UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

| FIRST UNITED CORPORATION |

(Name of Registrant as Specified in Its Charter) |

| |

DRIVER MANAGEMENT COMPANY LLC DRIVER OPPORTUNITY PARTNERS I LP J. ABBOTT R. COOPER MICHAEL J. DRISCOLL, ED.D ETHAN C. ELZEN LISA NARRELL-MEAD |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Driver Management Company LLC, together with the other participants named herein (collectively, “Driver”), have filed a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the election of its slate of director nominees at the upcoming annual meeting of shareholders of First United Corporation, a Maryland corporation (the “Company”).

On March 31, 2020, Driver issued the following letter to shareholders of the Company:

Fellow Shareholders,

Driver Management Company (together with its affiliates, “Driver” or “we”) is the largest shareholder of First United Corporation (“First United” or the “Company”), owning approximately 5% of the Company’s outstanding shares. We are writing to you today in connection with our nomination of three highly-qualified, independent candidates – Michael J. Driscoll, Ed.D, Ethan C. Elzen and Lisa Narrell-Mead – for election to First United’s Board of Directors (the “Board”) at the Company’s 2020 Annual Meeting of Shareholders (the “Annual Meeting”).

As outlined in this letter, Driver is very concerned about First United’s direction under the current Board, and we believe that it is particularly importantthat you vote for the election of new directors this year.We contend that urgent change is needed in the boardroom and plan to send you materials showing you how to vote for new shareholder-nominated directors on theWHITE proxy card. These materials will be distinct and separate from the materials that you receive from First United recommending that you vote for the incumbent directors on the blue proxy card. We encourage you tonot return the blue proxy card sent to you from First United.

