UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23425

CIM Real Assets & Credit Fund

(Exact Name of Registrant as Specified in Charter)

4700 Wilshire Boulevard

Los Angeles, California 90010

(Address of Principal Executive Offices)

David Thompson

Chief Executive Officer

CIM Real Assets & Credit Fund

4700 Wilshire Boulevard

Los Angeles, California 90010

(Name and Address of Agent for Service)

Registrant’s Telephone Number, Including Area Code: (323) 860-7421

Date of fiscal year end: September 30

Date of reporting period: October 1, 2021 – March 31, 2022

Item 1. Reports to Stockholders.

Table of Contents

Important Notice Regarding Electronic Delivery

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. For shareholder reports and other communications from the Fund issued prior to 2022, you may elect to receive such reports and other communications electronically. If you own shares of the Fund through a financial intermediary, you may contact your financial intermediary to elect to receive materials electronically. This information is available free of charge by contacting us by mail at 4700 Wilshire Boulevard, Los Angeles, CA, 90010, by telephone at (866) 907-2653 or on our website at https://www.cimgroup.com/ public-investment-programs/current-public-programs/racr.

You may elect to receive all future reports in paper, free of charge. If you own shares of the Fund through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports in 2022. This information is available free of charge by contacting us by mail at 4700 Wilshire Boulevard, Los Angeles, CA, 90010, by telephone at (866) 907-2653 or on our website at https://www.cimgroup.com/public-investment-programs/current-public-programs/racr. If you make such an election through your financial intermediary, your election to receive reports in paper may apply to all funds held through your financial intermediary.

| CIM Real Assets & Credit Fund | Shareholder Letter |

March 31, 2022 (Unaudited)

Dear Shareholders,

We are pleased to provide you with the 2022 semi-annual report for CIM Real Assets & Credit Fund (“we,” “us,” “our,” “CIM RACR,” or the “Fund”). CIM RACR is a continuously-offered, closed-end interval fund registered under the Investment Company Act of 1940, as amended, that launched its offering on May 4, 2020. The Fund invests in real assets (both debt and equity) and corporate credit.

We believe the portfolio is well positioned for the current rising interest rate and inflationary environment. As of March 31, 2022, 100% of CIM RACR’s corporate credit investments were floating rate; if short-term interest rates continue to rise, we anticipate that these investments will generate higher interest income for our shareholders. In addition, we believe our real estate investments may provide shareholders with a degree of protection against inflation. We are specifically focused on investing in real estate where we can leverage CIM’s vertically integrated platform to execute on an identified business plan in order to create value for shareholders.

The Fund’s investment objective is to generate current income through cash distributions and preserve shareholders’ capital across various market cycles, with a secondary objective of capital appreciation. However, there can be no assurance that the Fund will achieve its investment objective.

The Fund seeks to provide shareholders with income with a low correlation to the broader equity markets, by investing in a mix of institutional-quality real assets and credit instruments.

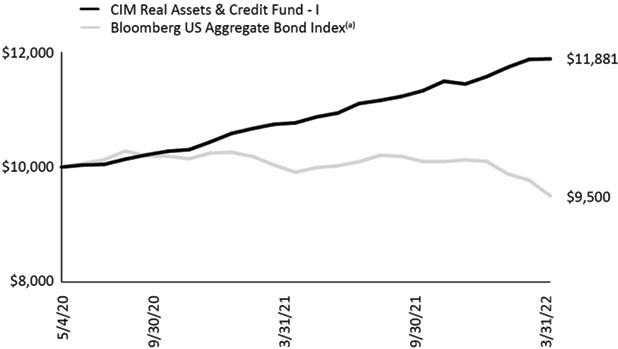

Since inception (May 2020), CIM RACR has generated an annualized return of 9.46%, 9.20%, 8.90% and 8.39% for the Class I Common Shares, Class A Common Shares, Class L Common Shares, and Class C Common Shares, respectively, and has outperformed the Bloomberg US Aggregate Bond Index. RACR’s returns since inception have primarily been driven by interest income from our real estate debt and corporate credit investments as well as appreciation on our real estate debt and equity investments.

The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principle value of an investment will fluctuate so that an investor’s shares, when sold or repurchased, may be worth more or less than the original cost. The current performance may be lower or higher than performance data quoted.

Distributions*

Since the Fund’s inception, we have increased the distribution four times for the Class C and Class A Common Shares, five times for the Class L Common Shares, and six times for the Class I Common Shares.

On December 15, 2021, CIM RACR announced that its Board of Trustees declared monthly cash dividends for each of January, February and March 2022 of $0.129 per share of Class C Common Shares, $0.130 per share of Class A and CIass L Common Shares and $0.131 per share of Class I Common Shares. These dividends in the aggregate represent an annual dividend rate of 6.0% of the Fund’s per share NAV as of December 14, 2021.

Fund Overview

We believe CIM RACR is a highly differentiated interval fund that offers several compelling features to its shareholders:

Innovative Structure. The Fund’s innovative structure allows it to directly invest in real estate rather than private funds of other managers, and thus avoiding multiple layers of fees. The Fund also intends to continue to allocate capital to liquid asset classes, allowing the Fund to provide shareholders with partial liquidity on a quarterly basis.

Alignment. To promote further alignment with other funds managed by affiliates of CIM Group, LLC ("CIM") and OFS Capital Management, LLC (the "OFS Sub-Adviser" or "OFS"), the Fund has obtained exemptive relief from the U.S. Securities and Exchange Commission ("SEC") that allows it to co-invest alongside funds managed by affiliates of CIM and OFS, in accordance with the conditions specified in the exemptive relief. The Fund seeks to provide investors with exposure to proprietary transactions, alongside large, sophisticated institutions, that otherwise may not be available to retail investors and that may have high investment minimums.

To further promote alignment, CIM and its affiliates will invest an aggregate of $20 million in the Fund. As of the date of this letter, CIM and its affiliates have invested $9.6 million in the Fund.

Balanced Portfolio. The Fund seeks to provide investors with exposure to complementary asset classes – real assets and corporate debt. The Fund’s target asset mix seeks to leverage CIM’s and OFS’ insight across asset classes and strategies to identify the best opportunities for its portfolio. CIM has a research-focused approach, and leverages its vertically integrated team to conduct a detailed underwriting analysis on each potential investment, in order to understand the investment’s return profile under different scenarios and the risks of the investment.

| Semi-Annual Report | March 31, 2022 | 1 |

| CIM Real Assets & Credit Fund | Shareholder Letter |

March 31, 2022 (Unaudited)

About the Advisor

CIM Capital IC Management, LLC (the “Adviser”), registered as an investment adviser with the SEC under the Investment Advisers Act of 1940, as amended (the” Advisers Act”), acts as the Fund’s investment adviser and is primarily responsible for determining the amount of the Fund’s total assets that are allocated to each of the Fund’s sub-advisers. The Adviser has engaged each of CIM Capital SA Management, LLC (the “CIM Sub-Adviser”) and the OFS Sub-Adviser, each a SEC-registered investment adviser, to act as an investment sub-adviser to the Fund. The CIM Sub-Adviser is responsible for identifying and sourcing investment opportunities with respect to investments in real assets held by the Fund. The OFS Sub-Adviser is responsible for identifying and sourcing credit and credit-related investment opportunities.

CIM is a vertically-integrated owner and operator of real assets for its own account and on behalf of its partners and co-investors, seeking exposure to real assets and associated credit strategies, with a principal focus on metropolitan areas across the Americas. Since inception, CIM, on behalf of itself and over 175 institutional partners and co-investors, has operated over 270 discretionary real estate and real estate-related equity, debt and infrastructure holdings. As of December 31, 2021, CIM owns and operates approximately $31.2 billion of assets** across its products and has deployed assets for its Principals, partners and co-investors, which include U.S. and Non-U.S. public and corporate pension funds, endowments and foundations, sovereign wealth funds and other institutional and private partners and co-investors since 2000. CIM has over 1,000 employees and more than 570 professionals and 9 corporate offices worldwide.

OFS is a full-service provider of capital and levered financial solutions with $3.0 billion in assets under management as of December 31, 2021, with a focus on middle market lending, broadly syndicated loans, and structured credit. OFS serves as the investment adviser to business development companies, registered closed-end funds, and separately managed, proprietary and sub-advised accounts, as well as the collateral manager to various collateralized loan obligations.

Thank you for your investment in CIM RACR. If you have any questions, please contact the CIM Shareholder Relations team at 866.907.2653. We look forward to continuing our relationship in the years to come.

Sincerely,

David Thompson

Chief Executive Officer

| * | Our distributions may exceed our earnings, and therefore, portions of the distributions that we make may be a return of the money that you originally invested and represent a return of capital to you for tax purposes. Such a return of capital is not immediately taxable, but reduces your tax basis in our shares, which may result in higher taxes for you even if your shares are sold at a price below your original investment. |

| ** | “Assets Owned and Operated” represents the aggregate assets owned and operated by CIM Group on behalf of partners (including where CIM Group contributes alongside for its own account) and co-investors, whether or not CIM Group has discretion, in each case without duplication. |

Forward-Looking Statements

Statements in this letter regarding management's future expectations, beliefs, intentions, goals, strategies, plans or prospects, including statements relating management’s belief that CIM RACR will benefit from CIM Group’s combined real assets, credit and transaction experience and deal-sourcing capabilities; the composition of CIM RACR’s portfolio of real assets and corporate credit assets and the potential benefits to investors, which may not be realized; opportunities for individuals to invest alongside institutional partners, and whether those opportunities will align the interests among sponsors, partners and shareholders; and other factors may constitute forward-looking statements for purposes of the safe harbor protection under applicable securities laws. Forward-looking statements can be identified by terminology such as “anticipate,” “believe,” “could,” “could increase the likelihood,” “estimate,” “expect,” “intend,” “is planned,” “may,” “should,” “will,” “will enable,” “would be expected,” “look forward,” “may provide,” “would” or similar terms, variations of such terms or the negative of those terms. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, including the impact of COVID-19 rising inflation, and the ongoing conflict between Russia and Ukraine, and related changes in base interest rates, supply chain disruptions, and significant market volatility on our business, our industry, and the global economy, as well as those risks, uncertainties and factors referred to in CIM RACR’s Prospectus filed with the SEC on January 29, 2021 under the section “Risks” as well as other documents that may be filed by CIM RACR from time to time with the SEC. As a result of such risks, uncertainties and factors, actual results may differ materially from any future results, performance or achievements discussed in or implied by the forward-looking statements contained herein. CIM RACR is providing the information in this letter as of this date and assumes no obligations to update the information included in this letter or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| 2 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Portfolio Update |

March 31, 2022 (Unaudited)

Performance as of March 31, 2022

| CIM Real Assets & Credit Fund | 1 Month | Quarter | 6 Month | YTD | 1 Year(a) | Since Inception |

| CIM Real Assets & Credit Fund - A - NAV | 0.07% | 2.60% | 4.78% | 2.60% | 10.10% | 9.20% |

| CIM Real Assets & Credit Fund - A - LOAD | -5.67% | -3.30% | -1.25% | -3.30% | 3.77% | 5.85% |

| CIM Real Assets & Credit Fund - C - NAV | 0.00% | 2.46% | 4.40% | 2.46% | 9.30% | 8.39% |

| CIM Real Assets & Credit Fund - I - NAV | 0.08% | 2.67% | 4.89% | 2.67% | 10.34% | 9.46% |

| CIM Real Assets & Credit Fund - L - NAV | 0.04% | 2.53% | 4.63% | 2.53% | 9.78% | 8.90% |

| CIM Real Assets & Credit Fund - L - LOAD | -4.23% | -1.83% | 0.19% | -1.83% | 5.12% | 6.45% |

| Bloomberg US Aggregate Bond Index | -2.78% | -5.93% | -5.92% | -5.93% | -4.15% | -2.66% |

| (a) | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

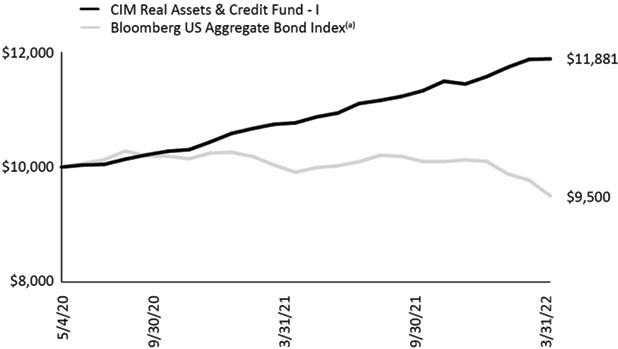

Comparison of the Change in Value of a $10,000 Investment

| (a) | The Bloomberg US Aggregate Bond Index is a broad based, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio. |

The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principle value of an investment will fluctuate so that an investor’s shares, when sold or repurchased, may be worth more or less than the original cost. The current performance may be lower or higher than performance data quoted. Please visit the Fund’s website at https://www.cimgroup.com/public-investment-programs/current-public-programs/racr for performance data current to the most recent month-end.

| Semi-Annual Report | March 31, 2022 | 3 |

| CIM Real Assets & Credit Fund | Portfolio Update |

March 31, 2022 (Unaudited)

Top Ten Long Holdings as of March 31, 2022

| | Percent of

Net Assets |

| EPIC Dallas | 8.80% |

| Del Mar Terrace - Phoenix, AZ | 7.43% |

| Sora Multifamily Residential Property | 6.41% |

| Society Las Olas - PMG-Greybook Riverfront I LLC | 5.01% |

| Vale at the Parks - DC | 3.06% |

| Society Las Olas - 301 SW 1st Avenue Holdings LLC | 2.52% |

| LAQ 2022-LAQ Mortgage Trust | 2.45% |

| Dryden 98 CLO, Ltd. | 2.41% |

| Boca Home Care Holdings, Inc DDTL | 2.14% |

| Brightwood Capital MM CLO 2022-11, LTD Class B LND | 1.94% |

| | 42.17% |

Portfolio Composition as of March 31, 2022

| Asset Type Allocation | Percent of

Net Assets |

| Real Estate-Related Securities | 8.20% |

| Direct Real Estate | 25.71% |

| Collateralized Loan Obligations | 21.00% |

| Bank Loan | 19.30% |

| Commercial Mortgage-Backed Securities | 5.53% |

| Common Stock | 3.56% |

| Cash, Cash Equivalents, & Other Net Assets | 16.70% |

| | 100.00% |

| 4 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

March 31, 2022 (Unaudited)

| | | Maturity Date | | Rate | | Principal | | | Value | |

| Bank Loans (19.30%)(a) | | | | | | | | | | | | |

| Chemicals (0.95%) | | | | | | | | | | | | |

| Molded Devices, Inc., Delayed Draw Term Loan(b) | | 11/01/2026 | | 1M US L + 6.00% | | $ | 277,778 | | | $ | 272,811 | |

| Molded Devices, Inc., Revolver(b) | | 11/01/2026 | | 1M US L + 6.00% | | | 185,185 | | | | 181,874 | |

| Molded Devices, Inc., Term Loan(b) | | 11/01/2026 | | 1M US L + 6.00% | | | 1,533,194 | | | | 1,505,782 | |

| Total Chemicals | | | | | | | | | | | 1,960,467 | |

| | | | | | | | | | | | | |

| Consumer, Non-cyclical (0.93%) | | | | | | | | | | | | |

| Bengal Debt Merger SUB, LLC TL 1L(b) | | 01/24/2030 | | L + 6.00% | | | 500,000 | | | | 500,000 | |

| RC Buyer, Inc., Second Lien Initial Term Loan(b) | | 07/30/2029 | | 3M US L + 6.50% | | | 1,016,949 | | | | 1,014,407 | |

| Spring Education Group, Inc., Second Lien Initial Term Loan(b) | | 07/30/2026 | | 3M US L + 8.25% | | | 430,240 | | | | 418,408 | |

| Total Consumer, Non-cyclical | | | | | | | | | | | 1,932,815 | |

| | | | | | | | | | | | | |

| Electronics (0.96%) | | | | | | | | | | | | |

| Idera, Inc.(b) | | 03/02/2029 | | 3M US L + 6.75% | | | 2,000,000 | | | | 1,975,000 | |

| | | | | | | | | | | | | |

| Food Products (0.40%) | | | | | | | | | | | | |

| BCPE North Star US Holdco 2, Inc. 2L TL(b) | | 06/08/2029 | | 3M US L + 7.25% | | | 833,333 | | | | 820,833 | |

| | | | | | | | | | | | | |

| Healthcare Equipment and Supplies (1.33%) | | | | | | | | | | | | |

| Kreg LLC, Revolver(b) | | 12/20/2026 | | 3M US L + 6.25% | | | 271,739 | | | | 268,816 | |

| Kreg LLC, Term Loan(b) | | 12/20/2026 | | 3M US L + 6.25% | | | 2,500,000 | | | | 2,473,102 | |

| Total Healthcare Equipment and Supplies | | | | | | | | | | | 2,741,918 | |

| | | | | | | | | | | | | |

| Healthcare Providers and Services (6.01%) | | | | | | | | | | | | |

| Baart Programs, Inc., Second Lien Term Loan(b) | | 06/11/2028 | | 3M US L + 8.50% | | | 2,189,394 | | | | 2,156,553 | |

| Boca Home Care Holdings Revolver(b) | | 02/25/2027 | | 1M SOFR + 6.50% | | | 580,645 | | | | 569,032 | |

| Boca Home Care Holdings, Inc DDTL(b) | | 02/25/2027 | | 1M SOFR + 6.50% | | | 4,500,000 | | | | 4,410,000 | |

| Honor HN Buyer, Inc., Delayed Draw Term Loan(b) | | 10/15/2027 | | 1M US L + 6.00% | | | 720,475 | | | | 705,009 | |

| Honor HN Buyer, Inc., Revolver(b) | | 10/15/2027 | | 1M US L + 6.00% | | | 132,013 | | | | 129,179 | |

| Honor HN Buyer, Inc., Term Loan(b) | | 10/15/2027 | | 1M US L + 6.00% | | | 1,147,512 | | | | 1,122,879 | |

| MedMark Services, Inc., Second Lien Term Loan(b) | | 06/11/2028 | | 3M US L + 8.50% | | | 378,788 | | | | 373,106 | |

| One GI Intermediate LLC, Revolver Upsize(b) | | 12/22/2025 | | 3M US L + 6.75% | | | 333,333 | | | | 326,018 | |

| One GI Intermediate LLC, Tranche B Delayed Draw Term Loan(b) | | 12/22/2025 | | 3M US L + 6.75% | | | 1,750,000 | | | | 1,711,593 | |

| One GI Intermediate LLC, Tranche C Delayed Draw Term Loan(b) | | 12/22/2025 | | 3M US L + 6.75% | | | 916,667 | | | | 896,549 | |

| Total Healthcare Providers and Services | | | | | | | | | | | 12,399,918 | |

| | | | | | | | | | | | | |

| Hotels, Restaurants & Leisure (2.29%) | | | | | | | | | | | | |

| SS Acquisition LLC, Delayed Draw Term Loan(b) | | 12/30/2026 | | L + 6.50% | | | 1,800,000 | | | | 1,775,983 | |

| SS Acquisition LLC, Term Loan(b) | | 12/30/2026 | | L + 6.50% | | | 3,000,000 | | | | 2,959,973 | |

| Total Hotels, Restaurants & Leisure | | | | | | | | | | | 4,735,956 | |

| | | | | | | | | | | | | |

| Household Durables (0.44%) | | | | | | | | | | | | |

| Astro One Acquisition Corporation(b) | | 09/14/2029 | | 3M US L + 8.50% | | | 1,000,000 | | | | 913,205 | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 5 |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

