0001755281scl:CotaiJet5HKLimitedMember2022-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

Form 20-F

__________________________________

| | | | | |

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

| | | | | |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-262328

__________________________________

Sands China Ltd.

(Exact name of Registrant as specified in its charter)

__________________________________

Cayman Islands

(Jurisdiction of Incorporation or Organization)

__________________________________

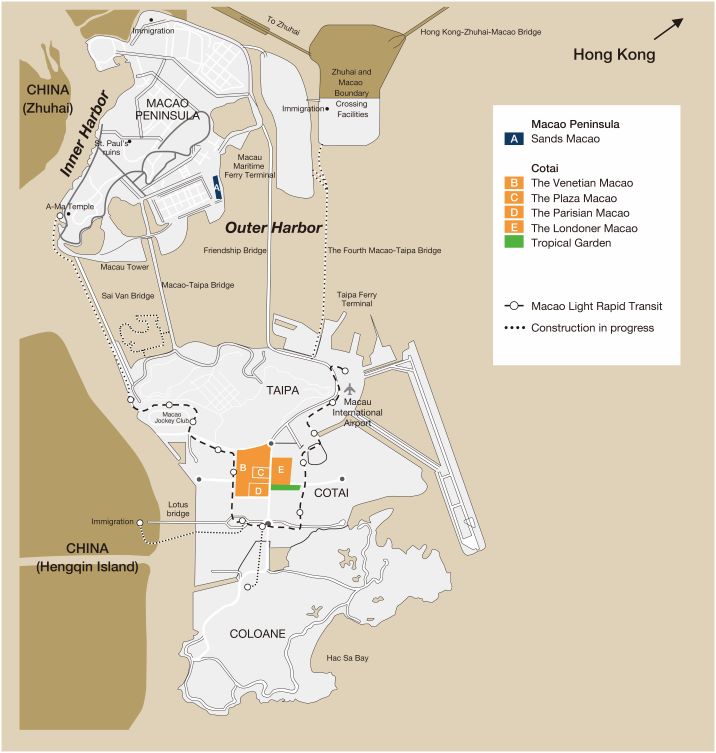

The Venetian Macao Resort Hotel, L2 Executive Offices

Estrada da Baía de N. Senhora da Esperança, s/n

Macao

(Address of principal executive offices)

__________________________________

Dylan James Williams, Company Secretary

Sands China Ltd.

The Venetian Macao Resort Hotel, Legal Department, L2 Executive Offices

Estrada da Baía de N. Senhora da Esperança, s/n

Macao

Telephone: +853 8118-2888 Facsimile: +853 2888-3382

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

__________________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| N/A | | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

__________________________________

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

2.300% Notes Due March 8, 2027

2.850% Notes Due March 8, 2029

3.250% Notes Due August 8, 2031

__________________________________

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

8,093,188,866 ordinary shares outstanding as of December 31, 2022

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | | Accelerated filer | ¨ | | Non-Accelerated filer | x | | Emerging growth company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP | ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board | x | | Other | ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

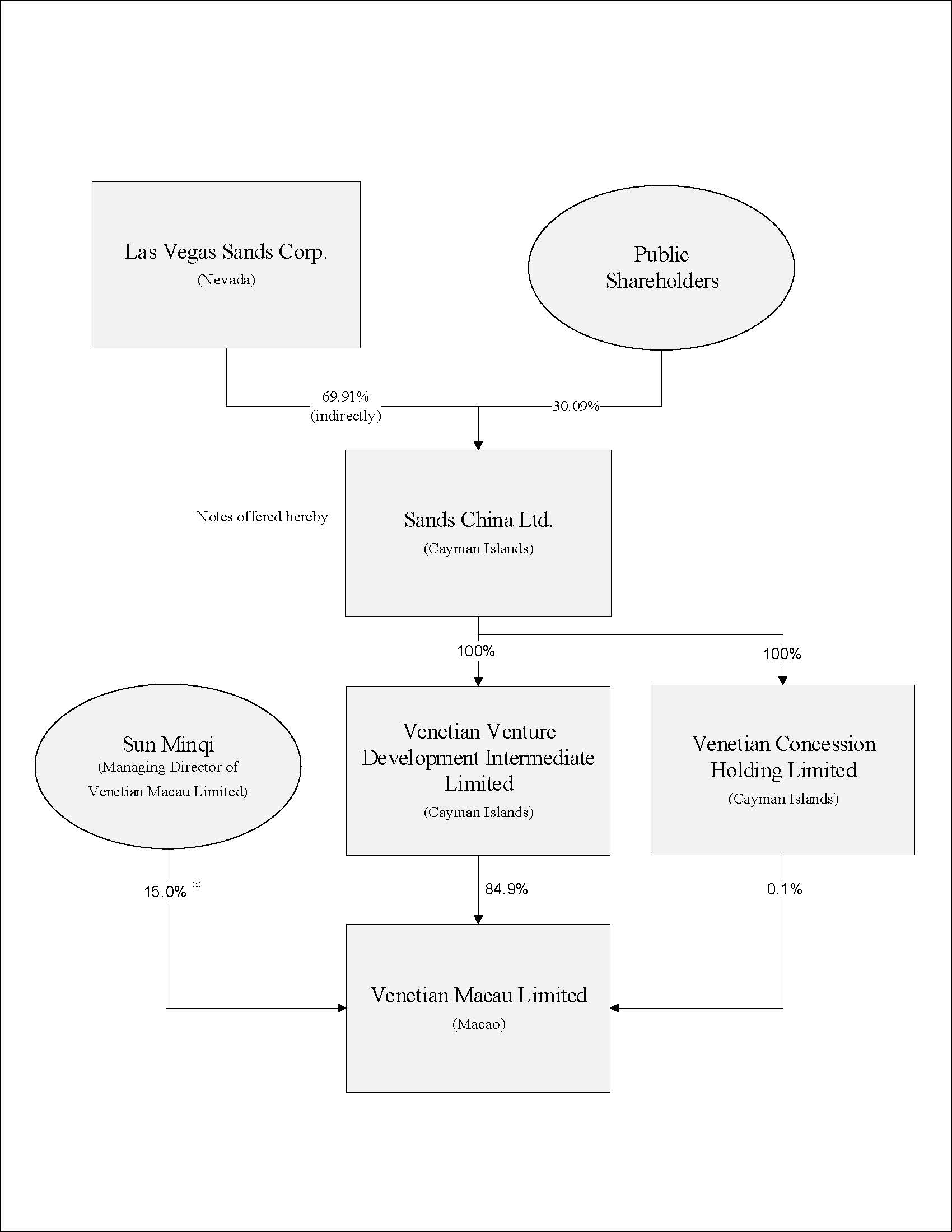

Sands China Ltd. is a holding company incorporated in the Cayman Islands. We conduct our operations in Macao through subsidiaries located in Macao. In addition, we have subsidiaries incorporated in Hong Kong and two subsidiaries incorporated in mainland China that provide back office support for our business operations in Macao, such as information technology, accounting, hotel management and marketing services, which complement and support our main back office functions in Macao. We do not have any variable interest entities (“VIEs”) nor do we have material contractual arrangements with VIEs based in China, including Hong Kong and Macao.

