ITsavvy Acquisition Company, Inc. Condensed Consolidated Financial Report (Reviewed) September 30, 2024

Contents Financial statements Condensed consolidated balance sheets 1-2 Condensed consolidated statements of income 3 Condensed consolidated statements of stockholders’ equity 4 Condensed consolidated statements of cash flows 5 Notes to condensed consolidated financial statements 6-9

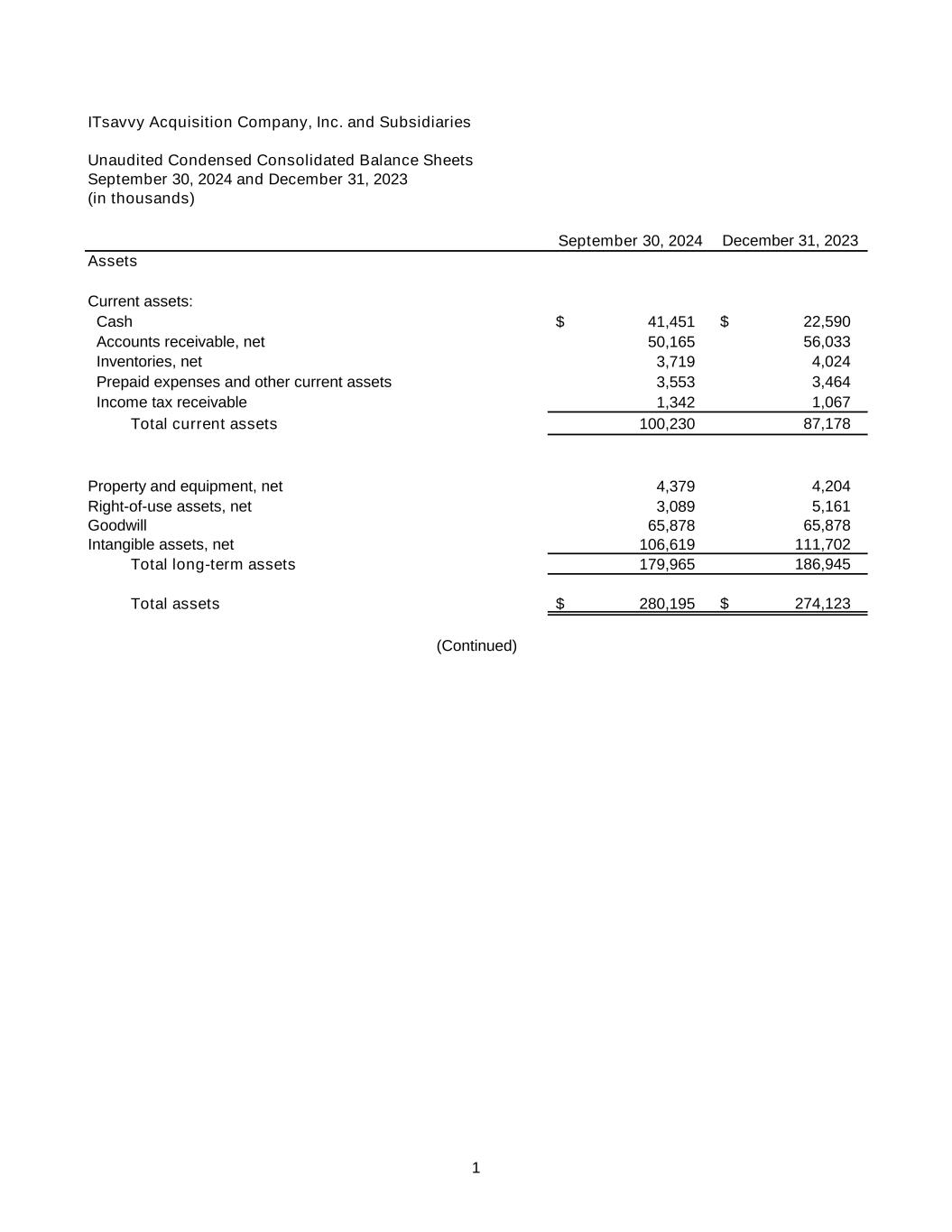

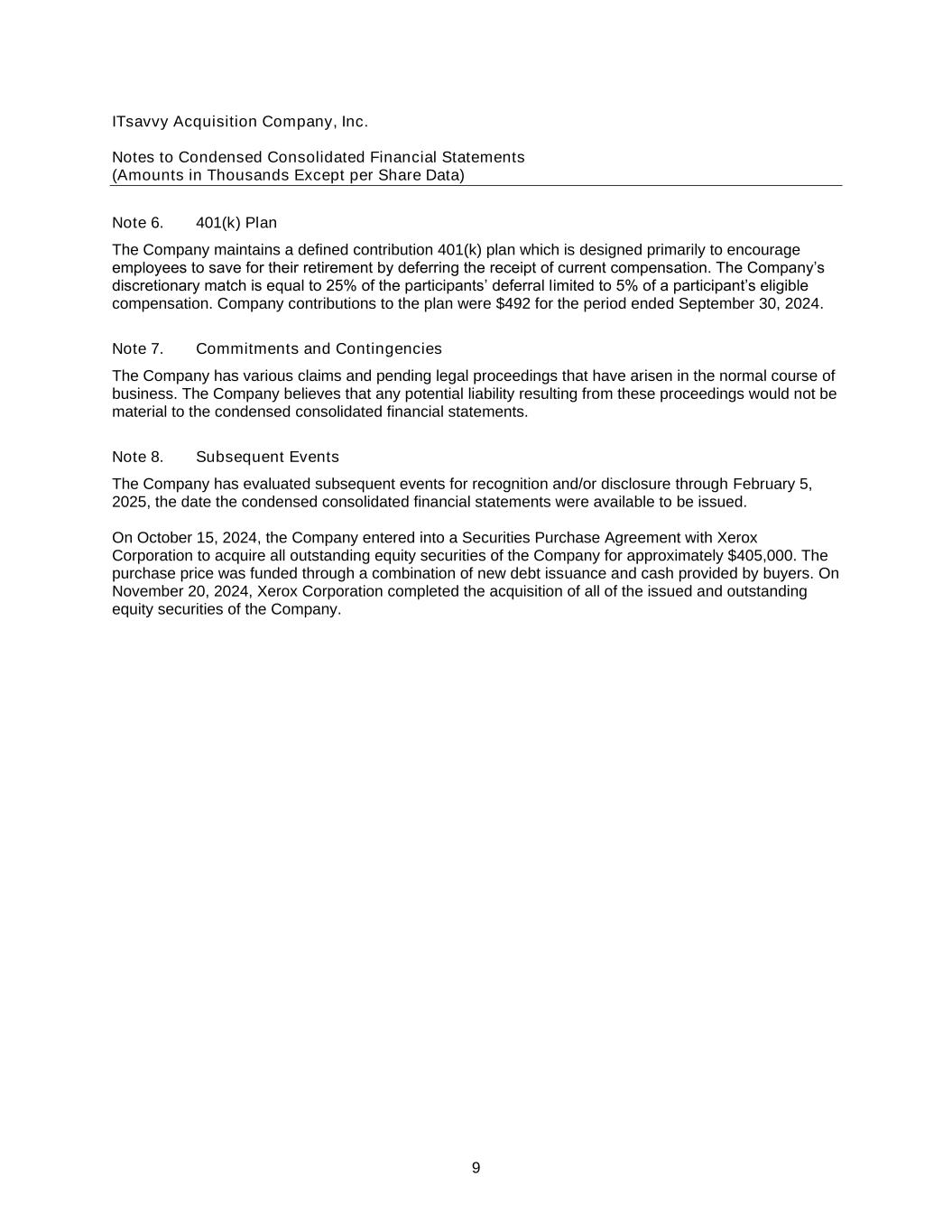

1 September 30, 2024 December 31, 2023 Assets Current assets: Cash 41,451 $ 22,590 $ Accounts receivable, net 50,165 56,033 Inventories, net 3,719 4,024 Prepaid expenses and other current assets 3,553 3,464 Income tax receivable 1,342 1,067 Total current assets 100,230 87,178 Property and equipment, net 4,379 4,204 Right-of-use assets, net 3,089 5,161 Goodwill 65,878 65,878 Intangible