ITsavvy Acquisition Company, Inc. and Subsidiaries Consolidated Financial Report December 31, 2023

Contents Independent auditor’s report 1-2 Financial statements Consolidated balance sheet 3-4 Consolidated statement of income 5 Consolidated statement of stockholder’s equity 6 Consolidated statement of cash flows 7-8 Notes to the consolidated financial statements 9-22

1 Independent Auditor’s Report Board of Directors ITsavvy Acquisition Company, Inc. Opinion We have audited the consolidated financial statements of ITsavvy Acquisition Company, Inc. and its subsidiaries (the Company), which comprise the consolidated balance sheet as of December 31, 2023, the related consolidated statements of income, stockholder’s equity and cash flows for the year then ended, and the related notes to the consolidated financial statements (collectively, the financial statements). In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Emphasis of Matter The Company, effective August 8, 2022, is no longer electing the Private Company Council (PCC) alternatives. As a result of this election the Company unwound previous amortization of goodwill and allocated purchase price of prior acquisitions to customer relationships. The effect of this change in accounting principle as of December 31, 2022, was a decrease in the accumulated deficit of $1,791 which is the result of the difference of goodwill and customer relationships amortization as well as tax effects. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are issued or available to be issued.

2 Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. Rockford, Illinois February 5, 2025

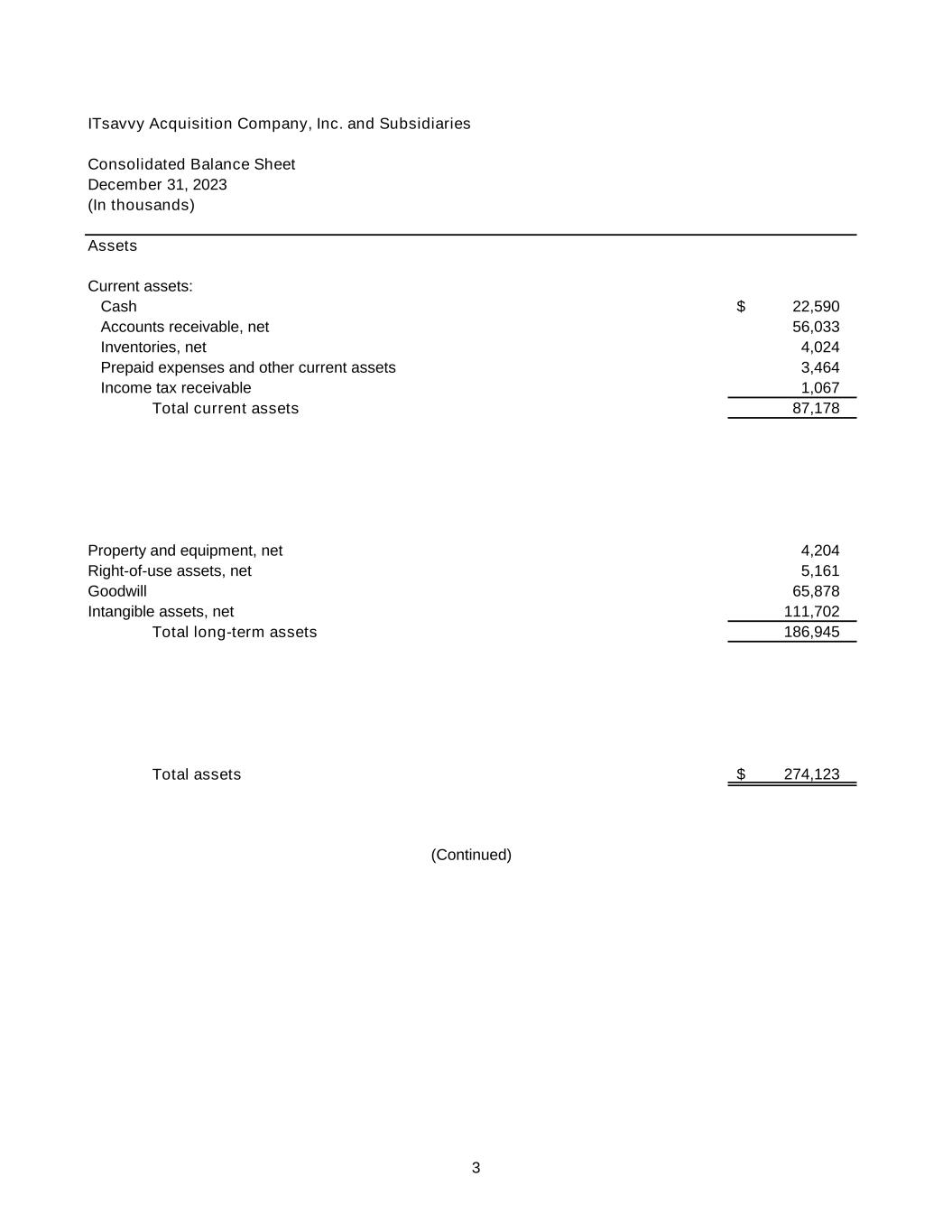

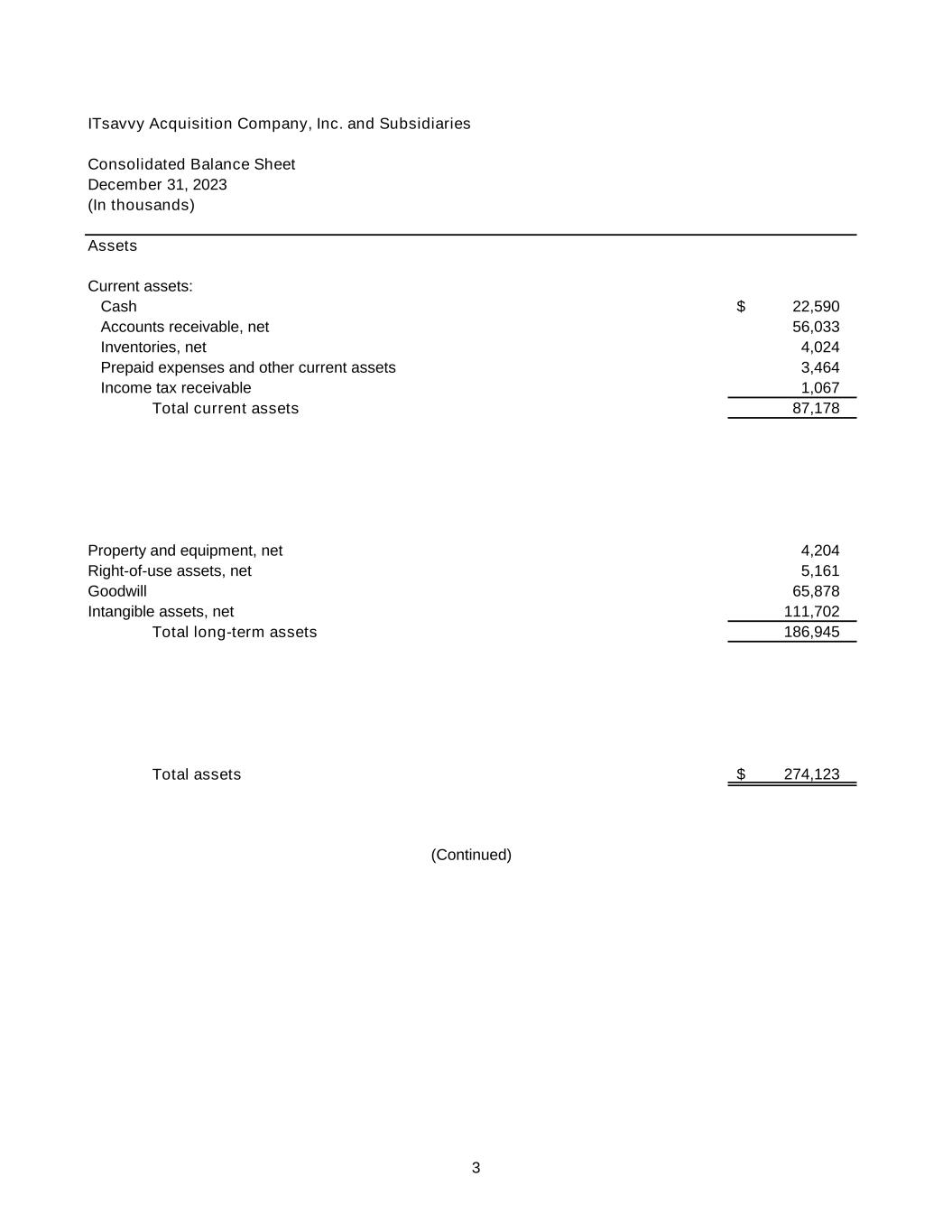

3 ITsavvy Acquisition Company, Inc. and Subsidiaries Consolidated Balance Sheet December 31, 2023 (In thousands) Assets Current assets: Cash 22,590 $ Accounts receivable, net 56,033 Inventories, net 4,024 Prepaid expenses and other current assets 3,464 Income tax receivable 1,067 Total current assets 87,178 Property and equipment, net 4,204 Right-of-use assets, net 5,161 Goodwill 65,878 Intangible assets, net 111,702 Total long-term assets 186,945 Total assets 274,123 $ (Continued)

4 Liabilities and Stockholder’s Equity Current liabilities: Accounts payable 48,625 $ Accrued expense 8,406 Deferred revenue—current portion 11,012 Current portion of operating lease liabilities 1,037 Current portion of long-term debt 934 Total current liabilities 70,014 Long-term liabilities: Long-term debt, less current portion, net 79,635 Deferred revenue—long-term 11,821 Contingent consideration 14,875 Operating lease liabilities, net of current portion 4,385 Deferred tax liability 11,429 Other long-term liabilities 1,980 Total long-term liabilities 124,125 Total liabilities 194,139 Common stock 1 Additional paid-In capital 80,279 Accumulated deficit (296) Total stockholder’s equity 79,984 Total liabilities and stockholder’s equity 274,123 $ See notes to consolidated financial statements.

5 ITsavvy Acquisition Company, Inc. and Subsidiaries Consolidated Statement of Income Year Ended December 31, 2023 (In thousands) Net sales 409,648 $ Cost of goods sold 350,179 Gross profit 59,469 Selling, general and administrative expenses 48,533 Operating income 10,936 Interest expense 9,215 Income before income tax expense 1,721 Income tax expense 671 Net income 1,050 $ See notes to consolidated financial statements.

6 ITsavvy Acquisition Company, Inc. and Subsidiaries Consolidated Statement of Stockholder’s Equity Year Ended December 31, 2023 (In thousands) Additional Total Common Paid-In Accumulated Stockholder’s Stock Capital Deficit Equity Balance, December 31, 2022 1 $ 78,119 $ (1,346) $ 76,774 $ Issuance of Class A units pursuant to business combination - 2,160 - 2,160 Net income - - 1,050 1,050 Balance, December 31, 2023 1 $ 80,279 $ (296) $ 79,984 $ See notes to consolidated financial statements.

