UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT

SEMIANNUAL REPORT PURSUANT TO REGULATION A

For the Semiannual Period Ended June 30, 2021

WILEY AREA DEVELOPMENT LLC

(Exact name of registrant as specified in its charter)

Commission File Number: 024-11010

Ohio

(State or other jurisdiction of

incorporation or organization)

81-5422785

(I.R.S. Employer Identification No.)

572 Breckenridge Way

Beavercreek, OH 45430

(Address of principal executive offices)

937.410.0041

Issuer’s telephone number, including area code

Class B Units

(Title of each class of securities issued pursuant to Regulation A)

1

10

DRAFT

Item 1.Management’s Discussion and Analysis of Financial Condition and Results of Operations

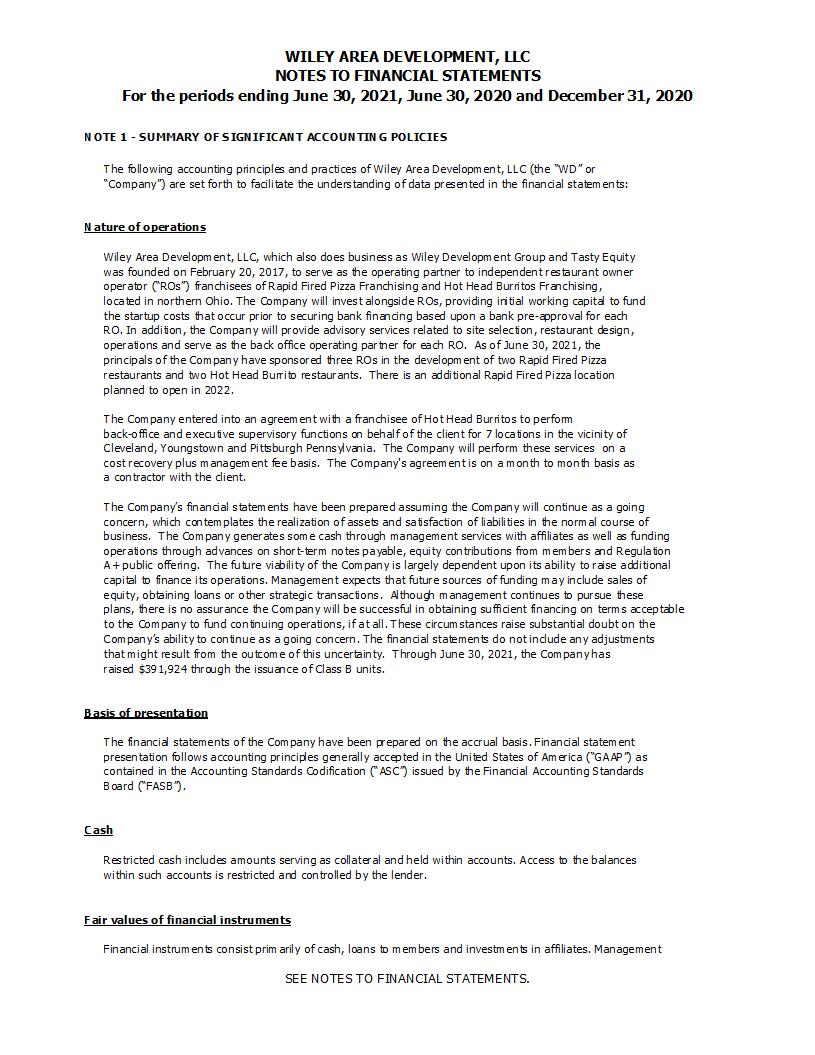

Wiley Area Development LLC was formed on February 20, 2017 as an Ohio limited liability company. On February 1, 2019, Wiley Area Development LLC registered the trade name Tasty Equity in the state of Ohio in order to do business under that name. The Company was formed to leverage the extensive relationships, operational expertise and in-the-trenches operational experience of its founders to serve as the operating partner to independent restaurant owner-operator franchisees of Rapid Fired Franchising and Hot Head Franchising.

