FSD PHARMA INC.

LISTING STATEMENT

FORM 2A

MAY 28, 2018

Cautionary Note Regarding Forward-Looking Statements

The information provided in this Listing Statement, including information incorporated by reference, may contain "forward-looking statements" about FSD Pharma (the "Corporation") and FV Pharma Inc. ("FV Pharma"). In addition, the Corporation may make or approve certain statements in future filings with Canadian securities regulatory authorities, in press releases, or in oral or written presentations by representatives of the Corporation or FV Pharma that are not statements of historical fact and may also constitute forward-looking statements. All statements, other than statements of historical fact, made by the Corporation or FV Pharma that address activities, events or developments that the Corporation expects or anticipates will or may occur in the future are forward- looking statements, including, but not limited to, statements preceded by, followed by or that include words such as "may", "will", "would", "could", "should", "believes", "estimates", "projects", "potential", "expects", "plans", "intends", "anticipates", "targeted", "continues", "forecasts", "designed", "goal", or the negative of those words or other similar or comparable words.

Forward-looking statements may relate to future financial conditions, results of operations, plans, objectives, performance or business developments. These statements speak only as at the date they are made and are based on information currently available and on the then current expectations of the party making the statement and assumptions concerning future events, which are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from that which was expressed or implied by such forward looking statements, including, but not limited to, risks and uncertainties related to:

• the regulation of the medical cannabis industry in Canada;

• the availability of financing opportunities, risks associated with economic conditions, dependence on management and conflicts of interest; and

• other risks described in this Listing Statement and described from time to time in documents filed by the Corporation with Canadian securities regulatory authorities.

The forward-looking statements contained herein are based on certain key expectations and assumptions, including: (i) expectations and assumptions concerning timing of receipt of required shareholder and regulatory approvals, including with respect to the receipt of required licenses and third party consents, if any; and (ii) expectations and assumptions concerning the success of the operations of the Corporation.

With respect to the forward-looking statements contained herein, although the Corporation and FV Pharma believe that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements, because no assurance can be given that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to: the availability of sources of income to generate cash flow and revenue; the dependence on management and directors; risks relating to the receipt of the required licenses, risks relating to federal and provincial regulations applicable to the production and sale of cannabis, risks relating to additional funding requirements; due diligence risks; exchange rate risks; risks relating to non-controlling interests; potential conflicts of interest; and potential transaction and legal risks, as more particularly described under the heading "Risk Factors" in this Listing Statement.

Consequently, all forward-looking statements made in this Listing Statement and other documents of the Corporation or FV Pharma, as applicable, are qualified by such cautionary statements and there can be no assurance that the anticipated results or developments will actually be realized or, even if realized, that they will have the expected consequences to or effects on the Corporation and FV Pharma.

The cautionary statements contained or referred to in this section should be considered in connection with any subsequent written or oral forward-looking statements that the Corporation, FV Pharma and/or persons acting on their behalf may issue. Neither the Corporation nor FV Pharma undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required under securities legislation.

Market and Industry Data

This Listing Statement includes market and industry data that has been obtained from third party sources, including industry publications. The Corporation believes that its industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance as to the accuracy or completeness of included information. Although the data is believed to be reliable, the Corporation has not independently verified any of the data from third party sources referred to in this Listing Statement or ascertained the underlying economic assumptions relied upon by such sources.

Glossary of Terms

The following is a glossary of certain general terms used in this Listing Statement including the summary hereof. Terms and abbreviations used in the financial statements included in, or appended to this Listing Statement are defined separately and the terms and abbreviations defined below are not used therein, except where otherwise indicated. Words importing the singular, where the context requires, include the plural and vice versa and words importing any gender include all genders.

"ACMPR" means the Access to Cannabis for Medical Purposes Regulations (Canada) pursuant to the Controlled Drugs and Substances Act (Canada).

"Acquireco" means 2620756 Ontario Inc., a wholly-owned subsidiary of the Corporation incorporated under the OBCA for the purpose of carrying out the Amalgamation.

"Affiliate" means a corporation that is affiliated with another corporation as described below. A corporation is an "Affiliate" of another corporation if:

(a) one of them is the subsidiary of the other; or

(b) each of them is controlled by the same Person.

A corporation is "controlled" by a Person if:

(a) voting securities of the corporation are held, other than by way of security only, by or for the benefit of that Person; and

(b) the voting securities, if voted, entitle the Person to elect a majority of the directors of the corporation.

A Person beneficially owns securities that are beneficially owned by:

(a) a corporation controlled by that Person; or

(b) an Affiliate of that Person or an Affiliate of any corporation controlled by that Person.

"Amalco" means the entity formed upon completion of the Amalgamation, which will be a wholly- owned subsidiary of the Corporation.

"Amalgamation Agreement" means the agreement entered into between the Corporation, Acquireco, and FV Pharma in respect of the Amalgamation, dated May 24, 2018, as amended from time to time.

"Amalgamation" means the amalgamation of Acquireco and FV Pharma, pursuant to the terms of the Amalgamation Agreement.

"Articles Amendment" means collectively, the amendment to the articles of the Corporation providing for the Name Change and the Share Reorganization.

"Associate" when used to indicate a relationship with a Person, means:

(a) an issuer of which the Person beneficially owns or controls, directly or indirectly, voting securities entitling him to more than 10% of the voting rights attached to outstanding securities of the issuer;

(b) any partner of the Person;

(c) any trust or estate in which the Person has a substantial beneficial interest or in respect of which a Person serves as trustee or in a similar capacity; or

(d) in the case of a Person who is an individual:

(i) that Person's spouse or child, or

(ii) any relative of the Person or of his spouse who has the same residence as that Person.

"CDSA" means the Controlled Drugs and Substances Act (Canada).

“Century Common Shares” means common shares in the capital of Century as such were constituted prior to the Share Reorganization.

"Corporation Stock Options" means the stock options of the Corporation which are outstanding under the Stock Option Plan.

"Corporation Warrants" means warrants of the Corporation to purchase Class B Subordinate Voting Shares.

"Change of Business" means the change of business of the Corporation from leasing operating and manufacturing equipment to the medical cannabis industry.

"Class A Multiple Voting Shares" means the issued and outstanding Class A Multiple Voting Shares in the capital of the Corporation.

"Class B Subordinate Voting Shares" means the issued and outstanding Class B Subordinate Voting Shares in the capital of the Corporation.

"Corporation" means FSD Pharma Inc. (formerly Century Financial Capital Group Inc.), a corporation formed under the Business Corporations Act (Ontario).

"Corporation's Board of Directors" means the board of directors of the Corporation.

"CSE" means the Canadian Securities Exchange.

"CSE Approval" means the final approval of the CSE in respect of the listing of the Corporation's Class B Subordinate Voting Shares on the CSE, as evidenced by the issuance of the final approval bulletin of the CSE in respect thereof.

"CSE Policies" means the rules and policies of the CSE in effect as of the date hereof.

"Escrow Agent" means Garfinkle Biderman LLP.

"Escrow Agreement" means the escrow agreement entered into by the Corporation, the Escrow Agent and certain securityholders of the Corporation in compliance with the requirements of the CSE.

"Escrowed Securities" means the Class B Subordinate Voting Shares subject to the Escrow Agreement.

"Facility" means FV Pharma's proposed facility located in Coburg, Ontario for the purposes of the cultivation and sale of medical cannabis.

"FV Pharma" means FV Pharma Inc., a corporation incorporated under the Business Corporations Act (Ontario), and a wholly-owned subsidiary of the Corporation.

"FV Pharma's Board of Directors" means the board of directors of FV Pharma.

"FV Pharma Broker Warrants" means the issued and outstanding broker warrants of FV Pharma, each of which entitles the holder thereof to purchase one FV Pharma Class B Share at a price of $0.05 until two years after their respective issuance date.

"FV Pharma Class A Shares" means the issued and outstanding class "A" voting common shares without par value in the capital of FV Pharma.

"FV Pharma Class A Shareholders" means the holders of FV Pharma Class A shares.

"FV Pharma Class B Shares" means the issued and outstanding class "B" non-voting common shares without par value in the capital of FV Pharma.

"FV Pharma Class B Shareholders" means the holders of FV Pharma Class B Shares.

"FV Pharma Shareholders" means, collectively the holders of FV Pharma Class A Shares and FV Pharma Class B shares.

"FV Pharma Options" means the incentive stock options of FV Pharma.

"FV Pharma Shares" means, collectively, the FV Pharma Class A Shares and FV Pharma Class B Shares.

"FV Pharma Special Warrants" means the outstanding special warrants of FV Pharma, each of which entitles the holder thereof to purchase one FV Pharma Class B Share at a price of $0.0294 until September 15, 2022.

"Good Production Practices" means record-keeping methods pertaining to security as required and outlined under the ACMPR.

"License" means a license from Health Canada designating that pursuant to the ACMPR, FV Pharma is a "Licensed Producer" authorized to cultivate cannabis.

"Licensed Producer" has the meaning ascribed to such term in the ACMPR.

"Listing Statement" means this listing statement of the Corporation, including the schedules hereto, prepared in support of the listing of the Class B Subordinate Voting Shares on the CSE.

"MMPR" means the Cannabis for Medical Purposes Regulations (Canada) pursuant to the Controlled Drugs and Substances Act (Canada).

"Name Change" means the change of the Corporation's name from "Century Financial Capital Group Inc." to "FSD Pharma Inc." pursuant to the Articles of Amendment.

"NP 46-201" means National Policy 46-201 – Escrow for Initial Public Offerings.

