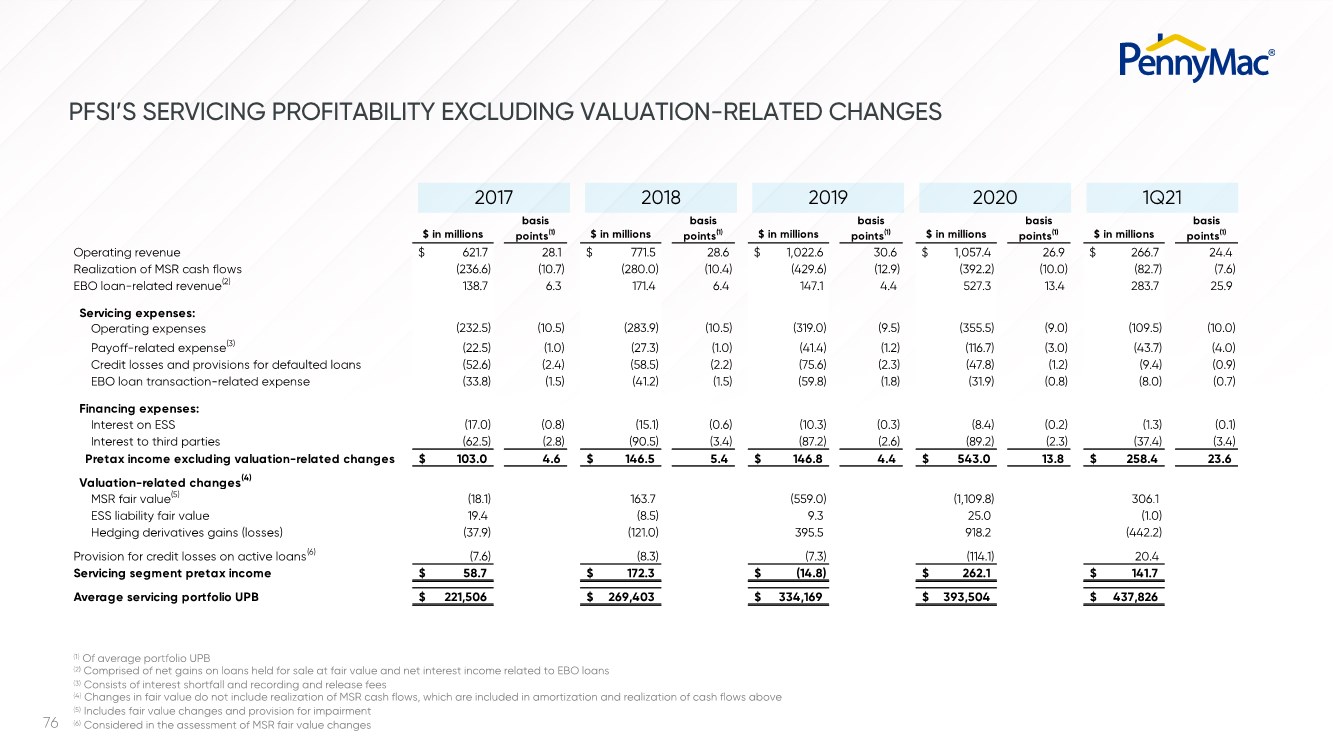

| 2 This presentation contains information from PennyMac Financial Services, Inc.’s (“PFSI”) and PennyMac Mortgage Investment Trust’s (“PMT”) joint investor day held on June 17, 2021 (collectively, “PennyMac,” “our” or “we”) and contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding PFSI’s and PMT’s beliefs, estimates, projections and assumptions with respect to, among other things, financial results, operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “project,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein and from past results discussed herein. These forward-looking statements include, but are not limited to, statements regarding the future impact of COVID-19 on our business and financial operations, loan originations and servicing, production, loan delinquencies and forbearances, servicing advances requirements and other business and financial expectations. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: our exposure to risks of loss and disruptions in operations resulting from adverse weather conditions, man-made or natural disasters, climate change and pandemics such as COVID-19; the continually changing federal, state and local laws and regulations applicable to the highly regulated industry in which we operate; lawsuits or governmental actions that may result from any noncompliance with the laws and regulations applicable to our businesses; the mortgage lending and servicing-related regulations promulgated by the Consumer Financial Protection Bureau and other regulatory bodies; our dependence on U.S. government-sponsored entities and changes in their current roles or their guarantees or guidelines; volatility in the debt or equity markets, the general economy or the real estate finance and real estate markets; changes in general business, economic, market, employment and domestic and international political conditions, or in consumer confidence and spending habits from those expected; the concentration of credit risk; the degree and nature of competition; the degree to which our hedging strategies may or may not protect against interest rate volatility; the effect of the accuracy of or changes in the estimates made about uncertainties, contingencies and asset and liability valuations when measuring and reporting upon our financial condition and results of operations; changes to government mortgage modification programs; licensing and operational regulatory requirements applicable to our business, to which bank competitors are not subject; foreclosure delays and changes in foreclosure practices; difficulties inherent in growing loan production volume; difficulties inherent in adjusting the size of our operations to reflect changes in business levels; purchase opportunities for mortgage servicing rights and our success in winning bids; our substantial amount of indebtedness; expected discontinuation of LIBOR; increases in loan delinquencies and defaults; maintaining sufficient capital and liquidity including compliance with financial covenants; unanticipated increases or volatility in financing and other costs, including changes in interest rates; our obligation to indemnify third-party purchasers or repurchase loans if loans that we originate, acquire, service or assist in the fulfillment of, fail to meet certain criteria or characteristics or under other circumstances; decreases in management and incentive fees; conflicts of interest in allocating our services and business opportunities between PFSI and PMT and their affiliates; limitations imposed on PMT’s ability to satisfy complex rules for it to qualify as a REIT for U.S. federal income tax purposes and qualify for an exclusion from the Investment Company Act of 1940 and the ability of certain of PMT’s subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal income tax purposes; the effect of public opinion on our reputation; our ability to effectively identify, manage, monitor and mitigate financial risks; our initiation or expansion of new business and investment activities or strategies; our ability to detect misconduct and fraud; our ability to maintain appropriate internal control over financial reporting; our ability to mitigate cybersecurity risks and cyber incidents; our ability to pay dividends; and our organizational structure and certain requirements in our charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by PFSI and PMT with the Securities and Exchange Commission from time to time. PFSI and PMT undertake no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation. This presentation also contains financial information calculated other than in accordance with U.S. generally accepted accounting principles (“GAAP”), such as pretax income excluding valuation items that provide a meaningful perspective on PFSI’s business results since it utilizes this information to evaluate and manage the business. Non-GAAP disclosure has limitations as an analytical tool and should not be viewed as a substitute for financial information determined in accordance with GAAP. FORWARD-LOOKING STATEMENTS |