UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23368

1WS Credit Income Fund

(Exact name of registrant as specified in charter)

299 Park Avenue, 25th Floor

New York, New York 10171

(Address of principal executive offices)

Kurt A. Locher

Chief Executive Officer

c/o 1WS Credit Income Fund

299 Park Avenue, 25th Floor

New York, New York 10171

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (212) 377-4810

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023 – October 31, 2024

Item 1. Reports to Stockholders.

Table of Contents

| Management Commentary | 1 |

| Consolidated Schedule of Investments | 8 |

| Consolidated Statement of Assets and Liabilities | 26 |

| Consolidated Statement of Operations | 27 |

| Consolidated Statements of Changes in Net Assets | 28 |

| Consolidated Statement of Cash Flows | 30 |

| Consolidated Financial Highlights | 32 |

| Notes to Consolidated Financial Statements | 34 |

| Report of Independent Registered Public Accounting Firm | 47 |

| Approval of Investment Advisory Agreement | 48 |

| Additional Information | 50 |

| Trustees and Officers | 51 |

| Privacy Policy | 53 |

| 1WS Credit Income Fund | Management Commentary |

October 31, 2024 (Unaudited)

The 1WS Credit Income Fund (the “Fund”) is a closed-end interval fund launched in March 2019. As of October 31, 2024, the Fund has gross assets under management of approximately $507 million (approximately $420 million net assets). The Fund is a non-diversified, closed-end investment management company. Its investment objective is to seek attractive risk-adjusted total returns through generating income and capital appreciation. The Fund seeks its objective by investing primarily in a wide array of predominantly structured credit and securitized debt instruments.

Overview:

The Fed ended the market debate with respect to the timing of interest rate cuts by lowering the target funds rate at their September FOMC meeting and punctuating the move with a 50 bps rate cut, as opposed to 25 bps. While not yet declaring victory over inflation, in their statement and during the news conference following the rate move, Chairman Powell indicated that it was time to recalibrate their interest rate policy to something more balanced between their dual mandates of stable prices and stable unemployment. While highly anticipated, the market reaction suggests that investors were generally pleased with the rate move, with equities extending their rally into quarter-end and credit spreads generally tightening. For now, it would appear as if the soft landing narrative is gaining favor and continues to support risk assets across credit and equity markets.

While spreads within structured credit sectors have also narrowed, we remain encouraged by the investment opportunities we continue to see. This is particularly true within sectors of consumer ABS and commercial real estate, where we believe fundamental uncertainty remains elevated. This fundamental uncertainty, in our opinion, has resulted in elevated risk premia across a number of sectors, resulting in attractive investment opportunities for those with the requisite underwriting capabilities. Of course, where there is uncertainty there is risk, and rigorous due diligence is paramount. Our underwriting is grounded in bottom-up security-level analysis and stress testing in an attempt to assure adequate asset coverage and principal preservation under a range of potentially adverse future economic outcomes. We believe this enables us to identify and quantify a security's embedded risk profile while also allowing us to select highly attractive risk-adjusted return opportunities.

In contrast to corporate credit spreads, we believe that many sectors within structured credit continue to trade at spread levels well off of their lows, and meaningfully wider on a relative basis when compared with historical corporate benchmarks. While these spreads represent benchmark, new issue pricing levels, there is significant dispersion within the broader sector based on individual security/collateral characteristics, which can drive even greater value and excess return potential, in our opinion.

Net Return Performance as of 10/31/24*

| Calendar YTD | Fiscal YTD | 5 Year Annualized | ITD (3/4/19) Annualized | ITD (3/4/19) |

| 1WS Credit Income Fund (OWSCX) Class I shares | 9.71% | 12.40% | 7.59% | 7.57% | 51.25% |

| 1WS Credit Income Fund (OWSAX) Class A-2 shares** | 9.18% | 11.72% | 6.89% | 6.85% | 45.67% |

| Bloomberg Barclays U.S. Aggregate Bond Index1 | 1.86% | 10.55% | -0.23% | 1.16% | 6.74% |

| ICE BofAML U.S. High Yield Index2 | 7.44% | 16.47% | 4.38% | 4.76% | 30.16% |

Source: Bloomberg, Finance L.P., Bank of America, OWS

Past performance is not indicative of future returns.

| * | OWSCX and OWSAX returns are presented net of all fees and expenses, benchmark returns are gross. Please see pp. 5-7 for important risk disclosures and definitions. |

| ** | OWSAX returns prior to May 2021 reflect the performance of Class I shares, adjusted to reflect the distribution and shareholder servicing fees applicable to Class A2 shares. Additional information on the relevance of Class I performance prior to May 2021 is available upon request by calling the client service number provided at the bottom of this page. Class A2 shares are subject to an upfront sales load of up to 3%, which is not reflected in the returns shown above and, if applied, would lower such returns. |

| Annual Report | October 31, 2024 | 1 |

| 1WS Credit Income Fund | Management Commentary |

October 31, 2024 (Unaudited)

Management Fee under the Advisory Agreement is calculated at an annual rate of 1.50% of the daily gross assets of the Fund. "Gross Assets" means the total assets of the Fund prior to deducting liabilities. Derivatives are valued at market value for purposes of determining "Gross Assets" in the calculation of management fees. Because the Management Fee is based on the Fund's daily gross assets, the Fund's use of leverage, if any, will increase the Management Fee paid to the Adviser. For the initial year of the Fund, the Adviser voluntarily agreed to reduce the Management Fee to .75%. For the one year period beginning on March 1, 2020, and continuing through the present, the Adviser has voluntarily agreed to reduce the Management Fee to 1.25% of the Fund’s daily gross assets. The Adviser’s board is under no obligation to continue the fee waiver but may continue to do so.

| 1,2 | Please refer to the risk disclosures and definitions on pp. 5-7 for a description of the benchmark indices chosen and the risks associated with comparing 1WS Credit Income Fund returns to those of an index. Investors cannot invest directly in an index. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (833) 834-4923 or visiting www.1wscapital.com. Investors cannot invest directly in an index. All performance shown assumes reinvestment of dividends and capital gains distribution in present value. Dividends are not guaranteed and will constitute a return of capital if dividend distributions exceed current-year earnings. Please refer to the Fund’s most recent Section 19(a) notice for an estimate of the composition of the Fund’s most recent distribution, available at www.1WSCapital.com.

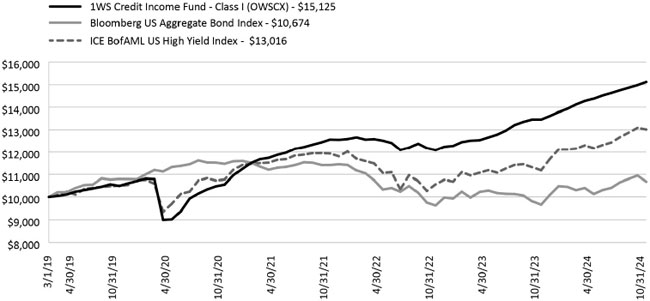

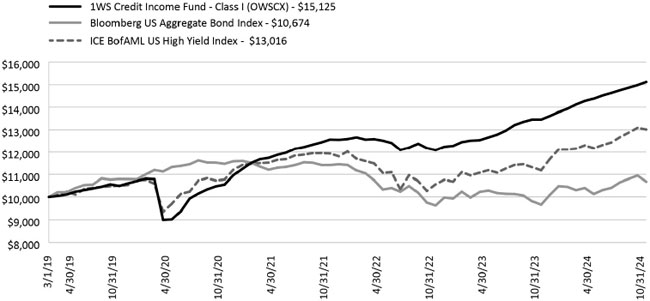

Comparison of the Change in Value of a $10,000 Investment

The chart above assumes an initial hypothetical investment of $10,000 made in Class I shares of the Fund on March 4, 2019 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or share repurchases. In the absence of fee waivers and reimbursements, which can be necessary to keep expenses at the expense cap, total return would be reduced.

| 1WS Credit Income Fund | Management Commentary |

October 31, 2024 (Unaudited)

Portfolio Composition1 and Net Return Attribution2

| Asset Type | Net Return2 Attribution Calendar YTD |

| Asset-Backed Securities (ABS) | 2.54% |

| Collateralized Loan Obligations (CLOs) | 0.98% |

| Commercial Mortgage-Backed Securities (CMBS) | 1.04% |

| European ABS & RMBS | 2.41% |

| Residential Mortgage-Backed Securities (RMBS) | 1.63% |

| Other | 1.06% |

| Interest Rate Hedges | 0.05% |

| Total | 9.71% |

| 1 | The Portfolio Composition as of 10/31/24 differs from the portfolio composition for any point prior to such date and is subject to change at any time. Calculation details based on gross data are available by calling the customer service number on page 5. |

| 2 | Net return attribution represents portfolio PnL by sector divided by the Fund’s average net asset value for the period reduced by operating expenses and management fee allocated to the sectors based on the market value of the portfolio for the period. |

Portfolio Activity:

Consumer fundamentals continue to be mixed across loan type and borrower characteristics. In aggregate, new delinquencies in the credit card and auto loan sectors continue to increase, however, the rate of change has slowed from the pace early following the pandemic. Mortgage and home equity lines of credit (HELOC) continue to track below levels prior to the pandemic, however in aggregate, delinquencies have increased off of their absolute lows according to Equifax data compiled by the New York Fed Consumer Credit Panel.

There continues to be significant dispersion in the underlying fundamental performance across different borrower cohorts. For instance, delinquencies among younger borrowers continue to worsen relative to older borrowers. Similar dispersion can be seen across income and credit cohorts. This reinforces the need for security-level underwriting when evaluating investment opportunities within and across structured credit sectors. Structured credit securities are not homogeneous, even within narrowly defined subsectors of the market. The fundamental performance of seemingly similar securities can vary dramatically based on differences in underlying borrower characteristics, loan originator, excess interest, and deal structure.

We believe that residential credit continues to be supported by strong fundamentals (low delinquencies) and strong technicals (low supply). From a fundamental perspective, seasoned RMBS continues to be supported by historical home price appreciation (HPA), which has resulted in growing home equity for existing homeowners and also reduces the likelihood of default. Despite historically low affordability, home prices have continued to increase due to limited supply and still strong demand. While we expect that HPA will likely moderate going forward, fundamentals of newer originations are supported by strong underlying borrower characteristics. Mortgage credit availability remains historically tight while the distribution of borrowers who are qualifying for mortgages is highly skewed to those with the highest quality credit. This trend has been in place since the global financial crisis (GFC), however, it remains the case.

We continue to be active in the mortgage credit market, focusing primarily on agency credit risk transfer (CRT) securities, and, to a lesser degree, seasoned legacy mortgages and residential transitional loans (RTLs). Agency CRT securities have been among the best-performing sectors within structured credit recently, supported by strong mortgage credit fundamentals and limited supply, according to J.P. Morgan.