"OBCA" means the Business Corporations Act (Ontario).

"Permitted Holders" means, in respect of a holder of Class A Multiple Voting Shares that is an individual, the members of the immediate family of such individual and any Person controlled, directly or indirectly, by any such holder, and in respect of a holder of Class A Multiple Voting Shares that is not an individual, an Affiliate of that holder.

"Person" means any individual, corporation, Corporation, partnership, unincorporated association, trust, joint venture, governmental body or any other legal entity whatsoever.

"Preferred Shares" means the outstanding Class A Preferred Shares and Class B Preferred Shares in the share capital of the Corporation as constituted prior to the Share Reorganization.

"Shareholders" means shareholders of the Corporation.

"Share Reorganization" means the amendment and re-designation of the Corporation's share capitalization pursuant to the Articles of Amendment, which provided for the re-designation of the existing common shares as "Class B Subordinate Voting Shares", the creation of a new class of "Class A Multiple Voting Shares", and the elimination of the existing class of non-voting Class A Preferred Shares and non-voting Class B Preferred Shares.

2. CORPORATE STRUCTURE

2.1 Corporate Name and Head and Registered Office

This Listing Statement has been prepared with respect to the Corporation in connection with its proposed listing on the CSE. The head office of the Corporation is located at 1 Rossland Road West, Suite 202, Ajax, Ontario L1Z 1Z2.

2.2 Jurisdiction of Incorporation

The Corporation was formed under the OBCA on November 1, 1998 pursuant to the amalgamation of Olympic ROM World Inc., 1305206 Ontario Corporation, 1305207 Ontario Inc., Century Financial Capital Group Inc. and Dunberry Graphic Associates Ltd. On May 24, 2018 pursuant to the Articles of Amendment, the Corporation changed its name to "FSD Pharma Inc.".

2.3 Inter-corporate Relationships

FV Pharma was formed under the OBCA on May 24, 2018, pursuant to the Amalgamation of Acquireco and FV Pharma, and is a wholly-owned subsidiary of the Corporation.

2.4 Fundamental Change

See Item 3.1 – General Development of the Business – The Amalgamation.

2.5 Non-corporate Issuers and Issuers incorporated outside of Canada

This section is not applicable to the Corporation.

3. GENERAL DEVELOPMENT OF THE BUSINESS

3.1 General Development of the Business

The Corporation

The Corporation has historically engaged in in the leasing of various kinds of operating and manufacturing equipment such as industrial and construction machinery. All leases have since been written off and as of August 31, 2016, the Corporation had no more leases and is currently inactive. The Corporation is headquartered in Toronto, Ontario.

On March 9, 2018, the Corporation, Acquireco, and FV Pharma entered into the Amalgamation Agreement, in respect of the Amalgamation. The Amalgamation was completed on May 24, 2018, pursuant to which the Corporation assumed the business of FV Pharma, which constituted a Change of Business for the Corporation.

FV Pharma Inc.

FV Pharma was incorporated under the OBCA on September 12, 2011 as 2298519 Ontario Corp. and changed to its present name, FV Pharma, on September 17, 2013. The registered and head office of FV Pharma is located at 1 Rossland Road West, Suite 202, Ajax Ontario, L1Z 1Z2. FV Pharma's plant and operations are located at 520 William Street, Area 4, Bldg. #3, Coburg, Ontario, K9A 3A5 (the "Facility").

FV Pharma is a Licensed Producer of medical cannabis in Canada under the ACMPR and is committed to transforming the Facility into one of the largest hydroponic indoor cannabis facility in the world. FV Pharma intends to target all legal aspects of the cannabis industry, including cultivation, processing, manufacturing, extracts, and research and development.

FV Pharma's authorized share capital consists of an unlimited number of FV Pharma Class A Shares and an unlimited number of FV Pharma Class B Shares. As at December 31, 2017, there were 15,000 Class A Shares issued and outstanding and 762,764,138 Class B Shares issued and outstanding.

FV Pharma License and Facility Overview

i. The License

FV Pharma is in the business of the production and sale of medical cannabis in accordance with the ACMPR issued pursuant to the Controlled Drugs and Substances Act (Canada) (the “CDSA”).

FV Pharma received its License under section 22(2) of the ACMPR on October 13, 2017. The License permits FV Pharma to acquire cannabis plants and/or seeds for the purpose of initiating plant growth and for conducting analytical testing.

The License does not currently permit FV Pharma to sell medical cannabis. In order to proceed with the sale of medical cannabis, FV Pharma will first have to obtain an amendment to its License from Health Canada. The granting of such an amendment is dependent upon FV Pharma demonstrating compliance with the quality control standards and the Good Production Practices as established under Subdivision D of the ACMPR, as well as Health Canada completing an inspection with respect to record-keeping, security measures, packaging, labelling, shipping and other requirements prescribed by the ACMPR. Health Canada may then issue an extended license which would allow FV Pharma to sell or provide fresh or dried cannabis or cannabis oil to patients of FV Pharma, or such other persons who are permitted to purchase cannabis products under subsection 22(2) of the ACMPR.

ii. The Facility

FV Pharma’s License permits the cultivation of cannabis at the Facility. FV Pharma acquired the Facility in November 2017 and intends to expand operations into the Facility’s remaining space in 2018 pending approval from Health Canada and raising sufficient financing to complete its proposed capital improvements.

The Facility hosts an existing 620,000 square feet of building space and is famously known as the former KRAFT® food manufacturing facility. The Facility is situated only one hour east of Toronto in Cobourg, Ontario, off the 401 highway and has access by car or rail to Ottawa and Montreal.

The Facility rests on 70 acres of land, 32 of which have been utilized for the current building with the remaining 40 acres available for the staged-phased development of the Facility. Upon completion of its development, FV Pharma expects to achieve a total of approximately 3,800,000 square feet dedicated to cannabis cultivation and related ancillary businesses all under one roof making it one of the largest indoor cannabis cultivation facility in the world. The Facility has an electrical substation on site, natural gas lines, multiple water intakes, rail lines directly into the Facility and 26 loading docks thereby providing the robust infrastructure necessary to accommodate FV Pharma's expansion plans.

FV Pharma anticipates hiring personnel to grow, process and market their products in compliance with Health Canada requirements. At full capacity in the Facility’s current build-out, the estimated annual production output is approximately 4 million grams of cannabis.

ACMPR Licensing Process Overview

The market for cannabis (including medical cannabis) in Canada is regulated by the CDSA, the ACMPR, the Narcotic Control Regulations and other applicable law. Health Canada is the primary regulator of the industry as a whole. The ACMPR aims to treat cannabis like any other narcotic used for medical purposes by creating conditions for a new commercial industry that is responsible for its production and distribution.

Any applicant seeking to become a licensed producer or seller under the ACMPR is subject to stringent Health Canada licensing requirements. According to Health Canada, effective May 25, 2017, there is a six- step licensing process under the ACMPR:

i. Intake and Initial Screening

When an application is received, it undergoes an assessment by Health Canada for completeness. If an application appears to be complete, it will be assigned an application number. The application number means that the application has completed the assessment. Applicants reference their application number in all correspondence with Health Canada.

The Initial Screening includes an assessment of:

i. the proposed business plan;

ii. the Security Clearance Application Form; and

iii. record-keeping methods pertaining to security, Good Production Practices, inventory, and destruction methods.

If an application is not complete, depending on the information that is missing, applicants may be contacted by Health Canada to obtain the missing information or the application may be returned to the applicant. Health Canada will also verify that applicants have provided notices to the senior officials with the local government where their proposed site is located.

ii. Detailed Review and Initiation of Security Clearance Process

All information submitted to Health Canada, and any other relevant information, is reviewed by Health Canada to:

i. complete the assessment of the application to ensure that it meets the requirements of the regulations;

ii. establish that the issuance of the license is not likely to create risks to public health, safety or security, including the risk of cannabis being diverted to an illicit market or use; and

iii. establish that there are no other grounds for refusing the application.

Health Canada thoroughly reviews the application to ensure the level of detail included in the application is sufficient to assess the requirements of the ACMPR and validate the information provided. Consideration is also given by Health Canada to the proposed security measures including those required by Subdivision C of the ACMPR and the description of the storage area for cannabis as required by the Security Directive; the credentials of the proposed quality assurance person to meet the good production requirements outlined in Subdivision D of the ACMPR; and the details listed in the quality assurance report relating to premises, equipment and sanitation program. Physical security plans are reviewed and assessed in detail at this stage.

Licensed producers are required to comply with all applicable provincial/territorial and municipal laws, including zoning restrictions, fire and electrical safety, and environmental legislation (e.g. waste management).

