united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-23435 |

| Zacks Trust |

| (Exact name of registrant as specified in charter) |

| 227 West Monroe Street Suite 4350, Chicago, IL | 60606 |

| (Address of principal executive offices) | (Zip code) |

| Corporation Trust Company |

| 1209 Orange Street Wilmington, Delaware 19808 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 312-265-9359 |

| Date of fiscal year end: | 11/30 | |

| | | |

| Date of reporting period: | 5/31/24 | |

Item 1. Reports to Stockholders.

(a)

Institutional Class (CZOVX)

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Zacks All-Cap Core Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $50 | 1.00% |

How did the Fund perform during the reporting period?

In the six-month period from December 1, 2023, to May 31, 2024, the Zacks All-Cap Core Fund Institutional Class delivered a return of +18.48%, outperforming the benchmark Russell 3000 Index by a solid margin (the index rose +15.99% over the same period). The All-Cap Core Fund’s outperformance was largely driven by stock selection, which bolstered relative returns by +3.42%. The sector allocation effect on performance was more muted, at -0.44%. Risk controls kept the strategy weights relatively close to their benchmark weights.

Performance analysis of the All-Cap Core Fund showed that the best performing sector for the period was Technology, which was also by far the largest weighting (35.53%) in the All-Cap Fund. The Technology sector soared by +31.28% in the six-month period analyzed, as continued enthusiasm over the commercial potential for artificial intelligence (AI) combined with strong earnings reports and booming capital expenditures from technology companies at the forefront of this new innovation. The U.S. economy also continued to grow outside of the Tech sector, and U.S. consumers continued to spend at stronger-than-expected rates, while inflation moderated. The Technology sector led returns, but all sectors in the All-Cap Core Fund delivered positive returns during this six-month stretch.

Looking ahead, U.S. economic growth continues to surprise to the upside, with the recent 2.8% GDP growth rate in Q2 serving as another data point signaling the economy is in strong fundamental shape. We believe the Zacks All-Cap Core Fund is well-positioned for additional growth, and also for what we view as more runway in the AI-fueled infrastructure buildout.

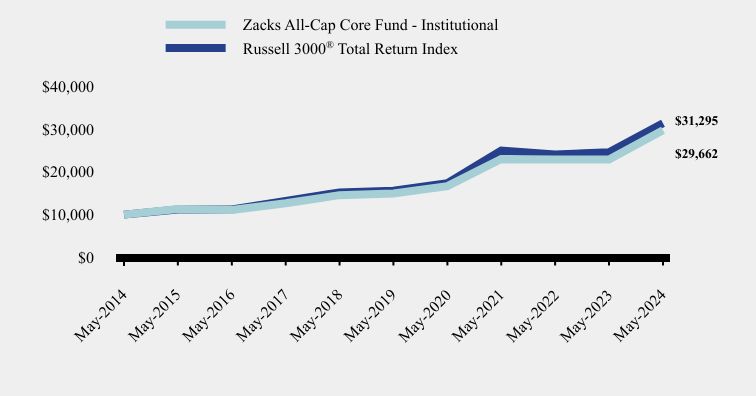

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Zacks All-Cap Core Fund - Institutional | Russell 3000® Total Return Index |

|---|

| May-2014 | $10,000 | $10,000 |

| May-2015 | $11,329 | $11,186 |

| May-2016 | $11,064 | $11,211 |

| May-2017 | $12,633 | $13,194 |

| May-2018 | $14,535 | $15,181 |

| May-2019 | $14,927 | $15,560 |

| May-2020 | $16,644 | $17,344 |

| May-2021 | $22,980 | $24,960 |

| May-2022 | $22,853 | $24,040 |

| May-2023 | $22,857 | $24,529 |

| May-2024 | $29,662 | $31,295 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 years | 10 Years |

|---|

| Zacks All-Cap Core Fund - Institutional | 18.48% | 29.77% | 14.72% | 11.49% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 15.00% | 12.09% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $31,795,036 |

| Number of Portfolio Holdings | 104 |

| Advisory Fee (net of waivers) | $73,588 |

| Portfolio Turnover | 7% |

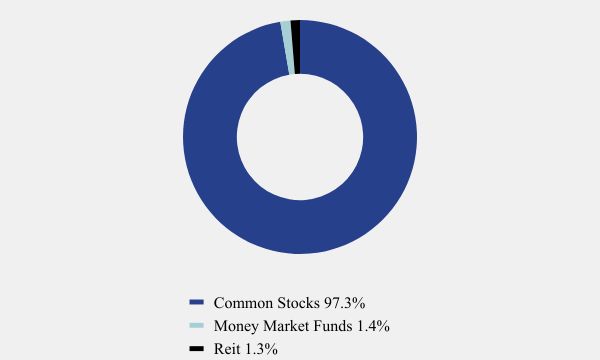

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 97.3% |

| Money Market Funds | 1.4% |

| Reit | 1.3% |

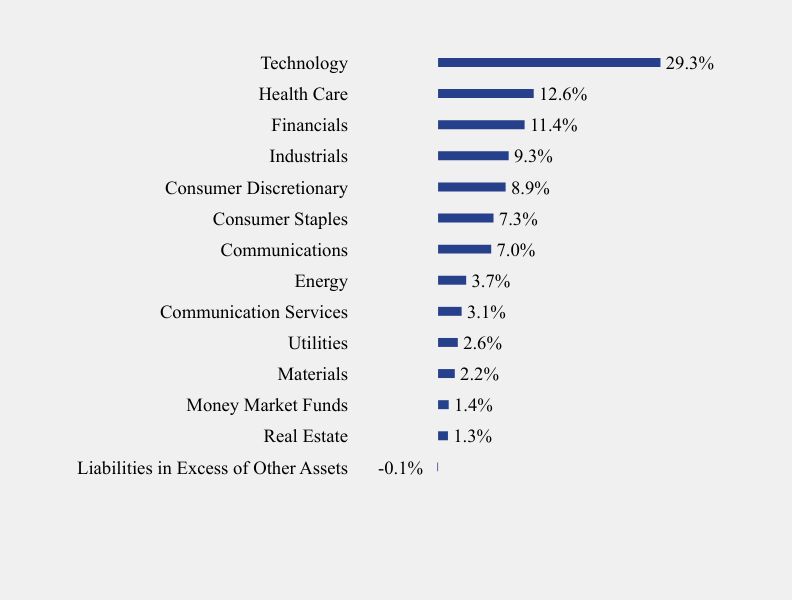

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Real Estate | 1.3% |

| Money Market Funds | 1.4% |

| Materials | 2.2% |

| Utilities | 2.6% |

| Communication Services | 3.1% |

| Energy | 3.7% |

| Communications | 7.0% |

| Consumer Staples | 7.3% |

| Consumer Discretionary | 8.9% |

| Industrials | 9.3% |

| Financials | 11.4% |

| Health Care | 12.6% |

| Technology | 29.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| NVIDIA Corporation | 7.2% |

| Microsoft Corporation | 3.9% |

| Apple, Inc. | 3.6% |

| Alphabet, Inc., Class A | 3.1% |

| Meta Platforms, Inc., Class A | 3.1% |

| Amazon.com, Inc. | 3.0% |

| Procter & Gamble Company (The) | 1.8% |

| Synopsys, Inc. | 1.6% |

| UnitedHealth Group, Inc. | 1.6% |

| Eli Lilly & Company | 1.6% |

The Fund was treated as a separate series (the “Predecessor Fund”) of Investment Managers Series Trust, an open-end management investment company established as a Delaware statutory trust. Effective as of the close of business on January 26, 2024, the Predecessor Fund was reorganized into the Fund, as a new series of the Trust in a tax-free reorganization (the “Reorganization”), whereby the Fund acquired all the assets and liabilities of the Predecessor Fund in exchange for shares of the Fund which were distributed pro rata by the Predecessor Fund to its shareholders in complete liquidation and termination of the Predecessor Fund. The Agreement and Plan of Reorganization pursuant to which the Reorganization was accomplished was approved by shareholders of the Predecessor Fund on November 16, 2023.

Zacks All-Cap Core Fund - Institutional (CZOVX)

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Zacks All-Cap Core Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

Prospectus

Financial information

Holdings

Proxy voting information

Institutional Class (ZDIIX)

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Zacks Dividend Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $53 | 1.05% |

How did the Fund perform during the reporting period?

In the six-month period from December 1, 2023, to May 31, 2024, the Zacks Dividend Fund Institutional Class delivered a return of +13.13%, slightly outperforming the benchmark Russell 1000 Value Index. Our outperformance was driven by stock selection within the Dividend Fund, which added +0.47% of return relative to the benchmark.

Performance analysis of the Dividend Fund showed that Producer Durables was the top performing sector, having risen +21.38% over the six-month stretch. Companies in the Producer Durables sector benefited from stronger-than-expected consumer spending in the first half of 2024, which bolstered earnings results. Positive returns were not limited to Producer Durables, however, as all sectors in the Dividend Fund posted positive returns during the holding period.

From a sector standpoint, Financial Services and Technology were the two largest sectors in the Dividend Fund, at 25.91% and 13.40%, respectively. Technology was also our largest overweight, which bolstered returns during the six-month stretch. Our positioning in Technology, and our stock selection within the sector, provided the largest positive effects from both an allocation and selection standpoint. The largest underweight during this period was Health Care, at -2.34%. Risk controls in the Dividend Fund kept strategy weights relatively close to its benchmark weights throughout the six-month stretch.

Looking ahead to the balance of 2024, we remain confident in the Dividend Fund’s positioning, and believe that sectors beyond Technology will experience an earnings rebound and deliver comparable year-over-year growth rates by Q4 2024. Given that valuations outside of the Technology sector are ‘reasonable’ by historical standards, we could see a rotation that increases the breadth of the rally.

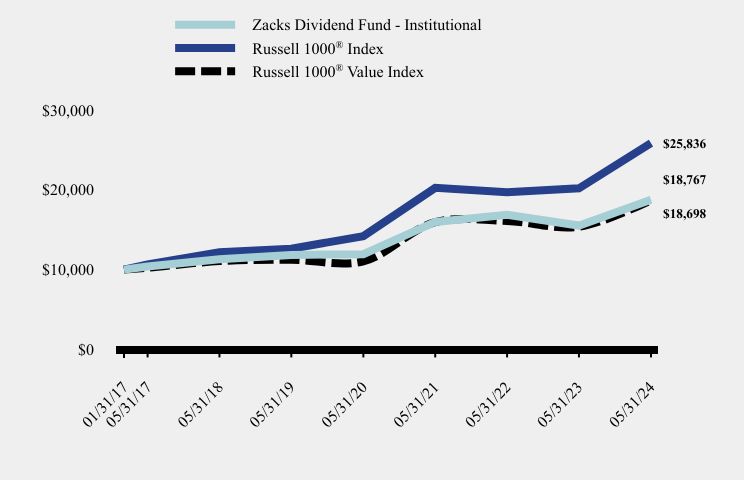

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Zacks Dividend Fund - Institutional | Russell 1000® Index | Russell 1000® Value Index |

|---|

| 01/31/17 | $10,000 | $10,000 | $10,000 |

| 05/31/17 | $10,400 | $10,638 | $10,225 |

| 05/31/18 | $11,289 | $12,190 | $11,068 |

| 05/31/19 | $11,840 | $12,613 | $11,228 |

| 05/31/20 | $11,931 | $14,194 | $11,044 |

| 05/31/21 | $15,970 | $20,250 | $15,946 |

| 05/31/22 | $16,877 | $19,701 | $16,094 |

| 05/31/23 | $15,520 | $20,184 | $15,363 |

| 05/31/24 | $18,767 | $25,836 | $18,698 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 years | Since Inception (1/31/2017) |

|---|

| Zacks Dividend Fund - Institutional | 13.13% | 20.92% | 9.65% | 8.97% |

Russell 1000® Index | 16.03% | 28.01% | 15.42% | 13.83% |

Russell 1000® Value Index | 13.60% | 21.71% | 10.74% | 8.91% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $128,212,171 |

| Number of Portfolio Holdings | 70 |

| Advisory Fee (net of waivers) | $585,718 |

| Portfolio Turnover | 5% |

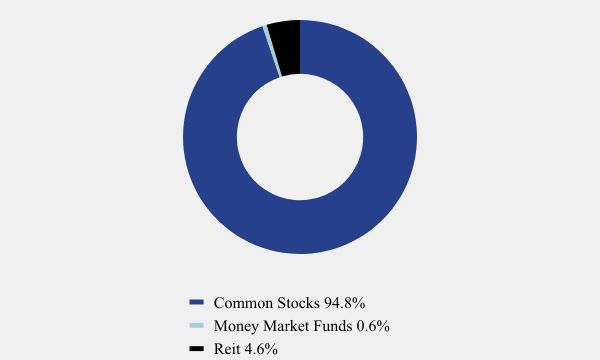

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 94.8% |

| Money Market Funds | 0.6% |

| Reit | 4.6% |

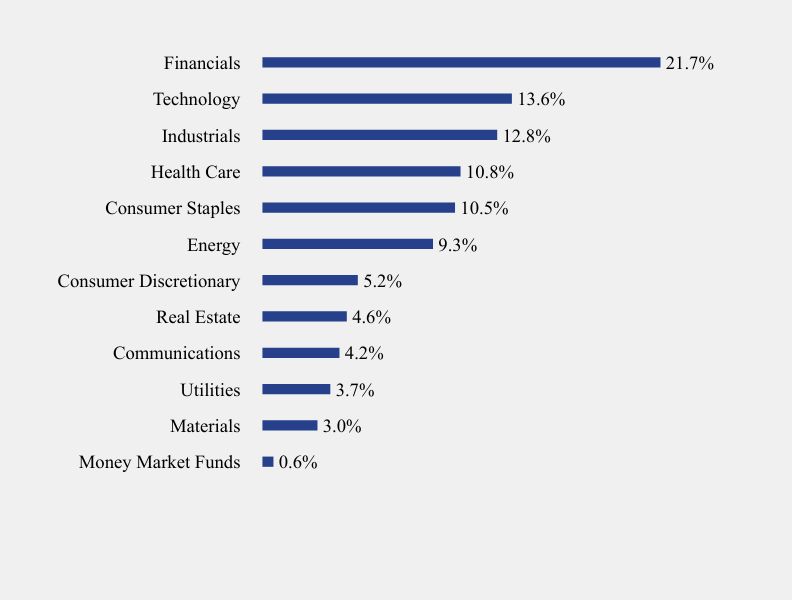

What did the Fund invest in?

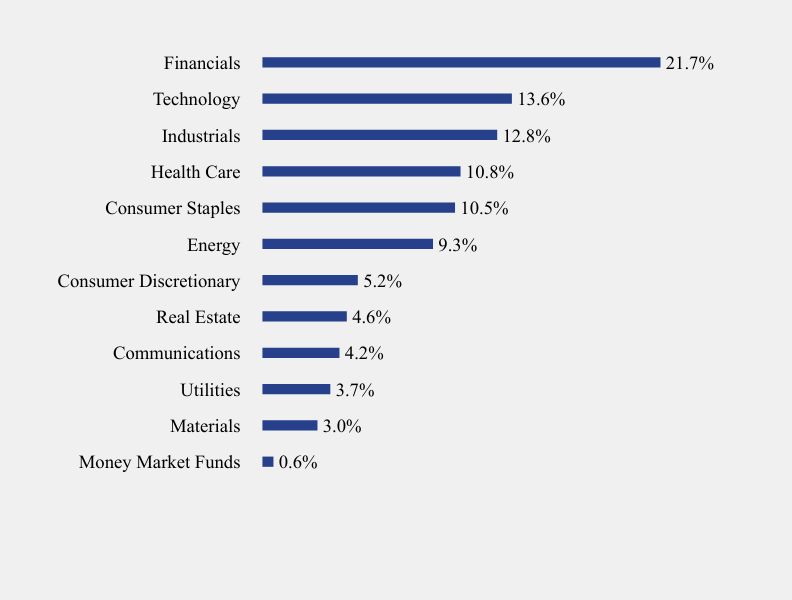

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Money Market Funds | 0.6% |

| Materials | 3.0% |

| Utilities | 3.7% |

| Communications | 4.2% |

| Real Estate | 4.6% |

| Consumer Discretionary | 5.2% |

| Energy | 9.3% |

| Consumer Staples | 10.5% |

| Health Care | 10.8% |

| Industrials | 12.8% |

| Technology | 13.6% |

| Financials | 21.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| JPMorgan Chase & Company | 4.1% |

| Microsoft Corporation | 3.9% |

| Exxon Mobil Corporation | 3.4% |

| Procter & Gamble Company (The) | 3.1% |

| Arthur J Gallagher & Company | 2.8% |

| Home Depot, Inc. (The) | 2.5% |

| Chevron Corporation | 2.4% |

| Parker-Hannifin Corporation | 2.4% |

| Broadcom, Inc. | 2.4% |

| Prudential Financial, Inc. | 2.3% |

The Fund was treated as a separate series (the “Predecessor Fund”) of Investment Managers Series Trust, an open-end management investment company established as a Delaware statutory trust. Effective as of the close of business on January 26, 2024, the Predecessor Fund was reorganized into the Fund, as a new series of the Trust in a tax-free reorganization (the “Reorganization”), whereby the Fund acquired all the assets and liabilities of the Predecessor Fund in exchange for shares of the Fund which were distributed pro rata by the Predecessor Fund to its shareholders in complete liquidation and termination of the Predecessor Fund. The Agreement and Plan of Reorganization pursuant to which the Reorganization was accomplished was approved by shareholders of the Predecessor Fund on December 15, 2023.

Zacks Dividend Fund - Institutional Class (ZDIIX)

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Zacks Dividend Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Zacks Dividend Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $65 | 1.30% |

How did the Fund perform during the reporting period?

In the six-month period from December 1, 2023, to May 31, 2024, the Zacks Dividend Fund Investor Class delivered a return of +13.06%, slightly outperforming the benchmark Russell 1000 Value Index. Our outperformance was driven by stock selection within the Fund, which added +0.54% of return relative to the benchmark.

Performance analysis of the Dividend Fund showed that Producer Durables was the top performing sector, having risen +21.38% over the six-month stretch. Companies in the Producer Durables sector benefited from stronger-than-expected consumer spending in the first half of 2024, which bolstered earnings results. Positive returns were not limited to Producer Durables, however, as all sectors in the Dividend Fund posted positive returns during the holding period.

From a sector standpoint, Financial Services and Technology were the two largest sectors in the Dividend Fund, at 25.91% and 13.40%, respectively. Technology was also our largest overweight, which bolstered returns during the six-month stretch. Our positioning in Technology, and our stock selection within the sector, provided the largest positive effects from both an allocation and selection standpoint. The largest underweight during this period was Health Care, at -2.34%. Risk controls in the Dividend Fund kept strategy weights relatively close to its benchmark weights throughout the six-month stretch.

Looking ahead to the balance of 2024, we remain confident in the Dividend Fund’s positioning, and believe that sectors beyond Technology will experience an earnings rebound and deliver comparable year-over-year growth rates by Q4 2024. Given that valuations outside of the Technology sector are ‘reasonable’ by historical standards, we could see a rotation that increases the breadth of the rally.

