In February and June 2019, the Company issued 222,222,222 ordinary shares in aggregate to existing shareholders at a price of US$0.45 per share for a total cash consideration of US$100 million. Out of the 222,222,222 ordinary shares issued, 403,157 shares were contributed by the then existing shareholders to the Trust for future share awards.

As of June 30, 2019, 52,027,157 ordinary shares in total were contributed to the Trust for share awards and were accounted for as treasury stocks of the Company (being issued but not outstanding shares).

As of December 31, 2018, the authorized ordinary shares are 1,000,000,000,000, of which 2,000,000,000 shares were issued and 1,948,376,000 shares were outstanding.

As of June 30, 2019, the authorized ordinary shares are 1,000,000,000,000 shares, of which 2,222,222,222 shares were issued and 2,170,195,065 shares were outstanding.

| 13. | Share-based compensation |

On October 8, 2016, Canaan Chaoxin, which was a holding company controlled by the controlling shareholders, established 2016 Equity Incentive Plan (the “2016 Plan”) with the purpose of which is to provide share options for employees contributing to the Company. On October 8, 2016, Canaan Chaoxin granted 39,600,000 share options to the Company’s employees at an exercise price of RMB0.023 per share under the 2016 Plan. The vesting period was from October 2016 to May 2017 and the exercise period was from June 2017 to July 2017.

On November 22, 2017, Canaan Chaoxin approved the establishment of 2017 Equity Incentive Plan (the “2017 Plan”) with the purpose of which is to provide restricted share units (“RSUs”) to its employees. In November 2017, Canaan Chaoxin granted 71,200,000 RSUs to the Company’s employees at an exercise price of RMB0.015 per share under the 2017 Plan, among which, 39,170,000 RSUs are vested immediately on the grant day, 30,030,000 RSUs contain two or four service years of the employees and the remaining 2,000,000 RSUs shall be vested upon IPO.

As part of the Reorganization in 2018, the Board of Directors of the Company approved the 2018 Equity Incentive Plan (the “2018 Plan”) on April 25, 2018, which assumed Canaan Chaoxin’s obligations and duties under the share awards granted by Canaan Chaoxin. As a result, the unvested RSUs granted by Canaan Chaoxin under the 2017 Plan were replaced with RSUs of the Company. Such new RSUs replaced the RSUs granted under Canaan Chaoxin’s existing RSUs in its entirety by exchanging of the RSU granted by Canaan Chaoxin for the RSU of the Company while maintaining their respective terms and vesting schedules unchanged except for the addition of performance condition of IPO. This resulted in a probable to improbable (Type II) modification, and no incremental fair value would be recognized unless and until vesting of the award under the modified conditions becomes probable. Since this modification was not beneficial to its employees, no incremental value was resulting from the modification. The Group recognized compensation cost equal to the award’s original grant-date fair value when the original vesting conditions are satisfied, regardless of whether the modified IPO condition is satisfied.

On the same day, some employees who are under the 2016 Plan entered into share award replacement agreement (the “Replacement Agreement”) with the Company under which a total of 19,594,000 ordinary shares of the Company held by the employees became restricted and will be vested upon IPO of the Company. In the event that the employees voluntarily and unilaterally terminates his employment/service contract with any group entities or his employment, the unvested restricted shares shall automatically lapse. Deferred share-based compensation was measured for the restricted shares using the estimated fair value of the Company’s ordinary shares at the date of imposition of the restriction in April 2018, and the compensation cost for the restricted shares will be recognized upon occurrence of IPO.

Share-based compensation expense related to the share awards granted to the employees amounted to approximately RMB9,461 and RMB221,006 for the six months ended June 30, 2018 and 2019, respectively.

F-55

), or the PRC EIT Law and its relevant regulations, PRC companies are typically subject to an income tax rate of 25% under the PRC EIT Law. Meanwhile, we shall, in accordance with the requirements of the tax authority and other relevant authorities, retain and submit our financial statements together with details of our research and development activities and other technological innovation activities for future reference to enjoy the preferential tax treatment. As advised by Commerce & Finance Law Offices, our PRC legal adviser, if we fail to provide materials retained for future reference, we will not be entitled to enjoy the preferential tax treatment, as well as other benefits conferred under the accreditations.

), or the PRC EIT Law and its relevant regulations, PRC companies are typically subject to an income tax rate of 25% under the PRC EIT Law. Meanwhile, we shall, in accordance with the requirements of the tax authority and other relevant authorities, retain and submit our financial statements together with details of our research and development activities and other technological innovation activities for future reference to enjoy the preferential tax treatment. As advised by Commerce & Finance Law Offices, our PRC legal adviser, if we fail to provide materials retained for future reference, we will not be entitled to enjoy the preferential tax treatment, as well as other benefits conferred under the accreditations.

