UNITED STATES Washington, D.C. 20549

|

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

|

Filed by the Registrant☐ Filed by the Party other than the Registrant☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement. |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material under § 240.14a-12 |

VERSUM MATERIALS, INC.

(Name of Registrant as Specified In Its Charter)

MERCK KGAA

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| ☒ No fee required. | |

| ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies. |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ Fee paid previously with preliminary materials. | |

| ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

This filing contains the following communications:

| 1. | Merck KGaA, Darmstadt, Germany/Versum Materials, Inc. Joint Press Release |

| 2. | Investor Presentation |

| 3. | Q&A |

| 4. | News Release Posted to the Internal Website |

| 5. | Investor Call Transcript |

| 1. | Merck KGaA, Darmstadt, Germany and Versum Materials, Inc. issued the following press release on April 12, 2019. |

|  |

| News Release | Your Contacts Media Relations thomas.moeller@emdgroup.com Phone: +49 6151 72-62445

Investor Relations investor.relations@emdgroup.com Phone: +49 6151 72-3321 |

April 12, 2019

Merck KGaA, Darmstadt, Germany, Signs Definitive Agreement to Acquire Versum Materials for $53 per Share

| · | Business combination creates a leading electronic materials player able to capitalize on attractive long-term secular growth drivers |

| · | Versum is a “Best in Class” asset with industry-leading financial metrics |

| · | Expected to be immediately accretive to earnings per share pre (EPS pre) |

| · | €75 million in expected run-rate synergies by the third full year after closing |

| · | Commitment to preserving strong investment grade credit rating |

| · | Versum has terminated its previously announced merger agreement with Entegris |

Darmstadt, Germany, and Tempe, Arizona, U.S., April 12, 2019 – Merck KGaA, Darmstadt, Germany, a leading science and technology company, has signed a definitive agreement to acquire Versum Materials, Inc. (NYSE: VSM) for $53 per share in cash. The business combination has been unanimously approved by the Executive Board of Merck KGaA, Darmstadt, Germany and by Versum’s Board of Directors.

“With this transaction, Merck KGaA, Darmstadt, Germany, will be optimally positioned to capitalize on long-term growth trends in the electronic materials industry. Our combined business shall deliver leading-edge innovations to our customers around the globe,” said Stefan Oschmann, Chairman of the Executive Board and CEO of Merck KGaA, Darmstadt, Germany.

Page 1 of 6

|

Frankfurter Strasse 250 64293 Darmstadt · Germany Hotline +49 6151 72-5000 www.emdgroup.com |

Head of Media Relations -6328 Spokesperson: -9591 / -7144 / -8908 / -55707

|

|  |

| News Release |

Seifi Ghasemi, Chairman of Versum, said: “The Merck-Versum transaction offers compelling and certain value for our shareholders and will provide long-term benefits for our customers and employees. This exciting business combination will create increased scale, product and service depth, enhanced global presence, strengthened supply chain and combined R&D capabilities, driving leading innovation. We look forward to joining together our respective businesses and talented teams.”

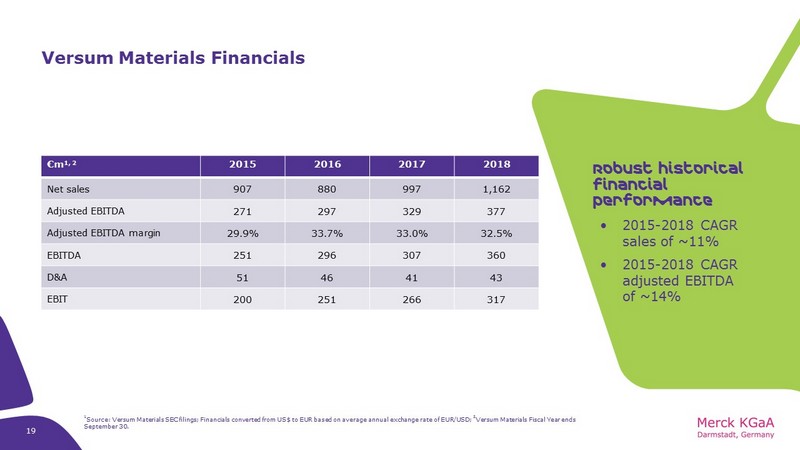

Versum is one of the world's leading suppliers of innovation-driven, high-purity process chemicals, gases and equipment for semiconductor manufacturing. The company reported annual sales of approximately €1.2 billion ($1.4 billion) in FY2018, has approximately 2,300 employees, and operates 15 manufacturing and seven research and development facilities throughout Asia and North America. Versum has achieved revenue and adjusted EBITDA compounded annual growth in excess of 10% over the last three fiscal years with industry-leading adjusted EBITDA margins at 33%.

The business combination is expected to significantly strengthen Merck KGaA, Darmstadt, Germany’s Performance Materials business sector, creating a leading electronic materials player focused on the semiconductor and display industries. The business combination rebalances the company’s diversified three pillar portfolio of Healthcare, Life Sciences and Performance Materials while executing on Performance Material’s previously communicated transformation program.

The combined companies and their customers and employees will benefit from increased scale, product portfolio, innovation and services depth, globally. In addition, with the combined business, the Performance Materials business sector will strengthen its global supply chain.

Merck KGaA, Darmstadt, Germany intends to maintain Versum’s Tempe, AZ headquarters as the major hub for the combined electronic materials business in the United States, complementing Merck KGaA, Darmstadt, Germany’s already strong footprint and track record as a top employer in the U.S. Over the past decade, the company has invested approximately $24 billion in the U.S. through acquisitions alone, including the successful acquisitions of Millipore in 2010 and Sigma-Aldrich in 2015. Versum employees will become an integral part of a leading electronic materials business and will benefit from new and exciting development opportunities within a truly global science and technology company.

Page 2 of 6

|  |

| News Release |

The agreed upon price reflects an enterprise value (EV) for Versum of approximately €5.8 billion, implying an EV/2019 EBITDA multiple of approximately 13.7x based upon consensus estimates and a pro-forma multiple of 11.6x including €75 million of identified annual run-rate cost synergies. The business combination is expected to be immediately accretive to earnings per share pre (EPS pre) and accretive to reported EPS in the third full year after closing.

Versum’s Board of Directors, in consultation with its legal and financial advisors, has unanimously determined that this business combination constitutes a “Superior Proposal” as defined in Versum’s previously announced merger agreement with Entegris, Inc., and Versum has terminated the merger agreement with Entegris concurrently with the execution of the definitive agreement with Merck KGaA, Darmstadt, Germany.

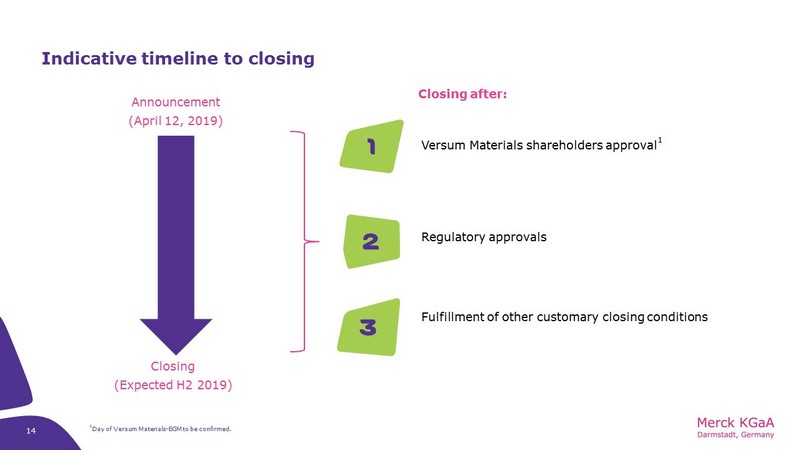

The transaction is expected to close in the second half of 2019, subject to the approval of Versum stockholders at a Versum special meeting, regulatory clearances and the satisfaction of other customary closing conditions. The applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, for U.S. antitrust purposes has already expired.

The business combination will be financed with cash on hand and debt by way of a facilities agreement with Bank of America Merrill Lynch, BNP Paribas Fortis and Deutsche Bank AG. Merck KGaA, Darmstadt, Germany, is committed to preserving its strong investment grade credit rating.

