UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☒ | Preliminary Proxy Statement |

| |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ | Definitive Proxy Statement |

| |

☐ | Definitive Additional Materials |

| |

☐ | Soliciting Material under §240.14a-12 |

VARAGON CAPITAL CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

☐ | Fee paid previously with preliminary materials. |

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Varagon Capital Corporation

151 West 42nd Street, 53rd Floor

New York, New York 10036

[ ], 2024

Dear Shareholder:

You are cordially invited to participate in the 2024 Annual Meeting of Shareholders (the “Meeting”) of Varagon Capital Corporation (the “Company”) to be held on June 12, 2024 at 12:00 p.m., Eastern Time. The Meeting will be held in a virtual meeting format only. You will be able to participate in the Meeting, vote and submit your questions via live webcast by visiting www.virtualshareholdermeeting.com/VARAGON2024 and entering your control number on your proxy card or voting instruction form. Prior to the Meeting, you will be able to vote electronically at www.proxyvote.com.

The Notice of Annual Meeting of Shareholders and Proxy Statement accompanying this letter provide an outline of the business to be conducted at the Meeting. At the Meeting, you will be asked to: (i) elect one member of the board of directors of the Company (the "Board") to serve until the 2027 annual meeting of shareholders and until a successor is duly elected and qualified; (ii) approve an amended and restated investment advisory agreement by and between the Company and VCC Advisors, LLC; and (iii) to transact such other business that may properly come before the Meeting. Details of the business to be conducted at the Meeting are set forth in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. I, along with other members of the Company’s management, will be available to respond to shareholders’ questions. The Board unanimously recommends that you vote FOR the proposals to be considered and voted at the Meeting.

The Company has elected to provide access to its proxy materials to its shareholders over the Internet under the Securities and Exchange Commission’s (the “SEC”) “notice and access” rules. On or about [ ], the Company intends to mail to its shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”) and how to submit proxies over the Internet or by telephone. The Notice of Internet Availability of Proxy Materials also contains instructions on how you may request from us, free of charge, hard copies of the proxy statement, the proxy card and the Annual Report. The Company believes that providing its proxy materials over the Internet will expedite shareholders’ receipt of proxy materials, lower the costs associated with the Meeting and conserve resources.

It is important that your shares be represented at the Meeting. If you are unable to participate in the Meeting during the scheduled time, I urge you to complete, date and sign the enclosed proxy card and promptly return it in the envelope provided. If you prefer, you can save time by voting through the Internet or by telephone as described in the Proxy Statement and on the enclosed proxy card.

We look forward to your participation in the Meeting. Your vote and participation in the governance of the Company is very important to us.

| | | |

| | | Sincerely Yours, |

| | | /s/ Walter J. Owens |

| | | Walter J. Owens |

| | | Chief Executive Officer and Chairman of the Board of Directors |

Varagon Capital Corporation

151 West 42nd Street, 53rd Floor

New York, New York 10036

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

To be Held on

June 12, 2024, 12:00 p.m., Eastern Time

To the Shareholders of Varagon Capital Corporation:

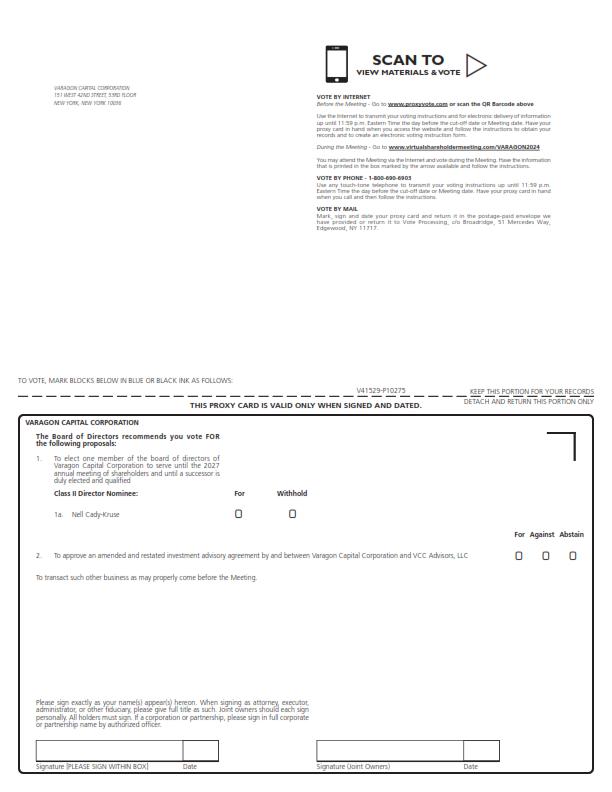

NOTICE IS HEREBY GIVEN THAT the 2024 Annual Meeting of Shareholders (the “Meeting”) of Varagon Capital Corporation (the “Company”) will be held on Wednesday, June 12, 2024, at 12:00 p.m., Eastern Time. The Meeting will be held in a virtual meeting format setting only, and you will be conducted via live audio webcast. It is important to note that shareholders have the same rights and opportunities by participating in the virtual meeting as they would if attending an in-person meeting. You will be able to participate in the Meeting online, vote your shares electronically and submit questions during the Meeting by visiting www.virtualshareholdermeeting.com/VARAGON2024. You must have your 16-Digit Control Number in order to access the Meeting. The Meeting will be held for the following purposes:

1.to elect one member of the board of directors of the Company (the "Board") to serve until the 2027 annual meeting of shareholders and until a successor is duly elected and qualified;

2.to approve an amended and restated investment advisory agreement by and between the Company and VCC Advisors, LLC; and

3.to transact such other business as may properly come before the Meeting.

You have the right to receive notice of and to vote at the Meeting if you were a shareholder of record at the close of business on April 15, 2024. If you are unable to attend virtually, please sign the enclosed proxy card and return it promptly in the self-addressed envelope provided or vote by telephone or through the Internet. Please refer to the voting instructions provided on your proxy card. In the event there are not sufficient votes for a quorum or to approve the proposals at the time of the Meeting, the Meeting may be adjourned in order to permit further solicitation of proxies by the Company. Thank you for your support of the Company.

Important Notice Regarding the Availability of Proxy Materials for the Meeting to Be Held on June 12, 2024. The Company’s Proxy Statement, the proxy card, and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”) are available at www.virtualshareholdermeeting.com/VARAGON2024 and www.proxyvote.com. This Proxy Statement and the Annual Report also can be found on our website at www.varagon.com/vcc or the SEC’s EDGAR website at www.sec.gov.

| | | |

| | | By Order of the Board of Directors, |

| | | /s/ Walter J. Owens |

| | | Walter J. Owens |

| | | Chairman of the Board of Directors |

New York, New York

[ ], 2024

This is an important meeting. To ensure proper representation at the Meeting, please follow the instructions on the Notice of Internet Availability of Proxy Materials to vote your proxy via the Internet or by telephone, or complete, sign, date and return the proxy card in the enclosed self-addressed envelope or vote by telephone or through the Internet.

Proxies may be revoked at any time before they are exercised by submitting a written notice of revocation or subsequently executed proxy, or by attending the Meeting and voting virtually. Instructions on how to vote while participating at the Meeting live via the Internet are posted at www.virtualshareholdermeeting.com/VARAGON2024.

Varagon Capital Corporation

151 West 42nd Street, 53rd Floor

New York, New York 10036

____________________________________________________________________________________________________________

PROXY STATEMENT

2024 Annual Meeting of Shareholders

To Be Held on June 12, 2024

____________________________________________________________________________________________________________

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors (the "Board") of Varagon Capital Corporation (the “Company,” “we,” “us,” or “our”) for use at the Company’s 2024 Annual Meeting of Shareholders (the “Meeting”) to be held on Wednesday, June 12, 2024, at 12:00 p.m., Eastern Time. The Meeting will be held in a virtual meeting format setting only, and will be conducted via live audio webcast. You can virtually attend the Meeting online, vote your shares electronically and submit questions during the Meeting by visiting www.virtualshareholdermeeting.com/VARAGON2024, and at any postponements or adjournments thereof. In addition, a Notice of Internet Availability of Proxy Materials containing instructions on how to access this Proxy Statement, the accompanying proxy card and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the "Annual Report"), and how to submit proxies over the Internet or by telephone are being mailed to our shareholders of record on or about April 15, 2024. The Annual Report and this Proxy Statement both can be accessed online at www.virtualshareholdermeeting.com/VARAGON2024 and www.proxyvote.com.

We encourage you to vote your shares, either by voting via the Internet while virtually attending the Meeting, by telephone, or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card, or by telephone or through the Internet, and the Company receives your vote in time for voting at the Meeting, the persons named as proxies will vote your shares in the manner that you specify. If you give no instructions on your signed proxy card, the shares covered by the proxy card will be voted (i) FOR the election of the director nominee; and (ii) FOR the approval of the Amended Advisory Agreement (as defined below), in accordance with the recommendation of the Board.

Purpose of Meeting

At the Meeting, you will be asked to vote on the following proposals:

1.to elect one member of the Board to serve until the 2027 annual meeting of shareholders and until a successor is duly elected and qualified;

2.to approve an amended and restated investment advisory agreement (the "Amended Advisory Agreement") by and between the Company and VCC Advisors, LLC, the Company's investment adviser (the "Adviser" or "VCC Advisors"); and

3.to transact such other business as may properly come before the Meeting.

Record Date and Voting Securities

The Board has fixed the close of business on April 15, 2024 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof (the “Record Date”). You may cast one vote for each share of common stock that you owned as of the Record Date. There were [ ] shares of the Company’s common stock outstanding as of the Record Date.

Quorum Required

A quorum must be present at the Meeting for any business to be conducted. The presence at the Meeting, virtually or by proxy, of the holders entitled to cast a majority of the shares of common stock of the Company entitled to be cast as of the Record Date will constitute a quorum. Abstentions will be treated as shares present for quorum purposes. If a beneficial owner does not provide voting instructions to its broker, the broker is not permitted to give a proxy with respect to such beneficial owner's shares, and accordingly such shares will not count as present for quorum purposes or for purposes of Section 2(a)(42) of the Investment Company Act of 1940, as amended (the “1940 Act”). In addition, abstentions are not counted as votes cast.

If a quorum is not present at the Meeting, the shareholders who are represented may adjourn the Meeting until a quorum is present. The persons named as proxies will vote those proxies for such adjournment, unless the proxies are marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies.

Voting

You may vote at the Meeting by using the control number contained in the Notice of Internet Availability of Proxy Materials or by proxy in accordance with the instructions provided below. You also may authorize a proxy through the Internet or by telephone using the web address or telephone number included in your Notice of Internet Availability of Proxy Materials. These options require you to input the control number located on your Notice of Internet Availability of Proxy Materials. After inputting the control number, you will be prompted to direct your proxy to vote on the proposal. You will have an opportunity to review your voting instructions and make any necessary changes before submitting your voting instructions and terminating the telephone call or Internet link. Shareholders who vote via the Internet, in addition to confirming your voting instructions prior to submission, will also receive an e-mail confirming your instructions upon request. When voting by proxy and mailing your proxy card, you are required to:

•indicate your instructions on the proxy card;

•date and sign the proxy card;

•mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and

•allow sufficient time for the proxy card to be received on or before 11:59 p.m., Eastern Time, on June 11, 2024.

If you hold shares of common stock through a broker, bank or other nominee, you must follow the voting instructions you receive from your broker, bank or nominee. If you hold shares of common stock through a broker, bank or other nominee and you want to participate in the Meeting, you must obtain a legal proxy from the record holder of your shares and present it at the Meeting. If a beneficial owner does not provide voting instructions to its broker, the broker is not permitted to give a proxy with respect to such beneficial owner's shares.

You may receive more than one proxy statement and proxy card or voting instructions form if your shares are held through more than one account (e.g., through different account holders). Each proxy card or voting instructions form only covers those shares held in the applicable account. If you hold shares in more than one account, you must provide voting instructions as to all your accounts to vote all your shares.

Important notice regarding the availability of proxy materials for the Meeting. The Company’s Proxy Statement, the proxy card, and the Annual Report are available at www.virtualshareholdermeeting.com/VARAGON2024 and www.proxyvote.com. The Notice of Internet Availability of Proxy Materials contains instructions on how you can elect to receive a printed copy of the Proxy Statement and the Annual Report.

If you plan to attend the Meeting and vote your shares virtually, you will need your control number located on your Notice of Internet Availability of Proxy Materials in order to be admitted to the Meeting.

Revocability of Proxies

If you are a “shareholder of record” (i.e., you hold shares directly in your name), you may revoke a proxy at any time before it is exercised by notifying the proxy tabulator, Broadridge Financial Solutions, Inc. (“Broadridge”), in writing, by submitting a properly executed, later-dated proxy, or by virtually attending the Meeting online and voting your shares during the Meeting. Please send your notification to Varagon Capital Corporation, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717. Any shareholder of record participating in the Meeting may vote at such time whether or not he or she has previously voted his or her shares. Shareholders have no appraisal or dissenters’ rights in connection with the proposals described herein.

Vote Required

Election of Directors. The election of a director requires the affirmative vote of a plurality of the votes cast at the Meeting or by proxy. Shareholders may not cumulate their votes. If you vote “Withhold Authority” with respect to a nominee, your shares will not be voted with respect to the director nominee. If you give no instructions on your signed proxy card, the shares covered by the proxy card will be voted FOR the election of the director nominee in accordance with the recommendation of the Board. Abstentions and broker non-votes are not counted as votes cast for purposes of the election of directors and, therefore, will have no effect on the outcome of such election.

Approval of Amended Advisory Agreement. This proposal will be approved if the holders of a majority of the outstanding voting securities of the Company as of the Record Date vote in favor of the Amended Advisory Agreement. Pursuant to Section 15(a) of the 1940 Act, approval of a written contract for a person to serve or act as an investment adviser to a business development company (“BDC”) requires the vote of a “majority of the outstanding voting securities” of the Company, defined under Section 2(a)(42) of the 1940 Act as the lesser of: (1) 67% or more of the voting securities of the Company present or represented by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Company are present or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Company, whichever is less. Because the vote on the proposal is based on the total number of shares outstanding, abstentions will have the same effect as voting “AGAINST” the approval of the proposal. If you give no instructions on your signed proxy card, the shares covered by the proxy card will be voted FOR the approval of the Amended Advisory Agreement in accordance with the recommendation of the Board. Abstentions and broker non-votes will have the effect of a vote against the proposal.

Additional Solicitation. If there are not enough votes to approve any proposals at the Meeting, the shareholders who are represented at the Meeting may adjourn the Meeting to permit the further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment, unless the proxies are marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies.

Also, a shareholder vote may be taken on one or more of the proposals in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval of such proposal(s). Abstentions will not be counted as votes cast on such adjournment and will have no effect on the adjournment vote.

In addition, the Chair of the Meeting will have the authority to adjourn the Meeting from time-to-time without notice and without the vote or approval of the shareholders.

Proxies for the Annual Meeting

The named proxies for the Meeting are Walter J. Owens, Robert J. Bourgeois and Afsar Farman-Farmaian (or their duly authorized designees), who will follow submitted proxy voting instructions. They will vote as the Board recommends herein as to any submitted proxies that do not direct how to vote on any item and will vote on any other matters properly presented at the Meeting in their judgment.

Information Regarding this Solicitation

The Company will bear the expense of the solicitation of proxies for the Meeting, including the cost of preparing and posting this Proxy Statement and the Annual Report and the cost of mailing the Notice of Internet Availability of Proxy Materials and any requested proxy materials to shareholders. If brokers, trustees, or fiduciaries and other institutions or nominees holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners, we will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mail, proxies may be solicited in person and/or by telephone or facsimile transmission by directors, officers or employees of the Company and/or officers or employees of the Adviser. The Adviser is located at 151 West 42nd Street, 53rd Floor, New York, New York 10036. No additional compensation will be paid to directors, officers or regular employees of the Company or the Adviser for such services.

Notice of Internet Availability of Proxy Materials

In accordance with regulations promulgated by the Securities and Exchange Commission (the “SEC”), the Company has made this Proxy Statement, the Notice of Annual Meeting of Shareholders, and the Annual Report available to shareholders on the Internet. Shareholders may (i) access and review the Company’s proxy materials, (ii) authorize their proxies, as described in “Voting” above and/or (iii) elect to receive future proxy materials by electronic delivery via the Internet address provided below.

This Proxy Statement, the Notice of Annual Meeting and the Annual Report are available at www.virtualshareholdermeeting.com/VARAGON2024 and www.proxyvote.com.

Electronic Delivery of Proxy Materials

Pursuant to the rules adopted by the SEC, the Company furnishes proxy materials by email to those shareholders who have elected to receive their proxy materials electronically. While the Company encourages Shareholders to take advantage of electronic delivery of proxy materials, which helps to reduce the environmental impact of annual meetings of shareholders and the cost associated with the physical printing and mailing of materials, Shareholders who have elected to receive proxy materials electronically by email, as well as beneficial owners of shares held by a broker or custodian, may request a printed set of proxy materials. The Notice of Internet Availability of Proxy Materials contains instructions on how you can elect to receive a printed copy of the Proxy Statement and the Annual Report.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the Record Date, the beneficial ownership of each current director, the director nominee, the Company’s executive officers, each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. The percentage ownership is based on [ ] shares outstanding as of the Record Date. Ownership information for those persons who beneficially own 5% or more of our shares of common stock is based upon reports filed by such persons with the SEC and other information obtained from such persons, if available.

To our knowledge, except as indicated in the footnotes to the table, the Company believes that each beneficial owner set forth in the table below has sole voting and investment power and has the same address as the Company. The Company’s directors are divided into two groups — interested directors and independent directors. Interested directors are “interested persons” of the Company as defined in Section 2(a)(19) of the 1940 Act. The address of all executive officers and directors is c/o Varagon Capital Corporation, 151 West 42nd Street, 53rd Floor, New York, NY 10036.

| | |

Name and Address | Number of Shares Owned | Percentage of Shares Outstanding |

Interested Director | | |

Walter J. Owens | [ ](1) | * |

Independent Directors | | |

Nell Cady-Kruse | [ ] | * |

James Gertie | — | — |

Shawn Hessing | — | — |

Executive Officers who are not Directors | | |

Charles Riceman | [ ](2) | * |

Kevin Marchetti | [ ](3) | * |

Robert J. Bourgeois | [ ](4) | * |

Directors and Executive Officers as a Group (7 persons) | [ ] | * |

5% Holders | | |

California Institute of Technology (5) | [ ] | [ ] % |

Aflac Life Insurance Japan, Ltd. (6) | [ ] | [ ] % |

VCBD Feeder I, LLC (7) | [ ] | [ ] % |

VCBD Feeder II, LLC (8) | [ ] | [ ] % |

State Teachers Retirement System of Ohio (9) | [ ] | [ ] % |

* Represents less than one percent.

(1)Mr. Owens owns [ ] shares of common stock directly and [ ] shares indirectly through VCC Professionals Fund, L.P. VCC Professionals Fund, L.P. is a private fund organized for employees of Varagon Capital Partners, L.P., the direct parent company and managing member of the Adviser ("Varagon") to invest in shares of common stock. Mr. Owens disclaims beneficial ownership of the reported shares of common stock except to the extent of his pecuniary interest therein.

(2)Mr. Riceman owns [ ] shares of common stock directly and [ ] shares indirectly through VCC Professionals Fund, L.P. VCC Professionals Fund, L.P. is a private fund organized for employees of Varagon to invest in shares of common stock. Mr. Riceman disclaims beneficial ownership of the reported shares of common stock except to the extent of his pecuniary interest therein.

(3)Mr. Marchetti owns [ ] shares of common stock directly and [ ] shares indirectly through VCC Professionals Fund, L.P. VCC Professionals Fund, L.P. is a private fund organized for employees of Varagon to invest in shares of common stock. Mr. Marchetti disclaims beneficial ownership of the reported shares of common stock except to the extent of his pecuniary interest therein.

(4)Mr. Bourgeois owns [ ] shares of common stock directly and [ ] shares of common stock indirectly through VCC Professionals Fund, L.P. VCC Professionals Fund, L.P. is a private fund organized for employees of Varagon to invest in shares of common stock. Mr. Bourgeois disclaims beneficial ownership of the reported shares of common stock except to the extent of his pecuniary interest therein.

(5)The address of California Institute of Technology is 551 S. Wilson Ave, MC 2-42, Pasadena, California 91125.

(6)The address of Aflac Life Insurance Japan, Ltd. is 1932 Wynnton Road, Columbus, Georgia 31999.

(7)The address of VCBD Feeder I, LLC is 151 West 42ndStreet, 53rd Floor, New York, New York 10036.

(8)The address of VCBD Feeder II, LLC is 151 West 42ndStreet, 53rd Floor, New York, New York 10036.

(9)The address of State Teachers Retirement System of Ohio is 275 East Broad Street, Columbus, Ohio 43215.

Set forth below is the dollar range of equity securities beneficially owned by each of our directors as of the Record Date. We are not part of a “family of investment companies,” as that term is defined in the 1940 Act.

| | |

Name of Director | | Dollar Range of Equity Securities Beneficially Owned(1)(2) |

Interested Director | | |

Walter J. Owens | | [ ] |

Independent Directors | | |

Nell Cady-Kruse | $ | [ ] |

James Gertie | | None |

Shawn Hessing | | None |

(1)The dollar ranges are: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, $100,001 – $500,000, $500,001 – $1,000,000 or over $1,000,000.

(2)The dollar range of equity securities beneficially owned by directors of the Company, if applicable, is the product obtained by multiplying the current net asset value per share of the Company's common stock, times the number of shares of the Company's stock beneficially owned.

PROPOSAL I: ELECTION OF DIRECTORS

At the Meeting, shareholders are being asked to consider the election of one director of the Board. Pursuant to our charter (the "Charter") and bylaws, the Board is divided into three classes, designated Class I, Class II, and Class III. At the Meeting, a Class II director will be elected for a three-year term. Directors are elected for a staggered term of three years each, with a term of office of one of the three classes of directors expiring each year; however the initial members of the three classes had initial terms of one, two and three years, respectively. Each director will hold office for the term to which he or she is elected or until his or her successor is duly elected and qualified.

Nell Cady-Kruse has been nominated for re-election for a three-year term until the 2027 annual meeting of shareholders or until her successor is duly elected or qualified. If elected, Ms. Cady-Kruse will continue to serve as an independent director and on the Board's Audit Committee (the "Audit Committee") and the Chair of the Board's Nominating and Corporate Governance Committee (the "NCG Committee").

Required Vote

The election of a director requires the affirmative vote of a plurality of the votes cast at the Meeting or by proxy. A shareholder can vote for or withhold his or her vote from the director nominee. If a shareholder withholds his or her vote for a nominee, such shares will not be voted with respect to the nominee indicated. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of the director nominee in accordance with the recommendation of the Board. If the director nominee should decline or be unable to serve as a director, it is intended that the proxy will vote for the election of such person as is nominated by the Board as a replacement. The Board has no reason to believe that Ms. Cady-Kruse will be unable or unwilling to serve.

Information about the Nominee and Directors

As described below under “Committees of the Board of Directors — Nominating and Corporate Governance Committee,” the Board has identified certain desired attributes for its directors. Each of our directors and the director nominee has demonstrated high character and integrity, superior credentials and recognition in his or her respective field and the relevant expertise and experience upon which to be able to offer advice and guidance to our management. Each of our directors and the director nominee also has sufficient time available to devote to the affairs of the Company, is able to work with the other members of the Board and contribute to the success of the Company and can represent the long-term interests of the Company’s shareholders as a whole. Our directors and the director nominee have been selected such that the Board represents a range of backgrounds and experience.

Certain information, as of the Record Date, with respect to the nominees for election at the Meeting, as well as each of the current directors, is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds, the year in which each person became a director of the Company, and a discussion of their particular experience, qualifications, attributes or skills that lead us to conclude, as of the Record Date, that such individual should serve as a director of the Company, in light of the Company’s business and structure. There were no legal proceedings of the type described in Item 401(f)(7) and (8) of Regulation S-K, as promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), in the past 10 years against any of our directors, director nominee or officers, and none are currently pending.

Nominee for Class II Directors — Term Expiring 2024

The Board has determined that Ms. Cady-Kruse is not an “interested person” (as defined in the 1940 Act) of the Company.

| | | | | | | | |

Independent Director |

Name, Address and Age(1) | | Position(s) Held with Company | | Principal Occupation(s) During the Past 5 Year | | Term of Office and Length of Time Served | | Other Directorships Held by Director or Nominee for Director During Past 5 Years |

Nell Cady-Kruse, 62 | | Director | | Member of Advisory Board for Futurebank; member of Advisory Board for Inflection | | Class II Director since 2022; Term expires 2024 | | Director and Chairperson of Barclays US and Barclays Bank Delaware; Director of Freedom Acquisition I Corp. |

Ms. Nell Cady-Kruse is an industry-leading executive with over 35 years of global banking, finance and risk experience having been based in the Europe, Asia, and the U.S. She now focuses on effective board governance. Ms. Cady-Kruse was an independent director and chaired the board risk committees for Barclays US from September 2017 to December 2023 and Barclays Bank Delaware from September 2016 to December 2023. She served on the Advisory Board for Futurebank from February 2021 to December 2022. Ms. Cady-Kruse was also an independent director on the board of directors of Freedom Acquisition I Corp., a special purpose acquisition company, from May 2022 to July 2023. Prior to board service, Ms. Cady-Kruse was most recently a senior global executive at Standard Chartered Bank, as global Chief Risk Officer, Wholesale Banking, retiring in 2014. Over her career, she specialized in Leveraged Finance, Corporate Credit and Structured Finance, Portfolio Management, Private Equity, and Risk Management & Strategy, and worked at Bankers Trust, Credit Suisse, and Standard Chartered Bank. Ms. Cady-Kruse is a CFA Charterholder and holds a CIPM (Certificate in Investment Performance Measurement). She is a Leadership Fellow of the National Association of Corporate Directors

and holds a Certificate in Cybersecurity Oversight from Carnegie Mellon Software Engineering Institute. Ms. Cady-Kruse has served on numerous boards, including Bankers Trust of California, the Risk Management Institute of the National University of Singapore, Young Enterprise London, and currently serves on the Senior Advisory Board of No One Left Behind. Nell received her M.B.A. from Johnson at Cornell. She received her B.Sc. with Honors in Agricultural Economics from Cornell University. We believe Ms. Cady-Kruse’s broad experiences in the financial services sector, depth of knowledge of financial issues and corporate governance experience makes her qualified to serve as a member of our Board.

Incumbent Directors

The Board has determined that each of Mr. Hessing and Mr. Gertie is not an “interested person” (as defined in the 1940 Act) of the Company. Mr. Owens is an “interested person” due to his positions as the Chief Executive Officer of the Company, Chief Executive Officer of Varagon and member of the Adviser’s Investment Committee.

Class III Directors — Term Expiring 2025

| | | | | | | | |

Interested Director |

Name, Address and Age(1) | | Position(s) Held with Company | | Principal Occupation(s) During the Past 5 Year | | Term of Office and Length of Time Served | | Other Directorships Held by Director or Nominee for Director During Past 5 Years |

Walter J. Owens, 63 | | Chairman, Chief Executive Officer and Director | | Chief Executive Officer of Varagon Capital Partners L.P. and member of the Adviser's Investment Committee | | Class III Director since 2022; Term expires 2025 | | None. |

Walter Owens is the Chief Executive Officer of Varagon Capital Corporation. He is also a member of the Adviser’s Investment Committee. Mr. Owens has deep experience in all aspects of middle market leveraged finance and has led multiple successful lending and asset management businesses over his 35-year career. Prior to Varagon, he held senior leadership roles at GE Capital, CIT, and TD Bank Group. Mr. Owens holds a B.S. from Villanova University and an M.B.A. from New York University’s Stern School of Business.

| | | | | | | | |

Independent Director |

Name, Address and Age(1) | | Position(s) Held with Company | | Principal Occupation(s) During the Past 5 Year | | Term of Office and Length of Time Served | | Other Directorships Held by Director or Nominee for Director During Past 5 Years |

Shawn Hessing, 66 | | Director | | Retired | | Class III Director since 2022; Term expires 2025 | | None |

Mr. Shawn Hessing is a Strategic Advisor and Chief Compliance Officer at Tailwind Advisors since March 2018 where he is responsible for all aspects of financial control and the compliance operations across the firm. Prior to joining Tailwind, Mr. Hessing served as a member of the business development team at Blue River Partners, LLC, a premier service provider to the alternative asset industry. Prior to Blue River, he served as the Chief Financial Officer of Oak Hill Capital Partners before retiring in December 2015. At Oak Hill, Mr. Hessing was responsible for managing financial operations and implementing and transitioning new funds and management company accounting systems. Prior to joining Oak Hill, Mr. Hessing spent over 32 years at KPMG, most recently as the National Managing Partner of Private Equity, splitting time in KPMG’s New York and Fort Worth offices. Mr. Hessing also held multiple other leadership roles including the Audit Partner-in-Charge US of Private Equity, Managing Partner in the firm’s Fort Worth, TX office, and Lead Partner-Real Estate in the Southwest Region. He retired from KPMG in June 2011. Mr. Hessing earned a Bachelor of Business Administration (“BBA”) degree in Accounting from Midwestern State University, where he served on the Board of Regents and is past Chairman. He is also a Certified Public Accountant (Retired). We believe Mr. Hessing’s numerous management positions and broad experience in the accounting sector make him well qualified to serve on the Board.

Class I Director — Term Expiring 2026

| | | | | | | | |

Independent Director |

Name, Address and Age(1) | | Position(s) Held with Company | | Principal Occupation(s) During the Past 5 Year | | Term of Office and Length of Time Served | | Other Directorships Held by Director or Nominee for Director During Past 5 Years |

James Gertie, 67 | | Director | | Retired | | Class I Director since 2022; Term expires 2026 | | None |

Mr. James Gertie has nearly 40 years of relevant business and financial experience serving as Chief Credit or Risk Officer at a number of prominent financial institutions. Most recently, Mr. Gertie served as Chief Credit Officer at TD Bank Financial Group (“TDBFG”) from March 2009 to February 2015, where he was responsible for merging the credit groups and cultures of TD BankNorth, Commerce Bancorp and TDBFG. Prior to the merger, Mr. Gertie served as Chief Risk Officer of Commerce Bancorp where he responsible for building the firm’s Risk Management model and managing its risk operations overall. Prior to Commerce Bancorp, he served in various risk and portfolio management roles at Provident Financial Group, FleetBoston Financial and BankBoston Corporation. Mr. Gertie began his career in the Office of the Comptroller of Currency. He is a Chartered Financial Analyst and a Certified Public Accountant. Mr. Gertie received a B.S. in Accounting from LaSalle College and has completed Masters Studies at Drexel University, University of Oklahoma and University of Pittsburgh. We believe Mr. Gertie’s broad experiences in the financial services sector and business strategy and risk management makes him qualified to serve as a member of our Board.

(1) The business address of the director nominee and other directors is c/o Varagon Capital Corporation, 151 West 42nd Street, 53rd Floor, New York, NY 10036.

Information about Executive Officers Who Are Not Directors

The following information, as of the Record Date, pertains to our executive officers who are not directors of the Company.

| | | | |

Name, Address and Age(1) | | Position(s) Held with Company | | Principal Occupation(s) During the Past 5 Year |

Kevin Marchetti, 43 | | Co-President | | Partner and Co-President of Varagon Capital Partners, L.P. |

Charles Riceman, 54 | | Co-President | | Partner and Co-President of Varagon Capital Partners, L.P. |

Robert J. Bourgeois, 40 | | Chief Financial Officer and Treasurer | | Chief Financial Officer of Varagon Capital Partners, L.P. |

(1) The business address of the executive officers is c/o Varagon Capital Corporation, 151 West 42nd Street, 53rd Floor, New York, NY 10036.

Kevin Marchetti, Co-President

Kevin Marchetti is a Partner and Co-Head of Direct Lending of Varagon and leads the firm’s Underwriting & Portfolio Management team as Varagon’s Chief Credit Officer. He has extensive experience in risk management and middle market leveraged finance across a range of industries and strategies. Prior to joining Varagon, Mr. Marchetti was a Senior Vice President at GE Antares Capital. He has also held senior risk positions at CIT Group and TD Bank. Mr. Marchetti earned a B.A. degree from Springfield College and an M.B.A. from The University of North Carolina at Charlotte.

Charles Riceman, Co-President

Charles Riceman is a Partner and Co-Head of Direct Lending of Varagon Capital Partners, L.P. and leads its Investment Originations and Capital Markets team. Mr. Riceman has spent his career originating, structuring, underwriting, and executing financings in support of middle market private equity clients and has over 20 years of leveraged lending experience across a variety of industries. Prior to joining Varagon Capital Partners, L.P., he was Managing Director at Golub Capital. He earned a B.S. degree from Villanova University and an M.B.A. from the Fuqua School of Business at Duke University.

Robert Bourgeois, Chief Financial Officer and Treasurer

Robert Bourgeois is a Partner of Varagon and serves as Varagon’s Chief Financial Officer. Mr. Bourgeois joined Varagon from Sixth Street Partners (“Sixth Street”) (formerly TPG Sixth Street Partners). Mr. Bourgeois held multiple roles at Sixth Street, serving as Vice President & Controller over its actively-managed credit funds and Sixth Street Specialty Lending, a publicly-traded business development company. Prior to Sixth Street, Mr. Bourgeois was responsible for the accounting and back office operations for private equity funds of TPG Capital. Mr. Bourgeois began his career at Ernst & Young in the Assurance & Advisory practices. He earned a B.B.A. in Accounting & Finance from Texas Christian University.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE DIRECTOR NOMINEE NAMED IN THIS PROXY STATEMENT.

CORPORATE GOVERNANCE

Director Independence

Our Board consists of four (4) members, three (3) of whom are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of us, the Adviser, or our respective affiliates. Our Board has determined that each of Nell Cady-Kruse, James Gertie, and Shawn Hessing is not an “interested person” of us, the Adviser or their respective affiliates, which we refer to as our "Independent Directors." Based upon information requested from each such director concerning his or her background, employment and affiliations, the Board has affirmatively determined that none of the Independent Directors has a material business or professional relationship with the Company, other than in his or her capacity as a member of the Board or any committee thereof. All of the members of the Audit Committee and the NCG Committee are Independent Directors.

Meetings and Attendance

The Board met twenty-one times during the fiscal year ended December 31, 2023 and took action on various occasions by unanimous written consent. Each of the incumbent directors attended at least 75% of the aggregate of the Board meetings and meetings of the committee(s) on which she or he served during the last fiscal year and while she or he served as a director.

Board Attendance at the Annual Meeting

The Company’s practice is to encourage its directors to attend each annual meeting of shareholders; however, such attendance is not required at this time. All of the directors attended the 2023 annual meeting of shareholders.

Leadership Structure and Oversight Responsibilities

Overall responsibility for our oversight rests with the Board. We have entered into the investment advisory agreement, dated September 6, 2023, with VCC Advisors (the "Advisory Agreement"), pursuant to which the Adviser manages our day-to-day operations and provides investment advisory services to us. The Board is responsible for overseeing the Adviser and other service providers in our operations in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and the Charter. The Board consists of four (4) members, three (3) of whom are Independent Directors. The Board meets in-person at regularly scheduled quarterly meetings each year. In addition, the Board may hold special in-person or telephonic meetings or informal conference calls to discuss specific matters that may arise or require action between regular meetings.

Oversight of our investment activities extends to oversight of the risk management processes employed by the Adviser as part of its day-to-day management of our investment activities. Our Board anticipates reviewing risk management processes at both regular and special board meetings throughout the year, consulting with appropriate representatives of the Adviser as necessary and periodically requesting the production of risk management reports or presentations. The goal of our Board’s risk oversight function is to ensure that the risks associated with our investment activities are accurately identified, thoroughly investigated and responsibly addressed. Shareholders should note, however, that our Board’s oversight function cannot eliminate all risks or ensure that particular events do not adversely affect the value of investments.

As described below, the Board has established the Audit Committee and the NCG Committee and may establish additional committees from time to time as necessary. The scope of the responsibilities assigned to each of these committees is discussed in greater detail below. Walter Owens serves as Chair of our Board. Mr. Owens, as the Chief Executive Officer of the Adviser, is considered an interested person of the Company under the 1940 Act. Despite being an interested director, we believe that Mr. Owens’ history with Varagon, his familiarity with the investment platform, and his extensive knowledge of and experience in the financial services industry qualify him to serve as the Chairman of our Board.

The designated lead Independent Director of the Board is James Gertie. We are aware of the potential conflicts that may arise when a non-independent director is Chair of the Board, but believe these potential conflicts are offset by having a designated lead Independent Director and by our strong corporate governance policies. The lead Independent Director, among other things, chairs executive sessions of the Independent Directors, acts as a liaison between the Independent Directors and the Chair of the Board, and between the Independent Directors and the officers of the Company and the Adviser, facilitates communication among the Independent Directors and the Company’s counsel, reviews and comments on Board and committee meeting agendas and calls additional meetings of the Independent Directors, as appropriate.

Our corporate governance policies include regular meetings of the Independent Directors in executive session without the presence of interested directors and management, the designation of a lead Independent Director, the establishment of an audit committee and a nominating and corporate governance committee that are each comprised solely of Independent Directors, and the appointment of a Chief Compliance Officer, with whom the Independent Directors meet regularly without the presence of interested directors and other members of management, for administering our compliance policies and procedures.

Our Board has considered whether each of the directors is qualified to serve as a director, based on a review of the experience, qualifications, attributes and skills of each director, including those described below. Our Board has also considered whether each director has significant experience in the investment or financial services industries and has held management, board or oversight positions in other companies and organizations. We recognize that different board leadership structures are appropriate for companies

in different situations. We intend to re-examine our corporate governance policies on an ongoing basis to ensure that they continue to meet our needs.

Communications with Directors

Shareholders and other interested parties may contact any member (or all members) of the Board by mail. To communicate with the Board, any individual directors or any group or committee of directors, correspondence should be addressed to the Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent Varagon Capital Corporation, 151 West 42nd Street, 53rd Floor, New York, NY 10036, Attention: Chief Compliance Officer.

Committees of the Board

Our Board has established the Audit Committee and the NCG Committee and may establish additional committees from time to time as necessary.

Audit Committee

The Audit Committee held 5 meetings during the fiscal year ended December 31, 2023 and took actions by unanimous written consent.

The Audit Committee comprises Nell Cady-Kruse, James Gertie, and Shawn Hessing, each of whom is an Independent Director. Mr. Hessing serves as the Chair of the Audit Committee. Our Board has determined that Mr. Hessing qualifies as an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K, as promulgated under the Exchange Act. The members of the Audit Committee meet the current independence and experience requirements of Rule 10A-3 of the Exchange Act. The Audit Committee operates pursuant to a charter approved by our Board, which sets forth the responsibilities of the Audit Committee. The Audit Committee’s responsibilities include establishing guidelines and making recommendations to the Board regarding the valuation of our loans and investments, selecting our independent registered public accounting firm (subject to the Board’s approval), reviewing with such independent registered public accounting firm the planning, scope and results of their audit of our financial statements, pre-approving the fees for services performed, reviewing with the independent registered public accounting firm the adequacy of internal control systems, reviewing our annual financial statements, overseeing internal audit staff and periodic filings and receiving our audit reports and financial statements.

Nominating and Corporate Governance Committee

The NCG Committee held one meeting during the fiscal year ended December 31, 2023.

The NCG Committee comprises Nell Cady-Kruse, James Gertie, and Shawn Hessing, each of whom is an Independent Director. Ms. Cady-Kruse serves as the Chair of the NCG Committee. The NCG Committee operates pursuant to a charter approved by our Board. The NCG Committee is responsible for selecting, researching and nominating directors for election by our shareholders, selecting nominees to fill vacancies on our Board or a committee thereof, developing and recommending to our Board a set of corporate governance principles and overseeing the evaluation of our Board and our management. The NCG Committee may consider nominating an individual recommended by a shareholder for election as a director.

The NCG Committee will seek candidates who possess the background, skills and expertise to make a significant contribution to our Board, the Company and our shareholders. In considering possible candidates for election as a director, the NCG Committee will take into account, in addition to such other factors as it deems relevant, the desirability of selecting directors who:

•are of high character and integrity;

•are accomplished in their respective fields, with superior credentials and recognition;

•have relevant expertise and experience upon which to be able to offer advice and guidance to management;

•have sufficient time available to devote to our affairs;

•are able to work with the other members of our Board and contribute to our success;

•can represent the long-term interests of our shareholders as a whole; and

•are selected such that our Board represents a range of backgrounds and experience.

We have not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. In determining whether to recommend a director nominee, the Board considers and discusses diversity, among other factors, with a view toward the needs of our Board as a whole. The Board generally conceptualizes diversity expansively to include, without limitation, concepts such as race, gender, color, ethnicity, religious creed, ancestry, citizenship status, military status, veteran status, marital status, physical disability, registered domestic partner or civil union status, national origin, medical condition, sexual orientation, differences of viewpoint, professional experience, education, skill and other qualities that contribute to our Board, when identifying and recommending director nominees. Our Board believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Board’s goal of creating a board of directors that best serves our needs and the interests of our shareholders and

the Company’s long-term and strategic objectives. In addition, as part of our Board’s annual-self assessment, the Board will evaluate the membership of our Board and whether our Board maintains satisfactory policies regarding membership selection.

Compensation Committee

The Board does not currently intend to delegate any authority to a compensation committee because our executive officers will not receive any direct compensation from us. The Board, as a whole, is responsible for reviewing the reimbursement by the Company to Varagon, in its capacity as the Company's administrator (the "Administrator"), of the allocable portion of the cost of the Company's Chief Financial Officer and Chief Compliance Officer and their respective staffs and also participates in the consideration of the Independent Directors' compensation.

Practice and Policies Regarding Personal Trading and Hedging of Company Securities

The Company has established a policy designed to prohibit our executive officers, directors, and certain employees of the Adviser from purchasing or selling shares of the Company while in possession of material nonpublic information, or otherwise using such information for their personal benefit or in any manner that would violate applicable laws and regulations. The Company’s shares of common stock are not listed on any securities exchange and therefore hedging of our securities and or related activities are not applicable to the Company.

Insider Trading Policies

The Company has adopted insider trading policies and procedures governing the purchase, sale, and disposition of its securities by its officers and directors that are reasonably designed to promote compliance with insider trading laws, rules and regulations.

Code of Ethics

The Company and the Adviser have adopted a joint code of ethics pursuant to Rule 17j-1 under the 1940 Act and Rule 204A-1 under the Investment Advisers Act of 1940, as amended (the "Advisers Act") that establishes procedures for personal investments and restricts certain transactions by our personnel. Our code of ethics does not permit investments by the Adviser’s employees in securities that may be purchased or held by us. The joint code of ethics is available on the SEC’s website at www.sec.gov.

Compensation of Directors

No compensation is expected to be paid to our directors who are “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the Company. The Independent Directors will receive an annual fee of $80,000. The Independent Directors also will receive an additional fee of $2,500 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each regular meeting of the Board. In addition, the Independent Directors will receive an additional fee of $1,500 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each special Board meeting. The Independent Directors also will receive a fee of $1,000 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each committee meeting. The lead Independent Director will receive an additional annual fee of $7,500. The chair of our Audit Committee will receive an additional annual fee of $15,000 in lieu of fees for attending Audit Committee meetings. The chair of our NCG Committee will receive an additional annual fee of $7,500 in lieu of fees for attending NCG Committee meetings. Independent Directors will have the option of having their directors’ fees paid in shares of common stock issued at a price per share equal to the net asset value per share.

The following table sets forth compensation of the Independent Directors, for the year ended December 31, 2023 (dollars in thousands):

| | | | | | |

Name | | Fees Earned or Paid in Cash (1) | | All other Compensation | | Total Compensation |

Interested Director | | | | | | |

Walter J. Owens | | — | | — | | — |

Independent Directors | | | | | | |

Nell Cady-Kruse | $ | 105 | | — | $ | 105 |

James Gertie | $ | 106 | | — | $ | 106 |

Shawn Hessing | $ | 113 | | — | $ | 113 |

(1) For a discussion of the Independent Directors’ compensation, see above.

Transactions with Related Persons, Promoters and Certain Control Persons

The Company has procedures in place for the review, approval and monitoring of transactions involving the Company and certain persons related to it. For example, the Company has a code of ethics that generally prohibits officers or directors of the Company from engaging in any transaction where there is a conflict between such individual’s personal interest and the interests of the Company. Waivers to the code of ethics can generally only be obtained from the Chief Compliance Officer, the Chair of the Board or the Chair of

the Audit Committee and are publicly disclosed as required by applicable law and regulations. In addition, the Audit Committee is required to review and approve all related-party transactions (as defined in Item 404 of Regulation S-K).

Investment Advisory Agreement

On July 5, 2023, Varagon entered into an Agreement and Plan of Merger with affiliates of Man Group plc (“Man Group”), pursuant to which a newly formed indirect subsidiary of Man Group merged with and into Varagon, with Varagon surviving the merger as an indirect subsidiary of Man Group (the “Transaction”). In anticipation of the automatic termination of the prior investment advisory agreement, dated June 2, 2022, by and between the Company and VCC Advisors upon the closing of the Transaction, the Board and the Company’s shareholders approved the Advisory Agreement with the Adviser, which became effective on September 6, 2023 upon the consummation of the Transaction. Varagon's management owns, directly or indirectly, a minority interest in Varagon, the direct parent company and managing member of the Adviser. For the year ended December 31, 2023, the base management fees payable under the terms of the Advisory Agreement was approximately $1.3 million. For the year ended December 31, 2023, the income-based incentive fees payable under the terms of the Advisory Agreement was approximately $2.2 million.

Administration Agreement

We have entered into the Administration Agreement with the Administrator, pursuant to which the Administrator is responsible for providing us with clerical, bookkeeping, recordkeeping and other administrative services at such facilities. Payments under the Administration Agreement are based upon our allocable portion of overhead and other expenses incurred by our Administrator in performing its obligations under the Administration Agreement, including a portion of the rent and the compensation of our Chief Financial Officer and Chief Compliance Officer and their respective staffs. In accordance with the terms of the Administration Agreement, overhead and other administrative expenses are generally allocated between us and the Administrator by reference to the relative time spent by personnel in performing administrative and similar functions on our behalf as compared to performing administrative functions on behalf of the Administrator, its other clients or the Adviser. To the extent personnel retained by the Administrator perform administrative tasks for the Adviser, the fees incurred with respect to the actual time dedicated to such tasks will be reimbursed by the Adviser. For the fiscal year ended December 31, 2023, the Company incurred administrator expenses and other general and administrative expenses of approximately $0.3 million under the terms of the Administration Agreement.

Expense Reimbursement Agreement

We have entered into an expense reimbursement agreement (the “Expense Reimbursement Agreement”) with the Adviser, pursuant to which the Company will reimburse Varagon or the Adviser, as applicable, for the organizational and offering expenses incurred by the Company and funded by the Adviser or Varagon. The Adviser elected to incur the organizational and offering expenses associated with the Company for the period from July 31, 2019 through March 29, 2022. Such organizational and offering expenses are not reimbursable by the Company.

Any such reimbursement will be made during the first four fiscal quarters following the 24-month period after the Initial Closing, as defined below (the “Fundraising Period”). The Fundraising Period may be extended by up to an additional 18 months in the sole discretion of the Board (i.e., from 24 months to up to 42 months after the Initial Closing). For the avoidance of doubt, to the extent the Fundraising Period is extended by up to an additional 18 months in the sole discretion of the Board, the Company will reimburse the Adviser or, as applicable, Varagon, for the organizational and offering expenses incurred by the Company during the first four fiscal quarters following the extended Fundraising Period. The “Initial Closing” occurred on June 2, 2022, the first date a subscription agreement in which an investor had made capital commitments to purchase shares of common stock was accepted by the Company. On March 20, 2024, the Board determined to extend the Fundraising Period from 24 months to 42 months after the Initial Closing. As a result of the foregoing, the Company extended the period during which it may hold subsequent closings from June 2, 2024 to December 2, 2025. The Company’s obligation to reimburse the Adviser or Varagon, as applicable, under the Expense Reimbursement Agreement automatically became a liability of the Company on June 2, 2022, when the Company elected to be regulated as a BDC under the 1940 Act. For the avoidance of doubt, reimbursements under the Expense Reimbursement Agreement are not conditioned on any performance threshold and are not considered a contingent liability for accounting purposes.

Fronting Letter Agreement

On December 15, 2022, we and Varagon entered into the Fronting Letter. Pursuant to the Fronting Letter, for purposes of facilitating our funding obligations under or in connection with one or more of our portfolio investments, upon request by us or the Adviser, and the consent of Varagon, Varagon will advance up to an aggregate amount of $15.0 million to us (each advance, a “Fronted Amount”). Each Fronted Amount shall be reimbursed to Varagon by us within 90 days of receipt without any interest or fees. As of December 31, 2023, there were no Fronted Amounts due to Varagon.

Placement Agent Agreement

On May 23, 2022, the Adviser entered into an agreement with Rondout Partners, LLC (“Rondout”) on behalf of the Company, pursuant to which Rondout assisted the Company in conducting the Company’s private offering of shares (the “Offering”). Rondout provided notice of the agreement’s termination on July 18, 2023, which termination became effective on August 17, 2023.

On September 6, 2023, the Adviser entered into an agreement with Man Investments Inc. on behalf of the Company, pursuant to which Man Investments Inc. assists the Company in conducting the Offering. On October 13, 2023, the Adviser entered into an agreement with Man Investments Inc. on behalf of the Company, pursuant to which Man Investments Inc. assists the Company in conducting the Offering in Canada.

For avoidance of doubt, the Adviser or its affiliates are solely responsible for any placement or “finder’s” fees payable to any placement agents engaged by the Adviser on behalf of the Company in connection with the Offering.

PROPOSAL 2: APPROVAL OF AMENDED ADVISORY AGREEMENT

Background

VCC Advisors currently provides investment advisory services to the Company pursuant to the Advisory Agreement. In connection with the Transaction, on July 24, 2023, the Board, including all of the Independent Directors, approved the Advisory Agreement. On August 24, 2023, at a special meeting of the shareholders, the Company’s shareholders also approved the Advisory Agreement. The Advisory Agreement became effective on September 6, 2023 upon the consummation of the Transaction.

Shareholders of the Company are being asked to consider and vote on a proposal to approve the Amended Advisory Agreement. In that regard, the Board has determined that it would be in the Company’s best interest to (a) reduce the incentive fee on income payable by the Company to VCC Advisors following an initial public offering or a listing of the common stock (a “Public Listing”) from 20% of all remaining Pre-Incentive Fee Net Investment Income (as defined below) above the “catch-up” to 17.5% of all remaining Pre-Incentive Fee Net Investment Income above the “catch-up”; and (b) more accurately reflect the original intent of the parties with respect to the “three-year look back” relating to the calculation of the incentive fee on income.

The Board met on March 20, 2024, to, among other things, review and approve the Amended Advisory Agreement and recommended that the Company's shareholders approve the Amended Advisory Agreement. If the Amended Advisory Agreement is not approved by the Company’s shareholders, the Advisory Agreement will continue in effect.

Information Regarding VCC Advisors

VCC Advisors has served as the investment adviser to the Company since the commencement of the Company’s operations in June 2022. Varagon is the direct parent company and managing member of VCC Advisors. The address of VCC Advisors and Varagon is 151 West 42nd Street, 53rd Floor, New York, NY 10036.

Varagon provides VCC Advisors with experienced investment professionals, including the members of VCC Advisor’s Investment Committee, and access to Varagon’s resources. Launched in 2014, Varagon is a leading direct lender to performing, sponsor-backed U.S. middle market companies, with approximately $13.3 billion of assets under management as of December 31, 2023. Following the consummation of the Transaction, Varagon is an indirect subsidiary of Man Group and Man Group own a majority interest in Varagon and Varagon's management owns, directly or indirectly a minority interest in Varagon. Varagon believes that Man Group's extensive distribution network and operational expertise is expected to support and grow Varagon's private credit and direct lending platform.

Varagon offers complete financing solutions through a flexible and competitive product suite to middle market businesses with EBITDA generally between $10 million and $75 million. From inception (June 2014) to December 31, 2023, Varagon has invested and managed (including co-investments) over $27.0 billion in performing, senior secured loan investments across more than 310 borrowers.

Varagon believes it has built a platform with a senior management team that has extensive experience investing across the capital structure. Varagon’s senior management team members share a common investment philosophy built on a framework of assessing companies with a disciplined, fundamentals-based, deep value-approach. As of December 31, 2023, Varagon had 77 employees, 46 of whom are dedicated investment professionals, with three primary offices located in New York, New York, Fort Worth, Texas, and Chicago, Illinois. Man Group is a global active investment management firm focused on delivering attractive risk adjusted performance for clients. Headquartered in London, Man Group manages $167.5 billion in assets under management as of December 31, 2023, and operates across multiple offices globally. Man Group is listed on the London Stock Exchange under the ticker “EMG” and is a constituent of the FTSE 250 Index.

Interests of Certain Persons in the Approval of the Amended Advisory Agreement

Certain of the Company’s executive officers and the interested director of the Board are also officers and employees of VCC Advisors and Varagon. Walter Owens, our Chief Executive Officer and Chairman of our Board, is also the Chief Executive Officer of Varagon, and a member of Varagon’s Investment Committee. Kevin Marchetti, our Co-President, is also a Partner of Varagon and leads Varagon’s Underwriting & Portfolio Management team as Varagon’s Chief Credit Officer. Charles Riceman, our Co-President, is also a Partner of Varagon and leads Varagon’s Investment Originations and Capital Markets team. Robert Bourgeois, our Chief Financial Officer and Treasurer, is also a Partner of Varagon and serves as Varagon’s Chief Financial Officer. Varagon, directly and indirectly, beneficially owns [ ]% of the Company’s issued and outstanding shares of common stock as of the Record Date.

Summary of Changes in the Amended Advisory Agreement

The Board has approved, and recommends to the shareholders of the Company that they approve, the Amended Advisory Agreement. The Amended Advisory Agreement amends the Advisory Agreement as follows:

•reduces the incentive fee on income payable by the Company to VCC Advisors following a Public Listing from 20% of all remaining Pre-Incentive Fee Net Investment Income above the “catch-up” to 17.5% of all remaining Pre-Incentive Fee Net Investment Income above the “catch-up”; and

•more accurately reflect the original intent of the parties with respect to the “three-year look back” relating to the calculation of the incentive fee on income.

Other than the foregoing, no other material provisions of the Advisory Agreement will change. If approved, VCC Advisors will continue to provide the same services to the Company pursuant to the Amended Advisory Agreement as it currently provides pursuant to the Advisory Agreement. The terms summarized above are discussed in greater detail below. You should refer to the form of the Amended Advisory Agreement attached hereto as Annex A for its complete terms.

Advisory Agreement

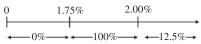

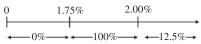

Prior to a Public Listing, the amount of the incentive fee on income payable quarterly in arrears is equal to:

•100% of the excess of the Company’s Pre-Incentive Fee Net Investment Income expressed as a rate of return on the Company’s net assets before taking into account any incentive fee on income during such period, for the immediately preceding quarter, over a preferred return of 1.75% per quarter (7% annualized), until VCC Advisors has received a “catch-up” equal to 12.5% of the Pre-Incentive Fee Net Investment Income for the immediately preceding quarter; and

•12.5% of all remaining Pre-Incentive Fee Net Investment Income above the “catch-up.”

Quarterly Income Incentive Fee

Pre-incentive fee net investment income

(expressed as a percentage of the value of net assets)

Percentage of pre-incentive fee net investment income

allocated to the Adviser

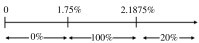

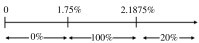

Following a Public Listing, the amount of incentive fee on income payable quarterly in arrears will be equal to:

•100% of the excess of the Company’s Pre-Incentive Fee Net Investment Income for the immediately preceding quarter, over a preferred return of 1.75% per quarter (7% annualized), until VCC Advisors has received a “catch-up” equal to 20% of the Pre-Incentive Fee Net Investment Income for the immediately preceding quarter; and

•20% of all remaining Pre-Incentive Fee Net Investment Income above the “catch-up.”

Quarterly Income Incentive Fee

Pre-incentive fee net investment income

(expressed as a percentage of the value of net assets)

Percentage of pre-incentive fee net investment income

allocated to the Adviser

“Pre-Incentive Fee Net Investment Income” means interest income, dividend income, accrued interest on the capital provided to the Company’s joint venture through subordinated certificates, and any other income including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies accrued during the quarter, minus the Company’s operating expenses for the quarter including the base management fee, expenses payable under the administration agreement, and any interest expense and any dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee on income. Pre-Incentive Fee Net Investment Income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with “payment-in-kind” interest and zero coupon securities), accrued income that the Company has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

The incentive fee on income for a particular quarter is subject to a cap (the “Incentive Fee Cap”). For periods prior to a Public Listing, the Incentive Fee Cap is equal to the difference between (x) 12.5% of the Cumulative Net Return (as defined below) from the calendar quarter then ending and the eleven preceding calendar quarters (such period the “Trailing Twelve Quarters”) and (y) the aggregate

incentive fees on income that were paid to VCC Advisors by the Company in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters. Following a Public Listing, the Incentive Fee Cap will be equal to the difference between (x) 20% of the Cumulative Net Return during the relevant Trailing Twelve Quarters and (y) the aggregate incentive fees on income that were paid to VCC Advisors by the Company in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters.

Cumulative Net Return is defined as the sum of (a) Pre-Incentive Fee Net Investment Income in respect of the relevant Trailing Twelve Quarters and (b) cumulative aggregate realized capital gains, cumulative aggregate realized capital losses, cumulative aggregate unrealized capital depreciation and cumulative aggregate unrealized capital appreciation in respect of the relevant Trailing Twelve Quarters.

Amended Advisory Agreement

Prior to a Public Listing, under the Amended Advisory Agreement, the incentive fee on income will be calculated, subject to the Incentive Fee Cap, and payable quarterly in arrears in respect of the Trailing Twelve Quarters as follows:

•no incentive fee in any calendar quarter in which the Company’s aggregate Pre-Incentive Fee Net Investment Income in respect of the Trailing Twelve Quarters does not exceed the hurdle rate of 1.75% for such Trailing Twelve Quarters;

•100% of the excess of the Company’s aggregate Pre-Incentive Fee Net Investment Income in respect of the relevant Trailing Twelve Quarters with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle rate until VCC Advisors has received a “catch-up” equal to 12.5% of the aggregate Pre-Incentive Fee Net Investment Income in respect of the relevant Trailing Twelve Quarters; and

•12.5% of the Company’s remaining aggregate Pre-Incentive Fee Net Investment Income in respect of the relevant Trailing Twelve Quarters, if any, that exceeds the “catch-up.”

Beginning with the first full calendar quarter following a Public Listing, under the Amended Advisory Agreement, the incentive fee on income will be calculated, subject to the Incentive Fee Cap, and payable quarterly in arrears in respect of the Trailing Twelve Quarters as follows:

•no incentive fee in any calendar quarter in which the Company’s aggregate Pre-Incentive Fee Net Investment Income in respect of the Trailing Twelve Quarters does not exceed the hurdle rate of 1.75% for such Trailing Twelve Quarters;

•100% of the excess of the Company’s aggregate Pre-Incentive Fee Net Investment Income in respect of the relevant Trailing Twelve Quarters with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle rate until VCC Advisors has received a “catch-up” equal to 17.5% of the aggregate Pre-Incentive Fee Net Investment Income in respect of the relevant Trailing Twelve Quarters; and

•17.5% of the Company’s remaining aggregate Pre-Incentive Fee Net Investment Income in respect of the relevant Trailing Twelve Quarters, if any, that exceeds the “catch-up”.