UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23368

1WS Credit Income Fund

(Exact name of registrant as specified in charter)

299 Park Avenue, 25th Floor

New York, New York 10171

(Address of principal executive offices)

Kurt A. Locher

Chief Executive Officer

c/o 1WS Credit Income Fund

299 Park Avenue, 25th Floor

New York, New York 10171

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (212) 377-4810

Date of fiscal year end: October 31

Date of reporting period: October 31, 2021 – October 31, 2022

Item 1. Reports to Stockholders.

Table of Contents

| Fund Commentary | 1 |

| Consolidated Schedule of Investments | 8 |

| Consolidated Statement of Assets and Liabilities | 17 |

| Consolidated Statement of Operations | 18 |

| Consolidated Statement of Changes in Net Assets | 19 |

| Consolidated Statement of Cash Flows | 20 |

| Consolidated Financial Highlights | 22 |

| Notes to Consolidated Financial Statements | 24 |

| Report of Independent Registered Public Accounting Firm | 37 |

| Approval of Investment Advisory Agreement | 38 |

| Additional Information | 40 |

| Trustees and Officers | 41 |

| Privacy Policy | 43 |

| 1WS Credit Income Fund | Fund Commentary |

October 31, 2022 (Unaudited)

The 1WS Credit Income Fund (the “Fund”) is a closed-end interval fund launched in March 2019. As of October 31, 2022, the Fund has gross assets under management of approximately $165 million (approximately $112 million net assets). The Fund is a non-diversified, closed-end investment management company. Its investment objective is to seek attractive risk-adjusted total returns through generating income and capital appreciation by investing primarily in a wide array of predominantly structured credit and securitized debt instruments.

Overview:

Market volatility has defined the investment landscape in 2022, as investors grapple with the implications of an aggressive Fed attempting to slow aggregate demand to contain multi-decade high inflation. Market expectations of the future Fed Funds target rate have steadily increased throughout the year. As a result of the sharp increase in interest rates, market prices across equities, sovereign debt, and fixed income credit have all cheapened in 2022. Year-to-date losses across most sectors are now largely double digits resulting from higher nominal yields and higher market and credit risk premia across sectors.

While much of the market price declines are the result of higher interest rates, in our opinion, risk premia have also increased reflecting higher realized and implied market volatility as well as increasing credit risk across most sectors. Fed activity has lowered near-term growth expectations and many economists have increased their expected probability of a U.S. recession over the coming year. Consequently, credit spreads have widened across fixed-income sectors, lower-rated credits have generally under- performed, on both a nominal and duration-adjusted basis. Rising yields and wider credit spreads have resulted in many fixed income securities now offering among the highest all-in yields since the global financial crisis (GFC), in our opinion.

While fundamental uncertainty has increased, we believe we are starting from a solid base and that aggregate credit fundamentals remain robust across the majority of sectors backing structured credit. We believe that consumer credit fundamentals, in aggregate, are much stronger today than leading up to the global financial crisis (GFC), for instance. Consumer balance sheets were strong prior to COVID, and have continued to improve. Total debt-to-equity ratios are currently near 12%, down from 24% prior to the GFC. Coverage ratios (disposable personal income to total debt payments) are currently near record highs, while they were at record lows prior to GFC. We do, however, expect consumer delinquencies, and losses to rise from the significant relative outperformance we observed during COVID (relative to Pre-COVID expectations). We also expect to see weaker headline performance in many consumer assets based on the quality of the underlying assets and borrower credit characteristics. This has created an environment in which investor expectations of future performance can differ greatly depending on level and sophistication of underwriting. In our opinion, high-level evaluation of historical performance is flawed unless one can identify changes in specific loan-level characteristics and portfolio composition that can affect future performance trends.

| Annual Report | October 31, 2022 | 1 |

| 1WS Credit Income Fund | Fund Commentary |

October 31, 2022 (Unaudited)

| Net Return Performance as of 10/31/22* | | | |

| | MTD | Calendar

YTD | ITD

(3/4/19) |

| 1WS Credit Income Fund (OWSCX) Class I shares | -0.74% | -3.96% | 20.87% |

| 1WS Credit Income Fund (OWSAX) Class A-2 shares | -0.80% | -4.43% | 17.86%** |

| Bloomberg U.S. Aggregate Bond Index1 | -1.30% | -15.72% | -3.78% |

| ICE BofAML U.S. High Yield Index2 | 2.85% | -12.19% | 5.62% |

| * | OWSCX and OWSAX returns are presented net of all fees and expenses, benchmark returns are gross. Please see pp. 5-6 for important disclaimers. |

| ** | OWSAX returns prior to May 2021 reflect the performance of Class I shares, adjusted to reflect the distribution and shareholder servicing fees applicable to Class A2 shares. Additional information on the relevance of Class I performance prior to May 2021 is available upon request by calling the client service number provided at the bottom of this page. Class A2 shares are subject to an upfront sales load of up to 3%, which is not reflected in the returns shown above and, if applied, would lower such returns. |

Management Fee: under the Advisory Agreement will be calculated at an annual rate of 1.50% of the daily gross assets of the Fund. "Gross Assets" means the total assets of the Fund prior to deducting liabilities. Derivatives will be valued at market value for purposes of determining "Gross Assets" in the calculation of management fees.

Because the Management Fee is based on the Fund's daily gross assets, the Fund's use of leverage, if any, will increase the Management Fee paid to the Adviser. For the initial year of the Fund, the Adviser voluntarily agreed to reduce the Management Fee to .75%. For the one-year period beginning on March 1, 2020, and continuing through the present, the Adviser has voluntarily agreed to reduce the Management Fee to 1.25% of the Fund’s daily gross assets. The Adviser’s board is under no obligation to continue the fee waiver but may continue to do so.

| 1,2 | Please refer to the risk disclosures and definitions on pp. 5-6 for a description of the benchmark indices chosen and the risks associated with comparing 1WS Credit Income Fund returns to those of an index. Investors cannot invest directly in an index. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (833) 834-4923 or visiting www.1wscapital.com. Investors cannot invest directly in an index. All performance shown assumes reinvestment of dividends and capital gains distribution in percent value. Dividends are not guaranteed and will constitute a return of capital if dividend distributions exceed current-year earnings. Please refer to the Fund’s most recent Section 19(a) notice for an estimate of the composition of the Fund’s most recent distribution, available at www.1WSCapital.com.

| 1WS Credit Income Fund | Fund Commentary |

October 31, 2022 (Unaudited)

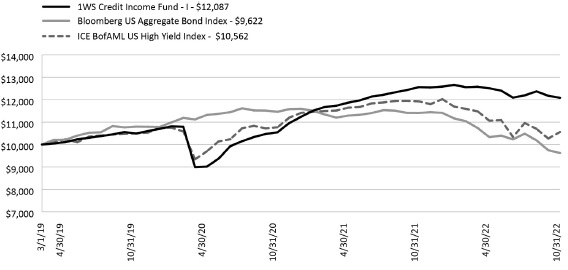

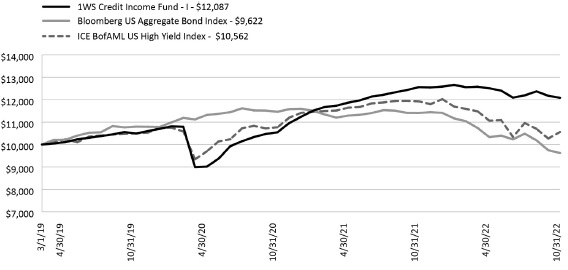

Comparison of the Change in Value of a $10,000 Investment

The chart above assumes an initial investment of $10,000 made on March 4, 2019 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or share repurchases. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced.

Portfolio Composition1 and Net Return Attribution2

| Asset Type | Portfolio

Composition

10/31/2022 | Net Return

Attribution

Calendar YTD |

| Asset-Backed Securities (ABS) | 28.2% | -0.46% |

| Collateralized Loan Obligations (CLOs) | 16.1% | -1.83% |

| Commercial Mortgage-Backed Securities (CMBS) | 19.1% | -0.19% |

| European ABS & RMBS | 15.8% | -2.63% |

| Residential Mortgage-Backed Securities (RMBS) | 20.8% | -2.43% |

| Other | – | 1.92% |

| Interest Rate Hedges | – | 4.16% |

| Total | 100.0% | -1.46% |

| 1 | The Portfolio Composition as of 10/31/22 differs from the portfolio composition for any point prior to such date and is subject to change at any time. Calculation details based on gross data are available by calling the customer service number on page 5. |

| 2 | Net return attribution represents portfolio PnL by sector divided by the Fund’s average net asset value for the period reduced by operating expenses and management fee allocated to the sectors based on the market value of the portfolio for the period. |

| Annual Report | October 31, 2022 | 3 |

| 1WS Credit Income Fund | Fund Commentary |

October 31, 2022 (Unaudited)

Portfolio Activity:

With a continued challenging investment environment across capital markets in 2022, we believe the Fund has benefited from a number of targeted exposures and investment strategies we have focused on throughout the year. We have sought to limit market risk exposure while attempting to capitalize on the increase in market volatility through more active relative value trading. We have also sought to favor short-duration fundamental credit profiles when underwritten valuations were supported under deteriorating and stressed economic assumptions. We believe many of our fundamental credit profiles are more seasoned exposures that have already experienced credit deleveraging and are less sensitive to future fundamental uncertainty.