We face various legal and operational risks and uncertainties relating to our operations, including those risks associated with being based in China, including Macao and Hong Kong. If, in the future, there were to be a significant change in the manner in which the Chinese government exercises direct or indirect oversight, discretion or control over businesses operated in China (including Macao and Hong Kong), including the current interpretation and application of existing Chinese laws and regulations on how the Chinese government exercises direct or indirect oversight, discretion or control over businesses operated in China (including Macao and Hong Kong), it could potentially result in our operations in Macao and Hong Kong being materially adversely affected. Substantially all of our assets are located in Macao and substantially all of our revenue is derived from Macao. Accordingly, our results of operations, financial position and prospects are subject to a significant degree to the economic, political and legal situation in Macao. From December 20, 1999, Macao became a Special Administrative Region of China when China resumed the exercise of sovereignty over Macao. The Basic Law of Macao provides that Macao will be governed under the principle of “one country, two systems” with its own separate government and legislature and that Macao will have a high degree of legislative, judicial and economic autonomy. However, there can be no assurance that economic, political and legal developments in Macao will not adversely affect our operations, or that there will not be a change in the manner in which regulatory oversight is conducted in Macao, if China were to exercise greater control over Macao. If any such change were to occur, it could potentially adversely affect our results of operations, financial position and prospects.

China’s economy differs from the economies of most developed countries, including the structure of the economy, level of government involvement, level of development, growth rate, control of capital inflows and outflows, control of foreign exchange and allocation of resources. China’s economy has been transitioning from a planned economy to a more market-oriented economy. We face risks and uncertainties associated with evolving Chinese laws and regulations, such as those associated with the level of Chinese government involvement, control of capital inflows and outflows, control of foreign exchange and allocation of resources, and other risks and uncertainties as to whether and how recent Chinese government statements and regulatory developments, such as those relating to data and cyberspace security and anti-monopoly (which, where applicable to us), could result in a material change in our operations and/or the value of our securities or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors, cause the value of such securities to significantly decline or be worthless and affect our ability to list securities on a U.S. or other foreign exchange. For example, on August 20, 2021, the Standing Committee of the National People's Congress of the PRC (“SCNPC”) promulgated the Personal Information Protection Law of the PRC (“PIPL”), which became effective on November 1, 2021. As the first systematic and comprehensive law specifically for the protection of personal information in the PRC, the PIPL provides extraterritorial effect on the personal information processing activities. Since our data processing activities outside mainland China relate to the offering of goods or services directed at natural persons in mainland China, our businesses operated outside mainland China are potentially subject to the requirements of PIPL. However, the implementation rules to the extraterritorial jurisdiction of the PIPL have not been finalized yet, and it remains unclear how the Chinese government will enforce such law. If the extraterritorial jurisdiction under the PIPL actually extends to us, we will be subject to certain data privacy obligations. Moreover, if the recent Chinese regulatory actions on data security or other data-related laws and regulations were to become applicable to us, we could become subject to the potential requirement to conduct a cybersecurity review for listing on a foreign stock exchange. The failure to meet such obligations could result in penalties and other regulatory actions against us and may materially and adversely affect the manner in which we conduct our business and our results of operations.

Furthermore, on December 2, 2021, the SEC adopted final amendments implementing the disclosure and submission requirements under the Holding Foreign Companies Accountable Act (the “HFCA Act”), pursuant to which the SEC will identify a “Commission-Identified Issuer” if an issuer has filed an annual report containing an audit report issued by a registered public accounting firm that the Public Company Accounting Oversight Board (“PCAOB”) has determined it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction, and will then impose a trading prohibition on an issuer if and after it is identified as a Commission-Identified Issuer for three consecutive years. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was signed into law, which reduced the number of consecutive non-inspection years required for triggering the listing and trading prohibitions under the HFCA Act from three years to two years. On December 15, 2022, the PCAOB reported that it was able, in 2022, to inspect and investigate completely audit firms headquartered in mainland China and Hong Kong and that, as a result, the PCAOB voted to vacate previous determinations to the contrary. However, uncertainties remain whether the PCAOB can continue to make a determination in the future that it is able to inspect and investigate completely PCAOB-registered audit firms based in mainland China and Hong Kong.

As a holding company, we rely on the receipt of dividends and other distributions and interest or principal payments on intercompany loans or advances and intragroup transfers of cash and other assets, from or between our Group members, to fund our payments with respect to the Notes (together, the “Intragroup Distributions and Arrangements”). The amounts and types of assets involved in these Intragroup Distributions and Arrangements are subject to change from time to time. The Intragroup Distributions and Arrangements have supported our ability to discharge our payment obligations under the terms of our debt financing and debt securities (including our obligation to pay interest on our senior notes) and to fund our operations. During the years ended December 31, 2020, 2021 and 2022, the Company advanced an aggregated principal of US$1.58 billion, US$872 million and US$697 million, respectively, of promissory notes to its subsidiaries from the proceeds of Senior Notes and 2018 SCL Revolving Facility. During the years ended December 31, 2020, 2021 and 2022, the Company received from its subsidiaries interest and principal repayments of US$83 million, US$487 million and US$200 million, respectively, and dividend income of US$1.03 billion, nil and nil, respectively. During the years ended December 31, 2020, 2021 and 2022, the Company made interest payments of US$294 million, US$352 million and US$310 million, respectively, to the holders of the Senior Notes. Our ability to meet our payment obligations under the Notes to both U.S. and non-U.S. investors depends on the ability of our subsidiaries to pay or make the Intragroup Distributions and Arrangements. Such ability of our subsidiaries is subject to, among other things, the laws and regulations currently applicable to us and in the future, and restrictions in connection with the contractual arrangements of such subsidiaries. For example, our revenues in Macao are denominated in patacas and HK dollars. The Macao pataca is pegged to the HK dollar and, in many cases, is used interchangeably with the HK dollar in Macao. The HK dollar is pegged to the U.S. dollar. While currently there is no foreign exchange or capital control restriction applicable to the Intragroup Distributions and Arrangements conducted in Macao by our Macao subsidiaries, we cannot assure you that this will continue to be the case in the future, and that our ability to convert large amounts of patacas and HK dollars into U.S. dollars over a relatively short period may be limited. If, in the future, foreign exchange or capital control restrictions were to be imposed and become applicable to us, such restrictions could potentially reduce the amounts that we would be able to receive from our subsidiaries, which would restrict our ability to fund our payment obligations under the Notes. In addition, U.S. investors should refer to (i) “Taxation - United States Federal Income Tax Considerations” of this prospectus for a summary of U.S. federal income tax considerations generally applicable to the exchange of Outstanding Notes for Notes pursuant to the exchange offer, and (ii) “United States Federal Income Tax Considerations” of the final offering memorandum distributed in connection with the private offering of the Outstanding Notes for a summary of U.S. federal income tax considerations of the ownership and disposition of the Outstanding Notes.

TABLE OF CONTENTS

Special Note Regarding Forward-Looking Statements

This annual report contains or incorporates by reference forward-looking statements that are, by their nature, subject to significant risks and uncertainties. These forward-looking statements include the discussions of our business strategies and expectations concerning future operations, margins, profitability, liquidity and capital resources. Any statements contained in this prospectus that are not statements of historical fact may be deemed to be forward-looking statements. In addition, in certain portions included in this prospectus, the words “anticipates,” “believes,” “estimates,” “seeks,” “expects,” “plans,” “intends” and similar expressions, as they relate to our Company or management, are intended to identify forward-looking statements. Although we believe these forward-looking statements are reasonable, we cannot assure you any forward-looking statements will prove to be correct. These forward-looking statements involve known and unknown risks, uncertainties and other factors beyond our control, which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. These factors include, among others, the risks associated with:

•the uncertainty of the extent, duration and effects of the COVID-19 Pandemic (as defined in the “Glossary” section of this prospectus) and the response of governments and other third parties, including government-mandated property closures, increased operational regulatory requirements or travel restrictions, on our business, results of operations, cash flows, liquidity and development prospects;

•our ability to maintain our Concession in Macao;

•our ability to invest in future growth opportunities;

•general economic and business conditions, which may impact levels of disposable income, consumer spending, group meeting business, pricing of hotel rooms and retail and mall tenant sales;

•disruptions or reductions in travel and our operations, due to natural or man-made disasters, pandemics, epidemics or outbreaks of infectious or contagious diseases, political instability, civil unrest, terrorist activity or war;

•the uncertainty of consumer behavior related to discretionary spending and vacationing at our integrated resorts;

•the extensive regulations to which we are subject and the costs of compliance or failure to comply with such regulations;

•new developments and construction projects and ventures, including developments at our Cotai Strip properties;

•regulatory policies in mainland China or other countries in which our patrons reside, or where we have operations, including visa restrictions limiting the number of visits or the length of stay for visitors from mainland China to Macao, restrictions on foreign currency exchange or importation of currency, and the judicial enforcement of gaming debts;

•the possibility that the laws and regulations of mainland China become applicable to our operations in Macao and Hong Kong;

•the possibility that economic, political and legal developments in Macao adversely affect our operations, or that there is a change in the manner in which regulatory oversight is conducted in Macao;

•our leverage, debt service and debt covenant compliance and ability to refinance our debt obligations as they come due or to obtain sufficient funding for our planned, or any future, development projects;

•fluctuations in currency exchange rates and interest rates, and the possibility of increased expense as a result;

•increased competition for labor and materials due to planned construction projects and quota limits on the hiring of foreign workers;

•our ability to compete for limited management and labor resources in Macao, and the policies of the government may also affect our ability to employ imported managers or labor from other countries;

•our dependence upon properties in Macao for all of our cash flow;

•the passage of new legislation and receipt of governmental approvals for our operations;

•the ability of our insurance coverage to cover all possible losses that our properties could suffer and the potential for our insurance costs to increase in the future;

•our ability to collect gaming receivables from our credit players;

•our dependence on chance and theoretical win rates;

•fraud and cheating;

•our ability to establish and protect our intellectual property rights;

•the possibility that our securities may be prohibited from being traded in the U.S. securities market under the Holding Foreign Companies Accountable Act;

•conflicts of interest that arise because certain of our directors and officers are also directors of LVS;

•government regulation of the casino industry (as well as new laws and regulations and changes to existing laws and regulations), including gaming license regulation, the requirement for certain beneficial owners of our securities to be found suitable by gaming authorities, the legalization of gaming in other jurisdictions and regulation of gaming on the internet;

•increased competition, including recent and upcoming increases in hotel rooms, meeting and convention space, retail space, potential additional gaming licenses and online gaming;

•the popularity of Macao as a convention and trade show destination;

•new taxes, changes to existing tax rates or proposed changes in tax legislation;

•the continued services of our key officers;

•labor actions and other labor problems;

•our failure to maintain the integrity of our information and information systems or comply with applicable privacy and data security requirements and regulations could harm our reputation and adversely affect our business;

•the completion of infrastructure projects;

•limitations on the transfers of cash to and from our subsidiaries, limitations of the pataca exchange markets and restrictions on the export of the renminbi;

•the outcome of any ongoing and future litigation;

•potential negative impacts from ESG and sustainability matters; and

•other factors described under “Item 3 - Key Information — D. Risk Factors.”

All future written and verbal forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. Readers are cautioned not to place undue reliance on these forward-looking statements. We assume no obligation to update any forward-looking statements after the date of this prospectus, as a result of new information, future events or developments, except as required by federal securities laws.

All forward-looking statements contained in this prospectus are qualified by reference to this cautionary statement.

PART I

ITEM 1. — IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. — OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. — KEY INFORMATION

A. [RESERVED]

B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

D. RISK FACTORS

We have identified and set out below the principal risks to the Group's business. In evaluating the Company, you should carefully consider these risks in addition to other information in this annual report. Additional risks and uncertainties not currently known to us or that we currently deem to be insignificant may also have a material adverse effect on the business, financial condition, results of operations and cash flows.

Risks Related to Doing Business in China

Our securities may be prohibited from being traded in the U.S. securities market and our investors may be deprived of the benefits of such inspections or investigations if the PCAOB were not able to conduct full inspections or investigations of our auditor.

The Holding Foreign Companies Accountable Act (the “HFCA Act”) was enacted on December 18, 2020. The HFCA Act states that if the SEC determines that an issuer has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years, the SEC shall prohibit the securities of the issuer from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was signed into law, which reduced the number of consecutive non-inspection years required for triggering the listing and trading prohibitions under the HFCA Act from three years to two years.

Under the HFCA Act, the SEC will identify a “Commission-Identified Issuer” if an issuer has filed an annual report containing an audit report issued by a registered public accounting firm that the PCAOB has determined it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction, and will then impose a trading prohibition on an issuer after it is identified as a Commission-Identified Issuer for two consecutive years. If we were identified by the SEC as a Commission-Identified Issuer and have a “non-inspection” year, there is no assurance that we will be able to take remedial measures in a timely manner. On December 15, 2022, the PCAOB reported that it was able, in 2022, to inspect and investigate completely audit firms headquartered in mainland China and Hong Kong and that, as a result, the PCAOB voted to vacate previous determinations to the contrary. Our auditor, Deloitte Touche Tohmatsu, is headquartered in Hong Kong and was subject to the determination that the PCAOB was unable to inspect, pursuant to the HFCA Act; however, subsequent to December 15, 2022, Deloitte Touche Tohmatsu is no longer subject to the determination. However, uncertainties remain whether the PCAOB can continue to make a determination in the future that it is able to inspect and investigate completely PCAOB-registered audit firms based in mainland China and Hong Kong.

There could be additional regulatory or legislative requirements or guidance that could impact us if, in the future, our auditor is not subject to PCAOB inspection. The SEC also may propose additional rules or guidance that could impact us if our auditor is not subject to PCAOB inspection. The implications of any additional regulation or guidance in addition to the requirements of the HFCA Act are uncertain, and such uncertainty could cause the market price of our securities to be materially and adversely affected.

If the PCAOB is unable to conduct inspections or full investigations of our auditor, our securities could be prohibited from being traded in the U.S. securities market, including “over-the-counter,” if, in the future, we were to be identified as a Commission-Identified Issuer for two consecutive years. Such a prohibition could substantially impair your ability to sell or purchase our securities

when you wish to do so, and the risk and uncertainty associated with a potential prohibition could have a negative impact on the price of our securities. Also, such a prohibition could significantly affect our ability to raise capital on acceptable terms, or at all, which may have a material adverse effect on our business, financial condition and prospects.

Inspections of other audit firms that the PCAOB has conducted outside China have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. If the PCAOB were unable to conduct inspections or full investigations of our auditor, we and investors in our securities would be deprived of the benefits of such PCAOB inspections. In addition, the inability of the PCAOB to conduct inspections or full investigations of auditors would make it more difficult to evaluate the effectiveness of our independent registered public accounting firm’s audit procedures or quality control procedures as compared to auditors that are subject to the PCAOB inspections, which could cause investors and potential investors to lose confidence in the audit procedures and reported financial information and the quality of our financial statements.

Our business, financial condition and results of operations and/or the value of our securities or our ability to offer or continue to offer securities to investors may be materially and adversely affected to the extent the laws and regulations of mainland China become applicable to our operations in Macao and Hong Kong or economic, political and legal developments in Macao adversely affect our Macao operations.

We are a parent company with limited business operations of our own, and our main asset is the capital stock of our subsidiaries. A significant portion of our business operations are based in Macao and held by our various Macao-incorporated indirect subsidiaries (collectively referred to as the "Macao Operations"). We also have subsidiaries incorporated in mainland China and Hong Kong that provide back-office support, such as information technology, accounting, hotel management and marketing services, which complement and support our main back-office functions in Macao.

We face various legal and operational risks and uncertainties relating to having our operations based in Macao and held by various Macao-incorporated indirect subsidiaries. Substantially all of our assets are located in Macao and substantially all of our revenue is derived from Macao. Accordingly, our results of operations, financial position and prospects are subject to a significant degree to the economic, political and legal situation in Macao. China’s economy differs from the economies of many other countries, including the structure of the economy, level of government involvement, level of development, growth rate, control of capital inflows and outflows, control of foreign exchange and allocation of resources. Our operations face risks and uncertainties associated with evolving Chinese laws and regulations, such as those associated with the extent to which the level of Chinese government involvement, control of capital inflows and outflows, control of foreign exchange and allocation of resources currently applicable within mainland China may become applicable to us. If, in the future, there were to be a significant change in the manner in which the Chinese government exercises direct or indirect oversight, discretion or control over businesses operated in Macao, mainland China and Hong Kong, it could potentially result in our Macao Operations being materially adversely affected and it could potentially adversely affect our results of operations, financial position and cash flows. For example, currently in mainland China, the renminbi cannot be freely exchanged into any foreign currencies, and exchange and remittance of foreign currencies are subject to Chinese foreign exchange regulations. If, in the future, similar regulations were to become applicable to the exchange and remittance of patacas or other currencies in Macao, there could potentially be a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, the Chinese government has recently indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. Based on the final rules that have been published and that are to take effect on March 31, 2023, we believe they will not be applicable to us, but if this or other laws and regulations in China were to change in the future, it could limit or hinder our ability to offer or continue to offer securities to investors and affect our ability to list securities on a foreign exchange.

There may be risks and uncertainties associated with the evolving laws and regulations in China, including their interpretation and implementation and the possibility of changes thereto with little advance notice, such as those relating to data and cyberspace security and anti-monopoly. If, in the future, there were to be any significant governmental intervention or influence on, or in relation to our business or operations, this could potentially cause the value of our securities to significantly decline or be worthless. For example, on August 20, 2021, the Standing Committee of the National People's Congress (“SCNPC”) promulgated the Personal Information Protection Law of the PRC (“PIPL”), which became effective on November 1, 2021. As the first systematic and comprehensive law specifically for the protection of personal information in the PRC, the PIPL provides extraterritorial effect on the personal information processing activities. Since our data processing activities outside mainland China from our Macao Operations relate to the offering of goods or services directed at natural persons in mainland China, our businesses from our Macao Operations operated outside mainland China are potentially subject to the requirements of PIPL. However, the implementation rules to the extraterritorial jurisdiction of the PIPL have not been finalized yet, and it remains unclear how the Chinese government will enforce such law. If the extraterritorial jurisdiction under the PIPL were to be extended to us, our Macao Operations would be subject to certain data privacy obligations, which could potentially result in a material change to our operations. These data privacy obligations would primarily include bearing the responsibility for our personal information processing activities, and adopting the necessary measures to safeguard the security of the personal information we process in compliance with the standards required under the PIPL, the failure of which may result in us being ordered to correct or suspend or terminate the provision of services, confiscation of illegal income, fines or other penalties. Specifically, if the PIPL were to become applicable to us, we would be required to (i) notify the

individuals concerned of the processing of their personal information in detail and establish legal bases for such processing; (ii) improve internal data governance by implementing managerial and technical security measures and response plans for security incidents; (iii) designate a person in charge of personal information protection where we qualify as a “quantity handler” (to be defined by the CAC); (iv) establish a special agency or designate a representative within the territory of the PRC to be responsible for handling matters relating to personal information protection; (v) establish and make public the procedure for individuals to exercise their rights related to personal information; (vi) conduct an impact assessment on personal information protection before any high-risk processing activities; (vii) conclude an agreement with such vendor and supervise its processing where we entrust processing of personal information to any vendor; (viii) meet one of the conditions prescribed by the PIPL where we transfer personal information outside the territory of the PRC due to business or other needs (“Transfer Mechanisms”).

The CAC has promulgated, from July 2022 to February 2023, the respective implementation regulations for the three major Transfer Mechanisms under the PIPL, being: (a) passing the security assessment organized by the CAC (“Security Assessment”), (b) obtaining the personal information protection certification issued by a specialized agency in accordance with the CAC provisions (“Specialized Certification”), and (c) entering into the standard contract formulated by the CAC with the overseas recipient (“Standard Contract”). Among other obligations, the Security Assessment requires prior approval by the CAC for the cross-border transfer of personal information. It is possible that the Security Assessment may apply to us as an offshore data handler subject to the PIPL’s extraterritorial jurisdiction and on meeting the Security Assessment’s thresholds such as: (a) processing the personal information of more than 1 million individuals in total, or (b) transferring abroad the personal information of more than 100,000 individuals or the sensitive personal information of more than 10,000 individuals in total since January 1 of the preceding year. Failure to apply for the Security Assessment and obtain the CAC’s approval prior to the cross-border transfer of personal information may lead to legal liabilities and penalties under the PIPL, and may materially and adversely affect our business and results of operations. If the PIPL were to become applicable to us, even if the Security Assessment does not apply to us, we still will be required to fulfill the Standard Contract and Specialized Certification as Transfer Mechanisms on the cross-border transfer of personal information. The Standard Contract is required to be filed for record with the CAC, and the Specialized Certification requires a substantive review and certification by a specialized agency. If the PIPL were to become applicable to us and if we were to conduct a cross-border transfer of personal information absent proper compliance with the Transfer Mechanisms, then such action will be in violation of the PIPL, which may lead to legal liabilities and penalties under the PIPL, and may materially and adversely affect our business and results of operations.

