in, or in respect of, this Presentation. To the fullest extent pe rmitted by law in no circumstances will Graf, Velodyne or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequenti al loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information co nta ined within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data us ed in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. Neither Graf nor Velodyne has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. T his data is subject to change. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Velodyne or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of Velodyne and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward - Looking Statements Certain statements included in this Presentation that are not historical facts are forward - looking statements for purposes of th e safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect, ” “ should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict o r i ndicate future events or trends or that are not statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market and revenue opportunities, planned business strategies, the impact of the COVID - 19 pandemic, competitive position and technological and mark et trends. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Velodyne’s and Graf’s management and are not predictions of actual performance. These forward - looking statements are provided for illustra tive purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circ ums tances are difficult or impossible to predict and may differ materially from assumptions. Many actual events and circumstance s a re beyond the control of Velodyne and Graf. These forward - looking statements are subject to a number of risks and uncertainties, including the inability of the p arties to successfully or timely consummate the Proposed Business Combination or that the approval of the stockholders of Graf or Velodyne is not obtained; the inability to meet the NYSE's listing standards; costs related to the Business Combination; Velodyne’s ability to manage growth; Velodyne’s ability to execute its business plan; the timing of revenue from existing customers, including uncertainties related to the ability of Velodyne’s customers to commercialize their products and the ultimate market acceptance of these products; the uncertain impact of the C OV ID - 19 pandemic on Velodyne’s and its customers’ businesses; uncertainties related to Velodyne’s estimates of the size of the markets for its products and future revenue opportunities; the rate and degree of market accepta nc e of Velodyne’s products; the success of other competing lidar and sensor - related products and services that exist or may become available; Velodyne’s ability to identify and integrate acquisitions; rising costs adversely affecting Velodyne’s profitability; uncertainties related to Velodyne’s current litigation and potential litigation involving GRAF or Velodyne or the validity or enforceability of Velodyne’s intellectual property; Velodyne’s ability to partner with and rely on third party manufacturers; general economic and market conditions impacting demand for Velodyne’s products and services; and those factors discussed in Graf’s Annual Report on Form 10 - K for the year ended December 31, 2019 and Quarterly Report on Form 10 - Q for the quarter ended March 31, 2020, in each case, under the headings “Risk Factors” and other documents of Graf filed, or to be filed, with the Securities and Exchange Commission (“SEC”). If any of these risks ma terialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forwar d - looking statements. There may be additional risks that neither Graf nor Velodyne presently know or that Graf and Velodyne currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking sta tements. In addition, forward - looking statements reflect Graf’s and Velodyne’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Graf and Velodyne anticipate that subsequent events and developments may cause Graf’s and Velodyne’s assessments to change. However, while Graf and Velodyne may elect to update these forward - looking statements at some point in the future, Graf and Velodyne specifically disclaim any obligation to do so. These forward - looking statements should not be relied upon as representing Graf’s and Velodyne’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon t he forward - looking statements. Use of Projections This Presentation contains projected financial information with respect to Velodyne . Such projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently unc ert ain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward - Looking Statements” above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded a s a representation by any person that the results reflected in such forecasts will be achieved .

Page 3 | Disclaimer (Cont’d) Financial Information; Non - GAAP Financial Measures Some of the financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X. A ccordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, the prox y statement to be filed by Graf with the SEC. Some of the financial information and data contained in this Presentation, such a s E BITDA and free cash flow, has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Graf and Velodyne believe these non - GAAP measures of financial results provide useful information to management and investors regarding certain f inancial and business trends relating to Velodyne’s financial condition and results of operations. Velodyne’s management uses these non - GAAP measures for purposes of budgeting, planning and other purposes. Graf and Velodyne believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Velodyne’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors. Manage ment does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these no n - GAAP financial measures is that they exclude significant items that are required by GAAP to be recorded in Velodyne’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by mana gem ent about what is excluded or included in determining these non - GAAP financial measures. In order to compensate for these limitations, management presents non - GAAP financial measures in connection with GAAP results. You should review Velodyne’s audited financial statements, which will be included in the proxy statement to be filed by Graf with the SEC. Additionally, t o the extent that forward - looking non - GAAP financial measures are provided, they are presented on a non - GAAP basis without reconciliat ions of such forward - looking non - GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Important Information About the Proposed Business Combination and Where to Find It In connection with the Proposed Business Combination, Graf intends to file a preliminary proxy statement with the SEC and a d efi nitive proxy statement will be distributed to holders of Graf’s common stock in connection with Graf’s solicitation of proxie s f or the vote by Graf’s stockholders with respect to the Proposed Business Combination and other matters as described in the proxy st atement. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT, ANY AMENDMENTS THERETO AND ANY OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECA USE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GRAF, VELODYNE AND THE PROPOSED BUSINESS COMBINATION. Investors and security holders may obtain free copies of the preliminary prox y s tatement and definitive proxy statement (when available) and other documents filed with the SEC by Graf through the website maintained by the SEC at http://www.sec.gov, or by directing a request to Graf Industrial Corp., 118 Vint age Park Blvd., Suite W - 222, Houston, TX 77070, Attention: James A. Graf, Chief Executive Officer, james@grafacq.com. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORI TY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIM INA L OFFENSE. Participants in the Solicitation Graf and Velodyne and their respective directors and certain of their respective executive officers and other members of management and employe es may be considered participants in the solicitation of proxies with respect to the Proposed Business Combination. Information about the directors and executive officers of Graf is set forth in its Annual Report on Form 10 - K for t he fiscal year ended December 31, 2019. Additional information regarding the participants in the proxy solicitation and a des cri ption of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement and other rel evant materials to be filed with the SEC regarding the Proposed Business Combination when they become available. Stockholders , potential investors and other interested persons should read the proxy statement carefully when it becomes available before m aki ng any voting or investment decisions. You may obtain free copies of these documents as indicated above. No Offer or Solicitation This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall ther e b e any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registratio n o r qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus m eet ing the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Trademarks This Presentation contains trademarks, service marks, trade names and copyrights of Graf, Velodyne and other companies, which are the property of their respective owners.

