UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT

SEMIANNUAL REPORT PURSUANT TO REGULATION A

For the Semiannual Period Ended June 30, 2020

WILEY AREA DEVELOPMENT LLC

(Exact name of registrant as specified in its charter)

Commission File Number: 024-11010

Ohio

(State or other jurisdiction of

incorporation or organization)

81-5422785

(I.R.S. Employer Identification No.)

572 Breckenridge Way

Beavercreek, OH 45430

(Address of principal executive offices)

937.410.0041

Issuer’s telephone number, including area code

Class B Units

(Title of each class of securities issued pursuant to Regulation A)

1

10

Item 1.Management’s Discussion and Analysis of Financial Condition and Results of Operations

Wiley Area Development LLC was formed on February 20, 2017 as an Ohio limited liability company. On February 1, 2019, Wiley Area Development LLC registered the trade name Tasty Equity in the state of Ohio in order to do business under that name. The Company was formed to leverage the extensive relationships, operational expertise and in-the-trenches operational experience of its founders to serve as the operating partner to independent restaurant owner-operator franchisees of Rapid Fired Franchising and Hot Head Franchising.

Management’s discussion and analysis of financial condition and results of operations as of April 29, 2020 is available for review here and incorporated by reference.

https://www.sec.gov/Archives/edgar/data/1766914/000176691420000004/wiley253g2.htm

A.Operating Results Overview

Wiley Area Development LLC was formed on February 20, 2017 as an Ohio limited liability company. On February 1, 2019, Wiley Area Development LLC registered the trade name Tasty Equity in the state of Ohio in order to do business under that name. The Company was formed to leverage the extensive relationships, operational expertise and in-the-trenches operational experience of its founders to serve as the operating partner to independent restaurant owner-operator franchisees of Rapid Fired Franchising and Hot Head Franchising.

Results of Operations

The period of January 1, 2020 to June 30, 2020

Revenue. Total revenue for the period of January 1, 2020 to June 30, 2020 was $0.00.

Cost of Sales. Cost of sales for the period of January 1, 2020 to June 30, 2020 was $0.00.

Administrative Expenses. Operating expenses for the period of January 1, 2020 to June 30, 2020 were $187,803. Operating expenses for the period were comprised of professional fees, advertising and marketing, office expenses, bank charges, licenses, travel and lodging, meals and entertainment, depreciation and other administrative expenses.

Net Loss. Net loss for the period of January 1, 2020 to June 30, 2020 was $(223,175). This net loss was the result of operating expenses exceeding early stage operating revenues.

B.Liquidity and Capital Resources

We had net cash of $376,379 at June 30, 2020.

During the period of January 1, 2020 to June 30, 2020, operating activities used $(187,803).

Cash used by investing activities relating to capital expenditures during the period of January 1, 2020 to June 30, 2020 was $(36,234).

2

C.Plan of Operations

Our plan of operation for the period of January 1, 2020 to June 30, 2020 and for the remainder of 2020 has not changed from that set out in our filing found here and incorporated by reference:

https://www.sec.gov/Archives/edgar/data/1766914/000176691420000004/wiley253g2.htm

D.Trend Information

Trend information for the period of January 1, 2020 to June 30, 2020 and for the remainder of 2020 has not changed from that set out in our filing found here and incorporated by reference:

https://www.sec.gov/Archives/edgar/data/1766914/000176691420000004/wiley253g2.htm

E.Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

F.Critical Accounting Policies

We have identified the policies outlined below in the Notes to our interim financial statements attached to this filing as critical to our business operations and an understanding of our results of operations. The list is not intended to be a comprehensive list of all of our accounting policies. In many cases, the accounting treatment of a particular transaction is specifically dictated by accounting principles generally accepted in the United States, with no need for management's judgment in their application. The impact and any associated risks related to these policies on our business operations is discussed throughout Management's Discussion and Analysis of Financial Condition and Results of Operations of our SEC filings found here: (https://www.sec.gov/Archives/edgar/data/1766914/000176691420000004/wiley253g2.htm)

where such policies affect our reported and expected financial results. Note that our preparation of the consolidated financial statements requires us to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of our consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurance that actual results will not differ from those estimates.

For a summary discussion of the critical accounting policies, please read Note 1 to the attached financial statements.

G.Additional Company Matters

The Company has not filed for bankruptcy protection nor has it ever been involved in receivership or similar proceedings. The Company is not presently involved legal proceedings material to the business or financial condition of the Company. The Company does not anticipate any material reclassification, merger, consolidation, or purchase or sale of a significant amount of assets not in

3

the ordinary course of business, in the next 12 months.

Item 2.Other Information

None.

Item 3.Financial Statements

INDEX TO FINANCIAL STATEMENTS OF WILEY AREA DEVELOPMENT LLC |

Balance Sheet as of June 30, 2020 (unaudited) and December 31, 2019 (audited) | 5 |

Statement Of Operations And Changes In Members' Equity for the Six Months Ended June 30, 2020 (unaudited) and for the Six Months Ended June 30, 2019 (unaudited) | 6 |

Statement Of Cash Flows as of June 30, 2020 (unaudited) | 7 |

Notes | 8 |

4

WILEY AREA DEVELOPMENT LLC

BALANCE SHEET

As of June 30, 2020 (unaudited) and December 31, 2019 (audited)

| ASSETS | |

June 30, 2020 | | December 31, 2019 |

CURRENT ASSETS CASH | $ 375,513 | | $1,626 |

RESTRICTED CASH | 866 | | 1,346 |

TOTAL CURRENT ASSETS | 376,379 | | 2,972 |

PROPERTY AND EQUIPMENT | 1,981 | | 917 |

OTHER ASSETS LOAN TO MEMBERS | 122,878 | | 91,447 |

INVESTMENT IN AFFILIATES | 164,572 | | 163,988 |

TOTAL OTHER ASSETS | 287,450 | | 255,435 |

TOTAL ASSETS | $ 665,810 | | $259,324 |

LIABILITIES AND MEMBERS' EQUITY

CURRENT LIABILITIES NOTES PAYABLE AND ACCRUED INTEREST | $ | 624,456 | $ | 555,500 |

LONG TERM LIABILITIES | 500,000 | - |

MEMBERS' EQUITY | (458,646) | (296,176) |

TOTAL LIABILITIES AND EQUITY | $665,810 | $259,324 |

5

SEE NOTES TO FINANCIAL STATEMENTS

WILEY AREA DEVELOPMENT LLC

STATEMENT OF OPERATIONS AND CHANGES IN MEMBERS' EQUITY

For the six months ended June 30, 2020 (unaudited)

and for the six months ended June 30, 2019 (unaudited)

| 6 Months Ended | | 6 Months Ended |

Jun. 30, 2020 | | Jun. 30, 2019 |

REVENUE | | | |

MANAGEMENT FEE | $- | | $- |

TOTAL REVENUE | - | | - |

OPERATING EXPENSES | | | |

PROFESSIONAL FEES | 120,640 | | 89,067 |

ADVERTISING & MARKETING | 36,070 | | 20,773 |

OFFICE EXPENSE | 13,953 | | 4,845 |

BANK CHARGES | 11,201 | | 1,769 |

LICENSES | 1,000 | | 6,718 |

TRAVEL AND LODGING | 3,337 | | 6,698 |

MEALS AND ENTERTAINMENT | 1,355 | | 1,106 |

DEPRECIATION | 220 | | - |

OTHER ADMINISTRATIVE EXPENSES | 27 | | 63 |

TOTAL EXPENSES | 187,803 | | 131,039 |

LOSS FROM OPERATIONS | (187,803) | | (131,039) |

OTHER INCOME (EXPENSE) | | | |

INTEREST EXPENSE | (42,456) | | (34,183) |

INTEREST INCOME | 19 | | - |

OTHER INCOME | 10,000 | | - |

EQUITY LOSS IN AFFILIATES | (2,935) | | (1,338) |

NET LOSS | $(223,175) | | $(166,560) |

CHANGES IN MEMBERS' EQUITY: | | | |

MEMBERS' EQUITY - BEGINNING OF PERIOD | $ (296,176) | | $20,087 |

ISSUANCE OF CLASS B UNITS | 60,705 | | - |

NET LOSS | (223,175) | | (166,560) |

MEMBERS' EQUITY (DEFICIT) - END OF PERIOD | $ (458,646) | | $ (146,473) |

PER UNIT AMOUNTS: | | | |

BASIC EARNINGS PER UNIT | $ (0.03) | | $ (0.02) |

DILUTED EARNINGS PER UNIT | $ (0.03) | | $ (0.02) |

6

SEE NOTES TO FINANCIAL STATEMENTS

WILEY AREA DEVELOPMENT, LLC STATEMENT OF CASH FLOWS

For the six months ended June 30, 2020 (unaudited)

and for the six months ended June 30, 2019 (unaudited)