Residential Credit is increasingly a topic of interest given the sharp increase in mortgage interest rates and subsequent decline in housing sales activity in 2022. While acknowledging the potential for future deterioration in mortgage credit fundamentals, we believe we are starting from a solid base with a much stronger outlook today than leading up to the GFC, for instance. We believe the outstanding residential mortgage sector is currently supported by strong consumer balance sheets, recent strength in home price appreciation, and strong borrower credit, with limited mortgage lending to lower-tier credit borrowers following the GFC. We continue to look for opportunities within the seasoned residential mortgage sector. Despite an expectation for home price appreciation (HPA) to moderate or even decline modestly as a result of higher mortgage rates, significant accrued gains in HPA over the past several years have resulted in the majority of seasoned mortgage loans now having LTVs well below the value of the home. This significant deleveraging from improving LTVs and asset coverage should improve cash-flow recoveries in legacy pools with accumulated forbearance losses. We have selectively added some exposure to credit risk-transfer (CRT) securities, given recent market dislocations. We believe these securities have been at the epicenter of the perfect storm, and their performance has been hampered by a combination of wider spreads, higher interest rates, slower prepayments, and heavy supply, in our opinion. Spreads have widened and prices have declined appreciably, in our opinion. We continue to evaluate the sector and may add incremental exposure on further weakness. We have generally favored securities higher in the capital structure, as opposed to first loss exposures, and stress-test each under a number of deteriorating fundamental credit scenarios.

While we recognize investor concerns regarding some broad sectors within commercial real estate (CRE), we believe this has actually increased the attractiveness of many CRE opportunities for fundamental property underwriters. We approach our commercial real estate investments in both the CMBS market as well as our CRE lending business as individual property underwriters. That is why we favor single-asset single-borrower (SASB) securities within CMBS. We want to be able to underwrite our exposures at the property level as opposed to having generic exposure to commercial real estate in general. This allows us to be selective in choosing property type, strength of sponsor, geography, and targeted underwriting metrics. We accomplish this by investing substantial resources in the detailed underwriting of individual assets, markets, and sponsors. Within CMBS we continue to look for opportunities within the SASB sector for short duration, generally one- to two-year max maturity, and well- covered mezzanine securities trading at what we believe to be attractive discounts. We attempt to identify situations in which, notwithstanding broader capital markets challenges or higher interest rates, we believe the underlying sponsor has a potential incentive to refinance the loan or sell the property prior to final maturity, thereby resulting in an attractive total return opportunity. We favor shorter-duration securities higher in the capital structure, where we can capitalize on the recent market repricing while limiting exposure to further spread volatility.

While investors are pricing increasing recession risks into credit sectors, we believe that many consumer ABS are supported by solid fundamentals, and robust structural features/credit support, which will continue to support solid credit performance over the intermediate term. Fundamental performance dispersion will continue to increase across portfolios with different credit characteristics (FICO, Income, LTV, etc ). Macro headwinds are affecting different segments to different degrees. In addition, one of the more attractive features of many consumer ABS is their short duration paired with rapidly deleveraging credit profiles that can be found in certain consumer ABS structures. These may limit market risk exposure and longer-term fundamental uncertainty. While consumer credit fundamentals remain relatively strong, in this environment of high inflation, higher volatility, and growing recession fears, investors are demanding greater price tiering across vintages and originators. We believe this has increased relative value opportunities for those with the requisite credit underwriting expertise to differentiate the many collateral and structural nuances across the sector. In addition to capitalizing on increased volatility to upgrade existing positions, we are presently looking for opportunities to begin adding select exposure outright or on a hedged basis relative to such other credit sectors as corporates. In all cases, we focus on underwriting securities to stressed fundamental economic scenarios, as we seek to identify the best risk-adjusted opportunities. In many cases, this is higher in the capital structure given the cheapening of spreads across the capital structure in 2022.

As in the U.S., capital market volatility has exploded in the U.K. and Europe, particularly in the U.K. following surprise fiscal and monetary policy shocks during the third quarter of 2022. European credit spreads have widened as much as 100 bps relative to those in the U.S during 2022. Compounding the increase in capital market volatility, currencies have cheapened meaningfully relative to the U.S. dollar. Of course, we seek to hedge interest rate exposure as we do across all of our portfolios, and we also hedge any non-dollar currency exposure. However, in light of economic uncertainty and rising volatility, we believe there is little risk of a rapid repricing from current levels due to the macro backdrop. Inflation and broader economic risks are, perhaps, greater in the Eurozone than in the U.S. As such, we are being selective with our portfolio trading, looking for opportunities to selectively upgrade existing positions after carefully underwriting credits in the context of a heightened risk environment. Consistent with our overall portfolio positioning, we have favored seeking to limit market risk exposure outright, and favor short-duration fundamental credit profiles when underwritten valuations are supported under deteriorating and stressed economic assumptions. Many of our fundamental credit profiles are seasoned exposures that have already experienced credit deleveraging and are less sensitive to future fundamental uncertainty.

| 1WS Credit Income Fund | Fund Commentary |

October 31, 2022 (Unaudited)

We entered 2022 with a relatively conservative approach to our CLO exposure. Our thesis was that there was a higher potential for credit risk repricing in corporate sectors relative to select structured credit profiles. In addition, when spreads are narrow and prices near par, the convexity profile is less attractive given the callability of the underlying loans. Despite having floating rate coupons and being backed by floating rate loans, leveraged loan prices have not escaped the price volatility witnessed in other credit sectors. As a result, we were generally a net seller of CLOs in 2022. Given the recent market repricing, the convexity profile has improved along with nominal spreads and yields and investment opportunities are becoming more attractive. While we have not yet begun adding exposure to the sector outright we have been actively trading CLOs in an attempt to capture relative value opportunities and upgrade existing positions. If the current market dynamic continues it could lead to interesting investment transaction opportunities. This is, essentially, the dynamic we have been setting up for.

Outlook:

Given the spread expansion across credit sectors in 2022, we believe current valuations are among the cheapest we have seen in years, and attractive investment opportunities have increased significantly. This is true up and down the capital structure, on an absolute and relative basis, creating greater future potential for excess return and optimal portfolio diversification. Credit tiering has returned to many sectors, and we believe the current investment environment favors those with deep credit underwriting experience - particularly across structured credit sectors, where the interplay between credit fundamentals and the many nuanced structural features differentiate structured credit securities. In addition to higher yields, and wider credit spreads, many outstanding securities have been marked down appreciably and now offer upside credit convexity relative to par-priced new issue securities.

That said, risk factors have increased and credit fundamentals will change as the economic outlook evolves. As a result, we believe underwriting to future potential distressed economic outcomes is critical to evaluating security-specific risks and identifying the most attractive risk-adjusted return opportunities available. In our opinion, the current environment’s increasing fundamental uncertainty has introduced even more opportunities to leverage our infrastructure to underwrite borrower and collateral fundamentals, and the many nuanced structural characteristics differentiating structured credit relative to other credit sectors. We believe investment opportunities will increasingly arise from sellers less capable of underwriting credit and structure in these uncertain times.

Investing in the Fund may be considered speculative and involves a high degree of risk, including the risk of possible substantial loss of your investment.

Prior to investing, Investors should carefully consider the investment objectives, risks, charges and expenses of the 1WS Credit Income Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (833) 834-4923 or visiting www.1wscapital.com. The prospectus should be read carefully before investing.

Net performance data are pre-tax, fund-level, net of operating expenses, management fees, and any applicable shareholder servicing and distribution fees charged to investors. Actual returns experienced by an investor may vary due to these factors, among others. Inception-to-date (ITD) Net return is a linked monthly return.

1WS Credit Income Fund is distributed by ALPS Distributors, Inc. ALPS Distributors, Inc. is not affiliated with 1WS Capital Advisors, LLC or One William Street Capital Management, L.P.

Risk Disclosures

Past performance is not a guarantee of future results. There is no assurance that the Fund will meet its investment objective.

Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire to sell in a quarterly repurchase offer. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment.

The Fund’s investments may be negatively affected by the broad investment environment in the real estate market, the debt market and/or the equity securities market. The value of the Fund’s investments will increase or decrease based on changes in the prices of the investments it holds. This will cause the value of the Fund’s shares to increase or decrease. The Fund is “non-diversified” under the Investment Company Act of 1940 and, thus, changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund’s net asset value than in a “diversified” fund. Diversification does not eliminate the risk of experiencing investment losses. The Fund is not intended to be a complete investment program.

The Fund expects most of its investments to be in securities that are rated below investment grade or would be rated below investment grade if they were rated. Below investment grade instruments or “junk securities” are particularly susceptible to economic downturns compared to higher rated investments. While the Fund may employ hedging techniques to seek to minimize interest rate risk, there can be no assurance that it will engage in such techniques at any given time or that such techniques would be successful. As such, the Fund is subject to interest rate risk and may decline in value as interest rates rise. The Fund may use leverage to achieve its investment objective, which involves risks, including the increased likelihood of net asset value volatility and the increased risk that fluctuations in interest rates on borrowings will reduce the return to investors. In addition to the normal risks associated with investing, investing in international and emerging markets involves risk of capital loss from unfavorable fluctuations in currency values, differences in generally accepted accounting principles or from social, economic or political instability in other nations. The Fund may employ hedging techniques to seek to minimize foreign currency risk.

| Annual Report | October 31, 2022 | 5 |

| 1WS Credit Income Fund | Fund Commentary |

October 31, 2022 (Unaudited)

There can be no assurance that it will engage in such techniques at any given time or that such techniques would be successful. The Fund may invest in derivatives, which, depending on market conditions and the type of derivative, are more volatile than other investments and could magnify the Fund’s gains or losses. An investment in shares should be considered only by investors who can assess and bear the illiquidity and other risks associated with such an investment.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Mortgage-backed and asset-backed securities are affected by interest rates, financial health of issuers/originators, creditworthiness of entities providing credit enhancements and the value of underlying assets. Fixed-income securities present issuer default risk. Prepayment and extension risk exists because a loan, bond or other investment may be called, prepaid or redeemed before maturity and similar yielding investments may not be available for purchase. Structured finance securities may present risks similar to those of the other types of debt obligations in which the Fund may invest and, in fact, such risks may be of greater significance in the case of structured finance securities. Investing in structured finance securities may be affected by a variety of factors, including priority in the capital structure of the issuer thereof, the availability of any credit enhancement, and the level and timing of payments and recoveries on and the characteristics of the underlying receivables, loans or other assets that are being securitized, among others. Market or other (e.g., interest rate) environments may adversely affect the liquidity of Fund investments, negatively impacting their price. Generally, the less liquid the market at the time the Fund sells a holding, the greater the risk of loss or decline of value to the Fund. See the Fund’s prospectus for information on these and other risks.