Page 4 | Highly Experienced Leadership Team David Hall Founder & Executive Chairman ▪ David Hall is a serial inventor and the Founder and Executive Chairman of Velodyne Lidar ▪ He is one of the original entrants in the DARPA Grand Challenge in 2005 and invented 3D Lidar to give autonomous vehicles real - time 360º vision ▪ Mr. Hall continues to serve as a visionary inventor whose technologies are enabling safe autonomous mobility Dr. Anand Gopalan Chief Executive Officer ▪ Anand Gopalan is a seasoned executive with experience building and leading world - wide engineering organizations and managing organizations through business model transitions ▪ Prior to succeeding Mr. Hall as CEO, Dr. Gopalan served as Velodyne’s CTO and as a VP of Engineering at Rambus, where he oversaw chip and IP development activities for the Memory and Interfaced Division ▪ Dr. Gopalan received his PhD in Electrical engineering and Microsystems Engineering from the Rochester Institute of Technology Andrew Hamer Chief Financial Officer ▪ Drew Hamer is a seasoned finance executive with over 25 years of financial leadership experience at public and private technology companies ▪ Prior to joining Velodyne, Mr. Hamer managed investor relations, implemented financial efficiencies, raised capital, and oversaw the expansion of financial and business operations at various companies around the world ▪ Mr. Hamer is a member of Financial Executives International, the American Institute of CPAs and the Florida Institute of CPAs James Graf Chief Executive Officer of Graf Industrial ▪ Jim Graf is a renowned businessman with over 32 years of deal making and international capital markets experience ▪ Mr. Graf has completed four successful SPAC transactions as both sponsor/CFO (Global Eagle/Row44/Advanced Inflight Alliance, Silver Eagle/Videocon d2h, Double Eagle/Williams Scotsman) and as a board director (Platinum Eagle/Target Logistics) ▪ Mr. Graf was previously Founder and CEO of Praedea Solutions and spent nearly 15 years in investment banking at Merrill Lynch, Morgan Stanley, and elsewhere Michael Dee Chief Financial Officer of Graf Industrial ▪ Michael Dee is an experienced deal maker with nearly three decades of public markets, corporate finance, private equity and M&A experience ▪ Mr. Dee was a Senior Advisor at the Asian Infrastructure Investment Bank in Beijing and a member of its Investment Committees ▪ He was previously a Senior Managing Director at Temasek , Singapore’s sovereign investment company, and spent over 26 years at Morgan Stanley in a variety of senior positions across the globe

Page 5 | Transaction Overview ____________________ Note: Dollars in millions. (1) Based on $117mm cash in trust (assuming no redemptions) and 15mm shares at $10/share PIPE ($150mm) less $25mm transaction exp ens es, including a 21% / 79% primary / secondary split. Timeline Valuation ▪ Velodyne Lidar and Graf Industrial announced a business combination and expect to file a proxy statement in July 2020 ▪ Expected timing for transaction closing is Q3 2020 ▪ It is anticipated that the post - closing company will be a Delaware corporation, retain the Velodyne Lidar name, and be listed on the NYSE ▪ Valuation implies a pro forma enterprise value of $1.6bn (2.3x 2024E Revenue of Approximately $680mm ) and equity value of $ 1.8bn ▪ At this valuation level, existing Velodyne stockholders will receive c. 83% of the pro forma equity and $50mm in cash Transaction Funding ▪ The transaction will be funded by a combination of Graf cash held in a trust account, Graf common stock, and proceeds from th e P IPE ▪ Fully committed PIPE of $150mm ▪ Transaction will result in approximately $192mm cash to the balance sheet to fund growth (1)

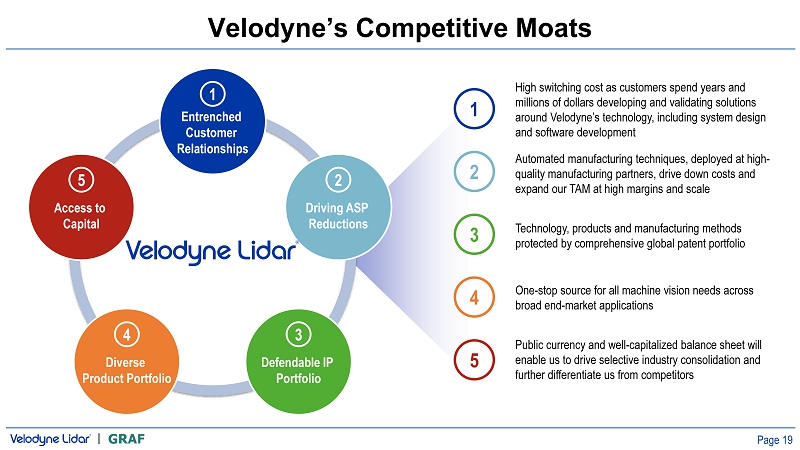

Page 6 | Investment Highlights ____________________ (1) As of December 2019. (2) Per FactSet data as of June 26, 2020. Peer group includes Ambarella , Ballard, Cree, Melexis , Mobileye , Nikola, Nvidia , Plug Power, Tesla, and Xilinx. Metrics reflect CY2021E values. Mobileye reflects pre - announcement unaffected metrics as of March 10, 2017 . ▪ Entrenched Customer Relationships with high switching costs ▪ Extensive and defendable patent portfolio ▪ Broad product portfolio ( sensor + software ) with proven volume manufacturing Deep Defendable Competitive Moats ▪ Lidar is critical to “safety first” culture ▪ Our drive to lower ASPs is accelerating adoption across industries Strong Secular Trends ▪ Estimated $800mm + in contracted revenue through 2024 (~ 50% of 2024 is contracted) ▪ Opportunity for 60%+ revenue CAGR from 2020 - 2024 Highly - Visible Growth ▪ First mover eclipsing the market share of our nearest competitor ▪ 300+ customers with $570mm of cumulative revenue since 2010 (1) Established Market L eader ▪ Would be only pure - play public lidar company ▪ Pro forma valuation at a substantial discount vs comparable companies (2) Scarce Investment at Attractive Valuation 1 2 3 4 5

Company Overview

Page 8 | 2005 Invented Real - Time 3D Lidar 2007 Began World’s First Commercial Production of Real - Time 3D Lidar Leading Lidar Technology TODAY ▪ Dominated the market for 13 years ▪ Broad product portfolio ▪ Cumulative sales of over $570 million (1) ▪ 300+ customers, including major OEMs and leading Tech companies ▪ Global sales and mass scale manufacturing ▪ 25+ new market segments outside automotive ▪ Backed by industry - leading strategic investors , including Ford, Baidu , Nikon and Hyundai Mobis HIGHLIGHTS ____________________ (1) As of December 2019. We Are The First Mover and Market Leader

Page 9 | Velodyne is THE Leading Lidar Provider ____________________ (1) Based on volume and price arrangements as of June 1, 2020 . Contracts represent agreed upon terms and conditions but do not include firm commitment purchase orders. Actual sales may differ materi all y from projected volume. (2) As of June 1, 2020. (3) Represents the number of unique customers including distributors that purchased smart vision solutions from us in 2017, 2018 and 2019. (4) As of June 30, 2020. (5) As of December 31, 2019 . 2017 2018 2019 2005 - 2016 2020 David Hall invented smart v ision technology First real - time, 3D - lidar Launched Less than 1kg lidar Manufacturing a greement with Nikon Production partnership with Veoneer Opened advanced manufacturing facility in San Jose Launched 300 meter, high resolution lidar Launched Lidar for price - sensitive applications $680M+ 2024 Projected Revenue Opportunity 55+ Granted / Pending Patents (4) 300+ Customers (3) (5) HDL - 64E Puck Alpha Prime Velabit Launched Lidar for consumer ADAS Velarray Launched Near - object detection lidar Veladome Strategic i nvestment from Ford and Baidu Strategic i nvestment from Hyundai Mobis 16 Signed / Awarded Multi - Year Contracts (2) Acquired Mapper.ai Strategic i nvestment from Nikon 40,000 + Units Shipped ~50% Contracted (1)

