FSD Pharma Inc.

Condensed consolidated interim financial statements

For the three and nine months ended September 30, 2019 and 2018

[unaudited, expressed in Canadian dollars, except share and per share amounts]

NOTICE OF NO AUDITOR REVIEW OF CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Under Part 4, subsection 4.3(3)(a) of National Instrument 51-102 – Continuous Disclosure Obligations, if an auditor has not performed a review of the condensed consolidated interim financial statements, they must be accompanied by a notice indicating that the interim financial statements have not been reviewed by an auditor.

The accompanying unaudited condensed consolidated interim financial statements of FSD Pharma Inc. (the “Company”) have been prepared by and are the responsibility of the Company’s management.

The Company’s independent auditor has not performed a review of these condensed consolidated interim financial statements in accordance with standards established by the Canadian Institute of Chartered Accountants for a review of interim financial statements by an entity’s auditor.

FSD PHARMA INC.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

[unaudited, expressed in Canadian dollars]

[see going concern uncertainty – note 2]

| As at | | September 30, | | | December 31, | |

| | | 2019 | | | 2018 | |

| | | $ | | | $ | |

| Assets | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | 7,251,696 | | | 21,134,930 | |

| Sales taxes recoverable | | 1,857,142 | | | 982,663 | |

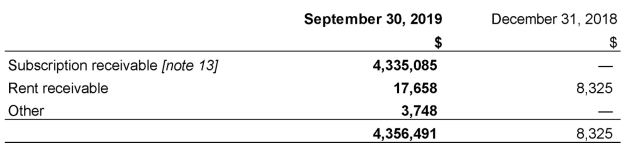

| Trade and other receivables [note 5] | | 4,356,491 | | | 8,325 | |

| Prepaid expenses and deposits | | 193,645 | | | 444,099 | |

| Inventories [note 6] | | 1,749,025 | | | — | |

| Biological assets [note 7] | | 80,008 | | | — | |

| | | 15,488,007 | | | 22,570,017 | |

| Non-current assets | | | | | | |

| Other investments [note 8] | | 18,768,147 | | | 18,064,541 | |

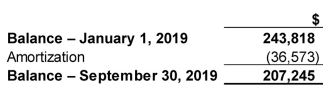

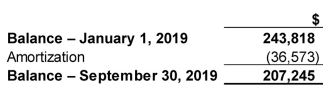

| Right-of-use asset, net [note 9] | | 207,245 | | | — | |

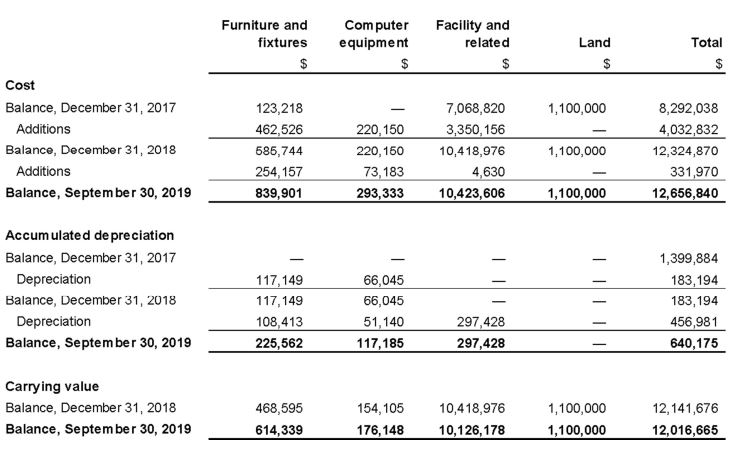

| Property, plant and equipment, net [note 11] | | 12,016,665 | | | 12,141,676 | |

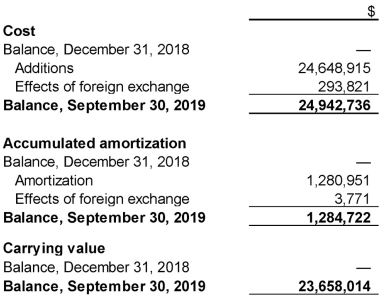

| Intangible assets, net [note 12] | | 23,658,014 | | | — | |

| | | 70,138,078 | | | 52,776,234 | |

| Liabilities | | | | | | |

| Current liabilities | | | | | | |

| Trade payables and accrued liabilities | | 4,359,599 | | | 1,743,806 | |

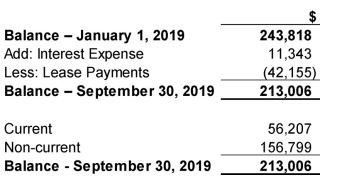

| Lease obligations [note 10] | | 56,207 | | | — | |

| Derivative liability [note 17] | | 2,200,000 | | | — | |

| Convertible notes | | 1,748,076 | | | — | |

| Short-term notes | | 197,805 | | | — | |

| | | 8,561,687 | | | 1,743,806 | |

| Non-current liabilities | | | | | | |

| Lease obligations [note 10] | | 156,799 | | | — | |

| | | 8,718,486 | | | 1,743,806 | |

| Shareholders’ equity | | | | | | |

| Class A share capital [note 13] | | 201,500 | | | 201,500 | |

| Class B share capital [note 13] | | 95,957,746 | | | 67,916,302 | |

| Warrants [note 13] | | 6,327,748 | | | 4,442,145 | |

| Contributed surplus [note 14] | | 18,386,147 | | | 4,977,300 | |

| Foreign exchange translation reserve | | 244,814 | | | — | |

| Deficit | | (59,698,363 | ) | | (26,504,819 | ) |

| | | 61,419,592 | | | 51,032,428 | |

| | | 70,138,078 | | | 52,776,234 | |

Commitments and contingencies [note 18]

Subsequent events [note 20]

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

On behalf of the Board:

"Signed" | "Signed" |

Director - Raza Bokhari | Director - Donal Carroll |

FSD PHARMA INC.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF INCOME (LOSS) AND COMPREHENSIVE INCOME (LOSS)

[unaudited, expressed in Canadian dollars, except share and per share amounts]

| | | Three months ended September 30 | | | Nine months ended September 30 | |

| | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

| | | $ | | | $ | | | $ | | | $ | |

| Revenue | | 12,805 | | | 13,833 | | | 49,806 | | | 83,188 | |

| Cost of sales | | 849,950 | | | — | | | 849,950 | | | — | |

| Gross (loss) profit before fair value adjustments | | (837,145 | ) | | 13,833 | | | (800,144 | ) | | 83,188 | |

| Unrealized loss (gain) on changes in fair value of biological assets [note 7] | | 132,966 | | | — | | | 308,490 | | | — | |

| Gross (loss) profit | | (970,111 | ) | | 13,833 | | | (1,108,634 | ) | | 83,188 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Share-based payments [note 14] | | 6,205,323 | | | 438,378 | | | 11,891,380 | | | 2,514,674 | |

| General and administrative [note 16] | | 1,236,523 | | | 984,694 | | | 3,942,317 | | | 1,319,037 | |

| Salaries, wages and benefits | | 431,260 | | | 436,576 | | | 1,877,187 | | | 1,084,402 | |

| Professional fees | | 1,655,233 | | | 267,887 | | | 2,540,091 | | | 899,466 | |

| Depreciation and amortization [note 9, 11 and 12] | | 1,460,023 | | | 41,547 | | | 1,686,298 | | | 98,258 | |

| Consulting fees | | 544,223 | | | 239,097 | | | 1,726,092 | | | 1,170,367 | |

| Facility related expenditures | | 92,441 | | | 394,058 | | | 868,518 | | | 920,566 | |

| Insurance | | 92,344 | | | 60,421 | | | 219,409 | | | 135,103 | |

| Shareholder and public company costs | | 85,033 | | | 10,906 | | | 190,035 | | | 20,906 | |

| Interest expense | | 102,507 | | | — | | | 109,749 | | | — | |

| Listing expense | | — | | | — | | | — | | | 7,885,144 | |

| Production and growing | | — | | | 159,088 | | | 37,440 | | | 223,815 | |

| Operating loss | | (12,875,021 | ) | | (3,018,819 | ) | | (26,197,150 | ) | | (16,188,550 | ) |