Page 3 of 6

|  |

| News Release |

Concurrently with the signing, the previously announced tender offer to acquire Versum common stock has been terminated and the contested solicitation of proxies has also ended.

Merck KGaA, Darmstadt, Germany, will be hosting a conference call [Hyperlink] with the financial community at 10:00 am EST to discuss the business combination.

Copies of the Merger Agreement and other related materials are available on the SEC website at www.sec.gov.

Guggenheim Securities, LLC and Goldman Sachs & Co. LLC are acting as financial advisors, and Sullivan & Cromwell LLP is acting as legal counsel to Merck KGaA, Darmstadt, Germany, in connection with the business combination. Lazard and Citi are serving as financial advisors to Versum and Simpson Thacher & Bartlett LLP is serving as legal counsel.

Versum Materials Contacts

Media Relations

tiffany.elle@versummaterials.com

Phone: 480-282-6475

Investor Relations

soohwan.kim@versummaterials.com

Phone: 602-282-0957

Sard Verbinnen & Co

Emily Claffey / Julie Rudnick

Phone: 212-687-8080

All Merck KGaA, Darmstadt, Germany, press releases are distributed by e-mail at the same time they become available on the EMD Group Website. In case you are a resident of the USA or Canada please go to www.emdgroup.com/subscribe to register for your online subscription of this service as our geo-targeting requires new links in the email. You may later change your selection or discontinue this service.

Page 4 of 6

|  |

| News Release |

About Merck KGaA, Darmstadt, Germany

Merck KGaA, Darmstadt, Germany,a long-term oriented, predominantly family-ownedleader in science and technology, operates across healthcare, life science and performance materials. Around 52,000 employees work to make a positive difference to millions of people’s lives every day by creating more joyful and sustainable ways to live.In Merck KGaA, Darmstadt, Germany’s more than 350-year history, people have always been and will continue to be at the center of everything it does.From advancing gene editing technologies and discovering unique ways to treat the most challenging diseases to enabling the intelligence of devices – the company is everywhere. In 2018, Merck KGaA, Darmstadt, Germany, generated sales of € 14.8 billion in 66 countries.

The company holds the global rights to the name and trademark “Merck” internationally. The only exceptions are the United States and Canada, where the business sectors of Merck KGaA, Darmstadt, Germany, operate as EMD Serono in healthcare, MilliporeSigma in life science, and EMD Performance Materials. Since its founding 1668, scientific exploration and responsible entrepreneurship have been key to the company’s technological and scientific advances. To this day, the founding family remains the majority owner of the publicly listed company.

About Versum Materials

Versum Materials, Inc. (NYSE: VSM) is a leading global specialty materials company providing high-purity chemicals and gases, delivery systems, services and materials expertise to meet the evolving needs of the global semiconductor and display industries. Derived from the Latin word for "toward," the name "Versum" communicates the company's deep commitment to helping customers move toward the future by collaborating, innovating and creating cutting-edge solutions.

A global leader in technology, quality, safety and reliability, Versum Materials is one of the world's leading suppliers of next-generation CMP slurries, ultra-thin dielectric and metal film precursors, formulated cleans and etching products, and delivery equipment that has revolutionized the semiconductor industry. Versum Materials reported fiscal year 2018 annual sales of about U.S. $1.4 billion, has approximately 2,300 employees and operates 14 major facilities in Asia and the North America. It is headquartered in Tempe, Arizona. Versum Materials had operated for more than three decades as a division of Air Products and Chemicals, Inc. (NYSE: APD).

For additional information, please visit http://www.versummaterials.com.

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements based on current assumptions and forecasts made by Merck KGaA, Darmstadt, Germany’s and Versum Materials, Inc.’s (“Versum”) management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include the following: Merck KGaA, Darmstadt, Germany’s ability to successfully complete the proposed acquisition of Versum or realize the anticipated benefits of the proposed transaction in the expected time-frames or at all; Merck KGaA, Darmstadt, Germany’s ability to successfully integrate Versum’s operations into those of Merck KGaA, Darmstadt, Germany; such integration may be more difficult, time-consuming or costly than expected; the failure to obtain Versum’s stockholders’ approval of the proposed transaction; the failure of any of the conditions to the proposed transaction to be satisfied; revenues following the proposed transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the proposed transaction; the retention of certain key employees at Versum; risks associated with the disruption of management’s attention from ongoing business operations due to the proposed transaction; the outcome of any legal proceedings related to the proposed transaction; the impact of the proposed transaction on Versum’s credit rating; the parties’ ability to meet expectations regarding the timing and completion of the proposed transaction; delays in obtaining any approvals required for the proposed transaction or an inability to obtain them on the terms proposed or on the anticipated schedule; the impact of indebtedness incurred by Merck KGaA, Darmstadt, Germany, in connection with the proposed transaction; the effects of the business combination of Versum and Merck KGaA, Darmstadt, Germany, including the combined company’s future financial condition, operating results, strategy and plans; and other factors discussed in Merck KGaA, Darmstadt, Germany’s public reports which are available on the Merck KGaA, Darmstadt, Germany, website at www.emdgroup.com or in Versum’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) for the fiscal year ended on September 30, 2018 and Versum’s other filings with the SEC, which are available at http://www.sec.gov and Versum’s website at www.versummaterials.com. Except as otherwise required by law, Merck KGaA, Darmstadt, Germany and Versum assume no liability whatsoever to update these forward-looking statements or to conform them to future events or developments. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Page 5 of 6

|  |

| News Release |

Additional Important Information and Where to Find It

This communication relates to the proposed merger transaction involving Versum and Merck KGaA, Darmstadt, Germany. In connection with the proposed merger, Versum and Merck KGaA, Darmstadt, Germany, intend to file relevant materials with the SEC, including Versum’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, and is not a substitute for the Proxy Statement or any other document that Versum or Merck KGaA, Darmstadt, Germany, may file with the SEC or send to Versum’s stockholders in connection with the proposed merger. STOCKHOLDERS OF VERSUM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s web site, http://www.sec.gov, or Versum’s website at http://investors.versummaterials.com or by phone at 484-275-5907.

Participants in Solicitation

Versum, Merck KGaA, Darmstadt, Germany, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction. Information about the directors and executive officers of Versum is set forth in Versum’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018, which was filed with the SEC on November 21, 2018, and the proxy statement for Versum’s 2019 annual meeting of stockholders, which was filed with the SEC on December 20, 2018. Information about the directors and executive officers of Merck KGaA, Darmstadt, Germany, is set forth on Schedule I of the Schedule 14A filed by Merck KGaA, Darmstadt, Germany, with the SEC on March 22, 2019. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Page 6 of 6

| 2. | The following presentation was first used on April 12, 2019. |

Merck KGaA, Darmstadt, Germany Marcus Kuhnert, CFO April 12, 2019 ACQUISITION OF VERSUM MATERIALS

Disclaimer Publication of Merck KGaA , Darmstadt, Germany . In the United States and Canada the group of companies affiliated with Merck KGaA , Darmstadt, Germany operates under individual business names (EMD Serono, Millipore Sigma, EMD Performance Materials) . To reflect such fact and to avoid any misconceptions of the reader of the publication certain logos, terms and business descriptions of the publication have been substituted or additional descriptions have been added . This version of the publication, therefore, slightly deviates from the otherwise identical version of the publication provided outside the United States and Canada . 2

Disclaimer Cautionary Note Regarding Forward - Looking Statements and financial indicators This communication may include “forward - looking statements . ” Statements that include words such as “anticipate,” “expect,” “should,” “would,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” and other words of similar meaning in connection with future events or future operating or financial performance are often used to identify forward - looking statements . All statements in this communication, other than those relating to historical information or current conditions, are forward - looking statements . We intend these forward - looking statements to be covered by the safe harbor provisions for forward - looking statements in the Private Securities Litigation Reform Act of 1995 . These forward - looking statements are subject to a number of risks and uncertainties, many of which are beyond control of Merck KGaA , Darmstadt, Germany, which could cause actual results to differ materially from such statements . Risks and uncertainties include, but are not limited to : the risks of more restrictive regulatory requirements regarding drug pricing, reimbursement and approval ; the risk of stricter regulations for the manufacture, testing and marketing of products ; the risk of destabilization of political systems and the establishment of trade barriers ; the risk of a changing marketing environment for multiple sclerosis products in the European Union ; the risk of greater competitive pressure due to biosimilars ; the risks of research and development ; the risks of discontinuing development projects and regulatory approval of developed medicines ; the risk of a temporary ban on products/production facilities or of non - registration of products due to non - compliance with quality standards ; the risk of an import ban on products to the United States due to an FDA warning letter ; the risks of dependency on suppliers ; risks due to product - related crime and espionage ; risks in relation to the use of financial instruments ; liquidity risks ; counterparty risks ; market risks ; risks of impairment on balance sheet items ; risks from pension obligations ; risks from product - related and patent law disputes ; risks from antitrust law proceedings ; risks from drug pricing by the divested Generics Group ; risks in human resources ; risks from e - crime and cyber attacks ; risks due to failure of business - critical information technology applications or to failure of data center capacity ; environmental and safety risks ; unanticipated contract or regulatory issues ; a potential downgrade in the rating of the indebtedness of Merck KGaA , Darmstadt, Germany ; downward pressure on the common stock price of Merck KGaA , Darmstadt, Germany and its impact on goodwill impairment evaluations as well as the impact of future regulatory or legislative actions . The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere, including the Report on Risks and Opportunities Section of the most recent annual report and quarterly report of Merck KGaA , Darmstadt, Germany . Any forward - looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations . Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward - looking statement, whether as a result of new information, future developments or otherwise . This presentation contains certain financial indicators such as EBITDA pre exceptionals, net financial debt and earnings per share pre exceptionals, which are not defined by International Financial Reporting Standards (IFRS) . These financial indicators should not be taken into account in order to assess the performance of Merck KGaA , Darmstadt, Germany in isolation or used as an alternative to the financial indicators presented in the consolidated financial statements and determined in accordance with IFRS . The figures presented in this statement have been rounded . This may lead to individual values not adding up to the totals presented . Additional Important Information and Where to Find It This communication relates to the proposed merger transaction involving Versum and Merck KGaA , Darmstadt, Germany . In connection with the proposed merger, Versum and Merck KGaA , Darmstadt, Germany, intend to file relevant materials with the SEC, including Versum’s proxy statement on Schedule 14 A (the “Proxy Statement”) . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, and is not a substitute for the Proxy Statement or any other document that Versum or Merck KGaA , Darmstadt, Germany, may file with the SEC or send to Versum’s stockholders in connection with the proposed merger . STOCKHOLDERS OF VERSUM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER . Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s web site, http : //www . sec . gov, or Versum’s website at http : //investors . versummaterials . com or by phone at 484 - 275 - 5907 . Participants in Solicitation Versum , Merck KGaA , Darmstadt, Germany, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction . Information about the directors and executive officers of Versum is set forth in Versum’s Annual Report on Form 10 - K for the fiscal year ended September 30 , 2018 , which was filed with the SEC on November 21 , 2018 , and the proxy statement for Versum’s 2019 annual meeting of stockholders, which was filed with the SEC on December 20 , 2018 . Information about the directors and executive officers of Merck KGaA , Darmstadt, Germany, is set forth on Schedule I of the Schedule 14 A filed by Merck KGaA , Darmstadt, Germany, with the SEC on March 22 , 2019 . Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available . 3

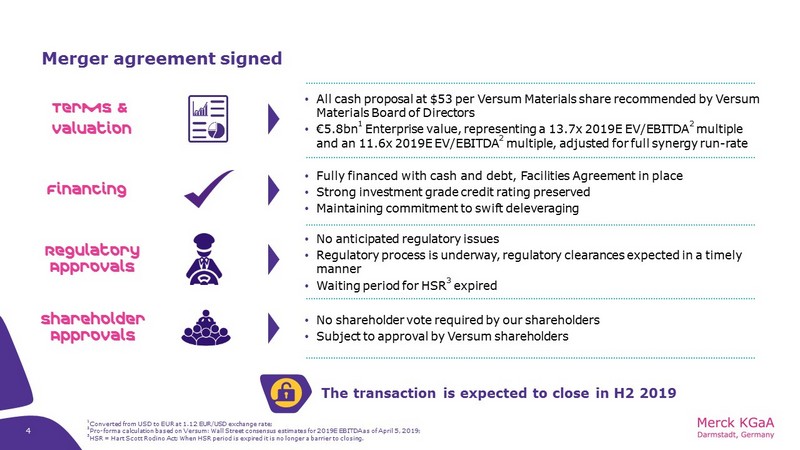

• All cash proposal at $53 per Versum Materials share recommended by Versum Materials Board of Directors • €5.8bn 1 Enterprise value, representing a 13.7x 2019E EV/EBITDA 2 multiple and an 11.6x 2019E EV/EBITDA 2 multiple, adjusted for full synergy run - rate • Fully financed with cash and debt, Facilities Agreement in place • Strong investment grade credit rating preserved • Maintaining commitment to swift deleveraging • No anticipated regulatory issues • Regulatory process is underway, regulatory clearances expected in a timely manner • Waiting period for HSR 3 expired • No shareholder vote required by our shareholders • Subject to approval by Versum shareholders Merger agreement signed 1 Converted from USD to EUR at 1.12 EUR/USD exchange rate; 2 Pro - forma calculation based on Versum : Wall Street consensus estimates for 2019E EBITDA as of April 5 , 2019; 3 HSR = Hart Scott Rodino Act; When HSR period is expired it is no longer a barrier to closing. 4 The transaction is expected to close in H2 2019 Terms & Valuation Financing Regulatory Approvals Shareholder Approvals

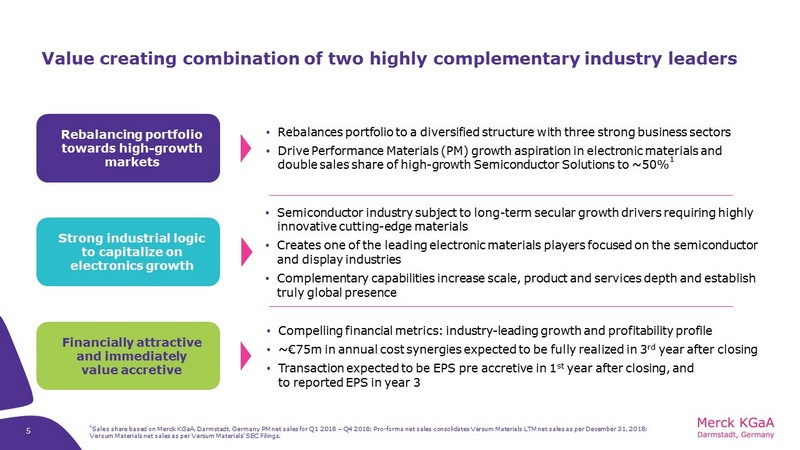

Value creating combination of two highly complementary industry leaders Financially attractive and immediately value accretive • Semiconductor industry subject to long - term secular growth drivers requiring highly innovative cutting - edge materials • Creates one of the leading electronic materials players focused on the semiconductor and display industries • Complementary capabilities increase scale, product and services depth and establish truly global presence • Rebalances portfolio to a diversified structure with three strong business sectors • Drive Performance Materials (PM) growth aspiration in electronic materials and double sales share of high - growth Semiconductor Solutions to ~50% 1 • Compelling financial metrics: industry - leading growth and profitability profile • ~€75m in annual cost synergies expected to be fully realized in 3 rd year after closing • Transaction expected to be EPS pre accretive in 1 st year after closing, and to reported EPS in year 3 Rebalancing portfolio towards high - growth markets Strong industrial logic to capitalize on electronics growth 5 1 Sales share based on Merck KGaA, Darmstadt, Germany PM net sales for Q1 2018 – Q4 2018; Pro - forma net sales consolidates Versum Materials LTM net sales as per December 31, 2018; Versum Materials net sales as per Versum Materials’ SEC Filings.

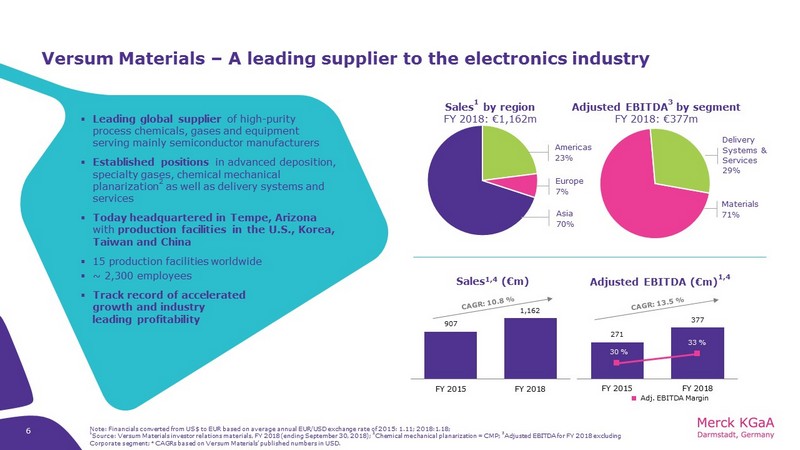

▪ Leading global supplier of high - purity process chemicals, gases and equipment serving mainly semiconductor manufacturers ▪ Established positions in advanced deposition, specialty gases, chemical mechanical planarization 2 as well as delivery systems and services ▪ Today headquartered in Tempe, Arizona with production facilities in the U.S., Korea, Taiwan and China ▪ 15 production facilities worldwide ▪ ~ 2,300 employees ▪ Track record of accelerated growth and industry leading profitability Note: Financials converted from US$ to EUR based on average annual EUR/USD exchange rate of 2015: 1.11; 2018:1.18; 1 Source: Versum Materials investor relations materials, FY 2018 (ending September 30, 2018); 2 Chemical mechanical planarization = CMP; 3 Adjusted EBITDA for FY 2018 excluding Corporate segment; 4 CAGRs based on Versum Materials’ published numbers in USD. Versum Materials – A leading supplier to the electronics industry Versum Materials – A leading supplier to the electronics industry Sales 1,4 (€m) Adjusted EBITDA (€m) 1,4 Sales 1 by region FY 2018: €1,162m Adjusted EBITDA 3 by segment FY 2018: €377m Materials 71% Delivery Systems & Services 29% Asia 70% Americas 23% Europe 7% 907 1,162 FY 2015 FY 2018 271 377 30 % 33 % FY 2015 FY 2018 6 Adj. EBITDA Margin

Combination creates a leading electronic materials player • Complementary capabilities • Versum Materials’ business adds positions in advanced deposition, specialty gases and chemical mechanical planarization to our established presence • Creating a leading electronic materials player with focus on the semiconductor and display industries and deep customer relationships • Combined pro - forma Performance Materials annual sales ~ €3.6bn 1 • Optimally positioned to capitalize on strong long - term secular trends in the semiconductor industry, incl. the emergence of artificial intelligence, autonomous mobility, big data, internet of things, global connectivity • Increasing diversification of end - markets • Build an attractive portfolio in high value materials • E.g. in advanced deposition materials, dielectrics, CMP slurries, and cleaning chemicals • Expanding Merck’s KGaA , Darmstadt, Germany electronic materials business and tapping new growth opportunities • Versum Materials’ equipment and services business allows broader positioning along the wafer processing value chain for Merck KGaA , Darmstadt, Germany • Accelerating ability to innovate through the combination of R&D efforts • Combine technological capabilities in order to generate novel technologies and better serve our customers 1 Includes Performance Materials’ Semiconductor Solutions business Q1 2018 - Q4 2018 and Versum Materials FY 2018. Innovation Broadened offering Deep portfolio Poised for growth Partner of choice Comple - mentary 7

…driving the digital revolution as semiconductors are required for data processing and storage 1 Source: IDC, White paper #US444133, November 18, 2018. Size of global data sphere in zettabytes 1 The combined business capitalizes on electronics industry growth Internet of things Big data Artificial intelligence Autonomous mobility New markets and applications emerge daily… Global connectivity 1 2 3 4 5 8 TODAY 1 Zettabyte = 1 trillion gigabytes Data communication is growing with >30% annually

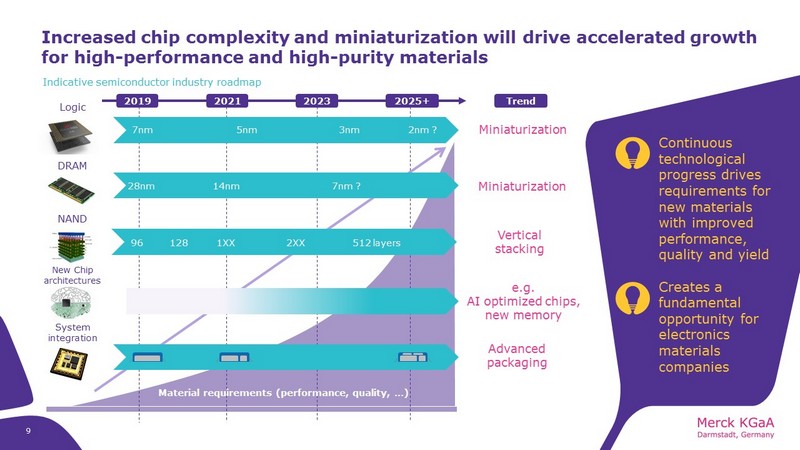

Increased chip complexity and miniaturization will drive accelerated growth for high - performance and high - purity materials Logic DRAM NAND System integration New Chip architectures 2019 2021 2023 2025+ 7 nm 5 nm 3nm 2 nm ? Miniaturization 14nm 7nm ? 28 nm Vertical stacking Advanced packaging 96 128 2XX 512 layers 1XX e.g. AI optimized chips, new memory Indicative semiconductor industry roadmap • Continuous technological progress drives requirements for new materials with improved performance, quality and yield • Creates a fundamental opportunity for electronics materials companies 9 Trend Miniaturization Material requirements (performance, quality, …)

Semiconductor market value 1 Silicon Photomasks Bulk gases SOI Deposition materials Photoresist anciliaries CMP (slurries, pads) Photoresists Specialty gases Process chemicals Sputtering targets Combination with Versum Materials enables competitive edge, as future - critical materials will become increasingly important • Electronics materials market is driven by innovation • High purity materials (CMP, deposition materials) for wafer processing play a crucial role in enabling semiconductor industry innovation 2016 2017 2018E Manufacturing Equipment Materials 10 1 Source: Versum Materials investor Relations materials; * SOI = Silicon on insulator. * Innovation - critical wafer processing materials

Value accretive for Merck KGaA, Darmstadt, Germany shareholders Merck’s KGaA , Darmstadt, Germany 2018 sales 1 increase by ~8% Merck’s KGaA , Darmstadt, Germany 2018 EBITDA pre 1 rises by ~13% 2 Merck’s KGaA , Darmstadt, Germany EBITDA pre margin expansion by ~60 bps 3 Cost synergies of ~€75m p.a. To be fully captured by year 3 Immediately accretive to EPS pre Accretive to reported EPS including all transaction - related costs in year 3 Transaction IRR > WACC Fully financed with cash and debt (Term Loan, hybrid bond, EUR bond) Strong investment grade credit rating preserved • Solid pro - forma balance sheet with estimated net debt / EBITDA pre 4 of 3.0x and pro - forma 2.9x including 100% run - rate cost synergies Pro - forma Value creation Balance sheet Enhancing sales and EBITDA pre Expected synergies drive value creation Solid financial structure preserved Acquisition of Versum Materials strengthens Merck KGaA, Darmstadt, Germany portfolio and meets group‘s clear financial M&A criteria 1 Based on results FY 2018; 2 Pro - forma including 100% synergy run - rate of €75m; 3 bps = basis points; 4 Pro - forma as per December 31, 2018. 11

Due diligence completed ~€75m in annual run - rate cost synergies identified Time to realization reiterated 1 : 100% by year 3, up to 50% realized in year 1 Integration costs of €125m, spread over 2 years Cost synergies of 6% 2 of acquired net sales 1 Post closing; 2 Assumes LTM Dec - 2018 Versum Materials Revenue of €1,233m and 1.12 USD to EUR exchange rate. Transaction offers well - founded cost synergies driving value creation Corporate / Administrative Functions • Integrate corporate & administrative functions • Save U.S. public company costs • Transform country setup • Streamline duplicate structures Business Optimization • Optimize production and supply chain network • Achieve savings through joint procurement Procurement / Supply Chain 12

Solid financing structure for Versum Materials acquisition secured Financing structure secured with mix of cash and debt Fully committed financing is in place by way of a facilities agreement with Bank of America Merrill Lynch, BNP Paribas Fortis and Deutsche Bank Facilities Agreement consists of a USD 4.0bn Bridge Loan and a USD 2.3bn Term Loan The Bridge Loan is targeted to be taken out by a EUR hybrid bond as well as EUR senior bond offering Strong commitment to rating reiterated Merck KGaA, Darmstadt, Germany has a history of rapid deleveraging after larger acquisitions and will continue to keep that focus The hybrid bond offering underpins Merck‘s KGaA, Darmstadt, Germany commitment to support its strong credit ratings 13

Indicative timeline to closing Announcement (April 12, 2019) Closing (Expected H2 2019) Closing after: 1 2 3 1 Day of Versum Materials - EGM to be confirmed. Fulfillment of other customary closing conditions Versum Materials shareholders approval 1 Regulatory approvals 14

Executive summary EPS pre accretive in first full year after closing and to reported EPS in year 3 Capitalizing on attractive secular electronics industry growth trends Rebalancing group’s and Performance Materials’ portfolio towards high - growth markets Creating a leading electronic materials players focused on the semiconductor and display industries Sustainable value creation for Merck KGaA , Darmstadt, Germany 1 2 3 4 5 15

BACK - UP

Providing leading - edge technology backed by the capabilities, scale and quality of Merck KGaA, Darmstadt, Germany Truly global footprint and close proximity to customers worldwide Combines innovation strength to better serve our customers in a rapidly evolving marketplace A strategically and financially compelling transaction for Merck KGaA , Darmstadt, Germany shareholders Delivers on strategy of building leading positions in attractive markets 11.6x EBITDA 2019E multiple (incl. synergies) and all cash consideration make the transaction financially attractive Combining the certainty of an all - cash transaction with an attractive valuation Becoming an integral part of leading science and technology company Merck KGaA , Darmstadt, Germany Commitment to maintain Tempe, Arizona presence as the major hub for the combined electronic materials business in the U.S. Merck KGaA, Darmstadt, Germany – the best strategic owner of Versum Materials to the highest benefit of shareholders, employees and customers A compelling proposal for all stakeholders 17

Rebalancing Group portfolio to diversified structure of three strong pillars Healthcare Life Science Performance Materials Merck KGaA, Darmstadt, Germany N et sales 1 Pro - forma net sales 1 16% 23% 19% 27% Merck KGaA, Darmstadt, Germany EBITDA pre 1 Pro - forma EBITDA pre 1, 2 1 LTM results as of December 31, 2018. EBITDA pre excludes Corporate & Other; 2 Including 100% synergies; 3 Merck KGaA, Darmstadt, Germany PM net sales for LTM Q1 2018 – Q4 2018; 4 Pro - forma net sales consolidates Versum Materials LTM net sales as of September 30, 2018; All Versum Material’s data as per Versum Materials SEC filings. Actively rebalances the Group portfolio for diversified, accelerated growth Performance Materials executes on its transformation program ~50% Today 3 Pro - forma 4 25% Semiconductor Solutions Display Solutions Surface Solutions Performance Materials and Versum Materials will have pro - forma LTM net sales of ~€3.6bn 1 and LTM EBITDA pre of ~€1.3bn 1,2 Actively rebalances the Group portfolio for diversified, accelerated growth 18 Increasing exposure to high - growth market segments in electronic materials and solutions

Versum Materials Financials €m 1, 2 2015 2016 2017 2018 Net sales 907 880 997 1,162 Adjusted EBITDA 271 297 329 377 Adjusted EBITDA m argin 29.9% 33.7% 33.0% 32.5% EBITDA 251 296 307 360 D&A 51 46 41 43 EBIT 200 251 266 317 1 Source: Versum Materials SEC filings; Financials converted from US$ to EUR based on average annual exchange rate of EUR/USD; 2 Versum Materials Fiscal Year ends September 30. Robust historical financial performance • 2015 - 2018 CAGR sales of ~11% • 2015 - 2018 CAGR adjusted EBITDA of ~14% 19

CONSTANTIN FEST Head of Investor Relations +49 6151 72 - 5271 constantin.fest@emdgroup.com EVA STERZEL Retail Investors / AGM / CMDs / IR Media +49 6151 72 - 5355 eva.sterzel@ emd group.com ANNETT WEBER Institutional Investors / Analysts +49 6151 72 - 63723 annett.weber @emdgroup.com Assistant Investor Relations +49 6151 72 - 3744 svenja.bundschuh @ emd group.com SVENJA BUNDSCHUH ALESSANDRA HEINZ Assistant Investor Relations +49 6151 72 - 3321 alessandra.heinz @ emd group.com EMAIL: investor.relations @ emd group.com WEB: www.emdgroup.com/investors FAX: +49 6151 72 - 913321 Institutional Investors / Analysts +49 6151 72 - 5642 patrick.bayer @ emd group.com PATRICK BAYER Institutional Investors / Analysts +49 6151 72 - 22076 amelie.schrader @ emd g roup.com AMELIE SCHRADER

| 3. | The following talking points (Q&A) were first used on April 12, 2019. |

Merger Agreement Q&A

| 1. | What is the premium on the transaction? What are the multiples paid? |

This $53 price per share represents a 67.5% premium over Versum’s last undisturbed trading price on January 25th, 2019, of $31.65. The agreed price reflects an enterprise value (EV) for Versum of approximately €5.8 billion, implying an EV/FY19 EBITDA multiple of approximately 13.7x and a pro-forma multiple of 11.6x, including €75 million of identified annual run-rate cost synergies.

| 2. | How did you arrive at this price? |

This price was determined following the completion of our due diligence and recognition of the value and synergies that the business combination is expected to yield. The business combination is expected to be immediately accretive to earnings per share before exceptional items (EPS pre) and accretive to reported EPS in the third full year after closing.

| 3. | What happens to your proxy solicitation campaign against the proposed Entegris merger and your tender offer? |

Merck KGaA, Darmstadt, Germany’s proxy solicitation against the proposed Entegris merger is over, as the proposed Entegris merger has been terminated. Merck KGaA, Darmstadt, Germany’s tender offer has been terminated as well.

| 4. | Is the deal subject to Versum shareholder approval? |

The transaction has been unanimously approved by Versum’s Board of Directors and is subject to approval at a special meeting of Versum shareholders (yet to be scheduled).

| 5. | Is the deal subject to Merck KGaA, Darmstadt, Germany, shareholder approval? |

No.

| 6. | When is the transaction expected to close? |

The transaction is expected to close in the second half of 2019, subject to Versum shareholder approval at a special meeting of Versum shareholders (yet to be scheduled), regulatory clearances and the satisfaction of other customary closing conditions. The applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, for U.S. antitrust purposes has already expired.

| 1 |

| 7. | What are the conditions to the merger and closing? |

The transaction is subject to Versum shareholder approval at a special meeting of Versum shareholders, regulatory clearances, and the satisfaction of other customary closing conditions. The applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, for U.S. antitrust purposes has already expired. The Merger Agreement has been filed with the SEC and contains the closing conditions.

| 8. | What regulatory approvals are required? What countries are key and what issues do you expect and what is the timing? |

We will submit all customary regulatory filings in various jurisdictions around the world, including the United States. In the U.S., the applicable waiting period under the Hart-Scott-Rodino Act for U.S. antitrust purposes has already expired, and a CFIUS filing will be made. Further details will be contained in Versum’s proxy statement. Merck KGaA, Darmstadt, Germany, expects that regulatory clearances will be received in a timely manner.

| 9. | What are the other customary closing conditions? |

The Merger Agreement has been filed with the SEC and contains the closing conditions.

| 10. | What are the next steps? |

Versum will file a proxy statement with the SEC and schedule a special meeting of its shareholders to approve the merger. We are confident that this will all happen in a timely manner.

| 11. | What isthe impact of Entegris’ announcement on April 8 that it does not intend to propose to revise the terms of its acquisition of Versum? |

This development has no impact on the Merger Agreement between Merck KGaA, Darmstadt, Germany, and Versum. Versum terminated its merger agreement with Entegris.

| 12. | Sincethe Sigma Aldrich acquisition, you’ve only been able to decrease debt with the recent sale of the Consumer Health business. Are you now looking to sell another one of your business units? |

We are not going to speculate on any potential asset sales.

| 13. | Can you talk about the synergy-delta: Where are the new synergies coming from that you found during due diligence? |

With the benefit of incremental information and access to management, we felt that our initial synergy estimates across all categories were too conservative. Specifically, we have identified additional savings related to duplicative costs, revised management structures and additional site optimization across our combined network. We are confident that at this new synergy level, our day-to-day business, customers and growth prospects will not be adversely impacted.

| 2 |

| 14. | Are you accounting for any top-line synergies? |

The synergy run-rate target of €75m relates to cost synergies only and is a top-down estimate based on our discussions with Versum’s senior management to date. We are confident to realize this target by year 3 following closing. However, the bottom-up detailing will be done as soon as the integration teams commence work and prepare further analyses based on more granular insights obtained. We will be able to share further details post-closing.

| 15. | Duringthe due diligence, did you identify any antitrust issues? |

After the due diligence, we remain confident that we will obtain all regulatory approvals in a timely manner.

| 16. | Even including higher synergies, your EV/EBITDA multiple increased. How do you justify this versus your initial announcement? |

Our deal price reflects the benefit of additional information and access to management as a result of our due diligence efforts. We now even more firmly believe that Versum is a best-in-class asset and the business combination will create a leading electronic materials player focused on the semiconductor and display industries. We have adhered to our rigorous M&A criteria, and as such, are confident that the higher valuation is not only justified by the underlying business we are acquiring, but also creates value for our shareholders.

| 17. | Whenwill we see more granularity on synergies? Why not show us everything now? |

The synergy run-rate target of €75m is a top-down estimate based on our discussions with Versum’s senior management to date. These synergies are derived from three key categories:

| - | Integration of corporate & administrative functions; |

| - | Procurement & supply chain optimization; and |

| - | Streamlining duplicate operating structures. |

We expect to realize this targetby the third full year after closing. However, the bottom-up detailing within those categories will be done as soon as the integration teams commence work and prepare further analyses based on more granular insights obtained. We will be able to share further details post-closing.

| 3 |

| 18. | Whenwill the Versum shareholders meeting to approve the transaction be scheduled? |

The date of the Versum shareholders meeting will be included in Versum’s proxy statement.

| 19. | PMis stillsmaller than HC and LS, so will your next acquisition after Versum be in semiconductors? |

We are not going to speculate on potential future M&A activities.

| 20. | Whatwould be the next steps if shareholders vote against you? |

We are not going to speculate on hypotheticals.

| 21. | We saw the latest MSI report from Linx (March), which states a MSI slow down for 2019 and 2020. Given that you stated in the past that you are correlating with MSI growth, how does this fit with your high-growth assumption in this particular business? Given that we are already in mid-April, have you seen any signs of a slowdown in Q1 2019 in the semiconductor business? |

Current global economic pressure (due to US China Trade, Brexit…) is also impacting the electronics market, which is – with its diverse end-markets – linked towards global GDP. On Q1 I would ask you to wait until our Q1 reporting on 14th May. Nevertheless, long-term trends like Big Data, Connectivity and Artificial Intelligence remain intact and will drive a positive MSI development in the future.

We therefore stick to our guidance, of mid-to-high single-digit which is a “mid-term” outlook. The acquisition of Versum is the best indicator that we believe in the prospects of this business.

| 22. | What is covered by the €125m of expected integration costs over two years? |

The mentioned amount of €125m over two years is a top-down estimate based on our experience from similar post-merger integration processes in past transactions. It is primarily covering one-off costs in connection with the integration and harmonization of systems & processes. The integration teams will commence work to prepare further analyses based on their insights. We will be able to share further details following closing.

| 4 |

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements based on current assumptions and forecasts made by Merck KGaA, Darmstadt, Germany, management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include the following: Merck KGaA, Darmstadt, Germany’s ability to successfully complete the proposed acquisition of Versum Materials, Inc. (“Versum”) or realize the anticipated benefits of the proposed transaction in the expected time-frames or at all; Merck KGaA, Darmstadt, Germany’s ability to successfully integrate Versum’s operations into those of Merck KGaA, Darmstadt, Germany; such integration may be more difficult, time-consuming or costly than expected; the failure to obtain Versum’s stockholders’ approval of the proposed transaction; the failure of any of the conditions to the proposed transaction to be satisfied; revenues following the proposed transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the proposed transaction; the retention of certain key employees at Versum; risks associated with the disruption of management’s attention from ongoing business operations due to the proposed transaction; the outcome of any legal proceedings related to the proposed transaction; the impact of the proposed transaction on Versum’s credit rating; the parties’ ability to meet expectations regarding the timing and completion of the proposed transaction; delays in obtaining any approvals required for the proposed transaction or an inability to obtain them on the terms proposed or on the anticipated schedule; the impact of indebtedness incurred by Merck KGaA, Darmstadt, Germany, in connection with the proposed transaction; the effects of the business combination of Versum and Merck KGaA, Darmstadt, Germany, including the combined company’s future financial condition, operating results, strategy and plans; and other factors discussed in Merck KGaA, Darmstadt, Germany’s public reports which are available on the Merck KGaA, Darmstadt, Germany, website at www.emdgroup.com or in Versum’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) for the fiscal year ended on September 30, 2018 and Versum’s other filings with the SEC, which are available at http://www.sec.gov and Versum’s website at www.versummaterials.com. Except as otherwise required by law, Merck KGaA, Darmstadt, Germany, assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Additional Important Information and Where to Find It

This communication relates to the proposed merger transaction involving Versum and Merck KGaA, Darmstadt, Germany. In connection with the proposed merger, Versum and Merck KGaA, Darmstadt, Germany, intend to file relevant materials with the SEC, including Versum’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, and is not a substitute for the Proxy Statement or any other document that Versum or Merck KGaA, Darmstadt, Germany, may file with the SEC or send to Versum’s stockholders in connection with the proposed merger. STOCKHOLDERS OF VERSUM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s web site, http://www.sec.gov, or Versum’s website at http://investors.versummaterials.com or by phone at 484-275-5907.

Participants in Solicitation

Versum, Merck KGaA, Darmstadt, Germany, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction. Information about the directors and executive officers of Versum is set forth in Versum’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018, which was filed with the SEC on November 21, 2018, and the proxy statement for Versum’s 2019 annual meeting of stockholders, which was filed with the SEC on December 20, 2018. Information about the directors and executive officers of Merck KGaA, Darmstadt, Germany, is set forth on Schedule I of the Schedule 14A filed by Merck KGaA, Darmstadt, Germany, with the SEC on March 22, 2019. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

| 5 |

| 4. | The following news release was posted to internal site of Merck KGaA, Darmstadt, Germany on April 12, 2019. |

[April 12, 2019]

|

Header:Definitive Agreement to Acquire Versum is Signed

Subheader: Stefan Oschmann speaks to Versum employees at Town Hall in Tempe

Today Merck KGaA, Darmstadt, Germany has signed a definitive agreement to acquire Versum for $53 per share in cash. he business combination has been unanimously approved by the Executive Board of Merck KGaA, Darmstadt, Germany and by Versum’s Board of Directors.

This transaction is expected to significantly strengthen the Performance Materials business, and to create a leading electronic materials player focused on the semiconductor and display industries. The business combination will create increased scale, product, and services depth globally. In addition, it will strengthen its global supply chain and supply reliability.

“With this transaction, Merck KGaA, Darmstadt, Germany will be optimally positioned to capitalize on long-term growth trends in the electronic materials industry. Our combined business shall deliver leading-edge innovations to our customers around the globe,” said Stefan Oschmann, Chairman of the Executive Board and CEO of Merck KGaA, Darmstadt, Germany.

Shortly after the agreement was signed Stefan Oschmann spoke to the Versum employees at a global town hall in Tempe, Arizona. (pictures)

Almost in parallel Kai Beckmann; Executive Board Member and CEO of Performance Materials together with Marcus Kuhnert Executive Board Member and CFO held a global townhall from Darmstadt for all Merck KGaA, Darmstadt, Germany colleagues. Present at the panel discussion was as well Benjamin Hein Head of Strategy & Business Transformation PM (A link/summary of the recording can be found here)

| Page 1 of 3 |

Merck KGaA, Darmstadt, Germany intends to maintain Versum’s Tempe, Arizona site as the major hub for the combined electronic materials business in the U.S., complementing the already strong commitment to this important market.

The business combination is expected to close in the second half of 2019, subject to an approval by the Versum shareholders, regulatory clearances and satisfaction of other customary closing conditions. Expectations are to generate approximately €75 million in run-rate synergies by the third full year after closing.

More information can be found in the press release as well as in the Do's and Don'ts for employees. (LINK)

InfoBox

Versum is a provider of materials mainly for the semiconductor wafer processing and the memory and logic segment. It is a stock-listed company with a high profitability of a 33% EBITDA margin. Headquarter is based in Tempe, Arizona, USA and they employee around 2,300 employees globally in 15 production facilities located in the US and Asia.

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements based on current assumptions and forecasts made by Merck KGaA, Darmstadt, Germany, management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include the following: Merck KGaA, Darmstadt, Germany’s ability to successfully complete the proposed acquisition of Versum Materials, Inc. (“Versum”) or realize the anticipated benefits of the proposed transaction in the expected time-frames or at all; Merck KGaA, Darmstadt, Germany’s ability to successfully integrate Versum’s operations into those of Merck KGaA, Darmstadt, Germany; such integration may be more difficult, time-consuming or costly than expected; the failure to obtain Versum’s stockholders’ approval of the proposed transaction; the failure of any of the conditions to the proposed transaction to be satisfied; revenues following the proposed transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the proposed transaction; the retention of certain key employees at Versum; risks associated with the disruption of management’s attention from ongoing business operations due to the proposed transaction; the outcome of any legal proceedings related to the proposed transaction; the impact of the proposed transaction on Versum’s credit rating; the parties’ ability to meet expectations regarding the timing and completion of the proposed transaction; delays in obtaining any approvals required for the proposed transaction or an inability to obtain them on the terms proposed or on the anticipated schedule; the impact of indebtedness incurred by Merck KGaA, Darmstadt, Germany, in connection with the proposed transaction; the effects of the business combination of Versum and Merck KGaA, Darmstadt, Germany, including the combined company’s future financial condition, operating results, strategy and plans; and other factors discussed in Merck KGaA, Darmstadt, Germany’s public reports which are available on the Merck KGaA, Darmstadt, Germany, website at www.emdgroup.com or in Versum’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) for the fiscal year ended on September 30, 2018 and Versum’s other filings with the SEC, which are available at http://www.sec.gov and Versum’s website at www.versummaterials.com. Except as otherwise required by law, Merck KGaA, Darmstadt, Germany, assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

| Page 2 of 3 |

Additional Important Information and Where to Find It

This communication relates to the proposed merger transaction involving Versum and Merck KGaA, Darmstadt, Germany. In connection with the proposed merger, Versum and Merck KGaA, Darmstadt, Germany, intend to file relevant materials with the SEC, including Versum’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, and is not a substitute for the Proxy Statement or any other document that Versum or Merck KGaA, Darmstadt, Germany, may file with the SEC or send to Versum’s stockholders in connection with the proposed merger. STOCKHOLDERS OF VERSUM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s web site, http://www.sec.gov, or Versum’s website at http://investors.versummaterials.com or by phone at 484-275-5907.

Participants in Solicitation

Versum, Merck KGaA, Darmstadt, Germany, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction. Information about the directors and executive officers of Versum is set forth in Versum’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018, which was filed with the SEC on November 21, 2018, and the proxy statement for Versum’s 2019 annual meeting of stockholders, which was filed with the SEC on December 20, 2018. Information about the directors and executive officers of Merck KGaA, Darmstadt, Germany, is set forth on Schedule I of the Schedule 14A filed by Merck KGaA, Darmstadt, Germany, with the SEC on March 22, 2019. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

| Page 3 of 3 |

| 5. | The following is the transcript of an investor and analyst call for Merck KGaA, Darmstadt, Germany. |

Event Name: Merck KGaA, Darmstadt, Germany Signs Definitive Agreement to Acquire Versum Materials Call

Event Date: 2019-04-12T14:00:00 UTC

P: Operator;;

C: Constantin Fest;Merck KGaA, Darmstadt, Germany;Head of IR

C: Marcus Kuhnert; Merck KGaA, Darmstadt, Germany;CFO & Member of Executive Board

P: Hima B. Inguva;BofA Merrill Lynch, Research Division;Director

P: Luisa Caroline Hector;Exane BNP Paribas, Research Division; Pharma Research Analyst

P: Marietta Eva Miemietz;Primavenue Advisory Services Limited; Founder & Director

P: Matthew Weston;Crédit Suisse AG, Research Division; MD and Co-Head of European Pharmaceutical Equity Research

P: Simon Baker;;

P: Wimal Kapadia;Sanford C. Bernstein & Co., LLC., Research Division; Research Analyst

+++ presentation+++

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements based on current assumptions and forecasts made by Merck KGaA, Darmstadt, Germany, management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include the following: Merck KGaA, Darmstadt, Germany’s ability to successfully complete the proposed acquisition of Versum Materials, Inc. (“Versum”) or realize the anticipated benefits of the proposed transaction in the expected time-frames or at all; Merck KGaA, Darmstadt, Germany’s ability to successfully integrate Versum’s operations into those of Merck KGaA, Darmstadt, Germany; such integration may be more difficult, time-consuming or costly than expected; the failure to obtain Versum’s stockholders’ approval of the proposed transaction; the failure of any of the conditions to the proposed transaction to be satisfied; revenues following the proposed transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the proposed transaction; the retention of certain key employees at Versum; risks associated with the disruption of management’s attention from ongoing business operations due to the proposed transaction; the outcome of any legal proceedings related to the proposed transaction; the impact of the proposed transaction on Versum’s credit rating; the parties’ ability to meet expectations regarding the timing and completion of the proposed transaction; delays in obtaining any approvals required for the proposed transaction or an inability to obtain them on the terms proposed or on the anticipated schedule; the impact of indebtedness incurred by Merck KGaA, Darmstadt, Germany, in connection with the proposed transaction; the effects of the business combination of Versum and Merck KGaA, Darmstadt, Germany, including the combined company’s future financial condition, operating results, strategy and plans; and other factors discussed in Merck KGaA, Darmstadt, Germany’s public reports which are available on the Merck KGaA, Darmstadt, Germany, website at www.emdgroup.com or in Versum’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) for the fiscal year ended on September 30, 2018 and Versum’s other filings with the SEC, which are available at http://www.sec.gov and Versum’s website at www.versummaterials.com. Except as otherwise required by law, Merck KGaA, Darmstadt, Germany assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Additional Important Information and Where to Find It

This communication relates to the proposed merger transaction involving Versum and Merck KGaA, Darmstadt, Germany. In connection with the proposed merger, Versum and Merck KGaA, Darmstadt, Germany, intend to file relevant materials with the SEC, including Versum’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, and is not a substitute for the Proxy Statement or any other document that Versum or Merck KGaA, Darmstadt, Germany, may file with the SEC or send to Versum’s stockholders in connection with the proposed merger. STOCKHOLDERS OF VERSUM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s web site, http://www.sec.gov, or Versum’s website at http://investors.versummaterials.com or by phone at 484-275-5907.

Participants in Solicitation

Versum, Merck KGaA, Darmstadt, Germany, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction. Information about the directors and executive officers of Versum is set forth in Versum’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018, which was filed with the SEC on November 21, 2018, and the proxy statement for Versum’s 2019 annual meeting of stockholders, which was filed with the SEC on December 20, 2018. Information about the directors and executive officers of Merck KGaA, Darmstadt, Germany, is set forth on Schedule I of the Schedule 14A filed by Merck KGaA, Darmstadt, Germany, with the SEC on March 22, 2019. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Operator^ Dear ladies and gentlemen, welcome to the Merck KGaA, Darmstadt, Germany Investor and Analyst Conference call on the acquisition of Versum Materials. (Operator Instructions) May I now hand over to Constantin Fest, Head of Investor Relations, who will lead you through this conference. Please go ahead, sir.

Constantin Fest^ Many thanks, Evie, and very warm welcome to all of you joining this conference call on the news that Merck KGaA, Darmstadt, Germany has signed a definitive agreement to acquire Versum Materials for USD 53 per share. My name is Constantin Fest, Head of Investor Relations, and I'm pleased to let you know that today I'm joined on this call by our Chief Financial Officer, Marcus Kuhnert. In the next 15 to 20 minutes, we would like to run you through the key slides of this presentation, and following that, we have reserved some additional 15 to 20 minutes to take your questions.

With this, I'd like to directly hand over to you, Marcus, to kick off this presentation.

Marcus Kuhnert^ Thank you, Constantin. Ladies and gentlemen, welcome to our conference call today, and thanks a lot for dialing in on a Friday afternoon on such a short notice. Special greetings from our Chief Executive Officer, Stefan Oschmann, who's currently in Tempe, Arizona for a very specific reason.

We just signed our merger agreement with Versum Materials today. The Versum Board of Directors agreed to our increased all cash proposal of USD 53 per share. And as a result of the due diligence that we conducted last week, we identified EUR 75 million in annual cost synergies will be -- which will be fully realized in the third year after closing. So with $53 per share, Versum is valued an enterprise value of EUR 5.8 billion, which is equivalent to a pro forma 2019 enterprise value EBITDA multiple of 11.6x on a full synergy run rate.

Let me also emphasize that we continue to see no changes in terms of timing. The regulatory process is well underway, with regulatory clearance expected to be received in timely manner and the acquisition of Versum Materials is expected to be closed by the second half of this year.

I'm now on Page #5. As you know, this transaction is a value-creating combination of 2 highly complementary industry leaders and in line with our outline strategy for Performance Materials to further invest into our semiconductor materials business. We see attractive growth opportunities in this sector, and we strongly believe in the compelling strategic fit with Versum Materials. With this merger, we rebalance the group's portfolio to a diversified structured of 3 attractive and strong business sectors.

We doubled Semiconductor Solutions share of Performance Materials sales to round about 50%, and we fundamentally expand the PM exposure to the high-growth semiconductors industry. We'll be ideally positioned to capitalize on the electronics industry's growth and will be a leading cutting-edge technology supplier to the semiconductor and display industry.

The transaction will be value accretive with compelling financial metrics. We will talk about this in a minute more in detail. And also, we reconfirm that the transaction's expected to be EPS pre accretive in the first full year after closing and accretive to reported earnings per share in year 3.

I think Page 6 is well known to you. Versum Materials is a global material supplier to the electronics industry, specifically of high-purity process chemicals, gases and equipment, serving mainly semiconductor manufacturers. And it has well-established positions along the entire semiconductor processing value chain. It is a highly attractive asset with average growth rates of 11% in net sales and 14% in EBITDA over the last 3 years and above-average profitability.

On Page #7, you find the key points of the transaction strategic rationale. I'm not going to dive into this for too long, so just let me reiterate and let us assume we will be even better positioned to capitalize on the semiconductor industry's secular growth trend.

These are driven by the emergence of new markets and applications like artificial intelligence, autonomous mobility, big data and the Internet of Things. The drive for digital revolution and data volumes are projected to grow sharply. This in turn has fundamental implications for data processing and storage.

The expected surge in data volume can only be enabled and dealt with by ongoing technological advances and developments in the semiconductor industry. This is not a trivial issue. Our customers need to produce increasingly complex chip structures with vertical stacking rising from some 96 layers today to possible as many as 512 layers in the next years and with structures shrinking from 7 nanometers today to 3 or maybe even 2 nanometers in the future. All these developments require innovative materials that meet the highest performance, quality and yield standards. And this, again, creates an opportunity for specialty materials companies like us. We're convinced that Merck KGaA, Darmstadt, Germany and Versum Materials will have a podium positioned to capitalize on these trends.

And let me give you another reason, why? The combined business will have leading positions in the relevant material classes, like CMP slurries, spin-on dielectric and deposition materials, which are key to support and enable the future technological developments, which I just outlined. Our ultrahigh purity materials, even if they only account for a small part of the total production cost, have an immense impact on the value created by our customers' products.

And now we look a little bit deeper into the financials. I'm on Slide 11. In our due diligence process last week, we identified some potential for higher cost synergies, which is why we raised our synergy target from originally EUR 60 million now to EUR 75 million per year. As a result, the inclusion of Versum Materials will raise group EBITDA pre by 13% and the EBITDA pre-margin will expand by 60 basis points already in the first full year after the expected closing.

Despite the higher price take of now USD 53 per Versum share, we confirm that the transaction will be immediately EPS accretive in the first full year after closing and accretive to EPS reported that means all in so to say, including integration and transaction costs after the third year.

We also confirm that the transaction earns its cost of capital and therefore, it's going to meet another very important financial M&A criteria and metric.

From a leverage perspective, we expect net debt to EBITDA to rise to 3x on day 1, only marginally above the ratio we communicated in February when we initially announced our plans to acquire Versum and also significantly below the ratio that we were having when we acquired Sigma-Aldrich back then in 2015 where we had some 3.5x net debt to EBITDA.

On Page #12, let me give you some more details on the cost synergies of EUR 75 million that we have identified. As before, they're expected to be fully realized in the third year after closing and they represent approximately 6% of acquired sales. The cost synergies will be derived mainly from 3 different sources: integration of corporate and administrative functions, procurement and supply chain optimization as well as streamlining duplicate business and operating structures. Given our high-cost synergy estimate, we expect integration cost -- higher cost synergy estimate, we expect integration cost to be in the range of EUR 125 million and -- which will be spread over the next 2 years.

On Slide #13, you see some information about our financing. We have secured the financing with a mix of cash and debt like we did back then in the Sigma acquisition. The debt portion will consist of bank loans, senior bond offerings and hybrid debt in order to support our rating. As you know from prior transactions, we are highly committed to our strong credit rating, and we will focus on rapid deleveraging starting day 1 after closing.

With regard to the timing, I'm now on Page #14, we are confident to reach closing in the second half of 2019 as previously communicated. The next step needed would be the Versum shareholders' approval and of course as before the regulatory approvals as well as the fulfillment of other customary closing conditions.

With this merger agreement, Performance Materials portfolio is rebalancing towards high-growth markets. Thus, we create one of the leading electronic materials players that is uniquely positioned to capitalize on long-term industry trends for the digital revolution. The transaction is expected to be EPS pre-accretive in the first full year after closing and to reported EPS in year 3. We're convinced that this merger with Versum will generate meaningful value to our shareholders, to our employees and to our customers.

With that short summary at the end of the presentation, I would now be ready to take your questions. Thank you very much.

+++ q-and-a +++

Operator^ (Operator Instructions) And your first question today comes from the line of Matthew Weston from Crédit Suisse.

Matthew Weston^ Two quick questions, please, Marcus, both financial. Could you walk us through where the incremental synergies are coming from that took the number from EUR 60 million to EUR 75 million? And whether or not you see those phasing in a similar manner? I think you've said yes, but I just wanted to check that. And then secondly, with respect to the cash cost of the transaction -- or apologies the cost of the transaction, can you let us know how much of that EUR 125 million you anticipate will be cash? And how you see that being phased over the 2 years that you've suggested it will be spent over?

Marcus Kuhnert^ Yes, thanks for the question. So the incremental synergies are coming predominantly from a deeper look into the business and operating structures. We also have carefully reviewed the sources of synergies that we have identified so far, which means administrative structures and procurement among others. So these are the areas where we have found more potential after having had deeper access to the numbers in the due diligence and after having gained access to Versum's top management.