Page 10 | Velodyne Product Roadmap Surround View Rotational Hybrid Solid State Directional Solid State Broad Product Portfolio Full Range of Form Factors Superior Perception Low Power Consumption Durability Hemispherical Architectures Key Technologies Embedded Signal Processing Software Proprietary Calibration and Manufacturing IP Portfolio Custom ASICs Micro - Lidar Array Technology Tireless Innovation to Bring New Technologies and Products HDL - 64E HDL - 32E VLP - 16 (Puck Series) VLP - 32 (Ultra Puck Series) VLS - 128 (Alpha Prime) VelaDome Announced Future Products Vella TM Software Velarray Velabit Sensors are Ruggedized and Leverage Tightly Integrated Hardware and Software Solutions Software

Page 11 | Margin Expansion Through Increasing Software Content Vella ™ Software + Low Cost Velabit for cost efficient, highly profitable ADAS Software s olutions power the Vela Family of lidar products, designed for automotive ADAS applications ▪ Velodyne acquired Mapper.ai with 25 engineers in 2019. ▪ Auto Pilot, Collision Avoidance, Pedestrian Automotive Emergency Braking, and more available in 2020. ▪ ADAS applications enabled by the Vela Family of products and solutions contribute to roughly half of our current contracts. ▪ Multiple OEMs are in development on Velodyne ADAS projects, with initial deliverables in 2020 . ▪ High margin software subscriptions on broad installed base and IP licensing are expected to drive incremental revenues and profitability. Vella TM Collision Warning System

Page 12 | Our Investments Drive Gross Margin Expansion at Scale Fully automated wafer - scale lidar manufacturing processes Micro - L idar Arrays and custom ASICs enable mass production at lower unit cost Partnerships add capacity and opportunity for higher margins Established low cost production in Thailand Transitioning Q3’20 Completed Transition Technology Miniaturization Manufacturing Partnerships Overseas Production Proprietary Manufacturing IP (NYSE: FN) (TSE: 7731) (NYSE: VNE) Velarray VLP - 16

Page 13 | Global Manufacturing Capacity to Address Growing Demand San Jose, USA Sendai, Japan Chonburi, Thailand

Page 14 | ADAS & other applications comprise majority of revenue Autonomous Vehicles (AV) Advanced Driver Assistance Systems (ADAS) Robotics and Industrial Mapping Shuttles Smart City Delivery Autonomous Vehicles (AV) Robotics and Industrial Mapping Highly affordable Many form factors Proven durability Many applications Lidar Today 2017 Today Very expensive Limited form factors Developing durability Limited applications Lidar 2017 $ $ $ $ We Are Much More than an Autonomous Vehicle Company

Page 15 | Highly Diversified Projects Across Industries ____________________ Note: The chart above reflects a visual representation of how we believe the market is developing based on multi - year commercial demands that we currently see from customers and is not indicative of projected revenue or unit shipment. Signed and awarded co ntracts represent agreed terms and conditions of supply, but do not reflect firm orders unless and until purchase orders are received . T o date, shipments under and revenue from these signed contracts have not been material. Based on data as of June 1, 2020 . (Chart represents sensor units ) (Stages of projects shown in the above table vary from signed / awarded phase to pre - RFI phase) Number of Projects Advanced Driver Assistance Systems (ADAS) 58 Autonomous Vehicles (AV) 35 Delivery 11 Mapping 10 Robotics & Industrial 34 Shuttles 11 Smart City 6 Total 165 165 Projects Could Potentially Yield a Total of ~8M Units Shipped by 2025 ADAS AV Delivery Mapping Smart City Shuttles 2020 2021 2022 2023 2024 2025

Page 16 | ▪ Technology differentiation ▪ Long - term contracted volume arrangements ▪ Lengthy and rigorous validation process Barriers to Entry: Robust Durability of Installed Customer Base A ▪ High switching costs Why We Have a Sticky Customer Base C D Request for Information (RFI) Request for Quotation (RFQ) Production Contract Our Commitment in Platform Development Drives Customer Loyalty B

Page 17 | Demand Curve Reflects a Growing Market Opportunity Velodyne is currently in the process of negotiating RFIs , RFQs, and long - term contracts with many customers. The below pipeline only reflects identified projects as of June 1, 2020 . $7Bn+ Cumulative Revenue Opportunity (2020 – 2025) (Chart represents sensor units ) RFQ RFI Pre - RFI Signed/Awarded ____________________ Note: The chart above reflects a visual representation of how we believe the market is developing based on multi - year commercial demands t hat we currently see from customers and is not indicative of projected revenue or unit shipment. (1) Signed and awarded contracts represent agreed terms and conditions of supply, but do not reflect firm orders unless and until purcha se orders are received. To date, shipments under and revenue from these signed contracts have not been material. Based on data a s o f June 1, 2020 . (2) Additional Pipeline includes RFQ, RFI, and Pre - RFI projects. Pre - RFI projects are defined as i ) a particular sensor and/or sensor set for a project has been identified, ii) the goal for a particular project has been ide nti fied, iii) pricing and the future ASP have been discussed, iv) an approximate volume growth over the next 2 - 5 years has been discussed and identified and v) multiple meetings have taken place regarding the project with several technical discussion. T her e can be no assurance that any pre - RFI projects will result in significant future unit sales within any specific time frame, if at all . (3) $7 billion+ represents estimated cumulative revenue opportunities inclusive of our signed and awarded contracts and current a ddi tional pipeline. 165 Projects In Funnel (2) (3) 2020 2021 2022 2023 2024 2025 Number of Current Contracts / Pipeline Signed / Awarded 16 Additional Pipeline 149 Total 165 January 2019 1 January 2020 3 June 2020 16 Signed & Awarded Progression