| Loss on change in fair value of derivative liability [note 17] | | (1,700,000 | ) | | — | | | (1,700,000 | ) | | — | |

| Gain (loss) on changes in fair value of other investments [note 8] | | (2,075,717 | ) | | 6,876,000 | | | (5,296,394 | ) | | 14,376,000 | |

| Net (loss) income | | (16,650,738 | ) | | 3,857,181 | | | (33,193,544 | ) | | (1,812,550 | ) |

| Other comprehensive income | | | | | | | | | | | | |

| Exchange gain on translation of foreign operations | | (244,814 | ) | | — | | | (244,814 | ) | | — | |

| Comprehensive (loss) income | | (16,405,924 | ) | | 3,857,181 | | | (32,948,730 | ) | | (1,812,550 | ) |

| Net (loss) income per share – basic | | (2.20 | ) | | 0.59 | | | (4.64 | ) | | (0.32 | ) |

| Net (loss) income per share – diluted | | (2.20 | ) | | 0.50 | | | (4.64 | ) | | (0.32 | ) |

| Weighted average number of shares outstanding – basic [note 15] | | 7,564,004 | | | 6,586,526 | | | 7,160,458 | | | 5,614,151 | |

| Weighted average number of shares outstanding – diluted [note 15] | | 7,564,004 | | | 7,715,346 | | | 7,160,458 | | | 5,614,151 | |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

FSD PHARMA INC.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDER'S EQUITY

[unaudited, expressed in Canadian dollars]

| | | | | | | | | | | | | | | | | | | | | | | | Foreign exchange | | | | | | | |

| | | Class A shares | | | Class B shares | | | Warrants | | | | | | Contributed surplus | | | translation reserve | | | Deficit | | | Total | |

| | | # | | | $ | | | # | | | $ | | | # | | | $ | | | $ | | | $ | | | $ | | | $ | |

| Balance, December 31, 2017 | | 15,000 | | | 201,500 | | | 3,794,846 | | | 12,794,962 | | | — | | | — | | | 3,612,500 | | | — | | | (4,195,264 | ) | | 12,413,698 | |

| Share issued | | — | | | — | | | 280,764 | | | 59,025,775 | | | — | | | — | | | — | | | — | | | — | | | 59,025,775 | |

| Share issuance costs | | — | | | — | | | — | | | (5,877,313 | ) | | — | | | — | | | — | | | — | | | — | | | (5,877,313 | ) |

| Warrant valuations | | — | | | — | | | — | | | (3,477,214 | ) | | 553,040 | | | 3,477,214 | | | — | | | — | | | — | | | — | |

| Share-based payments | | — | | | — | | | — | | | — | | | — | | | — | | | 2,540,399 | | | — | | | — | | | 2,540,399 | |

| Share options exercised | | — | | | — | | | 146,517 | | | 1,597,643 | | | — | | | — | | | (1,597,643 | ) | | — | | | — | | | — | |

| Share options cancelled | | — | | | — | | | — | | | — | | | — | | | — | | | (562,500 | ) | | — | | | 562,500 | | | — | |

| Warrants exercised | | — | | | — | | | 33,673 | | | 374,403 | | | (33,673 | ) | | (374,403 | ) | | — | | | — | | | — | | | — | |

| Net comprehensive loss for the period | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,812,550 | ) | | (1,812,550 | ) |

| Balance, September 30, 2018 | | 15,000 | | | 201,500 | | | 4,255,800 | | | 64,438,256 | | | 519,367 | | | 3,102,811 | | | 3,992,756 | | | — | | | (5,445,314 | ) | | 66,290,009 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2018 | | 15,000 | | | 201,500 | | | 6,843,780 | | | 67,916,302 | | | 546,214 | | | 4,442,145 | | | 4,977,300 | | | — | | | (26,504,819 | ) | | 51,032,428 | |

| Shares issued [note 13] | | — | | | — | | | 331,004 | | | 9,821,141 | | | — | | | — | | | — | | | — | | | — | | | 9,821,141 | |

| Issued on acquisition of net assets of Prismic Pharmaceuticals, Inc. | | — | | | — | | | 510,940 | | | 16,431,818 | | | 67,600 | | | 1,888,086 | | | 2,567,306 | | | — | | | — | | | 20,887,210 | |

| Share-based payments | | — | | | — | | | — | | | — | | | — | | | — | | | 11,891,380 | | | — | | | — | | | 11,891,380 | |

| Share options exercised | | — | | | — | | | 130,189 | | | 1,782,438 | | | — | | | — | | | (1,049,839 | ) | | — | | | — | | | 732,599 | |

| Warrants exercised | | — | | | — | | | 197 | | | 6,047 | | | (197 | ) | | (2,483 | ) | | — | | | — | | | — | | | 3,564 | |

| Net comprehensive loss for the period | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 244,814 | | | (33,193,544 | ) | | (32,948,730 | ) |

| Balance, September 30, 2019 | | 15,000 | | | 201,500 | | | 7,816,110 | | | 95,957,746 | | | 613,617 | | | 6,327,748 | | | 18,386,147 | | | 244,814 | | | (59,698,363 | ) | | 61,419,592 | |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

FSD PHARMA INC.

CONDENSENED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

[unaudited, expressed in Canadian dollars]

| For the nine months ended September 30, | | 2019 | | | 2018 | |

| | | $ | | | $ | |

| Operating activities | | | | | | |

| Net loss | | (33,193,544 | ) | | (1,812,550 | ) |

| Add (deduct) items not affecting cash | | | | | | |

| Depreciation and amortization | | 1,774,505 | | | 98,258 | |

| Interest expense | | 109,749 | | | — | |

| Share-based payments | | 11,891,380 | | | 2,514,674 | |

| Cancellation of stock options | | — | | | 562,500 | |

| Change in fair value of other investments | | 5,296,394 | | | (14,376,000 | ) |

| Change in fair value of derivative liability | | 1,700,000 | | | — | |

| Change in fair value of biological assets | | 308,490 | | | — | |

| Changes in non-cash working capital balances related to operations | | | | | | |

| Sales taxes recoverable | | (874,479 | ) | | (379,760 | ) |

| Trade and other receivables | | (13,081 | ) | | — | |

| Prepaid expenses and deposits | | 276,628 | | | 50,811 | |

| Inventories | | (1,749,025 | ) | | — | |

| Biological assets | | (388,498 | ) | | — | |

| Trade payables | | 613,880 | | | (979,161 | ) |

| Cash used in operating activities | | (14,247,601 | ) | | (14,321,228 | ) |

| | | | | | | |

| Investing activities | | | | | | |

| Acquisition of net assets of Prismic Pharmaceuticals Inc. | | 2,329 | | | — | |

| Repayment of lease obligation | | (42,155 | ) | | — | |

| Purchase of other investments | | — | | | (5,699,991 | ) |

| Purchase of property, plant and equipment | | (331,970 | ) | | (3,540,534 | ) |

| Cash used in investing activities | | (371,796 | ) | | (9,240,525 | ) |

| | | | | | | |

| Financing activities | | | | | | |

| Proceeds from issuance of shares | | — | | | 52,611,687 | |

| Proceeds from exercise of share options | | 732,599 | | | — | |

| Warrants exercised | | 3,564 | | | — | |

| Cash provided by financing activities | | 736,163 | | | 52,611,687 | |

| | | | | | | |

| Net (decrease) increase in cash and cash equivalents during the period | | (13,883,234 | ) | | 29,049,934 | |

| Cash and cash equivalents, beginning of period | | 21,134,930 | | | 4,739,988 | |

| Cash and cash equivalents, end of period | | 7,251,696 | | | 33,789,922 | |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

1. Nature of business

FSD Pharma Inc. ("FSD", or the "Company") is focused on the research and development of novel cannabinoid-based treatments for several central nervous system disorders including chronic pain, fibromyalgia and irritable bowel syndrome, and on the development of the highest quality indoor grown, pharmaceutical-grade cannabis. The Company, through its wholly-owned subsidiary, FV Pharma Inc. (“FV Pharma”), is licensed to cultivate cannabis in approximately 25,000 square feet.