When applying for a license to produce under the ACMPR, a security clearance application form must be submitted for the following individuals:

i. the proposed senior person in charge;

ii. the proposed responsible person in charge;

iii. the proposed alternate responsible person(s) in charge (if applicable);

iv. if a producer’s license is issued to an individual, that individual; and,

v. if a producer’s license is issued to a corporation, each officer and director of the corporation.

iii. Issuance of License to Produce

Once Health Canada confirms that the requirements of the ACMPR have been met, and the applicant successfully completes the Detailed Review and Initiation of Security Clearance Process stage, a license to produce will be issued.

iv. Introductory Inspection (as cultivation begins)

As part of the Terms and Conditions on the Health Canada licence, a Licensed Producer is required to notify Health Canada as cultivation begins. Once notified, Health Canada will schedule an initial inspection to verify that the Licensed Producer is meeting the requirements of the ACMPR including, but not limited to, the physical security requirements for the site, record-keeping practices and Good Production Practices and to confirm that the activities being conducted by the Licensed Producer to those indicated on the license.

v. Pre-Sales Inspection

When FV Pharma wishes to add the activity of sale to its existing license, an amendment application must be submitted to the Office of Medical Cannabis. Health Canada will then schedule an inspection to verify that the Corporation is meeting the requirements of the ACMPR including, but not limited to, Good Production Practices, packaging, labelling, shipping, and record keeping prior to allowing the sale or provision of product.

vi. Issuance of License to Sell

To complete the assessment of the requirements of the ACMPR and establish that adding the activity of sale of cannabis products is not likely to create a risk to public health, safety or security, and to confirm that there are no other grounds for refusing the amendment application, Health Canada reviews the following information:

i. results of the pre-sale inspection;

ii. information submitted in the amendment application to add the activity of sale to the license; and

iii. any other relevant information.

When the review is completed, an amended license, including the activity of sale, is issued to the Corporation. Once an amended license is issued, the Corporation can begin supplying cannabis products to registered clients, other Licensed Producer and/or other parties named in subsection 22(2) of the ACMPR, depending on the activities licensed. Health Canada issues separate licenses for dried marijuana, plants and/or cannabis oil.

Recent Financings

During the period from May 2017 to September 2017, FV Pharma closed a multi-tranche non-brokered private placement issuing 52,906,147 FV Pharma Class B Shares for aggregate gross proceeds of $688,219.

During the period October 20, 2017 to December 29, 2017, FV Pharma closed a multi-tranche private placement issuing 348,380,200 FV Pharma Class B Shares for aggregate gross proceeds of $13,097,000.

In connection with the October 20, 2017 to December 29, 2017 offerings above, FV Pharma issued 31,354,218 broker warrants with an exercise price of $0.0376 expiring two years after their respective issuance dates, and also paid corporate finance fees, finders fees and legal costs aggregating $1,262,150.

On March 26, 2018, FV Pharma completed a non-brokered private placement raising gross proceeds of $2,838,280 through the issuance of 31,536,454 FV Pharma Class B Shares at a price of $ 0.09 per share.

On April 18, 2018, FV Pharma completed a non-brokered private placement raising gross proceeds of $1,121,220 through the issuance of 12,457,936 FV Pharma Class B Shares at a price of $ 0.09 per share.

On May 8, 2018, FV Pharma completed a non-brokered private placement raising gross proceeds of $123,530 through the issuance of 1,372,553 FV Pharma Class B Shares at a price of $ 0.09 per share.

Subscription Receipt Financing

On March 9, 2018, FV Pharma completed the first tranche of a previously announced private placement of subscription receipts (the "Subscription Receipts") of FV Pharma (the "Subscription Receipt Financing") for aggregate gross proceeds of $11,483,856.27, for which First Republic Capital Corporation acted as exclusive agent (the “Agent”). Under the first tranche of the Subscription Receipt Financing, 127,598,403 Subscription Receipts were sold at a price of $0.09 per Subscription Receipt (the “Subscription Price”).

On March 28, 2018, FV Pharma completed the second tranche of the Subscription Receipt Financing for aggregate gross proceeds of $21,920,535.90. Under the second tranche of the Subscription Receipt Financing, 243,561,510 Subscription Receipts were sold at the Subscription Price.

The gross proceeds will be held in escrow pending satisfaction of certain conditions (the “Escrow Release Conditions”) set out in the agency agreement dated March 9, 2018 between FV Pharma and the Agent (the “Agency Agreement”) and the subscription receipt agreement dated March 9, 2018 among FV Pharma, the Agent and Garfinkle Biderman LLP, as subscription agent (the “Subscription Receipt Agreement”). Upon satisfaction of the Escrow Release Conditions, each Subscription Receipt will be automatically converted without any payment of additional consideration by the holder thereof into one (1) FV Pharma Class B Share. The escrow release deadline under the Subscription Receipt Agreement is May 31, 2018.

In connection with the Subscription Receipt Financing, the Agent will receive a corporate finance fee equal to 2% of the gross proceeds of the Financing and a sales commission equal to 7% of the gross proceeds of the Subscription Receipt Financing. In addition, the Agent will receive a number of corporate finance broker warrants equal to 2% of the aggregate number of Subscription Receipts issued under the Subscription Receipt Financing and a number of selling compensation warrants equal to 7% of the aggregate number of Subscription Receipts issued under the Subscription Receipt Financing (together, the "Broker Warrants"). Each Broker Warrant issued to the Agent will entitle the holder thereof to acquire one (1) FV Pharma Class B Share at the Subscription Price for a period of 48 months from the date of issue.

(1) Name change to CannaConneXion Inc.

On May 24, 2018, the Corporation entered into the Amalgamation Agreement with Acquireco and FV Pharma, pursuant to which the Corporation acquired all of the issued and outstanding FV Pharma Shares by way of a "three-cornered" amalgamation whereby:

(a) the Corporation filed Articles Amendment, providing for the Name Change and Share Reorganization;

(b) Acquireco and FV Pharma amalgamated pursuant to the Amalgamation, thereby forming Amalco;

(c) each FV Pharma Class A Shareholder transfered their FV Pharma Class A Shares to the Corporation in exchange for one (1) fully paid and non-assessable Class A Multiple Voting Shares for each FV Pharma Share held (15,000 total) and each FV Pharma Class B Shareholder transfered their FV Pharma Class B Shares to the Corporation in exchange for 1 (one) fully paid and non-assessable Class B Subordinate Voting Shares for each FV Pharma Share held (1,305,770,018 total);

(d) the Corporation received one fully paid and non-assessable common share of Amalco for all of the common shares of Acquireco held by the Corporation, following which all such common shares of Acquireco were cancelled;

(e) all FV Pharma Shares held by the Corporation as a result of the exchanges described above were cancelled and the Corporation received, for each FV Pharma Share, one common share of Amalco and Amalco became a wholly-owned subsidiary of the Corporation; and

(f) Corporation Stock Options and Corporation Warrants were issued to the holders of the FV Pharma Options and FV Pharma Warrants, respectively, in exchange and replacement for, on an equivalent basis, such FV Pharma Options and FV Pharma Warrants, which were cancelled.

The Amalgamation resulted in Amalco becoming a wholly-owned subsidiary of the Corporation. Concurrently with the completion of the Amalgamation, the Corporation changed its name to "FSD Pharma Inc." and Amalco continued under the name "FV Pharma Inc.".

The valuation ascribed to FV Pharma in the Amalgamation was determined by arm's length negotiation between the Corporation and FV Pharma, and based in part upon FV Pharma's pre-Amalgamation financings. A formal third party valuation was not determined to be necessary.

The Amalgamation was approved by a special resolution passed by the FV Pharma Shareholders at a shareholder meeting held on May 15, 2018 and by the Corporation, in its capacity as sole shareholder of Acquireco. The Amalgamation was approved, pursuant to CSE Policies, by a majority (50% plus one vote) of the votes cast at a meeting of shareholders of FV Pharma.

The directors and officers of the Corporation are Thomas Fairfull (Director and Chief Executive Officer), Zeeshan Saeed (Director and Executive Vice-President), Donal Carrol (Director), Gerry Goldberg (Director), and Vladimir Klacar (Director).

The outstanding capital of the Corporation consists of:

(a) 15,000 Class A Multiple Voting Shares;

(b) 1,319,600,458 Class B Subordinate Voting Shares;

(c) 100,000,000 Corporation Options

(d) 112,242,457 Corporation Warrants

3.2 Significant Acquisitions and Dispositions

See Item 3.1 – General Development of the Business – The Amalgamation.

3.3 Trends, Commitments, Events or Uncertainties

Recreational use of cannabis is not currently legal in Canada. On June 30, 2016, the federal government appointed a task force. The task force completed consultations in August 2016 and published its final report on November 30, 2016 containing its recommendations. On April 13, 2017, the federal government released Bill C-45, An Act respecting cannabis and to amend the Controlled Drugs and Substances Act, the Criminal Code and other Acts (Canada) (the “Cannabis Act”). The Cannabis Act is intended to support the federal government’s platform advocating for the legalization of recreational cannabis in order to regulate the illegal market and restrict access by under-aged individuals. If enacted, the Cannabis Act will regulate the production, distribution and sale of cannabis for adult use. The target implementation date of the Cannabis Act is July 2018.

On October 3, 2017, the Parliamentary Standing Committee on Health proposed amendments to the Cannabis Act, which if approved would allow for cannabis edibles and concentrates to be available for sale within 12 months of the Cannabis Act coming into force.

On November 10, 2017, the federal government proposed that federal tax on cannabis for recreational purposes should not exceed $1 per gram or 10% of the producer’s price, whichever is higher, with retail sales taxes levied on top of that amount.

Health Canada launched a 60-day public consultation on the proposed approach to the regulation of cannabis on November 21, 2017. The consultation proposals address matters with respect to licensing, security requirements for producers and their facilities, product standards and labelling and packaging, access to cannabis for medical purposes and health products containing cannabis, and will inform the drafting of regulations to the Cannabis Act.

The Cannabis Act provides a licensing and permitting scheme for the production, testing, packaging, labelling, sending, delivery, transportation, sale, possession and disposal of cannabis, to be implemented by regulations made under the Cannabis Act. It is proposed that provincial legislation will implement measures authorizing the sale of cannabis that has been produced by a person authorized under the Cannabis Act to produce cannabis for commercial purposes. The licensing, permitting and authorization regime will be implemented by regulations made under the Cannabis Act. Draft regulations have not yet been disclosed, however, the Cannabis Act contains some details of the application requirements for licences and permits that are similar in nature to the application requirements under the ACMPR.

The Cannabis Act proposes to maintain separate access to cannabis for medical purposes, including providing that import and export licences and permits will only be issued in respect of cannabis for medical or scientific purposes. On November 27, 2017, the Proposed Cannabis Act was approved by the House of Commons following the addition of three significant amendments:

• the removal of a restriction on the height of cannabis plants maintained in a Person's home,

• a requirement that regulations on edible cannabis products be enacted within twelve months and,

• a provision requiring a review of the law in three years following its passage into law.

On March 22, 2018, the Cannabis Act passed Second Reading in the Senate and was referred to the Standing Senate Committee on Social Affairs, Science and Technology.

The impact of such regulatory changes on the Corporation's business is unknown, and the proposed regulatory changes may not be implemented at all. There are significant risks associated with the Corporation's business, as described in Item 17 – Risk Factors.

4. NARRATIVE DESCRIPTION OF THE BUSINESS

4.1 Narrative Description of the Corporation's Business

Business of the Corporation

Business Objectives

The principal business intended to be carried on by the Corporation is the production of medical cannabis in Canada, through FV Pharma, and subsequently the sale of medical cannabis in Canada. On October 13, 2017, FV Pharma received its Licence from Health Canada (see Item 17 – Risk Factors – Licensing Requirements under the ACMPR).

The Corporation expects to complete the following over the next 12 months:

Objective | Target Date | Anticipated Costs |

| | |

| | | $2,000,000 |

Continue capital improvements to 25,000 square feet of | June 2018 | |

the Facility | | |

| | |

Commence cultivation and hire an additional 30 | October 2018 | $500,000 |

employees | | |

| | |

Obtain an amendment to its License allowing it to sell | September 2018 | $10,000 |

cannabis pursuant to the ACMPR | | |

| | |

| | November— | $1,000,000 |

Commence sale of cannabis products | December 2018 | |

| | |

Commence build-out of additional 100,000 square foot area of the Facility with Cannabis Wheaton Income Corp | July 2018 | To be paid by |

| | | Cannabis Wheaton – |

| | see "Joint Venture |

| | with Cannabis |

| | Wheaton Income |

| | Corp." section |

| | |

Significant Events or Milestones

The principal milestones that must occur during the 12-month period following the Amalgamation for the business objectives described above to be accomplished are as follows:

Significant Event or Milestone | Target Date | Anticipated Costs |

| | |

FV Pharma producing its first batches of dried cannabis | October 2018 | $700,000 |

| | |

Obtain sales license under the ACMPR | September 2018 | $10,000 |

| | |

Production and sale of medical cannabis | November— | $1,000,000 |

| December 2018 | |

| | |

Production of cannabis oils | December 2018 | $750,000 |

| | |

Develop distribution channels for products | June—December | $2,500,000 |

| 2018 | |

| | |

Joint Venture with Cannabis Wheaton Income Corp.

On December 21, 2017, FV Pharma announced that it had entered into a letter of intent with Cannabis Wheaton Income Corp. ("Cannabis Wheaton"), and on March 5, 2018, the parties entered into a binding definitive agreement (the “CBW Agreement”). Under the terms of the CBW Agreement, the parties agreed to combine their respective capabilities to develop certain portions of the Facility in mutually agreed upon phases (each, a “Project Phase”) on identified areas within the Facility (the “Project Facility”). The CBW Agreement provides that Cannabis Wheaton will assume primary carriage through the implementation of each Project Phase at the Project Facility, including, but not limited to:

• the design of each phase of development at the Facility and the management and supervision of all professional services performed in connection therewith, including architectural services, engineering services, construction services and security services;

• the selection of and provision of Cannabis genetics (e.g. seeds, cuttings or clones) for each phase of development at the Project Facility

• assisting in the hiring, training and oversight of professional and operational staff;

• assisting in the development and implementation of distribution strategies for all Products produced at the Project Facility including sourcing unique distribution channels for such Products; and

• assisting with the regulatory licensing process including facilitating interaction between FV Pharma and Health Canada.

The CBW Agreement also provides that Cannabis Wheaton has primary responsibility for financing and/or sourcing the funds required for the capital expenditures for each Project Phase at the Project Facility, to be comprised of both equity and debt financing provided directly by Cannabis Wheaton or by a third party lender arranged for and designated by Cannabis Wheaton. It is expected that capital expenditure funding provided directly by Cannabis Wheaton will be provided by way of equity subscription for Class B Subordinate Shares at a mutually agreed upon premium to the trading price of such shares. Capital expenditure funding arranged by Cannabis Wheaton but provided by a third-party lender will be provided by way of a loan payable by and/or guaranteed by Cannabis Wheaton, on terms to be mutually agreed to by the parties.

In addition, until such time that FV Pharma generates its first revenue from the sale of cannabis products at the Facility, Cannabis Wheaton will provide up to 50% of the mutual agreed upon working capital funding necessary to operate the Facility.

As consideration for the services described above, Cannabis Wheaton will be entitled to receive a monthly payment equal to 49.9% of the revenue received by FV Pharma for any retail sales of cannabis derived from each completed Project Phase within the Project Facility (“Product”), less the Total Retail Costs of FV Pharma, subject to adjustment in certain circumstances. Cannabis Wheaton also has the right to direct the sale of up to 49.9% of Product on a wholesale basis, for which Cannabis Wheaton is entitled to receive a payment equal to the difference between the wholesale transfer price of such Product less the Total Wholesale Costs of FV Pharma.

“Total Retail Costs” is equal to the cultivation, shipping, packaging and marketing costs associated with producing the Product plus a mark-up of 10%

“Total Wholesale Costs” is equal to the cultivation, shipping and packaging costs associated with producing the Product plus a mark-up of 10%.

Total Funds Available

The pro forma working capital position of the Corporation as at February 28, 2018 was approximately $40,863,000.

The consolidated pro forma balance sheet of the Corporation is attached hereto as Schedule A.

Purpose of Funds

The Corporation has $40,863,000 in funds available to it to spend for the principal purpose of supporting its efforts to commence cultivation and sale of cannabis products and for general corporate purposes. Notwithstanding the foregoing, there may be circumstances where, for sound business reasons, a reallocation of funds may be necessary for the Corporation to achieve its objectives. The Corporation may also require additional funds in order to fulfill its expenditure requirements to meet existing and any new business objectives and expects to either issue additional securities or incur debt to do so. There can be no assurance that additional funding required by the Corporation will be available if required. However, it is anticipated that the available funds will be sufficient to satisfy the Corporation's objectives for the 12 month period following the completion of the Amalgamation.

Forecast 12 Month Budget | |

Funds Available | $40,863,000 |

Salaries, Office and General Expenses | $10,000,000 |

Future Capital Expenditures | $7,000,000 |

Genetic Material Purchased | $2,500,000 |

Set up laboratory in genetics | $3,000,000 |

| Excess Funds Available to the Corporation for General Working Capital | $18,363,000 |

4.2 Principal Products or Services

Initially, the Corporation will focus on the production, provision and sale of medical cannabis to an established list of qualified clients. With the expansion of the Facility, the Corporation intends to engage in research and development relating to cannabis in its natural form and/or cannabis oil, in relation to pharmaceutical and product delivery applications, as well as the exportation of same.

4.3 Production and Sales

The Corporation expects to engage in various patient outreach strategies in order to establish a client base. Until such time that FV Pharma receives the applicable licences from Health Canada it will not be able to sell medical cannabis.

4.4 Competitive Conditions and Position

See Item 17 – Risk Factors - Competition.

4.5 Lending and Investment Policies and Restrictions

This is not applicable to the Corporation.

4.6 Bankruptcy and Receivership

Neither FV Pharma, the Corporation, nor any of the Corporation's subsidiaries, has been the subject of any bankruptcy or any receivership or similar proceedings or any voluntary bankruptcy, receivership or similar proceedings, within any of the three most recently completed financial years (as applicable) or the current financial year.

4.7 Material Restructuring

As a condition to closing the Amalgamation, the Corporation completed the Share Reorganization pursuant to which the Corporation:

i. amended and re-designated the Corporation's common shares as "Class B Subordinate Voting Shares";

ii. created a new class of "Class A Multiple Voting Shares";

iii. eliminated the existing classes of non-voting Class A Preferred Shares and non-voting Class B Preferred Shares; and

iv. changed the Corporation's name to "FSD Pharma Inc.".

On February 15, 2018, the Corporation arranged for the incorporation of Acquireco, a wholly-owned subsidiary established pursuant to the OBCA, for the purposes of completing the Amalgamation.

4.8 Asset Backed Securities

The Corporation does not have any asset backed securities.

4.9 Companies with Mineral Projects

This is not applicable to the Corporation.

4.10 Companies with Oil and Gas Operations

The Corporation does not have any oil and gas operations.