Management’s discussion and analysis of financial condition and results of operations as of April 29, 2020 is available for review here and incorporated by reference.

https://www.sec.gov/Archives/edgar/data/1766914/000176691421000001/wileyform1k2020.htm

A.Operating Results Overview

Wiley Area Development LLC was formed on February 20, 2017 as an Ohio limited liability company. On February 1, 2019, Wiley Area Development LLC registered the trade name Tasty Equity in the state of Ohio in order to do business under that name. The Company was formed to leverage the extensive relationships, operational expertise and in-the-trenches operational experience of its founders to serve as the operating partner to independent restaurant owner-operator franchisees of Rapid Fired Franchising and Hot Head Franchising.

Results of Operations

The period of January 1, 2020 to June 30, 2020

Revenue. Total revenue for the period of January 1, 2021 to June 30, 2021 was $67,434.

Cost of Sales. Cost of sales for the period of January 1, 2021 to June 30, 2021 was $0.00.

Administrative Expenses. Operating expenses for the period of January 1, 2021 to June 30, 2021 were $347,017. Operating expenses for the period were comprised of professional fees, advertising and marketing, office expenses, bank charges, licenses, travel and lodging, meals and entertainment, depreciation and other administrative expenses.

Net Loss. Net loss for the period of January 1, 2021 to June 30, 2021 was $(318,118). This net loss was the result of operating expenses exceeding early stage operating revenues.

B.Liquidity and Capital Resources

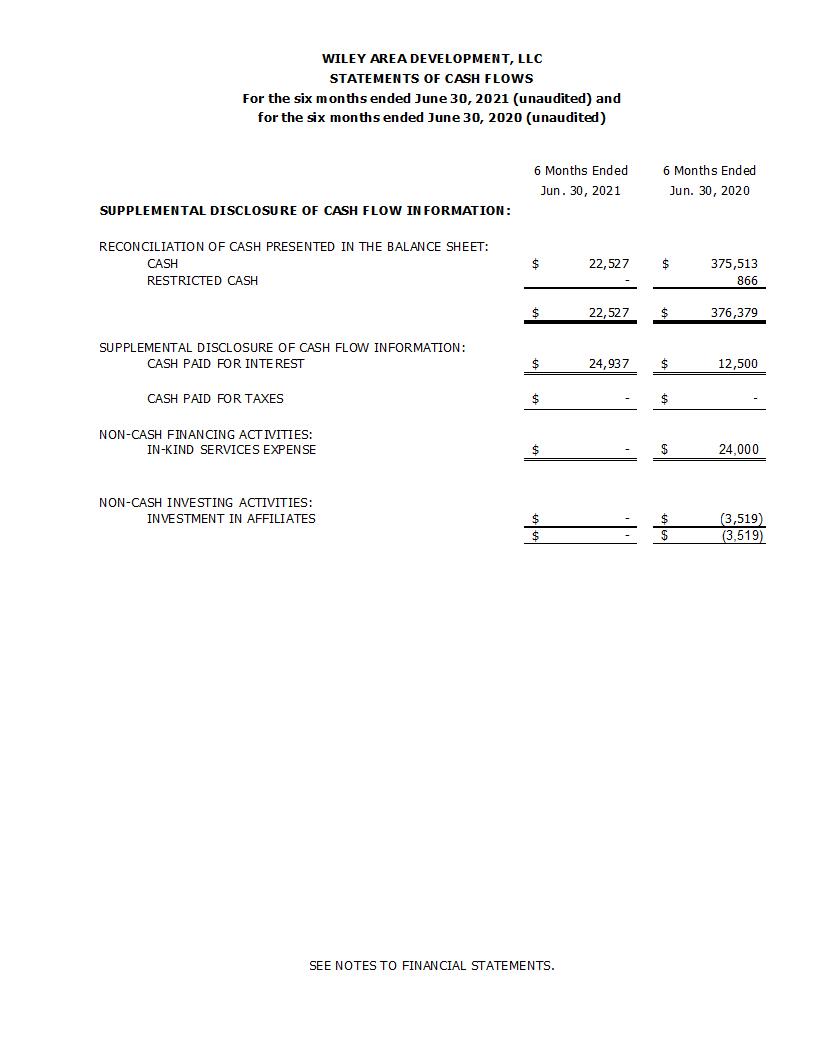

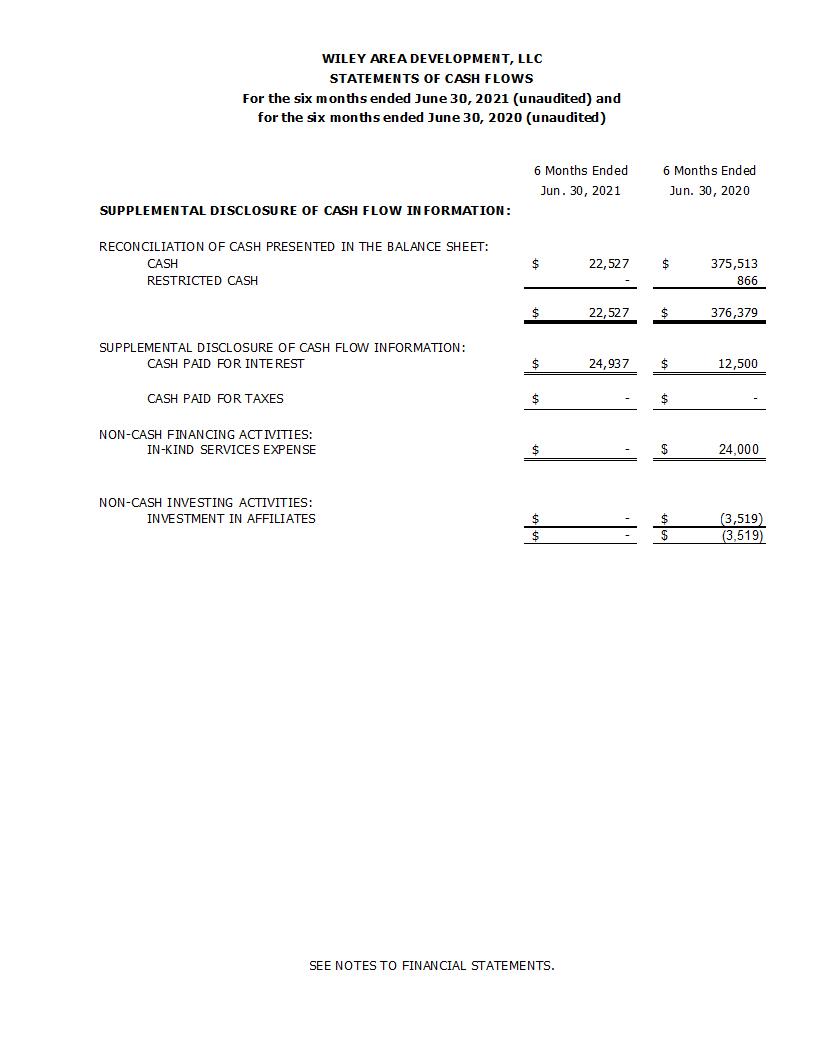

We had net cash of $22,527 at June 30, 2021.

During the period of January 1, 2021 to June 30, 2021, operating activities used $(347,017).

Cash used by investing activities relating to capital expenditures during the period of January 1, 2021 to June 30, 2021 was $0.00.

20

DRAFT

C.Plan of Operations

Our plan of operation for the period of January 1, 2021 to June 30, 2021 and for the remainder of 2021 has not changed from that set out in our filing found here and incorporated by reference:

https://www.sec.gov/Archives/edgar/data/1766914/000176691421000001/wileyform1k2020.htm

D.Trend Information

Trend information for the period of January 1, 2021 to June 30, 2021 and for the remainder of 2021 has not changed from that set out in our filing found here and incorporated by reference:

https://www.sec.gov/Archives/edgar/data/1766914/000176691421000001/wileyform1k2020.htm

E.Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

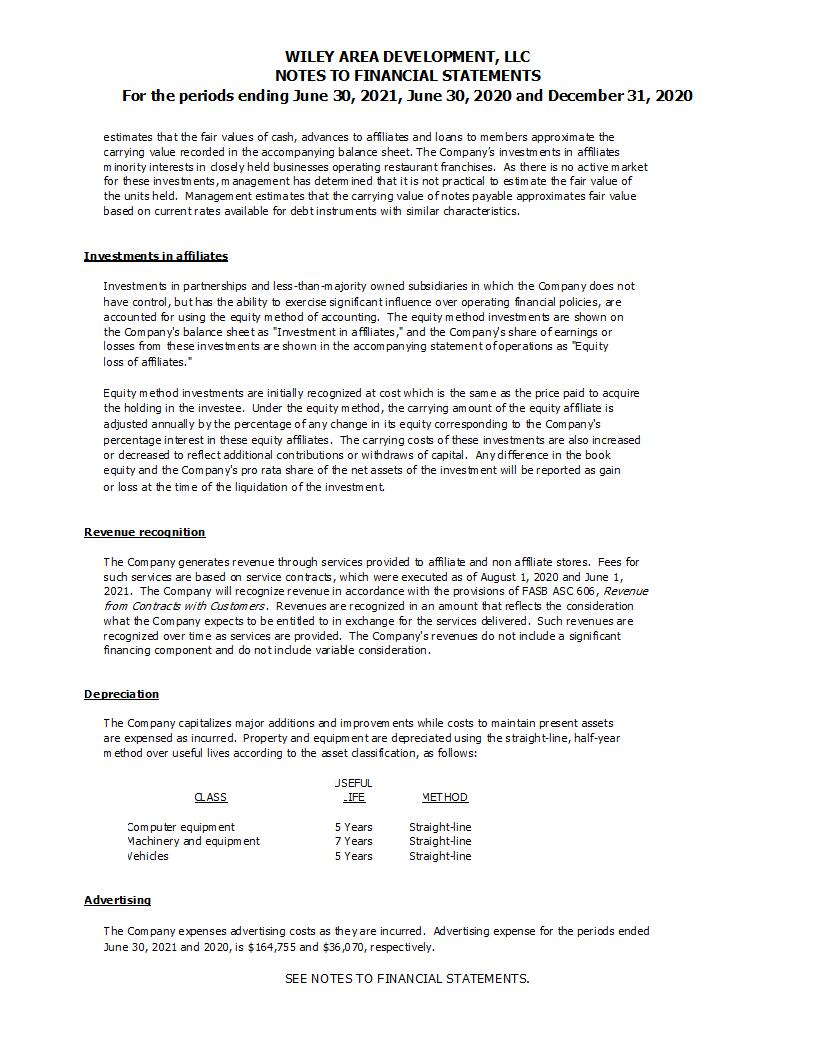

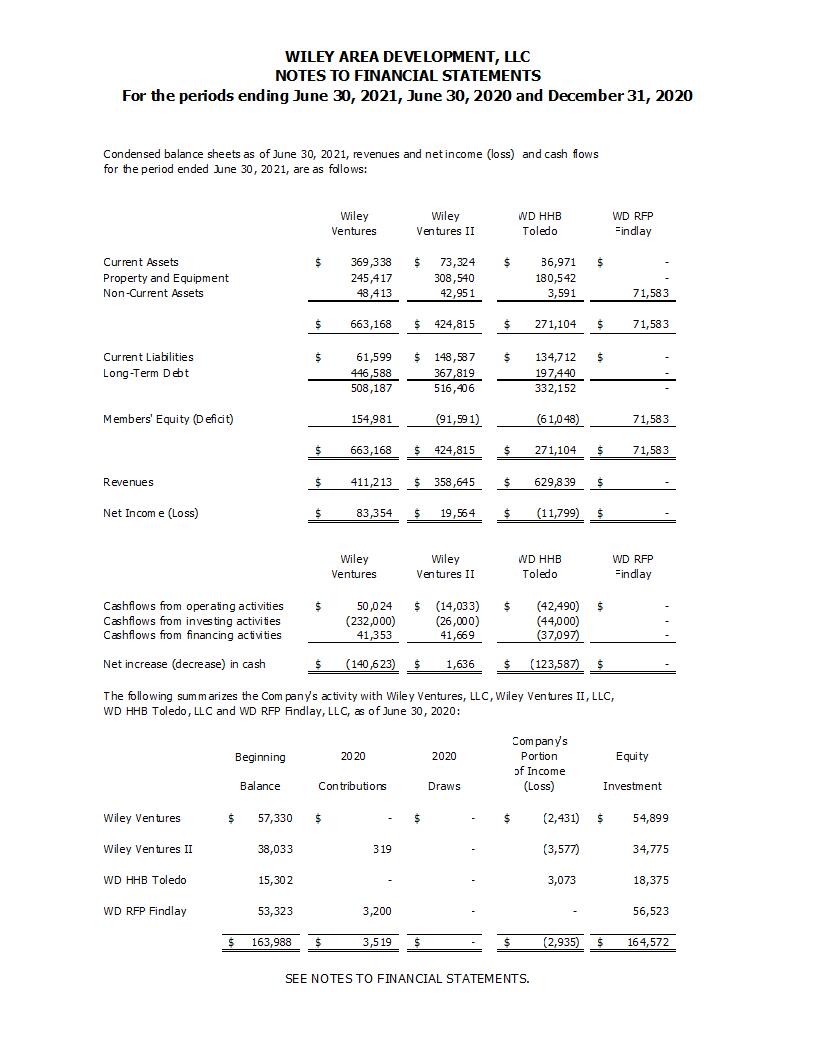

F.Critical Accounting Policies

We have identified the policies outlined below in the Notes to our interim financial statements attached to this filing as critical to our business operations and an understanding of our results of operations. The list is not intended to be a comprehensive list of all of our accounting policies. In many cases, the accounting treatment of a particular transaction is specifically dictated by accounting principles generally accepted in the United States, with no need for management's judgment in their application. The impact and any associated risks related to these policies on our business operations is discussed throughout Management's Discussion and Analysis of Financial Condition and Results of Operations of our SEC filings found here: (https://www.sec.gov/Archives/edgar/data/1766914/000176691421000001/wileyform1k2020.htm)

where such policies affect our reported and expected financial results. Note that our preparation of the consolidated financial statements requires us to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of our consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurance that actual results will not differ from those estimates.

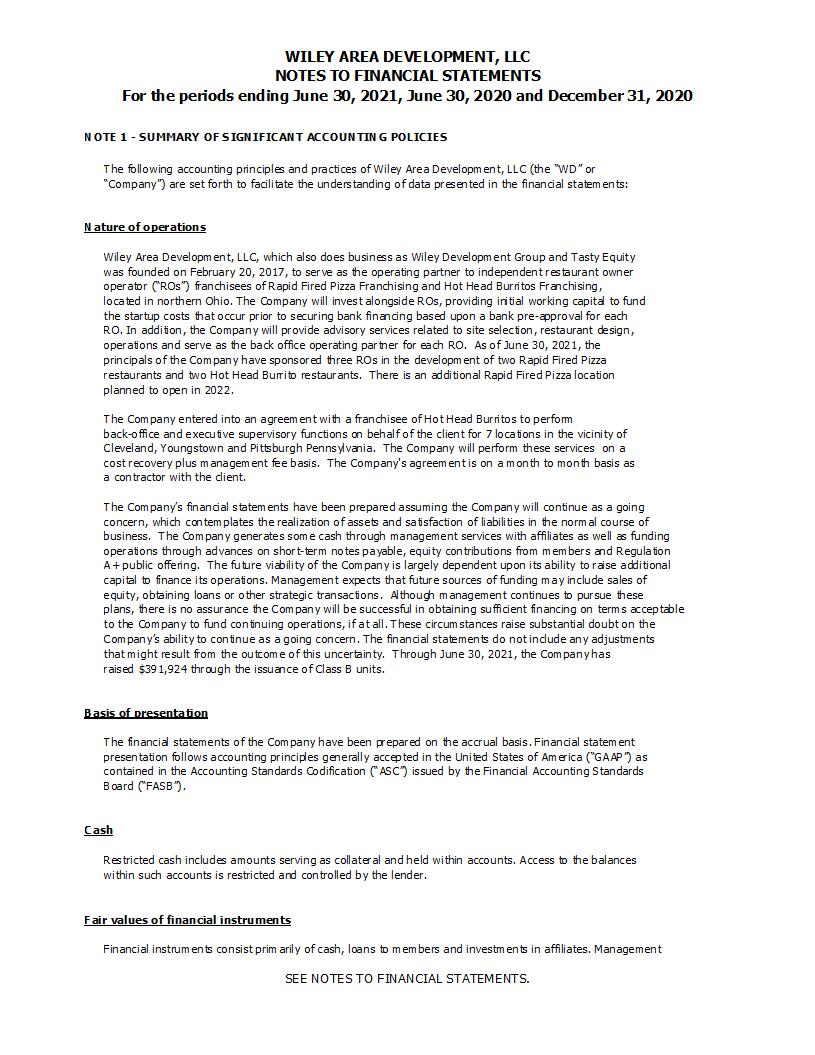

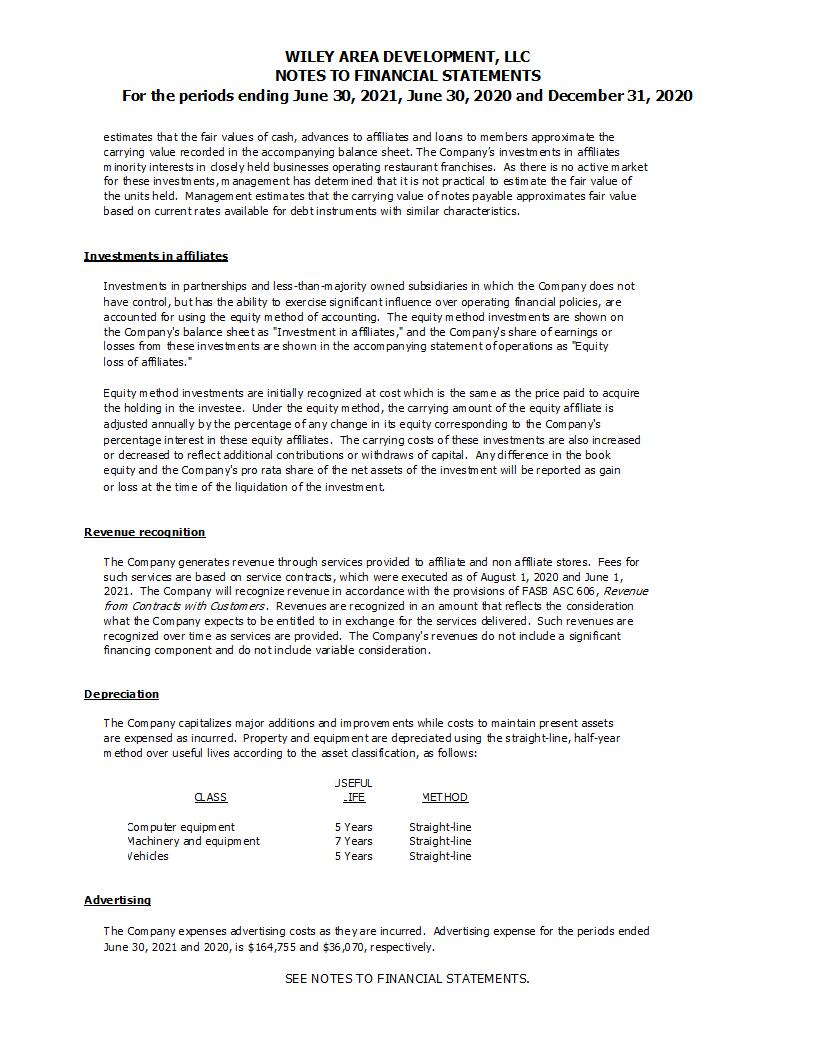

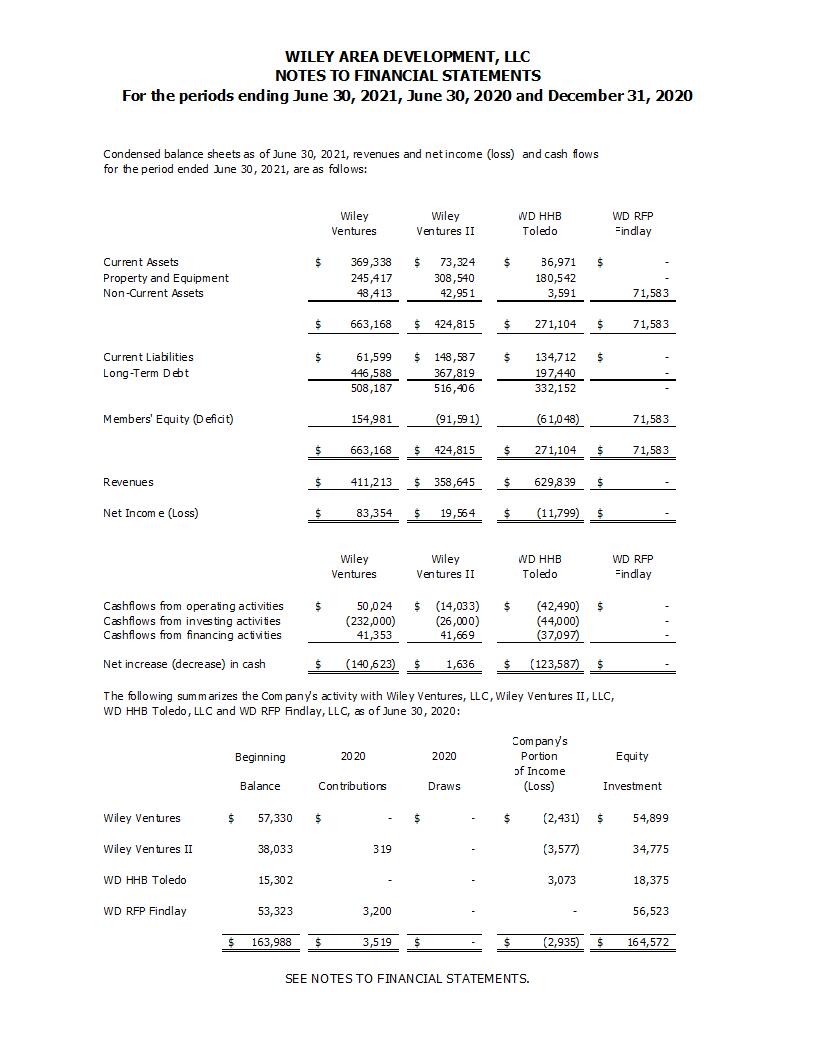

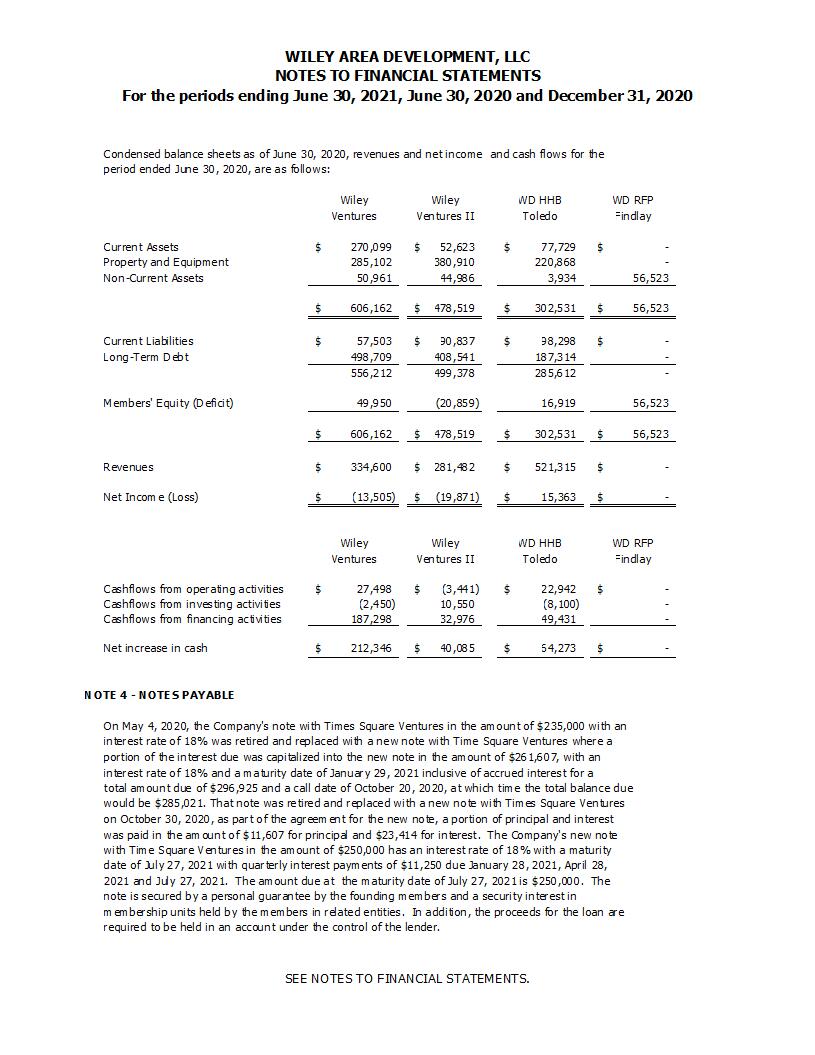

For a summary discussion of the critical accounting policies, please read Note 1 to the attached financial statements.

G.Additional Company Matters

The Company has not filed for bankruptcy protection nor has it ever been involved in receivership or similar proceedings. The Company is not presently involved legal proceedings material to the business or financial condition of the Company. The Company does not anticipate any material reclassification, merger, consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business, in the next 12 months.

21

DRAFT

Item 2.Other Information

None.

Item 3.Financial Statements

INDEX TO FINANCIAL STATEMENTS OF WILEY AREA DEVELOPMENT LLC |

Balance Sheet as of June 30, 2021 (unaudited) and December 31, 2020 (audited) | 5 |

Statement Of Operations And Changes In Members' Equity for the Six Months Ended June 30, 2021 (unaudited) and for the Six Months Ended June 30, 2020 (unaudited) | 6 |

Statement Of Cash Flows as of June 30, 2021 (unaudited) | 7 |

Notes | 8 |

22

DRAFT

23

DRAFT

24

DRAFT

25

DRAFT

26

DRAFT

27

DRAFT

28

DRAFT

29

DRAFT

30

DRAFT

31

DRAFT

32

DRAFT

33

DRAFT

34

DRAFT

35

DRAFT

36

DRAFT

37

DRAFT

INDEX TO EXHIBITS

Charters (including amendments) * | Item 17.2 |

Bylaws * | Item 17.2 |

Material Contracts* | Item 17.6 |

* Previously filed with Offering Circular. | |

| |

38

DRAFT

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this special financial report on Form 1-SA to be signed on its behalf by the undersigned, thereunto duly authorized, in Beavercreek, OH on September 30, 202 1 .

WILEY AREA DEVELOPMENT LLC

By: /s/ Byron C. (Chris) Wiley | |

President (Principal Executive Officer) and Manager | |

| |

Pursuant to the requirements of Regulation A, this report has been signed below by the following persons on behalf of the issuer in the capacities and on the dates indicated.

Signature | | Title |

| | |

By: /s/ Byron C. (Chris) Wiley | | President (Principal Executive Officer) and Manager |

| | Wiley Area Development LLC |

| | September 30, 2021 |

| | |

By: /s/ Peter Wiley | | Treasurer (Principal Financial Officer and Principal Accounting Officer) and Manager |

| | Wiley Area Development LLC |

| | September 30, 2021 |

39