UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23474)

KKR Credit Opportunities Portfolio

(Exact name of registrant as specified in charter)

555 California Street, 50th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Annette O’Donnell-Butner

KKR Credit Advisors (US) LLC

555 California Street, 50th Floor

San Francisco, CA 94104

(Name and address of agent for service)

(415) 315-3620

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2020

Date of reporting period: October 31, 2020

Item 1. Reports to Stockholders.

KKR Credit Opportunities Portfolio

Annual Report

October 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary or, if you are a direct investor, by calling the Fund at 1-855-862-6092.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call the Fund at 1-855-862-6092. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary.

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

Table of Contents

The KKR Credit Opportunities Portfolio (the “Fund”) files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT within sixty days after the end of the period. The Fund’s Form N-PORT is available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent period ended June 30 will be available (i) without charge, upon request, by calling 855- 862-6092; and (ii) on the Commission’s website at http://www.sec.gov.

INFORMATION ABOUT THE FUND’S TRUSTEES

The proxy statements and annual reports include information about the Fund’s Trustees and are available without charge, upon request, by calling 855-862-6092 and by visiting the Commission’s website at www.sec.gov.

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

Management Discussion of Fund Performance

Looking Back on the Markets — October 31, 2020

KKR Credit Opportunities Portfolio (“KCOP”) aims to dynamically allocate across credit instruments to capitalize on changes in relative value among corporate credit investments and manage against macroeconomic risks. Our portfolio seeks exposure to companies where the perception of risk may be high but our analysis leads us to believe that that risk is lower. KCOP is focused on where we believe risk or true value is misperceived by many market participants. Our predominant focus is on large companies in sectors where names are not typically over-valued. We believe KCOP is well suited to the current credit market conditions as we seek assets that we believe are dislocated or fundamentally mispriced. We believe we are well equipped to construct a robust portfolio in times of stress and provide value to portfolios that have broad credit exposure.

This pandemic has disrupted the markets in a way we have not seen since the 2008 recession. The sudden halting of our movement and business activities has created a ghost that is looming through our economy, daily routines, and for a large array of companies — uncertain future revenue streams. Although it may feel as though life has stagnated since the start of the global pandemic, we do continue to make strides forward. Healthcare professionals have become more knowledgeable on how to manage COVID-19 and the race for multiple vaccines pushes onward. Like all trying times in history, we continue to be faced with challenges every day as the world finds its footing in the midst of a thick fog of continued uncertainty. We view this road ahead as our Odyssey — a continued long journey through evolving unprecedented times. The waters ahead may sometimes be calm or volatile, but we will continue to row forward. Sometimes we will move with the current, but regardless always striving toward our destination and desired outcome. As we look back on the last six months, the market continued to inch upward and onward as the U.S. Federal Reserve’s historic intervention continued to seep through the market’s pipes and corporate issuance continued to surge.

As the Fed continues to hover over the market with their excess capacity, we believe there will be more punch to come from them and that lends itself well to risk assets. However, we do believe there will be long-term implications to the Fed’s backstop and, as a result, a longer tail for these effects to surface. The tide is shifting and the growing number of issuers will present more opportunities to begin to weave complexity back into asset allocations vis-à-vis rescue financings and workouts.

We continue to see attractive opportunities in this market that span the credit realm. We believe there will be second and third derivative effects of the dislocation which may not be overly obvious today. We also believe a multi-asset credit strategy enables investors to get exposure to a curated portfolio of credit selection layered across a blend of credit products truly affording the opportunity to be agile and more flexible in future dislocations and take advantage of differing dispersion across the market. Overall, we view the current environment as an attractive one to translate thematic macro views into executable micro level investments.

Market Commentary1

High-yield bond prices rallied in early October amid hopes for a vaccine and US stimulus bill, although came under pressure as October progressed alongside stocks amid rising infections and tougher restrictions in Europe. In addition, the market was anxious due to the lack of stimulus in the US and an upcoming election. Leveraged loan prices also rose through the first three weeks of October only to succumb to a risk-off tone in the final week. In terms of performance, the BAML High Yield Master Index II returned +0.47% in October and the S&P LSTA Leveraged Loan index returned +0.20%.

Domestically, through the first ten months of the year, a total of 87 companies have defaulted, totaling $125.9bn in bonds and loans; of which there were nine defaults totaling $11.5bn in U.S. bonds and loans in October. There have also been 18 distressed transactions totaling $10.9bn. The YTD default total of $136.7bn inclusive of

1

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

distressed exchanges ranks as the second highest annual default total on record and only trails the $2.2bn that occurred in 2009. The bond par weighted default rate for the last 12 months is 6.87% and the loan par weighted default rate for the last 12 months is 3.99%.

Capital market activity for bonds was elevated in October from a historical sense, but did slow versus August and September’s record pace. October’s new issue volume totaled $37.3bn, down from $50.9bn in September and $54.7bn in August. YTD HY gross, refinancing, and net issuance totals $387.6bn, which is up 68% from the $230.1bn that priced over the first ten months of 2019. Meanwhile, leveraged loan issuance was very active following an extended lull since February. In particular, leveraged loan issuance totaled $49.9bn in October following September’s heaviest activity ($33.7bn) since February. The year-to-date high for net issuance was $26bn in February and October’s activity marked a high since June 2018. Institutional loan new-issue volume now totals $363.1bn YTD, which is up +22% year-over-year.

U.S. CLO issuance picked up in October, as 55 deals priced for $16.3bn, following last month’s volume of $12.1bn. October’s issuance was the highest monthly total since February’s $29.0bn. Year-to-date, 282 U.S. CLOs have priced totaling $102.2bn, compared to 298 U.S. CLOs totaling $140.5bn for the same period last year (-27%).

In October, high yield mutual funds reported a $3.9bn inflow, which followed a -$7.7bn outflow in September, which was the 11th largest outflow on record and the first since March’s -$11.7bn outflow. Notably, between March and September, high yield funds reported five consecutive months of inflows totaling a combined +$59.1bn, which included the top two largest inflows on record in May +$20.5bn and April +$17.1bn. Loan funds reported their 25th consecutive outflow in October, albeit the second lowest outflow over this two-year span. October’s outflow totaled -$254mn. Loan outflows year-to-date total $26.6bn, which compares to record outflows in FY 2019 totaling $38.3bn.

The Market in Numbers1

For the period of May 1, 2020 – October 31, 2020:

| | • | | Returns: Over the six month period ending October 31, 2020, the high yield and leveraged loan markets returned +11.08%2 and +9.54%2, as measured by the Bank of America Merrill Lynch High Yield Index and the S&P LSTA Leveraged Loan Index), respectively. |

| | • | | Spreads: The option adjusted spread on the Bank of America Merrill Lynch High Yield Index ended the period at 532bps2 (October 31st, 2020). The 3-year discounted spread on the S&P LSTA Leveraged Loan Index ended the period at 585bps3 (October 31, 2020). |

| | • | | Volatility: As measured by the VIX Index, over the last six months, the VIX increased to as high as 40.8 in June 2020, before settling at 38.02 as of October 31, 2020.4 |

Fund Background and Performance

The Fund is a newly organized, diversified, closed-end management investment company that continuously offers its shares (the “Shares”) and is operated as an “interval fund.” The Fund’s investment objective is to seek to provide attractive risk-adjusted returns and high current income.

2

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

The Fund seeks to achieve its investment objectives by investing in a select portfolio with exposure to two primary credit strategies:

| | 1. | Opportunistic Credit, a conviction-based approach investing in a portfolio consisting primarily of publicly traded high yield bonds, first- and second-lien secured bank loans and structured credit (e.g., collateralized loan obligation (“CLO”) and mezzanine debt); and |

| | 2. | Private Credit, which includes directly originated hard and financial asset-based lending, corporate mezzanine debt, as well as directly originated first-lien, second-lien and unitranche senior loans to upper middle-market companies. |

Under normal market conditions, the Fund will invest at least 80% of its Managed Assets5 in senior and subordinated corporate debt and debt related instruments, including bonds, secured bank loans, convertible securities, structured products, convertible debt securities, repurchase agreements, and municipal securities.

During the initial ramp period that may continue through August 31, 2021, the Fund will invest substantially all of its assets in the Opportunistic Credit Strategy. Following that initial period, the Fund expects, under normal circumstances, to invest 70-80% of its Managed Assets in the Opportunistic Credit strategy and 20-30% of its Managed Assets in the Private Credit Strategy, though the Fund’s allocation in investments could vary from these guidelines at any time in the Fund’s discretion. Investment in the Private Credit Strategy is contingent upon the Fund first achieving sufficient scale to acquire such positions, and there can be no assurance that the Fund will ever raise sufficient assets to invest in the Private Credit Strategy. On at least a quarterly basis, the Fund’s Investment Committee will meet to, among other things, review and establish the allocation percentage between the Opportunistic Credit Strategy and Private Credit Strategy for the ensuing period. The Investment Committee will consider factors such as KKR’s macro-economic and market outlooks, assessment of the relative risk and return of each strategy, and other factors in making its determination. “Managed Assets” means the total assets of the Fund (including any assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes).

