John L. Sabre

SEMIANNUAL REPORT

June 30, 2020

Beginning on January 1, 2021 as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically from the Fund by calling 800-236-4424 or by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can request to continue receiving paper copies of your shareholder reports by contacting your financial intermediary or, if you invest directly with the Fund, calling 800-236-4424 to let the Fund know of your request. Your election to receive in paper will apply to all funds held in your account.

Ellington Income Opportunities Fund

TABLE OF CONTENTS

Ellington Income Opportunities Fund

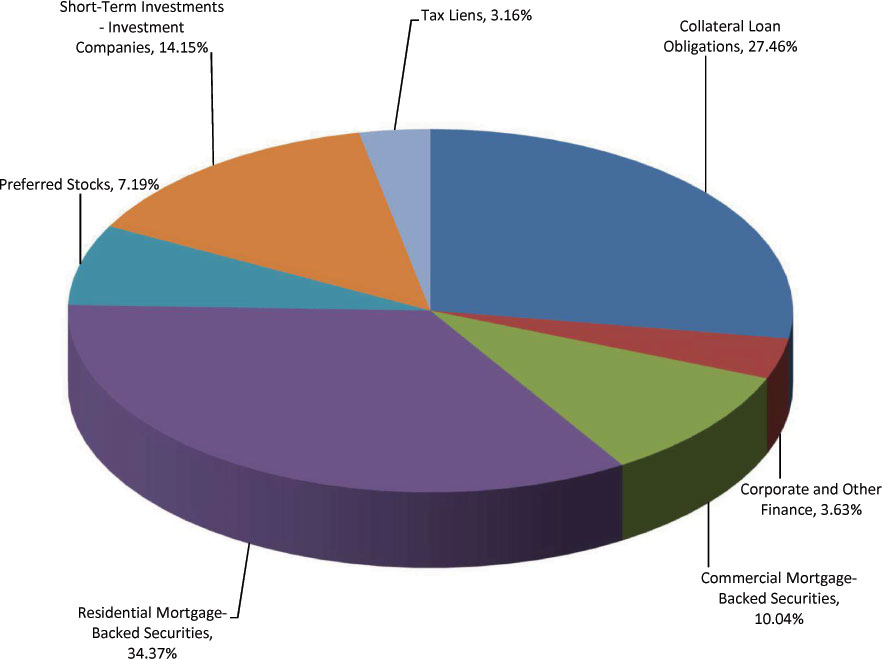

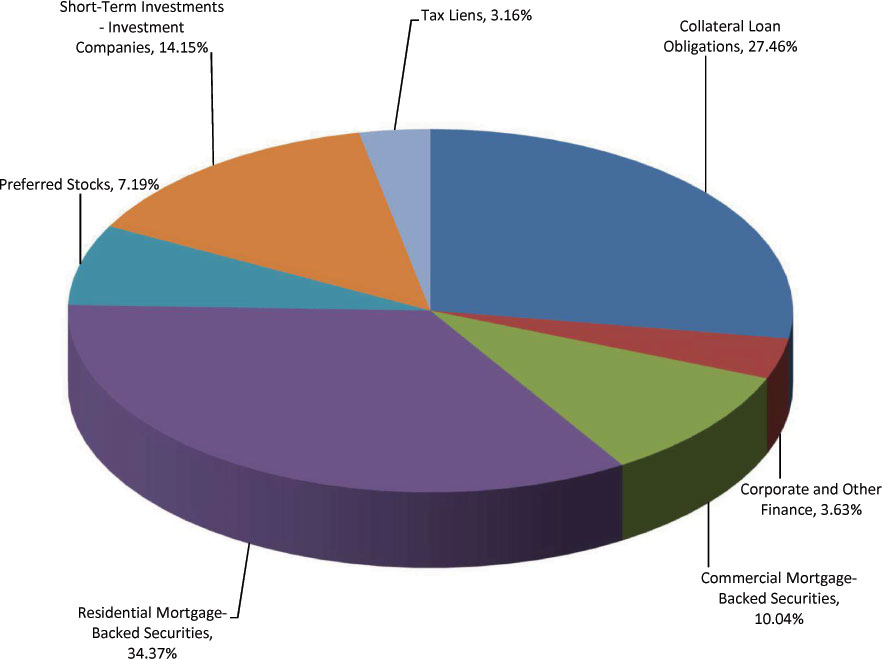

ALLOCATION OF PORTFOLIO ASSETS(1) (Unaudited)

June 30, 2020

(Expressed as a Percentage of Total Investments)

(1) Fund holdings are subject to change and there is no assurance that the Fund will continue to hold any particular security.

| | Please see the Schedule of Investments for a detailed listing of the Fund’s holdings. See Accompanying Notes to the Financial Statements. |

|

Ellington Income Opportunities Fund

SCHEDULE OF INVESTMENTS

June 30, 2020 (Unaudited)

Current

Principal

Amount/

Shares | | Description | | Rate(2) | | Maturity | | Percentage

of Net Assets | | Fair Value | |

| | | | | | | | | | | | |

| Collateral Loan Obligations (28.52%)(1) | | | | | | | | | |

| 500,000 | | Black Diamond CLO (3 Month LIBOR USD + 5.30%, 0.00% Floor) (4)(5) | | 6.43% | | 10/17/2026 | | 1.29% | | $ | 400,948 | |

| 600,000 | | Cutwater Ltd Series 2014-2A (3 Month LIBOR USD + 3.75%, 0.00% Floor)(4)(5) | | 4.97% | | 01/15/2027 | | 1.69% | | 525,282 | |

| 650,000 | | Grand Avenue CRE Series 2019-FL1 (1 Month LIBOR USB + 2.80%, 0.00% Floor)(4) | | 2.98% | | 06/15/2037 | | 1.93% | | 598,000 | |

| 15,671 | | Grayson CLO (3 Month LIBOR USD + 1.55%, 1.55% Floor) (4) | | 2.24% | | 11/01/2021 | | 0.05% | | 15,559 | |

| 500,000 | | Halcyon Loan Advisors Series 2013-2A (3 Month LIBOR + 3.80%, 0.00% Floor) (4)(5) | | 4.49% | | 08/01/2025 | | 1.29% | | 400,298 | |

| 1,100,000 | | Halcyon Loan Advisors Series 2015 -2A (3 Month LIBOR USD + 3.10%, 0.00% Floor)(4)(5) | | 4.09% | | 07/25/2027 | | 3.05% | | 945,964 | |

| 1,000,000 | | JFIN CLO Series 2014-1A (3 Month LIBOR USD + 3.65%, 0.00% Floor) (4) | | 4.79% | | 04/21/2025 | | 2.99% | | 926,565 | |

| 1,400,000 | | JFIN CLO Series 2014-2A (3 Month LIBOR USD + 3.25%, 0.00% Floor) (4) | | 4.39% | | 07/20/2026 | | 4.13% | | 1,280,531 | |

| 560,000 | | JFIN CLO Series 2015-1A (3 Month LIBOR USD + 2.65%, 0.00% Floor) (4) | | 2.96% | | 03/15/2026 | | 1.54% | | 475,877 | |

| 300,000 | | KREF 2018 FL1 (1 Month LIBOR + 2.55%, 2.55% Floor) (4) | | 2.74% | | 06/15/2036 | | 0.90% | | 277,500 | |

| 5,000,000 | | Neuberger Berman CLO Series 2019-35A(4) | | 3.64% | | 01/19/2033 | | 4.27% | | 1,321,910 | |

| 876,356 | | Ocean Trails CLO Series 2013-4A (3 Month LIBOR USD + 5.90%)(4) | | 6.33% | | 08/13/2025 | | 1.54% | | 477,168 | |

| 1,010,000 | | TICP CLO (3 Month LIBOR USD + 2.95%, 2.95% Floor)(4)(5) | | 4.09% | | 04/20/2028 | | 3.03% | | 938,365 | |

| 264,702 | | WhiteHorse VII (3 Month LIBOR USD + 4.80%, 0.00% Floor) (4) | | 5.16% | | 11/24/2025 | | 0.82% | | 253,935 | |

