As filed with the U.S. Securities and Exchange Commission on February 4, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23450)

Global Beta ETF Trust

(Exact name of registrant as specified in charter)

2001 Market Street, Suite 2630

Philadelphia, PA 19103

(Address of principal executive offices) (Zip code)

Vince Lowry

2001 Market Street, Suite 2630

Philadelphia, PA 19103

(Name and address of agent for service)

(215) 531-8234

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2020

Item 1. Reports to Stockholders.

Annual Report

November 30, 2020

Global Beta ETF Trust

● Global Beta Smart Income ETF | | GBDV | | NYSE Arca |

● Global Beta Low Beta ETF | | GBLO | | NYSE Arca |

● Global Beta Momentum-Growth ETF | | GBGR | | NYSE Arca |

Table of Contents

| | Page |

Shareholder Letter | 1 |

Management’s Discussion of Fund Performance | 3 |

Global Beta Smart Income ETF | 3 |

Global Beta Low Beta ETF | 6 |

Global Beta Momentum-Growth ETF | 9 |

Schedule of Investments | 12 |

Statement of Assets and Liabilities | 21 |

Statement of Operations | 22 |

Statement of Changes in Net Assets | 23 |

Financial Highlights | 26 |

Notes to the Financial Statements | 29 |

Report of Independent Registered Accounting Firm | 36 |

Expense Example | 37 |

Approval of Advisory Agreement and Board Considerations | 39 |

Trustees and Officers | 41 |

Funds’ Liquidity Risk Management Program | 44 |

Additional Information | 45 |

Shareholder Letter | Global Beta ETF Trust |

November 30, 2020

Dear Shareholder,

From the time I wrote to you at the conclusion of our semi-annual period ending 05/31/2020, we have seen global markets soar to record valuations. There were several factors that contributed to this phenomenon: the re-opening of several shuttered businesses as a result of the COVID-19 pandemic, the federal reserve’s pledge to indefinitely keep interest rates at 0% and potentially additional accommodations, and the rise of retail brokerage activity.

In particular, the U.S. growth markets saw an enormous run up during the summer months in the wake of record earnings growth due to technological needs derived from the work/communicate remotely lifestyle resulting from the pandemic as well as the introduction of new investors pouring into the market place. From 05/31/20 through 08/31/20, the S&P 500 Growth Index returned 22.05%, which represented the 5th highest 3-month return for the index, dating back to 1991 (Source: Factset Research Systems). As a result, this saw the price-to-sales multiple of the S&P 500 Growth Index balloon to 4.98, which was a nearly 50% premium to its 3.37 5-year average, trailing from 08/31/20 (Source: Factset Research Systems). From 03/31/95 through 08/31/20, the S&P 500 Growth Index’s average 1-year, 5-year, and 10-year forward looking returns, from any point in time where the S&P 500 Growth Index’s price-to-sales ratio was above 3.5, were all negative (Source: Factset Research Systems). Consequently, the back half of this 6-month period, spanning from 08/31/20 through 11/30/20, has seen the S&P 500 Growth Index return 1.35% (Source: Factset Research Systems)

In our market commentary in October, we noted our concern with market volatility heading through the end of the year. September and October are generally two of the most volatile months in the calendar year, and they certainly lived up to their historical trend as the S&P 500 returned -6.36% from 08/31/20 through 10/31/20 (Source: Factset Research Systems).

In the middle of October, the November VIX futures options were indicating significant volatility ahead. The catalysts to that volatility were the election, the anticipated release of Pfizer-BioNTech’s and Moderna’s COVID-19 vaccine trial data, and concern about rising COVID-19 cases and hospitalizations as most of the country was heading into the flu season while experiencing much colder climates, leading to more indoor congregations. As a result, investors saw significant volatility in the 2nd half of October and through November, aside from a brief market rally earlier in November on the promising news from Pfizer-BioNTech’s vaccine trial data.

With much of the country in the middle of the flu season, and as they have settled into the winter months, hospitalizations have soared with both COVID-19 and flu patients as people congregate more indoors, which have sparked fears that the economy may be looking at another economic slowdown or even another economic lockdown. We believe an economic lockdown is unlikely, considering the very low political appetite that a decision like that would have at this point. However, we do expect targeted mitigation steps to continue throughout the country, and that some consumers will choose not to leave their homes as often as they may have in the prior months. This may wear on the economy in the fourth quarter, and it appears that the markets are beginning to price that in. It remains to be seen whether consumer spending during the holiday season may help offset some of those pressures.

However, as we look forward, based on our assessment, consumer cyclicals, value, and size are likely to see significant benefits once more federal stimulus is introduced following president-elect Joe Biden’s inauguration in the new year, and thus, are likely market catalysts in the new year. However, given that we could face a divided Congress, we expect the stimulus to be fairly modest, although, any stimulus at all will certainly propel the aforementioned sectors of the market. Although growth may underperform, we believe value can be found in the growth sector of the market through mid and small cap companies that are emerging. Overall, putting a lid on COVID-19 cases will be paramount for the market to move forward and determine the market’s go forward leadership.

Thank you and stay safe.

Justin Lowry

President and CIO, Global Beta Advisors, LLC

Must be preceded or accompanied by a prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from a Fund. Brokerage commissions will reduce returns.

The Funds’ return may not match or achieve a high degree of correlation with the return of the underlying index.

The Funds are subject to the risks of investing in equity securities. Please refer to the prospectus for a more detailed explanation of the Funds’ principal risks. There is no assurance that the investment objectives of the Funds will be achieved.

| |

| 1 |

Shareholder Letter (Continued) | Global Beta ETF Trust |

November 30, 2020

Diversification does not assure a profit or protect against a loss in a declining market.

Global Beta Smart Income ETF, Global Beta Low Beta ETF and Global Beta Momentum-Growth ETF are distributed by Compass Distributors, LLC.

Index Definitions

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses have been reflected. Individuals cannot invest directly in an index.

S&P 500® Growth Index: Measures growth stocks using three factors: sales growth, the ratio of earnings change to price, and momentum. S&P Style Indices divide the complete market capitalization of each parent index into growth and value segments. Constituents are drawn from the S&P 500®.

| |

| 2 |

Management’s Discussion of Fund Performance | Global Beta Smart Income ETF |

November 30, 2020

The Global Beta Smart Income ETF’s (the “Fund” or “GBDV”) seeks to track the performance (before fees and expenses) of the Global Beta Smart Income Index (the “Target Index”). The Target Index is comprised of equity securities of U.S. companies in the highest quintile of the average twelve month trailing dividend yield over each of the prior four quarters in the S&P 900 (a broad-based benchmark index), and that rank in the top half of their respective GICS sector classification. The constituent securities of the Target Index are weighted based on their revenue, with each individual index constituent capped at 5% at each quarterly rebalance.

For the period, which spans from the Fund’s inception of 12/27/19 through the end of the Fund’s annual period of 11/30/20, the Fund underperformed its benchmark, the S&P 900 Index. For the period, the Fund’s net asset value (“NAV”) return was -10.35% and the Fund’s market price return was -10.54%1. The benchmark return was 13.26% during the same period. The Fund’s market price at 11/30/20 was $17.14.

As mentioned in the fund discussion from the end of the semi-annual period, we believe the underperformance was largely attributed to the recession from the COVID-19 global health pandemic. The recession caused significant strain on the balance sheet of many companies around the world, which in turn, caused substantial uncertainty as to whether dividend paying companies would be able to make their regular dividend payments. This uncertainty led to a significant sell off in high dividend paying securities. However, as the economy has begun to come out of the recession with the reopening of businesses as well as recent developments suggesting that therapeutics and vaccines will potentially put an end to the global health pandemic in the near term; economically sensitive securities, such as dividend paying stocks, have begun to perform much better. In fact, GBDV has begun to outperform its benchmark as the fund’s NAV returned 21.60% vs 20.21% for the S&P 900 Index from the end of the semi-annual period, 05/31/20, through the end of the fund’s fiscal year end of 11/30/20.

Frequency Distribution of Premium and Discounts — Information concerning the number of days that the Fund trades at a premium or discount can be found on the Funds’ website, www.globalbetaetf.com.