There can be no assurance that the Fund will achieve its investment objective. Many of the Fund’s investments may be considered speculative and subject to increased risk. Neither One William Street Capital Management, LP nor 1WS Capital Advisors, LLC has managed a 1940-Act registered product prior to managing the fund. Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Adviser to allocate effectively the assets of the Fund among the various securities and investments in which the Fund invests. There can be no assurance that the actual allocations or investment selections will be effective in achieving the Fund’s investment objective or delivering positive returns.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the portfolio manager disclaims any responsibility to update such views. The views expressed in this report reflect the current views of the portfolio manager as of October 31st, 2022.

There are limitations when comparing the 1WS Credit Income Fund to indices. Many open-end funds which track these indices offer daily liquidity, while closed-end interval funds offer liquidity on a periodic basis. Deteriorating general market conditions will reduce the value of stock securities. When interest rates rise, the value of bond securities tends to fall. Investing in lower-rated securities involves special risks in addition to the risks associated with investments in investment grade securities, including a high degree of credit risk. Lower-rated securities may be regarded as predominately speculative with respect to the issuer’s continuing ability to meet principal and interest payments. Analysis of the creditworthiness of issuers/ issues of lower-rated securities may be more complex than for issuers/issues of higher quality debt securities. There is a risk that issuers will not make payments, resulting in losses to the Fund. In addition, the credit quality of securities may be lowered if an issuer’s financial condition changes. Assets and securities contained within indices are different than the assets and securities contained in the 1WS Credit Income Fund and will therefore have different risk and reward profiles. An investment cannot be made in an index, which is unmanaged and has returns that do not reflect any trading, management or other costs. Please see definitions for a description of the investment indexes selected.

| 1WS Credit Income Fund | Fund Commentary |

October 31, 2022 (Unaudited)

Definitions

ABS: Asset-Backed Securities are instruments secured by financial, physical, and/or intangible assets (e.g., receivables or pools of receivables), and investments in any assets/instruments underlying the foregoing structured/secured obligations.

Basis Points (bps): A basis point is a common unit of measurement for interest rates and credit spreads and is equal to one hundredth of one percent.

Bloomberg U.S. Aggregate Bond Index: The index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency). Investors cannot invest directly in an index.

CLO: Collateralized Loan Obligations are instruments that represent debt and equity tranches of collateralized loan obligations and collateralized debt obligations.

CMBS: Commercial Mortgage-Backed Securities are fixed income instruments that are secured by mortgage loans on commercial real property.

Convexity: Convexity is a measure of the curvature, or the degree of the curve, in the relationship between bond prices and bond yields.

Credit Enhancement: Credit enhancement is a risk-reduction technique that provides protection, in the form of financial support, to cover losses under stressed scenarios.

Credit Risk Transfer (CRT) Securities: CRT securities effectively transfer a portion of the risk associated with credit losses within pools of residential mortgage loans to investors.

Debt Service Ratio: The household debt service ratio (DSR) is the ratio of total required household debt payments to total disposable income.

Duration-Adjusted: Duration-adjusted or excess return is a measure of pure credit performance for fixed-rate bonds by adjusting for movements in benchmark interest rates.

FICO: The Fico Score is used by lenders to help make accurate, reliable, and fast credit risk decisions across the customer lifecycle.

Financial Obligation Ratio: The financial obligation ratio is the ratio of required household debt payments to total disposable income and includes rent payments on tenant-occupied property, auto lease payments, homeowners’ insurance, and property tax payments

Floating Rate Loans: A floating rate loan has an interest rate which changes periodically based on an underlying index plus a spread.

Forbearance: The temporary suspension of loan repayments due to demonstrated financial hardship on the part of the borrower.

ICE BofAML US High Yield Master II TR Index: The index tracks the performance of US dollar denominated below investment grade rated corporate debt publically issued in the US domestic market. Investors cannot invest directly in an index.

Loan-to-Value (LTV) Loan-to-value is a measure of the size of a loan relative to the value of an asset.

Mezzanine Tranche: A mezzanine tranche within a securitization lies in the middle of the capital structure, below the senior tranche and above the junior tranche (typically an unrated equity tranche).

Non Qualified Mortgages (Non-QM): A non-qualified mortgage is a residential home loan that is not required to meet agency-standard documentation requirements as outlined by the Consumer Financial Protection Bureau (CFPB).

RMBS: Residential Mortgage-Backed Securities are securities that may be secured by interests in a single residential mortgage loan or a pool of mortgage loans secured by residential property.

Risk-Adjusted: A risk -adjusted return is a calculation of the profit or potential profit from an investment that takes into account the degree of risk that must be accepted in order to achieve it. The risk is measured in comparison to that of a risk -free investment, usually U.S. Treasuries.

Risk Premia: Risk Premia is the investment return an asset is expected to yield in excess of the risk -free rate of return.

SASB: Single Asset Single Borrower (SASB) CMBS transactions involve the securitization of a single loan (SA) or collateralized by a group of assets all owned by the same borrower (SB).

Tranche: Tranches are segments created from a pool of assets - usually debt instruments such as bonds or mortgages - that are divvied up by risk, time to maturity, or other characteristics in order to be marketable to different investors.

| Annual Report | October 31, 2022 | 7 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

| Description | | Rate | | Maturity

Date(a) | | Principal

Amount | | | Fair

Value | |

| MORTGAGE-BACKED SECURITIES (62.52%) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Residential (36.99%) | | | | | | | | | | | | |

| ACE Securities Corp. Home Equity Loan Trust, Series 2005-HE7, Class M2(b)(c) | | 1M US L + 0.69% | | 11/25/35 | | $ | 513,034 | | | $ | 419,918 | |

| ACE Securities Corp. Home Equity Loan Trust, Series 2006-OP2, Class M1(b) | | 1M US L + 0.25% | | 08/25/36 | | | 653,757 | | | | 445,928 | |

| Ameriquest Mortgage Securities, Inc., Series 2005-R6, Class M6(b) | | 1M US L + 1.73% | | 08/25/35 | | | 607,558 | | | | 452,266 | |

| APS Resecuritization Trust, Series 2014-1, Class 1M(b)(d) | | 1.48% | | 08/28/54 | | | 2,260,676 | | | | 543,467 | |

| Argent Securities, Inc. Pass-Through Certificates, Series 2005-W5, Class M1(b) | | 1M US L + 0.69% | | 01/25/36 | | | 520,946 | | | | 406,703 | |

| Banc of America Funding , Series 2007-5, Class CA8(b)(e) | | 5.35% - 1M US L | | 07/25/37 | | | 2,831,816 | | | | 263,925 | |

| Bear Stearns Mortgage Funding Trust, Series 2006-AR1, Class 1A2(b)(c) | | 1M US L + 0.50% | | 07/25/36 | | | 303,762 | | | | 320,013 | |

| Bear Stearns Mortgage Funding Trust, Series 2006-AR5, Class 2A2(b)(c) | | 1M US L + 0.23% | | 01/25/37 | | | 840,583 | | | | 751,986 | |

| Bellemeade Re 2020-3, Ltd., Series 2020-3A, Class M2(b)(c)(d) | | 1M US L + 4.85% | | 10/25/30 | | | 739,000 | | | | 747,351 | |

| Bellemeade Re, Ltd., Series 2021-1A, Class M2(b)(c)(d) | | 30D US SOFR + 4.85% | | 03/25/31 | | | 647,000 | | | | 618,726 | |

| Carrington Mortgage Loan Trust, Series 2007-FRE1, Class M1(b) | | 1M US L + 0.50% | | 02/25/37 | | | 660,535 | | | | 475,255 | |

| CIT Mortgage Loan Trust, Series 2007-1, Class 1M2(b)(c)(d) | | 1M US L + 1.75% | | 10/25/37 | | | 1,000,000 | | | | 800,100 | |

| Citicorp Residential Mortgage Trust, Series 2006-2, Class M2(c)(f) | | 5.00% | | 09/25/36 | | | 795,000 | | | | 647,527 | |

| Connecticut Avenue Securities Trust, Series 2022-R04, Class 1B1(b)(d) | | 30D US SOFR + 5.25% | | 03/25/42 | | | 500,000 | | | | 473,250 | |

| Connecticut Avenue Securities Trust, Series 2022-R05, Class 2B1(b)(d) | | 30D US SOFR + 4.50% | | 04/25/42 | | | 285,000 | | | | 257,754 | |

| Countrywide Alternative Loan Trust, Series 2005-64CB, Class 1A17 | | 5.50% | | 12/25/35 | | | 211,548 | | | | 127,965 | |

| Countrywide Alternative Loan Trust, Series 2007-17CB, Class 1A6(b) | | 1M US L + 0.50% | | 08/25/37 | | | 834,296 | | | | 400,212 | |

| Countrywide Alternative Loan Trust, Series 2007-21CB, Class 2A2(b) | | 28.40% - 1M US L | | 09/25/37 | | | 34,797 | | | | 35,764 | |

| Countrywide Alternative Loan Trust, Series 2007-21CB, Class 2A3(b) | | 1M US L + 0.50% | | 09/25/37 | | | 1,026,211 | | | | 385,137 | |

| Countrywide Alternative Loan Trust, Series 2007-21CB, Class 2A4(b)(e) | | 5.60% - 1M US L | | 09/25/37 | | | 948,586 | | | | 91,349 | |

| CWABS Asset-Backed Certificates Trust, Series 2005-2, Class M6(b) | | 1M US L + 2.03% | | 08/25/35 | | | 527,918 | | | | 434,002 | |

| CWABS Asset-Backed Certificates Trust 2006-11, Series 2006-12, Class M1(b) | | 1M US L + 0.45% | | 12/25/36 | | | 620,931 | | | | 419,314 | |

| Deutsche Alt-A Securities Mortgage Loan Trust, Series 2007-OA4, Class 2A2(b) | | 1M US L + 0.64% | | 08/25/47 | | | 529,915 | | | | 380,320 | |

| Domi BV, Series 2020-1, Class F(b)(c) | | 3M EUR L + 6.50% | | 04/15/52 | | € | 500,000 | | | | 494,817 | |

