UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

| FIRST UNITED CORPORATION |

(Name of Registrant as Specified in Its Charter) |

| |

DRIVER MANAGEMENT COMPANY LLC DRIVER OPPORTUNITY PARTNERS I LP J. ABBOTT R. COOPER MICHAEL J. DRISCOLL, ED.D ETHAN C. ELZEN LISA NARRELL-MEAD |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Driver Management Company LLC, together with the other participants named herein (collectively, “Driver”), have filed a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the election of its slate of director nominees at the upcoming annual meeting of shareholders of First United Corporation, a Maryland corporation (the “Company”).

Item 1: On March 26, 2020, Driver delivered the following letter to the Issuer’s Lead Director, John McCullough:

March 26, 2020

Mr. John McCullough

Lead Director

First United Corporation

19 South Second Street

Oakland, MD 21550

Via Email to Tonya Sturm

Dear John,

I am writing in reference to the press release that First United issued today and filed with the Securities and Exchange Commission (the “SEC”) as additional proxy soliciting materials.1 In particular, I am writing to ask you to correct the statement “Driver will run a proxy fight every year for the next three proxy seasons until it has complete control of the Board” as well as the other inaccuracies listed in Exhibit A.

As you know, we have nominated three independent individuals to be voted on by shareholders for election to the Board. Not only is it troubling that you and the rest of the current Board seem to regard offering shareholders a choice in electing directors as an attempt to obtain control of the Board, but First United’s statement appears to be a deliberate attempt to mislead First United’s shareholders, employees, customers and regulators as to the true facts of this situation.

In addition, I object to your characterizations of any statements that we have made as “inappropriate rhetoric” “of a personal nature.” The overwhelming majority of statements that we have made have been based on First United’s own filings with the SEC and all relate to actions taken by members of First United’s management team and Board in their capacity as such. I realize that you and your fellow directors have grown accustomed to not being held accountable for your actions, but you should understand and respect the difference between personal attacks and the justified complaints of shareholders fed up with decades of mismanagement and cronyism. We have detailed some of First United’s many instances of value destruction, self-interest and inept management in the preliminary proxy statement we filed with the SEC this morning. We believe those and otherfacts are what shareholders will base their voting decisions on at the upcoming Annual Meeting of Shareholders. Rather than issuing blustery press releases in what appears to be a misguided and transparent attempt to claim some type of negotiating high ground, you and your fellow Board members might want to begin to provide some type of justification for your pastactions.

1https://www.sec.gov/Archives/edgar/data/763907/000110465920038577/tm2013891d1_ex99-1.htm

Thank you for your prompt attention to this matter,

/s/ J. Abbott R. Cooper

J. Abbott R. Cooper

Managing Member

Driver Management Company LLC

Exhibit A

Set forth below is a list of some of the inaccuracies contained in First United’s March 26, 2020 press release filed as additional proxy solicitation materials

| Inaccuracies | Facts |

“the directors designated by Driver would be guaranteed to serve at least three years on the Board” | Since there was no discussion of any class designation for any new additions to the Board, suggesting a “guarantee” of “at least three years” is improper |

| “Driver voluntarily offered two years” (referring to the term of a standstill provision) | Driver’s original term sheet proposed a standstill term of less than one year—a proposal countered by First United with a term of three years |

Driver “again demanded a sale of First United” | This is a wholesale fabrication—First United should have sold itself last fall before the recent precipitous decline in bank stocks |

| First United “made the last true effort to avoid a costly and distracting proxy fight” | Driver both initiated settlement discussions and proposed the initial terms of a cooperation agreement |

About Driver Management Company

Driver employs a valued-oriented, event-driven investment strategy that focuses exclusively on equities in the U.S. banking sector. The firm’s leadership has decades of experience advising and engaging with bank management teams and boards of directors on strategies for enhancing shareholder value. For information, visitwww.drivermanagementcompany.com.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC, together with the other participants named herein (collectively, “Driver”), intend to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2020 annual meeting of stockholders of First United Corporation, a Maryland corporation (the “Corporation”).

DRIVER STRONGLY ADVISES ALL STOCKHOLDERS OF THE CORPORATION TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

Participants in the Solicitation

The participants in the proxy solicitation are anticipated to be Driver Management Company LLC (“Driver Management”), Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper, Michael J. Driscoll, Ed.D, Lisa Narrell-Mead and Ethan C. Elzen.