ALLOCATION BY SECTOR |

Sector | Percentage of

Total Net Assets |

Financials | 21.4% |

Information Technology | 15.0 |

Utilities | 12.6 |

Materials | 10.9 |

Consumer Staples | 10.8 |

Communication Services | 9.8 |

Health Care | 6.6 |

Industrials | 4.9 |

Energy | 3.0 |

Consumer Discretionary | 2.7 |

Real Estate | 2.3 |

Short-Term Investments and Other Assets and Liabilities | 0.0* |

Total | 100.0% |

* | Represents less than 0.05% of net assets. |

1. | A fund’s per share NAV is the value of one share of the Fund. NAV is calculated by taking the Fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the Fund, and the Market Price Return is based on the market price per share of the Fund. The price used to calculate market return (‘‘Market Price’’) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. |

| |

| 3 |

Fund Performance | Global Beta Smart Income ETF |

November 30, 2020

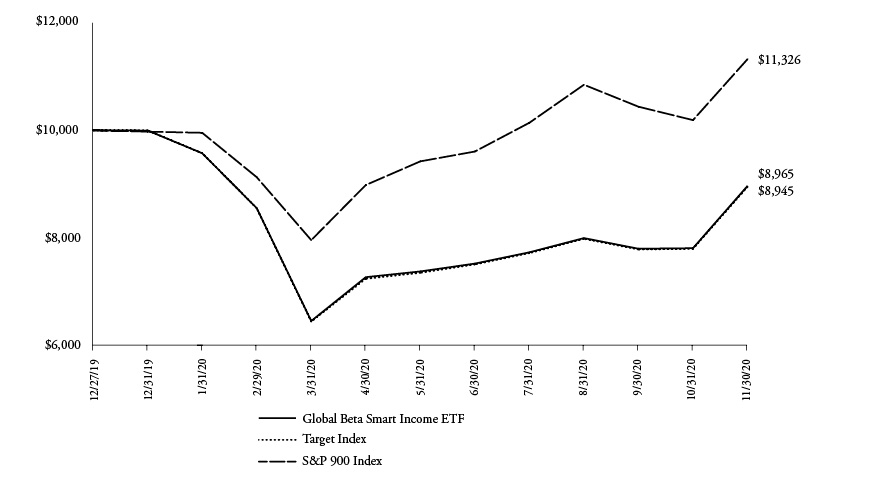

Performance (Cumulative Total Return as of November 30, 2020)

| | 1-Month | 3-Month | 6-Month | 9-Month | Since

Inception* |

Global Beta Smart Income ETF | | | | | |

NAV | 14.85% | 12.15% | 21.60% | 4.84% | -10.35% |

Market | 15.10% | 11.96% | 21.80% | 5.18% | -10.54% |

Target Index | 14.80% | 12.13% | 21.80% | 4.66% | -10.55% |

S&P 900 Index | 11.14% | 4.40% | 20.21% | 24.09% | 13.26% |

Growth of $10,000 Investment

(At Net Asset Value)

Performance measured by NAV differs from the Target Index primarily due to Fund fees and expenses and taxes.

(*) | Commencement of investment operations on December 27, 2019. |

This chart assumes an initial gross investment of $10,000 made on December 27, 2019 and reflects the fees charged on an account. Returns shown include the reinvestment of all dividends, if any, but do not include the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so your shares, when redeemed, may be worth more or less than the original cost.

Past performance is no guarantee of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of the Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.globalbetaetf.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Returns less than one year are not annualized. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a

| |

| 4 |

Fund Performance (Continued) | Global Beta Smart Income ETF |

November 30, 2020

waiver, performance would have been lower. As stated in the current prospectus, the Fund’s investment adviser, Global Beta Advisors LLC (“Adviser”), has agreed to reimburse the Fund through March 31, 2021 for the (i) compensation and expenses of the Trustees who are not interested persons as defined under Section 2(a)(19) of the Investment Company Act of 1940 (the “Independent Trustees”), and (ii) fees and expenses of counsel to the Independent Trustees, except for any (a) litigation expenses (including litigation to which the Trust or the Fund may be a party and indemnification of the Independent Trustees with respect thereto), and (b) extraordinary or non-routine fees or expenses. As stated in the current prospectus, the current gross and net expense ratios are 0.49% and 0.29% respectively. Please refer to the Financial Highlights herein for the most recent expense ratio information.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Individuals cannot invest directly in an index.

| |

| 5 |

Management’s Discussion of Fund Performance | Global Beta Low Beta ETF |

November 30, 2020

The Global Beta Low Beta ETF (the “Fund” or “GBLO”) seeks to track the performance (before fees and expenses) of the Global Beta Low Beta Factor Index (the “Target Index”). The Target Index is comprised of equity securities of U.S. companies from the S&P 500 (a broad-based benchmark index) in the lowest quintile (i.e., the lowest 20% of the S&P 500) based on their twelve month trailing beta relative to the S&P 500. Beta is a measure of the relative volatility of a security as compared to the market. The constituent securities of the Target Index are weighted based on their revenue, with each individual index constituent capped at 5% at each quarterly rebalance.

For the period, which spans from the Fund’s inception of 7/24/20 through the end of the Fund’s annual period of 11/30/20, the Fund underperformed its benchmark, the S&P 500 Index. For the period, the Fund’s net asset value (“NAV”) return was 8.06% and the Fund’s market price return was 7.97%1. The benchmark return was 12.62% during the same period. The Fund’s market price at 11/30/20 was $21.54.

We believe this underperformance was largely due to the major run up in the S&P 500 Index for the month of August, where momentum dominated the market and little volatility existed. However, for the months of September and October, where volatility began to creep back into the market, GBLO outperformed the S&P 500 Index with a fund NAV return of -5.56% vs. the S&P 500 Index’s return of -6.36%. GBLO is expected to outperform the broad market in times of volatility and when cyclicals perform well, but typically will underperform when growth and momentum stocks are in favor. As uncertain times may still lie ahead as continues continue to battle the COVID-19 health pandemic and restore their respective economies, the market may continue to see market volatility, which may lend to stronger relative performance in GBLO. Even absent market volatility; better performance from economically sensitive securities may lend to better relative performance for GBLO versus the S&P 500 Index.

Frequency Distribution of Premium and Discounts — Information concerning the number of days that the Fund trades at a premium or discount can be found on the Funds’ website, www.globalbetaetf.com.

ALLOCATION BY SECTOR |

Sector | Percentage of

Total Net Assets |

Consumer Staples | 34.5% |

Health Care | 26.1 |

Consumer Discretionary | 12.7 |

Communication Services | 11.0 |

Industrials | 8.3 |

Utilities | 2.4 |

Financials | 2.2 |

Information Technology | 1.3 |

Materials | 0.9 |

Real Estate | 0.3 |

Short-Term Investments and Other Assets and Liabilities | 0.2 |

Energy | 0.1 |

Total | 100.0% |

1. | A fund’s per share NAV is the value of one share of the Fund. NAV is calculated by taking the Fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the Fund, and the Market Price Return is based on the market price per share of the Fund. The price used to calculate market return (‘‘Market Price’’) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. |

| |

| 6 |

Fund Performance | Global Beta Low Beta ETF |

November 30, 2020

Performance (Cumulative Total Return as of November 30, 2020)

| | 1-Month | 3-Month | Since

Inception* |

Global Beta Low Beta ETF | | | |

NAV | 8.17% | 2.15% | 8.06% |

Market | 8.34% | 1.99% | 7.97% |

Target Index | 8.21% | 2.14% | 8.11% |

S&P 500 Index | 10.95% | 3.89% | 12.62% |

Growth of $10,000 Investment

(At Net Asset Value)

Performance measured by NAV differs from the Target Index primarily due to Fund fees and expenses and taxes.

(*) | Commencement of investment operations on July 24, 2020. |

This chart assumes an initial gross investment of $10,000 made on July 24, 2020 and reflects the fees charged on an account. Returns shown include the reinvestment of all dividends, if any, but do not include the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so your shares, when redeemed, may be worth more or less than the original cost.

Past performance is no guarantee of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of the Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.globalbetaetf.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Returns less than one year are not annualized. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a

| |

| 7 |

Fund Performance (Continued) | Global Beta Low Beta ETF |

November 30, 2020

waiver, performance would have been lower. As stated in the current prospectus, the Fund’s investment adviser, Global Beta Advisors LLC (“Adviser”), has agreed to reimburse the Fund through March 31, 2022 for the (i) compensation and expenses of the Trustees who are not interested persons as defined under Section 2(a)(19) of the Investment Company Act of 1940 (the “Independent Trustees”), and (ii) fees and expenses of counsel to the Independent Trustees, except for any (a) litigation expenses (including litigation to which the Trust or the Fund may be a party and indemnification of the Independent Trustees with respect thereto), and (b) extraordinary or non-routine fees or expenses. As stated in the current prospectus, the current gross and net expense ratios are 0.36% and 0.29% respectively. Please refer to the Financial Highlights herein for the most recent expense ratio information.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Individuals cannot invest directly in an index.

| |

| 8 |

Management’s Discussion of Fund Performance | Global Beta Momentum-Growth ETF |

November 30, 2020

The Global Beta Momentum-Growth ETF (the “Fund” or “GBGR”) seeks to track the performance (before fees and expenses) of the Global Beta Momentum-Growth Factor Index (the “Target Index”). The Target Index is comprised of equity securities of U.S. companies from the S&P 500 (a broad-based benchmark index) in the highest quintile (i.e., the highest 20% of the S&P 500) based on their year-over-year revenue growth rate, as measured by their most recently reported quarterly revenue as compared to the quarterly revenue reported four quarters ago. The constituent securities of the Target Index are weighted based on free-float market capitalization, with each individual index constituent capped at 10% at each quarterly rebalance. In addition, index constituents from the energy sector, as classified by the Global Industry Classification Standard (GICS®), are capped at 3% in the aggregate in the Target Index at each quarterly rebalance when the price of crude oil, as defined by Crude Oil WTI futures (ticker: CL00), is below its 30 day moving average.