As of October 31, 2020, the Fund held 43.7% of its net assets in first and second-lien leveraged loans, 53.2% of its net assets in high-yield corporate debt, 1.1% of its net assets in collateralized loan obligations, and 0.7% of its net assets in common stock. KCOP’s investments represented obligations and equity interests in 203 positions across a diverse group of industries. The top ten issuers represented 25.6% of the Fund’s net assets while the top five industry groups represented 42.0% of the Fund’s net assets. The Fund’s Securities and Exchange Commission 30-day yield for Class I, Class T, and Class U respectively, was 7.23%, 6.47% and 0.00%.

| 1 | Source: Source: S&P/LSTA LCD Index Monthly and JPM High Yield Bond and Leveraged Loan Market Monitor as of October 31, 2020. |

| 2 | Source: Bank of America Merrill Markets and S&P/LSTA Bloomberg data as of October 31, 2020. |

| 3 | Source: S&P LCD Discounted Spreads as of October 31, 2020. |

| 4 | Source: Bloomberg as of October 31, 2020. |

| 5 | “Managed Assets” means the total assets of the Fund (including any assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes). |

3

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

Business Updates

We thank you for your partnership and continued investment in KCOP. We look forward to continued communications and will keep you apprised of the progress of KCOP specifically and the leveraged finance market place generally. Fund information is available on our website at kkrfunds.com/KCOP.

Disclosures

The Bank of America Merrill Lynch High Yield Master II Index is a market-value weighted index of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. “Yankee” bonds (debt of foreign issuers issued in the U.S. domestic market) are included in the Bank of America Merrill Lynch High Yield Master II Index provided that the issuer is domiciled in a country having investment grade foreign currency long-term debt rating. Qualifying bonds must have maturities of one year or more, a fixed coupon schedule and minimum outstanding of US$100 million. In addition, issues having a credit rating lower than BBB3, but not in default, are also included.

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX) reflects the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. The VIX reflects the market’s estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes. The first and second month expirations are used until 8 days from expiration, then the second and third are used.

The S&P/LSTA Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. The Index was rolled out in 2000 and it was back-loaded with four years of data dating to 1997.

It is not possible to invest directly in an index.

Past performance is not an indication of future results. Returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, expense limitations and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when sold, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. An investment in the Fund involves risk, including the risk of loss of principal. For a discussion of the Fund’s risks, see Risk Considerations, Note 3 to the financial statements. Call 855-330-3927 for performance results current to the most recent calendar quarter-end.

Must be preceded or accompanied by a prospectus.

An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non–payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Borrowing to increase investments (leverage) will exaggerate the effect of any increase or decrease in the value of Fund investments. Investments rated below investment grade (typically referred to as “junk”) are generally subject to greater price volatility and illiquidity than higher rated investments. As interest rates rise, the value of certain income investments is likely to decline. Senior loans are subject to prepayment risk. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market economic, political, regulatory, geopolitical or other conditions. Changes in the value of investments entered for hedging purposes may not match those of the position being hedged. The Fund may engage in other investment practices that may involve additional risks.

4

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | |

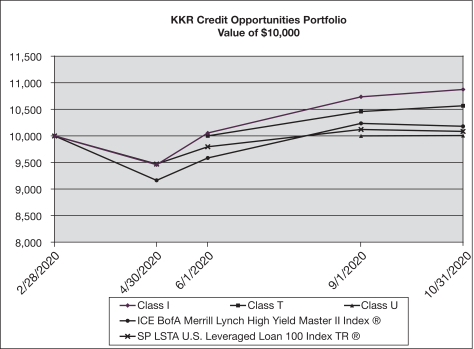

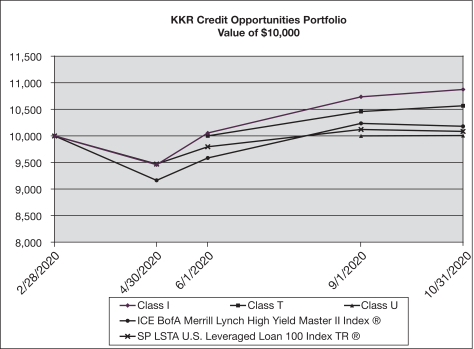

Average Annual Total Returns Period Ended October 31, 2020 | | Since Inception | | | Value of

$10,000

10/31/2020 | |

KKR Credit Opportunities Portfolio | | | | | | | | |

Class I (02/28/2020) | | | 8.71% | | | $ | 10,871 | |

Class T (06/01/2020) | | | 5.67% | | | | 10,567 | |

Class U (09/01/2020) | | | — | | | $ | 10,004 | |

ICE BofA Merrill Lynch High Yield Master II Index® | | | 1.78% | | | $ | 10,178 | |

SP LSTA U.S. Leveraged Loan 100 Index TR | | | 0.85% | | | $ | 10,085 | |

Total return assumes a purchase of common stock at the net asset value on the first day and a sale at the net asset value on the last day of each period reported on the table. Total return assumes reinvestment of dividends and distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan.

5

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

Schedule of Investments

| | | | | | | | | | |

| | | | | Par† | | | Value | |

Leveraged Loans - 43.7% | | | | | | | | | | |

| | | |

Aerospace & Defense - 3.0% | | | | | | | | | | |

| | | |

EaglePicher Technologies, LLC, TL 2L 02/18 | | | | | | | | | | |

| | | |

7.398% (1 Month US LIBOR + 7.250%), 03/08/2026 (a) | | | | | 62,000 | | | $ | 58,487 | |

| | |

Ontic Engineering & Manufacturing, Inc., TL 1L B-DD 10/19 | | | | | | |

| | | |

4.970% (3 Month US LIBOR + 4.750%), 10/31/2026 (a) | | | | | 11,338 | | | | 11,215 | |

| | |

Ontic Engineering & Manufacturing, Inc., TL 1L B 10/19 | | | | | | |

| | | |

4.970% (3 Month US LIBOR + 4.750%), 10/30/2026 (a) | | | | | 72,561 | | | | 71,776 | |

| | |

Sequa Corp. | | | | | | |

| | | |

10.500% (3 Month US LIBOR + 10.750%), 07/31/2025 (a)(d)(e)(h) | | | | | 403,860 | | | | 407,899 | |

| | | |

Sequa Corp., TL 1L 07/20 | | | | | | | | | | |

| | | |

7.750% (3 Month US LIBOR + 6.750%), 11/28/2023 (a)(h) | | | | | 2,470,247 | | | | 2,343,647 | |

| | | |

Sequa Corp., TL 2L 07/20 | | | | | | | | | | |

| | | |

11.750% (3 Month US LIBOR + 4.000%), 04/28/2024 (a)(h) | | | | | 931,985 | | | | 745,588 | |

| | |

Standard Aero Ltd., TL 1L 04/19 | | | | | | |

| | | |

3.720% (3 Month US LIBOR + 3.500%), 04/06/2026 (a) | | | | | 4,697 | | | | 4,220 | |

| | | |

Standard Aero Ltd., TL 1L 02/20 | | | | | | | | | | |

| | | |

3.720% (3 Month US LIBOR + 3.500%), 04/06/2026 (a) | | | | | 2,525 | | | | 2,269 | |

| | | | | | | | | | |

| | | | | | | | | 3,645,101 | |

| | | | | | | | | | |

| | | |

Auto Components - 1.0% | | | | | | | | | | |

| | | |

Innovative XCessories & Services LLC, TL 1L 02/20 | | | | | | | | | | |

| | | |

6.000% (3 Month US LIBOR + 5.000%), 03/05/2027 (a) | | | | | 1,244,900 | | | | 1,232,762 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | |

Building Products - 0.4% | | | | | | |

| | |

MI Windows and Doors, Inc., TL 1L 10/19 | | | | | | |

| | | |

6.500% (1 Month US LIBOR + 5.500%), 11/06/2026 (a) | | | | | 467,245 | | | | 467,245 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | |

Chemicals - 3.4% | | | | | | |

| | |

Allnex USA, Inc. TL 1L B 05/16 EUR | | | | | | |

| | | |

3.250% (3 Month EURIBOR + 3.250%), 09/13/2023 (a)(b) | | EUR | | | 539,098 | | | | 606,147 | |

| | |

Aruba Investments, Inc., TL 2L 10/20 | | | | | | |

| | | |

7.750%, 10/28/2028 (a)(c)(d) | | | | | 465,220 | | | | 463,475 | |

| | |

Diversey, Inc., TL 1L 07/17 | | | | | | |

| | | |

3.214% (3 Month US LIBOR + 3.000%), 09/06/2024 (a) | | | | | 347,943 | | | | 333,851 | |

| | |

Flint Group GmbH, TL 1L B 04/14 EUR | | | | | | |

| | | |

5.000% (3 Month EURIBOR + 4.250%), 09/21/2023 (a)(b) | | EUR | | | 701,080 | | | | 730,338 | |

| | |

Flint Group GmbH, TL 1L B3 05/15 EUR | | | | | | |

| | | |

5.000% (3 Month EURIBOR + 4.250%), 09/21/2023 (a)(b) | | EUR | | | 77,036 | | | | 80,244 | |

| | |

Flint Group GmbH, TL 1L B4 11/15 EUR | | | | | | |

| | | |

5.000% (3 Month EURIBOR + 0.000%), 09/21/2023 (a)(b) | | EUR | | | 54,214 | | | | 56,471 | |

| | | |

Invictus, TL 2L 05/18 | | | | | | | | | | |

| | | |

6.897% (1 Month US LIBOR + 6.750%), 03/30/2026 (a) | | | | | 39,000 | | | | 36,538 | |

| | |

New Arclin US Holding Corp. | | | | | | |

| | | |

9.750% (1 Month US LIBOR + 8.750%), 02/14/2025 (a) | | | | | 9,000 | | | | 8,483 | |

See accompanying notes to financial statements.

