UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23402

| Name of Fund: | | BlackRock ETF Trust |

| | | BlackRock Future Climate and Sustainable Economy ETF |

| | | BlackRock Future Financial and Technology ETF |

| | | BlackRock Future Health ETF |

| | | BlackRock Future Innovators ETF |

| | | BlackRock Future Tech ETF |

| | | BlackRock Future U.S. Themes ETF |

| | | BlackRock Large Cap Value ETF |

| | | BlackRock U.S. Carbon Transition Readiness ETF |

| | | BlackRock U.S. Equity Factor Rotation ETF |

| | | BlackRock World ex U.S. Carbon Transition Readiness ETF |

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock ETF Trust, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 07/31/2023

Date of reporting period: 07/31/2023

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

| | |

| | JULY 31, 2023 |

BlackRock ETF Trust

| · | | BlackRock Future Climate and Sustainable Economy ETF | BECO | NYSE Arca |

| · | | BlackRock Future Financial and Technology ETF | BPAY | NYSE Arca |

| · | | BlackRock Future Health ETF | BMED | NYSE Arca |

| · | | BlackRock Future Innovators ETF | BFTR | NYSE Arca |

| · | | BlackRock Future Tech ETF | BTEK | NYSE Arca |

| · | | BlackRock Future U.S. Themes ETF | BTHM | NYSE Arca |

| · | | BlackRock Large Cap Value ETF | BLCV | NASDAQ |

| · | | BlackRock U.S. Carbon Transition Readiness ETF | LCTU | NYSE Arca |

| · | | BlackRock U.S. Equity Factor Rotation ETF | DYNF | NYSE Arca |

| · | | BlackRock World ex U.S. Carbon Transition Readiness ETF | LCTD | NYSE Arca |

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

Despite an uncertain economic landscape during the 12-month reporting period ended July 31, 2023, the resilience of the U.S. economy in the face of ever tighter financial conditions provided an encouraging backdrop for investors. While inflation was near multi-decade highs at the beginning of the period, it declined precipitously as commodity prices dropped. Labor shortages also moderated, although wages continued to grow and unemployment rates reached the lowest levels in decades. This robust labor market powered further growth in consumer spending, backstopping the economy.

Equity returns were solid, as the durability of consumer sentiment eased investors’ concerns about the economy’s trajectory. The U.S. economy resumed growth in the third quarter of 2022 and continued to expand thereafter. Most major classes of equities advanced, including large- and small-capitalization U.S. stocks and equities from developed and emerging markets.

The 10-year U.S. Treasury yield rose during the reporting period, driving its price down, as investors reacted to elevated inflation and attempted to anticipate future interest rate changes. The corporate bond market also faced inflationary headwinds, although high-yield corporate bond prices fared significantly better than investment-grade bonds as demand from yield-seeking investors remained strong.

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates seven times during the 12-month period ended July 31, 2023. Furthermore, the Fed wound down its bond-buying programs and incrementally reduced its balance sheet by not replacing securities that reach maturity. However, the Fed declined to raise interest rates at its June 2023 meeting, the first time it paused its tightening in the current cycle, before again raising rates in July 2023.

Supply constraints appear to have become an embedded feature of the new macroeconomic environment, making it difficult for developed economies to increase production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and wage growth high. Although the Fed has decelerated the pace of interest rate hikes and recently opted for a pause, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period to keep inflation under control. Furthermore, ongoing structural changes may mean that the Fed will be hesitant to cut interest rates in the event of faltering economic activity lest inflation accelerate again. We believe investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt.

While we favor an overweight position to developed market equities in the long term, we prefer an underweight stance in the near-term. Expectations for corporate earnings remain elevated, which seems inconsistent with macroeconomic constraints. Nevertheless, we are overweight on emerging market stocks in the near-term as growth trends for emerging markets appear brighter. We also believe that stocks with an A.I. tilt should benefit from an investment cycle that is set to support revenues and margins. We are neutral on credit overall amid tightening credit and financial conditions; however, there are selective opportunities in the near term. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in short-term U.S. Treasuries, U.S. inflation-linked bonds, U.S. mortgage-backed securities, and hard-currency emerging market bonds.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

|

| Total Returns as of July 31, 2023 |

| | | |

| | | 6-Month | | 12-Month |

| | |

U.S. large cap equities

(S&P 500® Index) | | 13.52% | | 13.02% |

| | |

U.S. small cap equities

(Russell 2000® Index) | | 4.51 | | 7.91 |

| | |

International equities

(MSCI Europe, Australasia, Far East Index) | | 6.65 | | 16.79 |

| | |

Emerging market equities

(MSCI Emerging Markets Index) | | 3.26 | | 8.35 |

| | |

3-month Treasury bills

(ICE BofA 3-Month

U.S. Treasury Bill Index) | | 2.34 | | 3.96 |

| | |

U.S. Treasury securities

(ICE BofA 10-Year

U.S. Treasury Index) | | (2.08) | | (7.56) |

| | |

U.S. investment grade bonds

(Bloomberg U.S. Aggregate Bond Index) | | (1.02) | | (3.37) |

| | |

Tax-exempt municipal bonds

(Bloomberg Municipal Bond Index) | | 0.20 | | 0.93 |

| | |

U.S. high yield bonds

(Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | 2.92 | | 4.42 |

|

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

Table of Contents

| | |

| Fund Summary as of July 31, 2023 | | BlackRock Future Climate and Sustainable Economy ETF |

Investment Objective

The BlackRock Future Climate and Sustainable Economy ETF (the “Fund”) seeks to maximize total return by investing in companies that BlackRock Fund Advisors (“BFA”) believes are furthering the transition to a lower green house gas emissions economy.

On February 23, 2023, the Board approved a proposal to change the investment objective, investment strategy and investment process for BlackRock Future Climate and Sustainable Economy ETF. These changes became effective on May 2, 2023.

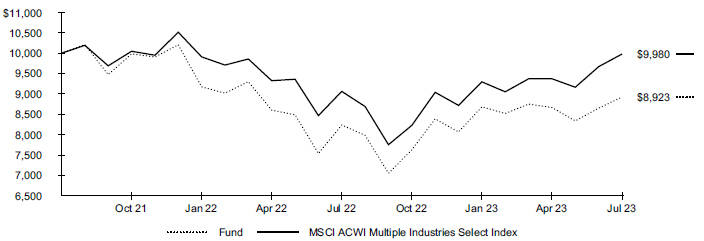

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since

Inception | | | | | | 1 Year | | | Since

Inception | |

Fund NAV | | | 8.31 | % | | | (5.55 | )% | | | | | | | 8.31 | % | | | (10.77 | )% |

Fund Market | | | 8.15 | | | | (5.65 | ) | | | | | | | 8.15 | | | | (10.95 | ) |

MSCI ACWI Multiple Industries Select Index(a) | | | 10.12 | | | | (0.10 | ) | | | | | | | 10.12 | | | | (0.20 | ) |

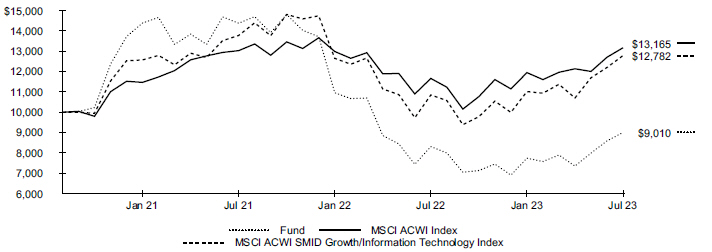

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was August 3, 2021. The first day of secondary market trading was August 5, 2021.

| | (a) | The MSCI ACWI Multiple Industries Select Index is an index that includes large- and mid-cap securities across certain Developed Markets and Emerging Markets countries. The index represents the performance of component indexes which includes securities from selected Global Industry Classification Standard (GICS®) Sectors and Industries i.e. Chemicals, Industrials, Consumer Staples, Containers & Packaging, Electronic Equipment, Instruments & Components, Semiconductors & Semiconductor Equipment and Utilities. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,027.60 | | | | $ 3.52 | | | | | | | | $ 1,000.00 | | | | $ 1,021.30 | | | | $ 3.51 | | | | 0.70 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 4 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock Future Climate and Sustainable Economy ETF |

Portfolio Management Commentary

The Fund underperformed its benchmark, the MSCI ACWI Multiple Industries Select Index. The Fund invests in companies furthering the transition to a lower carbon economy, allocating across five climate-oriented themes: sustainable food, resource efficiency, clean power, clean transportation, and climate resilience & biodiversity.

