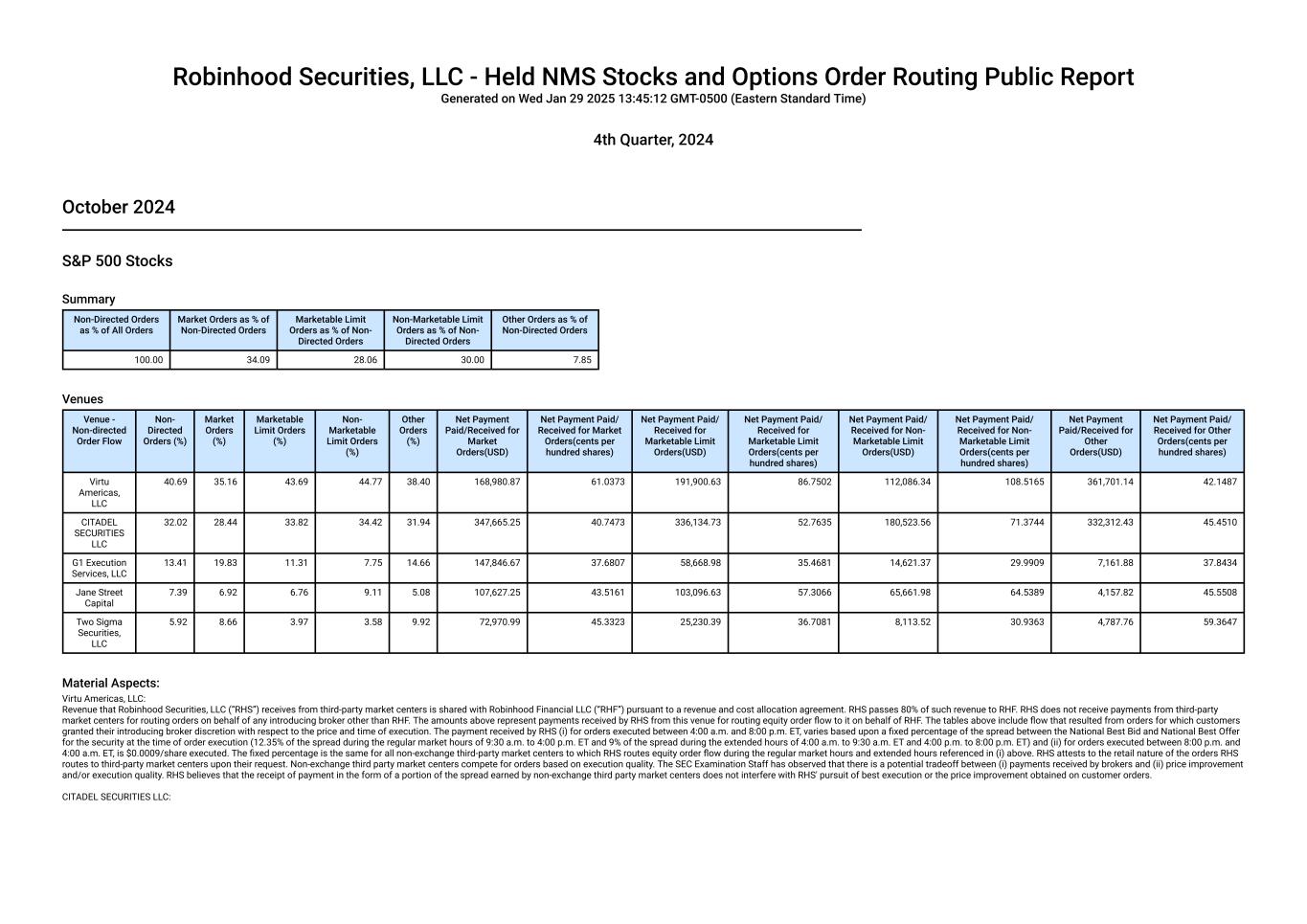

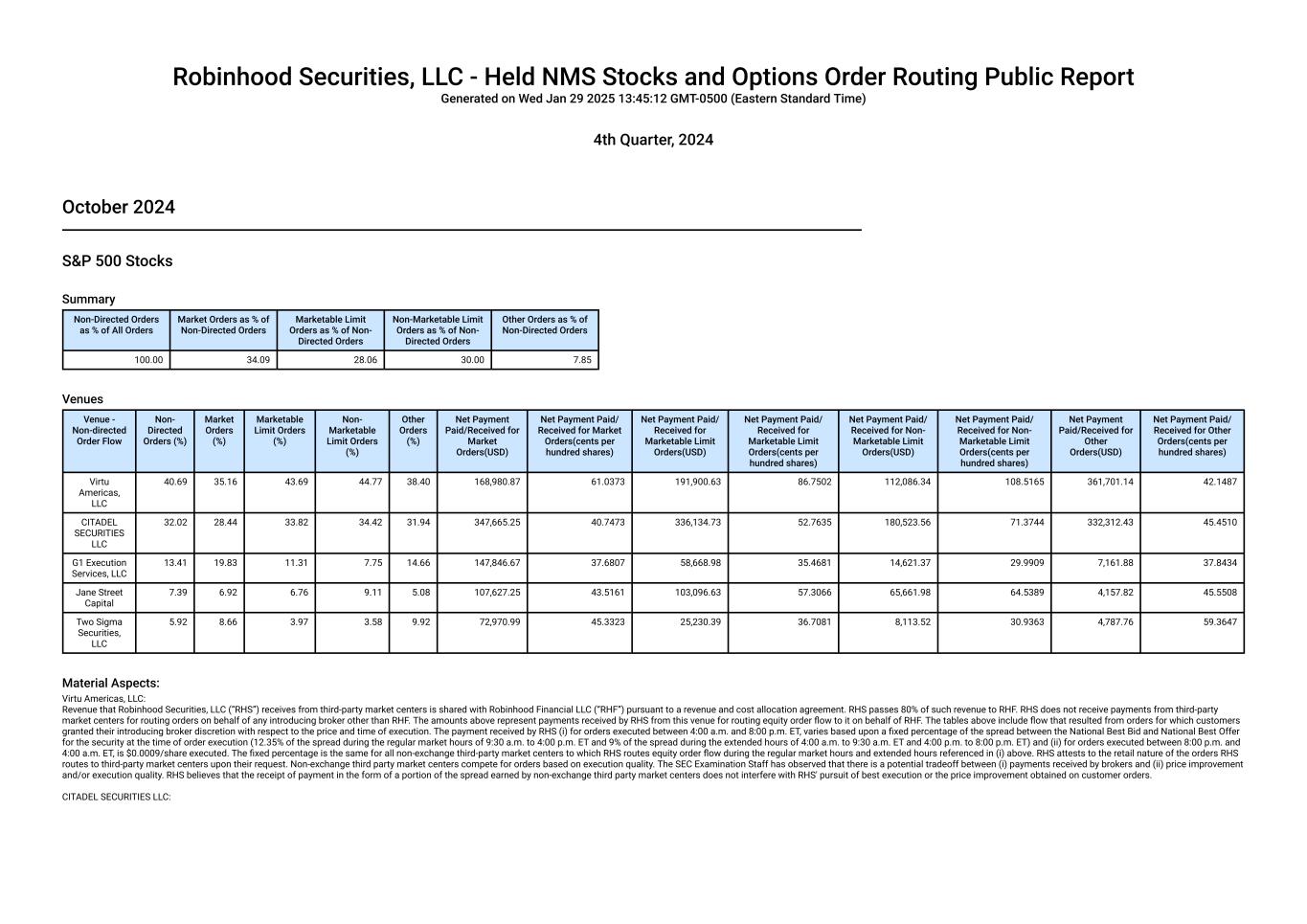

Robinhood Securities, LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Wed Jan 29 2025 13:45:12 GMT-0500 (Eastern Standard Time) 4th Quarter, 2024 October 2024 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 34.09 28.06 30.00 7.85 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 40.69 35.16 43.69 44.77 38.40 168,980.87 61.0373 191,900.63 86.7502 112,086.34 108.5165 361,701.14 42.1487 CITADEL SECURITIES LLC 32.02 28.44 33.82 34.42 31.94 347,665.25 40.7473 336,134.73 52.7635 180,523.56 71.3744 332,312.43 45.4510 G1 Execution Services, LLC 13.41 19.83 11.31 7.75 14.66 147,846.67 37.6807 58,668.98 35.4681 14,621.37 29.9909 7,161.88 37.8434 Jane Street Capital 7.39 6.92 6.76 9.11 5.08 107,627.25 43.5161 103,096.63 57.3066 65,661.98 64.5389 4,157.82 45.5508 Two Sigma Securities, LLC 5.92 8.66 3.97 3.58 9.92 72,970.99 45.3323 25,230.39 36.7081 8,113.52 30.9363 4,787.76 59.3647 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0009/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC:

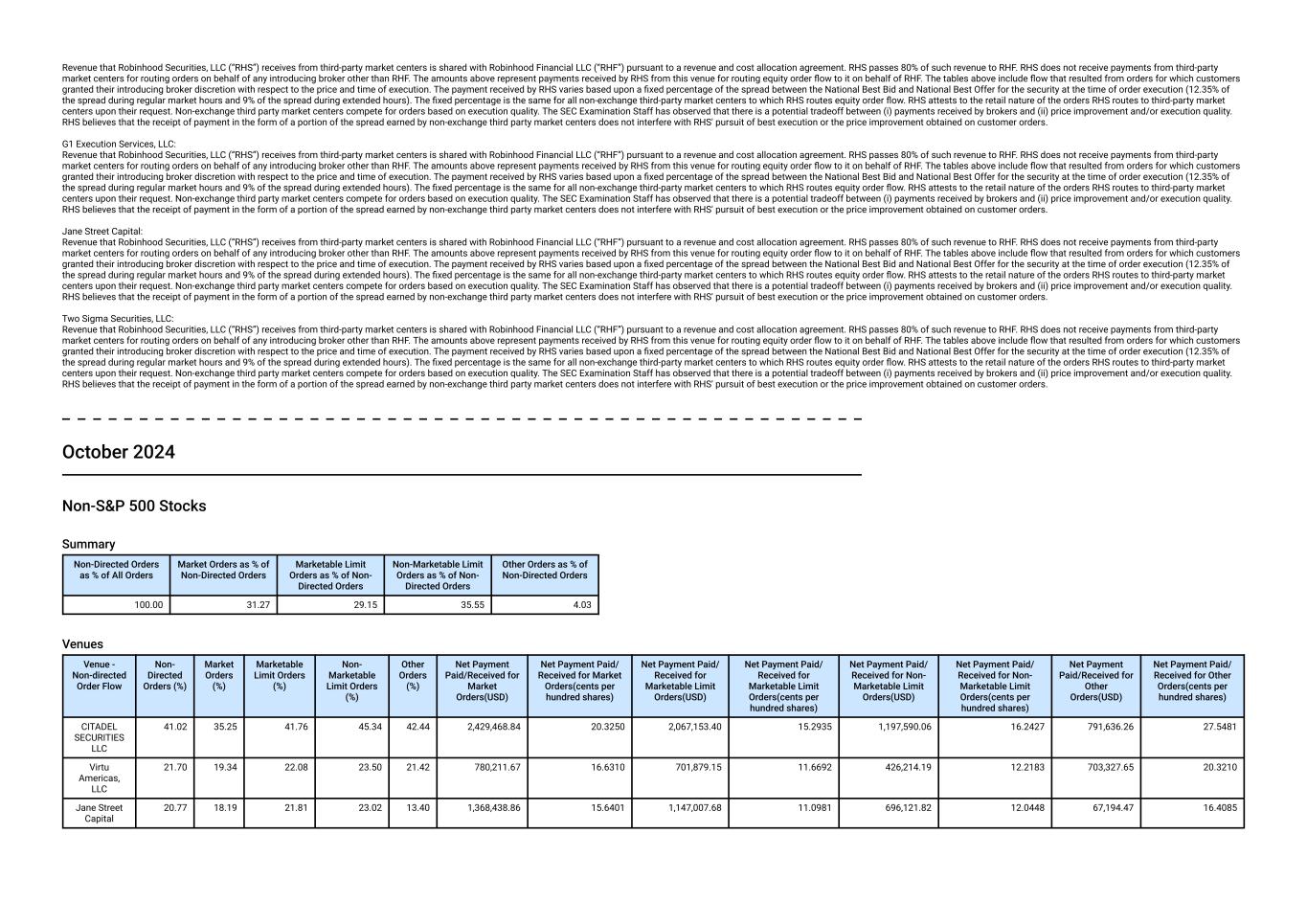

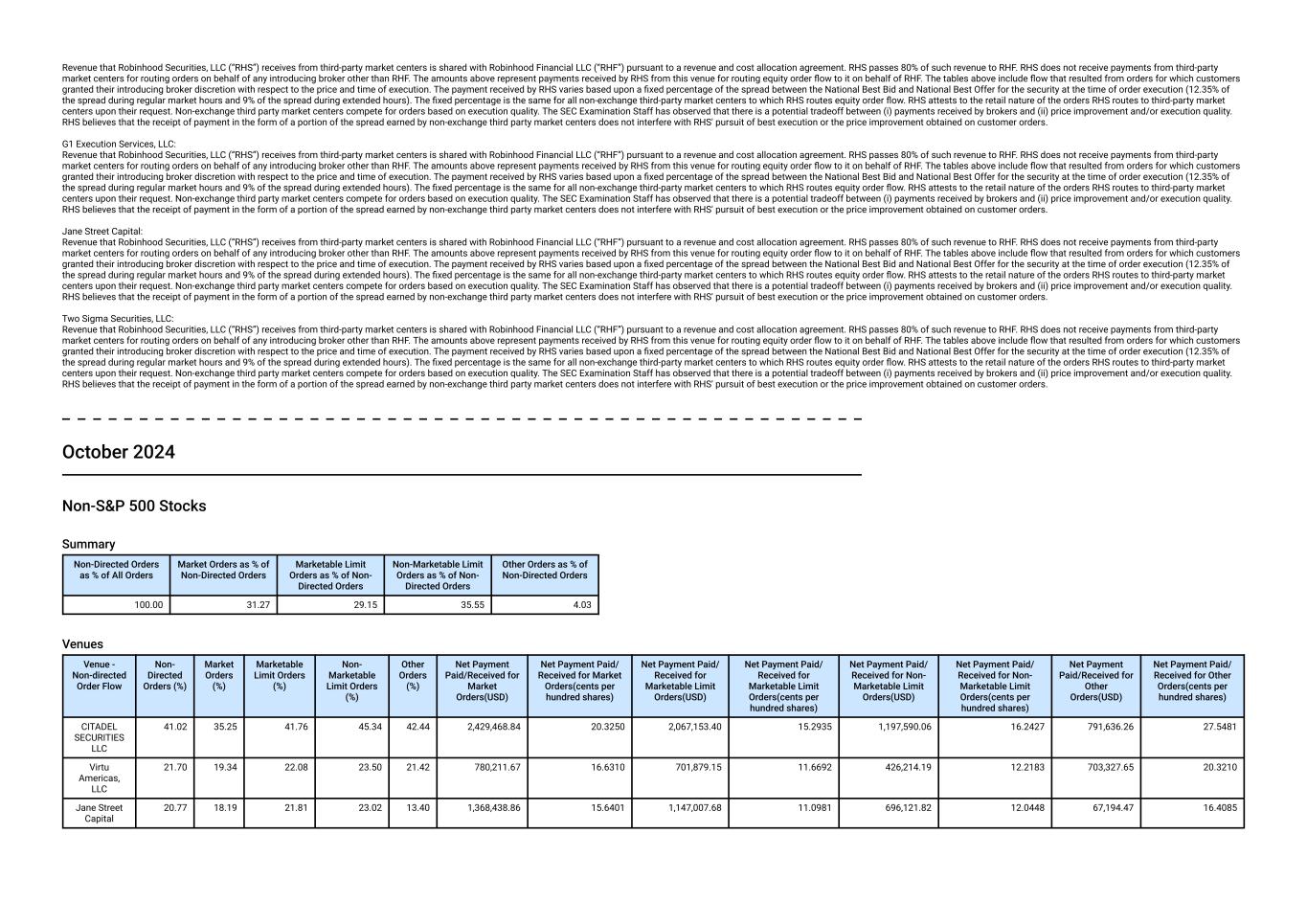

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. October 2024 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 31.27 29.15 35.55 4.03 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 41.02 35.25 41.76 45.34 42.44 2,429,468.84 20.3250 2,067,153.40 15.2935 1,197,590.06 16.2427 791,636.26 27.5481 Virtu Americas, LLC 21.70 19.34 22.08 23.50 21.42 780,211.67 16.6310 701,879.15 11.6692 426,214.19 12.2183 703,327.65 20.3210 Jane Street Capital 20.77 18.19 21.81 23.02 13.40 1,368,438.86 15.6401 1,147,007.68 11.0981 696,121.82 12.0448 67,194.47 16.4085

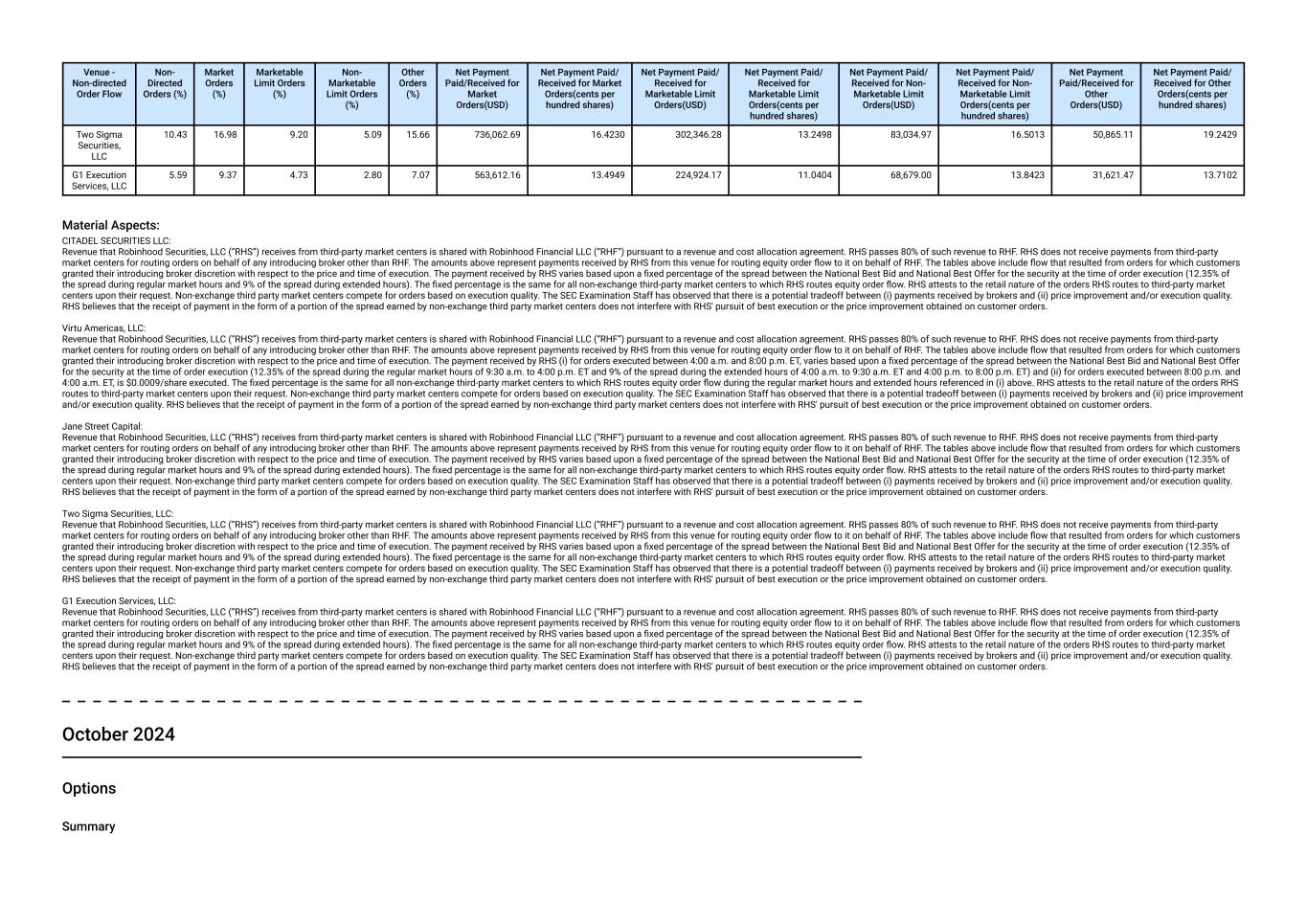

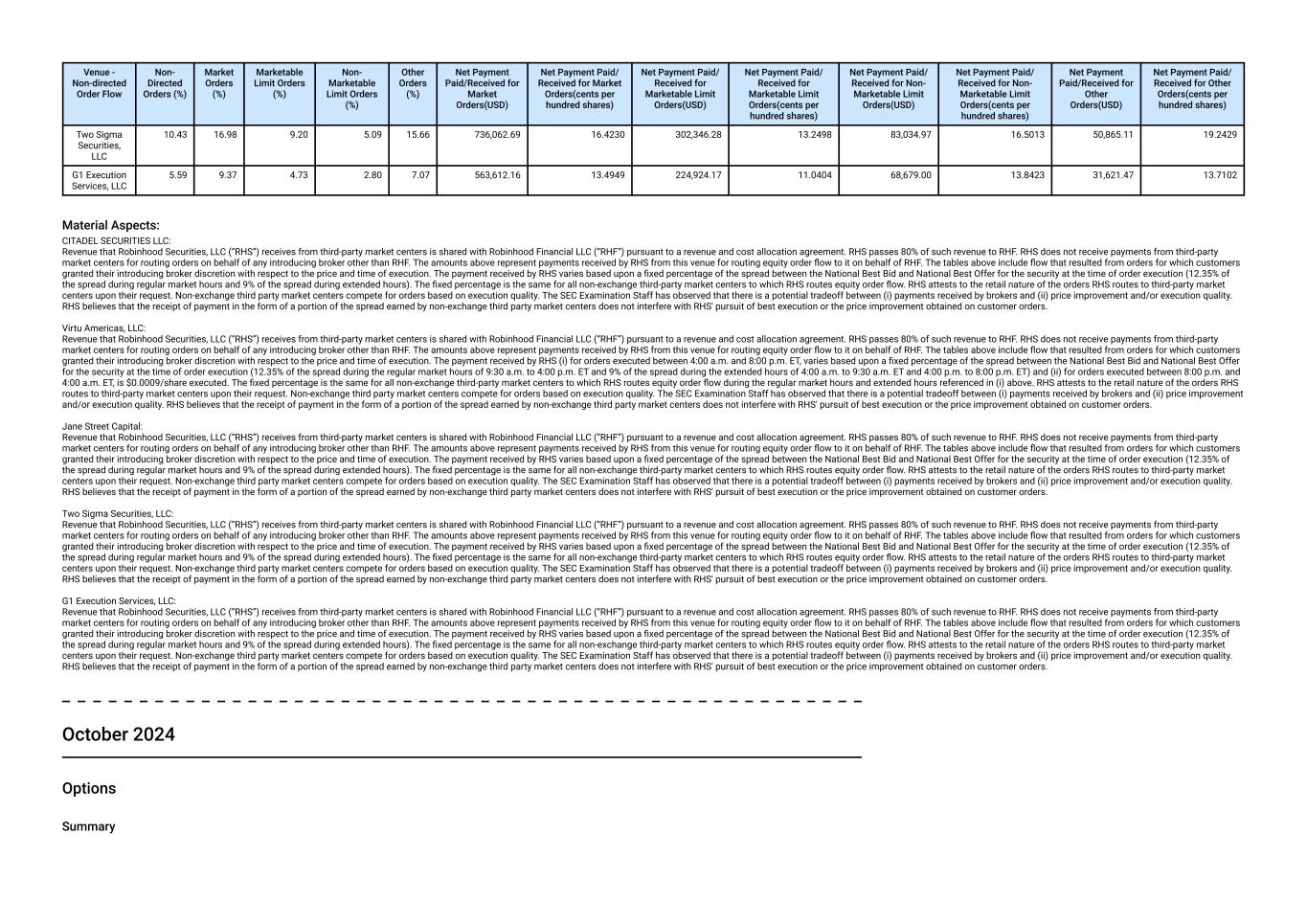

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Two Sigma Securities, LLC 10.43 16.98 9.20 5.09 15.66 736,062.69 16.4230 302,346.28 13.2498 83,034.97 16.5013 50,865.11 19.2429 G1 Execution Services, LLC 5.59 9.37 4.73 2.80 7.07 563,612.16 13.4949 224,924.17 11.0404 68,679.00 13.8423 31,621.47 13.7102 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0009/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. October 2024 Options Summary

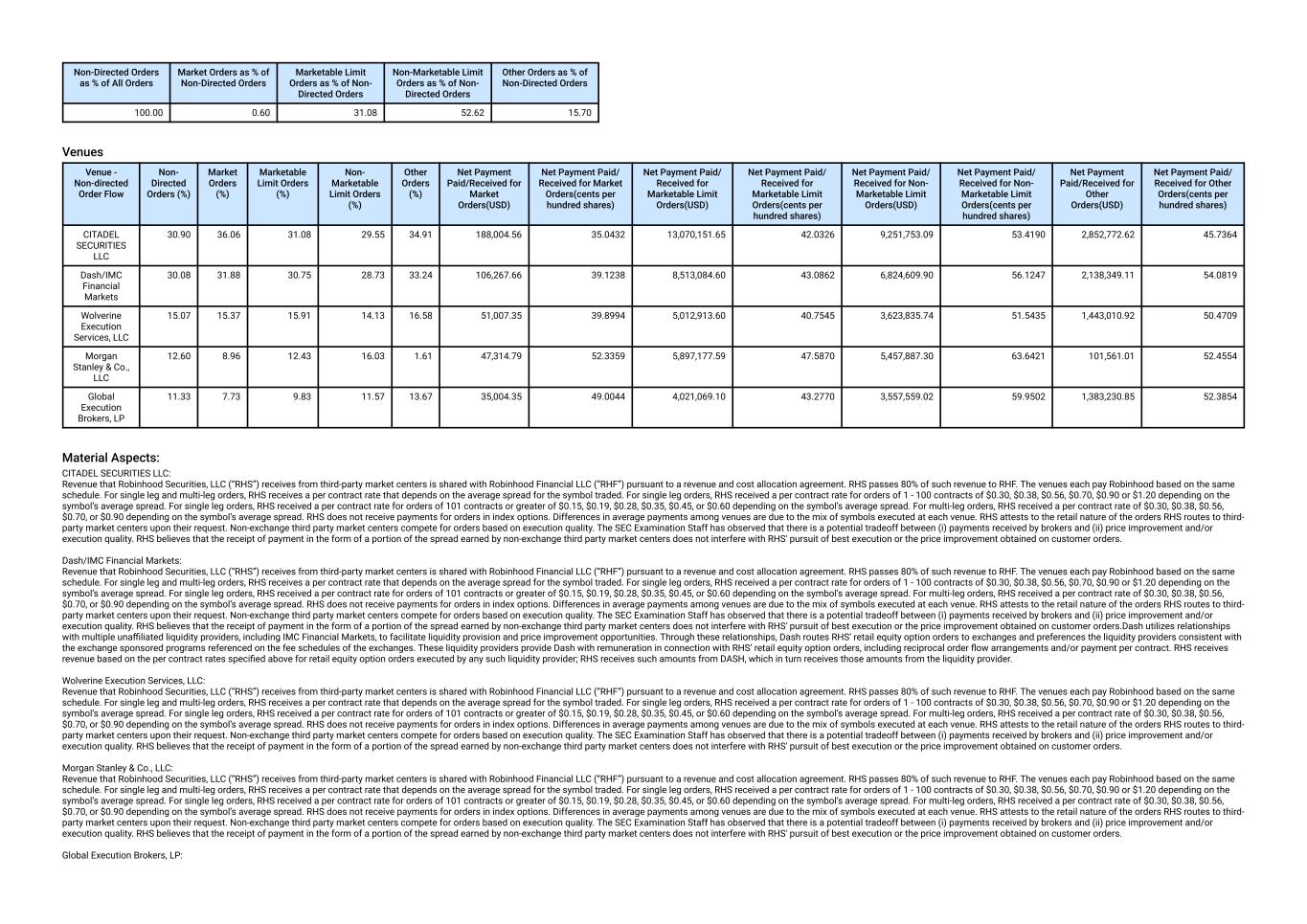

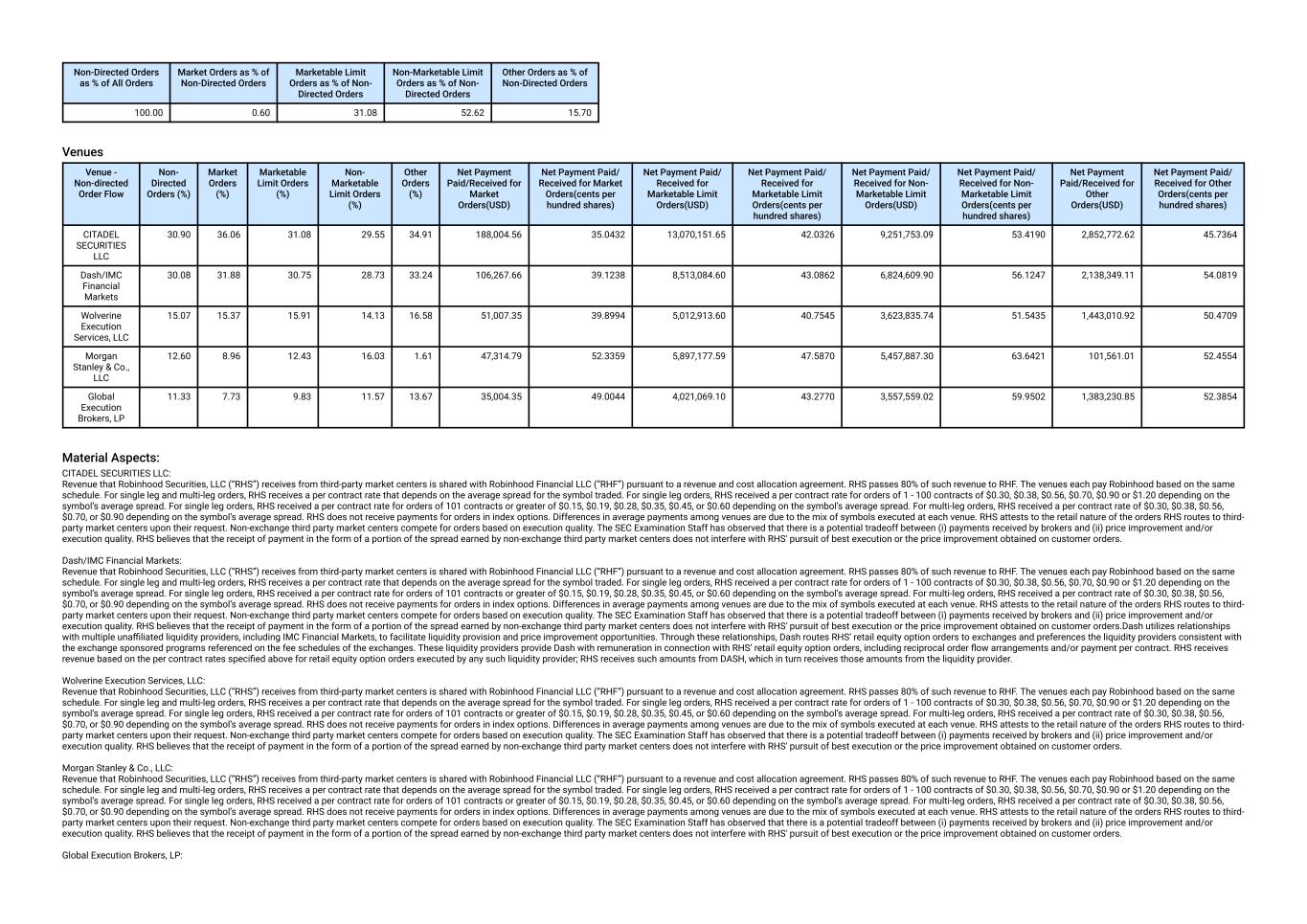

Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.60 31.08 52.62 15.70 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 30.90 36.06 31.08 29.55 34.91 188,004.56 35.0432 13,070,151.65 42.0326 9,251,753.09 53.4190 2,852,772.62 45.7364 Dash/IMC Financial Markets 30.08 31.88 30.75 28.73 33.24 106,267.66 39.1238 8,513,084.60 43.0862 6,824,609.90 56.1247 2,138,349.11 54.0819 Wolverine Execution Services, LLC 15.07 15.37 15.91 14.13 16.58 51,007.35 39.8994 5,012,913.60 40.7545 3,623,835.74 51.5435 1,443,010.92 50.4709 Morgan Stanley & Co., LLC 12.60 8.96 12.43 16.03 1.61 47,314.79 52.3359 5,897,177.59 47.5870 5,457,887.30 63.6421 101,561.01 52.4554 Global Execution Brokers, LP 11.33 7.73 9.83 11.57 13.67 35,004.35 49.0044 4,021,069.10 43.2770 3,557,559.02 59.9502 1,383,230.85 52.3854 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.Dash utilizes relationships with multiple unaffiliated liquidity providers, including IMC Financial Markets, to facilitate liquidity provision and price improvement opportunities. Through these relationships, Dash routes RHS’ retail equity option orders to exchanges and preferences the liquidity providers consistent with the exchange sponsored programs referenced on the fee schedules of the exchanges. These liquidity providers provide Dash with remuneration in connection with RHS’ retail equity option orders, including reciprocal order flow arrangements and/or payment per contract. RHS receives revenue based on the per contract rates specified above for retail equity option orders executed by any such liquidity provider; RHS receives such amounts from DASH, which in turn receives those amounts from the liquidity provider. Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Global Execution Brokers, LP:

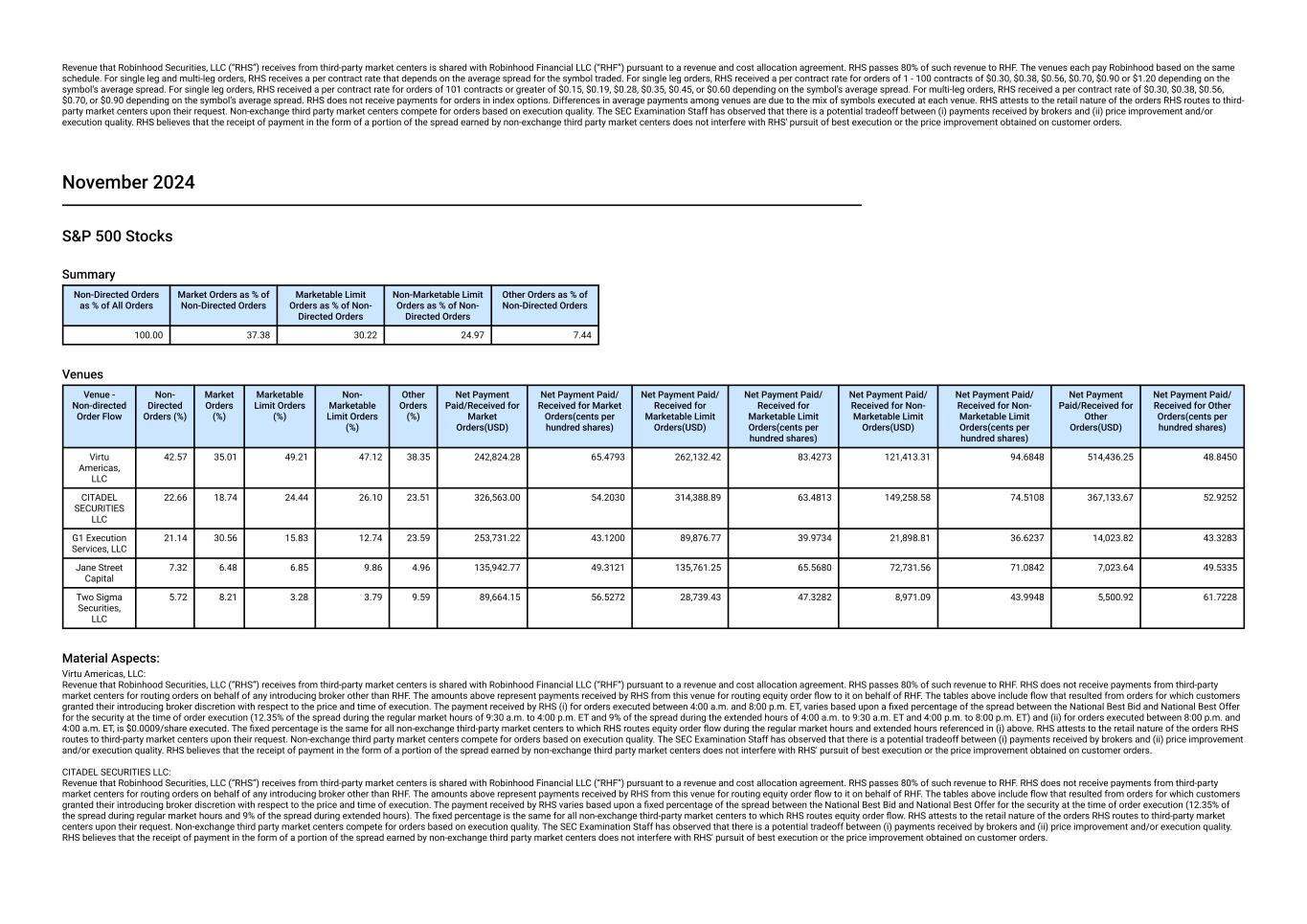

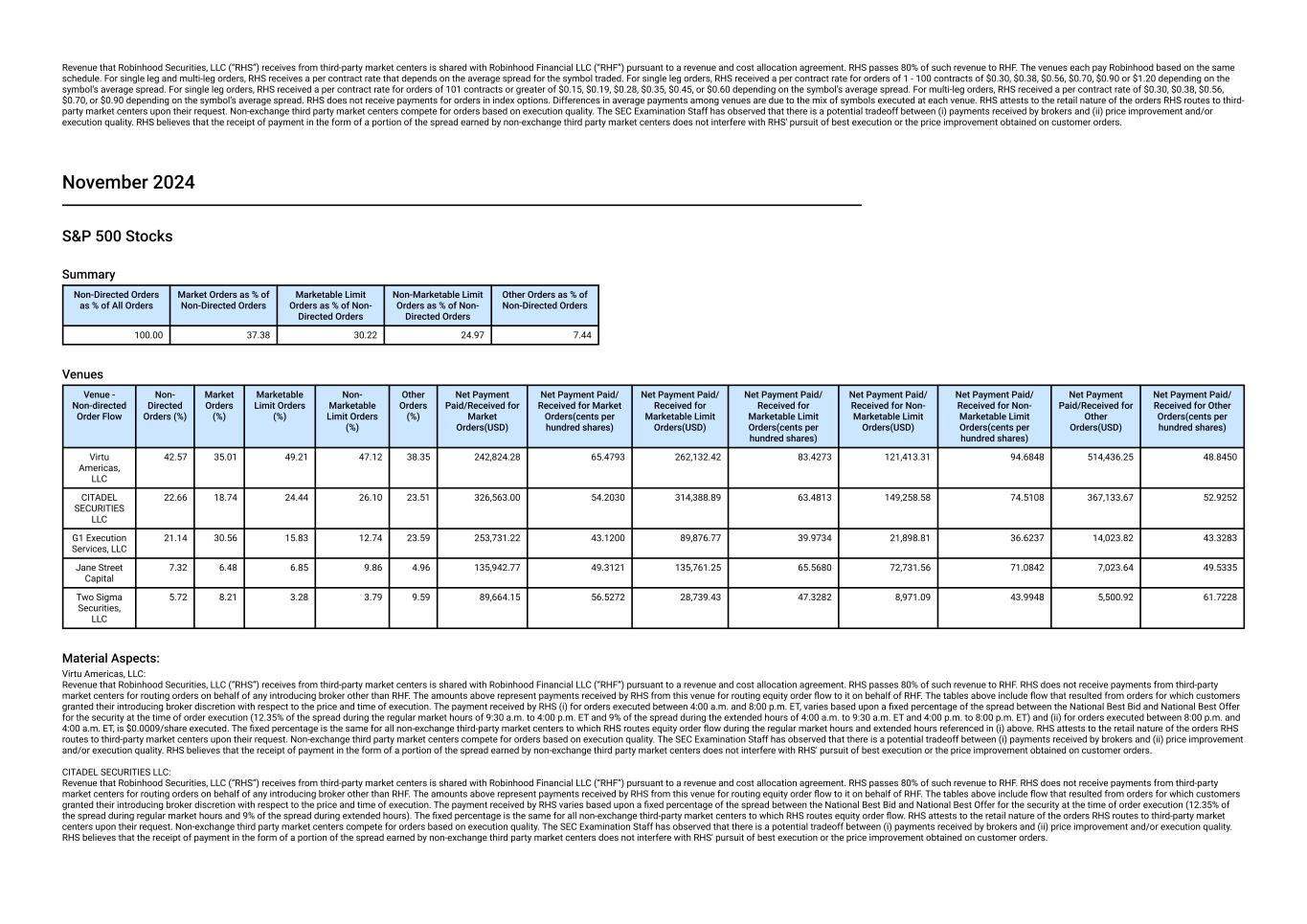

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. November 2024 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 37.38 30.22 24.97 7.44 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 42.57 35.01 49.21 47.12 38.35 242,824.28 65.4793 262,132.42 83.4273 121,413.31 94.6848 514,436.25 48.8450 CITADEL SECURITIES LLC 22.66 18.74 24.44 26.10 23.51 326,563.00 54.2030 314,388.89 63.4813 149,258.58 74.5108 367,133.67 52.9252 G1 Execution Services, LLC 21.14 30.56 15.83 12.74 23.59 253,731.22 43.1200 89,876.77 39.9734 21,898.81 36.6237 14,023.82 43.3283 Jane Street Capital 7.32 6.48 6.85 9.86 4.96 135,942.77 49.3121 135,761.25 65.5680 72,731.56 71.0842 7,023.64 49.5335 Two Sigma Securities, LLC 5.72 8.21 3.28 3.79 9.59 89,664.15 56.5272 28,739.43 47.3282 8,971.09 43.9948 5,500.92 61.7228 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0009/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.

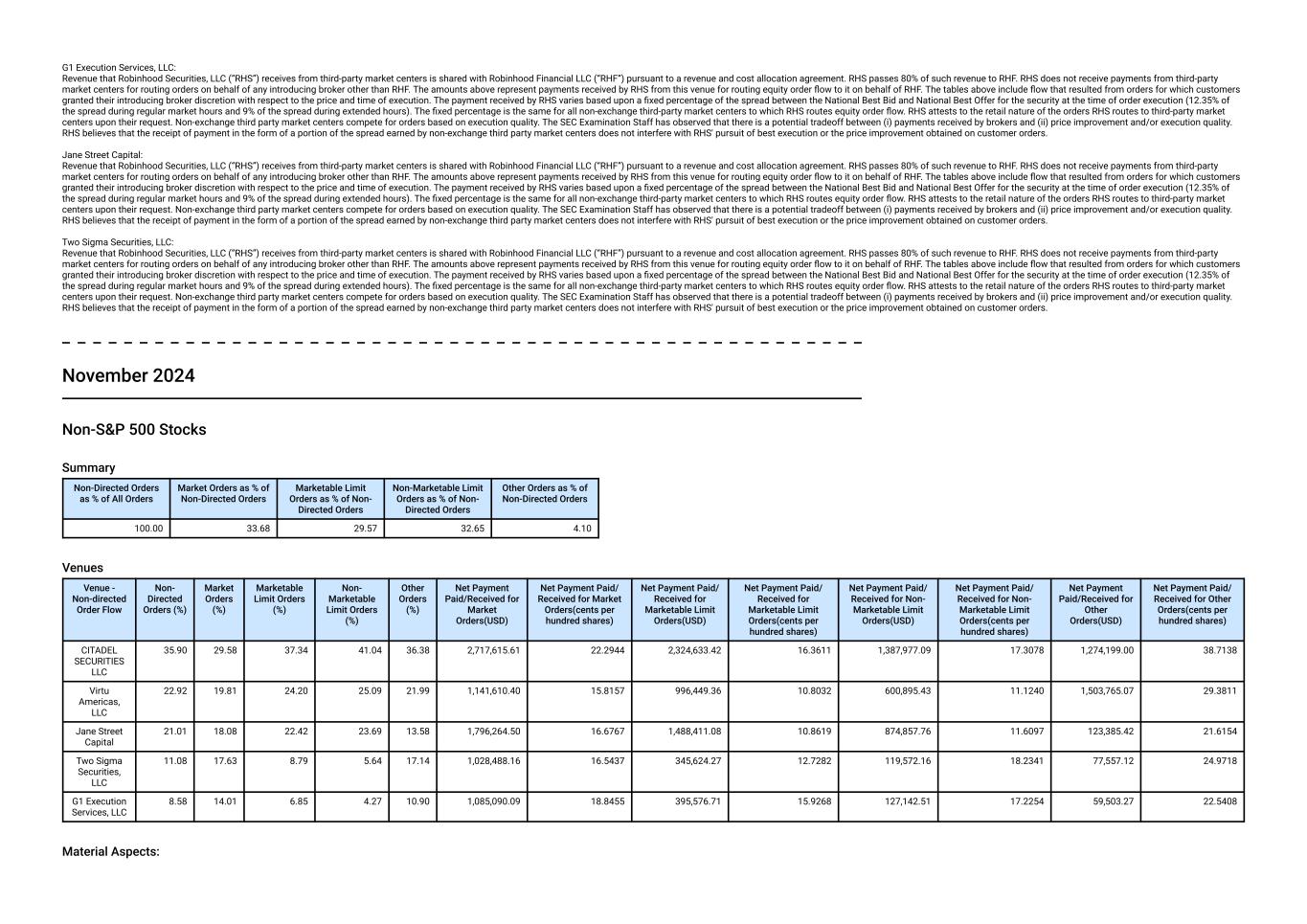

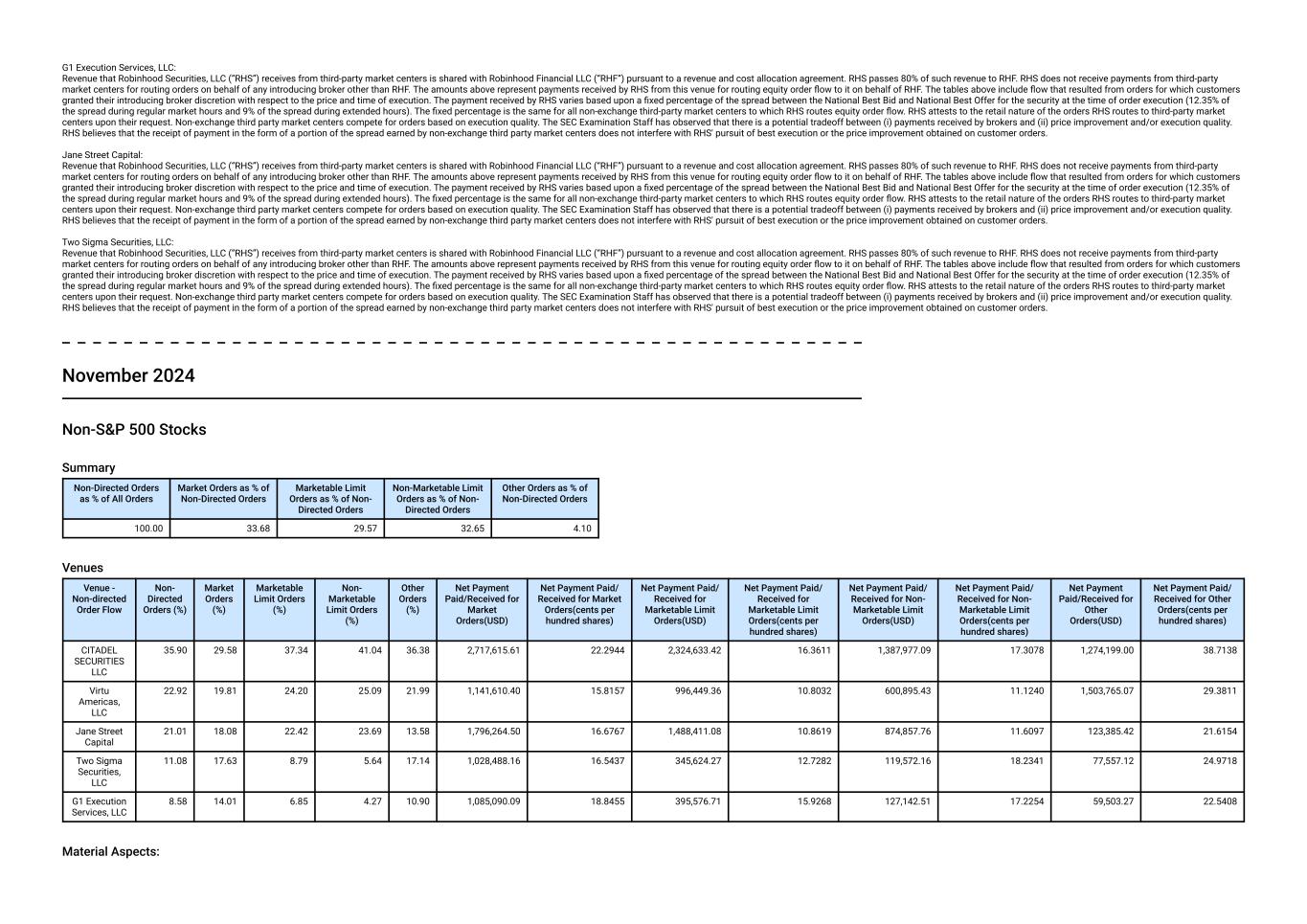

G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. November 2024 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 33.68 29.57 32.65 4.10 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 35.90 29.58 37.34 41.04 36.38 2,717,615.61 22.2944 2,324,633.42 16.3611 1,387,977.09 17.3078 1,274,199.00 38.7138 Virtu Americas, LLC 22.92 19.81 24.20 25.09 21.99 1,141,610.40 15.8157 996,449.36 10.8032 600,895.43 11.1240 1,503,765.07 29.3811 Jane Street Capital 21.01 18.08 22.42 23.69 13.58 1,796,264.50 16.6767 1,488,411.08 10.8619 874,857.76 11.6097 123,385.42 21.6154 Two Sigma Securities, LLC 11.08 17.63 8.79 5.64 17.14 1,028,488.16 16.5437 345,624.27 12.7282 119,572.16 18.2341 77,557.12 24.9718 G1 Execution Services, LLC 8.58 14.01 6.85 4.27 10.90 1,085,090.09 18.8455 395,576.71 15.9268 127,142.51 17.2254 59,503.27 22.5408 Material Aspects:

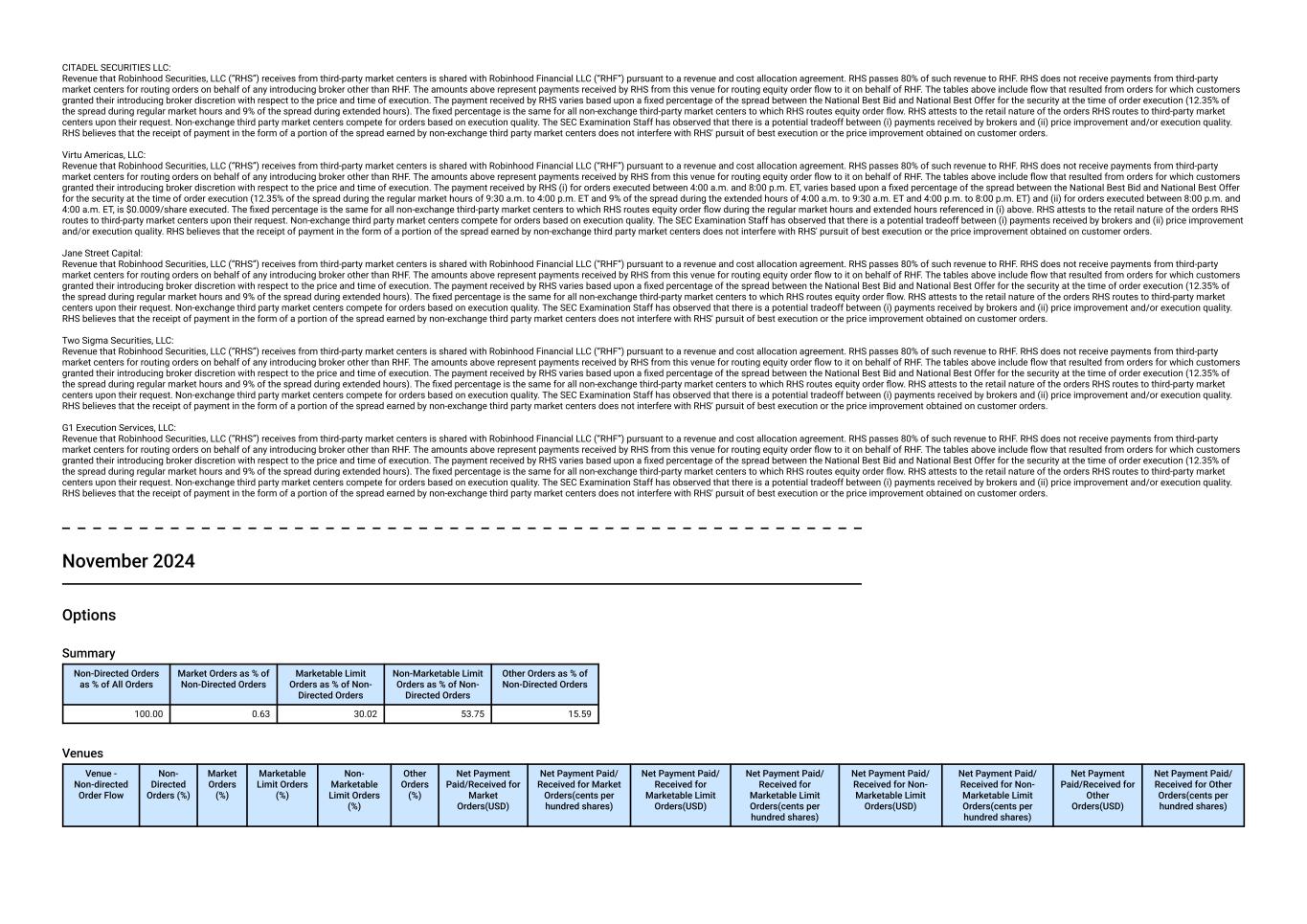

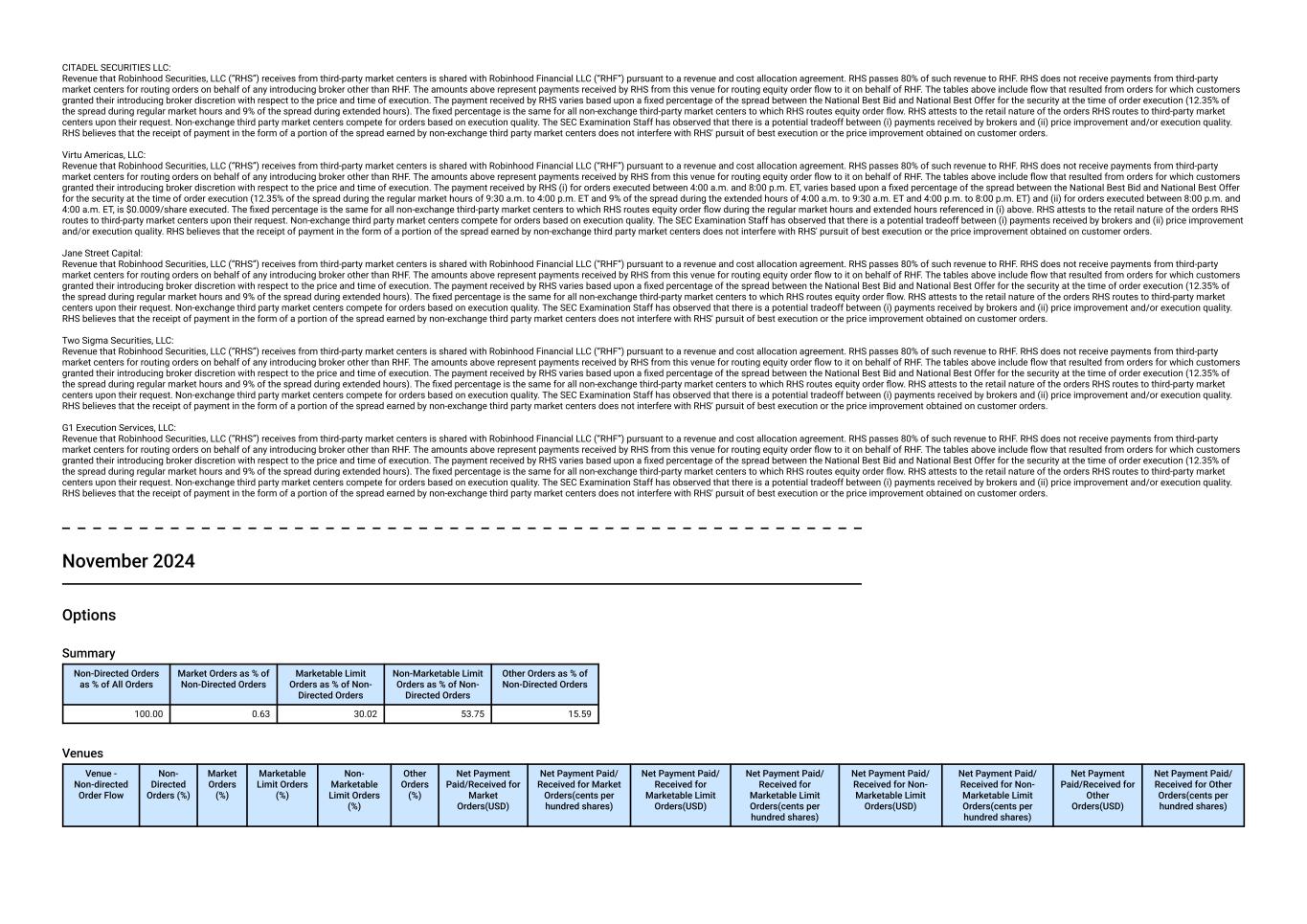

CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0009/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. November 2024 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.63 30.02 53.75 15.59 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares)

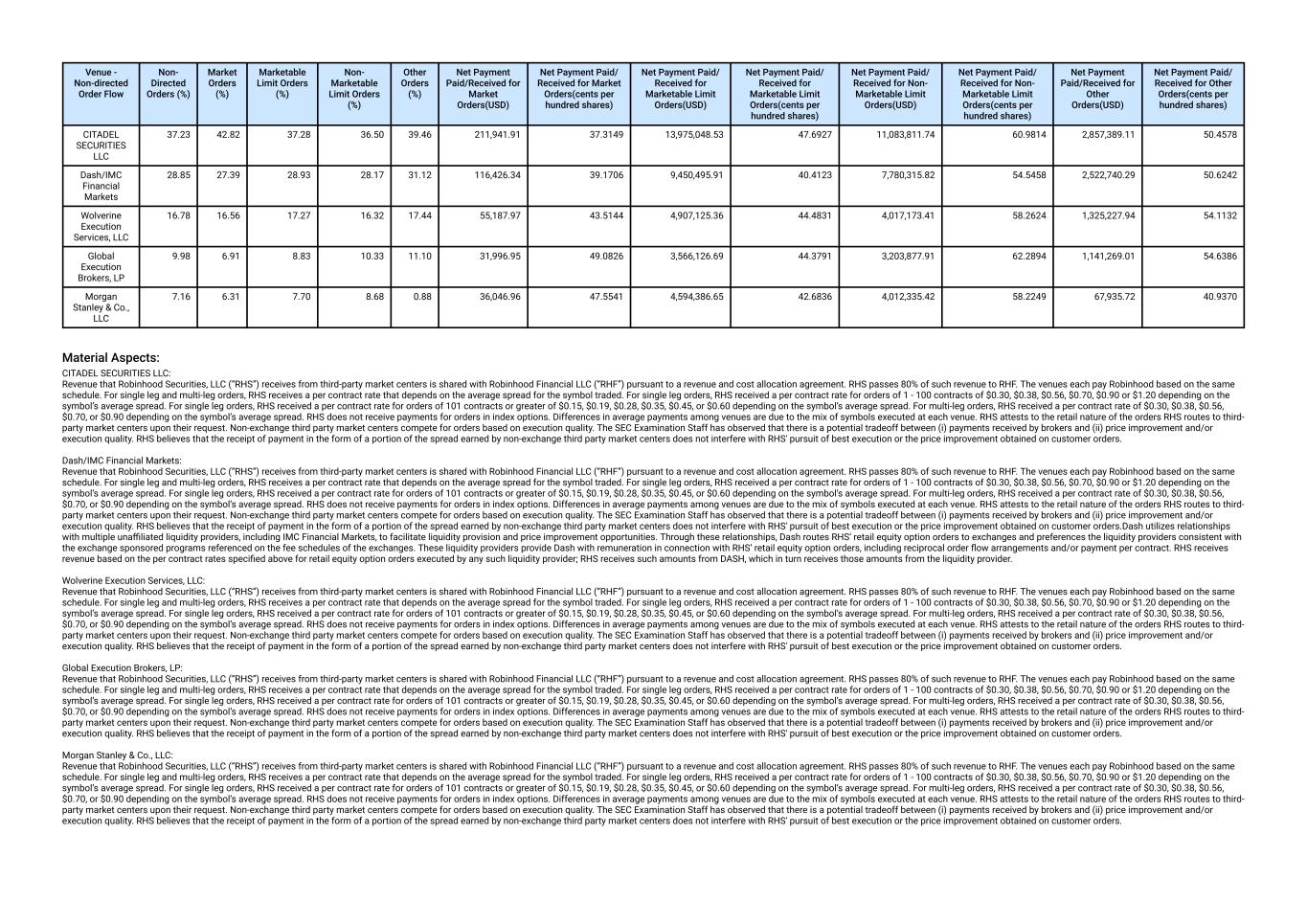

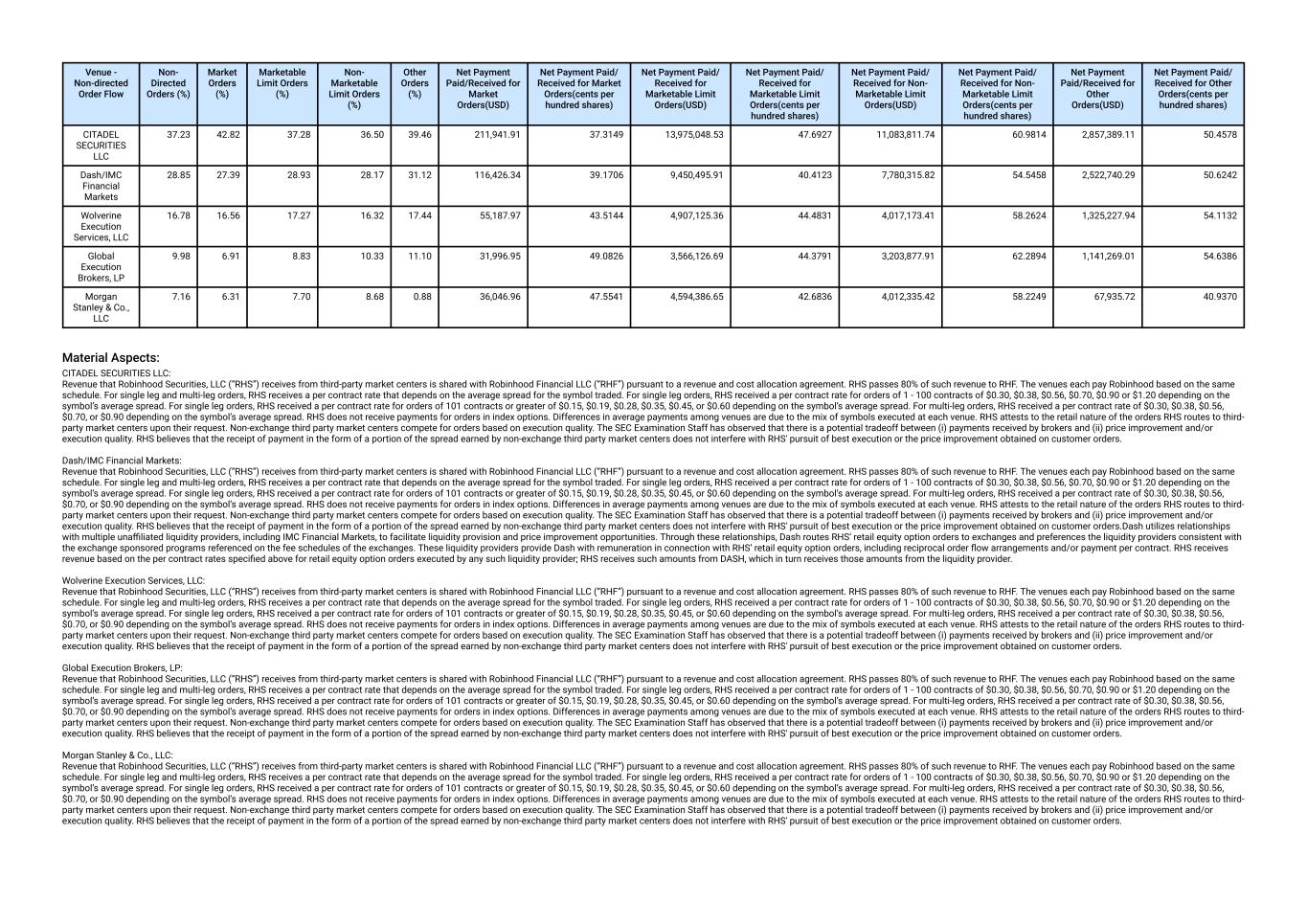

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 37.23 42.82 37.28 36.50 39.46 211,941.91 37.3149 13,975,048.53 47.6927 11,083,811.74 60.9814 2,857,389.11 50.4578 Dash/IMC Financial Markets 28.85 27.39 28.93 28.17 31.12 116,426.34 39.1706 9,450,495.91 40.4123 7,780,315.82 54.5458 2,522,740.29 50.6242 Wolverine Execution Services, LLC 16.78 16.56 17.27 16.32 17.44 55,187.97 43.5144 4,907,125.36 44.4831 4,017,173.41 58.2624 1,325,227.94 54.1132 Global Execution Brokers, LP 9.98 6.91 8.83 10.33 11.10 31,996.95 49.0826 3,566,126.69 44.3791 3,203,877.91 62.2894 1,141,269.01 54.6386 Morgan Stanley & Co., LLC 7.16 6.31 7.70 8.68 0.88 36,046.96 47.5541 4,594,386.65 42.6836 4,012,335.42 58.2249 67,935.72 40.9370 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.Dash utilizes relationships with multiple unaffiliated liquidity providers, including IMC Financial Markets, to facilitate liquidity provision and price improvement opportunities. Through these relationships, Dash routes RHS’ retail equity option orders to exchanges and preferences the liquidity providers consistent with the exchange sponsored programs referenced on the fee schedules of the exchanges. These liquidity providers provide Dash with remuneration in connection with RHS’ retail equity option orders, including reciprocal order flow arrangements and/or payment per contract. RHS receives revenue based on the per contract rates specified above for retail equity option orders executed by any such liquidity provider; RHS receives such amounts from DASH, which in turn receives those amounts from the liquidity provider. Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Global Execution Brokers, LP: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.

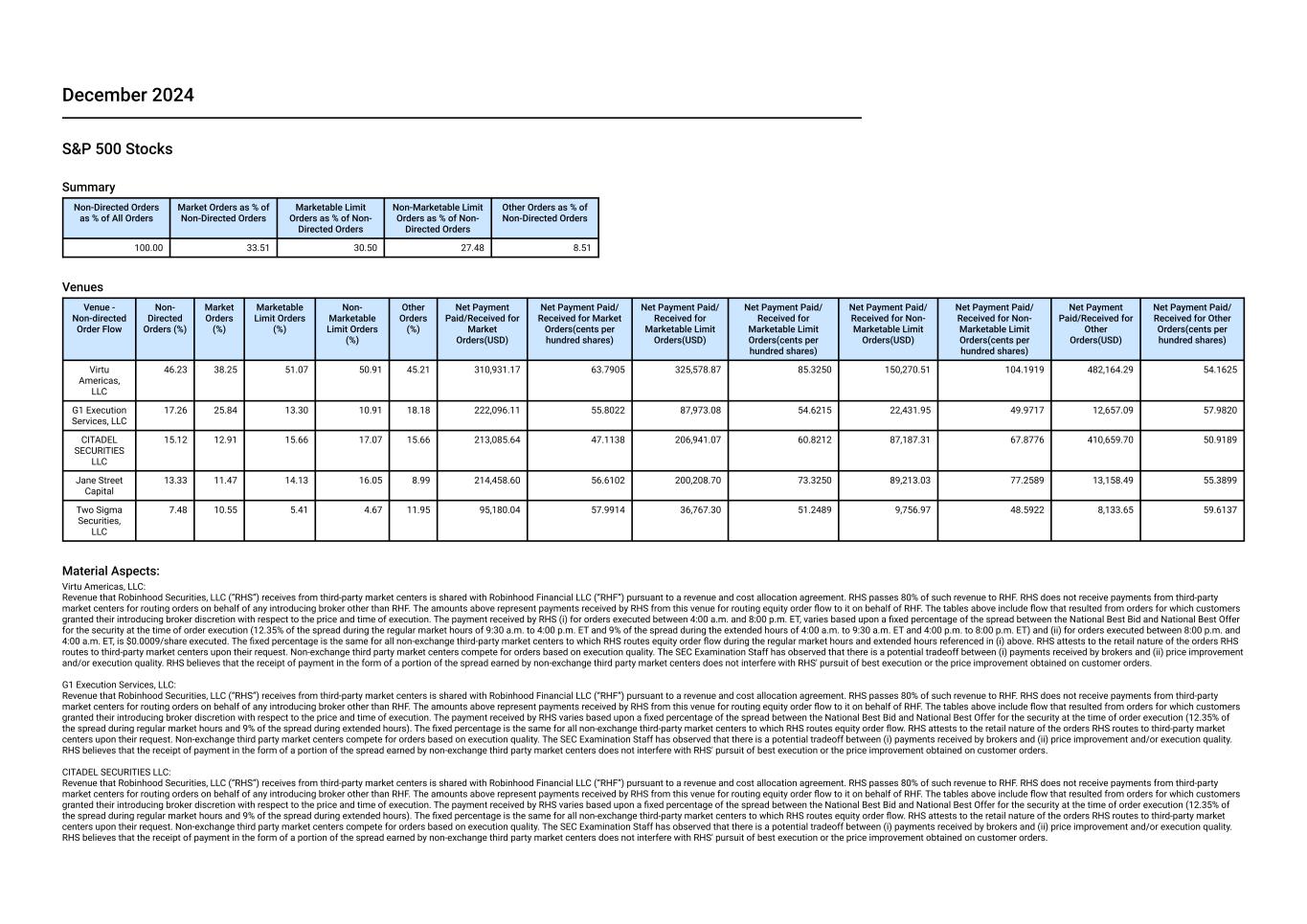

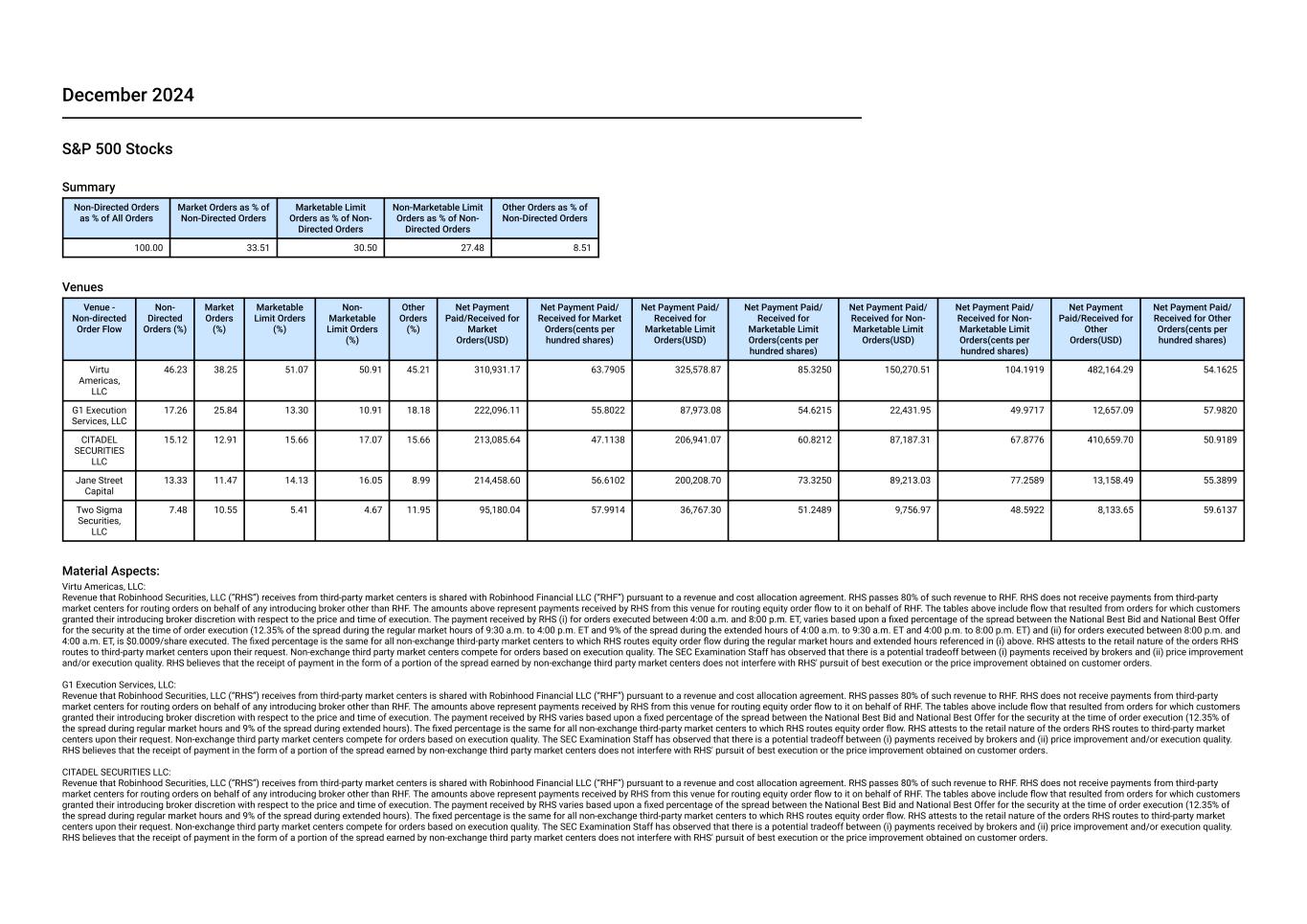

December 2024 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 33.51 30.50 27.48 8.51 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 46.23 38.25 51.07 50.91 45.21 310,931.17 63.7905 325,578.87 85.3250 150,270.51 104.1919 482,164.29 54.1625 G1 Execution Services, LLC 17.26 25.84 13.30 10.91 18.18 222,096.11 55.8022 87,973.08 54.6215 22,431.95 49.9717 12,657.09 57.9820 CITADEL SECURITIES LLC 15.12 12.91 15.66 17.07 15.66 213,085.64 47.1138 206,941.07 60.8212 87,187.31 67.8776 410,659.70 50.9189 Jane Street Capital 13.33 11.47 14.13 16.05 8.99 214,458.60 56.6102 200,208.70 73.3250 89,213.03 77.2589 13,158.49 55.3899 Two Sigma Securities, LLC 7.48 10.55 5.41 4.67 11.95 95,180.04 57.9914 36,767.30 51.2489 9,756.97 48.5922 8,133.65 59.6137 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0009/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.

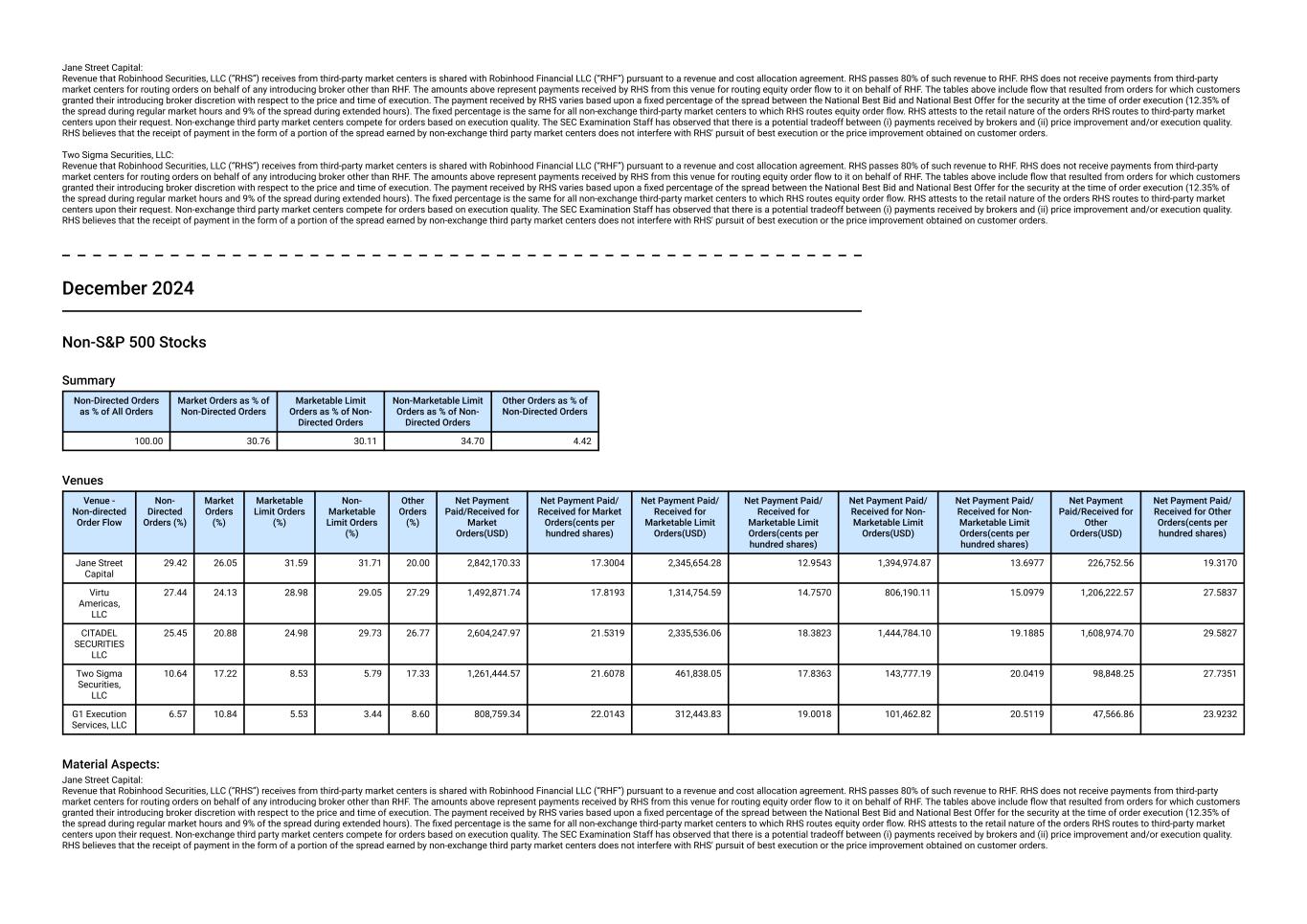

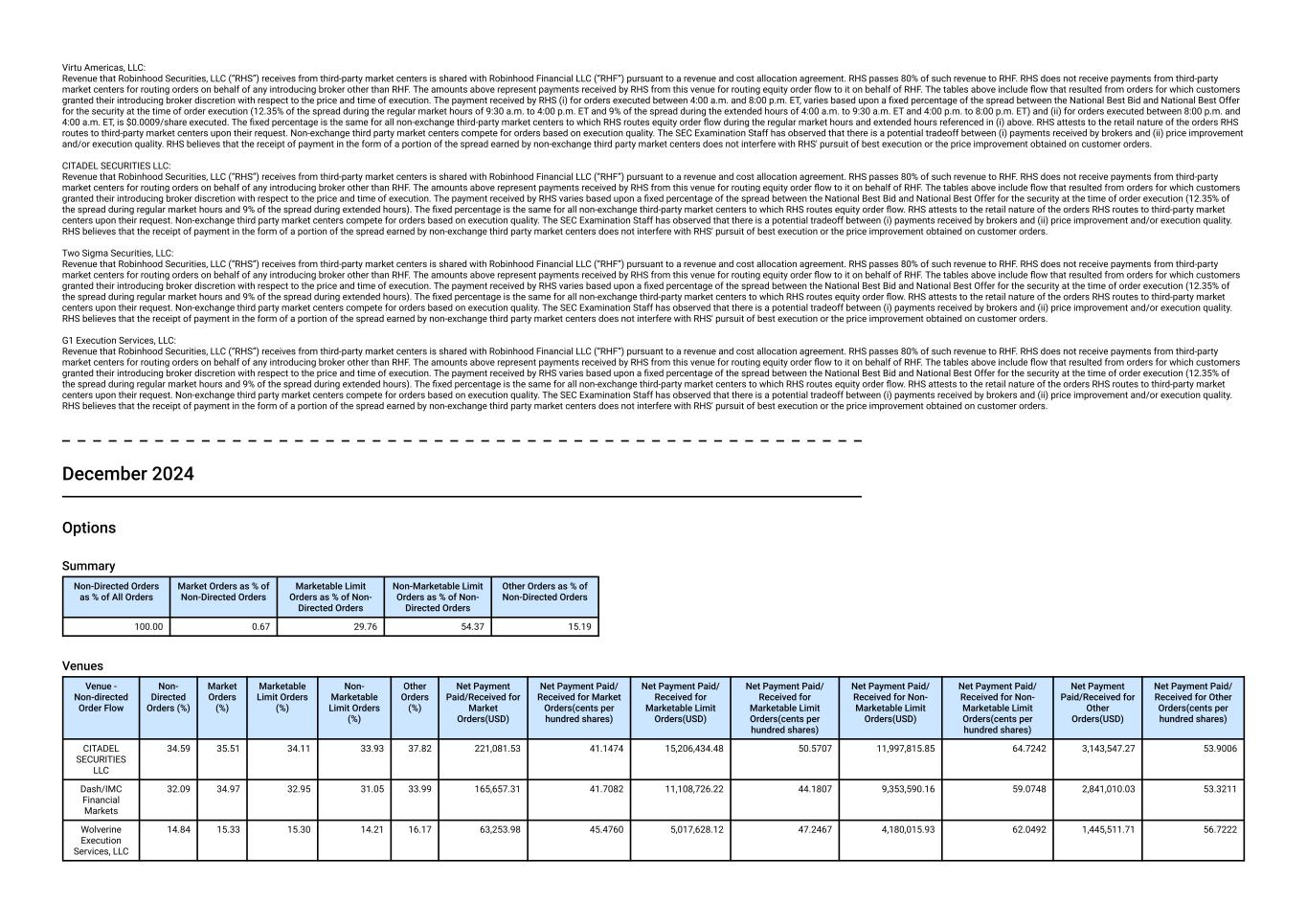

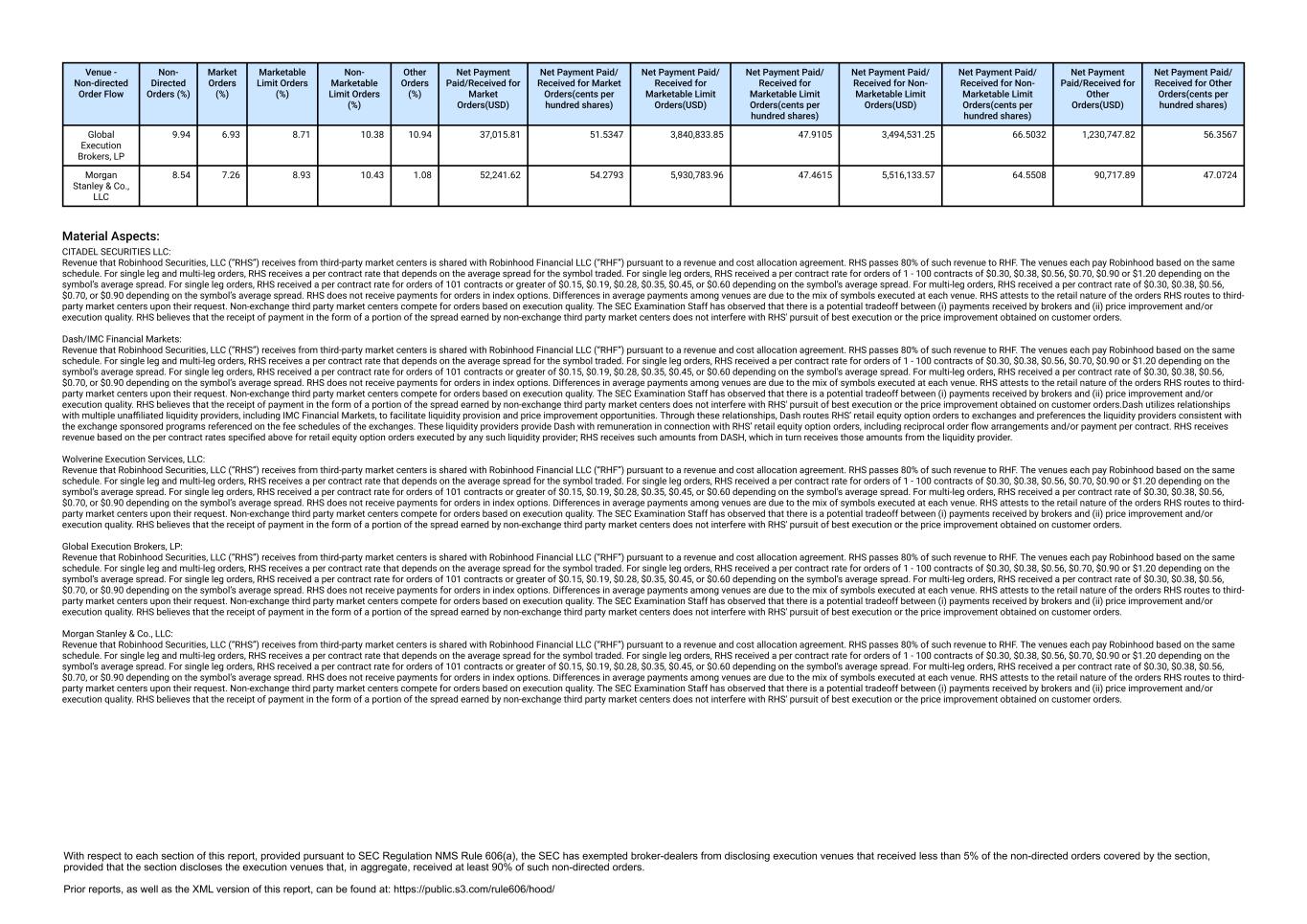

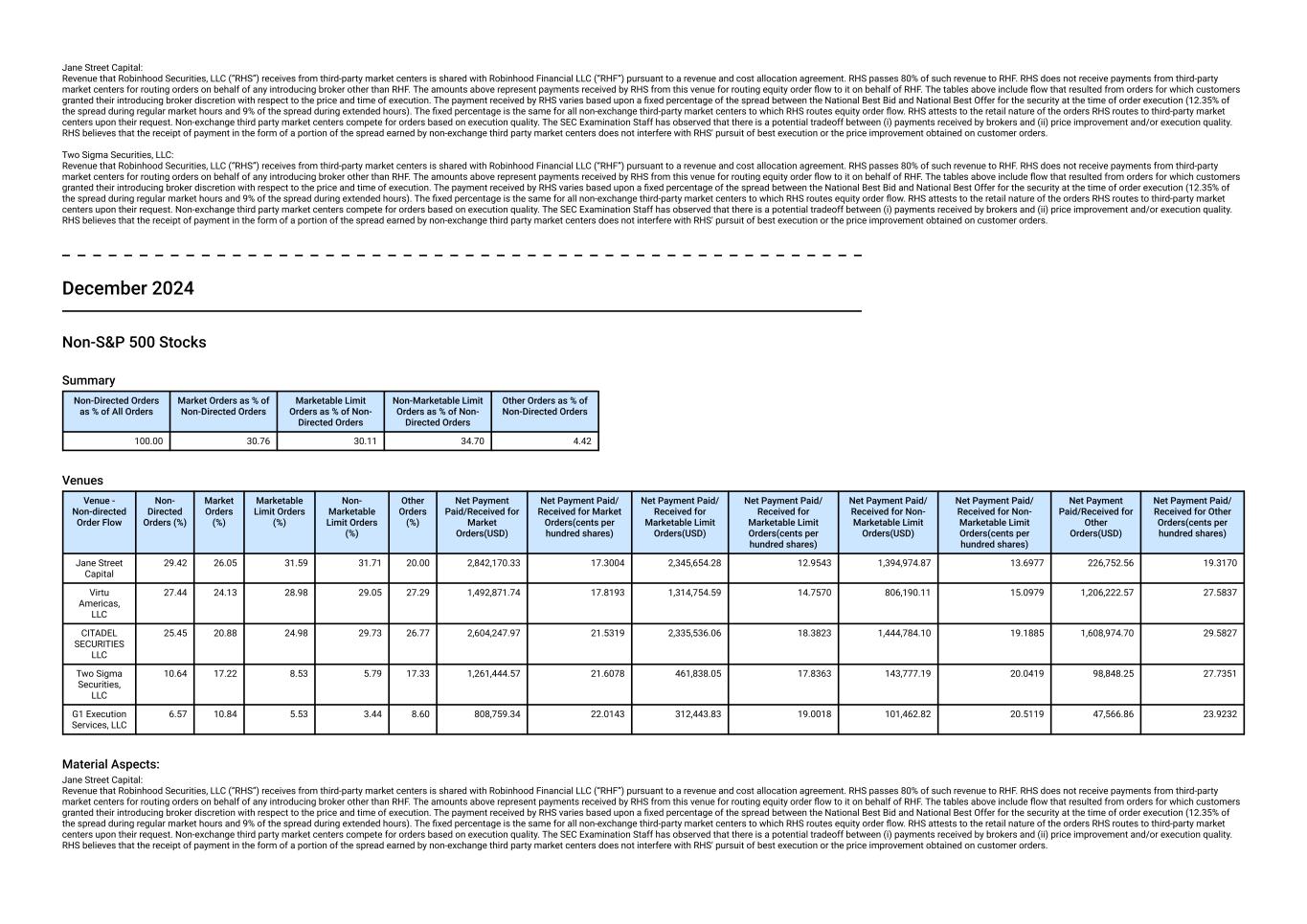

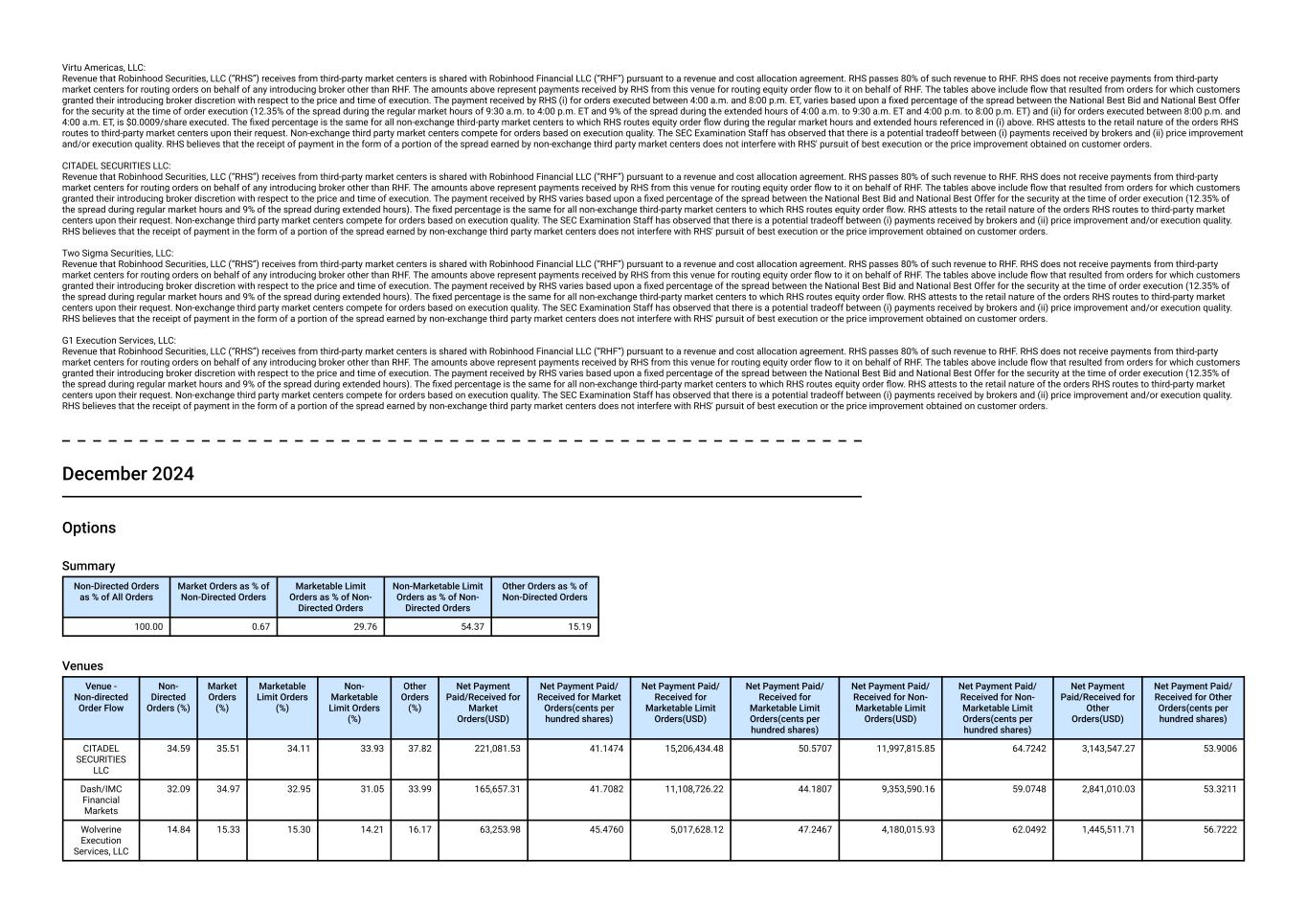

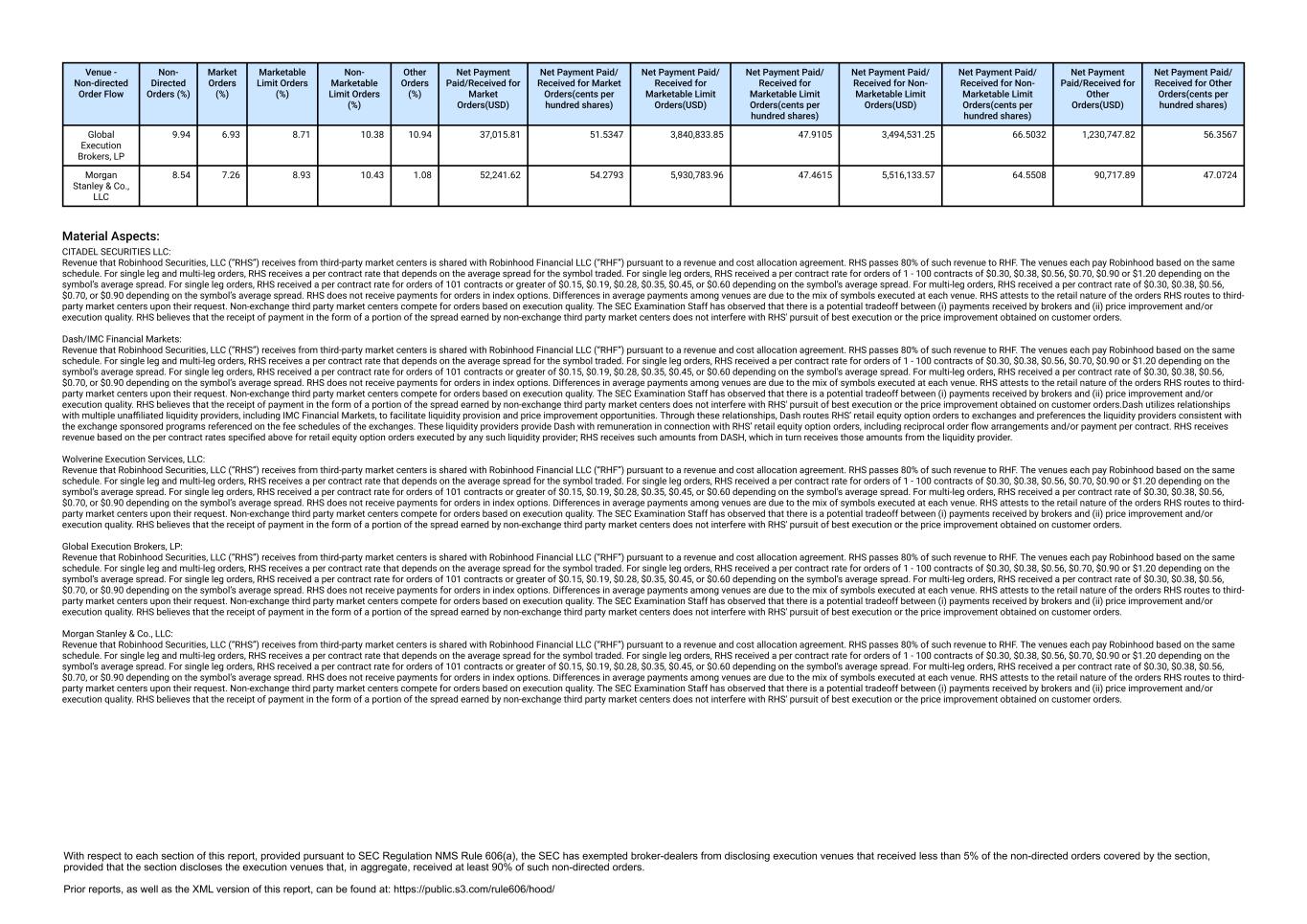

Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. December 2024 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 30.76 30.11 34.70 4.42 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Jane Street Capital 29.42 26.05 31.59 31.71 20.00 2,842,170.33 17.3004 2,345,654.28 12.9543 1,394,974.87 13.6977 226,752.56 19.3170 Virtu Americas, LLC 27.44 24.13 28.98 29.05 27.29 1,492,871.74 17.8193 1,314,754.59 14.7570 806,190.11 15.0979 1,206,222.57 27.5837 CITADEL SECURITIES LLC 25.45 20.88 24.98 29.73 26.77 2,604,247.97 21.5319 2,335,536.06 18.3823 1,444,784.10 19.1885 1,608,974.70 29.5827 Two Sigma Securities, LLC 10.64 17.22 8.53 5.79 17.33 1,261,444.57 21.6078 461,838.05 17.8363 143,777.19 20.0419 98,848.25 27.7351 G1 Execution Services, LLC 6.57 10.84 5.53 3.44 8.60 808,759.34 22.0143 312,443.83 19.0018 101,462.82 20.5119 47,566.86 23.9232 Material Aspects: Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.