6

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

SI Group, Inc. | | | | | | |

| | | |

4.897% (3 Month US LIBOR + 4.750%), 10/15/2025 (a) | | | | | 475,536 | | | $ | 458,892 | |

| | |

Vantage Specialty Chemicals, Inc., TL 2L 10/17 | | | | | | |

| | | |

9.250% (6 Month US LIBOR + 8.250%), 10/27/2025 (a) | | | | | 457,050 | | | | 359,262 | |

| | |

Vantage Specialty Chemicals, Inc., TL 1L B 10/17 | | | | | | |

| | | |

4.500% (6 Month US LIBOR + 3.500%), 10/26/2024 (a) | | | | | 1,008,267 | | | | 928,865 | |

| | | | | | | | | | |

| | | | | 4,062,566 | |

| | | | | | | | | | |

| | | |

Commercial Services & Supplies - 1.5% | | | | | | | | | | |

| | | |

Access CIG, LLC, TL 2L 02/18 | | | | | | | | | | |

| | | |

7.975% (1 Month US LIBOR + 7.750%), 02/27/2026 (a) | | | | | 143,000 | | | | 135,850 | |

| | | |

Access CIG, LLC, TL 1L 02/18 | | | | | | | | | | |

| | | |

3.975% (3 Month US LIBOR + 3.750%), 02/27/2025 (a) | | | | | 38,702 | | | | 37,691 | |

| | | |

Monitronics International, Inc., TL 1L EXIT 08/19 | | | | | | | | | | |

| | | |

7.750% (1 Month US LIBOR + 6.500%), 03/29/2024 (a) | | | | | 538,917 | | | | 427,992 | |

| | | |

VFS Global Services Pvt Ltd., TL 1L B 06/17 GBP | | | | | | | | | | |

| | | |

4.078%, 07/29/2024 (a)(b) | | GBP | | | 1,141,330 | | | | 1,278,987 | |

| | | | | | | | |

| | | | | | | | | 1,880,520 | |

| | | | | | | | |

| | | |

Construction & Engineering - 3.1% | | | | | | | | | | |

| | | |

Brand Energy & Infrastructure Services, Inc., TL 1L 05/17 | | | | | | | | | | |

| | | |

5.250% (3 Month US LIBOR + 4.250%), 06/21/2024 (a) | | | | | 1,078,192 | | | | 1,008,449 | |

| | | |

Total Safety US, Inc., TL 1L B 07/19 | | | | | | | | | | |

| | | |

7.000% (3 Month US LIBOR + 6.000%), 08/16/2025 (a) | | | | | 1,289,864 | | | | 1,230,531 | |

| | | |

Yak Access, LLC, TL 1L B 05/18 | | | | | | | | | | |

| | | |

5.223% (3 Month US LIBOR + 5.000%), 07/11/2025 (a) | | | | | 1,757,991 | | | | 1,489,167 | |

| | | | | | | | |

| | | | | | | | | 3,728,147 | |

| | | | | | | | |

| | | |

Construction Materials - 0.1% | | | | | | | | | | |

| | | |

Quimper AB, TL 2L 02/19 EUR | | | | | | | | | | |

| | | |

8.250% (3 Month EURIBOR + 8.250%), 02/15/2027 (a)(b) | | EUR | | | 94,000 | | | | 106,329 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Distributors - 0.3% | | | | | | | | | | |

| | | |

Distribution International, Inc., TL 1L 06/19 | | | | | | | | | | |

| | | |

6.750% (3 Month US LIBOR + 5.750%), 12/15/2023 (a) | | | | | 451,570 | | | | 410,929 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Diversified Consumer Services - 1.9% | | | | | | | | | | |

| | | |

Airbnb, Inc., TL 1L 03/20 | | | | | | | | | | |

| | | |

8.500% (3 Month US LIBOR + 7.500%), 04/17/2025 (a) | | | | | 241,864 | | | | 257,989 | |

| | | |

Conservice Midco LLC, TL 1L B 05/20 | | | | | | | | | | |

| | | |

4.470% (3 Month US LIBOR + 4.250%), 05/13/2027 (a) | | | | | 33,783 | | | | 33,192 | |

| | | |

Jostens, Inc., TL 1L 12/18 | | | | | | | | | | |

| | | |

5.720% (6 Month US LIBOR + 5.500%), 12/19/2025 (a) | | | | | 1,897,557 | | | | 1,790,526 | |

| | | |

Learning Care Group Inc.,TL 1L B 05/20 | | | | | | | | | | |

| | | |

9.500% (3 Month US LIBOR + 8.500%), 03/13/2025 (a) | | | | | 281,155 | | | | 283,967 | |

| | | | | | | | | | |

| | | | | | | | | 2,365,674 | |

| | | | | | | | | | |

| | | |

Diversified Telecommunication Services - 0.2% | | | | | | | | | | |

| | | |

Peak 10 Holding Corp., TL 1L 07/17 | | | | | | | | | | |

| | | |

3.720% (3 Month US LIBOR + 3.500%), 08/01/2024 (a) | | | | | 315,560 | | | | 275,721 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

7

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Electronic Equipment, Instruments & Components - 1.2% | | | | | | | | | | |

| | | |

Excelitas Technologies Corp., TL 2L 10/17 | | | | | | | | | | |

| | | |

8.500% (3 Month US LIBOR + 7.500%), 12/01/2025 (a) | | | | | 1,488,868 | | | $ | 1,477,240 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Energy Equipment & Services - 0.2% | | | | | | | | | | |

| | | |

Caprock Midstream, LLC, TL 1L B 10/18 | | | | | | | | | | |

| | | |

4.898% (1 Month US LIBOR + 4.750%), 11/03/2025 (a) | | | | | 144,900 | | | | 103,023 | |

| | | |

ChampionX Corp., TL 1L B 05/20 | | | | | | | | | | |

| | | |

6.000% (6 Month US LIBOR + 0.000%), 06/03/2027 (a) | | | | | 81,844 | | | | 81,708 | |

| | | | | | | | | | |

| | | | | | | | | 184,731 | |

| | | | | | | | | | |

| | | |

Food & Staples Retailing - 0.2% | | | | | | | | | | |

| | | |

Froneri Ltd., TL 2L 01/20 | | | | | | | | | | |

| | | |

5.897% (1 Month US LIBOR + 5.750%), 01/31/2028 (a)(b) | | | | | 60,000 | | | | 59,700 | |

| | | |

Smart & Final Stores LLC, TL 1L B 05/19 | | | | | | | | | | |

| | | |

6.966% (1 Month US LIBOR + 6.750%), 06/20/2025 (a) | | | | | 193,784 | | | | 195,480 | |

| | | | | | | | | | |

| | | | | | | | | 255,180 | |

| | | | | | | | | | |

| | | |

Food Products - 1.1% | | | | | | | | | | |

| | | |

CSM Bakery Products, TL 2L 07/13 | | | | | | | | | | |

| | | |

11.000% (3 Month US LIBOR + 10.000%), 02/04/2022 (a) | | | | | 77,087 | | | | 74,486 | |

| | | |

CSM Bakery Products, TL 1L B 07/13 | | | | | | | | | | |

| | | |

7.250% (3 Month US LIBOR + 6.250%), 01/04/2022 (a) | | | | | 1,286,178 | | | | 1,272,113 | |

| | | | | | | | | | |

| | | | | | | | | 1,346,599 | |

| | | | | | | | | | |

| | | |

Health Care Equipment & Supplies - 0.4% | | | | | | | | | | |

| | | |

DeVilbiss Healthcare LLC, TL 1L B 11/16 | | | | | | | | | | |

| | | |

8.500% (US LIBOR + 5.500%), 01/03/2023 (a) | | | | | 410,100 | | | | 302,448 | |

| | | |

Orchid Orthopedic Solutions LLC, TL 1L 02/19 | | | | | | | | | | |

| | | |

4.720% (3 Month US LIBOR + 4.500%), 03/05/2026 (a) | | | | | 147,247 | | | | 135,222 | |

| | | | | | | | | | |

| | | | | | | | | 437,670 | |

| | | | | | | | | | |

| | | |

Health Care Providers & Services - 0.4% | | | | | | | | | | |

| | | |

Affordable Care Inc., TL 1L 10/15 | | | | | | | | | | |

| | | |

5.750% (3 Month US LIBOR + 4.750%), 10/24/2022 (a) | | | | | 428,994 | | | | 398,248 | |

| | | |

Paradigm Acquistion Corp., TL 2L 10/18 LC | | | | | | | | | | |

| | | |

7.720% (3 Month US LIBOR + 7.500%), 10/26/2026 (a) | | | | | 30,000 | | | | 26,950 | |

| | | |

US Anesthesia Partners, Inc., TL 1L B 01/18 | | | | | | | | | | |

| | | |

4.000% (6 Month US LIBOR + 3.000%), 06/23/2024 (a) | | | | | 55,404 | | | | 52,129 | |

| | | | | | | | | | |

| | | | | | | | | 477,327 | |

| | | | | | | | | | |

| | | |

Hotels, Restaurants & Leisure - 6.7% | | | | | | | | | | |

| | | |

Aimbridge Acquisition Co, Inc., TL 1L B 09/20 | | | | | | | | | | |

| | | |

6.750% (3 Month US LIBOR + 6.000%), 02/02/2026 (a) | | | | | 413,880 | | | | 409,741 | |

| | | |

Aimbridge Acquisition Co, Inc., TL 1L B 10/19 | | | | | | | | | | |

| | | |

3.902% (1 Month US LIBOR + 3.750%), 02/02/2026 (a) | | | | | 1,219,674 | | | | 1,077,381 | |

| | | |

B&B Hotels SAS, TL l B3A 01/20 EUR | | | | | | | | | | |

| | | |

3.875% (6 Month EURIBOR + 3.875%), 07/31/2026 (a)(b) | | EUR | | | 1,121,450 | | | | 1,116,918 | |

See accompanying notes to financial statements.