Page 18 | Velodyne Believes It Is Well - Positioned to Capture Growth Win Additional Commercialization Contracts Capitalize on Regulatory and End Customer Demands for Transportation Safety Develop Licensing Opportunities Penetrate High Volume Markets Expand Manufacturing Partnerships Expand Global Customer Base and Channel Relationships Expand Software Offerings Pursue Acquisitions Vella TM

Page 19 | Velodyne’s Competitive Moats High switching cost as customers spend years and millions of dollars developing and validating solutions around Velodyne’s technology, including system design and software development Automated manufacturing techniques, deployed at high - quality manufacturing partners, drive down costs and expand our TAM at high margins and scale Technology, products and manufacturing methods protected by comprehensive global patent portfolio One - stop source for all machine vision needs across broad end - market applications Public currency and well - capitalized balance sheet will enable us to drive selective industry consolidation and further differentiate us from competitors 1 5 3 2 4 1 2 5 3 4 Entrenched Customer Relationships Driving ASP Reductions Defendable IP Portfolio Diverse Product Portfolio Access to Capital

Page 20 | Strong And Experienced Public Company Leadership David Hall Founder & Executive Chairman Rick Tewell Chief Operating Officer Drew Hamer Chief Financial Officer Dr. Anand Gopalan Chief Executive Officer Mike Jellen Chief Customer Officer Marta Thoma Hall Chief Marketing Officer James Graf Chief Executive Officer of Graf Industrial Michael Dee President and Chief Financial Officer of Graf Industrial

Financial Summary

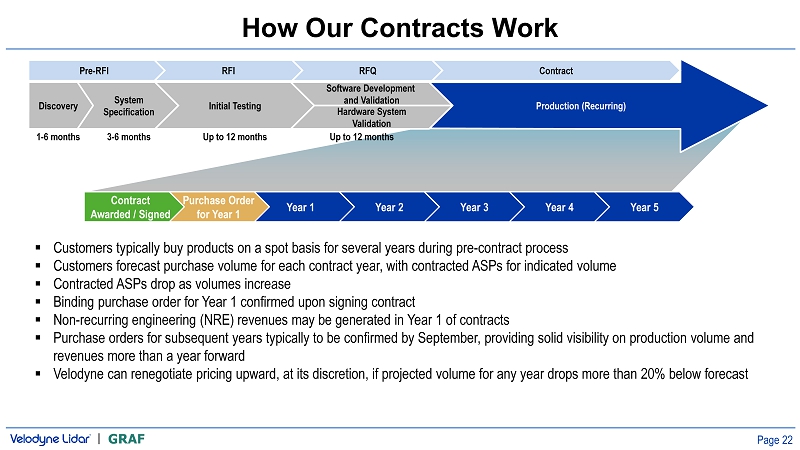

Page 22 | How Our Contracts Work 3 - 6 months 1 - 6 months Discovery Up to 12 months Initial Testing Up to 12 months Production (Recurring) Year 1 Year 2 Year 3 Year 4 Year 5 Pre - RFI RFI Software Development and Validation Hardware System Validation RFQ ▪ Customers typically buy products on a spot basis for several years during pre - contract process ▪ Customers forecast purchase volume for each contract year, with contracted ASPs for indicated volume ▪ C ontracted ASPs drop as volumes increase ▪ Binding purchase order for Year 1 confirmed upon signing contract ▪ Non - recurring engineering (NRE) revenues may be generated in Year 1 of contracts ▪ Purchase orders for subsequent years typically to be confirmed by September, providing solid visibility on production volume and revenues more than a year forward ▪ Velodyne can renegotiate pricing upward, at its discretion, if projected volume for any year drops more than 20% below forecast System Specification Purchase Order for Year 1 Contract Awarded / Signed Contract