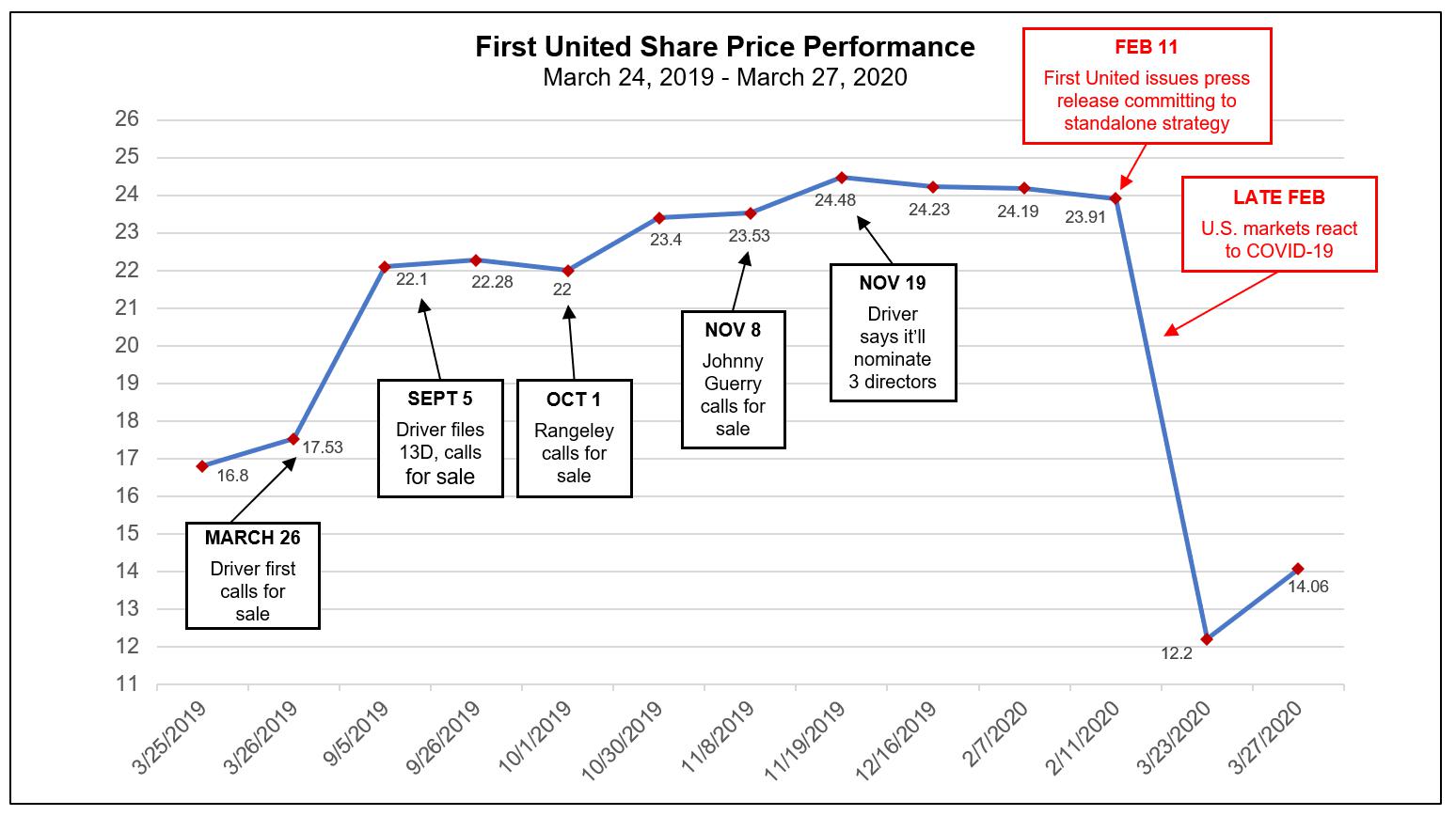

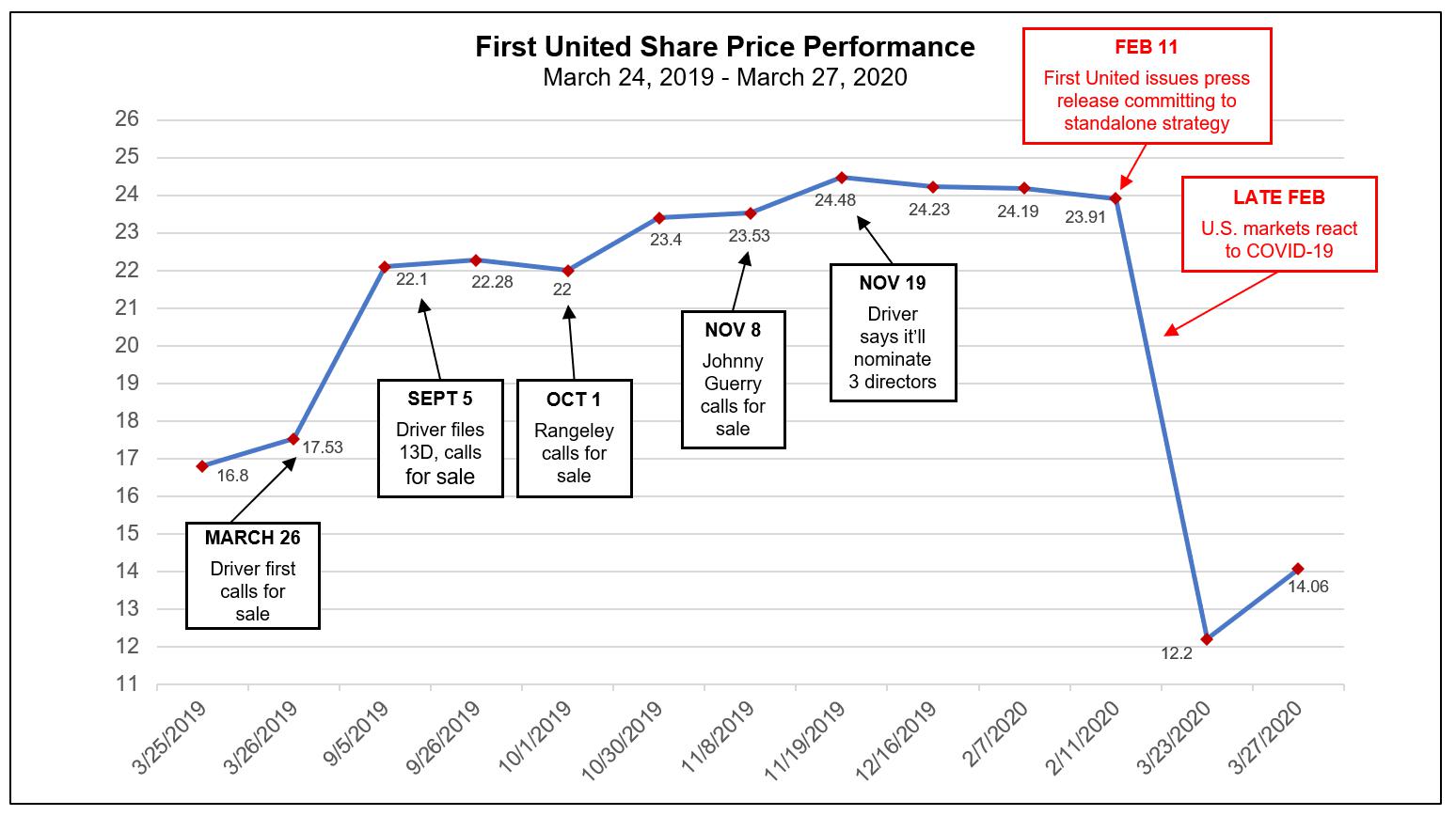

Despite Shareholder Support for Selling First United to a Stronger Bank That Could Have Paid $26-$33 Per Share In A Stock Transaction, the Board Remained Defiant and Put us All at Risk.1

Source: First United Corporation (NYSE: FUNC); Bloomberg.

Rather than appreciate the market’s clear enthusiasm for a combination with a stronger bank and heed the public calls of shareholders, the Board opted to reject investor feedback throughout the fall and winter and, in our view, put the safety of the Company at risk. The Board went as far as to brazenly declare in a February press release that, following an assessment of “macro-level changes” in its most recent strategic review, it still “unanimously concluded […] that executing on the Company's current strategy, rather than pursuing a sale, is in the best interests of the Company's stakeholders.”2

1 Driver presentation entitled “First United: Still No Strategy,” October 30, 2019.

2 First United's Board Of Directors Concludes Latest Strategic Review And Confirms Strategy, February 11, 2020.

ATTENTION SHAREHOLDERS: SIGN UP FOR UPDATES AT WWW.RENOVATEMYBANK.COM

We Believe Shareholders Should Recall What Happened to First United During and After the Global Financial Crisis, When the Company Could Not Even Make Payments on Its Government Bailout