8

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

ClubCorp Club Operations, Inc., TL 1L B 08/17 | | | | | | | | | | |

| | | |

2.970% (3 Month US LIBOR + 2.750%), 09/18/2024 (a) | | | | | 1,023,586 | | | $ | 866,209 | |

| | | |

Diamond Resorts International, Inc., TL 1L B 06/18 | | | | | | | | | | |

| | | |

4.750% (1 Month US LIBOR + 3.750%), 09/02/2023 (a) | | | | | 1,005,214 | | | | 908,286 | |

| | | |

Life Time Fitness, Inc., TL B 1L 01/17 | | | | | | | | | | |

| | | |

3.750% (6 Month US LIBOR + 2.750%), 06/10/2022 (a) | | | | | 2,799,200 | | | | 2,594,523 | |

| | | |

Piolin BidCo SAU, TL 1L B 05/20 EUR | | | | | | | | | | |

| | | |

7.500% (3 Month EURIBOR + 7.500%), 05/26/2024 (a)(b) | | EUR | | | 539,891 | | | | 591,055 | |

| | | |

SMG US Midco 2, Inc., TL 1L 01/20 | | | | | | | | | | |

| | | |

2.727% (1 Month US LIBOR + 2.500%), 01/23/2025 (a) | | | | | 83,070 | | | | 70,887 | |

| | | |

United PF Holdings LLC, TL 1L 01/20 | | | | | | | | | | |

| | | |

4.216% (3 Month US LIBOR + 4.000%), 12/30/2026 (a) | | | | | 689,125 | | | | 606,430 | |

| | | | | | | | | | |

| | | | | | | | | 8,241,430 | |

| | | | | | | | | | |

| | | |

Household Products - 0.3% | | | | | | | | | | |

| | | |

Steinhoff, TL 1L 07/19 (SFH Super Senior) | | | | | | | | | | |

| | | |

10.000%, 12/31/2021 (b)(h) | | EUR | | | 9,455 | | | | 10,847 | |

| | | |

Steinhoff, TL 1L 08/19 (SFH 1) | | | | | | | | | | |

| | | |

0.000% (3 Month EURIBOR + 0.000%), 12/31/2021 (b)(g)(h) | | EUR | | | 635,586 | | | | 395,284 | |

| | | | | | | | | | |

| | | | | | | | | 406,131 | |

| | | | | | | | | | |

| | | |

Industrial Conglomerates - 0.1% | | | | | | | | | | |

| | | |

Unifrax I LLC / Unifrax Holding Co., TL 1L B 10/18 USD | | | | | | | | | | |

| | | |

3.970% (6 Month US LIBOR + 3.750%), 12/12/2025 (a) | | | | | 110,159 | | | | 97,725 | |

| | | |

Unifrax I LLC / Unifrax Holding Co., TL 1L B 11/18 EUR | | | | | | | | | | |

| | | |

3.750% (3 Month EURIBOR + 3.750%), 12/12/2025 (a) | | EUR | | | 25,000 | | | | 24,985 | |

| | | | | | | | | | |

| | | | | | | | | 122,710 | |

| | | | | | | | | | |

| | | |

IT Services - 0.1% | | | | | | | | | | |

| | | |

PSAV, Inc., TL 2L 02/18 | | | | | | | | | | |

| | | |

8.250% (3 Month US LIBOR + 7.250%), 09/01/2025 (a) | | | | | 189,000 | | | | 80,136 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Leisure Products - 0.7% | | | | | | | | | | |

| | | |

Areas Worldwide SASU, TL 1L B1 06/19 | | | | | | | | | | |

| | | |

4.750% (3 Month EURIBOR + 4.750%), 07/01/2026 (a)(b) | | EUR | | | 875,023 | | | | 828,727 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Life Sciences Tools & Services - 0.4% | | | | | | | | | | |

| | | |

Albany Molecular Research, Inc., TL 1L 07/17 | | | | | | | | | | |

| | | |

4.250% (3 Month US LIBOR + 3.250%), 08/30/2024 (a) | | | | | 307,254 | | | | 303,446 | |

| | | |

BioClinica-Synowledge Holdings Corp., TL 1L 10/16 | | | | | | | | | | |

| | | |

5.250% (1 Month US LIBOR + 4.500%), 10/20/2023 (a) | | | | | 236,853 | | | | 229,748 | |

| | | | | | | | | | |

| | | | | | | | | 533,194 | |

| | | | | | | | | | |

| | | |

Machinery - 1.6% | | | | | | | | | | |

| | | |

Accuride Corp.m TL 1L B 10/17 | | | | | | | | | | |

| | | |

6.250% (3 Month US LIBOR + 5.250%), 11/17/2023 (a) | | | | | 521,725 | | | | 440,531 | |

| | | |

CPM Holdings, Inc., TL 2L 10/18 | | | | | | | | | | |

| | | |

8.399% (1 Month US LIBOR + 8.250%), 11/16/2026 (a) | | | | | 92,000 | | | | 84,564 | |

See accompanying notes to financial statements.

9

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Utility One Source LP, TL 1L B 02/20 | | | | | | | | | | |

| | | |

4.399% (1 Month US LIBOR + 4.250%), 04/18/2025 (a) | | | | | 626,748 | | | $ | 624,006 | |

| | | |

Welbilt, Inc. (Manitowoc Foodservice Inc), TL 1L B 10/18 | | | | | | | | | | |

| | | |

2.647% (1 Month US LIBOR + 2.500%), 10/23/2025 (a) | | | | | 583,820 | | | | 536,507 | |

| | | |

WireCo WorldGroup, Inc., TL 1L 07/16 | | | | | | | | | | |

| | | |

10.000% (6 Month US LIBOR + 9.000%), 09/30/2024 (a) | | | | | 239,000 | | | | 184,030 | |

| | | |

WireCo WorldGroup, Inc., TL 12L 07/16 | | | | | | | | | | |

| | | |

6.000% (6 Month US LIBOR + 5.000%), 09/29/2023 (a) | | | | | 87,691 | | | | 77,395 | |

| | | | | | | | | | |

| | | | | | | | | 1,947,033 | |

| | | | | | | | | | |

| | | |

Media - 2.2% | | | | | | | | | | |

| | | |

Emerald Expositions Holding, Inc., Tl 1L B 11/17 | | | | | | | | | | |

| | | |

2.647% (1 Month US LIBOR + 2.500%), 05/22/2024 (a) | | | | | 8,370 | | | | 7,600 | |

| | | |

NEP Broadcasting, LLC, TL 1L 05/20 | | | | | | | | | | |

| | | |

9.250% (1 Month US LIBOR + 0.000%), 06/01/2025 (a)(d)(e) | | | | | 122,952 | | | | 124,796 | |

| | | |

NEP Broadcasting, LLC, TL 1L 05/20 DD | | | | | | | | | | |

| | | |

0.000%, 06/01/2025 (a)(d)(e)(i) | | | | | 30,815 | | | | 462 | |

| | | |

NEP Broadcasting, LLC, TL 2L 09/18 | | | | | | | | | | |

| | | |

7.148% (1 Month US LIBOR + 7.000%), 10/19/2026 (a) | | | | | 393,000 | | | | 318,821 | |

| | | |

NEP Broadcasting, LLC, TL 1L B 09/18 EUR | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.500%), 10/20/2025 (a) | | EUR | | | 1,219,952 | | | | 1,269,969 | |

| | | |

NEP Broadcasting, LLC, TL 1L B 09/18 | | | | | | | | | | |

| | | |

3.397% (1 Month US LIBOR + 3.250%), 10/20/2025 (a) | | | | | 1,069,560 | | | | 970,327 | |

| | | | | | | | | | |

| | | | | | | | | 2,691,975 | |

| | | | | | | | | | |

| | | |

Metals & Mining - 0.1% | | | | | | | | | | |

| | | |

Foresight Energy LLC, TL 1L A 06/20 (Exit) | | | | | | | | | | |

| | | |

9.500% (3 Month US LIBOR + 8.000%), 06/30/2027 (a)(c)(d)(e) | | | | | 150,409 | | | | 150,409 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Multiline Retail - 0.3% | | | | | | | | | | |

| | | |

Belk, Inc., TL 1L B 10/19 | | | | | | | | | | |

| | | |

7.750% (6 Month US LIBOR + 6.750%), 07/31/2025 (a) | | | | | 1,192,151 | | | | 415,763 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Oil, Gas & Consumable Fuels - 0.2% | | | | | | | | | | |

| | | |

Eagleclaw Midstream Ventures, TL 1L 05/17 | | | | | | | | | | |

| | | |

5.250% (3 Month US LIBOR + 4.250%), 06/24/2024 (a) | | | | | 220,292 | | | | 182,567 | |

| | | |

Oryx Midstream Services, LLC, TL 1L B 04/19 | | | | | | | | | | |

| | | |

4.147% (3 Month US LIBOR + 4.000%), 05/08/2026 (a) | | | | | 10,917 | | | | 9,962 | |

| | | | | | | | | | |

| | | | | | | | | 192,529 | |

| | | | | | | | | | |

| | | |

Personal Products - 1.1% | | | | | | | | | | |

| | | |

Coty Inc., TL 1L B 03/18 EUR | | | | | | | | | | |

| | | |

2.500% (1 Month EURIBOR + 2.500%), 04/05/2025 (a) | | EUR | | | 49,039 | | | | 52,509 | |

| | | |

Coty Inc., TL 1L B 04/18 USD | | | | | | | | | | |

| | | |

2.390% (1 Month US LIBOR + 2.250%), 04/07/2025 (a) | | | | | 1,150,653 | | | | 1,012,845 | |

| | | |

Coty Inc., TL 1L A 04/18 USD | | | | | | | | | | |

| | | |

1.890% (1 Month US LIBOR + 1.750%), 04/05/2023 (a) | | | | | 229,049 | | | | 209,580 | |

| | | |

Coty, Inc., TL 1L 04/18 EUR | | | | | | | | | | |

| | | |

1.750% (1 Month EURIBOR + 0.000%), 04/05/2023 (a) | | EUR | | | 104,885 | | | | 114,927 | |

| | | | | | | | | | |

| | | | | | | | | 1,389,861 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