Page 23 | Projected Revenue ($mm) Application 2020 2021 2022 2023 2024 Last Mile Delivery (1) $9.3 $26.4 $75.5 $150.0 $149.3 RoboTaxi 15.5 14.3 33.4 96.0 123.5 ADAS 5.4 7.6 17.7 47.0 53.2 Shuttles 1.9 2.9 3.5 Mapping 0.6 0.9 0.8 Robotics 0.2 0.4 0.9 Smart City 0.2 0.6 0.6 Total Signed & Awarded (16 Contracts) $33.1 $53.0 $132.4 $293.0 $326.0 % of Projected Revenue 32.6% 34.9% 53.1% 71.1% 47.7% Projected Total Revenue $101.7 $152.0 $249.4 $412.1 $684.1 Summary of Multi - Year Contracts ____________________ Note: A warded multi - year contracts represent agreed terms and conditions of supply, but do not reflect firm orders unless and until purchase o rders are received. (1) One customer accounts for $316.3mm in cumulative projected revenue between 2020 and 2024. Number of Signed and Awarded Contracts January 2019 1 January 2020 3 June 2020 16

Page 24 | Product Mix Trend By Revenue Surround - View Lidar (4) Services License, Subscription Vela Family % Product Mix Trend By Revenue Revenue Detail ____________________ Note: 2020 and beyond are estimates of potential revenue opportunities. (1) Net Sales Revenue adjusted for one - time customer refund $4.1mm. Full Year US GAAP Net Revenue is $101.4mm . (2) Includes sales from multi year agreements plus software and subscription revenue for 2021 - 2024. (3) Includes sales that are not part of a multi year agreement, generally spot buys used for development of new programs. (4) Includes VLS - 128, HDL - 64, VLP - 32, HDL - 32 and VLP - 16. (1) FY17 FY18 FY19 FY20E FY21E FY22E FY23E FY24E $182.1 $142.9 $105.5 $101.7 $152.0 $249.4 $412.1 $684.1 FY2017 FY2018 FY2019 FY2020E FY2021E FY2022E FY2023E FY2024E Pre - Production Spot Buys (3) Commercial Revenue (2) Weighted ASP ($) ~$17,900 ~$10,800 ~$7,100 ~$5,200 ~$3,800 ~$1,000 ~$700 ~$600 ASP reduction proactively driven by Velodyne to drive lidar adoption ($ in mm)

Page 25 | Velodyne Forecasts Positive EBITDA and FCF in FY22 EBITDA % of Revenue EBITDA (1) ($ in mm) ($ in mm) Free Cash Flow % of Revenue ($55.7) ($52.0) ($7.5) $15.5 $56.7 $148.8 (52.8%) (51.2%) (4.9%) 6.2% 13.8% 21.8% FY19 FY20E FY21E FY22E FY23E FY24E ($48.5) ($85.6) ($4.1) $6.6 $29.9 $103.7 (45.9%) (84.2%) (2.7%) 2.6% 7.3% 15.2% FY19 FY20E FY21E FY22E FY23E FY24E Free Cash Flow (2) ____________________ (1) EBITDA defined as Operating Income plus Depreciation & Amortization. Please reference page titled, “Reconciliation of Non - GAAP Financials” in the back of this presentation (2) Free Cash Flow defined as Cash Flow from Operations minus Capital Expenditures. Please reference page titled, “Reconciliation of Non - GAAP Financials” in the back of this presentation.

Page 26 | Our Investments Drive Gross Margin Expansion at Scale Gross Margin Projections How We Expect to Realize This Expansion B Fully automated wafer scale lidar manufacturing processes A MLA and custom ASICs enable mass production at lower unit costs C Partnerships add capacity and opportunity for higher margins D Established low cost production in Thailand Transitioning Q3’20 Completed Transition E Purpose - built software to drive further margin expansion Vella TM E ($ in mm) $33.8 $32.0 $70.6 $125.6 $219.5 $395.3 32.1% 31.5% 46.4% 50.4% 53.3% 57.8% 17.6% 20.7% 40.1% 43.0% 44.5% 45.6% FY19 FY20E FY21E FY22E FY23E FY24E D Gross Profit Total Gross Margin Sensor Gross Margin