FV Pharma received a licence under section 22(2) of the ACMPR on October 13, 2017. The licence effectively permits FV Pharma to acquire marijuana plants and seeds for the purpose of cultivating, propagating and harvesting cannabis indoors within the confines of its Cobourg facility only, and to sell cannabis to other Licensed Producers and to the Minister. On February 19, 2019, the Company announced that FV Pharma had received its Standard Processing Licence (the “Processing Licence”). The Processing Licence allows FV Pharma to produce cannabis, other than obtain it by cultivating, propagating or harvesting it (i.e. extract oils). Under Health Canada’s new Cannabis Act regulations, the Processing Licence is required for any facility that is processing more than the equivalent of 600 kg of dried flowers per year. On April 18, 2019, the Company received a Sale of Medical Cannabis Licence to allow it to supply and sell cannabis plants and seeds to medical clients with a valid prescription. On June 21, 2019, the Company received an amendment to its Sale of Medical Cannabis Licence to authorize the sale of fresh cannabis and dried cannabis products to medical clients. The licences are valid until October 13, 2020.

The Company was incorporated under the provisions of the Business Corporations Act (Ontario) (the "OBCA") on November 1, 1998, pursuant to the amalgamation of Olympic ROM World Inc., 1305206 Ontario Corporation, 1305207 Ontario Inc., Century Financial Capital Group Inc. and Dunberry Graphic Associates Ltd. On May 24, 2018, pursuant to the Articles of Amendment, the Company changed its name to "FSD Pharma Inc.".

The head office of the Company is located at 1 Rossland Road West, Suite 202, Ajax, Ontario, L1Z 1Z2.

The Company has the following subsidiaries:

6

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

2. Basis of presentation

[a] Statement of compliance

These unaudited condensed consolidated interim financial statements (“financial statements’) were prepared using the same accounting policies and methods as those used in the Company’s audited consolidated financial statements for the year ended December 31, 2018 except for those changes in accounting policies described in Note 3. These condensed consolidated interim financial statements have been prepared in compliance with IAS 34 – Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”). Accordingly, certain disclosures normally included in annual financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”) have been omitted or condensed. These condensed consolidated interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2018.

These financial statements were approved and authorized for issuance by the Board of Directors of the Company on November 29, 2019.

[b] Going concern uncertainty

These financial statements have been prepared on the basis of accounting principles applicable to a going concern, which assumes that the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of operations. These financial statements do not include any adjustments to the amounts and classification of assets and liabilities that would be necessary, should the Company be unable to continue as a going concern. Such adjustments could be material.

The Company is in the preliminary stages of its planned operations and has not yet determined whether its processes and business plans are economically viable. The continued operations of the Company and the recoverability of amounts shown for property, plant and equipment are dependent upon the ability of the Company to obtain sufficient financing to complete the development of its facilities and extraction processes, and if they are proven successful, the existence of future profitable production, or alternatively, upon the Company’s ability to dispose of its interest on an advantageous basis, all of which are uncertain.

As at September 30, 2019, the Company has initiated the medicinal sale of its product and has an accumulated deficit of $59.7 million. Whether, and when, the Company can attain profitability and positive cash flows from operations is subject to material uncertainty. The application of the going concern assumption is dependent upon the Company’s ability to generate future profitable operations and obtain necessary financing to do so. The Company will need to raise additional capital in order to fund its planned operations and meet its obligations. While the Company has been successful in obtaining financing to date and believes it will be able to obtain sufficient funds in the future and ultimately achieve profitability and positive cash flows from operations, there can be no assurance that the Company will achieve profitability and be able to do so in the future on terms favourable for the Company. The above events and conditions indicate there is a material uncertainty that may cast significant doubt about the Company’s ability to continue as a going concern.

[c] Functional currency and presentation currency

These financial statements are presented in Canadian dollars, which is the functional currency of the Company.

7

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

[d] Use of estimates and judgements

The preparation of these financial statements in conformity with IFRS requires management to make estimates, judgements and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities, consistent with those disclosed in the audited consolidated financial statements for the year ended December 31, 2018 and described in these financial statements. Actual results could differ from these estimates.

Estimates are based on management’s best knowledge of current events and actions that the Company may undertake in the future. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods.

3. Significant accounting policies

Except for the adoption of IFRS 16 Leases (“IFRS 16”), the significant accounting policies used in preparing these financial statements are unchanged from those disclosed in the Company’s annual consolidated financial statements for the year ended December 31, 2018, and have been applied consistently to all periods presented in these financial statements.

New standards, amendments and interpretations adopted by the Company

IFRS 16 - Leases [“IFRS 16”]

The Company has adopted IFRS 16 with an initial adoption date of January 1, 2019. The Company utilized the modified retrospective method to adopt the new standard and therefore, the comparative information has not been restated and continues to be reported under IAS 17, Leases and related interpretations.

IFRS 16 specifies how leases will be recognized, measured, presented and disclosed and it provides a single lessee model requiring lessees to recognize right-of-use assets and lease liabilities for all major leases. The Company’s accounting policy under IFRS 16 is as follows.

At inception of a contract, the Company assesses whether a contract is, or contains, a lease based on whether the contract conveys the right to control the use of identified asset for a period of time in exchange for consideration. The Company recognized a right-of-use asset and a lease liability at the lease commencement date. The right-of-use asset is initially measured based on the initial amount of the lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and an estimate of the costs to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentives received. The assets are depreciated to the earlier of the end of useful life of the right-of-use asset or the lease term using the straight-line method as this most closely reflects the expected pattern of the consumption of the future economic benefits. The lease term includes periods covered by an option to extend if the Company is reasonably certain to exercise that option. In addition, the right-of-use asset can be periodically reduced by impairment losses, if any, and adjusted for certain remeasurements of the lease liability. The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the Company’s incremental borrowing rate. The Company used the mean incremental borrowing rate to discount the lease liabilities in the opening balance sheet at January 1, 2019 of 7.73%.

8

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

The lease liability is measured at the amortized cost using the effective interest method. It is remeasured when there is a change in future lease payments arising from change in an index or rate, if there is a change in the Company’s estimate of the amount expected to be payable under a residual value guarantee, or if the Company changes its assessment of whether it will exercise a purchase, extension or termination option. When the lease liability is remeasured in this way, a corresponding adjustment is made to the carrying amount of the right-of-use asset, unless it has been reduced to zero.

The Company has elected to apply the practical expedient not to recognize right-of-use assets and lease liabilities for short-term leases that have a lease term of 12 months or less or to leases of low value assets. The lease payments associated with those leases is recognized as an expense on a straight-line basis over the lease term.

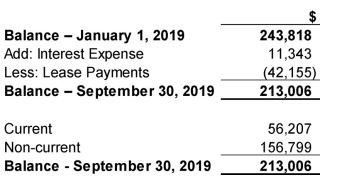

On initial application, the Company has elected to record right-of-use assets at the amount of the corresponding lease liability. Right-of-use assets and lease obligations of $243,818 were recorded as at January 1, 2019. When measuring lease liabilities, the Company discounted lease payments using its incremental borrowing rate at January 1, 2019. The Company has applied the practical expedient to account for leases for which the lease term ends within 12 months from the date of initial application as short-term leases. The company has elected to apply the practical expedient to grandfather the assessment of which transactions are leases on the date of initial application, as previously assessed under IAS 17 and IFRIC 4. The company applied the definition of a lease under IFRS 16 to contracts entered into or changed on or after January 1, 2019.

The following table reconciles the Company’s operating lease obligations at December 31, 2018, as previously disclosed in the Company’s audited consolidated financial statements for the year ended December 31, 2018, to the lease obligations recognized on initial application of IFRS 16 at January 1, 2019.

4. Reverse Takeover Transaction

Century Financial Capital Group Inc. (“Century”) and FV Pharma executed a definitive business combination agreement on March 9, 2018 (the "Definitive Agreement"), whereby FV Pharma would be combined with Century to continue the business of FV Pharma.

Under the terms of the Definitive Agreement, the Transaction was completed by way of a "three-cornered amalgamation" pursuant to the provisions of the Business Corporations Act (Ontario), whereby 2620756 Ontario Inc., a wholly-owned subsidiary of Century, amalgamated with FV Pharma (the "Amalgamation"), and the amalgamated entity is now a wholly-owned subsidiary of the Company (the “Transaction”).

Pursuant to the terms of the Definitive Agreement and in connection with the Amalgamation:

● Century amended its articles to: (i) amend and designate its outstanding common shares (the "Existing Century Shares") as Class B subordinate voting shares (the "Century Class B Shares"); and (ii) create a new class of Class A multiple voting shares (the "Century Class A Shares");

● holders of outstanding Class A common voting shares of FV Pharma (the "FV Class A Shares") received one

(1) Century Class A Share for each one (1) FV Class A Share held;

● holders of outstanding Class B common non-voting shares of FV Pharma (the "FV Class B Shares" and, together with the FV Class A Shares, the "FV Shares"), including FV Class B Shares issued on conversion of the Subscription Receipts, received one (1) Century Class B Share for each one (1) FV Class B Share held; and

9

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

● all outstanding options to purchase FV Pharma Class B shares and options to purchase Century shares were exchanged, on an equivalent basis, for options to purchase Class B shares of the Company, and all outstanding warrants to purchase FV Pharma Class B Shares and warrants to purchase Century shares were exchanged, on an equivalent basis, for warrants to purchase Class B shares of the Company.

The Transaction has been accounted for as a "reverse takeover" as the issuance of shares to the former shareholders of FV Pharma resulted in the former shareholders of FV Pharma holding a majority of the issued and outstanding shares of the Company. Under this method of accounting, FV Pharma (the legal subsidiary) is deemed to be the acquirer and Century (the legal parent) is deemed to be the acquired company.

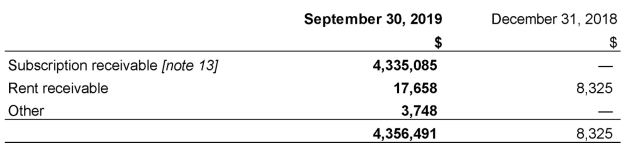

5. Trade and other receivables

The Company’s trade and other receivables as at September 30, 2019 and December 31, 2019 include the following:

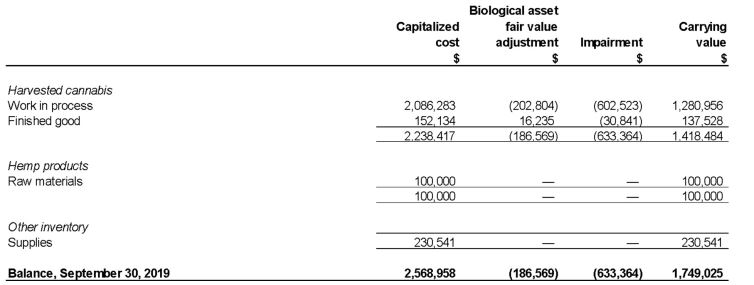

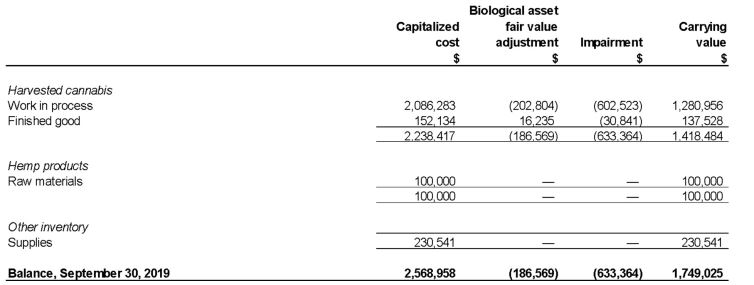

6. Inventories

Inventories as at September 30, 2019 are as follows:

Costs of sales primarily relate to production related expenditures not capitalized due to start-up costs, underutilization and impairment charges. Prior to the receipt of the Company’s Health Canada cultivation license, the Company did not incur production related expenditures.

10

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

During the three and nine months ended September 30, 2019 there was impairment of inventory of $633,364.

There was no inventory as at December 31, 2018.

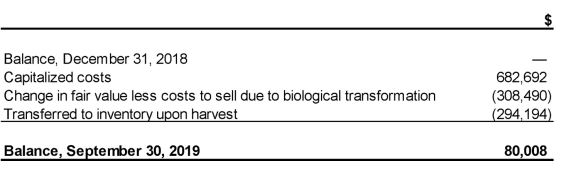

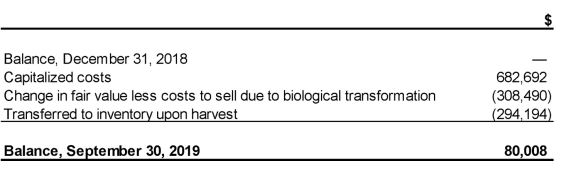

7. Biological assets

Biological assets consist of cannabis plants. The changes in the carrying value of biological assets are as follows:

The Company measures its biological assets at their fair value less costs to sell. This is determined using a model that estimates the expected harvest yield in grams for plants currently being cultivated, and then adjusts that amount by the expected selling price less costs to sell per gram.

The fair value measurements for biological assets have been categorized as Level 3 fair values based on the inputs to the valuation technique used. The Company’s method of accounting for biological assets attributes value accretion on a straight-line basis throughout the life of the biological asset from initial cloning to the point of harvest.

The Company capitalizes costs to biological assets in a manner consistent with the principles in IAS 2 (including but not limited to the determination of what types of costs are capitalized).

The following table quantifies each significant unobservable input, and provides the impact a 10% increase/decrease in each input would have on the fair value of biological assets:

| Assumptions: | As at September 30, 2019 |

| Input | 10% Change |

| | |

| i | Expected yields for cannabis plants (average grams per plant) [a] | 50 grams dry flower | | |

| 8 grams dry trim | $ | 8,049 |

| | |

| ii | Weighted average number of growing weeks completed as a | | | |

| percentage of total growing weeks as at period end [b] | 35% | $ | 8,049 |

| |

| iii | Estimated selling price per gram [c] | $5.72 for dry flower | | |

| $3.75 for dry trim | $ | 17,284 |

| | |

| iv | After harvest cost to complete and sell per gram | $2.89 for dry flower | | |

| $1.55 for dry trim | $ | 9,235 |

| | |

[a] The expected yield for cannabis plants will vary based on the variety of strains being grown at each reporting date.

[b] The weighted average number of growing weeks is 14.

[c] The estimated selling price per gram reflects the expected selling price the company expects to receive for the sale of various strains of dried cannabis flower in the medical market.

There were no biological assets as at December 31, 2018.

11

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

These estimates are subject to volatility in market prices and a number of uncontrollable factors, which could significantly affect the fair value of biological assets in future periods. The Company’s estimates are, by their nature, subject to change, and differences from the anticipated yield and the other assumptions will be reflected in the gain or loss on biological assets in future periods.

The Company estimates the harvest yields for cannabis at various stages of growth. As of September 30, 2019, it is expected that the Company’s cannabis plants will yield approximately 78,100 grams of dry flower and 13,032 grams of dry trim when harvested.

The fair value adjustments on biological assets are presented separately on the statements of income (loss) and comprehensive income (loss).