10

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Professional Services - 0.3% | | | | | | | | | | |

| | | |

SIRVA Worldwide, Inc., TL 2L 07/18 | | | | | | | | | | |

| | | |

9.745% (3 Month US LIBOR + 9.500%), 08/03/2026 (a) | | | | | 59,000 | | | $ | 42,185 | |

| | | |

SIRVA Worldwide, Inc., TL 1L 07/18 | | | | | | | | | | |

| | | |

5.676% (3 Month US LIBOR + 5.500%), 08/04/2025 (a) | | | | | 431,371 | | | | 359,476 | |

| | | | | | | | | | |

| | | | | | | | | 401,661 | |

| | | | | | | | | | |

| | | |

Road & Rail - 2.6% | | | | | | | | | | |

| | | |

Kenan Advantage Group, Inc./The, TL 1L B2 07/15 Canadian Borrower | | | | | | | | | | |

| | | |

4.000% (1 Month US LIBOR + 3.000%), 07/31/2022 (a) | | | | | 581,365 | | | | 562,802 | |

| | | |

Kenan Advantage Group, Inc./The, TL 1L B1 07/15 | | | | | | | | | | |

| | | |

4.000% (1 Month US LIBOR + 3.000%), 07/31/2022 (a) | | | | | 2,509,935 | | | | 2,429,793 | |

| | | |

Transplace, TL 2L 09/17 | | | | | | | | | | |

| | | |

9.750% (6 Month US LIBOR + 8.750%), 10/06/2025 (a) | | | | | 180,000 | | | | 164,700 | |

| | | | | | | | | | |

| | | | | | | | | 3,157,295 | |

| | | | | | | | | | |

| | | |

Software - 4.4% | | | | | | | | | | |

| | | |

Applied Systems, Inc., TL 2L 09/17 | | | | | | | | | | |

| | | |

8.000% (3 Month US LIBOR + 7.000%), 09/19/2025 (a) | | | | | 236,000 | | | | 238,613 | |

| | | |

Gigamon, Inc., TL 1L 11/17 | | | | | | | | | | |

| | | |

5.250% (6 Month US LIBOR + 4.500%), 12/27/2024 (a) | | | | | 621,973 | | | | 614,199 | |

| | | |

Misys Ltd., TL 2L 04/17 USD | | | | | | | | | | |

| | | |

8.250% (6 Month US LIBOR + 7.250%), 06/13/2025 (a) | | | | | 846,869 | | | | 828,873 | |

| | | |

Misys Ltd., TL 2L 04/17 USD | | | | | | | | | | |

| | | |

4.500% (6 Month US LIBOR + 3.500%), 06/13/2024 (a) | | | | | 1,945,720 | | | | 1,840,864 | |

| | | |

Syncsort, Inc., TL 1L B 10/19 (Add-on) | | | | | | | | | | |

| | | |

7.000% (3 Month US LIBOR + 6.000%), 08/16/2024 (a) | | | | | 214,920 | | | | 212,234 | |

| | | |

Syncsort, Inc., TL 1L B 11/18 | | | | | | | | | | |

| | | |

6.506% (3 Month US LIBOR + 6.250%), 08/16/2024 (a) | | | | | 154,215 | | | | 151,388 | |

| | | |

TIBCO Software, Inc., TL 2L 02/20 | | | | | | | | | | |

| | | |

7.400% (1 Month US LIBOR + 7.750%), 03/03/2028 (a) | | | | | 1,585,880 | | | | 1,558,127 | |

| | | | | | | | | | |

| | | | | | | | | 5,444,298 | |

| | | | | | | | | | |

| | | |

Specialty Retail - 1.1% | | | | | | | | | | |

| | | |

Douglas Holding AG, TL 1L B1 08/17 | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.500%), 08/12/2022 (a)(b) | | EUR | | | 387,783 | | | | 385,767 | |

| | | |

Douglas Holding AG, TL 1L B2 08/17 | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.500%), 08/12/2022 (a)(b) | | EUR | | | 106,379 | | | | 105,826 | |

| | | |

Douglas Holding AG, TL 1L B3 08/17 | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.250%), 08/12/2022 (a)(b) | | EUR | | | 245,864 | | | | 244,586 | |

| | | |

Douglas Holding AG, TL 1L B4 08/17 | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.500%), 08/12/2022 (a)(b) | | EUR | | | 131,425 | | | | 130,742 | |

| | | |

Douglas Holding AG, TL 1L B5 08/17 | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.500%), 08/12/2022 (a)(b) | | EUR | | | 39,870 | | | | 39,662 | |

| | | |

Douglas Holding AG, TL 1L B6 08/17 | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.500%), 08/12/2022 (a)(b) | | EUR | | | 153,733 | | | | 152,933 | |

See accompanying notes to financial statements.

11

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Douglas Holding AG, TL 1L B7 08/17 | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.500%), 08/12/2022 (a)(b) | | EUR | | | 121,966 | | | $ | 121,331 | |

| | | |

Talbots, Inc., TL 1L B 11/18 | | | | | | | | | | |

| | | |

8.000% (3 Month US LIBOR + 7.000%), 11/28/2022 (a) | | | | | 212,000 | | | | 168,893 | |

| | | | | | | | | | |

| | | | | | | | | 1,349,740 | |

| | | | | | | | | | |

| | | |

Textiles, Apparel & Luxury Goods - 2.1% | | | | | | | | | | |

| | | |

Varsity Brands, Inc., TL 1L B 11/18 | | | | | | | | | | |

| | | |

4.500% (1 Month US LIBOR + 3.500%), 12/16/2024 (a) | | | | | 2,918,755 | | | | 2,534,297 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Trading Companies & Distributors - 0.3% | | | | | | | | | | |

| | | |

FleetPride Corporation, TL 1L 12/18 | | | | | | | | | | |

| | | |

4.647% (3 Month US LIBOR + 4.500%), 02/04/2026 (a) | | | | | 381,942 | | | | 373,826 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Transportation Infrastructure - 0.7% | | | | | | | | | | |

| | | |

Direct ChassisLink, Inc., TL 2L 04/19 | | | | | | | | | | |

| | | |

8.474% (3 Month US LIBOR + 8.250%), 04/10/2026 (a) | | | | | 881,826 | | | | 861,985 | |

| | | | | | | | | | |

TOTAL LEVERAGED LOANS (amortized cost $55,636,346) | | | | | | | | | 53,476,741 | |

| | | | | | | | | | |

| | | |

High Yield Securities - 53.2% | | | | | | | | | | |

| | | |

Aerospace & Defense - 3.7% | | | | | | | | | | |

| | | |

Avolon Holdings Ltd. | | | | | | | | | | |

| | | |

5.500%, 01/15/2026 (b)(f) | | | | | 214,000 | | | | 219,005 | |

| | | |

4.375%, 05/01/2026 (b)(f) | | | | | 1,276,000 | | | | 1,239,818 | |

| | | |

3.250%, 02/15/2027 (b)(f) | | | | | 323,000 | | | | 295,384 | |

| | | |

2.875%, 02/15/2025 (b)(f) | | | | | 103,000 | | | | 97,264 | |

| | | |

5.500%, 02/15/2024 (b)(f) | | | | | 64,000 | | | | 66,165 | |

| | | |

TransDigm, Inc. | | | | | | | | | | |

| | | |

8.000%, 12/15/2025 (f) | | | | | 963,000 | | | | 1,042,207 | |

| | | |

6.500%, 07/15/2024 | | | | | 1,627,000 | | | | 1,628,016 | |

| | | | | | | | | | |

| | | | | | | | | 4,587,859 | |

| | | | | | | | | | |

| | | |

Auto Components - 0.3% | | | | | | | | | | |

| | | |

BBB Industries, LLC | | | | | | | | | | |

| | | |

9.250%, 08/01/2025 (f) | | | | | 425,000 | | | | 421,281 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Biotechnology - 0.2% | | | | | | | | | | |

| | | |

Radius Health, Inc. | | | | | | | | | | |

| | | |

3.000%, 09/01/2024 | | | | | 326,000 | | | | 273,139 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Building Products - 1.5% | | | | | | | | | | |

| | | |

Beacon Roofing Supply, Inc. | | | | | | | | | | |

| | | |

4.875%, 11/01/2025 (f) | | | | | 929,000 | | | | 913,035 | |

| | | |

Cornerstone Building Brands, Inc. | | | | | | | | | | |

| | | |

6.125%, 01/15/2029 (f) | | | | | 143,000 | | | | 146,350 | |

| | | |

SRS Distribution, Inc. | | | | | | | | | | |

| | | |

8.250%, 07/01/2026 (f) | | | | | 687,000 | | | | 726,503 | |

| | | | | | | | | | |

| | | | | | | | | 1,785,888 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

12

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Capital Markets - 0.5% | | | | | | | | | | |

| | | |

Blackstone Mortgage Trust, Inc. | | | | | | | | | | |

| | | |

4.375%, 05/05/2022 | | | | | 637,000 | | | $ | 624,260 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Chemicals - 0.1% | | | | | | | | | | |

| | | |

Cornerstone Chemical Co. | | | | | | | | | | |

| | | |

6.750%, 08/15/2024 (f) | | | | | 125,000 | | | | 117,956 | |

| | | | | | | | | | |

| | | | | | | | | | |

Commercial Services & Supplies - 2.3% | | | | | | | | | | |

| | | |

Multi-Color Corp | | | | | | | | | | |

| | | |

10.500%, 07/15/2027 (f) | | | | | 858,000 | | | | 923,959 | |

| | | |

6.750%, 07/15/2026 (f) | | | | | 273,000 | | | | 286,705 | |

| | | |

Vivint, Inc. | | | | | | | | | | |

| | | |

7.875%, 12/01/2022 | | | | | 541,000 | | | | 540,178 | |

| | | |

7.625%, 09/01/2023 | | | | | 1,015,000 | | | | 1,024,896 | |

| | | | | | | | | | |

| | | | | | | | | 2,775,738 | |

| | | | | | | | | | |

| | | |

Communications Equipment - 0.6% | | | | | | | | | | |

| | | |

Genesys Telecommunications Laboratories, Inc. | | | | | | | | | | |

| | | |

10.000%, 11/30/2024 (f) | | | | | 639,000 | | | | 675,072 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Construction & Engineering - 2.0% | | | | | | | | | | |

| | | |

Maxim Crane Works LP / Maxim Finance Corp. | | | | | | | | | | |

| | | |

10.125%, 08/01/2024 (f) | | | | | 2,301,000 | | | | 2,335,756 | |

| | | |

Pike Corp. | | | | | | | | | | |

| | | |

5.500%, 09/01/2028 (f) | | | | | 93,000 | | | | 95,345 | |

| | | | | | | | | | |

| | | | | | | | | 2,431,101 | |

| | | | | | | | | | |

| | | |

Construction Materials - 0.3% | | | | | | | | | | |

| | | |

Cemex Materials LLC | | | | | | | | | | |

| | | |

7.700%, 07/21/2025 (f) | | | | | 363,000 | | | | 391,119 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Containers & Packaging - 0.2% | | | | | | | | | | |

| | | |

Plastipak Holdings, Inc. | | | | | | | | | | |

| | | |

6.250%, 10/15/2025 (f) | | | | | 207,000 | | | | 207,647 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Diversified Consumer Services - 1.9% | | | | | | | | | | |

| | | |

Expedia Group, Inc. | | | | | | | | | | |

| | | |

6.250%, 05/01/2025 (f) | | | | | 1,618,000 | | | | 1,780,822 | |

| | | |

4.625%, 08/01/2027 (f) | | | | | 502,000 | | | | 526,649 | |

| | | | | | | | | | |

| | | | | | | | | 2,307,471 | |

| | | | | | | | | | |

| | | |

Diversified Telecommunication Services - 1.6% | | | | | | | | | | |

| | | |

Zayo Group LLC | | | | | | | | | | |

| | | |

6.125%, 03/01/2028 (f) | | | | | 1,972,000 | | | | 1,992,647 | |

| | | | | | | | | | |

| | | | | | | | | | |

See accompanying notes to financial statements.

13

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Electronic Equipment, Instruments & Components - 3.5% | | | | | | | | | | |

| | | |

CommScope, Inc. | | | | | | | | | | |

| | | |

8.250%, 03/01/2027 (f) | | | | | 2,727,000 | | | $ | 2,825,853 | |

| | | |

6.000%, 06/15/2025 (f) | | | | | 1,467,000 | | | | 1,456,334 | |

| | | | | | | | | | |

| | | | | | | | | 4,282,187 | |

| | | | | | | | | | |

| | | |

Energy Equipment & Services - 0.3% | | | | | | | | | | |

| | | |

Archrock Partners LP / Archrock Partners Finance Corp | | | | | | | | | | |

| | | |

6.875%, 04/01/2027 (f) | | | | | 324,000 | | | | 318,330 | |

| | | |

Transocean, Inc. | | | | | | | | | | |

| | | |

11.500%, 01/30/2027 (f) | | | | | 73,000 | | | | 24,271 | |

| | | | | | | | |

| | | | | | | | | 342,601 | |

| | | | | | | | | | |

| | | |

Entertainment - 0.3% | | | | | | | | | | |

| | | |

Live Nation Entertainment, Inc. | | | | | | | | | | |

| | | |

6.500%, 05/15/2027 (f) | | | | | 333,000 | | | | 356,736 | |

| | | | | | | | |

| | | | | | | | | | |

| | | |

Health Care Equipment & Supplies - 0.7% | | | | | | | | | | |

| | | |

Ortho-Clinical Diagnostics Inc. / Ortho-Clinical Diagnostics SA | | | | | | | | | | |

| | |

7.375%, 06/01/2025 (f) | | | 848,000 | | | | 896,230 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Health Care Providers & Services - 1.8% | | | | | | | | | | |

| | | |

CHS/Community Health Systems, Inc. | | | | | | | | | | |

| | | |

8.000%, 03/15/2026 (f) | | | | | 986,000 | | | | 990,930 | |

| | | |

LifePoint Hospitals, Inc. | | | | | | | | | | |

| | | |

9.750%, 12/01/2026 (f) | | | | | 295,000 | | | | 318,600 | |

| | | |

Radiology Partners Inc. | | | | | | | | | | |

| | | |

9.250%, 02/01/2028 (f) | | | | | 849,000 | | | | 907,140 | |

| | | | | | | | | | |

| | | | | | | | | 2,216,670 | |

| | | | | | | | | | |

| | | |

Health Care Technology - 0.3% | | | | | | | | | | |

| | | |

Verscend Holding Corp. | | | | | | | | | | |

| | | |

9.750%, 08/15/2026 (f) | | | | | 386,000 | | | | 415,674 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Hotels, Restaurants & Leisure - 9.8% | | | | | | | | | | |

| | | |

Boyd Gaming Corp | | | | | | | | | | |

| | | |

6.375%, 04/01/2026 | | | | | 663,000 | | | | 688,837 | |

| | | |

Boyd Gaming Corp. | | | | | | | | | | |

| | | |

6.000%, 08/15/2026 | | | | | 808,000 | | | | 830,826 | |

| | | |

ClubCorp Club Operations, Inc. | | | | | | | | | | |

| | | |

8.500%, 09/15/2025 (f) | | | | | 1,094,000 | | | | 906,538 | |

| | | |

Diamond Resorts International, Inc. | | | | | | | | | | |

| | | |

10.750%, 09/01/2024 (f) | | | | | 591,000 | | | | 538,487 | |

| | | |

7.750%, 09/01/2023 (f) | | | | | 1,712,000 | | | | 1,612,739 | |

| | | |

Enterprise Development Authority/The | | | | | | | | | | |

| | | |

12.000%, 07/15/2024 (f) | | | | | 1,252,000 | | | | 1,389,720 | |

| | | |

Marriott International Inc | | | | | | | | | | |

| | | |

5.750%, 05/01/2025 (c)(d) | | | | | 1,914,000 | | | | 2,133,766 | |

See accompanying notes to financial statements.

14

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Marriott International Inc/MD | | | | | | | | | | |

| | | |

4.625%, 06/15/2030 (c)(d) | | | | | 13,000 | | | $ | 13,887 | |

| | | |

Merlin Entertainments PLC | | | | | | | | | | |

| | | |

6.625%, 11/15/2027 (b)(f) | | | | | 1,267,000 | | | | 1,100,326 | |

| | | |

5.750%, 06/15/2026 (b)(f) | | | | | 690,000 | | | | 637,256 | |

| | | |

7.000%, 05/15/2025 (b)(f) | | EUR | | | 783,000 | | | | 892,899 | |

Powdr Corp. | | | | | | | | | | |

| | | |

6.000%, 08/01/2025 (f) | | | | | 443,000 | | | | 448,338 | |

| | | |

Station Casinos LLC | | | | | | | | | | |

| | | |

4.500%, 02/15/2028 (f) | | | | | 635,000 | | | | 602,853 | |

| | | |

Viking Cruises Ltd. | | | | | | | | | | |

| | | |

13.000%, 05/15/2025 (f) | | | | | 237,000 | | | | 268,847 | |

| | | | | | | | | | |

| | | | | | | | | 12,065,319 | |

| | | | | | | | | | |

| | | |

Insurance - 3.2% | | | | | | | | | | |

| | | |

Alliant Holdings I, Inc. | | | | | | | | | | |

| | | |

6.750%, 10/15/2027 (f) | | | | | 338,000 | | | | 355,471 | |

| | | |

AmWINS Group, Inc. | | | | | | | | | | |

| | | |

7.750%, 07/01/2026 (f) | | | | | 122,000 | | | | 130,669 | |

| | | |

Aspen Insurance Holdings Ltd. | | | | | | | | | | |

| | | |

7.625%, 10/15/2025 (f)(h) | | | | | 984,000 | | | | 984,000 | |

| | | |

Hub International Ltd. | | | | | | | | | | |

| | | |

7.000%, 05/01/2026 (f) | | | | | 750,000 | | | | 769,504 | |

| | | |

National Financial Partners Corp | | | | | | | | | | |

| | | |

7.000%, 05/15/2025 (f) | | | | | 69,000 | | | | 73,269 | |

| | | |

6.875%, 08/15/2028 (f) | | | | | 625,000 | | | | 607,031 | |

| | | |

Radian Group, Inc. | | | | | | | | | | |

| | | |

6.625%, 03/15/2025 | | | | | 948,000 | | | | 1,027,988 | |

| | | | | | | | | | |

| | | | | | | | | 3,947,932 | |

| | | | | | | | | | |

| | | |

IT Services - 0.2% | | | | | | | | | | |

| | | |

Dun & Bradstreet Corp./The | | | | | | | | | | |

| | | |

10.250%, 02/15/2027 (f) | | | | | 56,000 | | | | 62,833 | |

| | | |

Sabre, Inc. | | | | | | | | | | |

| | | |

9.250%, 04/15/2025 (f) | | | | | 193,000 | | | | 213,024 | |

| | | | | | | | | | |

| | | | | | | | | 275,857 | |

| | | | | | | | | | |

| | | |

Machinery - 2.0% | | | | | | | | | | |

| | | |

Welbilt, Inc. (Manitowoc Foodservice, Inc.) | | | | | | | | | | |

| | | |

9.500%, 02/15/2024 | | | | | 2,380,000 | | | | 2,420,662 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Media - 0.8% | | | | | | | | | | |

| | | |

Intelsat Jackson Holdings SA | | | | | | | | | | |

| | | |

0.000%, 08/01/2023 (b)(g) | | | | | 207,000 | | | | 121,871 | |

| | | |

Outfront Media Capital LLC | | | | | | | | | | |

| | | |

5.000%, 08/15/2027 (f) | | | | | 9,000 | | | | 8,543 | |

| | | |

4.625%, 03/15/2030 (f) | | | | | 930,000 | | | | 855,600 | |

| | | | | | | | | | |

| | | | | | | | | 986,014 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

15

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Multiline Retail - 0.0% | | | | | | | | | | |

| | | |

JC Penney Corp, Inc. | | | | | | | | | | |

| | | |

8.625%, 03/15/2025 (c)(d)(f)(g) | | | | | 98,000 | | | $ | 1,169 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Oil, Gas & Consumable Fuels - 6.9% | | | | | | | | | | |

| | | |

Energy Transfer Operating LP | | | | | | | | | | |

| | | |

3.750%, 05/15/2030 | | | | | 939,000 | | | | 921,643 | |

Global Partners LP / GLP Finance Corp | | | | | | | | | | |

| | | |

7.000%, 08/01/2027 | | | | | 574,000 | | | | 592,577 | |

| | | |

Global Partners LP / GLP Finance Corp. | | | | | | | | | | |

| | | |

6.875%, 01/15/2029 (f) | | | | | 364,000 | | | | 375,803 | |

| | | |

Indigo Natural Resources, LLC | | | | | | | | | | |

| | | |

6.875%, 02/15/2026 (f) | | | | | 1,239,000 | | | | 1,220,414 | |

| | | |

Parsley Energy, Inc. | | | | | | | | | | |

| | | |

5.625%, 10/15/2027 (f) | | | | | 166,000 | | | | 176,832 | |

| | | |

5.375%, 01/15/2025 (f) | | | | | 1,084,000 | | | | 1,110,423 | |

| | | |

PBF Holding Co. LLC / PBF Finance Corp. | | | | | | | | | | |

| | | |

6.000%, 02/15/2028 (f) | | | | | 28,000 | | | | 10,868 | |

| | | |

Rockies Express Pipeline LLC | | | | | | | | | | |

| | | |

4.800%, 05/15/2030 (f) | | | | | 31,000 | | | | 29,438 | |

| | | |

3.600%, 05/15/2025 (f) | | | | | 533,000 | | | | 533,000 | |

| | | |

Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp | | | | | | | | | | |

| | | |

6.000%, 03/01/2027 (f) | | | | | 211,000 | | | | 199,923 | |

| | | |

Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp. | | | | | | | | | | |

| | | |

4.750%, 10/01/2023 (f) | | | | | 1,559,000 | | | | 1,485,438 | |

| | | |

Targa Resources Partners LP / Targa Resources Partners Finance Corp. | | | | | | | | | | |

| | | |

5.000%, 01/15/2028 | | | | | 458,000 | | | | 453,134 | |

| | | |

Viper Energy Partners LP | | | | | | | | | | |

| | | |

5.375%, 11/01/2027 (f) | | | | | 1,274,000 | | | | 1,302,525 | |

| | | |

WPX Energy, Inc. | | | | | | | | | | |

| | | |

4.500%, 01/15/2030 | | | | | 81,000 | | | | 77,882 | |

| | | | | | | | | | |

| | | | | | | | | 8,489,900 | |

| | | | | | | | | | |

| | | |

Road & Rail - 0.7% | | | | | | | | | | |

| | | |

Kenan Advantage Group, Inc./The | | | | | | | | | | |

| | | |

7.875%, 07/31/2023 (f) | | | | | 778,000 | | | | 780,836 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Software - 2.0% | | | | | | | | | | |

| | | |

Solera Holdings, Inc. | | | | | | | | | | |

| | | |

10.500%, 03/01/2024 (f) | | | | | 2,317,000 | | | | 2,408,567 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Textiles, Apparel & Luxury Goods - 0.9% | | | | | | | | | | |

| | | |

Lycra | | | | | | | | | | |

| | | |

7.500%, 05/01/2025 (b)(f) | | | | | 335,000 | | | | 236,175 | |

| | | |

5.375%, 05/01/2023 (b)(f) | | EUR | | | 736,000 | | | | 578,596 | |

See accompanying notes to financial statements.

16

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| | | | | | | | | | |

Varsity Brands, Inc. | | | | | | | | | | |

| | | |

9.000% (3 Month LIBOR USD + 8.000%), 12/22/2024 (a)(f) | | | | | 309,000 | | | $ | 297,799 | |

| | | | | | | | | | |

| | | | | | | | | 1,112,570 | |

| | | | | | | | | | |

| | | |

Thrifts & Mortgage Financing - 0.9% | | | | | | | | | | |

| | | |

MGIC Investment Corp. | | | | | | | | | | |

| | | |

5.250%, 08/15/2028 | | | | | 1,070,000 | | | | 1,101,431 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Trading Companies & Distributors - 3.7% | | | | | | | | | | |

| | | |

AerCap Holdings | | | | | | | | | | |

| | | |

6.500%, 07/15/2025 (b) | | | | | 1,257,000 | | | | 1,384,716 | |

| | | |

4.625%, 10/15/2027 (b) | | | | | 1,126,000 | | | | 1,116,563 | |

Neon Holdings, Inc. | | | | | | | | | | |

| | | |

10.125%, 04/01/2026 (f) | | | | | 852,000 | | | | 905,250 | |

| | | |

TruckPro LLC | | | | | | | | | | |

| | | |

11.000%, 10/15/2024 (f) | | | | | 691,000 | | | | 696,183 | |

| | | |

White Cap Buyer LLC | | | | | | | | | | |

| | | |

6.875%, 10/15/2028 (f) | | | | | 433,000 | | | | 444,637 | |

| | | | | | | | | | |

| | | | | | | | | 4,547,349 | |

| | | | | | | | | | |

TOTAL HIGH YIELD SECURITIES (amortized cost $61,043,440) | | | | | | | | | 65,238,882 | |

| | | | | | | | | | |

| | | |

Collateralized Loan Obligations - 1.1% | | | | | | | | | | |

| | | |

Diversified Financial Services - 1.1% | | | | | | | | | | |

| | | |

Octagon Investment Partners 48 Ltd. | | | | | | | | | | |

| | | |

7.892% (3 Month LIBOR USD + 7.660%), 10/20/2031 (a)(d)(e)(f) | | | | | 53,100 | | | | 52,348 | |

| | | |

TICP CLO Ltd. | | | | | | | | | | |

| | | |

5.818% (3 Month LIBOR USD + 5.600%), 01/20/2031 (a)(d)(e)(f) | | | | | 738,460 | | | | 663,822 | |

| | | |

TRESTLES CLO, LLC | | | | | | | | | | |

| | | |

6.895% (3 Month LIBOR USD + 6.680%), 07/25/2029 (a)(d)(e)(f) | | | | | 693,640 | | | | 649,632 | |

| | | | | | | | | | |

| | | | | | | | | 1,365,802 | |

| | | | | | | | | | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS (amortized cost $1,279,648) | | | | | | | | | 1,365,802 | |

| | | | | | | | | | |

| | | |

Common Stocks - 0.7% | | | | | | | | | | |

| | | |

Health Care Providers & Services - 0.0% | | | | | | | | | | |

| | | |

Quorum Health Corp. (d)(e)(g) | | | | | 214,074 | | | | 36,889 | |

| | | | | | | | | | |

| | | |

Hotels, Restaurants & Leisure - 0.2% | | | | | | | | | | |

| | | |

Six Flags Entertainment Corp. | | | | | 10,937 | | | | 236,458 | |

| | | | | | | | | | |

| | | |

Machinery - 0.3% | | | | | | | | | | |

| | | |

Welbilt, Inc. (g) | | | | | 59,614 | | | | 362,453 | |

| | | | | | | | | | |

| | | |

Metals & Mining - 0.2% | | | | | | | | | | |

| | | |

Foresight Energy LLC (c)(d)(e)(g) | | | | | 17,979 | | | | 268,665 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS (cost $984,139) | | | | | | | | | 904,465 | |

| | | | | | | | | | |

| | | |

TOTAL INVESTMENTS (cost $118,943,573) (j) - 98.7% | | | | | | | | | 120,985,890 | |

| | | | | | | | | | |

OTHER ASSETS EXCEEDING LIABILITIES, NET - 1.3% | | | | | | | | | 1,640,095 | |

| | | | | | | | | | |

NET ASSETS - 100.0% | | | | | | | | $ | 122,625,985 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

17

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

| † | | In U.S. Dollars unless otherwise indicated. | |

| (a) | | Variable rate security, the coupon rate shown is the effective rate as of October 31, 2020. | |

| (c) | | Security considered restricted due to the Adviser’s knowledge of material non-public information. The total value of these securities as of October 31, 2020 was $3,031,371 and represented 2.5% of net assets. | |

| (d) | | Security considered illiquid, as defined by the Securities and Exchange Commission. The total value of these securities as of October 31, 2020 was $4,967,219 and represented 4.1% of net assets. | |

| (e) | | Value determined using significant unobservable inputs. | |

| (f) | | Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold to qualified institutional buyers in transactions exempt from registration. The total value of these securities as of October 31, 2020 was $49,628,412, which represent 40.5% of net assets. | |

| (g) | | Non-income producing security. | |

| (h) | | Represents a payment-in-kind (“PIK”) security which may pay interest/dividend in additional par/shares. | |

| (i) | | Represents unfunded loan commitments. | |

| (j) | | All investments are held as collateral for the Fund’s credit facility. | |

The following table represents the Fund’s investments categorized by country of risk as of October 31, 2020:

| | | | | | |

| | | Country: | | % of Net Assets | |

| | |

| | United States | | | 86.4% | |

| | |

| | Netherlands | | | 2.7% | |

| | |

| | Germany | | | 2.2% | |

| | |

| | United Kingdom | | | 2.2% | |

| | |

| | Ireland | | | 1.6% | |

| | |

| | France | | | 1.6% | |

| | |

| | Sweden | | | 1.1% | |

| | |

| | Spain | | | 0.5% | |

| | |

| | Luxembourg | | | 0.4% | |

| | | | | | |

| | | | | 98.7% | |

| | | | | | |

| | Other Assets Exceeding Liabilities, Net | | | 1.3% | |

| | | | | | |

| | | | | 100.0% | |

| | | | | | |

See accompanying notes to financial statements.

18

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

Statement of Assets and Liabilities

As of October 31, 2020

| | | | |

Assets | | | | |

| |

Investments, at value (amortized cost $118,943,573) | | $ | 120,985,890 | |

| |

Cash and cash equivalents | | | 3,333,913 | |

| |

Receivable for shares issued | | | 9,982,000 | |

| |

Dividends and interest receivable | | | 1,474,918 | |

| |

Due from Adviser | | | 108,242 | |

| |

Receivable for investments sold | | | 26,795 | |

| |

Deferred offering costs | | | 277,543 | |

| | | | |

Total assets | | | 136,189,301 | |

| | | | |

| |

Liabilities | | | | |

| |

Credit Facility (net of deferred financing costs of $137,606) | | | 5,400,635 | |

| |

Payable for investments purchased | | | 6,882,940 | |

| |

Distribution Payable | | | 654,598 | |

| |

Investment advisory fees | | | 64,506 | |

| |

Trustees’ fees | | | 81,330 | |

| |

Other accrued expenses | | | 479,307 | |

| | | | |

Total liabilities | | | 13,563,316 | |

| | | | |

Net assets | | $ | 122,625,985 | |

| | | | |

| |

Net Assets | | | | |

| |

Paid-in capital — (unlimited shares authorized — $0.001 par value) | | $ | 118,259,112 | |

| |

Retained earnings | | | 4,366,873 | |

| | | | |

Net assets | | $ | 122,625,985 | |

| | | | |

| |

Class I: | | | | |

| |

Net asset value | | $ | 106,962,353 | |

| | | | |

Price per share (4,101,236.495 shares) | | $ | 26.08 | |

| | | | |

| |

Class T: | | | | |

| |

Net asset value | | $ | 8,242,632 | |

| | | | |

Price per share (319,080.643 shares) | | $ | 25.83 | |

| | | | |

| |

Class U: | | | | |

| |

Net asset value | | $ | 7,421,000 | |

| | | | |

Price per share (296,840.000 shares) | | $ | 25.00 | |

| | | | |

See accompanying notes to financial statements.

19

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

Statement of Operations

| | | | |

| | | Year Ended

October 31, 2020 | |

Investment income | | | | |

| |

Interest income | | $ | 4,881,265 | |

| |

Dividend income | | | 5,390 | |

| |

Other income | | | 313,032 | |

| | | | |

Total investment income | | | 5,199,687 | |

| | | | |

Expenses | | | | |

| |

Investment advisory fees | | | 444,324 | |

| |

Credit facility interest expense | | | 270,580 | |

| |

Offering Costs | | | 570,017 | |

| |

Organizational Costs | | | 304,805 | |

| |

Legal fees | | | 349,545 | |

| |

Administration fees | | | 129,709 | |

| |

Term loan expense | | | 126,483 | |

| |

Audit and tax fees | | | 82,500 | |

| |

Trustees’ fees | | | 80,004 | |

| |

Transfer agent fees | | | 35,851 | |

| |

Shareholder reporting expense | | | 27,203 | |

| |

Custodian fees | | | 15,653 | |

| |

Other expenses | | | 117,285 | |

| | | | |

Total expenses prior to expense reimbursement | | | 2,553,959 | |

| |

Expense reimbursement | | | (1,434,841 | ) |

| | | | |

Net expenses | | | 1,119,118 | |

| | | | |

| |

Net investment income | | | 4,080,569 | |

| | | | |

| |

Realized and unrealized gain (loss) | | | | |

| |

Net realized gain (loss) on | | | | |

| |

Investments | | | 2,441,940 | |

| |

Foreign currency transactions | | | (159,874 | ) |

| | | | |

Net realized gain | | | 2,282,066 | |

| |

Net change in unrealized appreciation (depreciation) on | | | | |

| |

Investments | | | 1,761,183 | |

| |

Foreign currency translation | | | 398,673 | |

| |

Deferred Trustees’ fees | | | (8,826 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) | | | 2,151,030 | |

| |

Net realized and unrealized gain (loss) | | | 4,433,096 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 8,513,665 | |

| | | | |

See accompanying notes to financial statements.

20

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

Statements of Changes in Net Assets

| | | | |

| | | Year Ended

October 31, 2020 | |

Increase (decrease) in net assets resulting from operations | | | | |

| |

Net investment income | | $ | 4,080,569 | |

| |

Net realized gain on investments | | | 2,282,066 | |

| |

Net change in unrealized appreciation | | | 2,151,030 | |

| | | | |

Net increase in net assets resulting from operations | | | 8,513,665 | |

| | | | |

| |

Dividends to shareholders from | | | | |

| |

Net dividend and distributions — Class I | | | (4,076,334 | ) |

| |

Net dividend and distributions — Class T | | | (70,458 | ) |

| |

Net dividend and distributions — Class U | | | — | |

| | | | |

Total distributions | | | (4,146,792 | ) |

| | | | |

Shareholder transactions | | | | |

| |

Class I | | | | |

| |

Subscriptions | | | 102,640,250 | |

| |

Issued to shareholder in reinvestment of distributions | | | 769 | |

| |

Shares redeemed | | | — | |

| | | | |

| | | 102,641,019 | |

| | | | |

Class T | | | | |

| |

Subscriptions | | | 8,164,260 | |

| |

Issued to shareholder in reinvestment of distributions | | | 32,833 | |

| |

Shares redeemed | | | — | |

| | | | |

| | | 8,197,093 | |

| | | | |

Class U | | | | |

| |

Subscriptions | | | 7,421,000 | |

| |

Issued to shareholder in reinvestment of distributions | | | — | |

| |

Shares redeemed | | | — | |

| | | | |

| | | 7,421,000 | |

| | | | |

Net increase in net assets | | $ | 122,625,985 | |

| |

Net assets | | | | |

| |

Beginning of year | | $ | — | |

| | | | |

End of year | | $ | 122,625,985 | |

| | | | |

See accompanying notes to financial statements.

21

| | | | |

| |

Credit Opportunities Portfolio | | October 31, 2020 |

| | | | |

Statement of Cash Flows

| | | | |

| | | Year Ended

October 31, 2020 | |

Cash Flows from Operating Activities: | | | | |

| |

Net increase in net assets resulting from operations | | $ | 8,513,665 | |

| |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| |

Purchases of investments | | | (136,147,227 | ) |

| |

Proceeds from sales of investments | | | 65,125,004 | |

| |

Net amortization (accretion) of premiums/discounts | | | (753,643 | ) |

| |

Net change in unrealized appreciation of investments | | | (1,761,183 | ) |

| |

Net change in unrealized appreciation on foreign currency transactions | | | (398,673 | ) |

| |

Net change in unrealized depreciation on deferred Trustees’ fees | | | 8,826 | |

| |

Net realized gain from investments | | | (2,441,940 | ) |

| |

Net realized gain on investments (foreign currency related) | | | (13,475 | ) |

| |

Amortization of deferred financing costs | | | 80,768 | |

| |

Changes in assets and liabilities: | | | | |

| |

Increase in receivable for investments sold | | | (25,483 | ) |

| |

Increase in dividends and interest receivable | | | (1,474,225 | ) |

| |

Increase in due from Adviser | | | (94,221 | ) |

| |

Increase in deferred offering costs | | | (74,380 | ) |

| |

Increase in investment advisory fees payable | | | 64,506 | |

| |

Increase in payable for investments purchased | | | 6,908,645 | |

| |

Increase in Trustees’ fees payable | | | 72,504 | |

| |

Increase in accrued expenses and other liabilities | | | 197,357 | |

| | | | |

Net cash used in operating activities | | | (62,213,175 | ) |

| | | | |

Cash Flows from Financing Activities | | | | |

| |

Subscriptions for shares, net of change in receivable | | | 63,531,218 | |

| |

Cash dividends paid to shareholders, net of reinvestments | | | (3,458,592 | ) |

| |

Deferred financing costs paid | | | (153,374 | ) |

| |

Proceeds from credit facility | | | 5,637,413 | |

| | | | |

Net cash provided by financing activities | | | 65,556,665 | |

| | | | |

| |

Effect of exchange rate changes on cash | | | (9,577 | ) |

| | | | |

Net increase in cash and cash equivalents | | $ | 3,333,913 | |

| | | | |

| |

Cash and Cash Equivalents | | | | |

| |

Beginning balance | | | — | |

| | | | |

Ending balance | | $ | 3,333,913 | |

| | | | |

| |

Supplemental Disclosure of cash flow information and non-cash financing activities: | | | | |

| |

Cash paid for interest expense | | $ | 130,616 | |

Deferred financing costs accrued in other accrued expenses | | $ | 65,000 | |