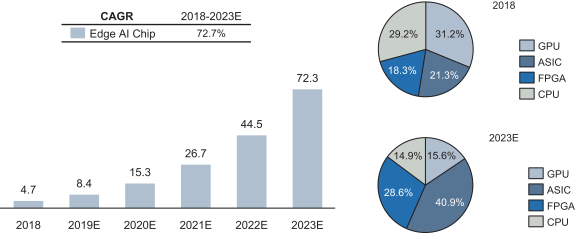

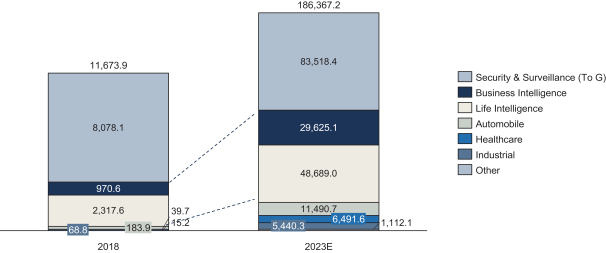

). This policy outlines China’s strategy to build a domestic AI industry worth nearly US$150 billion in the next few years and to become the leading AI power by 2030.

). This policy outlines China’s strategy to build a domestic AI industry worth nearly US$150 billion in the next few years and to become the leading AI power by 2030.

), or the Foreign Investment Catalog, which was jointly promulgated by the Ministry of Commerce of the PRC, or MOFCOM, and the National Development and Reform Commission of the PRC, or NDRC, on June 30, 2019 and to be effective on July 30, 2019. The Foreign Investment Catalog contains specific provisions guiding market access of foreign capital, stipulating in detail different areas of entry, which include encouraged foreign-invested industries. Our business falls within the category of encouraged foreign-invested industries, according to catalogs 281, 282, 286, 287, 290 and 291 of encouraged foreign invested industries listed in the Foreign Investment Catalog.

), or the Foreign Investment Catalog, which was jointly promulgated by the Ministry of Commerce of the PRC, or MOFCOM, and the National Development and Reform Commission of the PRC, or NDRC, on June 30, 2019 and to be effective on July 30, 2019. The Foreign Investment Catalog contains specific provisions guiding market access of foreign capital, stipulating in detail different areas of entry, which include encouraged foreign-invested industries. Our business falls within the category of encouraged foreign-invested industries, according to catalogs 281, 282, 286, 287, 290 and 291 of encouraged foreign invested industries listed in the Foreign Investment Catalog. ), projects with foreign investment fall into 4 categories, namely encouraged, permitted, restricted and prohibited. Projects with foreign investment that are encouraged, restricted or prohibited shall be listed in the Foreign Investment Catalog. Projects with foreign investment not listed as encouraged, restricted or prohibited projects are permitted projects.

), projects with foreign investment fall into 4 categories, namely encouraged, permitted, restricted and prohibited. Projects with foreign investment that are encouraged, restricted or prohibited shall be listed in the Foreign Investment Catalog. Projects with foreign investment not listed as encouraged, restricted or prohibited projects are permitted projects.

) issued on June 24, 2000, the PRC continues to enact policies encouraging new and advanced technology and supporting the software and IC industries.

) issued on June 24, 2000, the PRC continues to enact policies encouraging new and advanced technology and supporting the software and IC industries.

) effective from January 28, 2011 and the Announcement of the State Administration of Taxation on Issues Concerning the Accreditation and the Administration for Software and Integrated Circuit Enterprises (

) effective from January 28, 2011 and the Announcement of the State Administration of Taxation on Issues Concerning the Accreditation and the Administration for Software and Integrated Circuit Enterprises ( ) effective from May 30, 2012 (abolished on May 29, 2016), the following financial and tax policies were formulated:

) effective from May 30, 2012 (abolished on May 29, 2016), the following financial and tax policies were formulated: ) was promulgated on March 1, 1983 with the last amendment effective from May 1, 2014. The implementing regulations of Trademark Law of the PRC (

) was promulgated on March 1, 1983 with the last amendment effective from May 1, 2014. The implementing regulations of Trademark Law of the PRC (

) was promulgated on August 3, 2002 by the State Council and amended on April 29, 2014 and became effective on May 1, 2014. These current effective laws and regulations provide the basic legal framework for the regulations of trademarks in the PRC, covering registered trademarks including commodity trademarks, service trademarks, collective marks and certificate marks. The Trademark Office under the SAMR is responsible for the registration and administration of trademarks in the PRC. Trademarks are granted on a term of 10 years commencing on its registration date. Six months prior to the expiration of the10-year term, an application may renew the trademark for another 10 years.

) was promulgated on August 3, 2002 by the State Council and amended on April 29, 2014 and became effective on May 1, 2014. These current effective laws and regulations provide the basic legal framework for the regulations of trademarks in the PRC, covering registered trademarks including commodity trademarks, service trademarks, collective marks and certificate marks. The Trademark Office under the SAMR is responsible for the registration and administration of trademarks in the PRC. Trademarks are granted on a term of 10 years commencing on its registration date. Six months prior to the expiration of the10-year term, an application may renew the trademark for another 10 years. ), or the Patent Law of the PRC, promulgated on March 12, 1984 with the last amendment effective from October 1, 2009, and the Implementing Regulations of the Patent Law of the PRC (

), or the Patent Law of the PRC, promulgated on March 12, 1984 with the last amendment effective from October 1, 2009, and the Implementing Regulations of the Patent Law of the PRC ( ) promulgated on June 15, 2001 with the last amendment effective from February 1,2010, respectively, an inventor or a designer may apply to the State Intellectual Property Office, or the SIPO for the grant of an invention patent, an utility model patent or a design patent. According to the Patent Law of the PRC, the right to apply for a patent (a patent application) and of registered patent can be transferred upon completion of registration with SIPO. The patent right duration is 20 years for invention and 10 years for utility model and design, starting from the date of application. A patentee is obligated to pay annual fee beginning with the year in which the patent right is granted. Failure to pay the annual fee may result in a termination of the patent right duration.

) promulgated on June 15, 2001 with the last amendment effective from February 1,2010, respectively, an inventor or a designer may apply to the State Intellectual Property Office, or the SIPO for the grant of an invention patent, an utility model patent or a design patent. According to the Patent Law of the PRC, the right to apply for a patent (a patent application) and of registered patent can be transferred upon completion of registration with SIPO. The patent right duration is 20 years for invention and 10 years for utility model and design, starting from the date of application. A patentee is obligated to pay annual fee beginning with the year in which the patent right is granted. Failure to pay the annual fee may result in a termination of the patent right duration. ), promulgated on September 7, 1990 with the last amendment effective from April 1, 2010, protects copyright and explicitly covers computer software copyright. The Regulations on the Protection of Computer Software (

), promulgated on September 7, 1990 with the last amendment effective from April 1, 2010, protects copyright and explicitly covers computer software copyright. The Regulations on the Protection of Computer Software ( ), promulgated on December 20, 2001 and amended on January 30, 2013 and came into force on March 1, 2013, protects the rights and interests of the computer software copyright holders and encourages the development of the software industry and information economy. In the PRC, software developed by PRC citizens, legal persons or other organizations are automatically protected immediately after its development, whether published or not. Foreigners or stateless persons having software first published within the territory of the PRC enjoy copyright in accordance with these regulations. Software owned by foreigners or stateless persons are protected in the PRC under these regulations according to an agreement signed between the country to which the foreigner belongs or the habitual residence of its developer and the PRC or according to the international conventions the PRC participated in. A software copyright owner may register with the software registration institution recognized by the copyright administration department of the State Council. A registration certificate issued by the software registration institution is a preliminary proof of the registered items. On February 20, 2002, the National Copyright Administration of the PRC promulgated the Measures for the Registration of Computer Software Copyright (

), promulgated on December 20, 2001 and amended on January 30, 2013 and came into force on March 1, 2013, protects the rights and interests of the computer software copyright holders and encourages the development of the software industry and information economy. In the PRC, software developed by PRC citizens, legal persons or other organizations are automatically protected immediately after its development, whether published or not. Foreigners or stateless persons having software first published within the territory of the PRC enjoy copyright in accordance with these regulations. Software owned by foreigners or stateless persons are protected in the PRC under these regulations according to an agreement signed between the country to which the foreigner belongs or the habitual residence of its developer and the PRC or according to the international conventions the PRC participated in. A software copyright owner may register with the software registration institution recognized by the copyright administration department of the State Council. A registration certificate issued by the software registration institution is a preliminary proof of the registered items. On February 20, 2002, the National Copyright Administration of the PRC promulgated the Measures for the Registration of Computer Software Copyright ( ), which came into force on the date of promulgation and outlines the operational procedures for registration of software copyright, as well as registration of software copyright licenses and transfer contracts. The copyright Protection Center of PRC is mandated as the software registration agency under the regulations.

), which came into force on the date of promulgation and outlines the operational procedures for registration of software copyright, as well as registration of software copyright licenses and transfer contracts. The copyright Protection Center of PRC is mandated as the software registration agency under the regulations.

) was promulgated by the State Council on April 2, 2001 and became effective on October 1, 2001, and the Detailed Implementing Rules of the Regulations on the Protection of Layout Designs of Integrated Circuits (

) was promulgated by the State Council on April 2, 2001 and became effective on October 1, 2001, and the Detailed Implementing Rules of the Regulations on the Protection of Layout Designs of Integrated Circuits (

) were promulgated by SIPO, the authority to receive and examine applications for registrations of layout IC designs, on September 18, 2001 and came into effect on October 1,2001, or collectively the Layout-design Regulations.

) were promulgated by SIPO, the authority to receive and examine applications for registrations of layout IC designs, on September 18, 2001 and came into effect on October 1,2001, or collectively the Layout-design Regulations. ) issued by the Ministry of Industry and Information Technology (

) issued by the Ministry of Industry and Information Technology ( ), or the MIIT, on August 24, 2017 which became effective on November 1, 2017, the Implementing Rules of Domain Name Registration (

), or the MIIT, on August 24, 2017 which became effective on November 1, 2017, the Implementing Rules of Domain Name Registration (

) issued by China Internet Network Information Center (

) issued by China Internet Network Information Center ( ), or the CINIC, which became effective on May 29, 2012, and the Measures on Domain Name Disputes Resolution (

), or the CINIC, which became effective on May 29, 2012, and the Measures on Domain Name Disputes Resolution (

) issued by CINIC which became effective on September 1, 2014. Domain name registrations are handled through domain name service agencies established under the relevant regulations, and the applicants become domain name holders upon successful registration. Domain name disputes shall be submitted to institutions authorized by the CINIC for resolution.

) issued by CINIC which became effective on September 1, 2014. Domain name registrations are handled through domain name service agencies established under the relevant regulations, and the applicants become domain name holders upon successful registration. Domain name disputes shall be submitted to institutions authorized by the CINIC for resolution. ) was promulgated on February 22, 1993 and amended on July 8, 2000, August 27, 2009 and December 29, 2018, respectively. The product quality supervision department under the State Council is responsible for nationwide product quality supervision. All the relevant departments under the State Council are in charge of product quality supervision according to their respective responsibilities. Local product quality supervision departments at or above the county level are responsible for product quality supervision within their own administrative areas.

) was promulgated on February 22, 1993 and amended on July 8, 2000, August 27, 2009 and December 29, 2018, respectively. The product quality supervision department under the State Council is responsible for nationwide product quality supervision. All the relevant departments under the State Council are in charge of product quality supervision according to their respective responsibilities. Local product quality supervision departments at or above the county level are responsible for product quality supervision within their own administrative areas. ) promulgated on June 29, 2002, with the latest amended version effective from December 1, 2014, is the principal law governing the supervision and administration of production safety in the PRC. Entities engaged in production and business activities within the territory of the PRC shall abide by the relevant legal requirements such as providing its staff with training on production safety and providing safe working environment in compliance with relevant laws and regulations. Any entities unable to provide the required safe working environment may not engage in production activities. Any failure to comply with the aforesaid provisions or to rectify noncompliance within a time limit may subject the relevant entities to fines and penalties, suspension of operations, ceasing of operations, or even criminal liability in severe situations.

) promulgated on June 29, 2002, with the latest amended version effective from December 1, 2014, is the principal law governing the supervision and administration of production safety in the PRC. Entities engaged in production and business activities within the territory of the PRC shall abide by the relevant legal requirements such as providing its staff with training on production safety and providing safe working environment in compliance with relevant laws and regulations. Any entities unable to provide the required safe working environment may not engage in production activities. Any failure to comply with the aforesaid provisions or to rectify noncompliance within a time limit may subject the relevant entities to fines and penalties, suspension of operations, ceasing of operations, or even criminal liability in severe situations. ), or the EIT Law which was promulgated by the National People’s Congress on March 16, 2007 with the latest amended version effective from December 29, 2018, and its implementing rules, a unified EIT rate of 25% is applied equally to both domestic enterprises and foreign invested enterprises, excludingnon-resident enterprises. The EIT rate could be reduced to 15% for High-tech enterprises in need of special support from the PRC government.

), or the EIT Law which was promulgated by the National People’s Congress on March 16, 2007 with the latest amended version effective from December 29, 2018, and its implementing rules, a unified EIT rate of 25% is applied equally to both domestic enterprises and foreign invested enterprises, excludingnon-resident enterprises. The EIT rate could be reduced to 15% for High-tech enterprises in need of special support from the PRC government. ), or the Administrative Measures, which became effective on January 1, 2016, High-tech enterprises, which are recognized in accordance with the Administrative Measures, may apply for the tax preferential policy in accordance with the EIT Law and the Implementing Measures thereof, the Law of PRC Concerning the Administration of Tax Collection (

), or the Administrative Measures, which became effective on January 1, 2016, High-tech enterprises, which are recognized in accordance with the Administrative Measures, may apply for the tax preferential policy in accordance with the EIT Law and the Implementing Measures thereof, the Law of PRC Concerning the Administration of Tax Collection ( ) and Implementing Rules of the Law of the PRC Concerning the Administration of Tax Collection (

) and Implementing Rules of the Law of the PRC Concerning the Administration of Tax Collection ( ). The qualified high-tech enterprises would be taxed at a rate of 15% on EIT. The validity period of High-tech enterprises shall be three years from the date of issuance of the certificate of High-tech enterprise. After obtaining the High-tech enterprise qualification, such enterprise shall retain its financial statements together with details of its research and development activities and other technological innovation activities for future reference in accordance with the requirements of the tax authority and other relevant authorities. Where a significant change occurred such as change of name or other conditions related to the High-tech enterprises identified (e.g., separation, merger, restructuring and change of business), such enterprise shall report it to the relevant competent tax authority, which would accredit such enterprise within three months. Upon such accreditation, the High-tech enterprise would either remain its qualification or be disqualified. For enterprises undergoing a change of name, the authority wouldre-issue the certificate with the certificate number and duration of validity remains unchanged.

). The qualified high-tech enterprises would be taxed at a rate of 15% on EIT. The validity period of High-tech enterprises shall be three years from the date of issuance of the certificate of High-tech enterprise. After obtaining the High-tech enterprise qualification, such enterprise shall retain its financial statements together with details of its research and development activities and other technological innovation activities for future reference in accordance with the requirements of the tax authority and other relevant authorities. Where a significant change occurred such as change of name or other conditions related to the High-tech enterprises identified (e.g., separation, merger, restructuring and change of business), such enterprise shall report it to the relevant competent tax authority, which would accredit such enterprise within three months. Upon such accreditation, the High-tech enterprise would either remain its qualification or be disqualified. For enterprises undergoing a change of name, the authority wouldre-issue the certificate with the certificate number and duration of validity remains unchanged.

) promulgated and with effect from February 3, 2015, or Circular 7, and Announcement of the State Administration of Taxation on Issues Relating to Withholding at Source of Income Tax ofNon-resident Enterprises (

) promulgated and with effect from February 3, 2015, or Circular 7, and Announcement of the State Administration of Taxation on Issues Relating to Withholding at Source of Income Tax ofNon-resident Enterprises ( ) promulgated on December 1, 2017 with last amendment on June 15, 2018, or Circular 37, where anon-resident enterprise indirectly transfers equities and other properties of a PRC resident enterprise, or PRC Taxable Properties, to

) promulgated on December 1, 2017 with last amendment on June 15, 2018, or Circular 37, where anon-resident enterprise indirectly transfers equities and other properties of a PRC resident enterprise, or PRC Taxable Properties, to ) promulgated by the Stated Council on December 13, 1993 with the latest amended version effective from November 19, 2017, and its implementing rules (

) promulgated by the Stated Council on December 13, 1993 with the latest amended version effective from November 19, 2017, and its implementing rules ( ) promulgated by MOF on December 25, 1993 and revised on December 18, 2008 and October 28, 2011, respectively, tax payers engaging in sale of goods, provision of processing services, repairs and replacement services or importation of goods within the territory of the PRC shall pay value-added tax, or the VAT. Unless stated otherwise, the rate of value-added tax is 17%.

) promulgated by MOF on December 25, 1993 and revised on December 18, 2008 and October 28, 2011, respectively, tax payers engaging in sale of goods, provision of processing services, repairs and replacement services or importation of goods within the territory of the PRC shall pay value-added tax, or the VAT. Unless stated otherwise, the rate of value-added tax is 17%. ), a general taxpayer who sells its self-develop software products and borne a VAT more than 3%, could enjoy a levy-refund policy on VAT after being taxed at the fixed rate of 17%. However, in practice, such general taxpayer should present the license of software products (

), a general taxpayer who sells its self-develop software products and borne a VAT more than 3%, could enjoy a levy-refund policy on VAT after being taxed at the fixed rate of 17%. However, in practice, such general taxpayer should present the license of software products ( ) or registration certificates of software copyrights (

) or registration certificates of software copyrights ( ) to prove the software products were developed and produced by its own.

) to prove the software products were developed and produced by its own.

), or Circular 32, according to which (i) for VAT taxable sales or imports of goods originally subject to value-added tax rates of 17% and 11% respectively, such tax rates were adjusted to 16% and 10%, respectively; and (ii) for exported goods originally subject to a tax rate of 17% and an export tax refund rate of 17%, the export tax refund rate was adjusted to 16%. Circular 32 became effective on May 1, 2018 and superseded existing provisions which were inconsistent with Circular 32.

), or Circular 32, according to which (i) for VAT taxable sales or imports of goods originally subject to value-added tax rates of 17% and 11% respectively, such tax rates were adjusted to 16% and 10%, respectively; and (ii) for exported goods originally subject to a tax rate of 17% and an export tax refund rate of 17%, the export tax refund rate was adjusted to 16%. Circular 32 became effective on May 1, 2018 and superseded existing provisions which were inconsistent with Circular 32. ) ,which was promulgated by MOF, State Administration of Taxation and the General Administration of Customs on March 20, 2019, where (i) for VAT taxable sales or imports of goods originally subject to value-added tax rates of 16%, such tax rates shall be adjusted to 13%; (ii) for the exported goods originally subject to a tax rate of 16% and an export tax refund rate of 16%, the export tax refund rate shall be adjusted to 13%.

) ,which was promulgated by MOF, State Administration of Taxation and the General Administration of Customs on March 20, 2019, where (i) for VAT taxable sales or imports of goods originally subject to value-added tax rates of 16%, such tax rates shall be adjusted to 13%; (ii) for the exported goods originally subject to a tax rate of 16% and an export tax refund rate of 16%, the export tax refund rate shall be adjusted to 13%. ), which was promulgated by the National People’s Congress of the PRC in 1986 and revised by the Standing Committee

), which was promulgated by the National People’s Congress of the PRC in 1986 and revised by the Standing Committee

), or the Arrangement, on August 21, 2006. According to the Arrangement, 5% withholding tax rate shall apply to the dividends paid by a PRC company to a Hong Kong resident, provided that such Hong Kong resident directly holds at least 25% of the equity interests in the PRC company, and 10% of withholding tax rate shall apply if the Hong Kong resident holds less than 25% of the equity interests in the PRC company.

), or the Arrangement, on August 21, 2006. According to the Arrangement, 5% withholding tax rate shall apply to the dividends paid by a PRC company to a Hong Kong resident, provided that such Hong Kong resident directly holds at least 25% of the equity interests in the PRC company, and 10% of withholding tax rate shall apply if the Hong Kong resident holds less than 25% of the equity interests in the PRC company. ), which was promulgated by the State Administration of Taxation, or SAT, and became effective on February 20, 2009, all of the following requirements shall be satisfied where a fiscal resident of the other party to a tax agreement needs to be entitled to such tax agreement treatment as being taxed at a tax rate specified in the tax agreement for the dividends paid to it by a PRC resident company: (i) such a fiscal resident who obtains dividends shall be a company as provided in the tax agreement; (ii) owner’s equity interests and voting shares of the PRC resident company directly owned by such a fiscal resident reaches a specified percentage; and (iii) the equity interests of the PRC resident company directly owned by such a fiscal resident, at any time during the 12 months prior to obtaining the dividends, reach a percentage specified in the tax agreement.

), which was promulgated by the State Administration of Taxation, or SAT, and became effective on February 20, 2009, all of the following requirements shall be satisfied where a fiscal resident of the other party to a tax agreement needs to be entitled to such tax agreement treatment as being taxed at a tax rate specified in the tax agreement for the dividends paid to it by a PRC resident company: (i) such a fiscal resident who obtains dividends shall be a company as provided in the tax agreement; (ii) owner’s equity interests and voting shares of the PRC resident company directly owned by such a fiscal resident reaches a specified percentage; and (iii) the equity interests of the PRC resident company directly owned by such a fiscal resident, at any time during the 12 months prior to obtaining the dividends, reach a percentage specified in the tax agreement. ), which was promulgated by the SAT on August 24, 2009 and became effective on October 1, 2009, where anon-resident enterprise that receives dividends from a PRC resident enterprise wishes to enjoy the favorable tax benefits under the tax arrangements, it shall submit an application for approval to the competent tax authority. Without being approved, thenon-resident enterprise may not enjoy the favorable tax treatment provided in the tax agreements.

), which was promulgated by the SAT on August 24, 2009 and became effective on October 1, 2009, where anon-resident enterprise that receives dividends from a PRC resident enterprise wishes to enjoy the favorable tax benefits under the tax arrangements, it shall submit an application for approval to the competent tax authority. Without being approved, thenon-resident enterprise may not enjoy the favorable tax treatment provided in the tax agreements. ) has been repealed by the Administrative Measures on Tax Convention Treatment forNon-Resident Taxpayers (

) has been repealed by the Administrative Measures on Tax Convention Treatment forNon-Resident Taxpayers ( ), which was promulgated by the SAT on August 27, 2015 and became effective on November 1, 2015 with last amendment on June 15, 2018, where anon-resident enterprise that receives dividends from a PRC resident enterprise, it could directly enjoy the favorable tax benefits under the tax arrangements at tax returns, and subject to the subsequent regulation of the competent tax authority.

), which was promulgated by the SAT on August 27, 2015 and became effective on November 1, 2015 with last amendment on June 15, 2018, where anon-resident enterprise that receives dividends from a PRC resident enterprise, it could directly enjoy the favorable tax benefits under the tax arrangements at tax returns, and subject to the subsequent regulation of the competent tax authority. ) promulgated on July 5, 1994 and effective from January 1, 1995, and last revised on August 27, 2009, as well as the PRC Labor Contract Law (

) promulgated on July 5, 1994 and effective from January 1, 1995, and last revised on August 27, 2009, as well as the PRC Labor Contract Law ( ) promulgated on December 29, 2018, revised on December 28, 2012 and effective from July 1, 2013, if an employment relationship is established between an entity and its employees, written

) promulgated on December 29, 2018, revised on December 28, 2012 and effective from July 1, 2013, if an employment relationship is established between an entity and its employees, written ) promulgated on January 22, 1999 and revised on March 24, 2019, Decisions of the State Council on Modifying the Basic Endowment Insurance System for Enterprise Employees (

) promulgated on January 22, 1999 and revised on March 24, 2019, Decisions of the State Council on Modifying the Basic Endowment Insurance System for Enterprise Employees (

) promulgated on December 3, 2005, Decision on Establishment of Basic Medical System for Urban Employee (

) promulgated on December 3, 2005, Decision on Establishment of Basic Medical System for Urban Employee ( ) issued by State Council with effect from December 14, 1998, the Regulations on Unemployment Insurance (

) issued by State Council with effect from December 14, 1998, the Regulations on Unemployment Insurance ( ) effective from January 22, 1999, Regulations on Work-Related Injury Insurance (

) effective from January 22, 1999, Regulations on Work-Related Injury Insurance ( ) promulgated on April 27, 2003 with effect from January 1, 2004, and as amended on December 20, 2010, and the Interim Measures concerning the Maternity Insurance for Enterprise Employees (

) promulgated on April 27, 2003 with effect from January 1, 2004, and as amended on December 20, 2010, and the Interim Measures concerning the Maternity Insurance for Enterprise Employees ( ) promulgated on December 14, 1994 with effect from January 1, 1995, employers are required to register with the competent social insurance authorities and provide their employees with welfare schemes covering pension insurance, unemployment insurance, maternity insurance, work-related injury insurance and medical insurance.

) promulgated on December 14, 1994 with effect from January 1, 1995, employers are required to register with the competent social insurance authorities and provide their employees with welfare schemes covering pension insurance, unemployment insurance, maternity insurance, work-related injury insurance and medical insurance. ), which became effective on July 1, 2011 with last amendment on December 29, 2019, all employees are required to participate in basic pension insurance, basic medical insurance schemes and unemployment insurance, which must be contributed by both the employers and the employees. All employees are required to participate in work-related injury insurance and maternity insurance schemes, which must be contributed by the employers. Employers are required to complete registrations with local social insurance authorities. Moreover, the employers must timely make all social insurance contributions. Except for mandatory exceptions such as force majeure, social insurance premiums may not be paid late, reduced or be exempted. Where an employer fails to make social insurance contributions in full and on time, the social insurance contribution collection agencies shall order it to make all or outstanding contributions within a specified period and impose a late payment fee at the rate of 0.05% per day from the date on which the contribution becomes due. If such employer fails to make the overdue contributions within such time limit, the relevant administrative department may impose a fine equivalent to 1—3 times the overdue amount.

), which became effective on July 1, 2011 with last amendment on December 29, 2019, all employees are required to participate in basic pension insurance, basic medical insurance schemes and unemployment insurance, which must be contributed by both the employers and the employees. All employees are required to participate in work-related injury insurance and maternity insurance schemes, which must be contributed by the employers. Employers are required to complete registrations with local social insurance authorities. Moreover, the employers must timely make all social insurance contributions. Except for mandatory exceptions such as force majeure, social insurance premiums may not be paid late, reduced or be exempted. Where an employer fails to make social insurance contributions in full and on time, the social insurance contribution collection agencies shall order it to make all or outstanding contributions within a specified period and impose a late payment fee at the rate of 0.05% per day from the date on which the contribution becomes due. If such employer fails to make the overdue contributions within such time limit, the relevant administrative department may impose a fine equivalent to 1—3 times the overdue amount. ) effective from April 3, 1999, amended on March 24, 2002 and March 24, 2019, enterprises are required to register with the competent administrative centers of housing provident fund and open bank accounts for housing provident funds for their employees. Employers are also required to timely pay all housing fund contributions for their employees. Where an employer fails to submit and deposit registration of housing provident fund or fails to go through the formalities of opening housing provident fund accounts for its employees, the housing provident fund management center shall order it to go through the formalities within a prescribed time limit. Failing to do so at the expiration of the time limit will subject the employer to a fine of not less than RMB10,000 and up to RMB50,000. When an employer fails to pay housing provident fund due in full and in time, housing provident fund center is entitled to order it to rectify, failing to do so would result in enforcement exerted by the court.

) effective from April 3, 1999, amended on March 24, 2002 and March 24, 2019, enterprises are required to register with the competent administrative centers of housing provident fund and open bank accounts for housing provident funds for their employees. Employers are also required to timely pay all housing fund contributions for their employees. Where an employer fails to submit and deposit registration of housing provident fund or fails to go through the formalities of opening housing provident fund accounts for its employees, the housing provident fund management center shall order it to go through the formalities within a prescribed time limit. Failing to do so at the expiration of the time limit will subject the employer to a fine of not less than RMB10,000 and up to RMB50,000. When an employer fails to pay housing provident fund due in full and in time, housing provident fund center is entitled to order it to rectify, failing to do so would result in enforcement exerted by the court. ) promulgated by the State Council on January 29, 1996 and amended on August 1, 2008 with effect from August 5, 2008, and various regulations issued by the State Administration of Foreign Exchange (

) promulgated by the State Council on January 29, 1996 and amended on August 1, 2008 with effect from August 5, 2008, and various regulations issued by the State Administration of Foreign Exchange ( ), or the SAFE, and other PRC regulatory agencies, foreign currency could be exchanged or paid

), or the SAFE, and other PRC regulatory agencies, foreign currency could be exchanged or paid

), or SAFE Circular 59, which became effective on December 17, 2012, with last amendment on October 10, 2018. SAFE Circular 59 substantially amends and simplifies the current foreign exchange procedure. According to SAFE Circular 59, the opening of various special purpose foreign exchange accounts (e.g.pre-investment expenses account, foreign exchange capital account, asset realization account, guarantee account) no longer requires SAFE’s approval. Furthermore, multiple capital accounts for the same entity may be opened in different provinces, which was not possible before the issuance of SAFE Circular 59. Reinvestment of lawful incomes derived by foreign investors in the PRC (e.g. profit, proceeds of equity transfer, capital reduction, liquidation and early repatriation of investment) no longer requires SAFE’s approval or verification, and purchase and remittance of foreign exchange as a result of capital reduction, liquidation, early repatriation or share transfer in a foreign-invested enterprise no longer requires SAFE’s approval.

), or SAFE Circular 59, which became effective on December 17, 2012, with last amendment on October 10, 2018. SAFE Circular 59 substantially amends and simplifies the current foreign exchange procedure. According to SAFE Circular 59, the opening of various special purpose foreign exchange accounts (e.g.pre-investment expenses account, foreign exchange capital account, asset realization account, guarantee account) no longer requires SAFE’s approval. Furthermore, multiple capital accounts for the same entity may be opened in different provinces, which was not possible before the issuance of SAFE Circular 59. Reinvestment of lawful incomes derived by foreign investors in the PRC (e.g. profit, proceeds of equity transfer, capital reduction, liquidation and early repatriation of investment) no longer requires SAFE’s approval or verification, and purchase and remittance of foreign exchange as a result of capital reduction, liquidation, early repatriation or share transfer in a foreign-invested enterprise no longer requires SAFE’s approval.

), or SAFE Circular 19, which came into effect on June 1, 2015. According to SAFE Circular 19, the foreign exchange capital of foreign-invested enterprises, or the FIE, shall be subject to a discretional foreign exchange settlement, or the Discretional Foreign Exchange Settlement. The Discretional Foreign Exchange Settlement refers to the foreign exchange capital in the capital account of an FIE for which the rights and interests of monetary contribution has been confirmed by the local foreign exchange bureau (or the book-entry registration of monetary contribution by the banks) and can be settled at the banks based on the actual operational needs of the FIE. The proportion of Discretional Foreign Exchange Settlement of the foreign exchange capital of an FIE is temporarily determined as 100%. Renminbi converted from a foreign exchange capital will be kept in a designated account and if an FIE needs to make further payment from such account, it still needs to provide supporting documents and go through the review process with the banks.

), or SAFE Circular 19, which came into effect on June 1, 2015. According to SAFE Circular 19, the foreign exchange capital of foreign-invested enterprises, or the FIE, shall be subject to a discretional foreign exchange settlement, or the Discretional Foreign Exchange Settlement. The Discretional Foreign Exchange Settlement refers to the foreign exchange capital in the capital account of an FIE for which the rights and interests of monetary contribution has been confirmed by the local foreign exchange bureau (or the book-entry registration of monetary contribution by the banks) and can be settled at the banks based on the actual operational needs of the FIE. The proportion of Discretional Foreign Exchange Settlement of the foreign exchange capital of an FIE is temporarily determined as 100%. Renminbi converted from a foreign exchange capital will be kept in a designated account and if an FIE needs to make further payment from such account, it still needs to provide supporting documents and go through the review process with the banks.

), or SAFE Circular 37, became effective on July 4, 2014. Pursuant to SAFE Circular 37, SAFE and its branches shall enforce registration management for establishment of a special purpose vehicle, or SPV, by domestic residents (including domestic institutions and domestic resident individuals, and domestic resident individuals shall refer to PRC citizens holding the identity cards for PRC domestic residents, military identity certificates or identity certificates for armed police force, and overseas individuals that do not hold any domestic legitimate identity certificates but have habitual residences within the territory of the PRC due to relationships of economic interests). Prior to contributing domestic and overseas legitimate assets or interests to an SPV, a domestic resident shall apply to SAFE for foreign exchange registration of overseas investment. Where a registered overseas SPV undergoes changes of its domestic resident individual shareholders, name, operating period or other basic information, or experiences substantial changes including without limitation the increase or reduction of registered capital by domestic resident individuals, transfer or replacement of equity and merger or split, the SPV shall go through modification registration of foreign exchange for overseas investment with SAFE. Where anon-listed SPV uses its own equity interests or options to grant equity incentives to the directors, supervisors and senior management of a domestic enterprise under its direct or indirect control, as well as other employees in employment or labor relationships with the aforesaid company, relevant domestic resident individuals may, before exercising their rights, apply to SAFE for foreign exchange registration of the SPV.

), or SAFE Circular 37, became effective on July 4, 2014. Pursuant to SAFE Circular 37, SAFE and its branches shall enforce registration management for establishment of a special purpose vehicle, or SPV, by domestic residents (including domestic institutions and domestic resident individuals, and domestic resident individuals shall refer to PRC citizens holding the identity cards for PRC domestic residents, military identity certificates or identity certificates for armed police force, and overseas individuals that do not hold any domestic legitimate identity certificates but have habitual residences within the territory of the PRC due to relationships of economic interests). Prior to contributing domestic and overseas legitimate assets or interests to an SPV, a domestic resident shall apply to SAFE for foreign exchange registration of overseas investment. Where a registered overseas SPV undergoes changes of its domestic resident individual shareholders, name, operating period or other basic information, or experiences substantial changes including without limitation the increase or reduction of registered capital by domestic resident individuals, transfer or replacement of equity and merger or split, the SPV shall go through modification registration of foreign exchange for overseas investment with SAFE. Where anon-listed SPV uses its own equity interests or options to grant equity incentives to the directors, supervisors and senior management of a domestic enterprise under its direct or indirect control, as well as other employees in employment or labor relationships with the aforesaid company, relevant domestic resident individuals may, before exercising their rights, apply to SAFE for foreign exchange registration of the SPV. ), or SAFE Circular 13, which was promulgated by SAFE on February 13, 2015 and became effective on June 1, 2015, the foreign exchange registration under domestic direct investment and the foreign exchange registration under overseas direct investment will be directly reviewed and handled by banks in accordance with SAFE Circular 13, and SAFE and its branches shall perform indirect regulation over the foreign exchange registration via banks.

), or SAFE Circular 13, which was promulgated by SAFE on February 13, 2015 and became effective on June 1, 2015, the foreign exchange registration under domestic direct investment and the foreign exchange registration under overseas direct investment will be directly reviewed and handled by banks in accordance with SAFE Circular 13, and SAFE and its branches shall perform indirect regulation over the foreign exchange registration via banks.