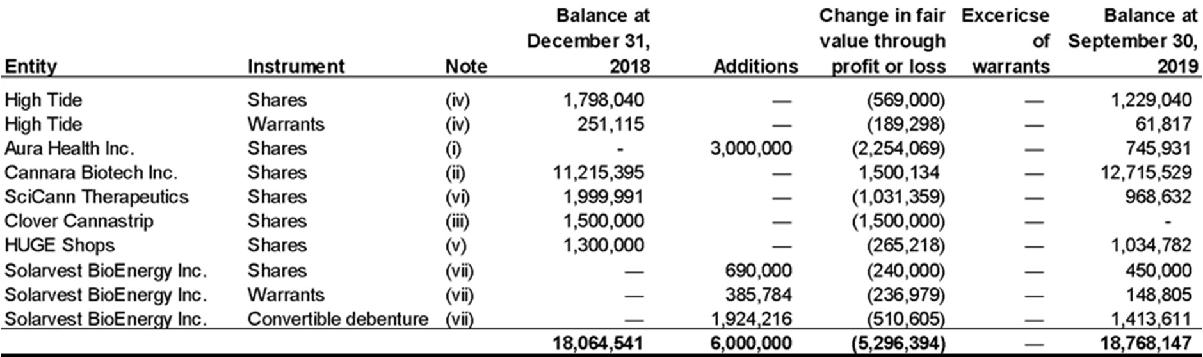

8. Other investments

The following table outlines changes in other investments:

(i) Aura Health Inc. (“Aura”)

On April 16, 2019, the Company entered into a share exchange agreement with Aura Health Inc. Pursuant to the share exchange agreement, FSD acquired 13,562,386 common shares at $0.2212 per share in the capital of Aura for a total value of $3,000,000 in exchange for the issuance of 65,577 Class B shares of the Company at $45.75 for a total value of $3,000,000. The shares have been classified as level 1 within the fair value hierarchy – quoted market price. Subsequent to September 30, 2019, Aura announced a name change to Pharmadrug Inc.

(ii) Cannara Biotech Inc. (“Cannara”)

The Company’s investment in 85,003,750 Class B shares of Cannara are subject to an escrow arrangement with timed releases at various dates over a three-year period. Consequently, shares that are not subject to escrow are valued at market price and shares that are in escrow are subject to a discount rate. The valuation was based on a September 30, 2019 quoted market price of $0.17 per share, subject to an aggregate discount for the escrow conditions determined to be 16.01% ($1,735,108). This investment has been classified as level 2 within the fair value hierarchy – valuation technique with observable inputs. The Company was a founder of Cannara and previously had common directors during 2018.

12

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

(iii) Clover Cannastrip Thin Film Technologies Corp. (“Clover”)

On September 6, 2018, the Company subscribed for $1,500,000 of equity units in a brokered private placement by Clover. In connection with that investment, on January 23, 2019, the Company entered into a licensing agreement with Pharmastrip, an entity represented to be an affiliate of Clover, whereby the Company would receive exclusive Canadian rights to certain technology intended to be used in the commercialization of cannabis-infused sublingual strips. Subsequently, the Company was informed that certain principals of Clover Cannastrip were the subject of Federal Trade Commission proceedings in the United States, and that the US-based owner of the licensed technology had been placed into receivership. As a result of the foregoing, it may be difficult or impossible for the Company to realize a return on its investment in Clover Cannastrip and to commercialize the licensed Pharmastrip technology.

The Company has determined that a write down of the equity investment to $0 is appropriate in the circumstances and is currently in the process of evaluating the legal remedies that may be available to the Company in regards to the foregoing. This investment has been classified as level 3 within the fair value hierarchy – valuation technique with non- observable inputs.

(iv) High Tide Inc.

The investment includes 4,551,999 shares and 2,000,000 warrants. The fair value of the shares is based on the quoted market price of the shares at September 30, 2019 being $0.27 per share. The fair value of the associated warrants was based on the Black-Scholes model with the following assumptions: exercise price $0.75, risk free rate 1.59%, expected volatility 90%, expected life 1.16 years and expected dividend yield of 0%. The shares have been classified as level 1 within the fair value hierarchy – quoted market price, and the warrants have been classified as level 2 – valuation technique with observable market inputs.

(v) HUGE Shops

The investment includes 17,333,333 shares based on the December 2018 subscription price of $0.075 per share. Management has assessed the performance of other similar companies within the cannabis industry and concluded that industry performance is reflective of the investment. Therefore, management has leveraged the performance of a comparable cannabis index as a benchmark to estimate the change in fair value of the investment from date of investment to the period ending September 30, 2019, in the absence of other available information.

The investment has been classified as level 3 within the fair value hierarchy – valuation technique with non-observable inputs.

(vi) SciCann Therapeutics Inc.

The investment includes 117,648 shares based on the subscription price in May of 2018 and October of 2018 of $17 per share. Management has assessed the performance of other similar companies within the cannabis industry and concluded that industry performance is reflective of the investment. Therefore, management has leveraged the performance of a comparable cannabis index as a benchmark to estimate the change in fair value of the investment from date of investment to the period ending September 30, 2019, in the absence of other available information.

The investment has been classified as level 3 within the fair value hierarchy – valuation technique with non-observable inputs.

(vii) Solarvest BioEnergy Inc.

The investment consists of 3,000,000 common shares, 3,000,000 warrants and a convertible debenture at a principal amount of $2,400,000. The fair value of the shares is based on the quoted market price of the shares at September 30, 2019 being $0.15 per share. The fair value of the associated warrants is based on the Black-Scholes model with the following assumptions: exercise price $0.25, risk free rate 1.58%, expected volatility 97%, expected life 1.6 years and expected dividend yield of 0%. The convertible debenture calculation is composed of: i) the debt option: which has September 30, 2019 and 2018 a calculated present value of $1,273,358 using the following assumptions: principal amount of $2,400,000, discount rate of 18%, 3% coupon rate and a term of 4.5 years ii) Conversion feature: the fair value was determined using Black-Scholes model with the following assumptions: exercise price $1, risk free rate 1.40%, expected volatility 97%, expected life 4.6 years and expected dividend yield of 0%. The shares have been classified as level 1 within the fair value hierarchy – quoted market price, the warrants have been classified as level 2 – valuation technique with observable market inputs, and the convertible debenture has been classified as level 3 within the fair value hierarchy – valuation technique with non-observable inputs.

13

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

9. Right-of-use asset

The right-of-use asset as at September 30, 2019 is as follows:

10. Lease obligations

The lease obligations as at September 30, 2019 is as follows:

14

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

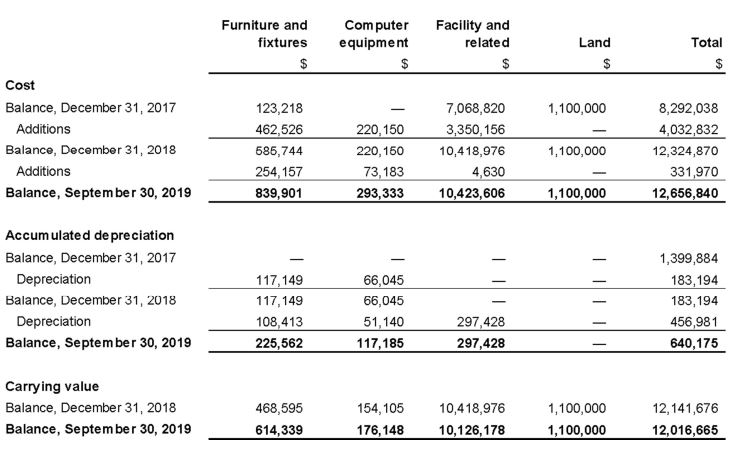

11. Property, plant and equipment

Property, plant and equipment as at September 30, 2019 is as follows:

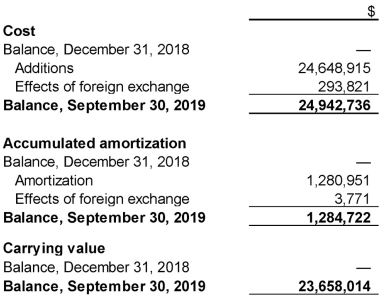

12. Intangible assets

Intangible assets as at September 30, 2019 are as follows:

15

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

The Company acquired intellectual property as part of the acquisition of Prismic Pharmaceuticals Inc. on June 28, 2019. The life of the intellectual property has been determined to be 5 years.

13. Share capital

[a] Authorized

The Company is authorized to issue an unlimited number of Class A multiple voting shares ("Class A shares") and an unlimited number of Class B subordinate voting shares ("Class B shares"), all without par value. All shares are ranked equally with regards to the Company's residual assets.

The holders of Class A shares are entitled to 55,608.66 votes per share at meetings of the Company.

