consummates a liquidation, merger, share exchange, reorganization or other similar transaction with an unaffiliated third party that results in all of the Company’s shareholders having the right to exchange their equity holdings in Company for cash, securities or other property; provided that 250 shares of Class A common stock shall be free from lock-up for each holder.

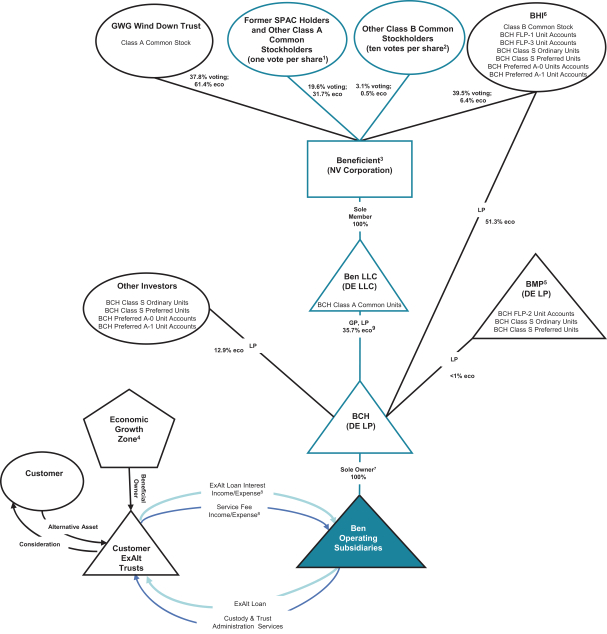

Beneficient Company Holdings, L.P. Interests

Many of our officers, directors and significant equity holders hold, either directly or indirectly, limited partner interests in BCH, and such interests are reflected within the noncontrolling interests in our financial statements. These equity interests in BCH have generally resulted from prior transactions involving the formation or recapitalization of the Company and its subsidiaries and constitute a significant ongoing economic interest in the Company as well as a source of significant economic value and income to the holders of these limited partner interests. Through their participation in the value of these equity interests in BCH, these related parties receive financial benefits from our businesses that include, but are not limited to, certain income allocations, preferred returns, issuances of additional limited partner interests, cash distributions and other payments. The following will describe certain of the rights and preferences of these limited partner interests in BCH and the benefits to our related parties who are holders, either directly or indirectly, of the limited partner interests in BCH.

BCH Preferred A-0 Unit Accounts

Holders of the BCH Preferred A-0 Unit Accounts, which include as of September 30, 2023, BHI, which is owned by The Highland Business Holdings Trust, of which Mr. Heppner is the trustee, and Mr. Heppner and his family are the beneficiaries, and Messrs. Fisher, Hicks (through Hicks Holdings, LLC), Schnitzer and Silk, who were directors of Ben Management and are currently directors of Beneficient, are entitled to quarterly guaranteed cash payments (the “Guaranteed Payments”) equal to 1.50% per fiscal quarter (or 6.0% per annum) of their then respective BCH Preferred A-0 Unit Accounts capital account balance on an annual basis. BCH’s obligation to make such Guaranteed Payment is not subject to available cash and has priority over all other distributions made by BCH. The Guaranteed Payments are not made payable in connection with an allocation of income but are a required cash payment recorded as an expense for BCH. BHI and the other holders of the BCH Preferred A-0 Unit Accounts entered into an agreement to defer the delivery of Guaranteed Payments until November 15, 2024; provided that, the right to such deferred Guaranteed Payments continue to accrue on a quarterly basis and that Guaranteed Payments may be made prior to November 15, 2024 if the Audit Committee of the general partner of BCG determines that making such payment, in part or in full, would not cause the Company to incur a going concern. For the twelve month period ended December 31, 2021 (the “FY 2021 Period”), the three month transition period ended March 31, 2022 (the “TP 2022 Period”), the year ended March 31, 2023 (the “FY 2023 Period”), the three months ended June 30, 2023 (the “Q1 2024 Period”) and the six months ended September 30, 2023 (the “Q2 2024 Period”). Guaranteed Payments in the following respective approximate amounts were accrued, but not paid, to such related party holders of the BCH Preferred A-0 Unit Accounts: BHI-FY 2021 Period, $1 million, TP 2022 Period, $3.1 million, FY 2023 Period, $12.9 million, the Q1 2024 Period, $3,349,720 and the Q2 2024 Period, $3,399,966; Mr. Fisher-FY 2021 Period, $6,000, TP 2022 Period, $17,000, FY 2023 Period, $71,630, the Q1 2024 Period, $18,584 and the Q2 2024 Period, $18,863; Mr. Hicks-FY 2021 Period, $76,601, TP 2022 Period, $230,954, FY 2023 Period, $958,982, the Q1 2024 Period, $248,803 and the Q2 2024 Period, $252,535; Mr. Schnitzer-FY 2021 Period, $6,000, TP 2022 Period, $17,000, FY 2023 Period, $71,630, the Q1 2024 Period $18,584 and the Q2 2024 Period, $18,863; and Mr. Silk-FY 2021 Period, $0, TP 2022 Period, $0 and FY 2023 Period, $70,220, the Q1 2024 Period, $18,218 and the Q2 2024 Period, $18,492. As of September 30, 2023, the aggregate approximate amount of the accrued but unpaid Guaranteed Payments for each of the related party holders of the BCH Preferred A-0 Unit Accounts were as follows: BHI, $23.8 million; Mr. Fisher, $132,049; Mr. Hicks, $1.8 million; Mr. Schnitzer, $132,049; and Mr. Silk, $106,930.

BCH Preferred A-1 Unit Accounts

Holders of the BCH Preferred A-1 Unit Accounts, which as of September 30, 2023 include, BHI, which is owned by The Highland Business Holdings Trust, of which Mr. Heppner is the trustee, and Mr. Heppner and his family are the beneficiaries and Messrs. Fisher, Hicks, Schnitzer and Silk, who were directors of Ben Management and

272