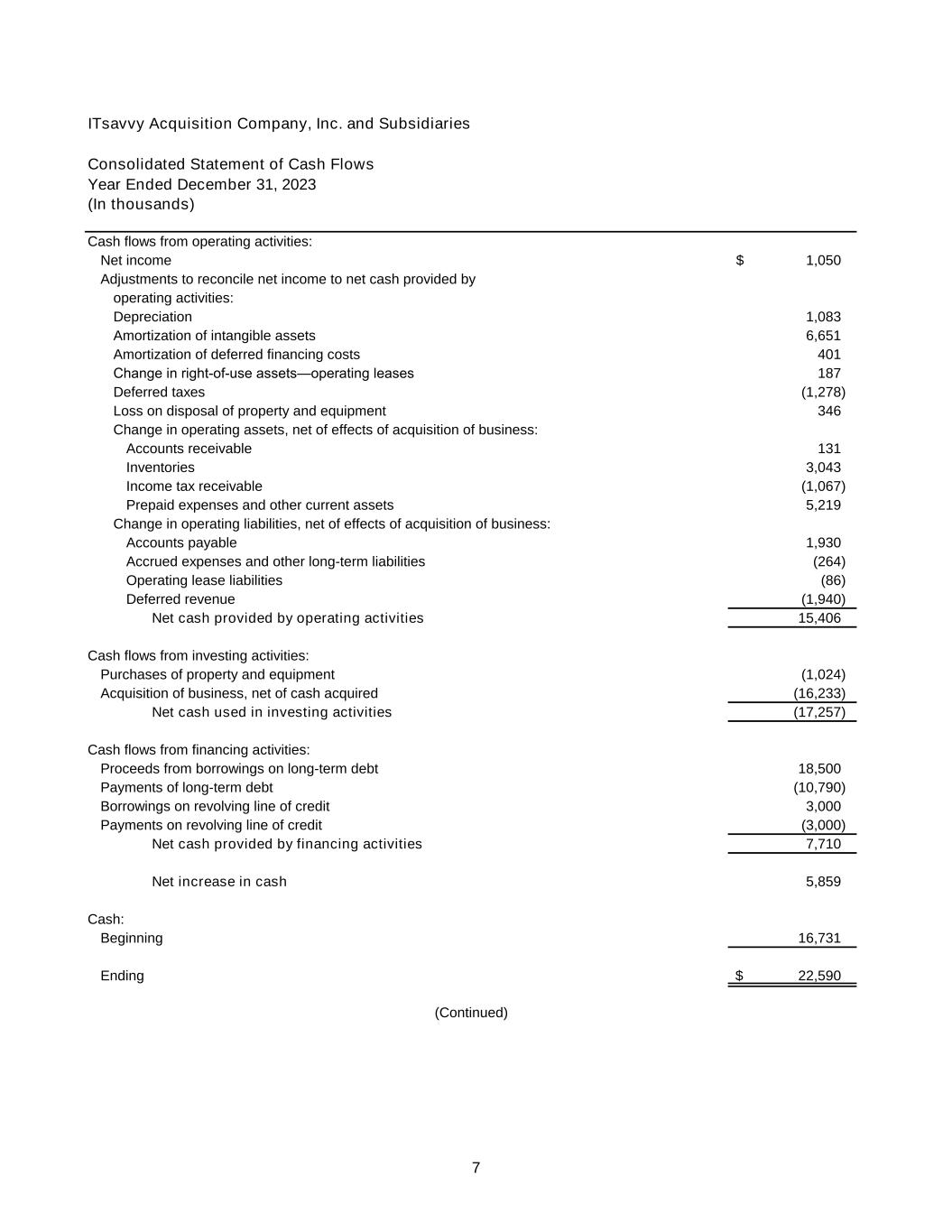

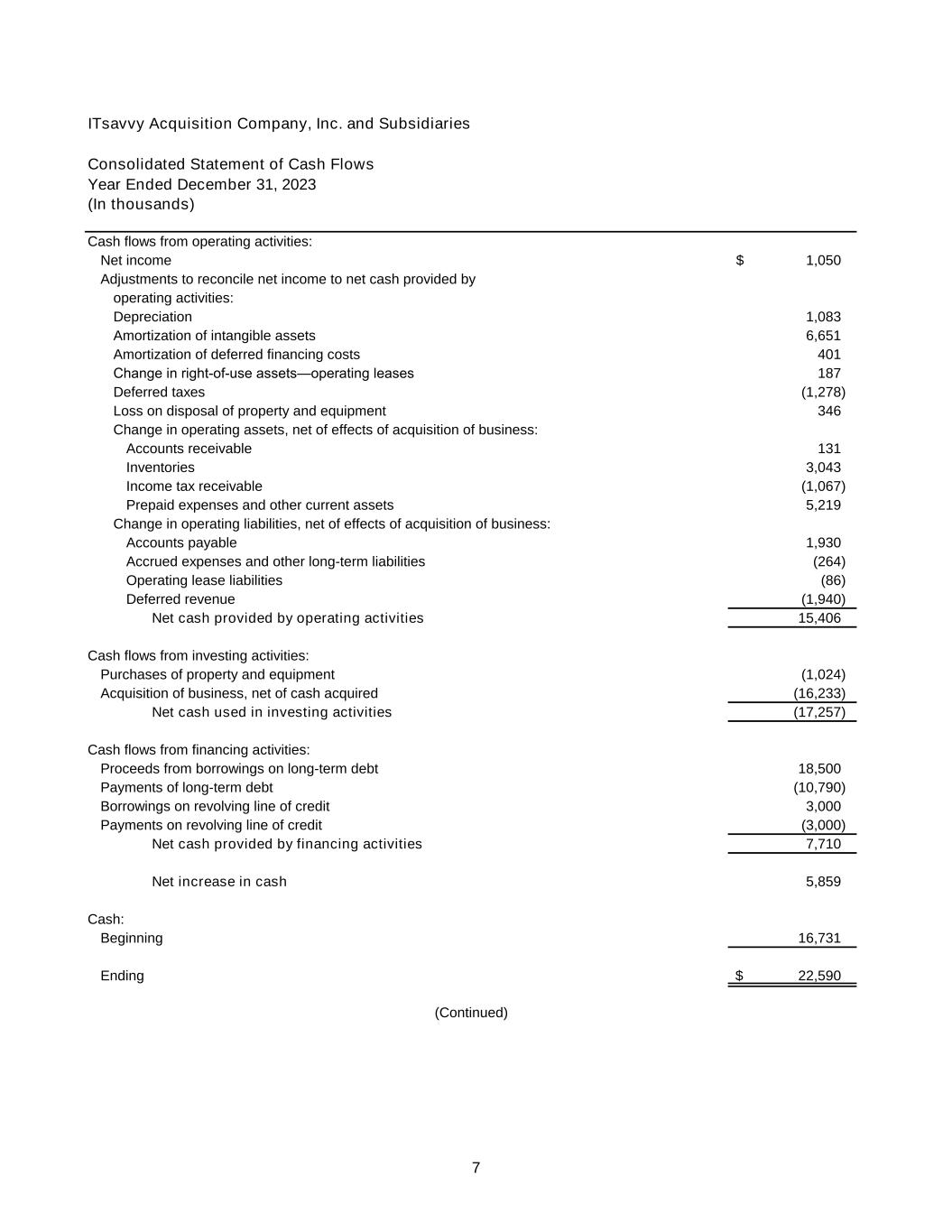

7 ITsavvy Acquisition Company, Inc. and Subsidiaries Consolidated Statement of Cash Flows Year Ended December 31, 2023 (In thousands) Cash flows from operating activities: Net income 1,050 $ Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 1,083 Amortization of intangible assets 6,651 Amortization of deferred financing costs 401 Change in right-of-use assets—operating leases 187 Deferred taxes (1,278) Loss on disposal of property and equipment 346 Change in operating assets, net of effects of acquisition of business: Accounts receivable 131 Inventories 3,043 Income tax receivable (1,067) Prepaid expenses and other current assets 5,219 Change in operating liabilities, net of effects of acquisition of business: Accounts payable 1,930 Accrued expenses and other long-term liabilities (264) Operating lease liabilities (86) Deferred revenue (1,940) Net cash provided by operating activities 15,406 Cash flows from investing activities: Purchases of property and equipment (1,024) Acquisition of business, net of cash acquired (16,233) Net cash used in investing activities (17,257) Cash flows from financing activities: Proceeds from borrowings on long-term debt 18,500 Payments of long-term debt (10,790) Borrowings on revolving line of credit 3,000 Payments on revolving line of credit (3,000) Net cash provided by financing activities 7,710 Net increase in cash 5,859 Cash: Beginning 16,731 Ending 22,590 $ (Continued)

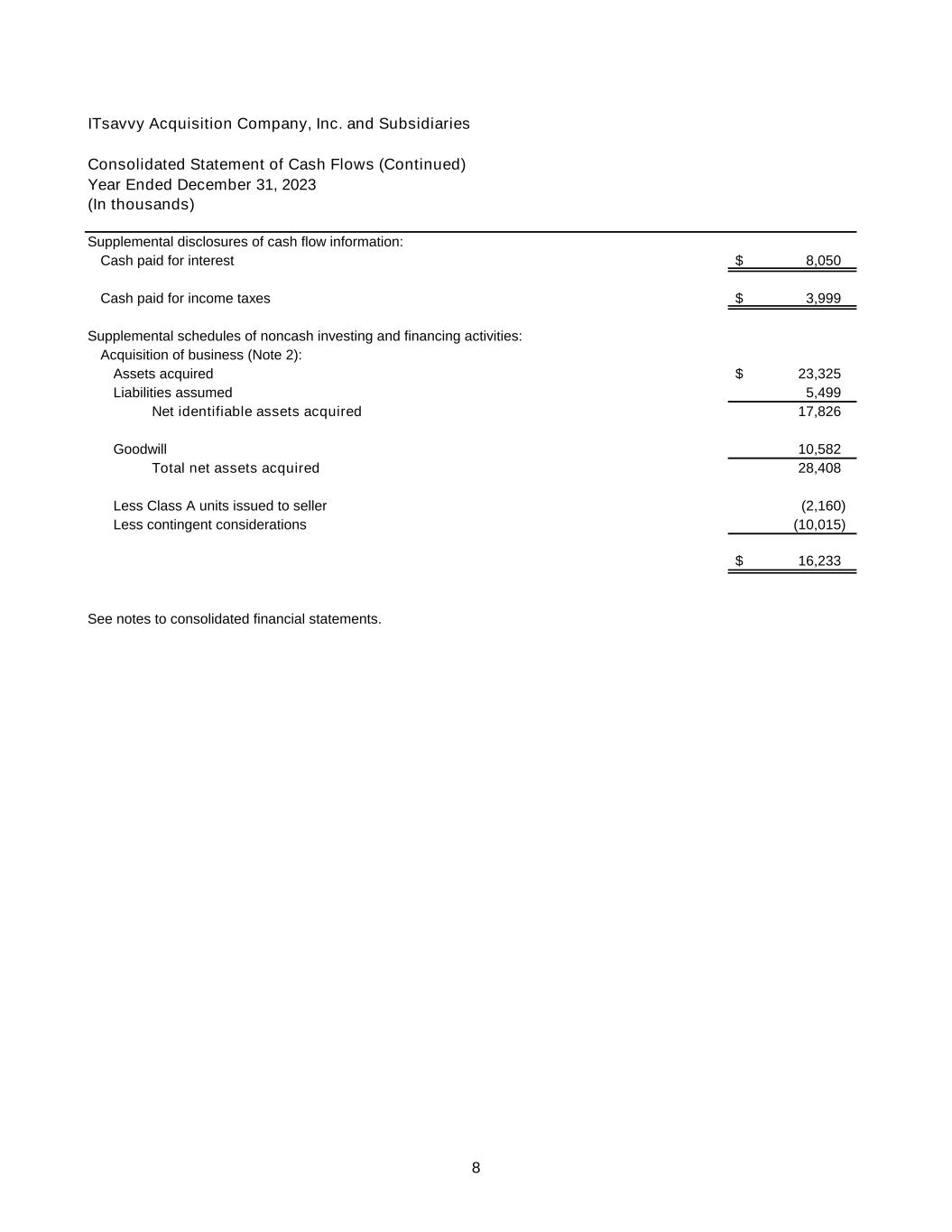

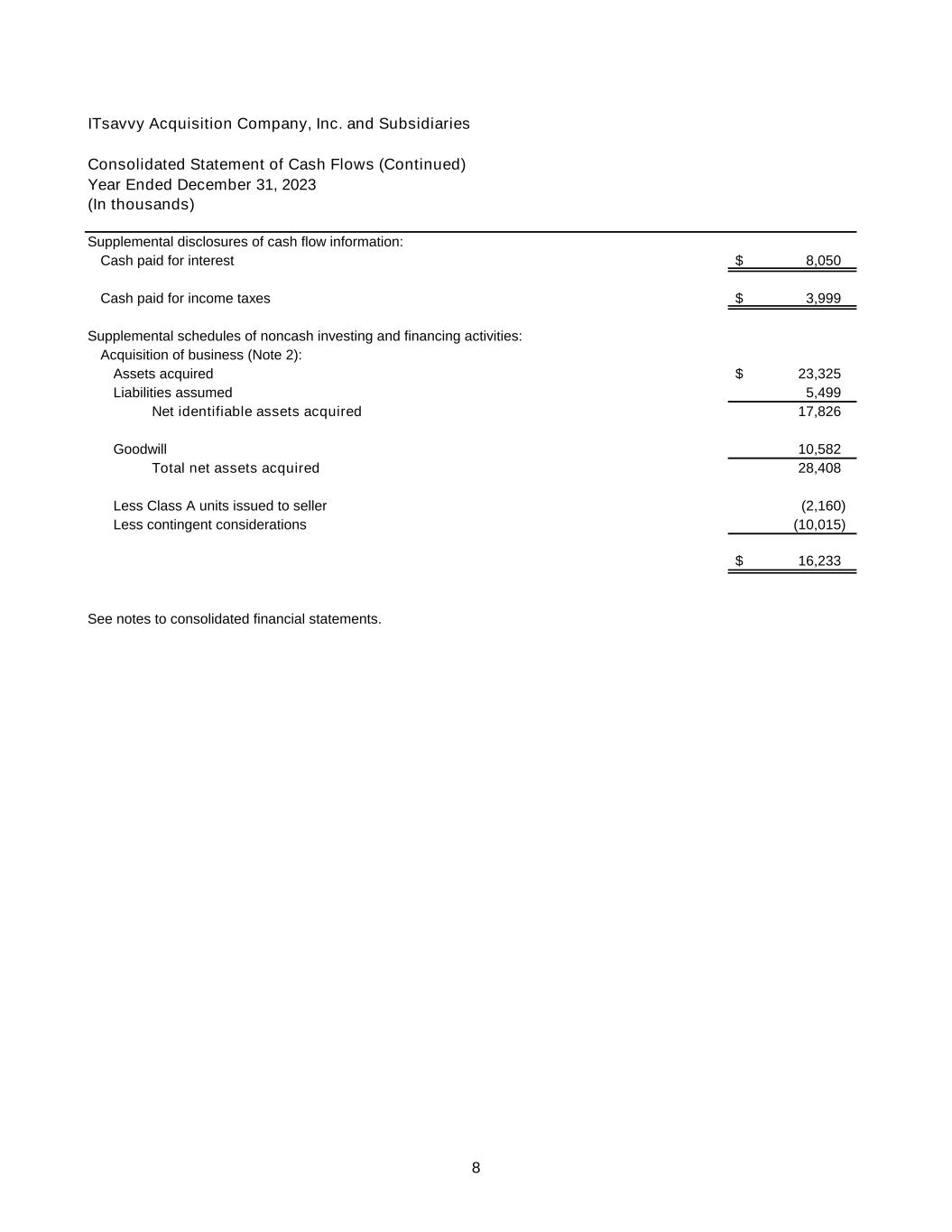

8 ITsavvy Acquisition Company, Inc. and Subsidiaries Consolidated Statement of Cash Flows (Continued) Year Ended December 31, 2023 (In thousands) Supplemental disclosures of cash flow information: Cash paid for interest 8,050 $ Cash paid for income taxes 3,999 $ Supplemental schedules of noncash investing and financing activities: Acquisition of business (Note 2): Assets acquired 23,325 $ Liabilities assumed 5,499 Net identifiable assets acquired 17,826 Goodwill 10,582 Total net assets acquired 28,408 Less Class A units issued to seller (2,160) Less contingent considerations (10,015) 16,233 $ See notes to consolidated financial statements.

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 9 Note 1. Nature of Organization and Summary of Significant Accounting Policies Nature of organization: ITsavvy Acquisition Company, Inc. and its Subsidiaries (the Company) is a technology infrastructure solutions provider focused on accelerating time to value in delivering business outcomes on behalf of our clients. The organization, from sales, service delivery, and back-office operations, is focused on enabling frictionless experiences for clients across all four client focus areas (Public Sector, Enterprise, Commercial, and SMB). The Company is focused on four main technology infrastructure verticals: Cloud & Hosting; Network & Security; Collaboration; and Hybrid Workforce/Anywhere Learning. Adoption of Public Company Standards: The Company is no longer electing the Private Company Council (PCC) alternatives. As a result of this election, the Company unwound previous amortization of goodwill and allocated purchase price of prior acquisitions to customer relationships. The effect of this change in accounting principle as of December 31, 2022 was a decrease in the accumulated deficit of $3,713 which is the result of the difference of goodwill and customer relationships as well as tax effects. Principles of consolidation: The consolidated financial statements include the accounts of the Company. All intercompany accounts and transactions have been eliminated in consolidation. The Company is wholly owned by its parent company, ITsavvy Holdings, LLC (Holdings). Basis of presentation: The Company was a newly formed entity on July 19, 2022 (Inception). The financial statements herein include the results of ITsavvy Acquisition Company, Inc. (Acquisition) and its subsidiaries for the year ended December 31, 2023. Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Cash: The Company maintains cash with multiple financial institutions in bank accounts which, may at times, exceed existing federally insured limits. The Company has not experienced any losses in these accounts. Accounts receivable, net: Accounts receivable primarily consist of amounts billed currently due from customers. Accounts receivable are presented net of an allowance for credit losses, which is an estimate of amounts that may not be collectible. In determining the amount of the allowance, the Company makes judgments about general economic conditions, historical write-off experience and any specific risks identified in customer collection matters, including the aging of unpaid accounts receivable and changes in customer financial conditions. The Company does not accrue interest on past due accounts. Account balances are written off after all means of collection are exhausted and the potential for non-recovery is determined to be probable. Adjustments to the allowance for credit losses are recorded as selling, general and administrative expenses in the consolidated statement of income. Activity in the Company’s allowance for expected credit losses for the year ended December 31, 2023 is as follows: Balance, beginning 775 $ Bad debt expense 1,173 Uncollectible accounts written off, net of recoveries (1,196) Balance, ending 752 $

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 10 Note 1. Nature of Organization and Summary of Significant Accounting Policies (Continued) Inventories, net: Inventories, consisting mainly of finished products, are valued at the lower of cost or net realizable value. The process for evaluating the value of excess and obsolete inventories requires the Company to make judgments and estimates concerning the future sales levels, quantities, and prices at which such inventories will be sold in the normal course of business. As of December 31, 2023, the Company has determined the reserve for excess and obsolete inventory is not material to the consolidated financial statements. Property and equipment: Property and equipment is carried at cost and depreciated over the estimated useful life of each asset on a straight-line basis: Furniture and office equipment 3 to 7 years Computer equipment 3 to 5 years Warehouse equipment 5 to 7 years Leasehold improvements Lesser of lease term or 5 to 29 years Major renewals and betterments are capitalized while maintenance and repairs that do not improve or extend the life of the respective assets are expensed in the period as such expenses are incurred. Goodwill: Goodwill is the excess of cost over the fair value of net assets acquired. Goodwill is not amortized but is tested for impairment. Under the provisions of Accounting Standards Codification (ASC) 350, Intangibles—Goodwill and Other, the Company is required to perform annual tests of its goodwill for impairment or additional tests whenever events or circumstances indicate impairment may exist. Under this guidance, goodwill must be tested at lease annually for impairment using either a quantitative or qualitative approach. The Company performs impairment test on December 31 whereby it compares the fair value of equity to the carrying amount and recognizes an impairment charge for an amount by which the carrying amount exceeds the fair value, when applicable. During the year ended December 31, 2023, the Company determined that impairment of goodwill did not exist. Intangible assets: Intangible assets acquired, primarily relating to customer relationships and tradenames, are amortized over their estimated useful lives on a straight-line basis. Deferred financing costs: Deferred financing costs of $2,405 at December 31, 2023 (net of accumulated amortization of $552), relating to the Company’s long-term debt are being amortized on a straight-line basis over the lines of the related debt agreements, which approximates the effective interest method. Impairment of long-lived assets: The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The assessment of impairment is based on the estimated undiscounted future cash flows from the asset compared with the carrying value of the asset group. If the undiscounted future cash flows for an asset group are less than the carrying value, a write-down will be recorded; measured by the amount of the difference between carrying value and the fair value of the asset group. There was no impairment noted for 2023. Fair value of financial instruments: The carrying amounts of cash, accounts receivable, accounts payable, accrued liabilities and short-term borrowings approximate the fair values of these financial instruments due to their short-term maturity of the instruments. The fair value of debt approximates the carrying value based on comparisons of terms (maturity, interest rate, etc.) to comparable debt offerings in the marketplace.

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 11 Note 1. Nature of Organization and Summary of Significant Accounting Policies (Continued) Revenue recognition: The Company recognizes revenue following a five-step model for recognizing revenue from contracts with clients consistent with ASC 606 as follows: • Identify the contract with a client • Identify the performance obligations in the contract • Determine the transaction price • Allocate the transaction price to the performance obligations in the contract • Recognize revenue when or as performance obligations are satisfied The Company distributes IT products and provides a variety of IT related services. The Company evaluates the following indicators amongst others when determining whether it is acting as a principal in the transaction and recording revenue on a gross basis: (i) the Company is primarily responsible for fulfilling the promise to provide the specified goods or services, (ii) the Company has inventory risk before the specified good or service has been transferred to the client and (iii) the Company has discretion in establishing the price for the specified good or service. The Company recognizes revenue in transactions for which it is acting as a principal once control has passed to the client. The following indicators are evaluated in determining when control has passed to the client: (i) the Company has a right to payment for the product or service, (ii) the client has legal title to the product, (iii) the Company has transferred physical possession of the product to the client, (iv) the client has the significant risk and rewards of ownership of the product and (v) the client has accepted the product. The Company’s products can be delivered to client in a variety of ways, including (i) as physical product shipped from the Company’s warehouse, (ii) via drop-shipment by the vendor or supplier or (iii) via electronic delivery of keys for software licenses. The Company’s shipping terms allow for the Company to recognize revenue when control of the product is transferred. The Company leverages drop-shipment arrangements with many of its vendors and suppliers to deliver products to its clients without having to physically hold the inventory at its warehouses. The Company is the principal in the transaction and recognizes revenue for drop-shipment arrangements on a gross basis. Revenue recognition for hardware: Revenues from sales of hardware products are recognized on a gross basis as the Company is acting as a principal in these transactions, with the selling price to the client recorded as net sales and the acquisition cost of the product recorded as cost of sales. Revenue recognition for software: Revenues from most software license sales are recognized as a single performance obligation on a gross basis as the Company is acting as a principal in these transactions at the point the software license is delivered to the client. The Company sells cloud computing solutions which include Software as a Service (SaaS). SaaS solutions utilize third-party partners to offer the Company’s clients access to software in the cloud that provide a variety of services to the end client. The Company’s clients are offered the opportunity by certain vendors to purchase software licenses and software assurance under enterprise agreements (EAs). Under most EA transactions, the Company’s obligation to the client is that of a distributor or sales agent of the software, where all obligations for providing the software to clients are passed to the Company’s vendors. The Company’s performance obligations are satisfied at the time of the sale.

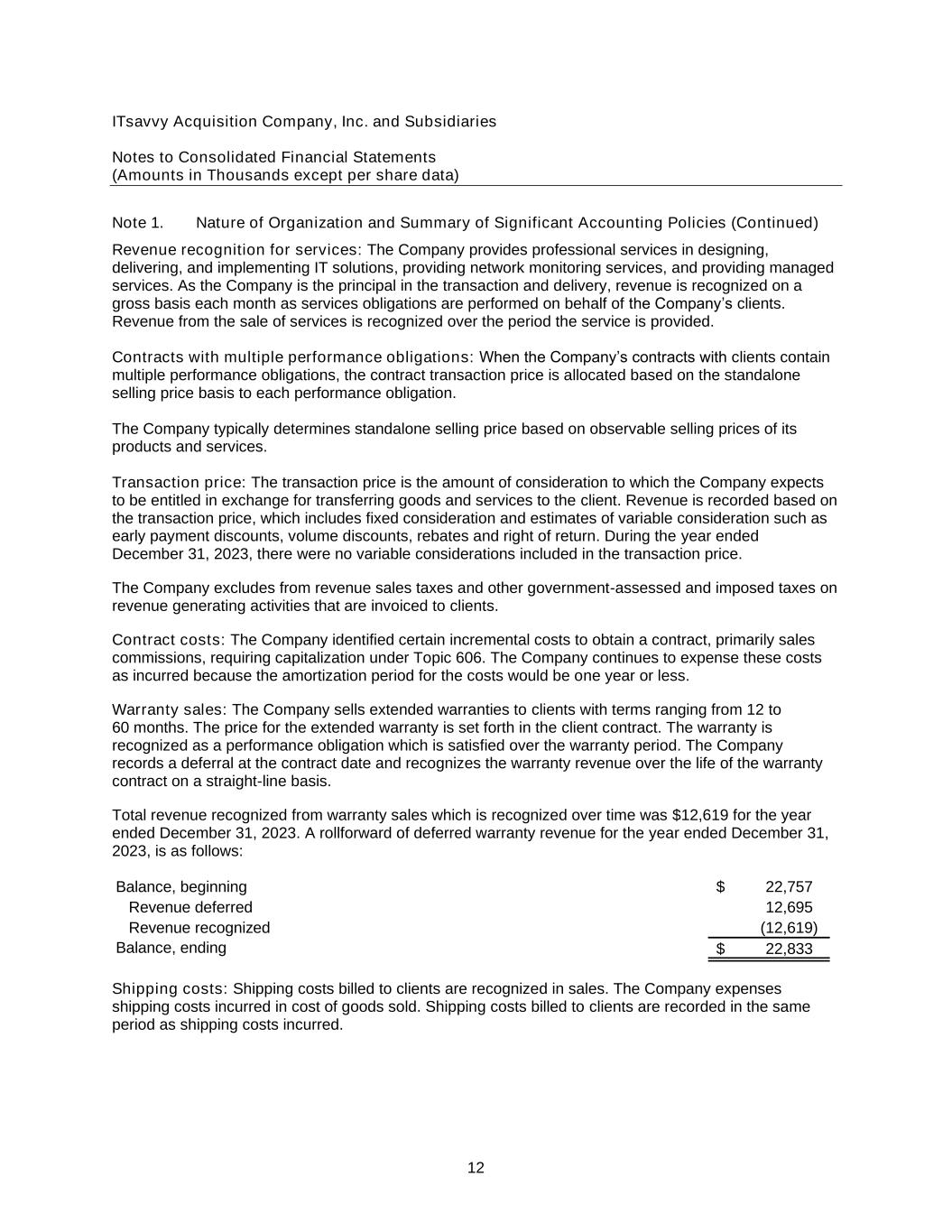

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 12 Note 1. Nature of Organization and Summary of Significant Accounting Policies (Continued) Revenue recognition for services: The Company provides professional services in designing, delivering, and implementing IT solutions, providing network monitoring services, and providing managed services. As the Company is the principal in the transaction and delivery, revenue is recognized on a gross basis each month as services obligations are performed on behalf of the Company’s clients. Revenue from the sale of services is recognized over the period the service is provided. Contracts with multiple performance obligations: When the Company’s contracts with clients contain multiple performance obligations, the contract transaction price is allocated based on the standalone selling price basis to each performance obligation. The Company typically determines standalone selling price based on observable selling prices of its products and services. Transaction price: The transaction price is the amount of consideration to which the Company expects to be entitled in exchange for transferring goods and services to the client. Revenue is recorded based on the transaction price, which includes fixed consideration and estimates of variable consideration such as early payment discounts, volume discounts, rebates and right of return. During the year ended December 31, 2023, there were no variable considerations included in the transaction price. The Company excludes from revenue sales taxes and other government-assessed and imposed taxes on revenue generating activities that are invoiced to clients. Contract costs: The Company identified certain incremental costs to obtain a contract, primarily sales commissions, requiring capitalization under Topic 606. The Company continues to expense these costs as incurred because the amortization period for the costs would be one year or less. Warranty sales: The Company sells extended warranties to clients with terms ranging from 12 to 60 months. The price for the extended warranty is set forth in the client contract. The warranty is recognized as a performance obligation which is satisfied over the warranty period. The Company records a deferral at the contract date and recognizes the warranty revenue over the life of the warranty contract on a straight-line basis. Total revenue recognized from warranty sales which is recognized over time was $12,619 for the year ended December 31, 2023. A rollforward of deferred warranty revenue for the year ended December 31, 2023, is as follows: Balance, beginning 22,757 $ Revenue deferred 12,695 Revenue recognized (12,619) Balance, ending 22,833 $ Shipping costs: Shipping costs billed to clients are recognized in sales. The Company expenses shipping costs incurred in cost of goods sold. Shipping costs billed to clients are recorded in the same period as shipping costs incurred.

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 13 Note 1. Nature of Organization and Summary of Significant Accounting Policies (Continued) Advertising and other marketing costs: Advertising and other marketing costs are expensed as incurred. Such expenses were not material for 2023. Income taxes: The Company accounts for income taxes using the liability method. As such, deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets and liabilities are calculated using the enacted tax rates and laws that are expected to be in effect when the anticipated reversal of these differences is scheduled to occur. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The Company follows the provisions of the Accounting for Uncertainty in Income Taxes subtopic of the Income Taxes Topic of the ASC. The Company has not recorded a reserve for any tax positions for which the ultimate deductibility is highly certain but for which there is uncertainty about the timing of such deductibility. The Company files tax returns in all appropriate jurisdictions. When and if applicable, potential interest and penalty costs are accrued as incurred, with expenses recognized in operating expenses in the consolidated statement of income, of which there were none in the year presented. As of December 31, 2023, the Company has no liability for unrecognized tax benefits. Lease accounting: In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02, Leases (Topic 842), to increase transparency and comparability among organizations related to their leasing arrangements. This comprehensive new standard amends and supersedes existing lease accounting guidance and is intended to increase transparency and comparability among organizations by recognizing right-of-use (ROU) lease assets and lease liabilities on the balance sheet and requiring disclosure of key information about leasing arrangements. Lease expense continues to be recognized in a manner similar to legacy U.S. GAAP. Generally, the Company’s lease contracts do not provide a readily determinable implicit rate, and therefore, the Company uses an estimated incremental borrowing rate as of the commencement date in determining the present value of lease payments. The Company made an accounting policy election under Topic 842 not to recognize ROU assets and lease liabilities for leases with a term of 12 months or less. For all other leases, the Company recognizes ROU assets and lease liabilities based on the present value of lease payments over the lease term at the commencement date of the lease. The ROU assets also include any initial direct costs incurred and lease payments made at or before the commencement date and are reduced by any lease incentives. Future lease payments may include fixed rent escalation clauses or payments that depend on an index (such as the consumer price index). Subsequent changes to an index and other periodic market-rate adjustments to base rent are recorded in variable lease expense in the period incurred. Payments for terminating the lease are included in the lease payments only when it is probable they will be incurred.

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 14 Note 1. Nature of Organization and Summary of Significant Accounting Policies (Continued) The Company’s leases may include a non-lease component representing additional services transferred to the Company, such as common area maintenance for real estate. The Company made an accounting policy election to account for each separate lease component and the non-lease components associated with that lease component as a single lease component. Non-lease components that are variable in nature are recorded in variable lease expense in the period incurred. Recently adopted standard: Effective January 1, 2023, the Company adopted ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which creates a new credit impairment standard for financial assets measured at amortized cost. The ASU requires financial assets measured at amortized cost (including loans, trade receivables and held-to- maturity debt securities) to be presented at the net amount expected to be collected, through an allowance for credit losses that are expected to occur over the remaining life of the asset, rather than incurred losses. The measurement of credit losses for newly recognized financial assets (other than certain purchased assets) and subsequent changes in the allowance for credit losses are recorded in the consolidated statement of income as the amounts expected to be collected change. The Company determined the new standard did not have a significant impact on the consolidated financial statements. Recently issued accounting pronouncements: In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which provides for improvements to income tax disclosures primarily related to the rate reconciliation and income taxes paid information. This ASU is effective for the Entity beginning on January 1, 2026. The Company is currently evaluating the impact of this new guidance on its consolidated financial statements. In November 2024, the FASB issued ASU 2024-03, Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses, which is intended to improve disclosures related to certain income statement expenses of the Company. This ASU is effective for fiscal years beginning after December 15, 2026, and interim periods within fiscal years beginning after December 15, 2027, with early adoption permitted. We are currently evaluating the impact of the adoption of this standard to determine its impact on the Company's disclosures. Note 2. Business Acquisitions and Subsequent Event The Company has adopted ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers. ASU 2021-08 removes the measurement of acquired contract assets and contract liabilities from the fair value measurement provisions of ASC 805 and instead requires that such acquired balances be recognized and measured in accordance with the provisions of ASC 606, Revenue from Contracts with Customers.

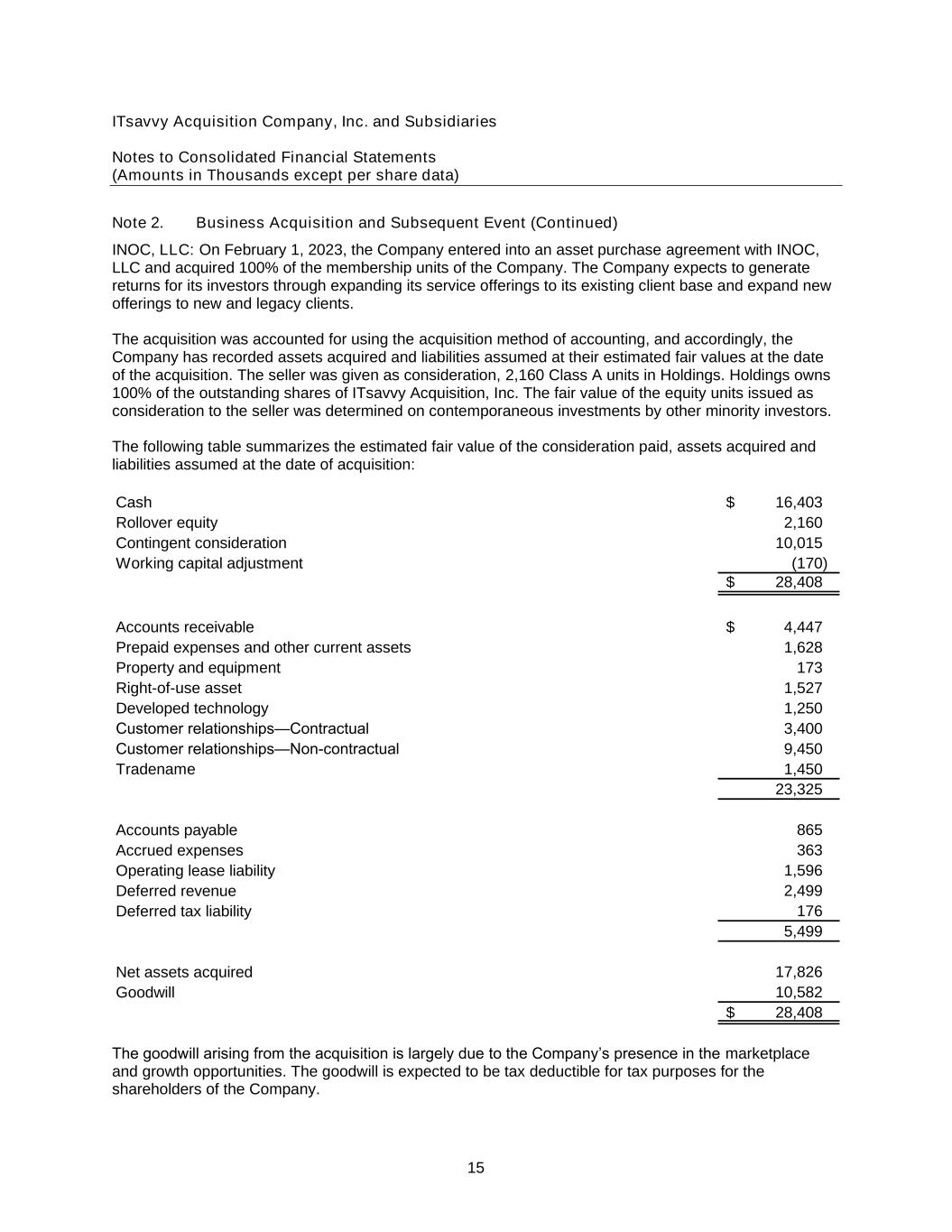

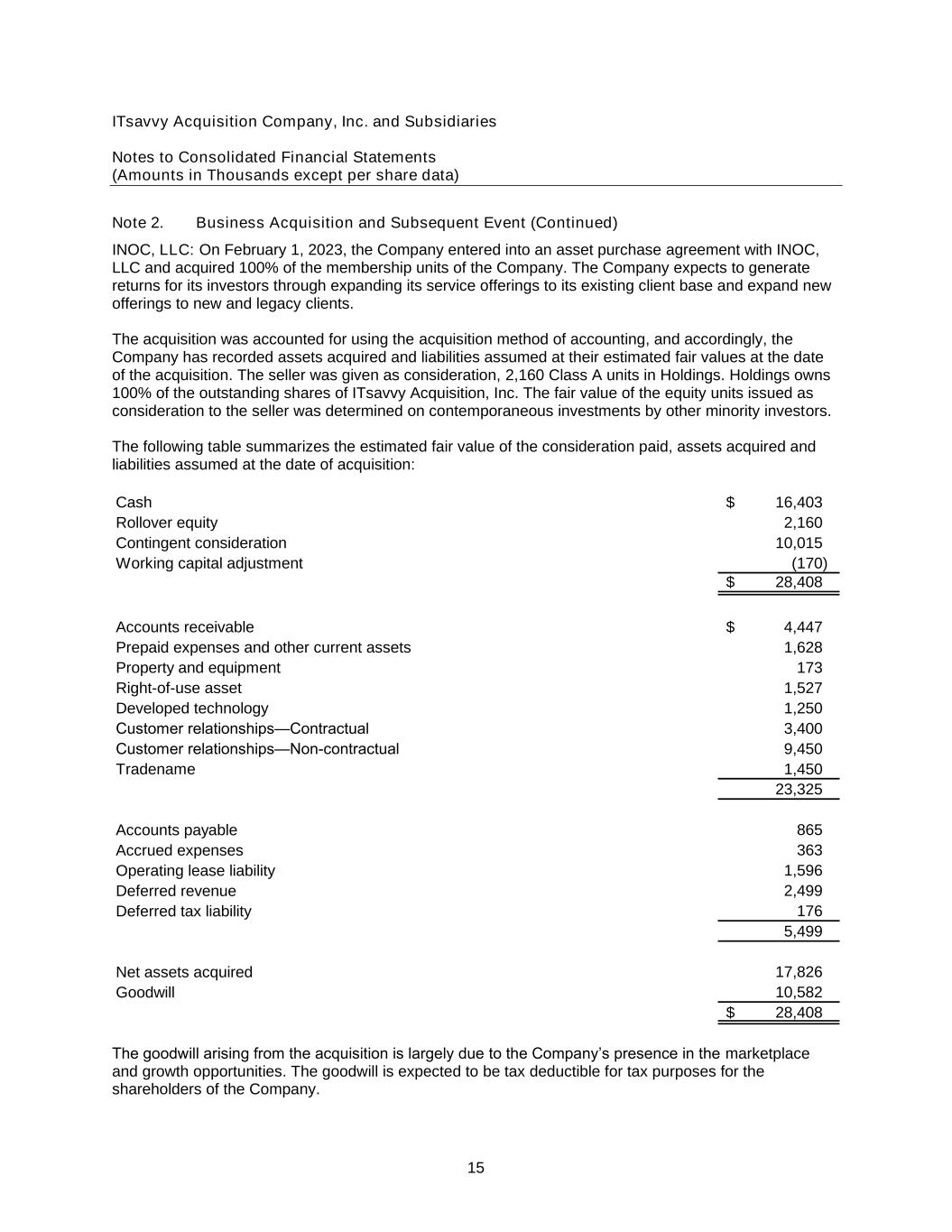

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 15 Note 2. Business Acquisition and Subsequent Event (Continued) INOC, LLC: On February 1, 2023, the Company entered into an asset purchase agreement with INOC, LLC and acquired 100% of the membership units of the Company. The Company expects to generate returns for its investors through expanding its service offerings to its existing client base and expand new offerings to new and legacy clients. The acquisition was accounted for using the acquisition method of accounting, and accordingly, the Company has recorded assets acquired and liabilities assumed at their estimated fair values at the date of the acquisition. The seller was given as consideration, 2,160 Class A units in Holdings. Holdings owns 100% of the outstanding shares of ITsavvy Acquisition, Inc. The fair value of the equity units issued as consideration to the seller was determined on contemporaneous investments by other minority investors. The following table summarizes the estimated fair value of the consideration paid, assets acquired and liabilities assumed at the date of acquisition: Cash 16,403 $ Rollover equity 2,160 Contingent consideration 10,015 Working capital adjustment (170) 28,408 $ Accounts receivable 4,447 $ Prepaid expenses and other current assets 1,628 Property and equipment 173 Right-of-use asset 1,527 Developed technology 1,250 Customer relationships—Contractual 3,400 Customer relationships—Non-contractual 9,450 Tradename 1,450 23,325 Accounts payable 865 Accrued expenses 363 Operating lease liability 1,596 Deferred revenue 2,499 Deferred tax liability 176 5,499 Net assets acquired 17,826 Goodwill 10,582 28,408 $ The goodwill arising from the acquisition is largely due to the Company’s presence in the marketplace and growth opportunities. The goodwill is expected to be tax deductible for tax purposes for the shareholders of the Company.

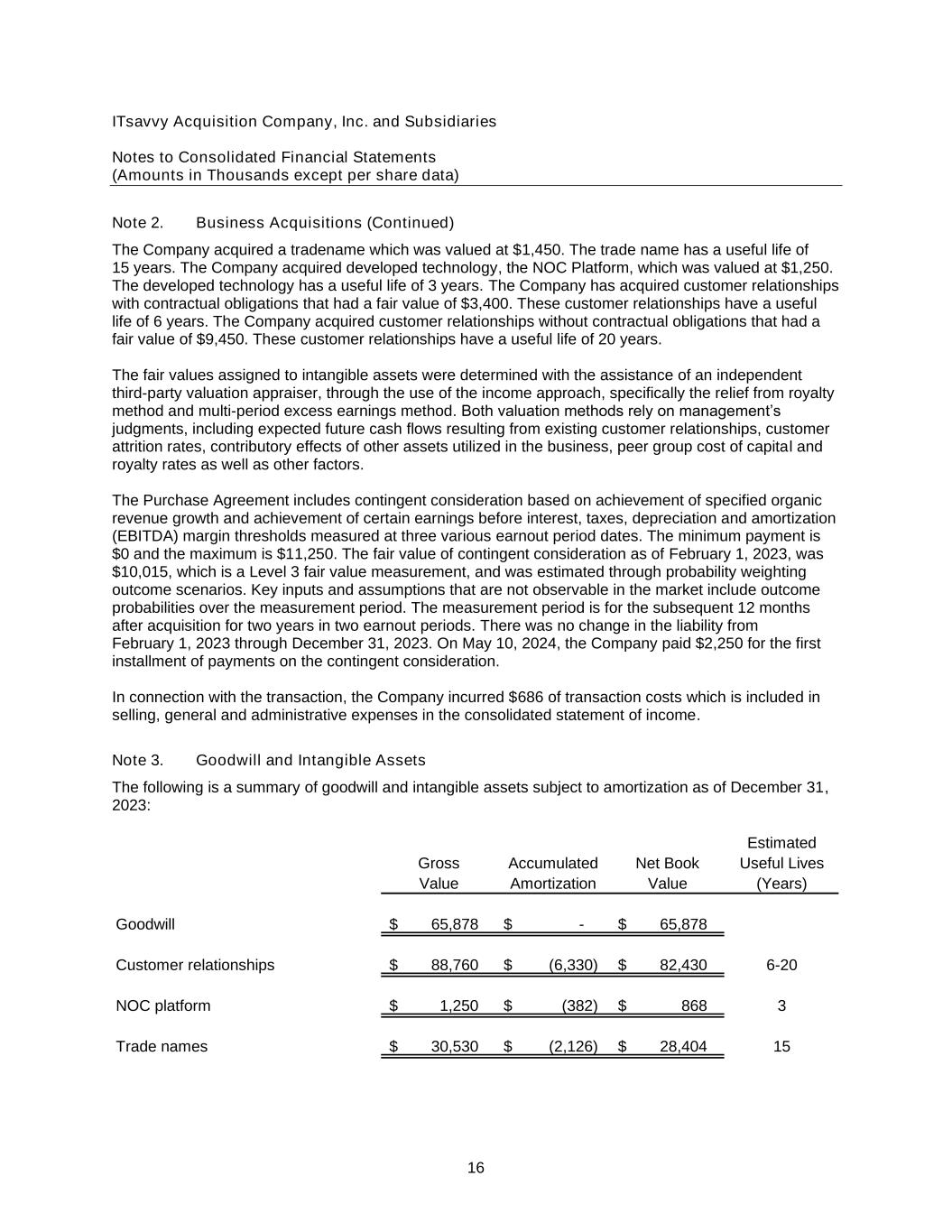

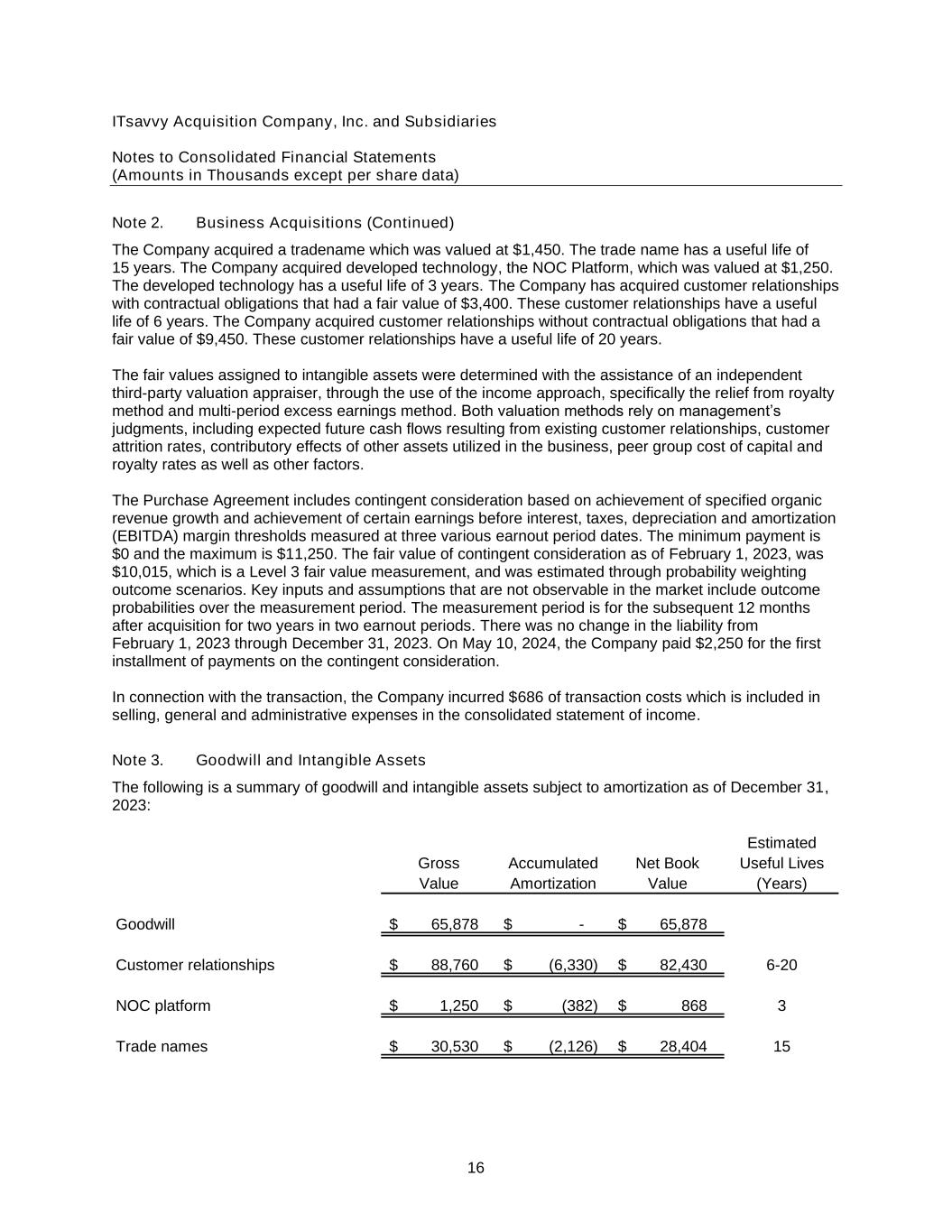

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 16 Note 2. Business Acquisitions (Continued) The Company acquired a tradename which was valued at $1,450. The trade name has a useful life of 15 years. The Company acquired developed technology, the NOC Platform, which was valued at $1,250. The developed technology has a useful life of 3 years. The Company has acquired customer relationships with contractual obligations that had a fair value of $3,400. These customer relationships have a useful life of 6 years. The Company acquired customer relationships without contractual obligations that had a fair value of $9,450. These customer relationships have a useful life of 20 years. The fair values assigned to intangible assets were determined with the assistance of an independent third-party valuation appraiser, through the use of the income approach, specifically the relief from royalty method and multi-period excess earnings method. Both valuation methods rely on management’s judgments, including expected future cash flows resulting from existing customer relationships, customer attrition rates, contributory effects of other assets utilized in the business, peer group cost of capital and royalty rates as well as other factors. The Purchase Agreement includes contingent consideration based on achievement of specified organic revenue growth and achievement of certain earnings before interest, taxes, depreciation and amortization (EBITDA) margin thresholds measured at three various earnout period dates. The minimum payment is $0 and the maximum is $11,250. The fair value of contingent consideration as of February 1, 2023, was $10,015, which is a Level 3 fair value measurement, and was estimated through probability weighting outcome scenarios. Key inputs and assumptions that are not observable in the market include outcome probabilities over the measurement period. The measurement period is for the subsequent 12 months after acquisition for two years in two earnout periods. There was no change in the liability from February 1, 2023 through December 31, 2023. On May 10, 2024, the Company paid $2,250 for the first installment of payments on the contingent consideration. In connection with the transaction, the Company incurred $686 of transaction costs which is included in selling, general and administrative expenses in the consolidated statement of income. Note 3. Goodwill and Intangible Assets The following is a summary of goodwill and intangible assets subject to amortization as of December 31, 2023: Estimated Gross Accumulated Net Book Useful Lives Value Amortization Value (Years) Goodwill 65,878 $ -$ 65,878 $ Customer relationships 88,760 $ (6,330) $ 82,430 $ 6-20 NOC platform 1,250 $ (382) $ 868 $ 3 Trade names 30,530 $ (2,126) $ 28,404 $ 15

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 17 Note 3. Goodwill and Intangible Assets (Continued) Amortization expense related to intangibles for the year ended December 31, 2023, was $6,917. Estimated amortization expense on all amortizable intangible assets during each of the next five years is as follows: Intangibles Years ending December 31: 2024 6,650 $ 2025 6,650 2026 6,650 2027 6,650 2028 6,650 Thereafter 78,452 111,702 $ Note 4. Long-Term Debt, Delayed Draw Term Loan, and Line of Credit In August 2022, the Company entered into a credit agreement with a lender that provided for $74,900 term loan and a revolving line of credit, with a maximum borrowing capacity of $10,000, and a delayed draw term loan. The term loan requires quarterly principal payments of $188 through August 2028, when the remaining principal and interest are due in full. The credit agreement has a maturity date of August 5, 2028. Interest is payable monthly or quarterly at a rate of Secured Overnight Financing Rate (SOFR) plus applicable margin. The outstanding balance on the term loan was $73,964 as of December 31, 2023. There were no outstanding borrowings on the line of credit as of December 31, 2023. On February 1, 2023, the Company amended the existing credit agreement to allow for borrowings on the delay draw term loan. The Company borrowed $18,500 on the delay draw term loan with no other significant amendments made to the credit agreement. The delay draw term loan has a maturity date of August 2028, similar to the remainder of the credit agreement. Principal payments are due quarterly of approximately $46 with the balance outstanding due upon maturity date of the delay draw term loan. Interest is payable at a rate of SOFR plus applicable margin. The outstanding balance on the delay draw term loan was $8,459 as of December 31, 2023. The effective rate was 10.89% at December 31, 2023 on the term loan. The effective rate was 10.78% at December 31, 2023 on the delay draw term loan. The term loan, delayed draw term loan, and line of credit are collateralized by substantially all assets of the Company. The credit agreement contains restrictions and covenants as defined in the agreement. The agreement also requires the Company to make annual payments in addition to the quarterly installments, based on excess cash flows, as defined, scheduled to commence with fiscal year ended December 31, 2023. There were no required payments for excess cash flows for the year ended December 31, 2023.

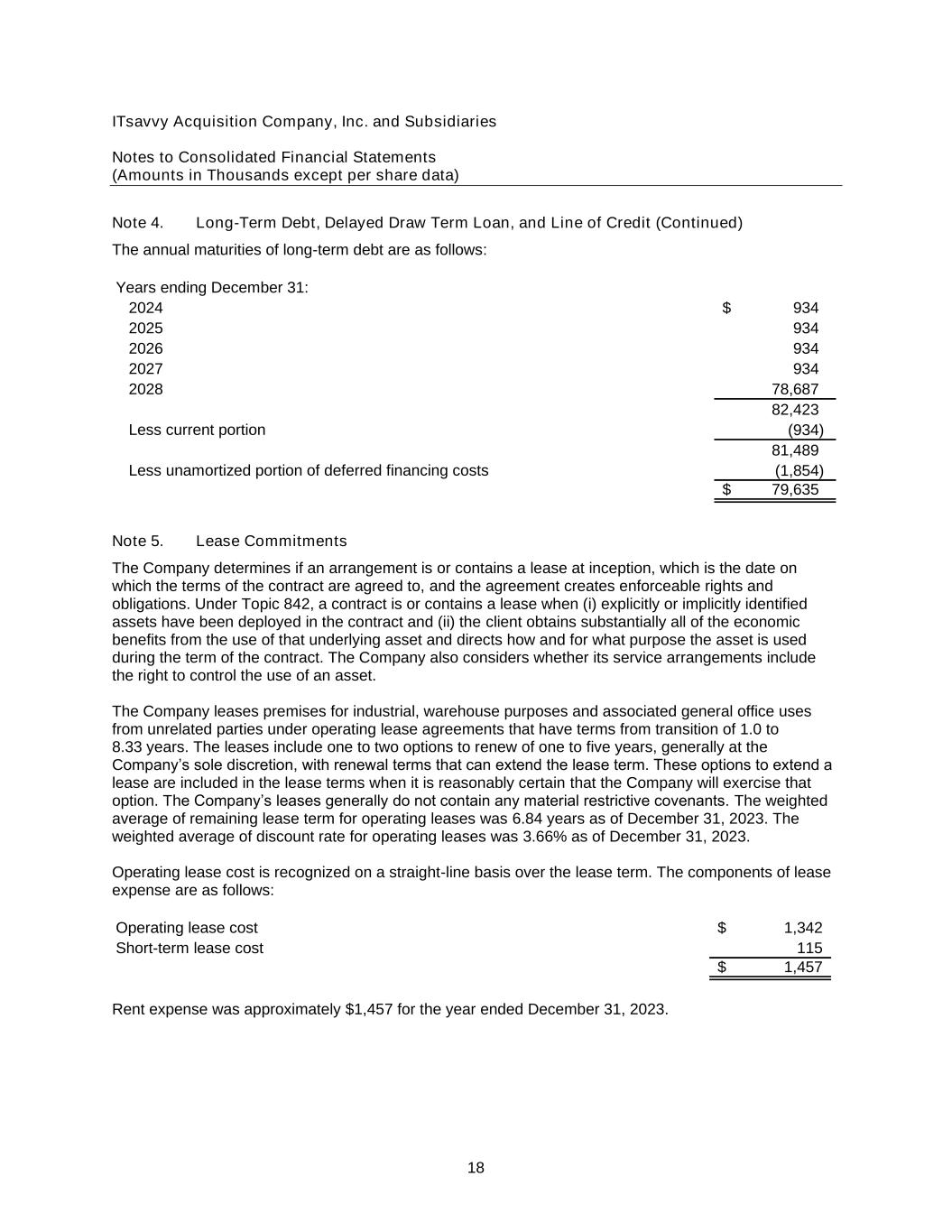

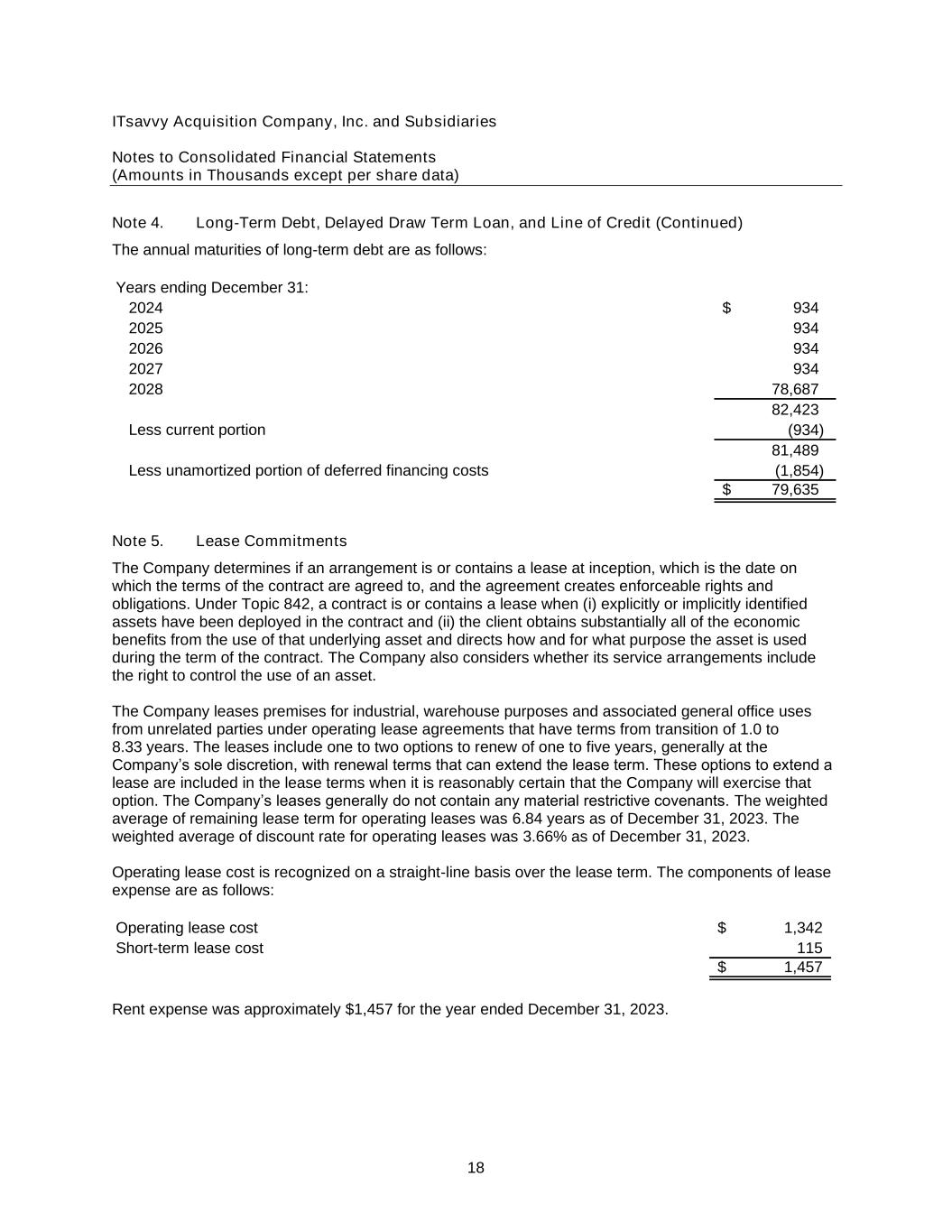

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 18 Note 4. Long-Term Debt, Delayed Draw Term Loan, and Line of Credit (Continued) The annual maturities of long-term debt are as follows: Years ending December 31: 2024 934 $ 2025 934 2026 934 2027 934 2028 78,687 82,423 Less current portion (934) 81,489 Less unamortized portion of deferred financing costs (1,854) 79,635 $ Note 5. Lease Commitments The Company determines if an arrangement is or contains a lease at inception, which is the date on which the terms of the contract are agreed to, and the agreement creates enforceable rights and obligations. Under Topic 842, a contract is or contains a lease when (i) explicitly or implicitly identified assets have been deployed in the contract and (ii) the client obtains substantially all of the economic benefits from the use of that underlying asset and directs how and for what purpose the asset is used during the term of the contract. The Company also considers whether its service arrangements include the right to control the use of an asset. The Company leases premises for industrial, warehouse purposes and associated general office uses from unrelated parties under operating lease agreements that have terms from transition of 1.0 to 8.33 years. The leases include one to two options to renew of one to five years, generally at the Company’s sole discretion, with renewal terms that can extend the lease term. These options to extend a lease are included in the lease terms when it is reasonably certain that the Company will exercise that option. The Company’s leases generally do not contain any material restrictive covenants. The weighted average of remaining lease term for operating leases was 6.84 years as of December 31, 2023. The weighted average of discount rate for operating leases was 3.66% as of December 31, 2023. Operating lease cost is recognized on a straight-line basis over the lease term. The components of lease expense are as follows: Operating lease cost 1,342$ Short-term lease cost 115 1,457$ Rent expense was approximately $1,457 for the year ended December 31, 2023.

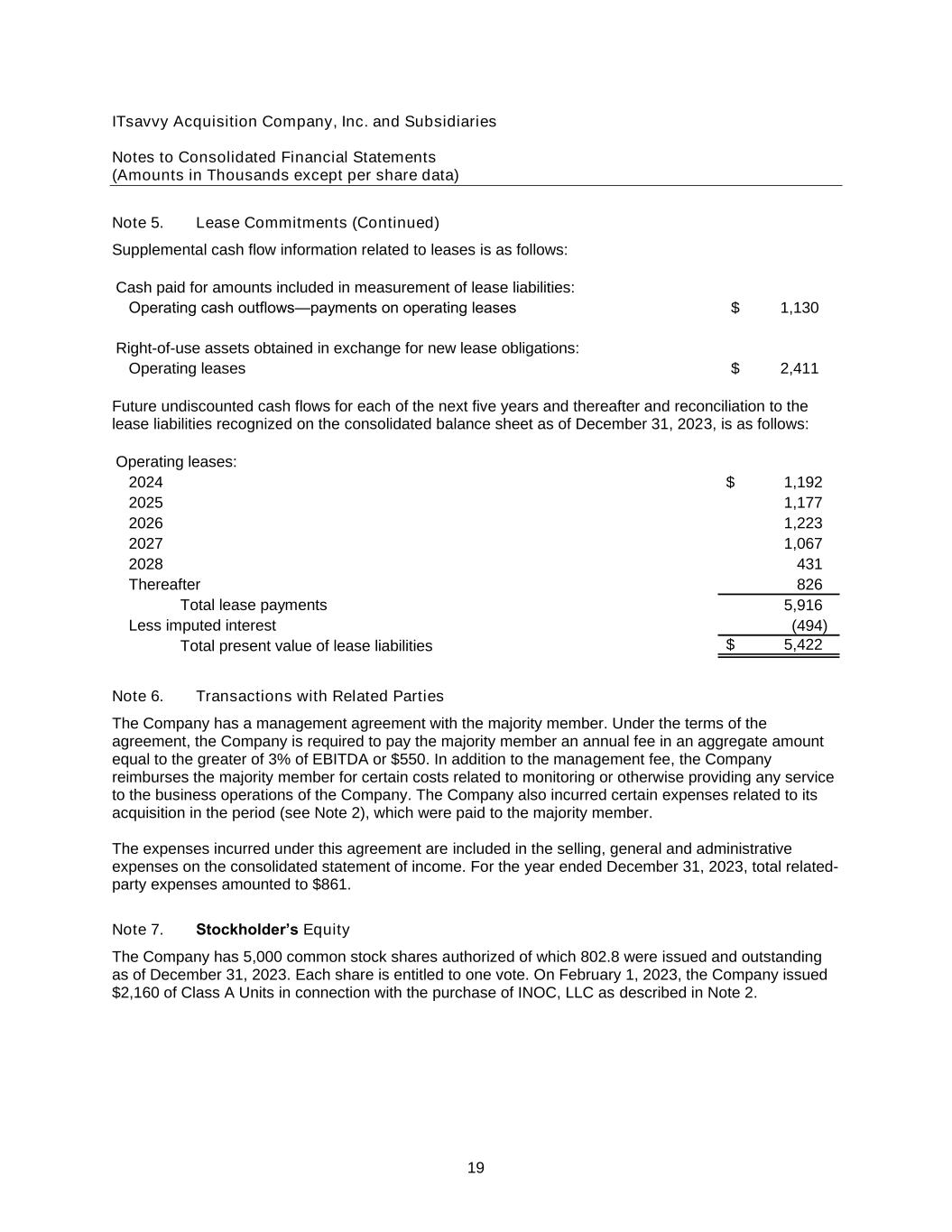

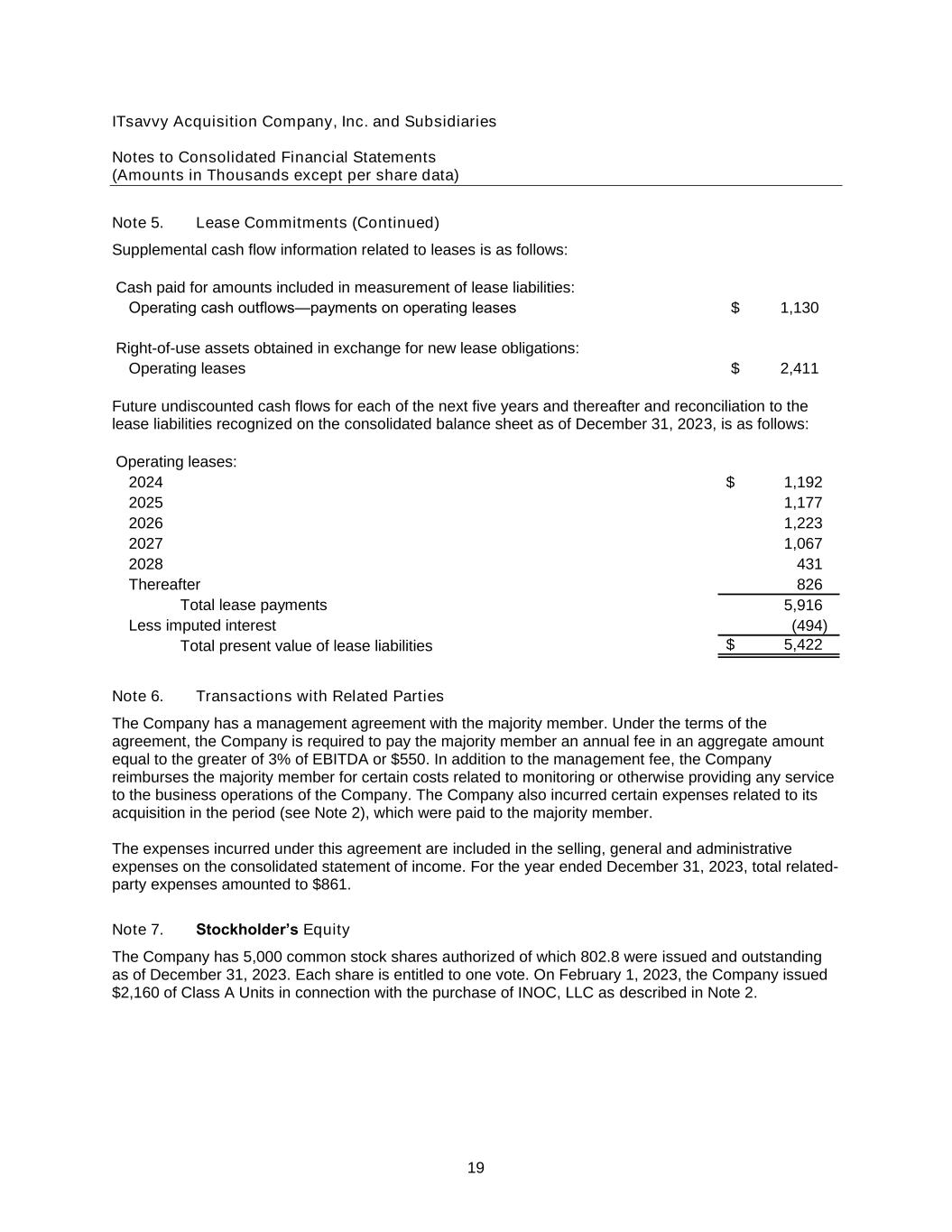

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 19 Note 5. Lease Commitments (Continued) Supplemental cash flow information related to leases is as follows: Cash paid for amounts included in measurement of lease liabilities: Operating cash outflows—payments on operating leases 1,130 $ Right-of-use assets obtained in exchange for new lease obligations: Operating leases 2,411 $ Future undiscounted cash flows for each of the next five years and thereafter and reconciliation to the lease liabilities recognized on the consolidated balance sheet as of December 31, 2023, is as follows: Operating leases: 2024 1,192 $ 2025 1,177 2026 1,223 2027 1,067 2028 431 Thereafter 826 Total lease payments 5,916 Less imputed interest (494) Total present value of lease liabilities 5,422 $ Note 6. Transactions with Related Parties The Company has a management agreement with the majority member. Under the terms of the agreement, the Company is required to pay the majority member an annual fee in an aggregate amount equal to the greater of 3% of EBITDA or $550. In addition to the management fee, the Company reimburses the majority member for certain costs related to monitoring or otherwise providing any service to the business operations of the Company. The Company also incurred certain expenses related to its acquisition in the period (see Note 2), which were paid to the majority member. The expenses incurred under this agreement are included in the selling, general and administrative expenses on the consolidated statement of income. For the year ended December 31, 2023, total related- party expenses amounted to $861. Note 7. Stockholder’s Equity The Company has 5,000 common stock shares authorized of which 802.8 were issued and outstanding as of December 31, 2023. Each share is entitled to one vote. On February 1, 2023, the Company issued $2,160 of Class A Units in connection with the purchase of INOC, LLC as described in Note 2.