[b] Issued and outstanding

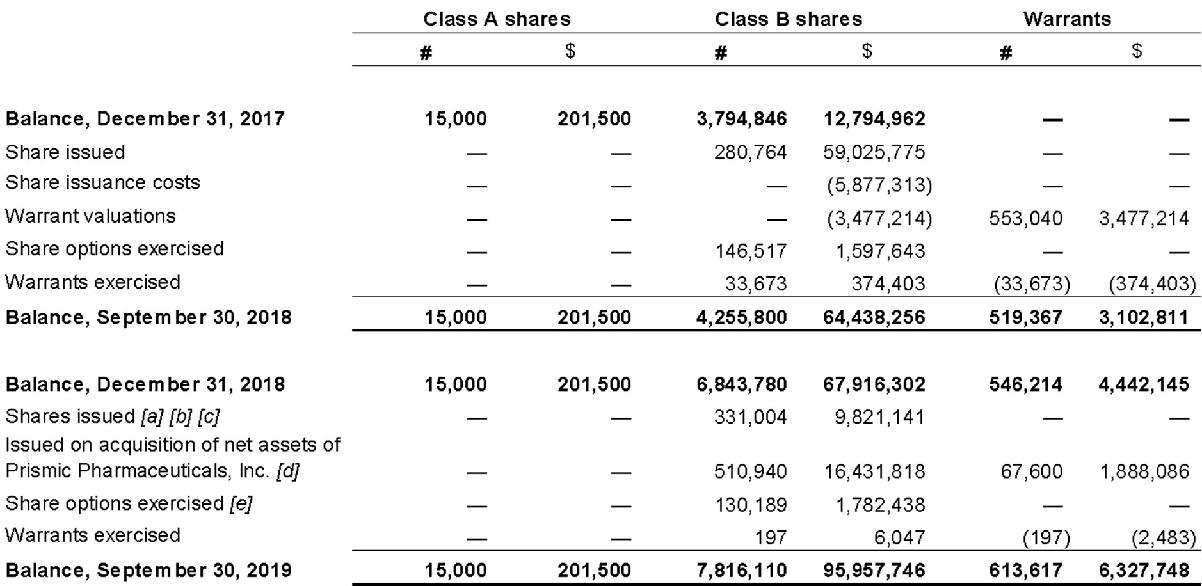

Reconciliation of the Company’s share capital is as follows:

[a] On April 24, 2019, the Company entered into a share exchange agreement with Aura Health Inc. Pursuant to the share exchange agreement, FSD acquired 13,562,386 common shares at $0.2212 per share in the capital of Aura for a total value of $3,000,000 in exchange for the issuance of 65,577 Class B shares of the Company at $45.75 for a total value of $3,000,000.

[b] On May 7, 2019, the Company entered into an agreement with Solarvest BioEnergy Inc. (“SVS”). Per the agreement the Company issued 49,751 Class B Shares to SVS in exchange for investment in SVS. Refer to note 8 for details regarding investment in SVS.

[c] On September 30, 2019, the Company completed the issuance of 215,676 Class B shares as part of a private placement of 228,013 Class B shares at a price of $20.10 per share for total gross proceeds of $4,335,085.

16

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

As at September 30, 2019 the funds were received in trust and were yet to be remitted to the Company therefore were recognized as subscription receivables. Transactions costs were $13,944 in cash. Portion of the shares issued under this private placement were to related parties of the Company, including Directors and Officers of the Company.

[d] The Company acquired all outstanding common and preferred shares of Prismic Pharmaceuticals Inc. through the issuance of an aggregate of 510,940 Class B Shares. The Class B Shares issued to the Prismic shareholders were deposited into escrow upon closing of the transaction, and are subject to an 18-month staggered escrow release.

[e] During the nine months ended September 20, 2019, 130,189 Class B Shares were exercised for proceeds of $1,782,438.

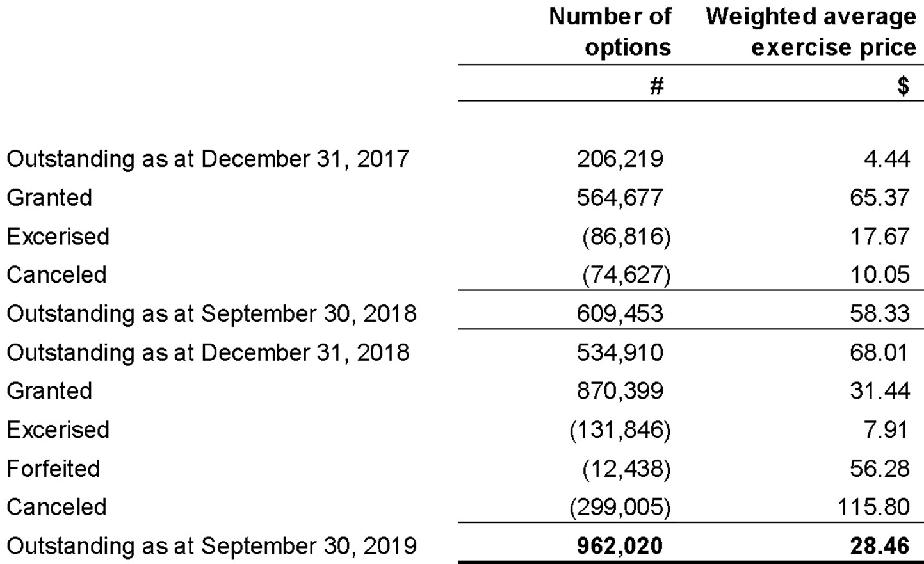

14. Share-based compensation

The Company has established a share option plan (the “Option Plan”) for directors, officers, employees and consultants of the Company. The Company’s Board of Directors determines, among other things, the eligibility of individuals to participate in the Option Plan and the term, vesting periods, and the exercise price of options granted to individuals under the Option Plan.

Each share option converts into one common share of the Company on exercise. No amounts are paid or payable by the individual on receipt of the option. The options carry neither rights to dividends nor voting rights. Options may be exercised at any time from the date of vesting to the date of their expiry.

Share-based payment arrangements

The changes in the number of share options during the nine-month period ended September 30, 2019 and 2018 were as follows:

17

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

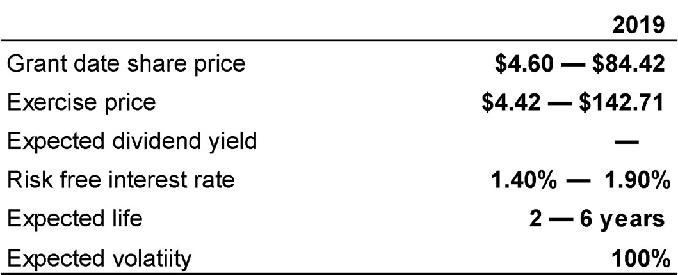

Measurement of fair values

The fair value of share options granted during the nine-month period ended September 30, 2019 were estimated at the date of grant using the Black-Scholes option pricing model with the following inputs:

Expected volatility was estimated by using the historical volatility of other companies that the Company considers comparable that have trading and volatility history. The expected life represents the period of time that options granted are expected to be outstanding. The risk-free interest rate is based on government bonds with a remaining term equal to the expected life of the options.