| Domi BV, Series 2020-1, Class X2(b)(c) | | 3M EUR L + 6.75% | | 04/15/52 | | | 500,000 | | | | 482,315 | |

| Domi BV, Series 2021-1, Class E(b) | | 3M EUR L + 6.50% | | 06/15/26 | | | 704,000 | | | | 563,470 | |

| Domi BV, Series 2021-1, Class X2(b) | | 3M EUR L + 6.50% | | 06/15/26 | | | 411,000 | | | | 367,869 | |

| Eagle RE, Ltd., Series 2021-1, Class M2(b)(c)(d) | | 30D US SOFR + 4.45% | | 10/25/33 | | $ | 1,393,000 | | | | 1,347,449 | |

| Fieldstone Mortgage Investment Trust, Series 2005-3, Class M2(b) | | 1M US L + 0.68% | | 02/25/36 | | | 1,626,000 | | | | 439,508 | |

| Finance Ireland Rmbs, Series 3, Class F(b) | | 3M EUR L + 4.23% | | 06/24/61 | | € | 420,000 | | | | 400,413 | |

| Finsbury Square 2021-2 PLC, Series 2021-2X, Class G(b) | | 3M SONIA IR + 5.25% | | 12/16/71 | | £ | 371,000 | | | | 407,211 | |

| First Franklin Mortgage Loan Trust, Series 2005-FF12, Class M3(b)(c) | | 1M US L + 0.75% | | 11/25/36 | | $ | 1,949,054 | | | | 1,146,044 | |

| First Franklin Mortgage Loan Trust, Series 2006-FFH1, Class M2(b) | | 1M US L + 0.60% | | 01/25/36 | | | 535,862 | | | | 451,195 | |

| Freddie Mac STACR REMIC Trust, Series 2021-HQA4, Class B1(b)(d) | | 30D US SOFR + 3.75% | | 12/25/41 | | | 588,000 | | | | 505,680 | |

| Freddie Mac STACR REMIC Trust, Series 2022-DNA2, Class M2(b)(c)(d) | | 30D US SOFR + 3.75% | | 02/25/42 | | | 714,000 | | | | 653,239 | |

| Freddie Mac STACR REMIC Trust, Series 2022-DNA3, Class B1(b)(d) | | 30D US SOFR + 5.65% | | 04/25/42 | | | 500,000 | | | | 472,800 | |

| Freddie Mac STACR REMIC Trust, Series 2022-DNA6, Class M2(b)(c)(d) | | 30D US SOFR + 5.75% | | 09/25/42 | | | 600,000 | | | | 595,500 | |

| Fremont Home Loan Trust, Series 2004-C, Class M3(b) | | 1M US L + 1.73% | | 08/25/34 | | | 21,266 | | | | 21,451 | |

| GSAA Home Equity Trust, Series 2007-8, Class A4(b) | | 1M US L + 1.20% | | 08/25/37 | | | 547,743 | | | | 277,213 | |

| GSAMP Trust, Series 2005-WMC1, Class M2(b)(c) | | 1M US L + 0.78% | | 09/25/35 | | | 728,787 | | | | 512,410 | |

| Home Equity Mortgage Trust Series INABS, Series 2005-D, Class M2(b) | | 1M US L + 0.71% | | 03/25/36 | | | 455,337 | | | | 280,533 | |

| Home RE, Ltd., Series 2022-1, Class M1C(b)(d) | | 30D US SOFR + 5.50% | | 10/25/34 | | | 500,000 | | | | 484,200 | |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

| Description | | Rate | | Maturity

Date(a) | | Principal

Amount | | | Fair

Value | |

| MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | | | | | |

| JP Morgan Mortgage Acquisition Corp., Series 2005-OPT2, Class M7(b) | | 1M US L + 2.48% | | 12/25/35 | | $ | 226,567 | | | $ | 187,915 | |

| JP Morgan Mortgage Acquisition Corp., Series 2006-FRE2, Class M3(b) | | 1M US L + 0.56% | | 02/25/36 | | | 878,996 | | | | 508,323 | |

| JP Morgan Mortgage Acquisition Trust, Series 2006-HE2, Class M2(b) | | 1M US L + 0.48% | | 07/25/36 | | | 1,088,588 | | | | 1,003,787 | |

| JP Morgan Mortgage Trust, Series 2005-A5, Class TB1(b) | | 3.28% | | 08/25/35 | | | 57 | | | | 53 | |

| Lansdowne Mortgage Securities No 1 PLC, Series 2006-1, Class M2(b)(c) | | 3M EUR L + 0.84% | | 06/15/45 | | € | 500,000 | | | | 328,988 | |

| Lehman Mortgage Trust, Series 2006-9, Class 1A5(b)(c) | | 1M US L + 0.60% | | 01/25/37 | | $ | 727,626 | | | | 445,089 | |

| Lehman Mortgage Trust, Series 2007-5, Class 6A1(b) | | 1M US L + 0.32% | | 10/25/36 | | | 731,034 | | | | 361,497 | |

| Miravet Sarl - Compartment, Series 2019-1, Class E(b)(c) | | 3M EUR L + 3.00% | | 05/26/65 | | € | 500,000 | | | | 465,663 | |

| Miravet Sarl - Compartment, Series 2020-1, Class E(b)(c) | | 3M EUR L + 4.00% | | 05/26/65 | | | 1,000,000 | | | | 959,195 | |

| Nationstar Home Equity Loan Trust, Series 2007-B, Class M2(b) | | 1M US L + 0.47% | | 04/25/37 | | $ | 1,125,006 | | | | 1,095,194 | |

| Oaktown Re VI, Ltd., Series 2021-1A, Class M1C(b)(d) | | 30D US SOFR + 3.00% | | 10/25/33 | | | 520,000 | | | | 485,368 | |

| Oaktown Re VII, Ltd., Series 2021-2, Class M1B(b)(d) | | 30D US SOFR + 2.90% | | 04/25/34 | | | 562,000 | | | | 501,360 | |

| Ownit Mortgage Loan Trust, Series 2005-4, Class M1(b)(c) | | 1M US L + 0.83% | | 08/25/36 | | | 1,110,684 | | | | 941,083 | |

| Polaris PLC, Series 2021-1, Class X2(b) | | 3M SONIA IR + 5.00% | | 12/23/58 | | £ | 336,250 | | | | 381,101 | |

| Polaris PLC, Series 2022-1, Class X2(b) | | 3M SONIA IR + 5.89% | | 10/23/59 | | | 371,000 | | | | 440,780 | |

| Polaris PLC, Series 2022-2, Class E(b) | | SONIA IR + 5.75% | | 05/23/59 | | | 795,579 | | | | 871,954 | |

| Popular ABS Mortgage Pass-Through Trust, Series 2005-5, Class MF1(f) | | 3.49% | | 11/25/35 | | $ | 395,923 | | | | 250,501 | |

| Popular ABS Mortgage Pass-Through Trust, Series 2005-D, Class M1(c)(f) | | 3.51% | | 01/25/36 | | | 390,064 | | | | 297,462 | |

| Residential Accredit Loans, Inc., Series 2006-Q05, Class 1A2(b)(c) | | 1M US L + 0.19% | | 05/25/46 | | | 879,566 | | | | 1,007,631 | |

| Residential Accredit Loans, Inc., Series 2006-QS9, Class 1A16(b)(c) | | 1M US L + 0.65% | | 07/25/36 | | | 485,375 | | | | 353,208 | |

| Residential Accredit Loans, Inc., Series 2006-QS9, Class 1A5(b)(c) | | 1M US L + 0.70% | | 07/25/36 | | | 715,576 | | | | 505,196 | |

| Residential Asset Securitization Trust, Series 2005-A15, Class 2A10(b) | | 1M US L + 0.45% | | 02/25/36 | | | 1,379,652 | | | | 462,183 | |

| Residential Mortgage Securities 32 PLC, Series 2020-32X, Class F1(b)(c) | | 3M SONIA IR + 6.50% | | 06/20/70 | | £ | 500,000 | | | | 582,977 | |

| Soundview Home Loan Trust, Series 2005-OPT4, Class M2(b)(c) | | 1M US L + 0.83% | | 12/25/35 | | $ | 683,595 | | | | 511,671 | |

| Soundview Home Loan Trust, Series 2006-OPT2, Class M1(b) | | 1M US L + 0.45% | | 05/25/36 | | | 625,084 | | | | 438,246 | |

| Stratton Mortgage Funding, Series 2021-2X, Class X(b)(c) | | 3M SONIA IR + 4.00% | | 07/20/60 | | £ | 264,577 | | | | 304,328 | |

| Stratton Mortgage Funding PLC, Series 2021-3, Class X2(b)(c) | | 3M SONIA IR + 3.50% | | 06/12/24 | | | 497,890 | | | | 569,496 | |

| Structured Asset Investment Loan Trust, Series 2005-8, Class M2(b)(c) | | 1M US L + 0.75% | | 10/25/35 | | $ | 984,544 | | | | 765,089 | |

| Structured Asset Investment Loan Trust, Series 2005-9, Class M2(b)(c) | | 1M US L + 0.68% | | 11/25/35 | | | 1,266,434 | | | | 1,021,886 | |

| Structured Asset Investment Loan Trust, Series 2006-BNC3, Class A4(b)(c) | | 1M US L + 0.31% | | 09/25/36 | | | 1,907,568 | | | | 964,848 | |

| SYON, Series 2020-2, Class E | | 6.27% | | 12/17/27 | | £ | 1,072,776 | | | | 1,240,349 | |

| Triangle Re, Ltd., Series 2021-2, Class M1C(b)(c)(d) | | 1M US L + 4.50% | | 10/25/33 | | $ | 1,545,000 | | | | 1,509,311 | |

| Twin Bridges PLC, Series 2021-1, Class X2(b) | | 3M SONIA IR + 5.00% | | 03/12/26 | | £ | 363,000 | | | | 411,835 | |

| Twin Bridges PLC, Series 2021-2, Class X2(b) | | SONIA IR + 4.40% | | 09/12/26 | | | 459,000 | | | | 501,800 | |

