Second Quarter 2023 Investor Presentation / August 2023 CSE: TRUL OTCQX: TCNNF Exhibit 99.2

Forward Looking Statements and Industry Data Unless the context otherwise requires, the terms “Trulieve,” “we,” “us” and “our” in this presentation refer to Trulieve Cannabis Corp. and its subsidiaries. Certain statements in this presentation constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation (collectively herein referred to as “forward-looking statements”), which can often be identified by words such as “will”, “may”, “estimate”, “expect”, “plan”, “project”, “intend”, “anticipate” and other words indicating that the statements are forward-looking. These forward-looking statements relate to Trulieve’s expectations or forecasts of business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs and include statements regarding Trulieve’s 2023 objectives for cash generation and preservation and investment, Trulieve’s financial targets, and its plans for potential acquisitions and expansion of the Company’s operations. Such forward-looking statements are expectations only and are subject to known and unknown risks, uncertainties and other important factors, including, but not limited to, risk factors included in this presentation, that could cause the Company’s actual results, performance or achievements or industry results to differ materially from any future results, performance or achievements implied by such forward-looking statements. Such risks and uncertainties include, among others, dependence on obtaining and maintaining regulatory approvals, including acquiring and renewing state, local or other licenses; engaging in activities which currently are illegal under United States federal law and the uncertainty of existing protection from United States federal or other prosecution; regulatory or political change such as changes in applicable laws and regulations, including United States state-law legalization, particularly in Florida, due to inconsistent public opinion, perception of the medical-use and adult-use cannabis industry, bureaucratic delays or inefficiencies or any other reasons; any other factors or developments which may hinder market growth; reliance on management; and the effect of capital market conditions and other factors on capital availability; competition, including from more established or better financed competitors; and the need to secure and maintain corporate alliances and partnerships, including with customers and suppliers. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Although it may voluntarily do so from time to time, the Company undertakes no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Unless otherwise noted, the forecasted industry and market data contained herein are based upon management estimates and industry and market publications and surveys. The information from industry and market publications has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. The Company has not independently verified any of the data from third-party sources, nor has the Company ascertained the underlying economic assumptions relied upon therein. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. Please note: MARIJUANA IS ILLEGAL UNDER U.S. FEDERAL LAW, including its consumption, possession, cultivation, distribution, manufacturing, dispensing, and possession with intent to distribute. Forward-looking statements made in this document are made only as of the date of their initial publication, and the Company undertakes no obligation to publicly update any of these forward-looking statements as actual events unfold.