March 31, 2022 (Unaudited)

| | | Maturity Date | | Rate | | Principal | | | Value | |

| Industrial (0.47%) | | | | | | | | | | | | |

| Energy Acquisition LP, Second Lien Initial Term Loan(b) | | 06/26/2026 | | 2M US L + 8.50% | | $ | 1,097,499 | | | $ | 963,056 | |

| | | | | | | | | | | | | |

| Retail (1.61%) | | | | | | | | | | | | |

| LSF9 ATLANTIS HOLDINGS, LLC(b) | | 03/29/2029 | | L + 7.25% | | | 3,368,421 | | | | 3,320,000 | |

| | | | | | | | | | | | | |

| Services, Business (2.40%) | | | | | | | | | | | | |

| 24 Seven, Inc., DDTL(b) | | 11/16/2027 | | 3M US L + 6.00% | | | 2,084,500 | | | | 2,059,385 | |

| 24 Seven, Inc., Term Loan(b) | | 11/16/2027 | | 3M US L + 6.00% | | | 1,915,500 | | | | 1,892,421 | |

| Convergint Technologies LLC, Second Lien Term Loan(b) | | 03/30/2029 | | L + 6.75% | | | 999,970 | | | | 1,002,471 | |

| Total Services, Business | | | | | | | | | | | 4,954,277 | |

| | | | | | | | | | | | | |

| Technology (1.51%) | | | | | | | | | | | | |

| Redstone HoldCo 2 LP, Second Lien Initial Term Loan(b) | | 04/27/2029 | | 3M US L + 7.75% | | | 800,000 | | | | 736,500 | |

| RumbleOn, Inc., Delayed Draw Term Loan(b) | | 08/31/2026 | | 1M US L + 8.25% | | | 750,000 | | | | 713,285 | |

| RumbleON, Inc., First Lien Term Loan(b) | | 08/31/2026 | | 1M US L + 8.25% | | | 1,745,625 | | | | 1,660,170 | |

| Total Technology | | | | | | | | | | | 3,109,955 | |

| | | | | | | | | | | | | |

| TOTAL BANK LOANS (Cost $40,222,604) | | | | | | | | | | | 39,827,400 | |

| | | | | | | | | | | | | |

| Collateralized Loan Obligations - Debt (9.34%)(a) | | | | | | | | | | | | |

| Allegro CLO XII, Ltd., Class E(c) | | 01/21/2032 | | 3M US L + 7.10% | | | 1,000,000 | | | | 972,193 | |

| Barings Middle Market CLO, Ltd. 2021-I, Class D(c) | | 07/20/2033 | | 3M US L + 8.65% | | | 1,000,000 | | | | 1,007,877 | |

| Flatiron CLO 20, Ltd., Class E(c) | | 11/20/2033 | | 3M US L + 7.85% | | | 500,000 | | | | 497,890 | |

| Ivy Hill Middle Market Credit Fund XVIII, Ltd., Class E(c) | | 04/22/2033 | | 3M US L + 7.75% | | | 2,000,000 | | | | 1,932,238 | |

| LCM 31, Ltd., Class E(c) | | 01/20/2032 | | 3M US L + 7.08% | | | 1,250,000 | | | | 1,228,414 | |

| Madison Park Funding XLVII, Ltd., Class E(c) | | 01/19/2034 | | 3M US L + 7.46% | | | 600,000 | | | | 601,882 | |

| MCF CLO VII LLC, Class ER(c) | | 07/20/2033 | | 3M US L + 9.15% | | | 2,500,000 | | | | 2,519,895 | |

| Monroe Capital Mml CLO X, Ltd., Class E(c) | | 08/20/2031 | | 3M US L + 8.85% | | | 2,050,000 | | | | 2,049,763 | |

| Northwoods Capital 25, Ltd., Class E(c) | | 07/20/2034 | | 3M US L + 7.14% | | | 2,250,000 | | | | 2,137,958 | |

| OCP CLO 2020-20, Ltd., Class E(c) | | 10/09/2033 | | 3M US L + 7.66% | | | 500,000 | | | | 499,989 | |

| PennantPark CLO III, Ltd., Class E(c) | | 10/22/2032 | | 3M US L + 8.14% | | | 3,000,000 | | | | 3,015,741 | |

| Regatta Funding LP 2013-2A, Class DR2(c) | | 01/15/2029 | | 3M US L + 6.95% | | | 400,000 | | | | 384,542 | |

| Saratoga Investment Corp., CLO 2013-1, Ltd., Class F1R3(c) | | 04/20/2033 | | 3M US L + 10.00% | | | 2,000,000 | | | | 1,920,255 | |

| VCP CLO II, Ltd., Class E(c) | | 04/15/2031 | | 3M US L + 8.40% | | | 500,000 | | | | 498,388 | |

| | | | | | | | | | | | | |

| TOTAL COLLATERALIZED LOAN OBLIGATIONS - DEBT (Cost $19,060,269) | | | | | | | 19,267,025 | |

See Notes to Consolidated Financial Statements.

| 6 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

March 31, 2022 (Unaudited)

| | | Maturity Date | Rate | | Principal | | | Value | |

| Collateralized Loan Obligations - Equity (9.73%)(a)(d) | | | | | | | | | | | | |

| | | | | Estimated yield of | | | | | | | | |

| Apex Credit CLO 2021, Ltd., Class SUB(b)(c) | | 07/18/2034 | | 13.28% | | $ | 2,980,000 | | | $ | 2,273,442 | |

| ArrowMark Colorado Holdings, Class SUB(b)(c) | | 01/05/2035 | | 16.90% | | | 3,750,000 | | | | 2,875,125 | |

| Atlas Senior Loan Fund XVII, Ltd., Class SUB(b)(c) | | 10/20/2034 | | 15.67% | | | 3,000,000 | | | | 2,591,850 | |

| Dryden 98 CLO, Ltd., Class SUB(b)(c) | | 04/20/2035 | | 13.61% | | | 5,500,000 | | | | 4,976,318 | |

| LCM 31, Ltd., Class INC(b)(c) | | 01/20/2032 | | 21.01% | | | 250,000 | | | | 203,150 | |

| Marble Point CLO XXI, Ltd., Class INC(b)(c) | | 10/17/2051 | | 14.47% | | | 2,750,000 | | | | 2,218,975 | |

| Steele Creek CLO 2022-1, Ltd., Class SUB(b)(c) | | 04/15/2035 | | 16.22% | | | 5,000,000 | | | | 3,635,000 | |

| Trinitas CLO VIII, Ltd., Class SUB(b)(c) | | 07/20/2117 | | 20.54% | | | 2,300,000 | | | | 1,300,880 | |

| | | | | | | | | |

| TOTAL COLLATERALIZED LOAN OBLIGATIONS - EQUITY (Cost $20,331,597) | | | | | | | 20,074,740 | |

| | | | | | | | | |

| Commercial Mortgage-Backed Securities (5.53%) | | | | | | | | | | | | |

| Campus Drive Secured Lease-Backed Pass-Through | | | | | | | | | | | | |

| Trust, Series C(b)(c) | | 06/15/2058 | | 6.91% | | | 3,745,537 | | | | 3,106,756 | |

| Capital Funding Mortgage Trust 2021-21, Class B(a)(b)(c) | | 11/15/2023 | | 1M US L + 12.25% | | | 500,000 | | | | 500,000 | |

| CSMC 2020-TMIC, Class C(a)(c) | | 11/15/2033 | | 1M US L + 6.75% | | | 400,000 | | | | 409,328 | |

| LAQ 2022-LAQ Mortgage Trust, Class E(a)(c) | | 03/15/2039 | | 1M US SOFR + 4.87% | | | 450,000 | | | | 454,260 | |

| LAQ 2022-LAQ Mortgage Trust, Class F(a)(c) | | 03/15/2039 | | 1M US SOFR + 5.97% | | | 5,000,000 | | | | 5,047,294 | |

| TWO VA Repack Trust Class B-2, Series B2(b)(c)(e) | | 11/15/2033 | | 0.00% | | | 1,811,000 | | | | 658,426 | |

| VA Gilbert AZ Subordinated Note Lease-Backed Pass-Through Trust(b)(c) | | 03/15/2034 | | 13.00% | | | 187,901 | | | | 241,467 | |

| Wells Fargo Commercial Mortgage Trust 2021-FCMT, Class F(a)(c) | | 05/15/2031 | | 1M US L + 5.90% | | | 1,000,000 | | | | 987,558 | |

| | | | | | | | | |

| TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES (Cost $11,333,686) | | | | | | | 11,405,089 | |

| | | | | | | | | |

| Direct Real Estate (25.71%) | | | | | | | | | | | | |

| Del Mar Terrace - Phoenix, AZ(b)(f)(g) | | | | N/A | | | 15,000,000 | | | | 15,330,492 | |

| EPIC Dallas(b)(f)(g) | | | | N/A | | | 13,630,333 | | | | 18,165,645 | |

| Sora Multifamily Residential Property(b)(g) | | | | N/A | | | 13,421,688 | | | | 13,233,570 | |

| Vale at the Parks - DC(b)(f)(g) | | | | N/A | | | 5,008,001 | | | | 6,317,544 | |

| TOTAL DIRECT REAL ESTATE (Cost $47,060,022) | | | | | | | | | | | 53,047,251 | |

| | | | | | | | | |

| Real Estate-Related Securities (8.20%)(a) | | | | | | | | | | | | |

| Debt Securities (5.68%) | | | | | | | | | | | | |

| IENTC 2, LLC(b)(f) | | 03/31/2031 | | Term US SOFR + 9.75% | | | 1,645,000 | | | | 1,391,200 | |

| Society Las Olas - PMG-Greybook Riverfront I LLC(b)(f) | | 10/07/2023 | | 1.47% | | | 10,376,845 | | | | 10,337,836 | |

| Total Debt Securities | | | | | | | | | | | 11,729,036 | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 7 |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

March 31, 2022 (Unaudited)

| | | Maturity Date | | Rate | | | Principal | | | Value | |

| Preferred Units (2.52%) | | | | | | | | | | | | | | |

| Society Las Olas - 301 SW 1st Avenue Holdings LLC(b)(f) | | 09/23/2023 | | | 8.80% | | | $ | 5,231,984 | | | $ | 5,208,993 | |

| Total Preferred Units | | | | | | | | | | | | | 5,208,993 | |

| | | | | | | | | | | | | | | |

| TOTAL REAL ESTATE-RELATED SECURITIES (Cost $16,874,039) | | | | | | | | | 16,938,029 | |

| | | | | | | | | | | | | | | |

| Loan Accumulation Facility (1.94%)(a)(d) | | | | | | | | | | | | | | |

| Brightwood Capital MM CLO 2022-11, LTD Class B LND(b)(c) | | 12/31/2032 | | | 13.50% | | | | 4,000,000 | | | | 4,000,000 | |

| | | | | | | | | | | | | | | |

| TOTAL LOAN ACCUMULATION FACILITY (Cost $4,000,000) | | | | | | | | | | | 4,000,000 | |

| | | | | | | | | | | | | | | |

| Common Stocks (3.56%) | | | | | | | | | | | | | | |

| Boca Homecare Holdings, Inc. (Equity)(b)(g) | | | | | | | | | 580,645 | | | | 580,802 | |

| IENTC 1, LLC(b)(f) | | | | | | | | | 3,760,000 | | | | 3,760,000 | |

| Creative Media & Community Trust Corp.(f) | | | | | | | | | 3,106,362 | | | | 3,005,782 | |

| | | | | | | | | | | | | | | |

| TOTAL COMMON STOCKS (Cost $7,447,007) | | | | | | | | | | | | | 7,346,584 | |

| | | | | | | | | | | | | | | |

| Warrants (0.03%) | | | | | | | | | | | | | | |

| RumbleON, Inc., Expires 02/28/2023, Strike Price $33.00(b) | | | | | | | | | 7,576 | | | | 72,118 | |

| | | | | | | | | | | | | | | |

| TOTAL WARRANTS (Cost $83,469) | | | | | | | | | | | | | 72,118 | |

| | | | | | | | | | | | | | | |

| Short Term Investments (15.73%) | | | | | | | | | | | | | | |

| First American Treasury Obligations Fund, 0.180%(h) (Cost $32,457,410) | | | | | | | | | 32,457,410 | | | | 32,457,410 | |

| | | | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS (Cost $32,457,410) | | | | | | | | | | | | | 32,457,410 | |

| | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS 99.07% (Cost $198,870,103) | | | | | | | | | | | | $ | 204,435,646 | |

| | | | | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities 0.93% | | | | | | | | | | | | | 1,922,858 | |

| | | | | | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | | | | | $ | 206,358,504 | |

| (a) | Floating or variable rate security. The reference rate is described above. The rate in effect as of March 31, 2022 is based on the reference rate plus the displayed spread as of the security's last reset date. |

| (b) | Fair value of this security was determined using significant, unobservable inputs and was determined in good faith under the procedures approved by the Fund's Board of Trustees. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. Total market value of Rule 144A securities amounts to $54,746,854, which represented approximately 26.53% of net assets as of March 31, 2022. Such securities may normally be sold to qualified institutional buyers in transactions exempt from registration. |

See Notes to Consolidated Financial Statements.

| 8 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

March 31, 2022 (Unaudited)

| (d) | CLO subordinated notes are residual positions in the CLO vehicle. CLO subordinated notes are entitled to distributions that are generally equal to the residual cash flows of the underlying securities less contractual payments to debt holders and fund expenses. The effective yield is estimated based upon the amount and timing of these distributions in addition to the estimated amount of terminal distribution. Effective yields for the CLO equity positions are updated generally once a quarter in connection with a transaction, such as an add-on purchase, refinancing or reset. The estimated yield and investment cost may ultimately not be realized. Estimated yields are periodically adjusted based on information reported by the CLO as of the date of determination. |

| (f) | Affiliated investments pursuant to the 1940 Act. See Note 5 for more information. |

| (g) | Non-income producing investment. |

| (h) | Money market fund; interest rate reflects seven-day yield as of March 31, 2022. |

Other than as described above, we do not "control" and are not an "affiliate" of any of our portfolio investments, each as defined in the Investment Company Act of 1940, as amended (the "1940 Act"). In general, under the 1940 Act, we would be presumed to "control" a portfolio investment if we owned 25% or more of its voting securities and would be an "affiliate" of a portfolio investment if we owned 5% or more of its voting securities.

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

SOFR - Secured Overnight Financing Rate

Reference Rates:

1M US L - 1 Month LIBOR as of March 31, 2022 was 0.46%

2M US L - 2 Month LIBOR as of March 31, 2022 was 0.11%

3M US L - 3 Month LIBOR as of March 31, 2022 was 0.97%

6M US L - 6 Month LIBOR as of March 31, 2022 was 1.47%

1M SOFR - 1 month SOFR as of March 31, 2022 was 0.30%

3M SOFR - 3 month SOFR as of March 31, 2022 was 0.68%

6M SOFR - 6 month SOFR as of March 31, 2022 was 1.08%

TOTAL RETURN SWAP CONTRACTS(a)

| Counterparty | | Reference Entity/Obligation | | | Notional

Amount | | | Fund Pays | | | Termination

Date | | | | Value | | | | Net Unrealized

Appreciation | |

| Citibank, N.A. | | Acrisure LLC, 1M US L + 3.75(b) | | $ | 551,177 | | | 3M US L + 1.35% | | | 02/15/2027 | | | $ | 553,615 | | | $ | 2,438 | |

| Citibank, N.A. | | Acrisure LLC, 1M US L + 4.25(b) | | | 148,875 | | | 3M US L + 1.35% | | | 02/15/2027 | | | | 149,626 | | | | 751 | |

| Citibank, N.A. | | Advantage Sales & Marketing, Inc., 3M US L + 4.50 | | | 758,077 | | | 3M US L + 1.35% | | | 10/28/2027 | | | | 759,933 | | | | 1,856 | |

| Citibank, N.A. | | Allen Media LLC, 3M US L + 5.50 | | | 1,520,871 | | | 3M US L + 1.35% | | | 02/10/2027 | | | | 1,526,248 | | | | 5,377 | |

| Citibank, N.A. | | AP Core Holdings II LLC, 1M US L + 5.50, 3M US L + 5.50 | | | 1,184,042 | | | 3M US L + 1.35% | | | 09/01/2027 | | | | 1,194,135 | | | | 10,093 | |

| Citibank, N.A. | | Athletico Physical Therapy TLB, 6M SOFR + 4.25(b) | | | 904,545 | | | 3M US L + 1.35% | | | 02/15/2029 | | | | 905,118 | | | | 573 | |

| Citibank, N.A. | | Bausch Health Companies Inc. 1L TLB, 1M US L + 5.25 | | | 950,400 | | | 3M US L + 1.35% | | | 01/27/2027 | | | | 952,277 | | | | 1,877 | |

| Citibank, N.A. | | Caesars Resort Collection LLC, 1M US L + 2.75 | | | 592,372 | | | 3M US L + 1.35% | | | 12/23/2024 | | | | 593,033 | | | | 661 | |

| Citibank, N.A. | | Clydesdale Acquisition Holdings, Inc.TL 1L, 1M SOFR + 4.25 | | | 557,143 | | | 3M US L + 1.35% | | | 04/13/2029 | | | | 562,857 | | | | 5,714 | |

| Citibank, N.A. | | Corel Corp., 3M US L + 5.00 | | | 528,116 | | | 3M US L + 1.35% | | | 07/02/2026 | | | | 528,283 | | | | 167 | |

| Citibank, N.A. | | Dermatology Intermediate Holdings III, Inc. 1L, 1M SOFR + 4.25(b) | | | 54,470 | | | 3M US L + 1.35% | | | 03/26/2029 | | | | 55,025 | | | | 555 | |

| Citibank, N.A. | | Dermatology Intermediate Holdings III, Inc. TLB 1L, 1M SOFR + 4.25(b) | | | 291,413 | | | 3M US L + 1.35% | | | 03/26/2029 | | | | 294,386 | | | | 2,973 | |

| Citibank, N.A. | | DIRECTV Financing LLC, 1M US L + 5.00 | | | 1,080,872 | | | 3M US L + 1.35% | | | 08/02/2027 | | | | 1,083,487 | | | | 2,615 | |

| Citibank, N.A. | | East West Manufacturing, LLC TLB 1L, 3M SOFR + 5.75(b) | | | 648,214 | | | 3M US L + 1.35% | | | 12/22/2028 | | | | 649,851 | | | | 1,637 | |

| Citibank, N.A. | | Garda World Security Corporation TLB 1L, 1M SOFR + 4.25(b) | | | 495,000 | | | 3M US L + 1.35% | | | 02/01/2029 | | | | 496,250 | | | | 1,250 | |

| Citibank, N.A. | | Great Outdoors Group, LLC TLB 1L, 1M L + 3.75% | | | 1,490,000 | | | 3M US L + 1.35% | | | 03/06/2028 | | | | 1,496,483 | | | | 6,483 | |

| Citibank, N.A. | | HUB International, Ltd., L + 3.25 | | | 198,750 | | | 3M US L + 1.35% | | | 04/25/2025 | | | | 199,000 | | | | 250 | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 9 |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

March 31, 2022 (Unaudited)

TOTAL RETURN SWAP CONTRACTS(a) (continued)

| Counterparty | | Reference Entity/Obligation | | Notional

Amount | | | Fund Pays | | Termination

Date | | | Value | | | Net Unrealized

Appreciation | |

| Citibank, N.A. | | LSF9 ATLANTIS HOLDINGS, LLC, L + 7.25(b) | | $ | 1,216,184 | | | 3M US L + 1.35% | | | 03/29/2029 | | | $ | 1,245,000 | | | $ | 28,816 | |

| Citibank, N.A. | | McGraw-Hill Education, Inc., 6M US L + 4.75 | | | 1,143,450 | | | 3M US L + 1.35% | | | 07/28/2028 | | | | 1,144,715 | | | | 1,265 | |

| Citibank, N.A. | | Olaplex, Inc TL 1L, 1M SOFR + 3.75(b) | | | 230,192 | | | 3M US L + 1.35% | | | 02/17/2029 | | | | 230,481 | | | | 289 | |

| Citibank, N.A. | | Owens & Minor, Inc. TLB 1L, 1M SOFR + 3.75(b) | | | 246,250 | | | 3M US L + 1.35% | | | 03/29/2029 | | | | 249,688 | | | | 3,438 | |

| Citibank, N.A. | | PetSmart LLC, 6M US L + 3.75 | | | 1,291,993 | | | 3M US L + 1.35% | | | 02/11/2028 | | | | 1,294,068 | | | | 2,075 | |

| Citibank, N.A. | | Prestige Brands, Inc., 1M US L + 2.00 | | | 253,725 | | | 3M US L + 1.35% | | | 07/03/2028 | | | | 254,586 | | | | 861 | |

| Citibank, N.A. | | Primary Products Finance LLC, 3M US L + 4.00 | | | 577,500 | | | 3M US L + 1.35% | | | 10/25/2028 | | | | 579,906 | | | | 2,406 | |

| Citibank, N.A. | | Seattle SpinCo, Inc., 1M SOFR + 4.00(b) | | | 247,500 | | | 3M US L + 1.35% | | | 02/28/2027 | | | | 247,500 | | | | – | |

| Citibank, N.A. | | Virtusa Corporation TL 1L, 1M SOFR + 3.75(b) | | | 297,000 | | | 3M US L + 1.35% | | | 02/15/2029 | | | | 297,938 | | | | 938 | |

| | | | | $ | 17,458,131 | | | | | | | | | $ | 17,543,489 | | | $ | 85,358 | |

| Counterparty | | Reference Entity/Obligation | | Notional

Amount | | | Fund Pays | | Termination

Date | | | Value | | | Net Unrealized

Depreciation | |

| Citibank, N.A. | | 1011778 B.C. Unlimited Liability Company, 1M US L + 1.75 | | $ | 156,236 | | | 3M US L + 1.35% | | | 11/19/2026 | | | $ | 149,553 | | | $ | (6,683 | ) |

| Citibank, N.A. | | Academy, Ltd., 1M US L + 3.75 | | | 872,858 | | | 3M US L + 1.35% | | | 11/05/2027 | | | | 864,100 | | | | (8,758 | ) |

| Citibank, N.A. | | Acrisure LLC, 1M US L + 3.50 | | | 593,222 | | | 3M US L + 1.35% | | | 02/15/2027 | | | | 588,261 | | | | (4,961 | ) |

| Citibank, N.A. | | ADMI Corp. TLB3 1L, 1M US L + 3.50 | | | 800,413 | | | 3M US L + 1.35% | | | 12/23/2027 | | | | 796,813 | | | | (3,600 | ) |

| Citibank, N.A. | | Aegion Corp., 3M US L + 4.75(b) | | | 436,400 | | | 3M US L + 1.35% | | | 05/17/2028 | | | | 436,296 | | | | (104 | ) |

| Citibank, N.A. | | AHP Health Partners, Inc., 1M US L + 3.50 | | | 288,546 | | | 3M US L + 1.35% | | | 08/24/2028 | | | | 287,432 | | | | (1,114 | ) |

| Citibank, N.A. | | Allied Universal Holdco LLC, 1M US L + 3.75 | | | 496,256 | | | 3M US L + 1.35% | | | 05/14/2028 | | | | 491,758 | | | | (4,498 | ) |

| Citibank, N.A. | | Amentum Government Services Holdings LLC TLB 1L, 6M SOFR + 4.00(b) | | | 351,176 | | | 3M US L + 1.35% | | | 02/15/2029 | | | | 350,735 | | | | (441 | ) |

| Citibank, N.A. | | Anesthesia Partners, Inc., 3M US L + 4.25 | | | 943,378 | | | 3M US L + 1.35% | | | 10/02/2028 | | | | 943,203 | | | | (175 | ) |

| Citibank, N.A. | | Applovin Corp., 1M US L + 3.25 | | | 196,563 | | | 3M US L + 1.35% | | | 08/15/2025 | | | | 195,735 | | | | (828 | ) |

| Citibank, N.A. | | Aramark Intermediate HoldCo Corp., 1M US L + 1.75 | | | 197,839 | | | 3M US L + 1.35% | | | 03/11/2025 | | | | 196,700 | | | | (1,139 | ) |

| Citibank, N.A. | | Arches Buyer, Inc., 1M US L + 3.25 | | | 601,022 | | | 3M US L + 1.35% | | | 12/06/2027 | | | | 594,928 | | | | (6,094 | ) |

| Citibank, N.A. | | Asurion LLC, 1M US L + 3.00 | | | 195,425 | | | 3M US L + 1.35% | | | 11/03/2024 | | | | 194,192 | | | | (1,233 | ) |

| Citibank, N.A. | | Athenahealth Group Inc. 1L, 1M SOFR + 3.50 | | | 101,087 | | | 3M US L + 1.35% | | | 2/15/2029 | | | | 100,562 | | | | (525 | ) |

| Citibank, N.A. | | Athenahealth Group Inc. TLB 1L, 1M SOFR + 3.50 | | | 595,558 | | | 3M US L + 1.35% | | | 2/15/2029 | | | | 593,313 | | | | (2,245 | ) |

| Citibank, N.A. | | Atlantic Aviation Corp., 1M US L + 3.00 | | | 959,551 | | | 3M US L + 1.35% | | | 09/22/2028 | | | | 951,846 | | | | (7,705 | ) |

| Citibank, N.A. | | Autokiniton US Holdings, Inc., 12M US L + 4.50 | | | 1,095,108 | | | 3M US L + 1.35% | | | 04/06/2028 | | | | 1,078,855 | | | | (16,253 | ) |

| Citibank, N.A. | | Bakemark Holdings, Inc., 1M US L + 4.00(b) | | | 497,500 | | | 3M US L + 1.35% | | | 09/05/2028 | | | | 492,503 | | | | (4,997 | ) |

| Citibank, N.A. | | Bausch Health Americas, Inc., 1M US L + 3.00 | | | 1,003,222 | | | 3M US L + 1.35% | | | 06/01/2025 | | | | 999,191 | | | | (4,031 | ) |

| Citibank, N.A. | | BCPE North Star US Holdco 2, Inc. TL 1L, 3M US L + 4.00(b) | | | 960,608 | | | 3M US L + 1.35% | | | 06/09/2028 | | | | 948,844 | | | | (11,764 | ) |

| Citibank, N.A. | | Burlington Coat Factory Warehouse Corp., 1M US L + 2.00 | | | 544,514 | | | 3M US L + 1.35% | | | 06/26/2028 | | | | 541,321 | | | | (3,193 | ) |

| Citibank, N.A. | | Caesars Resort Collection LLC, 1M US L + 3.50 | | | 497,481 | | | 3M US L + 1.35% | | | 07/20/2025 | | | | 496,486 | | | | (995 | ) |

| Citibank, N.A. | | CCRR Parent, 3M US L + 3.75(b) | | | 895,574 | | | 3M US L + 1.35% | | | 03/06/2028 | | | | 890,849 | | | | (4,725 | ) |

| Citibank, N.A. | | Charter Next Generation, Inc., 1ML + 3.75% | | | 496,958 | | | 3M US L + 1.35% | | | 12/01/2027 | | | | 492,911 | | | | (4,047 | ) |

| Citibank, N.A. | | CHG Healthcare Services, Inc., 6M US L + 3.50 | | | 350,299 | | | 3M US L + 1.35% | | | 09/29/2028 | | | | 349,418 | | | | (881 | ) |

| Citibank, N.A. | | City Brewing Co. LLC, 3M US L + 3.50(b) | | | 222,775 | | | 3M US L + 1.35% | | | 04/05/2028 | | | | 203,933 | | | | (18,842 | ) |

| Citibank, N.A. | | Conduent Business Services LLC, L + 4.25% | | | 495,000 | | | 3M US L + 1.35% | | | 09/28/2028 | | | | 494,480 | | | | (520 | ) |

| Citibank, N.A. | | Connect Finco Sarl, 1M US L + 3.50 | | | 744,295 | | | 3M US L + 1.35% | | | 12/12/2026 | | | | 737,451 | | | | (6,844 | ) |

| Citibank, N.A. | | Core & Main LP, 1M US L + 2.50 | | | 413,547 | | | 3M US L + 1.35% | | | 07/27/2028 | | | | 411,992 | | | | (1,555 | ) |

| Citibank, N.A. | | CoreLogic, Inc., 1M US L + 3.50 | | | 497,503 | | | 3M US L + 1.35% | | | 06/02/2028 | | | | 494,077 | | | | (3,426 | ) |

| Citibank, N.A. | | Cornerstone OnDemand, Inc, 1M US L + 3.75 | | | 692,876 | | | 3M US L + 1.35% | | | 10/16/2028 | | | | 689,739 | | | | (3,137 | ) |

| Citibank, N.A. | | CP Atlas Buyer, Inc., 1M US L + 3.75 | | | 398,538 | | | 3M US L + 1.35% | | | 11/23/2027 | | | | 388,076 | | | | (10,462 | ) |

| Citibank, N.A. | | DexKo Global Inc., Delayed TL, 3M US L + 3.75 | | | 131,185 | | | 3M US L + 1.35% | | | 10/04/2028 | | | | 128,930 | | | | (2,255 | ) |

| Citibank, N.A. | | DexKo Global Inc., TLB, 3M US L + 3.75 | | | 687,508 | | | 3M US L + 1.35% | | | 10/04/2028 | | | | 676,883 | | | | (10,625 | ) |

| Citibank, N.A. | | DG Investment Intermediate Holdings 2, Inc., 1M US L + 3.75 3.5% | | | 1,208,655 | | | 3M US L + 1.35% | | | 03/31/2028 | | | | 1,199,478 | | | | (9,177 | ) |

| Citibank, N.A. | | Diversitech Holdings, Inc., 3M US L + 3.75 | | | 51,171 | | | 3M US L + 1.35% | | | 12/22/2028 | | | | 50,826 | | | | (345 | ) |

See Notes to Consolidated Financial Statements.

| 10 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

March 31, 2022 (Unaudited)

TOTAL RETURN SWAP CONTRACTS(a) (continued)

| Counterparty | | Reference Entity/Obligation | | Notional

Amount | | | Fund Pays | | Termination

Date | | | Value | | | Net Unrealized

Appreciation | |

| Citibank, N.A. | | Diversitech Holdings, Inc., 3M US L + 3.75 | | $ | 247,329 | | | 3M US L + 1.35% | | | 12/22/2028 | | | $ | 245,658 | | | $ | (1,671 | ) |

| Citibank, N.A. | | East West Manufacturing, LLC Delayed TL 1L, 3M SOFR + 5.75(b) | | | 95,238 | | | 3M US L + 1.35% | | | 12/22/2026 | | | | 94,524 | | | | (714 | ) |

| Citibank, N.A. | | Fertitta Entertainment, LLC TLB 1L, 1M SOFR + 4.00 | | | 346,957 | | | 3M US L + 1.35% | | | 01/29/2029 | | | | 346,544 | | | | (413 | ) |

| Citibank, N.A. | | Gainwell Acquisition Corp., 3M US L + 4.00 | | | 297,668 | | | 3M US L + 1.35% | | | 10/01/2027 | | | | 297,000 | | | | (668 | ) |

| Citibank, N.A. | | Garda World Security Corp., 1M US L + 4.25 | | | 593,428 | | | 3M US L + 1.35% | | | 10/30/2026 | | | | 586,886 | | | | (6,542 | ) |

| Citibank, N.A. | | Help/Systems Holdings, Inc., 1M US L + 4.00 | | | 496,212 | | | 3M US L + 1.35% | | | 11/19/2026 | | | | 491,250 | | | | (4,962 | ) |

| Citibank, N.A. | | Hunter Douglas Inc.TLB 1L, 3M SOFR +3.50(b) | | | 497,500 | | | 3M US L + 1.35% | | | 02/25/2029 | | | | 490,783 | | | | (6,717 | ) |

| Citibank, N.A. | | Ivanti Software, Inc., 3M US L + 4.25 | | | 665,000 | | | 3M US L + 1.35% | | | 12/01/2027 | | | | 658,750 | | | | (6,250 | ) |

| Citibank, N.A. | | Jadex, Inc., 1M US L + 4.75(b) | | | 364,089 | | | 3M US L + 1.35% | | | 02/11/2028 | | | | 354,026 | | | | (10,063 | ) |

| Citibank, N.A. | | KNS Midco Corp., 3M US L + 6.25 | | | 596,250 | | | 3M US L + 1.35% | | | 04/16/2027 | | | | 584,176 | | | | (12,074 | ) |

| Citibank, N.A. | | LBM Acquisition LLC, 1M US L + 3.75 | | | 644,122 | | | 3M US L + 1.35% | | | 12/18/2027 | | | | 630,464 | | | | (13,658 | ) |

| Citibank, N.A. | | Liftoff Mobile, Inc., 3M US L + 3.75 | | | 496,958 | | | 3M US L + 1.35% | | | 10/02/2028 | | | | 493,244 | | | | (3,714 | ) |

| Citibank, N.A. | | LogMeIn, Inc., 1M US L + 4.75 | | | 694,969 | | | 3M US L + 1.35% | | | 08/31/2027 | | | | 683,285 | | | | (11,684 | ) |

| Citibank, N.A. | | LSCS Holdings, Inc., 1M US L + 4.50(b) | | | 348,250 | | | 3M US L + 1.35% | | | 12/16/2028 | | | | 346,939 | | | | (1,311 | ) |

| Citibank, N.A. | | MA FinanceCo LLC, 3M US L + 4.25(b) | | | 224,856 | | | 3M US L + 1.35% | | | 06/05/2025 | | | | 221,420 | | | | (3,436 | ) |

| Citibank, N.A. | | Madison IAQ LLC, 6M US L + 3.25 | | | 648,287 | | | 3M US L + 1.35% | | | 06/21/2028 | | | | 644,975 | | | | (3,312 | ) |

| Citibank, N.A. | | Magenta Buyer LLC, 3M US L + 5.00 | | | 806,661 | | | 3M US L + 1.35% | | | 07/27/2028 | | | | 804,933 | | | | (1,728 | ) |

| Citibank, N.A. | | McAfee Corp. TLB 1L, 1M SOFR + 4.00 | | | 918,462 | | | 3M US L + 1.35% | | | 03/01/2029 | | | | 917,885 | | | | (577 | ) |

| Citibank, N.A. | | Medline Industries, LP, Term Loan, 1M US L + 3.25 | | | 872,266 | | | 3M US L + 1.35% | | | 10/21/2028 | | | | 867,287 | | | | (4,979 | ) |

| Citibank, N.A. | | MH Sub I LLC, 1M US L + 3.75 | | | 247,382 | | | 3M US L + 1.35% | | | 09/15/2024 | | | | 244,575 | | | | (2,807 | ) |

| Citibank, N.A. | | Midwest Physician Administrative Services LLC, 3M US L + 3.25 | | | 731,911 | | | 3M US L + 1.35% | | | 03/13/2028 | | | | 723,678 | | | | (8,233 | ) |

| Citibank, N.A. | | Mitchell International, Inc., 3M US L + 3.75 | | | 661,667 | | | 3M US L + 1.35% | | | 10/15/2028 | | | | 656,933 | | | | (4,734 | ) |

| Citibank, N.A. | | MJH Healthcare Holdings, LLC, TLB, 1M SOFR + 3.50(b) | | | 165,833 | | | 3M US L + 1.35% | | | 01/28/2029 | | | | 165,417 | | | | (416 | ) |

| Citibank, N.A. | | Naked Juice LLC, 1M SOFR + 3.25% | | | 943,091 | | | 3M US L + 1.35% | | | 01/24/2029 | | | | 931,949 | | | | (11,142 | ) |

| Citibank, N.A. | | Naked Juice LLC, 1M SOFR + 3.25% | | | 54,409 | | | 3M US L + 1.35% | | | 01/24/2029 | | | | 53,766 | | | | (643 | ) |

| Citibank, N.A. | | Osmosis Buyer Limited Del T1 1L, L + 4%(b) | | | 137,847 | | | 3M US L + 1.35% | | | 07/31/2028 | | | | 137,631 | | | | (216 | ) |

| Citibank, N.A. | | Osmosis Buyer Limited TLB 1L, L + 3%(b) | | | 606,528 | | | 3M US L + 1.35% | | | 07/31/2028 | | | | 605,574 | | | | (954 | ) |

| Citibank, N.A. | | Pitney Bowes INC.TL, 1M US L + 4.00(b) | | | 694,989 | | | 3M US L + 1.35% | | | 03/17/2028 | | | | 684,889 | | | | (10,100 | ) |

| Citibank, N.A. | | Plaze, Inc., 1M US L + 3.75(b) | | | 792,498 | | | 3M US L + 1.35% | | | 08/03/2026 | | | | 766,742 | | | | (25,756 | ) |

| Citibank, N.A. | | Pretium PKG Holdings, Inc., 6M US L + 4.00 | | | 279,298 | | | 3M US L + 1.35% | | | 10/02/2028 | | | | 273,283 | | | | (6,015 | ) |

| Citibank, N.A. | | Proofpoint, Inc., 3M US L + 3.25 | | | 711,071 | | | 3M US L + 1.35% | | | 08/31/2028 | | | | 707,489 | | | | (3,582 | ) |

| Citibank, N.A. | | Quest Borrower Limited TL 1L, 3M SOFR + 4.25 | | | 990,000 | | | 3M US L + 1.35% | | | 02/01/2029 | | | | 986,485 | | | | (3,515 | ) |

| Citibank, N.A. | | Redstone Holdco 2 LP, 3M US L + 4.75 | | | 713,565 | | | 3M US L + 1.35% | | | 04/27/2028 | | | | 701,286 | | | | (12,279 | ) |

| Citibank, N.A. | | Ring Container Technologies Group LLC, 6M US L + 3.75 | | | 392,467 | | | 3M US L + 1.35% | | | 08/12/2028 | | | | 390,115 | | | | (2,352 | ) |

| Citibank, N.A. | | Rough Country, LLC 1L, 1M US L + 3.50(b) | | | 1,265,441 | | | 3M US L + 1.35% | | | 07/26/2028 | | | | 1,254,373 | | | | (11,068 | ) |

| Citibank, N.A. | | Ryan Specialty Group LLC, 1M US L + 3.00 | | | 197,830 | | | 3M US L + 1.35% | | | 09/01/2027 | | | | 196,514 | | | | (1,316 | ) |

| Citibank, N.A. | | Scientific Games Holdings LP TLB 1L, 3M SOFR + 3.5% | | | 454,545 | | | 3M US L + 1.35% | | | 02/04/2029 | | | | 451,055 | | | | (3,490 | ) |

| Citibank, N.A. | | Sitel Worldwide Corp., 1M US L + 3.75 | | | 680,580 | | | 3M US L + 1.35% | | | 08/27/2028 | | | | 679,441 | | | | (1,139 | ) |

| Citibank, N.A. | | Sovos Brands Intermediate, Inc., 3M US L + 3.75 | | | 351,098 | | | 3M US L + 1.35% | | | 06/08/2028 | | | | 350,238 | | | | (860 | ) |

| Citibank, N.A. | | Specialty Building Products Holdings LLC, 1M US L + 3.75 | | | 498,500 | | | 3M US L + 1.35% | | | 10/05/2028 | | | | 489,220 | | | | (9,280 | ) |

| Citibank, N.A. | | SRS Distribution Inc., 6M US L + 3.75 | | | 361,295 | | | 3M US L + 1.35% | | | 06/02/2028 | | | | 360,082 | | | | (1,213 | ) |

| Citibank, N.A. | | Sunshine Luxembourg VII S.a r.l., 3M US L + 3.75 | | | 968,594 | | | 3M US L + 1.35% | | | 10/02/2026 | | | | 961,500 | | | | (7,094 | ) |

| Citibank, N.A. | | Teneo Holdings LLC, 1M SOFR + 5.25 | | | 793,046 | | | 3M US L + 1.35% | | | 07/12/2025 | | | | 792,272 | | | | (774 | ) |

| Citibank, N.A. | | TGP Holdings III LLC, 1M US L + 3.25 | | | 318,971 | | | 3M US L + 1.35% | | | 06/29/2028 | | | | 307,650 | | | | (11,321 | ) |

| Citibank, N.A. | | TGP Holdings III LLC, 1M US L + 3.25 | | | 42,058 | | | 3M US L + 1.35% | | | 06/29/2028 | | | | 40,566 | | | | (1,492 | ) |

| Citibank, N.A. | | TricorBraun Holdings, Inc., 1M L + 3.25% | | | 614,790 | | | 3M US L + 1.35% | | | 03/03/2028 | | | | 607,198 | | | | (7,592 | ) |

| Citibank, N.A. | | TruGreen LP, 1M US L + 4.00 | | | 248,390 | | | 3M US L + 1.35% | | | 11/02/2027 | | | | 246,366 | | | | (2,024 | ) |

| Citibank, N.A. | | Unified Women’s Healthcare LP, 1M US L + 4.25 | | | 1,240,641 | | | 3M US L + 1.35% | | | 12/20/2027 | | | | 1,237,368 | | | | (3,273 | ) |

| Citibank, N.A. | | Watlow Electric Manufacturing Co., 3M US L + 3.75 | | | 1,054,969 | | | 3M US L + 1.35% | | | 03/02/2028 | | | | 1,044,155 | | | | (10,814 | ) |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 11 |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

March 31, 2022 (Unaudited)

TOTAL RETURN SWAP CONTRACTS(a) (continued)

| Counterparty | | Reference Entity/Obligation | | Notional

Amount | | | Fund Pays | | Termination

Date | | | Value | | | Net Unrealized

Appreciation | |

| Citibank, N.A. | | WW International, Inc., 1M US L + 3.50 | | $ | 1,171,997 | | | 3M US L + 1.35% | | | 04/13/2028 | | | $ | 1,073,368 | | | $ | (98,630 | ) |

| Citibank, N.A. | | Xperi Holding Corp., 1M US L + 3.50 | | | 970,125 | | | 3M US L + 1.35% | | | 06/08/2028 | | | | 965,372 | | | | (4,753 | ) |

| Citibank, N.A. | | Zelis Payments Buyer, Inc., 1M US L + 3.50 | | | 992,487 | | | 3M US L + 1.35% | | | 09/30/2026 | | | | 986,667 | | | | (5,820 | ) |

| | | | | $ | 49,872,262 | | | | | | | | | $ | 49,334,916 | | | $ | (537,346 | ) |

| TOTAL | | | | $ | 67,330,393 | | | | | | | | | $ | 66,878,405 | | | $ | (451,988 | ) |

| (a) | The Fund's interest in the total return swap transactions are held through a wholly-owned subsidiary of the Fund, RACR-FS, LLC, a Delaware Limited Liability Company. |

| (b) | Security is classified as Level 3 in the Fund's fair value hierarchy (see Note 2). |

See Notes to Consolidated Financial Statements.

| 12 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Statement of Assets and Liabilities |

March 31, 2022 (Unaudited)

ASSETS

| Investments, at fair value (Cost $141,491,369) | | $ | 140,918,154 | |

| Affiliated investments, at fair value (Cost $57,378,734) | | | 63,517,492 | |

| Cash | | | 202,649 | |

| Receivable for shares sold | | | 8,174,917 | |

| Cash collateral for total return swaps | | | 17,500,930 | |

| Interest receivable | | | 992,199 | |

| Due from Advisor | | | 144,311 | |

| Prepaid expenses and other assets | | | 794,865 | |

| Unrealized appreciation on total return swap contracts | | | 85,358 | |

| Total Assets | | | 232,330,875 | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 24,232,998 | |

| Unrealized depreciation on total return swap contracts | | | 537,346 | |

| Professional fees payable | | | 463,358 | |

| Administration fees payable (Note 7) | | | 167,904 | |

| Trustees' fees payable (Note 7) | | | 178,380 | |

| Line of credit interest payable (Note 6) | | | 66,774 | |

| Custody fees payable | | | 36,127 | |

| Transfer agency fees payable (Note 7) | | | 16,502 | |

| Distribution fees payable (Note 7) | | | 5,428 | |

| Shareholder servicing fees payable (Note 7) | | | 2,390 | |

| Accrued expenses and other liabilities | | | 265,164 | |

| Total Liabilities | | | 25,972,371 | |

| NET ASSETS | | $ | 206,358,504 | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital | | $ | 202,199,938 | |

| Total distributable earnings | | | 4,158,566 | |

| NET ASSETS | | $ | 206,358,504 | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 13 |

| CIM Real Assets & Credit Fund | Consolidated Statement of Assets and Liabilities |

March 31, 2022 (Unaudited)

| PRICING OF SHARES | | | |

| Class A | | | | |

| Net assets | | $ | 2,769,686 | |

| Shares of beneficial interest outstanding (unlimited number of authorized shares, no par value common stock authorized) | | | 104,461 | |

| Net asset value | | $ | 26.51 | |

| Maximum offering price per share (Maximum sales load of 5.75%) | | $ | 28.13 | |

| Class C | | | | |

| Net assets | | $ | 8,952,865 | |

| Shares of beneficial interest outstanding (unlimited number of authorized shares, no par value common stock authorized) | | | 342,627 | |

| Net asset value(a) | | $ | 26.13 | |

| Maximum offering price per share | | $ | 26.13 | |

| Class I | | | | |

| Net assets | | $ | 194,143,224 | |

| Shares of beneficial interest outstanding (unlimited number of authorized shares, no par value common stock authorized) | | | 7,289,345 | |

| Net asset value | | $ | 26.63 | |

| Maximum offering price per share | | $ | 26.63 | |

| Class L | | | | |

| Net assets | | $ | 492,729 | |

| Shares of beneficial interest outstanding (unlimited number of authorized shares, no par value common stock authorized) | | | 18,682 | |

| Net asset value | | $ | 26.37 | |

| Maximum offering price per share (Maximum sales load of 4.25%) | | $ | 27.54 | |

| (a) | Subject to early-withdrawal charge. Redemption price varies based on length of time held (Note 2). |

See Notes to Consolidated Financial Statements.

| 14 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Statement of Operations |

For the Six Months Ended March 31, 2022 (Unaudited)

| | | | |

| INVESTMENT INCOME | | | |

| Interest income | | $ | 3,962,245 | |

| Dividend income from affiliated investments | | | 62,034 | |

| Total Investment Income | | | 4,024,279 | |

| | | | | |

| EXPENSES | | | | |

| Management fees (Note 7) | | | 972,804 | |

| Shareholder servicing fees (Note 7) | | | | |

| Class A | | | 2,071 | |

| Class C | | | 8,771 | |

| Class L | | | 316 | |

| Distribution fees (Note 7): | | | | |

| Class C | | | 26,314 | |

| Class L | | | 316 | |

| Networking fees | | | | |

| Class I | | | 128 | |

| Administration fees (Note 7) | | | 412,232 | |

| Professional fees | | | 586,414 | |

| Trustees' fees (Note 7) | | | 93,750 | |

| Custody fees | | | 50,124 | |

| Interest expense (Note 6) | | | 49,590 | |

| State registration fees | | | 46,236 | |

| Printing fees | | | 21,104 | |

| Transfer agency fees (Note 7) | | | 8,044 | |

| Insurance fees | | | 5,313 | |

| Other expenses | | | 45,863 | |

| Total Expenses | | | 2,329,390 | |

| Expenses reimbursed by Adviser (Note 6) | | | (774,445 | ) |

| Net Expenses | | | 1,554,945 | |

| Net Investment Income | | | 2,469,334 | |

| Net realized gain on investments | | | 84,322 | |

| Net realized gain on total return swap contracts | | | 6,550 | |

| Net change in unrealized depreciation on investments | | | (1,570,785 | ) |

| Net change in unrealized appreciation on affiliated investments | | | 4,345,970 | |

| Net change in unrealized depreciation on total return swap contracts | | | (582,155 | ) |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 2,283,902 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 4,753,236 | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 15 |

| CIM Real Assets & Credit Fund | Consolidated Statements of Changes in Net Assets |

| | | For the Six Months Ended March 31, 2022 (Unaudited) | | | For the Year Ended September 30, 2021 | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 2,469,334 | | | $ | 1,383,257 | |

| Net realized gain on investments and total return swap contracts | | | 90,872 | | | | 591,951 | |

| Net change in unrealized appreciation on investments, affiliated investments and total return swap contracts | | | 2,193,030 | | | | 2,815,961 | |

| Net Increase in Net Assets Resulting from Operations | | | 4,753,236 | | | | 4,791,169 | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Class A | | | | | | | | |

| From distributable earnings | | | (46,552 | ) | | | (19,335 | ) |

| From return of capital | | | – | | | | (2,567 | ) |

| Class C | | | | | | | | |

| From distributable earnings | | | (202,123 | ) | | | (114,325 | ) |

| From return of capital | | | – | | | | (15,123 | ) |

| Class I | | | | | | | | |

| From distributable earnings | | | (3,479,852 | ) | | | (1,632,251 | ) |

| From return of capital | | | – | | | | (215,419 | ) |

| Class L | | | | | | | | |

| From distributable earnings | | | (6,915 | ) | | | (5,398 | ) |

| From return of capital | | | – | | | | (690 | ) |

| Net Decrease in Net Assets from Distributions to Shareholders | | | (3,735,442 | ) | | | (2,005,108 | ) |

| BENEFICIAL INTEREST TRANSACTIONS | | | | | | | | |

| Class A | | | | | | | | |

| Shares sold | | | 1,613,210 | | | | 983,730 | |

| Distributions reinvested | | | 21,944 | | | | 8,506 | |

| Class C | | | | | | | | |

| Shares sold | | | 2,872,750 | | | | 5,163,048 | |

| Distributions reinvested | | | 125,609 | | | | 62,377 | |

| Shares redeemed, net of redemption fees (Note 2) | | | (21,133 | ) | | | – | |

| Class I | | | | | | | | |

| Shares sold | | | 113,097,618 | | | | 72,175,473 | |

| Distributions reinvested | | | 1,154,098 | | | | 690,753 | |

| Shares redeemed | | | (2,331,999 | ) | | | (475,852 | ) |

| Class L | | | | | | | | |

| Shares sold | | | 383,000 | | | | – | |

| Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 116,915,097 | | | | 78,608,035 | |

| Net increase in net assets | | | 117,932,891 | | | | 81,394,096 | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 88,425,613 | | | | 7,031,517 | |

| End of period | | $ | 206,358,504 | | | $ | 88,425,613 | |

See Notes to Consolidated Financial Statements.

| 16 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Statements of Changes in Net Assets |

| | | For the Six Months Ended March 31, 2022 (Unaudited) | | | For the Year Ended September 30, 2021 | |

| Other Information | | | | | | | | |

| BENEFICIAL INTEREST TRANSACTIONS, IN SHARES | | | | | | | | |

| Class A | | | | | | | | |

| Beginning shares | | | 42,619 | | | | 4,000 | |

| Shares sold | | | 61,009 | | | | 38,289 | |

| Distributions reinvested | | | 833 | | | | 330 | |

| Net increase in shares outstanding | | | 61,842 | | | | 38,619 | |

| Ending shares | | | 104,461 | | | | 42,619 | |

| Class C | | | | | | | | |

| Beginning shares | | | 228,241 | | | | 22,786 | |

| Shares sold | | | 110,357 | | | | 203,009 | |

| Distributions reinvested | | | 4,840 | | | | 2,446 | |

| Shares redeemed | | | (811 | ) | | | – | |

| Net increase in shares outstanding | | | 114,386 | | | | 205,455 | |

| Ending shares | | | 342,627 | | | | 228,241 | |

| Class I | | | | | | | | |

| Beginning shares | | | 3,060,662 | | | | 248,515 | |

| Shares sold | | | 4,274,003 | | | | 2,803,647 | |

| Distributions reinvested | | | 43,723 | | | | 26,871 | |

| Shares redeemed | | | (89,043 | ) | | | (18,371 | ) |

| Net increase in shares outstanding | | | 4,228,683 | | | | 2,812,147 | |

| Ending shares | | | 7,289,345 | | | | 3,060,662 | |

| Class L | | | | | | | | |

| Beginning shares | | | 4,000 | | | | 4,000 | |

| Shares sold | | | 14,682 | | | | – | |

| Net increase in shares outstanding | | | 14,682 | | | | – | |

| Ending shares | | | 18,682 | | | | 4,000 | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 17 |

| CIM Real Assets & Credit Fund | Consolidated Statement of Cash Flows |

For the Six Months Ended March 31, 2022 (Unaudited)

| Cash Flows from Operating Activities: | | | |

| Net increase in net assets resulting from operations | | $ | 4,753,236 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchase of investments | | | (95,927,392 | ) |

| Purchase of affiliated investments | | | (18,834,951 | ) |

| Proceeds from sale of investments | | | 6,275,804 | |

| Amortization of premium and accretion of discount on investments | | | (240,922 | ) |

| Net realized gains on investments | | | (84,322 | ) |

| Net realized gain on total return swaps | | | (6,550 | ) |

| Net changed in unrealized depreciation on investments | | | 1,570,785 | |

| Net changed in unrealized appreciation on affiliated investments | | | (4,345,970 | ) |

| Total return swap contracts | | | 582,155 | |

| (Increase)/Decrease in assets: | | | | |

| Interest receivable | | | (535,252 | ) |

| Receivable due from Adviser | | | (140,150 | ) |

| Prepaid expenses and other assets | | | (756,212 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Professional fees payable | | | 206,523 | |

| Administration fees payable | | | 82,500 | |

| Transfer agency fees payable | | | (1,610 | ) |

| Custody fees payable | | | 29,156 | |

| Trustees' fees payable | | | 93,750 | |

| Distribution fees payable | | | (1,249 | ) |

| Shareholder servicing fees payable | | | (245 | ) |

| Accrued expenses and other liabilities | | | 123,003 | |

| Interest due on loan payable | | | 66,774 | |

| Net cash used in operating activities | | | (107,091,139 | ) |

| | | | | |

| Cash Flows from Financing Activities: | | | | |

| Proceeds from sale of shares | | | 110,301,922 | |

| Cost of shares redeemed | | | (2,353,132 | ) |

| Cash distributions paid | | | (2,433,791 | ) |

| Net cash provided by financing activities | | | 105,514,999 | |

| | | | | |

| Net change in cash & cash equivalents | | | (1,576,140 | ) |

| | | | | |

| Cash & cash equivalents, beginning of period | | | 19,279,719 | |

| Cash & cash equivalents, end of period | | | 17,703,579 | |

| | | | | |

| Non-cash financing activities not included herein consist of reinvestment of distributions of: | | | 1,301,651 | |

| | | | | |

| RECONCILIATION OF RESTRICTED AND UNRESTRICTED CASH AT THE BEGINNING OF YEAR TO THE STATEMENT OF ASSETS AND LIABILITIES | | | | |

| Cash | | $ | 6,732,517 | |

| Cash collateral for total return swaps | | $ | 12,547,202 | |

| RECONCILIATION OF RESTRICTED AND UNRESTRICTED CASH AT THE END OF YEAR TO THE STATEMENT OF ASSETS AND LIABILITIES | | | | |

| Cash | | $ | 202,649 | |

| Cash collateral for total return swaps | | $ | 17,500,930 | |

See Notes to Consolidated Financial Statements.

| 18 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| Class A | | For the Six Months Ended March 31, 2022 (Unaudited) | | | For the Year Ended September 30, 2021 | | | For the Period May 5, 2020 (Commencement of Operations) to September 30, 2020 | |

| Net asset value, beginning of period | | $ | 26.45 | | | $ | 25.16 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income(a) | | | 0.46 | | | | 0.91 | | | | 0.20 | |

| Net realized and unrealized gain | | | 0.38 | | | | 1.91 | | | | 0.46 | |

| Total from investment operations | | | 0.84 | | | | 2.82 | | | | 0.66 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS | | | | | | | | | | | | |

| From net investment income | | | (0.37 | ) | | | (0.99 | ) | | | (0.50 | ) |

| From net realized gain on investments | | | (0.03 | ) | | | (0.36 | ) | | | – | |

| Return of capital | | | (0.38 | ) | | | (0.18 | ) | | | – | |

| Total distributions | | | (0.78 | ) | | | (1.53 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net increase in net asset value | | | 0.06 | | | | 1.29 | | | | 0.16 | |

| Net asset value, end of period | | $ | 26.51 | | | $ | 26.45 | | | $ | 25.16 | |

| TOTAL RETURN(b) | | | 3.23 | % | | | 11.60 | % | | | 2.67 | % |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 2,770 | | | $ | 1,127 | | | $ | 101 | |

| | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 3.71 | %(c) | | | 9.94 | % | | | 45.26 | %(c) |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | | 2.50 | %(d) | | | 1.74 | %(e) | | | 1.00 | %(d)(e) |

| Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 3.51 | %(d) | | | 3.53 | % | | | 1.94 | %(d) |

| Portfolio turnover rate | | | 7 | %(f) | | | 122 | % | | | 1 | %(f) |

| (a) | Calculated using the average shares method. |

| (b) | Total returns have not been annualized and do not reflect the impact of sales load. Total returns would have been lower had certain expenses not been waived or reimbursed during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| (c) | These ratios to average net assets have been annualized except for the non-recurring offering and organizational expenses which have not been annualized. |

| (e) | The Adviser waived the management fees from commencement of operations May 5, 2020 to June 30, 2021. Without this waiver the net expense ratio would have been 2.50% |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 19 |

| CIM Real Assets & Credit Fund | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| Class C | | For the Six Months Ended March 31, 2022 (Unaudited) | | | For the Year Ended September 30, 2021 | | | For the Period May 5, 2020 (Commencement of Operations) to September 30, 2020 | |

| Net asset value, beginning of period | | $ | 26.16 | | | $ | 25.08 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income(a) | | | 0.37 | | | | 0.70 | | | | 0.22 | |

| Net realized and unrealized gain | | | 0.37 | | | | 1.90 | | | | 0.36 | |

| Total from investment operations | | | 0.74 | | | | 2.60 | | | | 0.58 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS | | | | | | | | | | | | |

| From net investment income | | | (0.36 | ) | | | (0.98 | ) | | | (0.50 | ) |

| From net realized gain on investments | | | (0.02 | ) | | | (0.36 | ) | | | – | |

| Return of capital | | | (0.39 | ) | | | (0.18 | ) | | | – | |

| Total distributions | | | (0.77 | ) | | | (1.52 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net increase/(decrease) in net asset value | | | (0.03 | ) | | | 1.08 | | | | 0.08 | |

| Net asset value, end of period | | $ | 26.13 | | | $ | 26.16 | | | $ | 25.08 | |

| TOTAL RETURN(b) | | | 2.88 | % | | | 10.73 | % | | | 2.35 | % |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 8,953 | | | $ | 5,972 | | | $ | 572 | |

| | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 4.36 | %(c) | | | 11.49 | % | | | 44.33 | %(c) |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | | 3.25 | %(d) | | | 2.48 | %(e) | | | 1.75 | %(d)(e) |

| Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 2.83 | %(d) | | | 2.73 | % | | | 2.20 | %(d) |

| Portfolio turnover rate | | | 7 | %(f) | | | 122 | % | | | 1 | %(f) |

| (a) | Calculated using the average shares method. |

| (b) | Total returns have not been annualized. Total returns would have been lower had certain expenses not been waived or reimbursed during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| (c) | These ratios to average net assets have been annualized except for the non-recurring offering and organizational expenses which have not been annualized. |

| (e) | The Adviser waived the management fees from commencement of operations May 5, 2020 to June 30, 2021. Without this waiver the net expense ratio would have been 3.25%. |

See Notes to Consolidated Financial Statements.

| 20 | https://www.cimgroup.com/public-investment-programs/current-public-programs/racr |

| CIM Real Assets & Credit Fund | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| Class I | | For the Six Months Ended March 31, 2022 (Unaudited) | | | For the Year Ended September 30, 2021 | | | For the Period May 5, 2020 (Commencement of Operations) to September 30, 2020 | |

| Net asset value, beginning of period | | $ | 26.54 | | | $ | 25.18 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income(a) | | | 0.49 | | | | 0.99 | | | | 0.23 | |

| Net realized and unrealized gain | | | 0.38 | | | | 1.90 | | | | 0.45 | |

| Total from investment operations | | | 0.87 | | | | 2.89 | | | | 0.68 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS | | | | | | | | | | | | |

| From net investment income | | | (0.37 | ) | | | (0.99 | ) | | | (0.50 | ) |

| From net realized gain on investments | | | (0.03 | ) | | | (0.36 | ) | | | – | |

| Return of capital | | | (0.38 | ) | | | (0.18 | ) | | | – | |

| Total distributions | | | (0.78 | ) | | | (1.53 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net increase in net asset value | | | 0.09 | | | | 1.36 | | | | 0.18 | |

| Net asset value, end of period | | $ | 26.63 | | | $ | 26.54 | | | $ | 25.18 | |

| TOTAL RETURN(b) | | | 3.35 | % | | | 11.88 | % | | | 2.75 | % |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 194,143 | | | $ | 81,221 | | | $ | 6,259 | |

| | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 3.44 | %(c) | | | 9.98 | % | | | 44.53 | %(c) |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | | 2.25 | %(d) | | | 1.48 | %(e) | | | 0.75 | %(d)(e) |

| Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 3.76 | %(d) | | | 3.86 | % | | | 2.29 | %(d) |

| Portfolio turnover rate | | | 7 | %(f) | | | 122 | % | | | 1 | %(f) |

| (a) | Calculated using the average shares method. |

| (b) | Total returns have not been annualized. Total returns would have been lower had certain expenses not been waived or reimbursed during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| (c) | These ratios to average net assets have been annualized except for the non-recurring offering and organizational expenses which have not been annualized. |

| (e) | The Adviser waived the management fees from commencement of operations May 5, 2020 to June 30, 2021. Without this waiver the net expense ratio would have been 2.25%. |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2022 | 21 |

| CIM Real Assets & Credit Fund | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| Class L | | For the Six Months Ended March 31, 2022 (Unaudited) | | | For the Year Ended September 30, 2021 | | | For the Period May 5, 2020 (Commencement of Operations) to September 30, 2020 | |

| Net asset value, beginning of period | | $ | 26.35 | | | $ | 25.13 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income(a) | | | 0.42 | | | | 0.95 | | | | 0.17 | |

| Net realized and unrealized gain | | | 0.38 | | | | 1.79 | | | | 0.46 | |

| Total from investment operations | | | 0.80 | | | | 2.74 | | | | 0.63 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS | | | | | | | | | | | | |

| From net investment income | | | (0.37 | ) | | | (0.98 | ) | | | (0.50 | ) |

| From net realized gain on investments | | | (0.03 | ) | | | (0.36 | ) | | | – | |

| Return of capital | | | (0.38 | ) | | | (0.18 | ) | | | – | |

| Total distributions | | | (0.78 | ) | | | (1.52 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net increase in net asset value | | | 0.02 | | | | 1.22 | | | | 0.13 | |

| Net asset value, end of period | | $ | 26.37 | | | $ | 26.35 | | | $ | 25.13 | |

| TOTAL RETURN(b) | | | 3.08 | % | | | 11.31 | % | | | 2.55 | % |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 493 | | | $ | 105 | | | $ | 101 | |

| | | | | | | | | | | | | |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 4.03 | %(c) | | | 17.63 | % | | | 45.51 | %(c) |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | | 2.75 | %(d) | | | 1.59 | %(e) | | | 1.25 | %(d)(e) |

| Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 3.23 | %(d) | | | 3.73 | % | | | 1.68 | %(d) |

| Portfolio turnover rate | | | 7 | %(f) | | | 122 | % | | | 1 | %(f) |

| (a) | Calculated using the average shares method. |