| Twin Bridges PLC, Series 2022-1, Class X2(b) | | 3M SONIA IR + 5.00% | | 06/12/27 | | | 377,000 | | | | 415,656 | |

| WaMu Mortgage Pass-Through Certificates, Series 2006-AR3, Class A1C(b) | | 12M US FED + 1.00% | | 02/25/46 | | $ | 342,666 | | | | 379,400 | |

| Total Residential Mortgage Backed Securities | | | | | | | | | | $ | 41,271,972 | |

| | | | | | | | | | | | | |

| Commercial (25.53%) | | | | | | | | | | | | |

| Ashford Hospitality Trust, Series 2018-KEYS, Class E(b)(c)(d) | | 1M US L + 4.15% | | 06/15/35 | | $ | 2,000,000 | | | $ | 1,857,800 | |

| Atrium Hotel Portfolio Trust, Series 2018-ATRM, Class F(b)(d) | | 1M US L + 4.00% | | 06/15/35 | | | 1,194,000 | | | | 1,107,316 | |

| BAMLL Commercial Mortgage Securities Trust, Series 2021-JACX, Class F(b)(c)(d) | | 1M US L + 5.00% | | 09/15/23 | | | 2,500,000 | | | | 2,286,250 | |

| BBCMS Mortgage Trust, Series 2021-AGW, Class F(b)(c)(d) | | 1M US L + 4.00% | | 06/15/26 | | | 2,000,000 | | | | 1,858,200 | |

| BFLD, Series 2019-DPLO, Class E(b)(d) | | 1M US L + 2.24% | | 10/15/23 | | | 2,000,000 | | | | 1,880,200 | |

| BFLD Trust, Series 2021-FPM, Class D(b)(c)(d) | | 1M US L + 4.65% | | 06/15/26 | | | 500,000 | | | | 480,400 | |

| BPR Trust, Series 2021-WILL, Class E(b)(c)(d) | | 1M US L + 6.75% | | 06/15/23 | | | 500,000 | | | | 471,300 | |

| Citigroup Commercial Mortgage Trust, Series 2013-GC17, Class D(b)(c)(d) | | 5.10% | | 11/10/23 | | | 2,000,000 | | | | 1,796,400 | |

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2022 | 9 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

| Description | | Rate | | Maturity

Date(a) | | Principal

Amount | | | Fair

Value | |

| MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | | | | | |

| Citigroup Commercial Mortgage Trust, Series 2014-GC25, Class E(c)(d) | | 3.30% | | 10/10/24 | | $ | 564,000 | | | $ | 479,626 | |

| Citigroup Commercial Mortgage Trust, Series 2016-C1, Class E(b)(c)(d) | | 4.94% | | 05/10/26 | | | 1,364,000 | | | | 1,064,738 | |

| COMM 2014-CCRE18 Mortgage Trust, Series 2014-CR18, Class E(d) | | 3.60% | | 07/15/24 | | | 1,000,000 | | | | 840,100 | |

| COMM Mortgage Trust, Series 2015-PC1, Class D(b)(c) | | 4.29% | | 06/10/25 | | | 656,000 | | | | 558,912 | |

| Commercial Mortgage Trust, Series 2014-FL5, Class KH2(b)(d) | | 1M US L + 4.50% | | 08/15/31 | | | 243,522 | | | | 227,620 | |

| CSMC, Series 2020-FACT, Class E(b)(d) | | 1M US L + 4.86% | | 10/15/25 | | | 534,000 | | | | 505,538 | |

| GS Mortgage Securities Corp. Trust, Series 2020-DUNE, Class G(b)(d) | | 1M US L + 4.00% | | 12/15/36 | | | 839,000 | | | | 787,821 | |

| J.P. Morgan Commercial Mortgage Securities Trust, Series 2017-FL11, Class E(b)(c)(d) | | 1M US L + 4.02% | | 10/15/32 | | | 134,545 | | | | 134,612 | |

| JPMBB Commercial Mortgage Securities Trust, Series 2013-C15, Class F(d) | | 3.59% | | 10/15/23 | | | 1,098,000 | | | | 978,098 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2014-C14, Class E(b)(c)(d) | | 5.06% | | 02/15/24 | | | 682,000 | | | | 635,283 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2014-C14, Class F(c)(d) | | 3.71% | | 02/15/24 | | | 500,000 | | | | 442,350 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C25, Class E(b)(c)(d) | | 4.53% | | 09/15/25 | | | 660,000 | | | | 534,534 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C25, Class G(b)(c)(d) | | 4.53% | | 09/15/30 | | | 1,500,000 | | | | 754,200 | |

| Morgan Stanley Capital I Trust, Series 2017-ASHF, Class E(b)(d) | | 1M US L + 3.15% | | 11/15/34 | | | 500,000 | | | | 475,050 | |

| Natixis Commercial Mortgage Securities Trust, Series 2019-FAME, Class C(b)(c)(d) | | 4.25% | | 08/15/24 | | | 679,000 | | | | 615,717 | |

| Natixis Commercial Mortgage Securities Trust, Series 2019-FAME, Class D(b)(c)(d) | | 4.40% | | 08/15/24 | | | 378,000 | | | | 337,214 | |

| SLIDE, Series 2018-FUN, Class F(b)(c)(d) | | 1M US L + 3.25% | | 06/15/31 | | | 513,360 | | | | 495,752 | |

| SMR Mortgage Trust, Series 2022-IND, Class E(b)(c)(d) | | 1M US SOFR + 5.00% | | 02/15/24 | | | 964,590 | | | | 904,882 | |

| SMR Mortgage Trust, Series 2022-IND, Class F(b)(d) | | 1M US SOFR + 6.00% | | 02/15/24 | | | 486,154 | | | | 450,859 | |

| Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class E(c)(d) | | 3.15% | | 09/15/57 | | | 1,311,000 | | | | 1,018,516 | |

| Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class F(c)(d) | | 3.15% | | 09/15/57 | | | 489,500 | | | | 351,020 | |

| Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class G(c)(d) | | 3.15% | | 09/15/57 | | | 814,500 | | | | 554,511 | |

| Wells Fargo Commercial Mortgage Trust, Series 2022-ONL, Class E(b)(c)(d) | | 4.93% | | 02/15/27 | | | 536,000 | | | | 435,554 | |

| Wells Fargo Commercial Mortgage Trust, Series 2022-ONL, Class F(b)(d) | | 4.93% | | 02/15/27 | | | 559,000 | | | | 438,368 | |

| WFRBS Commercial Mortgage Trust, Series 2013-C11, Class E(b)(c)(d) | | 4.21% | | 03/15/45 | | | 542,000 | | | | 495,822 | |

| WFRBS Commercial Mortgage Trust, Series 2013-C17, Class E(c)(d) | | 3.50% | | 12/15/46 | | | 249,000 | | | | 228,557 | |

| Wilmot Plaza Mezz Loan, Class F(g) | | 11.15% | | 10/01/31 | | | 2,000,000 | | | | 2,000,000 | |

| Total Commercial Mortgage Backed Securities | | | | | | | | | | $ | 28,483,120 | |

| | | | | | | | | | | | | |

| TOTAL MORTGAGE-BACKED SECURITIES (Cost $74,530,310) | | | | | | | | | | $ | 69,755,092 | |

| | | | | | | | | | | | | |

| ASSET-BACKED SECURITIES (49.90%) | | | | | | | | | | | | |

| Ares Lusitani-STC SA / Pelican Finance 2, Series 2021-2, Class E(b) | | 6.40% | | 01/25/35 | | € | 297,323 | | | $ | 273,937 | |

| Auto Abs Spanish Loans Fondo Titulizacion, Series 2022-1, Class D(b)(c) | | 1M EUR L + 4.25% | | 02/28/30 | | | 1,000,000 | | | | 919,072 | |

| Autonoria Spain 2021 FT, Series 2021-SP, Class G(b) | | 5.25% | | 01/31/39 | | | 618,539 | | | | 555,278 | |

| Autonoria Spain 2022 FT, Series 2022-SP, Class E(b) | | 1M EUR L + 7.00% | | 01/29/40 | | | 500,000 | | | | 490,567 | |

| BL Consumer Credit 2021, Series 2021-1, Class G | | 5.80% | | 09/25/38 | | | 561,000 | | | | 500,741 | |

| Brignole Co. 2021 SRL, Series 2021-2021, Class F(b) | | 1M EUR L + 5.90% | | 07/24/36 | | | 424,000 | | | | 400,832 | |

| CFG Investments, Ltd., Series 2021-1, Class A(c)(d) | | 4.70% | | 11/20/24 | | $ | 2,027,000 | | | | 1,944,906 | |

| CFG Investments, Ltd., Series 2021-1, Class B(c)(d) | | 5.82% | | 10/20/25 | | | 2,065,000 | | | | 2,024,526 | |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

| Description | | Rate | | Maturity

Date(a) | | Principal

Amount | | | Fair

Value | |

| ASSET-BACKED SECURITIES (continued) | | | | | | | | | | | | |

| CFG Investments, Ltd., Series 2021-1, Class C(c)(d) | | 7.48% | | 05/20/26 | | $ | 1,499,000 | | | $ | 1,424,500 | |

| Conn's Receivables Funding LLC, Series 2022-A, Class B(c)(d) | | 9.52% | | 06/15/24 | | | 663,000 | | | | 660,282 | |

| CPS Auto Receivables Trust, Series 2022-C, Class E(d) | | 9.08% | | 09/15/26 | | | 700,000 | | | | 677,250 | |

| CPS Auto Receivables Trust, Series 2022-D, Class E(d) | | 12.12% | | 11/16/26 | | | 992,000 | | | | 1,001,920 | |

| Credito Real USA Auto Receivables Trust 2021-1, Series 2021-1A, Class C(d) | | 4.37% | | 06/17/24 | | | 1,108,000 | | | | 1,003,294 | |

| Dowson PLC, Series 2021-1, Class F(b) | | 1M SONIA IR + 6.45% | | 03/20/28 | | £ | 363,000 | | | | 393,768 | |

