Incentive Plan Awards — Value Vested or Earned During the Year for Directors

No option-based or share-based awards vested for Directors, and no non-equity incentive plan compensation was earned by Directors, during the financial year ended December 31, 2022.

INDEBTEDNESS OF TRUSTEES, DIRECTORS AND EXECUTIVE OFFICERS

As at March 31, 2023, there was no indebtedness owing to Granite or any of its subsidiaries, excluding routine indebtedness, by present or former executive officers, trustees, directors or employees of Granite or any of its subsidiaries, nor was any indebtedness of any such person, excluding routine indebtedness, the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by Granite or any of its subsidiaries.

No individual who is, or at any time during the financial year ended December 31, 2022 was a trustee, a director or executive officer of Granite, no Proposed Trustee or Proposed Director, and no associate of any such trustee, director, executive officer, Proposed Trustee or Proposed Director (i) is, or at any time since January 1, 2022 has been, indebted to Granite or any of its subsidiaries whether or not under a securities purchase program or any other program, excluding routine indebtedness, or (ii) has had any indebtedness to any other entity, excluding routine indebtedness, that is, or at any time since January 1, 2022 has been, the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by Granite or any of its subsidiaries whether or not under a securities purchase program or any other program.

COMPENSATION DISCUSSION AND ANALYSIS

Unless otherwise specified or the context otherwise indicates, in this Compensation Discussion and Analysis, references to the “Board” refer to the board of directors of Granite GP.

Letter to Unitholders

Dear Granite Unitholders:

On behalf of the CGN Committee and the Board, we are pleased to share with you our approach to executive compensation for 2022, and to describe how this aligns with Granite’s strategic, financial and operational performance.

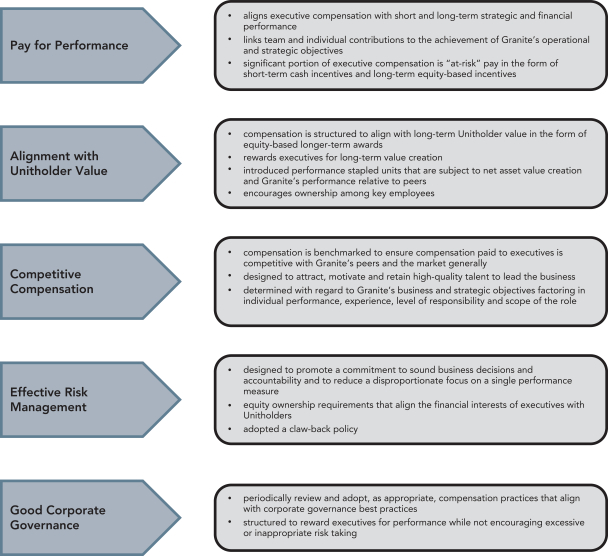

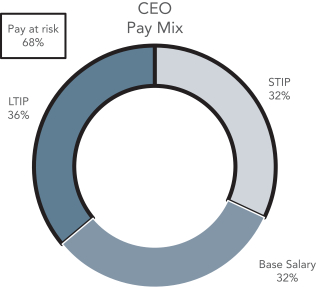

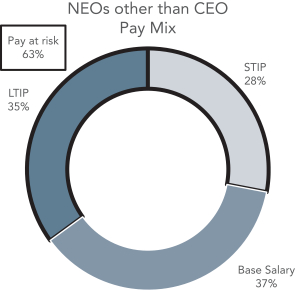

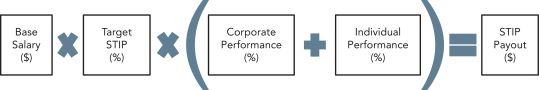

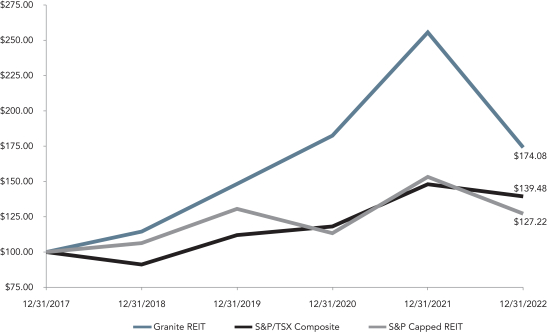

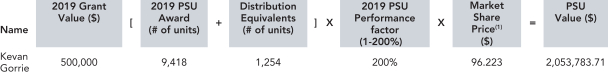

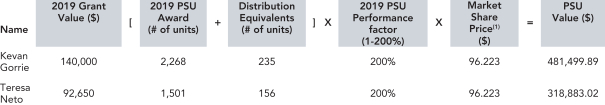

Our executive compensation program is designed to attract, motivate and retain high- achieving executives who are dedicated to the creation, protection and growth of long-term Unitholder value and to recognize and reward the successful execution of Granite’s business and strategic objectives. The CGN Committee is committed to continually reviewing and refining Granite’s approach to executive compensation to ensure that the program guides and rewards the achievement of results and is consistent with best governance practices. Granite’s short-term incentive plan (“STIP”) and long-term incentive plan (“LTIP”) are both designed to align compensation closely with Granite’s financial, operational and ESG performance. We tie a significant portion of our executive pay to the achievement of objectives that drive Unitholder value. In connection with the development of Granite’s ESG program, an increasing portion of Granite’s corporate performance goals are tied to the pursuit and achievement of Granite’s ESG objectives. The CGN Committee assesses and makes recommendations to the Board on the setting of performance measures and targets under Granite’s executive compensation program, which reflect both the short- and long-term strategic priorities of Granite. We believe that Granite is unique in the Canadian REIT marketplace due in part to its geographic reach and its listings on both the TSX and the NYSE, and the design of Granite’s compensation program reflects that.

- 25 -