6 Months Ended 6 Months Ended

June 30, 2020 June 30, 2019

CASH FLOW FROM OPERATING ACTIVITIES: | |

NET LOSS | $ | (223,175) | $ | (166,560) |

ADJUSTMENTS TO RECONCILE NET LOSS TO NET CASH | | | | |

USED IN OPERATING ACTIVITIES: | | | | |

DEPRECIATION | 220 | | - |

EQUITY LOSS IN AFFILIATES | 2,935 | | 1,338 |

ACCRUED INTEREST ON NOTES PAYABLE | (10,401) | | 34,183 |

NET CASH USED IN OPERATING ACTIVITIES | (230,421) | | (131,039) |

CASH FLOW FROM INVESTING ACTIVITIES: | | | |

PURCHASE OF PROPERTY & EQUIPMENT | (1,284) | | - |

LOAN TO MEMBERS | (31,431) | | (48,539) |

INVESTMENT IN AFFILIATES | (3,519) | | (28,526) |

NET CASH USED IN INVESTING ACTIVITIES | (36,234) | | (77,065) |

CASH FLOW FROM FINANCING ACTIVITIES: | | | |

CLASS B UNITS USSUED | 60,705 | | - |

PROCEEDS FROM NOTE PAYABLE | 579,357 | | 100,000 |

NET CASH PROVIDED BY FINANCING ACTIVITIES | 640,062 | | 100,000 |

INCREASE (DECREASE) IN CASH | 373,407 | | (108,104) |

CASH - BEGINNING OF PERIOD | 2,972 | | 222,624 |

CASH - END OF PERIOD | $376,379 | | $114,520 |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | |

RECONCILIATION OF CASH PRESENTED IN THE BALANCE SHEET: | | | |

CASH | $375,513 | | $12,674 |

RESTRICTED CASH | 866 | | 101,846 |

| $376,379 | | $114,520 |

NON-CASH INVESTING ACTIVITIES: CASH PAID FOR INTEREST | $12,500 | | $- |

CASH PAID FOR TAXES | $- | | $- |

ADVANCES TO AFFILIATES | $- | | $50,797 |

INVESTMENT IN AFFILIATES | (3,519) | | (50,797) |

| $(3,519) | | $- |

7

WILEY AREA DEVELOPMENT, LLC NOTES TO FINANCIAL STATEMENTS

June 30, 2020, June 30, 2019 and December 31, 2019

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following accounting principles and practices of Wiley Area Development, LLC (the “WD” or “Company”) are set forth to facilitate the understanding of data presented in the financial statements:

Nature of operations

Wiley Area Development, LLC, which also does business as Wiley Development Group and Tasty Equity was founded on February 20, 2017, to serve as the operating partner to independent restaurant owner operator (“ROs”) franchisees of Rapid Fired Pizza Franchising and Hot Head Burritos Franchising, located in northern Ohio. The Company will invest alongside ROs, providing initial working capital to fund the startup costs that occur prior to securing bank financing based upon a bank pre-approval for each RO. In addition, the Company will provide advisory services related to site selection, restaurant design, operations and serve as the back office operating partner for each RO. As of June 30, 2020, the principals of the Company have sponsored three ROs in the development of two Rapid Fired Pizza restaurants and two Hot Head Burrito restaurants. There is an additional Rapid Fired Pizza location planned to open in 2021.

The Company’s financial statements have been prepared assuming the Company will continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The Company currently does not generate cash on its own and has funded operations primarily through advances on short-term notes payable, equity contributions from members and Regulation A+ public offering. The future viability of the Company is largely dependent upon its ability to raise additional capital to finance its operations. Management expects that future sources of funding may include sales of equity, obtaining loans or other strategic transactions. Although management continues to pursue these plans, there is no assurance the Company will be successful in obtaining sufficient financing on terms acceptable to the Company to fund continuing operations, if at all. These circumstances raise substantial doubt on the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Through June 30, 2020, the Company has raised $60,705 through the issuance of Class B units.

Basis of presentation

The financial statements of the Company have been prepared on the accrual basis. Financial statement presentation follows accounting principles generally accepted in the United States of America (“GAAP”) as contained in the Accounting Standards Codification (“ASC”) issued by the Financial Accounting Standards Board (“FASB”).

Cash

Restricted cash includes amounts serving as collateral and held within accounts. Access to the balances within such accounts is restricted and controlled by the lender.

Fair values of financial instruments

Financial instruments consist primarily of cash, loans to members and investments in affiliates. Management estimates that the fair values of cash, advances to affiliates and loans to members approximate the carrying value recorded in the accompanying balance sheet. The Company’s investments in affiliates minority interests in closely held businesses operating restaurant franchises. As there is no active market for these investments, management has determined that it is not practical to estimate the fair value of the units held. Management estimates that the carrying value of notes payable approximates fair value based on current rates available for debt instruments with similar characteristics.

8

Investments in affiliates

Investments in partnerships and less-than-majority owned subsidiaries in which the Company does not have control, but has the ability to exercise significant influence over operating financial policies, are accounted for using the equity method of accounting. The equity method investments are shown on the Company's balance sheet as "Investment in affiliates," and the Company's share of earnings or losses from these investments are shown in the accompanying statement of operations as "Equity loss of affiliates."

Equity method investments are initially recognized at cost which is the same as the price paid to acquire the holding in the investee. Under the equity method, the carrying amount of the equity affiliate is adjusted annually by the percentage of any change in its equity corresponding to the Company's percentage interest in these equity affiliates. The carrying costs of these investments are also increased or decreased to reflect additional contributions or withdraws of capital. Any difference in the book equity and the Company's pro rata share of the net assets of the investment will be reported as gain or loss at the time of the liquidation of the investment.

Revenue recognition

The Company intends to generate revenue through services provided to affiliates. Fees for such services will be determined based on service contracts, none of which have been executed to date. The Company will recognize revenue in accordance with the provisions of FASB ASC 606, Revenue from Contracts with Customers . Revenues will be recognized in an amount that reflects the consideration that the Company expects to be entitled to in exchange for the services delivered. Such revenues will be recognized over time as services are provided.

Depreciation

The Company capitalizes major additions and improvements while costs to maintain present assets are expensed as incurred. Property and equipment are depreciated using the straight-line, half-year method over useful lives according to the asset classification, as follows:

USEFUL

CLASSLIFEMETHOD

Computer equipment | 5 Years | Straight-line |

Machinery and equipment | 7 Years | Straight-line |

Vehicles | 5 Years | Straight-line |

Income taxes

The members of the Company have elected to be taxed as a C-Corporation. Accordingly, income taxes are provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due plus or minus the net change in deferred tax assets and liabilities. Deferred income tax assets and liabilities are computed annually for differences between the financial statement and tax basis of assets and liabilities based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, if necessary, to reduce the deferred tax assets to the amount that will more likely than not be realized.

Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

9

NOTE 2 - PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

06/30/2006/30/19

Computer Equipment | $2,302 | | $ - |

| 2,302 | | - |

Less accumulated depreciation | (321) | | - |

| $1,981 | | $ - |

Depreciation expense for the period ended June 30, 2020 is $220 and for the period ended June 30, 2019 is $0.

NOTE 3 - INVESTMENT IN AFFILIATES:

During 2020 investments were made in Wiley Ventures, LLC, Wiley Ventures II, LLC, WD HHB Toledo, LLC and WD RFP Findlay, LLC. The Company holds 18% interest in Wiley Ventures, LLC, Wiley Ventures II, LLC and WD RFP Findlay, LLC and 20% in WD HHB Toledo, LLC. The Company's direct ownership interest, along with the ownership interest of the Company's members provides significant influence over the investees. The following summarizes the Company's activity with Wiley Ventures, LLC, Wiley Ventures II, LLC, WD HHB Toledo, LLC and WD RFP Findlay, LLC as of June 30, 2020:

| Beginning | | 2020 | | 2020 | | Company's Portion | | Equity |

| | | | | | of Income | | |

Balance | | Contributions | | Draws | | (Loss) | | Investment |

Wiley Ventures | $ 57,330 | | $ - | | $ - | | $ (2,431) | | $ 54,899 |

Wiley Ventures II | 38,033 | | 319 | | - | | (3,577) | | 34,775 |

WD HHB Toledo | 15,302 | | - | | - | | 3,073 | | 18,375 |

WD RFP Findlay | 53,323 | | 3,200 | | - | | - | | 56,523 |

| $ 163,988 | | $ 3,519 | | $ - | | $ (2,935) | | $ 164,572 |

Condensed balance sheets as of June 30, 2020, revenues and net income and cash flows for the period ended June 30, 2020, are as follows:

10

DRAFT

| Wiley Ventures | | Wiley Ventures II | | WD HHB Toledo | | WD RFP Findlay |

Current Assets | $270,099 | | $52,623 | | $77,729 | | $- |

Property and Equipment | 285,102 | | 380,910 | | 220,868 | | - |

Non-Current Assets | 50,961 | | 44,986 | | 3,934 | | 56,523 |

| $606,162 | | $478,519 | | $302,531 | | $56,523 |

Current Liabilities | $57,503 | | $90,837 | | $98,298 | | $- |

Long-Term Debt | 498,709 | | 408,541 | | 187,314 | | - |

| 556,212 | | 499,378 | | 285,612 | | - |

Members' Equity (Deficit) | 49,950 | | (20,859) | | 16,919 | | 56,523 |

| $606,162 | | $478,519 | | $302,531 | | $56,523 |

Revenues | $ 334,600 | | $ 281,482 | | $ 521,315 | | $ - |

Net Income (Loss) | $ (13,505) | | $ (19,871) | | $ 15,363 | | $ - |

| Wiley | | Wiley | | WD HHB | | WD RFP |

| Ventures | | Ventures II | | Toledo | | Findlay |

Cashflows from operating activities | $27,498 | | $ (3,441) | | $22,942 | | $- |

Cashflows from investing activities | (2,450) | | 10,550 | | (8,100) | | - |

Cashflows from financing activities | 187,298 | | 32,976 | | 49,431 | | - |

Net increase in cash | $ 212,346 | | $ 40,085 | | $ 64,273 | | $ - |

The following summarizes the Company's activity with Wiley Ventures, LLC, Wiley Ventures II, LLC, WD HHB Toledo, LLC and WD RFP Findlay, LLC, as of June 30, 2019:

| Beginning | | 2019 | | 2019 | | | Company's Portion | | Equity |

| | | | | | | of Income | | |

Balance | | Contributions | | Draws | | | (Loss) | | Investment |

Wiley Ventures | $ 51,644 | | 3,100 | | | - | | (1,419) | | 53,325 |

Wiley Ventures II | 19,960 | | 20,000 | | | - | | (3,499) | | 36,461 |

WD HHB Toledo | 42,029 | | 2,900 | | | - | | 4,034 | | 48,963 |

WD RFP Findlay | - | | 53,323 | | | - | | (455) | | 52,868 |

| $ 113,633 | | 79,323 | | | - | | (1,339) | | 191,617 |

Condensed balance sheets as of June 30, 2019, revenues and net income and cash flows for the period ended June 30, 2019, are as follows:

20

DRAFT

| Wiley Ventures | | Wiley Ventures II | | WD HHB Toledo | | WD RFP Findlay |

Current Assets | $58,581 | | 36,423 | | 25,743 | | - |

Property and Equipment | 349,745 | | 416,927 | | 256,526 | | - |

Non-Current Assets | 54,925 | | 56,271 | | 37,157 | | 50,797 |

| $463,251 | | 509,621 | | 319,426 | | 50,797 |

Current Liabilities | $52,681 | | 73,684 | | 99,054 | | - |

Long-Term Debt | 332,643 | | 401,214 | | 174,563 | | - |

| 385,324 | | 474,898 | | 273,617 | | - |

Members' Equity | 77,927 | | 34,723 | | 45,809 | | 50,797 |

| $463,251 | | 509,621 | | 319,426 | | 50,797 |

Revenues | $ 491,789 | | 455,590 | | 570,810 | | - |

Net Income (Loss) | $ (7,880) | | (19,439) | | 20,170 | | (2,526) |

| Wiley | | Wiley | | WD HHB | | WD RFP |

| Ventures | | Ventures II | | Toledo | | Findlay |

Cashflows from operating activities | $18,500 | | (117) | | 41,003 | | (2,526) |

Cashflows from investing activities | 8,515 | | 8,350 | | (11,350) | | 2,526 |

Cashflows from financing activities | (29,795) | | (1,598) | | (28,655) | | - |

Net increase (decrease) in cash | $ (2,780) | | 6,635 | | 998 | | - |

NOTE 4 - NOTES PAYABLE

At June 30, 2020, the Company's note with Times Square Ventures in the amount of $235,000 with an interest rate of 18% was renewed on May 1, 2020. That note was retired and replaced with a new note with Time Square Ventures on May 4, 2020 where a portion of the interest due was capitalized into the new note in the amount of $261,607.50, as a measure of Covid-19 relief, with an interest rate of 18% and has a maturity date of January 29, 2021 inclusive of accrued interest for a total amount due of $296,924.51 and a call date of October 20, 2020, at which time the total balance due would be $285,021.37. The note is secured by a personal guarantee by the members and a security interest in membership units held by the members in related entities. In addition, the proceeds for the loan are required to be held in a separate account under the control of the lender.

At June 30, 2020, the Company's note with Times Square Ventures in the amount of $150,000 with an interest rate of 18% was renewed on April 21, 2020. That note was retired and replaced with a new note with Times Square Ventures on April 21, 2020 where a portion of the interest due was capitalized into the new note in the amount of $163,750 as a measure of COVID-19 relief, with an interest rate of 18% and has a maturity date of January 19, 2021 inclusive of interest that will accrue for a total amount due on that date of $183,356.25. The note is secured by a personal guarantee by the members and a security interest in membership units held by the members in related entities. In addition, the proceeds for the loan are required to be held in a separate account under the control of the lender.

21

DRAFT

The balance due under both notes payable to Time Square Ventures, including accrued interest was

$424,311 at June 30, 2020 and $404,170 at December 31, 2019.

| 06/30/20 | | 12/31/19 |

Notes Payable$ | 425,357 | | $ 385,000 |

Accrued Interest | (1,046) | | 19,170 |

$ | 424,311 | | $ 404,170 |

On April 11, 2019, the Company entered into a convertible note payable in the amount of $100,000 with a minority member of the Company. The note bears interest at 8% per annum and is due December 31, 2020, subject to an accelerated maturity date if the proceeds from the Company's Offering reach $500,000. In the event that the Offering fails to raise $500,000 and the Company fails to repay the note, the principal and interest due by the maturity date, then the note is convertible into units representing 10% of the outstanding Class A membership units, which shall be transferred to the holder by the two founding members of the Company. The balance due under this note payable, including accrued interest, was $114,000 at June 30, 2020 and $108,000 at December 31, 2019.

| 06/30/20 | | 12/31/19 |

Note Payable | $ 100,000 | | $ 100,000 |

Accrued Interest | 14,000 | | 8,000 |

| $ 114,000 | | $ 108,000 |

On November 18, 2019, the Company entered into a convertible note payable in the amount of $25,000 with Brand Imperatives SSG, LLC. The Company added to the note in the amount of $15,000 in January 2020. The Company also received services in kind, in the amount of $24,000 through March 2020. The note has an interest rate of 8% and a maturity date of November 18, 2020, subject to an accelerated maturity date if the proceeds from the Company's Offering reach $500,000. By mutual agreement, Brand Imperative SSG, LLC may lend to the Company, or provide services in kind, thereby increasing the note to a maximum of $100,000 subject to the convertible note terms and existing maturity date. In connection with this Note, the Holder shall be granted Warrants equal to ten percent (10.0%) of additional Class A Membership Units that the Holder, at their option may exercise in exchange for payment of $100,000 to the founding members of the Company. Management estimated that the fair value of the warrants issued with the note payable were not material and as such, no value was assigned to the warrants at June 30, 2020. In the event that the Offering fails to raise $500,000 and the Company fails to repay the note, the principal and interest due by the maturity date, then the holder shall have the option to convert the note into units representing the note into units representing up to 10% of the outstanding Class A membership units, on a pro rata basis, which shall be transferred to the holder by the two founding members of the Company. It is the intention of the Company to repay the note in full on or before the maturity date and not exercise the conversion provisions. The balance due under this note payable, including accrued interest, was $66,476 at June 30, 2020 and $25,236 at December 31, 2019.

| 06/30/20 | | 12/31/19 |

Note Payable | $ 64,000 | | $ 25,000 |

Accrued Interest | 2,476 | | 236 |

| $ 66,476 | | $ 25,236 |

On October 17, 2019, the Company entered into a note payable with Coyote Development, LLC, a related party, see Note 7, in the amount of $17,500. The note bears interest at 18%. The entire balance plus accrued interest is due on July 13, 2020. The note is secured by a personal guarantee by Byron C. Wiley and a security

22

DRAFT

interest in membership units held by the member in related entities. The balance due under this note payable, including accrued interest, was $19,669 at June 30, 2020 and $18,094 at December 31, 2019.

| 06/30/20 | | 12/31/19 |

Note Payable | $ 17,500 | | $ 17,500 |

Accrued Interest | 2,169 | | 594 |

| $ 19,669 | | $ 18,094 |

The Company received an Economic Injury Disaster Loan from the Small Business Administration (SBA) on April 19, 2020 in the amount of $500,000. Payments are deferred for twelve months to begin April 19, 2021 with an interest rate of 3.75% for a 30 year term. This note is subject to various restrictions.

The Company cannot distribute assets, make any advances or loans, bonuses to any owner or partner or any of its employees or to any company directly or indirectly affiliated with or controlled by the Company without the prior written consent of the Small Business Administration. The balance due under this note payable was $500,000 as June 30, 2020.

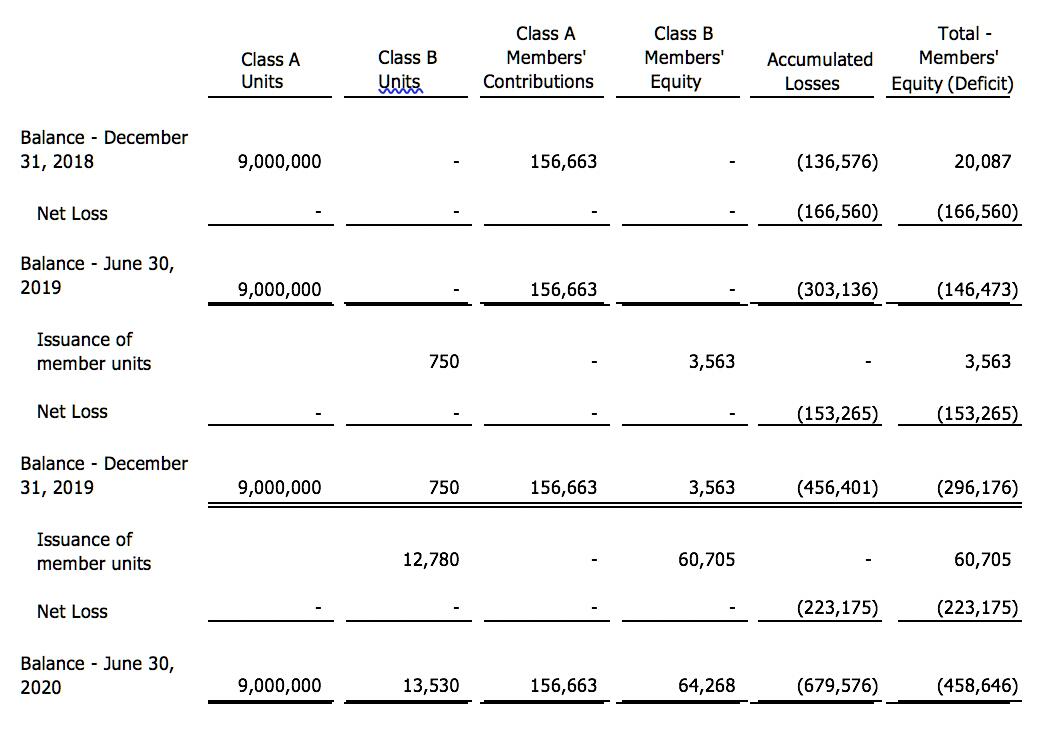

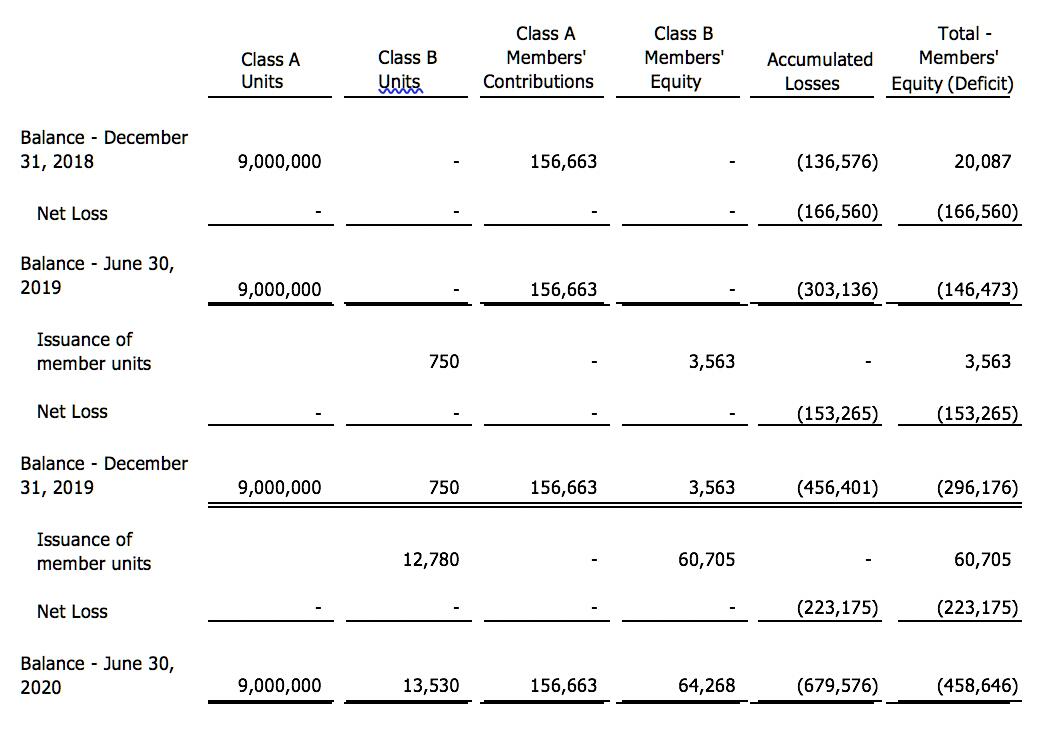

NOTE 5 - MEMBERS' EQUITY

On March 8, 2019, the Company’s members amended and restated the operating agreement to increase the permitted number of units from 180,000 Class A (voting) units and 20,000 Class B (non- voting) units to 9,000,000 Class A (voting) units and 1,000,000 Class B (non-voting) units. As this action is the equivalent of a 50 to 1 split, the effect has been reflected retrospectively. Class A units outstanding at December 31, 2019 and December 31, 2018 were 9,000,000. As of December 31, 2018, no Class B units had been issued. As of June 30, 2020, 13,530 units have been issued in the amount of $67,650 for net proceeds to the Company of $64,268, as of December 31, 2019, 750 units were issued in the amount of $3,750 for net proceeds to the Company of $3,563 and as of June 30, 2019 no Class B units had been issued.

Distributions to members may occur from the net proceeds received from a direct or indirect sale of a restaurant location. Such proceeds shall be distributed within 120 days of the end of the calendar year in accordance with the following formula (“Sharing Ratio”): 1) To each holder of Class B units up to the amount of the purchase price paid for such Class B units; 2) 60% to the holders of Class A units and 40% to the holders of Class B units. In addition, the Company may, from time to time, make additional distributions to members, subject to the Sharing Ratio.

Changes in membership units outstanding and members' equity (deficit) for the periods ended June 30, 2020 and December 31, 2019 were as follows:

23

DRAFT

NOTE 6 - INCOME TAXES

The components of income tax expense (benefit) for the periods ended June 30, 2020 and June 30, 2019, were as follows:

| 06/30/20 | | 06/30/19 |

Current | $- | | $- |

Deferred | (128,131) | | (34,469) |

Change in valuation allowance | 128,131 | | 34,469 |

| $- | | $- |

There were no material temporary differences between the Company's book income and taxable income for the period ended June 30, 2020 and June 30, 2019, and as such, no deferred tax assets or liabilities were recognized related to temporary differences. At June 30, 2020 and June 30, 2019 the Company had net operating loss carryforwards of $610,146 and $164,138, respectively, available to offset future taxable income. Due to the uncertainty of whether the Company will realize the benefit of the net operating loss carryforward, a valuation allowance equal to the full amount of the estimated tax benefit of $128,131 and $34,469 was established. As of June 30, 2020 there is no expiration on the carry forward of the net operating loss with a 80% income limitation. The Coronavirus Aid, Relief, and Economic Security Act (the CARES Act) eliminated the 80% income limitation for the net operating loss carry forward.

NOTE 7 - RELATED PARTY TRANSACTIONS

The Company and its Class A members hold membership interest in Wiley Ventures, LLC and Wiley Ventures II, LLC, which operate Rapid Fired Pizza Restaurants and WD HHB Toledo, LLC, which operates Hot Head Burritos restaurants. The Company's membership interest in Wiley Ventures, LLC, Wiley Ventures II, LLC and WD HHB Toledo, LLC are pledged as collateral for the note payable described in Note 4.

The Company’s members are also members in Coyote Development, LLC, a separate entity, which holds an area developer’s license (the "License") for Rapid Fired Pizza Franchising. The License entitles Coyote Development, LLC to a portion of the initial franchise fee and royalties earned from Rapid Fired Pizza franchisees located within the designated northern Ohio territory. The Company has a note payable with Coyote Development, LLC, see Note 4 for the details of this note.

The Company loaned two of the members $31,431 and $21,942 for the periods ended June 30, 2020 and December 31, 2019, respectively in the ordinary course of business. While formal repayment terms have

not been established, the Company expects repayment during 2020. Interest totaling $0 for the period ended ended June 30, 2020 and $1,441 for the period ended December 31, 2019 was accrued on the loans based on the short-term applicable federal interest rate. The balance on these loans including accrued interest are

$122,877 and $91,447 as of June 30, 2020 and December 31, 2019, respectively.

NOTE 8 - SUBSEQUENT EVENTS

The Company evaluates events and transactions occurring subsequent to the date of the financial statements for matters requiring recognition or disclosure in the financial statements. The accompanying financial statements considered events through September 25, 2020, the date on which the financial statements were available to be issued.

On July 13, 2020 the Company paid $20,000 to Coyote Development, LLC, $17,500 for a note originally dated dated October 17, 2019 and $2,500 in accrued interest.

Between June 30, 2020 and August 31, 2020, the Company advanced funds to a member totaling $30,000. No formal repayment terms have been established.

The Company has issued an additional 7,897 Class B units in the amount of $39,485 between July 1, 2020 and September 25, 2020.

24

DRAFT

Item 4.Exhibits

INDEX TO EXHIBITS

Charters (including amendments) * | Item 17.2 |

Bylaws * | Item 17.2 |

Material Contracts* | Item 17.6 |

* Previously filed with Offering Circular. | |

| |

25

DRAFT

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this special financial report on Form 1-SA to be signed on its behalf by the undersigned, thereunto duly authorized, in Beavercreek, OH on September 30, 2020.

WILEY AREA DEVELOPMENT LLC

By: /s/ Byron C. (Chris) Wiley | |

President (Principal Executive Officer) and Manager | |

| |

Pursuant to the requirements of Regulation A, this report has been signed below by the following persons on behalf of the issuer in the capacities and on the dates indicated.

Signature | | Title |

| | |

By: /s/ Byron C. (Chris) Wiley | | President (Principal Executive Officer) and Manager |

| | Wiley Area Development LLC |

| | September 30, 2020 |

| | |

By: /s/ Peter Wiley | | Treasurer (Principal Financial Officer and Principal Accounting Officer) and Manager |

| | Wiley Area Development LLC |

| | September 30, 2020 |

26