Uncertainty within the commercial real estate sector remains top of mind amongst most investors, with particular concern continuing to be concentrated in the office sector. While office properties garner the most headlines pertaining to CRE stress, there is considerable dispersion within the office sector. According to Trepp, when analyzing bank office CRE loans in their database, they found that there was vast dispersion in “criticized” loans (i.e. loans that are shown to have deteriorated, but have not yet been classified as nonperforming). For example, in San Francisco, so-called criticized office CRE loans accounted for more than 60%, of the total while in Phoenix, they were just shy of 20%.

There are many factors to take into account when underwriting commercial real estate, which is why our investments in CMBS are largely focused on single-asset-single-borrower (SASB) securities. We have more confidence in our ability to underwrite properties underlying SASB deals than we do underwriting large multi-property, mixed property type, conduit deals. In addition to being selective with respect to property type, location, and strength of sponsor, there are many other factors that need to be accounted for when estimating a property’s net operating cash flows.

| Annual Report | October 31, 2024 | 3 |

| 1WS Credit Income Fund | Management Commentary |

October 31, 2024 (Unaudited)

Within the CMBS sector, we have been taking profits and selling down a number of our exposures within the hospitality sector. Many of these exposures we added post-COVID following significant distress in the sector as a result of the pandemic. Many hospitality properties were closed for extended periods of time as a result of COVID lockdowns and there was limited visibility into the timing and extent of future cash flow recoveries coming out of the pandemic. While selective concerning individual property exposures, we felt the sector as a whole was selling at what we believed were attractive discounts due to distress in the sector as a whole. With the cash flow on many hospitality properties having now recovered, credit spreads in the sector have outperformed and we are now selectively re-allocating capital to what we believe are more attractive investment opportunities within the sector as they arise. We remain cautious of non-investment grade risk, in highly leveraged assets, as rates remain elevated and underwriting cash flows in our view remain challenged in the current environment. We expect to see continued opportunities arise as rating agencies adjust outlooks and more properties come to maturity, which we believe may lead to more ratings downgrades, adverse servicer behavior, further repricing, and in some instances, forced liquidations.

Our non-dollar ABS/RMBS strategy was one of our top-performing sector strategies throughout the year, as the European macro backdrop continues to improve. Many European economies are beginning to see growth strengthening in addition to rate cuts from the Bank of England and the European Central Bank. Within the non-dollar ABS sector, we have been active in the unsecured consumer sector. Similar to the U.S., the variability in consumer fundamentals and differences across collateral types, originators, vintages, and regions highlight the need for detailed underwriting at the security level. Although the European region has, in our opinion, a weaker economic outlook than in the U.S., we do not perceive a widespread decline in fundamental performance within the European ABS sector, and the modest rise in delinquencies and defaults we have seen appears to be specific to particular countries, types of collateral, and originators.

CLO issuance YTD has been robust, with issuance now skewed towards refinance/reset activity rather than new issue. As CLO spreads tighten, the callability option becomes more attractive, as equity holders look to lock in lower funding costs. According to J.P. Morgan, total gross refinance/reset issuance is expected to come in near the 2021 record high. We remain relatively cautious of exposure within the CLO sector. Despite market pricing reflecting minimal distress, defaults are now trending above their long- run average, and are expected to remain elevated throughout 2025, according to J.P. Morgan. We believe the market continues to underweight the fundamental deterioration and the potential tail risks of what an economic downturn, or even a slowing economy, would entail for the leveraged loan sector.

Outlook:

Looking forward, we expect the start of Fed rate policy normalization, albeit at a likely higher-than-expected neutral rate, should be supportive of the economy overall - particularly those sectors most impacted by higher, floating-rate financing costs. We believe that floating-rate corporate debt, commercial real estate, and even some consumer debt should all benefit. The level and pace of future rate moves will continue to be debated as inflation, geopolitical factors, and labor market data evolve. For now, at least, the pressure relief valve on funding costs has been opened.

The question for investors looking forward, in our opinion, is not whether the base case expectation of a soft landing will be realized but rather, whether investors are being adequately compensated for the risk. Broader equity benchmarks continue to set new record highs while corporate credit spreads remain at or near historic lows. We believe current pricing in the equity and corporate credit sectors reflects a benign fundamental outlook with little compensation (risk premia) for future uncertainty.

While spreads within structured credit sectors have also narrowed; in our view, consumer ABS and commercial real estate, for example, are credit sectors with a disproportionate focus on fundamental uncertainty. This fundamental uncertainty, in our opinion, has resulted in elevated risk premia across a number of sectors, resulting in attractive investment opportunities.

While increasing vacancies in the office sector garner the majority of headlines, the impact of higher interest rates, rising operating costs, and tighter lending standards continue to present challenges to the sector overall. As such, benchmark CMBS spreads remain meaningfully wider than historical levels, both on an outright basis and when compared with unsecured corporates. While there is significant dispersion within and across the CMBS market based on underlying property characteristics, we believe the general level of uncertainty surrounding CRE fundamentals has created elevated risk premia and attractive investment opportunities. Of course, having the ability to underwrite individual properties is critical to the valuation process. As important, in many cases, is having a thorough understanding of the cash flow implications of individual CMBS securitizations, particularly if a deal becomes distressed. These can have a material influence not only on the potential recovery of principal but also on the timing of principal recovery. In our opinion, excess return opportunities can be found in distressed situations when the timing of cash flow recoveries has a material influence over realized return.

In addition to outright spread and yield, we also believe that structured credit securities can offer attractive risk-adjusted return characteristics relative to traditional, non-amortizing fixed-maturity bonds like corporate or sovereign bonds. Within the securitized credit market, amortizing cash flows, the prioritization of principal payments within a securitization, excess interest and overcollateralization, as well as deal-specific performance triggers, all impact an individual security's risk profile. Importantly, an individual security's risk profile can change over time as collateral seasons and deal structures pay down. In many instances, as deals pay down, the risk profile of an individual security deleverages and it effectively becomes less risky (i.e. higher credit quality). This deleveraging can significantly enhance a security's expected holding period return relative to spread or yield alone, and protect against a widening of credit spreads generally. The benefits of credit deleveraging and credit spread roll-down within the structured credit sector can provide protection against future credit spread widening, in contrast to say, a portfolio of fixed-maturity corporate bonds. In our opinion, the challenge is identifying investment profiles and deal structures that will drive improving credit quality, deleveraging risk profiles over time.

| 1WS Credit Income Fund | Management Commentary |

October 31, 2024 (Unaudited)

While we are optimistic about the investment opportunities present in structured credit markets, we are cautious about potential macroeconomic factors that could lead to heightened volatility in fixed income, credit and equity markets. Although we are not anticipating a widespread decline in credit fundamentals, we recognize that there remain significant risks associated with current economic conditions, inflation, and the geopolitical landscape. Geopolitical tensions such as the ongoing conflict in Ukraine and escalating issues in the Middle East are factors that we believe are not fully reflected in market pricing. Furthermore, the results of the U.S. presidential election may introduce additional uncertainty into the macroeconomic landscape. Given that market risk premium in various credit and equity sectors are at historically low levels, we are not inclined at this time to increase overall portfolio risk exposure. Instead, we believe that this environment favors specialized credit underwriters who emphasize security selection, risk management, and the pursuit of unique sources of returns. It is worth re-iterating that as a dedicated structured “credit” investment manager, we seek to hedge all non-credit risk exposures across our portfolio. For instance, through the use of derivatives, we hedge all interest rate risk embedded within our portfolio as well as hedging various currency exposures derived from our non-dollar investment strategies.

Investing in the Fund may be considered speculative and involves a high degree of risk, including the risk of possible substantial loss of your investment.

Prior to investing, Investors should carefully consider the investment objectives, risks, charges and expenses of the 1WS Credit Income Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (833) 834-4923 or visiting www.1wscapital.com. The prospectus should be read carefully before investing.

Net performance data are pre-tax, fund-level, net of operating expenses, management fees, and any applicable shareholder servicing and distribution fees charged to investors. Actual returns experienced by an investor may vary due to these factors, among others. ITD Net return is a linked monthly return.

1WS Credit Income Fund is distributed by ALPS Distributors, Inc. ALPS Distributors, Inc. is not affiliated with 1WS Capital Advisors, LLC or One William Street Capital Management, L.P.

Risk Disclosures

Past performance is not a guarantee of future results. There is no assurance that the Fund will meet its investment objective.

Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire to sell in a quarterly repurchase offer. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment.

The Fund’s investments may be negatively affected by the broad investment environment in the real estate market, the debt market and/or the equity securities market. The value of the Fund’s investments will increase or decrease based on changes in the prices of the investments it holds. This will cause the value of the Fund’s shares to increase or decrease. The Fund is “non-diversified” under the Investment Company Act of 1940 and, thus, changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund’s net asset value than in a “diversified” fund. Diversification does not eliminate the risk of experiencing investment losses. The Fund is not intended to be a complete investment program.

The Fund expects most of its investments to be in securities that are rated below investment grade or would be rated below investment grade if they were rated. Below investment grade instruments or “junk securities” are particularly susceptible to economic downturns compared to higher rated investments. While the Fund may employ hedging techniques to seek to minimize interest rate risk, there can be no assurance that it will engage in such techniques at any given time or that such techniques would be successful. As such, the Fund is subject to interest rate risk and may decline in value as interest rates rise. The Fund may use leverage to achieve its investment objective, which involves risks, including the increased likelihood of net asset value volatility and the increased risk that fluctuations in interest rates on borrowings will reduce the return to investors. In addition to the normal risks associated with investing, investing in international and emerging markets involves risk of capital loss from unfavorable fluctuations in currency values, differences in generally accepted accounting principles or from social, economic or political instability in other nations. The Fund may employ hedging techniques to seek to minimize foreign currency risk.

There can be no assurance that the Fund will engage in such techniques at any given time or that such techniques would be successful. The Fund may invest in derivatives, which, depending on market conditions and the type of derivative, are more volatile than other investments and could magnify the Fund’s gains or losses. An investment in shares should be considered only by investors who can assess and bear the illiquidity and other risks associated with such an investment.

| Annual Report | October 31, 2024 | 5 |

| 1WS Credit Income Fund | Management Commentary |

October 31, 2024 (Unaudited)

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Mortgage-backed and asset-backed securities are affected by interest rates, financial health of issuers/originators, creditworthiness of entities providing credit enhancements and the value of underlying assets. Fixed-income securities present issuer default risk. Prepayment and extension risk exists because a loan, bond or other investment may be called, prepaid or redeemed before maturity and similar yielding investments may not be available for purchase. Structured finance securities may present risks similar to those of the other types of debt obligations in which the Fund may invest and, in fact, such risks may be of greater significance in the case of structured finance securities. Investing in structured finance securities may be affected by a variety of factors, including priority in the capital structure of the issuer thereof, the availability of any credit enhancement, and the level and timing of payments and recoveries on and the characteristics of the underlying receivables, loans or other assets that are being securitized, among others. Market or other (e.g., interest rate) environments may adversely affect the liquidity of Fund investments, negatively impacting their price. Generally, the less liquid the market at the time the Fund sells a holding, the greater the risk of loss or decline of value to the Fund. See the Fund’s prospectus for information on these and other risks.