18

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

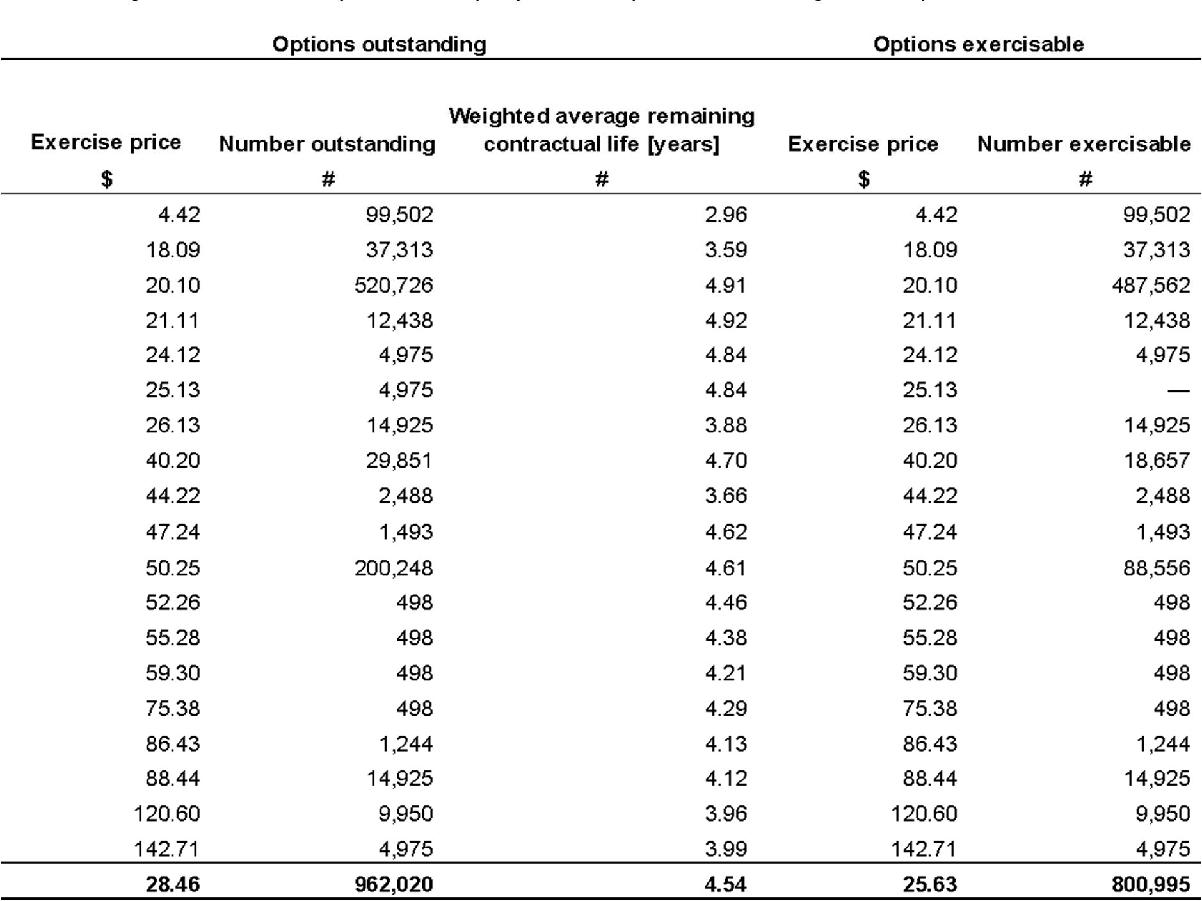

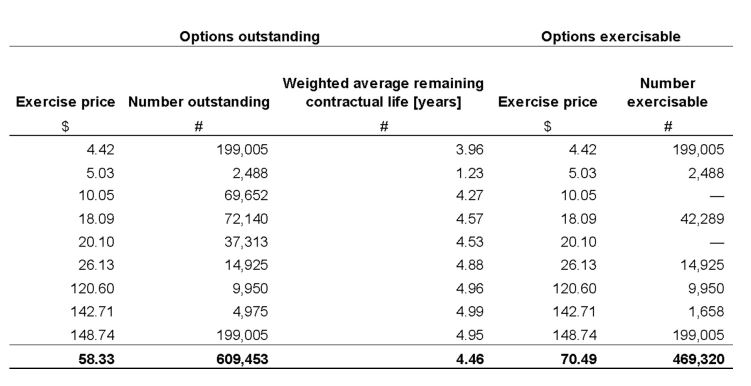

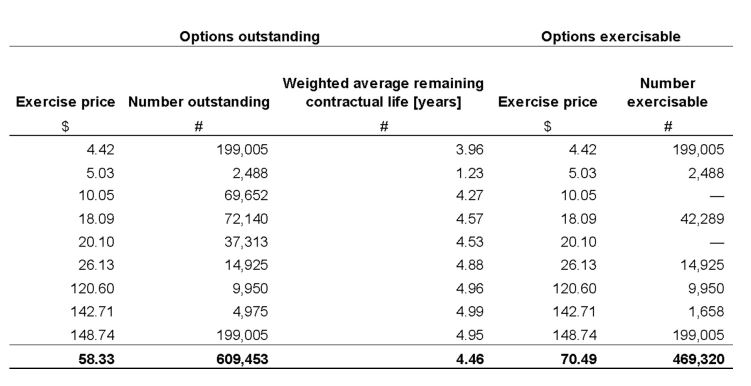

The following table is a summary of the Company’s share options outstanding as at September 30, 2019:

19

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

The following table is a summary of the Company’s share options outstanding as at September 30, 2018:

The Company recognized $6,205,323 and $11,891,380 of share-based compensation expenses during the three and nine-month periods ended September 30, 2019 (2018 – $438,378 and $2,514,674) respectively, with a corresponding amount recognized as a contributed surplus.

15. Loss per share

Net loss per common share represents net loss attributable to common shareholders divided by the weighted average number of common shares outstanding during the year.

Diluted loss per common share is calculated by dividing the applicable net loss by the sum of the weighted average number of common shares outstanding and all additional common shares that would have been outstanding if potentially dilutive common shares had been issued during the year.

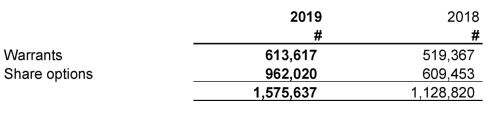

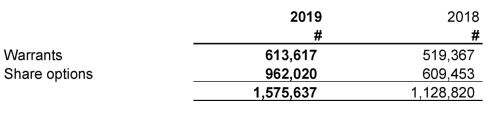

For all the periods presented, diluted loss per share equals basic loss per share due to the anti-dilutive effect of convertible debentures, warrants, contingently issuable warrants, and share options. The outstanding number and type of securities that could potentially dilute basic net loss per share in the future but would have decreased the loss per share [anti-dilutive] for the nine month period ended September 30, 2019 and 2018 are as follows:

20

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

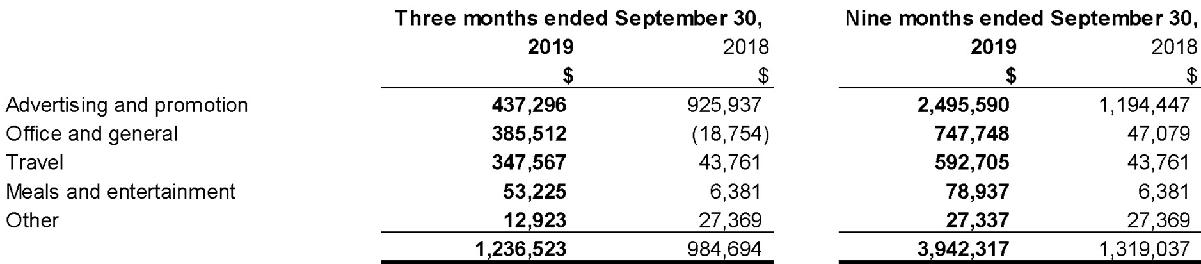

16. General and administrative

Components of general and administrative expenses for the three and nine months ended September 30, 2019 and

2018 were as follows:

17. Derivative liability

In May 2019, the Company entered into a Collaborative Research and Development Agreement (the “Agreement”) with Solarvest BioEnergy Inc. (“SVS”) to mutually invest into one another under the terms of the agreement. The Agreement guarantees that SVS’s investment in FSD will not fall below the minimum value of $3,000,000 within 8 months from the date of the Agreement. Under the Agreement, FSD is required to issue additional common shares such that SVS would realize the minimum value of $3,000,000 upon liquidation. As the minimum value obligation is derived from the share price of FSD’s common shares, the Company has concluded that the minimum value obligation is a derivative liability in accordance with IFRS 9. The Company has recognized a derivative liability of $2,200,000 as at ended September 30, 2019 (2018 – nil).

18. Commitments and contingencies

Commitments

Management and consulting contracts

The Company is subject to certain management contracts with minimum commitments totaling approximately $91,000.

Supply Agreement with Canntab Therapeutics Ltd. and World Class Extractions Inc.

