united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-23435 |

| Zacks Trust |

| (Exact name of registrant as specified in charter) |

| 227 West Monroe Street Suite 4350, Chicago, IL | 60606 |

| (Address of principal executive offices) | (Zip code) |

| Corporation Trust Company |

| 1209 Orange Street Wilmington, Delaware 19808 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 312-265-9359 |

| Date of fiscal year end: | 11/30 | |

| | | |

| Date of reporting period: | 5/31 | |

Item 1. Reports to Stockholders.

(a)

Zacks Earnings Consistent Portfolio ETF

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Zacks Earnings Consistent Portfolio ETF for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksetfs.com/resources.php. You can also request this information by contacting us at 1-855-813-3507.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Zacks Earnings Consistent Portfolio ETF | $28 | 0.55% |

How did the Fund perform during the reporting period?

During the six-month period from December 1, 2023, to May 31, 2024, the ZECP portfolio delivered a return of +11.38%, underperforming the Russell 3000 Index by -4.61%. Our underperformance was largely selection-driven, based on investment parameters within the portfolio.

ZECP is designed to invest in those companies that we expect to exhibit consistent earnings growth in the future. Our experience has been that companies that have historically been able to grow earnings consistently throughout various economic cycles are more likely to possess some degree of competitive advantage. Our view is that companies that have delivered consistent earnings historically tend to also possess “investment moats,” or a sustainable competitive advantages that can drive persistent earnings growth in the future.

Since the investment mandate on ZECP is based on earnings consistency factors—such as selecting companies with stable and predictable earnings—ZECP tends not to perform as well during a bullish or upward-trending market. In such market conditions, investors often favor higher-risk, high-growth stocks versus stable, consistent earners. Year-to-date performance in 2024 is a prime example of this investor preference playing out.

However, the same companies that generate stable earnings are valuable for providing downside protection when the market experiences downturns or increased volatility. These companies typically offer more resilience and stability, helping to cushion the portfolio against significant losses, as they have successfully weathered adverse market conditions in the past. Long stretches of positive performance, as we’ve seen in markets recently, tend to give way to higher levels of volatility in the future. ZECP is a valuable core holding in any portfolio for this reason, in our view, and we believe a continued focus on quality companies with stable and predictable earnings will help smooth out returns over time.

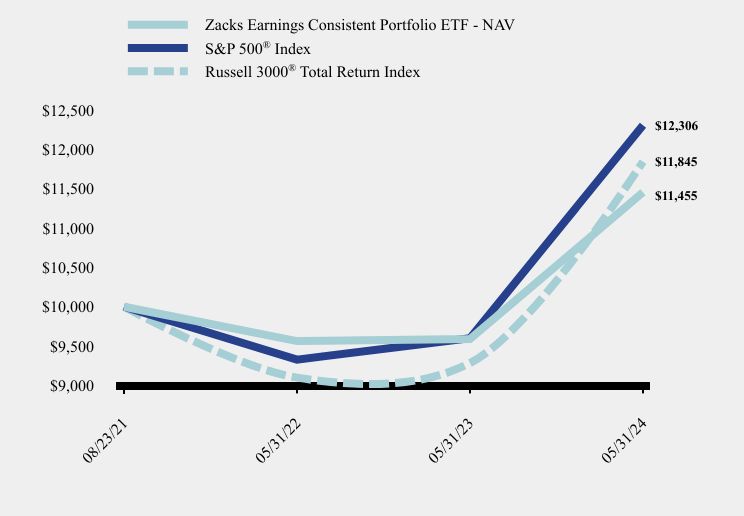

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Zacks Earnings Consistent Portfolio ETF - NAV | S&P 500® Index | Russell 3000® Total Return Index |

|---|

| 08/23/21 | $10,000 | $10,000 | $10,000 |

| 05/31/22 | $9,563 | $9,327 | $9,099 |

| 05/31/23 | $9,589 | $9,600 | $9,284 |

| 05/31/24 | $11,455 | $12,306 | $11,845 |

Average Annual Total Returns

| Name | 6 months | 1 Year | Since Inception (August 23, 2021) |

|---|

| Zacks Earnings Consistent Portfolio ETF - NAV | 11.38% | 19.46% | 5.03% |

| Zacks Earnings Consistent Portfolio ETF - Market Price | 11.26% | 19.16% | 5.01% |

Russell 3000® Total Return Index | 15.99% | 27.58% | 6.30% |

S&P 500® Index | 16.35% | 28.19% | 7.78% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $133,784,317 |

| Number of Portfolio Holdings | 53 |

| Advisory Fee | $54,276 |

| Portfolio Turnover | 3% |

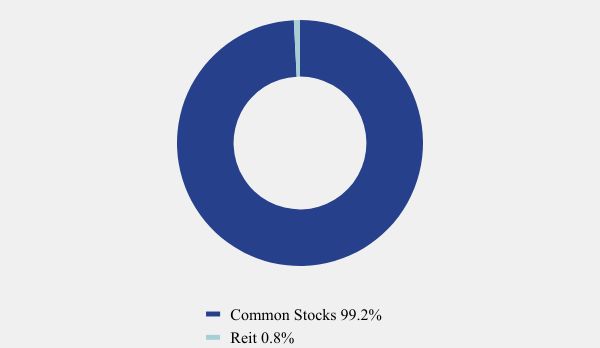

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.2% |

| Reit | 0.8% |

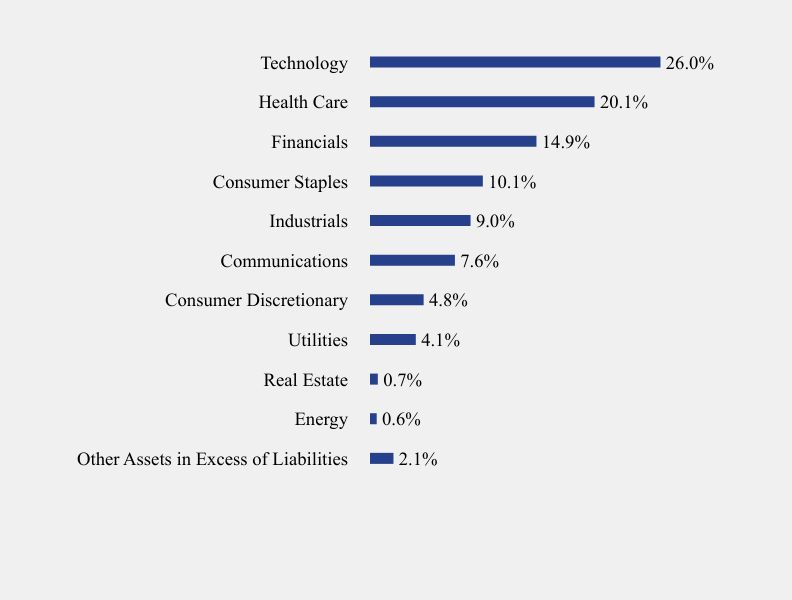

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.1% |

| Energy | 0.6% |

| Real Estate | 0.7% |

| Utilities | 4.1% |

| Consumer Discretionary | 4.8% |

| Communications | 7.6% |

| Industrials | 9.0% |

| Consumer Staples | 10.1% |

| Financials | 14.9% |

| Health Care | 20.1% |

| Technology | 26.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Microsoft Corporation | 6.9% |

| Apple, Inc. | 6.4% |

| Alphabet, Inc., Class A | 5.5% |

| Procter & Gamble Company (The) | 3.1% |

| Synopsys, Inc. | 2.9% |

| Eli Lilly & Company | 2.9% |

| UnitedHealth Group, Inc. | 2.9% |

| JPMorgan Chase & Company | 2.8% |

| Caterpillar, Inc. | 2.7% |

| American Express Company | 2.6% |

No material changes occurred during the period ended May 31, 2024.

Zacks Earnings Consistent Portfolio ETF

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Zacks Earnings Consistent Portfolio ETF for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksetfs.com/resources.php. You can also request this information by contacting us at 1-855-813-3507.

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about Zacks Small/Mid Cap ETF for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksetfs.com/resources.php. You can also request this information by contacting us at 1-855-813-3507.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Zacks Small/Mid Cap ETF | $28 | 0.55% |

How did the Fund perform during the reporting period?

In the six-month period from December 1, 2023 to May 31, 2024, the Zacks Small/Mid-Cap Fund (SMIZ) returned +17.45%, significantly outperforming the benchmark Russell 2500 Index, which rose a lesser +15.04% over the same period. Our stock selection and allocations in SMIZ drove an outperformance of +3.07% compared to the Russell 2500 Index. The top-performing sector in the Zacks Small/Mid-Cap Fund was Health Care, which rose +27.88%. SMIZ’s Health Care weighting was 11.69% compared to its 5.63% weighting in the Russell 2500 Index. The stock selection and over allocation contributed to +1.31% of the +3.07% outperformance of the Russell 2500 Index. In SMIZ, we seek to own companies that we expect to receive upward earnings estimate revisions in the future. Our proprietary earnings estimate revision model worked relatively well during the six-month period and contributed significantly to our outperformance compared to the Russell 2500 Index. In a market that is rising due to an expansion of P/E multiples, companies that experience upward earnings estimate revisions are generally more likely to outperform. This outperformance tends to occur because of the value the market places on projected earnings. We believe the portfolio benefited from this effect over the past six months. Currently, the portfolio consists of roughly 200 companies, half of which would be considered small-cap stocks and half of which would be considered mid-cap stocks. From a pure valuation standpoint, small-cap and mid-cap stocks generally trade at a historically larger discount to their large-cap peers. This discount persists even though many small-cap and mid-cap companies have similar profit and free cash flow margins to their larger-cap peers. Indeed, over the past decade, small- and mid-cap companies have grown earnings—on average—faster than their large-cap peers, but stock price appreciation over that time has lagged their large-cap peers. For these reasons, we believe SMIZ is positioned for more favorable growth looking forward, and should warrant an allocation in any balanced portfolio.

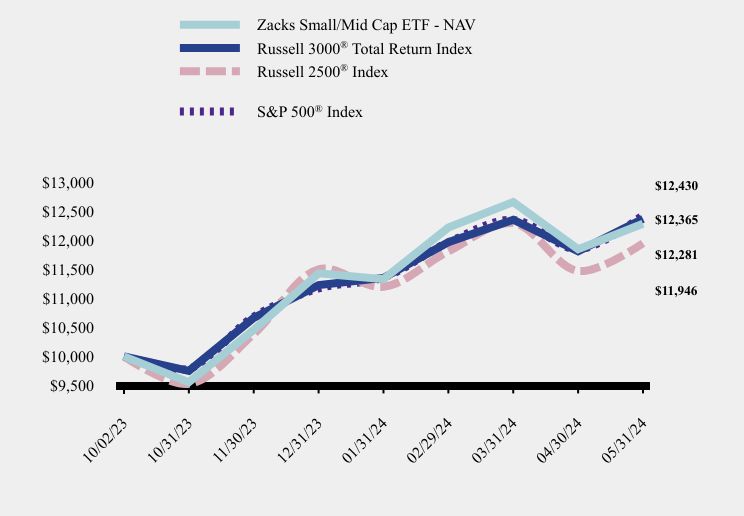

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Zacks Small/Mid Cap ETF - NAV | Russell 3000® Total Return Index | Russell 2500® Index | S&P 500® Index |

|---|

| 10/02/23 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/31/23 | $9,556 | $9,751 | $9,527 | $9,789 |

| 11/30/23 | $10,456 | $10,660 | $10,384 | $10,683 |

| 12/31/23 | $11,428 | $11,226 | $11,497 | $11,168 |

| 01/31/24 | $11,328 | $11,350 | $11,197 | $11,356 |

| 02/29/24 | $12,217 | $11,965 | $11,806 | $11,962 |

| 03/31/24 | $12,657 | $12,351 | $12,293 | $12,347 |

| 04/30/24 | $11,844 | $11,807 | $11,469 | $11,843 |

| 05/31/24 | $12,281 | $12,365 | $11,946 | $12,430 |

Average Annual Total Returns

| Name | 6 months | Since Inception (October 2, 2023) |

|---|

| Zacks Small/Mid Cap ETF - NAV | 17.45% | 22.81% |

| Zacks Small/Mid Cap ETF - Market Price | 17.34% | 22.93% |

Russell 2500® Index | 15.04% | 19.46% |

Russell 3000® Total Return Index | 15.99% | 23.65% |

S&P 500® Index | 16.35% | 24.30% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $52,923,996 |

| Number of Portfolio Holdings | 199 |

| Advisory Fee | $0 |

| Portfolio Turnover | 46% |

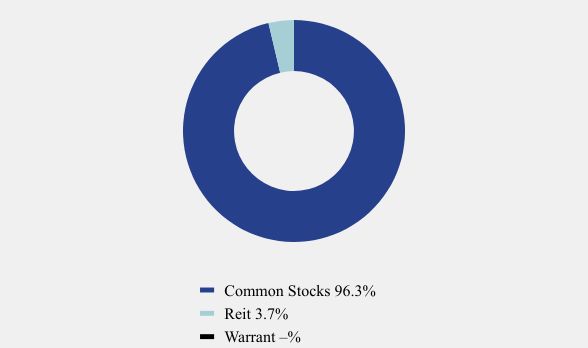

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 96.3% |

| Reit | 3.7% |

| Warrant | -% |

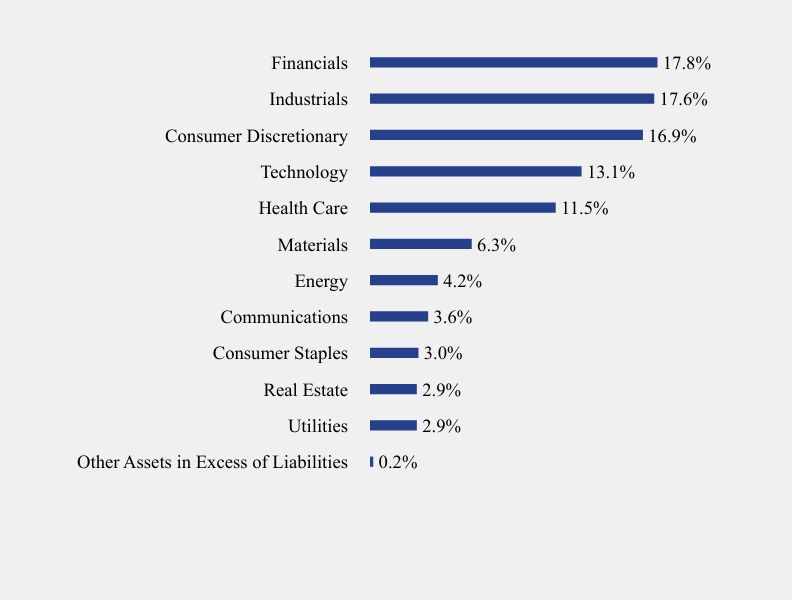

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.2% |

| Utilities | 2.9% |

| Real Estate | 2.9% |

| Consumer Staples | 3.0% |

| Communications | 3.6% |

| Energy | 4.2% |

| Materials | 6.3% |

| Health Care | 11.5% |

| Technology | 13.1% |

| Consumer Discretionary | 16.9% |

| Industrials | 17.6% |

| Financials | 17.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| EMCOR Group, Inc. | 1.9% |

| Sylvamo Corporation | 1.3% |

| Constellation Energy Corporation | 1.2% |

| Builders FirstSource, Inc. | 1.2% |

| Esab Corporation | 1.1% |

| BellRing Brands, Inc. | 1.1% |

| Murphy USA, Inc. | 1.1% |

| NetApp, Inc. | 1.0% |

| Cadence Design Systems, Inc. | 1.0% |

| Applied Industrial Technologies, Inc. | 1.0% |

No material changes occurred during the period ended May 31, 2024.

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

This semi-annual shareholder report contains important information about Zacks Small/Mid Cap ETF for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://zacksetfs.com/resources.php. You can also request this information by contacting us at 1-855-813-3507.

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

Not applicable

Item 3. Audit Committee Financial Expert.

Not applicable

Item 4. Principal Accountant Fees and Services.

Not applicable

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| Zacks Earnings Consistent Portfolio ETF |

| |

| (ZECP) |

| |

| |

| |

| |

| Zacks Small/Mid Cap ETF |

| |

| (SMIZ) |

| |

| |

| |

| |

| |

| Semi-Annual Report |

| |

| May 31, 2024 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 1-855-813-3507 |

| |

| www.ZacksETFs.com |

| |

| |

| |

| |

| |

| ZACKS EARNINGS CONSISTENT PORTFOLIO ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.9% | | | | |

| | | | | AEROSPACE & DEFENSE - 1.1% | | | | |

| | 4,779 | | | General Dynamics Corporation | | $ | 1,432,601 | |

| | | | | | | | | |

| | | | | ASSET MANAGEMENT - 2.7% | | | | |

| | 5,901 | | | Ameriprise Financial, Inc. | | | 2,576,436 | |

| | 1,331 | | | BlackRock, Inc. | | | 1,027,572 | |

| | | | | | | | 3,604,008 | |

| | | | | BANKING - 3.9% | | | | |

| | 18,827 | | | JPMorgan Chase & Company | | | 3,814,915 | |

| | 9,120 | | | PNC Financial Services Group, Inc. (The) | | | 1,435,397 | |

| | | | | | | | 5,250,312 | |

| | | | | BEVERAGES - 2.1% | | | | |

| | 15,958 | | | PepsiCo, Inc. | | | 2,759,138 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 9.3% | | | | |

| | 7,023 | | | Amgen, Inc. | | | 2,147,985 | |

| | 4,753 | | | Eli Lilly & Company | | | 3,899,075 | |

| | 13,860 | | | Johnson & Johnson | | | 2,032,846 | |

| | 17,796 | | | Merck & Company, Inc. | | | 2,234,110 | |

| | 4,742 | | | Vertex Pharmaceuticals, Inc.(a) | | | 2,159,222 | |

| | | | | | | | 12,473,238 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 3.7% | | | | |

| | 3,803 | | | Cintas Corporation | | | 2,578,320 | |

| | 13,122 | | | Republic Services, Inc. | | | 2,430,063 | |

| | | | | | | | 5,008,383 | |

| | | | | DIVERSIFIED INDUSTRIALS - 1.5% | | | | |

| | 9,684 | | | Honeywell International, Inc. | | | 1,958,008 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 4.1% | | | | |

| | 28,521 | | | American Electric Power Company, Inc. | | | 2,574,020 | |

| | 17,125 | | | NextEra Energy, Inc. | | | 1,370,343 | |

| | 19,378 | | | Southern Company (The) | | | 1,552,953 | |

| | | | | | | | 5,497,316 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS EARNINGS CONSISTENT PORTFOLIO ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.9% (Continued) | | | | |

| | | | | FOOD - 1.7% | | | | |

| | 11,242 | | | Hershey Company (The) | | $ | 2,224,005 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 5.3% | | | | |

| | 9,306 | | | Cardinal Health, Inc. | | | 923,807 | |

| | 5,332 | | | Labcorp Holdings, Inc. | | | 1,039,260 | |

| | 3,805 | | | Molina Healthcare, Inc.(a) | | | 1,196,977 | |

| | 7,819 | | | UnitedHealth Group, Inc. | | | 3,873,298 | |

| | | | | | | | 7,033,342 | |

| | | | | HOUSEHOLD PRODUCTS - 3.9% | | | | |

| | 10,881 | | | Church & Dwight Company, Inc. | | | 1,164,376 | |

| | 25,636 | | | Procter & Gamble Company (The) | | | 4,218,147 | |

| | | | | | | | 5,382,523 | |

| | | | | INDUSTRIAL REIT - 0.7% | | | | |

| | 8,919 | | | Prologis, Inc. | | | 985,460 | |

| | | | | | | | | |

| | | | | INSURANCE - 5.7% | | | | |

| | 25,498 | | | Hartford Financial Services Group, Inc. (The) | | | 2,637,768 | |

| | 14,277 | | | Marsh & McLennan Companies, Inc. | | | 2,963,619 | |

| | 27,589 | | | MetLife, Inc. | | | 1,996,616 | |

| | | | | | | | 7,598,003 | |

| | | | | INTERNET MEDIA & SERVICES - 7.6% | | | | |

| | 42,931 | | | Alphabet, Inc., Class A(a) | | | 7,405,597 | |

| | 4,322 | | | Netflix, Inc.(a) | | | 2,773,082 | |

| | | | | | | | 10,178,679 | |

| | | | | LEISURE FACILITIES & SERVICES - 2.4% | | | | |

| | 7,966 | | | Marriott International, Inc., Class A | | | 1,841,500 | |

| | 5,157 | | | McDonald’s Corporation | | | 1,335,096 | |

| | | | | | | | 3,176,596 | |

| | | | | MACHINERY - 2.7% | | | | |

| | 10,674 | | | Caterpillar, Inc. | | | 3,613,362 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 5.5% | | | | |

| | 15,022 | | | Abbott Laboratories | | | 1,535,098 | |

| | 18,821 | | | Boston Scientific Corporation(a) | | | 1,422,303 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS EARNINGS CONSISTENT PORTFOLIO ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.9% (Continued) | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 5.5% (Continued) | | | | |

| | 4,535 | | | Danaher Corporation | | $ | 1,164,588 | |

| | 4,762 | | | Stryker Corporation | | | 1,624,271 | |

| | 2,856 | | | Thermo Fisher Scientific, Inc. | | | 1,622,151 | |

| | | | | | | | 7,368,411 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 0.6% | | | | |

| | 17,489 | | | Schlumberger Ltd. | | | 802,570 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 2.4% | | | | |

| | 47,841 | | | Walmart, Inc. | | | 3,146,024 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 2.5% | | | | |

| | 9,909 | | | Home Depot, Inc. (The) | | | 3,318,227 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 2.1% | | | | |

| | 11,614 | | | Microchip Technology, Inc. | | | 1,129,229 | |

| | 8,381 | | | Texas Instruments, Inc. | | | 1,634,379 | |

| | | | | | | | 2,763,608 | |

| | | | | SOFTWARE - 12.2% | | | | |

| | 3,034 | | | Intuit, Inc. | | | 1,748,919 | |

| | 22,230 | | | Microsoft Corporation | | | 9,228,340 | |

| | 13,524 | | | Oracle Corporation | | | 1,584,878 | |

| | 7,022 | | | Synopsys, Inc.(a) | | | 3,937,938 | |

| | | | | | | | 16,500,075 | |

| | | | | SPECIALTY FINANCE - 2.6% | | | | |

| | 14,444 | | | American Express Company | | | 3,466,560 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 7.6% | | | | |

| | 44,895 | | | Apple, Inc. | | | 8,631,063 | |

| | 13,125 | | | Jabil, Inc. | | | 1,560,563 | |

| | | | | | | | 10,191,626 | |

| | | | | TECHNOLOGY SERVICES - 4.0% | | | | |

| | 7,438 | | | Accenture PLC, Class A | | | 2,099,673 | |

| | 9,315 | | | Fiserv, Inc.(a) | | | 1,395,014 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS EARNINGS CONSISTENT PORTFOLIO ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 97.9% (Continued) | | | | |

| | | | | TECHNOLOGY SERVICES - 4.0% (Continued) | | | | |

| | 4,544 | | | Moody’s Corporation | | $ | 1,803,923 | |

| | | | | | | | 5,298,610 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $117,998,287) | | | 131,030,685 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 97.9% (Cost $117,998,287) | | $ | 131,030,685 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES- 2.1% | | | 2,757,157 | |

| | | | | NET ASSETS - 100.0% | | $ | 133,787,842 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% | | | | |

| | | | | ADVERTISING & MARKETING - 0.3% | | | | |

| | 1,926 | | | Omnicom Group, Inc. | | $ | 179,041 | |

| | | | | | | | | |

| | | | | AEROSPACE & DEFENSE - 0.5% | | | | |

| | 2,863 | | | Textron, Inc. | | | 250,827 | |

| | | | | | | | | |

| | | | | ASSET MANAGEMENT - 2.1% | | | | |

| | 6,566 | | | Artisan Partners Asset Management, Inc., Class A | | | 289,101 | |

| | 4,796 | | | Janus Henderson Group plc | | | 160,666 | |

| | 1,386 | | | KKR & Company, Inc. | | | 142,536 | |

| | 4,187 | | | T Rowe Price Group, Inc. | | | 493,354 | |

| | | | | | | | 1,085,657 | |

| | | | | AUTOMOTIVE - 0.9% | | | | |

| | 23,229 | | | Goodyear Tire & Rubber Company (The)(a) | | | 285,949 | |

| | 1,830 | | | Modine Manufacturing Company(a) | | | 184,684 | |

| | | | | | | | 470,633 | |

| | | | | BANKING - 5.2% | | | | |

| | 14,865 | | | Alerus Financial Corporation | | | 287,489 | |

| | 3,035 | | | City Holding Company | | | 310,238 | |

| | 27,217 | | | Colony Bankcorp, Inc. | | | 328,781 | |

| | 4,324 | | | Equity Bancshares, Inc., Class A | | | 145,719 | |

| | 23,915 | | | First Horizon Corporation | | | 378,814 | |

| | 25,998 | | | Fulton Financial Corporation | | | 437,806 | |

| | 3,411 | | | Preferred Bank | | | 254,870 | |

| | 9,900 | | | Premier Financial Corporation | | | 195,129 | |

| | 10,420 | | | Synovus Financial Corporation | | | 413,570 | |

| | | | | | | | 2,752,416 | |

| | | | | BEVERAGES - 0.4% | | | | |

| | 4,155 | | | Molson Coors Beverage Company, Class B | | | 227,736 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 4.5% | | | | |

| | 45,696 | | | ADMA Biologics, Inc.(a) | | | 436,397 | |

| | 9,677 | | | Alkermes plc(a) | | | 226,442 | |

| | 66,210 | | | Allogene Therapeutics, Inc.(a) | | | 165,525 | |

| | 13,310 | | | Arvinas, Inc.(a) | | | 441,093 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% (Continued) | | | | |

| | | | | BIOTECH & PHARMA - 4.5% (Continued) | | | | |

| | 1,515 | | | BioMarin Pharmaceutical, Inc.(a) | | $ | 113,731 | |

| | 46,680 | | | Heron Therapeutics, Inc.(a) | | | 172,716 | |

| | 5,186 | | | Janux Therapeutics, Inc.(a) | | | 277,451 | |

| | 1,279 | | | Krystal Biotech, Inc.(a) | | | 204,704 | |

| | 10,153 | | | Organon & Company | | | 216,563 | |

| | 66,940 | | | Rigel Pharmaceuticals, Inc.(a) | | | 65,454 | |

| | 102,418 | | | Sangamo Therapeutics, Inc.(a) | | | 57,805 | |

| | | | | | | | 2,377,881 | |

| | | | | CHEMICALS - 2.2% | | | | |

| | 11,120 | | | Axalta Coating Systems Ltd.(a) | | | 395,761 | |

| | 114,221 | | | Danimer Scientific, Inc.(a) | | | 89,058 | |

| | 40,335 | | | Perimeter Solutions S.A.(a) | | | 306,546 | |

| | 2,132 | | | Quaker Chemical Corporation | | | 386,638 | |

| | | | | | | | 1,178,003 | |

| | | | | CONSTRUCTION MATERIALS - 0.5% | | | | |

| | 1,104 | | | Vulcan Materials Company | | | 282,370 | |

| | | | | | | | | |

| | | | | CONSUMER SERVICES - 1.3% | | | | |

| | 10,465 | | | Coursera, Inc.(a) | | | 79,534 | |

| | 12,305 | | | Perdoceo Education Corporation | | | 276,863 | |

| | 5,148 | | | Stride, Inc.(a) | | | 353,461 | |

| | | | | | | | 709,858 | |

| | | | | CONTAINERS & PACKAGING - 0.5% | | | | |

| | 9,770 | | | Karat Packaging, Inc. | | | 278,836 | |

| | | | | | | | | |

| | | | | DIVERSIFIED INDUSTRIALS - 0.4% | | | | |

| | 1,725 | | | ITT, Inc. | | | 229,218 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 2.1% | | | | |

| | 2,280 | | | Consolidated Edison, Inc. | | | 215,574 | |

| | 2,990 | | | Constellation Energy Corporation | | | 649,577 | |

| | 6,552 | | | OGE Energy Corporation | | | 237,838 | |

| | | | | | | | 1,102,989 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% (Continued) | | | | |

| | | | | ELECTRICAL EQUIPMENT - 5.4% | | | | |

| | 4,395 | | | AAON, Inc. | | $ | 329,845 | |

| | 1,307 | | | Acuity Brands, Inc. | | | 339,310 | |

| | 960 | | | AMETEK, Inc. | | | 162,797 | |

| | 2,279 | | | Amphenol Corporation, Class A | | | 301,671 | |

| | 1,794 | | | Badger Meter, Inc. | | | 346,170 | |

| | 759 | | | Hubbell, Inc. | | | 295,168 | |

| | 3,764 | | | Mesa Laboratories, Inc. | | | 360,214 | |

| | 5,143 | | | NEXTracker, Inc.(a) | | | 283,739 | |

| | 775 | | | Powell Industries, Inc. | | | 139,392 | |

| | 1,737 | | | Watts Water Technologies, Inc., Class A | | | 345,889 | |

| | | | | | | | 2,904,195 | |

| | | | | ENGINEERING & CONSTRUCTION - 2.9% | | | | |

| | 2,549 | | | EMCOR Group, Inc. | | | 990,694 | |

| | 5,833 | | | Fluor Corporation(a) | | | 253,152 | |

| | 1,284 | | | Installed Building Products, Inc. | | | 272,003 | |

| | | | | | | | 1,515,849 | |

| | | | | ENTERTAINMENT CONTENT - 0.1% | | | | |

| | 649 | | | AppLovin Corporation, Class A(a) | | | 52,881 | |

| | | | | | | | | |

| | | | | FOOD - 1.7% | | | | |

| | 10,149 | | | BellRing Brands, Inc.(a) | | | 590,367 | |

| | 1,053 | | | Post Holdings, Inc.(a) | | | 112,218 | |

| | 3,669 | | | Tyson Foods, Inc., Class A | | | 210,050 | |

| | | | | | | | 912,635 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 1.3% | | | | |

| | 9,300 | | | Sylvamo Corporation | | | 663,276 | |

| | | | | | | | | |

| | | | | GAS & WATER UTILITIES - 0.8% | | | | |

| | 4,041 | | | Consolidated Water Company Ltd. | | | 109,511 | |

| | 11,460 | | | NiSource, Inc. | | | 333,028 | |

| | | | | | | | 442,539 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 2.8% | | | | |

| | 3,656 | | | HealthEquity, Inc.(a) | | | 298,622 | |

| | 828 | | | McKesson Corporation | | | 471,621 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% (Continued) | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 2.8% (Continued) | | | | |

| | 966 | | | Medpace Holdings, Inc.(a) | | $ | 373,204 | |

| | 5,735 | | | Option Care Health, Inc.(a) | | | 171,018 | |

| | 5,332 | | | Progyny, Inc.(a) | | | 143,697 | |

| | | | | | | | 1,458,162 | |

| | | | | HOME CONSTRUCTION - 3.4% | | | | |

| | 3,085 | | | AZEK Company, Inc. (The)(a) | | | 147,957 | |

| | 2,156 | | | Century Communities, Inc. | | | 181,988 | |

| | 3,713 | | | Dream Finders Homes, Inc.(a) | | | 105,486 | |

| | 3,009 | | | Green Brick Partners, Inc.(a) | | | 164,291 | |

| | 2,823 | | | KB Home | | | 199,304 | |

| | 1,950 | | | Lennar Corporation, Class A | | | 312,683 | |

| | 1,786 | | | M/I Homes, Inc.(a) | | | 223,107 | |

| | 898 | | | PulteGroup, Inc. | | | 105,353 | |

| | 3,087 | | | Toll Brothers, Inc. | | | 375,503 | |

| | | | | | | | 1,815,672 | |

| | | | | HOTEL REIT - 0.9% | | | | |

| | 28,054 | | | Park Hotels & Resorts, Inc. | | | 444,935 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 0.4% | | | | |

| | 1,652 | | | Inter Parfums, Inc. | | | 197,877 | |

| | | | | | | | | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 1.5% | | | | |

| | 2,824 | | | Applied Industrial Technologies, Inc. | | | 545,032 | |

| | 4,412 | | | Core & Main Inc. - Class A(a) | | | 253,955 | |

| | | | | | | | 798,987 | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 1.3% | | | | |

| | 1,035 | | | Cboe Global Markets, Inc. | | | 179,045 | |

| | 5,941 | | | Northern Trust Corporation | | | 500,469 | |

| | | | | | | | 679,514 | |

| | | | | INSURANCE - 6.1% | | | | |

| | 1,947 | | | Arch Capital Group Ltd.(a) | | | 199,821 | |

| | 1,507 | | | Assured Guaranty Ltd. | | | 117,124 | |

| | 1,172 | | | Axis Capital Holdings Ltd. | | | 86,587 | |

| | 1,152 | | | Brown & Brown, Inc. | | | 103,116 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% (Continued) | | | | |

| | | | | INSURANCE - 6.1% (Continued) | | | | |

| | 2,509 | | | Cincinnati Financial Corporation | | $ | 295,008 | |

| | 2,972 | | | Hartford Financial Services Group, Inc. (The) | | | 307,453 | |

| | 11,444 | | | Horace Mann Educators Corporation | | | 391,041 | |

| | 1,910 | | | Kemper Corporation | | | 114,294 | |

| | 18,467 | | | Lemonade, Inc.(a) | | | 304,890 | |

| | 8,745 | | | Mercury General Corporation | | | 488,234 | |

| | 990 | | | Primerica, Inc. | | | 223,631 | |

| | 7,547 | | | Ryan Specialty Holdings, Inc., Class A | | | 419,086 | |

| | 4,244 | | | Unum Group | | | 228,582 | |

| | | | | | | | 3,278,867 | |

| | | | | INTERNET MEDIA & SERVICES - 1.5% | | | | |

| | 5,704 | | | HealthStream, Inc. | | | 155,662 | |

| | 40,729 | | | Opendoor Technologies, Inc.(a) | | | 88,789 | |

| | 3,986 | | | Pinterest, Inc., Class A(a) | | | 165,379 | |

| | 812 | | | Spotify Technology S.A.(a) | | | 240,986 | |

| | 6,944 | | | TripAdvisor, Inc.(a) | | | 127,422 | |

| | | | | | | | 778,238 | |

| | | | | LEISURE FACILITIES & SERVICES - 5.4% | | | | |

| | 128 | | | Chipotle Mexican Grill, Inc.(a) | | | 400,579 | |

| | 1,311 | | | Darden Restaurants, Inc. | | | 197,161 | |

| | 7,691 | | | DraftKings, Inc., Class A(a) | | | 270,185 | |

| | 828 | | | Hilton Worldwide Holdings, Inc. | | | 166,097 | |

| | 14,719 | | | Madison Square Garden Entertainment Corporation(a) | | | 523,113 | |

| | 4,447 | | | MGM Resorts International(a) | | | 178,636 | |

| | 23,290 | | | ONE Group Hospitality, Inc. (The)(a) | | | 121,108 | |

| | 1,714 | | | Royal Caribbean Cruises Ltd.(a) | | | 253,124 | |

| | 5,848 | | | Sphere Entertainment Company(a) | | | 213,452 | |

| | 3,080 | | | United Parks & Resorts, Inc.(a) | | | 161,053 | |

| | 74,116 | | | Virgin Galactic Holdings, Inc.(a) | | | 64,088 | |

| | 897 | | | Wingstop, Inc. | | | 330,679 | |

| | | | | | | | 2,879,275 | |

| | | | | MACHINERY - 3.6% | | | | |

| | 7,677 | | | Energy Recovery, Inc.(a) | | | 103,640 | |

| | 4,770 | | | Enerpac Tool Group Corporation | | | 187,556 | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% (Continued) | | | | |

| | | | | MACHINERY - 3.6% (Continued) | | | | |

| | 5,783 | | | Esab Corporation | | $ | 594,608 | |

| | 8,866 | | | Flowserve Corporation | | | 440,640 | |

| | 3,656 | | | Ingersoll Rand, Inc. | | | 340,191 | |

| | 4,291 | | | Terex Corporation | | | 256,044 | |

| | | | | | | | 1,922,679 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 4.2% | | | | |

| | 2,070 | | | Haemonetics Corporation(a) | | | 174,046 | |

| | 2,833 | | | Hologic, Inc.(a) | | | 209,019 | |

| | 3,613 | | | ICU Medical, Inc.(a) | | | 384,206 | |

| | 483 | | | IDEXX Laboratories, Inc.(a) | | | 240,027 | |

| | 996 | | | Inspire Medical Systems, Inc.(a) | | | 158,155 | |

| | 2,407 | | | Insulet Corporation(a) | | | 426,496 | |

| | 2,211 | | | Lantheus Holdings, Inc.(a) | | | 180,926 | |

| | 1,850 | | | Masimo Corporation(a) | | | 230,325 | |

| | 1,173 | | | ResMed, Inc. | | | 242,025 | |

| | | | | | | | 2,245,225 | |

| | | | | METALS & MINING - 1.1% | | | | |

| | 11,801 | | | Century Aluminum Company(a) | | | 216,312 | |

| | 50,833 | | | Energy Fuels Inc(a) | | | 355,831 | |

| | | | | | | | 572,143 | |

| | | | | MORTGAGE FINANCE - 1.4% | | | | |

| | 23,705 | | | AGNC Investment Corporation | | | 227,331 | |

| | 76,149 | | | Ares Commercial Real Estate Corporation | | | 529,997 | |

| | | | | | | | 757,328 | |

| | | | | OFFICE REIT - 0.5% | | | | |

| | 14,936 | | | Equity Commonwealth(a) | | | 288,414 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 3.9% | | | | |

| | 2,479 | | | Cheniere Energy, Inc. | | | 391,161 | |

| | 5,565 | | | Matador Resources Company | | | 353,099 | |

| | 1,325 | | | Murphy USA, Inc. | | | 581,344 | |

| | 7,452 | | | Par Pacific Holdings, Inc.(a) | | | 202,247 | |

| | 1,352 | | | Phillips 66 | | | 192,133 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% (Continued) | | | | |

| | | | | OIL & GAS PRODUCERS - 3.9% (Continued) | | | | |

| | 8,600 | | | Williams Companies, Inc. (The) | | $ | 356,986 | |

| | | | | | | | 2,076,970 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 0.3% | | | | |

| | 3,758 | | | Halliburton Company | | | 137,919 | |

| | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS - 0.6% | | | | |

| | 39,922 | | | Claros Mortgage Trust, Inc. | | | 314,985 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 6.0% | | | | |

| | 3,045 | | | Abercrombie & Fitch Company, Class A(a) | | | 526,389 | |

| | 4,417 | | | American Eagle Outfitters, Inc. | | | 97,041 | |

| | 138 | | | AutoZone, Inc.(a) | | | 382,252 | |

| | 4,002 | | | Builders FirstSource, Inc.(a) | | | 643,481 | |

| | 9,491 | | | Gap, Inc. (The) | | | 274,859 | |

| | 820 | | | Lululemon Athletica, Inc.(a) | | | 255,832 | |

| | 345 | | | O’Reilly Automotive, Inc.(a) | | | 332,325 | |

| | 1,376 | | | Ross Stores, Inc. | | | 192,310 | |

| | 414 | | | Ulta Beauty, Inc.(a) | | | 163,567 | |

| | 5,484 | | | Urban Outfitters, Inc.(a) | | | 228,738 | |

| | | | | | | | 3,096,794 | |

| | | | | SEMICONDUCTORS - 1.0% | | | | |

| | 13,000 | | | Veeco Instruments, Inc.(a) | | | 528,450 | |

| | | | | | | | | |

| | | | | SOFTWARE - 6.4% | | | | |

| | 2,959 | | | Altair Engineering, Inc., Class A(a) | | | 258,409 | |

| | 959 | | | Appfolio, Inc., Class A(a) | | | 218,959 | |

| | 1,710 | | | BILL Holdings, Inc.(a) | | | 89,006 | |

| | 1,919 | | | Cadence Design Systems, Inc.(a) | | | 549,429 | |

| | 3,287 | | | DocuSign, Inc.(a) | | | 179,930 | |

| | 802 | | | Duolingo, Inc.(a) | | | 153,503 | |

| | 2,182 | | | Fortinet, Inc.(a) | | | 129,436 | |

| | 2,470 | | | Guidewire Software, Inc.(a) | | | 281,382 | |

| | 29,300 | | | Health Catalyst, Inc.(a) | | | 194,259 | |

| | 2,681 | | | Okta, Inc.(a) | | | 237,751 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% (Continued) | | | | |

| | | | | SOFTWARE - 6.4% (Continued) | | | | |

| | 1,380 | | | Qualys, Inc.(a) | | $ | 194,056 | |

| | 1,176 | | | SPS Commerce, Inc.(a) | | | 221,194 | |

| | 583 | | | Veeva Systems, Inc., Class A(a) | | | 101,588 | |

| | 21,144 | | | Weave Communications, Inc.(a) | | | 182,896 | |

| | 1,630 | | | Zoom Video Communications, Inc., Class A(a) | | | 99,984 | |

| | 27,947 | | | Zuora, Inc.(a) | | | 283,662 | |

| | | | | | | | 3,375,444 | |

| | | | | SPECIALTY FINANCE - 1.7% | | | | |

| | 4,414 | | | Air Lease Corporation | | | 210,283 | |

| | 3,774 | | | Flywire Corporation(a) | | | 64,724 | |

| | 2,413 | | | GATX Corporation | | | 332,898 | |

| | 1,796 | | | Mr. Cooper Group, Inc.(a) | | | 149,786 | |

| | 12,740 | | | New Residential Investment Corporation | | | 142,815 | |

| | | | | | | | 900,506 | |

| | | | | SPECIALTY REIT - 0.6% | | | | |

| | 7,740 | | | EPR Properties | | | 317,650 | |

| | | | | | | | | |

| | | | | SPECIALTY REITS - 0.2% | | | | |

| | 1,143 | | | Iron Mountain, Inc. | | | 92,229 | |

| | | | | | | | | |

| | | | | STEEL - 0.7% | | | | |

| | 2,610 | | | Steel Dynamics, Inc. | | | 349,401 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 3.7% | | | | |

| | 1,404 | | | Arista Networks, Inc.(a) | | | 417,901 | |

| | 3,076 | | | Jabil, Inc. | | | 365,736 | |

| | 4,605 | | | NetApp, Inc. | | | 554,580 | |

| | 535 | | | Super Micro Computer, Inc.(a) | | | 419,713 | |

| | 11,898 | | | Turtle Beach Corporation(a) | | | 197,269 | |

| | | | | | | | 1,955,199 | |

| | | | | TECHNOLOGY SERVICES - 2.0% | | | | |

| | 1,658 | | | Booz Allen Hamilton Holding Corporation | | | 252,364 | |

| | 1,073 | | | Coinbase Global, Inc., Class A(a) | | | 242,412 | |

| | 1,816 | | | ICF International, Inc. | | | 259,235 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.8% (Continued) | | | | |

| | | | | TECHNOLOGY SERVICES - 2.0% (Continued) | | | | |

| | 14,860 | | | Riot Blockchain, Inc.(a) | | $ | 144,736 | |

| | 11,366 | | | StoneCompany Ltd.(a) | | | 157,305 | |

| | | | | | | | 1,056,052 | |

| | | | | TELECOMMUNICATIONS - 1.7% | | | | |

| | 49,350 | | | 8x8, Inc.(a) | | | 134,726 | |

| | 52,430 | | | AST SpaceMobile, Inc.(a) | | | 433,857 | |

| | 10,462 | | | Iridium Communications, Inc. | | | 315,011 | |

| | | | | | | | 883,594 | |

| | | | | TIMBER REIT - 0.1% | | | | |

| | 1,552 | | | Weyerhaeuser Company | | | 46,607 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 2.4% | | | | |

| | 2,475 | | | Copa Holdings S.A., Class A | | | 240,644 | |

| | 1,933 | | | Expeditors International of Washington, Inc. | | | 233,700 | |

| | 1,991 | | | Matson, Inc. | | | 255,246 | |

| | 412 | | | Saia, Inc.(a) | | | 168,706 | |

| | 2,422 | | | Teekay Tankers Ltd., Class A | | | 176,394 | |

| | 3,616 | | | United Airlines Holdings, Inc.(a) | | | 191,612 | |

| | | | | | | | 1,266,302 | |

| | | | | TRANSPORTATION EQUIPMENT - 0.8% | | | | |

| | 745 | | | Allison Transmission Holdings, Inc. | | | 56,478 | |

| | 3,451 | | | PACCAR, Inc. | | | 370,983 | |

| | | | | | | | 427,461 | |

| | | | | WHOLESALE - CONSUMER STAPLES - 0.5% | | | | |

| | 3,706 | | | Performance Food Group Company(a) | | | 257,938 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $49,951,144) | | | 52,817,657 | |

| | | | | | | | | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| ZACKS SMALL/MID CAP ETF |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| May 31, 2024 |

| |

| Shares | | | | | Expiration

Date | | Exercise

Price | | Fair Value | |

| | | | | WARRANT — 0.0%(b) | | | | | |

| | | | | CHEMICALS - 0.0% (b) | | | | | |

| | 37,030 | | | Danimer Scientific, Inc. | | 05/04/2029 | | $5.00 | | $ | — | |

| | | | | | | | | | | | | |

| | | | | TOTAL WARRANT (Cost $0) | | | — | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.8% (Cost $49,951,144) | | $ | 52,817,657 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES- 0.2% | | | 106,339 | |

| | | | | NET ASSETS - 100.0% | | $ | 52,923,996 | |

| | | | | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Percentage rounds to less than 0.1%. |

See accompanying notes which are an integral part of these financial statements.

| Zacks ETFs |

| STATEMENTS OF ASSETS AND LIABILITIES (Unaudited) |

| May 31, 2024 |

| |

| | | Zacks Earnings | | | | |

| | | Consistent Portfolio | | | Zacks Small/Mid Cap | |

| | | ETF | | | ETF | |

| ASSETS | | | | | | | | |

| Investment securities: | | | | | | | | |

| At cost | | $ | 117,998,287 | | | $ | 49,951,144 | |

| At fair value | | $ | 131,030,685 | | | $ | 52,817,657 | |

| Cash | | | 2,673,607 | | | | 207,200 | |

| Dividends receivable | | | 179,282 | | | | 30,179 | |

| TOTAL ASSETS | | | 133,883,574 | | | | 53,055,036 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Investment advisory fees payable | | | 33,462 | | | | 4,241 | |

| Payable to related parties | | | 23,790 | | | | 39,033 | |

| Payable for audit fees | | | — | | | | 24,331 | |

| Payable for legal fees | | | — | | | | 24,855 | |

| Accrued expenses and other liabilities | | | 42,005 | | | | 38,580 | |

| TOTAL LIABILITIES | | | 99,257 | | | | 131,040 | |

| NET ASSETS | | $ | 133,784,317 | | | $ | 52,923,996 | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Paid in capital | | $ | 121,560,852 | | | $ | 49,398,299 | |

| Accumulated earnings | | | 12,223,465 | | | | 3,525,697 | |

| NET ASSETS | | $ | 133,784,317 | | | $ | 52,923,996 | |

| | | | | | | | | |

| Net Asset Value Per Share: | | | | | | | | |

| Net Assets | | $ | 133,784,317 | | | $ | 52,923,996 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | 4,754,000 | | | | 1,725,000 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | | $ | 28.14 | | | $ | 30.68 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Zacks ETFs |

| STATEMENTS OF OPERATIONS (Unaudited) |

| For the Period or Six Months Ended May 31, 2024 |

| |

| | | Zacks Earnings | | | | |

| | | Consistent Portfolio | | | Zacks Small/Mid Cap | |

| | | ETF * | | | ETF | |

| INVESTMENT INCOME | | | | | | | | |

| Dividends | | $ | 581,923 | | | $ | 170,544 | |

| Foreign withholding taxes | | | — | | | | (8 | ) |

| TOTAL INVESTMENT INCOME | | | 581,923 | | | | 170,536 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Investment advisory fees | | | 162,161 | | | | 60,590 | |

| Administrative services fees | | | 56,528 | | | | 31,444 | |

| Compliance officer fees | | | 22,112 | | | | 9,550 | |

| Legal fees | | | 17,274 | | | | 27,934 | |

| Trustees fees and expenses | | | 17,238 | | | | 5,007 | |

| Audit fees | | | 15,349 | | | | 18,236 | |

| Custodian fees | | | 8,574 | | | | 8,880 | |

| Printing and postage expenses | | | 4,686 | | | | 9,780 | |

| Transfer agent fees | | | 3,123 | | | | 5,938 | |

| Insurance expense | | | — | | | | 3,411 | |

| Other expenses | | | 4,163 | | | | 13,770 | |

| TOTAL EXPENSES | | | 311,208 | | | | 194,540 | |

| Fees Waived/Expenses Reimbursed by the Advisor | | | (107,885 | ) | | | (118,147 | ) |

| NET EXPENSES | | | 203,323 | | | | 76,393 | |

| NET INVESTMENT INCOME | | | 378,600 | | | | 94,143 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | |

| Net realized gain (loss) from: | | | | | | | | |

| Investments | | | (226,117 | ) | | | 573,907 | |

| Investments delivered in-kind | | | 1,037,680 | | | | — | |

| | | | 811,563 | | | | 573,907 | |

| | | | | | | | | |

| Net change in unrealized appreciation on investments | | | 4,699,783 | | | | 2,717,975 | |

| | | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 5,511,346 | | | | 3,291,882 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 5,889,946 | | | $ | 3,386,025 | |

| | | | | | | | | |

| * | For the period February 1, 2024 to May 31, 2024. Effective February 1, 2024, the Fund changed its fiscal year end. See Note 1. |

See accompanying notes which are an integral part of these financial statements.

| Zacks Earnings Consistent Portfolio ETF |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | For The | | | For The | |

| | | Period Ended | | | Year Ended | |

| | | 5/31/2024* | | | January 31, 2024 | |

| | | (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 378,600 | | | $ | 616,233 | |

| Net realized gain (loss) from security transactions | | | 811,563 | | | | (1,443,388 | ) |

| Net change in unrealized appreciation of investments | | | 4,699,783 | | | | 8,764,876 | |

| Net increase in net assets resulting from operations | | | 5,889,946 | | | | 7,937,721 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total distributions paid | | | — | | | | (579,145 | ) |

| Net decrease in net assets resulting from distributions to shareholders | | | — | | | | (579,145 | ) |

| | | | | | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | 40,877,473 | | | | 61,740,809 | |

| Payments for shares redeemed: | | | (4,094,796 | ) | | | (655,191 | ) |

| Transaction fees (Note 7) | | | 9,600 | | | | 17,600 | |

| Net increase in net assets resulting from shares of beneficial interest | | | 36,792,277 | | | | 61,103,218 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 42,682,223 | | | | 68,461,794 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Period | | | 91,102,094 | | | | 22,640,300 | |

| End of Period | | $ | 133,784,317 | | | $ | 91,102,094 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 1,475,000 | | | | 2,500,000 | |

| Shares redeemed | | | (150,000 | ) | | | (25,000 | ) |

| Net increase in shares of beneficial interest outstanding | | | 1,325,000 | | | | 2,475,000 | |

| | | | | | | | | |

| * | For the period February 1, 2024 to May 31, 2024. Effective February 1, 2024, the Fund changed its fiscal year end. See Note 1. |

See accompanying notes which are an integral part of these financial statements.

| Zacks Small/Mid Cap ETF |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | For The | | | For The | |

| | | Six Months Ended | | | Period Ended | |

| | | May 31, 2024 | | | November 30, 2023 * | |

| | | (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 94,143 | | | $ | 3,855 | |

| Net realized gain (loss) from security transactions | | | 573,907 | | | | (3,631 | ) |

| Net change in unrealized appreciation of investments | | | 2,717,975 | | | | 148,538 | |

| Net increase in net assets resulting from operations | | | 3,386,025 | | | | 148,762 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total distributions paid | | | (9,090 | ) | | | — | |

| Net decrease in net assets resulting from distributions to shareholders | | | (9,090 | ) | | | — | |

| | | | | | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | 41,041,726 | | | | 8,344,573 | |

| Transaction fees (Note 7) | | | 9,600 | | | | 2,400 | |

| Net increase in net assets resulting from shares of beneficial interest | | | 41,051,326 | | | | 8,346,973 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 44,428,261 | | | | 8,495,735 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Period | | | 8,495,735 | | | | — | |

| End of Period | | $ | 52,923,996 | | | $ | 8,495,735 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Class I: | | | | | | | | |

| Shares sold | | | 1,400,000 | | | | 325,000 | |

| Net increase in shares of beneficial interest outstanding | | | 1,400,000 | | | | 325,000 | |

| | | | | | | | | |

| * | Commencement of Operations was October 2, 2023. |

See accompanying notes which are an integral part of these financial statements.

| Zacks Earnings Consistent Portfolio ETF |

| FINANCIAL HIGHLIGHTS |

| |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period

| | | For The | | | For The | | | For The | | | For The | |

| | | Period Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | May 31, 2024 ** | | | January 31, 2024 | | | January 31, 2023 | | | January 31, 2022 * | |

| | | (Unaudited) | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 26.57 | | | $ | 23.73 | | | $ | 25.40 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | | |

| Activity from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.09 | | | | 0.28 | | | | 0.27 | | | | 0.08 | |

| Net realized and unrealized gain (loss) on investments (4) | | | 1.48 | | | | 2.74 | | | | (1.74 | ) | | | 0.35 | |

| Total from investment operations | | | 1.57 | | | | 3.02 | | | | (1.47 | ) | | | 0.43 | |

| | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.19 | ) | | | (0.21 | ) | | | (0.03 | ) |

| Total distributions | | | — | | | | (0.19 | ) | | | (0.21 | ) | | | (0.03 | ) |

| Capital Share Transaction fees (Note 7) | | | 0.00 | | | | 0.01 | | | | 0.01 | | | | 0.00 | |

| Net asset value, end of period | | $ | 28.14 | | | $ | 26.57 | | | $ | 23.73 | | | $ | 25.40 | |

| Market price, end of period (unaudited) | | $ | 28.13 | | | $ | 26.62 | | | $ | 23.71 | | | $ | 25.40 | |

| Total return (2) | | | 11.38 | % (6) | | | 12.79 | % (7) | | | (5.72 | )% | | | 1.71 | % (6) |

| Market price total return (unaudited) | | | 11.26 | % (6) | | | 13.10 | % | | | (5.80 | )% | | | 1.71 | % (6) |

| Net assets, at end of period (000s) | | $ | 133,784 | | | $ | 91,102 | | | $ | 22,640 | | | $ | 11,531 | |

| | | | | | | | | | | | | | | | | |

| Ratio of gross expenses to average net assets | | | 0.84 | % (5) | | | 0.89 | % | | | 1.93 | % | | | 3.93 | % (5) |

| Ratio of net expenses to average net assets | | | 0.55 | % (5) | | | 0.55 | % | | | 0.55 | % | | | 0.55 | % (5) |

| Ratio of net investment income to average net assets | | | 1.02 | % (5) | | | 1.11 | % | | | 1.15 | % | | | 0.71 | % (5) |

| Portfolio Turnover Rate (3) | | | 3 | % (6) | | | 18 | % | | | 14 | % | | | 6 | % (6) |

| | | | | | | | | | | | | | | | | |

| * | Commencement of Operations was August 23, 2021. |

| ** | For the period February 1, 2024 to May 31, 2024. Effective February 1, 2024, the Fund changed its fiscal year end. See Note 1. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. |

| (3) | Portfolio turnover rate excludes portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. (Note 3) |

| (4) | As required by SEC standard per share data calculation methodology, this represents a balancing figure derived from the other amounts in the financial highlights tables that captures all other changes affecting net asset value per share. This per share gain amount may not correlate to the aggregate of the net realized and unrealized loss in the Statement of Operations, primarily due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating market values of the Fund’s portfolio. |

| (5) | Annualized for periods less than one full year. |

| (7) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes which are an integral part of these financial statements.

| Zacks Small/Mid Cap ETF |

| FINANCIAL HIGHLIGHTS |

| |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout each Period

| | | For The | | | For The | |

| | | Six Months Ended | | | Period Ended | |

| | | May 31, 2024 | | | November 30, 2023 * | |

| | | (Unaudited) | | | | |

| Net asset value, beginning of period | | $ | 26.14 | | | $ | 25.00 | |

| | | | | | | | | |

| Activity from investment operations: | | | | | | | | |

| Net investment income (1) | | | 0.10 | | | | 0.03 | |

| Net realized and unrealized gain on investments (4) | | | 4.45 | | | | 1.09 | |

| Total from investment operations | | | 4.55 | | | | 1.12 | |

| | | | | | | | | |

| Less distributions from: | | | | | | | | |

| Net investment income | | | (0.02 | ) | | | — | |

| Total distributions | | | (0.02 | ) | | | — | |

| Paid-in-Capital From Redemption Fees | | | — | | | | — | |

| Capital Share Transaction fees (Note 7) | | | 0.01 | | | | 0.02 | |

| Net asset value, end of period | | $ | 30.68 | | | $ | 26.14 | |

| Market price, end of period (unaudited) | | $ | 30.71 | | | $ | 26.19 | |

| Total return (2)(6) | | | 17.45 | % | | | 4.56 | % |

| Market price total return (unaudited) (6) | | | 17.34 | % | | | 4.76 | % |

| Net assets, at end of period (000s) | | $ | 52,924 | | | $ | 8,496 | |

| | | | | | | | | |

| Ratio of gross expenses to average (5) net assets | | | 1.40 | % | | | 11.88 | % |

| Ratio of net expenses to average (5) net assets | | | 0.55 | % | | | 0.55 | % |

| Ratio of net investment income (5) to average net assets | | | 0.68 | % | | | 0.72 | % |

| Portfolio Turnover Rate (3)(6) | | | 46 | % | | | 3 | % |

| | | | | | | | | |

| * | Commencement of Operations was October 2, 2023. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. |

| (3) | Portfolio turnover rate excludes portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. (Note 3) |

| (4) | As required by SEC standard per share data calculation methodology, this represents a balancing figure derived from the other amounts in the financial highlights tables that captures all other changes affecting net asset value per share. This per share gain amount may not correlate to the aggregate of the net realized and unrealized loss in the Statement of Operations, primarily due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating values of the Fund’s portfolio. |

See accompanying notes which are an integral part of these financial statements.

| Zacks ETFs |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) |

| May 31, 2024 |

The Zacks Earnings Consistent Portfolio ETF (“ZECP”) and the Zacks Small/Mid Cap ETF (“SMIZ”) (each a “Fund” and collectively the “Funds”) are each a diversified series of shares of beneficial interest in the Zacks Trust (the “Trust”), a statutory trust organized under the laws of the State of Delaware on November 14, 2018, and are registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. ZECP seeks to provide long-term total returns and minimize capital loss. SMIZ seeks to generate positive risk-adjusted returns. ZECP commenced operations on August 23, 2021 and SMIZ commenced operations on October 2, 2023.

Effective February 1, 2024, ZECP has changed its fiscal year-end from January 31 to November 30 for operational efficiencies.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Funds in preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Funds are each investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.”

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale such securities shall be valued at the mean between the current bid and ask prices on the day of valuation. Investments valued in currencies other than the U.S. dollar are converted to U.S. dollars using exchange rates obtained from pricing services. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost. Investments in open-end investment companies are valued at net asset value.

The Funds may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board of Trustees (the “Board”) of the Trust. The Board has delegated execution of these procedures to Zacks Investment Management, Inc. (the Advisor”) as its valuation designee (the “Valuation Designee”). The Board may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in

| Zacks ETFs |

| NOTES TO FINANCIAL STATEMENTS (Continued)(Unaudited) |

| May 31, 2024 |

determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee.

Fair Valuation Process – The applicable investments are valued by the Valuation Designee pursuant to valuation procedures established by the Board. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the Valuation Designee, the prices or values available do not represent the fair value of the instrument; factors which may cause the Valuation Designee to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If a current bid from such independent dealers or other independent parties is unavailable, the Valuation Designee shall determine, the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Funds utilize various methods to measure fair value of all of their investments on a recurring basis. GAAP establishes the hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Funds has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices

| Zacks ETFs |

| NOTES TO FINANCIAL STATEMENTS (Continued)(Unaudited) |

| May 31, 2024 |

for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of May 31, 2024, for the Fund’s assets and liabilities measured at fair value:

| Zacks Earnings Consistent Portfolio ETF |

| Assets* | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 131,030,685 | | | $ | — | | | $ | — | | | $ | 131,030,685 | |

| Total | | $ | 131,030,685 | | | $ | — | | | $ | — | | | $ | 131,030,685 | |

| | | | | | | | | | | | | | | | | |

| Zacks Small/Mid Cap ETF |

| Assets* | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 52,817,657 | | | $ | — | | | $ | — | | | $ | 52,817,657 | |

| Warrants | | | 0 | | | | — | | | | — | | | | 0 | |

| Total | | $ | 52,817,657 | | | $ | — | | | $ | — | | | $ | 52,817,657 | |

The Funds did not hold any Level 3 securities during the period.

| * | Please refer to the Schedule of Investments for industry classifications. |

| Zacks ETFs |

| NOTES TO FINANCIAL STATEMENTS (Continued)(Unaudited) |

| May 31, 2024 |

In accordance with each Fund’s investment objectives, each Fund may have increased or decreased exposure to one or more of the following risk factors defined below:

Equity Securities Risk – Equity securities are subject to changes in value, and their values may be more volatile than those of other asset classes. These changes in value may result from factors affecting individual issuers, industries or the stock market as a whole. In addition, equity markets tend to be cyclical which may cause stock prices to fall over short or extended periods of time.

Large-Cap Securities Risk – Stocks of large companies as a group can fall out of favor with the market, causing the Funds to underperform investments that have a greater focus on mid-cap or small-cap stocks. Larger, more established companies may be slow to respond to challenges and may grow more slowly than smaller companies.

Small and Medium Cap Securities Risk – The earnings and prospects of small and medium sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Small and medium sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience.

Quantitative Model Risk – Investments selected using quantitative methods may perform differently from the market as a whole. There can be no assurance that these methodologies will enable the Funds to achieve their objective.

Management Risk – The Funds are subject to management risk because they are each an actively managed portfolio. The Advisor’s judgments about the attractiveness, value, and stability of particular stocks in which the Funds invest may prove to be incorrect, and there is no guarantee that the Advisor’s judgment will produce the desired results.

Market Risk – Market risk refers to the possibility that the value of securities held by the Funds may decline due to daily fluctuations in the market. Market prices for securities change daily as a result of many factors, including developments affecting the condition of both individual companies and the market in general. The price of a security may even be affected by factors unrelated to the value or condition of its issuer, including changes in interest rates, economic and political conditions, and general market conditions. Each Fund’s performance per share will change daily in response to such factors.

Security Transactions and Related Income – Security transactions are accounted for on trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends and Distributions to Shareholders – Dividends from net investment income, if any, are declared and paid annually. Distributable net realized capital gains, if any, are declared and distributed annually in December. Dividends from net investment income and distributions

| Zacks ETFs |

| NOTES TO FINANCIAL STATEMENTS (Continued)(Unaudited) |

| May 31, 2024 |

from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions to shareholders are recorded on ex-dividend date.

Federal Income Taxes – The Funds intend to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no provision for Federal income tax is required. The Funds recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Interest and penalties related to income taxes would be recorded as tax expense in the Statement of Operations. During the period or six months ended May 31, 2024, the Funds did not incur any tax-related interest or penalties. Management has analyzed each Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for the open tax years ended 2022 and 2023, or expected to be taken in the Funds’ November 30, 2024 year-end tax returns. The Funds have identified their major tax jurisdictions as U.S. Federal and Ohio state, however, the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Indemnification – The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnities. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss due to these warranties and indemnities to be remote.

| 3. | INVESTMENT TRANSACTIONS |

For the period or six months ended May 31, 2024, cost of purchases and proceeds from sales of portfolio securities (excluding in-kind transactions and short-term investments), for the Funds were as follows:

| Ticker Symbol | | Purchases | | | Sales | |

| ZECP | | $ | 2,966,500 | | | $ | 3,860,878 | |

| SMIZ | | $ | 12,961,910 | | | $ | 12,745,661 | |

For the period or six months ended May 31, 2024, cost of purchases and proceeds from sales of portfolio securities for in-kind transactions for the Funds were as follows:

| Ticker Symbol | | Purchases | | | Sales | |

| ZECP | | $ | 40,086,557 | | | $ | 4,043,346 | |

| SMIZ | | $ | 40,985,810 | | | $ | — | |

| Zacks ETFs |

| NOTES TO FINANCIAL STATEMENTS (Continued)(Unaudited) |

| May 31, 2024 |

| 4. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

The Advisor serves as investment advisor to the Funds. Pursuant to an Advisory Agreement with the Trust, under the oversight of the Board, the Advisor manages the investment and reinvestment of the Fund’s assets. As compensation for its services and the related expenses borne by the Advisor, the Funds pays the Advisor a management fee, computed and accrued daily and paid monthly, at an annual rate of 0.44% of each Fund’s average daily net assets for ZECP and SMIZ of average daily net assets. For the period or six months ended May 31, 2024, the Funds incurred $162,161 and $60,590 in advisory fees for ZECP and SMIZ, respectively.

Pursuant to an Operating Expenses Limitation Agreement (the “Waiver Agreement”), the Advisor has agreed, at least until May 31, 2025 for ZECP and April 1, 2026 for SMIZ, to waive a portion of its advisory fee and has agreed to reimburse the Funds for other expenses to the extent necessary so that the total expenses incurred by the Funds (exclusive of any front-end or contingent deferred loads, taxes, brokerage fees and commissions, borrowing costs (such as interest and dividend expense on securities sold short), acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses), or extraordinary expenses such as litigation) do not exceed 0.55%. For the period or six months ended May 31, 2024, the Advisor waived fees/reimbursed expenses of $107,885 and $118,147 for ZECP and SMIZ, respectively.

If the Advisor waives any fee or reimburses any expenses pursuant to the Waiver Agreement, and any Funds operating expenses are subsequently lower than their respective expense limitation, the Advisor shall be entitled to reimbursement by the Funds provided that such reimbursement does not cause each Fund’s operating expenses to exceed the expense limitation. The Advisor is permitted to receive reimbursement from each Fund for fees it waived and each Funds expenses it paid, subject to the limitation that: (1) the reimbursement for fees and expenses will be made only if payable within three years from the date the fees and expenses were initially waived or reimbursed; and (2) the reimbursement may not be made if it would cause the expense limitation in effect at the time of the waiver or currently in effect, whichever is lower, to be exceeded. Each Fund must pay its current ordinary operating expenses before the Advisor is entitled to any reimbursement of management fees and/or expenses. This Waiver Agreement can be terminated only by, or with the consent, of the Board.

| Zacks ETFs |

| NOTES TO FINANCIAL STATEMENTS (Continued)(Unaudited) |

| May 31, 2024 |

As of May 31, 2024, the Advisor has $522,545 and $60,714 for ZECP and SMIZ respectively of waived fees within 3 years of reimbursement that may be recovered by the following dates:

| Fund | | January 31, 2024 | | | January 31, 2025 | | | January 31, 2026 | | | January 31, 2027 | | | Total | |

| ZECP | | $ | 55,949 | | | $ | 83,584 | | | $ | 196,824 | | | $ | 186,188 | | | $ | 522,545 | |

| | | November 30, 2026 | | | Total | |

| SMIZ | | $ | 60,714 | | | $ | 60,714 | |

Northern Lights Distributors, LLC, (the “Distributor”), is the distributor for the shares of the Funds. The Distributor has entered into a Distribution Agreement with the Trust pursuant to which it distributes Fund shares for the Funds.

The Funds are authorized to pay distribution fees to the distributor and other firms that provide distribution and shareholder services (“Service Providers”). If a Service Provider provides these services, the Funds may pay fees at an annual rate not to exceed 0.25% of average daily net assets. No distribution or service fees are currently paid by the Funds, and will not be paid by the Funds unless authorized by the Board. There are no current plans to impose these fees.