For the period, which spans from the Fund’s inception of 7/24/20 through the end of the Fund’s annual period of 11/30/20, the Fund underperformed its benchmark, the S&P 500 Index. For the period, the Fund’s net asset value (“NAV”) return was 11.39% and the Fund’s market price return was 11.27%1. The benchmark return was 12.62% during the same period. The Fund’s market price at 11/30/20 was $22.23.

GBGR had strong relative performance in the first 1+ month as the Fund’s NAV returned 10.39% versus 8.40% for that of the S&P 500 Index from 07/24/20 through 08/31/20. However, valuations within growth-oriented stocks began to come under pressure from September through November as valuations in growth oriented securities had become elevated due to suppressed economic growth from the COVID-19 related recession.We believe this correction led to the aforementioned underperformance of GBGR to the S&P 500 Index as GBGR’s investment focus is towards growth-oriented securities. Additionally, the outcome of the election raised the possibility of more fiscal stimulus from the federal government, and major COVID-19 vaccine developers reported exceedingly positive late trial results on their vaccines, indicating the end of the COVID-19 related health pandemic may be near. Consequently, investors saw a rotation out of growth-oriented securities and into more economically sensitive, value-oriented securities, which ultimately impacted GBGR’s relative return to that of the broad-based S&P 500 Index.

Frequency Distribution of Premium and Discounts — Information concerning the number of days that the Fund trades at a premium or discount can be found on the Funds’ website, www.globalbetaetf.com.

ALLOCATION BY SECTOR |

Sector | Percentage of

Total Net Assets |

Information Technology | 53.6% |

Health Care | 11.4 |

Financials | 9.8 |

Communication Services | 8.3 |

Consumer Discretionary | 7.0 |

Industrials | 4.7 |

Consumer Staples | 3.0 |

Utilities | 1.0 |

Real Estate | 0.6 |

Materials | 0.5 |

Short-Term Investments and Other Assets and Liabilities | 0.1 |

Total | 100.0% |

1. | A fund’s per share NAV is the value of one share of the Fund. NAV is calculated by taking the Fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the Fund, and the Market Price Return is based on the market price per share of the Fund. The price used to calculate market return (‘‘Market Price’’) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. |

| |

| 9 |

Fund Performance | Global Beta Momentum-Growth ETF |

November 30, 2020

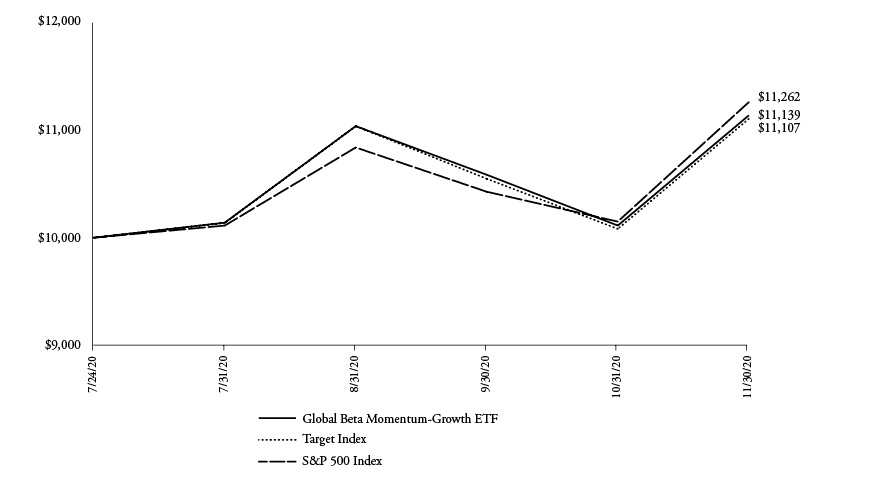

Performance (Cumulative Total Return as of November 30, 2020)

| | 1-Month | 3-Month | Since

Inception* |

Global Beta Momentum-Growth ETF | | | |

NAV | 10.14% | 0.90% | 11.39% |

Market | 10.30% | 0.64% | 11.27% |

Target Index | 10.17% | 0.61% | 11.07% |

S&P 500 Index | 10.95% | 3.89% | 12.62% |

Growth of $10,000 Investment

(At Net Asset Value)

Performance measured by NAV differs from the Target Index primarily due to Fund fees and expenses and taxes.

(*) | Commencement of investment operations on July 24, 2020. |

This chart assumes an initial gross investment of $10,000 made on July 24, 2020 and reflects the fees charged on an account. Returns shown include the reinvestment of all dividends, if any, but do not include the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so your shares, when redeemed, may be worth more or less than the original cost.

Past performance is no guarantee of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of the Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.globalbetaetf.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Returns less than one year are not annualized. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a

| |

| 10 |

Fund Performance (Continued) | Global Beta Momentum-Growth ETF |

November 30, 2020

waiver, performance would have been lower. As stated in the current prospectus, the Fund’s investment adviser, Global Beta Advisors LLC (“Adviser”), has agreed to reimburse the Fund through March 31, 2022 for the (i) compensation and expenses of the Trustees who are not interested persons as defined under Section 2(a)(19) of the Investment Company Act of 1940 (the “Independent Trustees”), and (ii) fees and expenses of counsel to the Independent Trustees, except for any (a) litigation expenses (including litigation to which the Trust or the Fund may be a party and indemnification of the Independent Trustees with respect thereto), and (b) extraordinary or non-routine fees or expenses. As stated in the current prospectus, the current gross and net expense ratios are 0.36% and 0.29% respectively. Please refer to the Financial Highlights herein for the most recent expense ratio information.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Individuals cannot invest directly in an index.

| |

| 11 |

Schedule of Investments | Global Beta Smart Income ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 100.0% | | | | | | | | |

Communication Services — 9.8% | | | | | | | | |

CenturyLink, Inc. | | | 3,951 | | | $ | 41,288 | |

Interpublic Group of Companies, Inc. | | | 1,096 | | | | 24,419 | |

Omnicom Group, Inc. | | | 524 | | | | 33,012 | |

Verizon Communications, Inc. | | | 1,142 | | | | 68,988 | |

| | | | | | | | 167,707 | |

Consumer Discretionary — 2.7% | | | | | | | | |

H&R Block, Inc. | | | 369 | | | | 6,937 | |

Leggett & Platt, Inc. | | | 195 | | | | 8,405 | |

Newell Brands, Inc. | | | 1,072 | | | | 22,791 | |

Wyndham Destinations, Inc. | | | 196 | | | | 8,244 | |

| | | | | | | | 46,377 | |

Consumer Staples — 10.8% | | | | | | | | |

Coca-Cola Co. | | | 1,353 | | | | 69,815 | |

General Mills, Inc. | | | 601 | | | | 36,553 | |

Nu Skin Enterprises, Inc. - Class A | | | 88 | | | | 4,533 | |

Walgreens Boots Alliance, Inc. | | | 1,960 | | | | 74,500 | |

| | | | | | | | 185,401 | |

Energy — 3.0% | | | | | | | | |

Antero Midstream Corp. | | | 19 | | | | 128 | |

Equitrans Midstream Corp. | | | 19 | | | | 155 | |

Exxon Mobil Corp. | | | 647 | | | | 24,670 | |

Kinder Morgan, Inc. | | | 103 | | | | 1,481 | |

Marathon Petroleum Corp. | | | 363 | | | | 14,113 | |

Valero Energy Corp. | | | 193 | | | | 10,378 | |

Williams Companies, Inc. | | | 41 | | | | 860 | |

| | | | | | | | 51,785 | |

Financials — 21.4% | | | | | | | | |

American Financial Group, Inc. | | | 224 | | | | 20,028 | |

Cathay General Bancorp | | | 69 | | | | 1,949 | |

CIT Group, Inc. | | | 361 | | | | 12,090 | |

Citizens Financial Group, Inc. | | | 596 | | | | 19,465 | |

Comerica, Inc. | | | 173 | | | | 8,512 | |

First Horizon National Corp. | | | 470 | | | | 5,743 | |

F.N.B. Corp. | | | 425 | | | | 3,753 | |

Franklin Resources, Inc. | | | 535 | | | | 11,765 | |

Hanover Insurance Group, Inc. | | | 101 | | | | 11,347 | |

Huntington Bancshares, Inc. | | | 1,094 | | | | 13,216 | |

Janus Henderson Group PLC ^ | | | 227 | | | | 6,476 | |

KeyCorp | | | 1,209 | | | | 18,691 | |

Mercury General Corp. | | | 182 | | | | 8,094 | |

MetLife, Inc. | | | 1,843 | | | | 85,091 | |

Navient Corp. | | | 1,138 | | | | 10,663 | |

New York Community Bancorp, Inc. | | | 418 | | | | 4,050 | |

Old Republic International Corp. | | | 847 | | | | 15,178 | |

People’s United Financial, Inc. | | | 471 | | | | 5,840 | |

Principal Financial Group, Inc. | | | 818 | | | | 40,728 | |

Regions Financial Corp. | | | 1,107 | | | | 16,904 | |

Synovus Financial Corp. | | | 225 | | | | 7,103 | |

United Bankshares, Inc. | | | 78 | | | | 2,284 | |

Unum Group | | | 1,316 | | | | 29,255 | |

Valley National Bancorp | | | 431 | | | | 3,939 | |

Webster Financial Corp. | | | 107 | | | | 4,049 | |

| | | | | | | | 366,213 | |

The accompanying notes are an integral part of these financial statements.