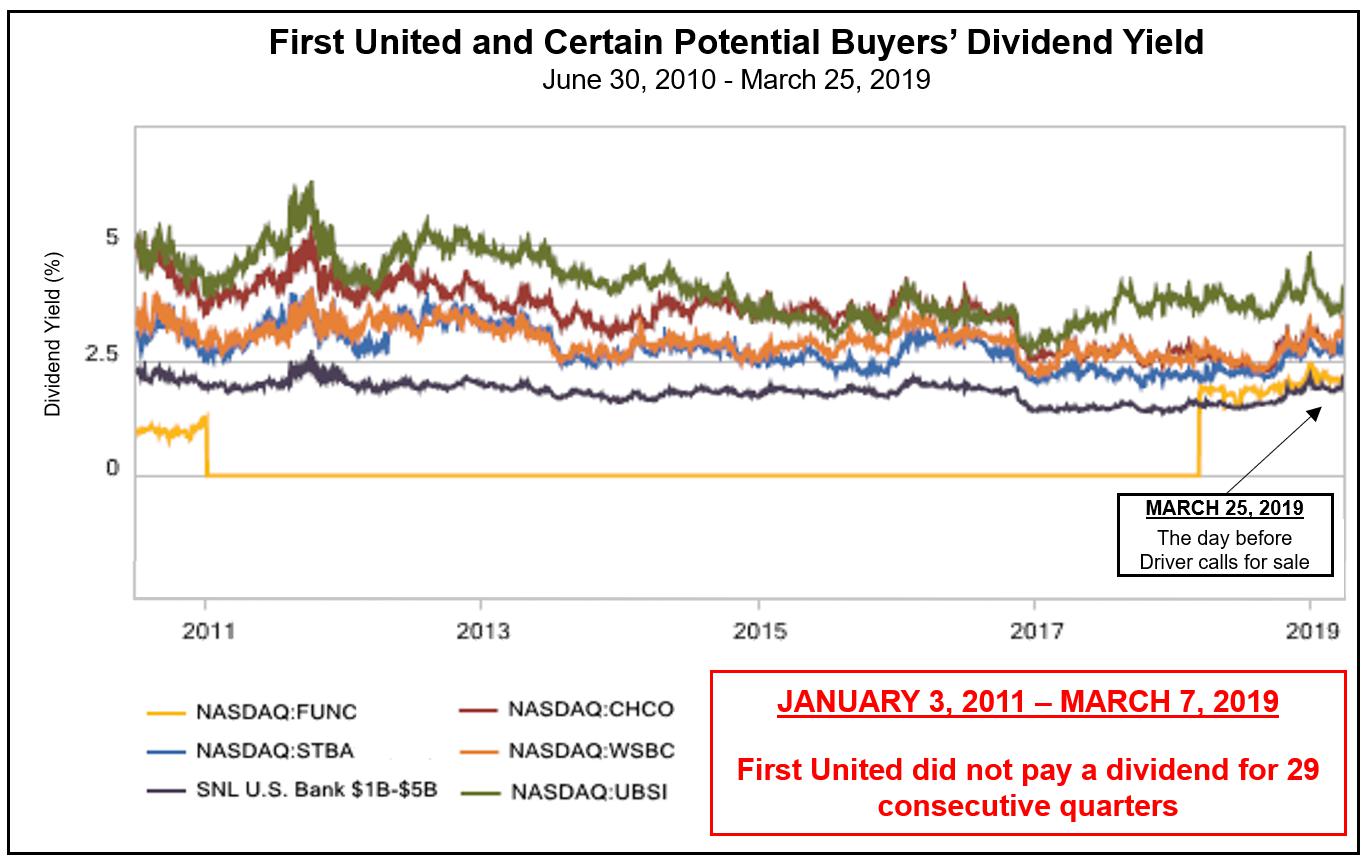

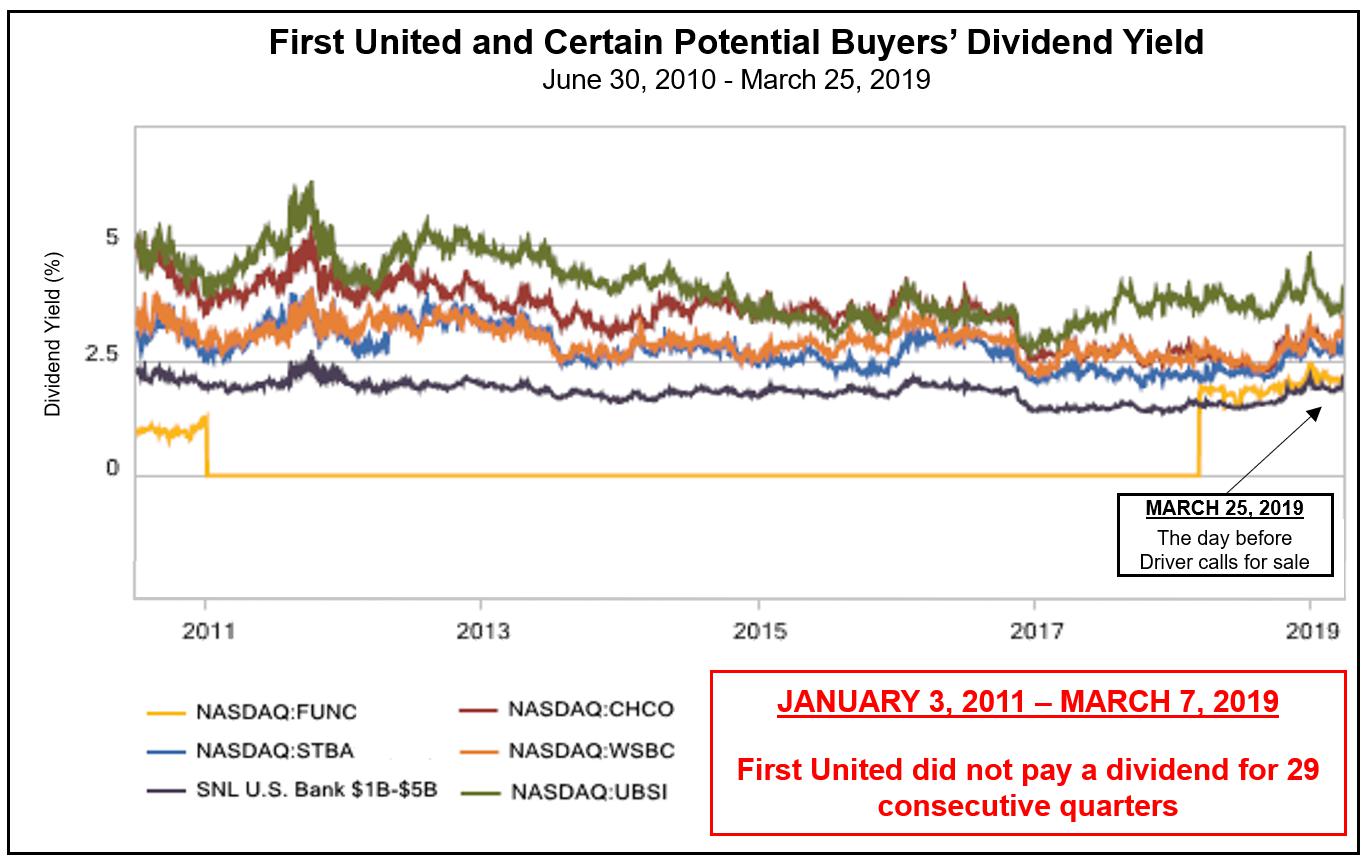

Source: S&P Global Market Intelligence.

Unfortunately, this is not the first time that the Board has failed shareholders by stubbornly ignoring red flags. Prior to the Great Recession, First United embarked on a disastrous strategy led by current Chairman and Chief Executive Officer Carissa Rodeheaver and current director and former Chief Risk Officer Robert Kurtz. This strategy resulted in massive financial losses, layoffs, value destruction and the elimination of the Company’s dividendfor more than seven years. First United’s woes continued long after the financial crisis ended, and the Company was unable to fully redeem the preferred stock first issued to the U.S. Treasury as part of the Troubled Asset Relief Program until 2017.

In keeping with First United’s apparent disregard for corporate accountability, many of the directors that presided over the Company’s crisis-era woes remain on the Board today, including Kathryn Burkey, Robert Rudy, Andrew Walls, John McCullough, Elaine McDonald and Gary Ruddell. Robert Kurtz, who retired after the last financial crisis, retained his seat on the Board. Carissa Rodeheaver, Chief Financial Officer at the time, was subsequently elevated to her current roles despite being at the center of the strategy that led to years of losses for First United’s shareholders.

