Robinhood Securities, LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Thu Jul 28 2022 14:38:08 GMT-0400 (Eastern Daylight Time) 2nd Quarter, 2022 April 2022 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 29.73 18.81 8.57 42.89 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 53.20 39.00 39.14 40.30 71.80 157,017.03 37.9890 89,486.96 41.8638 15,322.02 35.6547 319,498.44 105.0488 Virtu Americas, LLC 17.57 11.64 10.63 11.07 26.02 65,174.17 74.3966 33,011.19 74.0281 7,274.54 71.8066 188,491.57 238.3128 G1X Execution Services, LLC 12.25 20.76 22.34 20.70 0.23 153,426.16 126.8537 82,732.83 133.2005 16,712.51 130.1491 4,100.93 123.5056 Jane Street Capital 9.60 16.65 16.76 16.47 0.19 179,871.64 128.1711 87,827.45 125.6024 18,168.33 121.8827 3,366.79 89.9425 Two Sigma Securities, LLC 6.86 10.96 10.33 10.54 1.76 55,474.57 102.0300 27,908.33 100.4537 4,969.11 83.8433 5,652.62 184.0747 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1X Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow.

Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Two Sigma Securities, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. April 2022 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 25.84 19.95 8.72 45.49 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 43.87 33.58 31.40 33.22 57.22 1,261,896.54 18.1999 622,044.98 13.5483 115,983.89 16.8985 1,432,697.16 17.1798 Virtu Americas, LLC 30.08 20.59 20.18 20.78 41.60 765,467.82 21.9237 360,979.32 14.5181 69,521.54 18.3858 866,791.90 16.6837 Jane Street Capital 14.38 24.51 28.65 25.38 0.25 1,116,680.21 17.1541 543,373.35 10.9233 101,023.58 16.0606 32,718.99 20.7106 Two Sigma Securities, LLC 6.68 12.03 10.77 11.80 0.86 375,947.89 16.4422 180,260.29 10.5008 34,522.90 14.4195 26,650.12 20.0418 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Two Sigma Securities, LLC:

Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. April 2022 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.06 18.04 59.71 22.19 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 50.65 55.38 48.94 52.19 47.87 11,838.45 59.3972 7,626,425.95 57.2897 8,061,598.40 59.9205 1,719,824.85 53.0584 Wolverine Execution Services, LLC 22.95 19.59 21.41 22.80 24.63 4,813.65 60.1706 3,479,844.20 52.3564 4,097,943.90 55.9231 1,151,203.30 50.7324 Global Execution Brokers, LP 18.50 18.02 21.52 17.30 19.28 5,744.55 47.7400 4,083,732.50 50.8949 3,417,221.20 52.7515 881,902.60 47.3705 Morgan Stanley & Co., LLC 7.90 7.00 8.12 7.72 8.22 1,951.25 45.0531 1,440,024.90 52.1218 1,434,178.10 54.9234 438,521.85 48.8139 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Wolverine Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Global Execution Brokers, LP: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. May 2022

S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 29.49 18.29 8.63 43.60 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 53.33 44.89 44.30 47.07 64.06 155,979.22 40.3550 79,642.81 39.5430 12,674.01 35.8934 302,077.56 106.2556 Virtu Americas, LLC 26.74 20.16 20.16 19.53 35.37 154,852.32 164.1110 85,803.77 178.2414 14,380.29 142.1320 271,671.50 302.5457 G1X Execution Services, LLC 10.37 18.05 18.99 17.09 0.22 175,889.05 155.3877 97,306.46 167.7185 17,915.25 151.1738 5,213.92 166.3775 Jane Street Capital 8.39 14.79 14.85 14.24 0.20 205,632.43 167.9291 107,281.41 179.6275 20,086.23 153.5493 5,086.57 179.7387 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1X Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. May 2022 Non-S&P 500 Stocks