| |

| 12 |

Schedule of Investments (Continued) | Global Beta Smart Income ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 100.0% (Continued) | | | | | | | | |

Health Care — 6.6% | | | | | | | | |

Gilead Sciences, Inc. | | | 674 | | | $ | 40,892 | |

Pfizer, Inc. | | | 1,872 | | | | 71,716 | |

| | | | | | | | 112,608 | |

Industrials — 4.9% | | | | | | | | |

HNI Corp. | | | 142 | | | | 5,177 | |

MSC Industrial Direct Co., Inc. - Class A | | | 105 | | | | 8,749 | |

PACCAR, Inc. | | | 485 | | | | 42,224 | |

Ryder System, Inc. | | | 407 | | | | 24,102 | |

Werner Enterprises, Inc. | | | 108 | | | | 4,319 | |

| | | | | | | | 84,571 | |

Information Technology — 15.0% | | | | | | | | |

Hewlett Packard Enterprise Co. | | | 5,940 | | | | 65,578 | |

HP, Inc. | | | 3,592 | | | | 78,772 | |

International Business Machines Corp. | | | 565 | | | | 69,789 | |

NetApp, Inc. | | | 248 | | | | 13,221 | |

NortonLifeLock, Inc. | | | 231 | | | | 4,211 | |

Seagate Technology PLC | | | 447 | | | | 26,288 | |

| | | | | | | | 257,859 | |

Materials — 10.9% | | | | | | | | |

Chemours Co. | | | 482 | | | | 11,727 | |

Compass Minerals International, Inc. | | | 51 | | | | 3,185 | |

Dow, Inc. | | | 1,353 | | | | 71,723 | |

Eastman Chemical Co. | | | 218 | | | | 21,233 | |

Greif, Inc. - Class A | | | 134 | | | | 6,514 | |

International Paper Co. | | | 1,028 | | | | 50,865 | |

Olin Corp. | | | 981 | | | | 21,474 | |

| | | | | | | | 186,721 | |

Real Estate — 2.3% | | | | | | | | |

American Campus Communities, Inc. | | | 52 | | | | 2,069 | |

Apartment Investment and Management Co. - Class A | | | 65 | | | | 1,973 | |

Federal Realty Investment Trust | | | 22 | | | | 1,919 | |

Healthpeak Properties, Inc. | | | 160 | | | | 4,618 | |

Highwoods Properties, Inc. | | | 43 | | | | 1,647 | |

Iron Mountain, Inc. | | | 291 | | | | 8,002 | |

Medical Properties Trust, Inc. | | | 123 | | | | 2,386 | |

National Retail Properties, Inc. | | | 38 | | | | 1,433 | |

Omega Healthcare Investors, Inc. | | | 62 | | | | 2,184 | |

Physicians Realty Trust | | | 48 | | | | 833 | |

PotlatchDeltic Corp. | | | 39 | | | | 1,815 | |

Regency Centers Corp. | | | 55 | | | | 2,507 | |

SL Green Realty Corp. | | | 47 | | | | 2,721 | |

Spirit Realty Capital, Inc. | | | 29 | | | | 1,068 | |

STORE Capital Corp. | | | 48 | | | | 1,563 | |

Vornado Realty Trust | | | 70 | | | | 2,724 | |

| | | | | | | | 39,462 | |

The accompanying notes are an integral part of these financial statements.

| |

| 13 |

Schedule of Investments (Continued) | Global Beta Smart Income ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 100.0% (Continued) | | | | | | | | |

Utilities — 12.6% | | | | | | | | |

Dominion Energy, Inc. | | | 419 | | | $ | 32,887 | |

DTE Energy Co. | | | 202 | | | | 25,414 | |

Edison International | | | 487 | | | | 29,882 | |

FirstEnergy Corp. | | | 746 | | | | 19,814 | |

MDU Resources Group, Inc. | | | 484 | | | | 12,071 | |

National Fuel Gas Co. | | | 74 | | | | 3,046 | |

NorthWestern Corp. | | | 49 | | | | 2,842 | |

OGE Energy Corp. | | | 148 | | | | 4,794 | |

Pinnacle West Capital Corp. | | | 96 | | | | 7,858 | |

PPL Corp. | | | 569 | | | | 16,171 | |

Southern Co. | | | 779 | | | | 46,623 | |

UGI Corp. | | | 404 | | | | 14,334 | |

| | | | | | | | 215,736 | |

TOTAL COMMON STOCKS (Cost $1,493,818) | | | | | | | 1,714,440 | |

| | | | | | | | | |

MONEY MARKET FUND — 0.1% | | | | | | | | |

First American Government Obligations Fund - Class X, 0.05% (a) | | | 1,597 | | | | 1,597 | |

TOTAL MONEY MARKET FUND (Cost $1,597) | | | | | | | 1,597 | |

TOTAL INVESTMENTS — 100.1% (Cost $1,495,415) | | | | | | | 1,716,037 | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.1)% | | | | | | | (772 | ) |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 1,715,265 | |

^ | U.S. Dollar-denominated foreign security. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by Global Beta Advisors LLC.

The accompanying notes are an integral part of these financial statements.

| |

| 14 |

Schedule of Investments | Global Beta Low Beta ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 99.8% | | | | | | | | |

Communication Services — 11.0% | | | | | | | | |

Activision Blizzard, Inc. | | | 97 | | | $ | 7,710 | |

Charter Communications, Inc. - Class A * | | | 85 | | | | 55,419 | |

Electronic Arts, Inc. * | | | 51 | | | | 6,515 | |

Netflix, Inc. * | | | 52 | | | | 25,516 | |

Take-Two Interactive Software, Inc. * | | | 24 | | | | 4,332 | |

T-Mobile U.S., Inc. | | | 507 | | | | 67,401 | |

Verizon Communications, Inc. | | | 2,128 | | | | 128,553 | |

| | | | | | | | 295,446 | |

Consumer Discretionary — 12.7% | | | | | | | | |

Amazon.com, Inc. * | | | 41 | | | | 129,890 | |

Dollar General Corp. | | | 166 | | | | 36,284 | |

Dollar Tree, Inc. * | | | 309 | | | | 33,755 | |

Domino’s Pizza, Inc. | | | 11 | | | | 4,318 | |

eBay, Inc. | | | 235 | | | | 11,851 | |

Target Corp. | | | 611 | | | | 109,693 | |

Tiffany & Co. | | | 40 | | | | 5,259 | |

Tractor Supply Co. | | | 75 | | | | 10,561 | |

| | | | | | | | 341,611 | |

Consumer Staples — 34.5% | | | | | | | | |

Altria Group, Inc. | | | 541 | | | | 21,548 | |

Brown-Forman Corp. - Class B | | | 48 | | | | 3,872 | |

Campbell Soup Co. | | | 209 | | | | 10,454 | |

Church & Dwight Co, Inc. | | | 57 | | | | 5,003 | |

Clorox Co. | | | 36 | | | | 7,307 | |

Coca-Cola Co. | | | 765 | | | | 39,474 | |

Colgate-Palmolive Co. | | | 236 | | | | 20,211 | |

Conagra Brands, Inc. | | | 364 | | | | 13,308 | |

Costco Wholesale Corp. | | | 374 | | | | 146,522 | |

General Mills, Inc. | | | 340 | | | | 20,679 | |

Hershey Co. | | | 63 | | | | 9,317 | |

Hormel Foods Corp. | | | 219 | | | | 10,332 | |

J. M. Smucker Co. | | | 79 | | | | 9,259 | |

Kellogg Co. | | | 234 | | | | 14,955 | |

Kimberly-Clark Corp. | | | 146 | | | | 20,339 | |

Kroger Co. | | | 3,941 | | | | 130,053 | |

McCormick & Co., Inc. | | | 31 | | | | 5,796 | |

Mondelez International, Inc. - Class A | | | 507 | | | | 29,127 | |

Procter & Gamble Co. | | | 582 | | | | 80,822 | |

Tyson Foods, Inc. - Class A | | | 743 | | | | 48,444 | |

Walgreens Boots Alliance, Inc. | | | 3,656 | | | | 138,965 | |

Walmart, Inc. | | | 936 | | | | 143,011 | |

| | | | | | | | 928,798 | |

Energy — 0.1% | | | | | | | | |

Cabot Oil & Gas Corp. | | | 98 | | | | 1,717 | |

| | | | | | | | | |

Financials — 2.2% | | | | | | | | |

Aon PLC - Class A | | | 62 | | | | 12,703 | |

Cboe Global Markets, Inc. | | | 39 | | | | 3,562 | |

MarketAxess Holdings, Inc. | | | 2 | | | | 1,078 | |

Progressive Corp. | | | 485 | | | | 42,248 | |

| | | | | | | | 59,591 | |

The accompanying notes are an integral part of these financial statements.

| |

| 15 |

Schedule of Investments (Continued) | Global Beta Low Beta ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 99.8% (Continued) | | | | | | | | |

Health Care — 26.1% | | | | | | | | |

AbbVie, Inc. | | | 453 | | | $ | 47,375 | |

ABIOMED, Inc. * | | | 3 | | | | 822 | |

Alexion Pharmaceuticals, Inc. * | | | 55 | | | | 6,716 | |

Amgen, Inc. | | | 111 | | | | 24,646 | |

Baxter International, Inc. | | | 161 | | | | 12,247 | |

Becton Dickinson and Co. | | | 85 | | | | 19,961 | |

Biogen, Inc. * | | | 59 | | | | 14,170 | |

Bio-Rad Laboratories, Inc. - Class A * | | | 5 | | | | 2,693 | |

Bristol-Myers Squibb Co. | | | 666 | | | | 41,558 | |

Cerner Corp. | | | 89 | | | | 6,661 | |

CVS Health Corp. | | | 2,262 | | | | 153,341 | |

Danaher Corp. | | | 103 | | | | 23,137 | |

DaVita, Inc. * | | | 146 | | | | 16,038 | |

DexCom, Inc. * | | | 5 | | | | 1,598 | |

Eli Lilly and Co. | | | 174 | | | | 25,343 | |

Gilead Sciences, Inc. | | | 381 | | | | 23,115 | |

IDEXX Laboratories, Inc. * | | | 8 | | | | 3,688 | |

Illumina, Inc. * | | | 11 | | | | 3,543 | |

Incyte Corp. * | | | 30 | | | | 2,536 | |

Johnson & Johnson | | | 614 | | | | 88,834 | |

Merck & Co, Inc. | | | 636 | | | | 51,128 | |

PerkinElmer, Inc. | | | 29 | | | | 3,857 | |

Pfizer, Inc. | | | 1,515 | | | | 58,040 | |

Quest Diagnostics, Inc. | | | 75 | | | | 9,299 | |

Regeneron Pharmaceuticals, Inc. * | | | 16 | | | | 8,257 | |

Thermo Fisher Scientific, Inc. | | | 68 | | | | 31,619 | |

Vertex Pharmaceuticals, Inc. * | | | 23 | | | | 5,238 | |

Viatris, Inc. * | | | 1,008 | | | | 16,955 | |

West Pharmaceutical Services, Inc. | | | 8 | | | | 2,201 | |

| | | | | | | | 704,616 | |

Industrials — 8.3% | | | | | | | | |

3M Co. | | | 214 | | | | 36,964 | |

A.O. Smith Corp. | | | 62 | | | | 3,491 | |

C.H. Robinson Worldwide, Inc. | | | 165 | | | | 15,505 | |

Expeditors International of Washington, Inc. | | | 105 | | | | 9,384 | |

Northrop Grumman Corp. | | | 116 | | | | 35,062 | |

Republic Services, Inc. | | | 120 | | | | 11,607 | |

Rollins, Inc. | | | 44 | | | | 2,516 | |

United Parcel Service, Inc. - Class B | | | 544 | | | | 93,062 | |

Waste Management, Inc. | | | 147 | | | | 17,512 | |

| | | | | | | | 225,103 | |

Information Technology — 1.3% | | | | | | | | |

Akamai Technologies, Inc. * | | | 32 | | | | 3,312 | |

Broadridge Financial Solutions, Inc. | | | 38 | | | | 5,582 | |

Citrix Systems, Inc. | | | 27 | | | | 3,346 | |

F5 Networks, Inc. * | | | 22 | | | | 3,582 | |

FLIR Systems, Inc. | | | 61 | | | | 2,333 | |

Jack Henry & Associates, Inc. | | | 12 | | | | 1,930 | |

Juniper Networks, Inc. | | | 218 | | | | 4,746 | |

NortonLifeLock, Inc. | | | 132 | | | | 2,406 | |

Tyler Technologies, Inc. * | | | 4 | | | | 1,710 | |

Western Union Co. | | | 250 | | | | 5,640 | |

| | | | | | | | 34,587 | |

The accompanying notes are an integral part of these financial statements.

| |

| 16 |

Schedule of Investments (Continued) | Global Beta Low Beta ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 99.8% (Continued) | | | | | | | | |

Materials — 0.9% | | | | | | | | |

Ball Corp. | | | 152 | | | $ | 14,593 | |

Newmont Corp. | | | 179 | | | | 10,529 | |

| | | | | | | | 25,122 | |

Real Estate — 0.3% | | | | | | | | |

Digital Realty Trust, Inc. | | | 26 | | | | 3,504 | |

Extra Space Storage, Inc. | | | 14 | | | | 1,578 | |

Public Storage | | | 15 | | | | 3,367 | |

| | | | | | | | 8,449 | |

Utilities — 2.4% | | | | | | | | |

Alliant Energy Corp. | | | 77 | | | | 4,050 | |

American Electric Power Co., Inc. | | | 216 | | | | 18,336 | |

CMS Energy Corp. | | | 124 | | | | 7,631 | |

Consolidated Edison, Inc. | | | 187 | | | | 14,259 | |

WEC Energy Group, Inc. | | | 83 | | | | 7,881 | |

Xcel Energy, Inc. | | | 181 | | | | 12,192 | |

| | | | | | | | 64,349 | |

TOTAL COMMON STOCKS (Cost $2,526,104) | | | | | | | 2,689,389 | |

| | | | | | | | | |

MONEY MARKET FUND — 0.0% # | | | | | | | | |

First American Government Obligations Fund - Class X, 0.05% (a) | | | 766 | | | | 766 | |

TOTAL MONEY MARKET FUND (Cost $766) | | | | | | | 766 | |

TOTAL INVESTMENTS — 99.8% (Cost $2,526,870) | | | | | | | 2,690,155 | |

OTHER ASSETS LESS LIABILITIES — 0.2% | | | | | | | 4,377 | |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 2,694,532 | |

* | Non-income producing security. |

(#) | Represents less than 0.05% of net assets. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by Global Beta Advisors LLC.

The accompanying notes are an integral part of these financial statements.

| |

| 17 |

Schedule of Investments | Global Beta Momentum-Growth ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 99.9% | | | | | | | | |

Communication Services — 8.3% | | | | | | | | |

Activision Blizzard, Inc. | | | 207 | | | $ | 16,452 | |

Electronic Arts, Inc. * | | | 77 | | | | 9,837 | |

Facebook, Inc. - Class A * | | | 647 | | | | 179,200 | |

Take-Two Interactive Software, Inc. * | | | 31 | | | | 5,596 | |

T-Mobile U.S., Inc. | | | 156 | | | | 20,739 | |

| | | | | | | | 231,824 | |

Consumer Discretionary — 7.0% | | | | | | | | |

Advance Auto Parts, Inc. | | | 19 | | | | 2,806 | |

Dollar General Corp. | | | 68 | | | | 14,864 | |

Dollar Tree, Inc. * | | | 64 | | | | 6,991 | |

Domino’s Pizza, Inc. | | | 11 | | | | 4,318 | |

D.R. Horton, Inc. | | | 89 | | | | 6,631 | |

eBay, Inc. | | | 177 | | | | 8,926 | |

Home Depot, Inc. | | | 291 | | | | 80,726 | |

Lowe’s Companies, Inc. | | | 203 | | | | 31,631 | |

O’Reilly Automotive, Inc. * | | | 20 | | | | 8,849 | |

Target Corp. | | | 134 | | | | 24,057 | |

Tractor Supply Co. | | | 31 | | | | 4,365 | |

| | | | | | | | 194,164 | |

Consumer Staples — 3.0% | | | | | | | | |

Campbell Soup Co. | | | 45 | | | | 2,251 | |

Church & Dwight Co., Inc. | | | 66 | | | | 5,793 | |

Clorox Co. | | | 34 | | | | 6,901 | |

J. M. Smucker Co. | | | 31 | | | | 3,633 | |

Kroger Co. | | | 211 | | | | 6,963 | |

Walmart, Inc. | | | 381 | | | | 58,213 | |

| | | | | | | | 83,754 | |

Financials — 9.8% | | | | | | | | |

Berkshire Hathaway, Inc. - Class B * | | | 523 | | | | 119,720 | |

Cboe Global Markets, Inc. | | | 29 | | | | 2,648 | |

Chubb Ltd. ^ | | | 121 | | | | 17,887 | |

Cincinnati Financial Corp. | | | 40 | | | | 3,054 | |

Everest Re Group Ltd. ^ | | | 11 | | | | 2,501 | |

First Republic Bank | | | 46 | | | | 5,960 | |

Globe Life, Inc. | | | 26 | | | | 2,420 | |

Goldman Sachs Group, Inc. | | | 83 | | | | 19,138 | |

Intercontinental Exchange, Inc. | | | 147 | | | | 15,510 | |

MarketAxess Holdings, Inc. | | | 10 | | | | 5,392 | |

Moody’s Corp. | | | 44 | | | | 12,423 | |

MSCI, Inc. | | | 23 | | | | 9,417 | |

Nasdaq, Inc. | | | 31 | | | | 3,968 | |

Progressive Corp. | | | 157 | | | | 13,676 | |

S&P Global, Inc. | | | 65 | | | | 22,866 | |

Truist Financial Corp. | | | 361 | | | | 16,758 | |

| | | | | | | | 273,338 | |

The accompanying notes are an integral part of these financial statements.