ATTENTION SHAREHOLDERS: SIGN UP FOR UPDATES AT WWW.RENOVATEMYBANK.COM

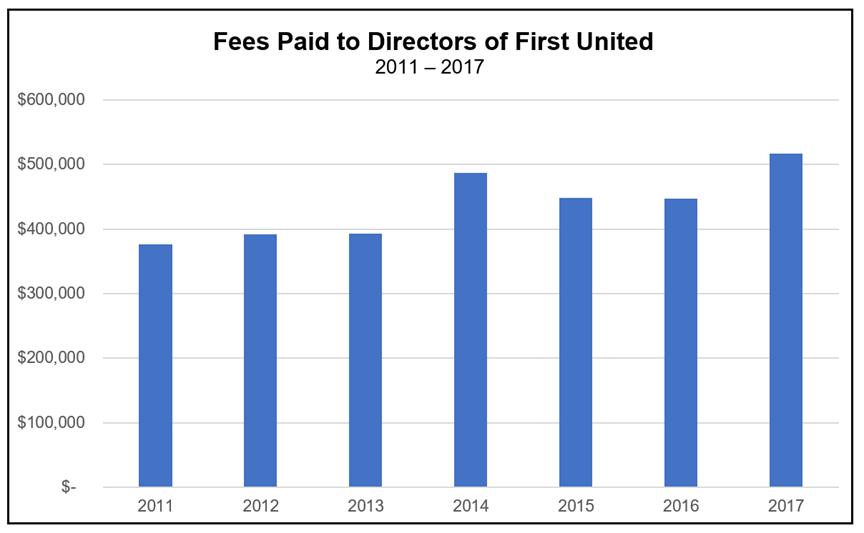

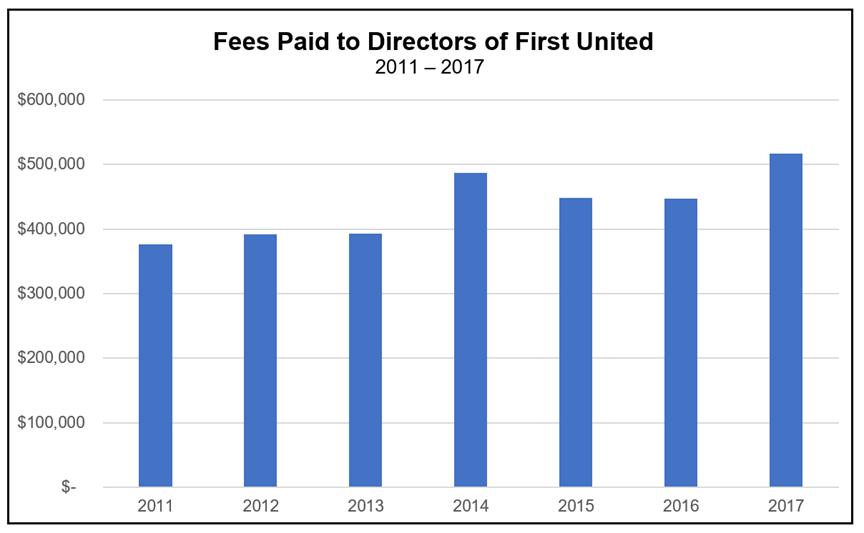

As evidence of the lack of accountability that Driver believes is pervasive at the Board level, the aggregate compensation paid to directorsincreased during the years when no dividends were paid to shareholders. From 2011 to 2017, while shareholders received no dividend payments from First Untied, these directors were paid over $3 million in fees.3

Source: First United Corporation; Securities and Exchange Commission (“SEC”) Filings.

We Believe First United Will Face Significant Headwinds if Another Prolonged Financial Crisis Results From the Coronavirus Pandemic

Even before the Coronavirus outbreak in the United States, Driver repeatedly warned First United that it faced a very challenging bank operating environment ahead, due to slowing economic growth and lower interest rates. Rather than listen to us, First United chose to spend shareholders’ money fighting us and paying for a series of self-serving “strategic reviews” to justify maintaining the status quo. Based on this, we can only surmise that the current Board is either completely clueless or totally disingenuous, but, in any event, ill-equipped to navigate what might be another prolonged economic downturn.