There can be no assurance that the Fund will achieve its investment objective. Many of the Fund’s investments may be considered speculative and subject to increased risk. Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Adviser to allocate effectively the assets of the Fund among the various securities and investments in which the Fund invests. There can be no assurance that the actual allocations or investment selections will be effective in achieving the Fund’s investment objective or delivering positive returns.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the portfolio manager disclaims any responsibility to update such views. The views expressed in this report reflect the current views of the portfolio manager as of October 31, 2024.

There are limitations when comparing the 1WS Credit Income Fund to indices. Many open-end funds which track these indices offer daily liquidity, while closed-end interval funds offer liquidity on a periodic basis. Deteriorating general market conditions will reduce the value of stock securities. When interest rates rise, the value of bond securities tends to fall. Investing in lower-rated securities involves special risks in addition to the risks associated with investments in investment grade securities, including a high degree of credit risk. Lower-rated securities may be regarded as predominately speculative with respect to the issuer’s continuing ability to meet principal and interest payments. Analysis of the creditworthiness of issuers/ issues of lower-rated securities may be more complex than for issuers/issues of higher quality debt securities. There is a risk that issuers will not make payments, resulting in losses to the Fund. In addition, the credit quality of securities may be lowered if an issuer’s financial condition changes. Assets and securities contained within indices are different than the assets and securities contained in the 1WS Credit Income Fund and will therefore have different risk and reward profiles. An investment cannot be made in an index, which is unmanaged and has returns that do not reflect any trading, management or other costs. Please see definitions for a description of the investment indexes selected.

| 1WS Credit Income Fund | Management Commentary |

October 31, 2024 (Unaudited)

Definitions

ABS: Asset-Backed Securities are instruments secured by financial, physical, and/or intangible assets (e.g., receivables or pools of receivables), and investments in any assets/instruments underlying the foregoing structured/secured obligations.

Basis Points (bps): A basis point is a common unit of measurement for interest rates and credit spreads and is equal to one hundredth of one percent.

CLO: Collateralized Loan Obligations are instruments that represent debt and equity tranches of collateralized loan obligations and collateralized debt obligations.

CMBS: Commercial Mortgage-Backed Securities are fixed income instruments that are secured by mortgage loans on commercial real property.

Credit Risk Transfer (CRT) Securities: CRT securities effectively transfer a portion of the risk associated with credit losses within pools of residential mortgage loans to investors.

Foreign Exchange Rate Hedges: Foreign exchange rate hedges include a variety of different products to help protect against foreign currency expo-sure within our portfolio. In principle, foreign exchange rate hedging products provide greater certainty over future loan repayments.

Interest Rate Hedges: Interest rate hedges include a variety of different products to help protect against interest rate risk. In principle, interest rate hedging products provide greater certainty over future loan repayments.

Non-Dollar ABS: Non-Dollar Asset-Backed Securities are instruments secured by financial, physical, and/or intangible assets (e.g., receivables or pools of receivables), and investments in any assets/instruments underlying the foregoing structured/secured obligations outside of the U.S. Non- Dollar Asset-Backed Securities are denominated in currencies other than the U.S. Dollar.

Residential Transitional Loans (RTL): Mortgage loans, specifically real estate investment loans, that are usually short duration financing for investors pursuing construction, renovation, and other rehabilitation projects on a property.

RMBS: Residential Mortgage-Backed Securities are securities that may be secured by interests in a single residential mortgage loan or a pool of mortgage loans secured by residential property.

Risk Premia: Risk Premia is the investment return an asset is expected to yield in excess of the risk-free rate of return.

SASB: Single Asset Single Borrower (SASB) CMBS transactions involve the securitization of a single loan (SA) or collateralized by a group of assets all owned by the same borrower (SB).

Tranche: Tranches are segments created from a pool of assets - usually debt instruments such as bonds or mortgages - that are divvied up by risk, time to maturity, or other characteristics in order to be marketable to different investors.

| Annual Report | October 31, 2024 | 7 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

| MORTGAGE-BACKED SECURITIES (38.48%) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Residential (26.88%) | | | | | | | | | | | | |

ACE Securities Corp. Home Equity Loan Trust, Series 2006-OP2, Class M1(b)(c) | | 1M CME TERM SOFR + 0.49% | | 08/25/36 | | $ | 674,445 | | | $ | 495,042 | |

| AIMS, Series 2007-1, Class B(b) | | 1M BBSW + 0.57% | | 07/10/38 | | A$ | 786,334 | | | | 424,441 | |

| Alternative Loan Trust, Series 2007-21CB, Class 2A3(b) | | 1M CME TERM SOFR + 0.61% | | 09/25/37 | | $ | 1,003,111 | | | | 297,623 | |

Alternative Loan Trust, Series 2007-21CB, Class 2A4(b)(d) | | 5.49% - 1M CME TERM SOFR | | 09/25/37 | | | 927,233 | | | | 78,629 | |

Ameriquest Mortgage Securities Trust, Series 2006-R1, Class M4(b) | | 1M CME TERM SOFR + 0.95% | | 03/25/36 | | | 710,138 | | | | 809,131 | |

Ameriquest Mortgage Securities, Inc. Asset-Backed Pass-Through Ctfs, Series 2005-R5, Class M7(b) | | 1M CME TERM SOFR + 1.94% | | 07/25/35 | | | 528,422 | | | | 609,799 | |

Argent Securities, Inc. Asset-Backed Pass-Through Certificates, Series 2005-W5, Class M1(b)(c) | | 1M CME TERM SOFR + 0.80% | | 01/25/36 | | | 1,353,027 | | | | 1,301,341 | |

Asset Backed Securities Corp. Home Equity Loan Trust Series OOMC, Series 2006-HE3, Class M1(b) | | 1M CME TERM SOFR + 0.56% | | 03/25/36 | | | 634,254 | | | | 540,575 | |

| Atlas Funding PLC, Series 2023-1, Class F(b) | | N/A(e) | | 01/25/61 | | £ | 402,000 | | | | 555,839 | |

| Banc of America Funding , Series 2007-5, Class CA8(b)(d) | | 5.35% - 1M CME TERM SOFR | | 07/25/37 | | $ | 2,228,954 | | | | 178,093 | |

Bear Stearns Mortgage Funding Trust, Series 2006-AR5, Class 2A2(b)(c) | | 1M CME TERM SOFR + 0.57% | | 01/25/37 | | | 854,137 | | | | 787,173 | |

Bear Stearns Mortgage Funding Trust, Series 2007-AR4, Class 2A2A(b) | | 1M CME TERM SOFR + 0.35% | | 04/25/37 | | | 857,143 | | | | 789,857 | |

Bletchley Park Funding PLC, Series 2024-1, Class E(b) | | SONIA IR + 4.12% | | 07/27/28 | | £ | 430,000 | | | | 555,132 | |

| Bletchley Park Funding PLC, Series 2024-1, Class X1(b) | | SONIA IR + 4.12% | | 07/27/28 | | | 252,016 | | | | 327,823 | |

| Brants Bridge PLC, Series 2023-1, Class E(b) | | SONIA IR + 4.25% | | 09/14/26 | | | 915,000 | | | | 1,194,484 | |

| Carrington Mortgage Loan Trust, Series 2007-FRE1, Class M1(b) | | 1M CME TERM SOFR + 0.61% | | 02/25/37 | | $ | 720,860 | | | | 519,596 | |

Castell PLC, Series 2023-1, Class G(b)(c) | | N/A(e) | | 05/25/55 | | £ | 399,000 | | | | 533,272 | |

| Castell PLC, Series 2023-2, Class G(b) | | SONIA IR + 9.90% | | 11/25/55 | | | 407,000 | | | | 541,551 | |

| Castell PLC, Series 2023-2, Class X(b) | | SONIA IR + 7.25% | | 11/25/55 | | | 70,498 | | | | 91,668 | |

| Connecticut Avenue Securities, Series 2021-R02, Class 2B2(b)(f) | | 30D US SOFR + 6.20% | | 11/25/41 | | $ | 2,926,000 | | | | 3,101,560 | |

| Connecticut Avenue Securities Trust, Series 2022-R05, Class 2B2(b)(f) | | 30D US SOFR + 7.00% | | 04/25/42 | | | 456,000 | | | | 499,913 | |

| Connecticut Avenue Securities Trust, Series 2023-R03, Class 2B1(b)(f) | | 30D US SOFR + 6.35% | | 04/25/43 | | | 996,000 | | | | 1,135,639 | |

| Connecticut Avenue Securities Trust, Series 2023-R06, Class 1B1(b)(f) | | 30D US SOFR + 3.90% | | 07/25/43 | | | 333,000 | | | | 361,738 | |

| Connecticut Avenue Securities Trust, Series 2024-R01, Class 1B2(b)(f) | | 30D US SOFR + 4.00% | | 01/25/44 | | | 1,875,000 | | | | 1,954,687 | |

| Connecticut Avenue Securities Trust, Series 2024-R02, Class 1B2(b)(c)(f) | | 30D US SOFR + 3.70% | | 02/25/44 | | | 2,655,000 | | | | 2,728,013 | |

| Countrywide Alternative Loan Trust, Series 2005-64CB, Class 1A17 | | 5.50% | | 12/25/35 | | | 127,148 | | | | 99,506 | |

| CWABS Asset-Backed Certificates Trust, Series 2004-15, Class MV7(b) | | 1M CME TERM SOFR + 2.51% | | 02/25/35 | | | 734,113 | | | | 508,080 | |

CWABS Asset-Backed Certificates Trust, Series 2005-2, Class M6(b)(c) | | 30D US SOFR + 2.03% | | 08/25/35 | | | 533,614 | | | | 498,075 | |

CWABS Asset-Backed Certificates Trust 2006-11, Series 2006-12, Class M1(b) | | 1M CME TERM SOFR + 0.56% | | 12/25/36 | | | 682,323 | | | | 650,391 | |

