UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-23409

American Funds Multi-Sector Income Fund

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Brian C. Janssen

American Funds Multi-Sector Income Fund

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

American Funds Multi-Sector

Income FundSM Annual report

for the period ended

December 31, 2019 |  |

Pursuing

consistent and

diversified income

Beginning January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, we intend to no longer mail paper copies of the fund’s shareholder reports, unless specifically requested from American Funds or your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Capital Group website (capitalgroup.com); you will be notified by mail and provided with a website link to access the report each time a report is posted. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at capitalgroup.com (for accounts held directly with the fund).

You may elect to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you may inform American Funds that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 421-4225. Your election to receive paper reports will apply to all funds held with American Funds or through your financial intermediary.

American Funds Multi-Sector Income Fund seeks to provide a high level of current income. Its secondary investment objective is capital appreciation.

This fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For nearly 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 3.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit capitalgroup.com.

See page 3 for Class A share results with relevant sales charges deducted. For other share class results visit capitalgroup.com and americanfundsretirement.com

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. The investment adviser is currently reimbursing a portion of the other expenses. This reimbursement will be in effect through at least March 22, 2020. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Visit capitalgroup.com for more information.

The fund’s 30-day yield for Class A shares as of January 31, 2020, reflecting the 3.75% maximum sales charge and calculated in accordance with the U.S. Securities and Exchange Commission formula, was 4.15% (4.15% without the reimbursement).

Investing outside the United States may be subject to risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Investments in mortgage-related securities involve additional risks, such as prepayment risk, as more fully described in the prospectus. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds. Refer to the fund prospectus and the Risk Factors section of this report for more information on risks associated with investing in the fund.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

Fellow investors:

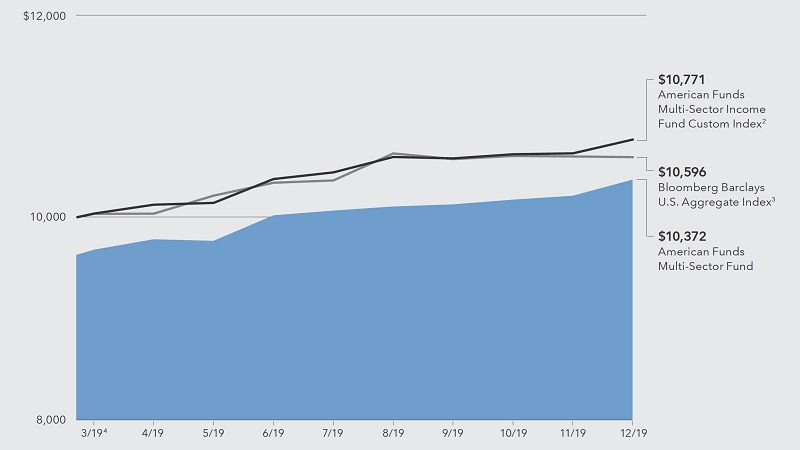

From its inception on March 22, 2019, through December 31, 2019, American Funds Multi-Sector Income Fund generated a total return of 7.76%.

The return assumes reinvestment of monthly dividends of roughly 35 cents a share, paid from April through December. Shareholders who reinvested dividends received an income return of 3.51% for the period. Those who elected to take their dividends in cash received an income return of 3.46%.

By way of comparison, the unmanaged Bloomberg Barclays U.S. Aggregate Index recorded a return of 5.96% over the same period. This index measures broad returns across U.S. dollar-denominated investment-grade bonds.

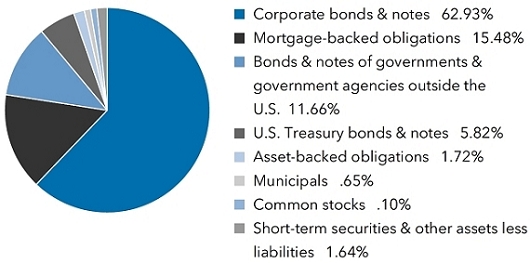

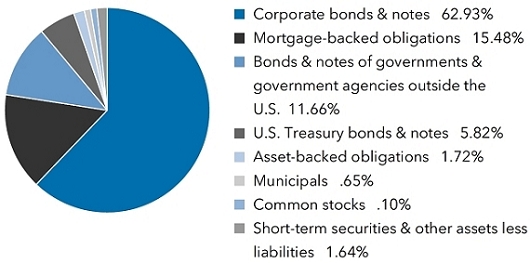

The American Funds Multi-Sector Income Fund provides diversification across income sectors including high-yield corporates, investment-grade corporates, emerging market debt, and securitized debt. The fund also has opportunistic investments in U.S. Treasuries, municipal bonds, and other debt instruments.

The Multi-Sector Income Fund Custom Index provides a secondary benchmark for investors to compare fund results to account for exposure to the sectors listed above. The custom index gained 7.71% from the fund’s inception date through December 31, 2019. The fund’s peer group, as measured by the Morningstar Multisector Bond Category, was up 5.48% over the same period. As of the fiscal year-end, the fund’s corporate holdings, representing 62.9% of the portfolio (39.7% high-yield corporates, and 23.2% investment-grade corporates) were invested across a variety of industries. The fund’s emerging market holdings represented 16.1% of the portfolio, while the fund’s exposure to securitized credit was 13.1%. Roughly 5.8% of the portfolio was invested in U.S. government securities.

Overall, the fund was weighted 48.5% to high yield and 46.4% to investment grade.

Market overview

Markets have been volatile since the fund’s inception, but monetary easing policies worldwide as well as progress on trade negotiations, fueled risk assets toward the end of the year.

The U.S. Federal Reserve cut interest rates in July, September and October amid a murky economic outlook, bringing the benchmark to a range of 1.5%-1.75%. During that time, U.S.-China trade tensions and softening economic data heightened concerns about the forecast for global growth.

Economic data in the U.S. remained resilient throughout the year, with modest growth in gross domestic product, low levels of unemployment, and solid consumer spending.

| American Funds Multi-Sector Income Fund | 1 |

Corporate bonds produced strong results across the ratings spectrum in 2019. Investment-grade corporate bonds in the U.S. returned 14.5% last year, while high-yield corporate bonds notched returns of 14.3%.

Meanwhile, the yield on the benchmark 10-year Treasury note settled at 1.92% at the end of 2019, versus its level of 2.44% on the fund’s inception date of March 22, 2019.

Looking ahead

We expect more volatility in 2020. Global economic growth is modest and fragile. Central bank policy remains uncertain, and the geopolitical environment is unstable. Credit valuations, especially for high yield and investment-grade corporate debt, remain frothy, and could retreat if concerns about the global economy gain renewed traction.

Considering this backdrop, we feel it is prudent to limit the fund’s exposure to corporate credit, and maintain a healthier exposure to securitized and emerging market credit, where valuations are more attractive.

We continually monitor economic trends, credit fundamentals and valuations, and will adjust the fund’s positioning as the landscape changes. We have relied on our deep, fundamental research capabilities and experience through many different credit cycles to help us find the right balance between risk and reward.

Thank you for making American Funds Multi-Sector Income Fund part of your portfolio. We appreciate your support and look forward to reporting to you again in six months.

Sincerely,

Damien J. McCann

President

February 20, 2020

For current information about the fund, visit capitalgroup.com.

| American Funds Multi-Sector Income Fund | 2 |

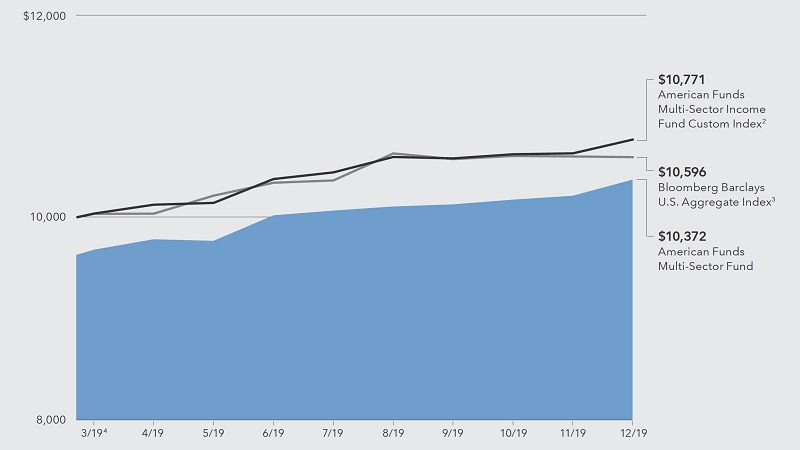

The value of a $10,000 investment

How a hypothetical $10,000 investment has fared for the period March 22, 2019, commencement of operations, to December 31, 2019, with all distributions reinvested.

Fund results shown are for Class A shares and reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.1Thus, the net amount invested was $9,625. Investing for short periods makes losses more likely.

Past results are not predictive of results for future periods. The results shown are before taxes on fund distributions and sale of fund shares.

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are invested in additional shares. |

| 2 | The American Funds Multi-Sector Income Fund Custom Index is composed of 45% Bloomberg Barclays US Corporate High Yield 2% Issuer Capped Index, 30% Bloomberg Barclays US Corporate Investment Grade Index, 15% JP Morgan EMBI Global Diversified, 8% Bloomberg Barclays US CMBS ex AAA Index, and 2% Bloomberg Barclays ABS ex AAA Index. The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Index is rebalanced monthly. |

| 3 | Source: Bloomberg Index Services Ltd. Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. |

| 4 | For the period March 22, 2019, commencement of operations, through December 31, 2019. |

Total return based on a $1,000 investment (for the period ended December 31, 2019)*

| | Lifetime |

| | (since 3/22/2019) |

| | |

| Class A shares | 3.71% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

The fund’s gross expense ratio for Class A shares is 1.05%, and the net expense ratio is 0.89% as of the prospectus dated March 22, 2019.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. Investment results shown reflect the reimbursement, without which the results would have been lower. Refer to the fund’s most recent prospectus for details.

Although the fund has plans of distribution for Class A shares, fees for distribution services are not paid by the fund on amounts invested in the fund by the fund’s investment adviser. Because fees for distribution services were not charged on these assets, total returns were higher. See the “Plans of distribution” section of the prospectus for information on the distribution service fees permitted to be charged by the fund.

| American Funds Multi-Sector Income Fund | 3 |

Investment portfolio December 31, 2019

| Portfolio by type of security | Percent of net assets |

| Portfolio quality summary* | | Percent of

net assets |

| U.S. Treasury and agency† | | | 5.82 | % |

| AAA/Aaa | | | 2.13 | |

| AA/Aa | | | 5.70 | |

| A/A | | | 14.63 | |

| BBB/Baa | | | 18.18 | |

| Below investment grade | | | 47.74 | |

| Unrated | | | 4.16 | |

| Short-term securities & other assets less liabilities | | | 1.64 | |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| † | These securities are guaranteed by the full faith and credit of the U.S. government. |

| Bonds, notes & other debt instruments 98.26% | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds & notes 62.93% | | | | | | | | |

| Health care 8.20% | | | | | | | | |

| Abbott Laboratories 3.75% 2026 | | $ | 30 | | | $ | 33 | |

| AbbVie Inc. 2.95% 20261 | | | 31 | | | | 32 | |

| AbbVie Inc. 3.20% 20291 | | | 62 | | | | 63 | |

| AbbVie Inc. 4.45% 2046 | | | 50 | | | | 54 | |

| AbbVie Inc. 4.25% 20491 | | | 55 | | | | 58 | |

| AstraZeneca PLC 3.375% 2025 | | | 65 | | | | 69 | |

| Bausch Health Cos. Inc. 5.00% 20281 | | | 145 | | | | 149 | |

| Bausch Health Cos. Inc. 5.25% 20301 | | | 140 | | | | 146 | |

| Bristol-Myers Squibb Co. 2.90% 20241 | | | 100 | | | | 103 | |

| Bristol-Myers Squibb Co. 3.40% 20291 | | | 115 | | | | 123 | |

| Centene Corp. 5.375% 20261 | | | 45 | | | | 48 | |

| Centene Corp. 4.25% 20271 | | | 355 | | | | 366 | |

| Centene Corp. 4.625% 20291 | | | 220 | | | | 232 | |

| Charles River Laboratories International, Inc. 5.50% 20261 | | | 45 | | | | 48 | |

| Charles River Laboratories International, Inc. 4.25% 20281 | | | 8 | | | | 8 | |

| Cigna Corp. 4.90% 2048 | | | 20 | | | | 24 | |

| Eagle Holding Co. II, LLC 7.625% 20221,2 | | | 25 | | | | 25 | |

| Eagle Holding Co. II, LLC 7.75% 20221,2 | | | 80 | | | | 81 | |

| Encompass Health Corp. 4.50% 2028 | | | 17 | | | | 18 | |

| Encompass Health Corp. 4.75% 2030 | | | 30 | | | | 31 | |

| GlaxoSmithKline PLC 3.125% 2021 | | | 100 | | | | 102 | |

| HCA Inc. 5.875% 2023 | | | 75 | | | | 83 | |

| HCA Inc. 5.375% 2026 | | | 75 | | | | 84 | |

| HCA Inc. 5.25% 2049 | | | 25 | | | | 28 | |

| IMS Health Holdings, Inc. 5.00% 20261 | | | 200 | | | | 211 | |

| American Funds Multi-Sector Income Fund | 4 |

| | | Principal amount

(000) | | | Value

(000) | |

| Jaguar Holding Co. 6.375% 20231 | | $ | 60 | | | $ | 62 | |

| Kinetic Concepts, Inc. 12.50% 20211 | | | 160 | | | | 165 | |

| Merck & Co., Inc. 3.40% 2029 | | | 30 | | | | 33 | |

| Molina Healthcare, Inc. 5.375% 2022 | | | 100 | | | | 106 | |

| NVA Holdings Inc. 6.875% 20261 | | | 75 | | | | 81 | |

| Par Pharmaceutical Cos. Inc. 7.50% 20271 | | | 30 | | | | 30 | |

| PAREXEL International Corp. 6.375% 20251 | | | 100 | | | | 100 | |

| Pfizer Inc. 4.00% 2049 | | | 10 | | | | 12 | |

| Prestige Brands International Inc. 6.375% 20241 | | | 25 | | | | 26 | |

| Select Medical Holdings Corp. 6.25% 20261 | | | 36 | | | | 39 | |

| Surgery Center Holdings 10.00% 20271 | | | 45 | | | | 50 | |

| Takeda Pharmaceutical Co., Ltd. 5.00% 2028 | | | 120 | | | | 140 | |

| Tenet Healthcare Corp. 4.625% 2024 | | | 50 | | | | 51 | |

| Tenet Healthcare Corp. 4.875% 20261 | | | 60 | | | | 63 | |

| Teva Pharmaceutical Finance Co. BV 3.15% 2026 | | | 625 | | | | 522 | |

| Teva Pharmaceutical Finance Co. BV 6.75% 2028 | | | 200 | | | | 203 | |

| UnitedHealth Group Inc. 2.375% 2024 | | | 15 | | | | 15 | |

| UnitedHealth Group Inc. 2.875% 2029 | | | 15 | | | | 15 | |

| UnitedHealth Group Inc. 4.45% 2048 | | | 35 | | | | 42 | |

| Valeant Pharmaceuticals International, Inc. 6.125% 20251 | | | 50 | | | | 52 | |

| Valeant Pharmaceuticals International, Inc. 9.00% 20251 | | | 100 | | | | 114 | |

| Valeant Pharmaceuticals International, Inc. 8.50% 20271 | | | 75 | | | | 86 | |

| Vizient Inc. 6.25% 20271 | | | 5 | | | | 5 | |

| | | | | | | | 4,231 | |

| | | | | | | | | |

| Energy7.33% | | | | | | | | |

| Apache Corp. 4.25% 2030 | | | 30 | | | | 31 | |

| Apache Corp. 5.35% 2049 | | | 125 | | | | 131 | |

| Ascent Resources - Utica LLC 7.00% 20261 | | | 50 | | | | 40 | |

| BP Capital Markets PLC 4.234% 2028 | | | 55 | | | | 62 | |

| California Resources Corp., Term Loan B, (3-month USD-LIBOR + 4.75%) 6.555% 20223,4 | | | 35 | | | | 31 | |

| Canadian Natural Resources Ltd. 4.95% 2047 | | | 65 | | | | 79 | |

| Carrizo Oil & Gas Inc. 6.25% 2023 | | | 90 | | | | 92 | |

| Cenovus Energy Inc. 4.25% 2027 | | | 80 | | | | 85 | |

| Cenovus Energy Inc. 5.25% 2037 | | | 20 | | | | 22 | |

| Cenovus Energy Inc. 5.40% 2047 | | | 25 | | | | 29 | |

| Centennial Resource Production, LLC 6.875% 20271 | | | 30 | | | | 31 | |

| Cheniere Energy Partners, LP 4.50% 20291 | | | 77 | | | | 79 | |

| Cheniere Energy, Inc. 7.00% 2024 | | | 100 | | | | 115 | |

| Cheniere Energy, Inc. 3.70% 20291 | | | 60 | | | | 61 | |

| Chesapeake Energy Corp. 11.50% 20251 | | | 21 | | | | 20 | |

| Concho Resources Inc. 4.30% 2028 | | | 40 | | | | 44 | |

| Denbury Resources Inc. 9.00% 20211 | | | 60 | | | | 58 | |

| Diamond Offshore Drilling, Inc. 7.875% 2025 | | | 30 | | | | 26 | |

| Enbridge Energy Partners, LP 7.375% 2045 | | | 35 | | | | 52 | |

| Energy Transfer Partners, LP 6.125% 2045 | | | 20 | | | | 23 | |

| Energy Transfer Partners, LP 5.30% 2047 | | | 35 | | | | 37 | |

| Energy Transfer Partners, LP 6.00% 2048 | | | 80 | | | | 93 | |

| Energy Transfer Partners, LP 6.25% 2049 | | | 60 | | | | 72 | |

| Equinor ASA 3.625% 2028 | | | 15 | | | | 17 | |

| Equinor ASA 3.25% 2049 | | | 23 | | | | 23 | |

| Matador Resources Co. 5.875% 2026 | | | 25 | | | | 25 | |

| Murphy Oil Corp. 5.875% 2027 | | | 15 | | | | 16 | |

| MV24 Capital BV 6.748% 20341 | | | 200 | | | | 212 | |

| Nabors Industries Inc. 5.75% 2025 | | | 30 | | | | 27 | |

| NGL Energy Partners LP 7.50% 2023 | | | 25 | | | | 25 | |

| Noble Energy, Inc. 3.25% 2029 | | | 150 | | | | 151 | |

| NuStar Logistics, LP 6.00% 2026 | | | 40 | | | | 42 | |

| Oasis Petroleum Inc. 6.875% 2022 | | | 100 | | | | 97 | |

| Oasis Petroleum Inc. 6.25% 20261 | | | 170 | | | | 142 | |

| Occidental Petroleum Corp. 3.20% 2026 | | | 25 | | | | 25 | |

| Occidental Petroleum Corp. 3.50% 2029 | | | 108 | | | | 110 | |

| Occidental Petroleum Corp. 4.40% 2049 | | | 20 | | | | 21 | |

| Petrobras Global Finance Co. 5.093% 20301 | | | 75 | | | | 81 | |

| Petróleos Mexicanos 5.625% 2046 | | | 27 | | | | 24 | |

| Petróleos Mexicanos 7.69% 20501 | | | 46 | | | | 50 | |

| QEP Resources, Inc. 5.25% 2023 | | | 20 | | | | 20 | |

| QEP Resources, Inc. 5.625% 2026 | | | 35 | | | | 34 | |

| American Funds Multi-Sector Income Fund | 5 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds & notes (continued) | | | | | | | | |

| Energy (continued) | | | | | | | | |

| Range Resources Corp. 5.00% 2023 | | $ | 25 | | | $ | 23 | |

| Range Resources Corp. 4.875% 2025 | | | 150 | | | | 129 | |

| Sanchez Energy Corp. 7.25% 20231,5 | | | 30 | | | | 20 | |

| Sanchez Energy Corp., Term Loan, (3-month USD-LIBOR + 8.00%) 10.176% 20203,4,6,7 | | | 3 | | | | 3 | |

| Shell International Finance BV 2.00% 2024 | | | 90 | | | | 90 | |

| SM Energy Co. 5.625% 2025 | | | 30 | | | | 29 | |

| SM Energy Co. 6.625% 2027 | | | 175 | | | | 172 | |

| Southwestern Energy Co. 7.50% 2026 | | | 50 | | | | 46 | |

| Sunoco LP 4.875% 2023 | | | 45 | | | | 46 | |

| Sunoco LP 6.00% 2027 | | | 40 | | | | 43 | |

| Targa Resources Partners LP 6.50% 20271 | | | 15 | | | | 17 | |

| Targa Resources Partners LP 6.875% 20291 | | | 15 | | | | 17 | |

| Targa Resources Partners LP 5.50% 20301 | | | 145 | | | | 149 | |

| Teekay Corp. 9.25% 20221 | | | 80 | | | | 84 | |

| Total Capital International 2.434% 2025 | | | 50 | | | | 51 | |

| Total Capital International 3.455% 2029 | | | 45 | | | | 49 | |

| Transocean Guardian Ltd. 5.875% 20241 | | | 36 | | | | 37 | |

| Transocean Inc. 8.375% 20218 | | | 45 | | | | 46 | |

| Transocean Inc. 6.125% 20251 | | | 36 | | | | 37 | |

| Transocean Poseidon Ltd. 6.875% 20271 | | | 40 | | | | 43 | |

| Valaris PLC 7.75% 2026 | | | 30 | | | | 17 | |

| Whiting Petroleum Corp. 6.25% 2023 | | | 50 | | | | 42 | |

| Whiting Petroleum Corp. 6.625% 2026 | | | 205 | | | | 140 | |

| | | | | | | | 3,785 | |

| | | | | | | | | |

| Materials 7.21% | | | | | | | | |

| AK Steel Holding Corp. 7.625% 2021 | | | 35 | | | | 35 | |

| AK Steel Holding Corp. 7.50% 2023 | | | 50 | | | | 52 | |

| Ardagh Group SA 6.50% 20271,2 | | | 200 | | | | 207 | |

| Axalta Coating Systems LLC 4.875% 20241 | | | 150 | | | | 156 | |

| Braskem Idesa Sapi 7.45% 20291 | | | 200 | | | | 213 | |

| Braskem SA 4.50% 20301 | | | 200 | | | | 199 | |

| BWAY Parent Co., Inc. 5.50% 20241 | | | 75 | | | | 77 | |

| BWAY Parent Co., Inc. 7.25% 20251 | | | 100 | | | | 99 | |

| Cascades Inc. 5.125% 20261 | | | 25 | | | | 26 | |

| Cleveland-Cliffs Inc. 4.875% 20241 | | | 55 | | | | 56 | |

| Cleveland-Cliffs Inc. 5.875% 20271 | | | 40 | | | | 38 | |

| CVR Partners, LP 9.25% 20231 | | | 100 | | | | 105 | |

| Cydsa SAB de CV 6.25% 2027 | | | 200 | | | | 206 | |

| Dow Chemical Co. 4.80% 2049 | | | 62 | | | | 72 | |

| First Quantum Minerals Ltd. 7.50% 20251 | | | 520 | | | | 533 | |

| Freeport-McMoRan Inc. 3.55% 2022 | | | 85 | | | | 86 | |

| Freeport-McMoRan Inc. 3.875% 2023 | | | 55 | | | | 56 | |

| FXI Holdings, Inc. 7.875% 20241 | | | 275 | | | | 265 | |

| Greif, Inc. 6.50% 20271 | | | 25 | | | | 27 | |

| Hexion Inc. 7.875% 20271 | | | 120 | | | | 125 | |

| LSB Industries, Inc. 9.625% 20231 | | | 145 | | | | 149 | |

| Mineral Resources Ltd. 8.125% 20271 | | | 25 | | | | 28 | |

| OCI NV 5.25% 20241 | | | 200 | | | | 209 | |

| Owens-Illinois, Inc. 5.875% 20231 | | | 120 | | | | 128 | |

| Platform Specialty Products Corp. 5.875% 20251 | | | 40 | | | | 42 | |

| Scotts Miracle-Gro Co. 4.50% 20291 | | | 50 | | | | 51 | |

| Sealed Air Corp. 5.25% 20231 | | | 25 | | | | 27 | |

| Sealed Air Corp. 4.00% 20271 | | | 38 | | | | 39 | |

| Silgan Holdings Inc. 4.125% 20281 | | | 49 | | | | 49 | |

| Summit Materials, Inc. 6.125% 2023 | | | 20 | | | | 20 | |

| Summit Materials, Inc. 6.50% 20271 | | | 25 | | | | 27 | |

| TPC Group Inc. 10.50% 20241 | | | 76 | | | | 77 | |

| Tronox Ltd. 5.75% 20251 | | | 30 | | | | 31 | |

| Tronox Ltd. 6.50% 20261 | | | 120 | | | | 124 | |

| Univar Solutions USA Inc. 5.125% 20271 | | | 15 | | | | 16 | |

| Venator Materials Corp. 5.75% 20251 | | | 80 | | | | 74 | |

| | | | | | | | 3,724 | |

| American Funds Multi-Sector Income Fund | 6 |

| | | Principal amount

(000) | | | Value

(000) | |

| Communication services 6.38% | | | | | | | | |

| AT&T Inc. (3-month USD-LIBOR + 0.65%) 2.651% 20204 | | $ | 120 | | | $ | 120 | |

| CBS Corp. 7.25% 20241 | | | 25 | | | | 26 | |

| CCO Holdings LLC and CCO Holdings Capital Corp. 5.00% 20281 | | | 200 | | | | 210 | |

| CCO Holdings LLC and CCO Holdings Capital Corp. 4.75% 20301 | | | 120 | | | | 123 | |

| CCO Holdings LLC and CCO Holdings Capital Corp. 5.125% 2049 | | | 133 | | | | 145 | |

| Cinemark USA, Inc. 4.875% 2023 | | | 50 | | | | 51 | |

| Clear Channel Worldwide Holdings, Inc. 9.25% 20241 | | | 85 | | | | 94 | |

| Comcast Corp. 2.65% 2030 | | | 110 | | | | 110 | |

| Comcast Corp. 4.00% 2048 | | | 35 | | | | 39 | |

| Cumulus Media New Holdings Inc. 6.75% 20261 | | | 35 | | | | 38 | |

| Diamond Sports Group LLC 5.375% 20261 | | | 38 | | | | 38 | |

| Diamond Sports Group LLC 6.625% 20271 | | | 45 | | | | 44 | |

| Entercom Media Corp. 6.50% 20271 | | | 5 | | | | 5 | |

| Frontier Communications Corp. 10.50% 2022 | | | 130 | | | | 64 | |

| Frontier Communications Corp. 8.50% 20261 | | | 50 | | | | 51 | |

| Frontier Communications Corp. 8.00% 20271 | | | 60 | | | | 63 | |

| Gray Television, Inc. 7.00% 20271 | | | 40 | | | | 44 | |

| iHeartCommunications, Inc. 5.25% 20271 | | | 32 | | | | 34 | |

| Inmarsat PLC 4.875% 20221 | | | 125 | | | | 127 | |

| Intelsat Jackson Holding Co. 5.50% 2023 | | | 110 | | | | 95 | |

| Intelsat Jackson Holding Co. 8.50% 20241 | | | 45 | | | | 41 | |

| Intelsat Jackson Holding Co., Term Loan, 6.625% 20243 | | | 35 | | | | 35 | |

| Live Nation Entertainment, Inc. 4.875% 20241 | | | 50 | | | | 52 | |

| Live Nation Entertainment, Inc. 5.625% 20261 | | | 35 | | | | 37 | |

| Live Nation Entertainment, Inc. 4.75% 20271 | | | 26 | | | | 27 | |

| MDC Partners Inc. 6.50% 20241 | | | 235 | | | | 213 | |

| Meredith Corp. 6.875% 2026 | | | 65 | | | | 68 | |

| Netflix, Inc. 4.875% 20301 | | | 332 | | | | 338 | |

| Nexstar Escrow Corp. 5.625% 20271 | | | 10 | | | | 11 | |

| OUTFRONT Media Cap LLC 5.00% 20271 | | | 25 | | | | 26 | |

| Sirius XM Radio Inc. 4.625% 20231 | | | 75 | | | | 76 | |

| Sirius XM Radio Inc. 4.625% 20241 | | | 10 | | | | 10 | |

| Sprint Corp. 7.25% 2021 | | | 110 | | | | 117 | |

| Sprint Corp. 6.875% 2028 | | | 340 | | | | 367 | |

| Sprint Corp. 8.75% 2032 | | | 20 | | | | 24 | |

| T-Mobile US, Inc. 4.00% 2022 | | | 50 | | | | 51 | |

| T-Mobile US, Inc. 6.375% 2025 | | | 25 | | | | 26 | |

| Univision Communications Inc. 5.125% 20231 | | | 50 | | | | 50 | |

| Univision Communications Inc. 5.125% 20251 | | | 50 | | | | 50 | |

| Vodafone Group PLC 4.25% 2050 | | | 25 | | | | 26 | |

| Warner Music Group 5.00% 20231 | | | 75 | | | | 77 | |

| Warner Music Group 5.50% 20261 | | | 50 | | | | 53 | |

| | | | | | | | 3,296 | |

| | | | | | | | | |

| Industrials 6.29% | | | | | | | | |

| Allison Transmission Holdings, Inc. 5.00% 20241 | | | 50 | | | | 51 | |

| ARAMARK Corp. 5.125% 2024 | | | 90 | | | | 93 | |

| Ashtead Group PLC 4.125% 20251 | | | 200 | | | | 206 | |

| Associated Materials, LLC 9.00% 20241 | | | 158 | | | | 139 | |

| Beacon Roofing Supply, Inc. 4.875% 20251 | | | 110 | | | | 111 | |

| Boeing Co. 3.10% 2026 | | | 84 | | | | 87 | |

| Boeing Co. 3.20% 2029 | | | 30 | | | | 31 | |

| Boeing Co. 2.95% 2030 | | | 5 | | | | 5 | |

| Boeing Co. 3.60% 2034 | | | 30 | | | | 32 | |

| Boeing Co. 3.90% 2049 | | | 80 | | | | 87 | |

| CSX Corp. 4.50% 2049 | | | 25 | | | | 29 | |

| Dun & Bradstreet Corp. 6.875% 20261 | | | 30 | | | | 33 | |

| Dun & Bradstreet Corp. 10.25% 20271 | | | 200 | | | | 230 | |

| FXI Holdings, Inc. 12.25% 20261 | | | 100 | | | | 104 | |

| General Dynamics Corp. 3.00% 2021 | | | 100 | | | | 102 | |

| Harsco Corp. 5.75% 20271 | | | 40 | | | | 43 | |

| Honeywell International Inc. 2.30% 2024 | | | 75 | | | | 76 | |

| Honeywell International Inc. 2.70% 2029 | | | 35 | | | | 36 | |

| JELD-WEN Holding, Inc. 4.875% 20271 | | | 70 | | | | 72 | |

| LABL Escrow Issuer, LLC 6.75% 20261 | | | 50 | | | | 53 | |

| LABL Escrow Issuer, LLC 10.50% 20271 | | | 45 | | | | 46 | |

| LSC Communications, Inc. 8.75% 20231 | | | 50 | | | | 27 | |

| Mexico City Airport Trust 5.50% 2047 | | | 200 | | | | 207 | |

| American Funds Multi-Sector Income Fund | 7 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds & notes (continued) | | | | | | | | |

| Industrials (continued) | | | | | | | | |

| Moog Inc. 4.25% 20271 | | $ | 43 | | | $ | 44 | |

| Norfolk Southern Corp. 3.00% 2022 | | | 44 | | | | 45 | |

| Northrop Grumman Corp. 2.55% 2022 | | | 60 | | | | 61 | |

| Pisces Parent LLC, Term Loan B, (3-month USD-LIBOR + 3.75%) 5.486% 20253,4 | | | 148 | | | | 148 | |

| PrimeSource Building Products Inc. 9.00% 20231 | | | 225 | | | | 224 | |

| Republic Services, Inc. 2.50% 2024 | | | 100 | | | | 101 | |

| Rexnord Corp. 4.875% 20251 | | | 100 | | | | 103 | |

| Sensata Technologies Holding BV 4.875% 20231 | | | 25 | | | | 27 | |

| Uber Technologies, Inc. 8.00% 20261 | | | 150 | | | | 157 | |

| Union Pacific Corp. 4.30% 2049 | | | 75 | | | | 87 | |

| United Rentals, Inc. 4.625% 2025 | | | 65 | | | | 67 | |

| Virgin Australia Holdings Ltd. 7.875% 20211 | | | 100 | | | | 103 | |

| Wesco Aircraft Holdings, Inc. 8.50% 20241 | | | 125 | | | | 130 | |

| Wesco Aircraft Holdings, Inc. 9.00% 20261 | | | 25 | | | | 26 | |

| Westinghouse Air Brake Technologies Corp. 4.40% 20248 | | | 22 | | | | 23 | |

| | | | | | | | 3,246 | |

| | | | | | | | | |

| Financials 6.08% | | | | | | | | |

| AG Merger Sub II, Inc. 10.75% 20271 | | | 133 | | | | 133 | |

| Alliant Holdings Intermediate, LLC 6.75% 20271 | | | 63 | | | | 68 | |

| Allstate Corp. 3.85% 2049 | | | 20 | | | | 22 | |

| Ally Financial Inc. 8.00% 2031 | | | 25 | | | | 34 | |

| AON Corp. 2.20% 2022 | | | 48 | | | | 48 | |

| AssuredPartners, Inc. 8.00% 20271 | | | 80 | | | | 83 | |

| Bank of America Corp. 3.458% 2025 (3-month USD-LIBOR + 0.97% on 3/15/2024)8 | | | 28 | | | | 29 | |

| Bank of America Corp. 2.88% 2030 (3-month USD-LIBOR + 1.19% on 10/22/2029)8 | | | 24 | | | | 24 | |

| Bank of Montreal 2.50% 2024 | | | 110 | | | | 111 | |

| CCCI Treasure Ltd., 3.50% (UST Yield Curve Rate T Note Constant Maturity 5-year + 7.192% on 4/21/2020)8 | | | 200 | | | | 201 | |

| CIT Group Inc. 4.125% 2021 | | | 50 | | | | 51 | |

| Citigroup Inc. 2.312% 2022 (USD-SOFR + 0.867% on 11/4/2021)8 | | | 90 | | | | 90 | |

| Citigroup Inc. 2.976% 2030 (USD-SOFR + 1.422% on 11/5/2029)8 | | | 10 | | | | 10 | |

| Compass Diversified Holdings 8.00% 20261 | | | 75 | | | | 81 | |

| Danske Bank AS 3.875% 20231 | | | 300 | | | | 312 | |

| Fairstone Financial Inc. 7.875% 20241 | | | 42 | | | | 45 | |

| FS Energy and Power Fund 7.50% 20231 | | | 230 | | | | 236 | |

| Goldman Sachs Group, Inc. 5.375% 2020 | | | 100 | | | | 101 | |

| Hartford Financial Services Group, Inc. 2.80% 2029 | | | 60 | | | | 61 | |

| HSBC Holdings PLC 3.973% 2030 (3-month USD-LIBOR + 1.61% on 5/22/2029)8 | | | 200 | | | | 216 | |

| HUB International Ltd. 7.00% 20261 | | | 180 | | | | 191 | |

| JPMorgan Chase & Co. 2.739% 2030 (USD-SOFR + 1.51% on 10/15/2029)8 | | | 50 | | | | 50 | |

| LPL Financial Holdings Inc. 4.625% 20271 | | | 65 | | | | 67 | |

| Metropolitan Life Global Funding I 2.40% 20211 | | | 150 | | | | 151 | |

| MSCI Inc. 5.375% 20271 | | | 50 | | | | 54 | |

| MSCI Inc. 4.00% 20291 | | | 45 | | | | 46 | |

| Travelers Cos., Inc. 4.10% 2049 | | | 20 | | | | 23 | |

| Wells Fargo & Co. 2.15% 2020 | | | 600 | | | | 600 | |

| | | | | | | | 3,138 | |

| | | | | | | | | |

| Information technology 5.55% | | | | | | | | |

| Almonde Inc., Term Loan, (3-month USD-LIBOR + 7.25%) 9.446% 20253,4 | | | 80 | | | | 78 | |

| Applied Systems, Inc., Term Loan, (3-month USD-LIBOR + 7.00%) 8.945% 20253,4 | | | 25 | | | | 26 | |

| Banff Merger Sub Inc. 9.75% 20261 | | | 75 | | | | 76 | |

| Broadcom Inc. 4.75% 20291 | | | 230 | | | | 252 | |

| Broadcom Ltd. 3.875% 2027 | | | 110 | | | | 114 | |

| Diebold Nixdorf AG, Term Loan A1, (3-month USD-LIBOR + 9.25%) 11.062% 20223,4 | | | 60 | | | | 64 | |

| Diebold, Inc. 8.50% 2024 | | | 175 | | | | 169 | |

| Diebold, Inc., Term Loan A, (3-month USD-LIBOR + 4.75%) 6.50% 20223,4,6 | | | 148 | | | | 144 | |

| Financial & Risk US Holdings, Inc. 6.25% 20261 | | | 105 | | | | 115 | |

| Financial & Risk US Holdings, Inc. 8.25% 20261 | | | 115 | | | | 130 | |

| Fiserv, Inc. 3.50% 2029 | | | 220 | | | | 231 | |

| Genesys Telecommunications Laboratories, Inc. 10.00% 20241 | | | 85 | | | | 92 | |

| GoDaddy Operating Co. 5.25% 20271 | | | 15 | | | | 16 | |

| Infor (US), Inc. 6.50% 2022 | | | 115 | | | | 117 | |

| Kronos Inc., Term Loan B, (3-month USD-LIBOR + 8.25%) 10.159% 20243,4 | | | 175 | | | | 180 | |

| Microsoft Corp. 2.40% 2022 | | | 200 | | | | 203 | |

| American Funds Multi-Sector Income Fund | 8 |

| | | Principal amount

(000) | | | Value

(000) | |

| MoneyGram International Inc., Term Loan B, (3-month USD-LIBOR + 6.00%) 7.799% 20233,4,6 | | $ | 149 | | | $ | 135 | |

| PayPal Holdings, Inc. 2.40% 2024 | | | 100 | | | | 101 | |

| PayPal Holdings, Inc. 2.65% 2026 | | | 59 | | | | 60 | |

| PayPal Holdings, Inc. 2.85% 2029 | | | 115 | | | | 116 | |

| Solera Holdings, Inc. 10.50% 20241 | | | 50 | | | | 53 | |

| Tempo Acquisition LLC 6.75% 20251 | | | 85 | | | | 88 | |

| Unisys Corp. 10.75% 20221 | | | 55 | | | | 59 | |

| VeriSign, Inc. 4.75% 2027 | | | 35 | | | | 37 | |

| Veritas Holdings Ltd. 10.50% 20241 | | | 200 | | | | 186 | |

| Veritas US Inc., Term Loan B, (3-month USD-LIBOR + 4.50%) 6.299% 20233,4 | | | 25 | | | | 24 | |

| | | | | | | | 2,866 | |

| | | | | | | | | |

| Consumer discretionary 5.11% | | | | | | | | |

| Allied Universal Holdco LLC 6.625% 20261 | | | 30 | | | | 32 | |

| Allied Universal Holdco LLC 9.75% 20271 | | | 70 | | | | 75 | |

| Bayerische Motoren Werke AG 2.95% 20221 | | | 200 | | | | 204 | |

| Boyd Gaming Corp. 4.75% 20271 | | | 50 | | | | 52 | |

| Cedar Fair, LP 5.25% 20291 | | | 10 | | | | 11 | |

| Churchill Downs Inc. 4.75% 20281 | | | 85 | | | | 88 | |

| Extended Stay America Inc. 4.625% 20271 | | | 53 | | | | 54 | |

| Fertitta Entertainment, Inc. 8.75% 20251 | | | 100 | | | | 107 | |

| General Motors Co. 5.95% 2049 | | | 35 | | | | 39 | |

| Hanesbrands Inc. 4.875% 20261 | | | 125 | | | | 133 | |

| Hilton Worldwide Holdings Inc. 4.875% 2030 | | | 20 | | | | 21 | |

| Home Depot, Inc. 2.95% 2029 | | | 55 | | | | 57 | |

| Levi Strauss & Co. 5.00% 2025 | | | 25 | | | | 26 | |

| Lowe’s Cos., Inc. 4.05% 2047 | | | 2 | | | | 2 | |

| Lowe’s Cos., Inc. 4.55% 2049 | | | 8 | | | | 9 | |

| Merlin Entertainment 5.75% 20261 | | | 200 | | | | 220 | |

| MGM Resorts International 7.75% 2022 | | | 25 | | | | 28 | |

| MGM Resorts International 6.00% 2023 | | | 85 | | | | 93 | |

| MGM Resorts International 5.50% 2027 | | | 85 | | | | 95 | |

| Neiman Marcus Group Ltd. LLC 8.00% 20241 | | | 90 | | | | 29 | |

| Neiman Marcus Group Ltd. LLC 14.00% 2024 (42.86% PIK)1,2 | | | 66 | | | | 35 | |

| Neiman Marcus Group Ltd. LLC, Term Loan B, (3-month USD-LIBOR + 6.00%) 8.27% 2023 (12.09% PIK)2,3,4 | | | 55 | | | | 45 | |

| Panther BF Aggregator 2, LP 6.25% 20261 | | | 40 | | | | 43 | |

| Panther BF Aggregator 2, LP 8.50% 20271 | | | 80 | | | | 85 | |

| Party City Holdings Inc. 6.125% 20231 | | | 50 | | | | 44 | |

| PetSmart, Inc. 7.125% 20231 | | | 150 | | | | 147 | |

| PetSmart, Inc. 5.875% 20251 | | | 75 | | | | 77 | |

| PetSmart, Inc. 8.875% 20251 | | | 150 | | | | 148 | |

| Scientific Games Corp. 8.25% 20261 | | | 50 | | | | 55 | |

| Scientific Games Corp. 7.00% 20281 | | | 10 | | | | 11 | |

| Scientific Games Corp. 7.25% 20291 | | | 15 | | | | 16 | |

| Six Flags Entertainment Corp. 4.875% 20241 | | | 150 | | | | 156 | |

| Staples, Inc. 7.50% 20261 | | | 75 | | | | 78 | |

| Toyota Motor Credit Corp. 1.90% 2021 | | | 64 | | | | 64 | |

| William Carter Co. 5.625% 20271 | | | 40 | | | | 43 | |

| Wyndham Worldwide Corp. 5.375% 20261 | | | 50 | | | | 53 | |

| Wynn Las Vegas, LLC and Wynn Capital Corp. 4.25% 20231 | | | 75 | | | | 79 | |

| Wynn Las Vegas, LLC and Wynn Capital Corp. 5.25% 20271 | | | 45 | | | | 48 | |

| Wynn Resorts Ltd. 5.125% 20291 | | | 32 | | | | 34 | |

| | | | | | | | 2,636 | |

| | | | | | | | | |

| Utilities 4.76% | | | | | | | | |

| AEP Transmission Co. LLC 3.80% 2049 | | | 20 | | | | 21 | |

| AES Corp. 4.875% 2023 | | | 17 | | | | 17 | |

| AES Corp. 6.00% 2026 | | | 130 | | | | 139 | |

| American Electric Power Co., Inc. 3.65% 2021 | | | 140 | | | | 144 | |

| Calpine Corp. 5.375% 2023 | | | 25 | | | | 25 | |

| Calpine Corp. 5.875% 20241 | | | 75 | | | | 77 | |

| Calpine Corp. 5.125% 20281 | | | 50 | | | | 51 | |

| CenterPoint Energy, Inc. 3.85% 2024 | | | 65 | | | | 69 | |

| Connecticut Light and Power Co. 3.20% 2027 | | | 25 | | | | 26 | |

| Consumers Energy Co. 3.10% 2050 | | | 30 | | | | 30 | |

| DTE Energy Co. 3.95% 2049 | | | 20 | | | | 23 | |

| American Funds Multi-Sector Income Fund | 9 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds & notes (continued) | | | | | | | | |

| Utilities (continued) | | | | | | | | |

| Duke Energy Florida, LLC 2.50% 2029 | | $ | 80 | | | $ | 80 | |

| Duke Energy Progress, LLC 3.60% 2047 | | | 5 | | | | 5 | |

| Edison International 3.125% 2022 | | | 150 | | | | 152 | |

| Edison International 3.55% 2024 | | | 75 | | | | 77 | |

| Edison International 5.75% 2027 | | | 16 | | | | 18 | |

| Edison International 4.125% 2028 | | | 14 | | | | 14 | |

| Entergy Corp. 2.95% 2026 | | | 65 | | | | 66 | |

| FirstEnergy Corp. 3.90% 2027 | | | 55 | | | | 59 | |

| Jersey Central Power & Light Co. 4.30% 20261 | | | 50 | | | | 54 | |

| MidAmerican Energy Holdings Co. 3.65% 2029 | | | 70 | | | | 77 | |

| NGL Energy Partners LP 7.50% 20261 | | | 150 | | | | 146 | |

| NRG Energy, Inc. 7.25% 2026 | | | 35 | | | | 38 | |

| Pacific Gas and Electric Co. 2.45% 20225 | | | 60 | | | | 60 | |

| Pacific Gas and Electric Co. 4.65% 20281,5 | | | 125 | | | | 129 | |

| Pacific Gas and Electric Co. 3.95% 20475 | | | 125 | | | | 124 | |

| Public Service Electric and Gas Co. 3.20% 2029 | | | 30 | | | | 32 | |

| San Diego Gas & Electric Co. 3.75% 2047 | | | 54 | | | | 56 | |

| SCANA Corp. 6.25% 2020 | | | 30 | | | | 30 | |

| Southern California Edison Co. 4.125% 2048 | | | 198 | | | | 211 | |

| State Grid Overseas Investment Ltd. 3.50% 20271 | | | 200 | | | | 210 | |

| Talen Energy Corp. 10.50% 20261 | | | 30 | | | | 29 | |

| Talen Energy Corp. 7.25% 20271 | | | 50 | | | | 53 | |

| Virginia Electric and Power Co. 3.30% 2049 | | | 25 | | | | 25 | |

| Xcel Energy Inc. 2.60% 2029 | | | 50 | | | | 50 | |

| Xcel Energy Inc. 3.50% 2049 | | | 40 | | | | 41 | |

| | | | | | | | 2,458 | |

| | | | | | | | | |

| Consumer staples 4.04% | | | | | | | | |

| Altria Group, Inc. 5.95% 2049 | | | 72 | | | | 87 | |

| Anheuser-Busch Co./InBev Worldwide 4.90% 2046 | | | 90 | | | | 107 | |

| B&G Foods, Inc. 5.25% 2025 | | | 125 | | | | 129 | |

| B&G Foods, Inc. 5.25% 2027 | | | 60 | | | | 61 | |

| British American Tobacco PLC 3.215% 2026 | | | 40 | | | | 40 | |

| British American Tobacco PLC 3.557% 2027 | | | 20 | | | | 20 | |

| British American Tobacco PLC 4.39% 2037 | | | 15 | | | | 15 | |

| British American Tobacco PLC 4.54% 2047 | | | 225 | | | | 226 | |

| Conagra Brands, Inc. 3.80% 2021 | | | 100 | | | | 103 | |

| Conagra Brands, Inc. 5.40% 2048 | | | 105 | | | | 128 | |

| Cott Beverages Inc. 5.50% 20251 | | | 50 | | | | 52 | |

| Darling Ingredients Inc. 5.25% 20271 | | | 125 | | | | 133 | |

| Energizer Holdings, Inc. 7.75% 20271 | | | 100 | | | | 112 | |

| Energizer SpinCo, Inc. 5.50% 20251 | | | 25 | | | | 26 | |

| First Quality Enterprises, Inc. 5.00% 20251 | | | 120 | | | | 125 | |

| Keurig Dr Pepper Inc. 5.085% 2048 | | | 10 | | | | 12 | |

| Kraft Heinz Co. 4.875% 20491 | | | 50 | | | | 53 | |

| Molson Coors Brewing Co. 4.20% 2046 | | | 20 | | | | 20 | |

| Nestle Skin Health SA, Term Loan B1, (3-month USD-LIBOR + 4.25%) 6.195% 20263,4 | | | 89 | | | | 90 | |

| Performance Food Group, Inc. 5.50% 20271 | | | 37 | | | | 40 | |

| Philip Morris International Inc. 3.375% 2029 | | | 235 | | | | 247 | |

| Post Holdings, Inc. 5.00% 20261 | | | 75 | | | | 79 | |

| Post Holdings, Inc. 5.50% 20291 | | | 30 | | | | 32 | |

| Prestige Brands International Inc. 5.125% 20281 | | | 14 | | | | 15 | |

| Wal-Mart Stores, Inc. 2.55% 2023 | | | 130 | | | | 133 | |

| | | | | | | | 2,085 | |

| | | | | | | | | |

| Real estate 1.98% | | | | | | | | |

| American Campus Communities, Inc. 3.30% 2026 | | | 38 | | | | 39 | |

| Brookfield Property REIT Inc. 5.75% 20261 | | | 95 | | | | 100 | |

| Equinix, Inc. 2.625% 2024 | | | 42 | | | | 42 | |

| Equinix, Inc. 2.90% 2026 | | | 68 | | | | 68 | |

| Equinix, Inc. 3.20% 2029 | | | 75 | | | | 76 | |

| Gaming and Leisure Properties, Inc. 3.35% 2024 | | | 11 | | | | 11 | |

| Gaming and Leisure Properties, Inc. 4.00% 2030 | | | 50 | | | | 51 | |

| Howard Hughes Corp. 5.375% 20251 | | | 150 | | | | 157 | |

| Iron Mountain Inc. 5.75% 2024 | | | 60 | | | | 61 | |

| Medical Properties Trust, Inc. 5.00% 2027 | | | 50 | | | | 53 | |

| Realogy Corp. 4.875% 20231 | | | 30 | | | | 30 | |

| American Funds Multi-Sector Income Fund | 10 |

| | | Principal amount

(000) | | | Value

(000) | |

| Realogy Corp. 9.375% 20271 | | $ | 170 | | | $ | 178 | |

| SBA Communications Corp. 4.00% 2022 | | | 100 | | | | 102 | |

| Westfield Corp. Ltd. 3.50% 20291 | | | 50 | | | | 52 | |

| | | | | | | | 1,020 | |

| | | | | | | | | |

| Total corporate bonds & notes | | | | | | | 32,485 | |

| | | | | | | | | |

| Mortgage-backed obligations 15.48% | | | | | | | | |

| Commercial mortgage-backed securities 9.74% | | | | | | | | |

| Citigroup Commercial Mortgage Trust, Series 2013-CG11, Class B, 3.732% 20464,9 | | | 95 | | | | 98 | |

| Citigroup Commercial Mortgage Trust, Series 2013-GC15, Class D, 5.388% 20461,4,9 | | | 250 | | | | 263 | |

| Citigroup Commercial Mortgage Trust, Series 2016-P6, Class B, 4.242% 20494,9 | | | 110 | | | | 117 | |

| Commercial Mortgage Trust, Series 2013-LC6, Class D, 4.265% 20461,4,9 | | | 113 | | | | 115 | |

| Commercial Mortgage Trust, Series 2013-CR10, Class D, 4.789% 20461,4,9 | | | 200 | | | | 207 | |

| Commercial Mortgage Trust, Series 2013-LC6, Class B, 5.388% 20469 | | | 50 | | | | 51 | |

| Commercial Mortgage Trust, Series 2014-UBS2, Class AM, 4.048% 20479 | | | 260 | | | | 274 | |

| Commercial Mortgage Trust, Series 2014-CR20, Class C, 4.513% 20474,9 | | | 110 | | | | 115 | |

| Commercial Mortgage Trust, Series 2014-UBS6, Class C, 4.597% 20474,9 | | | 93 | | | | 95 | |

| Commercial Mortgage Trust, Series 2014-CR19, Class C, 4.747% 20474,9 | | | 300 | | | | 316 | |

| Commercial Mortgage Trust, Series 2015-CR22, Class B, 3.926% 20484,9 | | | 25 | | | | 26 | |

| Commercial Mortgage Trust, Series 2015-LC23, Class C, 4.645% 20484,9 | | | 10 | | | | 11 | |

| Commercial Mortgage Trust, Series 2016-COR1, Class A4, 3.091% 20499 | | | 25 | | | | 26 | |

| GS Mortgage Securities Corp., Series 2013-GC14, Class D, 4.741% 20461,4,9 | | | 370 | | | | 381 | |

| GS Mortgage Securities Corp. II, Series 2014-GC18, Class B, 4.885% 20474,9 | | | 150 | | | | 156 | |

| JPMBB Commercial Mortgage Securities Trust, Series 2013-C14, Class C, 4.702% 20464,9 | | | 230 | | | | 241 | |

| JPMBB Commercial Mortgage Securities Trust, Series 2014-C19, Class D, 4.679% 20471,4,9 | | | 141 | | | | 143 | |

| JPMBB Commercial Mortgage Securities Trust, Series 2015-C31, Class C, 4.616% 20484,9 | | | 150 | | | | 157 | |

| JPMorgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class D, 4.168% 20464,9 | | | 435 | | | | 391 | |

| JPMorgan Chase Commercial Mortgage Securities Trust, Series 2015-JP1, Class B, 4.622% 20494,9 | | | 110 | | | | 119 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C7, Class C, 4.123% 20464,9 | | | 100 | | | | 103 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C7, Class D, 4.239% 20461,4,9 | | | 400 | | | | 388 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C11, Class AS, 4.353% 20464,9 | | | 40 | | | | 42 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2014-C19, Class B, 4.00% 20474,9 | | | 15 | | | | 16 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2014-C15, Class B, 4.565% 20474,9 | | | 100 | | | | 106 | |

| UBS-Barclays Commercial Mortgage Trust, Series 2013-C5, Class B, 3.649% 20461,4,9 | | | 25 | | | | 25 | |

| Wells Fargo Commercial Mortgage Trust, Series 2012-LC5, Class C, 4.693% 20454,9 | | | 20 | | | | 21 | |

| Wells Fargo Commercial Mortgage Trust, Series 2012-LC5, Class D, 4.755% 20451,4,9 | | | 44 | | | | 45 | |

| Wells Fargo Commercial Mortgage Trust, Series 2016-C34, Class A4, 3.096% 20499 | | | 25 | | | | 26 | |

| Wells Fargo Commercial Mortgage Trust, Series 2015-LC22, Class C, 4.534% 20584,9 | | | 110 | | | | 116 | |

| WF-RBS Commercial Mortgage Trust, Series 2013-C13, Class D, 4.139% 20451,4,9 | | | 40 | | | | 41 | |

| WF-RBS Commercial Mortgage Trust, Series 2013-C11, Class C, 4.205% 20454,9 | | | 240 | | | | 248 | |

| WF-RBS Commercial Mortgage Trust, Series 2012-C6, Class B, 4.697% 20459 | | | 40 | | | | 42 | |

| WF-RBS Commercial Mortgage Trust, Series 2012-C7, Class C, 4.813% 20454,9 | | | 300 | | | | 306 | |

| WF-RBS Commercial Mortgage Trust, Series 2013-C14, Class B, 3.841% 20464,9 | | | 198 | | | | 202 | |

| | | | | | | | 5,029 | |

| | | | | | | | | |

| Collateralized mortgage-backed obligations (privately originated) 4.70% | | | | | | | | |

| Bellemeade Re Ltd., Series 2019-3A, Class M1B, (1-month USD-LIBOR + 1.60%) 3.392% 20291,4,9 | | | 400 | | | | 401 | |

| Cascade Funding Mortgage Trust, Series 2018-RM2, Class A, 4.00% 20681,4,9 | | | 85 | | | | 87 | |

| Commercial Mortgage Trust, Series 2012-CR3, Class C, 4.584% 20451,4,9 | | | 300 | | | | 305 | |

| Commercial Mortgage Trust, Series 2013-CR7, Class C, 4.041% 20461,4,9 | | | 177 | | | | 175 | |

| Commercial Mortgage Trust, Series 2013-LC13, Class B, 5.009% 20461,4,9 | | | 200 | | | | 214 | |

| Finance of America Structured Securities Trust, Series 2019-JR2, Class A1, 2.00% 20691,9 | | | 264 | | | | 276 | |

| Finance of America Structured Securities Trust, Series 2019-JR1, Class A, 2.00% 20691,9 | | | 136 | | | | 141 | |

| Legacy Mortgage Asset Trust, Series 2019-GS5, Class A1, 3.20% 20591,4,9 | | | 196 | | | | 196 | |

| Legacy Mortgage Asset Trust, Series 2019-GS2, Class A1, 3.75% 20591,4,9 | | | 234 | | | | 236 | |

| Nationstar HECM Loan Trust, Series 2019-2A, Class M2, 2.645% 20291,4,9 | | | 200 | | | | 200 | |

| RMF Proprietary Issuance Trust, Series 2019-1, Class A, 2.75% 20631,4,9 | | | 200 | | | | 198 | |

| | | | | | | | 2,429 | |

| American Funds Multi-Sector Income Fund | 11 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations 1.04% | | | | | | | | |

| Commercial Mortgage Trust, Series 2013-CR12, Class B, 4.762% 20464,9 | | $ | 320 | | | $ | 333 | |

| Commercial Mortgage Trust, Series 2014-UBS4, Class AM, 3.968% 20479 | | | 68 | | | | 72 | |

| Commercial Mortgage Trust, Series 2014-UBS4, Class B, 4.35% 20479 | | | 75 | | | | 78 | |

| WF-RBS Commercial Mortgage Trust, Series 2012-C8, Class B, 4.311% 20459 | | | 50 | | | | 52 | |

| | | | | | | | 535 | |

| | | | | | | | | |

| Total mortgage-backed obligations | | | | | | | 7,993 | |

| | | | | | | | | |

| Bonds & notes of governments & government agencies outside the U.S. 11.66% | | | | | | | | |

| Abu Dhabi (Emirate of) 2.50% 20291 | | | 200 | | | | 200 | |

| Angola (Republic of) 8.00% 20291 | | | 200 | | | | 214 | |

| Argentine Republic 5.625% 2022 | | | 400 | | | | 208 | |

| Argentine Republic 6.875% 2027 | | | 200 | | | | 100 | |

| Bahrain (Kingdom of) 6.125% 2022 | | | 250 | | | | 270 | |

| Banque Centrale de Tunisie 6.375% 2026 | | € | 100 | | | | 112 | |

| Cameroon (Republic of) 9.50% 2025 | | $ | 200 | | | | 225 | |

| Costa Rica (Republic of) 4.375% 2025 | | | 200 | | | | 200 | |

| Dominican Republic 5.95% 2027 | | | 250 | | | | 277 | |

| Egypt (Arab Republic of) 6.588% 20281 | | | 200 | | | | 209 | |

| Ethiopia (Federal Democratic Republic of) 6.625% 20241 | | | 200 | | | | 216 | |

| Gabonese Republic 6.375% 2024 | | | 200 | | | | 209 | |

| Ghana (Republic of) 8.125% 20321 | | | 200 | | | | 204 | |

| Greece (Hellenic Republic of) 3.75% 2028 | | € | 100 | | | | 133 | |

| Honduras (Republic of) 6.25% 20271 | | $ | 150 | | | | 164 | |

| Kazakhstan (Republic of) 4.875% 2044 | | | 200 | | | | 248 | |

| Kenya (Republic of) 7.25% 2028 | | | 200 | | | | 218 | |

| Pakistan (Islamic Republic of) 8.25% 2024 | | | 400 | | | | 447 | |

| Poland (Republic of) 3.25% 2026 | | | 250 | | | | 266 | |

| Qatar (State of) 3.375% 20241 | | | 200 | | | | 210 | |

| Romania 3.50% 2034 | | € | 30 | | | | 38 | |

| Romania 5.125% 20481 | | $ | 100 | | | | 115 | |

| Romania 5.125% 2048 | | | 100 | | | | 115 | |

| Russian Federation 4.375% 2029 | | | 400 | | | | 445 | |

| South Africa (Republic of) 5.875% 2030 | | | 200 | | | | 217 | |

| Turkey (Republic of) 7.375% 2025 | | | 200 | | | | 219 | |

| Ukraine Government 7.75% 2020 | | | 100 | | | | 103 | |

| Ukraine Government 7.75% 2026 | | | 200 | | | | 219 | |

| United Mexican States 4.50% 2029 | | | 200 | | | | 220 | |

| | | | | | | | 6,021 | |

| | | | | | | | | |

| U.S. Treasury bonds & notes 5.82% | | | | | | | | |

| U.S. Treasury 5.82% | | | | | | | | |

| U.S. Treasury 1.75% 2024 | | | 832 | | | | 835 | |

| U.S. Treasury 1.75% 2026 | | | 158 | | | | 157 | |

| U.S. Treasury 1.75% 202910 | | | 1,544 | | | | 1,521 | |

| U.S. Treasury 2.25% 204910 | | | 506 | | | | 491 | |

| | | | | | | | 3,004 | |

| | | | | | | | | |

| Asset-backed obligations 1.72% | | | | | | | | |

| Aesop Funding LLC, Series 2019-2A, Class A, 3.35% 20251,9 | | | 100 | | | | 103 | |

| Global SC Finance V SRL, Series 2019-1A, Class B, 4.81% 20391,9 | | | 486 | | | | 480 | |

| Hertz Vehicle Financing LLC, Rental Car Asset-Backed Notes, Series 2019-3A, Class A, 2.67% 20251,9 | | | 200 | | | | 200 | |

| Hertz Vehicle Financing LLC, Rental Car Asset-Backed Notes, Series 2019-2A, Class A, 3.42% 20251,9 | | | 100 | | | | 103 | |

| | | | | | | | 886 | |

| | | | | | | | | |

| Municipals 0.65% | | | | | | | | |

| Illinois 0.19% | | | | | | | | |

| G.O. Bonds, Pension Funding, Series 2003, 5.10% 2033 | | | 90 | | | | 97 | |

| | | | | | | | | |

| Puerto Rico 0.28% | | | | | | | | |

| Aqueduct and Sewer Auth., Rev. Bonds, Series 2012-B, 5.35% 2027 | | | 150 | | | | 146 | |

| American Funds Multi-Sector Income Fund | 12 |

| | | Principal amount

(000) | | | Value

(000) | |

| South Carolina 0.18% | | | | | | | | |

| Public Service Auth., Rev. Obligations (Santee Cooper), Series 2015-E, 5.25% 2055 | | $ | 30 | | | $ | 35 | |

| Public Service Auth., Rev. Ref. Obligations (Santee Cooper), Series 2016-C, 5.00% 2035 | | | 50 | | | | 59 | |

| | | | | | | | 94 | |

| | | | | | | | | |

| Total municipals | | | | | | | 337 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments(cost: $49,444,000) | | | | | | | 50,726 | |

| | | | | | | | | |

| Common stocks 0.10% | | | Shares | | | | | |

| Materials 0.10% | | | | | | | | |

| Hexion Holdings Corp., Class B11 | | | 4,181 | | | | 50 | |

| | | | | | | | | |

| Total common stocks (cost: $66,000) | | | | | | | 50 | |

| | | | | | | | | |

| Short-term securities 1.66% | | | | | | | | |

| Money market investments 1.66% | | | | | | | | |

| Capital Group Central Cash Fund 1.73%12 | | | 8,579 | | | | 858 | |

| | | | | | | | | |

| Total short-term securities (cost: $854,000) | | | | | | | 858 | |

| Total investment securities 100.02% (cost: $50,364,000) | | | | | | | 51,634 | |

| Other assets less liabilities (0.02%) | | | | | | | (12 | ) |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 51,622 | |

Futures contracts

| | | | | Number of | | | | | Notional

amount | 13 | | Value at

12/31/2019 | 14 | | Unrealized

(depreciation)

appreciation

at 12/31/2019 | |

| Contracts | | Type | | contracts | | | Expiration | | (000) | | | (000) | | | (000) | |

| 2 Year U.S. Treasury Note Futures | | Long | | | 75 | | | April 2020 | | $ | 15,000 | | | $ | 16,163 | | | $ | (13 | ) |

| 5 Year U.S. Treasury Note Futures | | Long | | | 19 | | | April 2020 | | | 1,900 | | | | 2,254 | | | | (6 | ) |

| 10 Year U.S. Treasury Note Futures | | Long | | | 58 | | | March 2020 | | | 5,800 | | | | 7,448 | | | | (63 | ) |

| 10 Year Ultra U.S. Treasury Note Futures | | Short | | | 58 | | | March 2020 | | | (5,800 | ) | | | (8,161 | ) | | | 105 | |

| 20 Year U.S. Treasury Bond Futures | | Long | | | 7 | | | March 2020 | | | 700 | | | | 1,091 | | | | (23 | ) |

| 30 Year Ultra U.S. Treasury Bond Futures | | Short | | | 4 | | | March 2020 | | | (400 | ) | | | (727 | ) | | | 22 | |

| | | | | | | | | | | | | | | | | | | $ | 22 | |

Forward currency contracts

| Contract amount | | | | | | Unrealized

appreciation | |

Purchases

(000) | | Sales

(000) | | Counterparty | | Settlement

date | | (depreciation)

at 12/31/2019

(000) | |

| EUR100 | | USD112 | | Citibank | | 1/8/2020 | | $ | 1 | |

| USD111 | | EUR100 | | JPMorgan Chase | | 1/8/2020 | | | (1 | ) |

| USD17 | | EUR15 | | Morgan Stanley | | 1/23/2020 | | | — | 15 |

| USD113 | | EUR100 | | Citibank | | 6/19/2020 | | | (1 | ) |

| | | | | | | | | $ | (1 | ) |

| American Funds Multi-Sector Income Fund | 13 |

Swap contracts

Credit default swaps

Centrally cleared credit default swaps on credit indices — buy protection

| Receive | | Pay/

Payment frequency | | Expiration

date | | Notional

(000) | | | Value at

12/31/2019

(000) | | | Upfront

payments

(000) | | | Unrealized

depreciation

at 12/31/2019

(000) | |

| CDX.NA.HY.33 | | 5.00%/Quarterly | | 12/20/2024 | | $ | 3,217 | | | $ | (310 | ) | | $ | (221 | ) | | $ | (89 | ) |

| 1 | Acquired in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $23,907,000, which represented 46.31% of the net assets of the fund. |

| 2 | Payment in kind; the issuer has the option of paying additional securities in lieu of cash. Most recent payment was 100% cash unless otherwise noted. |

| 3 | Loan participations and assignments; may be subject to legal or contractual restrictions on resale. The total value of all such loans was $1,003,000, which represented 1.94% of the net assets of the fund. |

| 4 | Coupon rate may change periodically. Reference rate and spread are as of the most recent information available. Some coupon rates are determined by the issuer or agent based on current market conditions; therefore, the reference rate and spread are not available. |

| 5 | Scheduled interest and/or principal payment was not received. |

| 6 | Valued under fair value procedures adopted by authority of the board of trustees. The total value of all such securities was $282,000, which represented .55% of the net assets of the fund. |

| 7 | Value determined using significant unobservable inputs. |

| 8 | Step bond; coupon rate may change at a later date. |

| 9 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

| 10 | All or a portion of this security was pledged as collateral. The total value of pledged collateral was $182,000, which represented .35% of the net assets of the fund. |

| 11 | Security did not produce income during the last 12 months. |

| 12 | Rate represents the seven-day yield at 12/31/2019. |

| 13 | Notional amount is calculated based on the number of contracts and notional contract size. |

| 14 | Value is calculated based on the notional amount and current market price. |

| 15 | Amount less than one thousand. |

Key to abbreviations and symbols

Auth. = Authority

EUR/€ = Euros

G.O. = General Obligation

LIBOR = London Interbank Offered Rate

Ref. = Refunding

Rev. = Revenue

SOFR = Secured Overnight Financing Rate

USD/$ = U.S. dollars

See notes to financial statements.

| American Funds Multi-Sector Income Fund | 14 |

Financial statements

Statement of assets and liabilities

at December 31, 2019 | (dollars in thousands) |

| Assets: | | | | | | | | |

| Investment securities in unaffiliated issuers, at value (cost: $50,364) | | | | | | $ | 51,634 | |

| Cash | | | | | | | 56 | |

| Cash collateral pledged for futures contracts | | | | | | | 1 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 1 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | $ | 75 | | | | | |

| Dividends and interest | | | 560 | | | | | |

| Variation margin on futures contracts | | | 18 | | | | | |

| Variation margin on swap contracts | | | 2 | | | | | |

| Other | | | — | * | | | 655 | |

| | | | | | | | 52,347 | |

| Liabilities: | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | | | | | 2 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 1 | | | | | |

| Dividends on fund’s shares | | | 682 | | | | | |

| Investment advisory services | | | 19 | | | | | |

| Services provided by related parties | | | 11 | | | | | |

| Variation margin on futures contracts | | | 9 | | | | | |

| Other | | | 1 | | | | 723 | |

| Net assets at December 31, 2019 | | | | | | $ | 51,622 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 50,000 | |

| Total distributable earnings | | | | | | | 1,622 | |

| Net assets at December 31, 2019 | | | | | | $ | 51,622 | |

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (5,000 total shares outstanding)

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

| Class A | | $ | 51,544 | | | | 4,993 | | | $ | 10.32 | |

| Class F-2 | | | 26 | | | | 2 | | | | 10.32 | |

| Class F-3 | | | 26 | | | | 2 | | | | 10.32 | |

| Class R-6 | | | 26 | | | | 3 | | | | 10.32 | |

| * | Amount less than one thousand. |

See notes to financial statements.

| American Funds Multi-Sector Income Fund | 15 |

Statement of operations

for the period March 22, 2019* to December 31, 2019 | (dollars in thousands) |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Interest (net of non-U.S. taxes of $1) | | $ | 2,003 | | | | | |

| Dividends | | | 41 | | | $ | 2,044 | |

| Fees and expenses†: | | | | | | | | |

| Investment advisory services | | | 175 | | | | | |

| Transfer agent services | | | 9 | | | | | |

| Administrative services | | | 9 | | | | | |

| Reports to shareholders | | | 7 | | | | | |

| Registration statement and prospectus | | | 12 | | | | | |

| Auditing and legal | | | 15 | | | | | |

| Custodian | | | 11 | | | | | |

| Other | | | 1 | | | | | |

| Total fees and expenses before reimbursements | | | 239 | | | | | |

| Less miscellaneous fee reimbursements | | | 30 | | | | | |

| Total fees and expenses after reimbursements | | | | | | | 209 | |

| Net investment income | | | | | | | 1,835 | |

| | | | | | | | | |

| Net realized gain and unrealized appreciation: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | 1,158 | | | | | |

| Futures contracts | | | (290 | ) | | | | |

| Forward currency contracts | | | 3 | | | | | |

| Swap contracts | | | (58 | ) | | | 813 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | 1,270 | | | | | |

| Futures contracts | | | 22 | | | | | |

| Forward currency contracts | | | (1 | ) | | | | |

| Swap contracts | | | (89 | ) | | | 1,202 | |

| Net realized gain and unrealized appreciation | | | | | | | 2,015 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | | | | $ | 3,850 | |

| * | Commencement of operations. |

| † | Additional information related to class-specific fees and expenses is included in the notes to financial statements. |

| Statement of changes in net assets | |

| for the period March 22, 2019* to December 31, 2019 | (dollars in thousands) |

| Operations: | | | | |

| Net investment income | | $ | 1,835 | |

| Net realized gain | | | 813 | |

| Net unrealized appreciation | | | 1,202 | |

| Net increase in net assets resulting from operations | | | 3,850 | |

| | | | | |

| Distributions paid or accrued to shareholders | | | (2,228 | ) |

| | | | | |

| Net capital share transactions | | | 50,000 | |

| | | | | |

| Total increase in net assets | | | 51,622 | |

| | | | | |

| Net assets: | | | | |

| Beginning of period | | | — | |

| End of period | | $ | 51,622 | |

| * | Commencement of operations. |

See notes to financial statements.

| American Funds Multi-Sector Income Fund | 16 |

Notes to financial statements

1. Organization

American Funds Multi-Sector Income Fund (the “fund”) was organized on November 8, 2018, as a Delaware statutory trust. To date, the fund has had no transactions other than those relating to organization matters and the sale of 10,000 shares, divided equally, of Class A, F-2, F-3 and R-6 capital stock to Capital Research and Management Company (“CRMC”), the fund’s investment adviser. Operations commenced March 22, 2019, upon the initial purchase of investment securities. The fund’s fiscal year ends on December 31. The fund will, upon declaration of effectiveness by the Securities and Exchange Commission (“SEC”), be registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks to provide a high level of current income.

Upon declaration of effectiveness by the SEC, the fund will offer 19 share classes consisting of six retail share classes (Classes A, C, T, F-1, F-2 and F-3), five 529 college savings plan share classes (Classes 529-A, 529-C, 529-E, 529-T and 529-F-1) and eight retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The funds’ share classes are described further in the following table:

| Share class | | Initial sales charge | | Contingent deferred sales

charge upon redemption | | Conversion feature | |

| Classes A and 529-A | | Up to 3.75% | | None (except 1% for certain redemptions within 18 months of purchase without an initial sales charge) | | None | |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years | |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | None | |

| Class 529-E | | None | | None | | None | |

| Classes T and 529-T | | Up to 2.50% | | None | | None | |

| Classes F-1, F-2, F-3 and 529-F-1 | | None | | None | | None | |

| Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 | | None | | None | | None | |

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) are allocated daily among the various share classes based on the relative value of their settled shares. Realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

| American Funds Multi-Sector Income Fund | 17 |

Distributions paid or accrued to shareholders — Income dividends are declared daily after the determination of the fund’s net investment income and are paid to shareholders monthly. Capital gain distributions are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | | Examples of standard inputs |

| All | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | | Standard inputs and interest rate volatilities |

| Mortgage-backed; asset-backed obligations | | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information |

| Municipal securities | | Standard inputs and, for certain distressed securities, cash flows or liquidation values using a net present value calculation based on inputs that include, but are not limited to, financial statements and debt contracts |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

| American Funds Multi-Sector Income Fund | 18 |

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. The Capital Group Central Cash Fund (“CCF”), a fund within the Capital Group Central Fund Series (“Central Funds”), is valued based upon a floating net asset value, which fluctuates with changes in the value of CCF’s portfolio securities. The underlying securities are valued based on the policies and procedures in CCF’s statement of additional information. Exchange-traded futures are generally valued at the official settlement price of the exchange or market on which such instruments are traded, as of the close of business on the day the futures are being valued. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors. Credit default swaps are generally valued by pricing vendors based on market inputs that include the index and term of index, reset frequency, payer/receiver, currency and pay frequency.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

| American Funds Multi-Sector Income Fund | 19 |