points, respectively, as compared to 24.6% and 24.1%, respectively, for the three and nine months ended September 30, 2019 for our pharmaceutical segment. The increases were mainly due to a relatively larger portion of revenues from clinical study related collaborations, where higher staff costs and consumable costs are incurred as compared to patient screening collaborations in the past where the consumable costs were comparatively low due to different technologies being used in the testing.

Cost of sales incurred by our diagnostics segment for the three months ended September 30, 2020 represented 94.4% of the revenues from the segment, representing an increase of 14.3 percentage points as compared to 80.1% for the three months ended September 30, 2019. The increase was mainly due to the reallocation of some of the fixed costs incurred for the segment, such as depreciation of laboratory equipment, as well as personnel costs for employees for laboratory operations to the COVID-19 segment where such costs were incurred.

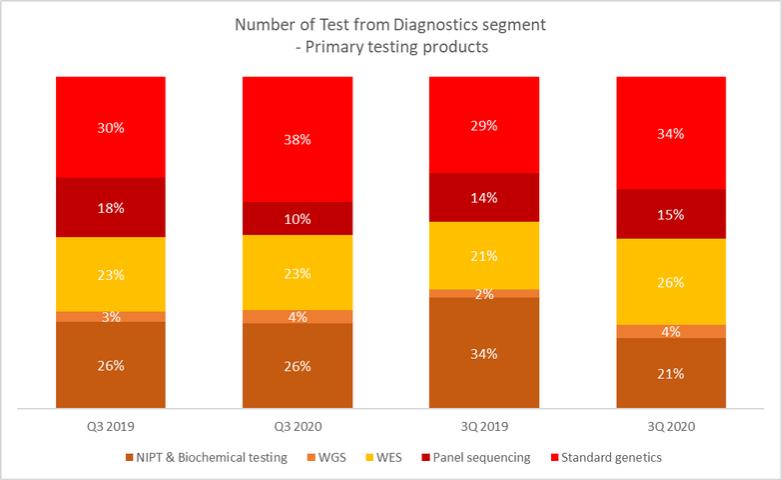

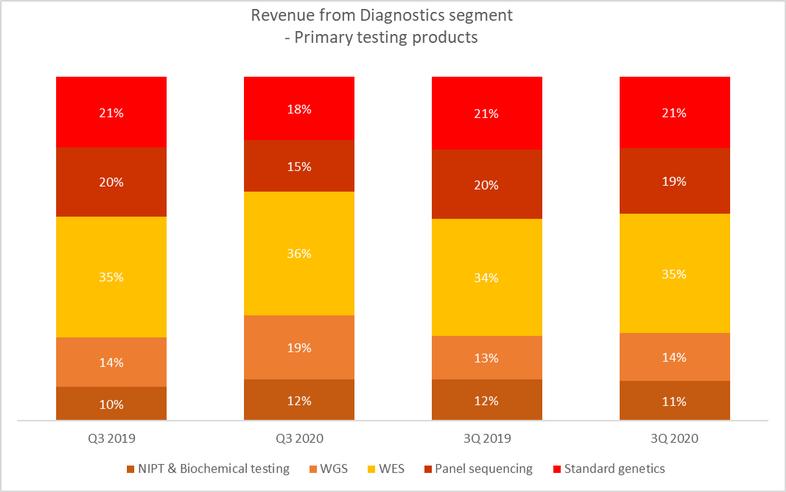

Cost of sales incurred by our diagnostics segment for the nine months ended September 30, 2020 represented 84.4% of the revenues from the segment, representing a increase of 3.3 percentage points as compared to 81.1% for the nine months ended September 30, 2019 for our diagnostics segment. The decrease was mainly due to reallocation of some of the fixed costs incurred for the segment, such as depreciation of laboratory equipment, as well as personnel costs for employees for laboratory operations to the COVID-19 segment where such costs were incurred. The decrease was further caused by the change in the Diagnostics product mix, with fewer NIPT tests (which have comparatively higher costs per test) performed in the nine months ended September 30, 2020.

Cost of sales incurred by our COVID-19 segment for the three months and nine months ended September 30, 2020 represent 65.7% and 65.7% of the revenues for the segment, respectively.

Gross Profit

As a result of the above factors, our gross profit increased by €5,249 thousand, or 105%, to €10,246 thousand for the three months ended September 30, 2020, from €4,997 thousand for the three months ended September 30, 2019, while our gross profit for the nine months ended September 30, 2020, increased by €4,177 thousand, or 29.7%, to €18,237 thousand from €14,060 thousand for the nine months ended September 30, 2019.

Research and Development Expenses

Research and development expenses increased by €2,785 thousand, or 138.5%, to €4,796 thousand for the three months ended September 30, 2020, from €2,011 thousand for the three months ended September 30, 2019, while our research and development expense increased by €4,487 thousand, or 73.3%, to €10,606 thousand for the nine months ended September 30, 2020, from €6,119 thousand for the nine months ended September 30, 2019. This mainly represents personnel costs, consumable costs and IT-related expenses incurred in the research phase that do not qualify for capitalization, or costs incurred for updates or improvements of our biomarkers, databases and technology platform for which development is completed.

General Administrative Expenses

General administrative expenses increased by €3,489 thousand, or 71.4%, to €8,373 thousand for the three months ended September 30, 2020, from €4,884 thousand for the three months ended September 30, 2019, while general administrative expenses increased by €7,551 thousand, or 45.8%, to €24,038 thousand for the nine months ended September 30, 2020, from €16,487 thousand for the nine months ended September 30, 2019.

The increases were principally due to an increase in personnel costs and operating expenses as a result of the expansion of the business. The increase was also largely due to costs of operating as a public company, such as additional legal, accounting, corporate governance and investor relations expenses, and higher directors’ and officers’ insurance premiums.

Share-based compensation expenses for the three and nine months ended September 30, 2019 were calculated based on the estimated fair values of the share-based awards as of September 30, 2019, as well as the estimated number of awards expected to vest. The share-based compensation expenses for the three and nine months ended September 30, 2020 were based on the estimated fair values of the share-based awards at the grant date.

Selling Expenses

Selling expenses for the three and nine months ended September 30, 2020 were €1,300 thousand and €6,012 thousand respectively, representing a decrease of €488 thousand, or 27.3% as compared to €1,788 thousand for the three months ended September 30, 2019, and a decrease of €132 thousand, or 2.1%, as compared to €6,144 thousand for the nine months ended September 30, 2019. The decreases for the three and nine months ended September 30, 2020 were mainly due to a reduction in expenses