| Dowson PLC, Series 2021-2, Class F(b) | | SONIA IR + 5.30% | | 10/20/24 | | | 461,000 | | | | 485,377 | |

| Dowson PLC, Series 2022-1, Class E(b) | | SONIA IR + 4.80% | | 05/20/25 | | | 381,000 | | | | 403,681 | |

| Dowson PLC, Series 2022-1, Class X(b) | | SONIA IR + 6.35% | | 05/20/25 | | | 118,760 | | | | 136,521 | |

| Dowson PLC, Series 2022-2, Class E(b) | | SONIA IR + 8.00% | | 05/20/25 | | | 651,000 | | | | 737,311 | |

| DT Auto Owner Trust 2022-1, Series 2022-1A, Class E(c)(d) | | 5.53% | | 11/17/25 | | $ | 500,000 | | | | 443,400 | |

| E-Carat 11 PLC, Series 2020-11, Class G(b)(c) | | 1M SONIA IR + 5.00% | | 01/18/24 | | £ | 171,751 | | | | 194,010 | |

| Exeter Automobile Receivables Trust 2022-1, Series 2022-1A, Class E(c)(d) | | 5.02% | | 10/15/26 | | $ | 1,070,000 | | | | 890,775 | |

| Exeter Automobile Receivables Trust 2022-4, Series 2022-4A, Class E(d) | | 8.23% | | 03/15/30 | | | 1,001,000 | | | | 935,935 | |

| Exeter Automobile Receivables Trust 2022-5, Series 2022-5A, Class E(d) | | 10.45% | | 06/15/27 | | | 1,507,000 | | | | 1,498,561 | |

| Exeter Automobile Receivables Trust R, Series 2018-2A, Class R(g) | | N/A(h) | | 05/15/30 | | | 4,839 | | | | 1,067,761 | |

| FCT Noria 2021, Series 2021-1, Class G | | 5.95% | | 10/25/49 | | € | 1,200,324 | | | | 1,089,899 | |

| FCT Pixel 2021, Series 2021-1, Class G | | 5.50% | | 02/25/38 | | | 400,000 | | | | 370,317 | |

| Flagship Credit Auto Trust, Series 2021-1, Class R(d)(g) | | N/A(h) | | 04/17/28 | | $ | 2,740 | | | | 484,836 | |

| Flagship Credit Auto Trust, Series 2022-2, Class E(c)(d) | | 8.20% | | 12/15/26 | | | 1,250,000 | | | | 1,175,875 | |

| Flagship Credit Auto Trust, Series 2022-4, Class E(d) | | 12.66% | | 06/15/27 | | | 1,310,000 | | | | 1,300,182 | |

| Fortuna Consumer Loan ABS 2021 DAC, Series 2021-2021, Class E(b) | | 1M EUR L + 3.50% | | 10/18/30 | | € | 500,000 | | | | 467,195 | |

| Frontline Re, Ltd., Series B(b)(d)(g)(i) | | 3M T-Bill + 0.50% | | 07/06/26 | | $ | 79,076 | | | | – | |

| FTA Santander Consumo 4, Series 2021-4, Class E | | 4.90% | | 09/18/32 | | € | 153,855 | | | | 147,440 | |

| FTA Santander Consumo 4, Series 2021-4, Class F | | 6.50% | | 09/18/32 | | | 200,000 | | | | 194,903 | |

| GLS Auto Receivables Issuer Trust 2019-1, Series 2019-1A, Class CERT(d)(g) | | N/A(h) | | 12/15/25 | | $ | 1,645 | | | | 222,026 | |

| GLS Auto Receivables Issuer Trust 2019-2, Series 2019-2A, Class R(d)(g) | | N/A(h) | | 02/17/26 | | | 1,091 | | | | 223,062 | |

| GLS Auto Receivables Issuer Trust 2019-3, Series 2019-3A, Class R(d)(g) | | N/A(h) | | 08/15/23 | | | 882 | | | | 210,282 | |

| GLS Auto Receivables Issuer Trust 2019-4, Series 2019-4A, Class R(d)(g) | | N/A(h) | | 08/17/26 | | | 941 | | | | 212,220 | |

| GLS Auto Receivables Trust 2018-3, Series 2018-3A, Class R(d)(g) | | N/A(h) | | 08/15/25 | | | 1,656 | | | | 218,953 | |

| Golden Bar Securitisation Srl, Series 2019-1, Class C | | 8.25% | | 07/20/39 | | € | 469,359 | | | | 426,412 | |

| Hertz Vehicle Financing LLC, Series 2021-1A, Class D(c)(d) | | 3.98% | | 12/25/24 | | $ | 5,000,000 | | | | 4,398,500 | |

| KeyCorp Student Loan Trust, Series 2006-A, Class 2C(b)(c) | | 3M US L + 1.15% | | 03/27/42 | | | 2,000,000 | | | | 1,545,000 | |

| Lendingpoint Asset Securitization Trust, Series 2022-B, Class C(d) | | 8.45% | | 02/17/26 | | | 517,000 | | | | 478,432 | |

| Marlette Funding Trust 2021-2, Series 2021-2A, Class R(d)(g) | | N/A(h) | | 02/15/26 | | | 1,296 | | | | 231,237 | |

| National Collegiate Student Loan Trust, Series 2005-3, Class B(b)(c) | | 1M US L + 0.50% | | 07/27/37 | | | 2,462,000 | | | | 1,901,649 | |

| National Collegiate Student Loan Trust, Series 2007-1, Class A4(b)(c) | | 1M US L + 0.31% | | 10/25/33 | | | 1,131,288 | | | | 1,038,748 | |

| Navient Private Education Refi Loan Trust 2021-B, Series 2021-BA, Class R(d)(g) | | N/A(h) | | 07/15/69 | | | 3,089 | | | | 1,718,241 | |

| Newday Funding Master Issuer PLC - Series 2021-1, Series 2021-1X, Class E(b) | | SONIA IR + 4.05% | | 03/15/24 | | £ | 452,000 | | | | 492,696 | |

| NOW Trust, Series 2021-1, Class F(b)(c) | | 1M BBSW + 6.40% | | 06/14/29 | | AUD | 503,124 | | | | 320,312 | |

| Pagaya AI Debt Selection Trust, Series 2020-3, Class CERT(b)(d)(e)(g) | | N/A(h) | | 05/17/27 | | $ | 510,470 | | | | 104,987 | |

| Pagaya AI Debt Selection Trust, Series 2021-1, Class B(c)(d) | | 2.13% | | 11/15/27 | | | 534,780 | | | | 497,773 | |

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2022 | 11 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

| Description | | Rate | | Maturity

Date(a) | | Principal

Amount | | | Fair

Value | |

| ASSET-BACKED SECURITIES (continued) | | | | | | | | | | | | |

| Pavillion Point of Sale 2021-1, Ltd., Series 2022-1, Class F(b) | | SONIA IR + 4.30% | | 12/30/31 | | £ | 394,000 | | | $ | 429,293 | |

| PBD Germany Auto Lease Master SA - Comprt 2021-1, Series 2021-GE2, Class E(b)(c) | | 1M EUR L + 3.50% | | 11/26/30 | | € | 800,000 | | | | 772,100 | |

| PBD Germany Auto Lease Master SA - Comprt 2021-1, Series 2021-GE2, Class F(b) | | 1M EUR L + 4.50% | | 11/26/30 | | | 400,000 | | | | 385,457 | |

| PBD Germany Auto Lease Master SA - Comprt 2021-1, Series 2021-GE2, Class G | | 6.50% | | 11/26/30 | | | 311,111 | | | | 300,876 | |

| Research-Driven Pagaya Motor Asset Trust VII, Series 2022-3A, Class C(c)(d) | | 10.04% | | 11/25/30 | | $ | 1,000,000 | | | | 970,900 | |

| SAFCO Mezz WH 2021(g) | | 9.00% | | 06/17/26 | | | 1,044,574 | | | | 1,044,574 | |

| Satus PLC, Series 2021-1, Class F(b) | | 1M SONIA IR + 5.40% | | 08/17/28 | | £ | 500,000 | | | | 553,963 | |

| SCF Rahoituspalvelut X DAC, Series 2021-10, Class D | | 5.35% | | 10/25/31 | | € | 400,000 | | | | 343,990 | |

| SoFi Consumer Loan Program , Series 2020-1, Class R1(d)(g) | | N/A(h) | | 01/25/29 | | $ | 14,000 | | | | 115,458 | |

| SoFi Consumer Loan Program , Series 2021-1, Class R1(d)(g) | | N/A(h) | | 09/25/30 | | | 28,777 | | | | 519,094 | |

| SoFi Professional Loan Program, Series 2020-A, Class R1(d)(g) | | N/A(h) | | 05/15/46 | | | 14,661 | | | | 459,299 | |

| SoFi Professional Loan Program , Series 2018-D, Class R1(d)(g) | | N/A(h) | | 02/25/48 | | | 21,839 | | | | 241,712 | |

| SoFi Professional Loan Program , Series 2020-B, Class R1(d)(g) | | N/A(h) | | 05/15/46 | | | 10,000 | | | | 488,869 | |

| SoFi Professional Loan Program , Series 2021-A, Class R1(d)(g) | | N/A(h) | | 08/17/43 | | | 19,142 | | | | 372,652 | |

| SoFi Professional Loan Program , Series 2021-B, Class R1(d)(g) | | N/A(h) | | 02/15/47 | | | 11,625 | | | | 609,419 | |

| SoFi Professional Loan Program LLC, Series 2017-D, Class R1(d)(g) | | N/A(h) | | 09/25/40 | | | 16,181 | | | | 252,009 | |

| SoFi Professional Loan Program LLC, Series 2019-B, Class R1(d)(g) | | N/A(h) | | 08/17/48 | | | 56,770 | | | | 629,152 | |

| SoFi Professional Loan Program LLC, Series 2019-B, Class R1(d)(g) | | N/A(h) | | 08/17/48 | | | 78,583 | | | | 870,894 | |

| SoFi Professional Loan Program LLC, Series 2019-A, Class R1(d)(g) | | N/A(h) | | 06/15/48 | | | 32,016 | | | | 304,919 | |

| TAGUS - Sociedade de Titularizacao de Creditos SA/Silk Finance No 5, Series 2020-5, Class D | | 7.25% | | 02/25/35 | | € | 450,248 | | | | 421,063 | |

| TAGUS - Sociedade de Titularizacao de Creditos SA/Silk Finance No 5, Series 2020-5, Class E(c) | | 8.00% | | 02/25/35 | | | 140,000 | | | | 139,102 | |

| TAGUS - Sociedade de Titularizacao de Creditos SA/Ulisses Finance No. 2, Series 2021-2, Class F(b) | | 1M EUR L + 5.49% | | 09/23/38 | | | 390,720 | | | | 371,379 | |

| TAGUS - Sociedade de Titularizacao de Creditos SA/Ulisses Finance No. 2, Series 2021-2, Class G(b) | | 1M EUR L + 5.00% | | 09/23/38 | | | 140,000 | | | | 138,203 | |

| Theorem Funding Trust 2022-1, Series 2022-1A, Class B(d) | | 3.10% | | 02/15/28 | | $ | 507,000 | | | | 467,251 | |

| United Auto Credit Securitization Trust, Series 2022-1, Class E(c)(d) | | 5.00% | | 12/10/25 | | | 1,037,000 | | | | 953,314 | |

| United Auto Credit Securitization Trust, Series 2022-2, Class E(c)(d) | | 10.00% | | 08/10/26 | | | 475,000 | | | | 457,948 | |

| Upstart Pass-Through Trust, Series 2020-ST2, Class CERT(d)(g) | | N/A(h) | | 03/20/28 | | | 5,000,000 | | | | 1,079,476 | |

| Upstart Pass-Through Trust, Series 2020-ST4, Class CERT(d)(g) | | N/A(h) | | 11/20/26 | | | 1,000,000 | | | | 330,090 | |

| Upstart Pass-Through Trust, Series 2022-ST1, Class CERT(d)(g) | | N/A(h) | | 03/20/30 | | | 539,000 | | | | 311,419 | |

| Upstart Pass-Through Trust Series, Series 2022-ST2, Class CERT(d)(g) | | N/A(h) | | 04/20/30 | | | 500,000 | | | | 348,034 | |

| Upstart Structured Pass-Through Trust, Series 2022-1A, Class CERT(d)(g) | | N/A(h) | | 04/15/30 | | | 608 | | | | 768,544 | |

| USASF Receivables LLC, Series 2021-1A, Class D(d) | | 4.36% | | 03/15/27 | | | 1,125,000 | | | | 1,053,000 | |

| Zip Master Trust, Series 2021-1, Class D(b) | | 1M BBSW + 3.70% | | 04/10/24 | | AUD | 500,000 | | | | 318,899 | |

| Zip Master Trust, Series 2021-1, Class E(b) | | 1M BBSW + 5.70% | | 04/10/24 | | | 500,000 | | | | 318,930 | |

| | | | | | | | | | | | | |

| TOTAL ASSET-BACKED SECURITIES (Cost $63,899,521) | | | | | | | | | | $ | 55,676,664 | |

| | | | | | | | | | | | | |

| COLLATERALIZED LOAN OBLIGATIONS (21.60%)(b) | | | | | | | | | | | | |

| ARES XLIV CLO, Ltd., Series 2017-44A, Class SUB(d)(g) | | N/A(h) | | 04/15/34 | | $ | 1,308,000 | | | $ | 444,720 | |

| Ares XXXVIII CLO, Ltd., Series 2015-38X, Class SUB(g) | | N/A(h) | | 04/20/30 | | | 735,000 | | | | 279,300 | |

| Barings CLO, Ltd. 2013-I, Series 2017-IA, Class ER(c)(d) | | 3M US L + 5.20% | | 01/20/28 | | | 514,000 | | | | 468,305 | |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

| Description | | Rate | | Maturity

Date(a) | | Principal

Amount | | | Fair

Value | |

| COLLATERALIZED LOAN OBLIGATIONS (continued) | | | | | | | | | | | | |

| Battalion Clo XV, Ltd., Series 2020-15A, Class SUB(d)(g) | | N/A(h) | | 01/17/33 | | $ | 613,000 | | | $ | 429,100 | |

| Buttermilk Park CLO, Ltd., Series 2018-1A, Class INC(d)(g) | | N/A(h) | | 10/15/31 | | | 871,000 | | | | 374,530 | |

| CFIP CLO 2014-1, Ltd., Series 2017-1A, Class ER(c)(d) | | 3M US L + 6.60% | | 07/13/29 | | | 1,833,000 | | | | 1,580,412 | |

| Generate CLO 3, Ltd., Series 2017-3A, Class ER(d) | | 3M US L + 6.40% | | 10/20/29 | | | 250,000 | | | | 222,475 | |

| KKR CLO 10, Ltd., Series 2017-10, Class ER(c)(d) | | 3M US L + 6.50% | | 09/15/29 | | | 755,000 | | | | 678,065 | |

| KKR CLO 18, Ltd., Series 2021-18, Class BR(d) | | 3M US L + 1.60% | | 07/18/30 | | | 250,000 | | | | 238,575 | |

| KKR Financial CLO 2013-1, Ltd., Series 2017-1A, Class DR(d) | | 3M US L + 6.08% | | 04/15/29 | | | 512,000 | | | | 432,077 | |

| Magnetite XVI, Ltd., Series 2018-16A, Class ER(d) | | 3M US L + 5.00% | | 01/18/28 | | | 549,000 | | | | 501,896 | |

| Mountain View CLO X, Ltd., Series 2015-10A, Class E(c)(d) | | 3M US L + 4.85% | | 10/13/27 | | | 799,000 | | | | 751,380 | |

| OZLM XII, Ltd., Series 2015-12A, Class D(c)(d) | | 3M US L + 5.40% | | 04/30/27 | | | 562,000 | | | | 546,995 | |

| Rockford Tower CLO, Ltd., Series 2019-1A, Class SUB(d)(g) | | N/A(h) | | 04/20/34 | | | 917,000 | | | | 614,390 | |

| RR 2, Ltd., Series 2017-2A, Class SUB(d)(g) | | N/A(h) | | 10/15/17 | | | 1,426,000 | | | | 869,860 | |

| Shackleton CLO, Ltd., Series 2017-8A, Class ER(d) | | 3M US L + 5.34% | | 10/20/27 | | | 1,000,000 | | | | 894,800 | |

| Signal Peak CLO 6, Ltd., Series 2018-6A, Class SUB(d)(g) | | N/A(h) | | 07/28/31 | | | 3,272,000 | | | | 1,406,960 | |

| Symphony CLO XVII, Ltd., Series 2018-17A, Class ER(d) | | 3M US L + 5.55% | | 04/15/28 | | | 523,560 | | | | 478,953 | |

| Symphony Static CLO I, Ltd., Series 2021-1A, Class A(c)(d) | | 3M US L + 0.83% | | 10/25/29 | | | 11,998,114 | | | | 11,762,951 | |

| Taberna Preferred Funding II, Ltd., Series 2005-2A, Class B(d) | | 3M US L + 0.90% | | 11/05/35 | | | 529,000 | | | | 142,830 | |

| Taberna Preferred Funding, Ltd., Series 2005-3X, Class B1(i) | | 3M US L + 0.80% | | 02/05/36 | | | 706,000 | | | | 268,280 | |

| Venture Xxv Clo, Ltd., Series 2016-25A, Class E(d) | | 3M US L + 7.20% | | 04/20/29 | | | 900,000 | | | | 715,860 | |

| | | | | | | | | | | | | |

| TOTAL COLLATERALIZED LOAN OBLIGATIONS (Cost $26,252,193) | | | | | | | | | | $ | 24,102,714 | |

| | | | | | | | | | | | | |

| | | | | | | | Shares | | | | Fair

Value | |

| PREFERRED STOCKS (0.42%)(b)(j) | | | | | | | | | | | | |

| New York Mortgage Trust, Inc., Series D | | | | | | | 8,071 | | | $ | 146,973 | |

| New York Mortgage Trust, Inc., Series E | | | | | | | 17,808 | | | | 323,571 | |

| | | | | | | | | | | | | |

| TOTAL PREFERRED STOCKS (Cost $482,862) | | | | | | | | | | $ | 470,544 | |

| | | | | | | | | | | | | |

| | | | | 7-Day

Yield | | | Shares | | | | Fair

Value | |

| MONEY MARKET FUNDS (7.69%) | | | | | | | | | | | | |

| BlackRock Liquidity Funds T-Fund, Institutional Class | | | | 2.93% | | | 6,559,843 | | | $ | 6,559,843 | |

| BNY Mellon U.S. Treasury Fund, Institutional Class | | | | 2.61% | | | 2,019,208 | | | | 2,019,208 | |

| | | | | | | | | | | | | |

| TOTAL MONEY MARKET FUNDS (Cost $8,579,051) | | | | | | | | | | $ | 8,579,051 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | Fair

Value | |

| TOTAL INVESTMENTS (142.13%) (Cost $173,743,937) | | | | | | | | | | $ | 158,584,065 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets (-42.13%)(k) | | | | | | | | | | | (47,007,980 | ) |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 111,576,085 | |

Percentages above are stated as a percentage of net assets as of October 31, 2022

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2022 | 13 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

EURIBOR - Euro Interbank Offered Rate

SONIA IR - Sterling Over Night Index Average

BBSW - Bank Bill Swap Rate

T-BILL - U.S. Treasury Bill

SOFR - Secured Overnight Financing Rate

Reference Rates:

1M EUR L - 1 Month EURIBOR as of October 31, 2022 was 1.25%

3M EUR L - 3 Month EURIBOR as of October 31, 2022 was 1.70%

1M US L - 1 Month USD LIBOR as of October 31, 2022 was 3.80%

3M US L - 3 Month USD LIBOR as of October 31, 2022 was 4.46%

3M T-Bill - 3 Month Treasury Bill as of October 31, 2022 was 4.11%

1M SONIA IR - 1 Month SONIA as of October 31, 2022 was 2.19%

3M SONIA IR - 3 Month SONIA as of October 31, 2022 was 1.87%

1M BBSW - 1 Month BBSW as of October 31, 2022 was 2.87%

30D US SOFR - 30 Day US SOFR as of October 31, 2022 was 3.04%

12M US FED – 12 Month US FED as of October 31, 2022 was 2.05%

| (a) | The maturity date for credit investments represents the expected maturity. Many of the instruments are callable through cash flows on the underlying securities or other call features. Expected maturity may be earlier than legal maturity. |

| (b) | Floating or variable rate security. The Reference Rate is described above. Interest rate shown reflects the rate in effect at October 31, 2022. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (c) | On October 31, 2022, all or a portion of these securities were pledged as collateral for reverse repurchase agreements in the amount of $54,883,823. |

| (d) | Securities not registered under the Securities Act of 1933, as amended (the "Securities Act"). These securities generally involve certain transfer restrictions and may be sold in the ordinary course of business in transactions exempt from registration. As of October 31, 2022, the aggregate market value of those securities was $95,060,305, representing 85.20% of net assets. |

| (e) | Interest only security. |

| (f) | Step bond. Coupon changes periodically based upon a predetermined schedule. Interest rate disclosed is that which is in effect at October 31, 2022. |

| (g) | This security has been classified as level 3 in accordance with ASC 820 as a result of unavailable quoted prices from an active market or the unavailability of other significant observable inputs. |

| (h) | This security is a residual or equity position that does not have a stated interest rate. This residual or equity position is entitled to recurring distributions which are generally equal to the remaining cash flow of payments made by underlying securities less contractual payments to debt holders and fund expenses. |

| (i) | Security was in default as of October 31, 2022, and is therefore non-income producing. |

| (k) | Includes cash being held as collateral for derivatives and reverse repurchase agreements. |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

DERIVATIVE INSTRUMENTS

CREDIT DEFAULT SWAP CONTRACTS - SELL PROTECTION (OVER THE COUNTER)(a)

| Reference Obligations | | Counterparty | | Fixed Deal Receive Rate | | Currency | | Maturity Date | | Implied Credit Spread at October 31, 2022(b) | | Notional Amount(c) | | Value | | | Upfront Premiums Received/ (Paid) | | Unrealized Appreciation/ (Depreciation) | |

| The Markit CDX High Yield Series 33 Index Tranche 15-25 | | Morgan Stanley | | | 5.00% | | USD | | 12/20/24 | | 10.95% | | 10,000,000 | | $ | (901,606 | ) | | $ | 491,250 | | $ | (410,356 | ) |

| The Markit CDX High Yield Series 37 Index Tranche 15-25 | | Morgan Stanley | | | 5.00% | | USD | | 12/20/26 | | 6.73% | | 1,000,000 | | | (52,334 | ) | | | 158,540 | | | 106,206 | |

| | | | | | | | | | | | | | | | $ | (953,940 | ) | | $ | 649,790 | | $ | (304,150 | ) |

CREDIT DEFAULT SWAP CONTRACTS ON CREDIT INDICES ISSUE - PURCHASE PROTECTION (CENTRALLY CLEARED)

| Reference Obligations | | Counterparty | | Fixed Deal Receive Rate | | Currency | | Maturity Date | | Implied Credit Spread at October 31, 2022(b) | | Notional

Amount(c) | | Value | | | Upfront Premiums Received/(Paid) | | Unrealized Appreciation | |

| The Markit CDX High Yield Series 38 Index | | Wells Fargo | | | 5.00% | | USD | | 6/20/27 | | 4.71% | | 6,791,400 | | $ | (50,514 | ) | | $ | 237,962 | | $ | 187,448 | |

| | | | | | | | | | | | | | | | $ | (50,514 | ) | | $ | 237,962 | | $ | 187,448 | |

Credit default swaps pay quarterly.

| (a) | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| (b) | Implied credit spreads, represented in absolute terms, utilized in determining the market value of credit default swap agreements as of year end serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. |

| (c) | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2022 | 15 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2022

DERIVATIVE INSTRUMENTS (continued)

INTEREST RATE SWAP CONTRACTS (CENTRALLY CLEARED)

| Pay/Receive Floating Rate | | Clearing House | | Floating Rate | | Expiration Date | | Notional Amount | | Currency | | | Fixed Rate | | Fair Value and Unrealized Appreciation/ (Depreciation) | |

| Receive | | LCH Ltd. | | SOFRRATE | | 02/23/2027 | | 300,000 | | USD | | | | 2.27% | | $ | 28,569 | |

| | | | | | | | | | | | | | | | | $ | 28,569 | |

FUTURES CONTRACTS - LONG (CENTRALLY CLEARED)

| Description | | Counterparty | | Position | | Contracts | | Expiration Date | | Notional Amount | | Fair Value and Unrealized Appreciation/ (Depreciation) | |

| 2-YR U.S. TREASURY NOTE | | Wells Fargo Securities, LLC | | Long | | 1 | | Dec 2022 | | $ | 204,383 | | $ | (469 | ) |

| | | | | | | | | | | $ | 204,383 | | $ | (469 | ) |

FUTURES CONTRACTS - SHORT (CENTRALLY CLEARED)

| Description | | Counterparty | | Position | | Contracts | | Expiration Date | | | Notional Amount | | | Fair Value and Unrealized Appreciation/ (Depreciation) | |

| 10-YR U.S. TREASURY NOTE | | Wells Fargo Securities, LLC | | Short | | 35 | | Dec 2022 | | $ | (3,870,781 | ) | $ | 249,102 | |

| 5-YR U.S. TREASURY NOTE | | Wells Fargo Securities, LLC | | Short | | 350 | | Dec 2022 | | | (37,307,813 | ) | | 1,495,564 | |

| AUD/USD CURRENCY | | Wells Fargo Securities, LLC | | Short | | 12 | | Dec 2022 | | | (768,120 | ) | | 43,126 | |

| EUR/USD CURRENCY | | Wells Fargo Securities, LLC | | Short | | 82 | | Dec 2022 | | | (10,171,588 | ) | | 122,239 | |

| EURO BOBL | | Wells Fargo Securities, LLC | | Short | | 11 | | Dec 2022 | | | (1,300,902 | ) | | 37,082 | |

| GBP/USD CURRENCY | | Wells Fargo Securities, LLC | | Short | | 107 | | Dec 2022 | | | (7,681,262 | ) | | 63,189 | |

| LONG GILT | | Wells Fargo Securities, LLC | | Short | | 1 | | Dec 2022 | | | (117,123 | ) | | 7,090 | |

| | | | | | | | | | | $ | (61,217,589 | ) | $ | 2,017,392 | |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Statement of Assets and Liabilities |

| ASSETS: | | | |

| Investments, at fair value (Cost $173,743,937) | | $ | 158,584,065 | |

| Cash | | | 17,608 | |

| Foreign Currency, at fair value (Cost $824,683) | | | 815,295 | |

| Unrealized appreciation on credit default swap contracts | | | 106,206 | |

| Receivable on derivative contracts | | | 23,233 | |

| Variation margin receivable on Centrally Cleared Swap Contracts | | | 45,815 | |

| Variation margin receivable for Futures Contracts | | | 282,999 | |

| Interest receivable | | | 719,351 | |

| Capital shares sold receivable | | | 129,696 | |

| Deposits held with brokers for derivatives and reverse repurchase agreements | | | 4,343,360 | |

| Prepaid expenses and other assets | | | 7,787 | |

| Total Assets | | | 165,075,415 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for swap contracts premiums | | | 887,753 | |

| Payable for investment securities purchased | | | 1,300,182 | |

| Payable for reverse repurchase agreements, including accrued interest of $148,236 | | | 50,167,245 | |

| Unrealized depreciation on credit default swap contracts | | | 410,356 | |

| Payable for shareholder servicing and distribution fees | | | 940 | |

| Net payable to Adviser for investment advisory fees | | | 195,362 | |

| Accrued fund accounting, administration and compliance fees payable | | | 168,404 | |

| Other payables and accrued expenses | | | 369,088 | |

| Total Liabilities | | | 53,499,330 | |

| Net Assets Attributable to Shareholders | | $ | 111,576,085 | |

| | | | | |

| COMPOSITION OF NET ASSETS ATTRIBUTABLE TO SHARES: | | | | |

| Paid-in capital | | $ | 117,382,293 | |

| Total distributable earnings | | | (5,806,208 | ) |

| Net Assets Attributable to Shareholders | | $ | 111,576,085 | |

| | | | | |

| NET ASSET VALUE | | | | |

| Class I: | | | | |

| Net assets | | $ | 110,679,788 | |

| Shares outstanding (unlimited shares authorized, par value $0.001 per share) | | | 5,867,411 | |

| Net Asset Value per Share | | $ | 18.86 | |

| Class A-2: | | | | |

| Net assets | | $ | 896,297 | |

| Shares outstanding (unlimited shares authorized, par value $0.001 per share) | | | 47,972 | |

| Net Asset Value per Share | | $ | 18.68 | |

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2022 | 17 |

| 1WS Credit Income Fund | Consolidated Statement of Operations |

| | | For the

Year Ended

October 31, 2022 | |

| INVESTMENT INCOME: | | | | |

| Dividends on short term money market funds | | $ | 102,335 | |

| Interest | | | 12,305,136 | |

| Total Investment Income | | | 12,407,471 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fee | | | 2,476,063 | |

| Fund Accounting and Administration fees | | | 599,770 | |

| Compliance fees | | | 35,000 | |

| Offering costs | | | 59,518 | |

| Legal fees | | | 268,829 | |

| Audit fees | | | 170,655 | |

| Trustees' fees and expenses | | | 76,500 | |

| Transfer agent fees | | | 237,091 | |

| Interest on reverse repurchase agreements | | | 1,089,000 | |

| Distribution and shareholder servicing fees | | | 3,064 | |

| Other expenses | | | 217,262 | |

| Total Expenses | | | 5,232,752 | |

| Less expenses reimbursed by Adviser (See Note 4) | | | (810,698 | ) |