On February 12, 2019, the Company announced that it had entered into a three-way supply agreement with Canntab Therapeutics Ltd. (“Canntab”), World Class Extractions Inc. (“World Class”) (together the “Purchasers”) and a Supplier to purchase up to 1,000 kg of the Supplier’s 2018 organic hemp crop, for which the Company has already purchased a quantity with a value of $100,000, which amount has been recorded in its inventory. The Purchasers intend to extract CBD oil from the 2019-2024 organic hemp crops and process the oil into gel capsules and tablets at the Company’s facility in Cobourg. The anticipated purchase price for the 2019 crop is $1,000,000 plus applicable taxes. Of this amount, $500,000 will be paid by the Purchasers as a loan to the Supplier in the form of equipment, to be paid back in the form of hemp.

Pursuant to the Agreement, the Supplier granted the Purchasers the right and option to purchase up to $5,000,000 of the Supplier’s hemp crop for a period of 5 years commencing in 2019 at a purchase price of $100 per kg per 1% of CBD extracted from the flower.

21

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

Canntab is a Canadian cannabis oral dosage formulation company based in Markham, Ontario, engaged in the research and development of advanced pharmaceutical-grade formulations of cannabinoids and trades on the Canadian Securities Exchange under the symbol PILL. World Class is understood to have developed a unique extraction process to produce quality, potent cannabis extracts using ultrasound to effectively produce extracts from cannabis and hemp and isolate essential compounds found in plant material.

Contingencies

Legal matters

From time to time, the Company is named as a party to claims or involved in proceedings, including legal, regulatory and tax related, in the ordinary course of its business. While the outcome of these matters may not be estimable at period end, the Company makes provisions, where possible, for the estimated outcome of such claims or proceedings. Should a loss result from the resolution of any claims or proceedings that differs from these estimates, the difference will be accounted for as a charge to profit or loss in that period.

Environmental

Management believes that there are no probable environmental related liabilities that will have a material adverse effect on the financial position or operating results of the Company.

Claims from suppliers

A dismissed contractor commenced a lien action combined with a breach of contract action in Cobourg Superior Court in early 2019 claiming approximately $1,700,000 in various purported damages, with a claim for lien component of $188,309 which claim was registered November 26, 2018. The Company is defending the action and has taken steps to obtain particulars and inspect documents of the plaintiff which remain unaddressed to date. The Company has paid monies into court totaling $235,387 to vacate the lien from title which funds stand as security for the lien claim and its costs in Cobourg Superior Court of Justice file no. CV-19-0002. As such, full provision for the lien claim and security for costs has been made; however, the 2019 breach of contract claim has not been provisioned as the Company intends to defend itself from this claim.

A creditor issued a claim alleging non-payment of accounts totaling $73,007. The Company has filed a Notice of Intent to Defend and it’s Demand for Particulars. Legal proceedings continue and the ultimate outcome of the matter cannot be determined at this time. No provision has been recorded for this matter as at September 30, 2019.

Former employee

FSD Pharma Inc. hired an individual, by way of employment agreement. The individual’s employment was subsequently terminated in the probationary period due to non-performance/cause in February 2019. The individual retained legal counsel in or around February 15, 2019 demanding that he be provided (i) unpaid wages; (ii) unpaid holiday pay, (iii) payment for wrongful dismissal (one week) and (iv) breach of contract.

A hearing in front of the Employment Tribunal is expected during the fourth quarter of 2019. The Company is of the view that the outcome will be unfavourable to the Company. For the nine-month period ended September 30, 2019 the Company recorded a provision of $97,320.

22

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

Class Action

On February 22, 2019, a shareholder in FSD commenced a proposed class action proceeding against the Company by issuing a statement of claim in the Ontario Superior Court. Amongst other causes of action, the individual seeks leave to bring a claim pursuant to s.138 of the Ontario Securities Act.

On October 16, 2019 dates for the leave motion were given – May 5-6, 2020. In advance of these dates FSD legal council is in the process of receiving a draft report from their expert and will start the documentation review process. The ultimate outcome of the matter cannot be determined at this time. No provision has been recorded for this matter as at September 30, 2019.

Auxly Cannabis Group Inc.

On March 3, 2018, FSD entered into a Definitive Strategic Alliance and Streaming Agreement (the “Agreement”) with Auxly Cannabis Group Inc. (“Auxly”). On February 6, 2019, the Company sent Auxly a Notice of Default, thereby terminating the Agreement effective immediately. Later that same day, Auxly sent a Notice of Default to the Company in response. To date, neither party has taken further steps.

To fund the development, Auxly purchased 37,313 Class B shares for the aggregate of $7,500,000 from the Company’s treasury by way of private placement, which funds were placed in trust to be spent on construction and development costs. The funds were placed in a trust account to be administered by Auxly. Due to the termination and subsequent negotiations, it is indeterminable at this point as to the amount, if any, of these funds will be released to the Company. As a result, the Company entered a provision for loss against the funds, which loss has been recognized in these financial statements. Should any funds be released to the Company, those amounts will be recognized in future periods as gains on recovery. No other provision has been recorded for this matter as at September 30, 2019.

19. Related party transactions

Key management personnel are those persons having the authority and responsibility for planning, directing and controlling activities of the entity, directly or indirectly.

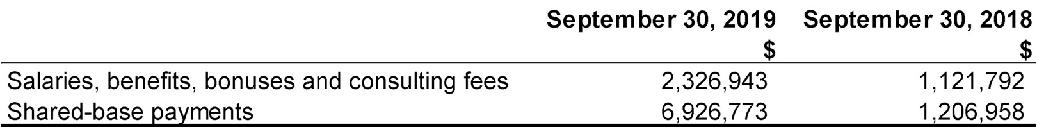

Compensation paid or payable to key management and directors comprised the following:

● The Company paid the former President and CEO of FV Pharma Inc. $770,000 in 2019 as a retirement benefit. The Company also paid the former President and CEO of FV Pharma $54,958 in salaries and benefits through a related entity owned by the former President and CEO on top of $96,250 in salaries and benefits paid directly to the Former CEO.

● The Company reimbursed $466,493 to a company owned by the CEO for costs incurred on behalf of the Company during the nine months ended September 30, 2019, included in the consolidated statement of income (loss) and comprehensive income (loss).

● The Company paid consulting fees $214,336 to the President of FSD Biosciences for services rendered for the nine months ended September 30, 2019, included in the consolidated statement of income (loss) and comprehensive income (loss) under consulting fees.

23

FSD PHARMA INC.

Notes to condensed consolidated interim financial statements

[unaudited, expressed in Canadian dollars, except share and per share amounts]

September 30, 2019 and 2018

● The Company paid management fees of $157,000 to a company owned by the CFO for services rendered for the nine months ended September 30, 2019, included in the consolidated statement of income (loss) and comprehensive income (loss) under Salaries, wages and benefits.

● The Company paid consulting fees of $23,077 to a company owned by the Chief Operating Consultant for services rendered for the nine months ended September 30, 2019, included in the consolidated statement of income (loss) and comprehensive income (loss) under consulting fees.

● The Company paid consulting fees of $16,667 to a company owned by the former COO for services rendered for the nine months ended September 30, 2019, included in the consolidated statement of income (loss) and comprehensive income (loss) under consulting fees.

● The Company pays independent directors annual rate of $40,000 per year, with the Chairman of each respective committee receiving an additional $10,000 per year. For the period ended September 30, 2019, the Company's independent directors were paid the amount of $95,000 (2018 - $44,167).

● On September 30, 2019, the Company completed the issuance of 215,676 Class B shares as part of a private placement of 228,013 Class B shares at a price of $20.10 per share for total gross proceeds of $4,335,085. 162,268 Class B Shares were subscribed by the Officers and Directors of the Company.

Key management personnel compensation during the nine months ended September 30, 2019 and 2018 comprised of:

20. Subsequent events

On October 4, 2019, the Company issued 3,735 Class B shares for settlement of loans and borrowings.

On October 11, 2019, the Company announced a reverse stock split of 201 to 1 for the Class B shares as part of the Company’s strategic plan. All share and per share amounts for all periods presented in these financial statements have been adjusted retrospectively to reflect the share split.

On October 30, 2019, the Company completed the private placement with the issuance of remaining 12,337 Class B shares for gross proceeds of $247,974.

On November 4, 2019, the Company issued 657 Class B shares for total gross proceeds of $13,206.

24