5. SELECTED CONSOLIDATED FINANCIAL INFORMATION

5.1 Consolidated Financial Information – Annual Information

The Corporation's Annual Information

The following table sets forth selected financial information for the Corporation for the years ended August 30 2017, 2016 and 2015. Such information is derived from the financial statements of Century Financial Capital Group Inc. and should be read in conjunction with such financial statements. See Schedule "B" – Financial Statements of Century Financial Capital Group Inc.

| For the Years Ended August 31 | |

| | | | |

| 2017 | 2016 | | 2015 |

Operating Data: | | | | |

Total revenues | $0 | $0 | | $0 |

| | | | |

Total expenses | $24,450 | $38,786 | | $43,434 |

| | | | |

Net loss for the year | $(24,450) | $(38,786) | | $(43,434) |

| | | | |

Basic and diluted loss per share(1) | $(0.02) | $(0.03) | | $(0.03) |

Dividends | $0 | $0 | | $0 |

| | | | |

Balance Sheet Data: | | | | |

Total assets | $17,693 | $9,343 | | $2,861 |

| | | | |

Total liabilities | $113,222 | $80,422 | | $80,154 |

| | | | |

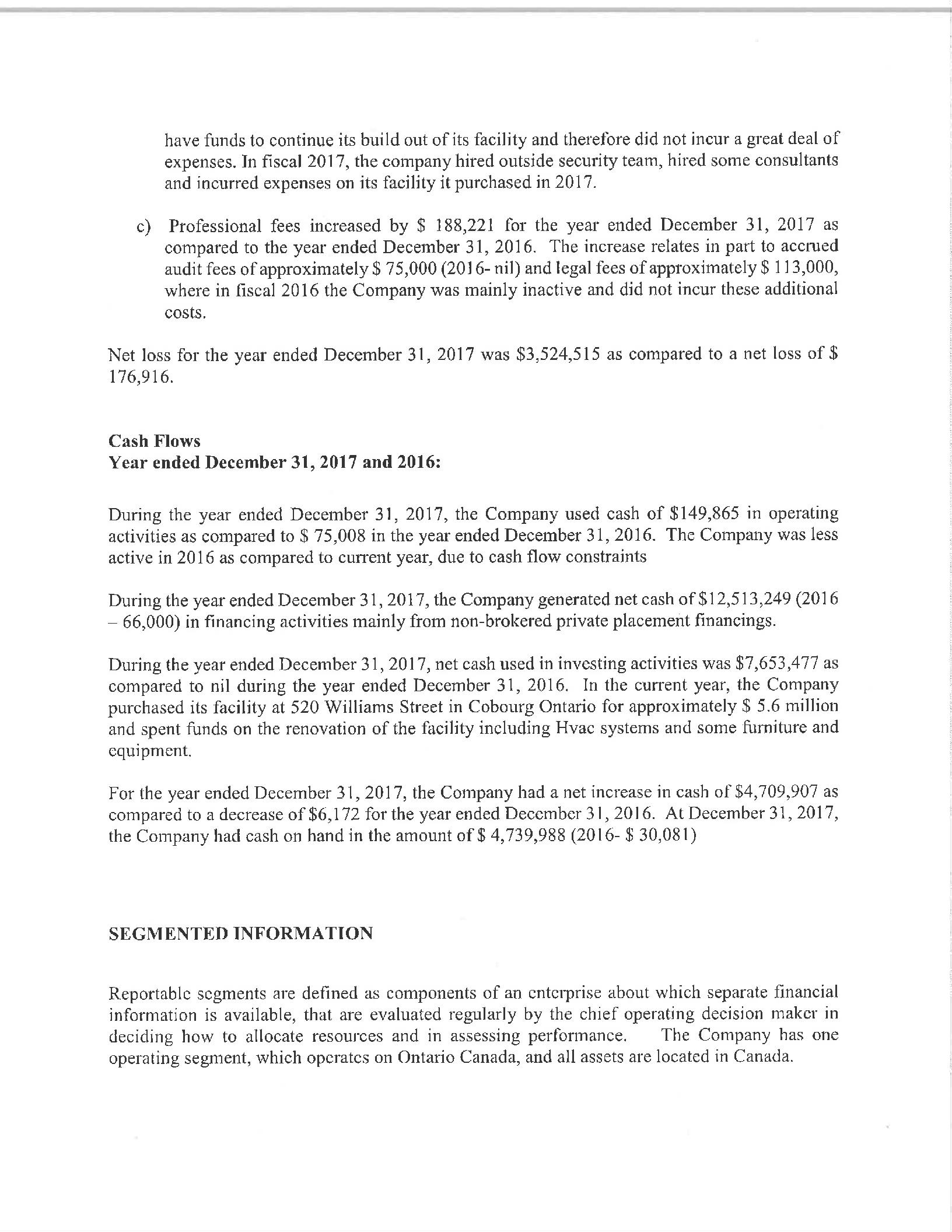

FV Pharma's Annual Information

The following table sets forth selected financial information for FV Pharma for the years ended December 31, 2017, 2016 and 2015. Such information is derived from the financial statements of FV Pharma and should be read in conjunction with such financial statements. See Schedule "E" – Financial Statements of FV Pharma Inc.

| For the Years Ended December 31 |

| 2017 | 2016 | 2015 |

Operating Data: | | | |

Total revenues | $25943 | Nil | Nil |

| | | |

Total expenses | 3,550,458 | 176,916 | 190,146 |

| | | |

Net loss for the year | (3,524,515) | (176,916) | (190,146) |

| | | |

| For the Years Ended December 31 |

| 2017 | 2016 | | 2015 |

| | | | |

Basic and diluted loss per share | 0.00 | 0.00 | | 0.00 |

| | | | |

Dividends | Nil | Nil | | Nil |

| | | | |

Balance Sheet Data: | | | | |

Total assets | 13,679,694 | 638,561 | | 699,788 |

| | | | |

Total liabilities | 1,265,995 | 281,164 | | 164,327 |

| | | | |

5.2 Consolidated Financial Information – Quarterly Information

The Corporation's Quarterly Information

The results for each of the eight most recently completed quarters of the Corporation ending at the end of the most recently competed interim period, being November 30, 2017 are summarized below:

Quarter Ended | Revenue | Net income (loss) and | Basic and diluted loss |

| | | comprehensive | per share |

| | | income (loss) for the | |

| | | period | |

February 28, 2018 | $0 | $63,931 | $0.00 |

| | | |

November 30, 2017 | $0 | ($6,506) | $0.00 |

| | | |

August 31, 2017 | $0 | ($6,591) | $0.00 |

| | | |

May 31, 2017 | $0 | ($4,319) | $0.00 |

| | | |

February 28, 2017 | $0 | ($12,502) | $0.01 |

| | | |

November 30, 2016 | $0 | ($1,038) | $0.00 |

| | | |

August 31, 2016 | $0 | ($17,706) | $0.00 |

| | | |

May 31, 2016 | $0 | ($9,818) | $0.01 |

| | | | |

5.3 Dividends

The future payment of dividends will be dependent upon the financial requirements of the Corporation to fund further growth, the financial condition of the Corporation and other factors which the Corporation's Board of Directors may consider in the circumstances. It is not contemplated that any dividends will be paid in the immediate or foreseeable future, if at all.

5.4 Foreign GAAP

This item does not apply to the Corporation.

6. MANAGEMENT'S DISCUSSION AND ANALYSIS

The Corporation's MD&A for the year ended August 31, 2017 is attached to this Listing Statement as Schedule "C" – MD&A of Century Financial Capital Group Inc. FV Pharma's MD&A for the year ended December 31, 2017 is attached hereto as Schedule "D" –MD&A of FV Pharma Inc.

7. MARKET FOR SECURITIES

The Class B Subordinate Voting Shares are currently unlisted. It is expected that the Class B Subordinate Voting Shares will be listed for trading on the CSE under the symbol "HUGE".

The FV Pharma Class B Shares are not listed for trading on any stock exchange.

8. CONSOLIDATED CAPITALIZATION

The outstanding capital of the Corporation consists of:

(a) 15,000 Class A Multiple Voting Shares

(b) 1,319,600,458 Class B Multiple Voting Shares

(c) 100,000,000 Corporation Options

(d) 112,242,457 Corporation Warrants

9. OPTIONS TO PURCHASE SECURITIES

On February 19, 2018 the Corporation’s Board of Directors approved a stock option plan (the “Stock Option Plan”). The Stock Option Plan provides that the aggregate number of securities reserved for issuance will be 10% of the number of common shares of the Corporation issued and outstanding from time to time.

The Stock Option Plan was established to provide incentive to qualified parties to increase their proprietary interest in the Corporation and thereby encourage their continuing association with the Corporation. Management proposes stock option grants to the Board based on such criteria as performance, previous grants, and hiring incentives. All grants require Board approval. The share option plan is administered by the Board and provides that options will be issued to directors, officers, employees or consultants of the Corporation or a subsidiary of the Corporation.

The Stock Option Plan is administered by the Board of Directors of the Corporation, which has full and final authority with respect to the granting of all options thereunder. Corporation Options may be granted under the Stock Option Plan to such service providers of the Corporation and its affiliates, if any, as the Board of Directors may from time to time designate. The exercise prices will be determined by the Board of Directors, but will, in no event, be less than the market value of the Class B Subordinate Voting Shares or the lowest price permitted by the policies of any stock exchange on which the Class B Subordinate Voting Shares may be listed. All Corporation Options granted under the Stock Option Plan will expire not later than the date that is ten years from the date that such options are granted. Corporation Options granted under the Stock Option Plan are not transferable or assignable other than by testamentary instrument or pursuant to the laws of succession.

Pursuant to the Amalgamation, Corporation Options were issued to the holders of the FV Pharma Options in exchange and replacement for, and on an equivalent basis as, the FV Pharma Options. The FV Pharma Options were cancelled.

The following tables sets out all Corporation Stock Options:

| | | Number of Options to |

| | | Acquire Class B |

| | | Subordinate Voting |

| Category of Option Holder | | Shares held as a Group |

(a) All proposed officers and directors (Thomas Fairfull, Zeeshan Saeed) | 40,000,000 |

(b) All consultants as a group | 42,000,000 |

(c) All other persons or companies (e.g. former officers and directors of FV Pharma and the Corporation, all employees) | 18,000,000 |

TOTAL NUMBER OF OUTSTANDING OPTIONS | 100,000,000 |

The following table provides information as to material provisions of the options of the Corporation that are outstanding:

| | Number of | | Exercise | | |

Date of Grant | | Options | | Price | | Expiry Date |

September 15, 2017 | 40,000,000 | $0.022 | | September 15, 2022 |

December 23, 2017 | 1,500,000 | $0.025 | | December 23, 2019 |

January 5, 2018 | 29,000,000 | $0.05 | | January 5, 2023 |

February 25, 2018 | 1,000,000 | $0.09 | | February 25, 2023 |

March 22, 2018 | 1,000,000 | $0.09 | | March 22, 2023 |

March 28, 2018 | 2,500,000 | $0.09 | | March 28, 2023 |

April 8, 2018 | 15,000,000 | $0.09 | | April 8, 2023 |

April 9, 2018 | 10,000,000 | $0.10 | | April 9, 2023 |

TOTAL | 100,000,000 | | | | |

10. DESCRIPTION OF THE SECURITIES

10.1 Description of the Corporation's Securities Corporation

The Corporation’s authorized share capital consists of an unlimited number of Class A Multiple Voting Shares and an unlimited number of Class B Subordinate Voting Shares. As at February 28, 2018, there were 15,000 Class A Multiple Voting Shares issued and outstanding and 1,319,600,458 Class B Subordinate Voting Shares issued and outstanding.

Voting Rights

Except as otherwise prescribed by the OBCA, at a meeting of shareholders of the Corporation, each Class B Subordinate Voting Share entitles the holder thereof to one vote and each Class A Multiple Voting Share entitles the holder thereof to 276,660 votes on all matters.

Rank

The Class A Multiple Voting Shares and Class B Subordinate Voting Shares rank pari passu with respect to the payment of dividends, return of capital and distribution of assets in the event of the liquidation, dissolution or winding up of the Corporation. In the event of the liquidation, dissolution or winding-up of the Corporation or any other distribution of its assets among its shareholders for the purpose of winding-up its affairs, whether voluntarily or involuntarily, the holders of Class A Multiple Voting Shares and the holders of Class B Subordinate Voting Shares are entitled to participate equally, share for share, subject always to the rights of the holders of any class of shares ranking senior to the Class A Multiple Voting Shares and the Class B Subordinate Voting Shares, in the remaining property and assets of the Corporation available for distribution to shareholders, without preference or distinction among or between the Class A Multiple Voting Shares and the Class B Subordinate Voting Shares.

Dividends

Holders of Class A Multiple Voting Shares and Class B Subordinate Voting Shares are entitled to receive, subject always to the rights of the holders of any class of shares ranking senior to the Class A Multiple Voting Shares and Class B Subordinate Voting Shares, dividends out of the assets of the Corporation legally available for the payment of dividends at such times and in such amount and form as the Board may from time to time determine and the Corporation will pay dividends thereon on a pari passu basis, if, as and when declared by the Board.

Conversion

The Class B Subordinate Voting Shares are not convertible into any other class of shares. Each outstanding Class A Multiple Voting Share may, at any time at the option of the holder, be converted into one Class B Subordinate Voting Share. Upon the first date that any Class A Multiple Voting Share is held other than by a Permitted Holder, the Permitted Holder which held such Class A Multiple Voting Share until such date, without any further action, shall automatically be deemed to have exercised his, her or its rights to convert such Class A Multiple Voting Share into a fully paid and non-assessable Class B Subordinate Voting Share.

Subdivision or Consolidation

No subdivision or consolidation of the Class A Multiple Voting Shares or the Class B Subordinate Voting Shares may be carried out unless, at the same time, the Class A Multiple Voting Shares or the Class B Subordinate Voting Shares, as the case may be, are subdivided or consolidated in the same manner and on the same basis.

Change of Control Transactions

The holders of Class B Subordinate Voting Shares are entitled to participate on an equal basis with holders of Class A Multiple Voting Shares in the event of a “Change of Control Transaction” requiring approval of the holders of Class A Multiple Voting Shares and Class B Subordinate Voting Shares under the OBCA, unless different treatment of the shares of each such class is approved by a majority of the votes cast by the holders of outstanding Class A Multiple Voting Shares and by a majority of the votes cast by the holders of outstanding Class B Subordinate Voting Shares each voting separately as a class.

Proposals to Amend the Articles of Amendment

Neither the holders of the Class A Multiple Voting Shares nor the holders of the Class B Subordinate Voting Shares are entitled to vote separately as a class upon a proposal to amend the Articles of Amendment in the case of an amendment referred to in paragraph (a) or (e) of subsection 170(1) of the OBCA.

Neither the holders of the Class A Multiple Voting Shares nor the holders of the Class B Subordinate Voting Shares shall be entitled to vote separately as a class upon a proposal to amend the Articles of Amendment in the case of an amendment referred to in paragraph (b) of subsection 170(1) of the OBCA unless such exchange, reclassification or cancellation: (a) affects only the holders of that class; or (b) affects the holders of Class A Multiple Voting Shares and Class B Subordinate Voting Shares differently, on a per share basis, and such holders are not otherwise entitled to vote separately as a class under any applicable law in respect of such exchange, reclassification or cancellation.

Take-Over Bid Protection

Under applicable Canadian law, an offer to purchase Class A Multiple Voting Shares would not necessarily require that an offer be made to purchase Class B Subordinate Voting Shares. In accordance with the rules of the CSE designed to ensure that, in the event of a take-over bid, the holders of Class B Subordinate Voting Shares will be entitled to participate on an equal footing with holders of Class A Multiple Voting Shares, the holders of not less than 80% of the outstanding Class A Multiple Voting Shares have entered into a customary coattail agreement with the Corporation and a trustee (the "Coattail Agreement"). The Coattail Agreement contains provisions customary for dual class, publicly-traded corporations designed to prevent transactions that otherwise would deprive the holders of Class B Subordinate Voting Shares of rights under the take-over bid provisions of applicable Canadian securities legislation to which they would have been entitled if the Class A Multiple Voting Shares had been Class B Subordinate Voting Shares.

The undertakings in the Coattail Agreement do not apply to prevent a sale of Class A Multiple Voting Shares by a holder of Class A Multiple Voting Shares party to the Coattail Agreement if concurrently an offer is made to purchase Class B Subordinate Voting Shares that:

a) offers a price per Class B Subordinate Voting Share at least as high as the highest price per share paid or required to be paid pursuant to the take-over bid for the Class A Multiple Voting Shares;

b) provides that the percentage of outstanding Class B Subordinate Voting Shares to be taken up (exclusive of shares owned immediately prior to the offer by the offeror or persons acting jointly or in concert with the offeror) is at least as high as the percentage of outstanding Class A Multiple Voting shares to be sold (exclusive of Class A Multiple Voting Shares owned immediately prior to the offer by the offeror and persons acting jointly or in concert with the offeror);

c) has no condition attached other than the right not to take up and pay for Class B Subordinate Voting Shares tendered if no shares are purchased pursuant to the offer for Class A Multiple Voting Shares; and

d) is in all other material respects identical to the offer for Class A Multiple Voting Shares.

In addition, the Coattail Agreement does not prevent the sale of Class A Multiple Voting Shares by a holder thereof to a Permitted Holder, provided such sale does not or would not constitute a take-over bid or, if so, is exempt or would be exempt from the formal bid requirements (as defined in applicable securities legislation). The conversion of Class A Multiple Voting Shares into Class B Subordinate Voting Shares, shall not, in of itself constitute a sale of Class A Multiple Voting Shares for the purposes of the Coattail Agreement.

Under the Coattail Agreement, any sale of Class A Multiple Voting Shares (including a transfer to a pledgee as security) by a holder of Class A Multiple Voting Shares party to the Coattail Agreement is conditional upon the transferee or pledgee becoming a party to the Coattail Agreement, to the extent such transferred Class A Multiple Voting Shares are not automatically converted into Class B Subordinate Voting Shares in accordance with the Articles of Amendment.

The Coattail Agreement contains provisions for authorizing action by the trustee to enforce the rights under the Coattail Agreement on behalf of the holders of the Class B Subordinate Voting Shares. The obligation of the trustee to take such action will be conditional on the Corporation or holders of the Class B Subordinate Voting Shares providing such funds and indemnity as the trustee may require. No holder of Class B Subordinate Voting Shares has the right, other than through the trustee, to institute any action or proceeding or to exercise any other remedy to enforce any rights arising under the Coattail Agreement unless the trustee fails to act on a request authorized by holders of not less than 10% of the outstanding Class B Subordinate Voting Shares and reasonable funds and indemnity have been provided to the trustee.

The Coattail Agreement may not be amended, and no provision thereof may be waived, unless, prior to giving effect to such amendment or waiver, the following have been obtained: (a) the consent of the CSE and any other applicable securities regulatory authority in Canada and (b) the approval of at least 662/3% of the votes cast by holders of Class B Subordinate Voting Shares represented at a meeting duly called for the purpose of considering such amendment or waiver, excluding votes attached to Class B Subordinate Voting Shares held directly or indirectly by holders of Class A Multiple Voting Shares, their affiliates and related parties and any persons who have an agreement to purchase Class A Multiple Voting Shares on terms which would constitute a sale for purposes of the Coattail Agreement other than as permitted thereby.

No provision of the Coattail Agreement limits the rights of any holders of Class B Subordinate Voting Shares under applicable law.

FV Pharma

FV Pharma's authorized share capital consists of an unlimited number of FV Pharma Class A Shares and an unlimited number of FV Pharma Class B Shares. Pursuant to the Amalgamation, FV Pharma is now a wholly-owned subsidiary of the Corporation.

10.2 Debt Securities

The Corporation is only seeking a listing of the Class B Subordinate Voting Shares and not a listing of any other securities, including but not limited to, debt securities.

10.3 Other Securities

The Corporation is only seeking a listing of the Class B Subordinate Voting Shares and not a listing of any other securities, including but not limited to, other equity securities.

10.4 Modification of Terms

(a) Alterations to Rights of Class B Subordinate Voting Shares

In addition to any other voting right or power to which the holders of Class B Subordinate Voting Shares shall be entitled by law or regulation or other provisions of the Articles from time to time in effect, but subject to the provisions of the Articles, holders of Class B Subordinate Voting Shares shall be entitled to vote separately as a class, in addition to any other vote of shareholders that may be required, in respect of any alteration, repeal or amendment of the Articles which would adversely affect the powers, preferences or rights of the holders of Class B Subordinate Voting Shares.

(b) Other Methods of Modifying Rights of Class B Subordinate Voting Shares

There are no methods of modifying the rights of the Class B Subordinate Voting Shares, other than as set out above.

10.5 Other Attributes

For a full description of the characteristics of the Class B Subordinate Voting Shares of the Corporation, reference should be made to the articles of amendment and by-laws of the Corporation which are available under the Corporation's SEDAR profile at www.sedar.com, and the relevant provisions of the OBCA.

10.6 Prior Sales of Century Common Shares and FV Pharma Class B Shares The Corporation

The following tables set forth the issuances of Century Common Shares within the last twelve (12) months before the date of this Listing Statement.

| Date Issued | Number of | Issue Price per | Total funds | Nature of |

| | Century | Share ($) | received ($) | Consideration |

| | Common Shares | | | |

| December 28, 2017 | 2,250,000 | 0.02 | 45,000 | Cash |

| | | | | |

| December 28, 2017 | 2,966,102 | 0.0118 | N/A | Note Conversion |

| | | | | |

| December 28, 2017 | 2,708,080 | 0.025 | N/A | Debt Settlements |

| | | | | |

| December 28, 2017 | 2,879,581 | 0.05 | N/A | Debt Settlements |

| | | | | |

| December 28, 2017 | 300,000 | 0.0667 | N/A | Debt Settlements |

| | | | | |

| January 4, 2018 | 41,666,666 | 0.06 | 2,499.999.96 | Cash |

| | | | | |

| March 16, 2018 | 54,230,708 | N/A | N/A | Stock Dividend |

| | | | | |

FV Pharma

The following table sets forth the issuances of FV Pharma Class B Shares within the last twelve (12) months before the date of this Listing Statement.

| Date Issued | Number of | Issue Price per | Total funds | Nature of |

| | Securities | Security ($) | received ($) | Consideration |

| May 24, 2017 – August 14, | 22,889,446 | $0.0294 | $688,219 | Cash |

| 2017 | | | | |

| October 20, 2017 | 26,733,000 | $0.376 | $1,005,000 | Cash |

| | | | | |

| November 1, 2017 | 173,897,500 | $0.376 | $1,005,000 | Cash |

| | | | | |

| November 14, 2017 | 119,241,150 | $0.376 | $4,482,750 | Cash |

| | | | | |

| November 21, 2017 | 23,932,020 | $0.376 | $899,700 | Cash |

| | | | | |

| December 12, 2017 | 2,421,930 | $0.376 | $91,050 | Cash |

| | | | | |

| December 29, 2017 | 2,394,000 | $0.376 | $90,000 | Cash |

| | | | | |

| March 27, 2018 | 31,536,454 | $0.09 | $2,838,280 | Cash |

| | | | | |

| March 9 – March 29, 2018(1) | 371,159,913 | $0.09 | $33,404,392 | Cash |

| April 18, 2018 | 12,457,936 | $0.09 | $1,121,220 | Cash |

| | | | | |

| May 8, 2018 | 1,372,553 | $0.09 | $123,530 | Cash |

| | | | | |

Notes:

(1) See "Recent Financings – Subscription Receipt Financing"

10.7 Stock Exchange Price

The Class B Subordinate Voting Shares are not currently listed for trading on any exchange or market and have not been listed at any time during the past 24 months.

11. ESCROWED SECURITIES

As required under the policies of the CSE, Principals of the Corporation will enter into an escrow agreement as if the Corporation was subject to the requirements of NP 46-201. The form of the escrow agreement must be as provided in NP 46-201. Escrowed Securities will be released on scheduled periods specified in NP 46-201 for emerging issuers, that is, 10% will be released upon listing followed by six subsequent releases of 15% each every six months thereafter.

The table below includes the details of Escrowed Securities that will be held by Principals of the Corporation:

| Designation of class held in | Number of securities | Percentage of class |

| escrow(1) | held in escrow | |

| Class B Subordinate Voting Shares | 169,007,547 | 12.81% |

| | | |

| Corporation Stock Options | 40,000,000 | 40% |

| | | |

| Warrants | 68,821,899 | 61.31% |

| | | |

Notes:

(1) Computershare Trust Company of Canada is the escrow agent for these shares.

12. PRINCIPAL SHAREHOLDERS

12.1 Principal Shareholders

To the knowledge of the directors and officers of the Corporation, the following Persons beneficially own, directly or indirectly, or exercise control or direction over voting securities carrying more than 10% of the voting rights attached to any class of voting securities of the Corporation:

| | | | Percentage of |

| Name and Municipality | Number of Class A | Number of Class B | Voting Shares |

| of Residence of | Multiple Voting | Subordinate Voting | Owned (Class A |

| Shareholder | Shares Owned(4) | Shares | & Class B) |

| Thomas Fairfull | 5,000 | 52,910,324 | 26.26% |

| Pickering, Ontario | | | |

| Zeeshan Saeed(1) | 5,000 | 62,934,474 | 26.44% |

| Mississauga, Ontario | | | |

| Anthony Durkacz(2) | 5,000 | 53,162,749(3) | 26.26% |

| Etobicoke, Ontario | | | |

Notes:

(1) Xorax Family Trust, a trust of which Zeeshan Saeed is a beneficiary, is the registered owner of the Class A Multiple Voting Shares.

(2) Fortius Research and Trading Corp., a corporation controlled by Anthony Durkacz, is the registered owner of the Class A Multiple Voting Shares.

(3) Fortius Research and Trading Corp., a corporation controlled by Anthony Durkacz, is the registered owner of 21,314,701 Class B Subordinate Voting Shares and First Republic Capital Corporation, a corporation majority owned by Anthony Durkacz, is the registered owner of 31,848,048 Class B Subordinate Voting Shares.

(4) Each Class A Multiple Voting Share has 276,660 votes per share, and each Class B Subordinate Voting Share has one (1) vote per share. Except as required by the OBCA or the Articles of Amendment, the holders of the Class A Multiple Voting Shares and holders of the Class B Subordinate Voting Shares vote together as a single class on all matters at meetings of the shareholders.

To the knowledge of the Corporation and FV Pharma, no voting trust exists within the Corporation such that more than 10% of any class of voting securities of the Corporation are held, or are to be held, subject to any voting trust or other similar agreement.

12.2 Associates and Affiliates

To the knowledge of the Corporation none of the principal shareholders is an Associate or Affiliate of any other principal shareholder.

13. DIRECTORS AND OFFICERS

13.1 − 13.5 – Directors and Officers

The Articles of the Corporation provide that the number of directors should not be fewer than three and not more than 12 directors. Each director holds office until the next annual meeting of the Corporation.

The Corporation's Board currently consists of three directors, two of whom can be defined as an "unrelated director" or a director who is independent of management and is free from any interests and any business or other relationship which could, or could reasonably be perceived to, materially interfere with the director's ability to act with a view to the best interests of the Corporation, other than interests and relationships arising from shareholders, and do not have interests in or relationships with the Corporation.

The following table lists the names, municipalities of residence of the directors and officers of the Corporation, their positions and offices to be held with the Corporation, and their principal occupations during the past five (5) years and the number of securities of the Corporation that are beneficially owned, directly or indirectly, or over which control or direction will be exercised by each.

| | | | Number and | Number and |

| | | | Percentage of | Percentage of |

| | | Director of | Class A | Class B |

| Name, Municipality | | the | Multiple | Subordinate |

| of Residence and | Principal Occupation | Corporation | Voting Shares | Voting Shares |

| Position Held | for Past Five Years(2) | Since | Owned | Owed |

| Thomas Fairfull, | Chief Executive | 2018 | 5,000 | 52,910,324 |

| Pickering, Ontario – | Officer of FV Pharma | | (33.33%) | (4.09%) |

| Director and Chief | | | | |

| Executive Officer | | | | |

| | | | | |

| Zeeshan Saeed, | Entrepreneur | 2018 | 5,000 | 62,934,484 |

| Mississauga, Ontario | | | (33.33%) | (4.77%) |

| – Director and | | | | |

| Executive Vice- | | | | |

| President(1) | | | | |

| Donal Carroll, | Corporate Finance | 2018 | Nil | 665,000 |

| Etobicoke, Ontario – | | | | (0.05%) |

| Director(3) | | | | |

| Vladimir Klacar, | Associate General | 2018 | Nil | Nil |

| Toronto, Ontario – | Counsel at Cannabis | | | |

| Director(3) | Wheaton Income | | | |

| | Corp. | | | |

| Gerry Goldberg, | Partner at Schwartz | 2018 | Nil | Nil |

| Toronto, Ontario – | Levitsky Feldman | | | |

| Director(3) | LLP | | | |

Notes:

(1) Xorax Family Trust, a trust of which Zeeshan Saeed is a beneficiary, is the registered owner of the Class A Common Shares and the Class B Common Shares.