At the individual stock level, an out-of-benchmark position in agricultural equipment company Ag Growth International, Inc. was the top contributor to relative performance. The stock appreciated on rising demand for agricultural products and strong execution by the company’s management team. An overweight in First Solar, Inc. also contributed to performance. Shares of the solar panel manufacturer rose as government incentives and falling polysilicon costs boosted demand. The Fund’s lack of a position in Nvidia Corp. was the largest detractor from relative performance. The semiconductor designer’s stock jumped on strong demand for its graphics processing units that enable artificial intelligence. An overweight position in clean energy utility company EDP Renováveis SA also detracted, as concerns about a potential energy crisis in Europe increased the risk of possible windfall taxes.

Portfolio Information

INDUSTRY ALLOCATION

| | | | |

Industry | |

| Percent of

Total Investments |

(a) |

Machinery | | | 16.9 | % |

Chemicals | | | 13.2 | |

Food Products | | | 13.1 | |

Semiconductors & Semiconductor Equipment | | | 7.9 | |

Containers & Packaging | | | 6.6 | |

Electrical Equipment | | | 6.1 | |

Commercial Services & Supplies | | | 5.8 | |

Electric Utilities | | | 5.7 | |

Electronic Equipment, Instruments & Components | | | 5.1 | |

Independent Power and Renewable Electricity Producers | | | 4.5 | |

Software | | | 3.9 | |

Professional Services | | | 2.7 | |

Construction & Engineering | | | 2.1 | |

Paper & Forest Products | | | 1.9 | |

Building Products | | | 1.6 | |

Metals & Mining | | | 1.0 | |

Capital Markets | | | 1.0 | |

Ground Transportation | | | 0.9 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

EDP Renovaveis SA | | | 4.0 | % |

Deere & Co. | | | 3.8 | |

Xylem Inc./NY | | | 3.4 | |

Bunge Ltd. | | | 3.2 | |

Enel SpA | | | 3.1 | |

Kerry Group PLC, Class A | | | 2.9 | |

Ecolab Inc. | | | 2.9 | |

Cleanaway Waste Management Ltd. | | | 2.7 | |

Ag Growth International Inc. | | | 2.5 | |

SIG Group AG | | | 2.1 | |

| | (a) | Excludes money market funds. | |

| | |

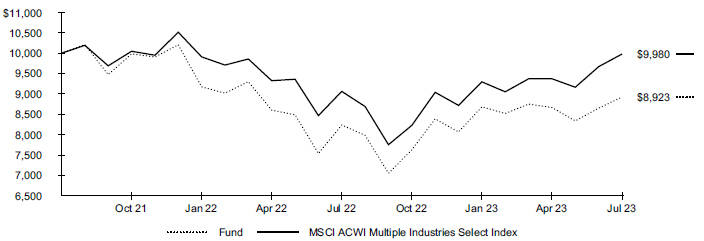

| Fund Summary as of July 31, 2023 | | BlackRock Future Financial and Technology ETF |

Investment Objective

The BlackRock Future Financial and Technology ETF (the “Fund”) seeks to maximize total return.

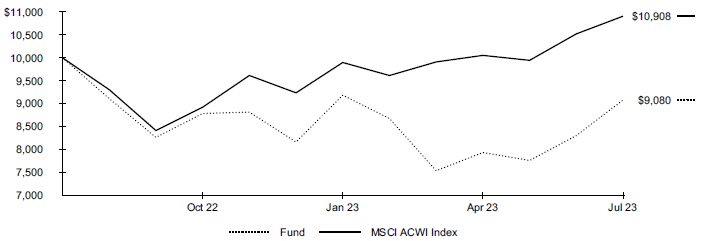

Performance

| | | | | | |

| | | | | Cumulative Total Returns | |

| | | | | Since Inception | |

| | |

Fund NAV | | | | | (9.20 | )%(a) |

Fund Market | | | | | (9.02 | ) |

MSCI ACWI Index(b) | | | | | 9.08 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was August 16, 2022. The first day of secondary market trading was August 18, 2022.

| | (a) | The NAV total return presented in the table for the one-year period differs from the same period return disclosed in the financial highlights. The total return in the financial highlights is calculated in the same manner but differs due to certain adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. | |

| | (b) | MSCI All Country World Index captures large- and mid-cap representation across certain developed and emerging markets. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 988.60 | | | | $ 3.45 | | | | | | | | $ 1,000.00 | | | | $ 1,021.30 | | | | $ 3.51 | | | | 0.70 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

Portfolio Management Commentary

The Fund posted a negative absolute return in the time from its inception on August 16, 2022, through the close of the period on July 31, 2023. In particular, it was hurt by its investments in three regional banks that failed in March 2023: Signature Bank, SVB Capital, and Silvergate Capital. All three have been sold from the Fund.

Network International Holdings PLC, which received multiple takeover bids, was a top contributor. The Fund sold the position in May, as the stock approached the takeover price. Kaspi.kz JSC, a Kazakhstan-based fintech company, also contributed to returns on the strength of robust earnings growth.

| | |

| 6 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock Future Financial and Technology ETF |

Portfolio Information

INDUSTRY ALLOCATION

| | | | |

Industry | |

| Percent of

Total Investments |

(a) |

Financial Services | | | 52.2 | % |

Consumer Finance | | | 15.2 | |

Banks | | | 14.4 | |

Software | | | 10.0 | |

Capital Markets | | | 8.2 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Black Knight Inc. | | | 5.9 | % |

Kaspi.KZ JSC | | | 5.2 | |

Global Payments Inc. | | | 4.9 | |

Pagseguro Digital Ltd., Class A | | | 4.9 | |

Fidelity National Information Services Inc. | | | 4.8 | |

Nuvei Corp. | | | 4.6 | |

WEX Inc. | | | 4.6 | |

Fiserv Inc. | | | 4.4 | |

XP Inc., Class A | | | 3.8 | |

Repay Holdings Corp. | | | 3.4 | |

| | (a) | Excludes money market funds. | |

| | |

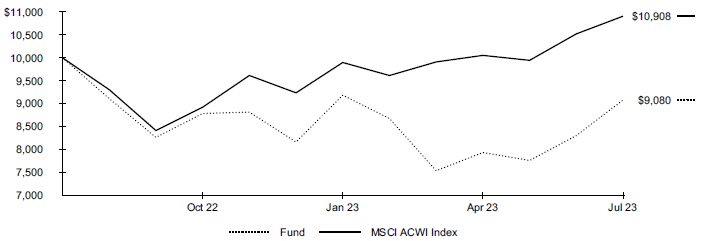

| Fund Summary as of July 31, 2023 | | BlackRock Future Health ETF |

Investment Objective

The BlackRock Future Health ETF (the “Fund”) seeks to maximize total return.