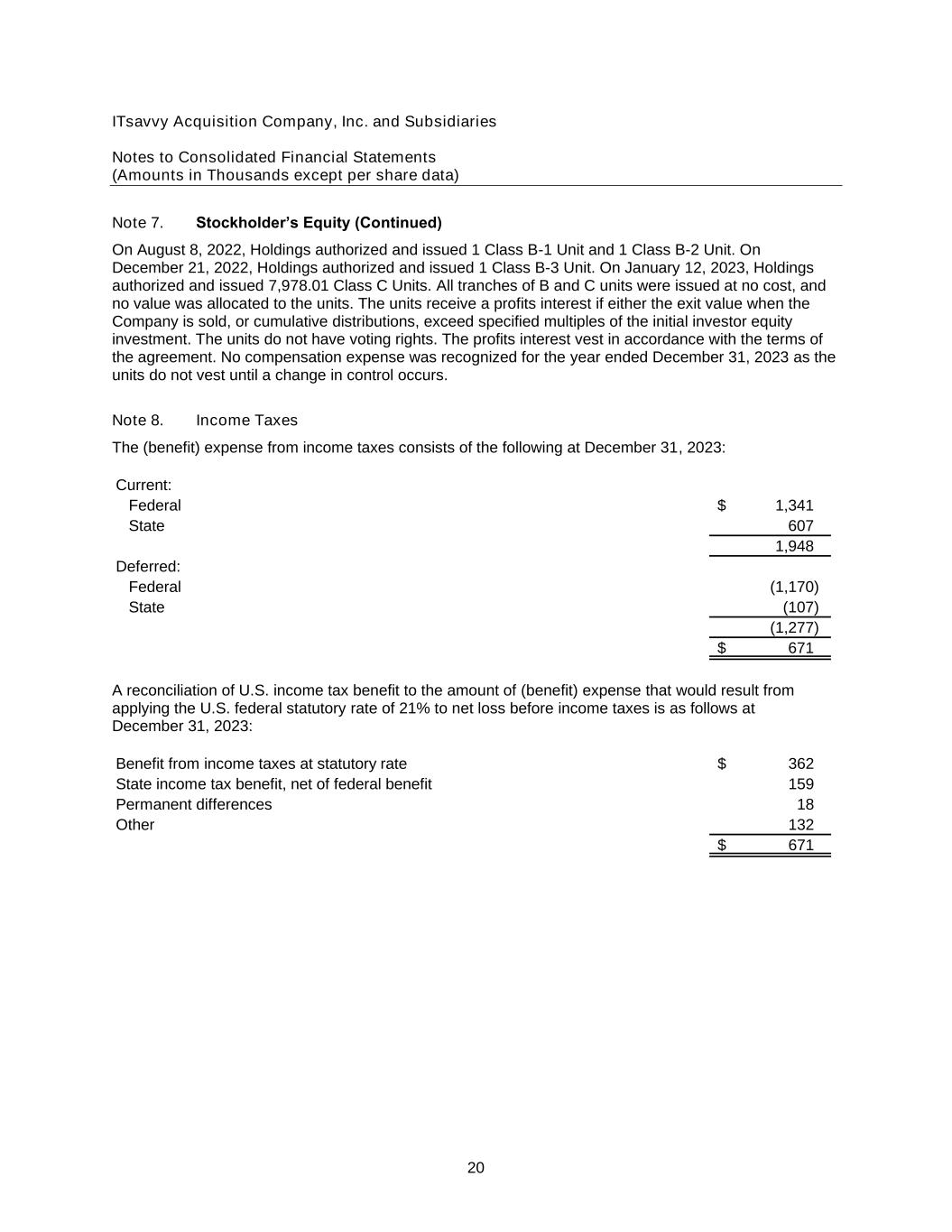

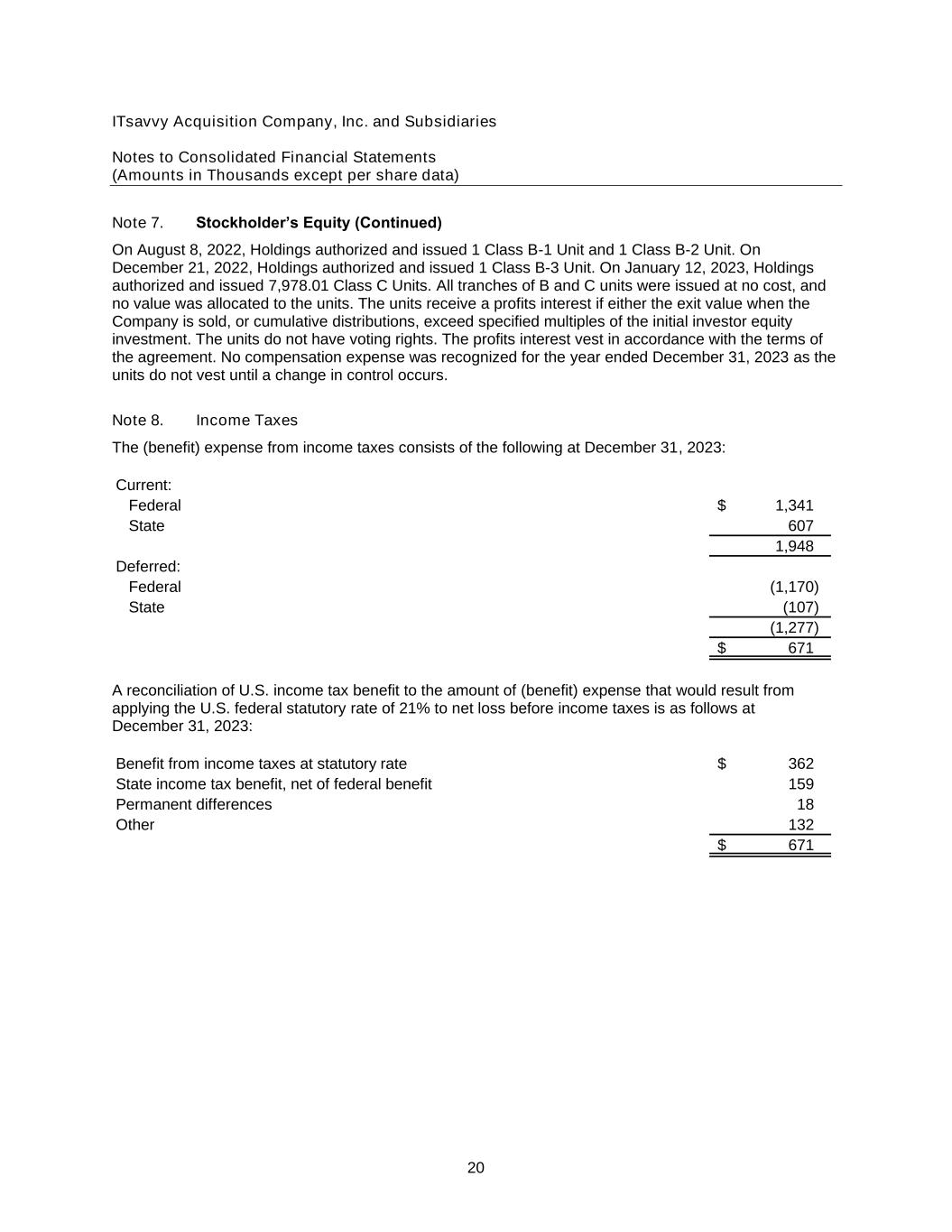

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 20 Note 7. Stockholder’s Equity (Continued) On August 8, 2022, Holdings authorized and issued 1 Class B-1 Unit and 1 Class B-2 Unit. On December 21, 2022, Holdings authorized and issued 1 Class B-3 Unit. On January 12, 2023, Holdings authorized and issued 7,978.01 Class C Units. All tranches of B and C units were issued at no cost, and no value was allocated to the units. The units receive a profits interest if either the exit value when the Company is sold, or cumulative distributions, exceed specified multiples of the initial investor equity investment. The units do not have voting rights. The profits interest vest in accordance with the terms of the agreement. No compensation expense was recognized for the year ended December 31, 2023 as the units do not vest until a change in control occurs. Note 8. Income Taxes The (benefit) expense from income taxes consists of the following at December 31, 2023: Current: Federal 1,341 $ State 607 1,948 Deferred: Federal (1,170) State (107) (1,277) 671 $ A reconciliation of U.S. income tax benefit to the amount of (benefit) expense that would result from applying the U.S. federal statutory rate of 21% to net loss before income taxes is as follows at December 31, 2023: Benefit from income taxes at statutory rate 362 $ State income tax benefit, net of federal benefit 159 Permanent differences 18 Other 132 671 $

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 21 Note 8. Income Taxes (Continued) Deferred income taxes reflect the net tax effects of loss and credit carryforwards and temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant components of the deferred tax assets for federal and state income taxes as of December 31, 2023, are as follows: Deferred tax assets: Deferred revenue 431 $ Interest expense limitation 1,929 Reserves and allowances 928 Lease liability 1,487 Accrued liabilities 661 Other 210 5,646 Deferred tax liabilities: Property and equipment 623 Right-of-use asset 1,415 Intangible assets 14,251 Other 786 Total deferred tax liabilities 17,075 (11,429) $ Note 9. 401(k) Plan The Company maintains a defined contribution 401(k) plan which is designed primarily to encourage employees to save for their retirement by deferring the receipt of current compensation. The Company’s discretionary match is equal to 25% of the participants’ deferral limited to 5% of a participant’s eligible compensation. Company contributions to the plan were $321 for the year ended December 31, 2023. Note 10. Commitments and Contingencies The Company has various claims and pending legal proceedings that have arisen in the normal course of business. The Company believes that any potential liability resulting from these proceedings would not be material to the consolidated financial statements. Note 11. Self-Insurance The Company is self-insured for a portion of its employees’ health insurance claims. An insurance policy limits the claims the Company may pay to $70 per member. In October 2023, the Company ended the self-insurance policy and entered into a new insurance policy with a third-party provider.

ITsavvy Acquisition Company, Inc. and Subsidiaries Notes to Consolidated Financial Statements (Amounts in Thousands except per share data) 22 Note 12. Subsequent Events The Company has evaluated subsequent events for recognition and/or disclosure through February 5, 2025, the date the consolidated financial statements were available to be issued. On October 15, 2024, the Company entered into a Securities Purchase Agreement with Xerox Corporation to acquire all outstanding equity securities of the Company for approximately $405,000. The purchase price was funded through a combination of new debt issuance and cash provided by buyers. On November 20, 2024, Xerox Corporation completed the acquisition of all the issued and outstanding equity securities of the Company.