| Total Collateralized Loan Obligation (Cost $9,905,684) | | | | | | | | 8,837,902 | |

| | | | | | | | | | | | |

| Commercial Mortgage-Backed Securities (10.43%)(1) | | | | | | | | | |

| 12,441,000 | | Bank 2019 - BN21 XF(4) | | 1.05% | | 10/17/2052 | | 2.65% | | 822,549 | |

| 7,900,000 | | Bank 2019 - BN23 XF(4) | | 0.88% | | 12/15/2052 | | 1.42% | | 439,438 | |

| 5,343,000 | | BENCHMARK Mortgage Trust Series 2020-B16(4) | | 1.21% | | 02/15/2053 | | 1.42% | | 438,548 | |

| 10,232,082 | | SBA Confirmation of Originator Fee Certificates (6) | | 2.56% | | 08/15/2044 | | 2.99% | | 925,922 | |

| 677,860 | | VMS 2019 - FL3 D (1 Month LIBOR USD + 2.65%, 2.65% Floor)(4) | | 2.84% | | 09/15/2036 | | 1.95% | | 605,614 | |

| Total Commercial Mortgage-Backed Securities (Cost $3,706,039) | | | | | | | | 3,232,071 | |

| | | | | | | | | | | | |

| Corporate and Other Finance (3.77%)(1) | | | | | | | | | |

| $669,358 | | Gacovino Litigation Financing (6)(7) | | 0.00% | | 12/20/2020 | | 2.16% | | 669,358 | |

| $500,000 | | Wagstaff Litigation Financing (6)(8) | | 0.00% | | 12/20/2020 | | 1.61% | | 500,000 | |

| Total Corporate and Other Finance (Cost $1,169,358) | | | | | | | | 1,169,358 | |

| | | | | | | | | | | | |

| Tax Liens (3.28%)(1) | | | | | | | | | |

| 1,015,533 | | Tax Lien 16-21-308-018-0000 (6) | | 9.60% | | 09/01/2020 | | 3.28% | | 1,015,533 | |

| Total Tax Liens (Cost $1,015,533) | | | | | | | | 1,015,533 | |

| | | | | | | | | | | | |

| Residential Mortgage-Backed Securities (35.69%)(1) | | | | | | | | | |

| 256,010 | | Banc of America Alternative Loan Mortgage | | 5.50% | | 10/25/2035 | | 0.78% | | 243,466 | |

| 475,393 | | Banc of America Funding Corporation Series 2008-R4 (1 Month LIBOR + 0.45%, 0.45% Floor, 7.00% Cap)(4) | | 0.62% | | 07/25/2037 | | 0.96% | | 297,750 | |

| 285,139 | | Bank of America Mortgage Securities Series 2007-1 | | 6.00% | | 01/25/2037 | | 0.86% | | 266,047 | |

| 812,051 | | Bear Stearns Alt-A Trust Series 2005-10 | | 3.13% | | 01/25/2036 | | 2.30% | | 711,842 | |

| 331,589 | | Bear Stearns Mortgage Funding Series 2007-AR1 (1 Month LIBOR + 0.20%, 0.20% Floor, 11.50% Cap)(3) | | 0.38% | | 02/25/2037 | | 1.09% | | 337,204 | |

| 171,594 | | Chase Mortgage Finance Corporation Series 2006-A1 | | 4.01% | | 09/25/2036 | | 0.49% | | 153,246 | |

| 263,685 | | Countrywide Alternative Loan Trust Series 2004-28CB | | 5.75% | | 01/25/2035 | | 0.88% | | 271,502 | |

| 328,548 | | Countrywide Alternative Loan Trust Series 2005-21CB | | 5.25% | | 06/25/2035 | | 1.03% | | 317,791 | |

| 572,250 | | Countrywide Alternative Loan Trust Series 2005-49CB | | 5.50% | | 11/25/2035 | | 1.25% | | 387,383 | |

| 328,271 | | Countrywide Alternative Loan Trust Series 2006-OA17 (Cost of Funds for the 11th District of San Francisco + 1.50%, 1.50% Floor) | | 2.24% | | 12/20/2046 | | 0.89% | | 275,215 | |

| 103,707 | | Countrywide Alternative Loan Trust Series 2006-6CB | | 5.50% | | 05/25/2036 | | 0.30% | | 97,609 | |

| 333,411 | | Countrywide Alternative Loan Trust Series 2006-J5 | | 6.50% | | 09/25/2036 | | 0.63% | | 196,047 | |

| 442,135 | | Countrywide Home Loan Series 2002-19 | | 6.25% | | 11/25/2032 | | 1.42% | | 438,844 | |

| 437,659 | | Countrywide Home Loan Series 2003-53 | | 4.07% | | 02/19/2034 | | 1.05% | | 325,404 | |

| 104,544 | | Countrywide Home Loan Series 2006-J2 | | 6.00% | | 04/25/2036 | | 0.29% | | 88,631 | |

| 161,004 | | Countrywide Home Loan Series 2003-49 | | 4.00% | | 12/19/2033 | | 0.51% | | 157,476 | |

| 886,234 | | Countrywide Home Loan Series 2004-18 | | 6.00% | | 10/25/2034 | | 2.34% | | 724,532 | |

| 395,879 | | Countrywide Home Loan Series 2005-28 | | 5.25% | | 11/25/2023 | | 1.06% | | 329,223 | |

| 528,066 | | Countrywide Alternative Loan Series 2007-OA2 (1 Month LIBOR USD +0.84%, 0.84% Floor) | | 2.34% | | 03/25/2047 | | 1.43% | | 441,670 | |

| 242,683 | | Credit Suisse Mortgage Trust Series 2006 1 | | 5.50% | | 02/25/2036 | | 0.75% | | 233,337 | |

| 295,888 | | Delta Funding Home Equity Loan Series 2000-2 M2 (3)(6) | | 8.86% | | 08/15/2030 | | 0.81% | | 250,088 | |

| 14,371 | | Deutsche Mortgage Securities, Inc. Series 2004-4 (1 Month LIBOR + 0.35%, 0.35% Floor) | | 0.53% | | 06/25/2034 | | 0.04% | | 12,892 | |

| 164,466 | | First Horizon Alternative Mortgage Securities 2004 AA3 | | 3.45% | | 09/25/2034 | | 0.41% | | 126,372 | |

| 81,685 | | HarborView Mortgage Loan Trust Series 2003-2 | | 3.90% | | 10/19/2033 | | 0.25% | | 78,203 | |

| 11,669 | | HarborView Mortgage Loan Trust Series 2004-2 (1 Month LIBOR + 0.52%, 0.52% Floor) | | 0.71% | | 06/19/2034 | | 0.04% | | 11,729 | |

| 23,071 | | HarborView Mortgage Loan Trust Series 2004-9 | | 3.67% | | 12/19/2034 | | 0.07% | | 20,662 | |

See Accompanying Notes to the Financial Statements.