As of the date hereof, the participants in the proxy solicitation beneficially own in the aggregate 366,212 shares of Common Stock, par value $0.01 per share, of the Corporation (the “Common Stock”). As of the date hereof, Driver Opportunity beneficially owns directly 360,637 shares of Common Stock. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the Managing Member of Driver Management, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date hereof, Dr. Driscoll directly beneficially owns 4,500 shares of Common Stock. As of the date hereof, Ms. Narrell-Mead directly beneficially owns 650 shares of Common Stock. As of the date hereof, Mr. Elzen directly beneficially owns 425 shares of Common Stock.

Item 2: On March 25, 2020, Driver delivered the following letter to the Issuer’s Lead Director, John McCullough:

March 25, 2020

Mr. John McCullough

Lead Director

First United Corporation

19 South Second Street

Oakland, MD 21550

Via Email to Tonya Sturm

Dear John,

In advance of our conversation later today (which, for the record will be the third in the last two weeks, yet still only our third overall despite the fact that Driver has been an owner of greater than 5% of First United’s common stock since September, 2019 and has been publicly calling for a sale sincelast March), I thought it would make sense to outline a few points.

While we have discussed a potential cooperation agreement for several weeks, circumstances have dramatically changed since we first began those discussions. In addition, since your “best and final” offer failed to meet what I clearly described as the minimum acceptable conditions for any cooperation agreement, I think it is appropriate to suspend those discussions.

To provide a summary recap, we had been willing to agree to a longer than standard standstill period in return for First United putting two of our nominees on the board, reimbursing our expenses and separating the roles of Chairman and CEO. Your “best and final” offer consisted of appointing one of our directors to the board along with another director to be agreed upon from a list of candidates picked by current Chairman and CEO Carissa Rodeheaver and contemplated that the Chairman and CEO roles would remain combined but with some window dressing about the role of the lead director.

In addition to the fact that there has clearly been no “meeting of the minds” with respect to a potential cooperation agreement, Driver is no longer willing to agree to a lengthy standstill period. To be blunt, I have zero confidence in either the ability of First United’s management to safely navigate through current economic conditions or the ability of the board to effectively oversee management and/or act in the best interests of shareholders. Given the likelihood of an imminent recession (if not a depression), there is simply no way that I could agree to any type of standstill provision without substantial change at the board level (which would include the resignation of any director who has served on the board for more than ten years, all of whom I considered to be irredeemably entrenched) and a radical overhaul in First United’s corporate governance practices and policies (that would include separation of the Chairman and CEO role, a commitment to declassify the board and to generally embrace best practices in corporate governance).

Just to point out a few items:

First United is poorly positioned to enter a recession. Given First United’s concentration (11.2% of total loans) of acquisition and development loans and what I consider First United’s history of questionable underwriting and risk management with respect to such loans (demonstrated, in both instances, by the $8 million participation in a development loan that was moved to non-accrural status in 2019), I believe that First United is particularly poorly positioned to enter a recession. Indeed, one of the reasons why First United should have sold last fall when we (and other shareholders) were urging a sale would have been to lessen First United’s dependence on land acquisition and development lending by merging with a banking organization that operated in faster growing and more economically diverse markets.

First United’s experience during the Financial Crisis does not inspire confidence. Our preliminary proxy statement will detail the disastrous decisions made by First United (and ratified by you) prior to the Financial Crisis that led to substantial losses and destruction of shareholder value. So as to not belabor the point, I will merely note that First United’s stock price declined by 63.51% between January 1, 2008 and December 31, 2012, during which time regulators forced First United to stop paying its dividend. In addition, not only did First United receive a $30 million TARP investment from the federal government in 2009, but First United did not have the capital strength to fully redeem that investment until 2017.

Even during an economic expansion, First United has consistently failed to earn its cost of equity. In First United’s Annual Report on Form 10-K for the year ended December 31, 2015 (the “2015-10-K”), First United appears, in connect to with its discussion of discounted cash flow analysis to determine the “fair value” of First United,2 to disclose that its cost of equity was 12.82%. First United’s return on equity for the past five years has been 10.44% (2019), 9.39% (2018), 4.52% (2017) 6.38% (2016) and 11.40% (2015).3 In the event the cost of equity of 12.82% continues to be a fair approximation of First United’s cost of equity, then First United has consistently failed to earn its cost of equity. To the extent that First United’s cost of equity is materially different, I would appreciate your disclosing the actual cost so that investors can better gauge First United’s performance.