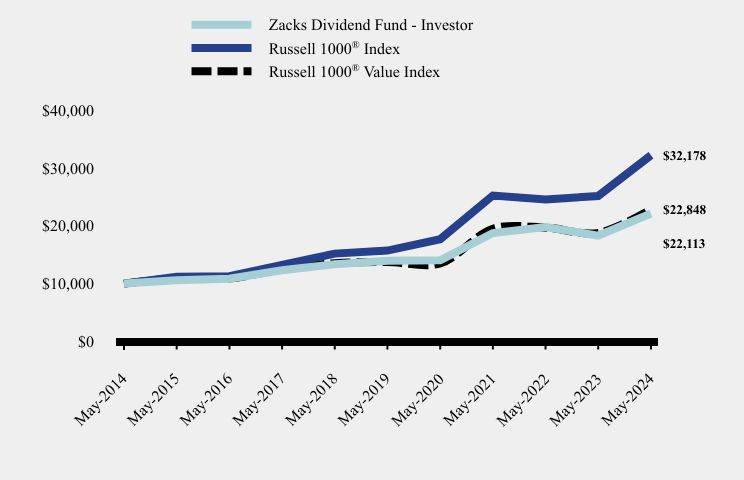

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Zacks Dividend Fund - Investor | Russell 1000® Index | Russell 1000® Value Index |

|---|

| May-2014 | $10,000 | $10,000 | $10,000 |

| May-2015 | $10,568 | $11,191 | $10,903 |

| May-2016 | $10,848 | $11,278 | $10,897 |

| May-2017 | $12,314 | $13,249 | $12,494 |

| May-2018 | $13,341 | $15,182 | $13,524 |

| May-2019 | $13,960 | $15,709 | $13,720 |

| May-2020 | $14,031 | $17,678 | $13,495 |

| May-2021 | $18,733 | $25,220 | $19,485 |

| May-2022 | $19,769 | $24,537 | $19,666 |

| May-2023 | $18,296 | $25,138 | $18,772 |

| May-2024 | $22,113 | $32,178 | $22,848 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 years | 10 Years |

|---|

| Zacks Dividend Fund - Investor | 13.06% | 20.86% | 9.64% | 8.26% |

Russell 1000® Index | 16.03% | 28.01% | 15.42% | 12.40% |

Russell 1000® Value Index | 13.60% | 21.71% | 10.74% | 8.61% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $128,212,171 |

| Number of Portfolio Holdings | 70 |

| Advisory Fee (net of waivers) | $585,718 |

| Portfolio Turnover | 5% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 94.8% |

| Money Market Funds | 0.6% |

| Reit | 4.6% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Money Market Funds | 0.6% |

| Materials | 3.0% |

| Utilities | 3.7% |

| Communications | 4.2% |

| Real Estate | 4.6% |

| Consumer Discretionary | 5.2% |

| Energy | 9.3% |

| Consumer Staples | 10.5% |

| Health Care | 10.8% |

| Industrials | 12.8% |

| Technology | 13.6% |

| Financials | 21.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| JPMorgan Chase & Company | 4.1% |

| Microsoft Corporation | 3.9% |

| Exxon Mobil Corporation | 3.4% |

| Procter & Gamble Company (The) | 3.1% |

| Arthur J Gallagher & Company | 2.8% |

| Home Depot, Inc. (The) | 2.5% |

| Chevron Corporation | 2.4% |

| Parker-Hannifin Corporation | 2.4% |

| Broadcom, Inc. | 2.4% |

| Prudential Financial, Inc. | 2.3% |

The Fund was treated as a separate series (the “Predecessor Fund”) of Investment Managers Series Trust, an open-end management investment company established as a Delaware statutory trust. Effective as of the close of business on January 26, 2024, the Predecessor Fund was reorganized into the Fund, as a new series of the Trust in a tax-free reorganization (the “Reorganization”), whereby the Fund acquired all the assets and liabilities of the Predecessor Fund in exchange for shares of the Fund which were distributed pro rata by the Predecessor Fund to its shareholders in complete liquidation and termination of the Predecessor Fund. The Agreement and Plan of Reorganization pursuant to which the Reorganization was accomplished was approved by shareholders of the Predecessor Fund on December 15, 2023.

Zacks Dividend Fund - Investor Class (ZDIVX)

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Zacks Dividend Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

Prospectus

Financial information

Holdings

Proxy voting information

Zacks Small-Cap Core Fund

Institutional Class (ZSCIX)

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Zacks Small-Cap Core Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Insitutional | $57 | 1.14% |

How did the fund perform last year?

In the six-month period from December 1, 2023, to May 31, 2024, the Zacks Small-Cap Core Fund Institutional Class yielded a return of 16.08%, outperforming the benchmark Russell 2000 Index by 1.65%. Our allocation decisions within the Small-Cap Fund drove relative outperformance of +1.18%, while stock selection detracted slightly.

The top-performing sector in the Small-Cap Core Fund during the performance period was Producer Durables, which rose +30.92%. The Utilities sector dragged on total return, as the elevated interest rate environment has had outsized impact on smaller Utilities that tend to carry higher debt loads—at a time when more investment in grid modernization is needed.

For much of the six-month performance period, investors remained most enthusiastic about mega-cap growth companies, particularly in the Technology sector. However, as the U.S. economy continues to expand and earnings growth extends beyond Technology companies and the AI-boom—which we expect to see in the second half of 2024—small-cap companies could experience a positive rotation. Small-caps currently trade at far lower valuations than their large-cap peers, which we believe could present strong opportunities looking forward.

From a pure valuation standpoint, high-quality small-cap stocks trade at a historically large discount to their large-cap peers, even though many of them have similar profit margins and free cash flows. Indeed, over the past decade, small- and mid-cap companies have grown earnings—on average—faster than their large-cap peers. For small caps, stock price appreciation over that time has lagged their large-cap peers but has also been driven far more by earnings growth than multiple expansion.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Zacks Small-Cap Core Fund - Institutional | Russell 3000® Total Return Index | Russell 2000® Index |

|---|

| May-2014 | $10,000 | $10,000 | $10,000 |

| May-2015 | $11,319 | $11,186 | $10,988 |

| May-2016 | $10,775 | $11,211 | $10,179 |

| May-2017 | $13,312 | $13,194 | $12,078 |

| May-2018 | $15,807 | $15,181 | $14,399 |

| May-2019 | $13,995 | $15,560 | $12,917 |

| May-2020 | $12,026 | $17,344 | $12,288 |

| May-2021 | $19,396 | $24,960 | $20,000 |

| May-2022 | $18,976 | $24,040 | $16,431 |

| May-2023 | $18,429 | $24,529 | $15,422 |

| May-2024 | $22,616 | $31,295 | $18,247 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 years | 10 Years |

|---|

| Zacks Small-Cap Core Fund - Institutional | 16.08% | 22.72% | 10.08% | 8.50% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 15.00% | 12.09% |

Russell 2000® Index | 14.43% | 18.32% | 7.15% | 6.20% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $33,170,822 |

| Number of Portfolio Holdings | 102 |

| Advisory Fee (net of waivers) | $103,854 |

| Portfolio Turnover | 76% |

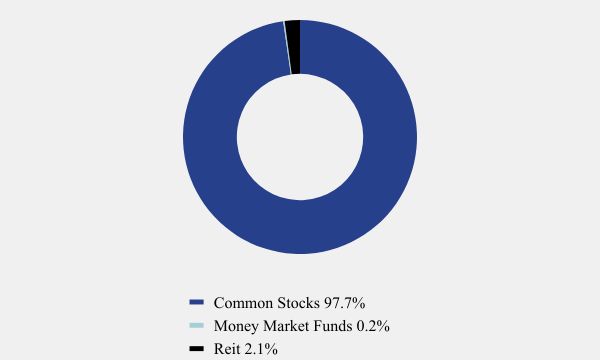

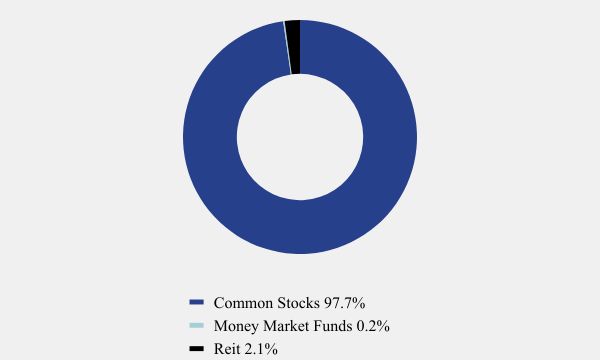

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 97.7% |

| Money Market Funds | 0.2% |

| Reit | 2.1% |

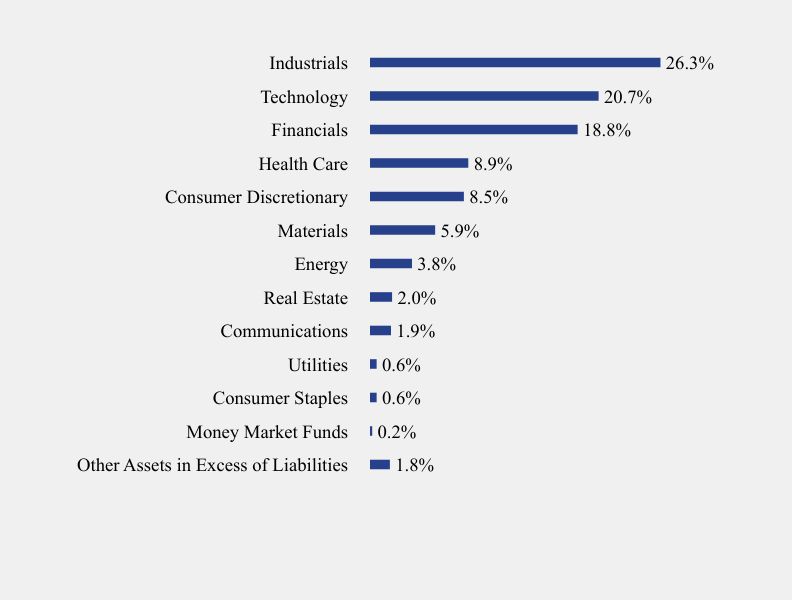

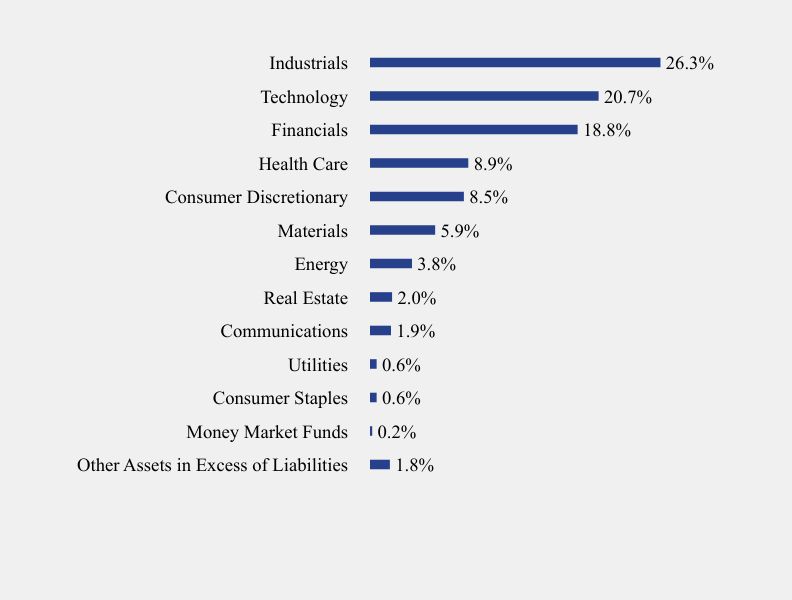

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.8% |

| Money Market Funds | 0.2% |

| Consumer Staples | 0.6% |

| Utilities | 0.6% |

| Communications | 1.9% |

| Real Estate | 2.0% |

| Energy | 3.8% |

| Materials | 5.9% |

| Consumer Discretionary | 8.5% |

| Health Care | 8.9% |

| Financials | 18.8% |

| Technology | 20.7% |

| Industrials | 26.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Teekay Tankers Ltd., Class A | 2.0% |

| PROG Holdings, Inc. | 2.0% |

| SPX Technologies, Inc. | 2.0% |

| PepGen, Inc. | 2.0% |

| Comfort Systems USA, Inc. | 1.9% |

| Merit Medical Systems, Inc. | 1.9% |

| Onto Innovation, Inc. | 1.9% |

| Blue Bird Corporation | 1.9% |

| CSW Industrials, Inc. | 1.8% |

| 1st Source Corporation | 1.8% |

The Fund was treated as a separate series (the “Predecessor Fund”) of Investment Managers Series Trust, an open-end management investment company established as a Delaware statutory trust. Effective as of the close of business on January 26, 2024, the Predecessor Fund was reorganized into the Fund, as a new series of the Trust in a tax-free reorganization (the “Reorganization”), whereby the Fund acquired all the assets and liabilities of the Predecessor Fund in exchange for shares of the Fund which were distributed pro rata by the Predecessor Fund to its shareholders in complete liquidation and termination of the Predecessor Fund. The Agreement and Plan of Reorganization pursuant to which the Reorganization was accomplished was approved by shareholders of the Predecessor Fund on December 15, 2023.

Zacks Small-Cap Core Fund - Insitutional (ZSCIX)

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Zacks Small-Cap Core Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

Prospectus

Financial information

Holdings

Proxy voting information

Zacks Small-Cap Core Fund

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Zacks Small-Cap Core Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $70 | 1.39% |

How did the fund perform last year?

In the six-month period from December 1, 2023, to May 31, 2024, the Zacks Small-Cap Core Fund Investor Class yielded a return of +15.97%, outperforming the benchmark Russell 2000 Index by 1.54%. Our allocation decisions within the Small Cap Core Fund drove relative outperformance of +1.18%, while stock selection detracted slightly.

The top-performing sector in the Small-Cap Core Fund during the performance period was Producer Durables, which rose +30.92%. The Utilities sector dragged on total return, as the elevated interest rate environment has had outsized impact on smaller Utilities that tend to carry higher debt loads—at a time when more investment in grid modernization is needed.

For much of the six-month performance period, investors remained most enthusiastic about mega-cap growth companies, particularly in the Technology sector. However, as the U.S. economy continues to expand and earnings growth extends beyond Technology companies and the AI-boom—which we expect to see in the second half of 2024—small-cap companies could experience a positive rotation. Small-caps currently trade at far lower valuations than their large-cap peers, which we believe could present strong opportunities looking forward.

From a pure valuation standpoint, high-quality small-cap stocks trade at a historically large discount to their large-cap peers, even though many of them have similar profit margins and free cash flows. Indeed, over the past decade, small- and mid-cap companies have grown earnings—on average—faster than their large-cap peers. For small caps, stock price appreciation over that time has lagged their large-cap peers but has also been driven far more by earnings growth than multiple expansion.

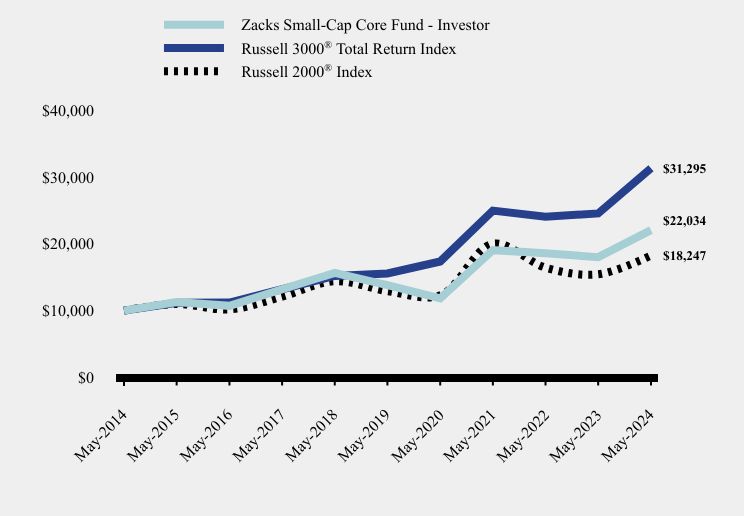

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Zacks Small-Cap Core Fund - Investor | Russell 3000® Total Return Index | Russell 2000® Index |

|---|

| May-2014 | $10,000 | $10,000 | $10,000 |

| May-2015 | $11,288 | $11,186 | $10,988 |

| May-2016 | $10,712 | $11,211 | $10,179 |

| May-2017 | $13,203 | $13,194 | $12,078 |

| May-2018 | $15,637 | $15,181 | $14,399 |

| May-2019 | $13,804 | $15,560 | $12,917 |

| May-2020 | $11,832 | $17,344 | $12,288 |

| May-2021 | $19,038 | $24,960 | $20,000 |

| May-2022 | $18,572 | $24,040 | $16,431 |

| May-2023 | $17,994 | $24,529 | $15,422 |

| May-2024 | $22,034 | $31,295 | $18,247 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 years | 10 Years |

|---|

| Zacks Small-Cap Core Fund - Investor | 15.97% | 22.45% | 9.80% | 8.22% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 15.00% | 12.09% |

Russell 2000® Index | 14.43% | 18.32% | 7.15% | 6.20% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $33,170,822 |

| Number of Portfolio Holdings | 102 |

| Advisory Fee (net of waivers) | $103,854 |

| Portfolio Turnover | 76% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 97.7% |

| Money Market Funds | 0.2% |

| Reit | 2.1% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.8% |

| Money Market Funds | 0.2% |

| Consumer Staples | 0.6% |

| Utilities | 0.6% |

| Communications | 1.9% |

| Real Estate | 2.0% |

| Energy | 3.8% |

| Materials | 5.9% |

| Consumer Discretionary | 8.5% |

| Health Care | 8.9% |

| Financials | 18.8% |

| Technology | 20.7% |

| Industrials | 26.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Teekay Tankers Ltd., Class A | 2.0% |

| PROG Holdings, Inc. | 2.0% |

| SPX Technologies, Inc. | 2.0% |

| PepGen, Inc. | 2.0% |

| Comfort Systems USA, Inc. | 1.9% |

| Merit Medical Systems, Inc. | 1.9% |

| Onto Innovation, Inc. | 1.9% |

| Blue Bird Corporation | 1.9% |

| CSW Industrials, Inc. | 1.8% |

| 1st Source Corporation | 1.8% |

The Fund was treated as a separate series (the “Predecessor Fund”) of Investment Managers Series Trust, an open-end management investment company established as a Delaware statutory trust. Effective as of the close of business on January 26, 2024, the Predecessor Fund was reorganized into the Fund, as a new series of the Trust in a tax-free reorganization (the “Reorganization”), whereby the Fund acquired all the assets and liabilities of the Predecessor Fund in exchange for shares of the Fund which were distributed pro rata by the Predecessor Fund to its shareholders in complete liquidation and termination of the Predecessor Fund. The Agreement and Plan of Reorganization pursuant to which the Reorganization was accomplished was approved by shareholders of the Predecessor Fund on December 15, 2023.

Zacks Small-Cap Core Fund - Investor Class (ZSCCX)

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Zacks Small-Cap Core Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksfunds.com/forms-and-resources.php#FundReports. You can also request this information by contacting us at 1-888 775-8351.

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end investment companies.

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| Zacks All-Cap Core Fund |

| Institutional Class Shares – CZOVX |

| |

| Zacks Small-Cap Core Fund |

| Investor Class Shares – ZSCCX |

| Institutional Class Shares - ZSCIX |

| |

| Zacks Dividend Fund |

| Investor Class Shares – ZDIVX |

| Institutional Class Shares - ZDIIX |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Semi-Annual Report |

| |

| May 31, 2024 |

| |

| |

| |

| |

| |

| 1-888-775-8351 |

| |

| www.zacksfunds.com |

| ZACKS ALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.7% | | | | |

| | | | | AEROSPACE & DEFENSE - 0.9% | | | | |

| | 655 | | | General Dynamics Corporation | | $ | 196,349 | |

| | 1,007 | | | Howmet Aerospace, Inc. | | | 85,243 | |

| | | | | | | | 281,592 | |

| | | | | ASSET MANAGEMENT - 1.5% | | | | |

| | 763 | | | Ameriprise Financial, Inc. | | | 333,134 | |

| | 180 | | | BlackRock, Inc. | | | 138,965 | |

| | | | | | | | 472,099 | |

| | | | | AUTOMOTIVE - 0.5% | | | | |

| | 907 | | | Tesla, Inc.(a) | | | 161,519 | |

| | | | | | | | | |

| | | | | BANKING - 4.3% | | | | |

| | 8,108 | | | Bank of America Corporation | | | 324,239 | |

| | 2,493 | | | JPMorgan Chase & Company | | | 505,157 | |

| | 1,234 | | | PNC Financial Services Group, Inc. (The) | | | 194,219 | |

| | 6,371 | | | Truist Financial Corporation | | | 240,505 | |

| | 1,209 | | | Wintrust Financial Corporation | | | 119,219 | |

| | | | | | | | 1,383,339 | |

| | | | | BEVERAGES - 1.2% | | | | |

| | 2,153 | | | PepsiCo, Inc. | | | 372,254 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 6.3% | | | | |

| | 2,178 | | | AbbVie, Inc. | | | 351,181 | |

| | 907 | | | Amgen, Inc. | | | 277,406 | |

| | 622 | | | Eli Lilly & Company | | | 510,251 | |

| | 1,838 | | | Johnson & Johnson | | | 269,579 | |

| | 2,392 | | | Merck & Company, Inc. | | | 300,292 | |

| | 646 | | | Vertex Pharmaceuticals, Inc.(a) | | | 294,150 | |

| | | | | | | | 2,002,859 | |

| | | | | CHEMICALS - 1.2% | | | | |

| | 1,678 | | | Celanese Corporation | | | 255,124 | |

| | 2,153 | | | Dow, Inc. | | | 124,077 | |

| | | | | | | | 379,201 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 2.1% | | | | |

| | 514 | | | Cintas Corporation | | | 348,476 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS ALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.7% (Continued) | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 2.1% (Continued) | | | | |

| | 1,750 | | | Republic Services, Inc. | | $ | 324,083 | |

| | | | | | | | 672,559 | |

| | | | | CONSTRUCTION MATERIALS - 0.5% | | | | |

| | 818 | | | Owens Corning | | | 148,115 | |

| | | | | | | | | |

| | | | | CONTAINERS & PACKAGING - 0.5% | | | | |

| | 5,792 | | | Graphic Packaging Holding Company | | | 164,029 | |

| | | | | | | | | |

| | | | | DIVERSIFIED INDUSTRIALS - 0.8% | | | | |

| | 1,259 | | | Honeywell International, Inc. | | | 254,557 | |

| | | | | | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 2.9% | | | | |

| | 5,364 | | | Amazon.com, Inc.(a) | | | 946,424 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 2.6% | | | | |

| | 3,802 | | | American Electric Power Company, Inc. | | | 343,130 | |

| | 2,278 | | | NextEra Energy, Inc. | | | 182,286 | |

| | 2,040 | | | Portland General Electric Company | | | 90,902 | |

| | 2,569 | | | Southern Company (The) | | | 205,880 | |

| | | | | | | | 822,198 | |

| | | | | ELECTRICAL EQUIPMENT - 1.5% | | | | |

| | 1,826 | | | Itron, Inc.(a) | | | 196,386 | |

| | 2,984 | | | Vertiv Holdings Company | | | 292,641 | |

| | | | | | | | 489,027 | |

| | | | | ENGINEERING & CONSTRUCTION - 1.8% | | | | |

| | 907 | | | EMCOR Group, Inc. | | | 352,515 | |

| | 1,070 | | | Tetra Tech, Inc. | | | 224,154 | |

| | | | | | | | 576,669 | |

| | | | | FOOD - 1.6% | | | | |

| | 3,173 | | | Conagra Brands, Inc. | | | 94,809 | |

| | 1,486 | | | Hershey Company (The) | | | 293,976 | |

| | 3,185 | | | Kraft Heinz Company (The) | | | 112,653 | |

| | | | | | | | 501,438 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS ALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.7% (Continued) | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 3.0% | | | | |

| | 1,284 | | | Cardinal Health, Inc. | | $ | 127,463 | |

| | 743 | | | Labcorp Holdings, Inc. | | | 144,818 | |

| | 529 | | | Molina Healthcare, Inc.(a) | | | 166,413 | |

| | 1,040 | | | UnitedHealth Group, Inc. | | | 515,184 | |

| | | | | | | | 953,878 | |

| | | | | HEALTH CARE REIT - 0.3% | | | | |

| | 4,369 | | | Healthpeak Properties, Inc. | | | 86,943 | |

| | | | | | | | | |

| | | | | HOME CONSTRUCTION - 0.8% | | | | |

| | 2,140 | | | PulteGroup, Inc. | | | 251,065 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 2.8% | | | | |

| | 1,461 | | | Church & Dwight Company, Inc. | | | 156,342 | |

| | 1,121 | | | elf Beauty, Inc.(a) | | | 209,526 | |

| | 3,412 | | | Procter & Gamble Company (The) | | | 561,410 | |

| | | | | | | | 927,278 | |

| | | | | INDUSTRIAL REIT - 0.4% | | | | |

| | 1,196 | | | Prologis, Inc. | | | 132,146 | |

| | | | | | | | | |

| | | | | INSURANCE - 4.1% | | | | |

| | 608 | | | Assurant, Inc. | | | 105,470 | |

| | 3,337 | | | Hartford Financial Services Group, Inc. (The) | | | 345,213 | |

| | 1,952 | | | Marsh & McLennan Companies, Inc. | | | 405,196 | |

| | 3,563 | | | MetLife, Inc. | | | 257,854 | |

| | 2,241 | | | W R Berkley Corporation | | | 181,588 | |

| | | | | | | | 1,295,321 | |

| | | | | INTERNET MEDIA & SERVICES - 9.2% | | | | |

| | 5,666 | | | Alphabet, Inc., Class A(a) | | | 977,384 | |

| | 1,360 | | | Alphabet, Inc., Class C(a) | | | 236,586 | |

| | 2,090 | | | Meta Platforms, Inc., Class A | | | 975,675 | |

| | 579 | | | Netflix, Inc.(a) | | | 371,498 | |

| | 699 | | | Spotify Technology S.A.(a) | | | 207,449 | |

| | 2,468 | | | Uber Technologies, Inc.(a) | | | 159,334 | |

| | | | | | | | 2,927,926 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS ALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.7% (Continued) | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 2.6% | | | | |

| | 1,070 | | | Marriott International, Inc., Class A | | $ | 247,352 | |

| | 729 | | | McDonald’s Corporation | | | 188,731 | |

| | 3,349 | | | MGM Resorts International(a) | | | 134,529 | |

| | 1,675 | | | Royal Caribbean Cruises Ltd.(a) | | | 247,364 | |

| | | | | | | | 817,976 | |

| | | | | MACHINERY - 1.6% | | | | |

| | 1,488 | | | Caterpillar, Inc. | | | 503,718 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 3.3% | | | | |

| | 2,002 | | | Abbott Laboratories | | | 204,584 | |

| | 2,543 | | | Boston Scientific Corporation(a) | | | 192,175 | |

| | 592 | | | Danaher Corporation | | | 152,026 | |

| | 894 | | | Hologic, Inc.(a) | | | 65,959 | |

| | 630 | | | Stryker Corporation | | | 214,887 | |

| | 395 | | | Thermo Fisher Scientific, Inc. | | | 224,352 | |

| | | | | | | | 1,053,983 | |

| | | | | OFFICE REIT - 0.2% | | | | |

| | 1,070 | | | Boston Properties, Inc. | | | 64,917 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 3.4% | | | | |

| | 3,066 | | | Chevron Corporation | | | 497,612 | |

| | 3,311 | | | ConocoPhillips | | | 385,665 | |

| | 6,661 | | | Marathon Oil Corporation | | | 192,903 | |

| | | | | | | | 1,076,180 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 0.3% | | | | |

| | 2,354 | | | Schlumberger Ltd. | | | 108,025 | |

| | | | | | | | | |

| | | | | RESIDENTIAL REIT - 0.5% | | | | |

| | 1,121 | | | Mid-America Apartment Communities, Inc. | | | 149,889 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 1.7% | | | | |

| | 1,272 | | | BJ’s Wholesale Club Holdings, Inc.(a) | | | 112,025 | |

| | 6,357 | | | Walmart, Inc. | | | 418,036 | |

| | | | | | | | 530,061 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS ALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.7% (Continued) | | | | |

| | | | | RETAIL - DISCRETIONARY - 2.1% | | | | |

| | 1,350 | | | Home Depot, Inc. (The) | | $ | 452,074 | |

| | 1,939 | | | TJX Companies, Inc. (The) | | | 199,911 | |

| | | | | | | | 651,985 | |

| | | | | SEMICONDUCTORS - 10.7% | | | | |

| | 1,838 | | | Advanced Micro Devices, Inc.(a) | | | 306,762 | |

| | 2,065 | | | Applied Materials, Inc. | | | 444,140 | |

| | 1,561 | | | Microchip Technology, Inc. | | | 151,776 | |

| | 2,103 | | | NVIDIA Corporation | | | 2,305,582 | |

| | 1,108 | | | Texas Instruments, Inc. | | | 216,071 | |

| | | | | | | | 3,424,331 | |

| | | | | SOFTWARE - 9.8% | | | | |

| | 957 | | | Cadence Design Systems, Inc.(a) | | | 273,999 | |

| | 403 | | | Intuit, Inc. | | | 232,305 | |

| | 1,045 | | | Manhattan Associates, Inc.(a) | | | 229,419 | |

| | 2,958 | | | Microsoft Corporation | | | 1,227,954 | |

| | 1,800 | | | Oracle Corporation | | | 210,942 | |

| | 1,070 | | | Palo Alto Networks, Inc.(a) | | | 315,554 | |

| | 937 | | | Synopsys, Inc.(a) | | | 525,470 | |

| | 1,511 | | | Zoom Video Communications, Inc., Class A(a) | | | 92,685 | |

| | | | | | | | 3,108,328 | |

| | | | | SPECIALTY FINANCE - 1.4% | | | | |

| | 1,901 | | | American Express Company | | | 456,240 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 5.5% | | | | |

| | 5,892 | | | Apple, Inc. | | | 1,132,738 | |

| | 591 | | | Fabrinet(a) | | | 141,562 | |

| | 1,851 | | | Jabil, Inc. | | | 220,084 | |

| | 4,205 | | | Pure Storage, Inc., Class A(a) | | | 253,519 | |

| | | | | | | | 1,747,903 | |

| | | | | TECHNOLOGY SERVICES - 3.3% | | | | |

| | 1,010 | | | Accenture PLC, Class A | | | 285,112 | |

| | 587 | | | CACI International, Inc., Class A(a) | | | 249,170 | |

| | 1,246 | | | Fiserv, Inc.(a) | | | 186,601 | |

| | 608 | | | Moody’s Corporation | | | 241,370 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS ALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.7% (Continued) | | | | |

| | | | | TECHNOLOGY SERVICES - 3.3% (Continued) | | | | |

| | 3,551 | | | Toast, Inc., Class A(a) | | $ | 86,041 | |

| | | | | | | | 1,048,294 | |

| | | | | TELECOMMUNICATIONS - 0.9% | | | | |

| | 1,561 | | | T-Mobile US, Inc. | | | 273,113 | |

| | | | | | | | | |

| | | | | TRANSPORTATION EQUIPMENT - 0.6% | | | | |

| | 1,649 | | | PACCAR, Inc. | | | 177,269 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $19,356,758) | | | 31,394,648 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 1.4% | | | | |

| | | | | MONEY MARKET FUND - 1.4% | | | | |

| | 433,619 | | | Federated Hermes Treasury Obligations Fund, Institutional Class, 5.17% (Cost $433,619)(b) | | | 433,619 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.1% (Cost $19,790,377) | | $ | 31,828,267 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.1)% | | | (33,231 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 31,795,036 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of May 31, 2024. |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% | | | | |

| | | | | AUTOMOTIVE - 0.8% | | | | |

| | 22,370 | | | Goodyear Tire & Rubber Company (The)(a) | | $ | 275,375 | |

| | | | | | | | | |

| | | | | BANKING - 12.5% | | | | |

| | 11,850 | | | 1st Source Corporation | | | 609,326 | |

| | 15,890 | | | Bank of NT Butterfield & Son Ltd. (The) | | | 541,372 | |

| | 15,744 | | | Equity Bancshares, Inc., Class A | | | 530,573 | |

| | 4,080 | | | First BanCorporation | | | 72,338 | |

| | 12,970 | | | First Community Bankshares, Inc. | | | 450,578 | |

| | 29,951 | | | HBT Financial, Inc. | | | 584,045 | |

| | 3,225 | | | Independent Bank Corporation | | | 80,819 | |

| | 7,240 | | | Mercantile Bank Corporation | | | 277,364 | |

| | 3,000 | | | OFG Bancorp | | | 111,480 | |

| | 12,525 | | | Old Second Bancorp, Inc. | | | 181,112 | |

| | 6,100 | | | SmartFinancial, Inc. | | | 141,154 | |

| | 21,948 | | | Towne Bank | | | 596,766 | |

| | | | | | | | 4,176,927 | |

| | | | | BIOTECH & PHARMA - 3.3% | | | | |

| | 23,500 | | | ADMA Biologics, Inc.(a) | | | 224,425 | |

| | 18,130 | | | HilleVax, Inc.(a) | | | 220,098 | |

| | 39,898 | | | PepGen, Inc.(a) | | | 651,534 | |

| | | | | | | | 1,096,057 | |

| | | | | CHEMICALS - 0.2% | | | | |

| | 4,293 | | | Mativ Holdings, Inc. | | | 77,145 | |

| | | | | | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 2.2% | | | | |

| | 2,977 | | | Cimpress plc(a) | | | 245,632 | |

| | 1,840 | | | Distribution Solutions Group, Inc.(a) | | | 61,419 | |

| | 11,050 | | | Enviri Corporation(a) | | | 97,793 | |

| | 3,663 | | | Huron Consulting Group, Inc.(a) | | | 323,480 | |

| | | | | | | | 728,324 | |

| | | | | CONSTRUCTION MATERIALS - 1.3% | | | | |

| | 57,928 | | | Concrete Pumping Holdings, Inc.(a) | | | 415,344 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% (Continued) | | | | |

| | | | | CONTAINERS & PACKAGING - 1.5% | | | | |

| | 16,954 | | | Karat Packaging, Inc. | | $ | 483,867 | |

| | | | | | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 0.2% | | | | |

| | 7,190 | | | 1-800-Flowers.com, Inc., Class A(a) | | | 69,599 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 7.2% | | | | |

| | 5,342 | | | AAON, Inc. | | | 400,917 | |

| | 943 | | | Belden, Inc. | | | 90,236 | |

| | 5,550 | | | Itron, Inc.(a) | | | 596,903 | |

| | 1,783 | | | Powell Industries, Inc. | | | 320,690 | |

| | 4,697 | | | SPX Technologies, Inc.(a) | | | 654,855 | |

| | 1,541 | | | Watts Water Technologies, Inc., Class A | | | 306,859 | |

| | | | | | | | 2,370,460 | |

| | | | | ENGINEERING & CONSTRUCTION - 2.6% | | | | |

| | 2,045 | | | Arcosa, Inc. | | | 179,776 | |

| | 1,954 | | | Comfort Systems USA, Inc. | | | 639,622 | |

| | 1,914 | | | Tutor Perini Corporation(a) | | | 42,223 | |

| | | | | | | | 861,621 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 1.4% | | | | |

| | 977 | | | Boise Cascade Company | | | 134,132 | |

| | 4,577 | | | Sylvamo Corporation | | | 326,432 | |

| | | | | | | | 460,564 | |

| | | | | GAS & WATER UTILITIES - 0.5% | | | | |

| | 4,889 | | | York Water Company (The) | | | 181,089 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 3.1% | | | | |

| | 16,064 | | | Option Care Health, Inc.(a) | | | 479,029 | |

| | 7,050 | | | Pennant Group, Inc. (The)(a) | | | 165,957 | |

| | 7,482 | | | SI-BONE, Inc.(a) | | | 105,122 | |

| | 10,002 | | | Surgery Partners, Inc.(a) | | | 276,055 | |

| | | | | | | | 1,026,163 | |

| | | | | HOME & OFFICE PRODUCTS - 0.6% | | | | |

| | 4,580 | | | HNI Corporation | | | 215,489 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% (Continued) | | | | |

| | | | | HOME CONSTRUCTION - 2.3% | | | | |

| | 6,240 | | | Green Brick Partners, Inc.(a) | | $ | 340,704 | |

| | 238 | | | M/I Homes, Inc.(a) | | | 29,731 | |

| | 6,800 | | | Taylor Morrison Home Corporation(a) | | | 393,244 | |

| | | | | | | | 763,679 | |

| | | | | HOTEL REIT - 0.3% | | | | |

| | 895 | | | Ryman Hospitality Properties, Inc. | | | 94,038 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 0.6% | | | | |

| | 1,049 | | | elf Beauty, Inc.(a) | | | 196,069 | |

| | | | | | | | | |

| | | | | INDUSTRIAL INTERMEDIATE PROD - 2.7% | | | | |

| | 4,382 | | | AZZ, Inc. | | | 367,562 | |

| | 6,912 | | | Gibraltar Industries, Inc.(a) | | | 521,580 | |

| | | | | | | | 889,142 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 1.7% | | | | |

| | 2,987 | | | Applied Industrial Technologies, Inc. | | | 576,491 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 1.2% | | | | |

| | 5,202 | | | StoneX Group, Inc.(a) | | | 390,514 | |

| | | | | | | | | |

| | | | | INSURANCE - 1.3% | | | | |

| | 6,790 | | | Mercury General Corporation | | | 379,086 | |

| | 456 | | | Palomar Holdings, Inc.(a) | | | 38,687 | |

| | | | | | | | 417,773 | |

| | | | | INTERNET MEDIA & SERVICES - 1.9% | | | | |

| | 12,200 | | | EverQuote, Inc.(a) | | | 291,458 | |

| | 12,925 | | | HealthStream, Inc. | | | 352,723 | |

| | | | | | | | 644,181 | |

| | | | | LEISURE FACILITIES & SERVICES - 1.9% | | | | |

| | 2,063 | | | Light & Wonder, Inc.(a) | | | 196,975 | |

| | 14,033 | | | OneSpaWorld Holdings Ltd.(a) | | | 218,213 | |

| | 19,306 | | | Target Hospitality Corporation(a) | | | 219,317 | |

| | | | | | | | 634,505 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% (Continued) | | | | |

| | | | | MACHINERY - 5.4% | | | | |

| | 6,856 | | | Albany International Corporation, Class A | | $ | 601,408 | |

| | 1,550 | | | Columbus McKinnon Corporation | | | 60,605 | |

| | 2,408 | | | CSW Industrials, Inc. | | | 612,258 | |

| | 3,050 | | | Enerpac Tool Group Corporation | | | 119,926 | |

| | 4,240 | | | Federal Signal Corporation | | | 390,165 | |

| | | | | | | | 1,784,362 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 2.5% | | | | |

| | 1,204 | | | Inspire Medical Systems, Inc.(a) | | | 191,183 | |

| | 7,779 | | | Merit Medical Systems, Inc.(a) | | | 631,266 | |

| | | | | | | | 822,449 | |

| | | | | OIL & GAS PRODUCERS - 1.5% | | | | |

| | 28,163 | | | Excelerate Energy, Inc., Class A | | | 501,583 | |

| | | | | | | | | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 2.0% | | | | |

| | 36,120 | | | DNOW, Inc.(a) | | | 526,991 | |

| | 17,862 | | | Newpark Resources, Inc.(a) | | | 151,470 | |

| | | | | | | | 678,461 | |

| | | | | RENEWABLE ENERGY - 0.3% | | | | |

| | 16,553 | | | Montauk Renewables, Inc.(a) | | | 88,724 | |

| | | | | | | | | |

| | | | | RESIDENTIAL REIT - 0.3% | | | | |

| | 1,495 | | | Centerspace | | | 102,049 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 2.7% | | | | |

| | 6,071 | | | GMS, Inc.(a) | | | 570,430 | |

| | 8,657 | | | J Jill, Inc. | | | 291,741 | |

| | | | | | | | 862,171 | |

| | | | | SEMICONDUCTORS - 3.7% | | | | |

| | 18,270 | | | Amkor Technology, Inc. | | | 595,419 | |

| | 2,913 | | | Onto Innovation, Inc.(a) | | | 631,247 | |

| | | | | | | | 1,226,666 | |

| | | | | SOFTWARE - 13.4% | | | | |

| | 11,455 | | | Adeia, Inc. | | | 135,513 | |

| | 2,564 | | | Agilysys, Inc.(a) | | | 244,785 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% (Continued) | | | | |

| | | | | SOFTWARE - 13.4% (Continued) | | | | |

| | 7,500 | | | Alkami Technology, Inc.(a) | | $ | 205,725 | |

| | 1,258 | | | Appfolio, Inc., Class A(a) | | | 287,227 | |

| | 26,075 | | | Cantaloupe, Inc.(a) | | | 186,697 | |

| | 3,750 | | | Donnelley Financial Solutions, Inc.(a) | | | 228,600 | |

| | 8,247 | | | Intapp, Inc.(a) | | | 296,067 | |

| | 65,252 | | | Olo, Inc.(a) | | | 298,854 | |

| | 18,934 | | | Oscar Health, Inc.(a) | | | 377,923 | |

| | 14,091 | | | PDF Solutions, Inc.(a) | | | 493,466 | |

| | 3,460 | | | PubMatic, Inc., Class A(a) | | | 75,774 | |

| | 12,475 | | | Sapiens International Corp N.V. | | | 418,162 | |

| | 11,564 | | | SEMrush Holdings, Inc.(a) | | | 176,467 | |

| | 6,385 | | | SolarWinds Corporation | | | 73,938 | |

| | 25,314 | | | Viant Technology, Inc.(a) | | | 240,736 | |

| | 39,767 | | | Weave Communications, Inc.(a) | | | 343,985 | |

| | 73,310 | | | Yext, Inc.(a) | | | 370,216 | |

| | | | | | | | 4,454,135 | |

| | | | | SPECIALTY FINANCE - 3.8% | | | | |

| | 4,047 | | | FirstCash Holdings, Inc. | | | 477,222 | |

| | 38,585 | | | OppFi, Inc. | | | 124,630 | |

| | 17,360 | | | PROG Holdings, Inc. | | | 656,034 | |

| | | | | | | | 1,257,886 | |

| | | | | SPECIALTY REITS - 1.5% | | | | |

| | 33,774 | | | Outfront Media, Inc. | | | 488,034 | |

| | | | | | | | | |

| | | | | STEEL - 1.5% | | | | |

| | 4,614 | | | Carpenter Technology Corporation | | | 511,554 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 1.6% | | | | |

| | 667 | | | Super Micro Computer, Inc.(a) | | | 523,268 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 2.0% | | | | |

| | 13,650 | | | LiveRamp Holdings, Inc.(a) | | | 427,109 | |

| | 19,857 | | | Pagseguro Digital Ltd., Class A(a) | | | 243,248 | |

| | | | | | | | 670,357 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL-CAP CORE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.0% (Continued) | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 2.6% | | | | |

| | 13,100 | | | Costamare, Inc. | | $ | 209,731 | |

| | 9,186 | | | Teekay Tankers Ltd., Class A | | | 669,016 | |

| | | | | | | | 878,747 | |

| | | | | TRANSPORTATION EQUIPMENT - 1.9% | | | | |

| | 10,911 | | | Blue Bird Corporation(a) | | | 622,037 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $28,889,451) | | | 32,516,899 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 0.2% | | | | |

| | | | | MONEY MARKET FUND - 0.2% | | | | |

| | 50,328 | | | Federated Hermes Treasury Obligations Fund, Institutional Class, 5.17% (Cost $50,328)(b) | | | 50,328 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 98.2% (Cost $28,939,779) | | $ | 32,567,227 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES- 1.8% | | | 603,595 | |

| | | | | NET ASSETS - 100.0% | | $ | 33,170,822 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of May 31, 2024. |

See accompanying notes which are an integral part of these financial statements.

| ZACKS DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.4% | | | | |

| | | | | AEROSPACE & DEFENSE - 3.1% | | | | |

| | 5,784 | | | General Dynamics Corporation | | $ | 1,733,869 | |

| | 4,538 | | | L3Harris Technologies, Inc. | | | 1,020,279 | |

| | 2,699 | | | Lockheed Martin Corporation, B | | | 1,269,448 | |

| | | | | | | | 4,023,596 | |

| | | | | APPAREL & TEXTILE PRODUCTS - 0.7% | | | | |

| | 10,026 | | | NIKE, Inc., Class B | | | 952,971 | |

| | | | | | | | | |

| | | | | ASSET MANAGEMENT - 2.1% | | | | |

| | 3,471 | | | BlackRock, Inc. | | | 2,679,716 | |

| | | | | | | | | |

| | | | | AUTOMOTIVE - 0.6% | | | | |

| | 60,114 | | | Ford Motor Company | | | 729,183 | |

| | | | | | | | | |

| | | | | BANKING - 10.7% | | | | |

| | 40,489 | | | Bank of America Corporation | | | 1,619,155 | |

| | 14,268 | | | Citigroup, Inc. | | | 889,039 | |

| | 16,196 | | | Citizens Financial Group, Inc. | | | 571,557 | |

| | 44,345 | | | Fifth Third Bancorp | | | 1,659,390 | |

| | 61,312 | | | Huntington Bancshares, Inc. | | | 853,463 | |

| | 26,222 | | | JPMorgan Chase & Company | | | 5,313,365 | |

| | 8,098 | | | PNC Financial Services Group, Inc. (The) | | | 1,274,544 | |

| | 40,489 | | | US Bancorp | | | 1,641,829 | |

| | | | | | | | 13,822,342 | |

| | | | | BEVERAGES - 2.9% | | | | |

| | 30,849 | | | Coca-Cola Company (The) | | | 1,941,327 | |

| | 10,412 | | | PepsiCo, Inc. | | | 1,800,235 | |

| | | | | | | | 3,741,562 | |

| | | | | BIOTECH & PHARMA - 8.0% | | | | |

| | 14,653 | | | AbbVie, Inc. | | | 2,362,650 | |

| | 9,255 | | | Gilead Sciences, Inc. | | | 594,819 | |

| | 18,509 | | | Johnson & Johnson | | | 2,714,715 | |

| | 23,137 | | | Merck & Company, Inc. | | | 2,904,618 | |

| | 61,698 | | | Pfizer, Inc. | | | 1,768,265 | |

| | | | | | | | 10,345,067 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.4% (Continued) | | | | |

| | | | | CABLE & SATELLITE - 1.1% | | | | |

| | 36,633 | | | Comcast Corporation, Class A | | $ | 1,466,419 | |

| | | | | | | | | |

| | | | | CHEMICALS - 2.4% | | | | |

| | 34,705 | | | Dow, Inc. | | | 2,000,049 | |

| | 11,183 | | | Eastman Chemical Company | | | 1,133,173 | |

| | | | | | | | 3,133,222 | |

| | | | | DIVERSIFIED INDUSTRIALS - 1.8% | | | | |

| | 11,183 | | | 3M Company | | | 1,119,866 | |

| | 10,412 | | | Emerson Electric Company | | | 1,167,810 | |

| | | | | | | | 2,287,676 | |

| | | | | ELECTRIC UTILITIES - 3.7% | | | | |

| | 10,797 | | | American Electric Power Company, Inc. | | | 974,429 | |

| | 18,895 | | | Public Service Enterprise Group, Inc. | | | 1,431,485 | |

| | 28,921 | | | Southern Company (The) | | | 2,317,729 | |

| | | | | | | | 4,723,643 | |

| | | | | ELECTRICAL EQUIPMENT - 1.0% | | | | |

| | 17,738 | | | Johnson Controls International plc | | | 1,275,540 | |

| | | | | | | | | |

| | | | | ENGINEERING & CONSTRUCTION - 0.8% | | | | |

| | 6,941 | | | Jacobs Solutions, Inc. | | | 967,159 | |

| | | | | | | | | |

| | | | | GAMING REITS - 0.5% | | | | |

| | 13,882 | | | Gaming and Leisure Properties, Inc. | | | 623,302 | |

| | | | | | | | | |

| | | | | HEALTH CARE REIT - 0.6% | | | | |

| | 36,247 | | | Healthpeak Properties, Inc. | | | 721,315 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 3.0% | | | | |

| | 23,908 | | | Procter & Gamble Company (The) | | | 3,933,823 | |

| | | | | | | | | |

| | | | | INDUSTRIAL REIT - 1.1% | | | | |

| | 13,496 | | | Prologis, Inc. | | | 1,491,173 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.4% (Continued) | | | | |

| | | | | INFRASTRUCTURE REIT - 0.6% | | | | |

| | 7,712 | | | Crown Castle, Inc. | | $ | 790,480 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 1.2% | | | | |

| | 25,065 | | | Bank of New York Mellon Corporation (The) | | | 1,494,125 | |

| | | | | | | | | |

| | | | | INSURANCE - 7.2% | | | | |

| | 14,268 | | | Arthur J Gallagher & Company | | | 3,614,512 | |

| | 35,862 | | | MetLife, Inc. | | | 2,595,333 | |

| | 24,679 | | | Prudential Financial, Inc. | | | 2,970,118 | |

| | | | | | | | 9,179,963 | |

| | | | | LEISURE FACILITIES & SERVICES - 1.4% | | | | |

| | 6,941 | | | McDonald’s Corporation | | | 1,796,955 | |

| | | | | | | | | |

| | | | | MACHINERY - 4.3% | | | | |

| | 7,330 | | | Caterpillar, Inc. | | | 2,481,352 | |

| | 5,829 | | | Parker-Hannifin Corporation | | | 3,098,229 | |

| | | | | | | | 5,579,581 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 2.8% | | | | |

| | 10,026 | | | Abbott Laboratories | | | 1,024,557 | |

| | 4,627 | | | Danaher Corporation | | | 1,188,214 | |

| | 16,196 | | | Medtronic PLC | | | 1,317,868 | |

| | | | | | | | 3,530,639 | |

| | | | | MULTI ASSET CLASS REIT - 0.7% | | | | |

| | 16,196 | | | WP Carey, Inc. | | | 913,454 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 9.3% | | | | |

| | 19,116 | | | Chevron Corporation | | | 3,102,527 | |

| | 24,679 | | | ConocoPhillips | | | 2,874,610 | |

| | 36,633 | | | Exxon Mobil Corporation | | | 4,295,585 | |

| | 82,906 | | | Kinder Morgan, Inc. | | | 1,615,838 | |

| | | | | | | | 11,888,560 | |

| | | | | RETAIL - CONSUMER STAPLES - 1.9% | | | | |

| | 37,019 | | | Walmart, Inc. | | | 2,434,369 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.4% (Continued) | | | | |

| | | | | RETAIL - DISCRETIONARY - 2.5% | | | | |

| | 9,640 | | | Home Depot, Inc. (The) | | $ | 3,228,147 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 5.8% | | | | |

| | 8,483 | | | Applied Materials, Inc. | | | 1,824,524 | |

| | 2,314 | | | Broadcom, Inc. | | | 3,074,265 | |

| | 13,111 | | | QUALCOMM, Inc. | | | 2,675,300 | |

| | | | | | | | 7,574,089 | |

| | | | | SOFTWARE - 4.7% | | | | |

| | 11,954 | | | Microsoft Corporation | | | 4,962,464 | |

| | 8,869 | | | Oracle Corporation | | | 1,039,358 | |

| | | | | | | | 6,001,822 | |

| | | | | SPECIALTY FINANCE - 0.5% | | | | |

| | 11,954 | | | Fidelity National Financial, Inc. | | | 602,003 | |

| | | | | | | | | |

| | | | | SPECIALTY REITS - 1.1% | | | | |

| | 11,954 | | | Lamar Advertising Company, Class A | | | 1,411,887 | |

| | | | | | | | | |

| | | | | STEEL - 0.6% | | | | |

| | 4,242 | | | Nucor Corporation | | | 716,262 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 2.0% | | | | |

| | 54,371 | | | Cisco Systems, Inc. | | | 2,528,252 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 1.1% | | | | |

| | 8,098 | | | International Business Machines Corporation | | | 1,351,151 | |

| | | | | | | | | |

| | | | | TELECOMMUNICATIONS - 3.1% | | | | |

| | 81,750 | | | AT&T, Inc. | | | 1,489,485 | |

| | 57,842 | | | Verizon Communications, Inc. | | | 2,380,198 | |

| | | | | | | | 3,869,683 | |

| | | | | TOBACCO & CANNABIS - 2.7% | | | | |

| | 22,751 | | | Altria Group, Inc. | | | 1,052,234 | |

| | 23,137 | | | Philip Morris International, Inc. | | | 2,345,629 | |

| | | | | | | | 3,397,863 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.4% (Continued) | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 1.8% | | | | |

| | 48,201 | | | CSX Corporation | | $ | 1,626,784 | |

| | 5,013 | | | United Parcel Service, Inc., B | | | 696,456 | |

| | | | | | | | 2,323,240 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $107,127,817) | | | 127,530,234 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 0.6% | | | | |

| | | | | MONEY MARKET FUND - 0.6% | | | | |

| | 706,887 | | | Federated Hermes Treasury Obligations Fund, Institutional Class, 5.17% (Cost $706,887)(a) | | | 706,887 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.0% (Cost $107,834,704) | | $ | 128,237,121 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - 0.0% | | | (24,950 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 128,212,171 | |

| (a) | Rate disclosed is the seven day effective yield as of May 31, 2024. |

See accompanying notes which are an integral part of these financial statements.

| Zacks Funds |

| STATEMENTS OF ASSETS AND LIABILITIES (Unaudited) |

| May 31, 2024 |

| | | Zacks All-Cap Core | | | Zacks Small-Cap | | | | |

| | | Fund | | | Core Fund | | | Zacks Dividend Fund | |

| ASSETS | | | | | | | | | | | | |

| Investment securities: | | | | | | | | | | | | |

| At cost | | $ | 19,790,377 | | | $ | 28,939,779 | | | $ | 107,834,704 | |

| At fair value | | $ | 31,828,267 | | | $ | 32,567,227 | | | $ | 128,237,121 | |

| Receivable for securities sold | | | — | | | | 5,615,221 | | | | — | |

| Receivable for fund shares sold | | | 296 | | | | 5,367 | | | | 117,058 | |

| Dividends and interest receivable | | | 42,898 | | | | 11,376 | | | | 343,718 | |

| Prepaid expenses | | | — | | | | — | | | | 2,942 | |

| TOTAL ASSETS | | | 31,871,461 | | | | 38,199,191 | | | | 128,700,839 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Payable for investments purchased | | | — | | | | 4,929,466 | | | | — | |

| Investment advisory fees payable | | | 55,291 | | | | 65,946 | | | | 282,560 | |

| Distribution (12b-1) fees payable | | | — | | | | 12,039 | | | | 22,779 | |

| Payable for Fund shares redeemed | | | — | | | | 132 | | | | 117,600 | |

| Payable to related parties | | | 1,741 | | | | 2,494 | | | | 7,145 | |

| Accrued expenses and other liabilities | | | 19,393 | | | | 18,292 | | | | 58,584 | |

| TOTAL LIABILITIES | | | 76,425 | | | | 5,028,369 | | | | 488,668 | |

| NET ASSETS | | $ | 31,795,036 | | | $ | 33,170,822 | | | $ | 128,212,171 | |

| | | | | | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | | | | | |

| Paid in capital | | $ | 17,179,721 | | | $ | 26,316,885 | | | $ | 105,043,034 | |

| Accumulated earnings | | | 14,615,315 | | | | 6,853,937 | | | | 23,169,137 | |

| NET ASSETS | | $ | 31,795,036 | | | $ | 33,170,822 | | | $ | 128,212,171 | |

| | | | | | | | | | | | | |

| Net Asset Value Per Share: | | | | | | | | | | | | |

| Investor Class Shares: | | | | | | | | | | | | |

| Net Assets | | | | | | $ | 14,989,081 | | | $ | 27,192,161 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | | | | | 428,260 | | | | 1,088,741 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | | | | | | $ | 35.00 | | | $ | 24.98 | |

| | | | | | | | | | | | | |

| Institutional Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 31,795,036 | | | $ | 18,181,741 | | | $ | 101,020,010 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | 1,179,129 | | | | 508,660 | | | | 4,109,192 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | | $ | 26.96 | | | $ | 35.74 | | | $ | 24.58 | |

| (a) | Redemptions of shares held less than 30 days may be assessed a redemption fee of 1.00%. |

| * | NAV may not recalculate due to rounding of shares. |

See accompanying notes which are an integral part of these financial statements.

| Zacks Funds |

| STATEMENTS OF OPERATIONS (Unaudited) |

| For the Six Months Ended May 31, 2024 |

| | | Zacks All-Cap | | | Zacks Small-Cap | | | Zacks Dividend | |

| | | Core Fund | | | Core Fund | | | Fund | |

| INVESTMENT INCOME | | | | | | | | | | | | |

| Dividends | | $ | 234,833 | | | $ | 189,673 | | | $ | 2,326,211 | |

| Interest | | | 5,598 | | | | 7,245 | | | | 29,096 | |

| Less: Foreign withholding taxes | | | — | | | | (348 | ) | | | (342 | ) |

| TOTAL INVESTMENT INCOME | | | 240,431 | | | | 196,570 | | | | 2,354,965 | |

| | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | |

| Investment advisory fees | | | 150,096 | | | | 151,277 | | | | 604,698 | |

| Distribution (12b-1) fees: | | | | | | | | | | | | |

| Investor Class | | | — | | | | 18,749 | | | | 36,201 | |

| Administrative services fees | | | 29,757 | | | | 20,307 | | | | 62,382 | |

| Registration fees | | | 22,306 | | | | 18,917 | | | | 24,768 | |

| Transfer agent fees | | | 16,586 | | | | 11,762 | | | | 43,188 | |

| Legal fees | | | 11,382 | | | | 9,743 | | | | 11,044 | |

| Custodian fees | | | 9,609 | | | | 3,516 | | | | 15,309 | |

| Audit fees | | | 7,081 | | | | 7,409 | | | | 8,264 | |

| Trustees fees and expenses | | | 5,559 | | | | 5,348 | | | | 6,852 | |

| Compliance officer fees | | | 3,972 | | | | 3,164 | | | | 10,491 | |

| Printing and postage expenses | | | 3,207 | | | | 2,329 | | | | 12,140 | |

| Insurance expense | | | 1,745 | | | | 3,475 | | | | 3,747 | |

| Other expenses | | | 2,796 | | | | 1,765 | | | | 9,764 | |

| TOTAL EXPENSES | | | 264,096 | | | | 257,761 | | | | 848,848 | |

| | | | | | | | | | | | | |

| Less: Expenses waived by the Adviser | | | (76,508 | ) | | | (47,423 | ) | | | (18,980 | ) |

| NET EXPENSES | | | 187,588 | | | | 210,338 | | | | 829,868 | |

| NET INVESTMENT INCOME (LOSS) | | | 52,843 | | | | (13,768 | ) | | | 1,525,097 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | | | | | |

| Net realized gain from investments | | | 2,734,849 | | | | 3,160,140 | | | | 2,036,462 | |

| Net change in unrealized appreciation on investments | | | 3,855,008 | | | | 1,780,922 | | | | 16,866,750 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 6,589,857 | | | | 4,941,062 | | | | 18,903,212 | |

| | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 6,642,700 | | | $ | 4,927,294 | | | $ | 20,428,309 | |

See accompanying notes which are an integral part of these financial statements.

| Zacks All-Cap Core Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | Year Ended | |

| | | May 31, 2024 | | | November 30, 2023 | |

| | | (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 52,843 | | | $ | 259,415 | |

| Net realized gain from investments | | | 2,734,849 | | | | 8,376,875 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 3,855,008 | | | | (3,875,704 | ) |

| Net increase in net assets resulting from operations | | | 6,642,700 | | | | 4,760,586 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total distributions paid: | | | | | | | | |

| Institutional Class | | | (8,757,374 | ) | | | (5,694,119 | ) |

| Net decrease in net assets resulting from distributions to shareholders | | | (8,757,374 | ) | | | (5,694,119 | ) |

| | | | | | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Institutional Class | | | 4,732,384 | | | | 18,392,081 | |

| Net asset value of shares issued in reinvestment of distributions: | | | | | | | | |

| Institutional Class | | | 5,335,116 | | | | 2,403,971 | |

| Payments for shares redeemed: | | | | | | | | |

| Institutional Class + | | | (16,021,645 | ) | | | (32,588,068 | ) |

| Net decrease in net assets resulting from shares of beneficial interest | | | (5,954,145 | ) | | | (11,792,016 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (8,068,819 | ) | | | (12,725,549 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Period | | | 39,863,855 | | | | 52,589,404 | |

| End of Period | | $ | 31,795,036 | | | $ | 39,863,855 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Shares Sold | | | 195,259 | | | | 683,138 | |

| Shares Reinvested | | | 225,873 | | | | 93,868 | |

| Shares Redeemed | | | (618,301 | ) | | | (1,202,211 | ) |

| Net decrease in shares of beneficial interest outstanding | | | (197,169 | ) | | | (425,205 | ) |

| + | Net of redemption fee proceeds received of $0 and $17, respectively. |

See accompanying notes which are an integral part of these financial statements.

| Zacks Small-Cap Core Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | Year Ended | |

| | | May 31, 2024 | | | November 30, 2023 | |

| | | (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income (loss) | | $ | (13,768 | ) | | $ | 1,952 | |

| Net realized gain from investments | | | 3,160,140 | | | | 1,621,998 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,780,922 | | | | (1,325,023 | ) |

| Net increase in net assets resulting from operations | | | 4,927,294 | | | | 298,927 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total distributions paid: | | | | | | | | |

| Investor Class | | | (820,807 | ) | | | (72,916 | ) |

| Institutional Class | | | (678,791 | ) | | | (162,226 | ) |

| Net decrease in net assets resulting from distributions to shareholders | | | (1,499,598 | ) | | | (235,142 | ) |

| | | | | | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Investor Class | | | 1,280,542 | | | | 855,782 | |

| Institutional Class | | | 498,674 | | | | 1,623,781 | |

| Net asset value of shares issued in reinvestment of distributions: | | | | | | | | |

| Investor Class | | | 790,824 | | | | 67,993 | |

| Institutional Class | | | 653,208 | | | | 157,711 | |

| Payments for shares redeemed: | | | | | | | | |

| Investor Class + | | | (2,973,565 | ) | | | (2,765,183 | ) |

| Institutional Class ++ | | | (1,985,704 | ) | | | (6,318,046 | ) |

| Net decrease in net assets resulting from shares of beneficial interest | | | (1,736,021 | ) | | | (6,377,962 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 1,691,675 | | | | (6,314,177 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Period | | | 31,479,147 | | | | 37,793,324 | |