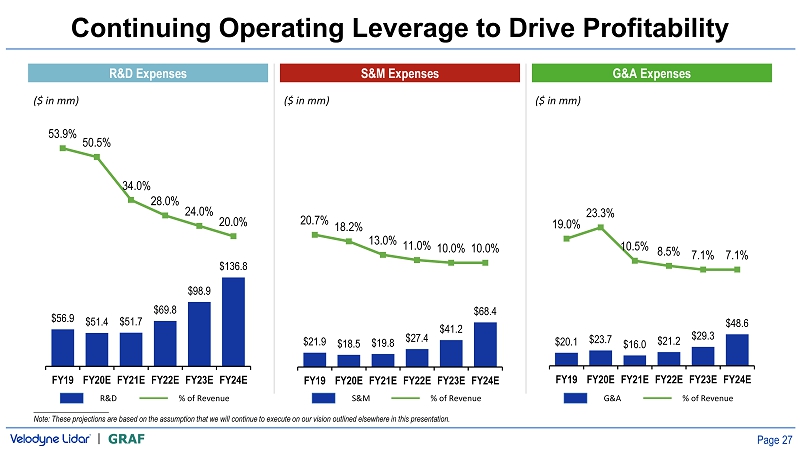

Page 27 | $56.9 $51.4 $51.7 $69.8 $98.9 $136.8 53.9% 50.5% 34.0% 28.0% 24.0% 20.0% FY19 FY20E FY21E FY22E FY23E FY24E $20.1 $23.7 $16.0 $21.2 $29.3 $48.6 19.0% 23.3% 10.5% 8.5% 7.1% 7.1% FY19 FY20E FY21E FY22E FY23E FY24E $21.9 $18.5 $19.8 $27.4 $41.2 $68.4 20.7% 18.2% 13.0% 11.0% 10.0% 10.0% FY19 FY20E FY21E FY22E FY23E FY24E Continuing Operating Leverage to Drive Profitability R&D % of Revenue R&D Expenses S&M Expenses G&A Expenses S&M % of Revenue G&A % of Revenue ($ in mm) ($ in mm) ($ in mm) ____________________ Note: These projections are based on the assumption that we will continue to execute on our vision outlined elsewhere in this pr esentation.

Transaction Overview and Validation

Page 29 | Detailed Transaction Overview ____________________ Note: Dollars in millions. (1) Assumes pro forma net cash of $200mm consisting of current net cash of $8mm and cash to the balance sheet of $192mm. (2) Sources and uses percentages do not match ownership percentages as a result of assumption of shares trading at $10.25. (3) Assumes no redemption of public shares, balance as of 5/28/2020 . Illustrative Pro Forma Valuation Illustrative Sources and Uses Pro Forma Ownership @ $10.25 / Share Key Transaction Terms ▪ $200mm minimum cash proceeds inclusive of PIPE proceeds and transaction expenses ▪ At least $150mm in PIPE commitments before transaction announcement ▪ Additional shares to be granted under an earnout to current Velodyne owners and SPAC founders (2 million and 275K, respectively), if the stock trades at or above $15 per share for 20 out of 30 trading days at any time before 6 months following completion of the business combination SPAC Shares 6.6% Founder Shares 1.3% PIPE Equity 8.7% Seller Rollover 83.3% Sources $ % Shares Seller Rollover $1,472 83.5% 143.576 Additional PIPE Equity 150 8.5% 15.000 SPAC Cash in Trust (3) 117 6.7% 11.455 Founder Shares 24 1.3% 2.300 Total Sources $1,763 100.0% 172.331 Uses $ % Seller Rollover $1,472 83.5% Cash to Balance Sheet 192 10.9% Cash to Velodyne Shareholders 50 2.8% Estimated Fees & Expenses 25 1.4% Founder Shares 24 1.3% Total Uses $1,763 100.0% Velodyne Illustrative Share Price $10.25 Pro Forma Shares Outstanding 172.331 Pro Forma Equity Value $1,766 (-) Assumed Pro Forma Net Cash (1) (200) Pro Forma Enterprise Value $1,566 Transaction Multiple Metric EV / 2024E Revenue $684 2.3x (2)

Page 30 | Who We Compare To (And Who We Don't) Computing Platforms Vision - Based Software - Rich Solutions Disruptive AutoTech Players Redundancy is increasingly recognized as essential to road safety Lidar is becoming a standard feature for ADAS and AV Lidar serves as a primary modality of machine perception We are a pure - play vision provider Our products enable a breadth of solutions across end markets We are creating an ecosystem around our software - embedded hardware Legacy Tier 1s End markets limited to automotive Limited technological innovation

Page 31 | Operational Benchmarking ____________________ Source: FactSet and CapIQ . Market data as of July 1, 2020. Note: Mobileye pre - announcement unaffected trading price as of March 10, 2017. 13.8% 21.8% 42.5% 30.7% 56.6% 5.8% 26.2% 15.9% 15.6% 11.9% 6.6% (12.5%) VELODYNE VELODYNE NVDA XLNX MBLY AMBA MELE-BE CREE TSLA PLUG NKLA BLDP 65.2% 66.0% 17.2% 7.3% 46.5% 12.5% 128.1% 41.1% 32.2% 31.9% 21.0% 14.2% VELODYNE VELODYNE NVDA XLNX MBLY AMBA NKLA TSLA PLUG BLDP MELE-BE CREE 53.3% 57.8% 68.5% 66.6% 75.3% 60.3% 40.9% 34.4% 25.3% 22.3% 20.8% 17.9% VELODYNE VELODYNE XLNX NVDA MBLY AMBA MELE-BE CREE BLDP NKLA TSLA PLUG (CY2023E) (CY2024E) (CY2023E) (CY2024E) Median : 12.3% Median: 29.5% Median: 32.0% Median: 36.6% Median: 31.2% Median : 13.8% (CY2018E) (CY2018E) (CY2023E) (CY2024E) Median: 67.5% Median: 67.8% Median: 23.8% (CY2018E) YoY Revenue Growth Gross Profit Margin EBITDA Margin (CY2024E) (CY2024E) (CY2024E) Computing Platforms Vision - Based Software - Rich Solutions Disruptive AutoTech Players Overall Median: 26.4% Overall Median: 37.7% Overall Median: 15.8% All metrics reflect CY2021E unless otherwise noted