Deutsche Alt-A Securities Mortgage Loan Trust, Series 2007-OA4, Class 2A2(b) | | 1M CME TERM SOFR + 0.75% | | 08/25/47 | | | 899,907 | | | | 648,293 | |

| Dilosk RMBS NO 7 DAC, Series 2023-7, Class X1(b) | | 3M EUR L + 6.33% | | 10/20/62 | | € | 159,586 | | | | 174,284 | |

| Dilosk RMBS No 8 Sts DAC, Series 2024-STS, Class F(b) | | 9.57% | | 05/20/62 | | | 459,000 | | | | 537,072 | |

| Dilosk RMBS No 8 Sts DAC, Series 2024-STS, Class X(b) | | 11.92% | | 05/20/62 | | | 500,714 | | | | 550,587 | |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

| MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | | | | | |

Dilosk Rmbs NO 9 Dac, Series 2024-9, Class X2(b) | | N/A(e) | | 01/25/28 | | € | 613,000 | | | $ | 545,034 | |

| Domi BV, Series 2020-1, Class F(b)(c) | | 3M EUR L + 6.50% | | 04/15/52 | | | 500,000 | | | | 547,138 | |

| Domi BV, Series 2020-1, Class X2(b)(c) | | 3M EUR L + 6.75% | | 04/15/52 | | | 211,935 | | | | 233,114 | |

| Domi BV, Series 2021-1, Class E(b)(c) | | 3M EUR L + 6.50% | | 06/15/53 | | | 704,000 | | | | 769,068 | |

| Domi BV, Series 2021-1, Class X2(b) | | 3M EUR L + 6.50% | | 06/15/53 | | | 96,794 | | | | 105,930 | |

| Domi BV, Series 2024-1, Class E(b) | | 3M EUR L + 5.65% | | 09/17/29 | | | 463,000 | | | | 504,887 | |

| Domi BV, Series 2024-1, Class X(b) | | 3M EUR L + 3.98% | | 09/17/29 | | | 463,000 | | | | 508,563 | |

| Eagle RE, Ltd., Series 2023-1, Class M2(b)(f) | | 30D US SOFR + 5.20% | | 09/26/33 | | $ | 728,500 | | | | 764,051 | |

| East One PLC, Series 2024-1, Class E(b) | | SONIA IR + 4.50% | | 06/27/27 | | £ | 783,000 | | | | 1,016,208 | |

| East One PLC, Series 2024-1, Class X(b) | | SONIA IR + 5.44% | | 06/27/27 | | | 213,876 | | | | 276,197 | |

| Elstree Funding No 5 PLC, Series 2024-5, Class E(b) | | N/A(e) | | 03/21/28 | | | 382,000 | | | | 493,213 | |

| Elstree Funding No 5 PLC, Series 2024-5, Class F(b) | | N/A(e) | | 03/21/28 | | | 404,000 | | | | 521,618 | |

| E-MAC Program BV, Series 2007-NL3X, Class D(b)(c) | | 3M EUR L + 0.50% | | 07/25/47 | | € | 543,241 | | | | 472,019 | |

| Eurohome UK Mortgages 2007 -1 PLC, Series 2007-1, Class B2(b) | | SONIA IR + 3.22% | | 06/15/44 | | £ | 430,000 | | | | 524,304 | |

| Eurohome UK Mortgages PLC, Series 2007-2, Class B1(b)(c) | | SONIA IR + 1.52% | | 09/15/44 | | | 1,467,000 | | | | 1,764,894 | |

| Eurosail 2006-2bl PLC, Series 2006-2X, Class D1C(b)(c) | | SONIA IR + 0.92% | | 12/15/44 | | | 1,191,000 | | | | 1,438,685 | |

| Eurosail 2006-3nc PLC, Series 2006-3X, Class D1A(b)(c) | | 3M EUR L + 0.90% | | 09/10/44 | | € | 624,000 | | | | 620,518 | |

| Eurosail 2006-4np PLC, Series 2006-4X, Class D1C(b)(c) | | SONIA IR + 0.92% | | 12/10/44 | | £ | 645,564 | | | | 777,237 | |

| Eurosail-UK 2007-5np PLC, Series 2007-5X, Class B1C(b) | | SONIA IR + 2.14% | | 09/13/45 | | | 389,132 | | | | 460,725 | |

| Exmoor Funding PLC, Series 2024-1, Class X(b) | | 3M EUR L + 5.65% | | 06/25/28 | | | 394,000 | | | | 512,161 | |

| Fieldstone Mortgage Investment Trust, Series 2005-3, Class M2(b) | | 1M CME TERM SOFR + 0.79% | | 02/25/36 | | $ | 1,626,000 | | | | 521,946 | |

Finance Ireland RMBS NO 7 DAC, Series 2024-7, Class E(b) | | 3M EUR L + 4.19% | | 12/24/63 | | € | 466,000 | | | | 508,361 | |

| Finance Ireland RMBS NO 7 DAC, Series 2024-7, Class X(b) | | 3M EUR L + 3.72% | | 12/24/63 | | | 374,764 | | | | 408,179 | |

| First Franklin Mortgage Loan Trust, Series 2005-FF12, Class M3(b)(c) | | 1M CME TERM SOFR + 0.86% | | 11/25/36 | | $ | 1,966,234 | | | | 1,315,608 | |

First Franklin Mortgage Loan Trust, Series 2006-FFH1, Class M2(b) | | 1M CME TERM SOFR + 0.71% | | 01/25/36 | | | 548,277 | | | | 518,396 | |

Freddie Mac STACR REMIC Trust, Series 2020-DNA1, Class B2(b)(f) | | 30D US SOFR + 5.36% | | 01/25/50 | | | 494,000 | | | | 548,044 | |

| Freddie Mac STACR REMIC Trust, Series 2020-DNA2, Class B2(b)(f) | | 30D US SOFR + 4.91% | | 02/25/50 | | | 1,749,000 | | | | 1,889,969 | |

| Freddie Mac STACR REMIC Trust, Series 2020-DNA6, Class B2(b)(f) | | 30D US SOFR + 5.65% | | 12/25/50 | | | 1,381,000 | | | | 1,571,302 | |

| Freddie Mac STACR REMIC Trust, Series 2020-HQA3, Class B2(b)(f) | | 30D US SOFR + 10.11% | | 07/25/50 | | | 1,029,000 | | | | 1,392,957 | |

Freddie Mac STACR REMIC Trust, Series 2020-HQA4, Class B2(b)(f) | | 30D US SOFR + 9.51% | | 09/25/50 | | | 439,000 | | | | 583,343 | |

| Freddie Mac STACR REMIC Trust, Series 2023-DNA1, Class B1(b)(f) | | 13.47% | | 03/25/43 | | | 547,000 | | | | 637,747 | |

| Freddie Mac STACR REMIC Trust, Series 2023-DNA2, Class B1(b)(f) | | 30D US SOFR + 7.60% | | 04/25/43 | | | 955,000 | | | | 1,100,829 | |

| Freddie Mac STACR REMIC Trust, Series 2023-DNA2, Class M2(b)(c)(f) | | 30D US SOFR + 5.70% | | 04/25/43 | | | 332,000 | | | | 374,795 | |

| Fremont Home Loan Trust, Series 2004-C, Class M3(b) | | 1M CME TERM SOFR + 1.84% | | 08/25/34 | | | 170 | | | | – | |

FT RMBS Miravet, Series 2023-1, Class E(b)(c) | | 3M EUR L + 3.00% | | 11/26/66 | | € | 600,000 | | | | 604,157 | |

| FT RMBS Miravet, Series 2023-1, Class F(b)(c) | | 3M EUR L + 4.00% | | 11/26/66 | | | 600,000 | | | | 592,475 | |

| Fylde Funding PLC, Series 2024-1, Class E(b) | | SONIA IR + 4.15% | | 10/25/28 | | £ | 741,000 | | | | 956,635 | |

| GSAA Home Equity Trust, Series 2007-8, Class A4(b) | | 1M CME TERM SOFR + 1.31% | | 08/25/37 | | $ | 547,743 | | | | 295,781 | |

Harben Finance, Series 2022-1RA, Class G(b)(f) | | SONIA IR + 4.30% | | 09/28/26 | | £ | 391,000 | | | | 506,598 | |

| Hermitage 2024 PLC, Series 2024-1, Class E(b) | | SONIA IR + 3.90% | | 04/21/33 | | | 349,702 | | | | 451,467 | |

Home Equity Mortgage Loan Asset-Backed Trust Series INABS, Series 2005-D, Class M2(b) | | 1M CME TERM SOFR + 0.82% | | 03/25/36 | | $ | 458,950 | | | | 288,680 | |

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2024 | 9 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

| MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | | | | | |

Home Equity Mortgage Loan Asset-Backed Trust Series INABS, Series 2006-A, Class M1(b) | | 1M CME TERM SOFR + 0.71% | | 03/25/36 | | $ | 785,417 | | | $ | 558,353 | |

Home Equity Mortgage Loan Asset-Backed Trust Series INABS, Series 2006-C, Class M1(b) | | 1M CME TERM SOFR + 0.55% | | 08/25/36 | | | 544,040 | | | | 584,952 | |

| Home RE, Ltd., Series 2022-1, Class M1C(b)(c)(f) | | 30D US SOFR + 5.50% | | 10/25/34 | | | 1,034,000 | | | | 1,090,560 | |

| Home RE, Ltd., Series 2023-1, Class M1B(b)(c)(f) | | 30D US SOFR + 4.60% | | 10/25/33 | | | 1,000,000 | | | | 1,038,500 | |

| Homeward Opportunities Fund Trust, Series 2024-RRTL2, Class M1(b)(f) | | 8.16% | | 09/25/39 | | | 500,000 | | | | 497,950 | |

| Hops Hill No2 PLC, Series 2022-2, Class E(b) | | SONIA IR + 5.25% | | 11/27/54 | | £ | 1,072,000 | | | | 1,410,083 | |

| JP Morgan Mortgage Acquisition Corp., Series 2006-FRE2, Class M3(b) | | 1M CME TERM SOFR + 0.67% | | 02/25/36 | | $ | 894,124 | | | | 621,237 | |

JP Morgan Mortgage Acquisition Trust, Series 2006-HE2, Class M2(b)(c) | | 1M CME TERM SOFR + 0.59% | | 07/25/36 | | | 1,105,092 | | | | 1,057,905 | |

Kinbane 2024-RPL 1 DAC, Series 2024-RPL1X, Class C(b) | | 1M EUR L + 2.50% | | 01/26/65 | | € | 880,000 | | | | 943,914 | |

| Kinbane 2024-RPL 1 DAC, Series 2024-RPL1X, Class D(b) | | 1M EUR L + 3.25% | | 01/26/65 | | | 557,000 | | | | 593,395 | |

| Kinbane 2024-RPL 1 DAC, Series 2024-RPL1X, Class E(b) | | 1M EUR L + 4.25% | | 01/26/65 | | | 557,000 | | | | 586,730 | |

| Kinbane 2024-RPL 1 DAC, Series 2024-RPL1X, Class F(b) | | 1M EUR L + 5.25% | | 01/26/65 | | | 749,000 | | | | 762,500 | |

| Landmark Mortgage Securities No 3 PLC, Series 2007-3, Class D(b)(c) | | SONIA IR + 4.12% | | 04/17/44 | | £ | 447,234 | | | | 578,880 | |

| Lansdowne Mortgage Securities No 1 PLC, Series 2006-1, Class M2(b)(c) | | 3M EUR L + 0.84% | | 06/15/45 | | € | 500,000 | | | | 380,440 | |

| Lehman Mortgage Trust, Series 2006-9, Class 1A5(b)(c) | | 1M CME TERM SOFR + 0.71% | | 01/25/37 | | $ | 687,647 | | | | 361,633 | |

Lehman Mortgage Trust, Series 2007-5, Class 6A1(b) | | 1M CME TERM SOFR + 0.43% | | 10/25/36 | | | 3,537,563 | | | | 1,432,006 | |

| LHOME Mortgage Trust, Series 2024-RTL4, Class M1(b)(f) | | 7.79% | | 01/25/27 | | | 500,000 | | | | 505,800 | |

| LHOME Mortgage Trust, Series 2024-RTL5, Class M1(b)(f) | | 6.82% | | 09/25/39 | | | 500,000 | | | | 500,400 | |

| Ludgate Funding PLC, Series 2008-W1X, Class D(b) | | SONIA IR + 1.62% | | 01/01/61 | | £ | 425,205 | | | | 482,873 | |

| Merrion Square Residential 2024-1 DAC, Series 2024-1X, Class C(b) | | 1M EUR L + 2.35% | | 06/24/27 | | € | 474,000 | | | | 507,343 | |

| Merrion Square Residential 2024-1 DAC, Series 2024-1X, Class D(b) | | 1M EUR L + 3.25% | | 06/24/27 | | | 475,000 | | | | 508,052 | |

| Merrion Square Residential 2024-1 DAC, Series 2024-1X, Class E(b) | | 1M EUR L + 4.25% | | 06/24/27 | | | 811,000 | | | | 856,229 | |

| MFA , Series 2024-RTL3, Class A1(f) | | 5.91% | | 11/25/39 | | $ | 643,000 | | | | 647,822 | |

| MFA , Series 2024-RTL3, Class A2(f) | | 6.54% | | 11/25/39 | | | 643,000 | | | | 647,823 | |

| Miravet Sarl - Compartment, Series 2019-1, Class E(b)(c) | | 3M EUR L + 3.00% | | 05/26/65 | | € | 500,000 | | | | 534,084 | |

| Miravet Sarl - Compartment, Series 2020-1, Class E(b)(c) | | 3M EUR L + 4.00% | | 05/26/65 | | | 1,135,000 | | | | 1,232,990 | |

| Molossus Btl PLC, Series 2024-1, Class E(b) | | SONIA IR + 3.94% | | 10/18/26 | | £ | 426,000 | | | | 549,748 | |

| Molossus Btl PLC, Series 2024-1, Class F(b) | | SONIA IR + 4.93% | | 10/18/26 | | | 399,000 | | | | 515,831 | |

| Molossus Btl PLC, Series 2024-1, Class X(b) | | SONIA IR + 4.83% | | 10/18/26 | | | 374,786 | | | | 487,331 | |

| MORTI 2024-MIX E | | N/A(e) | | 09/22/67 | | | 857,000 | | | | 1,105,065 | |

| MORTI 2024-MIX X | | N/A(e) | | 09/22/67 | | | 578,000 | | | | 745,306 | |

| Nationstar Home Equity Loan Trust, Series 2007-B, Class M2(b) | | 1M CME TERM SOFR + 0.58% | | 04/25/37 | | $ | 1,200,099 | | | | 1,260,584 | |

Newgate Funding PLC, Series 2006-2, Class DB(b) | | 3M EUR L + 0.90% | | 12/01/50 | | € | 40,364 | | | | 40,367 | |

| Newgate Funding PLC, Series 2007-1X, Class DB(b) | | 3M EUR L + 0.75% | | 12/01/50 | | | 539,307 | | | | 490,834 | |

| Newgate Funding PLC, Series 2007-2X, Class E(b) | | SONIA IR + 3.87% | | 12/15/50 | | £ | 419,190 | | | | 485,989 | |

| NYMT 2024-BPL2 M(f) | | 8.41% | | 05/25/39 | | $ | 3,750,000 | | | | 3,789,750 | |

| Ownit Mortgage Loan Trust, Series 2005-4, Class M1(b)(c) | | 1M CME TERM SOFR + 0.94% | | 08/25/36 | | | 913,970 | | | | 808,132 | |

Park Place Securities, Inc. Asset-Backed Pass-Through Certificates Series 2005-WCW, Series 2005-WCW2, Class M5(b) | | 1M CME TERM SOFR + 1.13% | | 07/25/35 | | | 554,509 | | | | 528,669 | |

| Parkmore Point RMBS 2022-1 PLC, Series 2022-1X, Class D(b)(c) | | SONIA IR + 3.50% | | 07/25/45 | | £ | 440,000 | | | | 564,071 | |

| Pierpont Btl PLC, Series 2023-1, Class X(b) | | SONIA IR + 7.94% | | 09/21/54 | | | 146,011 | | | | 189,555 | |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

| MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | | | |

| Polaris PLC, Series 2021-1, Class F(b) | | SONIA IR + 3.40% | | 12/23/58 | | £ | 377,000 | | | $ | 488,021 | |

| Polaris PLC, Series 2022-1, Class E(b) | | SONIA IR + 3.40% | | 10/23/59 | | | 553,000 | | | | 713,854 | |

| Polaris PLC, Series 2022-2, Class E(b) | | SONIA IR + 5.75% | | 05/23/59 | | | 795,579 | | | | 1,034,278 | |

| Polaris PLC, Series 2023-1, Class F(b) | | SONIA IR + 8.25% | | 02/23/61 | | | 403,000 | | | | 539,138 | |

| Polaris PLC, Series 2023-2, Class E(b) | | SONIA IR + 6.00% | | 02/27/27 | | | 555,000 | | | | 754,509 | |

| Polaris PLC, Series 2023-2, Class F(b) | | SONIA IR + 8.75% | | 02/27/27 | | | 403,000 | | | | 551,610 | |

| Polaris PLC, Series 2023-2, Class X(b) | | SONIA IR + 8.00% | | 02/27/27 | | | 111,699 | | | | 145,817 | |

| Polaris PLC, Series 2024-1, Class F(b) | | SONIA IR + 5.65% | | 02/26/28 | | | 395,000 | | | | 514,684 | |

| Polaris PLC, Series 2024-1, Class X(b) | | SONIA IR + 5.65% | | 02/26/28 | | | 260,499 | | | | 338,489 | |

| Popular ABS Mortgage Pass-Through Trust, Series 2005-5, Class MF1(g) | | 3.44% | | 11/25/35 | | $ | 404,130 | | | | 269,838 | |

| Popular ABS Mortgage Pass-Through Trust, Series 2005-D, Class M1(c)(g) | | 3.51% | | 01/25/36 | | | 396,293 | | | | 338,156 | |

| Portman Square 2023-NPL1 DAC, Series 2023-NPL1X, Class B(b) | | 3M EUR L + 4.00% | | 07/25/63 | | € | 367,750 | | | | 390,683 | |

| Radnor Re, Ltd., Series 2024-1, Class B1(b)(f) | | 30D US SOFR + 5.15% | | 09/25/34 | | $ | 150,000 | | | | 153,240 | |

| Radnor Re, Ltd., Series 2024-1, Class M1B(b)(f) | | 30D US SOFR + 2.90% | | 09/25/34 | | | 542,000 | | | | 545,360 | |

| Radnor Re, Ltd., Series 2024-1, Class M1C(b)(f) | | 30D US SOFR + 3.50% | | 09/25/34 | | | 500,000 | | | | 507,750 | |

| Residential Accredit Loans, Inc., Series 2006-Q05, Class 1A2(b)(c) | | 1M CME TERM SOFR + 0.49% | | 05/25/46 | | | 860,818 | | | | 884,836 | |

Residential Accredit Loans, Inc., Series 2006-QS9, Class 1A16(b)(c) | | 1M CME TERM SOFR + 0.76% | | 07/25/36 | | | 386,740 | | | | 275,513 | |

Residential Accredit Loans, Inc., Series 2006-QS9, Class 1A5(b)(c) | | 1M CME TERM SOFR + 0.81% | | 07/25/36 | | | 570,160 | | | | 407,208 | |

Residential Asset Securitization Trust, Series 2005-A15, Class 2A10(b) | | 1M CME TERM SOFR + 0.56% | | 02/25/36 | | | 1,382,180 | | | | 408,434 | |

RMAC Securities No 1 PLC, Series 2006-NS4X, Class B1C(b) | | 3M EUR L + 0.85% | | 06/12/44 | | € | 470,844 | | | | 468,831 | |

| Rochester Financing No 3 PLC, Series 2021-3, Class E(b) | | SONIA IR + 2.50% | | 12/18/44 | | £ | 404,000 | | | | 505,938 | |

| Rochester Financing No 3 PLC, Series 2021-3, Class F(b) | | SONIA IR + 2.50% | | 12/18/44 | | | 412,000 | | | | 507,350 | |

| SMI Equity Release 2018-1 DAC, Series 2023-1, Class BRR(b) | | 3M EUR L + 5.00% | | 06/20/45 | | € | 500,000 | | | | 505,205 | |

| Soundview Home Loan Trust, Series 2005-OPT4, Class M2(b)(c) | | 1M CME TERM SOFR + 0.94% | | 12/25/35 | | $ | 1,773,967 | | | | 1,563,929 | |

Soundview Home Loan Trust, Series 2006-OPT2, Class M1(b) | | 1M CME TERM SOFR + 0.56% | | 05/25/36 | | | 629,688 | | | | 498,273 | |

Stratton Mortgage Funding 2024-1 PLC, Series 2024-1A, Class F(b)(f) | | 3M SONIA IR + 4.00% | | 06/20/60 | | £ | 465,000 | | | | 591,323 | |

| Stratton Mortgage Funding 2024-2 PLC, Series 2024-2X, Class E(b) | | SONIA IR + 3.75% | | 06/28/50 | | | 400,000 | | | | 512,740 | |

| Stratton Mortgage Funding PLC, Series 2024-3, Class E(b) | | SONIA IR + 3.75% | | 06/25/49 | | | 395,000 | | | | 508,266 | |

| Stratton Mortgage Funding PLC, Series 2024-3, Class F(b) | | SONIA IR + 4.75% | | 06/25/49 | | | 396,000 | | | | 504,957 | |

| Structured Asset Investment Loan Trust, Series 2005-8, Class M2(b) | | 1M CME TERM SOFR + 0.86% | | 10/25/35 | | $ | 992,399 | | | | 830,440 | |

Structured Asset Investment Loan Trust, Series 2005-9, Class M2(b)(c) | | 1M CME TERM SOFR + 0.79% | | 11/25/35 | | | 1,331,870 | | | | 1,126,362 | |

