UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

(Amendment No. 2)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

INDUSTRIAL TECHNICAL HOLDINGS CORPORATION |

(Exact name of registrant as specified in its charter) |

BRITISH VIRGIN ISLANDS | | 3523 | | N/A |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification Number) |

Huanxiu Street Office

Shuanglong Industrial Park,

266201 Jimo, Qingdao

China

Telephone: +86(0)532-89657397-0

(Address of principal executive offices, including zip code, and telephone number, including area code)

Belmont Trust Limited

P.O. Box 3443

Road Town

Tortola, VG1110

British Virgin Islands

Telephone: (284) 494-5800

(Name, address, including zip code, and telephone number, including area code, of agent of service)

COPY TO:

Andrew J. Befumo, Esq.

andrew@befumolaw.com

Befumo & Schaeffer, PLLC

1629 K St., NW Suite 300

Washington, DC 20006

Telephone: (202) 669-0619

Approximate date of commencement of the proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” as set forth in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

| | Emerging growth company | x |

If an emerging growth company that prepared its consolidated financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | | Amount to be registered | | | Proposed maximum offering price per share | | | Proposed maximum aggregate offering price | | | Amount of registration fee | |

Ordinary Shares, no par value, being offered for resale by certain selling securityholders | | | 1,075,160 | | | $ | 5.00 | | | $ | 5,375,800 | | | $ | 697.78 | |

Totals | | | 1,075,160 | | | | | | | $ | 5,375,800 | * | | $ | 697.78 | |

* This Offering pertains to the resale of shares by selling securityholders only. The Registrant will receive no proceeds from this offering.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (SUBJECT TO COMPLETION) Dated ____, 2020

INDUSTRIAL TECHNICAL HOLDINGS CORPORATION

1,075,160 ORDINARY SHARES

This prospectus relates to the resale of up to 1,075,160 ordinary shares of our stock, from time to time, by the selling securityholders identified in this prospectus. The selling security holders will offer and sell the ordinary shares of outstanding stock at an initial price of $5.00 per share until our ordinary shares are quoted on a national securities exchange, and thereafter at prevailing market prices, at varying prices determined at the time of sale, or at negotiated prices. No cash will be received by us from the sale of ordinary shares of stock by the selling securityholders. We will incur all costs associated with this prospectus.

We have no class of securities registered under the Securities Exchange Act of 1934, as amended, and none of our securities are traded on any stock exchange or stock quotation system in the United States. While we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority to receive a stock symbol in order for such market maker to post a bid and ask on a national securities exchange, we do not currently have a market maker willing to post quotations for our ordinary shares, and there can be no assurance that an active trading market for our shares will develop, or if developed, that it will be sustained; therefore listing approval in major stock exchange is remote.

We are an “emerging growth company” as defined in section 3(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are therefore eligible for certain exemptions from various reporting requirements applicable to reporting companies under the Exchange Act. (See “Exemptions Under the Jumpstart Our Business Startups Act” on page 29.)

In reviewing this prospectus, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 8.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus shall not constitute an offer to sell or the solicitation of any offer to buy, nor shall the selling security holders sell any of these securities in any state where such an offer to sell or solicitation would be unlawful before registration or qualification under such state’s securities laws.

Until ______, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

TABLE OF CONTENTS

PROSPECTUS SUMMARY

The following summary highlights, and should be read in conjunction with, the more detailed information contained elsewhere in this prospectus. You should read carefully the entire document, including our combined consolidated financial statements and related notes, to understand our business, our ordinary shares and the other considerations that are important to your decision to invest in our ordinary shares. You should pay special attention to the “Risk Factors” section beginning on page 74.

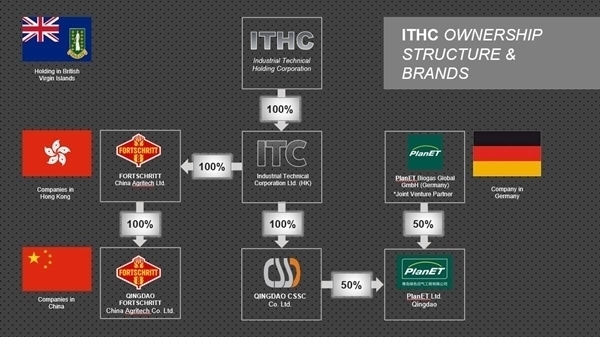

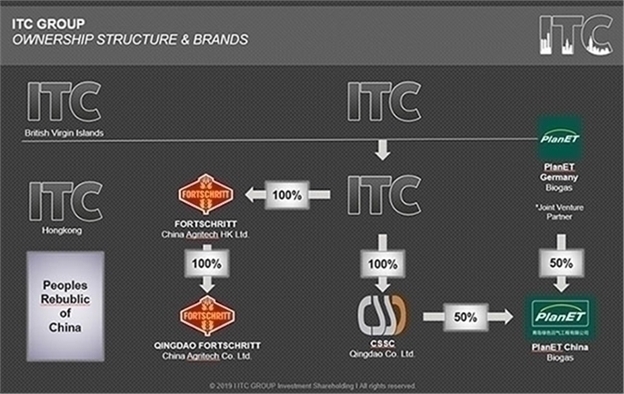

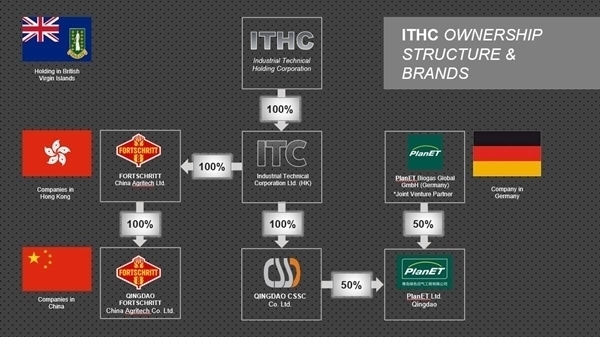

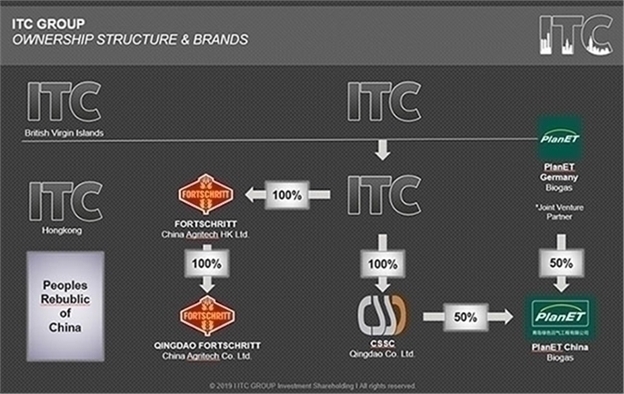

INDUSTRIAL TECHNICAL HOLDINGS CORPORATION (“ITHC” also the “Registrant” the “Company” “us” “we” and “our”) was incorporated on February 22, 2018, under the laws of the British Virgin Islands. ITHC owns 100% of Industrial Technical Corporation, Ltd. (HK) (“ITC-HK”). ITC-HK is a holding company based in Hong Kong which conducts operations through subsidiaries as follows :

(i) ITC-HK owns 100% of Qingdao CSSC Co. Ltd. (“CSSC”); a manufacturer of machinery components based in mainland China. CSSC specializes in the design and engineering of the precision parts of agricultural equipment and machinery; and

(ii) ITC-HK owns 100% of Fortschritt China Agritech Co. Ltd. (“Fortschritt HK”) ; a holding company based in Hong Kong; and

(iii) Fortschritt HK owns 100% of Qingdao Fortschritt China Agritech Co. Ltd (“Fortschritt” also “Fortschritt China”); a manufacturer of modern agricultural machinery . While Forschritt has no sales to date, it currently produces two models of high-density baler machines, with approximately two hundred in various stages of production. The company also has completed prototypes for several other agricultural machines; and

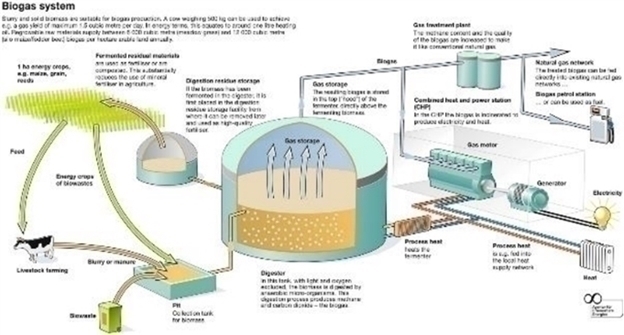

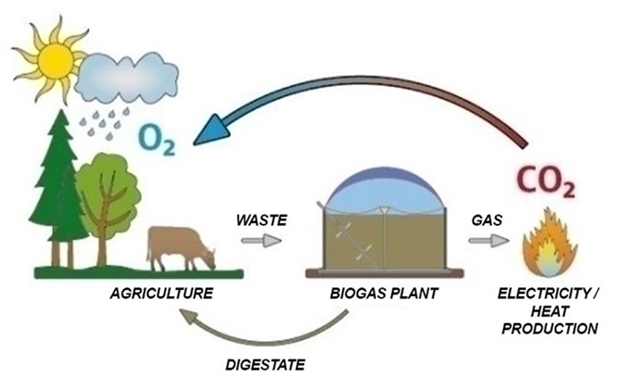

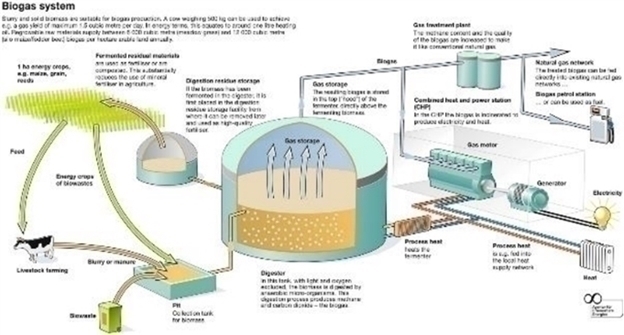

(iv) CSSC owns 50% of PlanET LTD Qingdao (“PlanET” also “PlanET China”); a joint venture with a leading German company in the area of engineering and building green energy biogas plants. PlanET has no sales to date.