| |

| 18 |

Schedule of Investments (Continued) | Global Beta Momentum-Growth ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 99.9% (Continued) | | | | | | | | |

Health Care — 11.4% | | | | | | | | |

AbbVie, Inc. | | | 474 | | | $ | 49,571 | |

Alexion Pharmaceuticals, Inc. * | | | 59 | | | | 7,204 | |

Amgen, Inc. | | | 158 | | | | 35,082 | |

Anthem, Inc. | | | 68 | | | | 21,183 | |

Bristol-Myers Squibb Co. | | | 609 | | | | 38,002 | |

Catalent, Inc. * | | | 44 | | | | 4,230 | |

Centene Corp. * | | | 155 | | | | 9,556 | |

Danaher Corp. | | | 169 | | | | 37,962 | |

Humana, Inc. | | | 36 | | | | 14,419 | |

Incyte Corp. * | | | 48 | | | | 4,058 | |

PerkinElmer, Inc. | | | 30 | | | | 3,990 | |

Regeneron Pharmaceuticals, Inc. * | | | 27 | | | | 13,933 | |

ResMed, Inc. | | | 39 | | | | 8,174 | |

Thermo Fisher Scientific, Inc. | | | 107 | | | | 49,753 | |

Vertex Pharmaceuticals, Inc. * | | | 70 | | | | 15,943 | |

West Pharmaceutical Services, Inc. | | | 20 | | | | 5,503 | |

| | | | | | | | 318,563 | |

Industrials — 4.7% | | | | | | | | |

Equifax, Inc. | | | 33 | | | | 5,508 | |

Expeditors International of Washington, Inc. | | | 45 | | | | 4,022 | |

Fastenal Co. | | | 153 | | | | 7,566 | |

Ingersoll Rand, Inc. * | | | 93 | | | | 4,117 | |

L3Harris Technologies, Inc. | | | 58 | | | | 11,135 | |

Lockheed Martin Corp. | | | 67 | | | | 24,455 | |

Northrop Grumman Corp. | | | 42 | | | | 12,695 | |

Raytheon Technologies Corp. | | | 394 | | | | 28,258 | |

United Parcel Service, Inc. - Class B | | | 189 | | | | 32,332 | |

| | | | | | | | 130,088 | |

Information Technology — 53.6% | | | | | | | | |

Advanced Micro Devices, Inc. * | | | 603 | | | | 55,874 | |

Akamai Technologies, Inc. * | | | 83 | | | | 8,591 | |

ANSYS, Inc. * | | | 44 | | | | 14,875 | |

Apple, Inc. | | | 2,266 | | | | 269,767 | |

Applied Materials, Inc. | | | 472 | | | | 38,931 | |

Autodesk, Inc. * | | | 113 | | | | 31,666 | |

Broadcom, Inc. | | | 206 | | | | 82,725 | |

Broadridge Financial Solutions, Inc. | | | 59 | | | | 8,666 | |

Cadence Design Systems, Inc. * | | | 143 | | | | 16,631 | |

Citrix Systems, Inc. | | | 60 | | | | 7,435 | |

Fidelity National Information Services, Inc. | | | 318 | | | | 47,194 | |

Fiserv, Inc. * | | | 290 | | | | 33,402 | |

Fortinet, Inc. * | | | 69 | | | | 8,503 | |

Global Payments, Inc. | | | 154 | | | | 30,059 | |

Intel Corp. | | | 2,180 | | | | 105,403 | |

Intuit, Inc. | | | 134 | | | | 47,171 | |

Jack Henry & Associates, Inc. | | | 39 | | | | 6,274 | |

KLA Corp. | | | 80 | | | | 20,158 | |

Lam Research Corp. | | | 75 | | | | 33,949 | |

Leidos Holdings, Inc. | | | 68 | | | | 6,848 | |

Microsoft Corp. | | | 1,262 | | | | 270,156 | |

NetApp, Inc. | | | 113 | | | | 6,024 | |

NVIDIA Corp. | | | 317 | | | | 169,931 | |

The accompanying notes are an integral part of these financial statements.

| |

| 19 |

Schedule of Investments (Continued) | Global Beta Momentum-Growth ETF |

November 30, 2020

| | Number of

Shares | | | Value | |

COMMON STOCKS — 99.9% (Continued) | | | | | | | | |

Information Technology — 53.6% (Continued) | | | | | | | | |

PayPal Holdings, Inc. * | | | 605 | | | $ | 129,543 | |

Seagate Technology PLC | | | 116 | | | | 6,822 | |

Synopsys, Inc. * | | | 78 | | | | 17,745 | |

Teradyne, Inc. | | | 85 | | | | 9,379 | |

Western Digital Corp. | | | 154 | | | | 6,911 | |

| | | | | | | | 1,490,633 | |

Materials — 0.5% | | | | | | | | |

Newmont Corp. | | | 215 | | | | 12,646 | |

| | | | | | | | | |

Real Estate — 0.6% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 34 | | | | 5,567 | |

Mid-America Apartment Communities, Inc. | | | 31 | | | | 3,911 | |

Realty Income Corp. | | | 92 | | | | 5,517 | |

UDR, Inc. | | | 79 | | | | 3,039 | |

| | | | | | | | 18,034 | |

Utilities — 1.0% | | | | | | | | |

American Water Works Co., Inc. | | | 51 | | | | 7,822 | |

Edison International | | | 101 | | | | 6,197 | |

Pinnacle West Capital Corp. | | | 30 | | | | 2,456 | |

Sempra Energy | | | 78 | | | | 9,943 | |

| | | | | | | | 26,418 | |

TOTAL COMMON STOCKS (Cost $2,534,977) | | | | | | | 2,779,462 | |

| | | | | | | | | |

Money Market Fund — 0.1% | | | | | | | | |

First American Government Obligations Fund - Class X, 0.05% (a) | | | 1,976 | | | | 1,976 | |

TOTAL MONEY MARKET FUND (Cost $1,976) | | | | | | | 1,976 | |

TOTAL INVESTMENTS — 100% (Cost $2,536,953) | | | | | | | 2,781,438 | |

OTHER ASSETS LESS LIABILITIES — 0.0% # | | | | | | | 477 | |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 2,781,915 | |

^ | U.S. Dollar-denominated foreign security. |

* | Non-income producing security. |

(#) | Represents less than 0.05% of net assets. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by Global Beta Advisors LLC.

The accompanying notes are an integral part of these financial statements.

| |

| 20 |

Statement of Assets and Liabilities | Global Beta ETF Trust |

November 30, 2020

| | | Global Beta

Smart Income

ETF | | | Global Beta

Low Beta

ETF | | | Global Beta

Momentum-

Growth ETF | |

ASSETS | | | | | | | | | | | | |

Investments in securities, at value (identified cost $1,493,818, $2,526,104, $2,534,977) (See Note 2) | | $ | 1,714,440 | | | $ | 2,689,389 | | | $ | 2,779,462 | |

Investments in money market fund, at value (identified cost $1,597, $766, $1,976) (See Note 2) | | | 1,597 | | | | 766 | | | | 1,976 | |

Total securities, at value (identified cost $1,495,415, $2,526,870, $2,536,953) (See Note 2) | | | 1,716,037 | | | | 2,690,155 | | | | 2,781,438 | |

Receivables: | | | | | | | | | | | | |

Investment securities sold | | | 8 | | | | — | | | | — | |

Dividends and interest | | | 10,244 | | | | 6,992 | | | | 3,107 | |

Due from adviser | | | 3,809 | | | | 3,218 | | | | 3,203 | |

Prepaid expenses and other assets | | | 167 | | | | 1,667 | | | | 1,667 | |

Total assets | | | 1,730,265 | | | | 2,702,032 | | | | 2,789,415 | |

| | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | |

Payables: | | | | | | | | | | | | |

Trustee fees | | | 15,000 | | | | 7,500 | | | | 7,500 | |

Total liabilities | | | 15,000 | | | | 7,500 | | | | 7,500 | |

NET ASSETS | | $ | 1,715,265 | | | $ | 2,694,532 | | | $ | 2,781,915 | |

| | | | | | | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | | | | | |

Paid-in capital | | $ | 2,069,891 | | | $ | 2,520,466 | | | $ | 2,558,295 | |

Total distributable earnings (loss) | | | (354,626 | ) | | | 174,066 | | | | 223,620 | |

NET ASSETS | | $ | 1,715,265 | | | $ | 2,694,532 | | | $ | 2,781,915 | |

| | | | | | | | | | | | | |

Shares issued and outstanding, $0 par value, unlimited shares authorized | | | 100,000 | | | | 125,000 | | | | 125,000 | |

| | | | | | | | | | | | | |

Net Asset Value, Offering Price and Redemption Price Per Share | | $ | 17.15 | | | $ | 21.56 | | | $ | 22.26 | |

The accompanying notes are an integral part of these financial statements.

| |

| 21 |

Statement of Operations | Global Beta ETF Trust |

For The Period Ended November 30, 2020

| | | Global Beta

Smart Income

ETF(a) | | | Global Beta

Low Beta

ETF(b) | | | Global Beta

Momentum-

Growth ETF(b) | |

INVESTMENT INCOME | | | | | | | | | | | | |

Dividends | | $ | 80,482 | | | $ | 21,484 | | | $ | 10,768 | |

Interest | | | 13 | | | | 4 | | | | 5 | |

Total investment income | | | 80,495 | | | | 21,488 | | | | 10,773 | |

| | | | | | | | | | | | | |

EXPENSES | | | | | | | | | | | | |

Investment advisory fees | | | 4,569 | | | | 2,692 | | | | 2,741 | |

Trustee fees | | | 67,500 | | | | 15,000 | | | | 15,000 | |

Legal fees | | | 13,167 | | | | 1,667 | | | | 1,667 | |

Total expenses | | | 85,236 | | | | 19,359 | | | | 19,408 | |

Less: voluntary fees waived adviser | | | (2,698 | ) | | | — | | | | — | |

Less: fees reimbursed by adviser | | | (80,667 | ) | | | (16,667 | ) | | | (16,667 | ) |

Net expenses | | | 1,871 | | | | 2,692 | | | | 2,741 | |

Net Investment Income | | | 78,624 | | | | 18,796 | | | | 8,032 | |

| | | | | | | | | | | | | |

REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Investments | | | (587,836 | ) | | | (15 | ) | | | (25,881 | ) |

In-Kind Redemptions | | | (119,000 | ) | | | 17,031 | | | | 47,854 | |

Net realized gains (losses) | | | (706,836 | ) | | | 17,016 | | | | 21,973 | |

Change in net unrealized appreciation on investments | | | 220,622 | | | | 163,285 | | | | 244,485 | |

Net realized and unrealized gain (loss) on investments | | | (486,214 | ) | | | 180,301 | | | | 266,458 | |

Net increase (decrease) in net assets resulting from operations | | $ | (407,590 | ) | | $ | 199,097 | | | $ | 274,490 | |

(a) | Commencement of investment operations on December 27, 2019. |

(b) | Commencement of investment operations on July 24, 2020. |

The accompanying notes are an integral part of these financial statements.

| |

| 22 |

Statement of Changes in Net Assets | Global Beta Smart Income ETF |

| | | For the Period

Ended

November 30,

2020(a) | |

OPERATIONS | | | | |

Net investment income | | $ | 78,624 | |

Net realized loss | | | (706,836 | ) |

Net change in unrealized appreciation | | | 220,622 | |

Net decrease in net assets resulting from operations | | | (407,590 | ) |

| | | | | |

DISTRIBUTIONS | | | | |

Distributable earnings | | | (66,000 | ) |

Total distributions | | | (66,000 | ) |

| | | | | |

CAPITAL TRANSACTIONS | | | | |

Proceeds from shares issued | | $ | 2,400,000 | |

Cost of shares redeemed | | | (311,145 | ) |

Net increase from capital transactions | | | 2,088,855 | |

Total Increase in Net Assets | | $ | 1,615,265 | |

| | | | | |

NET ASSETS | | | | |

Beginning of period | | | 100,000 | (b) |

End of period | | $ | 1,715,265 | |

| | | | | |

SHARE TRANSACTIONS | | | | |

Beginning of period | | | 5,000 | (b) |

Shares issued in-kind | | | 125,000 | |

Shares redeemed | | | (5,000 | )(b) |

Shares redeemed in-kind | | | (25,000 | ) |

Shares Outstanding, End of Period | | | 100,000 | |

(a) | Commencement of investment operations on December 27, 2019. |

(b) | Beginning capital of $100,000 was contributed by Global Beta Advisors LLC, investment adviser to the Fund, in exchange for 5,000 Shares of the Fund in connection with the seeding of the Trust. The Shares were redeemed by the adviser on the commencement of investment operations on December 27, 2019. |

The accompanying notes are an integral part of these financial statements.

| |

| 23 |

Statement of Changes in Net Assets | Global Beta Low Beta ETF |

| | | For the Period

Ended

November 30,

2020(a) | |

OPERATIONS | | | | |

Net investment income | | $ | 18,796 | |

Net realized gain | | | 17,016 | |

Net change in unrealized appreciation | | | 163,285 | |

Net increase in net assets resulting from operations | | | 199,097 | |

| | | | | |

DISTRIBUTIONS | | | | |

Distributable earnings | | | (8,000 | ) |

Total distributions | | | (8,000 | ) |

| | | | | |

CAPITAL TRANSACTIONS | | | | |

Proceeds from shares issued | | $ | 3,014,113 | |

Cost of shares redeemed | | | (510,678 | ) |

Net increase from capital transactions | | | 2,503,435 | |

Total Increase in Net Assets | | $ | 2,694,532 | |

| | | | | |

NET ASSETS | | | | |

Beginning of period | | | — | |

End of period | | $ | 2,694,532 | |

| | | | | |

SHARE TRANSACTIONS | | | | |

Beginning of period | | | — | |

Shares issued in-kind | | | 150,000 | |

Shares redeemed in-kind | | | (25,000 | ) |

Shares Outstanding, End of Period | | | 125,000 | |

(a) | Commencement of investment operations on July 24, 2020. |

The accompanying notes are an integral part of these financial statements.

| |

| 24 |

Statement of Changes in Net Assets | Global Beta Momentum-Growth ETF |

| | | For the Period

Ended

November 30,

2020(a) | |

OPERATIONS | | | | |

Net investment income | | $ | 8,032 | |

Net realized gain | | | 21,973 | |

Net change in unrealized appreciation | | | 244,485 | |

Net increase in net assets resulting from operations | | | 274,490 | |

| | | | | |

DISTRIBUTIONS | | | | |

Distributable earnings | | | (3,000 | ) |

Total distributions | | | (3,000 | ) |

| | | | | |

CAPITAL TRANSACTIONS | | | | |

Proceeds from shares issued | | $ | 3,019,328 | |

Cost of shares redeemed | | | (508,903 | ) |

Net increase from capital transactions | | | 2,510,425 | |

Total Increase in Net Assets | | $ | 2,781,915 | |

| | | | | |

NET ASSETS | | | | |

Beginning of period | | | — | |

End of period | | $ | 2,781,915 | |

| | | | | |

SHARE TRANSACTIONS | | | | |

Beginning of period | | | — | |

Shares issued in-kind | | | 150,000 | |

Shares redeemed in-kind | | | (25,000 | ) |

Shares Outstanding, End of Period | | | 125,000 | |

(a) | Commencement of investment operations on July 24, 2020. |

The accompanying notes are an integral part of these financial statements.

| |

| 25 |

Financial Highlights | Global Beta Smart Income ETF |

For a capital share outstanding throughout the period

| | | For the Period

Ended

November 30,

2020(a) | |

Net asset value, beginning of period | | $ | 20.00 | |

| | | | | |

INCOME FROM INVESTMENT OPERATIONS: | | | | |

Net investment income (b) | | | 0.74 | |

Net realized and unrealized loss on investments(c) | | | (2.99 | ) |

Total from investment operations | | | (2.25 | ) |

| | | | | |

LESS DISTRIBUTIONS: | | | | |

From net investment income | | | (0.60 | ) |

Total distributions | | | (0.60 | ) |

| | | | | |

Net asset value, end of period | | $ | 17.15 | |

| | | | | |

TOTAL RETURNS: | | | | |

Net Asset Value(f) | | | -10.35 | %^ |

Market Value(g) | | | -10.54 | %^ |

| | | | | |

RATIOS/SUPPLEMENTAL DATA: | | | | |

Net assets, end of period (millions) | | $ | 1.7 | |

RATIO OF EXPENSES TO AVERAGE NET ASSETS: | | | | |

Before fees waived and expenses reimbursed | | | 5.41 | %+ |

After fees waived and expenses reimbursed(d) | | | 0.12 | %+ |

RATIO OF NET INVESTMENT INCOME (LOSS) TO AVERAGE NET ASSETS: | | | | |

Before fees waived and expenses reimbursed | | | (0.30 | )%+ |

After fees waived and expenses reimbursed(d) | | | 4.99 | %+ |

Portfolio turnover rate(e) | | | 169 | %^ |

(a) | Commencement of investment operations on December 27, 2019. |

(b) | Calculated using average shares outstanding, during the period. |

(c) | The amounts reported for a share outstanding may not agree with the change in the aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