In addition, under the PIPL, where an overseas organization or individual engages in personal information processing activities that infringe upon the personal information rights and interests of PRC citizens or endangering the national security and public interests of the PRC, the CAC may include such organization or individual in the list of subjects to whom provision of personal information is restricted or prohibited, announce the same, and take measures such as restricting or prohibiting provision of personal information to such organization or individual. Moreover, if the recent Chinese regulatory actions on data security or other data-related laws and regulations were to become applicable to us in the future, we could become subject to certain cybersecurity and data privacy obligations, which could potentially result in a material change to our operations, and the failure to meet such obligations could result in penalties and other regulatory actions against us and may materially and adversely affect our business and results of operations.

Recent events also indicate greater oversight by the CAC over data security, particularly for companies with Chinese operations seeking to list on a foreign exchange. For example, the Measures for Cybersecurity Review (“Review Measures”) issued by the CAC came into effect on February 15, 2022. The Review Measures provide that, in addition to critical information infrastructure operators (“CIIOs”) that intend to purchase network products or services, online platform operators engaging in data processing activities that affect or may affect national security shall also be subject to cybersecurity review. The Review Measures require that an online platform operator which possesses the personal information of at least one million users must apply for a cybersecurity review by the CAC if it intends to be listed in foreign countries. The Review Measures do not provide for a definition of “online platform operator” and, therefore, we cannot assure you that our Macao Operations will not be deemed as an “online platform operator.” However, as of the date of this report, our subsidiaries incorporated in mainland China do not have over one million users’ personal information and do not anticipate that they will be collecting over one million users’ personal information in the foreseeable future, and on that basis we believe we are not required to apply for cybersecurity review by the CAC, even if we are deemed as an “online platform operator.” The Review Measures are not enacted in accordance with the PIPL, so our obligation to apply for cybersecurity review will not change no matter whether the PIPL applies to us or not. Further, we have not received any notice from any authorities identifying any of our subsidiaries as a CIIO or requiring them to undertake a cybersecurity review by the CAC. While we believe our subsidiaries are not required to apply for cybersecurity review, the Review Measures provide CAC and relevant authorities certain discretion to initiate cybersecurity review where any network product or service or any data handling activity is considered to affect or may affect national security, which may lead to uncertainties in relation to the Review Measures’ impact on our operations or the offering of our securities.

As advised by our PRC legal advisers, Haiwen & Partners, we are currently not required to obtain any permission or approval from the CSRC, CAC or any other mainland Chinese governmental authority to operate our business or to issue securities to foreign investors, other than those related to our two subsidiaries incorporated in mainland China that only provide back office support. We have received all requisite permissions and approvals for our back office supporting functions located in mainland China, primarily being the standard business licenses issued by the relevant authorities in mainland China, and we have never been denied such

permissions and approvals. However, if the extraterritorial jurisdiction under the PIPL were to be extended to us, we may need to obtain prior approval by the CAC for the cross-border transfer of personal information, and, in the event that we have inadvertently concluded that such permissions or approvals are not required or if, in the future, applicable laws, regulations or interpretations were to change and require us to obtain such permissions or approvals, the failure to obtain such permissions or approvals could potentially result in penalties and other regulatory actions against us and may materially and adversely affect our business and results of operations.

Risks Related to Our Business

COVID-19 has materially adversely affected the number of visitors to our facilities and has disrupted our operations.

COVID-19 has materially adversely affected the number of visitors to our facilities and disrupted our operations. While our properties are fully open as of the date of this annual report, the pace of recovery from the COVID-19 Pandemic has varied, and accordingly COVID-19 continues to have a significant impact on our operations. The extent to which the adverse impact on our business will be mitigated depends on future developments, which are highly uncertain and cannot be predicted with confidence. Such developments include the following:

•the extent of any resurgence or variants of COVID-19 or any other infectious diseases in areas where we operate or where our customers are located;

•the manner in which our customers, suppliers and other third parties respond to COVID-19, including the perception of safety and health measures we implement;

•new information that may emerge concerning the severity of COVID-19, and the actions to contain or treat it, especially in area where we operate;

•general, local or national economic conditions;

•local or national rules, regulations or policies which may restrict travel and operating hours or impose other operating restrictions;

•limitations or restrictions on domestic or international travel or reluctance to travel to our properties; and

•consumer confidence.

Accordingly, we cannot reasonably estimate the extent to which COVID-19 will further impact our business and financial condition, results of operations and cash flows.

Our business is particularly sensitive to reductions in discretionary consumer and corporate spending as a result of downturns in the economy.

Consumer demand for hotel/casino resorts, trade shows and conventions and for the type of luxury amenities we offer is particularly sensitive to downturns in the economy and the corresponding impact on discretionary spending. Changes in discretionary consumer spending or corporate spending on conventions and business travel could be driven by many factors, such as: perceived or actual general economic conditions; fear of exposure to a widespread health epidemic, such as the COVID-19 Pandemic; any weaknesses in the job or housing market; credit market disruptions; high energy, fuel and food costs; the increased cost of travel; the potential for bank failures; perceived or actual disposable consumer income and wealth; fears of recession and changes in consumer confidence in the economy; or fear of war, political instability, civil unrest or future acts of terrorism. These factors could reduce consumer and corporate demand for the luxury amenities and leisure and business activities we offer, thus imposing additional limits on pricing and harming our operations.

Natural or man-made disasters, an outbreak of highly infectious or contagious disease, political instability, civil unrest, terrorist activity or war could materially adversely affect the number of visitors to our facilities and disrupt our operations.

So-called "Acts of God," such as typhoons and rainstorms, particularly in Macao, and other natural disasters, man-made disasters, outbreaks of highly infectious or contagious diseases, political instability, civil unrest, terrorist activity or war may result, and in the case of the COVID-19 Pandemic, have resulted, in decreases in travel to and from, and economic activity in, area in which we operate, and may adversely affect, and the COVID-19 Pandemic has adversely affected, the number of visitors to our properties. We also face potential risks associated with the physical effects of climate change, which may include more frequent or severe storms, typhoons, flooding, rising sea levels and shortages of water. To the extent climate change causes additional changes in weather patterns, our properties along the coast could be subject to an increase in the number and severity of typhoons and coastal and river flooding could cause damage to these properties, and all our properties could be subject to increased precipitation levels and heat stress. Any of these events may disrupt our ability to staff our business adequately, could generally disrupt our operations, and could have a material adverse effect on our business, financial condition, results of operations and cash flows. Although we have insurance coverage with respect to some of these events, we cannot assure you any such coverage will provide any coverage or be sufficient to indemnify us fully against all direct and indirect costs, including any loss of business that could result from substantial damage to, or partial or complete destruction of, any of our properties.

Our business is sensitive to the willingness of our customers to travel.

We are dependent on the willingness of our customers to travel. Only a portion of our business is and will be generated by local residents. Most of our customers travel to reach our properties. Infectious diseases may severely disrupt, and in the case of the COVID-19 Pandemic, have severely disrupted, domestic and international travel, which would result in a decrease in customer visits to Macao, including our properties. Regional political events, acts of terrorism or civil unrest, including those resulting in travelers perceiving areas as unstable or an unwillingness of governments to grant visas, regional conflicts or an outbreak of hostilities or war could have a similar effect on domestic and international travel. Management cannot predict the extent to which disruptions from these types of events in air or other forms of travel would have on our business, financial condition, results of operations and cash flows.

We are subject to extensive regulations that govern our operations.

We are required to obtain and maintain licenses from various jurisdictions in order to operate certain aspects of our business, and we are subject to extensive background investigations and suitability standards in our gaming business. There can be no assurance we will be able to obtain new licenses or renew any of our existing licenses, or if such licenses are obtained, such licenses will not be conditioned, suspended or revoked; and the loss, denial or non-renewal of any of our licenses could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We are subject to anti-corruption laws and regulations, such as the FCPA, which generally prohibits U.S. companies (such as LVS, of which we are a subsidiary) and their intermediaries from making improper payments to foreign officials for the purpose of obtaining or retaining business. Any violation of the FCPA could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We also deal with significant amounts of cash in our operations and are subject to various reporting and anti-money laundering regulations, as well as regulations set forth by the gaming authorities in Macao. Any such laws and regulations could change or could be interpreted differently in the future, or new laws and regulations could be enacted. Any violation of anti-money laundering laws or regulations, or any accusations of money laundering or regulatory investigations into possible money laundering activities, by any of our properties, employees or customers could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our debt instruments, current debt service obligations and substantial indebtedness may restrict our current and future operations.

Our current debt service obligations contain, or any future debt service obligations and instruments may contain, a number of restrictive covenants that impose significant operating and financial restrictions on us, including restrictions on our ability to:

•incur additional debt, including providing guarantees or credit support;

•incur liens securing indebtedness or other obligations;

•dispose of certain assets;

•make certain acquisitions;

•pay dividends or make distributions and make other restricted payments, such as purchasing equity interests, repurchasing junior indebtedness or making investments in third parties;

•enter into sale and leaseback transactions;

•engage in any new businesses;

•issue preferred share; and

•enter into transactions with our Shareholders and our affiliates.

The 2018 SCL Credit Facility contains various financial covenants. As a result of the impact from the COVID-19 Pandemic, the 2018 SCL Credit Facility was amended on March 27, 2020, September 11, 2020, July 7, 2021 and again on November 30, 2022 to waive those financial covenants through July 31, 2023. We cannot assure you that we will be able to obtain similar waivers in the future.

As of December 31, 2022, we had US$10.11 billion of borrowings outstanding under the Senior Notes, the 2018 SCL Revolving Facility and the LVS Term Loan, and US$541 million of available borrowing capacity under the 2018 SCL Revolving Facility. This indebtedness could have important consequences to us. For example, it could:

•make it more difficult for us to satisfy our debt service obligations;

•increase our vulnerability to general adverse economic and industry conditions;

•impair our ability to obtain additional financing in the future for working capital needs, capital expenditures, development projects, acquisitions or general corporate purposes;

•require us to dedicate a significant portion of our cash flow from operations to the payment of principal and interest on our debt, which would reduce the funds available for our operations and development projects;

•limit our flexibility in planning for, or reacting to, changes in the business and the industry in which we operate;

•require us to repurchase our Senior Notes upon certain events, such as any change in gaming law or any action by a gaming authority after which none of the Group members owns or manages casino or gaming areas or operates casino games of chance in Macao in substantially the same manner as the Group was at the issue date of the Senior Notes for a period of 30 consecutive days or more;

•place us at a competitive disadvantage compared to our competitors that have less debt; and

•subject us to higher interest expense in the event of increases in interest rates.

Our ability to timely refinance and replace our indebtedness in the future will depend upon general economic and credit market conditions, potential approval required by local government regulators, adequate liquidity in the global credit markets, the particular circumstances of the gaming industry, and prevalent regulations and our cash flow and operations, in each case as evaluated at the time of such potential refinancing or replacement. If we are unable to refinance or generate sufficient cash flow from operations to repay our indebtedness on a timely basis, we might be forced to seek alternate forms of financing, dispose of certain assets or minimize capital expenditures and other investments, or not make dividend payments. There is no assurance any of these alternatives would be available to us, if at all, on satisfactory terms, on terms that would not be disadvantageous to us, or on terms that would not require us to breach the terms and conditions of our existing or future debt agreements.

We may attempt to arrange additional financing to fund the remainder of our planned, and any future, development projects. If we are required to raise additional capital in the future, our access to and cost of financing will depend on, among other things, global economic conditions, conditions in the global financing markets, the availability of sufficient amounts of financing, our prospects and our credit ratings. If our credit ratings were to be downgraded, or general market conditions were to ascribe higher risk to our rating levels, our industry, or us, our access to capital and the cost of any debt financing would be further negatively impacted. In addition, the terms of future debt agreements could require higher costs, include more restrictive covenants, or require incremental collateral, which may further restrict our business operations or be unavailable due to our covenant restrictions then in effect. There is no guarantee that debt financings will be available in the future to fund our obligations, or that they will be available on terms consistent with our expectations. Our credit agreement contains various financial covenants, we have entered into a waiver and amendment request letter with lenders to waive certain of its financial covenants through July 31, 2023.

We extend credit to a portion of our customers and we may not be able to collect gaming receivables from our credit players.

We conduct our gaming activities on a credit and cash basis. Any such credit we extend is unsecured. Table games players typically are extended more credit than slot players, and high-stakes players typically are extended more credit than players who tend to wager lesser amounts.

During the year ended December 31, 2022, approximately 9.8% of our table games drop at our properties was from credit-based wagering. We extend credit to those customers whose level of play and financial resources warrant, in the opinion of management, an extension of credit. These large receivables could have a significant impact on our results of operations if deemed uncollectible.

In particular, we expect our operations will be able to enforce gaming debts only in a limited number of jurisdictions, including Macao. To the extent our Macao gaming customers are from other jurisdictions, our operations may not have access to a forum in which it will be possible to collect all gaming receivables because, among other reasons, courts of many jurisdictions do not enforce gaming debts and our operations may encounter forums that will refuse to enforce such debts. Moreover, under applicable law, our operations remain obligated to pay taxes on uncollectible winnings from customers.

Even where gaming debts are enforceable, they may not be collectible. Our inability to collect gaming debts could have a significant adverse effect on our results of operations and cash flows.

We face the risk of fraud and cheating.

Our gaming customers may attempt or commit fraud or cheat in order to increase winnings. Acts of fraud or cheating could involve the use of counterfeit chips or other tactics, possibly in collusion with our employees. Internal acts of cheating could also be conducted by employees through collusion with dealers, surveillance staff, floor managers or other casino or gaming area staff. Failure to discover such acts or schemes in a timely manner could result in losses in our gaming operations. In addition, negative publicity related to such schemes could have an adverse effect on our reputation, potentially causing a material adverse effect on our business, financial condition, results of operations and cash flows.

Our operations face significant competition, which may increase in the future.

The hotel, resort and casino businesses are highly competitive. Our properties compete with numerous other casinos located within Macao. Additional Macao facilities announced by our competitors and the increasing capacity of hotel rooms in Macao could add to the competitive dynamic of the market.

Our operations will also compete to some extent with casinos located elsewhere in Asia, including Singapore, South Korea, Malaysia, Philippines, Australia, Cambodia and elsewhere in the world, including Las Vegas, as well as online gaming and cruise ships that offer gaming. Our operations also face increased competition from new developments in Malaysia, Australia and South Korea. In addition, certain countries have legalized, and others may in the future legalize, casino gaming.

The proliferation of gaming venues and gaming activities, such as online gaming, as well as renovations and expansions by our competitors, and their ability to attract customers away from our properties could have a material adverse effect on our financial condition, results of operations and cash flows.

Risks Associated with Our Operations

There are significant risks associated with our current and planned construction projects.

Our development projects and any other construction projects we undertake will entail significant risks. Construction activity requires us to obtain qualified contractors and subcontractors, the availability of which may be uncertain. Construction projects are subject to cost overruns and delays caused by events outside of our control or, in certain cases, our contractors' control, such as shortages of materials or skilled labor, unforeseen engineering, environmental and/or geological problems, work stoppages, weather interference, unanticipated cost increases and unavailability of construction materials or equipment. Construction, equipment or staffing problems or difficulties in obtaining any of the requisite materials, licenses, permits, allocations and authorizations from governmental or regulatory authorities could increase the total cost, delay, jeopardize, prevent the construction or opening of our projects, or otherwise affect the design and features. Construction contractors or counterparties for our current projects may be required to bear certain cost overruns for which they are contractually liable, and if such counterparties are unable to meet their obligations, we may incur increased costs for such developments. If our management is unable to manage successfully our construction projects, it could have a material adverse effect on our financial condition, results of operations and cash flows.

The anticipated costs and completion dates for our current and planned projects are based on budgets, designs, development and construction documents and schedule estimates are prepared with the assistance of architects and other construction development consultants and are subject to change as the design, development and construction documents are finalized and as actual construction work is performed. A failure to complete our projects on budget or on schedule may have a material adverse effect on our financial condition, results of operations and cash flows.

Our Concession is redeemable by the Macao government, with compensation to us, on or after January 1, 2029.

Beginning on January 1, 2029, the Macao government has the option to redeem the Concession by providing us at least one-year's notice. In the event the Macao government exercises this redemption right, we are entitled to fair compensation or indemnity. However, we cannot assure you if our Concession is redeemed, the compensation paid will be adequate to compensate us for the loss of future revenues.

Our Concession can be terminated under certain circumstances without compensation to us.

Although we were recently granted in December 2022 a new 10-year Concession to operate casino games of chance in Macao, the Macao government has the right to unilaterally terminate our Concession in the event of VML's serious non-compliance with its basic obligations under the Concession and applicable Macao laws. Upon termination of our Concession, the Gaming Assets, for which use was temporarily transferred by the Macao government to VML, would automatically be transferred back to the Macao government without compensation to us and we would cease to generate any revenues from these operations. The loss of our Concession would prohibit us from conducting gaming operations in Macao, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The number of visitors to Macao, particularly visitors from mainland China, may decline or travel to Macao may be disrupted.

Our VIP and mass market gaming customers typically come from nearby destinations in Asia, including mainland China, Hong Kong, South Korea and Japan. Increasingly, a significant number of gaming customers come to our casinos from mainland China. Slowdown in economic growth or changes of China's current restrictions on travel and currency movements have disrupted, and could further disrupt, the number of visitors from mainland China to our casinos as well as the amounts they are willing and able to spend while at our properties.

Policies and measures adopted from time to time by the Chinese government include restrictions imposed on exit visas granted to residents of mainland China for travel to Macao and Hong Kong, such as those implemented in connection with the COVID-19 Pandemic. These measures have, and any future policy developments implemented may have, the effect of reducing the number of visitors to Macao from mainland China, which could adversely impact tourism and the gaming industry in Macao.

The Macao government could grant additional rights to conduct gaming in the future and increase competition we face.

We hold one of only six gaming concessions authorized by the Macao government to operate casino games of chance in Macao through December 31, 2032. If in future the Macao government were to allow additional gaming operators in Macao, we would face additional competition, which could have a material adverse effect on our financial condition, results of operations and cash flows.

Conducting business in Macao has certain political and economic risks.

Our business development plans, financial condition, results of operations and cash flows may be materially and adversely affected by significant political, social and economic developments in Macao, and by changes in policies of the government or changes in laws and regulations or their interpretations. Our operations are also exposed to the risk of changes in laws and policies that

govern operations of companies based in Macao. Jurisdictional tax laws and regulations may also be subject to amendment or different interpretation and implementation, thereby having an adverse effect on our profitability after tax. These changes may have a material adverse effect on our financial condition, results of operations and cash flows.

Current Macao laws and regulations concerning gaming and gaming concessions are, for the most part, fairly recent and there is little precedent on the interpretation of these laws and regulations. We believe our organizational structure and operations are in compliance in all material respects with all applicable laws and regulations of Macao. These laws and regulations are complex and a court or an administrative or regulatory body may in the future render an interpretation of these laws and regulations, or issue regulations, which differs from our interpretation and could have a material adverse effect on our financial condition, results of operations and cash flows.

In addition, our activities are subject to administrative review and approval by various government agencies. We cannot assure you we will be able to obtain all necessary approvals, which may have a material adverse effect on our long-term business strategy and operations. Macao laws permit redress to the courts with respect to administrative actions; however, such redress is largely untested in relation to gaming issues.

The Macao smoking control legislation prohibits smoking in casinos other than in certain enumerated areas. Such legislation may deter potential gaming customers who are smokers from frequenting casinos with smoking bans. Such laws and regulations could change or could be interpreted differently in the future. We cannot predict the future likelihood or outcome of similar legislation or referendums in Macao or the magnitude of any decrease in revenues as a result of such regulations, though any smoking ban could have an adverse effect on our business, financial condition, results of operations and cash flows.

Our tax arrangements with the Macao government may not be available on terms favorable to us or at all.

We have had the benefit of a corporate tax exemption in Macao, which exempts us from paying the 12% corporate income tax on profits generated by the operation of casino games, but does not apply to our non-gaming activities. We continued to benefit from this tax exemption through December 31, 2022. Additionally, we entered into a shareholder dividend tax agreement with the Macao government in April 2019, effective through June 26, 2022, providing an annual payment as a substitution for a 12% tax otherwise due from VML shareholders on dividend distributions paid from VML gaming profits (the "Shareholder Dividend Tax Agreement"). In December 2022, we requested a corporate tax exemption on profits generated by the operation of casino games in Macao for the new gaming concession period effective from January 1, 2023 through December 31, 2032, or for a period of corporate tax exemption that the Chief Executive of Macao may deem more appropriate. We are evaluating the timing of an application for a new shareholder dividend tax agreement. There is no certainty either of these tax arrangements will be granted.

We may be held jointly liable with gaming promoters for their activities in our casinos.

Macao’s Court of Final Appeal ruled on November 19, 2021 that gaming concessionaires are jointly liable with gaming promoters, including their managers and employees, for activities conducted by gaming promoters in gaming concessionaires’ casinos when those activities relate to the typical activity of gaming promoters and are conducted for the benefit of gaming concessionaires. The Macao legislature has subsequently, and with retroactive effect, interpreted and clarified the law underpinning joint liability, stating that the activities of gaming promoters in the casinos of gaming concessionaires only result in joint liability if the deposited funds or chips were used to play games of chance in the casinos or correspond to winnings from such games. We do not currently depend on gaming promoters for any portion of our gaming revenue, but we have in the past and may do so again in the future. Whilst we have always strived for excellence in monitoring systems and practices for gaming promoters operating in our casinos, we cannot guarantee that we are able to monitor all of their activities. In addition, we cannot guarantee to what extent the Macao courts will hold us liable for the past and future activities conducted by gaming promoters in our casinos, nor can we determine what the Macao courts will consider to be typical activities of gaming promoters given the recently enacted interpretation of relevant laws.

We are subject to limitations of the pataca and HK dollars exchange markets and restrictions on the export of the Renminbi.

Our revenues are denominated in patacas and HK dollars. The Macao pataca is pegged to the HK dollar and, in many cases, is used interchangeably with the HK dollar in Macao. The HK dollar is pegged to the U.S. dollar. Although currently permitted, we cannot assure you patacas and HK dollars will continue to be freely exchangeable into U.S. dollars. Also, our ability to convert large amounts of patacas and HK dollars into U.S. dollars over a relatively short period may be limited.

We are currently prohibited from accepting wagers in Renminbi. There are also restrictions on the remittance of the Renminbi from mainland China and the amount of Renminbi that can be converted into foreign currencies, including the pataca and HK dollar. Restrictions on the remittance of the Renminbi from mainland China may impede the flow of gaming customers from mainland China to Macao, inhibit the growth of gaming in Macao and negatively impact our gaming operations. There is no assurance that incremental mainland Chinese regulations will not be promulgated in the future that have the effect of restricting or eliminating the remittance of Renminbi from mainland China. Further, if any new mainland Chinese regulations are promulgated in the future that have the effect of permitting or restricting (as the case may be) the remittance of Renminbi from mainland China, then such remittances will need to be made subject to the specific requirements or restrictions set out in such rules.

VML may have financial and other obligations to foreign workers seconded to its contractors under government labor quotas.

The Macao government has granted VML quotas to permit it to hire foreign workers. VML has effectively seconded part of the foreign workers employed under these quotas to its contractors for the construction of our Cotai Strip projects. VML, however, remains ultimately liable for all employer obligations relating to these workers, including for payment of wages and taxes and compliance with labor and workers' compensation laws. VML requires each contractor to whom it has seconded these foreign workers to indemnify VML for any costs or liabilities VML incurs as a result of such contractor's failure to fulfill their obligations. VML's agreements with its contractors also contain provisions that permit it to retain some payments for up to one year after the contractors' complete work on the projects. We cannot assure you VML's contractors will fulfill their obligations to foreign workers employed under the labor quotas or to VML under the indemnification agreements, or the amount of any indemnification payments received will be sufficient to pay for any obligations VML may owe to foreign workers seconded to contractors under VML's quotas. Until we make final payments to our contractors, we have offset rights to collect amounts they may owe us, including amounts owed under the indemnities relating to employer obligations. After we have made the final payments, it may be more difficult for us to enforce any unpaid indemnity obligations.

Human Capital Related Risk Factors

We depend on the continued services of key officers.

Our ability to maintain our competitive position is dependent to a large degree on the services of our senior management team, including our Chairman and Chief Executive Officer Mr. Robert Glen Goldstein, Dr. Wong Ying Wai (Wilfred), Mr. Chum Kwan Lock, Grant, Mr. Sun MinQi (Dave) and Mr. Dylan James Williams. The loss of their services or the services of our other senior managers, or the inability to attract and retain additional senior management personnel could have a material adverse effect on our business.

We compete for limited management and labor resources in Macao, and policies of government may also affect our ability to employ imported managers or labor.

Our success depends in large part upon our ability to attract, retain, train, manage and motivate skilled managers and employees at our properties. The Macao government requires we only hire Macao residents in our casinos for certain employee roles, including roles such as dealers. In addition, we are required to obtain visas and work permits for managers and employees we seek to employ from other countries. There is significant competition in Macao for managers and employees with the skills required to perform the services we offer and competition for these individuals is likely to increase as other competitors expand their operations. Such competition has intensified recently as certain skilled managers have elected to return to their home countries due to the impact of the COVID-19 Pandemic.

We may have to recruit managers and employees from other countries to adequately staff and manage our properties and certain Macao government policies affect our ability to hire non-resident managers and employees in certain job classifications. Despite our coordination with the Macao labor and immigration authorities to ensure our management and labor needs are satisfied, we may not be able to recruit and retain a sufficient number of qualified managers or employees for our operations or the Macao labor and immigration authorities may not grant us the necessary visas or work permits.

If we are unable to obtain, attract, retain and train skilled managers and employees, and obtain any required visas or work permits for our skilled managers and employees, our ability to adequately manage and staff our existing properties and planned development projects could be impaired, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

General Risk Factors

Our insurance coverage may not be adequate to cover all possible losses that our properties could suffer and our insurance costs may increase in the future.

We maintain comprehensive insurance programs for our properties in operation, as well as those in the course of construction, with coverage features and insured limits we believe are customary in their amount, breadth and scope. Market forces beyond our control may nonetheless limit the scope of the insurance coverage we can obtain or our ability to obtain coverage at reasonable rates. Certain types of losses, generally of a pandemic or catastrophic nature, such as infectious disease, (for example, the COVID-19 Pandemic), earthquakes, hurricanes, floods or cyber-related losses, or certain other liabilities including terrorist activity, political unrest, geopolitical strife or actual or threatened war may be, or are, uninsurable or too expensive to justify obtaining insurance. As a result, we may not be successful in obtaining insurance without increases in cost or decreases in coverage levels. In addition, in the event of a substantial loss, the insurance coverage we carry may not be sufficient to pay the full market value or replacement cost of our lost investment or in some cases could result in certain losses being totally uninsured. As a result, we could lose some or all of the capital we have invested in a property, as well as the anticipated future revenue from the property, and we could remain obligated for debt or other financial obligations related to the property.

Certain of our debt instruments and other material agreements require us to maintain a certain minimum level of insurance. Failure to satisfy these requirements could result in an event of default under these debt instruments or material agreements.

Failure to maintain the integrity of our information and information systems or comply with applicable privacy and cybersecurity requirements and regulations could harm our reputation and adversely affect our business.

Our business requires the collection and retention of large volumes of data and non-electronic information, including credit card numbers and other information in various information systems we maintain and in those maintained by third parties with whom we contract and may share data. We also maintain internal information about our employees and information relating to our operations. The integrity and protection of that information are important to us. Our collection of such information is subject to extensive private and governmental regulation.

Privacy and cybersecurity laws and regulations are developing and changing frequently, and vary significantly by jurisdiction. We may incur significant costs in our efforts to comply with the various applicable privacy and cybersecurity laws and regulations as they emerge and change. Compliance with applicable privacy laws and regulations also may adversely impact our ability to market our products, properties, and services to our guests and patrons. Non-compliance by us, or potentially by third parties with which we share information, with any applicable privacy and cybersecurity law or regulation, including accidental loss, inadvertent disclosure, unauthorized access or dissemination, or breach of security may result in damage to our reputation and could subject us to fines, penalties, required corrective actions, lawsuits, payment of damages, or restrictions on our use or transfer of data.