The Company’s corporate structure is shown in the below diagram:

Our operations began in 2004 with the founding of CSSC. CSSC produces agricultural machinery parts for the German market as well as for Fortschritt and PlanET. To date we have not sold any products through our Fortschritt or PlanET subsidiaries.

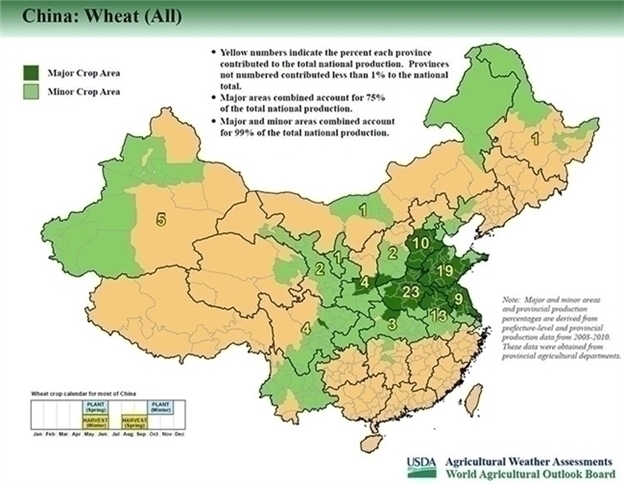

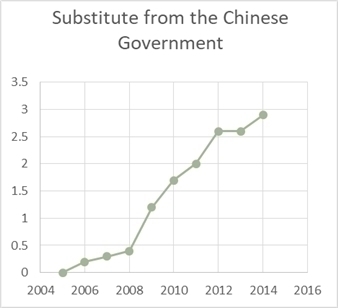

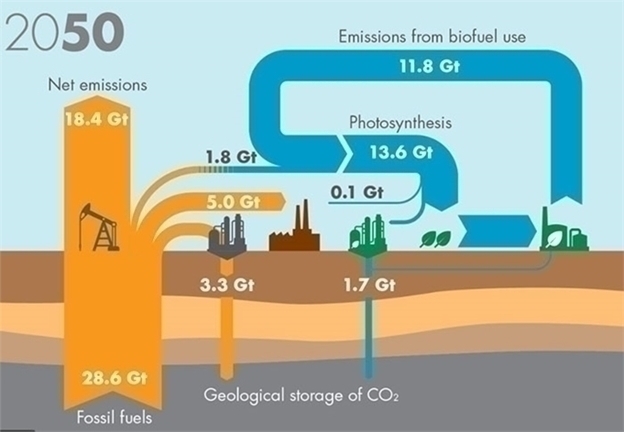

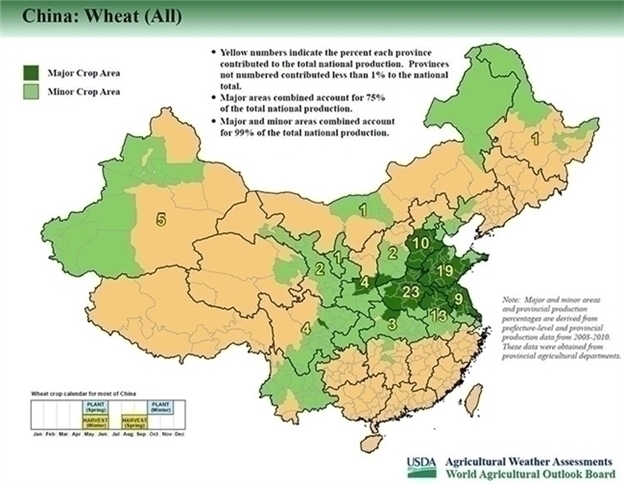

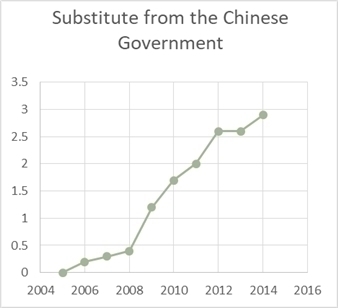

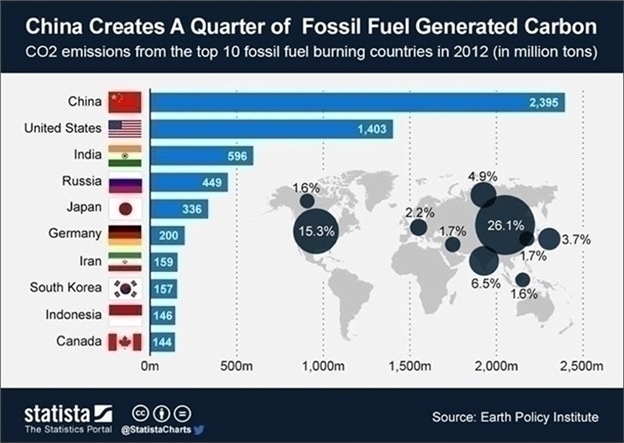

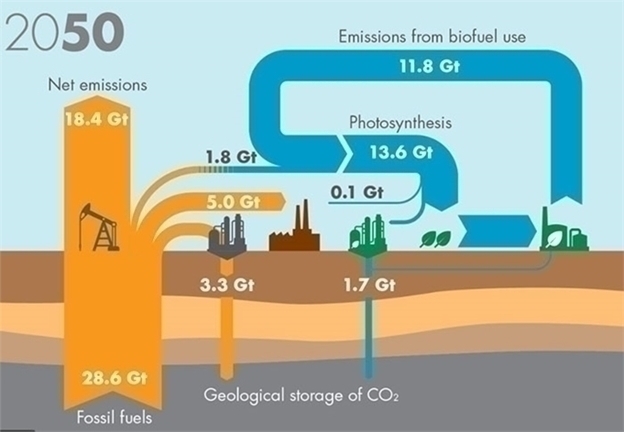

Due to China’s largely unmechanized agricultural industry, agricultural waste products (primarily straw) have typically been burned rather than baled for other uses. In 2015, as pollution levels from burning post-agricultural straw peaked in China, CSSC developed a potential solution to significantly reduce burning straw and instead convert the straw into green energy.

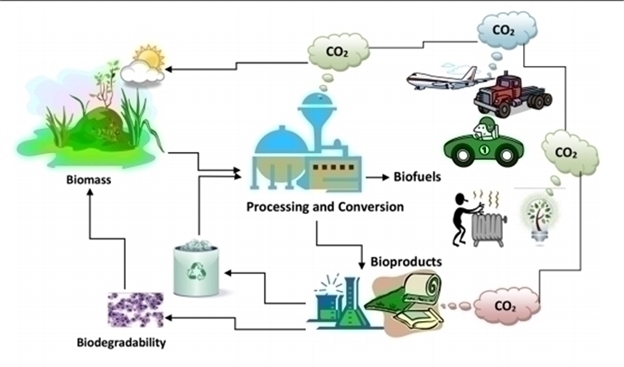

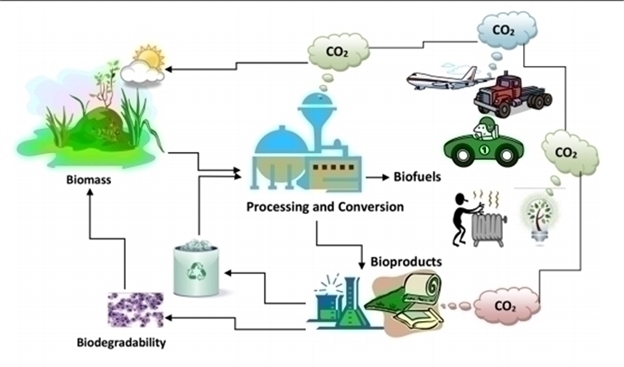

CSSC’s proposed solution to the pollution problem resulted in the Company’s expansion into the Fortschritt brand, to produce highly efficient state-of-the-art machinery for the mechanization of Chinese agriculture, and PlanET to process agricultural waste products into usable energy products.

The Company’s plan, as discussed in greater detail in this prospectus under the heading Our Company, is to leverage the synergies of its three brands, Fortschritt, CSSC and PlanET to become a leader in green agriculture both within China and worldwide.

Our principal executive offices are located at Huanxiu Street Office, Shuanglong Industrial Park, 266201 Jimo, Qingdao, China. Our telephone number is +86(0)532-89657397-0. Our website address is http://www.itc-group.biz. Information on our subsidiaries you can find here:

SUBSIDIARY | FIELD OF ACTIVITY | WEBSITE |

CSSC | MACHINERY COMPONENTS | http://www.cssctp.com |

Fortschritt | AGRICULTURAL MACHINERY | http://www.fortschritt.cn |

PlanET | GREEN ENERGY – BIOGAS PLANTS FOR AGRICULTURE | http://www.planet-biogas.com |

We are not a reporting issuer under any securities legislation and our securities are not listed or posted for trading on any securities exchange or stock quotation system.

OFFERING SUMMARY

The Issuer: | Industrial Technical Holdings Corporation |

| |

The Selling Security Holders: | The selling security holders (each a “Selling Security Holder”) are comprised of the holders of the ordinary shares (the “Shares”) which were issued pursuant to private placements on various dates from February 2018 through June 2019. |

| |

Shares Offered by the Selling Security Holders: | The Selling Security Holders are offering up to an aggregate of 1,075,160 ordinary shares of our stock. |

| |

Offering Price: | The selling security holders will offer and sell the ordinary shares of outstanding stock at an initial price of $5.00 per share until our ordinary shares are quoted on a national securities exchange, and thereafter at prevailing market prices, at varying prices determined at the time of sale, or at negotiated prices. No cash will be received by us from the sale of ordinary shares of stock by the selling securityholders. If the shares are sold through underwriters or broker-dealers, the Selling Security Holders will be responsible for underwriting discounts or commissions or agent’s commissions. |

| |

Use of Proceeds: | We will not receive any of the proceeds from the sale of 1,075,160 ordinary previously-issued-shares of stock by the Selling Security Holders. We will, however, incur all costs associated with this registration statement and prospectus. |

| |

The market for our Ordinary Shares: | Our ordinary shares are not listed or posted for trading on any securities exchange or stock quotation system. |

| |

Outstanding Ordinary Shares of Stock: | There are 3,373,760 ordinary shares of stock outstanding as of January 10, 2020. |

| |

Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in our securities. |

SUMMARY FINANCIAL DATA

The summary financial information set forth below has been derived from the consolidated financial statements of Industrial Technical Holdings Corporation for the period from January 1, 2017, to December 31, 2018, and for the six-month period ended June 30, 2019. You should read the following summary financial data together with our audited consolidated financial statements and the notes thereto included elsewhere in this prospectus.

STATEMENT OF OPERATIONS |

|

| | Six Months Ended, June 30 | | | Year Ended December 31 | |

| | 2019 | | | 2018 | | | 2018 | | | 2017 | |

Revenues | | | 2,280,798 | | | | 2,757,474 | | | | 6,182,801 | | | | 5,851,546 | |

Gross Margin | | | 478,344 | | | | 731,253 | | | | 1,439,347 | | | | 1,417,066 | |

Net Loss | | | 377,986 | | | | 217,328 | | | | 635,275 | | | | 579,629 | |

BALANCE SHEET |

|

| | June 30, 2019 | | | December 31, 2018 | | | December 31, 2017 | |

Cash | | | 261,285 | | | | 608,001 | | | | 124,152 | |

Current Assets | | | 3,102,893 | | | | 3,535,232 | | | | 2,981,252 | |

Total Assets | | | 3,751,450 | | | | 4,252,721 | | | | 3,936,676 | |

Current Liabilities | | | 2,825,891 | | | | 3,131,078 | | | | 3,570,959 | |

Total Liabilities | | | 2,825,891 | | | | 3,131,078 | | | | 3,570,959 | |

Shareholders’ Equity (Deficiency) | | | 925,559 | | | | 1,121,643 | | | | 365,717 | |

RISK FACTORS

An investment in our shares of common stock carries a significant degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus, including our consolidated financial statements and related notes, included elsewhere in this prospectus before you decide to purchase our shares. Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our common stock. Refer to “Forward-Looking Statements”.

There is no assurance that we will be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause, or that these potential risks and uncertainties are a complete list of the risks and uncertainties facing us. Furthermore, there may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

RISKS RELATING TO OUR BUSINESS

We will need a significant amount of capital to carry out our proposed business plan, and a failure to raise sufficient funds will have a material adverse effect on our operations.

In order to carry out our proposed business plan, we will require a significant amount of capital. We estimate that we will need approximately $10 million to finance our planned operations for the next 12 months.

We intend to raise our cash requirements for the next 12 months through the sale of our equity securities in private placements, through shareholder loans or possibly through a registered public offering (either self-underwritten or through a broker-dealer). If we are unsuccessful in raising enough money through such capital-raising efforts, we may review other financing possibilities such as bank loans. At this time we do not commit any broker-dealer to provide us with financing. There is no assurance that any financing will be available to us or if available, on terms that will be acceptable to us. We also may negotiate with our management and consultants to pay parts of their salaries and fees with stock and stock options instead of cash.

Our ability to obtain the necessary financing to carry out our business plan is subject to several factors, including general market conditions and investor acceptance of our business plan. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly reduce our spending, delay or cancel our planned activities or substantially change our current corporate structure. There is no guarantee that we will be able to obtain any funding or that we will have sufficient resources to conduct our business as projected, any of which may have an adverse material effect on our operations.

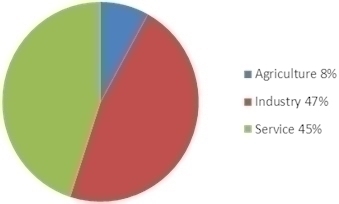

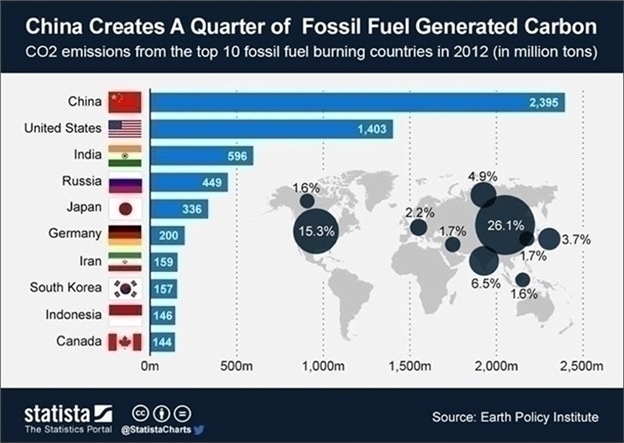

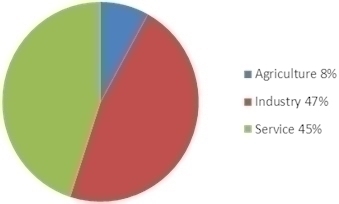

Our revenue and net income may be materially and adversely affected by any economic slowdown in China. The PRC government has in recent years implemented several measures to control the rate of economic growth, including by raising interest rates and adjusting deposit reserve ratios for commercial banks as well as by implementing other measures designed to tighten credit and liquidity. These measures have contributed to a slowdown of the PRC economy. According to the National Bureau of Statistics of China, China’s GDP growth rate was 6.7% in 2016. Any continuing or worsening slowdown could significantly reduce domestic commerce in China, including through the Internet generally and within our ecosystem. An economic downturn, whether actual or perceived, a further decrease in economic growth rates or an otherwise uncertain economic outlook in China or any other market in which we may operate could have a material adverse effect on our business, financial condition and results of operations.

Damage claims against our products could reduce our sales and revenues. If any of our products are found to cause injury or damage, the Company could suffer financial damages. We have not had significant claims for damages or losses from our products to date. The Company does not carry product liability insurance. Any claims for damages related to the products we sell could damage our reputation and reduce our revenues.

Disruption to our supply chain of parts needed for constructing our products could negatively affect our sales. The Company has not yet experienced significant problems in obtaining parts from suppliers required for constructing its products. However, there is no guarantee that some of the current suppliers may not be able to continue to provide parts needed for constructing our products from our current suppliers. We have no written agreements with any of our suppliers and order these parts from different manufacturers on a purchase order basis. If the manufactured parts do not meet the quality standard, the parts are not accepted by us. This could cause a shortage of those parts in inventory resulting in backorders and even cancellations of orders. Sales of existing products in inventory may not be sufficient to use all stock on hand before we can obtain replacement parts from other suppliers. This could reduce or eliminate our revenues.

Growth of our business will partially depend on the recognition of our Fortschritt brand, and any failure to maintain, protect and enhance our brand would limit our ability to expand or retain our customer base, which would materially and adversely affect our business, financial condition and results of operations. We believe that the recognition of our brand among customers has helped us manage our customer acquisition costs and contributed to the growth and success of our business. Accordingly, maintaining, protecting and enhancing the recognition of our brand is critical to our business and market position. Many factors, some of which are beyond our control, are important to maintaining, protecting and enhancing our brand. These factors include but not limited to our ability to:

| · | maintain the quality and attractiveness of the products we offer; |

| | |

| · | develop and launch new products that satisfy our customers’ needs; |

| | |

| · | provide a superior customer experience; |

| | |

| · | increase brand awareness through marketing and brand promotion activities; |

| | |

| · | maintain a good relationship and retain favorable terms with our suppliers, service providers, and other business partners; |

| | |

| · | stay compliant with relevant laws and regulations; |

| | |

| · | compete effectively against existing and future competitors; and |

| | |

| · | preserve our reputation and goodwill generally and in the event of any negative publicity on our products, services, or other issues affecting us, China’s agricultural industry or China’s manufacturing sector in general. |

A public perception that we do not provide satisfactory products or services to customers, even if factually incorrect or based on isolated incidents, could damage our reputation, diminish the value of our brand, undermine the trust and credibility we have established and had a negative impact on our ability to attract and retain customers, and our business, financial condition and results of operations may be materially and adversely affected.

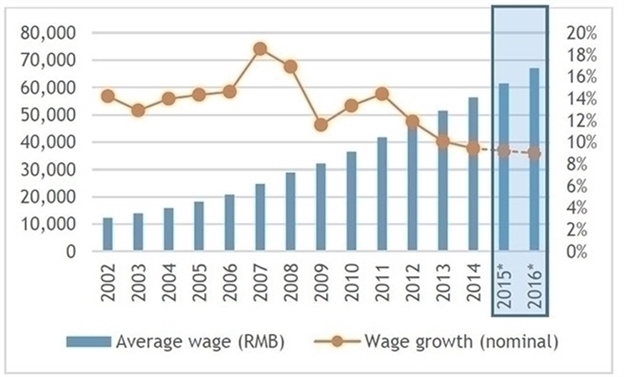

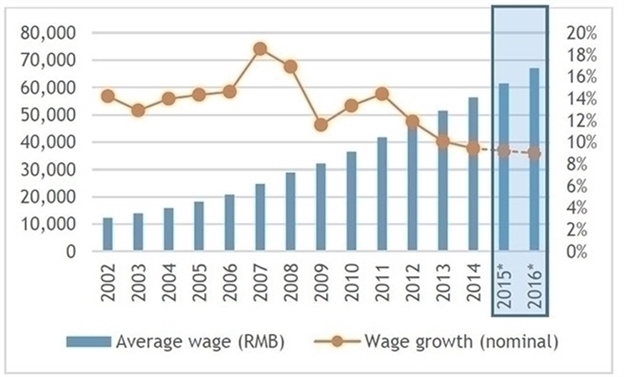

Overall tightening of the labor market, increases in labor costs or any possible labor unrest may adversely affect our business and results of operations. Our business requires a substantial number of workers, and any failure to retain stable and dedicated labor by us may lead to disruption to our business operations. Although we have not experienced any labor shortage to date, we have observed an overall tightening and increasingly competitive labor market. We have experienced, and expect to continue to experience, increases in labor costs due to increases in salary, social benefits, and employee headcount. We compete with other companies in our industry and other labor-intensive industries for labor, and we may not be able to offer competitive remuneration and benefits compared to them. If we are unable to manage and control our labor costs, our business, financial condition and results of operations may be materially and adversely affected.

If we fail to adopt new technologies to evolving customer needs or emerging industry standards, our business may be materially and adversely affected. To remain competitive, we must continue to stay abreast of the constantly evolving industry trends and to enhance and improve our technology accordingly. Our success will depend, in part, on our ability to identify, develop, acquire or license leading technologies useful in our business. There can be no assurance that we will be able to use new technologies effectively or adapt to meet customer requirements. If we are unable to adapt in a cost-effective and timely manner in response to changing market conditions or customer preferences, whether for technical, legal, financial or other reasons, our business may be materially and adversely affected.

We, our directors, management and employees may be subject to litigation and regulatory investigations and proceedings, such as claims relating to product safety, commercial, labor, employment, antitrust or securities matters, and may not always be successful in defending ourselves against such claims or proceedings. We face potential liability, expenses for legal claims and harm due to our business nature. For example, customers could assert legal claims against us in connection with personal injuries related use of our agricultural equipment. The PRC government, media outlets, and public advocacy groups have been increasingly focused on customer protection in recent years.

While we strive to maximize quality control, the selling of defective products may expose us to liabilities associated with customer protection laws. A manufacturer may be responsible for compensation on customer’s injury or loss even if such loss is not caused by the manufacturer. Thus, we may also be held liable if our suppliers, dealers or other business partners fail to comply with applicable rules and regulations. Though we can ask the responsible parties for indemnity, our reputation could still be adversely affected. In addition, our directors, management and employees may from time to time be subject to litigation and regulatory investigations and proceedings or otherwise face potential liability and expense in relation to commercial, labor, employment, antitrust, securities or other matters, which could adversely affect our reputation and results of operations.

After we become a publicly listed company, we may face additional exposure to claims and lawsuits. These claims could divert management time and attention away from our business and result in significant costs to investigate and defend, regardless of the merits of the claims. In some instances, we may elect or be forced to pay substantial damages if we are unsuccessful in our efforts to defend against these claims, which could harm our business, financial condition and results of operations.

We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business. We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate intellectual property rights held by third parties. We have not, but may in the future become, subject to legal proceedings and claims relating to the intellectual property rights of others. There could also be existing intellectual property of which we are not aware that our products may inadvertently infringe. We cannot assure you that holders of intellectual property purportedly relating to some aspect of our technology, products or business, if any such holders exist, would not seek to enforce such intellectual property against us in China, Europe, the United States or any other jurisdictions. If we are found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. In addition, we may incur significant expenses, and may be forced to divert management’s time and other resources from our business and operations to defend against any such infringement claims, regardless of their merits. Successful infringement or licensing claims made against us may result in significant monetary liabilities and may materially disrupt our business and operations by restricting or prohibiting our use of the intellectual property in question, and our business, financial position and results of operations could be materially and adversely affected.

RISKS RELATING TO DOING BUSINESS IN CHINA

Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.

Substantially all of our assets and operations are located in China. Accordingly, our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in China generally. The Chinese economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. The Chinese government also exercises significant control over China’s economic growth through allocating resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

While the Chinese economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy. Any adverse changes in economic conditions in China, in the policies of the Chinese government or in the laws and regulations in China could have a material adverse effect on the overall economic growth of China. Such developments could adversely affect our business and operating results, lead to a reduction in demand for our products and adversely affect our competitive position. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. While some of these measures may benefit the overall Chinese economy, they may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. In addition, in the past the Chinese government has implemented certain measures, including interest rate adjustment, to control the pace of economic growth. These measures may cause decreased economic activity in China, which may adversely affect our business and operating results.

Uncertainties with respect to the PRC legal system could adversely affect us. The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil law system may be cited for reference but have limited precedential value.

In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation since then has significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system, and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, the interpretation and enforcement of these laws and regulations involve uncertainties. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy. These uncertainties may affect our judgment on the relevance of legal requirements and our ability to enforce our contractual rights or tort claims. In addition, the regulatory uncertainties may be exploited through unmerited or frivolous legal actions or threats in attempts to extract payments or benefits from us.

Furthermore, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all and may have a retroactive effect. As a result, we may not be aware of our violation of any of these policies and rules until sometime after the violation. In addition, any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention.

You may experience difficulties in effecting service of the legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the prospectus based on foreign laws. We are a company incorporated under the laws of the British Virgin Islands, we conduct substantially all of our operations in China, and substantially all of our assets are located in China. As a result, it may be difficult for our shareholders to effect service of process upon us or those persons inside China. In addition, China does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the British Virgin Islands and many other countries and regions. Therefore, recognition and enforcement in China of judgments of a court in any of these non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult or impossible.

Our employment practices may be adversely impacted by the labor contract law of the PRC. The PRC National People’s Congress promulgated the Labor Contract Law which became effective on January 1, 2008, and was amended on December 28, 2012, and the State Council promulgated implementing rules for the labor contract law on September 18, 2008. The labor contract law and the implementing rules impose requirements concerning, among others, the execution of written contracts between employers and employees, the time limits for probationary periods, and the length of employment contracts. The interpretation and implementation of these regulations are still evolving, our employment practices may violate the labor contract law and related regulations and we could be subject to penalties, fines or legal fees as a result. If we are subject to severe penalties or incur significant legal fees in connection with labor law disputes or investigations, our business, financial condition and results of operations may be adversely affected.

Fluctuations in exchange rates could have a material and adverse effect on our results of operations and the value of your investment. The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions and the foreign exchange policy adopted by the PRC government. It is difficult to predict how long such depreciation of RMB against the U.S. dollar may last and when and how the relationship between the RMB and the U.S. dollar may change again. Much of our revenues and costs are denominated in Renminbi. a significant revaluation of Renminbi may materially and adversely affect our results of operations and financial position reported in Renminbi when translated into U.S. dollars, and the value of and any dividends payable on our Shares in U.S. dollars. To the extent that we need to convert U.S. dollars into Renminbi for our operations, appreciation of the Renminbi against the U.S. dollar would have an adverse effect on the Renminbi amount we would receive. Conversely, if we decide to convert our Renminbi into U.S. dollars to make payments for dividends on our Shares or other business purposes, appreciation of the U.S. dollar against the Renminbi would have a negative effect on the U.S. dollar amount.

Regulation and censorship of information disseminated over the internet in China may adversely affect our business and reputation and subject us to liability for information displayed on our website. The PRC government has adopted regulations governing internet access and the distribution of news and other information over the internet. Under these regulations, internet content providers and internet publishers are prohibited from posting or displaying over the internet content that, among other things, violates PRC laws and regulations, impairs the national dignity of China, or is reactionary, obscene, superstitious, fraudulent or defamatory. Failure to comply with these requirements may result in the revocation of licenses to provide internet content and other licenses, and the closure of the concerned websites. The website operator may also be held liable for such censored information displayed on or linked to the websites. If our website is found to be in violation of any such requirements, we may be penalized by relevant authorities, and our operations or reputation could be adversely affected.

The audit report included in this prospectus is prepared by an auditor who is not inspected by the Public Company Accounting Oversight Board and, as such, our investors are deprived of the benefits of such inspection. Our independent registered public accounting firm that issues the audit report included in our prospectus filed with the SEC, as auditors of companies that are traded publicly in the U.S. and a firm registered with the U.S. Public Company Accounting Oversight Board, or the PCAOB, is required by the laws of the U.S. to undergo regular inspections by the PCAOB to assess its compliance with the laws of the U.S. and professional standards. Because our auditors are located in the People’s Republic of China, a jurisdiction where the PCAOB is currently unable to conduct inspections without the approval of the Chinese authorities, our auditors, as well as all other firms located in the PRC, are not currently inspected by the PCAOB.

Inspections of other firms that the PCAOB has conducted outside China have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. This lack of PCAOB inspections in China prevents the PCAOB from regularly evaluating our auditor’s audits and its quality control procedures. As a result, investors may be deprived of the benefits of PCAOB inspections.

The inability of the PCAOB to conduct inspections of auditors in China makes it more difficult to evaluate the effectiveness of our auditor’s audit procedures or quality control procedures as compared to auditors outside of China that are subject to PCAOB inspections. Investors may lose confidence in our reported financial information and procedures and the quality of our consolidated financial statements.

We may be classified as a “resident enterprise” for PRC enterprise income tax purposes, which could result in unfavorable tax consequences to us and our non-PRC shareholders. The EIT Law provides that enterprises established outside of the PRC whose “de facto management bodies” are located in the PRC are considered “resident enterprises” and are generally subject to the uniform 25% enterprise income tax rate on their worldwide income. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 regarding the standards used to classify certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese group enterprises and established outside of the PRC as “resident enterprises” clarified that dividends and other income paid by such “resident enterprises” will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC enterprise shareholders. This circular also subjects such “resident enterprises” to various reporting requirements with the PRC tax authorities. Under the implementation regulations to the enterprise income tax, a “de facto management body” is defined as a body that has material and overall management and control over the manufacturing and business operations, personnel and human resources, finances and properties of an enterprise. In addition, the circular mentioned above sets out criteria for determining whether “de facto management bodies” are located in the PRC for overseas incorporated, domestically controlled enterprises. However, as this circular only applies to enterprises established outside of the PRC that are controlled by PRC enterprises or groups of PRC enterprises, it remains unclear how the tax authorities will determine the location of “de facto management bodies” for overseas incorporated enterprises that are controlled by individual PRC residents like us and some of our subsidiaries. Therefore, although substantially all of our management is currently located in the PRC, it remains unclear whether the PRC tax authorities would require or permit our overseas registered entities to be treated as PRC resident enterprises. We do not currently consider our company to be a PRC resident enterprise. However, if the PRC tax authorities disagree with our assessment and determine that we are a “resident enterprise” we may be subject to enterprise income tax at a rate of 25% on our worldwide income and dividends paid by us to our non-PRC shareholders as well as capital gains recognized by them with respect to the sale of the ADSs may be subject to a PRC withholding tax.

This will have an impact on our effective tax rate, a material adverse effect on our net income and results of operations, and may require us to withhold tax on our non-PRC shareholders.

We are subject to PRC laws governing the industry in which we operate. If we are found to have failed to comp ly with applicable laws, we may incur additional expenditures or be subject to significant fines and penalties, which would have a material adverse effect on our business and operations. Our operations are subject to PRC laws and regulations applicable to us. However, the scope of many PRC laws and regulations are uncertain, and their implementation could differ significantly in different localities. In certain instances, local rules and their implementation are not necessarily consistent with the regulations at the higher or national level. Although we strive to comply with all applicable PRC laws and regulations, the relevant PRC government authorities may decide that we have not been in compliance with certain laws or regulations.

If the Chinese government determines that the corporate structure through which we control our PRC subsidiaries does not comply with applicable regulations, our business would be adversely affected.

There are uncertainties regarding the interpretation and application of PRC laws, rules and regulations, including but not limited to the laws, rules and regulations governing the validity of our corporate structure and control of our operating PRC subsidiaries. Although we have been advised by our PRC counsel, Shangdong Huasai Law Firm that based on their understanding of the current PRC laws, rules and regulations, our corporate structure complies with all applicable PRC laws, rules and regulations, we cannot assure you that the PRC regulatory authorities will not determine that our corporate structure or operations violate PRC laws, rules or regulations. The Chinese government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies.

In addition, new PRC laws, rules and regulations may be introduced from time to time to impose additional requirements that may be applicable to us, our business and operations.

We cannot predict the effect of the interpretation of existing or new Chinese laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future Chinese laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease certain of our operations. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations.

If we are determined to be in violation of any existing or future PRC laws, rules or regulations or fail to obtain or maintain any of the required governmental permits or approvals, the relevant PRC regulatory authorities would have broad discretion in dealing with such violations, including:

| · | revoking the business and operating licenses of CSSC, Fortschritt, and PlanET; |

| | |

| · | discontinuing or restricting the operations of CSSC, Fortschritt, and PlanET ; |

| | |

| · | imposing conditions or requirements with which we may not be able to comply; |

| | |

| · | requiring us to restructure the relevant ownership structure or operations; |

| | |

| · | restricting or prohibiting our use of the proceeds from our offerings to finance our businesses and operations in China; or |

| | |

| · | imposing fines or other forms of economic penalties. |

The imposition of any of these penalties would have a material adverse effect on our financial condition, results of operations and prospects.

RISKS RELATING TO OUR ORDINARY SHARES OF STOCK

There is no public market for our ordinary shares and you may not be able to resell our ordinary shares at or above the price you paid, or at all. There is currently no public market for our ordinary shares. We cannot assure you that our ordinary shares will ever be qualified for public resale, or if qualified, that an active public market for our ordinary shares will develop. If there is no public market for our ordinary shares, you may lose some or all of your investment.

The continued sale of our equity securities will dilute the ownership percentage of our existing stockholders. The Board of Directors has the authority to issue additional shares of our capital stock to provide additional financing in the future and the issuance of any such shares may result in a reduction of the book value or market price, if one exists at the time, of the outstanding ordinary shares. If we do issue any such additional ordinary shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other stockholders. As a result of such dilution, if you acquire ordinary shares, your proportionate ownership interest and voting power could be decreased.

FINRA sales practice requirements may limit your ability to buy and sell our ordinary shares, which could depress the price of our shares. FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements may make it more difficult for broker-dealers to recommend that their customers buy our ordinary shares, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares and, thereby, depress our share price.

We are a “foreign private issuer,” and our disclosure obligations differ from those of U.S. domestic reporting companies. As a result, we may not provide you the same information as U.S. domestic reporting companies or we may provide information at different times, which may make it more difficult for you to evaluate our performance and prospects. We are a foreign private issuer and, as a result, we are not subject to the same requirements as U.S. domestic issuers. Under the Exchange Act, we will be subject to reporting obligations that, to some extent, are more lenient and less frequent than those of U.S. domestic reporting companies. For example, we will not be required to issue quarterly reports or proxy statements. We will not be required to disclose detailed individual executive compensation information. Furthermore, our directors and executive officers will not be required to report equity holdings under Section 16 of the Exchange Act and will not be subject to the insider short-swing profit disclosure and recovery regime. As a foreign private issuer, we will also be exempt from the requirements of Regulation FD (Fair Disclosure) which, generally, are meant to ensure that select groups of investors are not privy to specific information about an issuer before other investors. However, we will still be subject to the anti-fraud and anti-manipulation rules of the SEC, such as Rule 10b-5 under the Exchange Act. Since many of the disclosure obligations imposed on us as a foreign private issuer differs from those imposed on U.S. domestic reporting companies, you should not expect to receive the same information about us and at the same time as the information provided by U.S. domestic reporting companies.

We will incur increased costs and become subject to additional regulations and requirements as a result of becoming a newly public company, and our management will be required to devote substantial time to new compliance matters, which could lower our profits or make it more difficult to run our business. If we become a public company as planned, we will incur significant legal, accounting and other expenses that we have not incurred as a private company, including costs associated with public company reporting requirements and costs of recruiting and retaining non-executive directors. We also have incurred and will incur costs associated with rules implemented by the Securities and Exchange Commission, or the SEC, as well as any exchange or listing platformon which our securities may be quoted. The expenses incurred by public companies generally for reporting and corporate governance purposes have been increasing. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly, although we are currently unable to estimate these costs with any degree of certainty. Our management will need to devote a substantial amount of time to ensure that we comply with all of these requirements. These laws and regulations also could make it more difficult or costly for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. These laws and regulations could also make it more difficult for us to attract and retain qualified persons to serve on our Board of Directors, our board committees or as our executive officers. Furthermore, if we are unable to satisfy our obligations as a public company, we could be subject to delisting of our ordinary shares, fines, sanctions, and other regulatory action and potentially civil litigation.

Our Articles of Association provide that any Shareholder receiving a certificate shall indemnify and hold the Company and its directors and officers harmless from any loss or liability which it or they may incur by reason of any wrongful or fraudulent use or representation made by any person by virtue of the possession thereof. In the event a shareholder’s certificate is the subject of a fraudulent transfer or transaction, the shareholder may lose some or all of his investment.

The market price of common shares may be volatile, which could cause the value of your investment to decline. Even if a trading market develops, the market price of our ordinary shares may be highly volatile and could be subject to wide fluctuations. Securities markets worldwide experience significant price and volume fluctuations. This market volatility, as well as general economic, market or political conditions, could reduce the market price of our ordinary shares in spite of our operating performance. In addition, our results of operations could be below the expectations of public market analysts and investors due to a number of potential factors, including variations in our quarterly results of operations, additions or departures of key management personnel, failure to meet analysts’ earnings estimates, publication of research reports about our industry, litigation and government investigations, changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business, adverse market reaction to any indebtedness we may incur or securities we may issue in the future, changes in market valuations of similar companies or speculation in the press or investment community, announcements by our competitors of significant contracts, acquisitions, dispositions, strategic partnerships, joint ventures or capital commitments, adverse publicity about our industry in or individual scandals, and in response the market price of our ordinary shares could decrease significantly. You may be unable to resell your ordinary shares of at or above the initial public offering price. In the past few years, stock markets have experienced extreme price and volume fluctuations. In the past, following periods of volatility in the overall market and the market price of a company’s securities, securities class action litigation has often been instituted against these companies. This litigation, if instituted against us, could result in substantial costs and a diversion of our management’s attention and resources, or at all.

RISKS RELATING TO TAXATION

There are significant uncertainties under the PRC Enterprise Income Tax Law relating to the withholdin g tax liabilities of our PRC subsidiaries, and dividends payable by our PRC subsidiaries to our offshore subsidiaries may not qualified to enjoy certain treaty benefits. Under the PRC Enterprise Income Tax Law and its implementation rules, the profits of a foreign-invested enterprise generated through operations, which are distributed to its immediate holding company outside China, will be subject to a withholding tax rate of 10%. Pursuant to a special arrangement between Hong Kong and China, such rate may be reduced to 5% if a Hong Kong resident enterprise owns more than 25% of the equity interest in the PRC company. Our current PRC subsidiaries are wholly owned by our Hong Kong subsidiary. Accordingly, Industrial Technical Corporation, Ltd. (HK) may qualify for a 5% tax rate in respect of distributions from our PRC subsidiaries. Under the Notice of the State Administration of Taxation (“SAT”) on Issues regarding the Administration of the Dividend Provision in Tax Treaties promulgated in 2009, the taxpayer needs to satisfy certain conditions to enjoy the benefits under a tax treaty. These conditions include: (i) the taxpayer must be the beneficial owner of the relevant dividends, and (ii) the corporate shareholder to receive dividends from the PRC subsidiaries must have met the direct ownership thresholds during the 12 consecutive months preceding the receipt of the dividends. Further, the SAT promulgated the Notice on How to Understand and Recognize the “Beneficial Owner” in Tax Treaties in 2009, which limits the “beneficial owner” to individuals, enterprises or other organizations normally engaged in substantive operations, and sets forth certain detailed factors in determining “beneficial owner” status.

Entitlement to a lower tax rate on dividends according to tax treaties or arrangements between the PRC central government and governments of other countries or regions is subject to the Administrative Measures for Non-Resident Taxpayers to Enjoy Treatments under Tax Treaties, which provides that non-resident enterprises are not required to obtain pre-approval from the relevant tax authority in order to enjoy the reduced withholding tax. Instead, non-resident enterprises and their withholding agents may, by self-assessment and on confirmation that the prescribed criteria to enjoy the tax treaty benefits are met, directly apply the reduced withholding tax rate, and file necessary forms and supporting documents when performing tax filings, which will be subject to post-tax filing examinations by the relevant tax authorities. As a result, we cannot assure you that we will be entitled to any preferential withholding tax rate under treaties for dividends received from our PRC subsidiaries.

If we are classified as a PRC residen t enterprise for PRC enterprise income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders. Under the PRC Enterprise Income Tax Law and its implementation rules, an enterprise established outside of the PRC with its “de facto management body” within the PRC is considered a “resident enterprise” and will be subject to the enterprise income tax on its global income at the rate of 25%. The implementation rules define the term “de facto management body” as the body that exercises full and substantial control and overall management over the business, productions, personnel, accounts and properties of an enterprise. In 2009, the SAT issued a circular, known as SAT Circular 82, partially abolished on December 29, 2017, which provides certain specific criteria for determining whether the “de facto management body” of a PRC-controlled enterprise that is incorporated offshore is located in China. Although this circular applies only to offshore enterprises controlled by PRC enterprises or PRC enterprise groups, not those controlled by PRC individuals or foreigners, the criteria set forth in the circular may reflect the SAT’s general position on how the “de facto management body” text should be applied in determining the tax resident status of all offshore enterprises. According to SAT Circular 82, an offshore incorporated enterprise controlled by a PRC enterprise or a PRC enterprise group will be regarded as a PRC tax resident by virtue of having its “de facto management body” in China, and will be subject to PRC enterprise income tax on its global income only if all of the following conditions are met: (i) the primary location of the day-to-day operational management is in the PRC; (ii) decisions relating to the enterprise’s financial and human resource matters are made or are subject to approval by organizations or personnel in the PRC; (iii) the enterprise’s primary assets, accounting books and records, company seals, and board and shareholder resolutions are located or maintained in the PRC; and (iv) at least 50% of voting board members or senior executives habitually reside in the PRC.

We believe that, as a BVI company, our company is not a PRC resident enterprise for PRC tax purposes. However, the tax resident status of an enterprise is subject to determination by the PRC tax authorities and uncertainties remain with respect to the interpretation of the term “de facto management body.” If the PRC tax authorities determine that our company is a PRC resident enterprise for enterprise income tax purposes, we would be subject to PRC enterprise income on our worldwide income at the rate of 25%. Furthermore, we would be required to withhold a 10% tax from dividends we pay to our shareholders that are non-resident enterprises, including the holders of our ordinary shares. In addition, non-resident enterprise shareholders may be subject to PRC tax on gains realized on the sale or other disposition of the ordinary shares, if such income is treated as sourced from within the PRC. Furthermore, if we are deemed a PRC resident enterprise, dividends paid to our non-PRC individual shareholders and any gain realized on the transfer of the ordinary shares by such shareholders may be subject to PRC tax at a rate of 20% (which, in the case of dividends, may be withheld at source by us). These rates may be reduced by an applicable tax treaty, but it is unclear whether non-PRC shareholders of our company would be able to claim the benefits of any tax treaties between their country of tax residence and the PRC in the event that we are treated as a PRC resident enterprise. Any such tax may reduce the returns on your investment in our ordinary shares.

We face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.

On February 3, 2015, the SAT issued the Public Notice Regarding Certain Corporate Income Tax Matters on Indirect Transfer of Properties by Non-Tax Resident Enterprises, or SAT Bulletin 7. SAT Bulletin 7 extends its tax jurisdiction to transactions involving the transfer of taxable assets through offshore transfer of a foreign intermediate holding company. In addition, SAT Bulletin 7 has introduced safe harbors for internal group restructurings and the purchase and sale of equity through a public securities market. SAT Bulletin 7 also brings challenges to both foreign transferor and transferee (or other person who is obligated to pay for the transfer) of taxable assets, as such persons need to determine whether their transactions are subject to these rules and whether any withholding obligation applies.

On October 17, 2017, the SAT issued the Announcement of the State Administration of Taxation on Issues Concerning the Withholding of Non-resident Enterprise Income Tax at Source, or SAT Bulletin 37, which came into effect on December 1, 2017. The SAT Bulletin 37 further clarifies the practice and procedure of the withholding of non-resident enterprise income tax.

Where a non-resident enterprise transfers taxable assets indirectly by disposing of the equity interests of an overseas holding company, which is an Indirect Transfer, the non-resident enterprise as either transferor or transferee, or the PRC entity that directly owns the taxable assets, may report such Indirect Transfer to the relevant tax authority. Using a “substance over form” principle, the PRC tax authority may disregard the existence of the overseas holding company if it lacks a reasonable commercial purpose and was established for the purpose of reducing, avoiding or deferring PRC tax. As a result, gains derived from such Indirect Transfer may be subject to PRC enterprise income tax, and the transferee or other person who pays for the transfer is obligated to withhold the applicable taxes currently at a rate of 10% for the transfer of equity interests in a PRC resident enterprise. Both the transferor and the transferee may be subject to penalties under PRC tax laws if the transferee fails to withhold the taxes and the transferor fails to pay the taxes.

We face uncertainties as to the reporting and other implications of certain past and future transactions where PRC taxable assets are involved, such as offshore restructuring, or a sale of shares in our offshore subsidiaries and investments. Our company may be subject to filing obligations or may be taxed if our company is transferor in such transactions and may be subject to withholding obligations if our company is transferee in such transactions, under SAT Bulletin 7 and/or SAT Bulletin 37. For transfers of shares of our company by investors who are non-PRC resident enterprises, our PRC subsidiaries may be requested to assist in the filing under SAT Bulletin 7 and/or SAT Bulletin 37. As a result, we may be required to expend valuable resources to comply with SAT Bulletin 7 and/or SAT Bulletin 37 or to request the relevant transferors from whom we purchase taxable assets to comply with these circulars, or to establish that our company should not be taxed under these circulars, which may have a material adverse effect on our financial condition and results of operations.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements made under “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this prospectus constitute forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “beliefs,” “estimates,” “predicts,” “potential,” “intends,” or “continue,” or the negative of these terms or other comparable terminology.

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are no guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments, and other factors they believe to be appropriate.

Important factors that could cause actual results, developments and business decision to differ materially from those anticipated in these forward-looking statements include, among other things:

| · | Our planned level of revenues and capital expenditures; |

| | |

| · | Our ability to market and sell our products; |

| | |

| · | Our plans to continue to invest in research and development to develop technology for both existing and new products; |

| | |

| · | Our ability to maintain our relationships with channel partners; |

| | |

| · | Our ability to maintain or protect the validity of our European, U.S. and other patents and other intellectual property; |

| | |

| · | Our ability to launch and penetrate markets in new locations, including taking steps to expand our activities in Europe and Southeast Asia and to enter into engagements with new business partners in those markets; |

| | |

| · | Our intention to open new branches in key global locations and to increase marketing and sales activities; |

| | |

| · | Our intention to establish partnerships with industry leaders; |

| | |

| · | Our ability to implement on-line distribution channels and to generate sales from such channels; |

| | |

| · | Our ability to retain key executive members; |

| | |

| · | Our ability to internally develop new inventions and intellectual property; |

| | |

| · | Our expectations regarding future changes in our cost of revenues and our operating expenses; |

| | |

| · | Our expectations regarding our tax classifications; |

| | |

| · | Interpretations of current laws and the passages of future laws; |

| | |

| · | Acceptance of our business model by investors; and |

| | |

| · | Those factors referred to in the section of this prospectus titled “Risk Factors.” |

These statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, level of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in this prospectus in greater detail under the heading “Risk Factors.” You should not rely upon forward-looking statements as predictions of future events.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity performance, or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this prospectus.

Information on the Company

History and Development

The Company comprises Fortschritt, CSSC and PlanET, all three of which are operated through the Company’s Chinese subsidiaries.

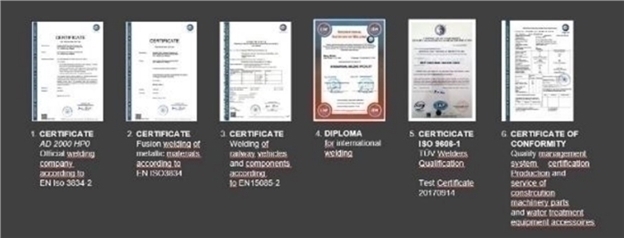

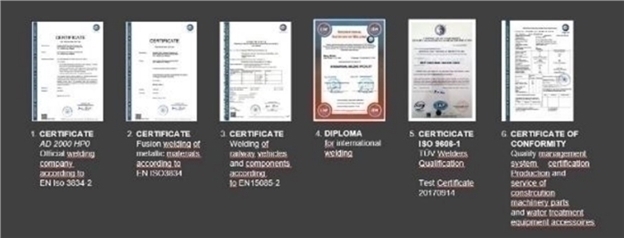

In 2004, CSSC was founded in Qingdao. The aim was to create a low-cost production platform supplier for German industry and to produce finished products for the Chinese market. Since its inception, CSSC’s Chinese workers have been trained to produce components acceptable to its primarily German clientele (over 90% of CSSC’s production is exported to Germany). The company’s workers receive intensive in-house training and instruction, and receive international licensing as needed through the German technical association (TÜV).

In 2015, pollution levels peaked in China. A major cause was attributed to the burning of straw after harvesting directly on the fields as agriculture was largely unmechanized at this time. In discussions with local government representatives, potential solutions were discussed to significantly reduce emissions.

The degree of pollution caused by the burning of the straw, which was carried out on a large scale in China, “was visible in the atmosphere”:

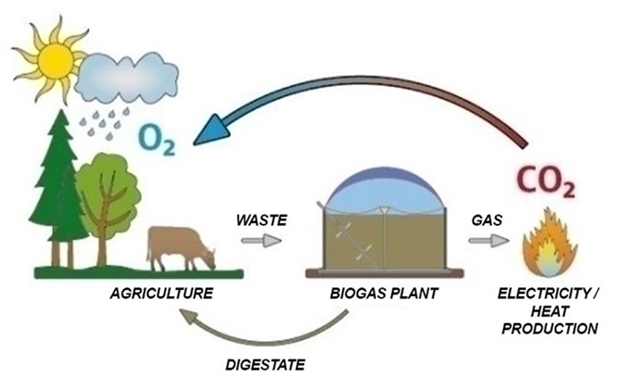

At that time, CSSC’s suggested a potential solution to the local government to significantly reduce or eliminate the burning of straw and begin collecting it by hay pressing (baler machines) and then ferment it in biogas plants to extract green energy.

For this reason, we founded two additional companies:

1. Fortschritt China Agritech Co. Ltd., produces modern agriculture machinery such as high pressure baler machines, transport units and harvesting machines, building upon the well known German brand, Fortschritt; and

2. PlanET, a joint venture with a leading German company in Biogas Plants engineering and building.

The CSSC, as a producer of machining parts and technical components, with highly-trained Chinese employees, was the base for the two new companies, as both require components according to German standards but produced in China.

The Company plans to use the synergies between its three brands to become a leader in green agriculture, both within China and worldwide, by providing machinery through Fortschritt and CSSC (i) for the mechanization of Chinese agriculture, (ii) for agricultural operations worldwide, and (iii) as part of a green agricultural system whereby organic agricultural waste products are converted into usable energy.

In order to carry out this plan, we estimate that we will need approximately $10 million for the next 12 months, as follows: approximately $4 million for purchasing raw material, employee wages and operating expenses until the company has sufficient income from sales to fund its operations; approximately $3.5 million for equipment, coating line and machinery; and approximately $2.5 million for research and development, including re-engineering of older model Fortschritt machines and development of new machines.

FORTSCHRITT COMPANY PROFILE |

|

Fortschritt was incorporated in December 2016 in Hong Kong and China . On May 9, 2016, Fortschritt entered into a Brand Licensing and Technology Transfer Agreement with M aschinenfabrik Stolpen Gmbh (“MAFA”) for the exclusive use, manufacturing, and sales and marketing rights of German designed agricultural machines in China under the well-known German brand name Fortschritt. A copy of the Brand Licensing and Technology Transfer Agreement is included in this registration statement as Exhibit 10.1. Pursuant to the Brand Licensing and Technology Transfer Agreement , MAFA granted to Fortschritt exclusiv e brand use rights of the “Fortschritt ” brand and brand designs for all agricultural machinery, spare parts, marketing material, and media and promotional use.

BRAND HISTORY

1. | The “Fortschritt” brand looks back on a rich history, stretching over more than 150 years of inventing, developing, and producing agricultural machines and special purpose vehicles. The foundations of the brand were laid in 1854, when August Klinger began to manufacture crop cleaning equipment in Neustadt, Saxony. Ten years later, the first moveable mower was introduced. 1896 the first straw press in the world was presented to the public. |

| |

2. | In the years between the world wars Klinger, still a family enterprise, expanded heavily, building a major production base in Neustadt and subsequently acquiring competitors and technology suppliers such as Kuettner and Hering AG in Nuremberg. |

| |

3. | Situated in Saxony, the company came under the control of the East German government in the soviet occupied part of Germany after WWII. In 1949 the “Fortschritt” brand was launched and the company nationalized. The following decades, further enterprises were put under the umbrella of the “Fortschritt” brand, culminating in the formation of a “Kombinat”, the socialist version of an integrated industrial complex in 1978. “Fortschritt” became one of East Germany’s most successful brands, its machinery was widely used throughout the eastern bloc- from the tobacco and sugar cane fields of Cuba to the Russian wheat growing plains in Europe and to the rice fields of China in the far east. Above that, the Kombinat’s machines were also exported to several western countries and “Fortschritt” became an important hard currency revenue generator for East Germany. After the collapse of the GDR, the Kombinat was reorganised by the Treuhand, the German state-owned asset administrator. At this point Jens Kroehnerts father, a direct descendant of August Klinger, purchased Maschinenfabrik Stolpen (“MAFA”), a company that had been spun off in the break-up of the Kombinat, including all plans, drawings, patents and other IPR of Kombinat Fortschritt’s machinery portfolio |

| |

4. | The other parts of the Kombinat were sold to different purchasers. In the following decade the successor companies of the Kombinat saw several changes of ownership and re-branding. In 2004, the production was ceased and the main factory in Neustadt closed down. Nowadays, MAFA is the only entity still active from the break of Kombinat Fortschritt over 25 years ago. |

MILESTONES FROM 1854 TILL NOW:

1854 | 1896 | 1945 | 1974 | 2001 |

|

|

|

|

|

Klinger’s first machine; a grain cleaning machine | Klinger received the first patent in the world for a baler machine | After WWWII started a new story as a part of the “Fortschritt” Kombinat Germany. | Small fields were put together to large farms, similar to the Chinese situation now in 2018. First export of these machines to China. | Modern agricultural machinery, sold all over the world, the Harvester E588 picture here. |

KOMBINAT FORTSCHRITT PRODUCTS 1990

(year of German Reunification, privatization and break-up of “Kombinat Fortschritt” begins)

EXAMPLES OF THE RANGE OF KOMBINAT FORTSCHRITT’S AGRICULTURAL MACHINERY:

RAKE, BALER, AND FORAGE HARVESTER

SPECIAL MACHINE SPRAYER, APPLE HARVESTER

POTATO HARVESTER, FULLY AUTOMATIC

All machines are state-of-the-art and demonstrably superior to existing Chinese equipment and harvesting techniques due to manufacturing efficiency, overall quality, and long useful life requiring minimal maintenance.

Since the 1970s almost all agricultural machines have seen only minor alteration of engineering and design features; this continues to be true for virtually all machinery manufactured and distributed today.

Kombinat Fortschritt, unlike most of its western counterparts, was organized as a fully integrated business. All engineering developments were completed by own internal design teams and all parts, to the last screw were manufactured in-house. This resulted in “Fortschritt” designs and engineering know-how being documented in detailed production drawings to the smallest part of a complex machine.

The Kombinat’s engineers had to fulfill the requirements of the socialist countries’ markets, demanding easy to maintain, durable machinery.

From the 1970s the Kombinat’s machines was also required to be suitable for export to western customers, in order to serve as hard currency spinner for the East Germany state.

At its height Kombinat Fortschritt employed more than 60,000 people in multiple locations throughout East Germany, being one of the nation’s biggest and internationally most successful enterprises.

With the end of East Germany, and the break-up of the Kombinat, the history of “Fortschritt” seemed to have come to an end, as western competitors picked up production sites and individual part producing outfits. Western competitors used their own designs and brands, and the knowledge and engineering designs of Fortschritt where ignored as they were deemed eastern, and thus unfashionable. Nevertheless, the brand continued to live on in many socialist countries, among them China, conserved through some of the original East German machines that can still be found operating in these countries.

MAFA, has since updated some of the designs acquired from Kombinat Fortschritt and used them for OEM products for companies such as Case, Fendt, Kvernerland and Kuhn.

BRAND STRENGTH AND PUBLIC AUDIENCE RECEPTION

Despite the fact that Kombinat Fortschritt was broken up more than 25 years ago, the brand is still well-known in many parts of the world and its products are widely featured and discussed on the internet, by historians, former users, agro-machine fans and collectors. On YouTube more than 252,000 videos feature Fortschritt machines. Google search Fortschritt + Landmaschinen counts 231,000 hits.

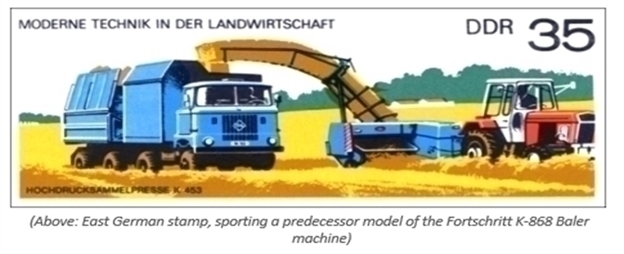

Other models by Fortschritt on the official stamps of the former GDR (East Germany): Tractor ZT 303, Beets-Toboggan-Core KS-6, Precision-Forage-Harvester E 280, Chopper-Harvester E 065

BANKNOTE: In the 70s and 80s, several “combine-harvesters” such as the Fortschritt E512

were shown on the reverse side of GDR (East Germany) banknote

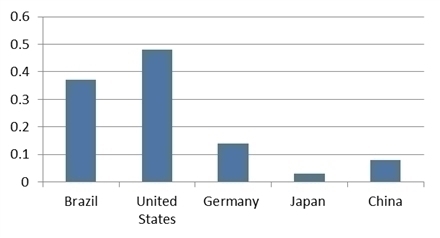

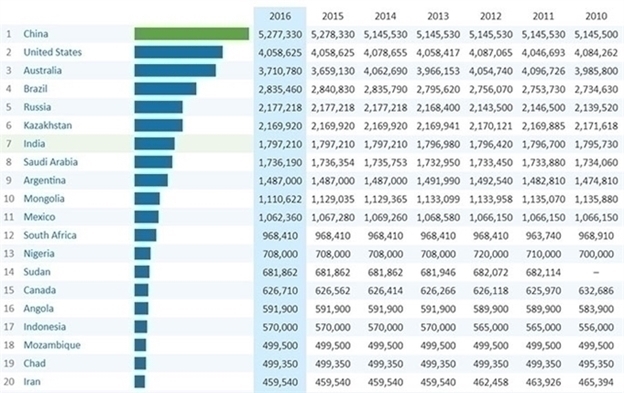

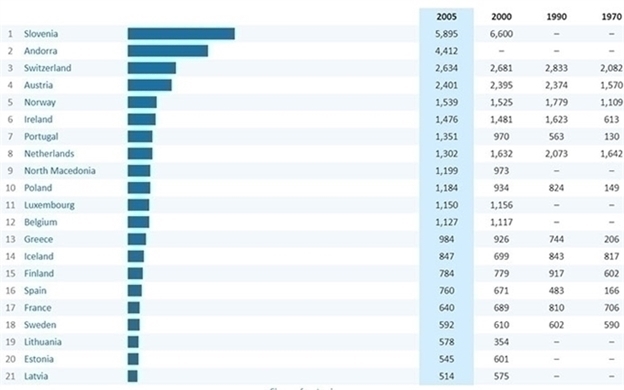

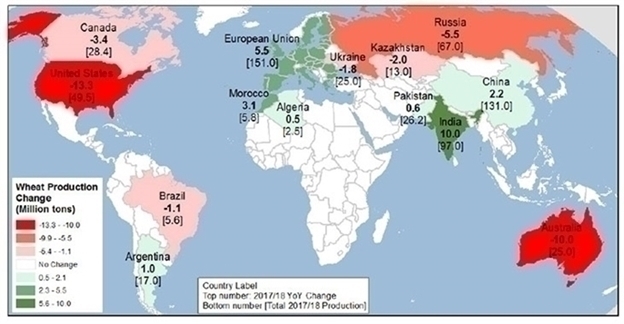

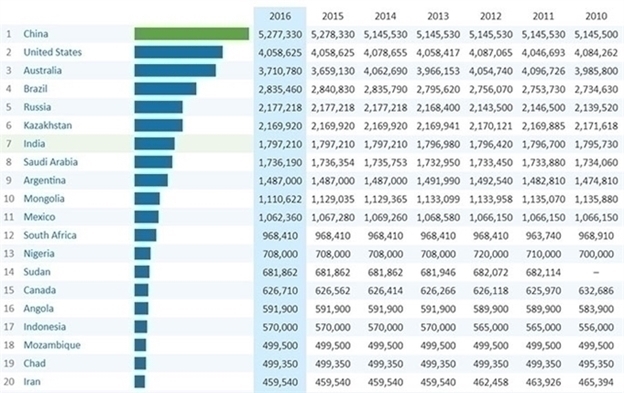

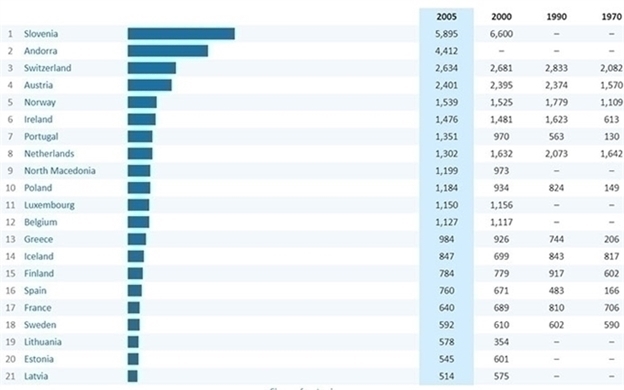

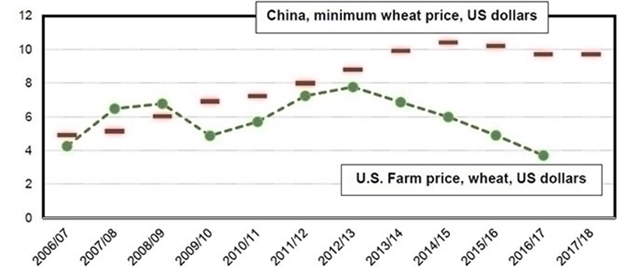

WORLDWIDE HARVESTER AND TRACTOR (ONE TYPE) EXPORT FIGURES:

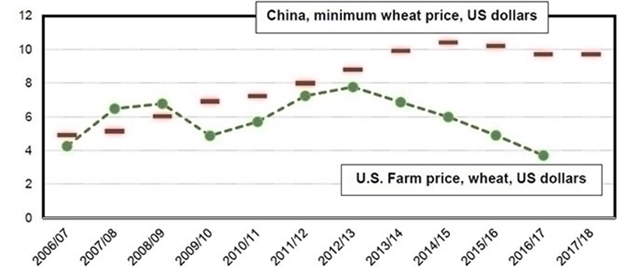

EXPORT FIGURES FOR THE K434 BALER MACHINES TO UKRAINE, RUSSIA, CUBA AND CHINA:

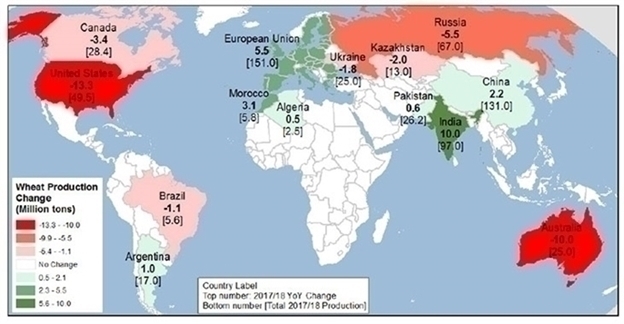

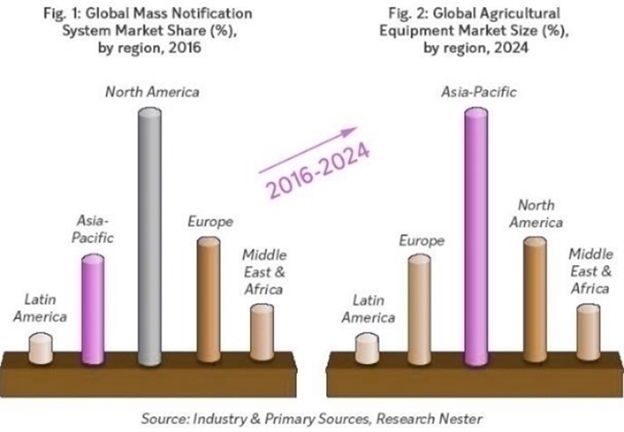

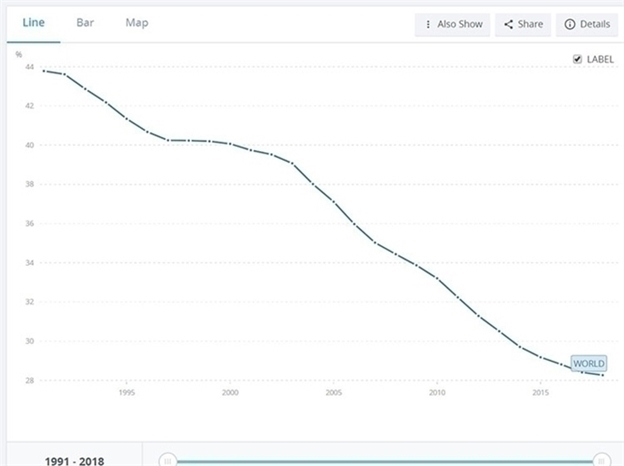

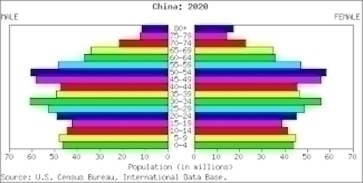

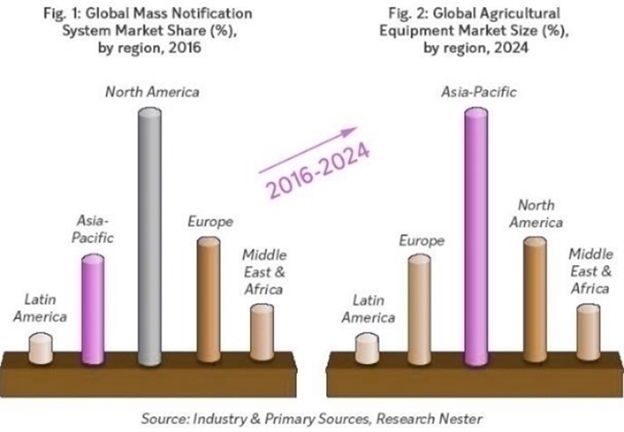

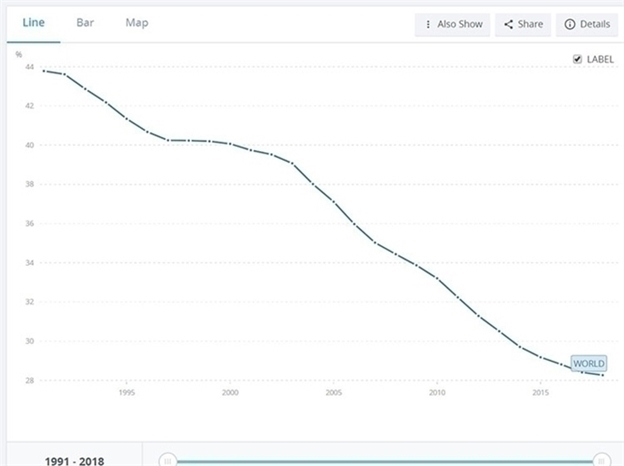

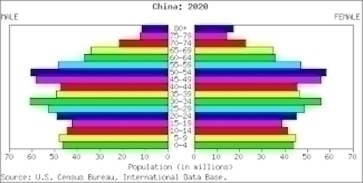

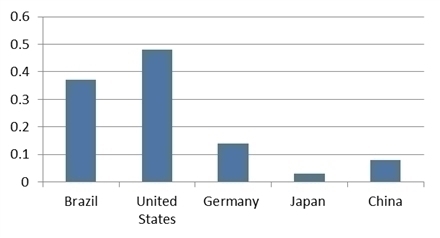

INITIAL PRODUCT FOR QINGDAO FORTSCHRITT CHINA AGRITECH CO. LTD