assets, net 106,619 111,702 Total long-term assets 179,965 186,945 Total assets 280,195 $ 274,123 $ ITsavvy Acquisition Company, Inc. and Subsidiaries Unaudited Condensed Consolidated Balance Sheets September 30, 2024 and December 31, 2023 (in thousands) (Continued)

2 September 30, 2024 December 31, 2023 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable 53,526 $ 48,625 $ Accrued expenses 6,889 8,406 Deferred revenue—current portion 13,247 11,012 Current portion of operating lease liabilities 940 1,037 Current portion of long-term debt 749 934 Total current liabilities 75,351 70,014 Long-term liabilities: Long-term debt, less current portion, net 71,066 79,635 Deferred revenue—long-term 12,703 11,821 Contingent consideration 12,625 14,875 Operating lease liabilities, net of current portion 2,370 4,385 Deferred tax liabilities 11,429 11,429 Other long-term obligations 12,246 1,980 Total long-term liabilities 122,439 124,125 Total liabilities 197,790 194,139 Common stock 1 1 Additional paid-in capital 80,099 80,279 Retained earnings (accumulated deficit) 2,305 (296) Total stockholders’ equity 82,405 79,984 Total liabilities and stockholders’ equity 280,195 $ 274,123 $ See notes to condensed consolidated financial statements.

3 ITsavvy Acquisition Company, Inc. and Subsidiaries Unaudited Condensed Consolidated Statements of Income (in thousands) Nine Months Ended September 30, 2024 Net sales 351,344 $ Cost of goods sold 302,151 Gross profit 49,193 Selling, general and administrative expenses 39,300 Operating income 9,893 Interest expense 6,268 Income before income tax expense 3,625 Income tax expense 1,024 Net income 2,601 $ See notes to condensed consolidated financial statements.