(2) For additional details on each Director, please see 13.11 "Management".

(3) Gerry Goldberg (chair), Donal Carroll and Vladimir Klacar will comprise the audit committee.

13.6 − 13.9 − Corporate Cease Trade Orders or Bankruptcies; Penalties or Sanctions; Personal

Bankruptcies

No proposed director of the Corporation:

(a) is, at the date of this Listing Statement, or has been, within 10 years before the date of this Listing Statement, a director, chief executive officer or chief financial officer of any Corporation, including any personal holding Corporation of such director, chief executive officer or chief financial officer that:

(i) while that person was acting in that capacity, was the subject of a cease trade or similar order, or an order that denied the other relevant Corporation access to any exemption under securities legislation, for a period of more than 30 consecutive days; or

(ii) was the subject of a cease trade or similar order or an order that denied the relevant Corporation access to any exemption under securities legislation for a period of more than 30 consecutive days issued after the that person issued after the director, chief executive officer or chief financial officer ceased to be a director or executive officer and which resulted from an event that occurred while the person was acting in such capacity;

(b) is, at the date of this Listing Statement, or has been, within 10 years before the date of this Listing Statement, a director or executive officer of any Corporation (including the Corporation and any personal holding Corporation of such director or executive officer) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or

(c) nor any personal holding Corporation has, within 10 years before the date of this Listing Statement, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of such person or their personal holding Corporation.

No proposed director of the Corporation has been subject to: (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

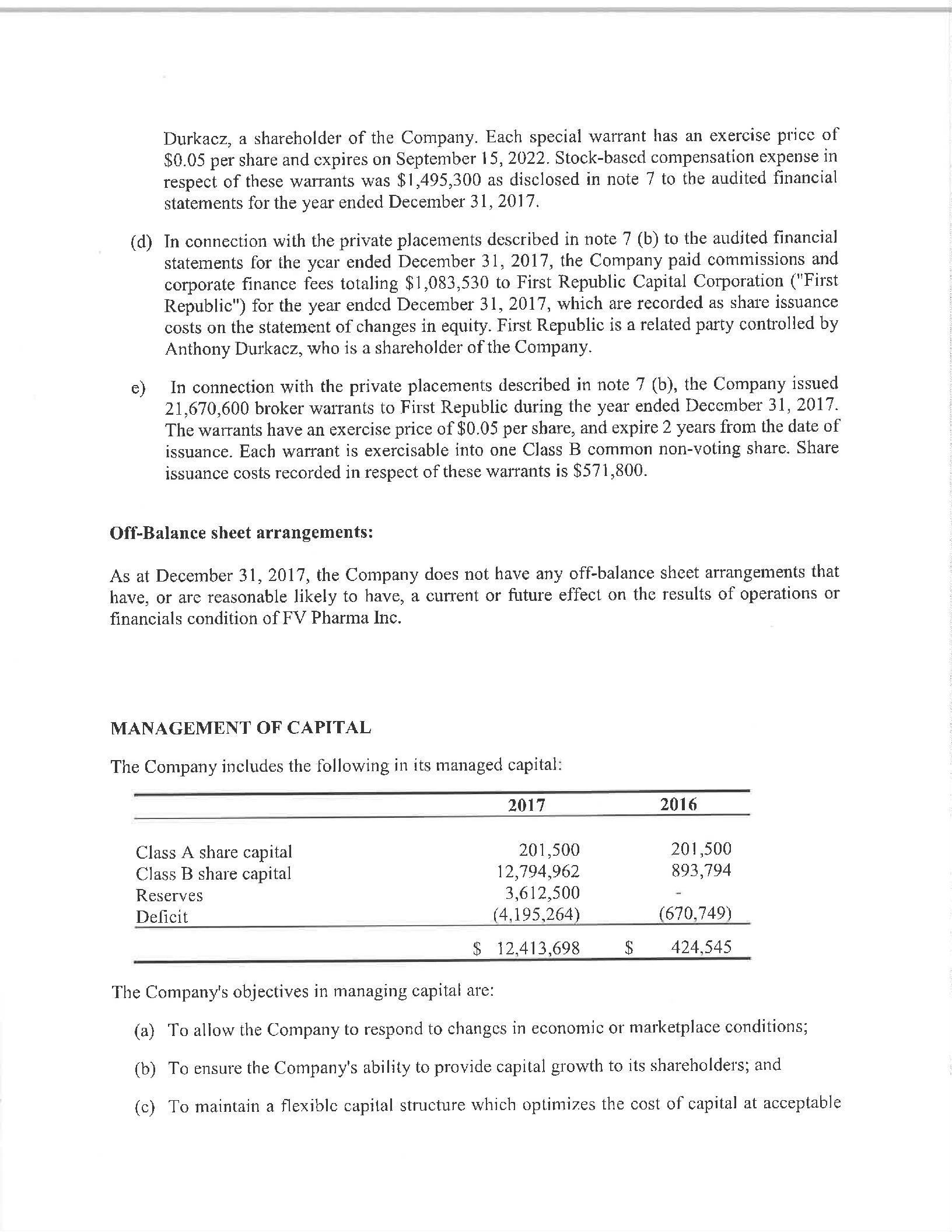

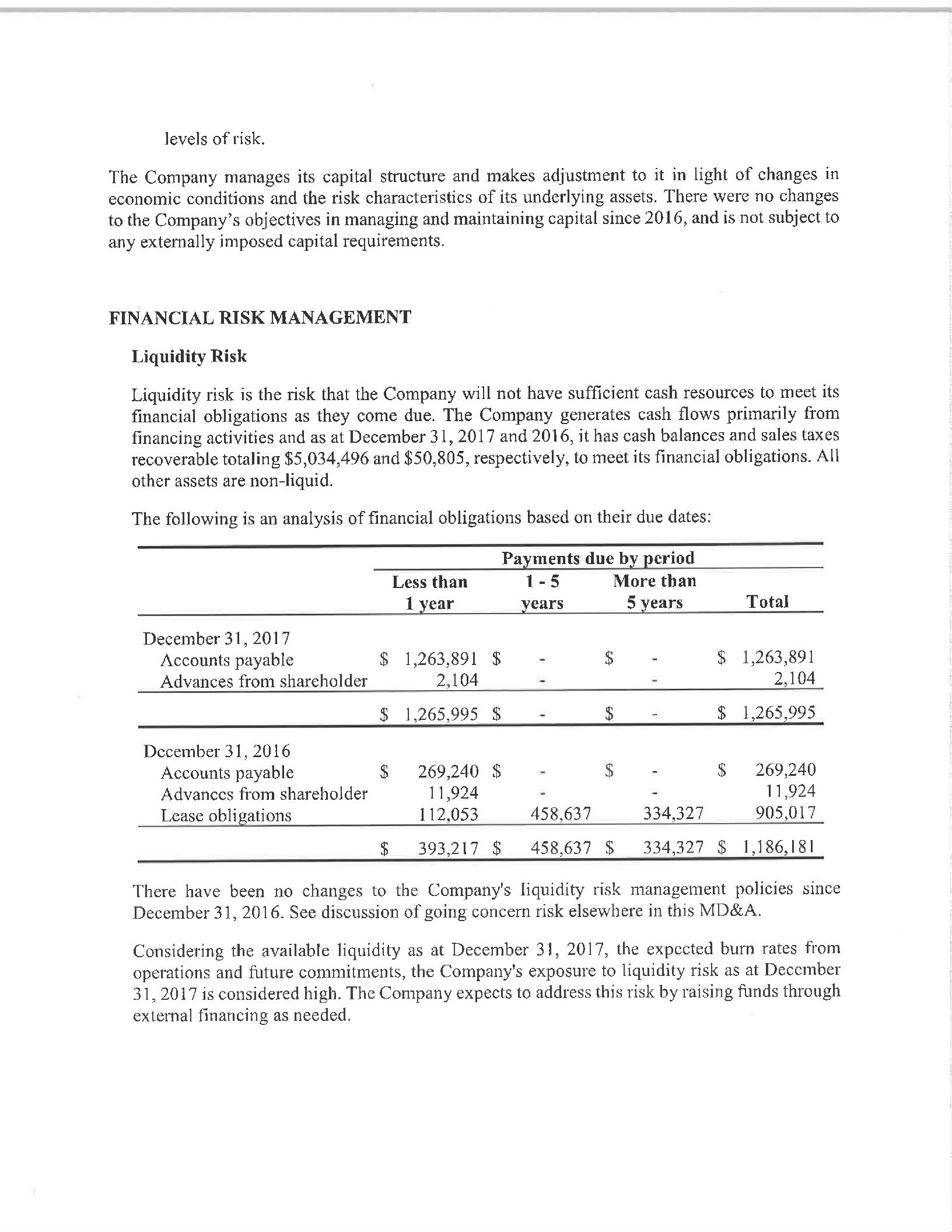

13.10 − Conflicts of Interest