As filed with the Securities and Exchange Commission on October 21, 2024.

Registration No. 333-281694

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-3 ON FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BENEFICIENT

(Exact name of registrant as specified in its charter)

| Nevada | | 6199 | | 72-1573705 |

(State or other Jurisdiction of Incorporation Or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

325 North St. Paul Street, Suite 4850

Dallas, TX 75201

(214) 445-4700

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Gregory W. Ezell

325 N. Saint Paul Street, Suite 4850

Dallas, TX 75201

(214) 445-4700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Matthew L. Fry, Esq.

Haynes and Boone, LLP

2801 N. Hardwood Street

Suite 2300

Dallas, Texas 75201

(214) 651-5000

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| | | | | |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | | | |

| | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Amendment No. 2 to Form S-3 on Form S-1 is being filed to convert the registration statement on Form S-3 originally filed by Beneficient on August 22, 2024 (Registration No. 333-281694) into a registration statement on Form S-1.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 21, 2024

PRELIMINARY PROSPECTUS

BENEFICIENT

203,212,927 Shares of Class A Common Stock

This prospectus relates to the offer and sale, from time to time, by the selling holders identified in this prospectus (the “Selling Holders”), or their permitted transferees, of up to 203,212,927 shares of Class A common stock, par value $0.001 (“Class A common stock”) of Beneficient, a Nevada corporation (the “Company,” “Beneficient” or “Ben”). These shares of Class A common stock consist of:

| ● | 200,081,301 shares of Class A common stock (the “SEPA Shares”) that we may, at our discretion, elect to issue and sell to YA II PN, Ltd. (“Yorkville”) from time to time after the date of this prospectus, pursuant to the Standby Equity Purchase Agreement, dated as of June 27, 2023, entered into by and between the Company and Yorkville (the “SEPA”); |

| ● | 1,325,382 shares of Class A common stock issuable upon conversion of the convertible debentures (the “Conversion Shares”) we agreed to issue and sell to Yorkville pursuant to that certain Securities Purchase Agreement, dated as of August 6, 2024, entered into by and between the Company and Yorkville (the “Purchase Agreement”), in an aggregate principal amount of $4.0 million (the “Convertible Debentures”); |

| ● | 1,325,382 shares of Class A common stock issuable upon exercise of the warrants (the “Warrant Shares”) to purchase 1,325,382 shares of Class A common stock at an exercise price of $2.63 we agreed to issue and sell to Yorkville pursuant to the Purchase Agreement (the “Warrants”); |

| ● | 125,000 shares of Class A common stock issuable upon conversion of the Series B-2 Resettable Convertible Preferred Stock, $0.001 par value per share (the “B-2 preferred stock”), we issued to Mendoza Ventures Pre-Seed Fund II LP (“Mendoza”) pursuant to that certain Subscription Agreement, dated as of January 17, 2024 (the “Mendoza Subscription Agreement”), entered into by and between the Company and Mendoza Ventures Pre-Seed Fund II GP, LLC; |

| ● | 14,286 shares of Class A common stock issuable upon conversion of the Series B-3 Resettable Convertible Preferred Stock, $0.001 par value per share (the “B-3 preferred stock”) we issued to Interest Solutions, LLC (“Interest Solutions”) pursuant to that certain Subscription Agreement, dated as of January 29, 2024 (the “Interest Solutions Subscription Agreement”), entered into by and between the Company and Interest Solutions; |

| ● | 25,751 shares of Class A common stock issuable upon conversion of the Series B-4 Resettable Convertible Preferred Stock, $0.001 par value per share (the “B-4 preferred stock”) we issued to Convergency Partners, LLC (“Convergency Partners”) pursuant to that certain Subscription Agreement, dated as of March 25, 2024 (the “Convergency Subscription Agreement”), entered into by and between the Company and Convergency Partners; |

| | | |

| | ● | 114,343 shares of Class A common stock issued to Maxim Partners LLC (“Maxim Partners” and such shares, the “Maxim Shares) pursuant to that certain Amendment to the Settlement and Release Agreement, dated as of May 9, 2024 (such amendment, the “Amendment to the Settlement and Release Agreement”), entered into by and between the Company and Maxim Group LLC (“Maxim Group”); and |

| | | |

| | ● | 201,482 shares of Class A common stock (the “Vendor Shares”) issued pursuant to that certain Subscription Agreement, dated as of September 17, 2024 (as amended, the “Vendor Subscription Agreement”), entered into by and between the Company and Mendota Financial Company, LLC (the “Vendor”). |

Pursuant to the terms of the SEPA, the Company agreed to issue and sell to Yorkville, from time to time, and Yorkville agreed to purchase from the Company, up to $250 million of the Company’s shares of Class A common stock.

As of the date hereof, 503,827 shares of the Company’s Class A common stock (as adjusted for stock splits) have been offered and sold to Yorkville under the SEPA for an aggregate price of approximately $3.9 million. On June 20, 2024, the Company received stockholder approval for purposes of Listing Rule 5635(d) of The Nasdaq Stock Market, LLC (“Nasdaq”) to issue more than 20% of the Company’s outstanding shares of Class A common stock as of June 27, 2023 under the SEPA. Approximately $246.1 million remains available under the SEPA. We are registering hereunder the resale of an additional 200,081,301 shares of our authorized shares of Class A common stock, representing a portion of the shares that may be issuable to Yorkville under the SEPA. Pursuant to the Company’s contractual obligations under the SEPA, the Company filed a registration statement on Form S-1 (File No. 333-273326) (the “SEPA Form S-1”) to register 1,140,511 shares of Class A common stock (as adjusted for stock splits) that may be sold by Yorkville. To date, 503,827 shares of the Company’s Class A common stock (as adjusted for stock splits) registered on the SEPA Form S-1 have been offered and sold to Yorkville under the SEPA. On July 9, 2024, the Company filed its Annual Report on Form 10-K, which constituted a fundamental change to the SEPA Form S-1 such that no additional shares may be sold by Yorkville pursuant to the SEPA Form S-1 without further amending the SEPA Form S-1. On September 20, 2024, the Company filed a post-effective amendment to the SEPA Form S-1 to terminate the effectiveness of the SEPA Form S-1 and to deregister, as of the effective date of the amendment, all registered securities that remained unsold under the SEPA Form S-1 as of the date thereof.

The shares under the SEPA may be issued and sold to Yorkville under one of two pricing options, at the election of the Company. Under the first option (“Pricing Option 1”), the Company will sell the shares of Class A common stock to Yorkville at 95% of the Market Price (as defined below) for any period commencing on the receipt of the advance notice by Yorkville and ending on 4:00 p.m. New York City time on the applicable advance notice date (the “Option 1 Pricing Period”). Under the second option (“Pricing Option 2”), the Company will sell the shares of Class A common stock to Yorkville at 97% of the Market Price for any three consecutive trading days commencing on the advance notice date (the “Option 2 Pricing Period”). “Market Price” is defined as, for any Option 1 Pricing Period, the daily volume weighted average price (“VWAP”) of the Class A common stock on Nasdaq during the Option 1 Pricing Period, and for any Option 2 Pricing Period, the lowest VWAP of the Class A common stock on the Nasdaq during the Option 2 Pricing Period.

We may not issue or sell any shares of Class A common stock to Yorkville under the SEPA that, when aggregated with all other shares of Class A common stock then beneficially owned by Yorkville and its affiliates (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 13d-3 promulgated thereunder), would result in Yorkville and its affiliates beneficially owning more than 9.99% of the outstanding shares of Class A common stock (the “9.99% Beneficial Ownership Limitation”). In addition, the number of shares of Class A common stock that we may issue to Yorkville under the SEPA may be limited by the number of our authorized shares of Class A common stock.

On October 2, 2024, we received stockholder approval to file an amendment to our Articles of Incorporation to increase the number of authorized shares of Class A common stock from 18,750,000 to 5,000,000,000. As a result, as of October 21, 2024, we were authorized to issue a maximum of 5,000,000,000 shares of Class A common stock, and we had an aggregate of 4,783,694 shares of Class A common stock outstanding. Assuming a (i) Market Price of $1.23, the closing price of our Class A common stock on October 18, 2024 and (ii) no beneficial ownership limitations, we may issue up to approximately 210,611,896 shares of Class A common stock under Pricing Option 1 and up to approximately 206,269,382 shares of Class A common stock under Pricing Option 2, which would reflect approximately 97.78% and 97.73%, respectively, of the outstanding shares of our Class A common stock as of the date hereof after giving effect to such issuances.

We may not have access to the full $246.1 million amount remaining available under the SEPA due to the reasons noted above. Please see “Selling Security Holders—Material Relationships with Selling Holders—SEPA” for more information regarding the SEPA.

On August 6, 2024, the Company, entered into a Purchase Agreement with Yorkville, in connection with the issuance and sale by the Company of Convertible Debentures issuable in an aggregate principal amount of up to $4.0 million, which will be convertible into shares of the Company’s Class A common stock (as converted, the “Conversion Shares”). Yorkville purchased and the Company issued $2.0 million in aggregate principal amount of Convertible Debentures upon the signing the Purchase Agreement (the “First Closing”). Yorkville will purchase and the Company will issue an additional $2.0 million in aggregate principal amount of Convertible Debentures on or before the first business day after the date the registration statement of which this prospectus forms a part registering the resale of the Conversion Shares and the Warrant Shares (each as defined below) is declared effective by the Securities and Exchange Commission (the “SEC” and such closing, the “Second Closing”). Contemporaneously with the execution and delivery of the Purchase Agreement, certain of the Company’s subsidiaries entered into a global guaranty agreement in favor of Yorkville with respect to the Company’s obligations under the Purchase Agreement, the Convertible Debentures and the Warrants.

The Convertible Debentures do not bear interest, subject to a potential increase to 18.0% per annum (or the maximum amount permitted by applicable law) upon the occurrence of certain events of default. The Convertible Debentures will mature on February 6, 2025 (the “Maturity Date”) and will result in gross proceeds to the Company of approximately $3.6 million. The Convertible Debentures are or will be issued at an original issue discount of 10%. The Company will be required to make monthly cash payments of principal in the amount of $1.3 million (or such lesser amount as may then be outstanding) plus all accrued and unpaid interest as of such payment. Such payments will commence 30 days following the Second Closing and will continue on a monthly basis thereafter until the Convertible Debentures are repaid in full, subject to certain conditions as described in the Convertible Debentures. The Convertible Debentures are convertible at the option of the holder into Class A common stock equal to the applicable Conversion Amount (as defined in the Convertible Debentures) divided by $3.018 (the “Conversion Price”). The maximum amount of shares issuable upon conversion of the Convertible Debentures is 1,325,382.

The Convertible Debentures provide the Company, subject to certain conditions, with an optional redemption right pursuant to which the Company, upon 10 trading days’ prior written notice to Yorkville (the “Redemption Notice”), may redeem in cash, in whole or in part, all amounts outstanding under the Convertible Debentures prior to the Maturity Date; provided that the volume weighted average price on the date such Redemption Notice is delivered is less than the Conversion Price at the time of the Redemption Notice. The redemption amount shall be equal to the outstanding principal balance being redeemed by the Company, plus the redemption premium of 10% of the principal amount being redeemed, plus all accrued and unpaid interest in respect of such redeemed principal amount.

Additionally, pursuant to the terms of the Purchase Agreement, the Company agreed to issue the Warrants to Yorkville to purchase up to 1,325,382 shares of Class A common stock at an exercise price of $2.63, which shall be exercisable into Class A common stock for cash. At the First Closing, the Company issued a Warrant to Yorkville to purchase up to 662,691 shares of Class A common stock, and at the Second Closing, the Company will issue an additional Warrant to Yorkville to purchase up to 662,691 shares of Class A common stock. The Company is filing this Registration Statement pursuant to its obligations under a registration rights agreement with Yorkville entered into in connection with the Purchase Agreement.

The shares of Class A common stock that may be sold by the Selling Holders and the shares of Class A common stock that may be issued by us are collectively referred to in this prospectus as the “Offered Securities.” We will not receive any of the proceeds from the sale by the Selling Holders of the Offered Securities.

We will bear all costs, expenses and fees in connection with the registration of Offered Securities. The Selling Holders will bear all commissions and discounts, if any, attributable to their respective sales of Offered Securities. We are registering certain shares of our Class A common stock for sale by the Selling Holders pursuant to various registration rights agreements with the Selling Holders. See the section of this prospectus entitled “Selling Security Holders” for more information.

Yorkville is an “underwriter” with respect to the SEPA Shares within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”), and any profits on the sales of the SEPA Shares by Yorkville and any discounts, commissions, or concessions received by Yorkville with respect to the SEPA Shares are deemed to be underwriting discounts and commissions under the Securities Act. Yorkville may be deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act with respect to the Warrant Shares and the Conversion Shares and any profits on the sales of shares of the Warrant Shares and the Conversion Shares by Yorkville and any discounts, commissions, or concessions received by Yorkville with respect to the Warrant Shares and Conversion Shares may be deemed to be underwriting discounts and commissions under the Securities Act. Additionally, Mendoza, Interest Solutions, Convergency Partners, Maxim Partners and the Vendor may be deemed “underwriters” within the meaning of Section 2(a)(11) of the Securities Act and any profits on the sales of shares of such securities by such Selling Holders and any discounts, commissions, or concessions received by the Selling Holders may be deemed to be underwriting discounts and commissions under the Securities Act.

The Selling Holders may offer and sell the Offered Securities owned by them covered by this prospectus from time to time. The Selling Holders may offer and sell the Offered Securities owned by them covered by this prospectus in a number of different ways and at varying prices. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in any applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and any applicable prospectus supplement describing the method and terms of the offering of such securities. You should carefully read this prospectus and any applicable prospectus supplement before you invest in our securities.

Our Class A common stock and public warrants (the “Public Warrants”) are listed on The Nasdaq Capital Market under the symbols “BENF” and “BENFW,” respectively. On October 18, 2024, the last reported sales price of the Class A common stock was $1.23 per share, and the last reported sales price of our Public Warrants was $0.0086 per Public Warrant. We are an “emerging growth company” and a “smaller reporting company” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. Certain holders of our Class B common stock, par value $0.001 (the “Class B common stock,” and together with the Class A common stock, the “Common Stock”) have entered into a stockholders agreement (the “Stockholders Agreement”) concerning the election of directors of the Company, and holders of Class B common stock (the “Class B Holders”) have the right to elect a majority of the Company’s directors. As a result, the Company is a “controlled company” within the meaning of the Nasdaq Listing Rules and may elect not to comply with certain corporate governance standards.

See “Risk Factors” beginning on page 9 to read about factors you should consider before investing in shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with SEC using a “shelf” registration process. The Selling Stockholders may, from time to time, sell the securities described in this prospectus. You should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. Neither we nor the Selling Stockholders have authorized anyone to provide you with different information. Neither we nor the Selling Stockholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should not assume that the information in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date of the applicable document. Since the date of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed. Neither we nor the Selling Stockholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus entitled “Where You Can Find More Information.”

Unless we state otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “our business” “Ben,” “Beneficient,” “the Company” and “our company” refer to and similar references refer to Beneficient and its consolidated subsidiaries.

MARKET AND INDUSTRY DATA

Certain industry data and market data included in this prospectus were obtained from independent third-party surveys, market research, publicly available information, reports of governmental agencies and industry publications and surveys. All of the estimates of Beneficient’s management presented herein are based upon review of independent third-party surveys and industry publications prepared by a number of sources and other publicly available information by Beneficient’s management. Third-party industry publications and forecasts state that the information contained therein has been obtained from sources generally believed to be reliable, yet not independently verified. The industry data, market data and estimates used in this prospectus involve assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. Although we have no reason to believe that the information from industry publications and surveys included in this prospectus is unreliable, we have not verified this information and cannot guarantee its accuracy or completeness. We believe that industry data, market data and related estimates provide general guidance, but are inherently imprecise. The industry in which Beneficient operates is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors—Risks Relating to Business and Industry” and elsewhere in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This document contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this registration statement may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

EXPLANATORY NOTE

On June 6, 2023, the registrant converted from a Delaware limited partnership called The Beneficient Company Group, L.P. (“BCG”) to a Nevada corporation called “Beneficient” (the “Conversion”) in connection with the closing of its merger with Avalon Acquisition Inc. (such transaction, the “Business Combination”), a special purpose acquisition vehicle and a Delaware corporation. References to “BCG,” “Ben,” “we,” “us,” “our,” the “Company” and similar terms, prior to the effective time of the Conversion, refer to the registrant when it was a Delaware limited partnership and such references following the effective time of the Conversion, refer to the registrant in its current corporate form as a Nevada corporation called “Beneficient.”

On June 6, 2023, immediately prior to the Conversion, BCG was recapitalized (the “BCG Recapitalization”) as follows: (i) the limited partnership agreement of BCG was amended to create one new subclass of BCG common units, the Class B Common Units (the “BCG Class B Common Units”), and the existing common units were renamed the Class A Common Units (the “BCG Class A Common Units”); and (ii) certain holders of the Preferred Series A Subclass 1 Unit Accounts of Beneficient Company Holdings, L.P. (“BCH” and such units, the “BCH Preferred A-1 Unit Accounts”) entered into conversion and exchange agreements (the “BCG Conversion and Exchange Agreements”) with BCG and BCH, pursuant to which they converted certain BCH Preferred A-1 Unit Accounts to Class S Ordinary Units of BCH (“BCH Class S Ordinary Units”), which were then contributed to BCG in exchange for BCG Class A Common Units.

Prior to the Conversion, the Company’s outstanding equity interests consisted of common units, one series of preferred units, and noncontrolling interests. Pursuant to the Conversion, each BCG Class A Common Unit converted into 1.25 shares of Class A common stock, each BCG Class B Common Unit converted into 1.25 shares of Class B common stock and the capital account balance of the Preferred Series B Subclass 2 Unit Accounts of BCG (“BCG Preferred B-2 Unit Accounts”) converted into shares of Class A common stock at a rate based on a 20% discount to the $800.00 valuation of the Class A common stock (or $640.00). As a result, in the Conversion, we issued 1,076,462 shares of Class A common stock with respect to the BCG Class A Common Units, 239,256 shares of Class B common stock with respect to the BCG Class B Common Units and 1,175,632 shares of Class A common stock with respect to the BCG Preferred B-2 Unit Accounts.

In order to maintain its listing on Nasdaq, the Company effected a reverse stock split of its Common Stock at a ratio of eighty (80) to one (1) and a simultaneous proportionate reduction in the authorized shares of each class of Common Stock as required by Nevada Revised Statues (“NRS”) Section 78.207 (the “Reverse Stock Split”). The Company’s Class A common stock commenced trading on a post-reverse stock split basis at market open on April 18, 2024. Proportional adjustments were made to the number of shares of Common Stock issuable upon exercise or conversion of the Company’s equity award, warrants, and other equity instruments convertible into common stock, as well as the applicable exercise price. All share and per share amounts of our Common Stock presented in this registration statement of which this prospectus forms a part have been retroactively adjusted to reflect the Reverse Stock Split.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and the documents incorporated by reference herein or therein contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, that are subject to risks and uncertainties. We have based these forward- looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of such terms or other similar expressions. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that could cause actual results to differ materially from those projected or otherwise implied by the forward- looking statements. Below is a summary of certain material factors that may make an investment in our Class A common stock speculative or risky:

| ● | we do not have a significant operating history or an established customer base; |

| ● | our fair value estimates of illiquid assets may not accurately estimate prices obtained at the time we enter into any liquidity transaction, and we cannot provide assurance that the values of the alternative assets underlying the liquidity transactions that we report from time to time will be realized; |

| ● | our failure to meet the continued listing requirements of Nasdaq could result in our Class A common stock being delisted from Nasdaq; |

| ● | the resulting market price of our Class A common stock following the Reverse Stock Split may not attract new investors, and it is not certain that the Reverse Stock Split will result in a sustained proportionate increase in the market price of our Class A common stock; |

| ● | the transfer of GWG Holdings Inc.’s (“GWG Holdings” or “GWG”) assets to the GWG Wind Down Trust and the Litigation Trust pursuant to the Second Amended Joint Chapter 11 Plan (the “Second Amended Plan”) could create significant uncertainties and risks for our continued operations and materially and adversely impact our financial operating results; |

| ● | future resales of Class A common stock may cause the market price of Class A common stock to drop significantly; |

| ● | the market price for Class A common stock may be subject to substantial fluctuations, which may make it difficult for stockholders to sell shares at the volumes, prices, and times desired; |

| ● | the GWG Wind Down Trust currently owns a substantial percentage of the Company and continues to have voting power with respect to those matters on which our stockholders have the right to vote; |

| ● | we may be adversely affected by negative publicity; |

| ● | we have been involved in a now-terminated SEC investigation and may be subject to other regulatory investigations and proceedings; |

| ● | a determination that we are an unregistered investment company would have serious adverse consequences; |

| ● | the Company is currently involved in legal proceedings and government investigations and may be a party to additional claims and litigation in the future; |

| ● | our liquidity, profitability and business may be adversely affected by concentrations of assets, which are collateralized by a portion of the cash flows from the exchanged alternative assets (the “Collateral”); |

| ● | we engage in related party transactions, which may result in conflicts of interest involving our senior management; |

| ● | Brad K. Heppner, our founder and CEO, may have financial interests that conflict with the interests of Beneficient and its stockholders; |

| ● | usage of our Class A common stock or securities convertible into Class A common stock as consideration for the Customer ExAlt Trusts’ (as defined herein) investments in alternative assets may create significant volatility in our investment income and the price of our Class A common stock; |

| ● | our current inability to raise sufficient capital, recurring losses from operations, negative cash flows from operations, and delays in executing our business plans. If we are unable to obtain sufficient additional funding or do not have access to capital, we may be required to terminate or significantly curtail our operations; |

| ● | our liquidity, profitability and business may be adversely affected by an inability to access, or ability to access only on unfavorable terms, the capital markets, and we may never obtain the maximum anticipated proceeds contemplated under the current capital raising agreements such as the SEPA; |

| ● | the due diligence process that we undertake in connection with any liquidity transaction may or may not reveal all facts that may be relevant in connection with such liquidity transaction; |

| ● | poor performance of our Collateral would cause a decline in our revenue, income and cash flow and could adversely affect our ability to raise capital for future liquidity transactions; |

| ● | we historically had a substantial amount of goodwill and intangible assets, which we have been, and may in the future be, required to write down the value of our intangible assets and goodwill due to impairment; |

| ● | we are subject to repayment risk in connection with our liquidity transactions; |

| ● | transfer restrictions applicable to alternative assets may prevent us from being able to attract a sufficient number of Customers to achieve our business goals; |

| ● | our operations, products and services may be negatively impacted by changes in economic and market conditions; |

| ● | shares of Class A common stock and Series A and Series B preferred stock issued by Beneficient are structurally subordinated to interests in BCH, a subsidiary of Beneficient; |

| ● | allocations of write downs in the value of our intangible assets and goodwill due to impairment will result in a decrease in the capital account balance of the Class A Units of BCH (the “BCH Class A Units”) indirectly held by the Company; |

| ● | we are or will become subject to comprehensive governmental regulation and supervision; |

| ● | we may incur fines, penalties and other negative consequences from regulatory violations; |

| ● | we may be impacted adversely by claims or litigation, including claims or litigation relating to our fiduciary responsibilities; |

| ● | if we are unable to protect our intellectual property rights, our business could be negatively affected; |

| ● | our Board and management have significant control over Beneficient’s business; |

| ● | we may issue additional shares of authorized Common Stock or preferred stock without stockholder approval subject to the applicable rules of Nasdaq and Nevada law, which would dilute existing stockholder interests; |

| | ● | the holders of Class B common stock have the right to elect a majority of the Board and the ability to vote with Class A common stock in director elections for the remaining directors, with each share of Class B common stock having 10 votes per share; and |

| | ● | the Company may engage in transactions that represent a conflict of interest, with the review of such transactions subject to the Nevada statutory business judgment rule. |

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements set forth under the heading “Risk Factors” below. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine these results are beyond our ability to control or predict. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

PROSPECTUS SUMMARY

Overview

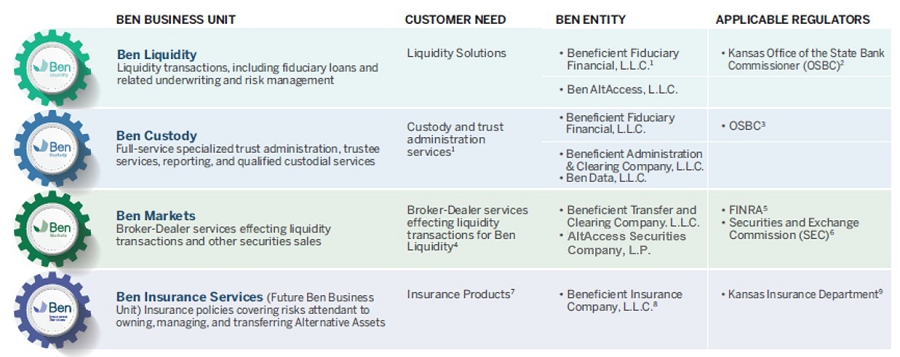

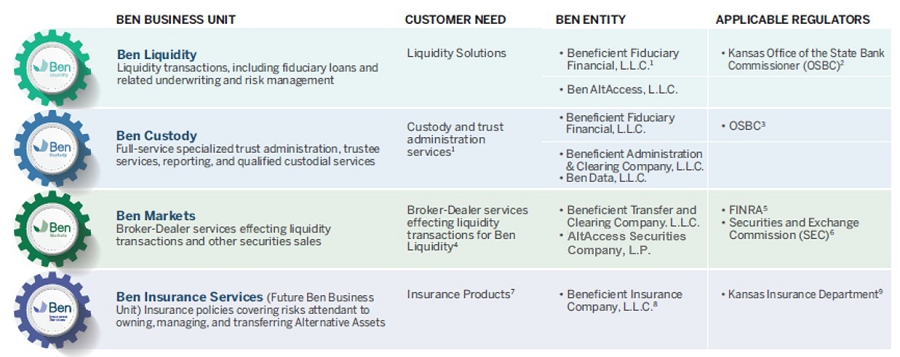

Beneficient is a technology-enabled financial services company that provides simple, rapid, and cost-effective liquidity solutions and related trustee, custody, and trust administration services to participants in the alternative assets industry. Through our business line operating subsidiaries (each a “Ben Business Unit” and collectively, the “Ben Business Units”), Ben Liquidity, Ben Custody, and Ben Markets, we seek to provide solutions in the alternative asset investment market for individual and institutional investors, general partners and sponsors (“GPs”) and the alternative asset funds they manage (“Customers”). Following receipt of regulatory approval, our Ben Business Units are expected to include an additional business line, Ben Insurance Services. Our products and services are designed to meet the unmet needs of mid-to-high net worth (“MHNW”) individual investors, small-to-midsize institutional (“STMI”) investors, family offices (“FAMOs”) and GPs, which collectively are our Customers. Beneficient’s bespoke liquidity solutions for otherwise illiquid alternative asset investments are delivered through proprietary technology and an innovative financing and trust structure (the “Customer ExAlt Trusts”).

Ben is on a mission to profoundly innovate the approximately $15.31 trillion global alternative asset investment market by disrupting what we consider outdated, inefficient, cost prohibitive and time-consuming processes to access early liquidity and for capital formation in our market. Investments in these types of alternative assets are inherently illiquid and thus require an investor to have unique skills, resources and flexible and extended timelines to realize liquidity. However, our Customers that invest in alternative assets often require near-term liquidity, long-term primary capital and continuously evolving tools because an investor’s investment capital is typically locked-up for ten or more years.

We estimate that the unmet demand for liquidity from our target market of MHNW and small-to-mid-sized STMI institutional investors is over $61 billion2,3 annually, and as our target markets grow in size and increase their allocations to alternative investments, we estimate the unmet demand for liquidity to grow to over $100 billion4 within the next five years. Further, as fund sponsors continue to launch new products and face an increasingly competitive and challenging fund-raising environment, Ben estimates the potential demand for primary commitments to meet fundraising needs, which we can finance from our balance sheet, to be up to $330 billion5. Lastly, general partner-led restructurings continue to drive a meaningful share of the overall secondary market deal flow. Ben is well positioned to compete for opportunities in this $106 billion6 market based on several factors that help define this large and growing target market. Our focus is to continually disrupt the old ways of operating in the alternative investment industry by introducing innovative new solutions for the future to address this unmet demand for liquidity, primary capital and tools to successfully navigate the alternative asset markets.

As alternative investments have proliferated globally among investor types, so has the need and demand for innovation relating to liquidity and capital formation. Increased industry innovation helped capital formation and democratize access into alternative investments. In fact, there is now over $2.7 trillion7 of net asset value owned by Ben’s target markets in the U.S. alone. While this industry has been slow to innovate for the democratization of early liquidity from alternative investments, Ben’s innovations are designed to fill that void and continue to meet the growing demand for capital formation.

1 Data from Preqin, all private capital assets under management as of September 30, 2023.

2 Data from Preqin, a widely accepted commercial private equity database and Ben’s own proprietary assumptions and calculations of MHNW and STMI alternatives AUM and turnover, which use data from Spectrum Group, Setter Capital, Capgemini, KKR, RBC-Campden, Cerulli, Goldman Sachs, Preqin, With Intelligence, and Credit Suisse.

3 This estimate relies on certain of our assumptions regarding the U.S. market, including, but not limited to, the amount of wealth held by MHNW investors, the amount of MHNW wealth allocated to alternative assets, the size of the private equity market, the share of the private equity market held by MHNW investors, the share of the private equity market held by STMI investors, the share of STMI assets in hedge fund assets, the value of STMI investors’ alternative assets, the turnover rate for alternative assets in the secondary market, and the secondary market demand.

4 Ben proprietary assumptions and calculations using data from Setter Capital and Preqin (for MHNW and STMI turnover rate) and calculations using data from Setter Capital and Preqin (for large institutional and UHNW turnover rate).

5 Preqin database, accessed in 2024.

6 Setter Capital Volume Report FY 2023.

7 Supra notes 2 and 3

Our Key Differentiators

Ben’s Tech Platform for Customer Engagement & Transactions: AltAccess Enterprise Software Systems

Because we envisioned Ben predominantly engaging and transacting with Customers online, we operate as a technology-enabled fiduciary financial services holding company. Our Kansas trust-company subsidiary Beneficient Fiduciary Financial, L.L.C. (“BFF”) serves our Customers in a regulated fiduciary capacity providing financing for secure, rapid, and cost-effective liquidity and primary capital solutions and other fiduciary services, including related custody, trustee, data management and trust administrative services to the Customer ExAlt Trusts and participants in the alternative asset industry – all of which we expect to ultimately be available online. Our liquidity and primary capital, custody, trustee, trust administration, transfer agent and broker-dealer services are designed to be deliverable to our Customers through our digital platform, AltAccess. AltAccess serves as the centralizing hub of our business and is an interactive, secure online entry point through which our Customers receive end-to-end delivery of liquidity, primary capital and our other services. BFF and our other subsidiaries deliver these products to our Customers through secure transactions subject to regulation through every step of the transaction process. AltAccess facilitates a seamless and efficient transaction experience through an online and customer-friendly portal. We have identified the aspects of each liquidity transaction that can be automated through the AltAccess portal and to date have automated 77% of those items and are working towards automating the remainder. We believe the automation of the transaction process may improve internal controls compliance, accuracy, and accelerated closing timelines.

Our Intellectual Property and Technology Solutions

Our operating subsidiaries employ Ben’s patent-pending systems and methodologies in connection with delivering financing for liquidity and primary capital coupled with other fiduciary and other services in a seamless, efficient manner. Our key intellectual property is embedded in Ben’s system-wide intelligence, which currently includes computer implemented algorithmic systems forming the basis for our seven patent-pending inventions, our copywritten AltAccess software enterprise application and Ben’s patent-pending ExAlt Plan product loan structure for delivering liquidity and primary capital to our Customers. We believe that this system-wide intelligence will ultimately drive Customer engagement, efficient transaction management processes and the delivery of our products and services. Our intellectual property has been engineered to facilitate superior Customer experiences for early exit solutions and primary capital commitments, alternative asset custody services, as well as alternative asset indicative quotes on more than 80,000 alternative asset funds within seconds. Ben is subject to regulatory oversight and proactively obtains other certification to ensure the soundness and security of our systems and processes that depend on our intellectual property. By continuing to expand and enhance our system-wide intelligence, Ben aims to continuously improve our internal transaction management processes and cost efficiency when transacting with our Customers.

Our Statutory and Regulated Customer Transaction EcoSystem

Our Customers benefit from AltAccess’ design to facilitate rapid and efficient transactions with Ben within a secure customer transaction ecosystem subject to regulatory oversight. In order to promote Customer confidence, Ben openly sought and embraced regulation, transparency and oversight as we introduced our capabilities to the alternative asset market. We believe these operating principals results in better outcomes for all participants. We finance liquidity and primary capital transactions for our Customers and provide an attendant series of fiduciary and other services through our subsidiary, BFF, a Kansas-regulated trust company operating as a Kansas Technology Enabled Fiduciary Financial Institution, under the Kansas Technology-Enabled Fiduciary Financial Institutions Act (the “TEFFI Act”) using a proprietary trust structure that we implement for our Customers. As a Fiduciary Financial Institution and trust company, BFF is subject to regular examinations by the Office of the State Banking Commission (“OSBC”) of its fiduciary financing, services and other authorized activities and Kansas legislative joint committee oversight. Additionally, to facilitate the delivery of our products and services, AltAccess Securities Company, L.P. (“AltAccess Securities”) operates as a Financial Industry Regulatory Authority (“FINRA”) member and SEC registered broker-dealer and Beneficient Transfer and Clearing Company, L.L.C. (“Beneficient Transfer”) operates as an SEC-registered transfer agent. Ben remains committed to delivering our products and services in a manner that provides our Customers with the confidence that comes with working with a fiduciary in a secure customer transaction ecosystem subject to regulatory oversight, which we believe differentiates Ben from other competitors.

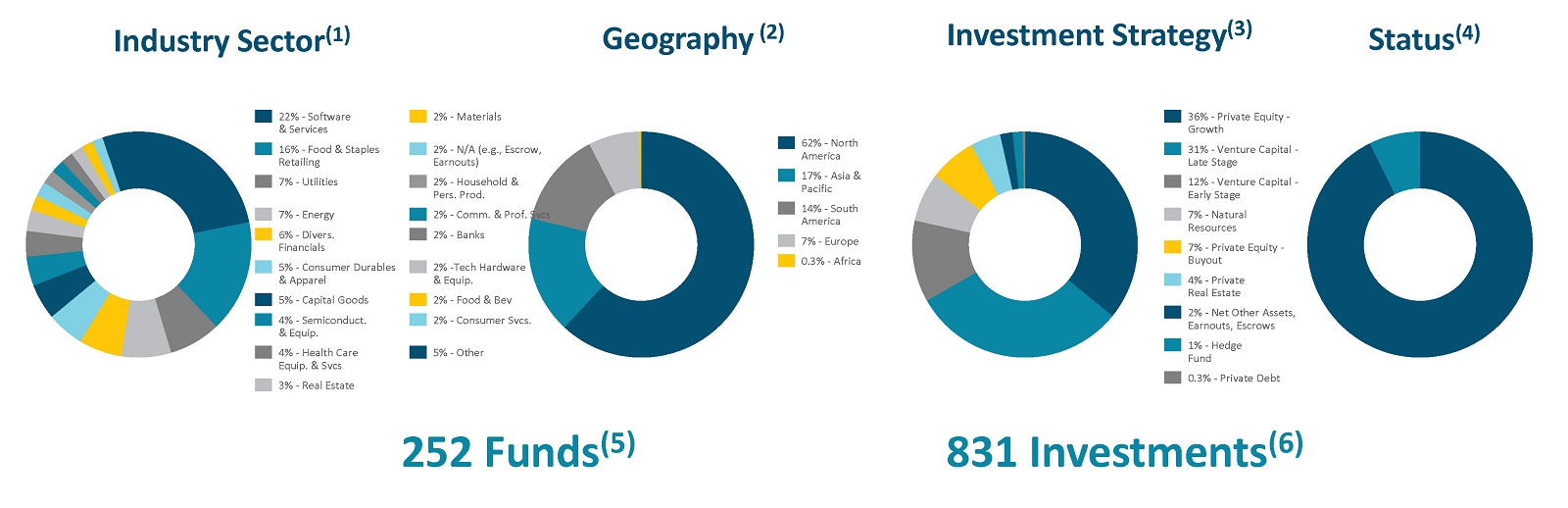

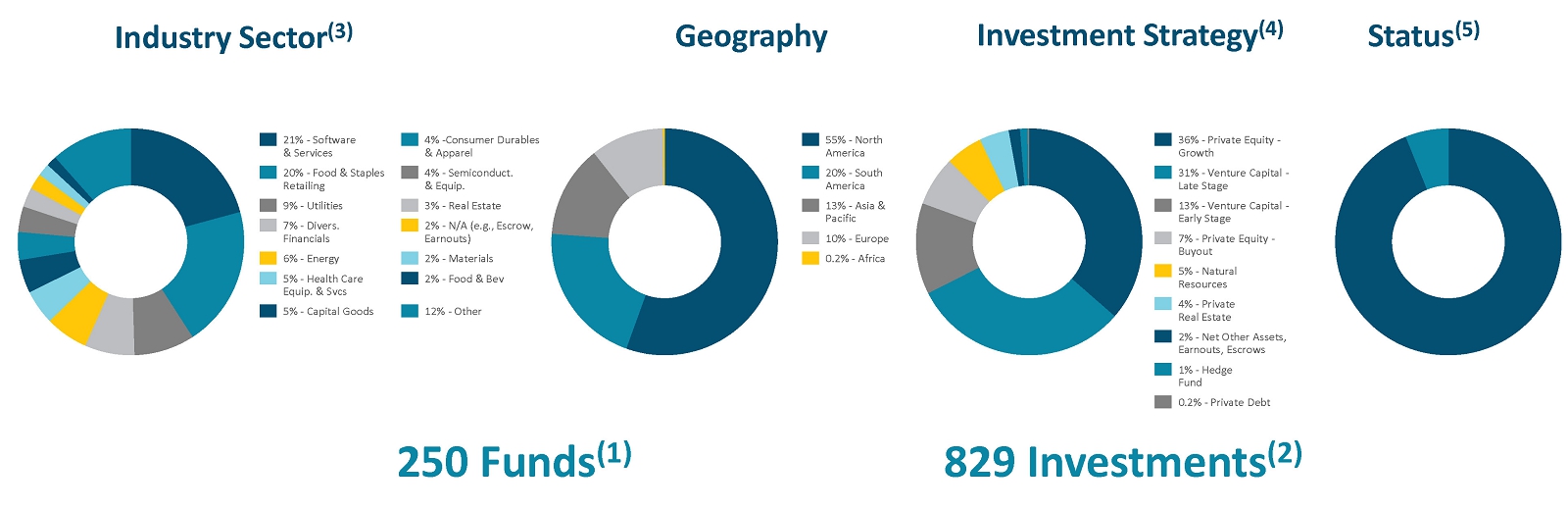

OptimumAlt Endowment Model

Ben’s balance sheet strategy for ExAlt Loan origination is built on the theory of the portfolio endowment model for the fiduciary financings we make by utilizing our patent-pending computer implemented technologies branded as OptimumAlt. Our OptimumAlt endowment model balance sheet approach guides diversification of our fiduciary financings across seven asset classes of alternative assets, over 11 industry sectors in which alternative asset managers invest, and at least six country wide exposures and multiple vintages of dates of investment into the private funds and companies. Proper diversification has aided in generating past revenues consistent with Ben’s managed revenue strategy and has provided economic exposure to some of the most exciting, sought after private funds and private company names worldwide.

ExchangeTrust Product Plan

As Ben Liquidity closes liquidity and primary capital transactions with our Customers, the ExAlt Loan Collateral Portfolio is expected to proportionately increase. Our plan is to grow and scale our capital commensurate with the demand for liquidity and primary capital products and in a manner that strengthens Ben’s balance sheet over time. In order to achieve an optimized risk adjusted return and diversification under our OptimumAlt endowment model, operational economies of scale, improved margins and tangible book value for our shareholders, the Board has approved the launch of a plan (the “ExchangeTrust Product Plan”) to complete up to $5 billion of fiduciary financings to Customer ExAlt Trusts through ExchangeTrust transactions. The ExchangeTrust Product Plan requires that each fiduciary financing to a Customer ExAlt Trust under the plan would be subject to pre-qualification and be priced based on an automated formula-based pricing model (the “Formula-Based Financing”). Once an ExchangeTrust transaction has cleared underwriting and risk pre-qualification, the formula is designed to automatically price the fiduciary financing to the Customer ExAlt Trust to achieve a required risk-adjusted return. Our objective is to further facilitate market adoption of our fiduciary services, including our liquidity and primary capital products, and potentially improve the economic efficiency of effecting the OptimumAlt endowment model balance sheet strategy. As a result of the adoption of the ExchangeTrust Product Plan and efficiencies in connection with the Formula-Based Financing, we believe we will ultimately be able to reduce our transaction closing timeline to 15 days, in contrast to the up to 15 months it could take to close a transaction through existing market solutions.

Simpler, Cost-effective and Accelerated Timelines that Outpace the Industry

Central to our business model is the belief that it is possible to provide MHNW individuals, STMI and GP Customers with a simple, rapid and cost-effective liquidity and primary capital experience through technological innovation and ingenuity in as few as 15 days. Existing competitors generally deliver complex, heavily negotiated transactions that involve significant time and cost. The complexity and cost of these existing approaches render the current market solutions impractical or impossible for smaller holders of alternative assets to achieve liquidity or secure primary capital on acceptable terms. By deploying our modernized, digital and regulated AltAccess platform and our patent-pending ExAlt Plan loan structure, we can provide earlier exit options and primary capital financing in as little as 15 days for most sub-classes of alternative assets and vehicle types. Our ExAlt Plan products utilize simplified and standardized transaction documents that meet applicable regulatory standards to ease the administrative burden on our Customers. Moreover, as a result of the approval of the ExchangeTrust Product Launch (as defined below), we believe we may be able to ultimately reduce transaction closing timeline to as few as 15 days, in contrast to the up to 15 months it could take to close a transaction through existing market solutions. This accelerated transaction process compared to industry averages provides certainty on price, cost and closing timelines and stands in contrast to other liquidity solutions that typically implement an auction-based process.

Diversified Revenue Strategy

Our primary business of financing liquidity and primary capital is coupled with a suite of complementary fiduciary and other financial products and services designed to address many of the challenges alternative asset market participants face in connection with their ownership, management and transfer of alternative assets. Our revenue model leverages our differentiating ExAlt PlanTM structure and unique competitive advantages to generate diversified revenue streams through our business line operating subsidiaries. The economics of our suite of products and services not only reflects Ben Liquidity’s diversified revenue strategy that aims to generate up to 30% in service fees from the transactions and services offered separately to Customers, but also embeds our liquidity and primary capital products that generate the other 70% or more of our revenues. Our service revenues include fees for providing custody, trustee, data and administrative services along with transaction-oriented fees for providing transfer agency and brokerage services related to our fiduciary financings. Additionally, Ben Liquidity and Ben Custody earn revenue from interest and fees, which are eliminated in consolidation, on the ExAlt Loans between Ben Liquidity and the Customer ExAlt Trusts. We offer our liquidity and primary capital products for our Customers as fiduciary financings, which are collateralized by alternative assets pursuant to the TEFFI Act under which BFF is chartered. The ExAlt Loans structure creates relatively stable net interest income that is partially insulated from changes in the net asset value of the alternative assets held by the Customer ExAlt Trusts.

Market Awareness Strategy

At Ben, we employ a cost effective, data driven approach designed to identify potential Customers. Using third-party data, internal system intelligence and Ben’s own networks, Ben creates awareness campaigns to engage with Customers who we believe could benefit from our products and services. Unlike some secondary fund liquidity market competitors who may be only in the market for a limited period of time and market to a limited number of investors, as a permanent capital company, Ben believes it will be able to leverage building long term brand and product awareness to a larger target market through strategic marketing initiatives. Our initiatives include targeted awareness campaigns to potential Customers through media, print and online channels. Following such campaigns, Ben utilizes industry-leading technology to evaluate the campaign’s (i) brand and product awareness, (ii) general Customer engagement with Ben’s platform, and (iii) the likelihood that a potential Customer intends to purchase Ben’s products and services. The analytic tools produce the conversion results from one stage to the next for each of the above items. We believe these initiatives and analytical tools for evaluating the success of our awareness campaigns will enable us to reach a meaningful percentage of our target customer market in a cost-efficient manner.

Leadership Driven Results

We built Ben from the ground up as a scalable, technology-enabled fiduciary financial services company to address what we estimate to be $61 billion in emerging demand for liquidity and primary capital for alternative asset investment by our Customers. Ben’s business success to date demonstrates the demand for and relevance of our products and services for our Customers. Our management team has closed over $1.1 billion in transactions with our liquidity and primary capital products with MHNW and STMI investors and our suite of GP Solutions. Our leadership team is not content with the current state of the alternative asset investment industry and intends to disrupt the status quo. Driven by our founder’s strategically disruptive approach, we are focused on profound innovation in areas across our industry and are committed to continuing the development of new, innovative and diverse products and services. Furthermore, our leadership team includes many industry veterans with broad fiduciary, investing and operating experience in relevant industries, and the benefit of guidance of a world-class Board representing fiduciary, legal, investment, capital markets and economic policy expertise.

Recent Developments

Amendment to Articles of Incorporation

On October 2, 2024, the Company received stockholder approval of a Certificate of Amendment (the “Certificate of Amendment”) to the Company’s Articles of Incorporation (as amended, the “Articles of Incorporation”) with the Secretary of State of the State of Nevada to increase the number of authorized shares of Class A common stock from 18,750,000 to 5,000,000,000.

First Amendment to the Ninth Amended and Restated Limited Partnership Agreement of BCH

On September 30, 2024, Beneficient Company Group, L.L.C. (“Ben LLC”) in its capacity as the sole general partner of BCH, entered into and adopted the First Amendment to the Ninth Amended and Restated Limited Partnership Agreement of BCH effective April 18, 2024 (as amended and restated, the “BCH A&R LPA” and such amendment, the “BCH A&R LPA Amendment”) in order to, among other things, effect (i) the redesignation of fifty percent (50%) of the aggregate capital account balances in the Preferred A-0 Accounts as non-redeemable Preferred A-0 Accounts (such redesignated portion, the “Preferred A-0 Non-Redeemable Accounts”) and (ii) the remaining fifty percent (50%) of the capital account balances in the Preferred A-0 Accounts to remain redeemable (such remaining Preferred A-0 Accounts being the “Preferred A-0 Redeemable Accounts”), with the amendment and redesignation being applicable to all holders of the Preferred A-0 Accounts (the foregoing being referred to as the “Redesignation”). As a result of the Redesignation, the Company expects approximately $126 million of temporary equity to be reclassified to permanent equity on the Company’s statement of financial condition as of September 30, 2024.

Securities Purchase Agreement

On August 6, 2024, the Company, entered into a Purchase Agreement with Yorkville, in connection with the issuance and sale by the Company of Convertible Debentures issuable in an aggregate principal amount of up to $4,000,000, which will be convertible into shares of the Company’s Class A common stock. Yorkville purchased and the Company issued $2,000,000 in aggregate principal amount of Convertible Debentures upon the signing the Purchase Agreement. Yorkville will purchase and the Company will issue an additional $2,000,000 in aggregate principal amount of Convertible Debentures on or before the first business day after the date the registration statement with the SEC registering the resale of the Conversion Shares and the Warrant Shares is declared effective by the SEC. Contemporaneously with the execution and delivery of the Purchase Agreement, certain of the Company’s subsidiaries entered into a global guaranty agreement in favor of Yorkville with respect to the Company’s obligations under the Purchase Agreement, the Convertible Debentures and the Warrants.

The Convertible Debentures do not bear interest, subject to a potential increase to 18.0% per annum (or the maximum amount permitted by applicable law) upon the occurrence of certain events of default. The Convertible Debentures will mature on February 6, 2025 and will result in gross proceeds to the Company of approximately $3,600,000. The Convertible Debentures will be issued at an original issue discount of 10%. The Company will be required to make monthly cash payments of principal in the amount of $1,300,000 (or such lesser amount as may then be outstanding) plus all accrued and unpaid interest as of such payment. Such payments will commence 30 days following the Second Closing and will continue on a monthly basis thereafter until the Convertible Debentures are repaid in full, subject to certain conditions as described in the Convertible Debenture. The Convertible Debentures are convertible at the option of the holder into Class A common stock equal to the applicable Conversion Amount (as in the Convertible Debenture) divided by $3.018. The maximum amount of shares issuable upon conversion of the Convertible Debentures is 1,325,382.

The Convertible Debenture provides the Company, subject to certain conditions, with an optional redemption right pursuant to which the Company, upon 10 trading days’ prior written notice to Yorkville, may redeem in cash, in whole or in part, all amounts outstanding under the Convertible Debentures prior to the Maturity Date; provided that the volume weighted average price on the date such Redemption Notice is delivered is less than the Conversion Price at the time of the Redemption Notice. The redemption amount shall be equal to the outstanding principal balance being redeemed by the Company, plus the redemption premium of 10% of the principal amount being redeemed, plus all accrued and unpaid interest in respect of such redeemed principal amount.

Additionally, pursuant to the terms of the Purchase Agreement, the Company agreed to issue the Warrants to Yorkville to purchase up to 1,325,382 shares of Class A common stock at an exercise price of $2.63, which shall be exercisable into Class A common stock for cash. At the First Closing, the Company issued a Warrant to Yorkville to purchase up to 662,691 shares of Class A common stock, and at the Second Closing, the Company will issue an additional Warrant to Yorkville to purchase up to 662,691 shares of Class A common stock. The Company is filing this Registration Statement pursuant to its obligations under a registration rights agreement with Yorkville entered into in connection with the Purchase Agreement. Pursuant to the Company’s contractual obligations under the Purchase Agreement, the Company is filing this registration statement of which this prospectus forms a part to register the Warrant Shares and the Conversion Shares.

Reverse Stock Split

On November 28, 2023, we received a letter from the Listing Qualifications Department of Nasdaq (the “Nasdaq Staff”) notifying the Company that, because the bid price for our Class A common stock had closed below $1.00 per share for the prior 30 consecutive business days, we were not in compliance with Nasdaq Listing Rule 5450(a)(1), which is the minimum bid price requirement for continued listing on the Nasdaq Global Market. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were provided a 180-calendar day period, or until May 28, 2024, to regain compliance with the minimum bid price requirement. Effective February 26, 2024, the Company transferred from the Nasdaq Global Market to the Nasdaq Capital Market. To regain compliance with the Nasdaq Listing Rules, following stockholder approval, the Company effected a reverse stock split at a ratio of eighty (80) to one (1) on April 18, 2024 (the “Reverse Stock Split”), at which time our Class A common stock began trading on the Nasdaq Capital Market on a post-split basis. The Company regained compliance with the minimum bid price requirement of the Nasdaq Listing Rules on May 2, 2024, by having the closing bid price of our Class A common stock exceed $1.00 for a minimum of ten consecutive trading days during the compliance period.

In connection with the Reverse Stock Split, on April 11, 2024, the Company, in its capacity as the sole managing member and the sole non-managing member of Ben LLC, entered into and adopted the Second Amended and Restated Limited Liability Company Agreement of Beneficient Company Group, L.L.C. (the “Ben LLC A&R LLCA”), which became effective on April 18, 2024, simultaneously with the effectiveness of the Reverse Stock Split. The Ben LLC A&R LLCA provides that, among other things, in the event that the Company at any time (i) subdivides (by any stock split, dividend, recapitalization or otherwise), the outstanding shares of the Class A common stock and Class B common stock, as applicable) of the Company into a greater number of shares, Ben LLC shall (A) cause the issuance of additional Class A Units of Ben LLC (the “Ben LLC Class A Units”) and (B) cause BCH to issue additional BCH Class A Units (and such other limited partner interests, if any, as determined by Ben LLC in its capacity as general partner of BCH to be appropriate), in both cases to reflect the increase in the number of shares of Common Stock of the Company outstanding, and (ii) combines (by combination, reverse split or otherwise) the outstanding shares of Class A common stock (and Class B common stock, as applicable) of the Company into a smaller number of shares, Ben LLC shall (A) cause a reduction in the number of Ben LLC Class A Units outstanding and (B) cause BCH to reduce the number of BCH Class A Units (and such other limited partner interests, if any, as determined by Ben LLC in its capacity as the general partner of BCH to be appropriate), in both cases to reflect the decrease in the number of shares of Common Stock of the Company outstanding.

Also in connection with the Reverse Stock Split, on April 11, 2024, Ben LLC, in its capacity as the sole general partner of BCH, entered into and adopted the Ninth Amended and Restated Limited Partnership Agreement of BCH, which became effective on April 18, 2024, simultaneously with the effectiveness of the Reverse Stock Split and provides for, among other things, (i) the combination of certain units of BCH in connection with the Reverse Stock Split and the corresponding reverse unit split of the Ben LLC Class A Units as well as amendments to the definition of the Preferred Series A Subclass 0 Unit Conversion Price and Preferred Series A Subclass 1 Unit Conversion Price (each as defined in the BCH A&R LPA) and (ii) remove references to the previously authorized BCH Preferred C-1 Unit Accounts, which are no longer outstanding.

Nasdaq Continued Listing Standards

As referenced above, on November 28, 2023, we received a letter from Nasdaq Staff notifying the Company that, for the previous 30 consecutive business days, the closing bid price for the Company’s Class A common stock had been below the minimum $1.00 per share required for continued listing on The Nasdaq Global Market under Nasdaq Listing Rule 5450(a)(1). As a result, on April 18, 2024, the Company effected the Reverse Stock Split, and on May 2, 2024, the Company received noticed from the Nasdaq Staff that the Company had regained compliance with the Bid Price Requirement, and that therefore, the Company was therefore in compliance with the listing requirements of the Nasdaq Capital Market.

On July 16, 2024, the Company received a notice from the Nasdaq Staff indicating that it is no longer in compliance with the minimum stockholders’ equity requirement (the “Minimum Stockholders’ Equity Requirement”) for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(b)(1) (the “Stockholders’ Equity Notice”). Nasdaq Listing Rule 5550(b)(1) requires listed companies to maintain stockholders’ equity of at least $2,500,000 or meet the alternative compliance standards relating to the market value of listed securities or net income from continuing operations, which the Company does not currently meet.

Pursuant to the Stockholders’ Equity Notice and the Listing Rules of Nasdaq, Nasdaq provided the Company with 45 calendar days, or until August 30, 2024, to submit a plan to regain compliance with the Minimum Stockholders’ Equity Requirement. On August 30, 2024, the Company timely submitted a plan to the Staff to regain compliance with the Minimum Stockholders’ Equity Requirement. If the Company’s plan to regain compliance is accepted, the Staff can grant an extension of up to 180 calendar days from the date of the notice to evidence compliance. If the Company’s plan to regain compliance is not accepted, or if it is accepted and the Company does not regain compliance in the timeframe required by Nasdaq, the Nasdaq Staff could provide notice that the Company’s shares of Class A common stock are subject to delisting. In such an event, the Company would have the right to request a hearing before the Panel. The hearing request would automatically stay any suspension or delisting action pending the completion of the hearings process. The Stockholders’ Equity Notice had no immediate impact on the listing of the Class A common stock, which will continue to be listed and traded on Nasdaq under the symbol “BENF,” subject to the Company’s compliance with the other listing requirements of Nasdaq. While the Company has not yet received a determination from the Staff regarding the plan, the Company is currently progressing under the plan submitted to the Staff to regain compliance with the Minimum Stockholders’ Equity Requirement. Although the Company intends to use all reasonable efforts to achieve compliance with the Minimum Stockholders’ Equity Requirement, there can be no assurance that the Company will be able to regain compliance with the Minimum Stockholders’ Equity Requirement or that the Company will otherwise be in compliance with other applicable Nasdaq listing criteria.

Additionally, on July 23, 2024, the Company notified Nasdaq that, following the resignations of Emily B. Hill and Dennis P. Lockhart from the Company’s Board and Audit Committee of the Board (the “Audit Committee”), the Company currently has a vacancy on the Audit Committee and intends to rely on the cure period set forth in the Nasdaq Listing Rules while it recruits a new Audit Committee member.

On July 25, 2024, the Company received a notice from Nasdaq (the “Audit Committee Notice”) confirming that the Company was no longer in compliance with Nasdaq’s audit committee composition requirements as set forth in Nasdaq Listing Rule 5605, which requires that the audit committee of a listed company be comprised of at least three “independent directors” (as defined in Nasdaq Listing Rule 5605(a)(2)). Pursuant to Nasdaq Listing Rule 5605(c)(4), the Company intends to rely on the cure period to reestablish compliance with Nasdaq Listing Rule 5605. The cure period is generally defined as until the earlier of the Company’s next annual meeting of stockholders or July 21, 2025. If the Company’s next annual meeting of stockholders is held before January 15, 2025, then the Company must evidence compliance no later than January 15, 2025.

On September 30, 2024, Patrick J. Donegan was appointed to the Board as an independent director and a member of the Audit, Products and Related Party Transactions, Credit and Enterprise Risk committees of the Board. The Board is in the process of identifying and selecting an additional member of the Board who qualifies as “independent” and meets the audit committee criteria set forth in Nasdaq Listing Rule 5605. The Board intends to comply fully with Nasdaq audit committee requirements by or before the end of the cure period described above, but there can be no assurance that the Company will be able to regain compliance with Nasdaq Listing Rule 5605 or that the Company will otherwise be in compliance with other applicable Nasdaq listing criteria. The Audit Committee Notice had no immediate impact on the listing of the Class A common stock, which will continue to be listed and traded on Nasdaq under the symbol “BENF,” subject to the Company’s compliance with the other listing requirements of Nasdaq.

Corporate Information

Our Class A common stock and Public Warrants are listed on Nasdaq under the symbol “BENF” and “BENFW,” respectively. Beneficient’s principal executive offices are located at 325 N. Saint Paul St., Suite 4850, Dallas, Texas 75201, and its phone number is (214) 445-4700. Beneficient’s website is https://www.trustben.com/. Information found on or accessible though out website is not incorporated by reference into this prospectus and should not be considered part of this prospectus.

Implications of Being an Emerging Growth Company, a Smaller Reporting Company and a Controlled Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For so long as we remain an emerging growth company, we are permitted, and currently intend, to rely on the following provisions of the JOBS Act that contain exceptions from disclosure and other requirements that otherwise are applicable to public companies and file periodic reports with the SEC. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and selected financial data and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including this prospectus, subject to certain exceptions; |

| | | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended; |

| | | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements, and registration statements, including in this prospectus; |

| | | |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; and |

| | | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We will remain an emerging growth company until the earliest to occur of:

| ● | the last day of the fiscal year that follows the fifth anniversary of the effectiveness of our registration statement on Form S-4 in connection with the Business Combination; |

| | | |

| ● | the last day of the fiscal year in which we have total annual gross revenue of at least $1.235 billion; |

| | | |

| ● | the date on which we are deemed to be a “large accelerated filer,” as defined in the Exchange Act; and |

| | | |

| ● | the date on which we have issued more than $1 billion in non-convertible debt over a three-year period. |

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to holders of our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

We have elected to avail ourselves of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies.

We are also a “smaller reporting company” as defined in the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies until the fiscal year following the determination that our voting and non-voting Common Stock held by non-affiliates is $250 million or more measured on the last business day of our second fiscal quarter, or our annual revenues are less than $100 million during the most recently completed fiscal year and our voting and non-voting Common Stock held by non-affiliates is $700 million or more measured on the last business day of our second fiscal quarter.

Under the Nasdaq Listing Rules, a company of which more than 50% of the voting power for the election of directors is held by an individual, group or another company is a “controlled company.” Pursuant to the terms of the Stockholders Agreement, the Class B Holders have the right to elect a majority of the Company’s directors. As a result, we are a “controlled company” within the meaning of the Nasdaq Listing Rules. A controlled company may elect not to comply with certain corporate governance standards. If we cease to be a “controlled company” and our securities continue to be listed on Nasdaq, we will be required to comply with these standards within the applicable transition period.

RISK FACTORS

An investment in our securities involves a variety of risks, some of which are specific to us and some of which are inherent to the industry in which we operate. The following risks and other information in this prospectus including our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” should be read carefully before investing in our securities. These risks may adversely affect our financial condition, results of operations or liquidity. Many of these risks are out of our direct control, though efforts are made to manage those risks while optimizing financial results. These risks are not the only risks we face. Additional risks and uncertainties that we are not aware of or focused on or that we currently deem immaterial may also adversely affect our business and operations. This prospectus is qualified in its entirety by all these risk factors. References in this section to the “Company,” “Ben,” “we,” “us,” or “our” refer to Beneficient and its subsidiaries.

Risks Related to Our Business

Risks Related to Our Liquidity Products Business