We Believe Shareholders Should Know That First United Opted to Fight Its Largest Shareholder Rather Than Proactively Enhance Its Board Structure and Address Its Failed Strategy

Although First United has gone to great lengths to disparage Driver, the reality is that we have been a fully-aligned and staunch advocate for all shareholders. We spent the majority of the past year trying to convince the Board that selling First United to one of the many viable acquirers in the industry was a superior alternative to betting on the Company’s bleak prospects.4 We showed that combining with a larger bank could unlock cost-efficiencies, improve technology and install superior management—leading to better outcomes for all shareholders, as well as the customers and communities that the Board claims to care so much about.

3 First United Corporation’s Securities and Exchange Commission (“SEC”) filings.

4 Driver presentation entitled “First United: Still No Strategy,” October 30, 2019.

ATTENTION SHAREHOLDERS: SIGN UP FOR UPDATES AT WWW.RENOVATEMYBANK.COM

We recently held discussions with the Board about a settlement that could have enhanced the Company’s leadership and saved shareholders the expense of a proxy contest. After refusing to pursue a sale and presiding over more than a 50% drop in share price, the Board rejected our commonsense proposal to:

| 1. | Immediately refresh the Board by appointing two of Driver’s highly-qualified, independent nominees, each of whom possess robust banking and financial sector expertise; |

| 2. | Immediately improve corporate governance by splitting the Chief Executive Officer and Chairman roles currently held by Ms. Rodeheaver, and; |

| 3. | Immediately establish proper procedures to ensure bids from potential acquirers are properly assessed. |

We Are Offering Shareholders a Clear Path to Improving the Board and Protecting Your Investment in First United

As noted, we have nominated three exceptional director candidates to bring credibility to the boardroom: Michael J. Driscoll, Ed.D, Ethan C. Elzen, and Lisa Narrell-Mead. We believe there is minimal risk in adding all three of our nominees to the Board, especially since 11 directors currently serve on the Board. In our view, it will only benefit shareholders for independent thinkers to be able to encourage a boardroom dialogue about improved governance, enhanced investor transparency and the need to credibly assess sale options that can unlock significant value.

Remember, the Board does not simply appoint directors. They must be elected by shareholders. This year, you have a real choice and can vote for new director candidates nominated by Driver, who are independent and aligned with your interests.

As always, Driver is aligned with you and committed to transparent information sharing. We invite all shareholders to visit www.RenovateMyBank.com to learn more about our case for change and nominees.

Sincerely,

/s/ J. Abbott R. Cooper

J. Abbott R. Cooper

Managing Member

Driver Management Company LLC

* * *

ATTENTION SHAREHOLDERS: SIGN UP FOR UPDATES AT WWW.RENOVATEMYBANK.COM

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC, together with the other participants named herein (collectively, “Driver”), have filed a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2020 annual meeting of stockholders of First United Corporation, a Maryland corporation (the “Corporation”).

DRIVER STRONGLY ADVISES ALL STOCKHOLDERS OF THE CORPORATION TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE ATHTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

Participants in the Solicitation

The participants in the proxy solicitation are anticipated to be Driver Management Company LLC (“Driver Management”), Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper, Michael J. Driscoll, Ed.D, Lisa Narrell-Mead and Ethan C. Elzen.

As of the date hereof, the participants in the proxy solicitation beneficially own in the aggregate 366,212 shares of Common Stock, par value $0.01 per share, of the Corporation (the “Common Stock”). As of the date hereof, Driver Opportunity beneficially owns directly 360,637 shares of Common Stock. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the Managing Member of Driver Management, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date hereof, Dr. Driscoll directly beneficially owns 4,500 shares of Common Stock. As of the date hereof, Ms. Narrell-Mead directly beneficially owns 650 shares of Common Stock. As of the date hereof, Mr. Elzen directly beneficially owns 425 shares of Common Stock.