UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23425

CIM Real Assets & Credit Fund

(Exact Name of Registrant as Specified in Charter)

4700 Wilshire Boulevard

Los Angeles, California 90010

(Address of Principal Executive Offices)

David Thompson

Chief Executive Officer

CIM Real Assets & Credit Fund

4700 Wilshire Boulevard

Los Angeles, California 90010

(Name and Address of Agent for Service)

Registrant’s Telephone Number, Including Area Code: (323) 860-4900

Date of fiscal year end: September 30

Date of reporting period: March 31, 2024

| Item 1. | Reports to Stockholders. |

(a)

| Shareholder Letter | 1 |

| Portfolio Update | 4 |

| Consolidated Schedule of Investments | 6 |

| Consolidated Statement of Assets and Liabilities | 14 |

| Consolidated Statement of Operations | 16 |

| Consolidated Statements of Changes in Net Assets | 17 |

| Consolidated Statement of Cash Flows | 19 |

| Consolidated Financial Highlights | |

| Class A | 20 |

| Class C | 21 |

| Class I | 22 |

| Class L | 23 |

| Consolidated Notes to Financial Statements | 24 |

| Additional Information | 44 |

| Board Approval of the Advisory Agreements | 46 |

| Privacy Policy | 47 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Important Notice Regarding Electronic Delivery

You may elect to receive shareholder reports and other communications from the Fund electronically. If you already elected to receive shareholder reports electronically, you do not need to take any action. If you own shares of the Fund through a financial intermediary, you may contact your financial intermediary to elect to receive materials electronically.

You may elect to receive all future reports in paper, free of charge. If you own shares of the Fund through a financial intermediary, you may contact your financial intermediary to elect to receive paper copies of your shareholder reports. If you make such an election through your financial intermediary, your election to receive reports in paper may apply to all funds held through your financial intermediary.

This information is available free of charge by contacting us by mail at 4700 Wilshire Boulevard, Los Angeles, CA, 90010, by telephone at (866) 907-2653 or on our website at https://www.cimgroup.com/public-investment-programs/current-public-programs/racr.

Dear Shareholders,

We are pleased to provide you with the 2024 semi-annual report for CIM Real Assets & Credit Fund (“we,” “us,” “our,” “CIM RACR,” or the “Fund”). CIM RACR is a continuously-offered, closed-end interval fund registered under the Investment Company Act of 1940, as amended. The Fund primarily invests in credit (of both real assets and corporates) and real estate equity.

In April 2024, our Board of Trustees declared monthly cash dividends representing an annualized distribution rate1 of 8.5% of net asset value per share (as of the close of business on May 1, 2024). A portion of RACR’s distribution may be tax deferred whereas income from bonds and credit funds are typically 100% ordinary income and taxed at the highest rate.

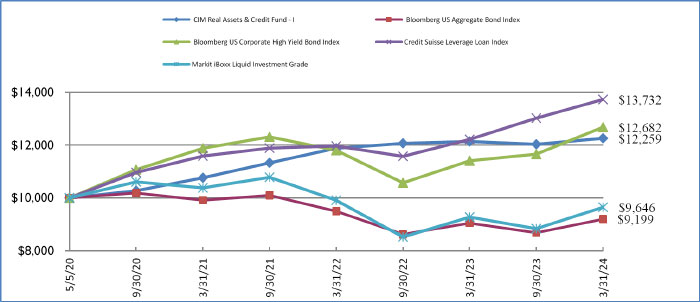

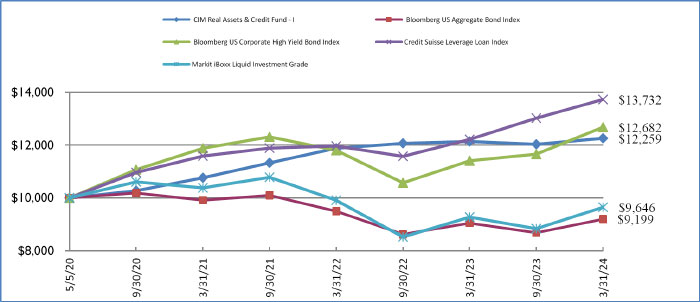

Since inception (May 4, 2020), RACR’s Class I Common Shares have generated an annualized return of 5.35%, as of March 31, 2024, and have outperformed widely followed income alternatives such as the Bloomberg US Aggregate Bond Index and The Markit iBoxx USD Liquid Investment Grade Index.2

RACR’s returns since inception have primarily been driven by interest income from our real estate debt and corporate credit investments.

We believe the Fund is well positioned for several reasons. We are primarily invested in floating rate credit investments that are generating significant interest income for the fund. And our multi-strategy approach makes us ideally positioned to capitalize on future opportunities in real estate. Real estate values have declined due to a sharp increase in interest rates. As a result, many real estate owners may require additional capital to extend their debt maturities. This dynamic may create an opportunity to invest in high quality assets that have too much leverage. RACR’s mandate allows it to shift its allocation to these potential higher return opportunities as they arise, while our existing credit portfolio can be used as a source of capital to make these investments.

Fund Overview

The Fund’s investment objective is to generate current income through cash distributions and preserve shareholders’ capital across various market cycles, with a secondary objective of capital appreciation. However, there can be no assurance that the Fund will achieve its investment objective.

The Fund seeks to provide shareholders with income and capital appreciation, with lower volatility and correlation to the broader equity markets and other widely used income alternatives. We believe our real asset equity allocation may reduce volatility and correlation, while creating the potential for appreciation as well as allowing for the Fund to generate income used to pay distributions. This real asset equity allocation may also create the potential for tax deferred distributions for shareholders. Real estate investments generate tax depreciation expenses. These tax depreciation expenses can be used to reduce the taxable income generated from credit investments, resulting in a lower current year taxable income.

The Fund’s innovative structure allows it to directly invest in real estate rather than private funds of other managers, and thus avoiding multiple layers of fees. To promote further alignment with other funds managed by affiliates of CIM Group, LLC (“CIM”) and OFS Capital Management, LLC (the “OFS Sub-Adviser” or “OFS”), the Fund has obtained exemptive relief from the U.S. Securities and Exchange Commission (“SEC”) that allows it to co- invest alongside funds managed by affiliates of CIM and OFS, in accordance with the conditions specified in the exemptive relief. The Fund seeks to provide investors with exposure to proprietary transactions, alongside large, sophisticated institutions, that otherwise may not be available to retail investors and that may have high investment minimums.

About the Advisor

CIM Capital IC Management, LLC (the “Adviser”), registered as an investment adviser with the SEC under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), acts as the Fund’s investment adviser and is primarily responsible for determining the amount of the Fund’s total assets that are allocated to each of the Fund’s sub-advisers. The Adviser has engaged each of CIM Capital SA Management, LLC (the “CIM Sub-Adviser”) and the OFS Sub-Adviser, each a SEC-registered investment adviser, to act as an investment sub-adviser to the Fund. The CIM Sub-Adviser is responsible for identifying and sourcing investment opportunities with respect to investments in real assets held by the Fund. The OFS Sub-Adviser is responsible for identifying and sourcing credit and credit-related investment opportunities.

CIM is a vertically-integrated owner and operator of real assets for its own account and on behalf of its partners and co-investors, seeking exposure to real assets and associated credit strategies, with a principal focus on metropolitan areas across the Americas. Since inception, CIM, on behalf of itself and over 200 institutional partners and co-investors, has operated over 300 discretionary real estate and real estate-related equity, debt and infrastructure holdings (excluding net-lease).3 As of December 31, 2023, CIM owns and operates approximately $29.2 billion of assets4 across its products and has deployed assets for its Principals, partners and co- investors, which include U.S. and Non-U.S. public and corporate pension funds, endowments, foundations, sovereign wealth funds and other institutional and private partners and co-investors since 2000. As of December 31, 2023, CIM has over 1,000 employees and more than 600 professionals and 9 corporate offices worldwide. CIM also maintains additional offices across the United States as well as in Korea to support its platform.

OFS is a full- service provider of capital and levered financial solutions with $4.0 billion in assets under management as of March 31, 2024, with a focus on middle market lending, broadly syndicated loans, and structured credit. OFS serves as the investment adviser to business development companies, registered closed-end funds, and separately managed, proprietary and sub-advised accounts, as well as the collateral manager to various collateralized loan obligations.

Thank you for your investment in CIM RACR. If you have any questions, please contact the CIM Shareholder Relations team at 866.907.2653. We look forward to continuing our relationship in the years to come.

Sincerely,

Steve Altebrando

1st Vice President, Portfolio Oversight

David Thompson

Chief Executive Officer

| 1. | Based on current estimates, the Fund expects a portion of the distributions to be a return of capital. |

| 2. | The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principle value of an investment will fluctuate so that an investor’s shares, when sold or repurchased, may be worth more or less than the original cost. The current performance may be lower or higher than performance data quoted. The indices shown are for informational purposes only and are not reflective of any investment. Investors cannot invest directly in an index, and unmanaged index returns do no reflect any fees, expenses or sales charges. |

| 3. | As of December 31, 2023 |

| 4. | “Assets Owned and Operated” represents the aggregate assets owned and operated by CIM on behalf of partners (including where CIM Group contributes alongside for its own account) and co-investors, whether or not CIM has discretion, in each case without duplication. |

Forward-Looking Statements

Statements in this letter regarding management’s future expectations, beliefs, intentions, goals, strategies, plans or prospects, including statements relating management’s belief that CIM RACR will benefit from CIM Group’s combined real assets, credit and transaction experience and deal- sourcing capabilities; the composition of CIM RACR’s portfolio of real assets and corporate credit assets and the potential benefits to investors, which may not be realized; opportunities for individuals to invest alongside institutional partners, and whether those opportunities will align the interests among sponsors, partners and shareholders; and other factors may constitute forward-looking statements for purposes of the safe harbor protection under applicable securities laws. Forward-looking statements can be identified by terminology such as “anticipate,” “believe,” “could,” “could increase the likelihood,” “estimate,” “expect,” “intend,” “is planned,” “may,” “should,” “will,” “will enable,” “would be expected,” “look forward,” “may provide,” “would” or similar terms, variations of such terms or the negative of those terms. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, including rising inflation and interest rates, the risk of recession, the ongoing war between Russia and Ukraine, the escalated conflict in the Middle East, supply chain disruptions, resource shortages, significant market volatility on our business, our industry, and the global economy, and those risks, uncertainties and factors referred to in CIM RACR’s Prospectus filed with the SEC under the section “Risks” and other documents that may be filed by CIM RACR from time to time with the SEC. As a result of such risks, uncertainties and factors, actual results may differ materially from any future results, performance or achievements discussed in or implied by the forward-looking statements contained herein. CIM RACR is providing the information in this letter as of this date and assumes no obligations to update the information included in this letter or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| CIM Real Assets & Credit Fund | Portfolio Update |

| | March 31, 2024 (Unaudited) |

| | |

Performance as of March 31, 2024

| CIM Real Assets & Credit Fund | 1 Month | 6 Months | 1 Year | Annualized

3 Year | Annualized

Since

Inception |

| CIM Real Assets & Credit Fund - A-NAV | 0.30% | 1.78% | 0.71% | 4.17% | 5.10% |

| CIM Real Assets & Credit Fund - A-Load | (5.49)% | (4.06)% | (5.08)% | 2.13% | 3.51% |

| CIM Real Assets & Credit Fund - C-NAV | 0.24% | 1.63% | 0.04% | 3.43% | 4.34% |

| CIM Real Assets & Credit Fund - I-NAV | 0.30% | 1.89% | 0.97% | 4.42% | 5.35% |

| CIM Real Assets & Credit Fund - L-NAV | 0.29% | 1.75% | 0.48% | 3.90% | 4.83% |

| CIM Real Assets & Credit Fund - L-Load | (3.98)% | (2.58)% | (3.79)% | 2.41% | 3.67% |

| Bloomberg US Aggregate Bond Index (a) | 0.92% | 5.99% | 1.70% | (2.46)% | (2.11)% |

| Bloomberg US Corporate High Yield Bond Index (b) | 1.18% | 8.75% | 11.15% | 2.19% | 6.27% |

| Credit Suisse Leveraged Loan Index (c) | 0.83% | 5.45% | 12.40% | 5.82% | 8.43% |

| Markit iBoxx Liquid Investment Grade Index (d) | 1.59% | 9.16% | 4.04% | (2.40)% | (0.91)% |

| | | | | | |

Comparison of the Change in Value of a $10,000 Investment

| (a) | Bloomberg US Aggregate Bond Index is a broad based flagship benchmark that measures the investment grade, US dollar (“USD”)-denominated, fixed-rate taxable bond market. The index includes treasuries, government-related and corporate securities, fixed-rate agency mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities (“CMBS”) (agency and non-agency). |

| (b) | The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indices’ EM country definition, are excluded. |

| (c) | The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the USD-denominated leveraged loan market. New loans are added to the index on their effective date if they qualify according to the following criteria: (i) loans must be rated “5B” or lower; (ii) only fully-funded term loans are included; (iii) the tenor must be at least one year; and (iv) the Issuers must be domiciled in developed countries (issuers from developing countries are excluded). Loans are removed from the index when they are upgraded to investment grade, or when they exit the market (for example, at maturity, refinancing or bankruptcy workout). Note that issuers remain in the index following default. |

| (d) | The Markit iBoxx USD Liquid Investment Grade Index is designed to reflect the performance of USD denominated investment grade corporate debt. The index rules aim to offer a broad coverage of the USD investment grade liquid bond universe. The index is market-value weighted with an issuer cap of 3%. |

Index performance is shown for illustrative purposes only as (i) all indices referenced above are unmanaged, (ii) index performance does not reflect the expenses associated with active management of an actual portfolio, (iii) the composition of each of the indices differs signficantly significantly from that of the portfolio of the Fund and (iv) investors cannot invest directly in an index. The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principalle value of an investment will fluctuate so that an investor’s shares, when sold or repurchased, may be worth more or less than the original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on any fund distributions or the sale of fund shares. The current performance may be lower or higher than performance data quoted. Please visit the Fund’s website at https://www.cimgroup.com/public-investment-programs/current-public-programs/racr for performance data current to the most recent month-end.

| CIM Real Assets & Credit Fund | Portfolio Update |

| | March 31, 2024 (Unaudited) |

| | |

| Top Ten Long Holdings as of March 31, 2024 |

| |

| Sora Multifamily Residential Property | 7.6% |

| EPIC Dallas | 5.0% |

| Del Mar Terrace - Phoenix, AZ | 4.9% |

| Society Las Olas - PMG Greybook Riverfront I LLC | 3.3% |

| Elevation CLO 2022-16, Ltd., Class E | 3.0% |

| Extended Stay America Trust 2021-ESH, Class F | 3.0% |

| IENTC 2, LLC Delayed Draw Term Loan B-1 | 2.7% |

| IENTC 1, LLC | 2.6% |

| WMRK Commercial Mortgage Trust 2022-WMRK, Class E | 2.5% |

| Regatta XXII Funding, Ltd., Class E | 2.3% |

| | 36.9% |

| | |

| Portfolio Composition as of March 31, 2024 | |

| | |

| Collateralized Loan Obligations | 31.35% |

| Direct Real Estate | 25.00% |

| Commercial Mortgage-Backed Securities | 20.60% |

| Bank Loans | 18.18% |

| Real Estate-Related Loans and Securities | 9.46% |

| Common Stock | 3.29% |

| Warrants | 0.01% |

| Cash, Cash Equivalents, & Other Net Assets | -7.89% |

| | 100.00% |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

| | March 31, 2024 (Unaudited) |

| Cost Basis $ | | | | | | | | | | | Fair Value | |

| | | | | Common Stock - 3.29% | | | | | | | | | | |

| | | | | Private - 2.75% | | | | | | | | | | |

| | 212,208 | | | Avison Young Common Equity (a) | | | | | | | | $ | — | |

| | 213,549 | | | Avison Young Pref. Equity (a) | | | | | | | | | — | |

| | 580,645 | | | Boca Homecare Holdings, Inc. (Equity) (a),(b),(c),(e) | | | | | | | | | 330,910 | |

| | 155,086 | | | CGA Holdings, Inc., Class A (a),(b),(c) | | | | | | | | | 157,890 | |

| | 3,772,723 | | | IENTC 1, LLC (a),(c),(d),(e) | | | | | | | | | 7,893,180 | |

| | | | | | | | | | | | | | 8,381,980 | |

| | | | | | | | | | | | | | | |

| Shares | | | | | | | | | | | | | |

| | | | Real Estate Investment Trust - 0.54% | | | | | | | | | | |

| | 388,344 | | | Creative Media & Community Trust Corp. (f) | | | | | | | | | 1,654,345 | |

| | | | | | | | | | | | | | | |

| | | | | Total Common Stock (Cost $7,772,487) | | | | | | | | | 10,036,325 | |

| | | | | | | | | | | | | | | |

| Principal | | | | | | | Coupon | | | | | | |

| Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | | | |

| | | | | Bank Loans - 18.18% | | | | | | | | | | |

| | | | | Consumer Non-Cyclical - 1.58% | | | | | | | | | | |

| | 1,026,443 | | | Baart Programs, Inc., Second Lien Term Loan (a),(g) | | 3M SOFR + 8.500% | | 14.152 | | 6/11/2028 | | | 1,026,443 | |

| | 500,000 | | | Bengal Debt Merger SUB, LLC Term Loan 1L (a),(g) | | 3M SOFR + 6.000% | | 11.490 | | 1/24/2030 | | | 409,843 | |

| | 378,788 | | | MedMark Services, Inc., Second Lien Term Loan (a),(g) | | 3M SOFR + 8.500% | | 14.152 | | 6/11/2028 | | | 378,788 | |

| | 2,962,500 | | | Spear Education Holdings, LLC Term A Loan (a),(b),(c),(g) | | 3M SOFR + 7.500% | | 13.040 | | 12/15/2027 | | | 2,992,125 | |

| | | | | | | | | | | | | | 4,807,199 | |

| | | | | Financial Services - 0.65% | | | | | | | | | | |

| | 1,992,365 | | | PSB Group, LLC, Term Loan (Last Out) - May 2023 (a),(b),(c),(g) | | 3M SOFR + 7.629% | | 13.263 | | 9/17/2026 | | | 1,986,388 | |

| | | | | | | | | | | | | | | |

| | | | | Financials - 0.16% | | | | | | | | | | |

| | 141,389 | | | Avison Young Canada, Inc., First Out Term Loan (a),(g) | | 3M SOFR + 7.500% | | 13.082 | | 3/13/2028 | | | 141,389 | |

| | 250,527 | | | Avison Young Canada, Inc., 2nd PIK Term Loan (a),(g) | | 3M SOFR + 8.000% | | 13.582 | | 3/12/2029 | | | 250,527 | |

| | 84,383 | | | Avison Young Canada, Inc., 3rd PIK Lien Term Loan (a),(g) | | 3M SOFR + 8.000% | | 13.582 | | 3/12/2029 | | | 84,383 | |

| | | | | | | | | | | | | | 476,299 | |

| | | | | Food Products - 0.23% | | | | | | | | | | |

| | 833,333 | | | BCPE North Star US Holdco 2, Inc. 2L Term Loan (a),(g) | | 3M SOFR + 7.250% | | 12.680 | | 6/8/2029 | | | 713,887 | |

| | | | | | | | | | | | | | | |

| | | | | Health Care Equipment & Supplies - 0.69% | | | | | | | | | | |

| | 163,043 | | | Kreg LLC, Revolver (a),(b),(c),(g),(h) | | 3M SOFR + 6.250% | | 0.500 | | 12/20/2026 | | | 151,304 | |

| | 2,103,389 | | | Kreg LLC, Term Loan (a),(b),(c),(g) | | 3M SOFR + 2.250% | | 12.209 | | 12/20/2026 | | | 1,951,945 | |

| | | | | | | | | | | | | | 2,103,249 | |

| | | | | Health Care Providers & Services - 7.63% | | | | | | | | | | |

| | 580,645 | | | Boca Home Care Holdings Revolver (a),(b),(c),(g),(h) | | 3M SOFR + 6.500% | | — | | 2/25/2027 | | | 563,806 | |

| | 4,905,000 | | | Boca Home Care Holdings, Inc Delayed Draw Term Loan (a),(b),(c),(g) | | 1M SOFR + 6.500% | | 11.930 | | 2/25/2027 | | | 4,762,755 | |

| | 881,148 | | | CVAUSA Management, LLC Primary Delayed Draw Term Loan (a),(b),(c),(g),(h) | | 3M SOFR + 6.500% | | — | | 5/22/2029 | | | 882,029 | |

| | 368,852 | | | CVAUSA Management, LLC Secondary Delayed Draw Term Loan (a),(b),(c),(g),(h) | | 3M SOFR + 6.500% | | — | | 5/22/2029 | | | 369,221 | |

| | 285,714 | | | CVAUSA Management, LLC, Revolver, Term Loan (a),(b),(c),(g),(h) | | 3M SOFR + 6.500% | | — | | 5/22/2028 | | | 285,714 | |

| | 2,453,033 | | | CVAUSA Management, LLC, Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.500% | | 11.914 | | 5/22/2029 | | | 2,455,486 | |

| | 709,308 | | | Honor HN Buyer, Inc. Delayed Draw Term Loan (a),(b),(c),(g),(h) | | 3M SOFR + 5.750% | | 11.290 | | 10/15/2027 | | | 709,308 | |

| | 132,013 | | | Honor HN Buyer, Inc. Revolver (a),(b),(c),(g),(h) | | Prime + 5.000% | | 13.250 | | 10/15/2027 | | | 132,013 | |

| | 1,121,693 | | | Honor HN Buyer, Inc. Term Loan (a),(b),(c),(g) | | 3M SOFR + 5.750% | | 11.290 | | 10/15/2027 | | | 1,121,693 | |

| | 788,062 | | | Honor HN Buyer, Inc. Term Loan 1st Amendment Health Network (a),(b),(c),(g) | | 6M SOFR + 6.000% | | 11.540 | | 10/15/2027 | | | 788,062 | |

| | 1,485,638 | | | MEDRINA, LLC Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.250% | | 11.670 | | 10/20/2029 | | | 1,473,753 | |

| | 297,872 | | | MEDRINA, LLC Delayed Draw Term Loan (a),(b),(c),(g),(h) | | 3M SOFR + 6.250% | | — | | 10/20/2029 | | | 295,489 | |

| | 212,766 | | | MEDRINA, LLC Revolver (a),(b),(c),(g),(h) | | 3M SOFR + 6.250% | | — | | 10/20/2029 | | | 211,064 | |

| | 333,333 | | | One GI Intermediate LLC, Revolver Upsize (a),(b),(c),(g) | | 3M SOFR + 6.750% | | 12.166 | | 12/22/2025 | | | 321,333 | |

| | 1,710,625 | | | One GI Intermediate LLC, Tranche B Delayed Draw Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.750% | | 12.166 | | 12/22/2025 | | | 1,649,043 | |

| | 901,450 | | | One GI Intermediate LLC, Tranche C Delayed Draw Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.750% | | 12.166 | | 12/22/2025 | | | 868,998 | |

| | 147,059 | | | Shiftkey, Revolver (a),(b),(c),(g),(h) | | 3M SOFR + 5.750% | | — | | 6/21/2027 | | | 143,971 | |

| | 2,311,765 | | | Shiftkey, Term Loan (a),(b),(c),(g) | | 3M SOFR + 5.750% | | 11.402 | | 6/21/2027 | | | 2,263,218 | |

| | 3,959,518 | | | Spectrum Vision Partners, LLC (a),(b),(c),(g) | | 3M SOFR + 6.500% | | 12.152 | | 11/18/2024 | | | 3,943,680 | |

| | | | | | | | | | | | | | 23,240,636 | |

| | | | | Hotels, Restaurants & Leisure - 1.46% | | | | | | | | | | |

| | 1,440,000 | | | SS Acquisition LLC, Delayed Draw Term Loan (a),(b),(c),(g) | | 3M SOFR + 7.591% | | 13.028 | | 12/30/2026 | | | 1,440,000 | |

| | 3,000,000 | | | SS Acquisition LLC, Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.751% | | 12.334 | | 12/30/2026 | | | 3,000,000 | |

| | | | | | | | | | | | | | 4,440,000 | |

| | | | | Household Durables - 0.02% | | | | | | | | | | |

| | 1,000,000 | | | Astro One Acquisition Corporation (a),(g) | | 3M SOFR + 8.50% | | 14.071 | | 9/14/2029 | | | 60,000 | |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

| | March 31, 2024 (Unaudited) (Continued) |

| Principal | | | | | | | Coupon | | | | | |

| Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | Bank Loans - 18.18% (Continued) | | | | | | | | | | |