(d) | Includes voluntary fees waived by the Adviser of $2,698 or 0.17% of average net assets for the period. |

(e) | Portfolio turnover rate excludes in-kind transactions. |

(f) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at net asset value. |

(g) | Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at market value. The market value is determined by the midpoint of the bid/ask spread at 4:00 p.m. from the NYSE Arca, Inc. Exchange. Market value returns may vary from net asset value returns. |

The accompanying notes are an integral part of these financial statements.

| |

| 26 |

Financial Highlights | Global Beta Low Beta ETF |

For a capital share outstanding throughout the period

| | | For the Period

Ended

November 30,

2020(a) | |

Net asset value, beginning of period | | $ | 20.00 | |

| | | | | |

INCOME FROM INVESTMENT OPERATIONS: | | | | |

Net investment income (b) | | | 0.15 | |

Net realized and unrealized gain on investments(c) | | | 1.46 | |

Total from investment operations | | | 1.61 | |

| | | | | |

LESS DISTRIBUTIONS: | | | | |

From net investment income | | | (0.05 | ) |

Total distributions | | | (0.05 | ) |

| | | | | |

Net asset value, end of period | | $ | 21.56 | |

| | | | | |

TOTAL RETURNS: | | | | |

Net Asset Value(e) | | | 8.06 | %^ |

Market Value(f) | | | 7.97 | %^ |

| | | | | |

RATIOS/SUPPLEMENTAL DATA: | | | | |

Net assets, end of period (millions) | | $ | 2.7 | |

RATIO OF EXPENSES TO AVERAGE NET ASSETS: | | | | |

Before fees waived and expenses reimbursed | | | 2.09 | %+ |

After fees waived and expenses reimbursed | | | 0.29 | %+ |

RATIO OF NET INVESTMENT INCOME (LOSS) TO AVERAGE NET ASSETS: | | | | |

Before fees waived and expenses reimbursed | | | 0.23 | %+ |

After fees waived and expenses reimbursed | | | 2.03 | %+ |

Portfolio turnover rate(d) | | | 0 | %^,# |

(a) | Commencement of investment operations on July 24, 2020. |

(b) | Calculated using average shares outstanding, during the period. |

(c) | The amounts reported for a share outstanding may not agree with the change in the aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

(d) | Portfolio turnover rate excludes in-kind transactions. |

(e) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at net asset value. |

(f) | Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at market value. The market value is determined by the midpoint of the bid/ask spread at 4:00 p.m. from the NYSE Arca, Inc. Exchange. Market value returns may vary from net asset value returns. |

The accompanying notes are an integral part of these financial statements.

| |

| 27 |

Financial Highlights | Global Beta Momentum-Growth ETF |

For a capital share outstanding throughout the period

| | | For the Period

Ended

November 30,

2020(a) | |

Net asset value, beginning of period | | $ | 20.00 | |

| | | | | |

INCOME FROM INVESTMENT OPERATIONS: | | | | |

Net investment income (b) | | | 0.06 | |

Net realized and unrealized gain on investments(c) | | | 2.22 | |

Total from investment operations | | | 2.28 | |

| | | | | |

LESS DISTRIBUTIONS: | | | | |

From net investment income | | | (0.02 | ) |

Total distributions | | | (0.02 | ) |

| | | | | |

Net asset value, end of period | | $ | 22.26 | |

| | | | | |

TOTAL RETURNS: | | | | |

Net Asset Value(e) | | | 11.39 | %^ |

Market Value(f) | | | 11.27 | %^ |

| | | | | |

RATIOS/SUPPLEMENTAL DATA: | | | | |

Net assets, end of period (millions) | | $ | 2.8 | |

RATIO OF EXPENSES TO AVERAGE NET ASSETS: | | | | |

Before fees waived and expenses reimbursed | | | 2.05 | %+ |

After fees waived and expenses reimbursed | | | 0.29 | %+ |

RATIO OF NET INVESTMENT INCOME (LOSS) TO AVERAGE NET ASSETS: | | | | |

Before fees waived and expenses reimbursed | | | (0.91 | )%+ |

After fees waived and expenses reimbursed | | | 0.85 | %+ |

Portfolio turnover rate(d) | | | 30 | %^ |

(a) | Commencement of investment operations on July 24, 2020. |

(b) | Calculated using average shares outstanding, during the period. |

(c) | The amounts reported for a share outstanding may not agree with the change in the aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

(d) | Portfolio turnover rate excludes in-kind transactions. |

(e) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at net asset value. |

(f) | Market value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period and redemption on the last day of the period at market value. The market value is determined by the midpoint of the bid/ask spread at 4:00 p.m. from the NYSE Arca, Inc. Exchange. Market value returns may vary from net asset value returns. |

The accompanying notes are an integral part of these financial statements.

| |

| 28 |

Notes to the Financial Statements | Global Beta ETF Trust |

November 30, 2020

NOTE 1 – ORGANIZATION

The Global Beta ETF Trust (the “Trust”) was organized as a Delaware statutory trust on April 22, 2019 and is authorized to issue multiple series or portfolios. The Trust is an open-end management investment company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The offering of the Funds’ shares (“Shares”) is registered under the Securities Act of 1933, as amended. As of the period covered by this report, the Trust consists of three operational exchange-traded funds. The Global Beta Smart Income ETF (the “Smart Income ETF”), Global Beta Low Beta ETF (the “Low Beta ETF”) and Global Beta Momentum-Growth ETF (the “Momentum-Growth ETF”), (each the “Fund”, collectively the “Funds”) each are diversified series of the Trust, pursuant to the 1940 Act. The Funds seeks to track the performance (before fees and expenses) of the Global Beta Smart Income Index, Global Beta Low Beta Factor Index and Global Beta Momentum-Growth Factor Index (their respective “Target Index”), respectively. There can be no guarantee that a Fund will achieve its investment objective. The inception dates of the Smart Income ETF, Low Beta ETF and Momentum-Growth ETF are December 27, 2019, July 24, 2020 and July 24, 2020, respectively.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The Trust, which is an investment company, follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services — Investment Companies.”

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of the financial statements. These policies have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

A. Investment Valuation. The net asset value (“NAV”) of the Funds shares is calculated each business day as of the close of regular trading on the New York Stock Exchange (“NYSE”), generally 4:00 p.m., Eastern Time. NAV per share is computed by dividing the net assets by the number of shares outstanding.

When calculating the NAV of each Fund’s shares, securities held by the Funds are valued at market quotations when reliable market quotations are readily available. Exchange traded securities and instruments (including equity securities, depositary receipts and ETFs) are generally valued at the last reported sale price on the principal exchange on which such securities are traded (at the NASDAQ Official Closing Price for NASDAQ listed securities), as of the close of regular trading on the NYSE on the day the securities are being valued or, if there are no sales, at the mean of the most recent bid and asked prices. Over-the-counter securities and instruments not traded on an exchange are generally valued at the last traded price. In the absence of a recorded transaction sale price; or if the last sale price is unavailable, securities are valued at the mean between last bid and ask, as quoted. If an ask price is unavailable, last bid price is used. Such valuations would typically be categorized as Level 1 or Level 2 in the fair value hierarchy described below.

When reliable market quotations are not readily available, securities are priced at their fair value in accordance with the Trust’s valuation guidelines, which were approved by the Board of Trustees (the “Trustees” or the “Board”). The Fund may use fair value pricing in a variety of circumstances, including but not limited to, situations when the value of the Fund’s security has been materially affected by events occurring after the close of the market on which such security is principally traded (such as a corporate action or other news that may materially affect the price of such security) or trading in such security has been suspended or halted. Such valuations would typically be categorized as Level 2 or Level 3 in the fair value hierarchy described below. Fair value pricing involves subjective judgments and it is possible that a fair value determination for a security is materially different than the value that could be realized upon the sale of such security. In addition, fair value pricing could result in a difference between the prices used to calculate each Fund’s NAV and the prices used by the Funds’ Target Index. This may adversely affect the Funds’ ability to track its Target Index.

The Funds disclose the fair value of its investments in a hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of the Funds (observable inputs) and (2) the Funds’ own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the hierarchy are as follows:

| | ● | Level 1 — Quoted prices in active markets for identical assets. |

| | ● | Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| |

| 29 |

Notes to the Financial Statements (Continued) | Global Beta ETF Trust |

November 30, 2020

| | ● | Level 3 — Significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. |

The following is a summary of the inputs used to value the Global Beta Smart Income ETF investments as of November 30, 2020:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |