Q3 2019 EARNINGS SUPPLEMENT DECEMBER 2019

PRO FORMA INFORMATION AND NON-GAAP FINANCIAL MEASURES The pro forma information presented herein gives effect to the results of our 2019 and 2018 Partnerships during the unowned period as if the Company had acquired such Partners on January 1, 2019 and January 1, 2018, respectively. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisitions had occurred on that date, nor the results that may be obtained in the future. Pro forma Adjusted EBITDA and pro forma Adjusted EBITDA Margin are not measures of financial performance under GAAP and should not be considered substitutes for net income. These non-GAAP financial measures have limitations as analytical tools, and when assessing our operating performance, you should not consider these non-GAAP financial measures in isolation or as substitutes for commissions and fees, net income or other consolidated income statement data prepared in accordance with GAAP. Other companies in our industry may define or calculate these non-GAAP financial measures differently than we do, and accordingly these measures may not be comparable to similarly titled measures used by other companies. Pro forma Adjusted EBITDA eliminates the effects of financing, depreciation and amortization. We define pro forma Adjusted EBITDA as pro forma net income (loss) before interest, taxes, depreciation, amortization and certain items of income and expense, including share-based compensation expense, transaction-related expenses related to forming Partnerships including severance, and certain non-recurring costs, including those related to the Offering and loss on modification and extinguishment of debt. We believe that pro forma Adjusted EBITDA is an appropriate measure of operating performance because it eliminates the impact of expenses that do not relate to business performance, and that the presentation of this measure enhances an investor's understanding of our financial performance. Pro forma Adjusted EBITDA Margin is pro forma Adjusted EBITDA divided by pro forma commissions and fees. Pro forma Adjusted EBITDA is a key metric used by management and our board of directors to assess our financial performance. We believe that pro forma Adjusted EBITDA is an appropriate measure of operating performance because it eliminates the impact of expenses that do not relate to business performance, and that the presentation of this measure enhances an investor’s understanding of our financial performance. We believe that pro forma Adjusted EBITDA Margin is helpful in measuring profitability of operations on a consolidated level. 2

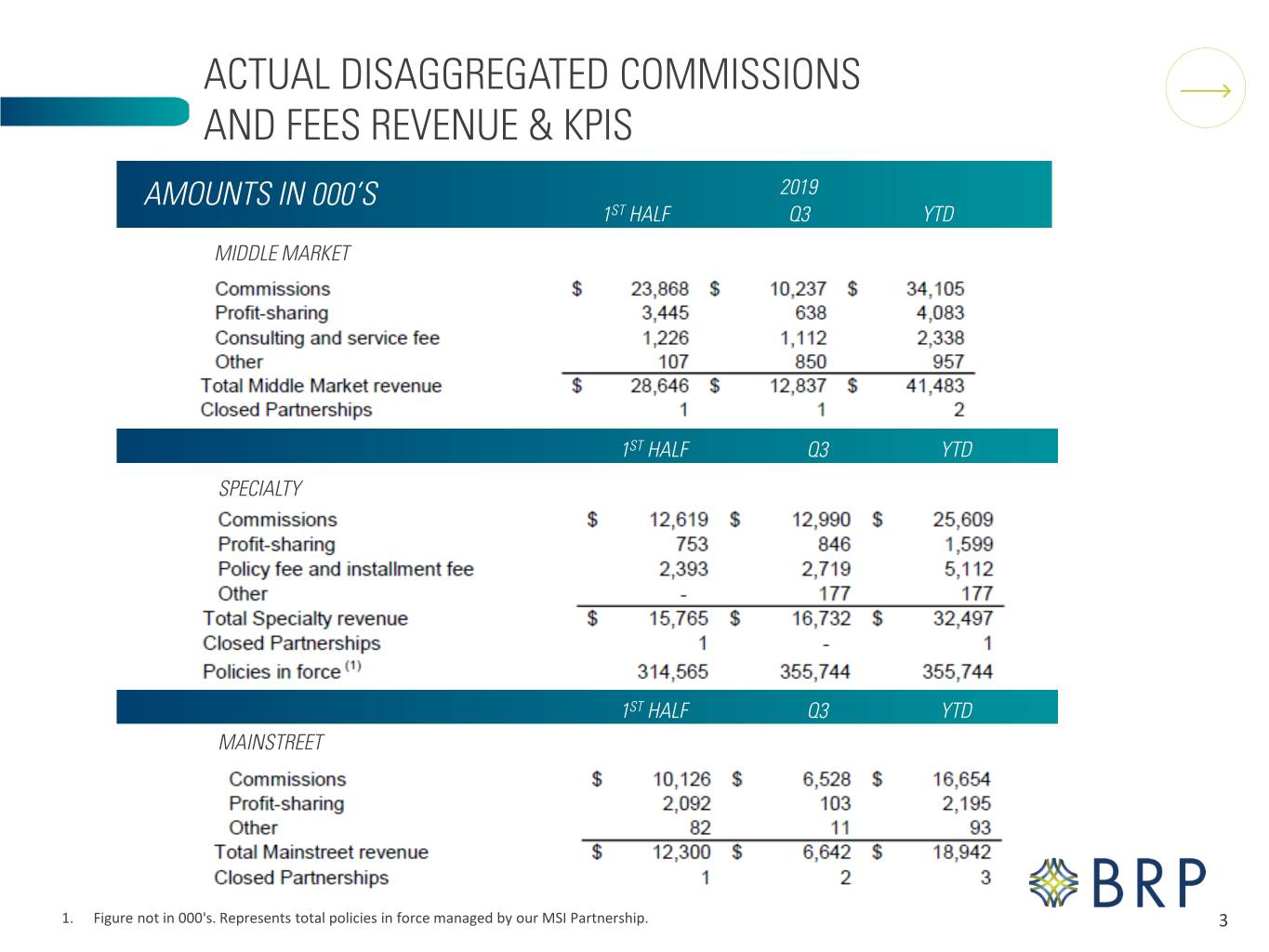

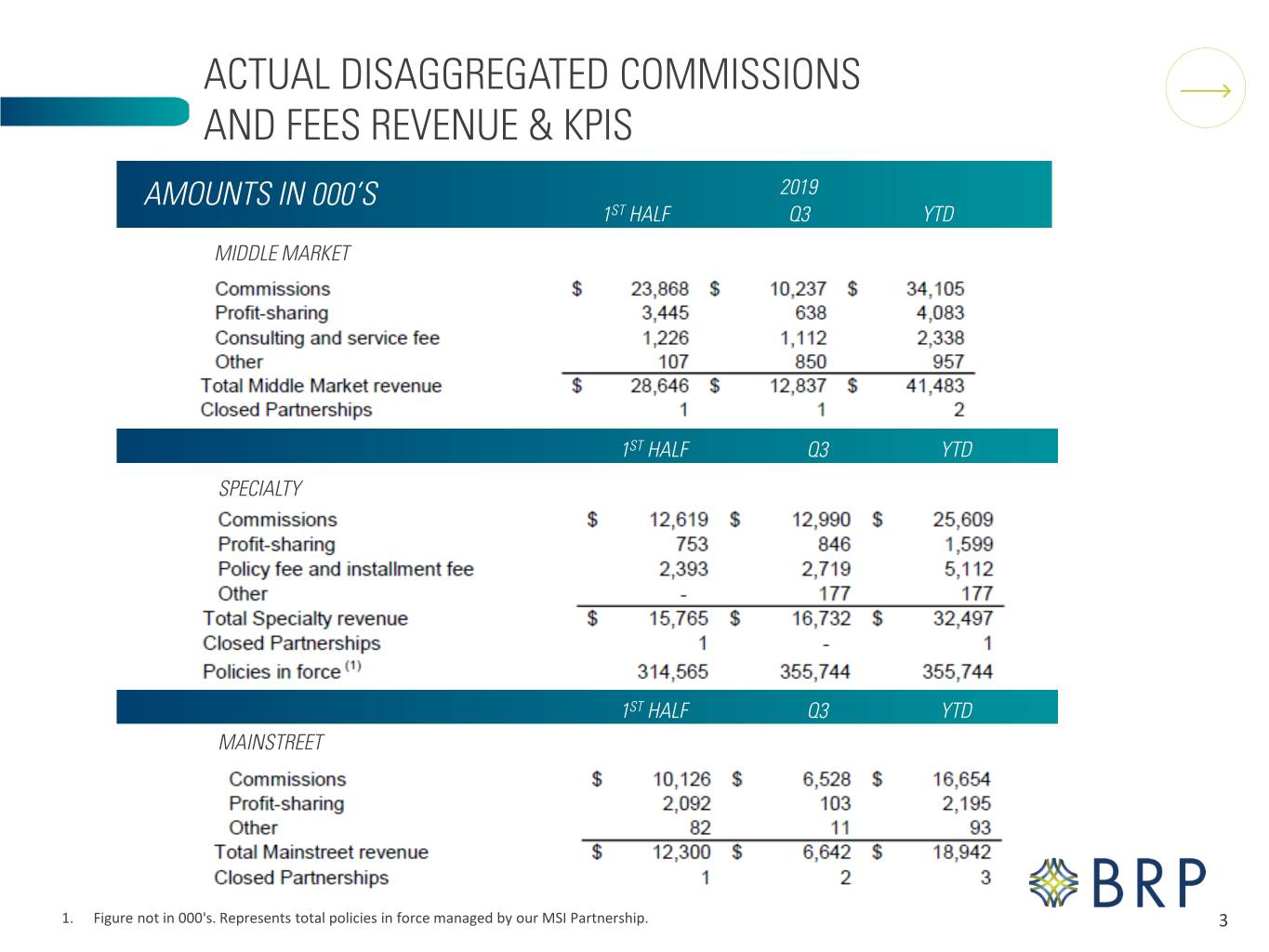

ACTUAL DISAGGREGATED COMMISSIONS AND FEES REVENUE & KPIS AMOUNTS IN 000’S 2019 1ST HALF Q3 YTD MIDDLE MARKET 1ST HALF Q3 YTD SPECIALTY 1ST HALF Q3 YTD MAINSTREET 1. Figure not in 000's. Represents total policies in force managed by our MSI Partnership. 3

ACTUAL DISAGGREGATED COMMISSIONS AND FEES REVENUE & KPIS AMOUNTS IN 000’S 2019 1ST HALF Q3 YTD MEDICARE 1ST HALF Q3 YTD CONSOLIDATED 2. Represents the aggregate revenues of acquired Partners for the most recent trailing twelve month period, in each case, at the time the due diligence was concluded. 4

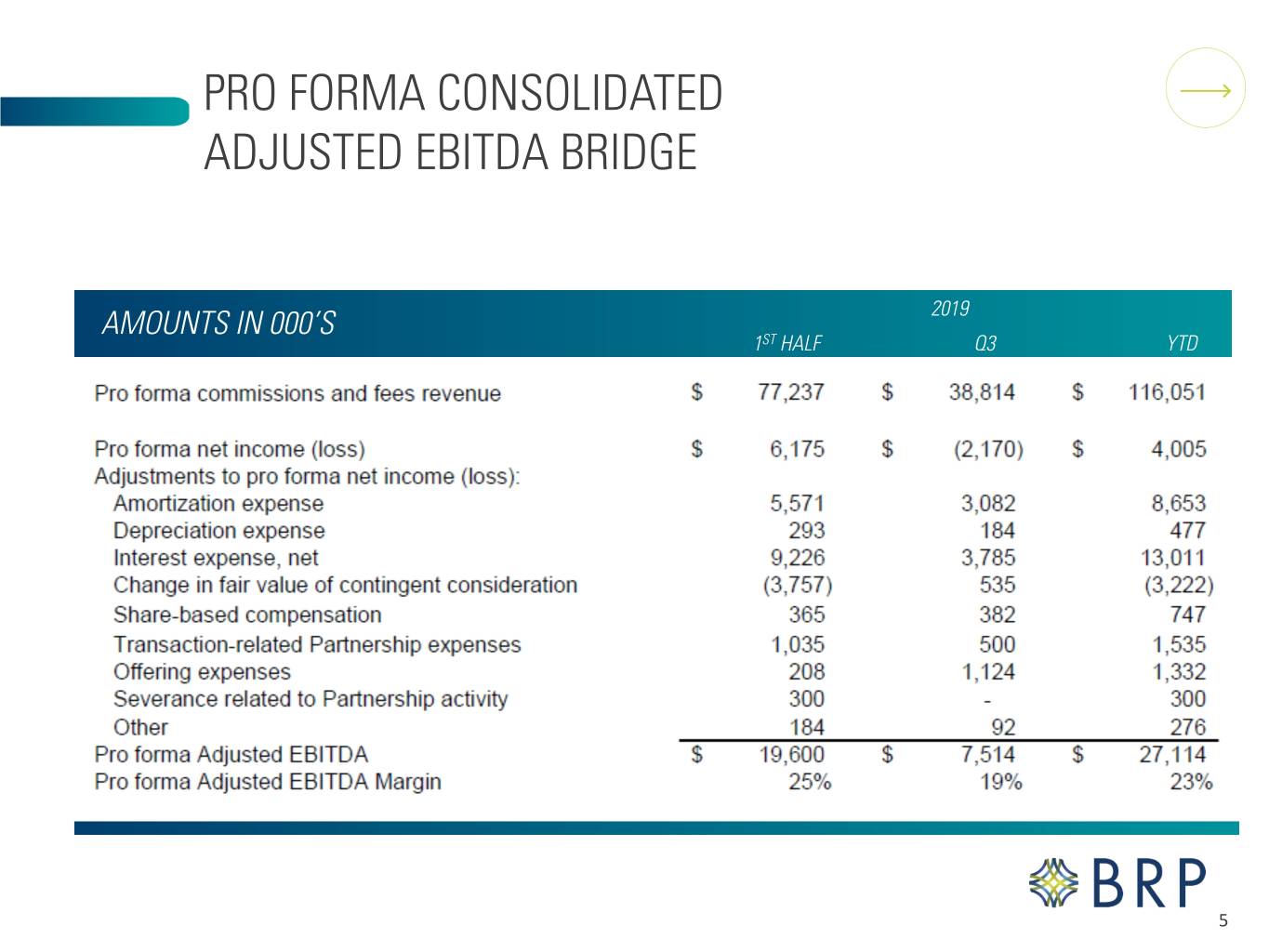

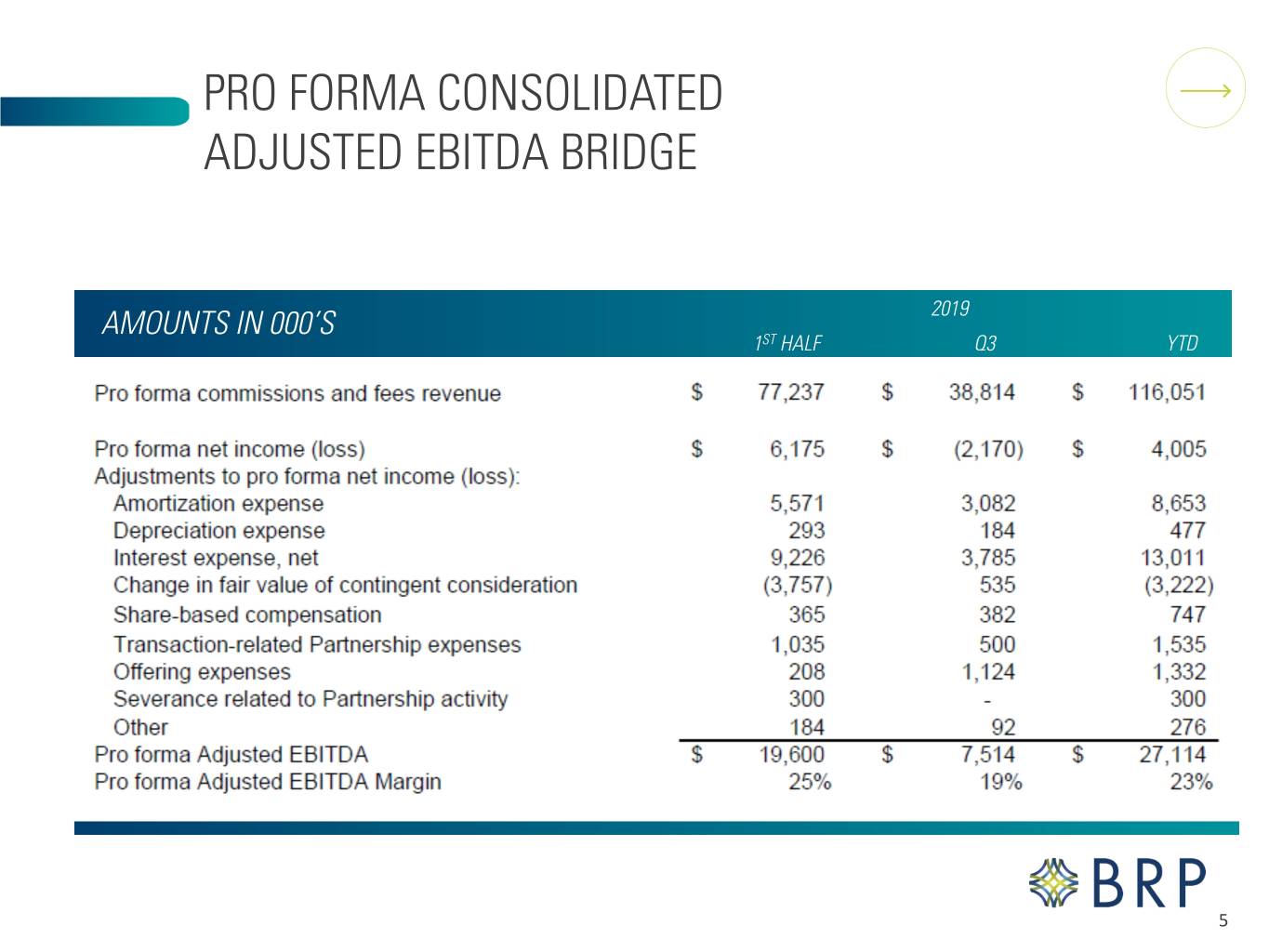

PRO FORMA CONSOLIDATED ADJUSTED EBITDA BRIDGE AMOUNTS IN 000’S 2019 1ST HALF Q3 YTD 5

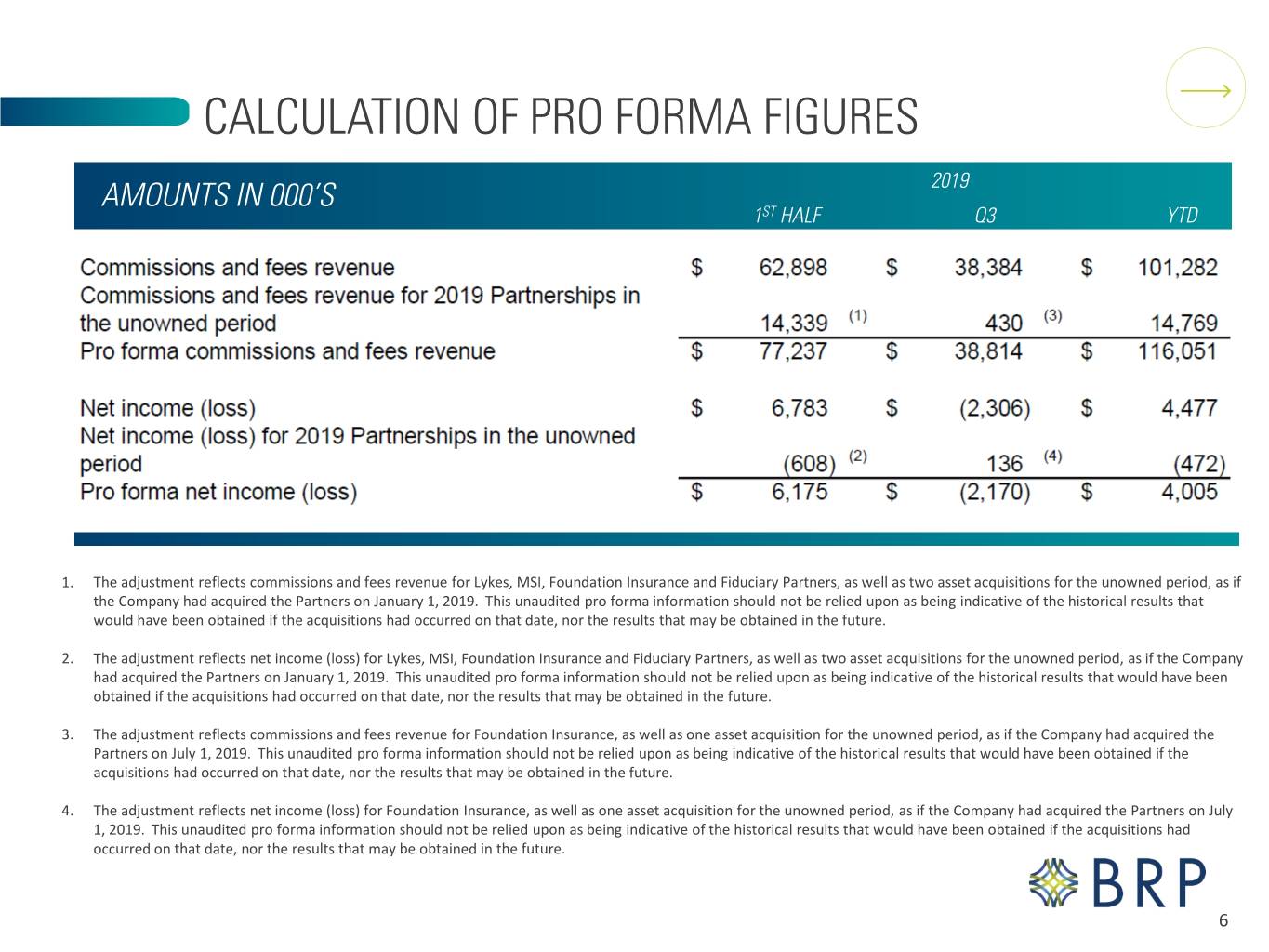

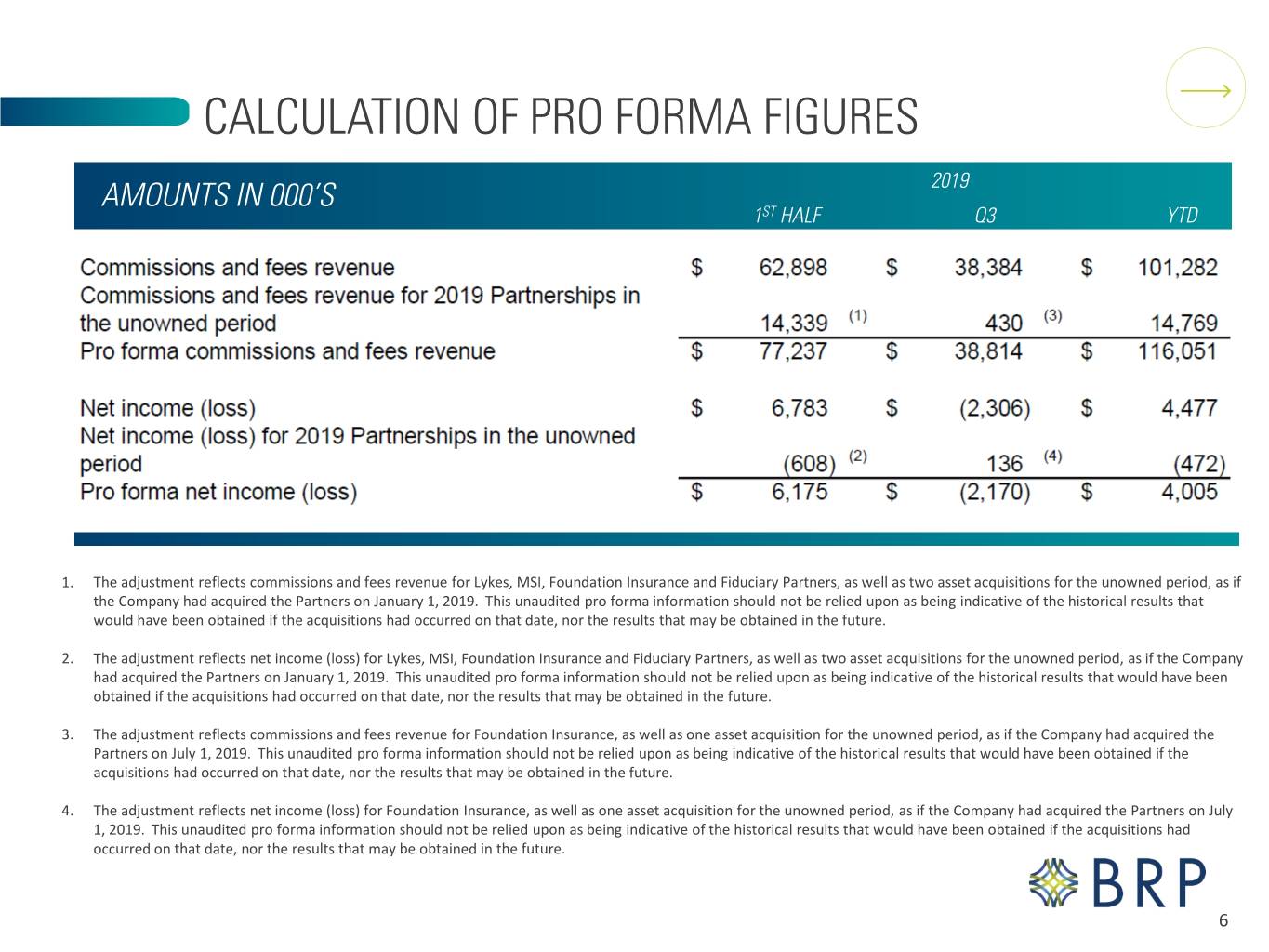

CALCULATION OF PRO FORMA FIGURES AMOUNTS IN 000’S 2019 1ST HALF Q3 YTD 1. The adjustment reflects commissions and fees revenue for Lykes, MSI, Foundation Insurance and Fiduciary Partners, as well as two asset acquisitions for the unowned period, as if the Company had acquired the Partners on January 1, 2019. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisitions had occurred on that date, nor the results that may be obtained in the future. 2. The adjustment reflects net income (loss) for Lykes, MSI, Foundation Insurance and Fiduciary Partners, as well as two asset acquisitions for the unowned period, as if the Company had acquired the Partners on January 1, 2019. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisitions had occurred on that date, nor the results that may be obtained in the future. 3. The adjustment reflects commissions and fees revenue for Foundation Insurance, as well as one asset acquisition for the unowned period, as if the Company had acquired the Partners on July 1, 2019. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisitions had occurred on that date, nor the results that may be obtained in the future. 4. The adjustment reflects net income (loss) for Foundation Insurance, as well as one asset acquisition for the unowned period, as if the Company had acquired the Partners on July 1, 2019. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisitions had occurred on that date, nor the results that may be obtained in the future. 6

PRO FORMA CONSOLIDATED ADJUSTED EBITDA BRIDGE AMOUNTS IN 000’S 2018 1ST HALF Q3 YTD 7

CALCULATION OF PRO FORMA FIGURES AMOUNTS IN 000’S 2018 1ST HALF Q3 YTD 1. The adjustment reflects commissions and fees revenue for AB Risk, Black Insurance, T&C Insurance and Montoya, as well as five asset acquisitions for the unowned period, as if the Company had acquired the Partners on January 1, 2018. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisitions had occurred on that date, nor the results that may be obtained in the future. 2. The adjustment reflects net income (loss) for AB Risk, Black Insurance, T&C Insurance and Montoya, as well as five asset acquisitions for the unowned period, as if the Company had acquired the Partners on January 1, 2018. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisitions had occurred on that date, nor the results that may be obtained in the future. 3. The adjustment reflects commissions and fees revenue for Montoya as if the Company had acquired the Partner on July 1, 2018. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisition had occurred on that date, nor the results that may be obtained in the future. 4. The adjustment reflects net income (loss) for Montoya as if the Company had acquired the Partner on July 1, 2018. This unaudited pro forma information should not be relied upon as being indicative of the historical results that would have been obtained if the acquisition had occurred on that date, nor the results that may be obtained in the future. 8

TREASURY DEBT OUTSTANDING AVAILABLE FOR CASH RATE MATURITY INSTRUMENT @ 9.30.19 BORROWING INTERST LIBOR + 3.50% Revolving lines of credit (1) $ 105,000,000 $ 20,000,000 March 2024 $3,180,000 (5.59%) (2) Fully repaid Fully repaid $4,300,000 Related party debt $ 88,425,293 8.75% October 2019 October 2019 1. On November 25, 2019, we repaid a portion of the Revolving Lines of Credit in the amount of $65.0 million, which results in remaining borrowing capacity of $85.0 million under the Cadence Credit Agreement. 2. On October 28, 2019, BRP used a portion of the proceeds it received from the sale of newly-issued LLC Units to BRP Group in connection with the Offering to repay in full the outstanding indebtedness and accrued interest under the Villages Credit Agreement in the amount of $89.0 million and concurrently terminated the Villages Credit Agreement. 9