Ellington Income Opportunities Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2020 (Unaudited)

Current

Principal

Amount/

Shares | | Description | | Rate | | Maturity | | Percentage

of Net Assets | | Fair Value | |

| | | | | | | | | | | | |

| 477,580 | | Harborview Mortgage Loan TRUST C M O SER 2005 7 CL 1A1 | | 2.59% | | 06/19/2045 | | 0.86% | | $ | 267,272 | |

| 92,955 | | IndyMac INDX Mortgage Loan Trust 2004 AR12 (1 Month LIBOR + 0.78%, 0.78% Floor) (3) | | 0.96% | | 12/25/2034 | | 0.24% | | 74,723 | |

| 372,744 | | IndyMac INDX Mortgage Loan Trust Series 2006-AR25 | | 3.51% | | 09/25/2036 | | 1.15% | | 356,353 | |

| 59,851 | | IndyMac INDX Mortgage Loan Trust 2006-AR2 (1 Month LIBOR + 0.21%, 0.21% Floor) (3) | | 0.39% | | 02/25/2046 | | 0.16% | | 50,273 | |

| 4,735 | | IndyMac INDX Mortgage Loan Trust Series 2006-AR25 | | 3.40% | | 09/25/2036 | | 0.02% | | 4,835 | |

| 39,474 | | JP Morgan Mortgage Trust Series 2006-A1 | | 4.29% | | 02/25/2036 | | 0.11% | | 33,682 | |

| 238,066 | | JP Morgan Mortgage Trust Series 2007-A4 | | 3.39% | | 06/25/2037 | | 0.73% | | 227,118 | |

| 49,486 | | MASTR Asset Securitization Trust 2006-1 | | 5.75% | | 05/25/2036 | | 0.14% | | 43,292 | |

| 504,404 | | Nomura Asset Acceptance Corporation | | 5.89% | | 05/25/2036 | | 0.66% | | 205,500 | |

| 281,633 | | Nomura Asset Acceptance Corporation | | 5.52% | | 01/25/2036 | | 0.43% | | 134,645 | |

| 93,619 | | Prime Mortgage Trust Series 2003-3 (4) | | 6.05% | | 01/25/2034 | | 0.17% | | 52,499 | |

| 370,423 | | Prime Mortgage Trust Series 2006-1 | | 6.25% | | 06/25/2036 | | 1.04% | | 322,795 | |

| 447,949 | | Residential Asset Securitization Trust | | 5.60% | | 02/25/2034 | | 1.40% | | 433,529 | |

| 18,212 | | Residential Funding Mortgage Securities I Series 2005-SA1 | | 4.58% | | 03/25/2035 | | 0.03% | | 10,829 | |

| 214,960 | | Structured Adjustable Rate Mortgage Loan Trust 2005-22 | | 4.03% | | 12/25/2035 | | 0.69% | | 213,406 | |

| 109,310 | | Structured Asset Securities Corporation 2003-9A(6) | | 3.62% | | 03/25/2033 | | 0.09% | | 27,328 | |

| 113,037 | | Terwin Mortgage Trust (1 Month LIBOR USD +1.05%, 1.05% Floor) | | 1.23% | | 11/25/2033 | | 0.36% | | 110,288 | |

| 290,200 | | Wachovia Mortgage Loan Trust Series 2005-A | | 3.95% | | 08/20/2035 | | 0.90% | | 279,659 | |

| 158,086 | | WAMU Mortgage Pass Through C M O SER 2002 AR12 CL B1 | | 4.20% | | 10/25/2032 | | 0.49% | | 151,036 | |

| 580,405 | | Washington Mutual Mortgage Payment 2005-5A5 | | 0.78% | | 06/25/2036 | | 1.47% | | 455,915 | |

| 225,825 | | Wells Fargo Mortgage Backed Security 2006-AR14 | | 4.55% | | 10/25/2036 | | 0.61% | | 188,262 | |

| 461,723 | | Wells Fargo Alternative Loan Trust 2007-PA4 | | 3.35% | | 07/25/2037 | | 1.39% | | 432,343 | |

| 196,056 | | Wells Fargo Alternative Loan Trust 2007-PA3 | | 6.00% | | 07/25/2037 | | 0.62% | | 191,426 | |

| Total Residential Mortgage-Backed Securities (Cost $11,450,858) | | | | | | | | 11,061,173 | |

| | | | | | | | | | | | |

| Preferred Stocks (7.46%)(1) | | | | | | | | | |

| 1,169 | | AGNC Investment Corp, Class B, Series D | | 6.88% | | | | 1.12% | | 347,153 | |

| 74 | | AGNC Investment Corp, Class B, Series E | | 6.50% | | | | 0.01% | | 1,601 | |

| 34,389 | | AGNC Investment Corp, Class B, Series F | | 6.13% | | | | 2.28% | | 706,350 | |

| 490 | | AGNC Investment Corp, Class X, Series X | | 7.00% | | | | 0.03% | | 11,118 | |

| 9,000 | | Annaly Capital Management, Class B | | 6.50% | | | | 0.58% | | 180,000 | |

| 2,400 | | Armour Residential REIT, Class B | | 7.00% | | | | 0.16% | | 51,384 | |

| 12,689 | | MFA Financial Inc., Class B | | 6.50% | | | | 0.73% | | 226,118 | |

| 21,087 | | New Residential Inv Corp, Class B | | 6.38% | | | | 1.22% | | 377,879 | |

| 1,144 | | New York Mortgage Trust Class B | | 7.88% | | | | 0.07% | | 21,770 | |

| 4,000 | | Pennymac Mtge Investment, Class B | | 8.00% | | | | 0.27% | | 84,320 | |

| 10,472 | | Two Harbors Investment Corporation, Class B | | 7.25% | | | | 0.70% | | 215,933 | |

| 4,282 | | Two Harbors Investment Corporation, Class B | | 7.63% | | | | 0.29% | | 89,879 | |

| Total Preferred Stocks (Cost $2,849,436) | | | | | | | | 2,313,505 | |

| | | | | | | | | | | | |

| Short-Term Investments - Investment Companies (14.69%)(1) | | | | | | | | | |

| 2,349,131 | | First American Government Obligation - Class X | | 0.09% | | | | 14.69% | | 4,552,301 | |

| Total Short-Term Investments - Investment Companies (Cost $4,552,301) | | | | | | | | 4,552,301 | |

| | | | | | | | | | | | |

| Total Investments (103.84%)(1) (Cost $34,649,209) | | | | | | | | 32,181,843 | |

| Other Liabilities in Excess of Assets (-3.84%)(1) | | | | | | | | (1,189,517 | ) |

| Total Net Assets Applicable to Unitholders (100.00%)(1) | | | | | | | | $ | 30,992,326 | |

| (1) | Percentages are stated as a percent of net assets. |

| (2) | Rate reported is the current yield as of June 30, 2020. |

| (3) | Step-up bond that pays an initial spread for the first period and then a higher spread for the following periods. Spread shown is as of period end. |

| (4) | 144(a) - Security was purchased pursuant to Rule 144a under the Securities Act of 1933 and may not be resold subject to that rule, except to qualified institutional buyers. As of June 30, 2020, these securities amounted to $11,494,300 or 37.10% of net assets. |

| (5) | Collateral or partial collateral for securities sold subject to repurchase. As of June 30, 2020, these securities amounted to $3,210,857 or 10.36% of net assets. |

| (6) | Security is categorized as Level 3 per the Fund’s fair value hierarchy. As of June 30, 2020, these securities amounted to $3,388,229 or 10.94% of net assets. |

| (7) | The Fund has made $690,000 of capital commitments, excluding capitalized interest, to fund its litigation financing, of which $74,698 remains unfunded as of June 30, 2020. This capital commitment are drawn down at the discretion of managing member of the loan syndicate in accordance with the terms of the governing documents. |

| (8) | The Fund has made $900,000 of capital commitments, excluding capitalized interest, to fund its litigation financing, of which $400,000 remains unfunded as of June 30, 2020. This capital commitment are drawn down at the discretion of managing member of the loan syndicate in accordance with the terms of the governing documents. |

| (9) | This security represents a basket of interest only strips. The rate disclosed is the weighted average rate on the basket. The maturity shown is the earliest maturity of the underlying strips. Additional information on the underlying strips of the basket are disclosed and can be found within the notes to the financial statements. |

See Accompanying Notes to the Financial Statements.

Ellington Income Opportunities Fund |

STATEMENT OF ASSETS & LIABILITIES (Unaudited)

June 30, 2020

| Assets | | |

| Investments at fair value ($34,649,209 cost) | | $ | 32,181,843 | |

| Deposits at Broker | | | 46,003 | |

| Receivable for Fund shares sold | | | 9,815 | |

| Receivable from Adviser, net of waiver | | | 18,817 | |

| Receivable for investments sold | | | 54,499 | |

| Interest receivable | | | 536,008 | |

| Other assets | | | 57,505 | |

| Total assets | | | 32,904,490 | |

| | | | | |

| Liabilities | | | | |

| Reverse repurchase agreements | | | 1,767,000 | |

| Accrued interest expense | | | 3,214 | |

| Accrued expenses | | | 141,950 | |

| Total liabilities | | | 1,912,164 | |

| Net assets | | $ | 30,992,326 | |

| | | | | |

| Net Assets Consisting of | | | | |

| Paid-in capital | | $ | 34,744,857 | |

| Total accumulated losses | | | (3,752,531 | ) |

| Net assets | | $ | 30,992,326 | |

| | | | | |

| Class A | | | | |

| Net Assets | | $ | 130,058 | |

| Shares outstanding, unlimited shares authorized | | | 14,275 | |

| Net Asset Value per Share | | $ | 9.11 | |

| Maximum Offering Price | | $ | 9.63 | |

| | | | | |

| Class M | | | | |

| Net Assets | | $ | 30,862,268 | |

| Shares outstanding, unlimited shares authorized | | | 3,419,419 | |

| Net Asset Value per Share | | $ | 9.03 | |

See Accompanying Notes to the Financial Statements.

Ellington Income Opportunities Fund |

STATEMENT OF OPERATIONS (Unaudited)For the Period Ended June 30, 2020

| Investment Income | | |

| Interest income | | $ | 1,014,207 | |

| Dividend income | | | 69,508 | |

| Total Investment Income | | | 1,083,715 | |

| | | | | |

| Expenses | | | | |

| Management fees | | | 272,746 | |

| Administrator fees | | | 94,743 | |

| Professional fees | | | 59,343 | |

| Transfer agent fees | | | 50,943 | |

| Interest expense | | | 38,305 | |

| Registration fees | | | 37,457 | |

| Trustees’ fees | | | 35,792 | |

| Sub-accounting transfer agency fees | | | 28,218 | |

| Compliance fees | | | 25,168 | |

| Insurance expense | | | 16,736 | |

| Research and trade expenses | | | 7,554 | |

| Custodian fees and expenses | | | 5,191 | |

| Shareholder reporting expense | | | 2,034 | |

| Shareholder servicing fees - Class A | | | 166 | |

| Other expenses | | | 9,812 | |

| Total Expenses | | | 684,208 | |

| Less: fees waived/expenses reimbursed by Adviser | | | (313,571 | ) |

| Net Expenses | | | 370,637 | |

| Net Investment Income/(Loss) | | | 713,078 | |

| | | | | |

| Realized and Change in Unrealized Gain/(Loss) on Investments | | | | |

| Net realized gain/(loss) on: | | | | |

| Investments | | | (99,512 | ) |

| Swap contracts | | | (1,144,057 | ) |

| Net realized gain/(loss) | | | (1,243,569 | ) |

| Net change in unrealized appreciation/(depreciation) of: | | | | |

| Investments | | | (2,617,129 | ) |

| Swap contracts | | | (81,816 | ) |

| Net unrealized appreciation/(depreciation) | | | (2,698,945 | ) |

| Net Realized and Change in Unrealized Gain/(Loss) on Investments | | | (3,942,514 | ) |

| | | | | |

| Increase/(Decrease) in Net Assets Resulting from Operations | | $ | (3,229,436 | ) |

See Accompanying Notes to the Financial Statements.

Ellington Income Opportunities Fund |

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Period Ended

June 30, 2020

(Unaudited) | | | For the Year Ended

December 31, 2019 | |

| | | | | |

| From Operations | | | | | | | | |

| Net investment income/(loss) | | $ | 713,078 | | | $ | 1,066,558 | |

| Net realized gain/(loss) | | | (1,243,569 | ) | | | 132,876 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (2,698,945 | ) | | | 288,581 | |

| Net increase/(decrease) in net assets resulting from operations | | | (3,229,436 | ) | | | 1,488,015 | |

| Distributions and Dividends to Shareholders | | | | | | | | |

| From distributable earnings | | | (678,305 | ) | | | (1,294,958 | ) |

| Total distributions and dividends to common shareholders | | | (678,305 | ) | | | (1,294,958 | ) |

| Capital Share Transactions(1) | | | | | | | | |

| Proceeds from Class A shareholder subscriptions | | | — | | | | 144,347 | |

| Class A distribution reinvestments | | | 2,538 | | | | 2,101 | |

| Payments for Class A redemptions | | | — | | | | — | |

| Proceeds from Class M shareholder subscriptions | | | 10,399,399 | | | | 14,375,779 | |

| Class M distribution reinvestments | | | 183,358 | | | | 410,814 | |

| Payments for Class M redemptions | | | (2,013,965 | ) | | | (21 | ) |

| Net increase/(decrease) in net assets from capital share transactions | | | 8,571,330 | | | | 14,933,020 | |

| Total increase/(decrease) in net assets | | | 4,663,589 | | | | 15,126,077 | |

| Net Assets | | | | | | | | |

| Beginning of fiscal period | | | 26,328,737 | | | | 11,202,660 | |

| End of fiscal period | | $ | 30,992,326 | | | $ | 26,328,737 | |

| (1) | For shareholder transaction activity, please see Note 8. |

See Accompanying Notes to the Financial Statements.

Ellington Income Opportunities Fund |

STATEMENT OF CASH FLOWS (Unaudited)For the Period Ended June 30, 2020

| Cash Flows From Operating Activities | | |

| Increase/(decrease) in Net Assets Resulting from Operations | | $ | (3,229,436 | ) |

| Adjustments to reconcile increase/(decrease) in net assets resulting from operations to net cash used in operating activities: | | | | |

| Net realized (gain)/loss on investments | | | 1,243,569 | |

| Net change in unrealized apperciation/depreciation of investments | | | 2,698,945 | |

| Purchases of investments in securities | | | (14,420,616 | ) |

| Proceeds from sales of investments in securities | | | 6,431,914 | |

| Net payments related to swap contracts | | | (1,096,757 | ) |

| Amortization and accretion on investments | | | — | |

| Changes in operating assets and liabilities: | | | | |

| Deposits at broker | | | 48,386 | |

| Receivable for investments sold | | | (39,599 | ) |

| Interest receivable | | | (271,224 | ) |

| Receivable from Adviser, net of waiver | | | 112,237 | |

| Other assets | | | (44,098 | ) |

| Accrued interest expense | | | (203 | ) |

| Accrued expenses | | | 52,187 | |

| Net cash used in operating activities | | | (8,514,695 | ) |

| Cash Flows From Financing Activities | | | | |

| Proceeds from reverse repurchase agreements | | | 148,000 | |

| Proceeds from issuance of shares, net of change in receivable for fund shares sold | | | 10,873,069 | |

| Payments for redemptions of shares | | | (2,013,965 | ) |

| Distributions paid, net of reinvestments | | | (492,409 | ) |

| Net cash provided by financing activities | | | 8,514,695 | |

| Net Increase/(Decrease) in Cash | | | — | |

| | | | | |

| Cash: | | | | |

| Beginning of fiscal period | | | — | |

| End of fiscal period | | $ | — | |

| | | | | |

| Supplemental Disclosure of Cash Flow and Non-Cash Information | | | | |

| Non-cash financing activities not included herein consist of distribution reinvestments | | $ | 183,358 | |

See Accompanying Notes to the Financial Statements.