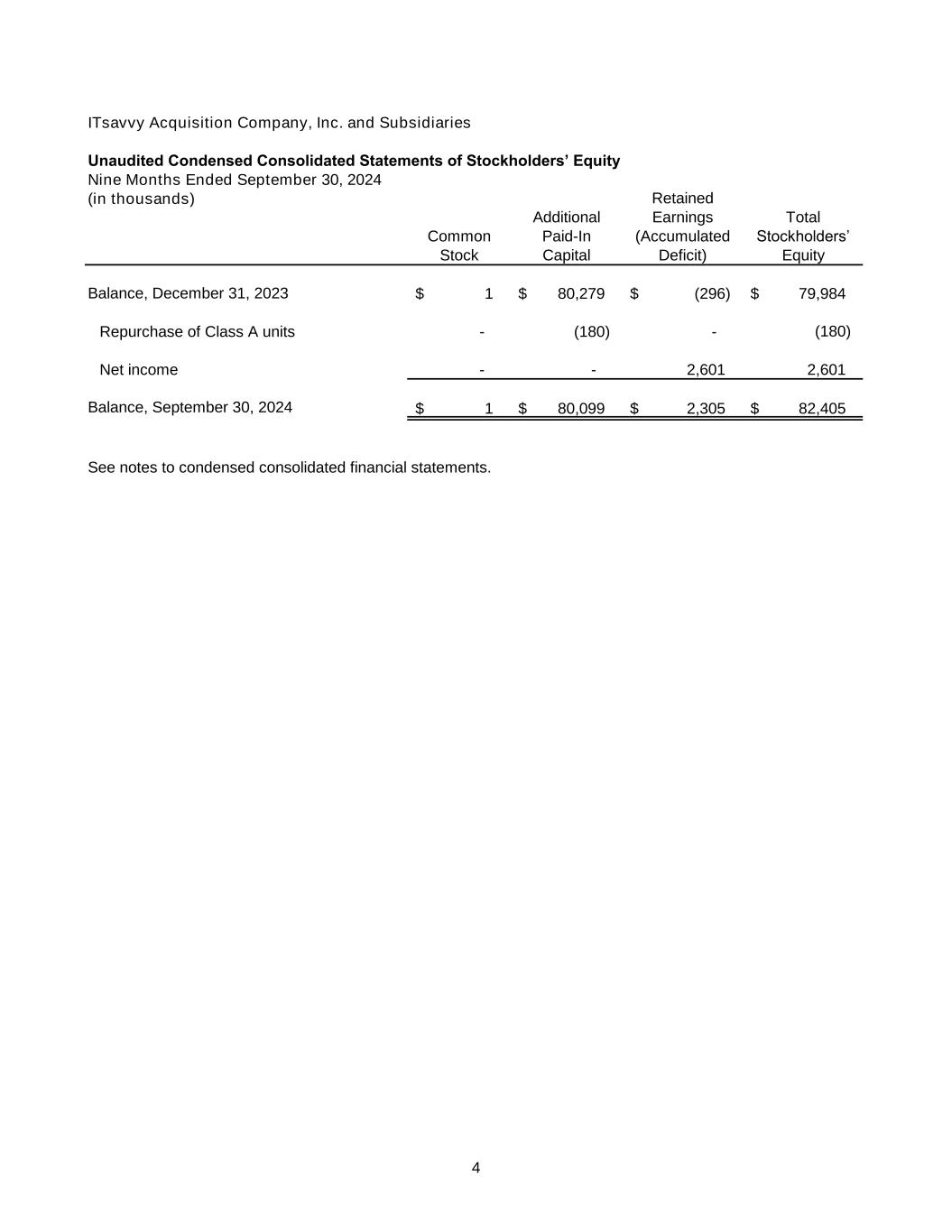

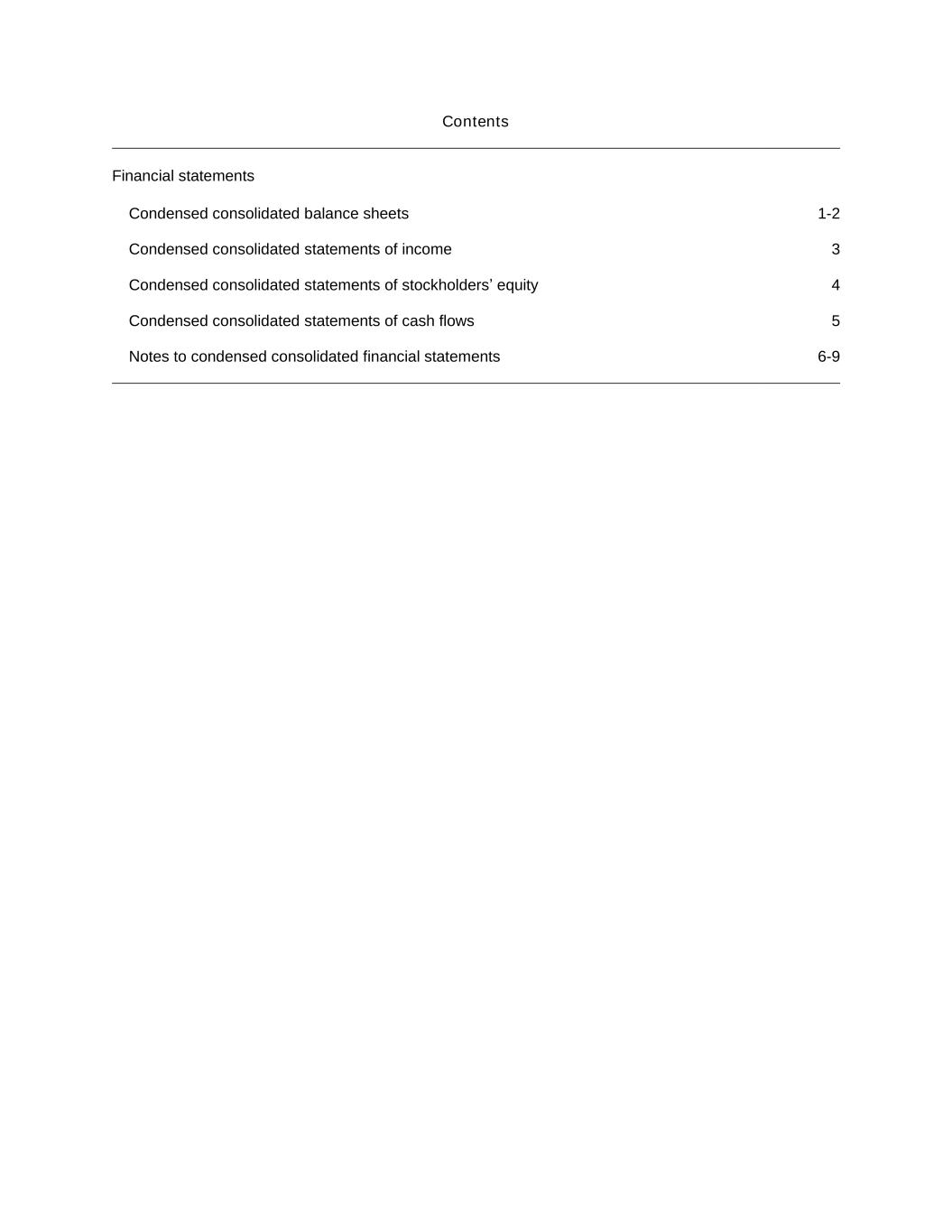

4 ITsavvy Acquisition Company, Inc. and Subsidiaries Unaudited Condensed Consolidated Statements of Stockholders’ Equity Nine Months Ended September 30, 2024 (in thousands) Retained Additional Earnings Total Common Paid-In (Accumulated Stockholders’ Stock Capital Deficit) Equity Balance, December 31, 2023 1 $ 80,279 $ (296) $ 79,984 $ Repurchase of Class A units - (180) - (180) Net income - - 2,601 2,601 Balance, September 30, 2024 1 $ 80,099 $ 2,305 $ 82,405 $ See notes to condensed consolidated financial statements.

5 ITsavvy Acquisition Company, Inc. and Subsidiaries Unaudited Condensed Consolidated Statements of Cash Flows Nine Months Ended September 30, 2024 (In thousands) Cash flows from operating activities: Net income 2,601 $ Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 1,135 Amortization of intangible assets 5,083 Amortization of deferred financing costs 267 Change in right-of-use assets—operating leases 2,072 Change in operating assets: Accounts receivable, net 5,868 Inventories, net 305 Prepaid expenses and other current assets (90) Income tax receivable (275) Change in operating liabilities: Accounts payable 4,901 Accrued expenses and other long-term liabilities 8,750 Operating lease liabilities (2,112) Deferred revenue 3,117 Net cash provided by operating activities 31,622 Cash flows from investing activities: Purchases of property and equipment (1,310) Net cash used in investing activities (1,310) Cash flows from financing activities: Payments of long-term debt (562) Payments on revolving line of credit (8,459) Payment of contingent consideration (2,250) Repurchase of Class A common units (180) Net cash used in financing activities (11,451) Net increase in cash 18,861 Cash: Beginning 22,590 Ending 41,451 $ See notes to condensed consolidated financial statements.

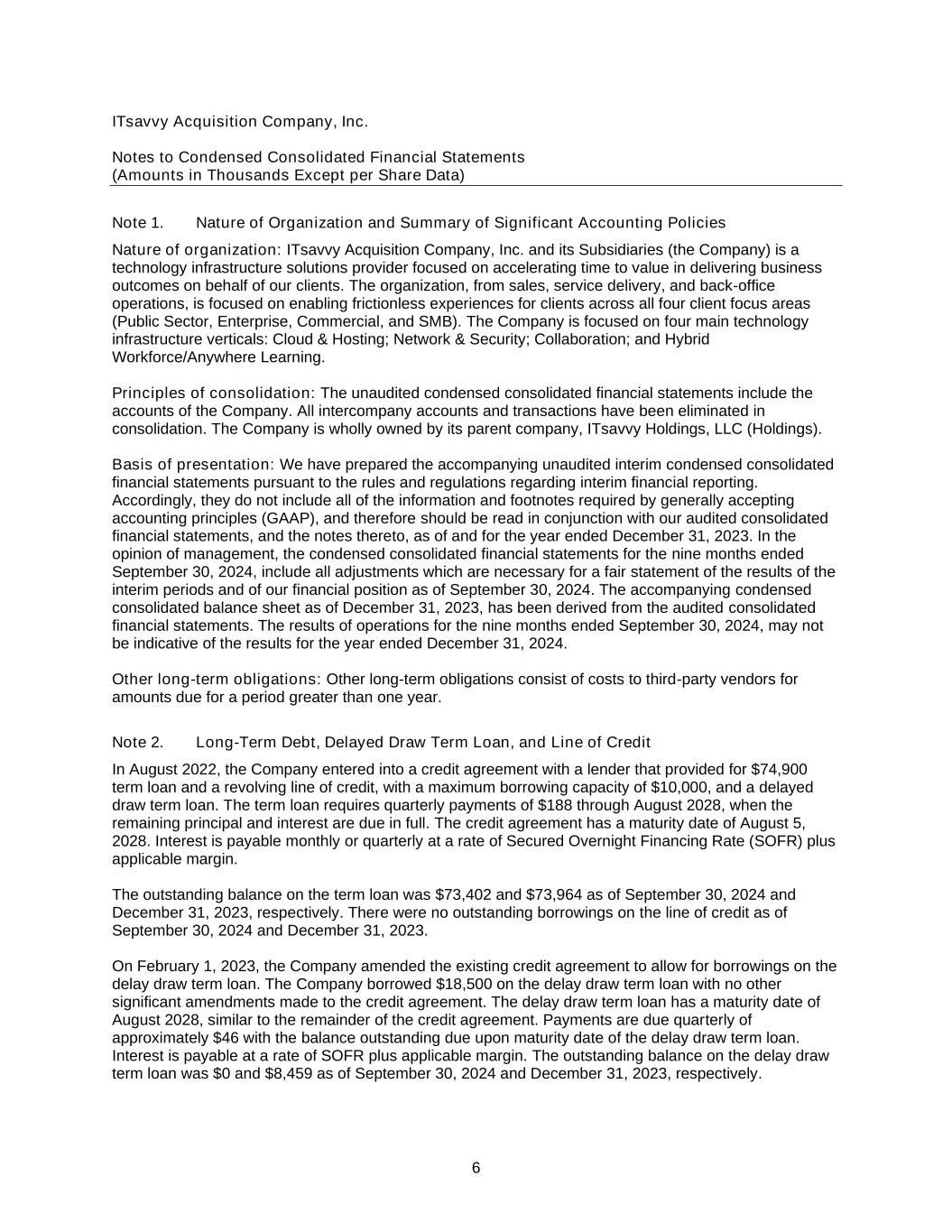

ITsavvy Acquisition Company, Inc. Notes to Condensed Consolidated Financial Statements (Amounts in Thousands Except per Share Data) 6 Note 1. Nature of Organization and Summary of Significant Accounting Policies Nature of organization: ITsavvy Acquisition Company, Inc. and its Subsidiaries (the Company) is a technology infrastructure solutions provider focused on accelerating time to value in delivering business outcomes on behalf of our clients. The organization, from sales, service delivery, and back-office operations, is focused on enabling frictionless experiences for clients across all four client focus areas (Public Sector, Enterprise, Commercial, and SMB). The Company is focused on four main technology infrastructure verticals: Cloud & Hosting; Network & Security; Collaboration; and Hybrid Workforce/Anywhere Learning. Principles of consolidation: The unaudited condensed consolidated financial statements include the accounts of the Company. All intercompany accounts and transactions have been eliminated in consolidation. The Company is wholly owned by its parent company, ITsavvy Holdings, LLC (Holdings). Basis of presentation: We have prepared the accompanying unaudited interim condensed consolidated financial statements pursuant to the rules and regulations regarding interim financial reporting. Accordingly, they do not include all of the information and footnotes required by generally accepting accounting principles (GAAP), and therefore should be read in conjunction with our audited consolidated financial statements, and the notes thereto, as of and for the year ended December 31, 2023. In the opinion of management, the condensed consolidated financial statements for the nine months ended September 30, 2024, include all adjustments which are necessary for a fair statement of the results of the interim periods and of our financial position as of September 30, 2024. The accompanying condensed consolidated balance sheet as of December 31, 2023, has been derived from the audited consolidated financial statements. The results of operations for the nine months ended September 30, 2024, may not be indicative of the results for the year ended December 31, 2024. Other long-term obligations: Other long-term obligations consist of costs to third-party vendors for amounts due for a period greater than one year. Note 2. Long-Term Debt, Delayed Draw Term Loan, and Line of Credit In August 2022, the Company entered into a credit agreement with a lender that provided for $74,900 term loan and a revolving line of credit, with a maximum borrowing capacity of $10,000, and a delayed draw term loan. The term loan requires quarterly payments of $188 through August 2028, when the remaining principal and interest are due in full. The credit agreement has a maturity date of August 5, 2028. Interest is payable monthly or quarterly at a rate of Secured Overnight Financing Rate (SOFR) plus applicable margin. The outstanding balance on the term loan was $73,402 and $73,964 as of September 30, 2024 and December 31, 2023, respectively. There were no outstanding borrowings on the line of credit as of September 30, 2024 and December 31, 2023. On February 1, 2023, the Company amended the existing credit agreement to allow for borrowings on the delay draw term loan. The Company borrowed $18,500 on the delay draw term loan with no other significant amendments made to the credit agreement. The delay draw term loan has a maturity date of August 2028, similar to the remainder of the credit agreement. Payments are due quarterly of approximately $46 with the balance outstanding due upon maturity date of the delay draw term loan. Interest is payable at a rate of SOFR plus applicable margin. The outstanding balance on the delay draw term loan was $0 and $8,459 as of September 30, 2024 and December 31, 2023, respectively.

ITsavvy Acquisition Company, Inc. Notes to Condensed Consolidated Financial Statements (Amounts in Thousands Except per Share Data) 7 Note 2. Long-Term Debt, Delayed Draw Term Loan, and Line of Credit (Continued) The effective rate was 10.20% and 10.89% at September 30, 2024 and December 31, 2023, respectively, on the term loan. The term loan, delayed draw term loan, and line of credit are collateralized by substantially all assets of the Company. The credit agreement contains restrictions and covenants as defined in the agreement. The agreement also requires the Company to make annual payments in addition to the quarterly installments, based on excess cash flows, as defined, scheduled to commence with fiscal year ended December 31, 2023. Deferred financing costs of $2,405 at September 30, 2024 and December 31, 2023 , net of accumulated amortization of $819 and $552, respectively, relating to the Company’s long-term debt are being amortized on a straight-line basis over the lines of the related debt agreements, which approximates the effective interest method. Note 3. Lease Commitments The Company determines if an arrangement is or contains a lease at inception, which is the date on which the terms of the contract are agreed to, and the agreement creates enforceable rights and obligations. Under Topic 842, a contract is or contains a lease when (i) explicitly or implicitly identified assets have been deployed in the contract and (ii) the client obtains substantially all of the economic benefits from the use of that underlying asset and directs how and for what purpose the asset is used during the term of the contract. The Company also considers whether its service arrangements include the right to control the use of an asset. The Company leases premises for industrial, warehouse purposes and associated general office uses from unrelated parties under operating lease agreements that have terms from transition of 1.0 to 8.33 years. The leases include one to two options to renew of one to five years, generally at the Company’s sole discretion, with renewal terms that can extend the lease term. These options to extend a lease are included in the lease terms when it is reasonably certain that the Company will exercise that option. The Company’s leases generally do not contain any material restrictive covenants. Operating lease cost is recognized on a straight-line basis over the lease term. The components of lease expense are as follows: September 30, 2024 Operating lease cost 1,092 $ Short-term lease cost 229 1,321 $ Rent expense was approximately $1,321 for the period ended September 30, 2024. Supplemental cash flow information related to leases is as follows: September 30, 2024 Cash paid for amounts included in measurement of lease liabilities: Operating cash outflows—payments on operating leases 800 $