2Candidly, Driver finds it bizarre that First United resorted to an “income approach” rather than a “market approach” to determine “fair value” due to “illiquidity in [First United’s] common stock and the adverse conditions surrounding the banking industry.” See, 2015 10-K p. 27 available athttps://www.sec.gov/Archives/edgar/data/763907/000114420416086953/v429417_10k.htm. As of December 31, 2015, for the SNL U.S. Bank $1B-$5B Index, core return on assets was 0.91%, efficiency ratio was 64.48% and non-performing assets to total assets were 1.12%, none of which metrics suggest to Driver any “adverse conditions surrounding the banking industry.” However, as of that same date, First United reported core return on assets of 0.37%, efficiency ratio of 78.14% and non-performing assets to total assets of 2.32%, which suggests to Driver that the “adverse conditions” referred to might be specific to First United. In addition, in Driver’s view, any “illiquidity” might be the result of the lack of investor interest given what Driver views as poor performance and limited prospects as well as First United’s lack of engagement with potential investors. Source: S&P Global Market Intelligence. Alternatively, to the extent that potential investors read First United’s lawsuit against FTN Financial, they could have been put off by the notion that Carissa Rodeheaver, Robert Kurtz and those of directors who were on the board at the time, had authorized a leverage strategy involving significant purchases of pooled trust preferred securities despite First United’s later admission that it “was not sophisticated and had no experience in TruPs, CDOs PreTSL CDOs or related matters.”

Perhaps even more bizarre, however, is the fact that in such analysis, First United used a “terminal value multiple” of 1.36x tangible book value when First United’s common stock traded at an average price to tangible book value multiple of 0.78x during 2015. Given what Driver views as First United’s stubborn and irrational commitment to remaining independent, it is unclear why First United would use any terminal value, since the use thereof would clearly imply some willingness to sell at some point. Source: S&P Global Market Intelligence. Core return on assets as calculated by S&P Global Market Intelligence.

3 First United’s core return on equity is even worse: 9.75% (2019), 9.31% (2018), 7.31% (2017), 6.01% (2016%) and 4.25% (2015). Source: S&P Global Market Intelligence. Core return on equity as calculated by S&P Global Market Intelligence.

If First United has not been able to earn its cost of equity during one of the longest economic expansions on record, what is the prospect of First United providing an acceptable return on investment to shareholders during what could be an unprecedented depression?

First United’s already meager earnings will come under greater pressure. First United’s return on assets for 2019 was 0.93%, while the return on assets for the SNL US Bank $1B-$5B Index was 1.19%.4 In First United’s Annual Report on Form 10-K for the year ended December 31, 2019 (the “2019 10-K”), First United estimated that net income for 2019 would have fallen by $2.5 million (a decrease of approximately 19%) had interest rates dropped by 100 basis points.5 Already this year, the Federal Reserve has lowered the target range for the federal funds rate from 1-1/2 to 1-3/4 percent to 0 to 1/4 percent—a greater than 100 basis point reduction. In addition to a difficult interest rate environment, First United will, in Driver’s view, face elevated costs related to deteriorating credit, the impact of social distancing on First United’s customers and employees and a steep decline in overall economic activity.