Ellington Income Opportunities Fund |

FINANCIAL HIGHLIGHTS - Class A

| | | For the Period Ended

June 30, 2020

(Unaudited) | | | For the Period

Ended

December 31,

2019(1) | |

| Per Share Data(2) | | | | |

| Net Asset Value, beginning of fiscal period | | $ | 10.33 | | | $ | 10.47 | |

| Activity from Investment Operations: | | | | | | | | |

| Net investment income/(loss) | | | 0.19 | | | | (0.04 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (1.23 | ) | | | 0.05 | |

| Total increase from investment operations | | | (1.04 | ) | | | 0.01 | |

| Less Distributions and Dividends to Unitholders: | | | | | | | | |

| Net investment income | | | (0.18 | ) | | | (0.05 | ) |

| Net realized gain/loss | | | — | | | | (0.10 | ) |

| Total distributions and dividends to shareholders | | | (0.18 | ) | | | (0.15 | ) |

| Net Asset Value, end of fiscal period | | $ | 9.11 | | | $ | 10.33 | |

| Total Investment Return(2) | | | (10.01 | )%(3) | | | 0.12 | % |

| | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | |

| Net assets, end of fiscal period (in 000s) | | $ | 130 | | | $ | 144 | |

| Ratio of expenses to average net assets before waiver | | | 4.84 | %(4) | | | 5.68 | %(4) |

| Ratio of expenses to average net assets after waiver | | | 3.13 | %(4) | | | 3.27 | %(4) |

| Ratio of net investment income (loss) to average net assets before waiver | | | 2.34 | %(4) | | | 1.73 | %(4) |

| Ratio of net investment income (loss) to average net assets after waiver | | | 4.05 | %(4) | | | 4.14 | %(4) |

| Portfolio turnover rate | | | 23.57 | %(3) | | | 64.79 | %(3) |

| (1) | Class A commenced operations on December 17, 2019. |

| (2) | Information presented relates to a unit outstanding for the period presented. |

| (4) | All income and expenses are annualized for periods less than one full year with the exception of organizational costs. |

See Accompanying Notes to the Financial Statements.

Ellington Income Opportunities Fund |

FINANCIAL HIGHLIGHTS - Class M

| | | For the Period

Ended June 30,

2020 (Unaudited) | | | For the Year Ended

December 31, 2019 | | | For the Period

Ended

December 31,

2018(1) | |

| Per Share Data(2) | | | | | | |

| Net Asset Value, beginning of fiscal period | | $ | 10.23 | | | $ | 9.97 | | | $ | 10.00 | |

| Activity from Investment Operations: | | | | | | | | | | | | |

| Net investment income/(loss) | | | 0.20 | | | | 0.54 | | | | 0.05 | |

| Net realized and unrealized gain/(loss) on investments | | | (1.19 | ) | | | 0.36 | | | | (0.04 | ) |

| Total increase from investment operations | | | (0.99 | ) | | | 0.90 | | | | 0.01 | |

| Less Distributions and Dividends to Unitholders: | | | | | | | | | | | | |

| Net investment income | | | (0.21 | ) | | | (0.54 | ) | | | (0.04 | ) |

| Net realized gain/loss | | | — | | | | (0.10 | ) | | | — | |

| Total distributions and dividends to shareholders | | | (0.21 | ) | | | (0.64 | ) | | | (0.04 | ) |

| Net Asset Value, end of fiscal period | | $ | 9.03 | | | $ | 10.23 | | | $ | 9.97 | |

| Total Investment Return(2) | | | (9.66 | )% | | | 9.16 | %(3) | | | 0.06 | %(3) |

| | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | |

| Net assets, end of fiscal period (in 000s) | | $ | 30,862 | | | $ | 26,184 | | | $ | 11,203 | |

| Ratio of expenses to average net assets before waiver | | | 4.64 | %(4) | | | 6.50 | % | | | 10.07 | %(4) |

| Ratio of expenses to average net assets after waiver | | | 2.51 | %(4) | | | 2.62 | % | | | 2.20 | %(4) |

| Ratio of net investment income (loss) to average net assets before waiver | | | 2.71 | %(4) | | | 2.04 | % | | | (4.32 | )%(4) |

| Ratio of net investment income (loss) to average net assets after waiver | | | 4.84 | %(4) | | | 5.92 | % | | | 3.55 | %(4) |

| Portfolio turnover rate | | | 23.57 | %(3) | | | 64.79 | % | | | 5.18 | %(3) |

| (1) | Class M commenced operations on November 13, 2018. |

| (2) | Information presented relates to a unit outstanding for the period presented. |

| (4) | All income and expenses are annualized for periods less than one full year with the exception of organizational costs. |

See Accompanying Notes to the Financial Statements.

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited)

June 30, 2020

Ellington Income Opportunities Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a continuously offered, closed-end management company, and it is non-diversified. The Fund is an interval fund that offers to make quarterly repurchases of shares at the net asset value (“NAV”) of Class A shares, Class C shares, Class I shares, and Class M shares. The Fund offers four classes of shares: Class A, Class C, Class I, and Class M. Class A shares are offered at NAV plus a maximum sales charge of 5.75%. Class C, I, and M are offered at NAV. Currently the Fund has two classes of shares operational: Class A and Class M.

Princeton Fund Advisors, LLC (the “Adviser”) serves as the Fund’s investment adviser. Ellington Global Asset Management, LLC (the “Sub-Adviser” or “Ellington”) serves as the Fund’s investment sub-adviser. The Fund’s investment objective is to seek total return, including capital gains and current income.

The Fund is organized as a statutory trust under the laws of the State of Delaware. The Fund commenced operations on November 13, 2018.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The Fund’s financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services - Investment Companies including FASB Accounting Standards Update (“ASU”) 2013-08. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material to the financial statements.

The following is a summary of the significant accounting policies followed by the Fund:

(A) Investments: In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements).

(B) Investment Transactions, Investment Income and Expense Recognition: Investment transactions are recorded on the trade date. Realized and unrealized gains and losses are calculated based on identified cost. Principal write-offs are treated as realized losses. Interest income is recorded as earned unless ultimate collection is in doubt. Generally, the Fund accretes market discounts and amortizes market premiums on debt securities using the effective yield method. Accretion of market discount and amortization of market premiums requires the use of a significant amount of judgment and the application of several assumptions including, but not limited to, prepayment assumptions and default rate assumptions. Swap contracts are valued using the market-standard sources and unrealized appreciation or depreciation is recorded daily as the difference between the prior day and current day closing price. Expenses that are directly attributable to the Fund (the “Fund Expenses”) consist of permitted expenses determined in accordance with the terms of the governing documents. Fund Expenses are charged when incurred. Fund Expenses include, but are not limited to, operational expenses and other expenses associated with the operation of the Fund. The Fund’s expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

June 30, 2020

(C) Cash: Cash and cash equivalents include cash. Cash is maintained at U.S. Bank National Association, a member of FDIC. Balances might exceed federally insured limits.

(D) Income Taxes: The Fund has elected to be treated as, and to qualify each year for special tax treatment afforded to, a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code (“IRC”). In order to qualify as a RIC, the Fund must, among other things, satisfy income, asset diversification and distribution requirements. As long as it so qualifies, the Fund will not be subject to U.S. federal income tax to the extent that it distributes annually its investment company taxable income and its net capital gain. The Fund intends to distribute at least annually all or substantially all of such income and gain. If the Fund retains any investment company taxable income or net capital gain, it will be subject to U.S. federal income tax on the retained amount at regular corporate tax rates. In addition, if the Fund fails to qualify as a RIC for any taxable year, it will be subject to U.S. federal income tax on all of its income and gains at regular corporate tax rates. The Fund’s current year and prior year tax filings are still open for examination.

Management has reviewed the Fund’s tax positions for all open tax years and has concluded that there is no tax liability/benefit resulting from uncertain income tax positions taken or expected to be taken in the future tax returns. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax expense will significantly change in the next twelve months.

(E) Distributions to Shareholders: Distributions from investment income are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

(F) Indemnifications: In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

(G) Recent Accounting Pronouncements: In August 2018, FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement. The primary focus of ASU 2018-13 is to improve the effectiveness of the disclosure requirements for fair value measurements, specifically, removing the requirement to disclose the amount and reasons for transfers between level 1 and level 2 securities of the fair value hierarchy and the policy for timing of transfers. The changes affect all companies that are required to include fair value measurement disclosures. In general, the amendments in ASU 2018-13 are effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. An entity is permitted to early adopt the removed or modified disclosures upon the issuance of ASU 2018-13 and may delay adoption of the additional disclosures, which are required for public companies only, until their effective date. Management has evaluated ASU 2018-13 and has early adopted the relevant provisions of the disclosure framework.

The following is a description of the valuation methodologies used for the Fund’s financial instruments. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 valuation methodologies include the observation of quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 valuation methodologies include the observation of (i) quoted prices for similar assets or liabilities in active markets, (ii) inputs other than quoted prices that are observable for the asset or liability (for example, interest rates and yield curves) in active markets and (iii) quoted prices for identical or similar assets or liabilities in markets that are not active.

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

June 30, 2020

Level 3 fair value methodologies include (i) the solicitation of valuations from third parties (typically, broker-dealers), (ii) the use of proprietary models that require the use of a significant amount of judgment and the application of various assumptions including, but not limited to, prepayment assumptions and default rate assumptions, and (iii) the assessment of observable or reported recent trading activity. The Fund utilizes such information to assign a good faith fair value (the estimated price that would be received to sell an asset or paid to transfer a liability in an orderly transaction at the valuation date) to each such financial instrument.

The Adviser seeks to obtain at least one third-party indicative valuation for each instrument and obtains multiple indicative valuations when available. Third-party valuation providers often utilize proprietary models that are highly subjective and also require the use of a significant amount of judgment and the application of various assumptions including, but not limited to, prepayment and default rate assumptions. The Adviser has been able to obtain third-party indicative valuations on the vast majority of the Fund’s investments and expects to continue to solicit third-party valuations on substantially all investments in the future to the extent practical. The Adviser generally values each financial instrument using a third-party valuation received. However, such third-party valuations are not binding, and while the Adviser generally does not adjust such valuations, the Adviser may challenge or reject a valuation when, based on validation criteria, the Adviser determines that such valuation is unreasonable or erroneous. Furthermore, the Adviser may determine, based on validation criteria, that for a given instrument the third-party valuations received does not result in what the Adviser believes to be fair value, and in such circumstances the Adviser may override the third-party valuation with their own good faith valuation. The validation criteria include the use of the Adviser’s own models, recent trading activity in the same or similar instruments, and valuations received from third parties.

The Adviser’s valuation process, including the application of validation criteria, is overseen and periodically reviewed by the Fund’s valuation committee. Because of the inherent uncertainty of valuations, these estimated values may differ significantly from the values that would have been used had a ready market for the financial instruments existed, and the differences could be material to the financial statements.

The table below reflects the value of the Fund’s Level 1, Level 2 and Level 3 financial instruments measured at fair value as of June 30, 2020:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | | | | | | | | | | |

| Investments | | | | | | | | | | | | | | | | |

| Collateralized Loan Obligations | | $ | — | | | $ | 8,837,902 | | | $ | — | | | $ | 8,837,902 | |

| Commercial Mortgage-Backed Securities | | | — | | | | 2,306,149 | | | | 925,922 | | | | 3,232,071 | |

| Corporate and Other Finance | | | — | | | | — | | | | 1,169,358 | | | | 1,169,358 | |

| Tax Liens | | | — | | | | — | | | | 1,015,533 | | | | 1,015,533 | |

| Residential Mortgage-Backed Securities | | | — | | | | 10,783,757 | | | | 277,416 | | | | 11,061,173 | |

| Preferred Stocks | | | 2,313,505 | | | | — | | | | — | | | | 2,313,505 | |

| Short-Term Investments | | | 4,552,301 | | | | — | | | | — | | | | 4,552,301 | |

| Total Investments | | $ | 6,865,806 | | | $ | 21,927,808 | | | $ | 3,388,229 | | | $ | 32,181,843 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments* | | | | | | | | | | | | | | | | |

| Swap Contracts | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| * | Other financial instruments are derivative instruments, such as swap contacts, which are reported at market value. |

The Fund generally uses prices provided by an independent pricing service, broker, or agent bank, which provide non- binding indicative prices on or near the valuation date as the primary basis for fair value determinations for certain instruments. The independent pricing services typically value such securities based on one or more inputs, including but not limited to benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities, and pricing models such as yield measurers calculated using factors such as cash flows, financial or collateral performance and other reference data. In addition to these inputs, mortgage-backed and asset-backed obligations may utilize cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements, and specific deal information. These values are non-binding and may not be determinative of fair value. Values are evaluated during the Fund’s valuation process by management in conjunction with additional information about the instrument, similar instruments, market indicators and other information.

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

June 30, 2020

Below is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| Description | | | |

| Balance as of December 31, 2019 | | $ | 3,075,577 | |

| Purchases | | | 115,593 | |

| Sales proceeds and paydowns | | | — | |

| Realized gain / (loss) | | | — | |

| Change in unrealized gain / (loss) | | | (80,357 | ) |

| Transfers into / (out of) Level 3 | | | 277,416 | |

| Ending Balance – June 30, 2020 | | $ | 3,388,229 | |

| | | | | |

| Change in unrealized appreciation / (depreciation) during the period for Level 3 investments held at December 31, 2019 | | $ | (80,357 | ) |

The following table presents information about unobservable inputs related to the Fund’s categories of Level 3 investments as of June 30, 2020:

| Security | Fair Value at 6/30/2020 | | Valuation Methodology | Unobservable Inputs | Input Value / Range | | Weighted Average | |

| SBA Confirmation of | $ | 925,922 | | Dealer Marks | Dealer Marks | | 10.32 | | | 10.32 | |

| Originator Fee Certificates | | | | | | | | | | | |

| | | | | | | | | | | | |

| Residential Mortgage | $ | 277,416 | | Market Quotes | Non Binding | | 21.06-94.52 | | | 58.51 | |

| Backed Securities | | | | | Indicative Prices | | | | | | |

A change in unobserved inputs might result in significantly higher or lower fair value measurement as of June 30, 2020. Certain of the Fund’s Level 3 investments have been valued using unadjusted inputs that have not been internally developed by the Fund, including third-party transaction and quotations. As a result, fair value assets of $2,184,891 have been excluded from the proceeding table.

| 4. | RELATED PARTY AGREEMENTS AND FEES |

The Adviser serves as the investment adviser to the Fund. Under the terms of the management agreement between the Fund and the Adviser dated October 17, 2018 (the “Agreement”), the Adviser, subject to the oversight of the Board of Trustees (the “Board”), provides or arranges to be provided to the Fund such investment advice as it deems advisable and will furnish or arrange to be furnished a continuous investment program for the Fund consistent with the Fund’s investment objectives and policies. As compensation for its management services, the Fund agrees to pay to the Adviser a monthly fee at the annual rate of 1.85% of the Fund’s average daily net assets. For the period ended June 30, 2020, the Fund incurred $272,746 in management fees under this Agreement.

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

June 30, 2020

The Adviser and the Fund have entered into an expense limitation and reimbursement agreement under which the Adviser has agreed, until at least April 30, 2021, to waive its management fees and to pay or absorb the ordinary operating expenses of the Fund (excluding (i) interest expense, and any fees and expenses incurred in connection with credit facilities, if any, obtained by the Fund; (ii) transaction costs and other expenses incurred in connection with the acquisition, financing, maintenance, and disposition of the Fund’s investments and prospective investments, including without limitation bank and custody fees, brokerage commissions, legal, data, consulting and due diligence costs, servicing and property management costs; (iii) acquired fund fees and expenses; (iv) taxes; and (v) extraordinary expenses), to the extent that its management fees plus applicable distribution and shareholder servicing fees and the Fund’s ordinary operating expenses would otherwise exceed, on a year-to-date basis, 2.85%, 3.60%, 2.60%, and 2.20% per annum of the Fund’s average daily net assets attributable to Class A, Class C, Class I, and Class M shares, respectively. The Expense Limitation Agreement may not be terminated by the Adviser, but it may be terminated by the Board, on 60 days written notice to the Adviser. Any waiver or reimbursement by the Adviser is subject to repayment by the Fund within the three years from the date the Adviser waived any payment or reimbursed any expense, if (after taking the repayment into account) the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or at the time of the reimbursement payment. The Adviser’s waived fees and reimbursed expenses that are subject to potential recoupment are as follows:

| Fiscal Year Incurred | | Amount Waived | | Amount Recouped | | Amount Subject to Potential Reimbursement | | Expiration Date |

| December 31, 2018 | | $ | 185,928 | | $ | — | | $ | 185,928 | | December 31, 2021 |

| December 31, 2019 | | $ | 698,064 | | $ | — | | $ | 698,064 | | December 31, 2022 |

| December 31, 2020 | | $ | 313,571 | | $ | — | | $ | 351,571 | | December 31, 2023 |

The Adviser engaged Ellington, an investment adviser registered with the U.S. Securities & Exchange Commission, to act as the Fund’s sub-adviser pursuant to a Subadvisory Agreement dated October 17, 2018 between Ellington and the Adviser (the “Subadvisory Agreement”). Under the terms of the Subadvisory Agreement, the Sub-Advisor is paid directly by the Adviser.