ITsavvy Acquisition Company, Inc. Notes to Condensed Consolidated Financial Statements (Amounts in Thousands Except per Share Data) 8 Note 3. Lease Commitments (Continued) Future undiscounted cash flows for each of the next five years and thereafter and reconciliation to the lease liabilities recognized on the condensed consolidated balance sheet as of September 30, 2024 and December 31, 2023, is as follows: September 30, December 31, 2024 2023 Operating leases: 2024 260 $ 1,192 $ 2025 1,018 1,177 2026 1,022 1,223 2027 858 1,067 2028 219 431 Thereafter 115 826 Total lease payments 3,492 5,916 Less imputed interest (182) (494) Total present value of lease liabilities 3,310 $ 5,422 $ Note 4. Transactions with Related Parties The Company has a management agreement with the majority member. Under the terms of the agreement, the Company is required to pay the majority member an annual fee in an aggregate amount equal to the greater of 3% of EBITDA or $550. In addition to the management fee, the Company reimburses the majority member for certain costs related to monitoring or otherwise providing any service to the business operations of the Company. The expenses incurred under this agreement are included in the selling, general and administrative expenses on the condensed consolidated statements of income. For the period ended September 30, 2024, total related-party expenses amounted to $842. Note 5. Stockholder’s Equity The Company has 5,000 common stock shares authorized of which 801 were issued and outstanding as of September 30, 2024. Each share is entitled to one vote. During the period ended September 30, 2024, the Company repurchased $180 of Class A units. On August 8, 2022, Holdings authorized and issued 1 Class B-1 Unit and 1 Class B-2 Unit. On December 21, 2022, Holdings authorized and issued 1 Class B-3 Unit. On January 12, 2023, Holdings authorized and issued 7,978.01 Class C Units. All tranches of B and C units were issued at no cost, and no value was allocated to the units. The units receive a profits interest if either the exit value when the Company is sold, or cumulative distributions, exceed specified multiples of the initial investor equity investment. The units do not have voting rights. The profits interest vest in accordance with the terms of the agreement. No compensation expense was recognized for the period ended September 30, 2024, as the units do not vest until a change in control occurs.

ITsavvy Acquisition Company, Inc. Notes to Condensed Consolidated Financial Statements (Amounts in Thousands Except per Share Data) 9 Note 6. 401(k) Plan The Company maintains a defined contribution 401(k) plan which is designed primarily to encourage employees to save for their retirement by deferring the receipt of current compensation. The Company’s discretionary match is equal to 25% of the participants’ deferral limited to 5% of a participant’s eligible compensation. Company contributions to the plan were $492 for the period ended September 30, 2024. Note 7. Commitments and Contingencies The Company has various claims and pending legal proceedings that have arisen in the normal course of business. The Company believes that any potential liability resulting from these proceedings would not be material to the condensed consolidated financial statements. Note 8. Subsequent Events The Company has evaluated subsequent events for recognition and/or disclosure through February 5, 2025, the date the condensed consolidated financial statements were available to be issued. On October 15, 2024, the Company entered into a Securities Purchase Agreement with Xerox Corporation to acquire all outstanding equity securities of the Company for approximately $405,000. The purchase price was funded through a combination of new debt issuance and cash provided by buyers. On November 20, 2024, Xerox Corporation completed the acquisition of all of the issued and outstanding equity securities of the Company.