Structured Asset Investment Loan Trust, Series 2006-BNC3, Class A4(b)(c) | | 1M CME TERM SOFR + 0.42% | | 09/25/36 | | | 1,907,568 | | | | 1,069,001 | |

Structured Asset Securities Corp. Mortgage Loan Trust, Series 2006-BC6, Class M1(b) | | 1M CME TERM SOFR + 0.38% | | 01/25/37 | | | 577,274 | | | | 500,958 | |

Structured Asset Securities Corp. Mortgage Loan Trust 2006-W1, Series 2006-W1A, Class M1(b)(f) | | 1M CME TERM SOFR + 0.41% | | 08/25/46 | | | 2,111,754 | | | | 2,077,121 | |

| SYON, Series 2020-2, Class E | | 6.27% | | 12/17/27 | | £ | 842,119 | | | | 1,118,887 | |

| Together Asset Backed Securitisation 2024-1ST2 PLC, Series 2024-1ST2X, Class E(b) | | N/A(e) | | 09/12/28 | | | 810,000 | | | | 1,045,714 | |

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2024 | 11 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

| MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | | | | | |

Towd Point Mortgage Funding 2024 - Granite 6 PLC, Series 2024-GR6X, Class E(b) | | SONIA IR + 3.50% | | 01/20/27 | | £ | 833,000 | | | $ | 1,078,200 | |

Towd Point Mortgage Funding 2024 - Granite 6 PLC, Series 2024-GR6X, Class F(b) | | SONIA IR + 4.50% | | 01/20/27 | | | 556,000 | | | | 721,096 | |

| Towd Point Mortgage Trust, Series 2017-1, Class B4(b)(f) | | 3.85% | | 06/25/32 | | $ | 743,000 | | | | 562,451 | |

| Triangle Re, Ltd., Series 2021-2, Class B1(b)(f) | | 1M CME TERM SOFR + 7.61% | | 10/25/33 | | | 469,000 | | | | 508,302 | |

Triangle Re, Ltd., Series 2021-3, Class B1(b)(f) | | 30D US SOFR + 4.95% | | 02/25/34 | | | 591,600 | | | | 610,768 | |

| Triangle Re, Ltd., Series 2023-1, Class M1B(b)(c)(f) | | 30D US SOFR + 5.25% | | 11/25/33 | | | 1,015,000 | | | | 1,073,058 | |

| Twin Bridges PLC, Series 2022-1, Class X2(b) | | 3M SONIA IR + 5.00% | | 12/01/55 | | £ | 367,541 | | | | 473,408 | |

| Twin Bridges PLC, Series 2022-2, Class E(b) | | SONIA IR + 5.50% | | 06/12/55 | | | 241,000 | | | | 312,841 | |

| Uropa Securities PLC, Series 2007-1, Class B1A(b)(c) | | SONIA IR + 1.47% | | 10/10/40 | | | 531,032 | | | | 611,749 | |

| Uropa Securities PLC, Series 2007-1, Class B1B(b)(c) | | 3M EUR L + 1.35% | | 10/10/40 | | € | 514,921 | | | | 501,686 | |

| Uropa Securities PLC, Series 2007-1, Class B2A(b) | | SONIA IR + 4.12% | | 10/10/40 | | £ | 433,748 | | | | 492,296 | |

WaMu Mortgage Pass-Through Certificates, Series 2006-AR3, Class A1C(b) | | 12M US FED + 1.00% | | 02/25/46 | | $ | 189,291 | | | | 287,514 | |

| Total Residential Mortgage Backed Securities | | | | | | | | | | $ | 112,915,508 | |

| | | | | | | | | | | | | |

| Commercial (11.60%) | | | | | | | | | | | | |

| BAMLL Commercial Mortgage Securities Trust, Series 2021-JACX, Class B(b)(f) | | 1M CME TERM SOFR + 1.56% | | 09/15/38 | | | 1,207,000 | | | | 1,112,492 | |

| BAMLL Commercial Mortgage Securities Trust, Series 2021-JACX, Class C(b)(f) | | 1M CME TERM SOFR + 2.11% | | 09/15/38 | | | 668,000 | | | | 604,206 | |

| BAMLL Commercial Mortgage Securities Trust, Series 2021-JACX, Class D(b)(f) | | 1M CME TERM SOFR + 2.86% | | 09/15/38 | | | 667,000 | | | | 563,615 | |

BAMLL Commercial Mortgage Securities Trust, Series 2021-JACX, Class F(b)(f) | | 1M CME TERM SOFR + 5.11% | | 09/15/38 | | | 2,500,000 | | | | 1,791,000 | |

| BBCMS Mortgage Trust, Series 2021-AGW, Class A(b)(f) | | 1M CME TERM SOFR + 1.36% | | 06/15/36 | | | 560,000 | | | | 536,704 | |

BBCMS Mortgage Trust, Series 2021-AGW, Class E(b)(f) | | 1M CME TERM SOFR + 3.26% | | 06/15/26 | | | 588,000 | | | | 507,856 | |

BBCMS Mortgage Trust, Series 2021-AGW, Class F(b)(c)(f) | | 1M CME TERM SOFR + 4.11% | | 06/15/36 | | | 1,361,000 | | | | 1,163,519 | |

BFLD Mortgage Trust, Series 2021-FPM, Class D(b)(c)(f) | | 1M CME TERM SOFR + 4.76% | | 06/15/38 | | | 500,000 | | | | 499,650 | |

BFLD Mortgage Trust, Series 2021-FPM, Class E(b)(c)(f) | | 1M CME TERM SOFR + 5.76% | | 06/15/38 | | | 533,000 | | | | 532,627 | |

BHMS, Series 2018-ATLS, Class D(b)(f) | | 1M CME TERM SOFR + 2.55% | | 07/15/35 | | | 1,202,000 | | | | 1,199,716 | |

BPR Trust, Series 2021-WILL, Class C(b)(c)(f) | | 1M CME TERM SOFR + 4.11% | | 06/15/38 | | | 500,000 | | | | 498,150 | |

BPR Trust, Series 2021-WILL, Class E(b)(f) | | 1M CME TERM SOFR + 6.86% | | 06/15/38 | | | 500,000 | | | | 498,250 | |

| Citigroup Commercial Mortgage Trust, Series 2013-GC17, Class D(b)(c)(f) | | 5.23% | | 11/10/46 | | | 583,581 | | | | 560,004 | |

| Citigroup Commercial Mortgage Trust, Series 2014-GC25, Class E(f) | | 3.30% | | 10/10/47 | | | 564,000 | | | | 254,420 | |

| Citigroup Commercial Mortgage Trust, Series 2016-C1, Class E(b)(f) | | 5.10% | | 05/10/49 | | | 1,364,000 | | | | 1,204,276 | |

| COMM 2014-CCRE18 Mortgage Trust, Series 2014-CR18, Class E(f) | | 3.60% | | 07/15/47 | | | 1,000,000 | | | | 902,600 | |

| COMM Mortgage Trust, Series 2019-521F, Class A(b)(f) | | 1M CME TERM SOFR + 1.05% | | 06/15/34 | | | 2,150,000 | | | | 2,034,760 | |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | | | | | |

| COMM Mortgage Trust, Series 2021-2400, Class B(b)(f) | | 1M CME TERM SOFR + 1.86% | | 12/15/38 | | $ | 5,000,000 | | | $ | 4,780,500 | |

CSMC, Series 2020-FACT, Class D(b)(c)(f) | | 1M CME TERM SOFR + 3.82% | | 10/15/37 | | | 500,000 | | | | 472,800 | |

CSMC, Series 2020-FACT, Class E(b)(f) | | 1M CME TERM SOFR + 4.98% | | 10/15/37 | | | 534,000 | | | | 497,207 | |

CSMC Trust, Series 2017-PFHP, Class A(b)(f) | | 1M CME TERM SOFR + 1.00% | | 12/15/30 | | | 1,190,000 | | | | 1,166,676 | |

DBWF Mortgage Trust, Series 2024-LCRS, Class E(b)(c)(f) | | 1M CME TERM SOFR + 4.19% | | 04/15/29 | | | 2,000,000 | | | | 2,001,800 | |

GS Mortgage Securities Corp. Trust, Series 2020-DUNE, Class G(b)(f) | | 1M CME TERM SOFR + 4.11% | | 12/15/36 | | | 839,000 | | | | 784,298 | |

GS Mortgage Securities Corp. Trust, Series 2021-ROSS, Class A(b)(f) | | 1M CME TERM SOFR + 1.41% | | 05/15/26 | | | 538,000 | | | | 501,093 | |

GS Mortgage Securities Corp. Trust, Series 2021-ROSS, Class B(b)(f) | | 1M CME TERM SOFR + 1.86% | | 05/15/26 | | | 1,000,000 | | | | 823,300 | |

GS Mortgage Securities Corp. Trust, Series 2021-ROSS, Class C(b)(f) | | 1M CME TERM SOFR + 2.11% | | 05/15/26 | | | 567,000 | | | | 418,219 | |

GS Mortgage Securities Corp. Trust, Series 2021-ROSS, Class D(b)(f) | | 1M CME TERM SOFR + 2.76% | | 05/15/26 | | | 1,043,000 | | | | 640,819 | |

| GS Mortgage Securities Trust, Series 2013-GC10, Class D(b)(f) | | 4.54% | | 02/10/46 | | | 585,000 | | | | 551,070 | |

| HPLY Trust, Series 2019-HIT, Class F(b)(f) | | 1M CME TERM SOFR + 3.26% | | 11/15/26 | | | 664,500 | | | | 670,613 | |

J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2017-FL11, Class E(b)(f) | | PRIME + 0.96% | | 10/15/32 | | | 128,168 | | | | 127,656 | |

| JP Morgan Chase Commercial Mortgage Securities Trust, Series 2019-BKWD, Class A(b)(f) | | 1M CME TERM SOFR + 1.61% | | 09/15/29 | | | 582,668 | | | | 550,388 | |

JP Morgan Chase Commercial Mortgage Securities Trust, Series 2019-BKWD, Class C(b)(f) | | 1M CME TERM SOFR + 2.21% | | 09/15/29 | | | 135,000 | | | | 116,735 | |

JP Morgan Chase Commercial Mortgage Securities Trust, Series 2019-BKWD, Class D(b)(f) | | 1M CME TERM SOFR + 2.46% | | 09/15/29 | | | 1,000,000 | | | | 769,600 | |

JPMBB Commercial Mortgage Securities Trust, Series 2013-C15, Class E(f) | | 3.50% | | 11/15/45 | | | 1,000,000 | | | | 741,800 | |

| JPMBB Commercial Mortgage Securities Trust, Series 2013-C15, Class F(f) | | 3.59% | | 11/15/45 | | | 1,098,000 | | | | 649,687 | |

JW Trust, Series 2024-BERY, Class E(b)(f) | | 1M CME TERM SOFR + 3.54% | | 11/15/29 | | | 1,500,000 | | | | 1,500,000 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Series 2014-C14, Class F(f) | | 3.71% | | 02/15/47 | | | 185,126 | | | | 173,000 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C25, Class E(b)(f) | | 4.52% | | 10/15/48 | | | 660,000 | | | | 551,694 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C25, Class G(b)(c)(f) | | 4.52% | | 10/15/48 | | | 1,449,060 | | | | 799,591 | |

Morgan Stanley Capital I Trust, Series 2017-ASHF, Class E(b)(f) | | 1M CME TERM SOFR + 3.32% | | 11/15/34 | | | 580,000 | | | | 573,098 | |

| Morgan Stanley Capital I Trust, Series 2018-H3, Class D(f) | | 3.00% | | 07/15/51 | | | 1,000,000 | | | | 815,700 | |

| Morgan Stanley Capital I Trust, Series 2021-230P, Class E(b)(f) | | 1M CME TERM SOFR + 3.19% | | 12/15/38 | | | 1,651,000 | | | | 1,362,901 | |

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2024 | 13 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

| MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | | | | | |

| Natixis Commercial Mortgage Securities Trust, Series 2019-FAME, Class C(b)(c)(f) | | 4.25% | | 08/15/36 | | $ | 895,000 | | | $ | 694,788 | |

| Natixis Commercial Mortgage Securities Trust, Series 2019-FAME, Class D(b)(f) | | 4.40% | | 08/15/36 | | | 378,000 | | | | 231,865 | |

Natixis Commercial Mortgage Securities Trust, Series 2022-JERI, Class A(b)(f) | | 1M CME TERM SOFR + 1.40% | | 01/15/39 | | | 2,084,266 | | | | 1,902,310 | |

| SMR Mortgage Trust, Series 2022-IND, Class E(b)(f) | | 1M CME TERM SOFR + 5.00% | | 02/15/39 | | | 915,677 | | | | 901,301 | |

| Taubman Centers Commercial Mortgage Trust, Series 2022-DPM, Class C(b)(f) | | 1M CME TERM SOFR + 3.78% | | 05/15/37 | | | 500,000 | | | | 503,400 | |

| VCP Tyler Pref, LLC(h) | | 13.50% | | 12/29/25 | | | 2,166,784 | | | | 2,166,784 | |

| Velocity Commercial Capital Loan Trust, Series 2024-2, Class M4(b)(f) | | 10.71% | | 04/25/54 | | | 493,144 | | | | 497,385 | |

| WCORE Commercial Mortgage Trust, Series 2024-CORE, Class E(b)(f) | | 1M CME TERM SOFR + 3.94% | | 11/15/26 | | | 1,110,000 | | | | 1,134,864 | |

| Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class E(f) | | 3.15% | | 09/15/57 | | | 1,311,000 | | | | 1,179,245 | |

| Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class F(f) | | 3.15% | | 09/15/57 | | | 489,500 | | | | 407,900 | |

| Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class G(f) | | 3.15% | | 09/15/57 | | | 814,500 | | | | 612,585 | |

| Wilmot Plaza Mezz Loan, Class F(h) | | 11.15% | | 10/01/31 | | | 2,000,000 | | | | 2,000,000 | |

| Total Commercial Mortgage Backed Securities | | | | | | | | | | $ | 48,736,517 | |

| | | | | | | | | | | | | |

| TOTAL MORTGAGE-BACKED SECURITIES (Cost $159,187,494) | | | | | | | | | | $ | 161,652,025 | |

| | | | | | | | | | | | | |

ASSET-BACKED SECURITIES (42.84%) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Automobile (19.60%) | | | | | | | | | | | | |

ACC Trust, Series 2022-1, Class C(f) | | 3.24% | | 10/20/25 | | | 1,100,000 | | | | 400,620 | |

| ACM Auto Trust 2023-1, Series 2023-1A, Class D(c)(f) | | 12.58% | | 01/22/30 | | | 2,777,000 | | | | 2,892,801 | |

| ACM Auto Trust 2023-2, Series 2023-2A, Class B(c)(f) | | 9.85% | | 06/20/30 | | | 1,835,000 | | | | 1,892,252 | |

| ACM Auto Trust 2024-1, Series 2024-1A, Class B(c)(f) | | 11.40% | | 01/21/31 | | | 851,000 | | | | 890,742 | |

| ACM Auto Trust 2024-2, Series 2024-2A, Class B(f) | | 9.21% | | 04/20/26 | | | 500,000 | | | | 514,900 | |

| Ares Lusitani-STC SA / Pelican Finance 2, Series 2021-2, Class E(b) | | 6.40% | | 01/25/35 | | € | 138,069 | | | | 141,849 | |

Arivo Acceptance Auto Loan Receivables Trust 2024-1, Series 2024-1A, Class D(f) | | 12.55% | | 01/15/28 | | $ | 1,250,000 | | | | 1,348,500 | |

| Asset-Backed European Securitisation Transaction Twenty-Three Sarl, Series 2024-23, Class M(b) | | 1M EUR L + 6.20% | | 03/21/34 | | € | 696,000 | | | | 758,057 | |

Auto ABS Italian Stella Loans SRL, Series 2024-1, Class E(b) | | 1M EUR L + 4.50% | | 12/29/36 | | | 47,513 | | | | 51,776 | |

| Auto ABS Spanish Loans Fondo Titulizacion, Series 2022-1, Class D(b) | | 1M EUR L + 4.25% | | 02/28/32 | | | 403,518 | | | | 443,600 | |

| Auto ABS Spanish Loans FT, Series 2024-1, Class D(b) | | N/A(e) | | 09/28/38 | | | 1,562,000 | | | | 1,701,103 | |

| Auto ABS Spanish Loans FT, Series 2024-1, Class E(b) | | 7.35% | | 09/28/38 | | | 448,000 | | | | 487,896 | |

| Auto1 Car Funding Sarl, Series 2024-1, Class D(b) | | 1M EUR L + 3.50% | | 12/15/33 | | | 500,000 | | | | 562,203 | |

| AutoFlorence 2 Srl, Series 2021-2, Class F | | 5.00% | | 12/24/44 | | | 36,424 | | | | 38,277 | |

| Autonoria Spain 2021 FT, Series 2021-SP, Class G(b) | | 5.25% | | 01/31/39 | | | 260,079 | | | | 259,872 | |

| Autonoria Spain 2022 FT, Series 2022-SP, Class E(b) | | 1M EUR L + 7.00% | | 01/29/40 | | | 300,284 | | | | 344,664 | |

| Autonoria Spain 2023 FT, Series 2023-SP, Class F(b) | | 1M EUR L + 6.90% | | 09/30/41 | | | 426,379 | | | | 477,660 | |

| Bbva Consumer Auto Fondo De Titulizacion, Series 2022-1, Class E(b) | | 3M EUR L + 8.00% | | 02/17/36 | | | 458,610 | | | | 537,015 | |

| Bbva Consumer Auto FT, Series 2024-1, Class D(b) | | 3M EUR L + 5.40% | | 10/22/29 | | | 446,812 | | | | 487,428 | |

| Bbva Consumer Auto FT, Series 2024-1, Class E(b) | | 3M EUR L + 8.20% | | 10/22/29 | | | 446,812 | | | | 491,608 | |

| Bbva Consumer Auto FT, Series 2024-1, Class Z(b) | | 3M EUR L + 7.90% | | 10/22/29 | | | 437,500 | | | | 479,745 | |

| Cardiff Auto Receivables Securitisation PLC, Series 2024-1, Class E(b) | | SONIA IR + 4.25% | | 08/20/31 | | £ | 1,976,000 | | | | 2,579,817 | |

See Notes to Consolidated Financial Statements.

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

ASSET-BACKED SECURITIES (continued) | | | | | | | | | | | | |

| CarNow Auto Receivables Trust 2023-1, Series 2023-1A, Class E(f) | | 12.04% | | 04/16/29 | | $ | 423,000 | | | $ | 348,171 | |

| Carvana Auto Receivables Trust, Series 2022-P1, Class R(f)(h) | | N/A(e) | | 07/10/27 | | | 4,000 | | | | 932,773 | |

| Carvana Auto Receivables Trust, Series 2023-N1, Class E(f) | | 10.46% | | 03/10/28 | | | 1,500,000 | | | | 1,613,100 | |

| Carvana Auto Receivables Trust, Series 2023-N4, Class E(c)(f) | | 9.56% | | 11/10/28 | | | 1,889,000 | | | | 1,985,906 | |

| Carvana Auto Receivables Trust, Series 2024-N3, Class E(c)(f) | | 7.66% | | 09/10/29 | | | 1,250,000 | | | | 1,235,625 | |

| CPS Auto Receivables Trust, Series 2022-C, Class E(f) | | 9.08% | | 04/15/30 | | | 700,000 | | | | 738,850 | |

| CPS Auto Receivables Trust, Series 2022-D, Class E(c)(f) | | 12.12% | | 06/17/30 | | | 1,431,000 | | | | 1,600,144 | |

| CPS Auto Receivables Trust, Series 2023-A, Class E(f) | | 10.59% | | 08/15/30 | | | 1,400,000 | | | | 1,516,620 | |

| CPS Auto Receivables Trust, Series 2023-C, Class E(f) | | 9.66% | | 08/16/27 | | | 780,000 | | | | 851,604 | |

| CPS Auto Receivables Trust, Series 2024-A, Class E(f) | | 8.42% | | 02/15/28 | | | 700,000 | | | | 715,750 | |

| CPS Auto Receivables Trust, Series 2024-D, Class E(f) | | 7.13% | | 12/17/28 | | | 1,000,000 | | | | 983,400 | |

| Credito Real USA Auto Receivables Trust 2021-1, Series 2021-1A, Class C(f) | | 4.37% | | 01/18/28 | | | 1,108,000 | | | | 1,108,000 | |

Dowson PLC, Series 2022-1, Class E(b) | | SONIA IR + 4.80% | | 05/20/25 | | £ | 109,000 | | | | 140,129 | |

| Dowson PLC, Series 2022-1, Class E(b) | | SONIA IR + 4.80% | | 01/20/29 | | | 381,000 | | | | 489,809 | |

| Dowson PLC, Series 2022-2, Class E(b) | | SONIA IR + 8.00% | | 08/20/29 | | | 651,000 | | | | 851,860 | |

| Dowson PLC, Series 2024-1, Class E(b) | | 8.88% | | 08/20/31 | | | 577,000 | | | | 744,910 | |

| Dowson PLC, Series 2024-1, Class F(b) | | 11.65% | | 08/20/31 | | | 1,252,000 | | | | 1,616,984 | |

| DT Auto Owner Trust 2022-1, Series 2022-1A, Class E(f) | | 5.53% | | 11/17/25 | | $ | 535,000 | | | | 520,716 | |

| E-Carat DE, Series 2024-1, Class F(b) | | 1M EUR L + 4.67% | | 11/25/35 | | € | 400,000 | | | | 441,234 | |

| Exeter Automobile Receivables Trust 2022-3, Series 2022-3A, Class E(f) | | 9.09% | | 02/16/27 | | $ | 1,396,000 | | | | 1,397,117 | |

| Exeter Automobile Receivables Trust 2022-4, Series 2022-4A, Class E(c)(f) | | 8.23% | | 03/15/30 | | | 2,853,000 | | | | 2,912,057 | |

Exeter Automobile Receivables Trust 2022-5, Series 2022-5A, Class E(f) | | 10.45% | | 04/15/30 | | | 1,989,000 | | | | 2,148,120 | |

| Exeter Automobile Receivables Trust 2022-6, Series 2022-6A, Class E(c)(f) | | 11.61% | | 06/17/30 | | | 2,611,000 | | | | 2,879,933 | |

Exeter Automobile Receivables Trust 2024-2, Series 2024-2A, Class E(f) | | 7.98% | | 11/15/28 | | | 1,783,000 | | | | 1,804,396 | |

| Exeter Automobile Receivables Trust 2024-4, Series 2024-4A, Class E(c)(f) | | 7.65% | | 02/17/32 | | | 863,000 | | | | 873,011 | |

FCT Autonoria DE 2023, Series 2023-DE, Class F(b) | | 1M EUR L + 7.50% | | 01/26/43 | | € | 311,649 | | | | 351,980 | |

| FCT Autonoria DE 2023, Series 2023-DE, Class G(b) | | 1M EUR L + 10.50% | | 01/26/43 | | | 310,663 | | | | 350,764 | |

| Flagship Credit Auto Trust, Series 2021-1, Class R(f)(h) | | N/A(e) | | 04/17/28 | | $ | 2,740 | | | | 187,825 | |

| Flagship Credit Auto Trust, Series 2022-2, Class E(f) | | 8.20% | | 06/15/29 | | | 926,000 | | | | 503,374 | |

| Flagship Credit Auto Trust, Series 2022-4, Class E(c)(f) | | 12.66% | | 01/15/30 | | | 1,879,000 | | | | 2,000,759 | |

| Flagship Credit Auto Trust, Series 2023-3, Class E(f) | | 9.74% | | 06/17/30 | | | 1,000,000 | | | | 998,600 | |

| FTA Santander Consumer Spain Auto, Series 2022-1, Class E(b) | | 3M EUR L + 12.00% | | 09/20/38 | | € | 379,428 | | | | 423,453 | |

| FTA Santander Consumer Spain Auto, Series 2023-1, Class E(b) | | 3M EUR L + 7.25% | | 12/22/30 | | | 600,000 | | | | 689,132 | |

| FTA Santander Consumer Spain Auto, Series 2023-1, Class F(b) | | 3M EUR L + 10.00% | | 12/22/30 | | | 40,071 | | | | 43,822 | |

| Golden Bar Securitisation Srl, Series 2024-1, Class D(b) | | 3M EUR L + 3.40% | | 09/22/43 | | | 674,000 | | | | 734,023 | |

| Golden Bar Securitisation Srl, Series 2021-1, Class E(c) | | 2.75% | | 09/22/41 | | | 239,447 | | | | 249,936 | |

| Golden Bar Securitisation Srl, Series 2023-2, Class E(b)(c) | | 3M EUR L + 8.50% | | 09/22/43 | | | 1,141,000 | | | | 1,310,996 | |

| Golden Bar Securitisation Srl, Series 2023-2, Class F(b) | | 3M EUR L + 10.90% | | 09/22/43 | | | 37,257 | | | | 40,797 | |

| Lobel Automobile Receivables Trust, Series 2023-1, Class D(f) | | 8.00% | | 06/15/27 | | $ | 500,000 | | | | 482,800 | |

| Merchants Fleet Funding LLC, Series 2024-1A, Class E(f) | | 9.35% | | 01/20/28 | | | 1,000,000 | | | | 1,007,700 | |

| Octane Receivables Trust 2023-2, Series 2023-2A, Class E(f) | | 10.50% | | 06/20/31 | | | 904,000 | | | | 949,833 | |

PBD Germany Auto Lease Master SA - Compartment 2021-1, Series 2021-GE2, Class F(b) | | 1M EUR L + 4.50% | | 11/26/30 | | € | 84,513 | | | | 92,260 | |

| Pony SA Compartment German Auto Loans, Series 2024-1, Class E(b) | | 1M EUR L + 3.75% | | 08/14/28 | | | 500,000 | | | | 550,292 | |

| Red & Black Auto Germany 9 UG, Series 2022-9, Class D(b) | | 1M EUR L + 5.60% | | 12/15/26 | | | 370,772 | | | | 419,923 | |

See Notes to Consolidated Financial Statements.

| Annual Report | October 31, 2024 | 15 |

| 1WS Credit Income Fund | Consolidated Schedule of Investments |

October 31, 2024

Description | | Rate | | Maturity Date(a) | | Principal Amount | | | Fair Value | |

ASSET-BACKED SECURITIES (continued) | | | | | | | | | | | | |

| Red & Black Auto Italy Srl, Series 2023-2, Class E(b) | | 1M EUR L + 7.00% | | 02/28/28 | | € | 469,000 | | | $ | 530,254 | |

Research-Driven Pagaya Motor Asset Trust 2023-3, Series 2023-3A, Class C(f) | | 9.00% | | 01/26/32 | | $ | 549,803 | | | | 533,639 | |

| Research-Driven Pagaya Motor Asset Trust 2023-4, Series 2023-4A, Class C(c)(f) | | 9.00% | | 01/25/27 | | | 549,236 | | | | 532,485 | |

| Research-Driven Pagaya Motor Asset Trust VII, Series 2022-3A, Class C(f) | | 10.04% | | 11/25/30 | | | 2,046,336 | | | | 2,056,772 | |

| SAFCO Auto Receivables Trust 2024-1, Series 2024-1A, Class E(f) | | 10.85% | | 01/18/30 | | | 500,000 | | | | 521,600 | |

| Santander Consumer Finance SA/NOMA, Series 2023-1, Class B(b) | | 12.37% | | 10/31/33 | | DKK | 10,076,220 | | | | 1,477,400 | |

| Satus PLC, Series 2021-1, Class F(b) | | 1M SONIA IR + 5.40% | | 08/17/28 | | £ | 600,000 | | | | 774,835 | |

| Satus PLC, Series 2024-1, Class D(b) | | SONIA IR + 3.30% | | 04/19/27 | | | 739,000 | | | | 953,576 | |

| Satus PLC, Series 2024-1, Class E(b) | | SONIA IR + 5.30% | | 04/19/27 | | | 670,000 | | | | 866,528 | |

| SCF Rahoituspalvelut X DAC, Series 2021-10, Class D | | 5.35% | | 10/25/31 | | € | 186,285 | | | | 194,019 | |

| SCF Rahoituspalvelut XIII DAC, Series 2024-13, Class E(b) | | 1M EUR L + 7.72% | | 02/25/29 | | | 500,000 | | | | 546,594 | |

| TAGUS - Sociedade de Titularizacao de Creditos SA/Silk Finance No 5, Series 2020-5, Class D | | 7.25% | | 02/25/35 | | | 214,012 | | | | 223,038 | |

| TAGUS - Sociedade de Titularizacao de Creditos SA/Ulisses Finance No. 2, Series 2021-2, Class F(b) | | 1M EUR L + 5.49% | | 09/20/38 | | | 207,611 | | | | 219,482 | |

Tricolor Auto Securitization Trust 2024-1, Series 2024-1A, Class E(f) | | 11.91% | | 11/15/26 | | $ | 386,000 | | | | 398,120 | |

| Tricolor Auto Securitization Trust 2024-2, Series 2024-2A, Class D(f) | | 7.61% | | 12/15/26 | | | 500,000 | | | | 504,400 | |

| Tricolor Auto Securitization Trust 2024-2, Series 2024-2A, Class E(f) | | 10.44% | | 04/15/27 | | | 700,000 | | | | 718,830 | |

| Tricolor Auto Securitization Trust 2024-2, Series 2024-2A, Class F(f) | | 16.56% | | 04/15/27 | | | 700,000 | | | | 734,720 | |

| Tricolor Auto Securitization Trust 2024-3, Series 2024-3A, Class E(f) | | 8.64% | | 11/15/27 | | | 1,400,000 | | | | 1,415,120 | |

| Tricolor Auto Securitization Trust 2024-3, Series 2024-3A, Class F(f) | | 13.51% | | 11/15/27 | | | 1,320,000 | | | | 1,321,320 | |

| Trustee for Metro Finance , Series 2023-1, Class E(b) | | 1M BBSW + 7.00% | | 02/18/29 | | A$ | 672,631 | | | | 454,166 | |

| Trustee for Metro Finance , Series 2023-1, Class F(b) | | 1M BBSW + 8.75% | | 02/18/29 | | | 436,301 | | | | 296,719 | |

| United Auto Credit Securitization Trust, Series 2022-1, Class E(c)(f) | | 5.00% | | 11/10/28 | | $ | 2,273,000 | | | | 2,191,854 | |

| United Auto Credit Securitization Trust, Series 2023-1, Class E(f) | | 10.98% | | 09/10/29 | | | 529,000 | | | | 542,860 | |

| United Auto Credit Securitization Trust, Series 2024-1, Class E(f) | | 10.45% | | 06/10/27 | | | 2,375,000 | | | | 2,430,337 | |

| USASF Receivables LLC, Series 2021-1A, Class D(f) | | 4.36% | | 03/15/27 | | | 1,125,000 | | | | 205,988 | |

| Veros Auto Receivables Trust, Series 2023-1, Class D(f) | | 11.46% | | 08/15/30 | | | 1,000,000 | | | | 1,047,700 | |

| Veros Auto Receivables Trust, Series 2024-1, Class D(f) | | 9.87% | | 05/15/31 | | | 1,000,000 | | | | 1,013,600 | |

| Total Automobile | | | | | | | | | | $ | 82,326,829 | |

| | | | | | | | | | | | | |

| Consumer (20.79%) | | | | | | | | | | | | |

ACHV ABS Trust, Series 2024-3AL, Class E(f) | | 7.00% | | 12/26/31 | | | 837,000 | | | | 797,912 | |

| ACHV ABS TRUST, Series 2023-4CP, Class E(f) | | 10.50% | | 07/25/26 | | | 1,000,000 | | | | 1,023,300 | |

| Affirm Asset Securitization Trust, Series 2024-A, Class 1E(f) | | 9.17% | | 02/17/26 | | | 1,500,000 | | | | 1,531,050 | |

| Aurorus 2023 BV, Series 2023-1, Class F(b) | | 11.19% | | 10/12/26 | | € | 500,000 | | | | 553,175 | |