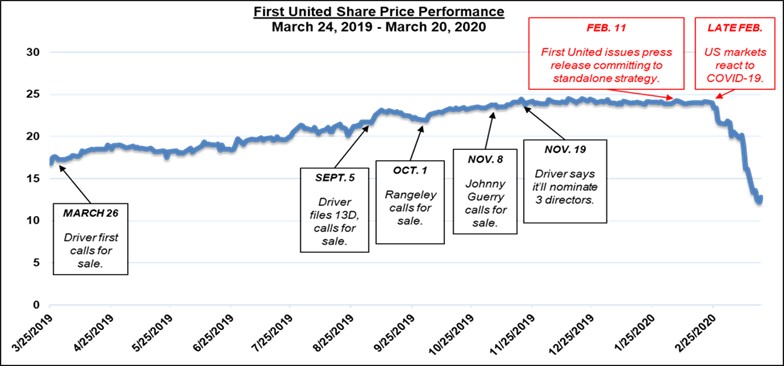

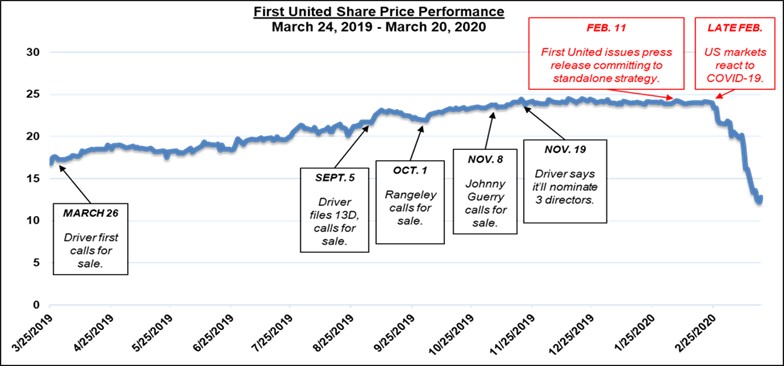

In the vein of a picture being worth a thousand words, I will leave you with this and the thought of shareholders soon voting for directors:

/s/ J. Abbott R. Cooper

J. Abbott R. Cooper

Managing Member

Driver Management Company LLC

4 Source S&P Global Market Intelligence.

52019 10-K p. 50 available athttps://www.sec.gov/Archives/edgar/data/763907/000156276220000119/func-20191231x10k.htm#Item_7A_Quantitative_And_Qualitative_Dis

About Driver Management Company

Driver employs a valued-oriented, event-driven investment strategy that focuses exclusively on equities in the U.S. banking sector. The firm’s leadership has decades of experience advising and engaging with bank management teams and boards of directors on strategies for enhancing shareholder value. For information, visitwww.drivermanagementcompany.com.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC, together with the other participants named herein (collectively, “Driver”), intend to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2020 annual meeting of stockholders of First United Corporation, a Maryland corporation (the “Corporation”).

DRIVER STRONGLY ADVISES ALL STOCKHOLDERS OF THE CORPORATION TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

Participants in the Solicitation

The participants in the proxy solicitation are anticipated to be Driver Management Company LLC (“Driver Management”), Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper, Michael J. Driscoll, Ed.D, Lisa Narrell-Mead and Ethan C. Elzen.

As of the date hereof, the participants in the proxy solicitation beneficially own in the aggregate 365,212 shares of Common Stock, par value $0.01 per share, of the Corporation (the “Common Stock”). As of the date hereof, Driver Opportunity beneficially owns directly 360,637 shares of Common Stock. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the Managing Member of Driver Management, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date hereof, Dr. Driscoll directly beneficially owns 4,500 shares of Common Stock. As of the date hereof, Ms. Narrell-Mead directly beneficially owns 650 shares of Common Stock. As of the date hereof, Mr. Elzen directly beneficially owns 425 shares of Common Stock.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC, together with the other participants named herein (collectively, “Driver”), have filed a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2020 annual meeting of stockholders of First United Corporation, a Maryland corporation (the “Corporation”).

DRIVER STRONGLY ADVISES ALL STOCKHOLDERS OF THE CORPORATION TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE ATHTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

Participants in the Solicitation

The participants in the proxy solicitation are anticipated to be Driver Management Company LLC (“Driver Management”), Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper, Michael J. Driscoll, Ed.D, Lisa Narrell-Mead and Ethan C. Elzen.

As of the date hereof, the participants in the proxy solicitation beneficially own in the aggregate 366,212 shares of Common Stock, par value $0.01 per share, of the Corporation (the “Common Stock”). As of the date hereof, Driver Opportunity beneficially owns directly 360,637 shares of Common Stock. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the Managing Member of Driver Management, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date hereof, Dr. Driscoll directly beneficially owns 4,500 shares of Common Stock. As of the date hereof, Ms. Narrell-Mead directly beneficially owns 650 shares of Common Stock. As of the date hereof, Mr. Elzen directly beneficially owns 425 shares of Common Stock.