UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant¨

Filed by a Party other than the Registrantx

Check the appropriate box:

| | | |

| ¨ | | Preliminary Proxy Statement |

| | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ¨ | | Definitive Proxy Statement |

| | |

| ¨ | | Definitive Additional Materials |

| | |

| x | | Soliciting Material Pursuant to §240.14a-12 |

Versum Materials, Inc.

(Name of the Registrant as Specified In Its Charter)

Merck KGaA

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| x | | No fee required. |

| | |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| | |

| ¨ | | Fee paid previously with preliminary materials. |

| | |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

The following investor presentation was first used on March 14, 2019.

March 14, 2019 OUR SUPERIOR PROPOSAL WHY MERCK KGAA, DARMSTADT, GERMANY IS THE RIGHT OWNER OF VERSUM

Disclaimer Publication of Merck KGaA, Darmstadt, Germany . In the United States and Canada the group of companies affiliated with Merck KGaA, Darmstadt, Germany operates under individual business names (EMD Serono, Millipore Sigma, EMD Performance Materials) . To reflect such fact and to avoid any misconceptions of the reader of the publication certain logos, terms and business descriptions of the publication have been substituted or additional descriptions have been added . This version of the publication, therefore, slightly deviates from the otherwise identical version of the publication provided outside the United States and Canada . 2

3 Disclaimer Cautionary Note Regarding Forward - Looking Statements and financial indicators This communication may include “forward - looking statements . ” Statements that include words such as “anticipate,” “expect,” “should,” “would,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” and other words of similar meaning in connection with future events or future operating or financial performance are often used to identify forward - looking statements . All statements in this communication, other than those relating to historical information or current conditions, are forward - looking statements . We intend these forward - looking statements to be covered by the safe harbor provisions for forward - looking statements in the Private Securities Litigation Reform Act of 1995 . These forward - looking statements are subject to a number of risks and uncertainties, many of which are beyond control of Merck KGaA, Darmstadt, Germany, which could cause actual results to differ materially from such statements . Risks and uncertainties include, but are not limited to : the risks of more restrictive regulatory requirements regarding drug pricing, reimbursement and approval ; the risk of stricter regulations for the manufacture, testing and marketing of products ; the risk of destabilization of political systems and the establishment of trade barriers ; the risk of a changing marketing environment for multiple sclerosis products in the European Union ; the risk of greater competitive pressure due to biosimilars ; the risks of research and development ; the risks of discontinuing development projects and regulatory approval of developed medicines ; the risk of a temporary ban on products/production facilities or of non - registration of products due to non - compliance with quality standards ; the risk of an import ban on products to the United States due to an FDA warning letter ; the risks of dependency on suppliers ; risks due to product - related crime and espionage ; risks in relation to the use of financial instruments ; liquidity risks ; counterparty risks ; market risks ; risks of impairment on balance sheet items ; risks from pension obligations ; risks from product - related and patent law disputes ; risks from antitrust law proceedings ; risks from drug pricing by the divested Generics Group ; risks in human resources ; risks from e - crime and cyber attacks ; risks due to failure of business - critical information technology applications or to failure of data center capacity ; environmental and safety risks ; unanticipated contract or regulatory issues ; a potential downgrade in the rating of the indebtedness of Merck KGaA, Darmstadt, Germany ; downward pressure on the common stock price of Merck KGaA, Darmstadt, Germany and its impact on goodwill impairment evaluations as well as the impact of future regulatory or legislative actions . The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere, including the Report on Risks and Opportunities Section of the most recent annual report and quarterly report of Merck KGaA, Darmstadt, Germany . Any forward - looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations . Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward - looking statement, whether as a result of new information, future developments or otherwise . This presentation contains certain financial indicators such as EBITDA pre exceptionals, net financial debt and earnings per share pre exceptionals, which are not defined by International Financial Reporting Standards (IFRS) . These financial indicators should not be taken into account in order to assess the performance of Merck KGaA, Darmstadt, Germany in isolation or used as an alternative to the financial indicators presented in the consolidated financial statements and determined in accordance with IFRS . The figures presented in this statement have been rounded . This may lead to individual values not adding up to the totals presented .

4 Disclaimer Additional Important Information and Where to Find It This communication does not constitute an offer to buy or solicitation of an offer to sell any securities . This communication relates to the proposal which Merck KGaA , Darmstadt, Germany has made for a business combination transaction with Versum Materials, Inc . (“ Versum ”) . Merck KGaA , Darmstadt, Germany filed the preliminary proxy statement on Schedule 14 A (the “Preliminary Proxy Statement”) and the accompanying GREEN proxy card with the Securities and Exchange Commission (the “SEC”) on March 12 , 2019 to be used to solicit proxies in opposition to the proposed business combination transaction between Versum and Entegris , Inc . , and intends to file other relevant materials with the SEC, including a proxy statement in definitive form (the “Proxy Statement”) . This communication is not a substitute for the Proxy Statement or any other document Merck KGaA , Darmstadt, Germany, Versum or Entegris , Inc . may file with the SEC in connection with the proposed transaction . STOCKHOLDERS OF VERSUM ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT, THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE AND ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING ALL PROXY MATERIALS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION . The Proxy Statement will be delivered to the stockholders of Versum . Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Merck KGaA , Darmstadt, Germany through the website maintained by the SEC at http : //www . sec . gov , or by contacting the proxy solicitor of Merck KGaA , Darmstadt, Germany, D . F . King & Co . , Inc . , at ( 212 ) 269 - 5550 for banks and brokers or at ( 800 ) 714 - 3312 for stockholders . Participants in Solicitation Merck KGaA , Darmstadt, Germany and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock . Additional information regarding the participants in the proxy solicitation is contained in the Preliminary Proxy Statement .

Our superior proposal for Versum shareholders 5 Source: CapIQ . 1 As of January 25, 2019; 2 Entegris share price as at March 13, 2019, multiplied by 1.120 exchange ratio; 3 Refer to page 15 for further detail Our superior proposal • Superior to Entegris ’ proposal and • in the best interest of Versum stakeholders All cash proposal Substantial premium Attractive valuation Certainty Beneficial for other stakeholders • ~52% premium over unaffected Versum closing price 1 • ~21% implied premium based on current “look through price” of the Entegris transaction 2 • No financing contingency • No anticipated regulatory issues • No shareholder vote required by Merck KGaA, Darmstadt, Germany • All cash proposal at $48 per Versum share • Certainty of value and immediate liquidity to Versum shareholders • Total transaction value of ~$5.9bn, inclusive of Versum’s net debt • Implied EBITDA multiple ~3.2x 3 above Entegris’ implied proposal • Merck KGaA, Darmstadt, Germany has track record as a top U.S. employer • Versum employees will become an integral part of a leading Performance Materials business • Tempe site will be the major hub for our combined electronic materials business in the U.S.