Under Administration, Fund Accounting and Transfer Agent Servicing Agreements between the Fund and U.S. Bancorp Fund Services, LLC doing business as U.S. Bancorp Global Fund Services, LLC (“Global Fund Services”), Global Fund Services is paid a monthly fee based on the net asset value of the Fund. Global Fund Services acts as fund administrator, fund accountant, registrar and transfer agent to the Fund.

For the period ended June 30, 2020, the Fund used U.S. Bank National Association (“U.S. Bank”) as its custodian pursuant to a Custody Agreement between U.S. Bank and the Fund.

Northern Lights Compliance Services, LLC (“NLCS”) provides a Chief Compliance Officer to the Fund as well as related compliance services pursuant to a consulting agreement between NLCS and the Fund.

Two Trustees and certain Officers of the Fund are also Officers of the Adviser or Sub-Adviser. Trustees and Officers, other than the Chief Compliance Officer, affiliated with the Adviser or the Sub-Adviser are not compensated by the Fund for their services.

| 5. | INVESTMENT TRANSACTIONS |

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the period ended June 30, 2020 amounted to $11,673,390 and $6,463,307, respectively.

The Fund uses derivative instruments as part of its investment strategy to achieve its stated investment objective. The Fund’s derivative contracts held at period end are not accounted for as hedging instruments under GAAP. For financial reporting purposes, the Fund does not offset derivative assets and liabilities across derivative types that are subject to a master netting arrangement in the Statement of Assets and Liabilities.

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

June 30, 2020

There were no derivative instruments held by the Fund at June 30, 2020.

The following table lists the effect of derivative instruments held by the Fund by primary underlying risk and contract type on the Statement of Operations for the period ended June 30, 2020:

| |

| Realized Gain/(Loss) on Derivatives recognized as a result of Operations | | Net Change in Unrealized Appreciation / (Depreciation) on Derivatives recognized as a result of Operations | |

Primary Underlying Risk: |

| Swapsx

| | Swaps | |

| Credit Risk |

| $(1,144,057) |

|

| $(81,816) |

|

The Fund’s average monthly notional amount of derivatives during the period ended June 30, 2020 were:

| Derivative Type | | Average Monthly Notional Amount |

| Credit Default Swaps | | |

| Average Amounts – Sell Protection | | $4,633,333 |

| 7. | ADDITIONAL DISCLOSURE OF SBA CONFIRMATION OF ORIGINATOR FEE CERTIFICATES CUSTOM BASKET HOLDINGS |

Current

Principal Amount | | Description | | Rate | | Maturity | | Percentage of

Custom Basket | | Fair Value | |

| $ | 837,281 | | | SBA Confirmation of Originator Fee Certificate 344019 | | 1.56% | | 08/15/2044 | | 8.18% | | $ | 75,767 | | |

| | 622,500 | | | SBA Confirmation of Originator Fee Certificate 344020 | | 2.31% | | 09/15/2044 | | 6.08% | | | 56,331 | | |

| | 775,384 | | | SBA Confirmation of Originator Fee Certificate 344021 | | 3.56% | | 10/15/2044 | | 7.58% | | | 70,166 | | |

| | 291,887 | | | SBA Confirmation of Originator Fee Certificate 344022 | | 3.06% | | 09/15/2044 | | 2.85% | | | 26,414 | | |

| | 1,047,319 | | | SBA Confirmation of Originator Fee Certificate 344023 | | 3.31% | | 09/15/2044 | | 10.24% | | | 94,774 | | |

| | 565,537 | | | SBA Confirmation of Originator Fee Certificate 344024 | | 2.31% | | 09/15/2044 | | 5.52% | | | 51,177 | | |

| | 985,119 | | | SBA Confirmation of Originator Fee Certificate 344025 | | 2.31% | | 10/15/2044 | | 9.63% | | | 89,145 | | |

| | 403,036 | | | SBA Confirmation of Originator Fee Certificate 344026 | | 3.56% | | 11/15/2044 | | 3.93% | | | 36,472 | | |

| | 2,473,967 | | | SBA Confirmation of Originator Fee Certificate 344027 | | 2.06% | | 10/15/2044 | | 24.18% | | | 223,874 | | |

| | 2,230,052 | | | SBA Confirmation of Originator Fee Certificate 344028 | | 2.81% | | 10/15/2044 | | 21.80% | | | 201,802 | | |

| $ | 10,232,082 | | | | | | | | | 100.00% | | $ | 925,922 | | |

It is the Fund’s intention to continue to qualify as a RIC under Subchapter M of the IRC and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in its financial statements.

The tax character of distributions paid to shareholders during the years ended December 31, 2018 and December 31, 2019, were as follows:

| | 2019 | | 2018 | |

| Ordinary Income | $ | 1,294,958 | | $ | 40,904 | |

| Net Long-Term Capital Gains | | — | | | — | |

| Return of Capital | | — | | | — | |

| Total Distributions Paid | $ | 1,294,958 | | $ | 40,904 | |

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

June 30, 2020

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differences in the timing of recognition of gains or losses on investments.

GAAP requires that certain components of net assets be reclassified between financial and tax reporting. Temporary differences do not require reclassification. Temporary and permanent differences have no effect on net assets or net asset value per share. For the year ended December 31, 2019, the Fund made the following permanent book to tax reclassification primarily related to excise tax:

| Distributable Earnings | | Paid-In Capital | |

| $397 | | $(397) | |

The following information is provided on a tax basis as of December 31, 2019:

| Tax cost of investments | $ | 26,770,150 | |

| Tax cost of over-the-counter credit default swaps | | 129,116 | |

| Total tax cost of portfolio | $ | 26,899,266 | |

| Gross unrealized appreciation | | 350,489 | |

| Gross unrealized depreciation | | (210,857 | ) |

| Net unrealized appreciation / (depreciation) | | 139,632 | |

| Undistributed ordinary income / (loss) | | 15,578 | |

| Undistributed long-term gain / (loss) | | — | |

| Other temporary differences | | — | |

| Total accumulated gain / (loss) | $ | 155,210 | |

The difference between book basis and tax basis unrealized appreciation / (depreciation) on investments is primarily attributable to mark to market on derivatives.

As of December 31, 2019, for federal income tax purposes, there were no capital loss carryforwards.

The Fund follows the authoritative guidance on accounting for and disclosure of uncertainty on tax positions, which requires management to determine whether a tax position of the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any related appeals of litigation process, based on the technical merits of the position. The tax benefit to be recognized is measured as the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. The Fund did not have any unrecognized tax benefits or unrecognized tax liabilities as of December 31, 2019. The Fund does not expect any change in unrecognized tax benefits or unrecognized tax liabilities within the next year. In the normal course of business, the Fund may be subject to examination by federal, state, local and foreign jurisdictions, where applicable, for all open tax years.

| 9. | SHAREHOLDER TRANSACTIONS |

The Fund operates as an interval fund pursuant to Rule 23c-3 under the 1940 Act and, as such, has adopted a fundamental policy to make quarterly repurchase offers, at NAV, of no less than 5% and no more than 25% of the Fund’s shares outstanding on the Repurchase Request Deadline (as defined below). There is no guarantee that shareholders will be able to sell all of the shares they desire to sell in a quarterly repurchase offer, although each shareholder will have the right to require the Fund to purchase at least 5% of such shareholder’s shares in each quarterly repurchase. Liquidity will be provided to shareholders only through the Fund’s quarterly repurchases. Shareholders will be notified in writing of each quarterly repurchase offer and the date the repurchase offer ends (the “Repurchase Request Deadline”). Shares will be repurchased at the NAV per share determined as of the close of regular trading on the NYSE no later than the 14th day after the Repurchase Request Deadline, or the next business day if the 14th day is not a business day.

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

June 30, 2020

During the period ended June 30, 2020, the Fund completed two repurchase offers. In the offers that commenced on February 26, 2020 and May 28, 2020, the Fund offered to repurchase up to 10% of the number of its outstanding shares as of the applicable Repurchase Pricing Date. The results of these repurchase offers are as follows:

| Commencement Date | February 26, 2020 | May 28, 2020 |

| Repurchase Request Deadline | March 18, 2020 | June 18, 2020 |

| Repurchase Pricing Date | March 18, 2020 | June 18, 2020 |

| Amount Repurchased | $1,513,539 | $500,426 |

| Shares Repurchased | 166,506 | 55,123 |

Class A had 14,275 shares outstanding as of June 30, 2020. Class A did not issue any shares through shareholder subscriptions, issued 488 shares through dividend reinvestments and did not repurchase any shares through shareholder redemptions during the period ended June 30, 2020.

Class M had 3,419,419 shares outstanding as of June 30, 2020. Class M issued 1,060,274 shares through shareholder subscriptions, 20,773 shares through dividend reinvestments and repurchased 221,629 shares through shareholder redemptions during the period ended June 30, 2020.

10. BORROWING

Reverse Repurchase Agreements: The Fund may enter into reverse repurchase agreements. In a reverse repurchase agreement, the Fund delivers a security in exchange for cash to a financial institution, the counterparty, with a simultaneous agreement to repurchase the same or substantially the same security at an agreed upon price and date. The Fund is entitled to receive the principal and interest payments, if any, made on the security delivered to the counterparty during the term of the agreement. Cash received in exchange for securities delivered plus accrued interest payments to be made by the Fund to counterparties are reflected as a liability on the Statement of Assets and Liabilities. Interest payments made by the Fund to counterparties are recorded as a component of interest expense on the Statement of Operations. The Fund will segregate assets determined to be liquid by the Adviser or will otherwise cover its obligations under reverse repurchase agreements.

Reverse repurchase agreements involve the risk that the market value of the securities retained in lieu of sale by the Fund may decline below the price of the securities the Fund has sold but is obligated to repurchase. In the event the buyer of securities under a reverse repurchase agreement files for bankruptcy or becomes insolvent, such buyer or its trustee or receiver may receive an extension of time to determine whether to enforce the Fund’s obligation to repurchase the securities, and the Fund’s use of the proceeds of the reverse repurchase agreement may effectively be restricted pending such decision. Also, the Fund would bear the risk of loss to the extent that the proceeds of the reverse repurchase agreement are less than the value of the securities subject to such agreements.

As of June 30, 2020, the Fund had the following reverse repurchase agreements outstanding, which were equal to 5.70% of the Fund’s net assets:

| Counterparty | | Amount Borrowed | | | Borrowing Rate | | | Borrowing Date | | Maturity Date | | Maturity Amount | |

| RBC Capital Markets | | $ | 510,000 | | | | 3.61 | % | | 05/04/2020 | | 07/02/2020 | | $ | 512,963 | |

| RBC Capital Markets | | | 190,000 | | | | 3.81 | % | | 06/29/2020 | | 08/31/2020 | | | 190,040 | |

| RBC Capital Markets | | | 265,000 | | | | 3.81 | % | | 06/29/2020 | | 08/31/2020 | | | 265,056 | |

| RBC Capital Markets | | | 220,000 | | | | 3.81 | % | | 06/29/2020 | | 08/31/2020 | | | 220,047 | |

| RBC Capital Markets | | | 582,000 | | | | 3.36 | % | | 06/29/2020 | | 08/31/2020 | | | 582,109 | |

| Totals | | $ | 1,767,000 | | | | | | | | | | | $ | 1,770,215 | |

As of June 30, 2020, the fair value of securities held as collateral for reverse repurchase agreements was $3,210,857, as noted on the Schedule of Investments. For the year ended June 30, 2020, the average daily balance and average interest rate in effect for reverse repurchase agreements were $2,337,033 and 3.34%, respectively.

Ellington Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

June 30, 2020

The following is a summary of the reverse repurchase agreements by the type of collateral and the remaining contractual maturity of the agreements:

| | | Overnight and Continuous | | | Up to 30 Days | | | 30 to 90 Days | | | Greater than 90 Days | | | Total | |

| Collateral Loan Obligation | | $ | — | | | $ | 510,000 | | | $ | 1,257,000 | | | $ | — | | | $ | 1,767,000 | |

Below is the gross and net information about instruments and transactions eligible for offset in the Statement of Assets and Liabilities as well as instruments and transactions subject to an agreement similar to a master netting arrangement:

| | | | | | | | | | | | | Gross Amounts of Collateral Not

Offset on the Statement of Assets

& Liabilities | | | |

| Description | | | Gross Amounts of

Recognized Liabilities | | | Gross Amounts

Offset in the

Statement of

Assets & Liabilities | | | Net Amounts

Presented in the

Statement of

Assets & Liabilities | | | Non-Cash Collateral

(Pledged) / Received | | Cash Collateral

(Pledged) / Received | | | Net

Amount | |

| Reverse Repurchase Agreements | | | $ | 1,767,000 | | | $ | — | | | $ | 1,767,000 | | | $ | (1,767,000) | (1) | | $ | — | | | $ | — | |

| (1) | Refer to the Schedule of Investments for the Securities pledged as collateral. The value of these securities is $3,210,857. |

Reverse repurchase transactions are entered into by the Fund under Master Repurchase Agreements (“MRA”) which permit the Fund, under certain circumstances, including an event of default of the Fund (such as bankruptcy or insolvency), to offset payables under the MRA with collateral held with the counterparty and create one single net payment from the Fund. Upon a bankruptcy or insolvency of the MRA counterparty, the Fund is considered an unsecured creditor with respect to excess collateral and, as such, the return of excess collateral may be delayed. In the event the buyer of securities (i.e. the MRA counterparty) under a MRA files for bankruptcy or becomes insolvent, the Fund’s use of the proceeds of the agreement may be restricted while the other party, or its trustee or receiver, determines whether or not to enforce the Fund’s obligation to repurchase the securities.

11. CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of June 30, 2020, National Financial Services held approximately 97% of the voting securities of the Fund.

12. SUBSEQUENT EVENTS

Subsequent events after the date of these financial statements have been evaluated through the date the financial statements were issued.

Management has determined that there were no subsequent events to disclose in the financial statements.

Ellington Income Opportunities Fund

ADDITIONAL INFORMATION (Unaudited)

June 30, 2020

Form N-PORT

The Fund files its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-PORT. The Fund’s Form N-PORT is available without charge by visiting the SEC’s Web site at www.sec.gov.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities owned by the Fund and information regarding how the Fund voted proxies relating to the portfolio of securities for the most recent 12-month period ended June 30 are available to stockholders without charge, upon request by calling the Adviser at (888) 862-3690.

Board of Trustees

The Fund’s prospectus and statement of additional information includes additional information about the Fund’s Trustees and is available upon request without charge by calling the Adviser at (888) 862-3690 or by visiting the SEC’s Web site at www.sec.gov.

Forward-Looking Statements

This report contains “forward-looking statements,’’ which are based on current management expectations. Actual future results, however, may prove to be different from expectations. You can identify forward-looking statements by words such as “may’’, “will’’, “believe’’, “attempt’’, “seem’’, “think’’, “ought’’, “try’’ and other similar terms. The Fund cannot promise future returns. Management’s opinions are a reflection of its best judgment at the time this report is compiled, and it disclaims any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Tax Notice

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871 (k)(2)(c) for the fiscal year ended December 31, 2019 was 2.85%.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not Applicable.

Not Applicable.

The registrant did not engage in securities lending activities during the fiscal period ended on June 30, 2020 reported on this Form N-CSR.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John L. Sabre, President

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

John L. Sabre, President

Christopher E. Moran, Treasurer