Page 32 | 27.62x 10.52x 31.64x 21.80x 83.87x 26.06x 89.77x 40.70x 35.65x 19.77x NM NM VELODYNE VELODYNE NVDA XLNX AMBA MBLY PLUG TSLA CREE MELE-BE BLDP NKLA 0.06x 0.03x 0.92x 0.78x 0.39x 0.32x 0.75x 0.40x 0.33x 0.25x 0.15x 0.08x VELODYNE VELODYNE XLNX NVDA AMBA MBLY BLDP CREE PLUG MELE-BE TSLA NKLA 3.80x 2.29x 13.43x 6.70x 14.76x 4.83x 23.92x 10.72x 7.37x 6.35x 5.67x 5.18x VELODYNE VELODYNE NVDA XLNX MBLY AMBA BLDP PLUG NKLA TSLA CREE MELE-BE Valuation Benchmarking ____________________ Source: FactSet and CapIQ . Market data as of July 1, 2020. Note: Assumes Velodyne Pro Forma Enterprise Value of $1.566bn. Mobileye pre - announcement unaffected trading price as of March 10, 2017. (1) Represents an EV / EBITDA of 111.66x. (CY2023E) (CY2024E) (CY2023E) (CY2024E) Median: 10.07x Median : 9.79x Median: 6.86x Median : 0.85x Median : 0.35x Median : 0.29x Median: 26.72x Median : 38.18x (CY2018E) Median: 54.96x (CY2023E) (CY2024E) (CY2018E) (CY2024E) (CY2024E) (CY2024E) (1) (CY2018E) Overall Median: 7.04x Overall Median: 0.36x Overall Median: 33.65x EV / Revenue EV / Revenue / Growth EV / EBITDA Computing Platforms Vision - Based Software - Rich Solutions Disruptive AutoTech Players All metrics reflect CY2021E unless otherwise noted

Page 33 | Transaction Priced At A Discount To Peer Multiples ____________________ Note: Figures in bar charts represent current enterprise value. Dollars in millions . ▪ Applies a range of 5.00x – 9.00x multiples to Velodyne’s 2024E Revenue to arrive at an Implied F uture Enterprise Value. That Future Enterprise Value is discounted 3 years back to today to arrive at an Implied Current Enterprise Value. ▪ The applied range of multiples is centered around the median of Velodyne’s peer group (7.04x), with sensitivity built in on both the high and low ends. ▪ 2024E projected financial based valuation is the appropriate approach given the contracted nature of Velodyne’s revenue in the future. $1,566 $3,420 $1,979 $6,156 $3,563 Implied Future Enterprise Value Implied Discounted Enterprise Value Post-Money Enterprise Value 2.29x 2024E Revenue Implied EV Based on Comparable Companies’ Current Trading Valuations ~45% Discount Transaction Value ~65% Discount Summary of Approach 5.00x – 9.00x 2024E Revenue Discount Rate: 20% 5.00x – 9.00x 2024E Revenue ($ in mm)

Page 34 | Thank You!

Page 35 | Reconciliation of Non - GAAP Financials EBITDA Free Cash Flow ($ Million) FY17A FY18A FY19A FY20E FY21E FY22E FY23E FY24E GAAP Operating Income $24.8 ($56.2) ($69.0) ($63.9) ($16.8) $7.2 $50.1 $141.5 Customer Refund $0.0 $0.0 $4.1 $0.0 $0.0 $0.0 $0.0 $0.0 Restructuring Costs $0.0 $0.0 $0.0 $2.4 $0.0 $0.0 $0.0 $0.0 Depreciation & Ammortization $3.4 $7.9 $9.3 $9.5 $9.3 $8.3 $6.6 $7.3 EBITDA $28.2 ($48.3) ($55.7) ($52.0) ($7.5) $15.5 $56.7 $148.8 ($ Million) FY17A FY18A FY19A FY20E FY21E FY22E FY23E FY24E Cash Flow from Operations ($12.6) ($30.5) ($43.2) ($82.5) ($0.1) $12.6 $37.9 $111.7 Capital Expenditures $18.1 $6.9 $5.2 $3.1 $4.0 $6.0 $8.0 $8.0 Free Cash Flow ($30.7) ($37.4) ($48.5) ($85.6) ($4.1) $6.6 $29.9 $103.7