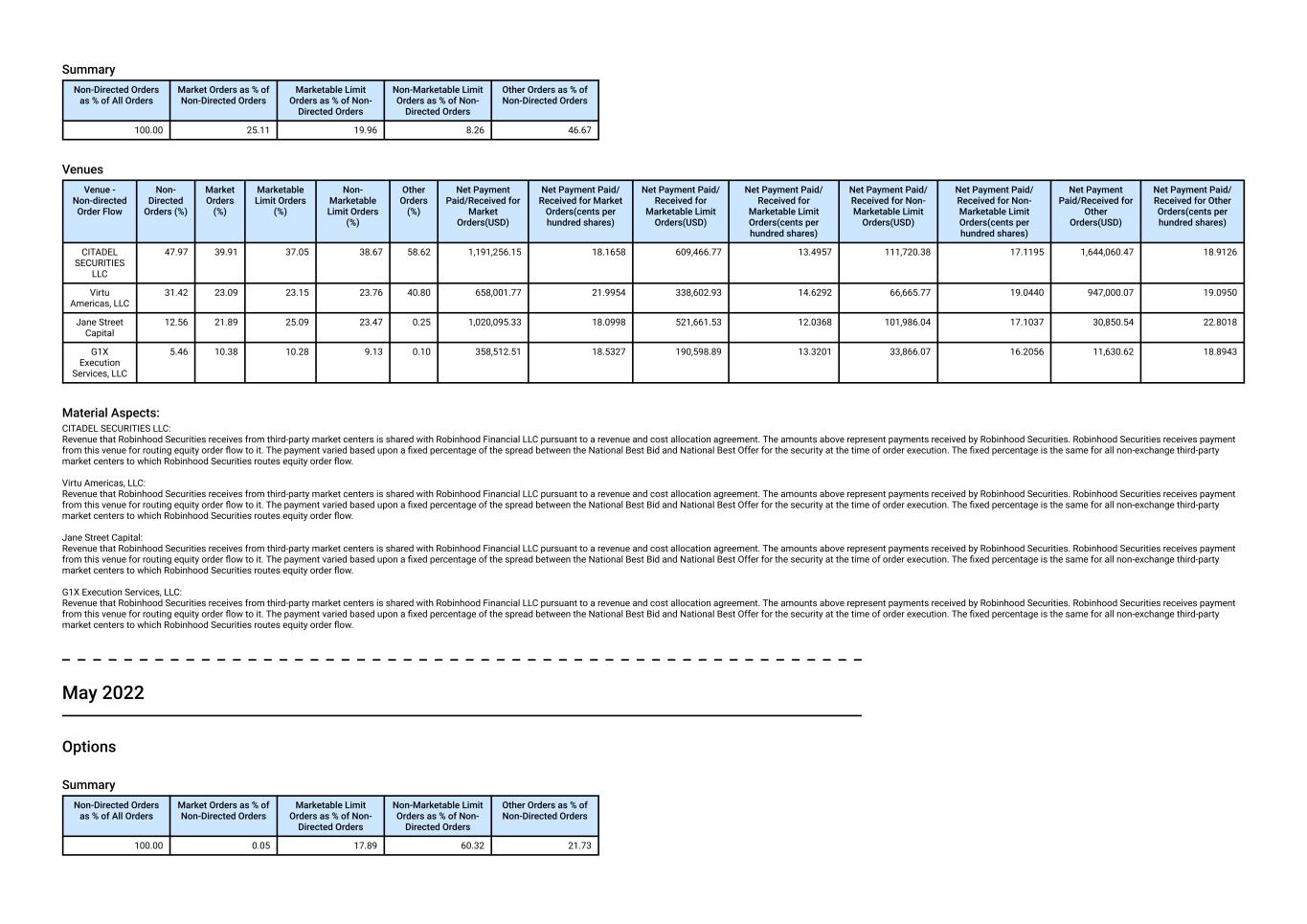

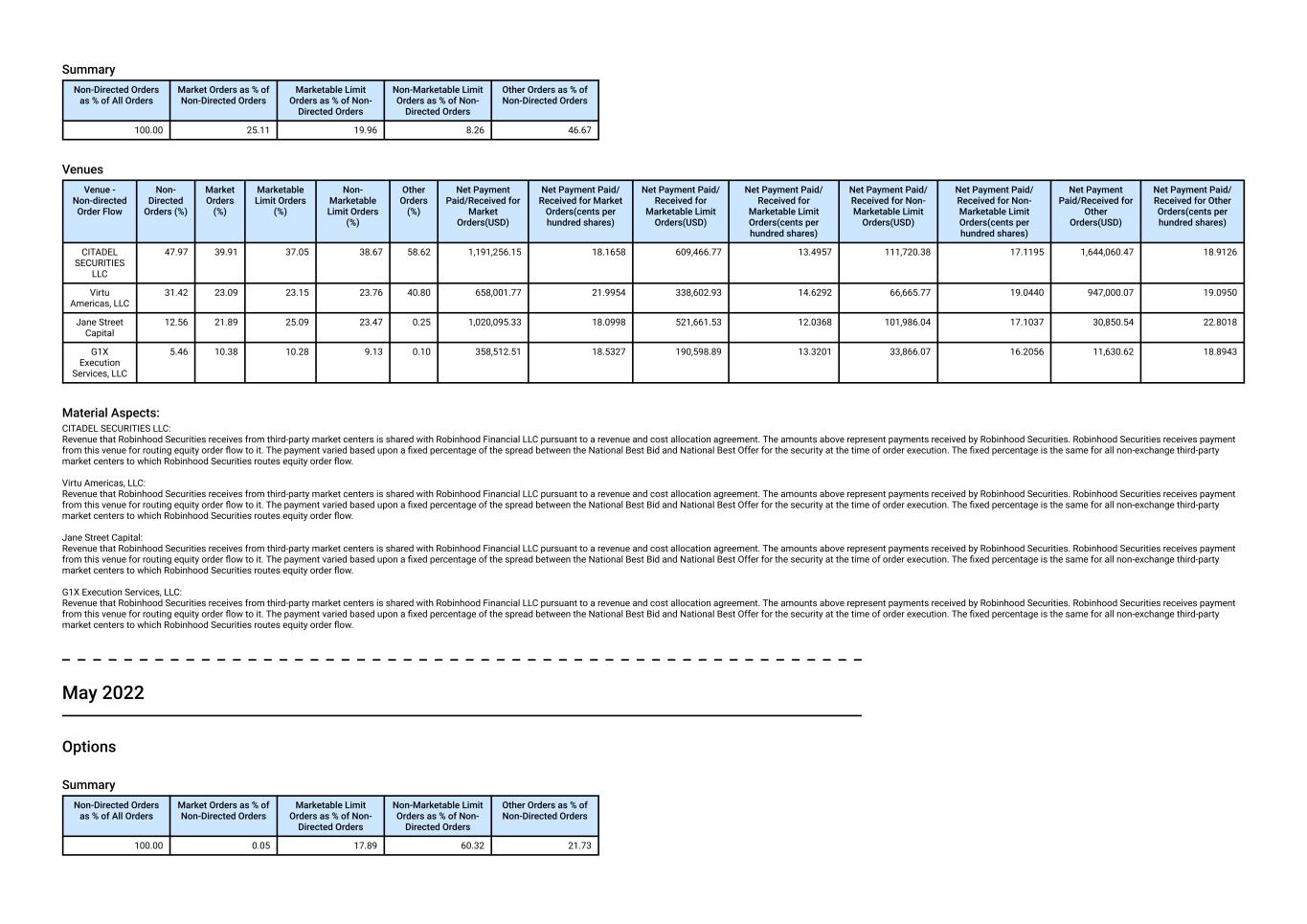

Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 25.11 19.96 8.26 46.67 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 47.97 39.91 37.05 38.67 58.62 1,191,256.15 18.1658 609,466.77 13.4957 111,720.38 17.1195 1,644,060.47 18.9126 Virtu Americas, LLC 31.42 23.09 23.15 23.76 40.80 658,001.77 21.9954 338,602.93 14.6292 66,665.77 19.0440 947,000.07 19.0950 Jane Street Capital 12.56 21.89 25.09 23.47 0.25 1,020,095.33 18.0998 521,661.53 12.0368 101,986.04 17.1037 30,850.54 22.8018 G1X Execution Services, LLC 5.46 10.38 10.28 9.13 0.10 358,512.51 18.5327 190,598.89 13.3201 33,866.07 16.2056 11,630.62 18.8943 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1X Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. May 2022 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.05 17.89 60.32 21.73

Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 47.50 50.70 45.17 48.80 45.80 12,737.25 60.6160 6,832,834.10 55.1136 7,805,455.25 59.0266 1,659,915.15 52.6471 Wolverine Execution Services, LLC 23.97 22.03 22.62 24.06 24.82 6,384.40 56.7049 3,428,947.60 49.9144 4,466,963.35 54.8456 1,131,410.35 49.9118 Global Execution Brokers, LP 19.60 18.77 23.01 18.34 20.29 7,030.40 50.3034 3,978,276.45 49.1899 3,616,672.35 51.4992 892,404.25 46.4906 Morgan Stanley & Co., LLC 8.22 7.71 8.52 8.07 8.38 2,663.75 51.4436 1,386,089.25 50.2312 1,513,519.25 53.8160 447,174.15 47.7159 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Wolverine Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Global Execution Brokers, LP: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. June 2022 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 27.03 18.95 8.85 45.17 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares)

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 46.60 38.32 36.90 41.86 56.55 109,478.05 33.4801 59,538.37 29.5036 9,160.25 25.8194 198,886.44 73.1973 Virtu Americas, LLC 35.78 30.12 31.08 27.21 42.83 131,617.12 100.4731 78,322.78 100.3744 10,469.05 67.8738 175,763.18 133.7282 Jane Street Capital 7.75 14.13 14.42 12.82 0.14 111,511.02 80.4701 63,553.99 78.0319 10,306.73 59.8449 2,674.81 95.2737 G1X Execution Services, LLC 6.94 12.34 12.66 12.87 0.14 82,306.10 83.6453 46,682.08 83.6759 7,732.53 62.0236 2,204.96 106.5064 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1X Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. June 2022 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 24.00 19.44 8.35 48.21 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares)

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 43.80 33.67 31.84 33.94 55.38 1,041,957.62 18.4294 549,220.06 13.3289 96,571.36 16.2190 1,461,193.32 16.8584 Virtu Americas, LLC 33.81 24.40 24.62 24.45 43.82 666,353.11 19.6508 356,520.84 13.3204 65,119.63 18.1270 937,782.23 15.6680 Jane Street Capital 12.46 22.64 25.52 23.32 0.24 985,223.59 17.9677 508,128.95 11.6876 89,150.60 15.7333 26,776.79 20.5210 G1X Execution Services, LLC 5.18 10.34 9.55 9.44 0.11 322,945.73 15.0724 178,955.79 11.1534 31,550.36 13.6401 12,861.16 16.2903 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1X Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. June 2022 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.05 21.00 57.19 21.76 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares)

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 43.93 44.50 41.70 45.28 42.54 8,150.85 55.7437 6,553,577.45 55.4275 6,248,506.65 58.7786 1,431,233.00 52.0646 Wolverine Execution Services, LLC 25.79 25.60 25.32 25.71 26.45 5,707.10 52.7605 4,085,339.75 51.6168 4,222,499.95 55.1421 1,141,500.55 50.7517 Global Execution Brokers, LP 20.04 19.91 22.57 18.89 20.65 4,041.50 47.3965 4,095,506.10 49.7607 3,175,939.00 51.7076 820,915.35 46.5822 Morgan Stanley & Co., LLC 8.40 8.09 8.65 8.26 8.52 1,540.85 49.4496 1,489,146.50 51.0175 1,354,974.85 53.8419 426,765.85 47.8828 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Wolverine Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Global Execution Brokers, LP: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue.