UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐ Check the appropriate box:

| |

☐ | Preliminary Proxy Statement |

| |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☒ | Definitive Proxy Statement |

| |

☐ | Definitive Additional Materials |

| |

☐ | Soliciting Material under §240.14a-12 |

VARAGON CAPITAL CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

☐ | Fee paid previously with preliminary materials. |

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Varagon Capital Corporation

151 West 42nd Street, 53rd Floor

New York, New York 10036

August 8, 2023

Dear Shareholder:

You are cordially invited to participate in a Special Meeting of Shareholders (the “Meeting”) of Varagon Capital Corporation (the “Company”) to be held on August 24, 2023 at 11:30 a.m., Eastern Time. The Meeting will be held at the offices of Eversheds Sutherland (US) LLP, located at 1114 Avenue of the Americas, New York, NY 10036. Prior to the Meeting, you will be able to complete a proxy as described below.

The Notice of Special Meeting of Shareholders and Proxy Statement accompanying this letter provide an outline of the business to be conducted at the Meeting. At the Meeting, you will be asked to approve a new investment advisory agreement by and between the Company and VCC Advisors, LLC (the “New Advisory Agreement”). Details of the business to be conducted at the Meeting are set forth in the accompanying Notice of Special Meeting of Shareholders and Proxy Statement. I, along with other members of the Company’s management, will be available to respond to shareholders’ questions. The Board unanimously recommends that you vote FOR the proposal to approve the New Advisory Agreement.

It is important that your shares be represented at the Meeting. If you are unable to participate in the Meeting during the scheduled time, I urge you to complete, date and sign the enclosed proxy card and promptly return it in the envelope provided. If you prefer, you can save time by voting through the Internet or by telephone as described in the Proxy Statement and on the enclosed proxy card.

We look forward to your participation in the Meeting. Your vote and participation in the governance of the Company is very important to us.

| | | |

| | | Sincerely Yours, |

| | | /s/ Walter J. Owens |

| | | Walter J. Owens |

| | | Chief Executive Officer and Chairman of the Board of Directors |

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on August 24, 2023.

Varagon Capital Corporation

151 West 42nd Street, 53rd Floor

New York, New York 10036

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be Held on

August 24, 2023, 11:30 a.m., Eastern Time

To the Shareholders of Varagon Capital Corporation:

NOTICE IS HEREBY GIVEN THAT a Special Meeting of Shareholders (the “Meeting”) of Varagon Capital Corporation (the “Company”) will be held on August 24, 2023, at 11:30 a.m., Eastern Time. The Meeting will be held at the offices of Eversheds Sutherland (US) LLP, located at 1114 Avenue of the Americas, New York, NY 10036, and for the following purpose:

1.To approve a new investment advisory agreement by and between the Company and VCC Advisors, LLC.

You have the right to receive notice of and to vote at the Meeting if you were a shareholder of record at the close of business on July 28, 2023. It is important that all shareholders participate in the affairs of the Company, regardless of the number of shares owned. Accordingly, the Company urges you to promptly fill out, sign, date and mail the enclosed proxy card or authorize your proxy by telephone or through the Internet as soon as possible even if you plan to attend the Meeting. Instructions are shown on the proxy card. Proxies may be revoked at any time before they are exercised by submitting a written notice of revocation or subsequently executed proxy, or by attending the Meeting and voting in-person.

In the event there are not sufficient votes for a quorum or to approve the proposal at the time of the Meeting, the Meeting may be adjourned in order to permit further solicitation of proxies by the Company. Thank you for your support of the Company.

| | | |

| | | By Order of the Board of Directors, |

| | | /s/ Walter J. Owens |

| | | Walter J. Owens |

| | | Chairman of the Board of Directors |

New York, New York

August 8, 2023

Varagon Capital Corporation

151 West 42nd Street, 53rd Floor

New York, New York 10036

____________________________________________________________________________________________________________

PROXY STATEMENT

Special Meeting of Shareholders

August 24, 2023

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of Varagon Capital Corporation (the “Company,” “we,” “us,” or “our”) for use at a Special Meeting of Shareholders (the “Meeting”) to be held on August 24, 2023, at 11:30 a.m., Eastern Time. The Meeting will be held at the offices of Eversheds Sutherland (US) LLP, located at 1114 Avenue of the Americas, New York, NY 10036. This proxy statement, the proxy card and the accompanying proxy materials are being mailed to shareholders on or about August 11, 2023. This Proxy Statement also can be accessed online at www.proxyvote.com.

We encourage you to vote your shares, either by voting in-person at the Meeting, by telephone, or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card, or by telephone or through the Internet, and the Company receives your vote in time for voting at the Meeting, the persons named as proxies will vote your shares in the manner that you specify. If you give no instructions on your signed proxy card, the shares covered by the proxy card will be voted FOR the approval of the New Advisory Agreement (as defined below) in accordance with the recommendation of the Board.

Purpose of Meeting

At the Meeting, you will be asked to approve a new investment advisory agreement (the “New Advisory Agreement”) by and between the Company and VCC Advisors, LLC, the Company’s investment adviser (the “Adviser” or “VCC Advisors”).

Record Date and Voting Securities

The Board has fixed the close of business on July 28, 2023 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof (the “Record Date”). You may cast one vote for each share of common stock that you owned as of the Record Date. There were 41,501,706 shares of the Company’s common stock outstanding as of the Record Date.

Quorum Required

A quorum must be present at the Meeting for any business to be conducted. The presence at the Meeting, in-person or by proxy, of the holders entitled to cast a majority of the shares of common stock of the Company entitled to be cast as of the Record Date will constitute a quorum. Abstentions will be treated as shares present for quorum purposes. If a beneficial owner does not provide voting instructions to its broker, the broker is not permitted to give a proxy with respect to such beneficial owner's shares, and accordingly such shares will not count as present for quorum purposes or for purposes of Section 2(a)(42) of the Investment Company Act of 1940, as amended (the "1940 Act"). In addition, abstentions are not counted as votes cast.

If a quorum is not present at the Meeting, the shareholders who are represented may adjourn the Meeting until a quorum is present. The persons named as proxies will vote those proxies for such adjournment, unless the proxies are marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies.

Voting

You may vote at the Meeting by using the control number contained in the enclosed proxy card or by proxy in accordance with the instructions provided below. You also may authorize a proxy through the Internet or by telephone using the web address or telephone number included in the enclosed proxy card. These options require you to input the control number located on the enclosed proxy card. After inputting the control number, you will be prompted to direct your proxy to vote on the proposal. You will have an opportunity to review your voting instructions and make any necessary changes before submitting your voting instructions and terminating the telephone call or Internet link. Shareholders who vote via the Internet, in addition to confirming your voting instructions prior to submission, will also receive an e-mail confirming your instructions upon request. When voting by proxy and mailing your proxy card, you are required to:

•indicate your instructions on the proxy card;

•date and sign the proxy card;

•mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and

•allow sufficient time for the proxy card to be received on or before 11:59 p.m., Eastern Time, on August 23, 2023.

If you hold shares of common stock through a broker, bank or other nominee, you must follow the voting instructions you receive from your broker, bank or nominee. If you hold shares of common stock through a broker, bank or other nominee and you want to participate

1

in the Meeting, you must obtain a legal proxy from the record holder of your shares and present it at the Meeting. If a beneficial owner does not provide voting instructions to its broker, the broker is not permitted to give a proxy with respect to such beneficial owner's shares.

You may receive more than one proxy statement and proxy card or voting instructions form if your shares are held through more than one account (e.g., through different account holders). Each proxy card or voting instructions form only covers those shares held in the applicable account. If you hold shares in more than one account, you must provide voting instructions as to all your accounts to vote all your shares.

Revocability of Proxies

If you are a “shareholder of record” (i.e., you hold shares directly in your name), you may revoke a proxy at any time before it is exercised by notifying the proxy tabulator, Broadridge Financial Solutions, Inc. (“Broadridge”), in writing, by submitting a properly executed, later-dated proxy, or by attending the Meeting in-person and voting your shares at the Meeting. Please send your notification to Varagon Capital Corporation, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717. Any shareholder of record participating in the Meeting may vote at such time whether or not he or she has previously voted his or her shares. Shareholders have no appraisal or dissenters’ rights in connection with the proposal described herein.

Vote Required

Approval of the New Advisory Agreement. This proposal will be approved if the holders of a majority of the outstanding voting securities of the Company as of the Record Date vote in favor of the New Advisory Agreement. Pursuant to Section 15(a) of the 1940 Act, approval of a written contract for a person to serve or act as an investment adviser to a business development company (“BDC”) requires the vote of a “majority of the outstanding voting securities” of the Company, defined under Section 2(a)(42) of the 1940 Act as the lesser of: (1) 67% or more of the voting securities of the Company present or represented by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Company are present or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Company, whichever is less. Because the vote on the proposal is based on the total number of shares outstanding, abstentions will have the same effect as voting “AGAINST” the approval of the proposal. If you give no instructions on your signed proxy card, the shares covered by the proxy card will be voted “FOR” the approval of the New Advisory Agreement in accordance with the recommendation of the Board.

Additional Solicitation. If there are not enough votes to approve the New Advisory Agreement, the shareholders who are represented at the Meeting may adjourn the Meeting to permit the further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment, unless the proxies are marked to be voted against the proposal, to permit the further solicitation of proxies. Abstentions will not be counted as votes cast on such adjournment and will have no effect on the adjournment vote.

In addition, the Chair of the Meeting will have the authority to adjourn the Meeting from time-to-time without notice and without the vote or approval of the shareholders.

Proxies for the Annual Meeting

The named proxies for the Meeting are Walter J. Owens, Robert J. Bourgeois and Afsar Farman-Farmaian (or their duly authorized designees), who will follow submitted proxy voting instructions. They will vote as the Board recommends herein as to any submitted proxies that do not direct how to vote on any item, and will vote on any other matters properly presented at the Meeting in their judgment.

Information Regarding this Solicitation

The Adviser will bear the expense of the solicitation of proxies for the Meeting, including the cost of preparing and mailing this Proxy Statement and any requested proxy materials to shareholders. If brokers, trustees, or fiduciaries and other institutions or nominees holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners, we will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mail, directors, officers or employees of the Company and/or officers or employees of the Adviser may solicit proxies in person and/or by telephone, electronic mail or other electronic means from the Company’s shareholders. No additional compensation will be paid to directors, officers or regular employees of the Company or the Adviser for such services. The Adviser is located at 151 West 42nd Street, 53rd Floor, New York, New York 10036.

Electronic Delivery of Proxy Materials

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), the Company furnishes proxy materials by email to those shareholders who have elected to receive their proxy materials electronically. While the Company encourages Shareholders to take advantage of electronic delivery of proxy materials, which helps to reduce the environmental impact of meetings of shareholders and the cost associated with the physical printing and mailing of materials, Shareholders who have elected to receive proxy materials electronically by email, as well as beneficial owners of shares held by a broker or custodian, may request a printed set of proxy materials. The enclosed proxy card contains instructions on how you can elect to receive a printed copy of this Proxy Statement.

Security Ownership of Certain Beneficial Owners and Management

2

The following table sets forth, as of the Record Date, the beneficial ownership of each current director, the Company’s executive officers, each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. The percentage ownership is based on 41,501,706 shares outstanding as of the Record Date. Ownership information for those persons who beneficially own 5% or more of our shares of common stock is based upon reports filed by such persons with the SEC and other information obtained from such persons, if available.

To our knowledge, except as indicated in the footnotes to the table, the Company believes that each beneficial owner set forth in the table below has sole voting and investment power. The Company’s directors are divided into two groups — interested directors and independent directors. Independent directors are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the Company (the “Independent Directors”). The address of all executive officers and directors is c/o Varagon Capital Corporation, 151 West 42nd Street, 53rd Floor, New York, NY 10036.

| | |

Name and Address | Number of Shares Owned | Percentage of Shares Outstanding |

Interested Director | | |

Walter J. Owens | 170,729.6471(1) | * |

Independent Directors | | |

Nell Cady-Kruse | 38,519.2784 | * |

James Gertie | — | — |

Shawn Hessing | — | — |

Executive Officers who are not Directors | | |

Kevin Marchetti | 21,732.5035(2) | * |

Robert J. Bourgeois | 16,677.9626(3) | * |

Directors and Executive Officers as a Group (7 persons) | 246,491.3727 | * |

5% Holders | | |

California Institute of Technology (4) | 9,728,256.0000 | 23.4 % |

Aflac Life Insurance Japan, Ltd. (5) | 2,190,074.0000 | 5.3 % |

VCBD Feeder I, LLC (6) | 9,629,814.4734 | 23.2 % |

VCBD Feeder II, LLC (7) | 3,081,540.9142 | 7.4 % |

State Teachers Retirement System of Ohio (8) | 7,703,851.7866 | 18.6 % |

* Represents less than one percent.

(1)Mr. Owens owns 146,000 shares of common stock directly and 24,729.6471 shares indirectly through VCC Professionals Fund, L.P. (“VCC Professionals Fund”). VCC Professionals Fund is a private fund organized for employees of Varagon Capital Partners, L.P., the direct parent company and managing member of the Adviser (“Varagon”), to invest in shares of common stock. Mr. Owens disclaims beneficial ownership of the reported shares of common stock except to the extent of his pecuniary interest therein.

(2)Mr. Marchetti owns 6,325 shares of common stock directly and 15,407.5035 shares indirectly through VCC Professionals Fund. VCC Professionals Fund is a private fund organized for employees of Varagon to invest in shares of common stock. Mr. Marchetti disclaims beneficial ownership of the reported shares of common stock except to the extent of his pecuniary interest therein.

(3)Mr. Bourgeois owns 9,732 shares of common stock directly, 5,777.9437 shares of common stock indirectly through VCC Professionals Fund, and 1,168.0189 shares of common stock indirectly through Varagon Professionals Fund, L.P. ("Varagon Professionals Fund"). VCC Professionals Fund and Varagon Professionals Fund are private funds organized for employees of Varagon to invest in shares of common stock. Mr. Bourgeois disclaims beneficial ownership of the reported shares of common stock except to the extent of his pecuniary interest therein.

(4)The address of California Institute of Technology is 551 S. Wilson Ave, MC 2-42, Pasadena, California 91125.

(5)The address of Aflac Life Insurance Japan, Ltd. is 1932 Wynnton Road, Columbus, Georgia 31999.

(6)The address of VCBD Feeder I, LLC is 151 West 42ndStreet, 53rd Floor, New York, New York 10036.

(7)The address of VCBD Feeder II, LLC is 151 West 42ndStreet, 53rd Floor, New York, New York 10036.

(8)The address of State Teachers Retirement System of Ohio is 275 East Broad Street, Columbus, Ohio 43215.

Set forth below is the dollar range of equity securities beneficially owned by each of our directors as of the Record Date. We are not part of a “family of investment companies,” as that term is defined in the 1940 Act.

| | |

Name of Director | | Dollar Range of Equity Securities Beneficially Owned(1)(2) |

Interested Director | | |

Walter J. Owens | | Over $1,000,000 |

Independent Directors | | |

Nell Cady-Kruse | $ | 100,001 - $500,000 |

3

| | |

James Gertie | | None |

Shawn Hessing | | None |

(1)The dollar ranges are: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, $100,001 – $500,000, $500,001 – $1,000,000 or over $1,000,000.

(2)The dollar range of equity securities beneficially owned by directors of the Company, if applicable, is the product obtained by multiplying the current net asset value per share of the Company's common stock, times the number of shares of the Company's stock beneficially owned.

4

PROPOSAL 1: APPROVAL OF THE NEW ADVISORY AGREEMENT

VCC Advisors currently provides investment advisory services to the Company pursuant to the investment advisory agreement, dated June 2, 2022, between the Company and VCC Advisors (the “Existing Advisory Agreement”). On July 24, 2023, the Board approved, and recommended that the Company’s shareholders approve the New Advisory Agreement. Under the New Advisory Agreement, VCC Advisors will continue to manage the day-to-day operation of and provide investment advisory services to the Company, subject to the overall supervision of the Board.

Background

VCC Advisors is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and is a subsidiary of Varagon Capital Partners, L.P. (“Varagon”), which is also registered with the SEC as an investment adviser under the Advisers Act. Varagon is the direct parent company and managing member of the Adviser. There is no intervening entity between the Adviser and Varagon.

On July 5, 2023, Varagon entered into an Agreement and Plan of Merger (the “Merger Agreement”) with affiliates of Man Group plc (“Man Group”), pursuant to which a newly formed indirect subsidiary of Man Group will merge with and into Varagon, with Varagon surviving the merger as an indirect subsidiary of Man Group (the “Transaction”). In connection with the signing of the Merger Agreement, certain members of Varagon’s existing management entered into separate rollover agreements with an affiliate of Man Group pursuant to which they agreed that instead of receiving the cash consideration they would have otherwise received pursuant to the Merger Agreement, they would contribute their existing equity in Varagon into the Man Group subsidiary that will become the owner of Varagon in exchange for equity interests in such subsidiary. As a result, following the Transaction, management will continue to own, directly or indirectly, approximately 27% of Varagon. The remainder of Varagon will be indirectly owned by Man Group. The Transaction will enhance the capabilities of each firm with the intention of better serving each of Varagon and Man Group’s respective clients. Varagon believes that the Transaction will allow Man Group’s extensive distribution network and operational expertise to support and grow Varagon’s private credit and direct lending platform.

Although the ownership of Varagon will change as a result of the Transaction, there will be no material changes to the investment advisory services performed by VCC Advisors as a result of the Transaction. The Adviser’s current management will continue to determine the investment strategies and policies of the Adviser following consummation of the Transaction. In addition, the Adviser’s investment process and the Company’s investment objective, investment strategies, investment portfolio, fundamental investment restrictions, fundamental policies, principal strategies and principal risks will not change as a result of the Transaction. In addition, the advisory fees payable by the Company to the Adviser will not change and the expenses of the Company are not expected to change as result of the Transaction or entering into the New Advisory Agreement.

The Transaction is expected to close in the third quarter of 2023 subject to the satisfaction or waiver of various conditions as set forth in the Merger Agreement. The closing of the Transaction is not conditioned upon the Company’s shareholders approving the New Advisory Agreement. Varagon expects that the Transaction will close after the date of the Meeting. Notwithstanding the foregoing, in the event that the closing of the Transaction occurs before the New Advisory Agreement is approved by the Company’s shareholders, an interim investment advisory agreement between the Company and VCC Advisors (the “Interim Advisory Agreement”) will take effect upon the closing of the Transaction and will continue in effect for a term ending on the earlier of 150 days from the closing of the Transaction or when the shareholders approve the New Advisory Agreement. If the New Advisory Agreement is not approved by the Company’s shareholders before the term of the Interim Advisory Agreement expires, the Board will consider other alternatives in the best interests of shareholders of the Company.

Section 15 of the 1940 Act, made applicable to BDCs under Section 59 of the 1940 Act, requires that all investment advisory agreements provide for automatic termination in the event of an assignment. An assignment of an investment advisory agreement is deemed to occur when a transaction results in a change of control (i.e., change in ownership of voting securities such that a person who owned less than 25% comes to own more than 25%, or vice versa) of an investment adviser. Consummation of the Transaction will be deemed to result in a change of control of VCC Advisors, and thus the automatic termination of the Existing Advisory Agreement. The 1940 Act further provides that it is unlawful for any person to serve as an investment adviser of a BDC, such as the Company, except pursuant to a written contract, which contract has been approved by the vote of a majority of the outstanding voting securities of such BDC.

In anticipation of the automatic termination of the Existing Advisory Agreement upon the closing of the Transaction, the Board including a majority of the Independent Directors, at a meeting held on July 24, 2023, voted to approve the New Advisory Agreement, subject to shareholder approval. Subject to approval by the Company’s shareholders, the New Advisory Agreement will take effect upon the consummation of the Transaction, which is anticipated to occur on or about September 7, 2023.

The New Advisory Agreement is identical to the Existing Advisory Agreement, including with respect to advisory fees, except that the initial term will begin upon the execution of the New Advisory Agreement and certain non-material changes. A copy of the New

5

Advisory Agreement is attached to this Proxy Statement as Annex A. You should read the New Advisory Agreement in its entirety. The description in this Proxy Statement of the New Advisory Agreement is only a summary.

Information Regarding VCC Advisors and the Transaction

VCC Advisors has served as the investment adviser to the Company since the commencement of the Company’s operations in June 2022. Varagon is the direct parent company and managing member of VCC Advisors. The address of VCC Advisors and Varagon is 151 West 42nd Street, 53rd Floor, New York, NY 10036.

Varagon provides VCC Advisors with experienced investment professionals, including the members of VCC Advisor’s Investment Committee, and access to Varagon’s resources. Launched in 2014, Varagon is a leading direct lender to performing, sponsor-backed U.S. middle market companies, with approximately $15.7 billion of assets under management as of December 31, 2022. Varagon offers complete financing solutions through a flexible and competitive product suite to middle market businesses with EBITDA generally between $10 million and $75 million. From inception (June 2014) to December 31, 2022, Varagon has invested and managed (including co-investments) over $24 billion in performing, senior secured loan investments across more than 275 borrowers.

Varagon believes it has built a platform with a senior management team that has extensive experience investing across the capital structure. Varagon’s senior management team members share a common investment philosophy built on a framework of assessing companies with a disciplined, fundamentals-based, deep value-approach. As of December 31, 2022, Varagon had 88 employees, 49 of whom are dedicated investment professionals, with three primary offices located in New York, New York, Fort Worth, Texas, and Chicago, Illinois.

Man Group is a global active investment management firm focused on delivering attractive risk adjusted performance for clients. Headquartered in London, Man Group manages $144.7 billion in assets under management as of March 31, 2023, and operates across multiple offices globally. Man Group is listed on the London Stock Exchange under the ticker “EMG” and is a constituent of the FTSE 250 Index.

The Company expects it will be able to leverage Man Group’s global brand recognition and relationships to accelerate the Company’s fundraising targets and to receive financing terms more favorable than the Company’s current financing terms. However, the Company’s investment and management functions will not materially change following the consummation of the Transaction.

Interests of Certain Persons in the Approval of the New Investment Advisory Agreement

Certain of the Company’s executive officers and the interested director of the Board are also officers and employees of the Adviser and Varagon. Walter Owens, our Chief Executive Officer and Chairman of our Board, is also the Chief Executive Officer of Varagon, a member of its Board of Directors, and a member of Varagon’s Investment Committee. Kevin Marchetti, our President, is also a Partner of Varagon and leads the firm’s Underwriting & Portfolio Management Team as Varagon’s Chief Risk Officer. Robert Bourgeois, our Chief Financial Officer and Treasurer, is also a Partner of Varagon and serves as Varagon’s Chief Financial Officer. Varagon, directly and indirectly, beneficially owns 1.7% of the Company’s issued and outstanding shares of common stock as of the Record Date.

Summary of the Existing Advisory Agreement, the New Advisory Agreement and the Interim Advisory Agreement

On March 8, 2022, the Board, including all of the Independent Directors, and the sole shareholder of the Company approved the Existing Advisory Agreement in connection with the organization of the Company. The Existing Advisory Agreement became effective on June 2, 2022, the date on which the Company elected to be regulated as a BDC under the 1940 Act.

If approved, VCC Advisors will continue to provide the same advisory services to the Company pursuant to the New Advisory Agreement as it currently provides pursuant to the Existing Advisory Agreement. Under the terms of the New Advisory Agreement, VCC Advisors will continue to manage the day-to-day operation of and provide investment advisory services to the Company in accordance with its investment objective, policies and restrictions, and will continue to be responsible for:

•formulating and implementing the Company’s investment program;

•determining the composition of the Company’s portfolio, the nature and timing of the changes to the Company’s portfolio and the manner of implementing such changes;

•identifying, evaluating and negotiating the structure of the investments and dispositions made by the Company (including performing due diligence on prospective portfolio companies);

•executing, closing, servicing and monitoring the Company’s investments, including the exercise of any rights in its capacity as a lender;

6

•determining the securities and other assets that the Company will originate, purchase, retain, sell and dispose of such securities and other assets, as appropriate;

•exercising voting rights in respect of portfolio securities and other investments for the Company; and

•providing the Company with such other investment advisory, research and related services as it may, from time to time, reasonably require for the investment of its capital.

Consistent with the Existing Advisory Agreement, the services VCC Advisors will provide to the Company will not be exclusive, and VCC Advisors may engage in any other business or render similar services to other entities so long as its services to the Company are not impaired.

Advisory Fees

The management fees under the New Advisory Agreement will be calculated in a manner identical to that of the Existing Advisory Agreement. The Company will pay the Adviser a fee for its services under the New Advisory Agreement consisting of two components: a base management fee and an incentive fee. The cost of both the base management fee and the incentive fee will ultimately be borne by the Company’s common shareholders.

Base Management Fee

The base management fee payable under the New Advisory Agreement will be calculated in a manner identical to that of the Existing Advisory Agreement.

Pursuant to the New Advisory Agreement, prior to an initial public offering or a listing of the common stock on a national securities exchange (a “Public Listing”), the Company will continue to pay a base management fee for management services in an amount equal to an annual rate of 0.75% of the Adjusted Gross Assets, payable quarterly in arrears. Adjusted Gross Assets refers to the average of the accreted or amortized cost basis of the Company’s portfolio investments, excluding cash and cash equivalents and undrawn capital commitments at the end of the two most recently completed fiscal quarters.

Following a Public Listing, the Company will pay the Adviser a base management fee in an amount equal to an annual rate of 1.00% of the Adjusted Gross Assets payable quarterly in arrears.

Incentive Fees

The incentive fees payable under the New Advisory Agreement will be calculated in a manner identical to that of the Existing Advisory Agreement. Pursuant to the New Advisory Agreement, the Company will continue to pay to the Adviser an incentive fee consisting of two components – an incentive fee based on a percentage of net investment income and an incentive fee based on a percentage of capital gains, each as described below. The two components of the incentive fee are independent of each other and therefore, one component may be payable to the Adviser even if the other component is not payable to the Adviser.

Incentive Fee on Income

Prior to a Public Listing

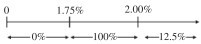

The incentive fee on income will continue to be calculated and payable quarterly in arrears. Under the New Advisory Agreement, prior to a Public Listing, the amount of incentive fee on income payable will continue to be equal to:

i.100% of the excess of the Company’s “pre-incentive fee net investment income” (as defined below) expressed as a rate of return on the Company’s net assets before taking into account any incentive fee on income during such period, for the immediately preceding quarter, over a preferred return of 1.75% per quarter (7% annualized), until the Adviser has received a “catch-up” equal to 12.5% of the pre-incentive fee net investment income for the immediately preceding quarter; and

ii.12.5% of all remaining pre-incentive fee net investment income above the “catch-up.”

Quarterly Income Incentive Fee

Pre-incentive fee net investment income

(expressed as a percentage of the value of net assets)

7

Percentage of pre-incentive fee net investment income

allocated to the Adviser

Following a Public Listing

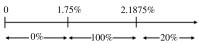

Under the New Advisory Agreement, following a Public Listing, the amount of incentive fee on income payable will continue to be equal to:

i.100% of the excess of the Company’s pre-incentive fee net investment income for the immediately preceding quarter, over a preferred return of 1.75% per quarter (7% annualized), until the Adviser has received a “catch-up” equal to 20% of the pre-incentive fee net investment income for the immediately preceding quarter; and

ii.20% of all remaining pre-incentive fee net investment income above the “catch-up.”

Quarterly Income Incentive Fee

Pre-incentive fee net investment income

(expressed as a percentage of the value of net assets)

Percentage of pre-incentive fee net investment income

allocated to the Adviser

“Pre-incentive fee net investment income” means interest income, dividend income, accrued interest on the capital provided to the Company’s joint venture through subordinated certificates, and any other income including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies accrued during the quarter, minus the Company's operating expenses for the quarter including the base management fee, expenses payable under the administration agreement , and any interest expense and any dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee on income. Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with “payment-in-kind” interest and zero coupon securities), accrued income that the Company has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

The incentive fee on income for a particular quarter will continue to be subject to a cap (the “Incentive Fee Cap”). For periods prior to a Public Listing, the Incentive Fee Cap is equal to the difference between (x) 12.5% of the Cumulative Net Return (as defined below) from the calendar quarter then ending and the eleven preceding calendar quarters (such period the “Trailing Twelve Quarters”) and (y) the aggregate incentive fees on income that were paid to the Adviser by the Company in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters. Following a Public Listing, the Incentive Fee Cap will be equal to the difference between (x) 20% of the Cumulative Net Return during the relevant Trailing Twelve Quarters and (y) the aggregate incentive fees on income that were paid to the Adviser by the Company in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters. Cumulative Net Return is defined as the sum of (a) pre-incentive fee net investment income in respect of the relevant Trailing Twelve Quarters and (b) cumulative aggregate realized capital gains, cumulative aggregate realized capital losses, cumulative aggregate unrealized capital depreciation and cumulative aggregate unrealized capital appreciation in respect of the relevant Trailing Twelve Quarters.

Examples of the incentive fee on income calculation are set forth in Annex B, which are identical to the examples provided in connection with the Existing Advisory Agreement, as previously disclosed by the Company in its public filings. Such examples are included for illustrative purposes only and are not considered part of the Existing Advisory Agreement or the New Advisory Agreement.

8

Incentive Fee on Capital Gains

The incentive fee on capital gains will continue to be determined and payable in arrears as of the end of each fiscal year. Under the New Advisory Agreement, prior to a Public Listing, the amount of the incentive fee on capital gains will continue to be equal to 12.5% of the Company’s realized capital gains, if any, on a cumulative basis from inception through the end of the fiscal year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees. Under the New Advisory Agreement, following a Public Listing, the amount of the incentive fee on capital gains will continue to be equal to 20% of the Company’s realized capital gains, if any, on a cumulative basis from inception through the end of the fiscal year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gains incentive fees.

Expenses

All professionals of VCC Advisors, when and to the extent engaged in providing investment advisory and management services to the Company, and the compensation and routine overhead expenses of personnel allocable to these services to the Company, are, and will continue to be, provided and paid for by VCC Advisors and not by the Company.

Limitations of Liability and Indemnification

The indemnification provisions under the New Advisory Agreement will be identical to the indemnification provisions under the Existing Advisory Agreement. The New Advisory Agreement will provide that the Company will indemnify the Adviser and its affiliates (each, an “Indemnitee”) against any liabilities relating to the offering of the Company’s common stock or its business, operation, administration or termination, if the Indemnitee acted in good faith and in a manner it believed to be in, or not opposed to, the Company’s interest and except to the extent arising out of the Indemnitee’s willful malfeasance, bad faith, or gross negligence, in the performance their duties, or by reason of reckless disregard of their obligations and duties under the New Advisory Agreement. The Company may pay the expenses incurred by the Indemnitee in defending an actual or threatened civil or criminal action in advance of the final disposition of such action, provided the Indemnitee agrees to repay those expenses if found by adjudication not to be entitled to indemnification.

Term, Continuance and Termination

The continuance and termination provisions under the New Investment Advisory Agreement are identical to the continuance and termination provisions under the Existing Advisory Agreement. The New Advisory Agreement provides that it will remain in effect for two (2) years from its effective date, and thereafter from year-to-year, subject to approval by the Board or a vote of a majority of the outstanding voting securities of the Company and by approval of a majority of the Independent Directors. The New Advisory Agreement may be terminated at any time, without the payment of any penalty, upon 60 days’ written notice, by (a) the affirmative vote of a majority of the Company’s outstanding voting securities, (b) the affirmative vote of a majority of our Board, including a majority of the Independent Directors, or (c) the Adviser.

Interim Advisory Agreement

On July 24, 2023, the Board, including all of the Independent Directors, approved the Interim Advisory Agreement. The Board, including all of the Independent Directors, determined that the scope and quality of services to be provided to the Company under the Interim Advisory Agreement would be at least equivalent to the scope and quality of services provided under the Existing Advisory Agreement, as required by Rule 15a-4 under the 1940 Act.

Varagon expects that the Transaction will close after the date of the Meeting. Notwithstanding the foregoing, in the event that the closing of the Transaction occurs before the New Advisory Agreement is approved by the Company’s shareholders, the Interim Advisory Agreement will take effect upon the closing of the Transaction and will continue in effect for a term ending on the earlier of 150 days from the closing or when the shareholders approve the New Advisory Agreement. If the New Advisory Agreement is not approved by the Company’s shareholders before the term of the Interim Advisory Agreement expires, the Board will consider other alternatives in the best interests of shareholders.

The terms of the Interim Advisory Agreement are materially the same as the Existing Advisory Agreement, except for the date and certain provisions that are required by Rule 15a-4 under the 1940 Act. The compensation to be received under the Interim Advisory Agreement would be no greater than the compensation the Adviser would receive under the Existing Advisory Agreement as required by Rule 15a-4 under the 1940 Act. The provisions required by Rule 15a-4 under the 1940 Act include a requirement that fees payable under the Interim Advisory Agreement be paid into an interest-bearing escrow account with the Company’s custodian. If the Company’s shareholders approve the New Advisory Agreement by the end of the 150-day period, the amount in the escrow account (including interest earned) payable by the Company under the Interim Advisory Agreement will be paid to VCC Advisors. If the New Advisory Agreement, however, is not approved, VCC Advisors will be paid, out of the escrow account, the lesser of any costs incurred by VCC

9

Advisors in performing the Interim Advisory Agreement (plus interest earned on that amount while in escrow) or the total amount in the escrow account (plus interest earned).

In addition, the Board or a majority of the Company’s outstanding voting securities may terminate the Interim Advisory Agreement at any time, without the payment of any penalty, on not more than 10 calendar days’ written notice to the Adviser.

Administration Agreement

Varagon, the direct parent company and managing member of VCC Advisors, serves as the administrator for the Company (the “Administrator”) pursuant to an administration agreement (the “Existing Administration Agreement”). In connection with the Transaction, and in conjunction with entering into the New Advisory Agreement, the Company will enter into a new administration agreement (the “New Administration Agreement”) with the Administrator. The New Administration Agreement will be materially identical to the Existing Administration Agreement. Pursuant to the New Administration Agreement, the Administrator (or one or more delegated service providers) will continue to furnish the Company with office facilities, together with equipment and clerical, bookkeeping and recordkeeping services at such facilities. Under the Administration Agreement, the Administrator will continue to perform, or oversee the performance of, the Company’s required administrative services, which includes being responsible for the financial records that the Company is required to maintain and preparing reports to the Company’s shareholders and reports filed with the SEC and otherwise assists with the Company’s compliance with the rules and regulations applicable to a BDC and regulated investment company under the Internal Revenue Code. In addition, the Administrator will continue to assist the Company in determining and publishing the Company’s net asset value, overseeing the preparation and filing of the Company’s tax returns and the printing and dissemination of reports to the Company’s shareholders, and generally overseeing the payment of the Company’s expenses and the performance of administrative and professional services rendered to the Company by others. The Administrator will charge the Company only for the actual expenses it incurs on its behalf, or its allocable portion thereof, without any profit to the Administrator.

Advisory Fees and Other Fees

The following table describes the fees paid/accrued to the Adviser under the Existing Advisory Agreement and Existing Administration Agreement during the fiscal year ended December 31, 2022.

| | |

Source Agreement & Description | | For the Fiscal Year Ended December 31, 2022 (in thousands) |

Existing Advisory Agreement - Base Management Fee | $ | 2,818 |

Existing Advisory Agreement - Income Incentive Fee | | 1,329 |

Existing Advisory Agreement - Capital Gains Incentive Fee | | — |

Existing Administration Agreement - Administrator Expenses | | 728 |

Board Consideration of the New Advisory Agreement

The Board, including all of the Independent Directors, unanimously approved the New Advisory Agreement on July 24, 2023.

In evaluating the New Advisory Agreement, the Board reviewed certain materials furnished by Man Group and VCC Advisors relevant to its decision. Those materials included a copy of the New Advisory Agreement; a memorandum from independent legal counsel to the Independent Directors outlining the legal principles that are applicable to consideration of the approval of the New Advisory Agreement by the Board; VCC Advisors’ response to certain questions to assist in the Board’s consideration of the approval of the New Advisory Agreement; and other supporting documents and attachments. At meetings held on June 23, 2023, July 7, 2023, July 20, 2023, and July 24, 2023, representatives of VCC Advisors discussed the Transaction and the New Advisory Agreement with the Board, and indicated that, as a result of the Transaction, the operations of VCC Advisors and its ability to provide the same advisory services to the Company would not be adversely affected. A representative of Man Group also provided information regarding Man Group and the resources it expected to provide to VCC Advisors.

In its consideration of the New Investment Advisory Agreement, the Board focused on information it had received relating to, among other things: (a) the nature, quality and extent of the advisory and other services to be provided to the Company by VCC Advisors; (b) the investment performance of the Company and VCC Advisors; (c) comparative data with respect to advisory fees or similar expenses paid by other BDCs with similar investment objectives; (d) the Company’s projected operating expenses and expense ratio compared to BDCs with similar investment objectives; (e) any existing and potential sources of indirect income to VCC Advisors and its affiliates from their relationships with the Company and the profitability of those relationships; (f) information about the services to be performed and the personnel who will be performing such services under the New Advisory Agreement; (g) the organizational capability and financial condition of VCC Advisors and its affiliates and how they would be affected by the Transaction; (h) possible economies of scale arising from the Company’s size and/or anticipated growth; and (i) possible alternative fee structures or bases for determining fees.

10

The Independent Directors met in executive session with their independent legal counsel regarding the approval of the New Advisory Agreement. Based on the information reviewed and discussions held with respect to each of the foregoing items, the Independent Directors concluded that the compensation payable to VCC Advisors under the New Advisory Agreement was reasonable in relation to the services to be provided by VCC Advisors to the Company. In particular, the Independent Directors noted that the nature, quality, and extent of the advisory services currently being provided by VCC Advisors to the Company were satisfactory and that the services were not expected to change materially after the Transaction as the operations and personnel of VCC Advisors would remain substantially the same. They also noted that the services could reasonably be expected to be augmented by the additional resources of Man Group. The Independent Directors concluded that the investment performance of the Company since inception in June 2022 had been satisfactory when compared to that of comparable BDCs and that the current investment personnel who were responsible for managing the Company would remain after the Transaction. The Independent Directors also noted that the advisory fees (which would remain the same) and operating expenses were in line with, or generally less than, those of comparable BDCs and that VCC Advisors and its affiliates did not and would not receive any indirect income from the Company apart from advisory fees and administrator expenses. The Independent Directors concluded that the organizational capability and financial condition of VCC Advisors and its affiliates were adequate and could reasonably be expected to improve following the Transaction due to the greater resources of the Man Group. The Independent Directors determined that the superior distribution capability of the Man Group could be reasonably expected to enhance the Company’s ability to gather assets and thereby realize economies of scale. Finally, the Independent Directors decided not to consider alternative fee structures as the current fee structure was consistent with that of other BDCs.

After these deliberations, the Board, including all of the Independent Directors, approved the New Advisory Agreement as being in the best interests of the Company and its shareholders. The Board then directed that the New Advisory Agreement be submitted to the Company’s shareholders for approval with the Board’s recommendation that shareholders vote to approve the New Advisory Agreement.

The Board did not assign relative weights to the above factors or the other factors considered by it. Individual members of the Board may have given different weights to different factors.

Additional Considerations under the 1940 Act

The Transaction is structured to comply with the “safe harbor” included in Section 15(f) of the 1940 Act. Section 15(f) provides that when a sale of securities or any other interest in an investment adviser occurs, the investment adviser or any of its affiliated persons may receive any amount or benefit in connection with the sale so long as two conditions are satisfied. These conditions are as follows:

•First, during the three-year period following the consummation of a transaction, at least 75% of the investment company’s board of directors must be comprised of Independent Directors. The Board is expected to meet this requirement at the time of the consummation of the Transaction, and for the three-year period thereafter.

•Second, an “unfair burden” must not be imposed on the investment company as a result of the transaction relating to the sale of such interest, or any of its applicable express or implied terms, conditions or understandings. The term “unfair burden,” as defined in the 1940 Act, includes any arrangement, during the two-year period after the date on which any such transaction occurs, whereby the investment adviser or corporate trustee or predecessor or successor investment advisers or corporate trustee or any interested person of any such adviser or any such corporate trustee receives or is entitled to receive any compensation directly or indirectly (i) from any person in connection with the purchase or sale of securities or other property to, from, or on behalf of such company, other than bona fide ordinary compensation as principal underwriter for such company, or (ii) from such company or its security holders for other than bona fide investment advisory or other services. The Board considered whether an unfair burden would be imposed on the Company as a result of the Transaction, and found that it was unaware of any arrangements that would constitute an unfair burden as such term is defined in the 1940 Act.

Principal Executive Offices

The principal executive office of each of the Company and VCC Advisors is 151 West 42nd Street, 53rd Floor, New York, NY 10036. Upon the approval of the New Advisory Agreement, the principal executive offices of each of the Company and VCC Advisors will remain at the locations set forth above.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE NEW ADVISORY AGREEMENT

11

OTHER BUSINESS

Under Maryland law, the only matters that may be acted on at a special meeting of shareholders are those stated in the Notice of Special Meeting. Accordingly, other than procedural matters relating to the proposals, no other business may properly come before the Meeting. Should any procedural matter requiring a vote of shareholders arise, it is the intention of the persons named in the proxy to vote in accordance with their discretion on such procedural matters.

AVAILABLE INFORMATION

We are required to file with or submit to the SEC annual, quarterly and current periodic reports, proxy statements and other information meeting the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This information will also be available free of charge by contacting us at Varagon Capital Corporation, 151 West 42nd Street, 53rd Floor, New York, NY 10036, by telephone at (212) 235-2600, or on our website at www.varagon.com/vcc.

SUBMISSION OF SHAREHOLDER PROPOSALS FOR THE 2024 ANNUAL MEETING

The Company expects that the 2024 annual meeting of shareholders will be held in May 2024, but the exact date, time, and location of that meeting have yet to be determined.

Any proposal of a shareholder intended to be included in our proxy statement and form of proxy/voting instruction card for the 2024 annual meeting of shareholders pursuant to Rule 14a-8 under the Exchange Act must be received by us on or before January 3, 2024. Such proposals must also comply with the requirements as to form and substance established by the SEC if such proposals are to be included in the proxy statement and form of proxy. All proposals should be addressed to Varagon Capital Corporation, 151 West 42nd Street, 53rd Floor, New York, NY 10036, Attention: Afsar Farman-Farmaian, Secretary. The Nominating and Corporate Governance Committee of our Board will review all shareholder proposals and will make recommendations to the Board for action on such proposals.

Shareholder proposals or director nominations to be presented at the 2024 annual meeting of shareholders, other than shareholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act, must be submitted in accordance with the advance notice procedures and other requirements set forth in our bylaws. These requirements are separate from the requirements discussed above to have the shareholder nomination or other proposal included in our proxy statement and form of proxy/voting instruction card pursuant to the SEC’s rules.

Our bylaws require that the proposal or recommendation for director nominations must be delivered to, or mailed and received at, the principal executive offices of the Company not earlier than December 4, 2023, the 150th day prior to the one year anniversary of the date of the Company’s proxy statement for the preceding year’s annual meeting of shareholders, and not later than 5:00 p.m., Eastern Time, on January 3, 2024, the 120th day prior to the first anniversary of the date of the proxy statement for the preceding year’s annual meeting of shareholders. If the date of the annual meeting has changed by more than 30 days from the first anniversary of the date of the preceding year’s annual meeting of shareholders, shareholder proposals or director nominations must be so received not earlier than the 150th day prior to the date of such annual meeting of shareholders and not later than the later of 5:00 p.m., Eastern Time, on the 120th day prior to the date of such annual meeting of shareholders or the tenth day following the day on which public announcement of the date of such meeting is first made. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

12

PRIVACY NOTICE

We are committed to maintaining the privacy of our shareholders and to safeguarding their non-public personal information. The following information is provided to help you understand what personal information we collect, how we protect that information and why, in certain cases, we may share information with select other parties. A copy of our privacy policy is posted on Varagon’s website at www.varagon.com/vcc.

Pursuant to our privacy policy, we do not disclose any non-public personal information about our shareholders or former shareholders to anyone, except as permitted by law or as is necessary in order to service shareholder accounts (for example, to a transfer agent or third-party administrator).

We may collect non-public information about shareholders from the subscription agreements or other forms, such as name, address, account number and the types and amounts of investments, and information about transactions with us or our affiliates, such as participation in other investment programs, ownership of certain types of accounts or other account data and activity. We may disclose the information that we collect from our shareholders or former shareholders, as described above, only to our affiliates and service providers and only as allowed by applicable law or regulation. Any party that receives this information uses it only for the services required by us and as allowed by applicable law or regulation, and is not permitted to share or use this information for any other purpose. To protect the non-public personal information of individuals, we restrict access to non-public personal information about our shareholders to employees of the Adviser and its affiliates with a legitimate business need for the information. In order to guard our shareholders’ non- public personal information, we maintain physical, electronic and procedural safeguards that are designed to comply with applicable law. Non-public personal information that we collect about our shareholders is generally stored on secured servers located in the United States. An individual shareholder’s right to privacy extends to all forms of contact with us, including telephone, written correspondence and electronic media, such as the Internet.

13

Annex A

INVESTMENT ADVISORY AGREEMENT

BETWEEN

VARAGON CAPITAL CORPORATION

AND

VCC ADVISORS, LLC

This Investment Advisory Agreement (the “Agreement”) is made this [ ] day of [ ], 2023, by and between Varagon Capital Corporation, a Maryland corporation (the “Corporation”), and VCC Advisors, LLC, a Delaware limited liability company (the “Adviser”).

WHEREAS, the Corporation operates as a closed-end non-diversified management investment company;

WHEREAS, the Corporation has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”);

WHEREAS, the Adviser is an investment adviser that is registered under the Investment Advisers Act of 1940, as amended (the “Advisers Act”); and

WHEREAS, the Corporation desires to retain the Adviser to furnish investment advisory services to the Corporation on the terms and conditions hereinafter set forth, and the Adviser wishes to be retained to provide such services.

NOW, THEREFORE, in consideration of the mutual premises and covenants herein contained and for other good and valuable consideration, the receipt of which is hereby acknowledged, it is agreed by and between the parties hereto as follows:

(a) The Corporation hereby retains the Adviser to act as the investment adviser to the Corporation and to manage the investment and reinvestment of the assets of the Corporation, subject to the supervision of the Corporation’s board of directors (the “Board”), for the period and upon the terms herein set forth, (i) in accordance with then-current investment objective, policies and restrictions that are set forth in the Corporation’s registration statement on Form 10, as amended from time to time (the “Registration Statement”), filed with the Securities and Exchange Commission (the “SEC”), and, to the extent subsequent to the effective date of the Registration Statement, any periodic report filed with the SEC, and in accordance with the investment objective, policies and restrictions set forth in the Corporation’s private placement memorandum, as amended from time, relating to the Corporation’s private offering of its common stock (the “Memorandum”) that reflects a different investment objective, policies and restrictions, whichever is filed or prepared, as the case may be, later; (ii) in accordance with the 1940 Act, the Advisers Act and all other applicable federal and state laws, rules and regulations; and (iii) in accordance with the Corporation’s articles of amendment and restatement (the “Charter”) and amended and restated bylaws (the “Bylaws”), each as amended from time to time. Without limiting the generality of the foregoing, the Adviser shall, during the term and subject to the provisions of this Agreement, (i) formulate and implement the Corporation’s investment program; (ii) determine the composition of the portfolio of the Corporation, the nature and timing of the changes therein and the manner of implementing such changes; (iii) identify/source, research, evaluate and negotiate the structure of the investments made by the Corporation (including performing due diligence on prospective portfolio companies); (iv) execute, close, service and monitor the Corporation’s investments, including the exercise of any rights in its capacity as a lender; (v) determine the securities and other assets that the Corporation will originate, purchase, retain, or sell and dispose of such securities and other assets, as appropriate; (vi) exercise voting rights in respect of portfolio securities and other investments for the Corporation; and (vii) provide the Corporation (and its subsidiaries) with such other investment advisory, research, and related services as the Corporation may, from time to time, reasonably require for the investment of its funds. Subject to the supervision of the Board, the Adviser shall have the power and authority on behalf of the Corporation to effectuate its investment decisions for the Corporation, including the execution and delivery of all documents relating to the Corporation’s investments and the placing of orders for and the purchase or sale transactions on behalf of the Corporation and its subsidiaries from time to time. In the event that the Corporation determines to acquire debt financing, the Adviser shall arrange for such financing on the Corporation’s behalf, subject to the oversight and approval of

Annex A-1

the Board. If it is necessary for the Adviser to make investments on behalf of the Corporation through a subsidiary of the Corporation or a special purpose vehicle, the Adviser shall have authority to create or arrange for the creation of such subsidiary or special purpose vehicle and to make such investments through such special purpose vehicle (in accordance with the 1940 Act).

(b) The Adviser hereby accepts such engagement and agrees during the term hereof to render the services described herein for the compensation provided herein.

(c) The Adviser, subject to the prior approval of the Board and, to the extent required, the Members, may from time to time enter into one or more sub-advisory agreements with other investment advisers (each a “Sub-Adviser”) as the Adviser may believe to be particularly fitted to assist it in the performance of this Agreement; provided, however, that the compensation of any Sub-Adviser shall be paid by the Adviser and that the Adviser shall be as fully responsible to the Corporation for the acts and omissions of any Sub-Adviser as it is for its own acts and omissions. Any sub-advisory agreement entered into by the Adviser shall be in accordance with the requirements of the 1940 Act and other applicable federal and state law.

(d) The Adviser shall for all purposes herein provided be deemed to be an independent contractor and, except as expressly provided or authorized herein, shall have no authority to act for or represent the Corporation in any way or otherwise be deemed an agent of the Corporation.

(e) The Adviser shall keep and preserve for the period required by the 1940 Act any books and records relevant to the provision of its investment advisory services to the Corporation and shall specifically maintain all books and records in accordance with Section 31(a) of the 1940 Act, and the rules and regulations promulgated thereunder, with respect to the Corporation’s portfolio transactions and shall render to the Board such periodic and special reports as the Board may reasonably request. The Adviser agrees that all records that it maintains for the Corporation are the property of the Corporation and shall surrender promptly to the Corporation any such records upon the Corporation’s request, provided that the Adviser may retain a copy of such records.

2. Corporation’s Responsibilities and Expenses Payable by the Corporation.

(a) All investment professionals of the Adviser and their respective staffs, when and to the extent engaged in providing investment advisory and management services hereunder, and the compensation and routine overhead expenses of such personnel allocable to such services, shall be provided and paid for by the Adviser and not by the Corporation. The Corporation shall bear all other out-of-pocket costs and expenses of its operations and transactions, including, without limitation, those relating to: (i) organization and offering of the common stock; (ii) the Corporation’s fees and expenses related to any Liquidity Event (as defined in the Memorandum) or the wind down and/or liquidation and dissolution of the Corporation; (iii) calculating the Corporation’s net asset value (including the cost and expenses of any independent valuation firm); (iv) fees and expenses payable to third parties, including agents, consultants or other advisers, in connection with monitoring financial and legal affairs for the Corporation and in providing administrative services, monitoring the Corporation’s investments and performing due diligence on the Corporation’s prospective portfolio investments or otherwise relating to, or associated with, evaluating and making investments; (v) fees and expenses incurred in connection with debt, if any, incurred to finance the Corporation’s investments or operations, and payment of interest and repayment of principal on such debt; (vi) fees and expenses related to sales and repurchases of the common stock and other securities; (vii) investment advisory and management fees; (viii) administration fees, if any, payable under the administration agreement (the “Administration Agreement”) between the Corporation and Varagon Capital Partners, L.P. (the “Administrator”); (ix) transfer agent, sub-administrator and custodial fees; (x) expenses relating to the issue, repurchase and transfer of common stock to the extent not borne by the relevant transferring shareholders and/or assignees; (xi) federal and state registration fees; (xii) all costs associated with a Public Listing (as defined in Section 3(a)(i)); (xiii) federal, state and local taxes and other governmental charges assessed against the Corporation; (xiv) independent directors’ fees and expenses and the costs associated with convening a meeting of the Board or any committee thereof; (xv) fees and expenses and the costs associated with convening a meeting of the shareholders or holders of any preferred stock, as well as the compensation of an investor relations professional responsible for the coordination and administration of the foregoing; (xvi) costs of preparing and filing reports or other documents required by the SEC, the Financial Industry Regulatory Authority or other regulators; (xvii) costs of any reports, proxy statements or other notices to shareholders, including printing and mailing costs; (xviii) costs and expenses related to the preparation of the Corporation’s financial statements and tax returns; (xix) the Corporation’s allocable portion of the fidelity bond, directors and officers/errors and omissions liability insurance, and any other insurance premiums; (xx) direct costs and expenses of administration, including printing, mailing, long distance telephone, and copying; (xxi)

Annex A-2

independent auditors and outside legal costs, including legal costs associated with any requests for exemptive relief, “no-action” positions or other guidance sought from a regulator, pertaining to the Corporation; (xxii) compensation of other third-party professionals to the extent they are devoted to preparing the Corporation’s financial statements or tax returns or providing similar “back office” financial services to the Corporation; (xxiii) Adviser costs and expenses (excluding travel) in connection with identifying and investigating investment opportunities for the Corporation, monitoring the investments of the Corporation and disposing of any such investments; (xxiv) portfolio risk management costs; (xxv) commissions or brokerage fees or similar charges incurred in connection with the purchase or sale of securities (including merger fees) and other assets; (xxvi) costs and expenses attributable to normal and extraordinary investment banking, commercial banking, accounting, auditing, appraisal, valuation, administrative agent activities, custodial and registration services provided to the Corporation, including in each case services with respect to the proposed purchase or sale of securities by the Corporation that are not reimbursed by the issuer of such securities or others (whether or not such purchase or sale is consummated); (xxvii) costs of amending, restating or modifying the Charter, the Bylaws, the Agreement, the Administration Agreement or related documents of the Corporation or related entities; (xxviii) fees, costs, and expenses incurred in connection with any restructuring, initial public offering or reorganization of the Corporation or related entities, the termination, liquidation or dissolution of the Corporation or related entities, or the required redemption of all or substantially all outstanding common stock (including the fees and expenses associated with any such transaction); (xxix) the expense reimbursements set forth in the Administration Agreement; and (xxx) all other properly and reasonably chargeable expenses incurred by the Corporation or the Administrator in connection with administering the Corporation’s business, including rent and the allocable portion of the cost of the Corporation’s Chief Compliance Officer and Chief Financial Officer and their respective staffs. Notwithstanding the foregoing, the Adviser shall have the right, from time to time in its sole discretion, to waive all or a portion of the costs and expenses due and payable to the Adviser by the Corporation pursuant to this Section 2(a).

(b) For the avoidance of doubt, the Adviser or its affiliates shall be solely responsible for any placement or “finder’s” fees payable to any placement agents engaged by the Adviser or its affiliates on behalf of the Corporation in connection with the offering of securities by the Corporation.

3. Compensation of the Adviser.

The Corporation agrees to pay, and the Adviser agrees to accept, as compensation for the services provided by the Adviser hereunder, a base management fee (“Base Management Fee”) and an incentive fee (“Incentive Fee”) as hereinafter set forth. The cost of both the Base Management Fee and the Incentive Fee will ultimately be borne by the Corporation’s common shareholders. The Corporation shall make any payments due hereunder to the Adviser or to the Adviser’s designee as the Adviser may otherwise direct. The Adviser may agree to temporarily or permanently waive, in whole or in part, the Base Management Fee and/or the Incentive Fee. Certain capitalized terms used in this Section 3 are defined in Section 3(d) below.

(a) Base Management Fee. The Base Management Fee shall be payable quarterly in arrears and shall be appropriately prorated for any partial quarter, if any. The Base Management Fee shall be calculated as follows:

(i) Until the earlier of (A) the consummation of an initial public offering of the Corporation’s common stock or (B) the listing of the Corporation’s common stock on a national securities exchange (together, a “Public Listing”), the Base Management Fee shall be calculated at an annual rate of 0.75% of the average of the Corporation’s Adjusted Gross Assets (as defined below) at the end of the two most recently completed fiscal quarters, payable quarterly in arrears and, in the case of the first quarter-end following the Initial Closing (as defined below), at the end of such fiscal quarter-end.

(ii) Following a Public Listing, the Base Management Fee shall be calculated at an annual rate of 1.00% of the average of the Corporation’s Adjusted Gross Assets at the end of the two most recently completed fiscal quarters, payable quarterly in arrears and, in the case of the first quarter-end following a Public Listing, at the end of such fiscal quarter-end.

(b) Incentive Fee. The Incentive Fee shall consist of two parts, as follows:

(i) The first part (the “Income Incentive Fee”) shall be calculated and payable quarterly in arrears based on the Pre-Incentive Fee Net Investment Income (as defined below) for the immediately preceding fiscal quarter. Pre-Incentive Fee Net Investment Income, expressed as a rate of return on the value of the Corporation’s net assets (defined as the total value of the Corporation’s assets minus

Annex A-3

its total liabilities, before taking into account any Incentive Fees payable during such period) at the end of the immediately preceding fiscal quarter, shall be compared to a fixed “hurdle rate” of 1.75% per quarter (7% annualized) and shall be appropriately adjusted for any share issuances or repurchases during such fiscal quarter (based on the actual number of days elapsed relative to the number of days in such fiscal quarter). The Corporation shall pay the Adviser an Income Incentive Fee with respect to the Corporation’s Pre-Incentive Fee Net Investment Income in each fiscal quarter as follows:

A. No Income Incentive Fee in any fiscal quarter in which the Corporation’s Pre-Incentive Fee Net Investment Income does not exceed the hurdle rate of 1.75%;

B. Prior to a Public Listing:

(1) 100% of the excess of the Corporation’s Pre-Incentive Fee Net Investment Income with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle rate until the Adviser has received a “catch-up” equal to 12.5% of the Pre-Incentive Fee Net Investment Income for the immediately preceding quarter; and