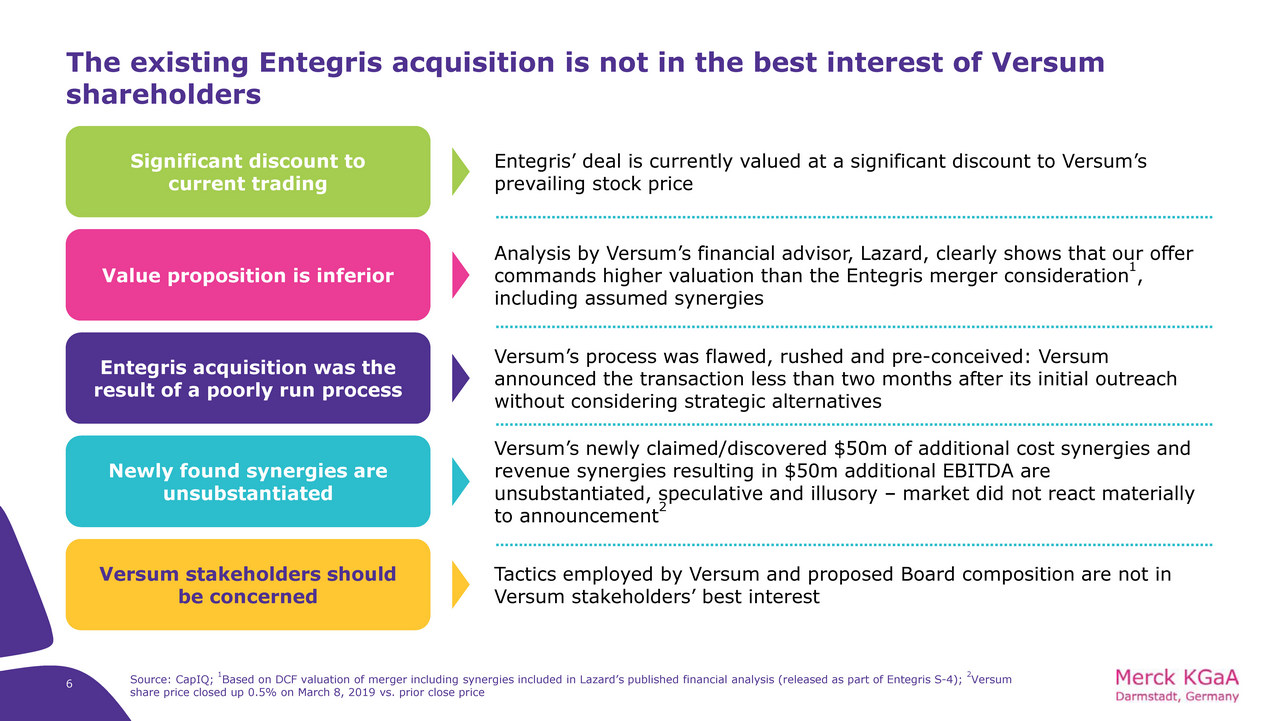

6 Significant discount to current trading Entegris’ deal is currently valued at a significant discount to Versum’s prevailing stock price Value proposition is inferior Analysis by Versum’s financial advisor, Lazard, clearly shows that our offer commands higher valuation than the Entegris merger consideration 1 , including assumed synergies Entegris acquisition was the result of a poorly run process Versum’s process was flawed, rushed and pre - conceived: Versum announced the transaction less than two months after its initial outreach without considering strategic alternatives Newly found synergies are unsubstantiated Versum’s newly claimed/discovered $50m of additional cost synergies and revenue synergies resulting in $50m additional EBITDA are unsubstantiated, speculative and illusory – market did not react materially to announcement 2 Versum stakeholders should be concerned Tactics employed by Versum and proposed Board composition are not in Versum stakeholders’ best interest The existing Entegris acquisition is not in the best interest of Versum shareholders Source: CapIQ ; 1 Based on DCF valuation of merger including synergies included in Lazard’s published financial analysis (released as part of Entegris S - 4); 2 Versum share price closed up 0.5% on March 8, 2019 vs. prior close price

ABOUT US

8 Sales by segment Sales by region Total capex and R&D * ($bn) Sales development * ($bn) * Based on FY 2018 financials (shown in USD based on EUR/USD rate of 1.12). Healthcare: 42% Life Science: 42% Performance Materials: 16% Europe: 31% Asia - Pacific: 33% Middle East & Africa: 4% Latin America: 6% North America: 26% We are a leading science and technology company , active in 3 areas: Healthcare , Life Science and Performance Materials Who we are Since establishment over 350 years ago , we have become a global company with over 52,000 employees in 66 countries Our ideas are everywhere , from cancer therapies and laboratory tools to the display of your smartphone or the color of your car Through our Performance Materials business, we offer specialty chemicals that enrich people’s lives in many ways - our technologies enable smart devices To strengthen our global leadership position, we are truly focused on industry leading research – with ~7,200 R&D professionals worldwide and $2.5bn R&D spending in 2018 North America is a core pillar to our success – more than 10,000 employees account for ~26% of Group revenues 12.7 14.4 16.8 16.3 16.6 2014 2015 2016 2017 2018 2.4 2.5 3.0 3.4 3.5 2014 2015 2016 2017 2018

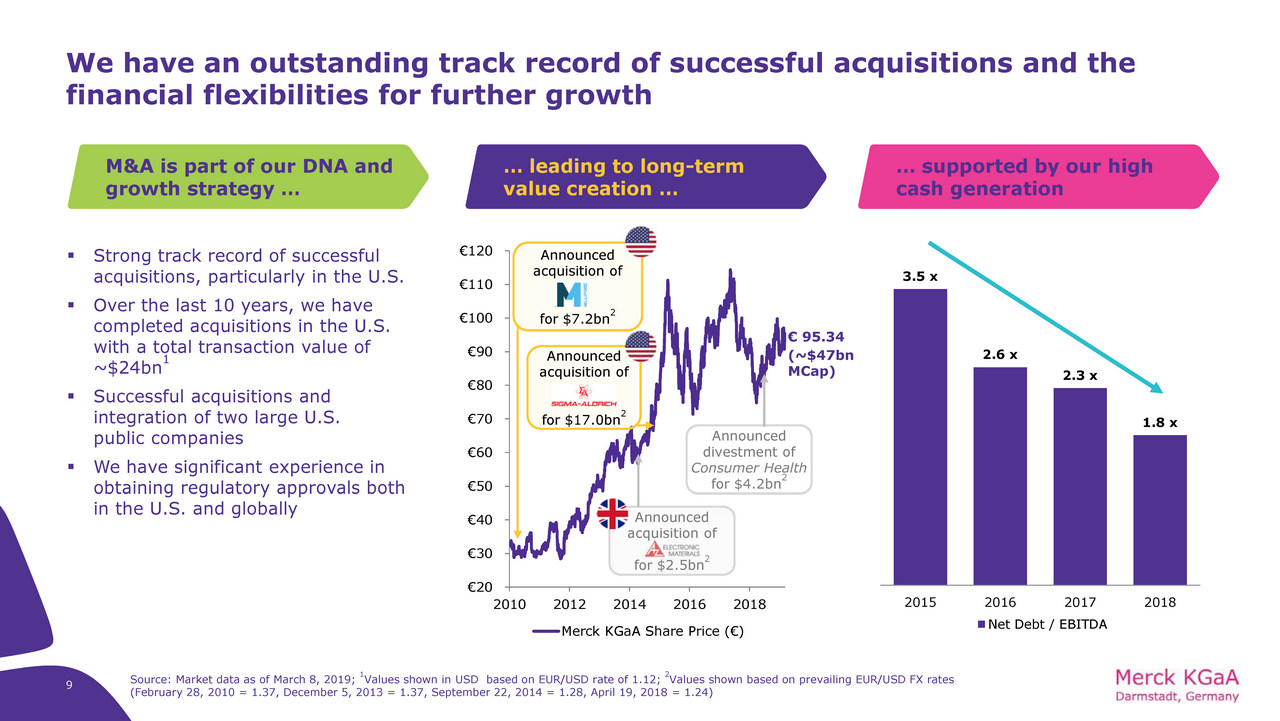

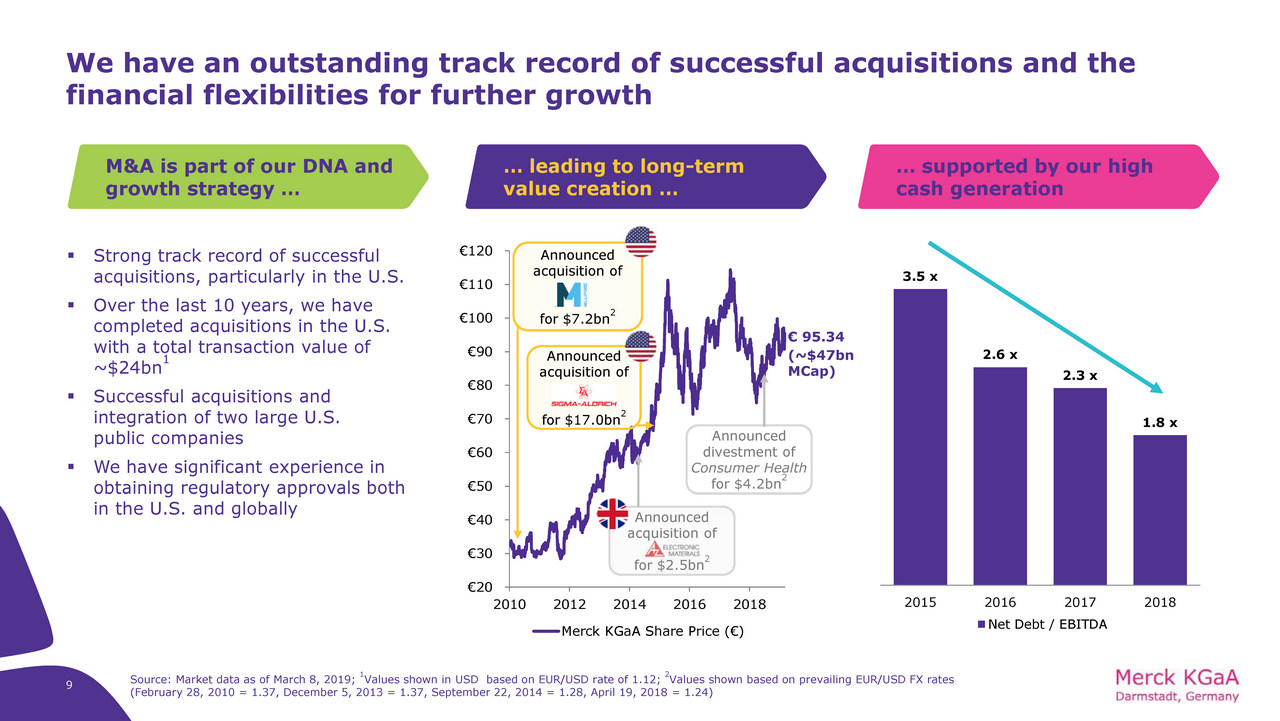

€ 20 € 30 € 40 € 50 € 60 € 70 € 80 € 90 € 100 € 110 € 120 2010 2012 2014 2016 2018 Merck KGaA Share Price ( € ) We have an outstanding track record of successful acquisitions and the financial flexibilities for further growth ▪ Strong track record of successful acquisitions, particularly in the U.S. ▪ Over the last 10 years, we have completed acquisitions in the U.S. with a total transaction value of ~$24bn 1 ▪ Successful acquisitions and integration of two large U.S. public companies ▪ We have significant experience in obtaining regulatory approvals both in the U.S. and globally Announced acquisition of for $2.5bn 2 Announced acquisition of for $17.0bn 2 Source: Market data as of March 8, 2019; 1 Values shown in USD based on EUR/USD rate of 1.12; 2 Values shown based on prevailing EUR/USD FX rates (February 28, 2010 = 1.37, December 5, 2013 = 1.37, September 22, 2014 = 1.28, April 19, 2018 = 1.24) Announced acquisition of for $7.2bn 2 3.5 x 2.6 x 2.3 x 1.8 x 2015 2016 2017 2018 Net Debt / EBITDA € 95.34 9 (~$47bn MCap) Announced divestment of Consumer Health for $4.2bn 2 M&A is part of our DNA and growth strategy … … leading to long - term value creation … … supported by our high cash generation

10 Text slides and Textboxes Why Versum and Merck KGaA , Darmstadt, Germany fit so well together – creating a leading electronic materials player 1 2 3 4 Note: Financials shown in USD based on EUR/USD FX rate of 1.12 Create a leading player • Create one of the leading electronic materials players focused on the semiconductor and display industries with cutting - edge technology • Increase scale, product and services depth and truly global presence • Accelerate innovation with Versum R&D focused on the Advanced Materials segment (10 - 15% R&D rate) Capitalize on long - term growth trends • Electronics industry expected to benefit from data volume increase tailwinds , enabled through high purity semiconductor materials • Semiconductor Solutions business to comprise ~50% of pro - forma Performance Materials sales versus ~25% today Complementary offering • Complementary capabilities with very little product overlap • Manufacturing facilities in the U.S. strengthen our supply chain and supply reliability Value accretive to shareholders • ~$65 - 70m in annual cost synergies fully realized in 3rd year after closing (2022) • Expected to be EPS pre accretive in first year after closing, and to reported EPS in year 3

OUR PROPOSAL IS SUPERIOR

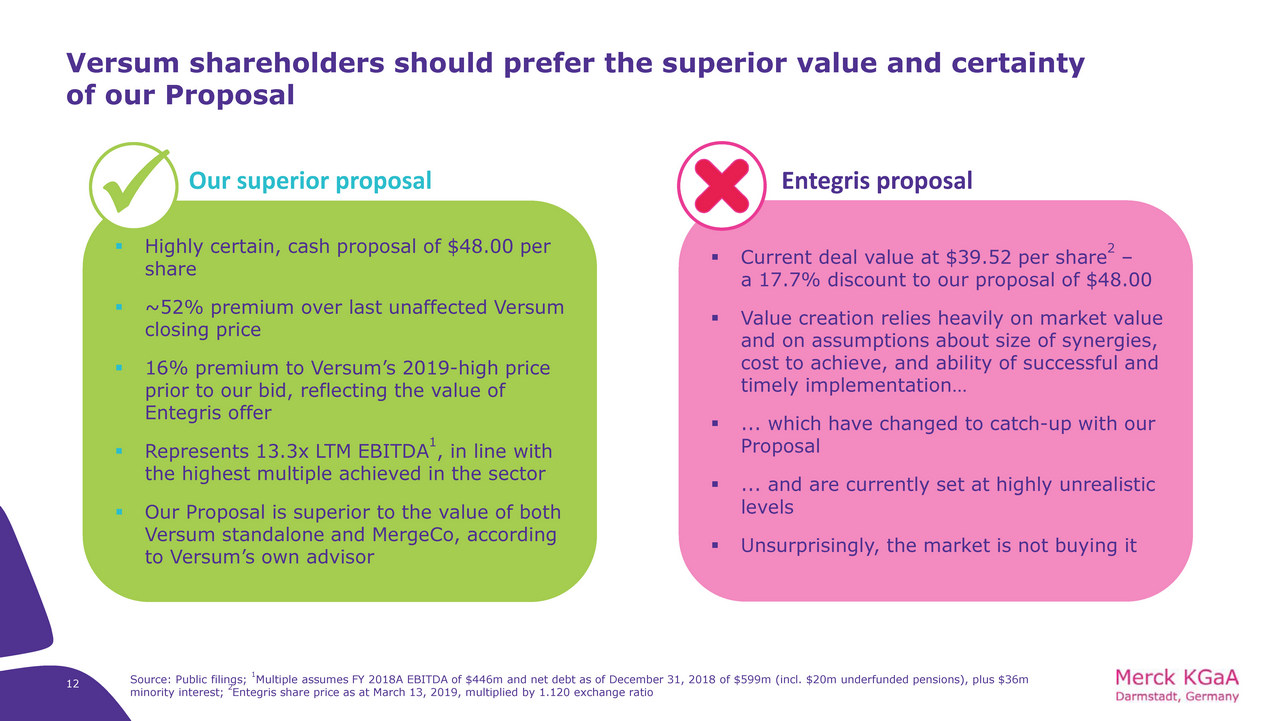

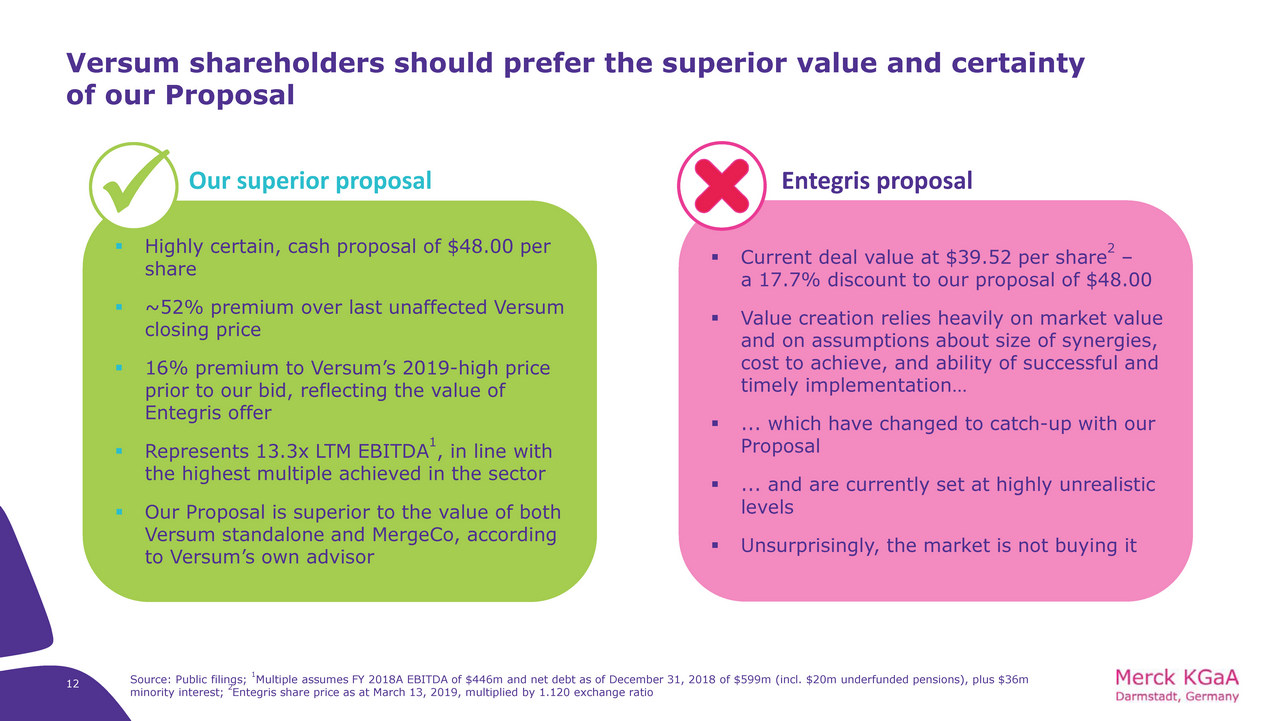

Versum shareholders should prefer the superior value and certainty of our Proposal 12 ▪ Highly certain, cash proposal of $48.00 per share ▪ ~52% premium over last unaffected Versum closing price ▪ 16% premium to Versum’s 2019 - high price prior to our bid, reflecting the value of Entegris offer ▪ Represents 13.3x LTM EBITDA 1 , in line with the highest multiple achieved in the sector ▪ Our Proposal is superior to the value of both Versum standalone and MergeCo, according to Versum’s own advisor ▪ Current deal value at $39.52 per share 2 – a 17.7% discount to our proposal of $48.00 ▪ Value creation relies heavily on market value and on assumptions about size of synergies, cost to achieve, and ability of successful and timely implementation… ▪ ... which have changed to catch - up with our Proposal ▪ ... and are currently set at highly unrealistic levels ▪ Unsurprisingly, the market is not buying it Source: Public filings; 1 Multiple assumes FY 2018A EBITDA of $446m and net debt as of December 31, 2018 of $599m (incl. $20m underfunded pensions), pl us $36m minority interest; 2 Entegris share price as at March 13, 2019, multiplied by 1.120 exchange ratio Our superior proposal Entegris proposal x

$48.80 $39.24 $48.00 $20 $30 $40 $50 1-Jan-2019 12-Jan-2019 23-Jan-2019 3-Feb-2019 14-Feb-2019 25-Feb-2019 8-Mar-2019 $ 27.72 Entegris Deal Value¹ Merck KGaA, Darmstadt, Germany Offer The market’s reaction supports view that our proposal is superior Source: Capital IQ, market data as of March 8, 2019; 1 Entegris deal value is equal to the value of Entegris stock multiplied by the exchange ratio of 1.120x 25 - Jan - 19 Undisturbed Date 28 - Jan - 19 Entegris Deal Announced 27 - Feb - 19 Our Offer Announce 52% Premium to Undisturbed 16 % Premium to Versum’s Pre - Our Offer High 8 - Mar - 19 Muted stock price reaction shows that market does not find “newly - found” synergies credible Versum Stock Price Entegris Deal Value¹ Merck KGaA, Darmstadt, Germany Offer 13 Our offer price of $48 is at a 52% premium to Versum’s undisturbed price and a 16% premium to Versum’s 2019 - high price prior to our bid

The published financial analysis of Lazard – Versum’s own financial advisor – supports our view that our Proposal is superior to the Entegris acquisition Our Proposal is superior to Lazard’s valuation of Versum on a standalone basis 1 … 14 … and when compared to Lazard’s DCF value of the merger consideration including synergies DCF (Stand - alone) EV / 2019E EBITDA PV of Future Share Price Analyst Price Targets (12 Months) Discounted Analyst Price Targets 52 - Week High / Low Source: Entegris S - 4. 1 Standalone Versum values per share compiled from Lazard’s valuation work disclosed in the Entegris S - 4. The premia of the value of our Proposal relative to each of the stand - alone values were calculated by Merck KGaA, Darmstadt, Germany. 2 DCF value per share of the merger consideration including synergies derived from Lazard’s has - gets analysis disclosed in the Entegris S - 4, which expresses these values as a premium to Versum’s share price. The premia of the value of our Proposal relative to each of the value of the merger consideration including synergies were calculated by Merck KGaA, Darmstadt, Germany. Run rate synergies ($m) DCF value per share of the Entegris merger consideration including synergies 2 Our Proposal Premium to DCF value per share of the Entegris merger consideration including synergies $75 $41.43 15.9% $85 $41.71 15.1% $100 $42.19 13.8% $ 35.05 $ 32.65 $ 33.10 $ 26.00 $ 23.20 $ 25.02 $ 45.40 $ 39.80 $ 42.60 $ 47.00 $ 41.90 $ 41.35 Our Proposal: $48.00 Our proposal: $ 48.00

Source: Public filings, press releases. Note: Versum multiples based on FY 2018A EBITDA of $446m and net debt as of December 31, 2018 of $599m (incl. $20m underfunded pensions), plus $36m minority interest. Diluted Versum shares outstanding calculated using the treasury stock method resulting in shares outstanding of (i) 110.52m for Merck KGaA, Darmstadt, Germany offer, (ii) 110.49m for Versum valuation as of February 26, 2019 (pre Merck offer), (iii) 110.45m for implied Versum valuation based on Entegris offer and (iv) 110.42m for Versum valuation pre Entegris offer; * Implied valuation based on Entegris share price of $31.32 and exchange ratio of 1.120x. 15 Versum Valuation pre Merck KGaA , Darmstadt, Germany proposal (26 - Feb - 2019) Versum Valuation pre Entegris Offer (25 - Jan - 2019 ) 1 13.4 x 13.3 x 13.1 x 13.0 x 12.3 x 11.9 x 10.7 x 10.1 x 10.0 x Entegris / ATMI Merck KgaA, Darmstadt, Germany Offer for Versum Platform Specialty / Alent Platform Specialty / OM Group Elec. Chem. Cabot Microelectronics / KMG Carlyle / Atotech Merck / AZ Electronic Materials Entegris Offer for Versum Platform Specialty / MacDermid 11.7 x 9.3 x Our Proposal represents a best - in - class valuation multiple EV / LTM EBITDA multiple Δ = +3.2 x *

CONCERNS ABOUT THE VERSUM /ENTEGRIS PROPOSAL

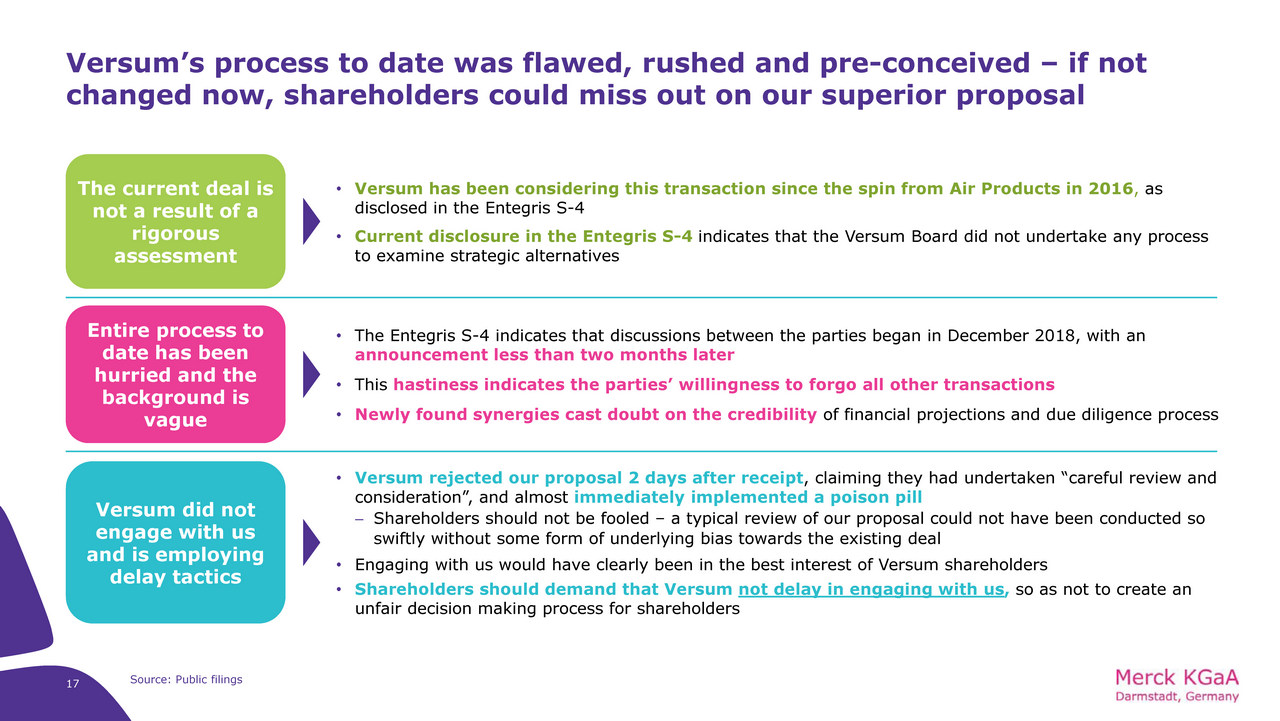

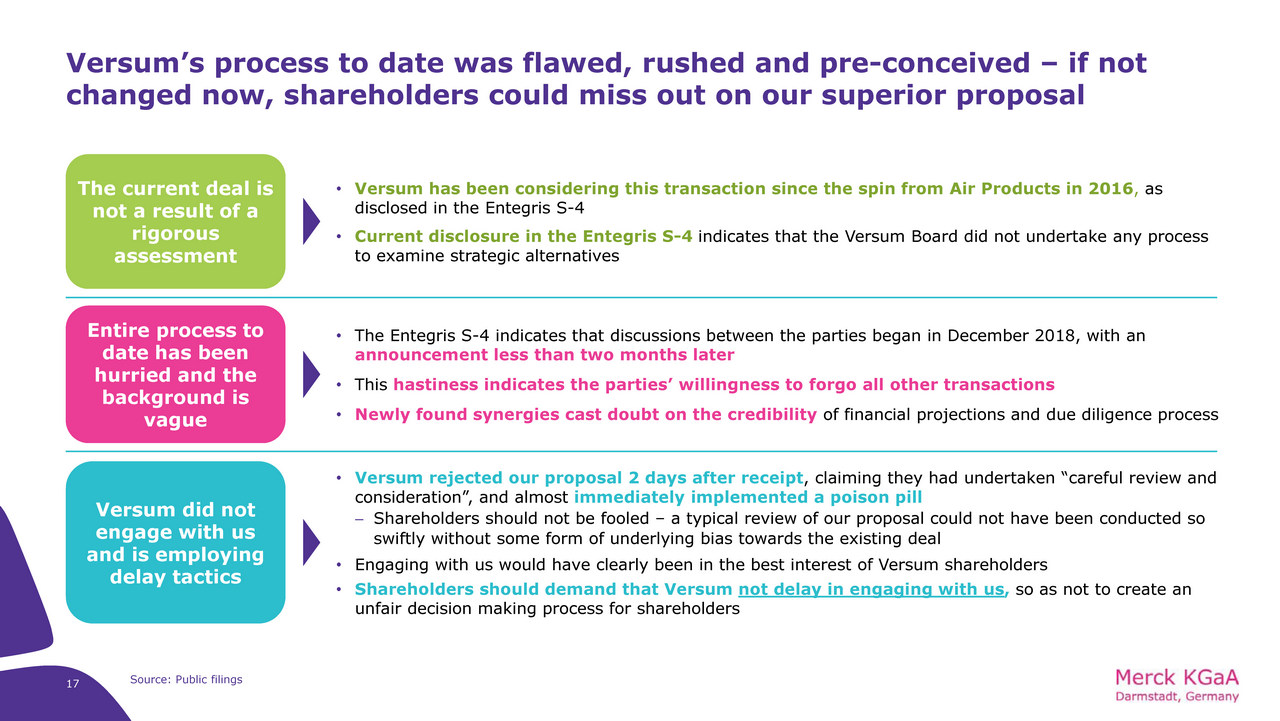

Versum’s process to date was flawed, rushed and pre - conceived – if not changed now, shareholders could miss out on our superior proposal Versum did not engage with us and is employing delay tactics The current deal is not a result of a rigorous assessment Entire process to date has been hurried and the background is vague 17 Source: Public filings • Versum rejected our proposal 2 days after receipt , claiming they had undertaken “careful review and consideration”, and almost immediately implemented a poison pill Shareholders should not be fooled – a typical review of our proposal could not have been conducted so swiftly without some form of underlying bias towards the existing deal • Engaging with us would have clearly been in the best interest of Versum shareholders • Shareholders should demand that Versum not delay in engaging with us , so as not to create an unfair decision making process for shareholders • Versum has been considering this transaction since the spin from Air Products in 2016 , as disclosed in the Entegris S - 4 • Current disclosure in the Entegris S - 4 indicates that the Versum Board did not undertake any process to examine strategic alternatives • The Entegris S - 4 indicates that discussions between the parties began in December 2018, with an announcement less than two months later • This hastiness indicates the parties’ willingness to forgo all other transactions • Newly found synergies cast doubt on the credibility of financial projections and due diligence process

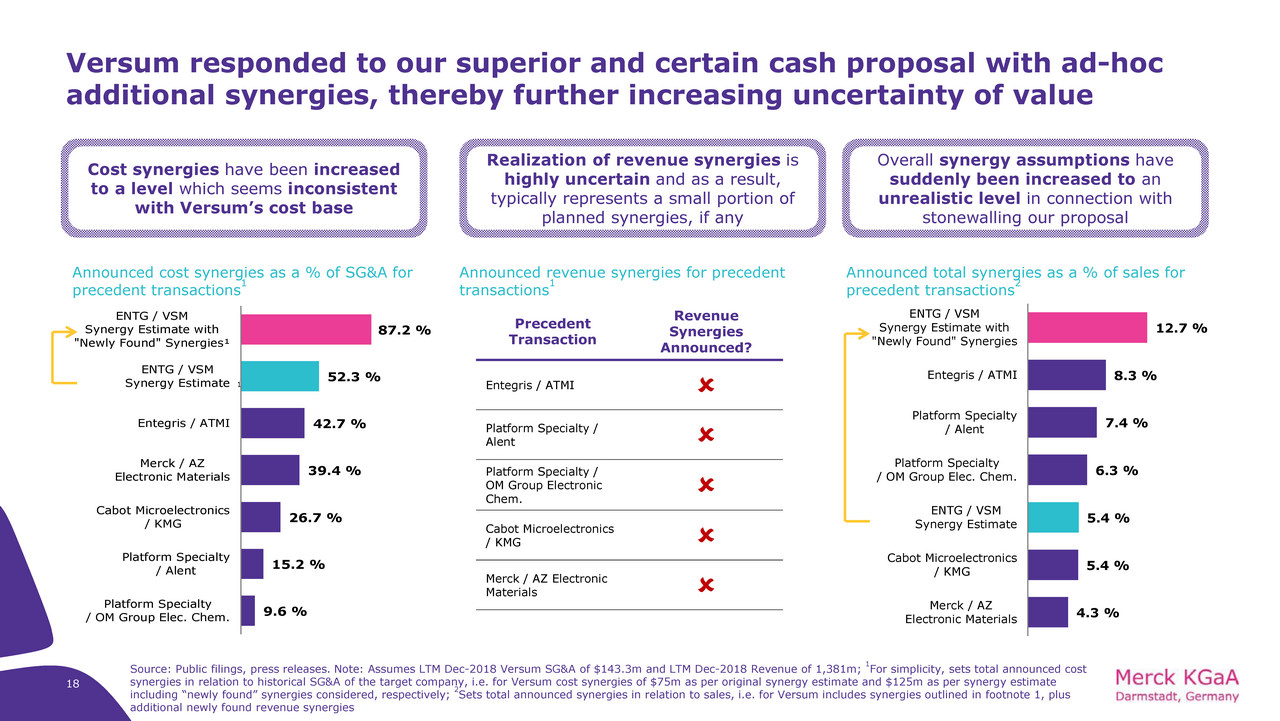

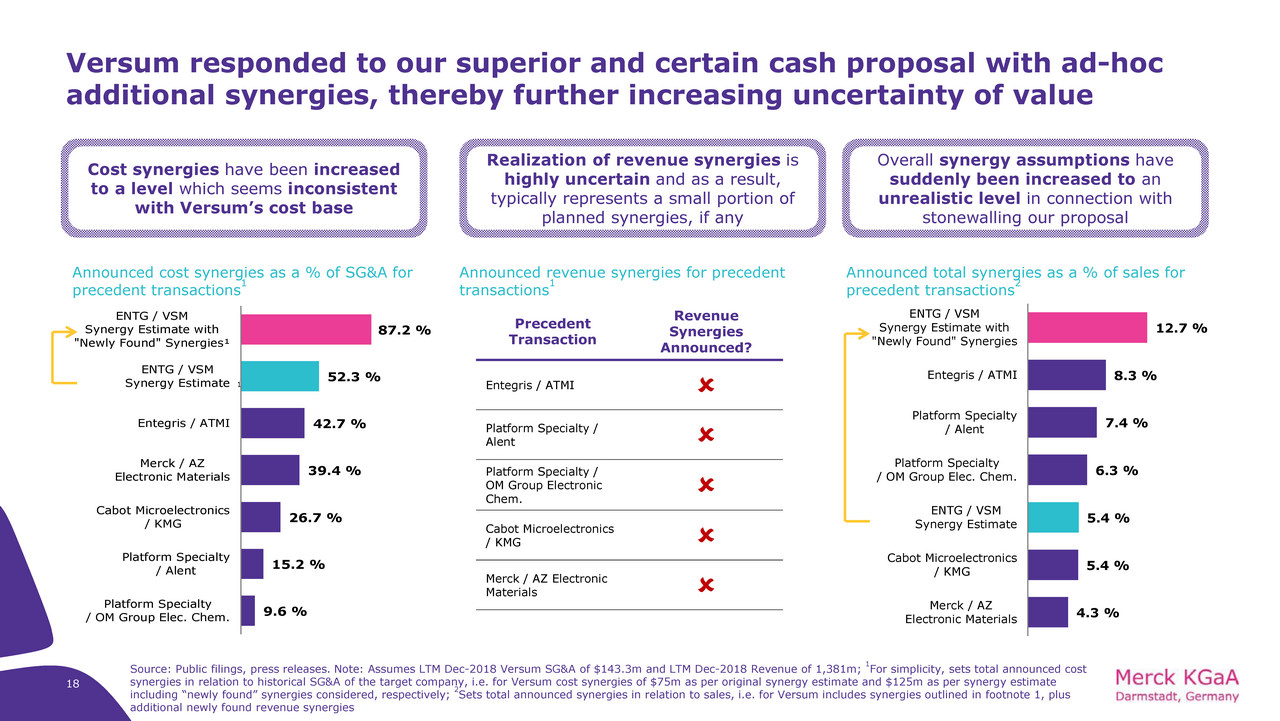

9.6 % 15.2 % 26.7 % 39.4 % 42.7 % 52.3 % 87.2 % Platform Specialty / OM Group Elec. Chem. Platform Specialty / Alent Cabot Microelectronics / KMG Merck / AZ Electronic Materials Entegris / ATMI ENTG / VSM Synergy Estimate ENTG / VSM Synergy Estimate with "Newly Found" Synergies¹ 4.3 % 5.4 % 5.4 % 6.3 % 7.4 % 8.3 % 12.7 % Merck / AZ Electronic Materials Cabot Microelectronics / KMG ENTG / VSM Synergy Estimate Platform Specialty / OM Group Elec. Chem. Platform Specialty / Alent Entegris / ATMI ENTG / VSM Synergy Estimate with "Newly Found" Synergies 18 Cost synergies have been increased to a level which seems inconsistent with Versum’s cost base Versum responded to our superior and certain cash proposal with ad - hoc additional synergies, thereby further increasing uncertainty of value Announced cost synergies as a % of SG&A for precedent transactions 1 Announced total synergies as a % of sales for precedent transactions 2 Announced revenue synergies for precedent transactions 1 Realization of revenue synergies is highly uncertain and as a result, typically represents a small portion of planned synergies, if any Overall synergy assumptions have suddenly been increased to an unrealistic level in connection with stonewalling our proposal Source: Public filings, press releases. Note: Assumes LTM Dec - 2018 Versum SG&A of $143.3m and LTM Dec - 2018 Revenue of 1,381m ; 1 For simplicity, sets total announced cost synergies in relation to historical SG&A of the target company, i.e. for Versum cost synergies of $75m as per original synergy estimate and $125m as per synergy estimate including “newly found” synergies considered, respectively; 2 Sets total announced synergies in relation to sales, i.e. for Versum includes synergies outlined in footnote 1, plus additional newly found revenue synergies Precedent Transaction Revenue Synergies Announced? Entegris / ATMI Platform Specialty / Alent Platform Specialty / OM Group Electronic Chem. Cabot Microelectronics / KMG Merck / AZ Electronic Materials 1

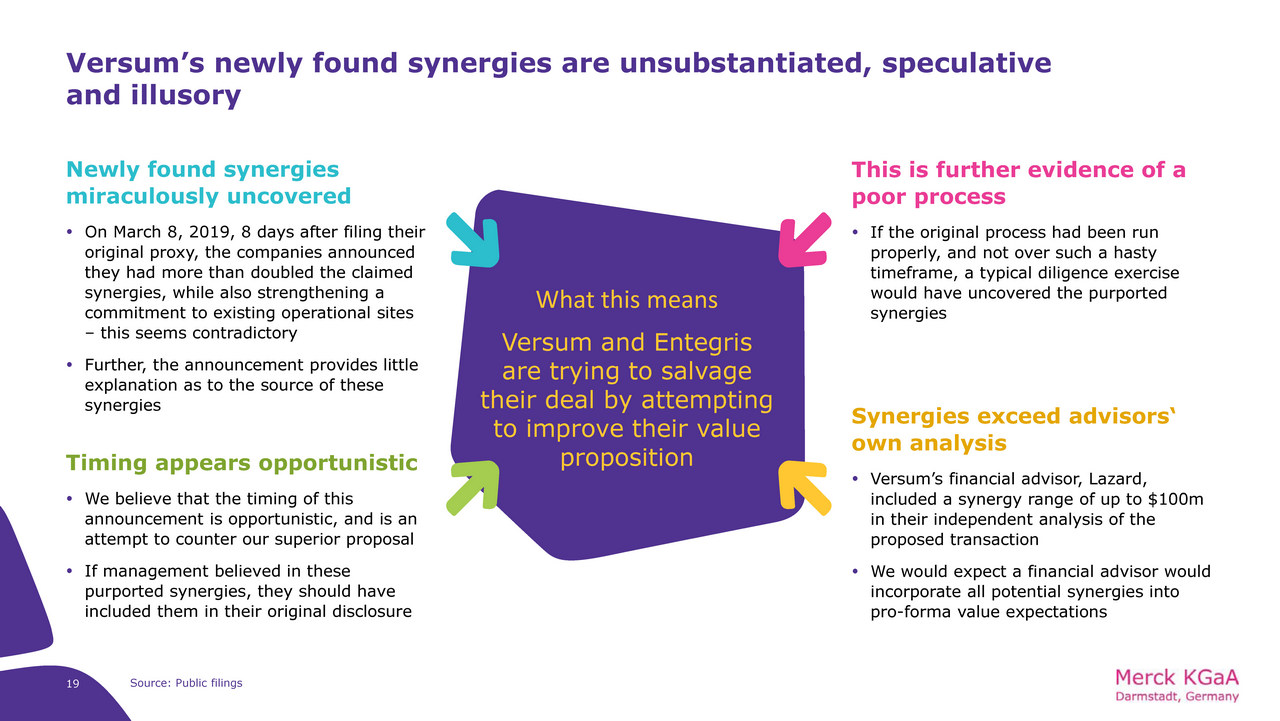

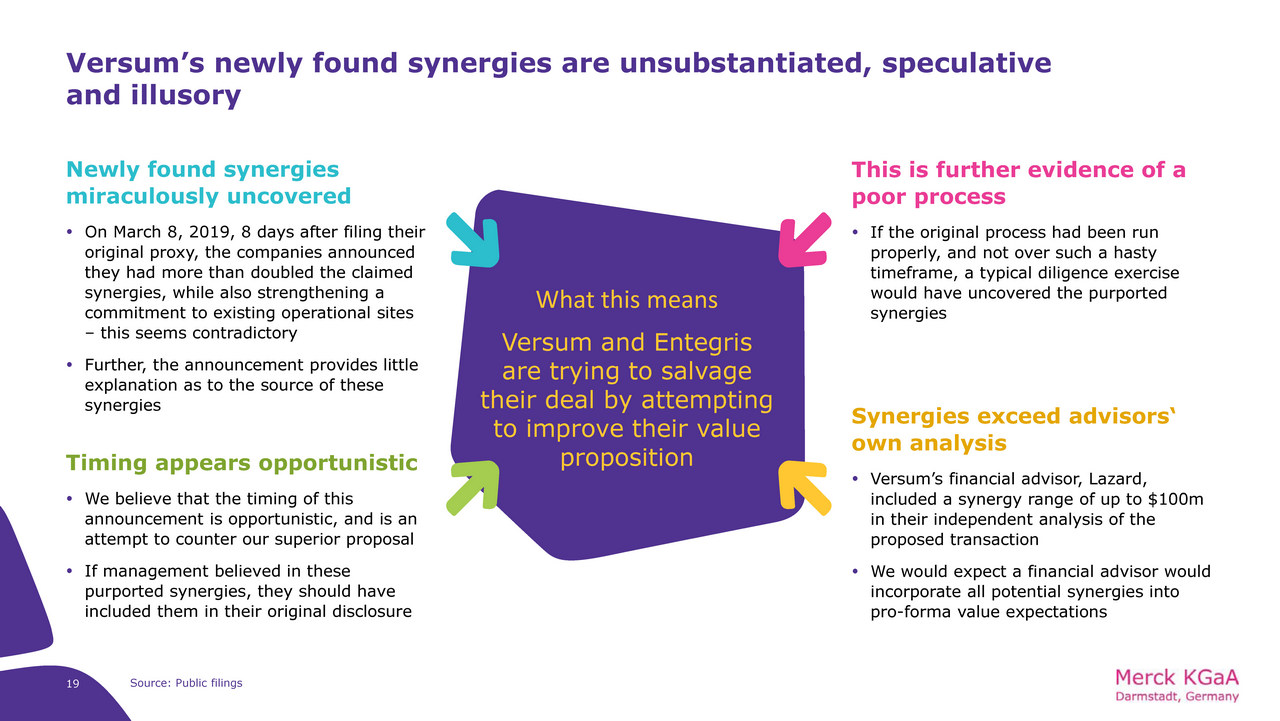

19 Versum’s newly found synergies are unsubstantiated, speculative and illusory Source: Public filings What this means Versum and Entegris are trying to salvage their deal by attempting to improve their value proposition This is further evidence of a poor process If the original process had been run properly, and not over such a hasty timeframe, a typical diligence exercise would have uncovered the purported synergies Synergies exceed advisors‘ own analysis Versum’s financial advisor, Lazard, included a synergy range of up to $100m in their independent analysis of the proposed transaction We would expect a financial advisor would incorporate all potential synergies into pro - forma value expectations Newly found synergies miraculously uncovered On March 8, 2019, 8 days after filing their original proxy, the companies announced they had more than doubled the claimed synergies, while also strengthening a commitment to existing operational sites – this seems contradictory Further, the announcement provides little explanation as to the source of these synergies Timing appears opportunistic We believe that the timing of this announcement is opportunistic, and is an attempt to counter our superior proposal If management believed in these purported synergies, they should have included them in their original disclosure

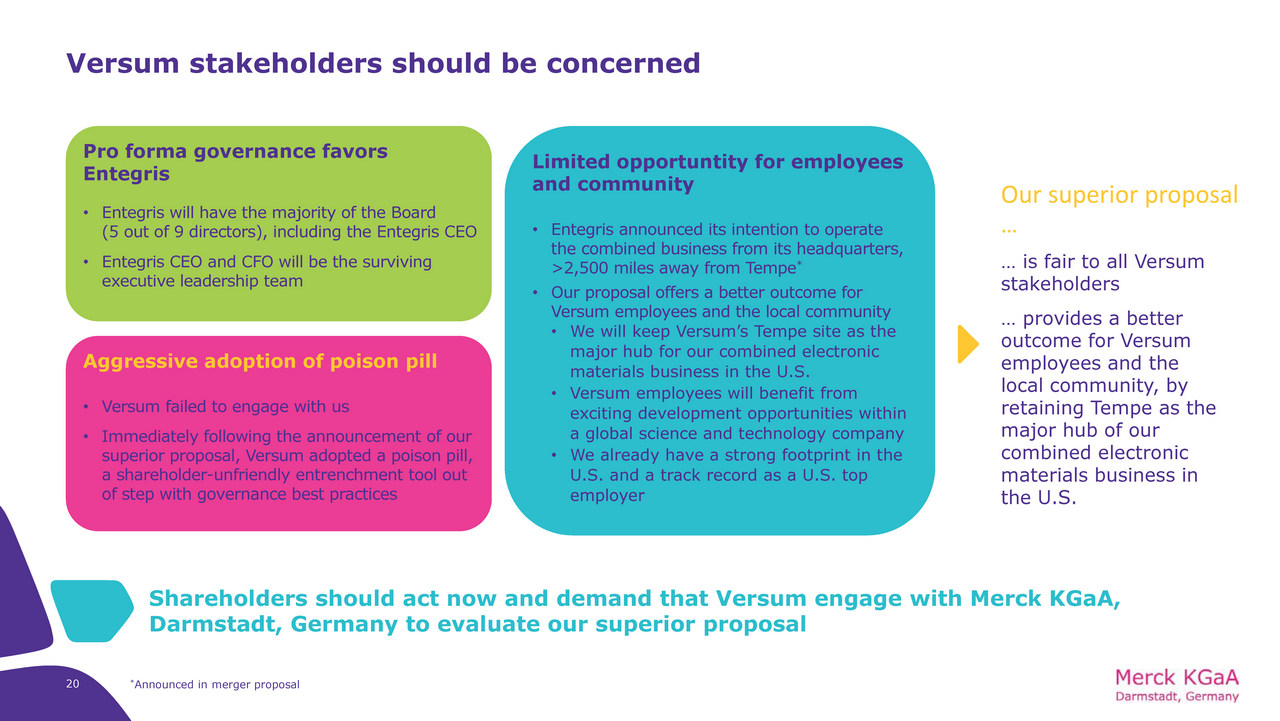

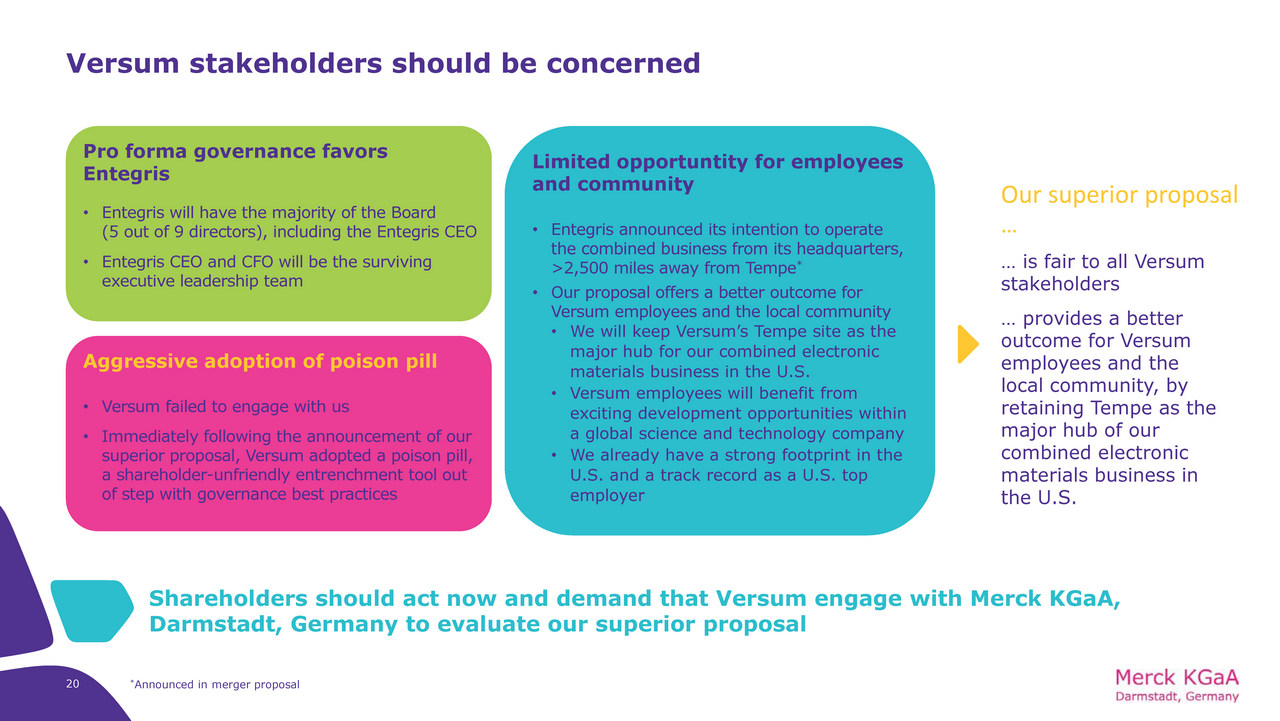

20 Versum stakeholders should be concerned Pro forma governance favors Entegris • Entegris will have the majority of the Board (5 out of 9 directors), including the Entegris CEO • Entegris CEO and CFO will be the surviving executive leadership team Aggressive adoption of poison pill • Versum failed to engage with us • Immediately following the announcement of our superior proposal, Versum adopted a poison pill, a shareholder - unfriendly entrenchment tool out of step with governance best practices Limited opportuntity for employees and community • Entegris announced its intention to operate the combined business from its headquarters, >2,500 miles away from Tempe * • Our proposal offers a better outcome for Versum employees and the local community • We will keep Versum’s Tempe site as the major hub for our combined electronic materials business in the U.S. • Versum employees will benefit from exciting development opportunities within a global science and technology company • We already have a strong footprint in the U.S. and a track record as a U.S. top employer Our superior proposal … * Announced in merger proposal Shareholders should act now and demand that Versum engage with Merck KGaA , Darmstadt, Germany to evaluate our superior proposal … is fair to all Versum stakeholders … provides a better outcome for Versum employees and the local community, by retaining Tempe as the major hub of our combined electronic materials business in the U.S.

HOW SHAREHOLDERS CAN WIN

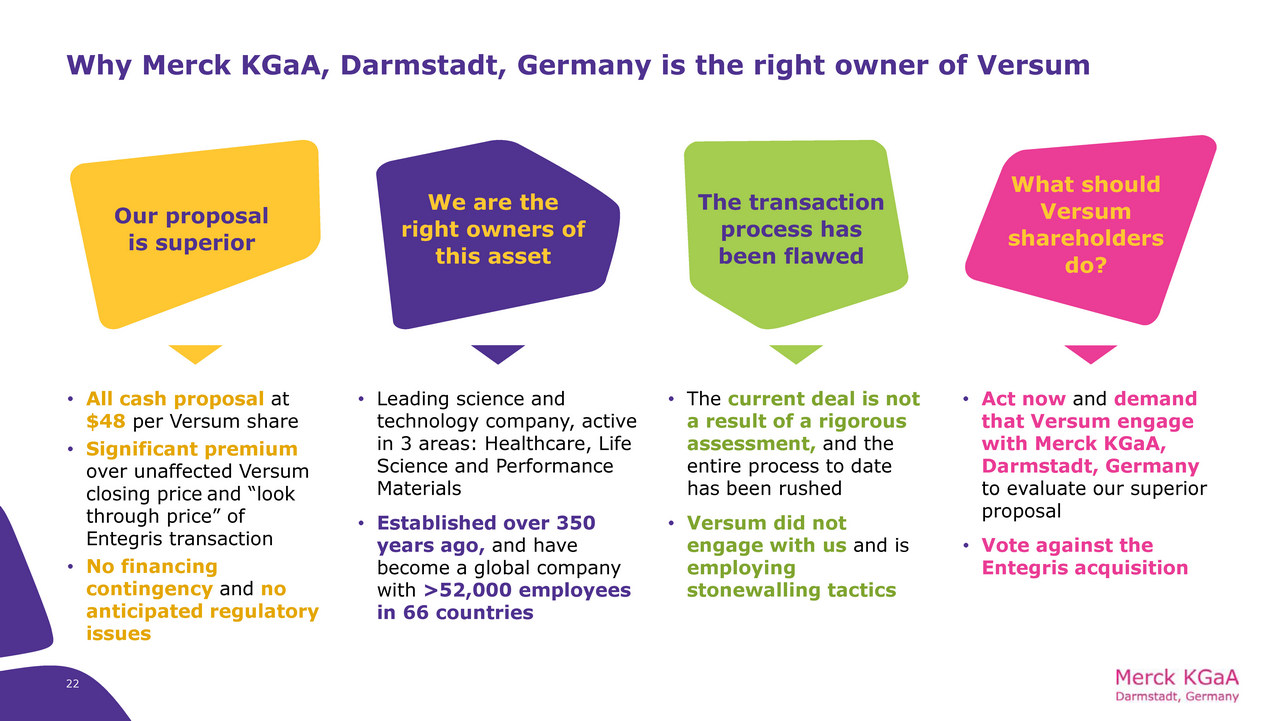

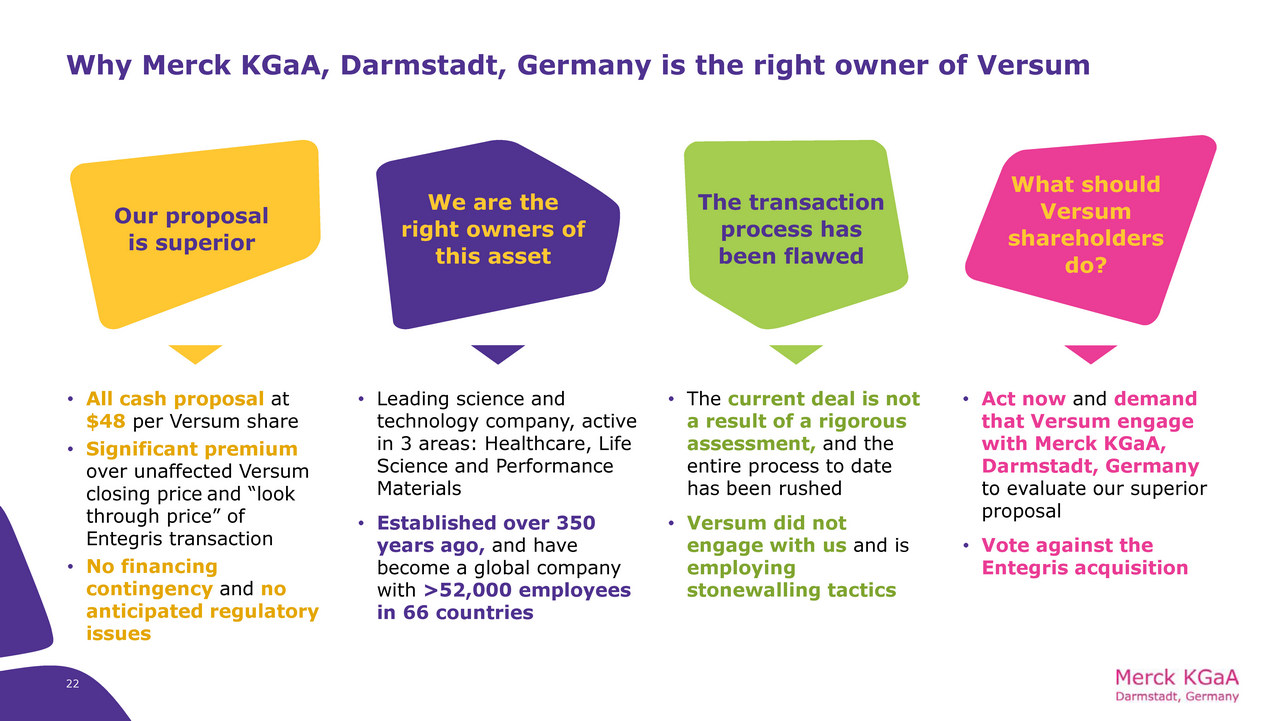

22 Our proposal is superior We are the right owners of this asset The transaction process has been flawed What should Versum shareholders do? Why Merck KGaA , Darmstadt, Germany is the right owner of Versum • Leading science and technology company, active in 3 areas: Healthcare, Life Science and Performance Materials • Established over 350 years ago, and have become a global company with >52,000 employees in 66 countries • The current deal is not a result of a rigorous assessment, and the entire process to date has been rushed • Versum did not engage with us and is employing stonewalling tactics • Act now and demand that Versum engage with Merck KGaA, Darmstadt, Germany to evaluate our superior proposal • Vote against the Entegris acquisition • All cash proposal at $48 per Versum share • Significant premium over unaffected Versum closing price and “look through price” of Entegris transaction • No financing contingency and no anticipated regulatory issues

23 A compelling proposal for all stakeholders Providing leading - edge technology backed by the capabilities, scale and quality of Merck KGaA, Darmstadt, Germany Truly global footprint and close proximity to customers worldwide Combines innovation strength to better serve our customers in a rapidly evolving marketplace Combining the certainty of an all - cash transaction with an attractive premium A strategically and financially compelling transaction for Merck KGaA, Darmstadt, Germany shareholders Delivers on strategy of building leading positions in attractive markets Meeting Merck KGaA, Darmstadt, Germany financial M&A criteria Becoming an integral part of leading science and technology company Merck KGaA, Darmstadt, Germany Commitment to maintain Tempe, Arizona presence as the major hub for the combined electronic materials business in the U.S. • ~ 52% premium to Versum’s unaffected closing price of $ 31.65 on January 25, 2019 • ~ 16% premium to Versum’s closing price of $ 41.40 on February 26, 2019 Merck KGaA, Darmstadt, Germany – the best strategic owner of Versum to the highest benefit of shareholders, employees and customers

If you support our superior proposal, demand that Versum engage with us, and, when available, vote the Green Proxy against the inferior Entegris acquisition Significant Premium 52% premium over Versum’s unaffected price, representing a total transaction value of $5.9bn All Cash Offer Our bid is not contingent on financing and has a high certainty of closing Represents the Best Outcome for Versum Employees and Stakeholders Provides employees with opportunity at integrated global technology company 24 x x x

Vote the GREEN proxy for our superior proposal 25 DISCARD any proxy cards sent to you by Versum as they will count as votes against the value and certainty of the Merck KGaA, Darmstadt, Germany transaction If you have any questions, require assistance with voting your GREEN proxy card or need additional copies of the proxy materials, please contact: 48 Wall Street New York, NY 10005 VSM@dfking.com (800) 714 - 3312 (toll - free) or (212) 269 - 5550 (call collect) Vote Discard