| | | | | Industrial - 1.18% | | | | | | | | | | |

| | 57,737 | | | AIDC Intermediate Co. 2, LLC, Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.250% | | 11.713 | | 7/22/2027 | | $ | 58,314 | |

| | 2,468,750 | | | AIDC Intermediate Co 2, Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.250% | | 11.719 | | 7/22/2027 | | | 2,493,438 | |

| | 1,097,499 | | | Energy Acquisition LP, Second Lien Initial Term Loan (a),(g) | | 3M SOFR + 8.500% | | 13.927 | | 6/26/2026 | | | 1,053,599 | |

| | | | | | | | | | | | | | 3,605,351 | |

| | | | | Services - 2.78% | | | | | | | | | | |

| | 4,254,348 | | | 24 Seven, Inc., Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.000% | | 11.320 | | 11/16/2027 | | | 4,160,752 | |

| | 999,970 | | | Convergint Technologies LLC, Second Lien Term Loan (a),(g) | | 3M SOFR + 6.750% | | 12.180 | | 3/30/2029 | | | 938,722 | |

| | 3,439,146 | | | EOS-Metasource Intermediate, Inc., Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.250% | | 11.681 | | 5/17/2027 | | | 3,370,363 | |

| | | | | | | | | | | | | | 8,469,837 | |

| | | | | Technology - 1.34% | | | | | | | | | | |

| | 2,977,500 | | | Exponential Power, Inc., Term Loan (a),(b),(c),(g) | | 3M SOFR + 6.500% | | 12.150 | | 5/12/2026 | | | 2,301,608 | |

| | 800,000 | | | Redstone HoldCo 2 LP, Second Lien Initial Term Loan (a),(g) | | 3M SOFR + 7.750% | | 13.183 | | 4/27/2029 | | | 481,332 | |

| | 326,350 | | | RumbleON, Inc. Delay Draw Term Loan (a),(b),(c),(g) | | 3M SOFR + 8.250% | | 8.750 | | 8/31/2026 | | | 303,021 | |

| | 1,081,395 | | | RumbleON, Inc. Term Loan (a),(b),(c),(g) | | 3M SOFR + 8.750% | | 8.250 | | 8/31/2026 | | | 1,006,186 | |

| | | | | | | | | | | | | | 4,092,147 | |

| | | | | Transportation - 0.46% | | | | | | | | | | |

| | 2,156,707 | | | Reception Purchaser, LLC (a),(g) | | 3M SOFR + 6.000% | | 11.540 | | 3/24/2028 | | | 1,412,643 | |

| | | | | | | | | | | | | | | |

| | | | | Total Bank Loans (Cost $58,426,513) | | | | | | | | | 55,407,636 | |

| | | | | | | | | | | | | | | |

| | | | | Collateralized Loan Obligations - Debt - 23.84% | | | | | | | | | | |

| | 1,000,000 | | | Allegro CLO XII, Ltd., Class E (b),(g),(i) | | 3M SOFR+ 7.100% | | 12.679 | | 1/21/2032 | | | 1,003,565 | |

| | 4,000,000 | | | Atlas Senior Loan Fund XX, Ltd., Class (b),(g),(i) | | 3M SOFR + 9.430% | | 14.740 | | 10/19/2035 | | | 4,180,075 | |

| | 1,000,000 | | | Barings Middle Market CLO, Ltd. 2021-I, Class D (g),(i) | | 3M SOFR+ 8.650% | | 14.229 | | 7/20/2033 | | | 990,740 | |

| | 2,500,000 | | | Birch Grove CLO 6 Ltd Series 6A E (b),(g),(i) | | 3M SOFR + 8.930% | | 14.248 | | 7/7/2035 | | | 2,565,963 | |

| | 430,442 | | | Brightwood Capital MM CLO 2023-1A D Ltd (g),(i) | | 3M SOFR + 6.460% | | 11.861 | | 10/15/2035 | | | 431,242 | |

| | 1,003,974 | | | Brightwood Capital MM CLO 2023-1A E Ltd (g),(i) | | 3M SOFR + 10.360% | | 15.761 | | 10/15/2035 | | | 1,000,886 | |

| | 4,250,000 | | | Carlyle US CLO 2022-4, Ltd., Class E (g),(i) | | 3M SOFR + 8.150% | | 13.475 | | 7/22/2034 | | | 4,283,165 | |

| | 2,000,000 | | | CGMS 2022-6A E Class E-R (g),(i) | | 3M SOFR + 7.900% | | 13.225 | | 10/25/2036 | | | 2,011,845 | |

| | 5,285,000 | | | CFIP CLO 2017-1, Ltd., Class ER (g),(i) | | 3M SOFR+ 7.300% | | 12.860 | | 10/18/2034 | | | 5,154,602 | |

| | 9,100,000 | | | Elevation CLO 2022-16, Ltd., Class E (g),(i) | | 3M SOFR + 8.300% | | 13.625 | | 7/25/2034 | | | 9,180,737 | |

| | 3,000,000 | | | Empower CLO 2022-1, Ltd., Class D (b),(g),(i) | | 3M SOFR + 5.500% | | 10.825 | | 4/25/2036 | | | 3,044,280 | |

| | 1,000,000 | | | Empower CLO 2023-1, Ltd., Class E (g),(i) | | 3M SOFR + 8.550% | | 13.868 | | 10/20/2034 | | | 1,022,966 | |

| | 500,000 | | | Flatiron CLO 20, Ltd., Class E (g),(i) | | 3M SOFR+ 7.850% | | 13.431 | | 11/20/2033 | | | 508,316 | |

| | 500,000 | | | Flatiron CLO 20-1A, Ltd., Class ER (g),(i) | | 3M SOFR + 6.400% | | 0.000 | | 5/20/2036 | | | 500,000 | |

| | 2,000,000 | | | Ivy Hill Middle Market Credit Fund XVIII, Ltd., Class E (g),(i) | | 3M SOFR+ 7.750% | | 13.329 | | 4/22/2033 | | | 1,891,677 | |

| | 1,250,000 | | | LCM 31, Ltd., Class E (g),(i) | | 3M SOFR + 7.08% | | 12.659 | | 1/20/2032 | | | 1,227,631 | |

| | 5,500,000 | | | LCM 38, Ltd., Class E (g),(i) | | 3M SOFR + 7.73% | | 13.044 | | 10/15/2036 | | | 5,499,908 | |

| | 2,500,000 | | | MCF CLO VII LLC, Class ER (g),(i) | | 3M SOFR + 9.150% | | 14.729 | | 7/20/2033 | | | 2,504,686 | |

| | 3,500,000 | | | Monroe Capital Mml CLO X, Ltd., Class ER (b),(g),(i) | | 3M SOFR + 8.750% | | 14.069 | | 5/20/2034 | | | 3,411,459 | |

| | 2,250,000 | | | Northwoods Capital 25, Ltd., Class E (g),(i) | | 3M SOFR + 7.140% | | 12.719 | | 7/20/2034 | | | 2,190,585 | |

| | 500,000 | | | OCP CLO 2020-20, Ltd., Class E (g),(i) | | 3M SOFR + 7.660% | | 13.251 | | 10/9/2033 | | | 504,033 | |

| | 3,000,000 | | | PennantPark CLO III, Ltd., Class E (g),(i) | | 3M SOFR + 8.140% | | 13.719 | | 10/22/2032 | | | 2,909,160 | |

| | 2,000,000 | | | PPMC 2022-6A Class E-R (g),(i) | | 3M SOFR + 8.960% | | 14.314 | | 1/20/2037 | | | 2,044,496 | |

| | 7,000,000 | | | Regatta XXII Funding, Ltd., Class E (b),(g),(i) | | 3M SOFR + 7.190% | | 12.606 | | 7/20/2035 | | | 6,937,399 | |

| | 2,800,000 | | | Sandstone Peak II Ltd 2023-2 (b),(g),(i) | | 3M SOFR + 8.790% | | 14.108 | | 7/20/2036 | | | 2,876,917 | |

| | 2,000,000 | | | Saratoga Investment Corp. CLO 2013-1, Ltd., Class F1R3 (g),(i) | | 3M SOFR+ 10.000% | | 15.579 | | 4/20/2033 | | | 1,732,897 | |

| | 500,000 | | | VCP CLO II, Ltd., Class E (b),(g),(i) | | 3M SOFR+ 8.400% | | 13.986 | | 4/15/2031 | | | 501,512 | |

| | 3,000,000 | | | Venture 45 CLO, Ltd., Class E (b),(g),(i) | | 3M SOFR + 7.700% | | 13.116 | | 7/20/2035 | | | 2,527,157 | |

| | | | | Total Collateralized Loan Obligations - Debt (Cost $71,222,531) | | | | | | | | | 72,637,899 | |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

| | March 31, 2024 (Unaudited) (Continued) |

| Principal | | | | | | | Coupon | | | | | |

| Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | Collateralized Loan Obligations - Equity - 7.51% | | | | | | | | | | |

| | 4,060,000 | | | Allegro CLO XV, Ltd., Class SUB (a),(b),(i),(j) | | | | 21.59 | | 7/20/2035 | | | 2,854,383 | |

| | 2,980,000 | | | Apex Credit CLO 2021, Ltd., Class SUB (a),(b),(i),(j) | | | | 21.61 | | 7/18/2034 | | | 1,932,232 | |

| | 3,000,000 | | | Atlas Senior Loan Fund XVII, Ltd., Class SUB (a),(b),(i),(j) | | | | 20.41 | | 10/20/2034 | | | 1,643,400 | |

| | 2,585,233 | | | Brightwood Capital MM CLO 2023-1A Sub1 Ltd (a),(b),(i),(j) | | | | 14.56 | | 10/15/2035 | | | 1,908,290 | |

| | 5,500,000 | | | Dryden 98 CLO, Ltd., Class SUB (a),(b),(i),(j) | | | | 18.82 | | 4/20/2035 | | | 3,921,775 | |

| | 3,750,000 | | | Elevation CLO 2021-15, Ltd., Class SUB (a),(b),(i),(j) | | | | 13.16 | | 1/5/2035 | | | 1,576,650 | |

| | 4,396,000 | | | Empower CLO 2024-1A SUB (a),(b),(i),(j) | | | | 15.07 | | 4/25/2037 | | | 3,412,043 | |

| | 250,000 | | | LCM 31, Ltd., Class INC (a),(b),(i),(j) | | | | 17.56 | | 1/20/2032 | | | 116,750 | |

| | 2,750,000 | | | Marble Point CLO XXI, Ltd., Class Inc (a),(b),(i),(j) | | | | 15.17 | | 10/17/2051 | | | 1,651,787 | |

| | 5,000,000 | | | Steele Creek CLO 2022-1, Ltd., Class SUB (a),(b),(i),(j) | | | | 23.59 | | 4/15/2035 | | | 3,286,164 | |

| | 2,300,000 | | | Trinitas CLO VIII, Ltd., Class SUB (a),(b),(i),(j) | | | | 7.33 | | 7/20/2117 | | | 567,525 | |

| | | | | Total Collateralized Loan Obligations - Equity (Cost $28,156,888) | | | | | | | | | 22,870,999 | |

| | | | | Commercial Mortgage-Backed Securities - 20.60% | | | | | | | | | | |

| | 391,000 | | | BPR Trust 2021-TY, Class D (g),(i) | | 1M SOFR + 2.464% | | 7.790 | | 9/15/2038 | | | 380,017 | |

| | 1,742,524 | | | BX Trust 2022-PSB, Class E (g),(i) | | 1M SOFR + 6.337% | | 11.662 | | 8/15/2039 | | | 1,760,199 | |

| | 3,485,048 | | | BX Trust 2022-PSB, Class F (g),(i) | | 1M SOFR + 7.333% | | 12.658 | | 8/15/2039 | | | 3,531,196 | |

| | 1,380,514 | | | BX Trust 2023-VLT2, Class C (g),(i) | | 1M SOFR + 4.176% | | 9.501 | | 6/15/2040 | | | 1,384,925 | |

| | 2,098,537 | | | BX Trust 2023-VLT2, Class D (g),(i) | | 1M SOFR + 4.774% | | 10.099 | | 6/15/2040 | | | 2,103,197 | |

| | 520,949 | | | BX Trust 2023-VLT2, Class E (g),(i) | | 1M SOFR + 5.871% | | 11.196 | | 6/15/2040 | | | 521,959 | |

| | 3,986,419 | | | Campus Drive Secured Lease-Backed Pass-Though Trust, Series C (a),(i) | | | | 6.912 | | 6/15/2058 | | | 2,459,620 | |

| | 4,500,000 | | | CXP Trust 2022-CXP1, Class E (g),(i) | | 1M SOFR + 4.545% | | 9.870 | | 12/15/2038 | | | 3,020,056 | |

| | 1,500,000 | | | CXP Trust 2022-CXP1, Class F (g),(i) | | 1M SOFR + 5.461% | | 10.787 | | 12/15/2038 | | | 465,469 | |

| | 182,851 | | | Extended Stay America Trust 2021-ESH, Class D (g),(i) | | 1M SOFR + 2.364% | | 7.682 | | 7/15/2038 | | | 181,159 | |

| | 2,834,193 | | | Extended Stay America Trust 2021-ESH, Class E (g),(i) | | 1M SOFR + 2.964% | | 8.282 | | 7/15/2038 | | | 2,811,151 | |

| | 9,024,756 | | | Extended Stay America Trust 2021-ESH, Class F (g),(i) | | 1M SOFR + 3.814% | | 9.132 | | 7/15/2038 | | | 9,014,131 | |

| | 4,034,600 | | | ILPT Commercial Mortgage Trust 2022-LPF2, Class E (g),(i) | | 1M SOFR + 5.940% | | 11.265 | | 10/15/2039 | | | 3,898,750 | |

| | 355,000 | | | KSL 2023-HT D Float - 12/2036 (g),(i) | | 1M SOFR + 4.287% | | 9.613 | | 12/15/2036 | | | 357,171 | |

| | 3,750,000 | | | LAQ 2023-LAQ Mortgage Trust, Class D (g),(i) | | 1M SOFR + 4.188% | | 9.506 | | 3/15/2036 | | | 3,669,191 | |

| | 3,710,000 | | | One New York Plaza Trust 2020-1NYP, Class B (g),(i) | | 1M SOFR + 1.614% | | 6.940 | | 1/15/2036 | | | 3,494,698 | |

| | 3,400,000 | | | One New York Plaza Trust 2020-1NYP, Class C (g),(i) | | 1M SOFR + 2.314% | | 7.640 | | 1/15/2036 | | | 2,916,549 | |

| | 1,500,000 | | | One New York Plaza Trust 2020-1NYP, Class D (g),(i) | | 1M SOFR + 2.864% | | 8.190 | | 1/15/2036 | | | 1,192,052 | |

| | 2,200,000 | | | ORL 2023-GLKS D Float - 10/2025 (g),(i) | | 1M SOFR + 4.301% | | 9.619 | | 10/19/2036 | | | 2,203,945 | |

| | 2,900,000 | | | PGA National Resort Trust 2023-RSRT, Class C (g),(i) | | 1M SOFR + 3.789% | | 9.106 | | 5/15/2033 | | | 2,896,366 | |

| | 1,370,000 | | | PGA National Resort Trust 2023-RSRT, Class D (g),(i) | | 1M SOFR + 4.588% | | 9.905 | | 5/15/2033 | | | 1,375,727 | |

| | 1,811,000 | | | TWO VA Repack Trust Class B-2, Series B2 (a),(e),(i),(k) | | | | 9.250 | | 11/15/2033 | | | 686,369 | |

| | 172,987 | | | VA Gilbert AZ Subordinated Note Lease-Backed Pass -Through Trust (a),(i) | | | | 12.997 | | 3/15/2034 | | | 201,703 | |

| | 4,010,000 | | | Wells Fargo Commercial Mortgage Trust 2021-FCMT, Class D (g),(i) | | 1M SOFR + 3.614% | | 8.932 | | 5/15/2031 | | | 3,785,051 | |

| | 1,000,000 | | | Wells Fargo Commercial Mortgage Trust 2021-FCMT, Class F (g),(i) | | 1M SOFR + 6.010% | | 11.332 | | 5/15/2031 | | | 941,969 | |

| | 7,500,000 | | | WMRK Commercial Mortgage Trust 2022-WMRK, Class E (g),(i) | | 1M SOFR + 5.676% | | 11.001 | | 11/15/2035 | | | 7,534,352 | |

| | | | | Total Commercial Mortgage-Backed Securities (Cost $65,810,777) | | | | | | | | | 62,786,972 | |

| | | | | | | | | | | | | | | |

| Cost Basis ($) | | | | | | | | | | | | | |

| | | | | Direct Real Estate - 25.00% | | | | | | | | | | |

| | 7,028,834 | | | 1902 Park Avenue (Los Angeles) Owner, L.P. (a),(d) | | | | | | | | | 6,739,209 | |

| | 5,107,443 | | | 3816-3822 W Jefferson Blvd (a) | | | | | | | | | 4,079,040 | |

| | 3,990,582 | | | 4707 W Jefferson Blvd (a),(e) | | | | | | | | | 2,605,118 | |

| | 4,958,174 | | | 4901 W Jefferson Blvd - Los Angeles, CA (a) | | | | | | | | | 4,945,499 | |

| | 19,648,423 | | | Del Mar Terrace - Phoenix, AZ (a),(d) | | | | | | | | | 14,806,234 | |

| | 13,671,116 | | | EPIC Dallas (a),(d) | | | | | | | | | 15,137,379 | |

| | 30,745,164 | | | Sora Multifamily Residential Property (a) | | | | | | | | | 23,113,258 | |

| | 5,151,761 | | | Vale at the Parks - DC (a),(d) | | | | | | | | | 4,742,969 | |

| | | | | Total Direct Real Estate (Cost $90,301,497) | | | | | | | | | 76,168,706 | |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

| | March 31, 2024 (Unaudited) (Continued) |

| Principal | | | | | | | Coupon | | | | | |

| Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | Real Estate-Related Loans and Securities - 9.46% | | | | | | | | | | |

| | | | | Other - 9.46% | | | | | | | | | | |

| | 1,645,000 | | | IENTC 2, LLC (a),(c),(d),(g) | | 1M SOFR + 9.750% | | 15.077 | | 3/31/2031 | | $ | 1,645,000 | |

| | 8,225,000 | | | IENTC 2, LLC Delayed Draw Term Loan B-1 (a),(c),(d),(g),(h) | | 1M SOFR + 9.750% | | 15.077 | | 3/31/2031 | | | 8,225,000 | |

| | 1,645,000 | | | IENTC 2, LLC 2023 Delayed Draw Term Loan B-1 (a),(c),(d),(g),(h) | | 3M SOFR + 7.000% | | 12.327 | | 3/31/2031 | | | 1,645,000 | |

| | 2,115,000 | | | IENTC 2, LLC 2023 (a),(c),(d),(g) | | 3M SOFR + 7.000% | | 12.327 | | 3/31/2031 | | | 2,115,000 | |

| | 10,181,385 | | | Society Las Olas - PMG Greybook Riverfront I LLC (a),(c),(d),(g) | | 1M SOFR + 1.470% | | 6.791 | | 10/7/2024 | | | 10,099,934 | |

| | 5,151,984 | | | Society Las Olas 301 - S 1st Avenue Holdings LLC (a),(c),(d),(g) | | 1M SOFR + 6.823% | | 12.144 | | 10/7/2024 | | | 5,110,768 | |

| | | | | Total Real Estate-Related Loans and Securities (Cost $28,953,631) | | | | | | | | | 28,840,702 | |

| | | | | | | | | | | | | | | |

| Shares | | | | | Expiration Date | | Strike Price | | | | | | |

| | | | | Warrant — 0.01% | | | | | | | | | | |

| | | | | Internet Media & Services - 0.01% | | | | | | | | | | |

| | 7,576 | | | RumbleON, Inc. (a),(b),(c),(e) | | 8/14/2028 | | $ 33.00 | | | | | 24,394 | |

| | | | | Total Warrant (Cost $83,469) | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | Short-Term Investments - 2.79% | | | | | | | | | | |

| | | | | Money Market Funds - 2.79% | | | | | | | | | | |

| | 8,487,581 | | | First American Treasury Obligations Fund, Class Z, 5.23% (l),(m) (Cost $8,487,581) | | | 8,487,581 | |

| | | | | | | | | | | | | | | |

| | | | | Total Investments 110.68% (Cost $359,215,374) | | $ | 337,261,214 | |

| | | | | Liabilities in Excess of Other Assets (10.68%) | | | | | | | | | (32,550,557 | ) |

| | | | | Net Assets 100.00% | | | | | | | | $ | 304,710,657 | |

| (a) | Fair value of this security was determined using significant, unobservable inputs and was determined in accordance with Rule 2a-5 under the Investment Company Act of 1940, as amended (the “1940 Act”). |

| (b) | A co-investment, completed under an order for exemptive relief granted by the U.S. Securities and Exchange Commission ("SEC") on August 4, 2020, that is advised by the OFS Adviser. |

| (d) | A co-investment, completed under an order for exemptive relief granted by the SEC on August 4,2020, that is advised by the CIM Sub-Adviser. |

| (e) | Non-income producing security. |

| (f) | Investment in affiliate. |

| (g) | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

| (h) | This Investment or portion thereof was not funded as of March 31, 2024. The Fund had $4,977,249 at par value in unfunded commitments as of March 31, 2024. |

| (i) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2024 the total market value of 144A securities is $158,295,870 or 51.95% of net assets. |

| (j) | Collateralized loan obligation ("CLO") subordinated notes are residual positions in the CLO vehicle. CLO subordinated notes are entitled to distributions that are generally equal to the residual cash flows of the underlying securities less contractual payments to debt holders and fund expenses. The effective yield is estimated based upon the amount and timing of these distributions in addition to the estimated amount of terminal distribution. Effective yields for the CLO equity positions are updated generally once a quarter in connection with a transaction, such as an add-on purchase, refinancing or reset. The estimated yield and investment cost may ultimately not be realized. Estimated yields are periodically adjusted based on information reported by the CLO as of the date of determination. |

| (l) | Rate disclosed is the seven day effective yield as of March 31, 2024. |

| (m) | A portion of this security is held as collateral for total return swaps. |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

| | March 31, 2024 (Unaudited) |

| | |

Restricted Securities

| | | | | | | | | | | Fair Value as a | |

| Issuer Description | | Acquisition Date | | Cost | | | Fair Value | | | Percentage of Net Assets | |

| 24 Seven, Inc., Term Loan | | 1/28/2022 | | $ | 4,224,924 | | | $ | 4,160,752 | | | | 1.37 | % |

| AIDC Intermediate Co 2, LLC, Term Loan | | 7/22/2022 | | | 2,444,193 | | | | 2,493,438 | | | | 0.82 | % |

| AIDC Intermediate Co 2,Term Loan | | 7/31/2023 | | | 50,475 | | | | 58,314 | | | | 0.02 | % |

| Boca Home Care Holdings Revolver | | 2/25/2022 | | | 574,839 | | | | 563,806 | | | | 0.19 | % |

| Boca Home Care Holdings, Inc. Delayed Draw Term Loan | | 2/25/2022 | | | 4,852,500 | | | | 4,762,755 | | | | 1.56 | % |

| Boca Homecare Holdings, Inc. (Equity) | | 2/25/2022 | | | 580,645 | | | | 330,910 | | | | 0.11 | % |

| CGA Holdings, Inc., Class A | | 3/3/2023 | | | 155,086 | | | | 157,890 | | | | 0.05 | % |

| CVAUSA Management, LLC Primary Delayed Draw Term Loan | | 5/22/2023 | | | 881,148 | | | | 882,029 | | | | 0.29 | % |

| CVAUSA Management, LLC Secondary Delayed Draw Term Loan | | 5/22/2023 | | | 368,852 | | | | 369,221 | | | | 0.12 | % |

| CVAUSA ManagemenTerm Loan, LLC, Revolver, Term Loan | | 5/22/2023 | | | 285,714 | | | | 285,714 | | | | 0.09 | % |

| CVAUSA Management, LLC, Term Loan | | 5/22/2023 | | | 2,412,068 | | | | 2,455,486 | | | | 0.81 | % |

| EOS-Metasource Intermediate, Inc., Term Loan | | 5/17/2022 | | | 3,415,141 | | | | 3,370,363 | | | | 1.11 | % |

| Exponential Power, Inc., Term Loan | | 5/17/2023 | | | 2,942,724 | | | | 2,301,608 | | | | 0.76 | % |

| Honor HN Buyer, Inc. Delayed Draw Term Loan | | 10/15/2021 | | | 709,308 | | | | 709,308 | | | | 0.23 | % |

| Honor HN Buyer, Inc. Revolver | | 10/15/2021 | | | 132,013 | | | | 132,013 | | | | 0.04 | % |

| Honor HN Buyer, Inc. Term Loan | | 10/15/2021 | | | 1,107,873 | | | | 1,121,693 | | | | 0.37 | % |

| Honor HN Buyer, Inc. Term Loan 1st Amendment Health Network | | 3/31/2023 | | | 788,062 | | | | 788,062 | | | | 0.26 | % |

| IENTC 1, LLC | | 3/31/2022 | | | 3,772,723 | | | | 7,893,180 | | | | 2.59 | % |

| IENTC 2, LLC | | 3/31/2022 | | | 1,645,000 | | | | 1,645,000 | | | | 0.54 | % |

| IENTC 2, LLC 2023 | | 12/13/2023 | | | 2,115,000 | | | | 2,115,000 | | | | 0.69 | % |

| IENTC 2, LLC Delayed Draw Term Loan B-1 | | 3/31/2022 | | | 8,225,000 | | | | 8,225,000 | | | | 2.70 | % |

| IENTC 2, LLC 2023 Delayed Draw Term Loan B-1 | | 12/13/2023 | | | 1,645,000 | | | | 1,645,000 | | | | 0.54 | % |

| Kreg LLC, Revolver | | 12/20/2021 | | | 162,228 | | | | 151,304 | | | | 0.05 | % |

| Kreg LLC, Term Loan | | 12/20/2021 | | | 2,093,465 | | | | 1,951,945 | | | | 0.64 | % |

| MEDRINA, LLC Term Loan | | 10/20/2023 | | | 1,450,382 | | | | 1,473,753 | | | | 0.48 | % |

| MEDRINA, LLC Delayed Draw Term Loan | | 10/20/2023 | | | 294,149 | | | | 295,489 | | | | 0.10 | % |

| MEDRINA, LLC Revolver | | 10/20/2023 | | | 207,447 | | | | 211,064 | | | | 0.07 | % |

| One GI Intermediate LLC, Revolver Upsize | | 12/13/2021 | | | 333,333 | | | | 321,333 | | | | 0.11 | % |

| One GI Intermediate LLC, Tranche B Delayed Draw Term Loan - | | 12/13/2021 | | | 1,701,233 | | | | 1,649,043 | | | | 0.54 | % |

| One GI Intermediate LLC, Tranche C Delayed Draw Term Loan | | 12/13/2021 | | | 907,501 | | | | 868,998 | | | | 0.29 | % |

| PSB Group, LLC, Term Loan (Last Out) May 2023 | | 5/1/2023 | | | 1,976,974 | | | | 1,986,388 | | | | 0.65 | % |

| RumbleOn, Inc., Term Loan | | 8/31/2021 | | | 1,045,183 | | | | 1,006,186 | | | | 0.33 | % |

| RumbleOn, Inc., Delayed Draw Term Loan | | 8/31/2021 | | | 325,130 | | | | 303,021 | | | | 0.10 | % |

| RumbleOn, Inc., (Warrant) | | 8/31/2021 | | | 83,469 | | | | 24,394 | | | | 0.01 | % |

| Shiftkey, Revolver | | 6/21/2022 | | | 147,059 | | | | 143,971 | | | | 0.05 | % |

| Shiftkey, Term Loan | | 6/21/2022 | | | 2,295,742 | | | | 2,263,218 | | | | 0.74 | % |

| Society Las Olas - PMG Greybook Riverfront I LLC | | 9/23/2021 | | | 10,171,646 | | | | 10,099,934 | | | | 3.31 | % |

| Society Las Olas 301 - S 1st Avenue Holdings LLC | | 6/7/2022 | | | 5,151,984 | | | | 5,110,768 | | | | 1.68 | % |

| Spear Education Holdings, LLC Term A Loan | | 2/10/2023 | | | 2,901,865 | | | | 2,992,125 | | | | 0.98 | % |

| Spectrum Vision Partners, LLC | | 5/2/2023 | | | 3,952,311 | | | | 3,943,680 | | | | 1.29 | % |

| SS Acquisition LLC, Delayed Draw Term Loan | | 12/30/2021 | | | 1,431,439 | | | | 1,440,000 | | | | 0.47 | % |

| SS Acquisition LLC, Term Loan | | 12/30/2021 | | | 2,979,871 | | | | 3,000,000 | | | | 0.98 | % |

| | | | | $ | 82,940,699 | | | $ | 85,703,156 | | | | 28.13 | % |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

| | March 31, 2024 (Unaudited) |

| | |

TOTAL RETURN SWAP CONTRACTS (a)

| | | | | | | | | | | | | | | Net Unrealized | |

| | | | | Notional | | | | | Termination | | | | | Appreciation | |

| Counterparty | | Reference Entity/Obligation | | Amount | | | Fund Pays | | Date | | Value | | | Depreciation | |

| Citibank, N.A. | | 84 Lumber Company New Term Loan B, 1M SOFR + 2.75% | | $ | 70,894 | | | 3M SOFR + 1.80% | | 11/29/2030 | | $ | 71,573 | | | $ | 674 | |

| Citibank, N.A. | | ABG Intermediate Holdings 2 LLC B-1 Term Loan (First Lien), 1M SOFR + 4.00% | | $ | 685,140 | | | 3M SOFR + 1.80% | | 12/21/2028 | | $ | 697,958 | | | $ | 12,476 | |

| Citibank, N.A. | | Academy, Ltd., 1M SOFR + 3.75% (b) | | $ | 266,768 | | | 3M SOFR + 1.80% | | 11/5/2027 | | $ | 265,748 | | | $ | (500 | ) |

| Citibank, N.A. | | Acrisure LLC, 1M SOFR + 3.50% | | $ | 581,146 | | | 3M SOFR + 1.80% | | 2/15/2027 | | $ | 583,698 | | | $ | 1,571 | |

| Citibank, N.A. | | Acrisure LLC, 1M SOFR + 3.75% | | $ | 538,744 | | | 3M SOFR + 1.80% | | 2/15/2027 | | $ | 545,375 | | | $ | 4,359 | |

| Citibank, N.A. | | Acrisure LLC, 1M SOFR + 4.25% | | $ | 145,525 | | | 3M SOFR + 1.80% | | 2/15/2027 | | $ | 147,266 | | | $ | 1,304 | |

| Citibank, N.A. | | ADMI Corp. Term Loan B3 1L, 1M SOFR + 3.75% | | $ | 782,359 | | | 3M SOFR + 1.80% | | 12/23/2027 | | $ | 761,227 | | | $ | (22,566 | ) |

| Citibank, N.A. | | Advantage Sales & Marketing, Inc., 3M SOFR + 4.50% | | $ | 740,304 | | | 3M SOFR + 1.80% | | 10/28/2027 | | $ | 753,596 | | | $ | 10,013 | |

| Citibank, N.A. | | Aegion Corp. Term Loan , 1M SOFR +4.25% | | $ | 810,203 | | | 3M SOFR + 1.80% | | 5/17/2028 | | $ | 814,258 | | | $ | 4,055 | |

| Citibank, N.A. | | AHP Health Partners, Inc., 1M SOFR + 3.50% | | $ | 282,038 | | | 3M SOFR + 1.80% | | 8/24/2028 | | $ | 283,957 | | | $ | 1,595 | |

| Citibank, N.A. | | AI Aqua Merger Sub, Inc., 1M SOFR + 3.75% | | $ | 733,865 | | | 3M SOFR + 1.80% | | 7/31/2028 | | $ | 741,021 | | | $ | 6,091 | |

| Citibank, N.A. | | Allen Media LLC, 3M SOFR + 5.50% | | $ | 1,486,036 | | | 3M SOFR + 1.80% | | 2/10/2027 | | $ | 1,315,758 | | | $ | (176,022 | ) |

| Citibank, N.A. | | Allied Universal Holdco LLC, 1M SOFR + 3.75% | | $ | 485,063 | | | 3M SOFR + 1.80% | | 5/14/2028 | | $ | 487,454 | | | $ | 1,634 | |

| Citibank, N.A. | | Amentum Government Services Holdings LLC Term Loan B 1L, 1M SOFR + 4.00% | | $ | 345,031 | | | 3M SOFR + 1.80% | | 2/15/2029 | | $ | 347,992 | | | $ | 2,530 | |

| Citibank, N.A. | | American Airlines, Inc. Seventh Amendment Extended Term Loan, 6M SOFR + 2.75% | | $ | 498,125 | | | 3M SOFR + 1.80% | | 2/7/2028 | | $ | 500,453 | | | $ | 2,192 | |

| Citibank, N.A. | | American Airlines, Inc. Term Loan B (Nov 2023), 6M SOFR + 3.50% | | $ | 275,000 | | | 3M SOFR + 1.80% | | 6/4/2029 | | $ | 278,993 | | | $ | 3,844 | |

| Citibank, N.A. | | American Axle & Manufacturing, Inc., Term Loan, 1M SOFR + 3.50% | | $ | 967,694 | | | 3M SOFR + 1.80% | | 12/13/2029 | | $ | 981,388 | | | $ | 12,329 | |

| Citibank, N.A. | | Amynta Agency Borrower, Inc. 1st Lien Term Loan B, 1M SOFR + 4.25% | | $ | 902,881 | | | 3M SOFR + 1.80% | | 2/28/2028 | | $ | 910,303 | | | $ | 7,253 | |

| Citibank, N.A. | | AP Core Holdings II LLC, 1M SOFR + 5.50% | | $ | 828,034 | | | 3M SOFR + 1.80% | | 9/1/2027 | | $ | 822,041 | | | $ | (7,892 | ) |

| Citibank, N.A. | | AppLovin Corporation Term Loan B, 1M SOFR + 3.10% | | $ | 687,568 | | | 3M SOFR + 1.80% | | 8/19/2030 | | $ | 690,382 | | | $ | 2,678 | |

| Citibank, N.A. | | Arches Buyer, Inc., 1M SOFR + 3.25% | | $ | 829,861 | | | 3M SOFR + 1.80% | | 12/6/2027 | | $ | 815,034 | | | $ | (16,481 | ) |

| Citibank, N.A. | | Asurion, LLC NEW B-11 TERM LOAN, 1M SOFR + 4.25% | | $ | 365,605 | | | 3M SOFR + 1.80% | | 8/19/2028 | | $ | 365,170 | | | $ | (1,596 | ) |

| Citibank, N.A. | | Asurion, LLC Term Loan B 1L, 1M SOFR + 4.00% | | $ | 584,844 | | | 3M SOFR + 1.80% | | 8/21/2028 | | $ | 594,463 | | | $ | 3,029 | |

| Citibank, N.A. | | Athenahealth Group Inc. Term Loan B 1L, 1M SOFR + 3.25% | | $ | 435,807 | | | 3M SOFR + 1.80% | | 2/15/2029 | | $ | 434,899 | | | $ | (1,480 | ) |

| Citibank, N.A. | | Athletico Physical Therapy Term Loan B, 3M SOFR + 4.25% | | $ | 888,716 | | | 3M SOFR + 1.80% | | 2/15/2029 | | $ | 672,490 | | | $ | (217,331 | ) |

| Citibank, N.A. | | Autokiniton US Holdings, Inc. Term Loan B , 1M SOFR +4.50 % | | $ | 1,070,413 | | | 3M SOFR + 1.80% | | 4/6/2028 | | $ | 1,071,899 | | | $ | 4,834 | |

| Citibank, N.A. | | Axalta Coating Systems US Holdings, Inc. Term Loan B6, 3M SOFR + 2.50% | | $ | 685,202 | | | 3M SOFR + 1.80% | | 12/20/2029 | | $ | 688,932 | | | $ | 3,587 | |

| Citibank, N.A. | | Bakemark Holdings, Inc., 1M SOFR + 4.00% | | $ | 486,306 | | | 3M SOFR + 1.80% | | 9/5/2028 | | $ | 488,801 | | | $ | 1,752 | |

| Citibank, N.A. | | Banijay Entertainment S.A.S., Banijay 1L, 1M SOFR + 3.25% | | $ | 355,401 | | | 3M SOFR + 1.80% | | 3/2/2028 | | $ | 360,075 | | | $ | 4,107 | |

| Citibank, N.A. | | Barnes Group First Lien Term Loan B, 1M SOFR + 3.00% | | $ | 495,009 | | | 3M SOFR + 1.80% | | 8/31/2030 | | $ | 500,059 | | | $ | 4,829 | |

| Citibank, N.A. | | BCPE North Star US Holdco 2, Inc. Term Loan 1L, 1M SOFR + 4.00% (b) | | $ | 938,949 | | | 3M SOFR + 1.80% | | 6/9/2028 | | $ | 884,103 | | | $ | (55,940 | ) |

| Citibank, N.A. | | BIP Pipco Holdings LLC Brookfield NGPL, 3M SOFR + 3.25% | | $ | 165,833 | | | 3M SOFR + 1.80% | | 12/6/2030 | | $ | 167,136 | | | $ | 1,271 | |

| Citibank, N.A. | | BJ's Wholesale Club, Inc. 2023 Other Term Loans, 1M SOFR + 2.75% | | $ | 176,090 | | | 3M SOFR + 1.80% | | 2/5/2029 | | $ | 177,451 | | | $ | 1,345 | |

| Citibank, N.A. | | Blackhawk Network Holdings, Inc. Term Loan B, 1M SOFR + 5.00% | | $ | 182,237 | | | 3M SOFR + 1.80% | | 3/12/2029 | | $ | 184,739 | | | $ | 2,490 | |

| Citibank, N.A. | | Brookfield WEC Holdings Term Loan B, 1M SOFR + 3.75% | | $ | 435,850 | | | 3M SOFR + 1.80% | | 1/17/2031 | | $ | 445,277 | | | $ | 9,296 | |

| Citibank, N.A. | | Brown Group Holding, LLC Term Loan B2 1L, 1M SOFR + 3.00% | | $ | 196,508 | | | 3M SOFR + 1.80% | | 7/2/2029 | | $ | 198,729 | | | $ | 2,012 | |

| Citibank, N.A. | | Burlington Coat Factory Warehouse Corp., 1M SOFR + 2.00% | | $ | 533,569 | | | 3M SOFR + 1.80% | | 6/26/2028 | | $ | 536,754 | | | $ | 2,297 | |

| Citibank, N.A. | | Buzz Merger Sub LTD. Initial Term Loan, 1M SOFR + 2.75% | | $ | 496,124 | | | 3M SOFR + 1.80% | | 1/29/2027 | | $ | 497,831 | | | $ | 1,707 | |

| Citibank, N.A. | | Canister International Term Loan B, 1M SOFR + 1.475% (b) | | $ | 62,188 | | | 3M SOFR + 1.80% | | 3/13/2029 | | $ | 62,682 | | | $ | 495 | |

| Citibank, N.A. | | CCRR Parent, Inc. Term Loan B, 1M SOFR + 3.75% (b) | | $ | 875,268 | | | 3M SOFR + 1.80% | | 3/5/2028 | | $ | 791,137 | | | $ | (83,388 | ) |

| Citibank, N.A. | | CD&R Hydra Buyer, Inc. Term Loan B, 1M SOFR + 4.10% (b) | | $ | 192,581 | | | 3M SOFR + 1.80% | | 3/14/2031 | | $ | 194,214 | | | $ | 1,634 | |

| Citibank, N.A. | | Charlotte Buyer, Inc.; Curo Health Services, LLC, 1M SOFR + 5.25% | | $ | 918,375 | | | 3M SOFR + 1.80% | | 2/11/2028 | | $ | 991,934 | | | $ | 57,174 | |

| Citibank, N.A. | | Chart Industries, Inc. Amendment No 5 Term Loan, 1M SOFR + 3.75% | | $ | 178,547 | | | 3M SOFR + 1.80% | | 3/15/2030 | | $ | 183,095 | | | $ | 4,444 | |

| Citibank, N.A. | | Charter NEX US, Inc Term Loan B, 1M SOFR + 4.25% | | $ | 730,570 | | | 3M SOFR + 1.80% | | 12/1/2027 | | $ | 732,728 | | | $ | 8,043 | |

| Citibank, N.A. | | CHG Healthcare Services Inc Term Loan B 2023, 1M SOFR + 3.75% | | $ | 246,881 | | | 3M SOFR + 1.80% | | 9/30/2028 | | $ | 250,311 | | | $ | 3,235 | |

| Citibank, N.A. | | CHG Healthcare Services, Inc., 1M SOFR + 3.25% | | $ | 342,397 | | | 3M SOFR + 1.80% | | 9/29/2028 | | $ | 344,799 | | | $ | 1,877 | |

| Citibank, N.A. | | City Brewing Co. LLC, 3M SOFR + 3.50% (b) | | $ | 217,750 | | | 3M SOFR + 1.80% | | 4/5/2028 | | $ | 170,142 | | | $ | (47,212 | ) |

| Citibank, N.A. | | CLARIOS GLOBAL LP Term Loan B, 1M SOFR + 3.75% | | $ | 286,302 | | | 3M SOFR + 1.80% | | 5/6/2030 | | $ | 288,819 | | | $ | 2,495 | |

| Citibank, N.A. | | Clydesdale Acquisition Holdings, Inc., 1M SOFR + 3.68% | | $ | 548,359 | | | 3M SOFR + 1.80% | | 4/13/2029 | | $ | 570,855 | | | $ | 18,264 | |

| Citibank, N.A. | | Cogeco Communications Finance (USA) LP,Term Loan B, 1M SOFR + 2.50% | | $ | 489,380 | | | 3M SOFR + 1.80% | | 9/1/2028 | | $ | 485,038 | | | $ | (10,308 | ) |

| Citibank, N.A. | | Compass Power Generation LLC, 1M SOFR + 4.25% | | $ | 831,563 | | | 3M SOFR + 1.80% | | 4/14/2029 | | $ | 851,847 | | | $ | 18,215 | |

| Citibank, N.A. | | Conduent Business Services LLC, 1M SOFR + 4.25% | | $ | 660,776 | | | 3M SOFR + 1.80% | | 10/15/2028 | | $ | 665,453 | | | $ | 3,946 | |

| Citibank, N.A. | | Connect Finco Sarl, 1M SOFR + 3.50% (b) | | $ | 977,243 | | | 3M SOFR + 1.80% | | 12/11/2026 | | $ | 975,673 | | | $ | (856 | ) |

| Citibank, N.A. | | Core & Main LP, 1M SOFR + 2.50% | | $ | 405,234 | | | 3M SOFR + 1.80% | | 7/27/2028 | | $ | 406,675 | | | $ | 1,106 | |

| Citibank, N.A. | | Corel Corp., 3M SOFR + 5.00% | | $ | 589,996 | | | 3M SOFR + 1.80% | | 7/2/2026 | | $ | 604,723 | | | $ | 9,802 | |

| Citibank, N.A. | | CoreLogic, Inc., 1M SOFR + 3.50% | | $ | 202,626 | | | 3M SOFR + 1.80% | | 6/2/2028 | | $ | 199,119 | | | $ | (3,627 | ) |

| Citibank, N.A. | | CORGI BIDCO, INC.Term Loan 1L, 3M SOFR + 5.00% | | $ | 170,366 | | | 3M SOFR + 1.80% | | 10/15/2029 | | $ | 181,681 | | | $ | 9,698 | |

| Citibank, N.A. | | Cornerstone Building Brands, Inc., 1M SOFR + 3.25% | | $ | 241,334 | | | 3M SOFR + 1.80% | | 4/12/2028 | | $ | 273,310 | | | $ | 27,105 | |

| Citibank, N.A. | | Cornerstone OnDemand, Inc., Term Loan, 1M SOFR + 3.75% | | $ | 679,018 | | | 3M SOFR + 1.80% | | 10/16/2028 | | $ | 669,841 | | | $ | (9,918 | ) |

| Citibank, N.A. | | CP Atlas Buyer, Inc., 1M SOFR + 3.75% | | $ | 389,740 | | | 3M SOFR + 1.80% | | 11/23/2027 | | $ | 385,792 | | | $ | (3,948 | ) |

| Citibank, N.A. | | Crosby Worldwide Limited Term Loan N, 1M SOFR + 4.00% | | $ | 114,521 | | | 3M SOFR + 1.80% | | 8/16/2029 | | $ | 115,875 | | | $ | 1,345 | |

| Citibank, N.A. | | Culligan 2023 Incremental Term Loan, 1M SOFR + 4.25% | | $ | 39,216 | | | 3M SOFR + 1.80% | | 7/31/2028 | | $ | 39,440 | | | $ | 1,383 | |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

| | March 31, 2024 (Unaudited) (Continued) |

| | |

TOTAL RETURN SWAP CONTRACTS (a)

| | | | | | | | | | | | | | | Net Unrealized | |

| | | | | Notional | | | | | Termination | | | | | Appreciation | |

| Counterparty | | Reference Entity/Obligation | | Amount | | | Fund Pays | | Date | | Value | | | Depreciation | |

| Citibank, N.A. | | Dermatology Intermediate Holdings III, Inc. Term Loan B 1L, 3M SOFR +4.25% | | $ | 341,027 | | | 3M SOFR + 1.80% | | 3/26/2029 | | $ | 339,499 | | | $ | (2,864 | ) |

| Citibank, N.A. | | DexKo Global Inc., Term Loan B, 3M SOFR + 3.75% | | $ | 635,895 | | | 3M SOFR + 1.80% | | 10/4/2028 | | $ | 631,573 | | | $ | (3,909 | ) |

| Citibank, N.A. | | DG Investment Intermediate Holdings 2, Inc., 1M SOFR + 3.75% | | $ | 734,048 | | | 3M SOFR + 1.80% | | 3/31/2028 | | $ | 735,598 | | | $ | 1,282 | |

| Citibank, N.A. | | DIRECTV Financing LLC, 1M SOFR + 5.00% | | $ | 525,855 | | | 3M SOFR + 1.80% | | 8/2/2027 | | $ | 529,214 | | | $ | 3,081 | |

| Citibank, N.A. | | East West Manufacturing, LLC Term Loan B 1L, 3M SOFR + 5.75% (b) | | $ | 635,250 | | | 3M SOFR + 1.80% | | 12/22/2028 | | $ | 599,958 | | | $ | (36,806 | ) |

| Citibank, N.A. | | Electrical Components International, Inc. Initial Term Loan (First Lien), 1M SOFR + 4.25% (b) | | $ | 614,003 | | | 3M SOFR + 1.80% | | 6/26/2025 | | $ | 616,677 | | | $ | 2,100 | |

| Citibank, N.A. | | Element Materials Tech Group US Holdings Delayed Term Loan, 3M SOFR + 4.25% (b) | | $ | 55,031 | | | 3M SOFR + 1.80% | | 6/22/2029 | | $ | 55,146 | | | $ | 115 | |

| Citibank, N.A. | | Element Materials Tech Group US Holdings Inc. Term Loan, 3M SOFR + 4.25% | | $ | 118,638 | | | 3M SOFR + 1.80% | | 6/22/2029 | | $ | 119,482 | | | $ | 742 | |

| Citibank, N.A. | | EnergySolutions, LLC 2023 Term Loan, 3M SOFR + 4.00% | | $ | 542,995 | | | 3M SOFR + 1.80% | | 9/23/2030 | | $ | 552,516 | | | $ | 9,035 | |

| Citibank, N.A. | | Fertitta Entertainment, LLC Term Loan B 1L, 1M SOFR + 3.75% | | $ | 340,017 | | | 3M SOFR + 1.80% | | 1/29/2029 | | $ | 342,078 | | | $ | 1,841 | |

| Citibank, N.A. | | Fiesta Purchaser, Inc Term Loan B, 1M SOFR + 4.00% | | $ | 180,000 | | | 3M SOFR + 1.80% | | 2/12/2031 | | $ | 182,335 | | | $ | 2,312 | |

| Citibank, N.A. | | First Brands Incremental Term Loan B, 3M SOFR + 5.1145% | | $ | 139,097 | | | 3M SOFR + 1.80% | | 3/30/2027 | | $ | 140,411 | | | $ | 1,305 | |

| Citibank, N.A. | | Flutter Entertainment plc 2023 Term Loan B, 3M SOFR + 2.25% | | $ | 165,834 | | | 3M SOFR + 1.80% | | 11/25/2030 | | $ | 166,621 | | | $ | 767 | |

| Citibank, N.A. | | Gainwell Acquisition Corp., 3M SOFR + 4.25% | | $ | 1,081,003 | | | 3M SOFR + 1.80% | | 2/1/2029 | | $ | 1,088,495 | | | $ | 7,113 | |

| Citibank, N.A. | | Gainwell Acquisition Corp., 3M SOFR + 4.00% | | $ | 230,467 | | | 3M SOFR + 1.80% | | 10/1/2027 | | $ | 220,378 | | | $ | (9,878 | ) |

| Citibank, N.A. | | GIP Pilot Acquisition Partners L.P. - 2023 Term Loan 2023 Term Loan, 3M SOFR + 3.00% | | $ | 248,750 | | | 3M SOFR + 1.80% | | 10/4/2030 | | $ | 251,125 | | | $ | 2,294 | |

| Citibank, N.A. | | Gloves Buyer, Inc. Non-Fung Inc 1L Term Loan, 1M SOFR + 5.00% (b) | | $ | 723,863 | | | 3M SOFR + 1.80% | | 12/29/2027 | | $ | 746,250 | | | $ | 20,141 | |

| Citibank, N.A. | | GoTo Group Inc Term Loan, 1M SOFR + 4.75% (b) | | $ | 219,982 | | | 3M SOFR + 1.80% | | 4/28/2028 | | $ | 210,311 | | | $ | (9,670 | ) |

| Citibank, N.A. | | GoTo Group Inc Term Loan, 1M SOFR + 4.75% (b) | | $ | 303,784 | | | 3M SOFR + 1.80% | | 4/28/2028 | | $ | 234,066 | | | $ | (69,718 | ) |

| Citibank, N.A. | | Great Outdoors Group, LLC Term Loan B 1L, 1M SOFR + 3.75% | | $ | 1,261,849 | | | 3M SOFR + 1.80% | | 3/6/2028 | | $ | 1,273,675 | | | $ | 9,073 | |

| Citibank, N.A. | | Help/Systems Holdings, Inc., 1M SOFR + 4.00% | | $ | 484,848 | | | 3M SOFR + 1.80% | | 11/19/2026 | | $ | 470,121 | | | $ | (14,727 | ) |

| Citibank, N.A. | | Hunter Douglas Inc. Term Loan B 1L, 3M SOFR + 3.50% | | $ | 488,794 | | | 3M SOFR + 1.80% | | 2/25/2029 | | $ | 486,453 | | | $ | (2,952 | ) |

| Citibank, N.A. | | Hyperion Materials and Technologies Inc Initial Term Loans, 1M SOFR + 4.50% | | $ | 741,808 | | | 3M SOFR + 1.80% | | 8/30/2028 | | $ | 744,874 | | | $ | 2,824 | |

| Citibank, N.A. | | Indicor Term Loan B, 3M SOFR + 4.50% | | $ | 95,537 | | | 3M SOFR + 1.80% | | 11/22/2029 | | $ | 99,704 | | | $ | 4,107 | |

| Citibank, N.A. | | Indy US Holdco LLC, 1M SOFR + 6.25% | | $ | 803,023 | | | 3M SOFR + 1.80% | | 3/5/2028 | | $ | 899,453 | | | $ | 84,400 | |

| Citibank, N.A. | | Installed Building Products, Inc. Repriced Term Loan B, 1M SOFR + 2.00% (b) | | $ | 497,500 | | | 3M SOFR + 1.80% | | 12/14/2028 | | $ | 498,590 | | | $ | 1,090 | |

| Citibank, N.A. | | Ivanti Software, Inc., 3M SOFR + 4.25% | | $ | 651,700 | | | 3M SOFR + 1.80% | | 12/1/2027 | | $ | 613,317 | | | $ | (38,929 | ) |

| Citibank, N.A. | | Jadex, Inc., 1M SOFR + 4.75% (b) | | $ | 355,835 | | | 3M SOFR + 1.80% | | 2/11/2028 | | $ | 339,574 | | | $ | (16,847 | ) |

| Citibank, N.A. | | Janus International Group LLC, Amendment No. 6 Refinancing Term Loan, 3M SOFR + 3.00% | | $ | 234,536 | | | 3M SOFR + 1.80% | | 8/5/2030 | | $ | 238,000 | | | $ | 3,295 | |

| Citibank, N.A. | | KKR Apple Bidco, LLC, 1M SOFR + 2.75% | | $ | 937,961 | | | 3M SOFR + 1.80% | | 9/22/2028 | | $ | 940,200 | | | $ | 1,614 | |

| Citibank, N.A. | | KNS Midco Corp., 1M SOFR + 6.25% | | $ | 562,500 | | | 3M SOFR + 1.80% | | 4/16/2027 | | $ | 495,087 | | | $ | (67,413 | ) |

| Citibank, N.A. | | LBM Acquisition LLC, 1M SOFR + 3.75% | | $ | 629,541 | | | 3M SOFR + 1.80% | | 12/17/2027 | | $ | 629,985 | | | $ | 129 | |

| Citibank, N.A. | | LifePoint Health Term Loan B Extension, 3M SOFR + 5.50% | | $ | 235,927 | | | 3M SOFR + 1.80% | | 11/16/2028 | | $ | 250,333 | | | $ | 13,649 | |

| Citibank, N.A. | | Liftoff Mobile, Inc., 1M SOFR + 3.75% | | $ | 485,748 | | | 3M SOFR + 1.80% | | 10/2/2028 | | $ | 480,534 | | | $ | (5,728 | ) |

| Citibank, N.A. | | LSF11 A5 HOLDCO LLC, Term Loan B, 1M SOFR + 4.25% | | $ | 640,149 | | | 3M SOFR + 1.80% | | 10/15/2028 | | $ | 652,447 | | | $ | 11,118 | |

| Citibank, N.A. | | LSF9 ATerm Loanantis Holdings, LLC Term Loan B, 1M SOFR + 7.25% | | $ | 723,199 | | | 3M SOFR + 1.80% | | 3/29/2029 | | $ | 756,475 | | | $ | (417 | ) |

| Citibank, N.A. | | Madison IAQ LLC, 1M SOFR + 3.25% | | $ | 633,628 | | | 3M SOFR + 1.80% | | 6/21/2028 | | $ | 638,473 | | | $ | 3,195 | |

| Citibank, N.A. | | Magenta Buyer LLC, 3M SOFR + 5.00% | | $ | 790,488 | | | 3M SOFR + 1.80% | | 7/27/2028 | | $ | 476,133 | | | $ | (315,281 | ) |

| Citibank, N.A. | | McAfee Corp. Term Loan B 1L, 1M SOFR + 3.75% | | $ | 902,388 | | | 3M SOFR + 1.80% | | 3/1/2029 | | $ | 907,367 | | | $ | 3,857 | |

| Citibank, N.A. | | McGraw-Hill Education, Inc., 1M SOFR + 4.75% | | $ | 714,119 | | | 3M SOFR + 1.80% | | 7/28/2028 | | $ | 723,522 | | | $ | 7,228 | |

| Citibank, N.A. | | Medline Industries, LP, Term Loan, 1M SOFR + 3.00% | | $ | 857,001 | | | 3M SOFR + 1.80% | | 10/23/2028 | | $ | 862,520 | | | $ | 4,724 | |

| Citibank, N.A. | | Mega Broadband Investments LLC Initial Term Loan, 3M SOFR + 3.00% | | $ | 484,316 | | | 3M SOFR + 1.80% | | 11/12/2027 | | $ | 493,824 | | | $ | 8,111 | |

| Citibank, N.A. | | MH Sub I LLC, 1M SOFR + 4.25% | | $ | 671,697 | | | 3M SOFR + 1.80% | | 5/3/2028 | | $ | 690,696 | | | $ | 16,765 | |

| Citibank, N.A. | | Midwest Physician Administrative Services LLC, 3M SOFR + 3.25% | | $ | 433,915 | | | 3M SOFR + 1.80% | | 3/13/2028 | | $ | 362,021 | | | $ | (71,281 | ) |

| Citibank, N.A. | | Mitchell International, Inc., 1M SOFR + 3.75% | | $ | 648,433 | | | 3M SOFR + 1.80% | | 10/16/2028 | | $ | 654,339 | | | $ | 4,446 | |

| Citibank, N.A. | | Mosel Bidco SE Term Loan B, 3M SOFR + 4.75% | | $ | 198,000 | | | 3M SOFR + 1.80% | | 9/16/2030 | | $ | 200,750 | | | $ | 2,652 | |

| Citibank, N.A. | | Naked Juice LLC 3M SOFR + 3.25% | | $ | 980,178 | | | 3M SOFR + 1.80% | | 1/24/2029 | | $ | 921,428 | | | $ | (59,255 | ) |

| Citibank, N.A. | | Olaplex, Inc Term Loan 1L, 1M SOFR + 3.50% | | $ | 347,167 | | | 3M SOFR + 1.80% | | 2/17/2029 | | $ | 330,259 | | | $ | (18,396 | ) |

| Citibank, N.A. | | OldcasTerm Loane Building Envelope Inc Term Loan B 1L, 3M SOFR + 4.50% | | $ | 721,823 | | | 3M SOFR + 1.80% | | 4/30/2029 | | $ | 743,392 | | | $ | 17,730 | |

| Citibank, N.A. | | OpenText Corporation Repriced Term Loan B, 1M SOFR + 2.75% | | $ | 461,188 | | | 3M SOFR + 1.80% | | 1/31/2030 | | $ | 462,501 | | | $ | 1,312 | |

| Citibank, N.A. | | PetSmart LLC, 1M SOFR + 3.75% | | $ | 1,266,023 | | | 3M SOFR + 1.80% | | 2/11/2028 | | $ | 1,269,117 | | | $ | 1,880 | |

| Citibank, N.A. | | PHOENIX GUARANTOR INC Term Loan B4, 1M SOFR + 3.25% | | $ | 742,500 | | | 3M SOFR + 1.80% | | 2/21/2031 | | $ | 741,199 | | | $ | (1,363 | ) |

| Citibank, N.A. | | Pitney Bowes INC.Term Loan, 1M SOFR + 4.00% | | $ | 740,749 | | | 3M SOFR + 1.80% | | 3/17/2028 | | $ | 744,452 | | | $ | 2,849 | |

| Citibank, N.A. | | Quest Borrower Limited Term Loan 1L, 3M SOFR + 4.25% | | $ | 975,150 | | | 3M SOFR + 1.80% | | 2/1/2029 | | $ | 753,037 | | | $ | (224,602 | ) |

| Citibank, N.A. | | Quikrete Holdings, Inc Term Loan B, 1M SOFR + 2.50% | | $ | 500,000 | | | 3M SOFR + 1.80% | | 4/14/2031 | | $ | 500,825 | | | $ | 2,075 | |

| Citibank, N.A. | | Redstone Holdco 2 LP, 1M SOFR + 4.75% | | $ | 829,962 | | | 3M SOFR + 1.80% | | 4/27/2028 | | $ | 779,522 | | | $ | (60,211 | ) |

| Citibank, N.A. | | Ring Container Technologies Group LLC, 1M SOFR + 3.50% | | $ | 381,704 | | | 3M SOFR + 1.80% | | 8/12/2028 | | $ | 385,921 | | | $ | 3,437 | |

| Citibank, N.A. | | Rough Country, LLC 1L, 1M SOFR + 3.50% | | $ | 1,243,355 | | | 3M SOFR + 1.80% | | 7/26/2028 | | $ | 1,243,371 | | | $ | (959 | ) |

| Citibank, N.A. | | Ryan Specialty Group LLC, 1M SOFR + 2.75% | | $ | 193,321 | | | 3M SOFR + 1.80% | | 9/1/2027 | | $ | 193,507 | | | $ | 320 | |

| Citibank, N.A. | | Scientific Games Holdings LP Term Loan B 1L, 3M SOFR + 3.25% | | $ | 693,357 | | | 3M SOFR + 1.80% | | 4/4/2029 | | $ | 696,510 | | | $ | 3,100 | |

| Citibank, N.A. | | Select Medical Corp. Tranche B-1 Term Loan, 1M SOFR + 3.00% | | $ | 317,536 | | | 3M SOFR + 1.80% | | 3/6/2027 | | $ | 320,030 | | | $ | 2,235 | |

| Citibank, N.A. | | Simon & Schuster Term Loan B, 3M SOFR + 4.00% | | $ | 99,000 | | | 3M SOFR + 1.80% | | 10/30/2030 | | $ | 100,488 | | | $ | 1,432 | |

| CIM Real Assets & Credit Fund | Consolidated Schedule of Investments |

| | March 31, 2024 (Unaudited) (Continued) |

| | |

TOTAL RETURN SWAP CONTRACTS (a)

| | | | | | | | | | | | | | | Net Unrealized | |

| | | | | Notional | | | | | Termination | | | | | Appreciation | |

| Counterparty | | Reference Entity/Obligation | | Amount | | | Fund Pays | | Date | | Value | | | Depreciation | |

| Citibank, N.A. | | Sinclair Television Group, Inc. Term Loan B4 1L, 1M SOFR + 3.75% | | $ | 563,178 | | | 3M SOFR + 1.80% | | 4/13/2029 | | $ | 473,816 | | | $ | (94,490 | ) |

| Citibank, N.A. | | Sitel Worldwide Corp., 1M SOFR + 3.75% | | $ | 665,229 | | | 3M SOFR + 1.80% | | 8/27/2028 | | $ | 576,643 | | | $ | (89,632 | ) |

| Citibank, N.A. | | Specialty Building Products Holdings LLC, 1M SOFR + 3.75% | | $ | 488,530 | | | 3M SOFR + 1.80% | | 10/15/2028 | | $ | 489,182 | | | $ | 208 | |

| Citibank, N.A. | | Spring Education Group, Inc., 3M SOFR + 4.50% | | $ | 136,649 | | | 3M SOFR + 1.80% | | 9/28/2030 | | $ | 139,123 | | | $ | 2,392 | |

| Citibank, N.A. | | SRS Distribution Inc., 1M SOFR + 3.50% | | $ | 174,714 | | | 3M SOFR + 1.80% | | 6/2/2028 | | $ | 177,451 | | | $ | 2,268 | |

| Citibank, N.A. | | Star Parent, Inc. Term Loan B, 3M SOFR + 4.00% | | $ | 175,893 | | | 3M SOFR + 1.80% | | 9/30/2030 | | $ | 177,690 | | | $ | 1,611 | |

| Citibank, N.A. | | Summit Materials Incremental Term Loan B, 3M SOFR + 2.50% | | $ | 90,682 | | | 3M SOFR + 1.80% | | 1/12/2029 | | $ | 91,466 | | | $ | 778 | |

| Citibank, N.A. | | SupplyOne, Inc. Term Loan B, 1M SOFR + 4.25% (b) | | $ | 21,739 | | | 3M SOFR + 1.80% | | 4/19/2031 | | $ | 21,671 | | | $ | 150 | |

| Citibank, N.A. | | Teneo Global LLC Term Loan B, 1M SOFR + 4.75% | | $ | 1,010,204 | | | 3M SOFR + 1.80% | | 3/7/2031 | | $ | 1,024,872 | | | $ | 14,638 | |

| Citibank, N.A. | | Tenneco Inc. Cov-Lite Term Loan B, 3M SOFR + 4.75% | | $ | 425,000 | | | 3M SOFR + 1.80% | | 11/17/2028 | | $ | 471,803 | | | $ | 38,749 | |

| Citibank, N.A. | | Tony's Fresh Market / Cardenas Markets Term Loan B 1L, 3M SOFR + 6.75% | | $ | 925,900 | | | 3M SOFR + 1.80% | | 8/1/2029 | | $ | 991,156 | | | $ | 55,412 | |

| Citibank, N.A. | | Topgolf Callaway Brands Corp, Term Loan B, 1M SOFR + 3.00% | | $ | 589,583 | | | 3M SOFR + 1.80% | | 3/15/2030 | | $ | 591,758 | | | $ | 2,069 | |

| Citibank, N.A. | | TransDigm Inc. Term Loan J, 3M SOFR + 3.25% | | $ | 90,455 | | | 3M SOFR + 1.80% | | 2/28/2031 | | $ | 91,228 | | | $ | 764 | |

| Citibank, N.A. | | TransDigm Inc., Term Loan K, 3M SOFR + 3.25% | | $ | 482,671 | | | 3M SOFR + 1.80% | | 2/22/2027 | | $ | 494,060 | | | $ | 8,749 | |

| Citibank, N.A. | | TricorBraun Holdings, Inc., 1M SOFR + 3.25% | | $ | 328,072 | | | 3M SOFR + 1.80% | | 3/3/2028 | | $ | 328,087 | | | $ | (1,016 | ) |

| Citibank, N.A. | | Tronox Finance LLC August 2023 Loan, 3M SOFR + 3.50% | | $ | 246,881 | | | 3M SOFR + 1.80% | | 8/16/2028 | | $ | 249,998 | | | $ | 2,912 | |

| Citibank, N.A. | | TruGreen LP, 1M SOFR + 4.00% | | $ | 358,160 | | | 3M SOFR + 1.80% | | 11/2/2027 | | $ | 364,824 | | | $ | 3,986 | |

| Citibank, N.A. | | TTM Technologies, Inc. Term Loan B 1L, 1M SOFR + 2.75% (b) | | $ | 82,088 | | | 3M SOFR + 1.80% | | 5/30/2030 | | $ | 83,072 | | | $ | 909 | |

| Citibank, N.A. | | U.S. Anesthesia Partners, Inc., 1M SOFR + 4.25% | | $ | 723,608 | | | 3M SOFR + 1.80% | | 10/2/2028 | | $ | 697,045 | | | $ | (27,654 | ) |

| Citibank, N.A. | | U.S. Silica Company Term Loan B, 1M SOFR + 4.00% | | $ | 573,622 | | | 3M SOFR + 1.80% | | 3/25/2030 | | $ | 600,861 | | | $ | 10,665 | |

| Citibank, N.A. | | United Airlines, Inc. Term Loan B, 3M SOFR + 2.75 | | $ | 199,000 | | | 3M SOFR + 1.80% | | 2/24/2031 | | $ | 200,562 | | | $ | 1,552 | |

| Citibank, N.A. | | Virtusa Corporation Term Loan 1L, 1M SOFR + 3.75% | | $ | 784,161 | | | 3M SOFR + 1.80% | | 2/15/2029 | | $ | 792,672 | | | $ | 7,567 | |

| Citibank, N.A. | | Vistage Worldwide Term Loan, 3M SOFR + 4.75% (b) | | $ | 496,241 | | | 3M SOFR + 1.80% | | 7/13/2029 | | $ | 499,358 | | | $ | 3,061 | |

| Citibank, N.A. | | Watlow Electric Manufacturing Co., 3M SOFR + 3.75% | | $ | 996,359 | | | 3M SOFR + 1.80% | | 3/2/2028 | | $ | 1,000,214 | | | $ | 4,007 | |

| Citibank, N.A. | | WhiteWater DBR Holdco, LLC Term Loan B, 1M SOFR + 2.75% | | $ | 710,714 | | | 3M SOFR + 1.80% | | 3/3/2031 | | $ | 716,368 | | | $ | 5,628 | |

| Citibank, N.A. | | WildBrain Ltd Initial Term Loan, 1M SOFR + 4.25% | | $ | 742,385 | | | 3M SOFR + 1.80% | | 3/24/2028 | | $ | 722,071 | | | $ | (20,404 | ) |

| Citibank, N.A. | | Worldpay 1L Term Loan, 1M SOFR + 3.00% | | $ | 271,364 | | | 3M SOFR + 1.80% | | 1/31/2031 | | $ | 274,035 | | | $ | 2,641 | |

| Citibank, N.A. | | WW International, Inc., 1M SOFR + 3.50% | | $ | 1,171,997 | | | 3M SOFR + 1.80% | | 4/13/2028 | | $ | 523,010 | | | $ | (648,946 | ) |

| Citibank, N.A. | | Xperi Corporation Term Loan B , 1M SOFR + 3.50% | | $ | 689,283 | | | 3M SOFR + 1.80% | | 6/8/2028 | | $ | 694,912 | | | $ | 3,366 | |

| Citibank, N.A. | | ZelisRedCard Term Loan B, 3M SOFR + 2.75% | | $ | 995,000 | | | 3M SOFR + 1.80% | | 9/28/2029 | | $ | 1,001,110 | | | $ | 5,942 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | $ | 81,527,327 | | | | | | | $ | 79,905,343 | | | $ | (1,834,199 | ) |

| (a) | The Fund’s interest in the total return swap transactions are held through a wholly-owned subsidiary of the Fund, RACR-FS, LLC, a Delaware limited liability company. |

| (b) | Security is classified as Level 3 in the Fund’s fair value hierarchy (see Note 2). |

| CIM Real Assets & Credit Fund | Consolidated Statement of Assets and Liabilities |

| | March 31, 2024 (Unaudited) |

| | |

| ASSETS | | | | |

| Investments: | | | | |

| Unaffiliated Investments at fair value (cost $278,150,561) | | $ | 257,447,196 | |

| Affiliated Investments at fair value (cost $81,064,813) | | | 79,814,018 | |

| Cash | | | 1,655,625 | |

| Cash collateral for total return swaps | | | 22,554,246 | |

| Interest receivable | | | 4,092,845 | |

| Receivable for investments sold | | | 150,106 | |

| Receivable for Fund shares sold | | | 537,584 | |

| Unrealized appreciation on total return swap contracts | | | 738,214 | |

| Prepaid expenses and other assets | | | 200,606 | |

| TOTAL ASSETS | | $ | 367,190,440 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for securities purchased | | | 5,477,249 | |

| Line of credit payable (Note 7) | | | 50,000,000 | |

| Unrealized depreciation on total return swap contracts | | | 2,572,413 | |

| Due to Advisor | | | 1,056,106 | |

| Administrative fees payable (Note 8) | | | 772,768 | |

| Professional fees payable | | | 299,745 | |

| Interest expense payable | | | 750,083 | |

| Trustee fees payable (Note 8) | | | 499,565 | |

| Payable for Fund shares repurchased | | | 26 | |

| Transfer agency fees payable (Note 8) | | | 53,667 | |

| Custody fees payable | | | 26,567 | |

| Distribution fee payable (Note 8) | | | 47,738 | |

| Shareholder Servicing fees payable (Note 8) | | | 24,799 | |

| Accrued expenses and other liabilities | | | 899,057 | |

| TOTAL LIABILITIES | | | 62,479,783 | |

| COMMITMENTS AND CONTINGENCIES (Note 2) | | | | |

| NET ASSETS | | $ | 304,710,657 | |

| | | | | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital | | $ | 319,461,616 | |

| Accumulated deficit | | | (14,750,959 | ) |

| NET ASSETS | | $ | 304,710,657 | |

| | | | | |

See Notes to Consolidated Financial Statements.

| CIM Real Assets & Credit Fund | Consolidated Statement of Assets and Liabilities |

| | March 31, 2024 (Unaudited) |

| | |

| PRICING OF SHARES | | | | |

| Class A | | | | |

| Net Assets | | $ | 12,400,863 | |

| Shares of beneficial interest outstanding (unlimited number of authorized shares, no par value common stock authorized) | | | 522,829 | |

| Net asset value | | $ | 23.72 | |

| Maximum offering price per share (Maximum sales load of 5.75%) | | $ | 25.17 | |

| Class C | | | | |

| Net Assets | | $ | 12,760,774 | |

| Shares of beneficial interest outstanding (unlimited number of authorized shares, no par value common stock authorized) | | | 553,650 | |

| Net asset value (a) | | $ | 23.05 | |

| Maximum offering price per share | | $ | 23.05 | |

| Class I | | | | |

| Net Assets | | $ | 278,846,426 | |

| Shares of beneficial interest outstanding (unlimited number of authorized shares, no par value common stock authorized) | | | 11,647,139 | |

| Net asset value | | $ | 23.94 | |

| Maximum offering price per share | | $ | 23.94 | |

| Class L | | | | |

| Net Assets | | $ | 702,594 | |

| Shares of beneficial interest outstanding (unlimited number of authorized shares, no par value common stock authorized) | | | 29,930 | |

| Net asset value | | $ | 23.47 | |

| Maximum offering price per share (Maximum sales load of 4.25%) | | $ | 24.51 | |

| | | | | |

| (a) | Subject to early-withdrawal charge. Redemption price varies based on length of time held (Note 2). |

See Notes to Consolidated Financial Statements.

| CIM Real Assets & Credit Fund | Consolidated Statement of Operations |

| For the Six Months Ended March 31, 2024 (Unaudited) |

| | |

| INVESTMENT INCOME | | | | |

| Interest income | | $ | 17,530,940 | |

| Dividend income from unaffiliated investments | | | 7,826 | |

| Income from affiliated investments | | | 1,480,849 | |

| Total Investment Income | | | 19,019,615 | |

| | | | | |

| EXPENSES | | | | |

| Management fees (Note 8) | | | 2,265,591 | |

| Incentive Fees (Note 8) | | | 2,033,434 | |

| Shareholder Servicing fees (Note 8) | | | | |

| Class A | | | 14,262 | |

| Class C | | | 15,508 | |

| Class L | | | 776 | |

| Distribution fees (Note 8) | | | | |

| Class C | | | 46,526 | |

| Class L | | | 776 | |

| Networking fees | | | | |

| Class I | | | 211,324 | |

| Class A | | | 4,426 | |

| Class C | | | 3,780 | |

| Class L | | | 246 | |

| Interest expense (Note 7) | | | 2,566,031 | |