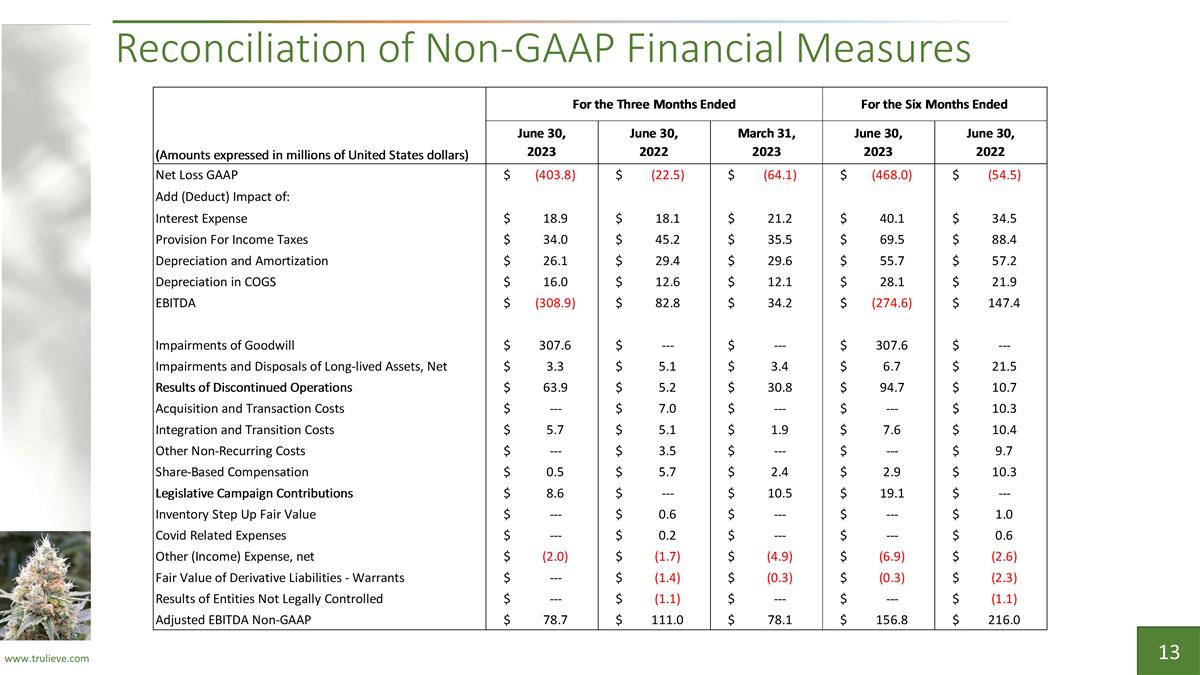

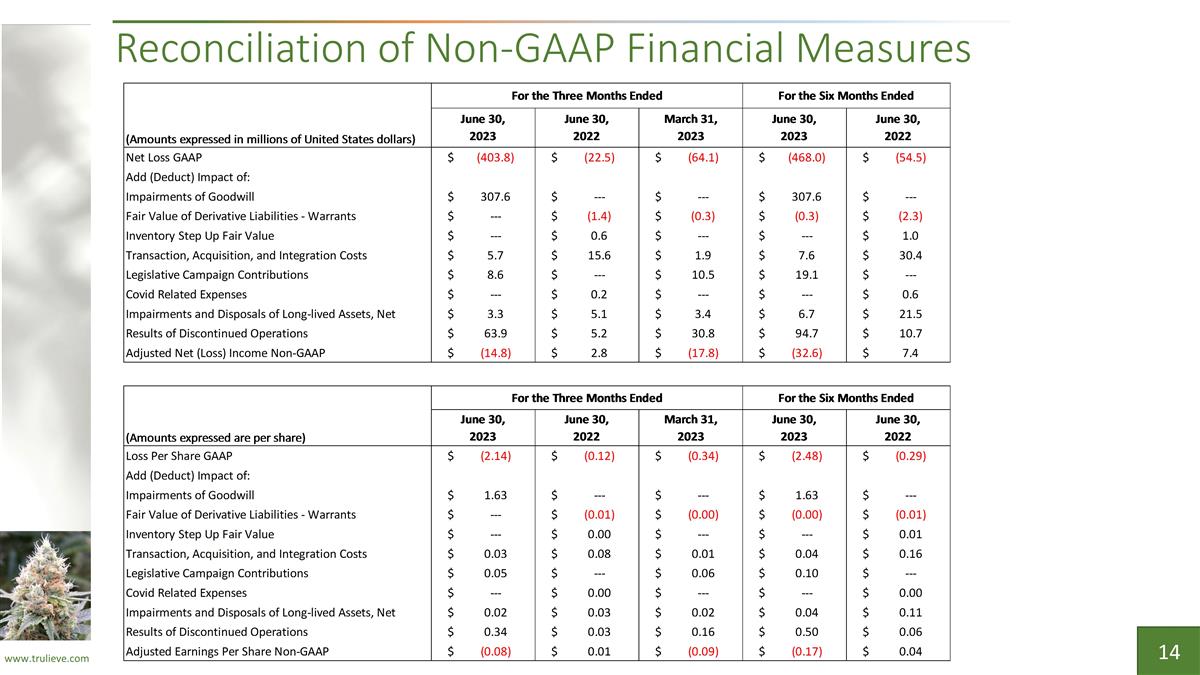

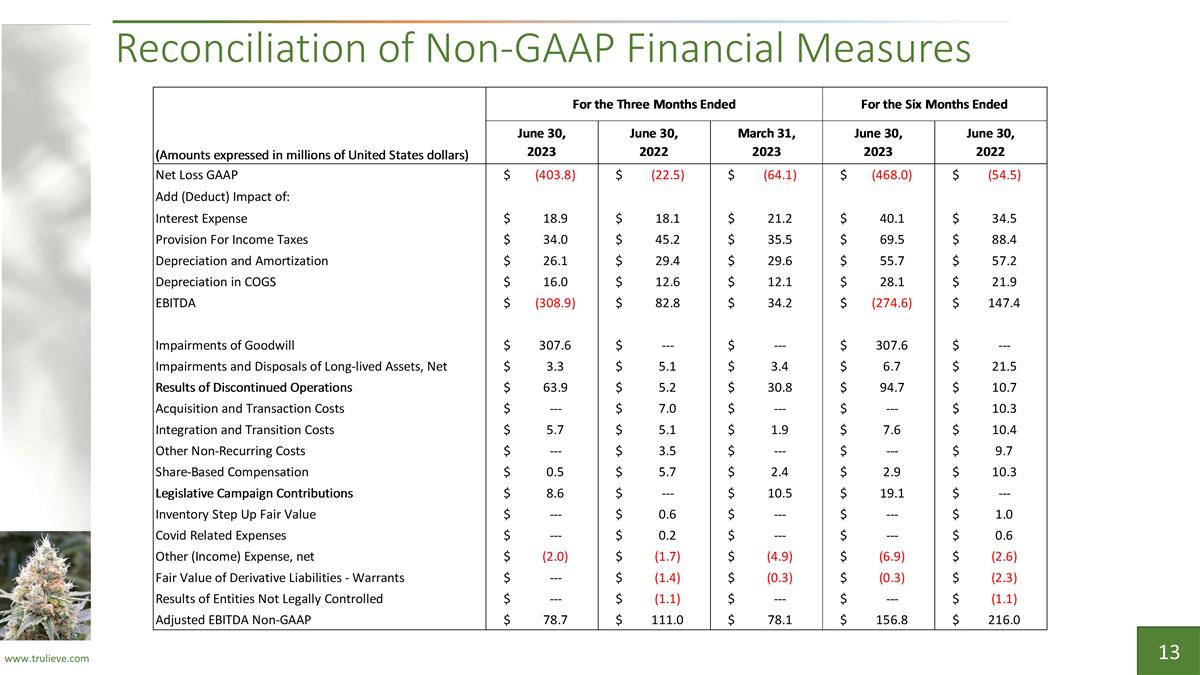

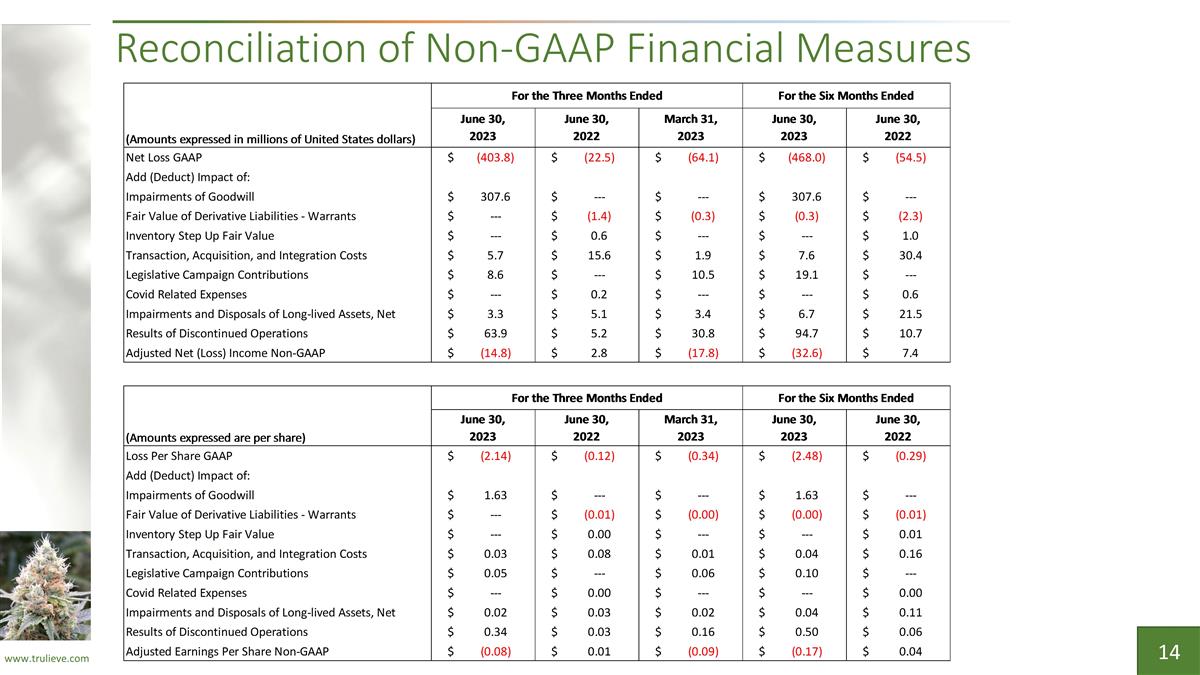

Management’s Use of Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we supplement our results with non-GAAP financial measures, including adjusted net income, adjusted earnings per share, and adjusted EBITDA. Our management uses these non-GAAP financial measures in conjunction with GAAP financial measures to evaluate our operating results and financial performance. We believe these measures are useful to investors as they are widely used measures of performance and can facilitate comparison to other companies. These non-GAAP financial measures are not, and should not be considered as measures of liquidity. These non-GAAP financial measures have limitations as analytical tools in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Because of these limitations, these non-GAAP financial measures should be considered along with GAAP financial performance measures. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of the non-GAAP financial measures to such GAAP measures can be found below. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP.

Agenda Second Quarter 2023 Financial and Operational Highlights Retail Highlights Recent Developments 2023 Objectives Financial Targets Financial Highlights

Second Quarter 2023 Financial and Operational Highlights* Revenue $282 million, with 96% revenue from retail sales GAAP gross profit of $142 million and 50% gross margin SG&A expenses lowered by $4 million sequentially Net loss of $404 million Adjusted net loss of $15 million excludes non-recurring charges, asset and goodwill impairments, disposals and discontinued operations Goodwill impairment was triggered by the recent stock price performance and is not connected to management’s forecasts Adjusted EBITDA of $79 million or 28% of revenue Generated cash flow from operations excluding tax payments of $98 million year to date Inventory reduction initiatives drive $24 million in cash generation year to date First to launch medical sales in Georgia Opened five dispensaries in Macon, Marietta, and Newnan, GA, Apache Junction, AZ, and Limerick, PA Relocated one dispensary in Phoenix, AZ and one dispensary in Fort Myers, FL Exited California retail assets and commenced wind down of operations in Massachusetts as part of cash preservation and generation plan to bolster business resilience * Adjusted net loss and adjusted EBITDA are Non-GAAP financial measures. See slides 13-14 for reconciliation to GAAP for all Non-GAAP financial measures. Numbers may not sum perfectly due to rounding.

Retail Highlights Revenue $282 million Retail revenue of $272 million Customer retention 64% companywide Customer retention 74% medical only Excluding deferred revenue, retail revenue increased by $3 million sequentially Sold 11.6 million units of branded product through branded retail, up 9% sequentially Achieved record traffic, customers served, and units sold on 4/20 holiday, up 10%, 11%, and 9%, respectively, year over year Exited the quarter with 32% of retail locations outside of the state of Florida

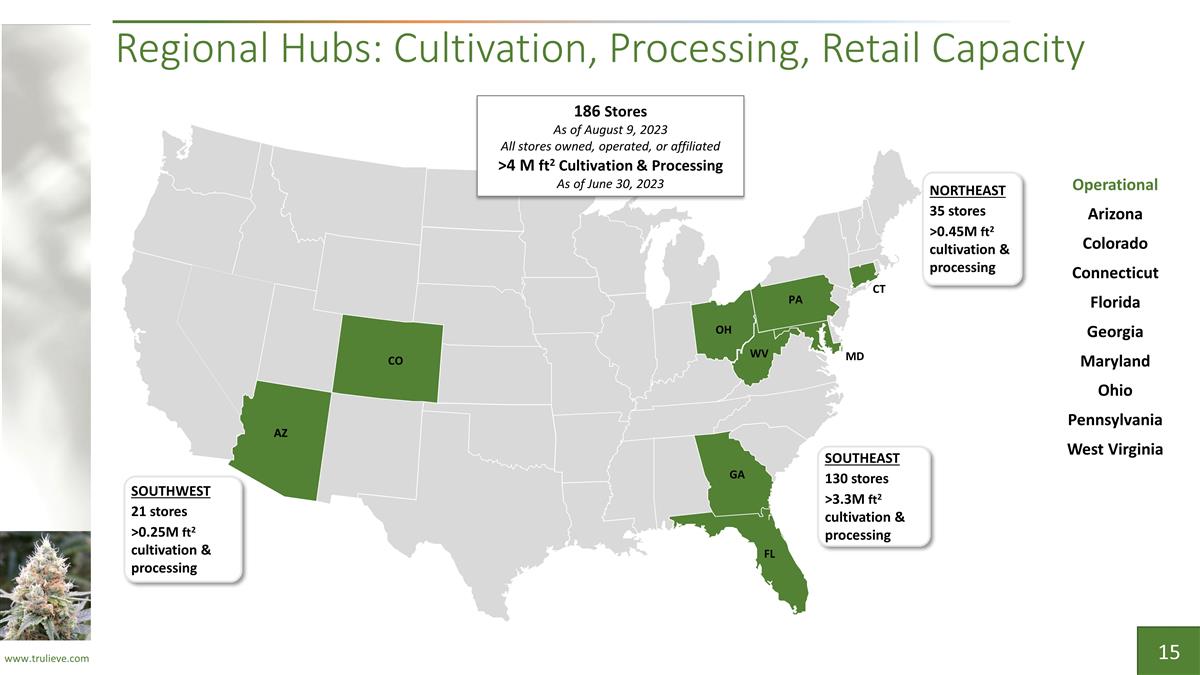

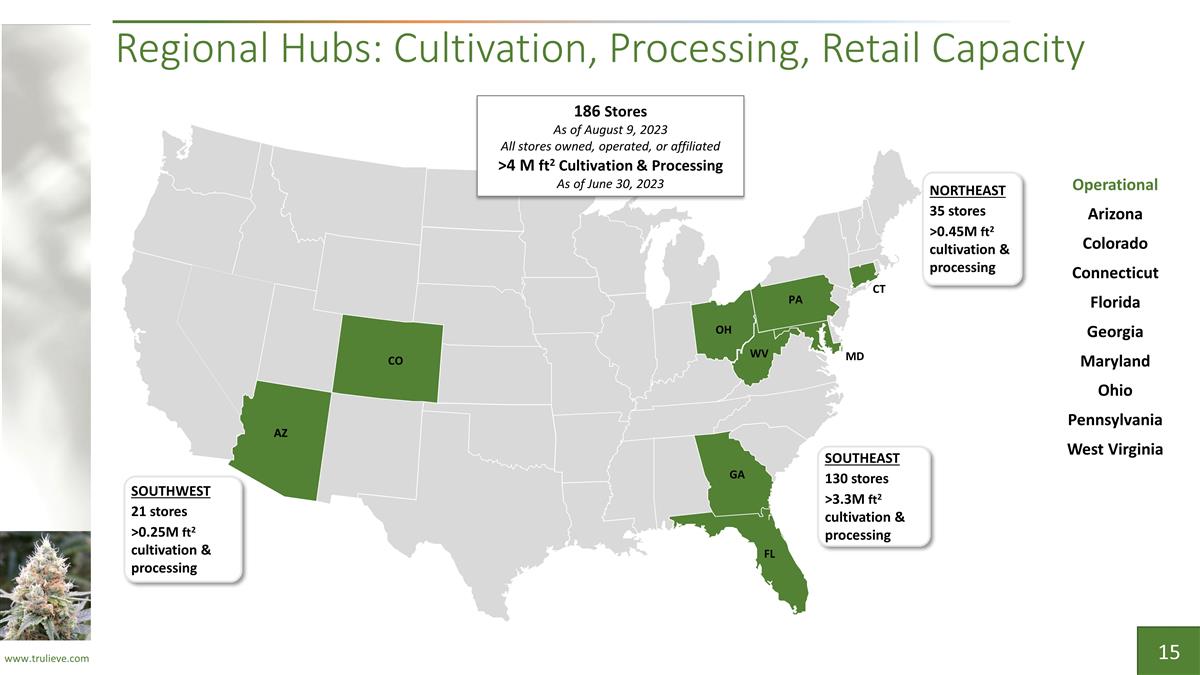

Recent Developments Realized 200% increase in Maryland traffic in July compared to June following the launch of adult-use sales at our three dispensaries Opened first medical marijuana dispensary in Columbus, OH Added retail locations in Sanford, FL and Pooler, GA and relocated one dispensary in Kissimmee, FL Currently operate 186 retail dispensaries and over 4 million square feet of cultivation and processing capacity in the United States

2023 Objectives Cash Preservation Reduce expenses through business optimization initiatives Reduce wages with elimination of redundancies Cash Generation Scale Optimize assortment to match customer preferences Adjust production mix and capacity utilization Reduce inventory throughout 2023 Ramp new lower cost 750K indoor production facility Service Service standards Customer journey mapping Customer education Investments in the Future: Smart and Safe Florida Campaign New market and retail development Technology platforms for integrated commerce environment Consideration of strategic M&A opportunities

Financials

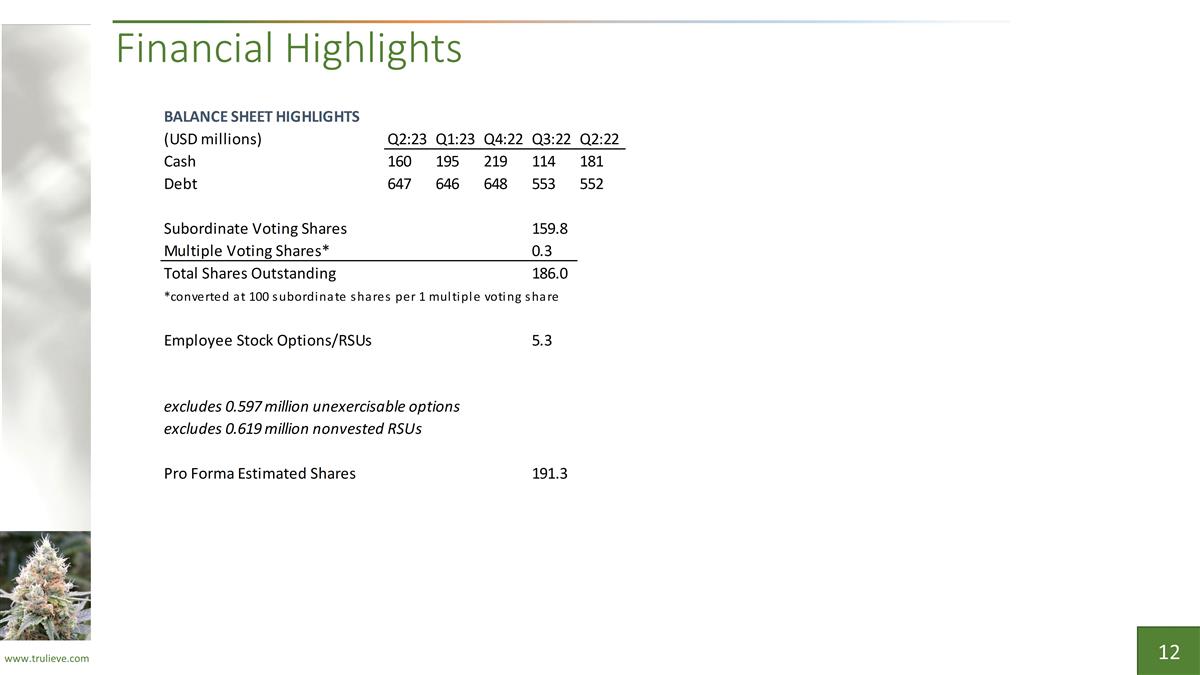

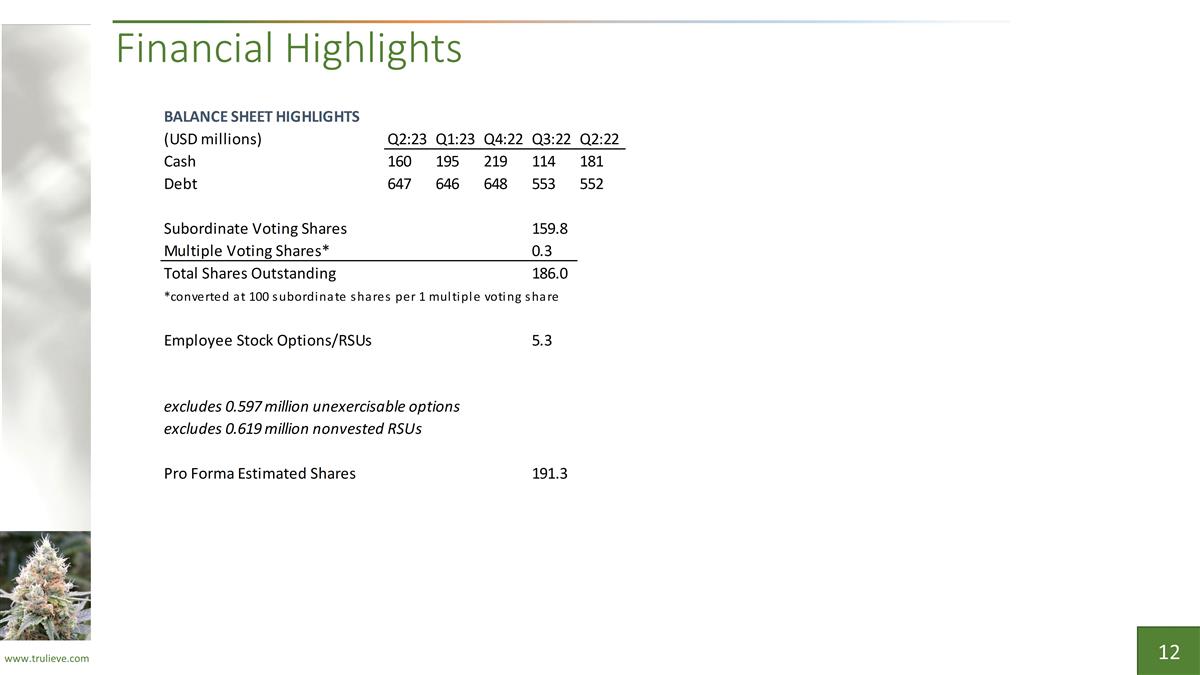

Financial Targets Financial Targets: Anticipate third quarter revenue will be down mid single digits sequentially Target operating cash flow of $100 million in 2023 Capital expenditures expected to be at least 50% lower in 2023 Expect positive free cash flow in 2023 Add 15-20 new dispensaries, relocate up to 6 Financial Position: $160 million in cash as of June 30, 2023

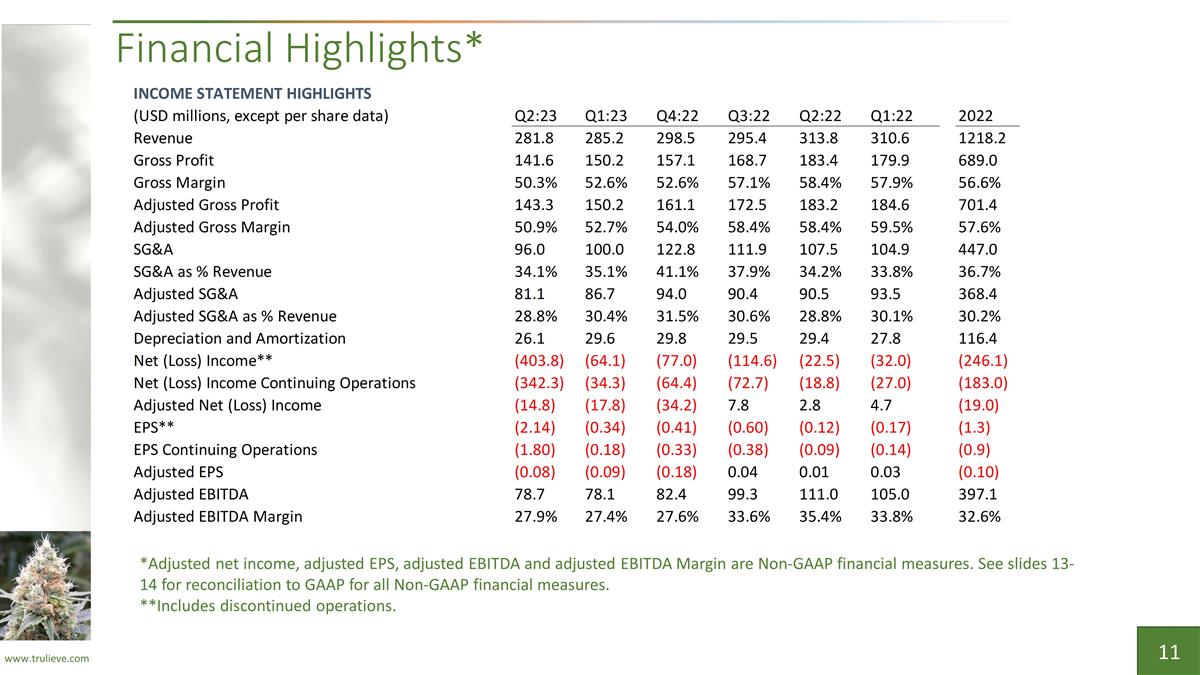

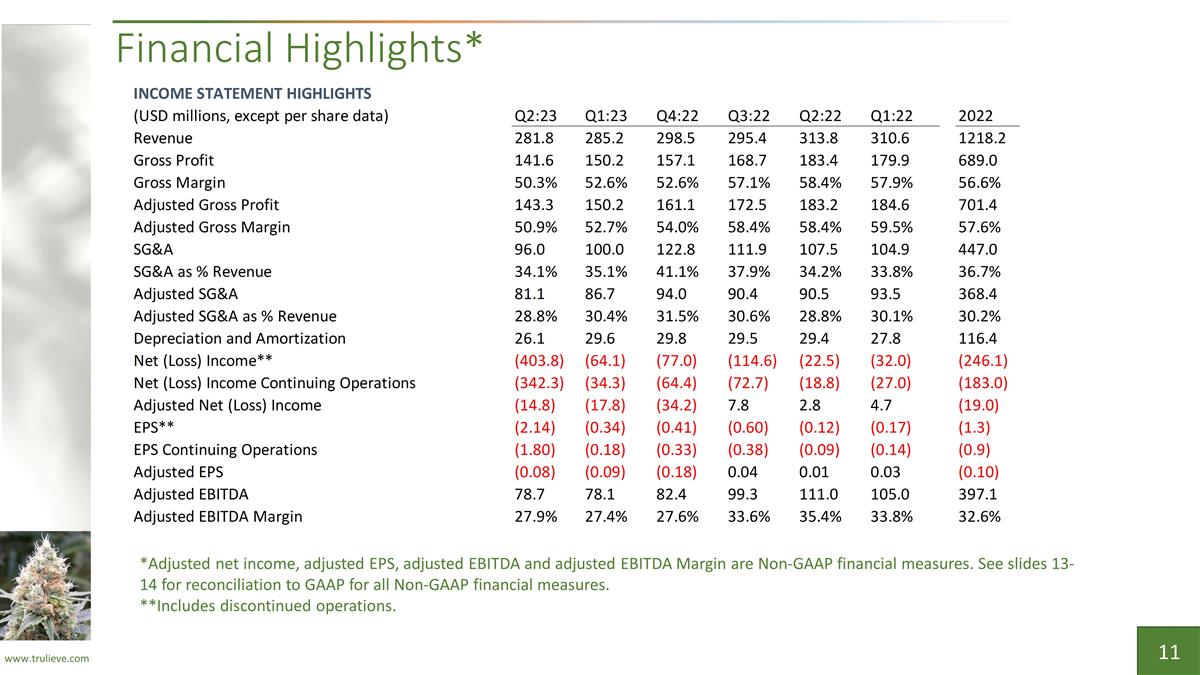

Financial Highlights* *Adjusted net income, adjusted EPS, adjusted EBITDA and adjusted EBITDA Margin are Non-GAAP financial measures. See slides 13-14 for reconciliation to GAAP for all Non-GAAP financial measures. **Includes discontinued operations.

Financial Highlights

Reconciliation of Non-GAAP Financial Measures

Reconciliation of Non-GAAP Financial Measures

Regional Hubs: Cultivation, Processing, Retail Capacity FL PA AZ MD WV AZ CO CT GA 186 Stores As of August 9, 2023 All stores owned, operated, or affiliated >4 M ft2 Cultivation & Processing As of June 30, 2023 Operational Arizona Colorado Connecticut Florida Georgia Maryland Ohio Pennsylvania West Virginia SOUTHWEST 21 stores >0.25M ft2 cultivation & processing NORTHEAST 35 stores >0.45M ft2 cultivation & processing SOUTHEAST 130 stores >3.3M ft2 cultivation & processing OH

House of Brands Trulieve Brands VALUE MID PREMIUM Partner Brands

Thank You CSE: TRUL OTCQX: TCNNF @Trulieve/@Trulieve_IR ir@trulieve.com