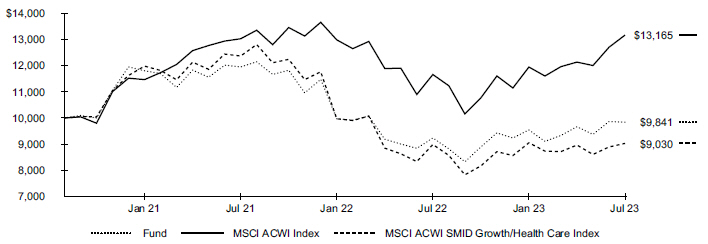

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since

Inception | | | | | | 1 Year | | | Since

Inception | |

Fund NAV | | | 6.56 | % | | | (0.56 | )% | | | | | | | 6.56 | % | | | (1.59 | )% |

Fund Market | | | 6.33 | | | | (0.61 | ) | | | | | | | 6.33 | | | | (1.71 | ) |

MSCI ACWI Index(a) | | | 12.91 | | | | 10.18 | | | | | | | | 12.91 | | | | 31.65 | |

MSCI ACWI SMID Growth Health Care Index (b) | | | 0.47 | | | | (3.53 | ) | | | | | | | 0.47 | | | | (9.70 | ) |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was September 29, 2020. The first day of secondary market trading was October 1, 2020.

| | (a) | MSCI All Country World Index captures large- and mid-cap representation across certain developed and emerging markets. | |

| | (b) | MSCI ACWI SMID Growth Health Care Index captures mid- and small-cap securities exhibiting overall growth style characteristics across certain developed markets and emerging markets countries. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,031.20 | | | | $ 4.28 | | | | | | | | $ 1,000.00 | | | | $ 1,020.60 | | | | $ 4.26 | | | | 0.85 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 8 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock Future Health ETF |

Portfolio Management Commentary

Small- to mid-sized healthcare stocks posted positive returns in the annual period, but they were unable to keep pace with broad-based measures of market performance, including the Fund’s benchmark, the MSCI ACWI Index.

At the industry level, the strongest performance came from the Fund’s positions in the biotechnology and healthcare equipment & supplies categories. Life sciences tools & services was the weakest performing area and the only segment of the Fund to finish the period with a negative total return.

On an individual security basis, an out-of-benchmark position in Penumbra, Inc. was the largest contributor to relative performance. The company continued to display strong fundamentals, and it benefitted from rumors of a potential acquisition. An out-of-benchmark holding in Reata Pharmaceuticals, Inc. was another top contributor. In March 2023, the company received FDA approval for its treatment of a rare hereditary neurological disorder. The company was acquired by Biogen in July 2023 as a result, boosting its shares.

An overweight position in Novocure was a key detractor. The U.S.-based oncology treatment provider reported weaker-than-expected clinical trial data for its electric-field based lung cancer treatment in June 2023, leading to a decline in its stock price.

Portfolio Information

INDUSTRY ALLOCATION

| | | | |

Industry | |

| Percent of

Total Investments |

(a) |

Biotechnology | | | 38.2 | % |

Health Care Equipment & Supplies | | | 36.5 | |

Life Sciences Tools & Services | | | 13.3 | |

Pharmaceuticals | | | 7.2 | |

Health Care Providers & Services | | | 4.5 | |

Other (each representing less than 1%) | | | 0.3 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Intuitive Surgical Inc. | | | 3.3 | % |

Alcon Inc. | | | 3.2 | |

Vertex Pharmaceuticals Inc. | | | 3.0 | |

Boston Scientific Corp. | | | 2.9 | |

AmerisourceBergen Corp. | | | 2.7 | |

Align Technology Inc. | | | 2.6 | |

Argenx SE | | | 2.6 | |

Dexcom Inc. | | | 2.5 | |

West Pharmaceutical Services Inc. | | | 2.5 | |

Stryker Corp. | | | 2.3 | |

| | (a) | Excludes money market funds. | |

| | |

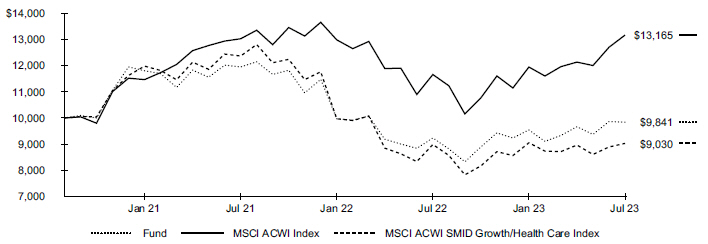

| Fund Summary as of July 31, 2023 | | BlackRock Future Innovators ETF |

Investment Objective

The BlackRock Future Innovators ETF (the “Fund”) seeks long-term capital appreciation.

On May 23, 2023, the Board approved the liquidation of BlackRock Future Innovators ETF. After the close of business on October 30, 2023, the Fund will no longer accept creation orders. Trading in the Fund will be halted prior to market open on October 31, 2023. Proceeds of the liquidation are expected to be sent to shareholders on or about November 2, 2023.

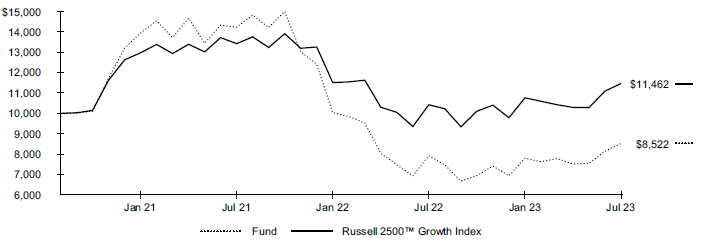

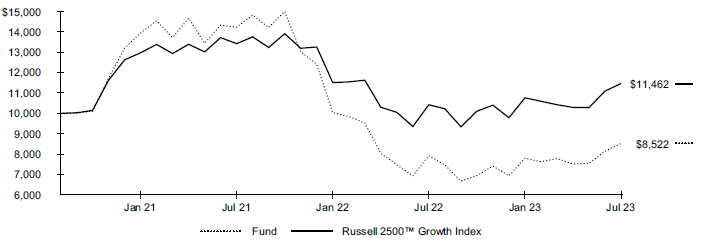

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since

Inception | | | | | | 1 Year | | | Since

Inception | |

Fund NAV | | | 7.61 | % | | | (5.48 | )% | | | | | | | 7.61 | % | | | (14.78 | )% |

Fund Market | | | 7.29 | | | | (5.59 | ) | | | | | | | 7.29 | | | | (15.07 | ) |

Russell 2500™ Growth Index(a) | | | 9.99 | | | | 4.93 | | | | | | | | 9.99 | | | | 14.62 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was September 29, 2020. The first day of secondary market trading was October 1, 2020.

| | (a) | The Russell 2500™ Growth Index measures the performance of the small to mid-cap growth segment of the US equity universe. It includes those Russell 2500™ companies with higher growth earning potential as defined by FTSE Russell’s leading style methodology. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,092.90 | | | | $ 4.15 | | | | | | | | $ 1,000.00 | | | | $ 1,020.80 | | | | $ 4.01 | | | | 0.80 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 10 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock Future Innovators ETF |

Portfolio Management Commentary

U.S. equities performed very well in the 12-month reporting period, as investors were cheered by the combination of positive economic growth and hopes that the U.S. Federal Reserve’s long series of interest rate increases would come to an end in 2023. Growth stocks outpaced the broader market, which was a tailwind for the Fund given its emphasis on small- to mid-sized, innovative companies. Its holdings in the industrials and information technology sectors performed particularly well in this environment. On the other hand, its positions in healthcare and communication services lagged.

Axon Enterprises, Inc. was a top contributor to performance. The stock was boosted by the growing adoption of Axon VR, an immersive de-escalation training system that helps make both communities and police officers safer. The company saw $20 million in bookings in its first year, with 1,100 public safety agencies signed up so far. Saia, Inc., a major player in the less-than-truckload industry, also contributed despite the softening in the economy. Saia has executed well, leading to robust earnings.

Match Group, Inc. and Azenta, Inc. were the largest detractors at the individual stock level. Match Group, an operator of dating applications and websites, posted lower-than-expected earnings due in part to foreign exchange headwinds and weakness in the Asia Pacific region. Azenta underperformed as a corporate restructuring and business rebranding weighed on operating results and contributed to disappointing forward guidance by management. The company was also negatively impacted from a roll-off in COVID-related sales, challenges tied to a weaker macro environment, reduced customer funding caused by higher interest rates, inventory destocking, and a delayed economic reopening in China.

Portfolio Information

INDUSTRY ALLOCATION

| | | | |

Industry | |

| Percent of

Total Investments |

(a) |

Software | | | 17.9 | % |

Semiconductors & Semiconductor Equipment | | | 12.8 | |

Life Sciences Tools & Services | | | 9.7 | |

Hotels, Restaurants & Leisure | | | 7.6 | |

Capital Markets | | | 6.5 | |

Aerospace & Defense | | | 5.8 | |

IT Services | | | 5.0 | |

Machinery | | | 3.7 | |

Health Care Equipment & Supplies | | | 3.6 | |

Ground Transportation | | | 3.6 | |

Diversified Consumer Services | | | 3.4 | |

Health Care Technology | | | 2.4 | |

Interactive Media & Services | | | 2.3 | |

Construction & Engineering | | | 2.3 | |

Automobile Components | | | 2.0 | |

Air Freight & Logistics | | | 2.0 | |

Building Products | | | 2.0 | |

Professional Services | | | 2.0 | |

Biotechnology | | | 1.4 | |

Health Care Providers & Services | | | 1.3 | |

Other (each representing less than 1%) | | | 2.7 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Saia Inc. | | | 3.6 | % |

Axon Enterprise Inc. | | | 3.2 | |

Entegris Inc. | | | 3.0 | |

Tradeweb Markets Inc., Class A | | | 3.0 | |

Monolithic Power Systems Inc. | | | 2.8 | |

Duolingo Inc, Class A | | | 2.8 | |

Lattice Semiconductor Corp. | | | 2.8 | |

HubSpot Inc. | | | 2.7 | |

Confluent Inc., Class A | | | 2.6 | |

HEICO Corp. | | | 2.6 | |

| | (a) | Excludes money market funds. | |

| | |

| Fund Summary as of July 31, 2023 | | BlackRock Future Tech ETF |

Investment Objective

The BlackRock Future Tech ETF (the “Fund”) seeks to maximize total return.

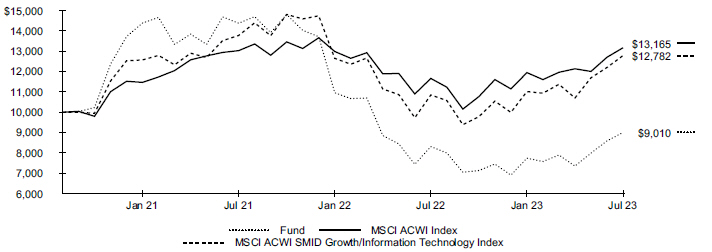

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since

Inception | | | | | | 1 Year | | | Since

Inception | |

Fund NAV | | | 8.35 | % | | | (3.61 | )% | | | | | | | 8.35 | % | | | (9.90 | )% |

Fund Market | | | 8.28 | | | | (3.61 | ) | | | | | | | 8.28 | | | | (9.90 | ) |

MSCI ACWI Index(a) | | | 12.91 | | | | 10.18 | | | | | | | | 12.91 | | | | 31.65 | |

MSCI ACWI SMID Growth Information Technology Index(b) | | | 17.83 | | | | 9.04 | | | | | | | | 17.83 | | | | 27.82 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was September 29, 2020. The first day of secondary market trading was October 1, 2020.

| | (a) | MSCI All Country World Index captures large- and mid-cap representation across certain developed and emerging markets. | |

| | (b) | MSCI ACWI SMID Growth Information Technology Index captures mid- and small-cap securities exhibiting overall growth style characteristics across certain Developed and Emerging Markets. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,163.30 | | | | $ 4.72 | | | | | | | | $ 1,000.00 | | | | $ 1,020.40 | | | | $ 4.41 | | | | 0.88 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 12 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock Future Tech ETF |

Portfolio Management Commentary

The Fund produced a positive absolute return in the annual period, reflecting strength in technology stocks. The strongest returns came from the Fund’s positions in the semiconductor & semiconductor equipment industry, followed by technology hardware & equipment, and IT services.

Among individual holdings, an overweight position in semiconductor designer NVIDIA, Inc. was the largest contributor to relative performance. The stock jumped on strong demand for the company’s graphics processing units (GPUs) that enable artificial intelligence (AI). An overweight position in Be Semiconductor Industries NV also contributed to relative performance. The semiconductor equipment manufacturer’s share price increased on rising demand for the tools required to produce leading-edge chips.

An overweight in the analog chip designer and manufacturer Wolfspeed, Inc. was the largest detractor. The stock fell on investor concerns about the company’s aggressive plan to ramp up production. An out-of-benchmark position in legal software provider CS Disco, Inc. also detracted from relative performance as customer usage for the company’s key product dropped sharply.

Portfolio Information

INDUSTRY ALLOCATION

| | | | |

Industry | |

| Percent of

Total Investments |

(a) |

Semiconductors & Semiconductor Equipment | | | 36.2 | % |

Software | | | 18.3 | |

Electronic Equipment, Instruments & Components | | | 9.6 | |

Technology Hardware, Storage & Peripherals | | | 4.9 | |

Entertainment | | | 4.7 | |

Financial Services | | | 4.0 | |

Automobiles | | | 2.9 | |

Hotels, Restaurants & Leisure | | | 2.8 | |

IT Services | | | 2.6 | |

Media | | | 2.3 | |

Professional Services | | | 2.2 | |

Interactive Media & Services | | | 2.1 | |

Broadline Retail | | | 2.1 | |

Communications Equipment | | | 1.3 | |

Consumer Finance | | | 1.1 | |

Other (each representing less than 1%) | | | 2.9 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Nvidia Corp. | | | 5.7 | % |

Synopsys Inc. | | | 4.2 | |

ASM International NV | | | 3.0 | |

Tesla Inc. | | | 2.9 | |

Lattice Semiconductor Corp. | | | 2.6 | |

Jabil Inc. | | | 2.4 | |

ON Semiconductor Corp. | | | 2.4 | |

Informa PLC | | | 2.3 | |

Monolithic Power Systems Inc. | | | 2.2 | |

MongoDB Inc. | | | 2.1 | |

| | (a) | Excludes money market funds. | |

| | |

| Fund Summary as of July 31, 2023 | | BlackRock Future U.S. Themes ETF |

Investment Objective

The BlackRock Future U.S. Themes ETF (the “Fund”) seeks long-term capital appreciation.

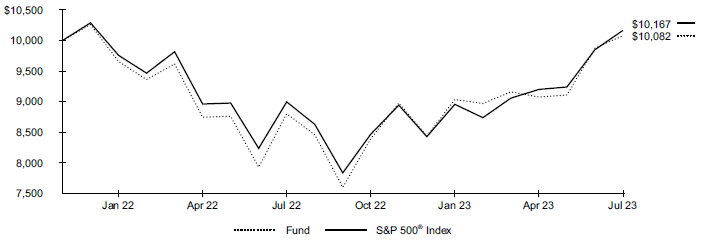

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since

Inception | | | | | | 1 Year | | | Since

Inception | |

Fund NAV | | | 14.56 | % | | | 0.50 | % | | | | | | | 14.56 | % | | | 0.82 | % |

Fund Market | | | 14.44 | | | | 0.43 | | | | | | | | 14.44 | | | | 0.70 | |

S&P 500® Index(a) | | | 13.02 | | | | 1.02 | | | | | | | | 13.02 | | | | 1.67 | |

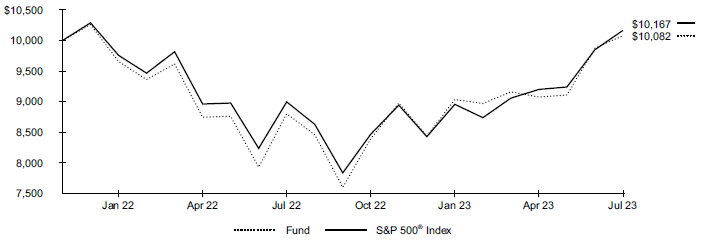

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was December 14, 2021. The first day of secondary market trading was December 16, 2021.

| | (a) | The S&P 500® Index covers 500 leading companies and captures approximately 80% coverage of available market capitalization. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,115.90 | | | | $ 3.15 | | | | | | | | $ 1,000.00 | | | | $ 1,021.80 | | | | $ 3.01 | | | | 0.60 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 14 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock Future U.S. Themes ETF |

Portfolio Management Commentary

U.S. equities delivered robust returns in the annual period, reflecting the backdrop of better-than-expected economic growth and hopes that the U.S. Federal Reserve would soon complete its long series of interest rate increases. The Fund posted a strong total return and outpaced the S&P 500 Index, led by the strength of its holdings in the information technology and industrials sectors.

Among individual holdings, Broadcom, Inc. and Palo Alto Networks, Inc. were the two largest contributors to performance. After challenges for technology firms in 2022, the ascendance of generative artificial intelligence (AI) in 2023 was perceived by investors as a watershed moment and quickly became a significant driver of market returns. Broadcom, as a developer of the chips and software used in AI development, benefited from this trend. Palo Alto Networks, a cybersecurity firm deploying advanced firewall solutions, also benefitted from tailwinds for technology- and AI-related stocks, as well as geopolitical tensions that could lead to higher cybersecurity demand.

An underweight position in Alphabet Inc., the parent company of Google and one of the leading technology firms by revenue and market capitalization, was the largest detractor from relative performance. Positions in Qualcomm, Inc. and Accenture PLC were also notable detractors in the annual period.

Portfolio Information

INDUSTRY ALLOCATION

| | | | |

Industry | |

| Percent of

Total Investments |

(a) |

Software | | | 15.7 | % |

Financial Services | | | 11.4 | |

Technology Hardware, Storage & Peripherals | | | 7.7 | |

Specialty Retail | | | 6.0 | |

Oil, Gas & Consumable Fuels | | | 5.5 | |

Semiconductors & Semiconductor Equipment | | | 4.7 | |

Hotels, Restaurants & Leisure | | | 4.4 | |

Professional Services | | | 4.2 | |

Electronic Equipment, Instruments & Components | | | 3.7 | |

Consumer Staples Distribution & Retail | | | 3.4 | |

Building Products | | | 2.8 | |

Trading Companies & Distributors | | | 2.7 | |

Machinery | | | 2.5 | |

Commercial Services & Supplies | | | 2.4 | |

Health Care Providers & Services | | | 2.4 | |

Textiles, Apparel & Luxury Goods | | | 1.7 | |

Ground Transportation | | | 1.7 | |

Construction & Engineering | | | 1.7 | |

Household Durables | | | 1.5 | |

Construction Materials | | | 1.4 | |

Metals & Mining | | | 1.3 | |

Distributors | | | 1.2 | |

Interactive Media & Services | | | 1.2 | |

Food Products | | | 1.2 | |

Electrical Equipment | | | 1.2 | |

Broadline Retail | | | 1.0 | |

Insurance | | | 1.0 | |

Other (each representing less than 1%) | | | 4.4 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Apple Inc. | | | 7.0 | % |

Microsoft Corp. | | | 3.7 | |

Berkshire Hathaway Inc., Class B | | | 3.7 | |

McDonald’s Corp. | | | 3.3 | |

Mastercard Inc., Class A | | | 3.0 | |

Broadcom Inc. | | | 2.8 | |

Visa Inc., Class A | | | 2.5 | |

Check Point Software Technologies Ltd. | | | 2.3 | |

TJX Companies Inc. (The) | | | 2.1 | |

Adobe Inc. | | | 2.1 | |

| | (a) | Excludes money market funds. | |

| | |

| Fund Summary as of July 31, 2023 | | BlackRock Large Cap Value ETF |

Investment Objective

The BlackRock Large Cap Value ETF (the “Fund”) seeks to maximize total return.

Performance

| | | | | | |

| | | | | Cumulative Total Returns | |

| | | | | Since Inception | |

| | |

Fund NAV | | | | | 8.70 | % |

Fund Market | | | | | 8.56 | |

Russell 1000 Value Index(a) | | | | | 8.24 | |

For the fiscal period ended July 31, 2023, the Fund did not have six months of performance and therefore line graphs are not presented.

The inception date of the Fund was May 19, 2023. The first day of secondary market trading was May 23, 2023.

| | (a) | The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(05/19/23 |

)(a) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(b) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(b) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,000.00 | | | | $ 1.10 | | | | | | | | $ 1,000.00 | | | | $ 1,022.10 | | | | $ 2.76 | | | | 0.55 | % |

| | (a) | Commencement of operations. | |

| | (b) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 73/365 for actual expenses and 181/365 for hypothetical expenses (to reflect the six month period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 16 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock Large Cap Value ETF |

Portfolio Information

SECTOR ALLOCATION

| | | | |

Industry | |

| Percent of

Total Investments |

(a) |

Health Care Providers & Services | | | 12.3 | % |

Banks | | | 10.0 | |

Professional Services | | | 7.0 | |

Oil, Gas & Consumable Fuels | | | 6.8 | |

Insurance | | | 4.7 | |

Capital Markets | | | 4.7 | |

Health Care Equipment & Supplies | | | 4.4 | |

Communications Equipment | | | 4.3 | |

Electric Utilities | | | 4.3 | |

Media | | | 4.0 | |

Financial Services | | | 3.9 | |

Consumer Staples Distribution & Retail | | | 3.8 | |

Containers & Packaging | | | 3.1 | |

Textiles, Apparel & Luxury Goods | | | 3.1 | |

Interactive Media & Services | | | 2.6 | |

Software | | | 2.4 | |

IT Services | | | 2.0 | |

Pharmaceuticals | | | 1.8 | |

Machinery | | | 1.7 | |

Beverages | | | 1.7 | |

Automobiles | | | 1.7 | |

Automobile Components | | | 1.5 | |

Food Products | | | 1.5 | |

Aerospace & Defense | | | 1.4 | |

Chemicals | | | 1.3 | |

Broadline Retail | | | 1.1 | |

Technology Hardware, Storage & Peripherals | | | 1.0 | |

Specialty Retail | | | 1.0 | |

Other (each representing less than 1%) | | | 0.9 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Cisco Systems Inc. | | | 3.9 | % |

Wells Fargo & Co. | | | 3.9 | |

Cardinal Health Inc. | | | 3.5 | |

Leidos Holdings Inc. | | | 3.4 | |

Ralph Lauren Corp. | | | 3.1 | |

Citigroup Inc. | | | 2.9 | |

Comcast Corp., Class A | | | 2.9 | |

Enterprise Products Partners LP | | | 2.7 | |

Cigna Group (The) | | | 2.7 | |

Laboratory Corp. of America Holdings | | | 2.6 | |

| | (a) | Excludes money market funds. | |

| | |

| Fund Summary as of July 31, 2023 | | BlackRock U.S. Carbon Transition Readiness ETF |

Investment Objective

The BlackRock U.S. Carbon Transition Readiness ETF (the “Fund”) seeks long-term capital appreciation by investing in large- and mid-capitalization U.S. equity securities that may be better positioned to benefit from the transition to a low-carbon economy.

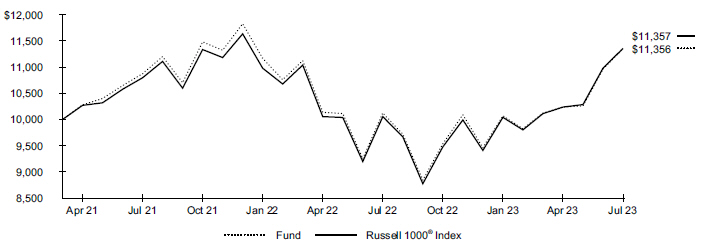

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since

Inception | | | | | | 1 Year | | | Since

Inception | |

Fund NAV | | | 12.16 | % | | | 5.63 | % | | | | | | | 12.16 | % | | | 13.56 | % |

Fund Market | | | 12.22 | | | | 5.65 | | | | | | | | 12.22 | | | | 13.61 | |

Russell 1000® Index(a) | | | 12.95 | | | | 5.65 | | | | | | | | 12.95 | | | | 13.57 | |

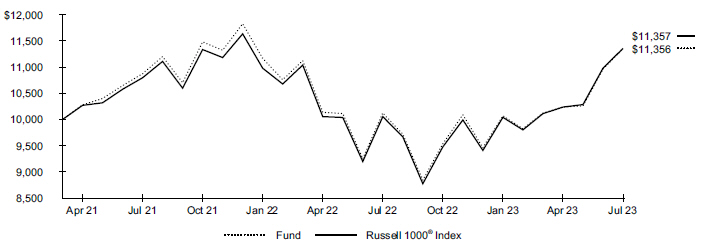

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was April 6, 2021. The first day of secondary market trading was April 8, 2021.

| | (a) | The Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The index represents approximately 93% of the U.S. market. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,127.60 | | | | $ 0.74 | | | | | | | | $ 1,000.00 | | | | $ 1,024.10 | | | | $ 0.70 | | | | 0.14 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 18 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock U.S. Carbon Transition Readiness ETF |

Portfolio Management Commentary

U.S. equities delivered robust returns in the annual period, as the combination of falling inflation and resilient economic growth raised hopes for a “soft landing.” Sustainable strategies generally underperformed in 2022, but they rebounded in the first seven months of 2023. The Fund’s exclusionary positions in fossil fuel sectors, which trailed due to the moderation in oil prices, benefited relative performance.

The Fund’s transition-readiness, model-driven investment process evaluates companies’ preparedness for the transition to a low-carbon economy across five “pillars” (Fossil Fuels, Clean Technology, Energy Management, Waste Management and Water Management). These evaluations are used to determine active portfolio weights, subject to risk and other constraints, relative to the Russell 1000 Index.

The Energy Production pillar added to performance in the annual period, while the Clean Technology Pillar detracted. Given the Fund’s tight risk constraints, Fund performance was primarily driven by individual stock selection. The Fund delivered the best results in the materials sector, while its positioning in financials detracted. Booking Holdings, Inc. and Netflix Inc. were among the top contributors at the individual company level, while Estee Lauder Inc. and Accenture Plc were among the largest detractors.

By design, the Fund remained largely sector neutral. With that said, it was slightly overweight in healthcare and modestly underweight in consumer staples, all within the risk bands employed by the portfolio management process.

Portfolio Information

SECTOR ALLOCATION

| | | | |

Sector | |

| Percent of

Total Investments |

(a) |

Information Technology | | | 27.1 | % |

Health Care | | | 13.4 | |

Financials | | | 13.1 | |

Consumer Discretionary | | | 10.8 | |

Industrials | | | 9.6 | |

Communication Services | | | 8.0 | |

Consumer Staples | | | 6.0 | |

Energy | | | 4.0 | |

Real Estate | | | 2.9 | |

Materials | | | 2.8 | |

Utilities | | | 2.3 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Apple Inc. | | | 7.0 | % |

Microsoft Corp. | | | 6.2 | |

Amazon.com Inc. | | | 2.8 | |

Nvidia Corp. | | | 2.7 | |

Alphabet Inc., Class A | | | 2.1 | |

Alphabet Inc., Class C | | | 1.8 | |

Tesla Inc. | | | 1.8 | |

Meta Platforms Inc, Class A | | | 1.8 | |

Johnson & Johnson | | | 1.7 | |

Berkshire Hathaway Inc., Class B | | | 1.4 | |

| | (a) | Excludes money market funds. | |

| | |

| Fund Summary as of July 31, 2023 | | BlackRock U.S. Equity Factor Rotation ETF |

Investment Objective

The BlackRock U.S. Equity Factor Rotation ETF (the “Fund”) seeks to outperform the investment results of the large- and mid-capitalization U.S. equity markets by providing diversified and tactical exposure to style factors via a factor rotation model.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since

Inception | | | | | | 1 Year | | | Since

Inception | |

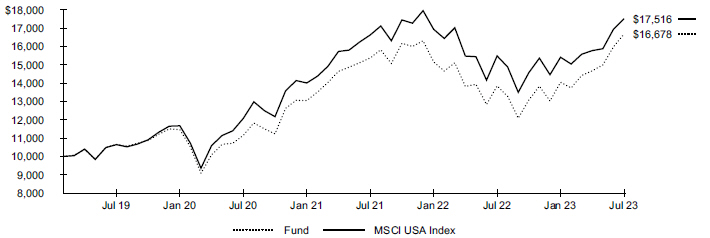

Fund NAV | | | 20.47 | % | | | 12.42 | % | | | | | | | 20.47 | % | | | 66.78 | % |

Fund Market | | | 20.41 | | | | 12.39 | | | | | | | | 20.41 | | | | 66.58 | |

MSCI USA Index(a) | | | 13.14 | | | | 13.71 | | | | | | | | 13.14 | | | | 75.16 | |

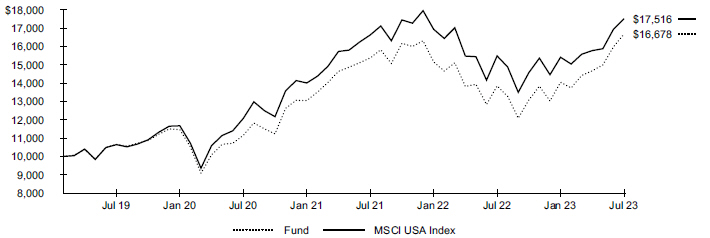

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was March 19, 2019. The first day of secondary market trading was March 21, 2019.

| | (a) | The MSCI USA Index is designed to measure the performance of the large- and mid cap segments of the US market. The index covers approximately 85% of the free float-adjusted market capitalization in the United States. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,187.70 | | | | $ 1.08 | | | | | | | | $ 1,000.00 | | | | $ 1,023.80 | | | | $ 1.00 | | | | 0.20 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 20 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock U.S. Equity Factor Rotation ETF |

Portfolio Management Commentary

U.S. equities delivered robust returns in the annual period, reflecting the backdrop of better-than-expected economic growth and hopes that the U.S. Federal Reserve would soon complete its long series of interest rate increases.

The Fund’s actively managed factor rotation strategy seeks diversified exposure to five style factors: value, low size, momentum, quality, and minimum volatility. The Fund strives to outperform the broader market through the efficacy of these factors, as well as by actively emphasizing exposure to the factors that the investment adviser believes will perform best based on forward-looking insights.

The quality factor outperformed the MSCI USA Index, while value, momentum, low size, and minimum volatility lagged. An equal-weighted portfolio of five factor indexes would have underperformed the MSCI USA Index. In this environment, the Fund’s tilt toward the quality factor was the primary reason for its strong 12-month results. The investment adviser believed the defensive characteristics and relative stability of the quality factor represented positive attributes at a time of market turbulence.

At the sector level, the Fund benefited from its overweight in information technology and underweight in healthcare. On the other hand, an overweight in energy and underweight in industrials detracted. NVIDIA Corp. and Microsoft Corp. were the top individual contributors, while Intel Corp. and United Health Group, Inc. were notable detractors.

Portfolio Information

SECTOR ALLOCATION

| | | | |

Sector | |

| Percent of

Total Investments |

(a) |

Information Technology | | | 33.3 | % |

Consumer Discretionary | | | 17.2 | |

Financials | | | 14.5 | |

Energy | | | 11.2 | |

Communication Services | | | 8.1 | |

Industrials | | | 4.9 | |

Real Estate | | | 3.3 | |

Health Care | | | 3.0 | |

Materials | | | 3.0 | |

Consumer Staples | | | 1.5 | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Microsoft Corp. | | | 9.4 | % |

Apple Inc. | | | 9.2 | |

Visa Inc., Class A | | | 4.6 | |

Amazon.com Inc. | | | 4.4 | |

Nvidia Corp. | | | 3.9 | |

Home Depot Inc. (The) | | | 3.8 | |

Chevron Corp. | | | 3.8 | |

Exxon Mobil Corp. | | | 3.7 | |

Alphabet Inc., Class A | | | 3.5 | |

Mastercard Inc., Class A | | | 3.1 | |

| | (a) | Excludes money market funds. | |

| | |

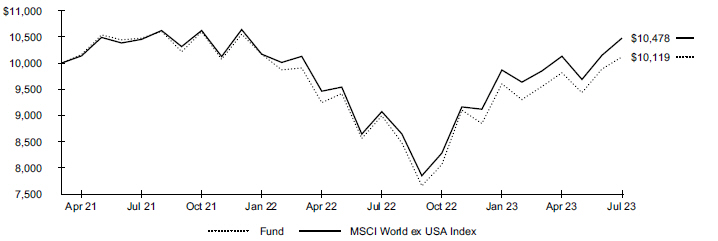

| Fund Summary as of July 31, 2023 | | BlackRock World ex U.S. Carbon Transition Readiness ETF |

Investment Objective

The BlackRock World ex U.S. Carbon Transition Readiness ETF (the “Fund”) seeks long-term capital appreciation by investing in large- and mid-capitalization World ex U.S. equity securities that may be better positioned to benefit from the transition to a low-carbon economy.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | Since

Inception | | | | | | 1 Year | | | Since

Inception | |

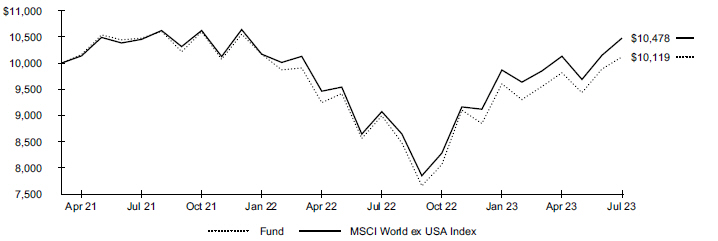

Fund NAV | | | 12.50 | % | | | 0.51 | % | | | | | | | 12.50 | % | | | 1.19 | % |

Fund Market | | | 12.71 | | | | 0.58 | | | | | | | | 12.71 | | | | 1.35 | |

MSCI World ex USA Index(a) | | | 15.47 | | | | 2.04 | | | | | | | | 15.47 | | | | 4.78 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was April 6, 2021. The first day of secondary market trading was April 8, 2021.

| | (a) | The MSCI World ex USA Index captures large- and mid-cap representation across certain developed markets countries, excluding the United States. The index covers approximately 85% of the free float-adjusted market capitalization in each country. | |

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/23 |

) | |

| Ending

Account Value

(07/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | $ 1,000.00 | | | | $ 1,053.60 | | | | $ 1.02 | | | | | | | | $ 1,000.00 | | | | $ 1,023.80 | | | | $ 1.00 | | | | 0.20 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| 22 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2023 (continued) | | BlackRock World ex U.S. Carbon Transition Readiness ETF |

Portfolio Management Commentary

Global equities delivered robust returns in the annual period, as the combination of falling inflation and resilient economic growth raised hopes for a “soft landing.” Sustainable strategies generally underperformed in 2022, but they rebounded in the first seven months of 2023. The Fund’s exclusionary positions in fossil fuel sectors, which trailed due to the moderation in oil prices, benefited relative performance.

The Fund’s transition-readiness, model-driven investment process evaluates companies’ preparedness for the transition to a low-carbon economy across five “pillars” (Fossil Fuels, Clean Technology, Energy Management, Waste Management and Water Management). These evaluations are used to determine active portfolio weights, subject to risk and other constraints, relative to the MSCI World ex USA Index.

The Energy Production pillar added to performance in the annual period, while the Clean Technology and Water Management pillars detracted. Given the Fund’s tight risk constraints, Fund performance was primarily driven by individual stock selection. The Fund delivered the best results in the information technology sector, while its positioning in communication services detracted. Advantest Corp and Abb Ltd were among the top contributors at the individual company level, while Tele2 AB and Enbridge, Inc. were among the largest detractors.

By design, the Fund remained largely sector neutral. With that said, it was slightly overweight in information technology and modestly underweight in financials, all within the risk bands employed by the portfolio management process. The Fund also keeps its geographic allocations close to that of the index.

Portfolio Information

SECTOR ALLOCATION

| | | | |

Sector | |

| Percent of

Total Investments |

(a) |

Financials | | | 20.5 | % |

Industrials | | | 15.4 | |

Consumer Discretionary | | | 11.9 | |

Health Care | | | 11.9 | |

Consumer Staples | | | 9.4 | |

Information Technology | | | 8.6 | |

Materials | | | 7.7 | |

Energy | | | 5.7 | |

Communication Services | | | 3.6 | |

Utilities | | | 3.4 | |

Real Estate | | | 1.9 | |

GEOGRAPHIC ALLOCATION

| | | | |

Country/Geographic Region | |

| Percent of

Total Investments |

(a) |

Japan | | | 19.7 | % |

United Kingdom | | | 13.2 | |

France | | | 11.1 | |

Canada | | | 10.9 | |

Switzerland | | | 10.5 | |

Germany | | | 6.5 | |

Australia | | | 6.3 | |

Netherlands | | | 3.7 | |

Denmark | | | 3.1 | |

Spain | | | 2.8 | |

| | (a) | Excludes money market funds. | |

About Fund Performance

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at blackrock.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not trade in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary market trading in shares of the fund, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Disclosure of Expenses

Shareholders of each Fund may incur the following charges: (1) transactional expenses, including brokerage commissions on purchases and sales of fund shares and (2) ongoing expenses, including management fees and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

| 24 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Schedule of Investments July 31, 2023 | | BlackRock Future Climate and Sustainable Economy ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

| | |

| Building Products — 1.5% | | | | | | |

Kingspan Group PLC | | | 845 | | | $ | 67,823 | |

| | | | | | | | |

| | |

| Capital Markets — 0.9% | | | | | | |

Agronomics Ltd.(a) | | | 315,629 | | | | 41,114 | |

| | | | | | | | |

| | |

| Chemicals — 12.6% | | | | | | |

Albemarle Corp. | | | 99 | | | | 21,016 | |

DSM-Firmenich AG | | | 625 | | | | 69,062 | |

Ecolab Inc. | | | 662 | | | | 121,238 | |

FMC Corp. | | | 777 | | | | 74,771 | |

LG Chem Ltd. | | | 81 | | | | 41,205 | |

Nutrien Ltd. | | | 1,017 | | | | 70,061 | |

Robertet SA | | | 85 | | | | 77,570 | |

Symrise AG, Class A | | | 759 | | | | 82,907 | |

| | | | | | | | |

| | |

| | | | | | | 557,830 | |

| | |

| Commercial Services & Supplies — 5.6% | | | | | | |

Cleanaway Waste Management Ltd. | | | 61,904 | | | | 114,899 | |

Republic Services Inc., Class A | | | 560 | | | | 84,621 | |

Waste Management Inc. | | | 280 | | | | 45,861 | |

| | | | | | | | |

| | |

| | | | | | | 245,381 | |

| | |

| Construction & Engineering — 2.0% | | | | | | |

AECOM | | | 498 | | | | 43,326 | |

Quanta Services Inc.(b) | | | 221 | | | | 44,558 | |

| | | | | | | | |

| | |

| | | | | | | 87,884 | |

| | |

| Containers & Packaging — 6.3% | | | | | | |

Avery Dennison Corp. | | | 255 | | | | 46,923 | |

Crown Holdings Inc. | | | 879 | | | | 81,536 | |

SIG Group AG | | | 3,386 | | | | 90,520 | |

Smurfit Kappa Group PLC | | | 1,490 | | | | 58,961 | |

| | | | | | | | |

| | |

| | | | | | | 277,940 | |

| | |

| Electric Utilities — 5.5% | | | | | | |

Enel SpA | | | 18,738 | | | | 129,202 | |

NextEra Energy Inc. | | | 548 | | | | 40,169 | |

Orsted AS(c) | | | 839 | | | | 73,009 | |

| | | | | | | | |

| | |

| | | | | | | 242,380 | |

| | |

| Electrical Equipment — 5.8% | | | | | | |

Canadian Solar Inc.(a) | | | 2,039 | | | | 73,730 | |

Contemporary Amperex Technology Co. Ltd., Class A | | | 1,400 | | | | 46,672 | |

Schneider Electric SE | | | 366 | | | | 65,284 | |

Vestas Wind Systems A/S(a) | | | 2,708 | | | | 72,430 | |

| | | | | | | | |

| | |

| | | | | | | 258,116 | |

|

| Electronic Equipment, Instruments & Components — 4.9% | |

Keyence Corp. | | | 200 | | | | 89,748 | |

Rogers Corp.(a) | | | 258 | | | | 43,501 | |

Samsung SDI Co. Ltd. | | | 163 | | | | 85,087 | |

| | | | | | | | |

| | |

| | | | | | | 218,336 | |

| | |

| Food Products — 12.5% | | | | | | |

Archer-Daniels-Midland Co. | | | 766 | | | | 65,079 | |

Bunge Ltd. | | | 1,232 | | | | 133,881 | |

Darling Ingredients Inc.(a) | | | 1,186 | | | | 82,131 | |

Kerry Group PLC, Class A | | | 1,243 | | | | 123,493 | |

Maple Leaf Foods Inc. | | | 2,345 | | | | 48,940 | |

Salmar ASA | | | 1,593 | | | | 73,594 | |

SunOpta Inc.(a) | | | 3,850 | | | | 25,526 | |

| | | | | | | | |

| | |

| | | | | | | 552,644 | |

|

| Independent Power and Renewable Electricity Producers — 4.3% | |

EDP Renovaveis SA | | | 8,866 | | | | 169,349 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Independent Power and Renewable Electricity Producers (continued) | |

Orron Energy AB(a) | | | 19,020 | | | $ | 21,987 | |

| | | | | | | | |

| | |

| | | | | | | 191,336 | |

| | |

| Machinery — 16.2% | | | | | | |

Ag Growth International Inc. | | | 2,564 | | | | 105,951 | |

AGCO Corp. | | | 547 | | | | 72,807 | |

Deere & Co. | | | 374 | | | | 160,670 | |

Ingersoll Rand Inc. | | | 1,009 | | | | 65,858 | |

John Bean Technologies Corp. | | | 518 | | | | 64,030 | |

Kurita Water Industries Ltd. | | | 1,000 | | | | 40,215 | |

Marel HF(c) | | | 5,648 | | | | 18,630 | |

Spirax-Sarco Engineering PLC | | | 314 | | | | 44,845 | |

Xylem Inc./NY | | | 1,277 | | | | 143,982 | |

| | | | | | | | |

| | |

| | | | | | | 716,988 | |

| | |

| Metals & Mining — 0.9% | | | | | | |

Sims Ltd. | | | 4,074 | | | | 41,558 | |

| | | | | | | | |

| | |

| Paper & Forest Products — 1.8% | | | | | | |

UPM-Kymmene OYJ | | | 2,380 | | | | 78,796 | |

| | | | | | | | |

| | |

| Professional Services — 2.6% | | | | | | |

Bureau Veritas SA | | | 2,976 | | | | 81,732 | |

SGS SA | | | 341 | | | | 33,110 | |

| | | | | | | | |

| | |

| | | | | | | 114,842 | |

| | |

| Ground Transportation — 0.9% | | | | | | |

Union Pacific Corp. | | | 163 | | | | 37,819 | |

| | | | | | | | |

|

| Semiconductors & Semiconductor Equipment — 7.6% | |

Analog Devices Inc. | | | 396 | | | | 79,014 | |

First Solar Inc.(a) | | | 423 | | | | 87,730 | |

Infineon Technologies AG | | | 1,913 | | | | 84,049 | |

STMicroelectronics NV | | | 1,563 | | | | 83,599 | |

| | | | | | | | |

| | |

| | | | | | | 334,392 | |

| | |

| Software — 3.8% | | | | | | |

Ansys Inc.(a) | | | 253 | | | | 86,551 | |

Dassault Systemes SE | | | 1,859 | | | | 79,451 | |

| | | | | | | | |

| | |

| | | | | | | 166,002 | |

| | | | | | | | |

| | |

Total Common Stocks — 95.7%

(Cost: $4,111,453) | | | | | | | 4,231,181 | |

| | | | | | | | |

| | |

Warrants | | | | | | | | |

| | |

| Capital Markets — 0.0% | | | | | | |

Agronomics Ltd., (Issued 06/01/21, Exercisable at calendar quarter end, 1 Share for 1 Warrant, Expires 12/08/23, Strike Price GBP 0.30)(a) | | | 329,052 | | | | 4 | |

| | | | | | | | |

| | |

Total Warrants — 0.0%

(Cost: $—) | | | | | | | 4 | |

| | | | | | | | |

| | |

Total Long-Term Investments — 95.7%

(Cost: $4,111,453) | | | | | | | 4,231,185 | |

| | | | | | | | |

| | |

Short-Term Securities | | | | | | | | |

| | |

| Money Market Funds — 5.3% | | | | | | |

BlackRock Cash Funds: Institutional, SL Agency Shares, 5.42%(d)(e)(f) | | | 44,587 | | | | 44,600 | |

| | |

SCHEDULE OF INVESTMENTS | | 25 |

| | |

Schedule of Investments (continued) July 31, 2023 | | BlackRock Future Climate and Sustainable Economy ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Money Market Funds (continued) | | | | | | |

BlackRock Cash Funds: Treasury, SL Agency Shares, 5.22%(d)(e) | | | 190,000 | | | $ | 190,000 | |

| | | | | | | | |

| | |

Total Short-Term Securities — 5.3%

(Cost: $234,595) | | | | | | | 234,600 | |

| | | | | | | | |

| | |

Total Investments — 101.0%

(Cost: $4,346,048) | | | | | | | 4,465,785 | |

| | |

Liabilities in Excess of Other Assets — (1.0)% | | | | | | | (42,646 | ) |

| | | | | | | | |

| | |

Net Assets — 100.0% | | | | | | $ | 4,423,139 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is on loan. |

| (c) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (d) | Affiliate of the Fund. |

| (e) | Annualized 7-day yield as of period end. |

| (f) | All or a portion of this security was purchased with the cash collateral from loaned securities. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the period ended July 31, 2023 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Affiliated Issuer | | Value at

07/31/22 | | | Purchases

at Cost | | | Proceeds

from Sale | | | Net Realized Gain (Loss) | | | Change in

Unrealized

Appreciation (Depreciation) | | | Value at

07/31/23 | | | Shares

Held at

07/31/23 | | | Income | | | Capital Gain

Distributions

from

Underlying

Funds | |

BlackRock Cash Funds: Institutional, SL Agency Shares | | $ | 127,650 | | | $ | — | | | $ | (83,135 | )(a) | | $ | 80 | | | $ | 5 | | | $ | 44,600 | | | | 44,587 | | | $ | 396 | (b) | | $ | — | |

BlackRock Cash Funds: Treasury, SL Agency Shares | | | 310,000 | | | | — | | | | (120,000 | )(a) | | | — | | | | — | | | | 190,000 | | | | 190,000 | | | | 9,935 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 80 | | | $ | 5 | | | $ | 234,600 | | | | | | | $ | 10,331 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Represents net amount purchased (sold). | |

| | (b) | All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. | |

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.