UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23474)

KKR Credit Opportunities Portfolio

(Exact name of registrant as specified in charter)

555 California Street, 50th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Lori Hoffman

KKR Credit Advisors (US) LLC

555 California Street, 50th Floor

San Francisco, CA 94104

(Name and address of agent for service)

(415) 315-3620

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2023

Date of reporting period: October 31, 2023

Item 1. Reports to Stockholders.

KKR Credit Opportunities Portfolio

Annual Report

October 31, 2023

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

The KKR Credit Opportunities Portfolio (the “Fund”) files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT within sixty days after the end of the period. The Fund’s Form N-PORT is available on the Commission’s website at www.sec.gov. A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent year ended June 30 will be available (i) without charge, upon request, by calling 855-862-6092; and (ii) on the Commission’s website at www.sec.gov.

INFORMATION ABOUT THE FUND’S TRUSTEES

The statement of additional information includes information about the Fund’s Trustees and is available without charge, upon request, by calling 855-862-6092 and by visiting the Commission’s website at www.sec.gov or the Fund’s website at kkrfunds.com/kcop.

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

Management’s Discussion of Fund Performance

Looking Back on the Markets — October 31, 2023

As we reflect on the past year, we have seen a continued trend of credit markets being in flux. Rising rates, geopolitical tensions, and deteriorating credit fundamentals have all posed headwinds for credit markets as investors navigate this volatile and opaque environment. However, the path forward for the asset class is becoming a little clearer. We see a trend in which private credit is becoming a more permanent allocation for investors, and we believe that flexibility and certainty of execution will continue to be attractive for borrowers even after syndicated markets reopen. While private credit has been getting a great deal of attention lately in both the press and investment circles, we think it is a mistake to ignore opportunities in liquid credit. We think the permanence of private credit does nothing to diminish the need for public credit markets. Both have a place in a healthy, functioning borrowing system and can serve different purposes. Public credit allows for quick deployment, and the relatively high yields currently available in public markets have the potential to cushion against price volatility. The liquidity of public markets creates the potential to shift quickly when market conditions change. As capital markets reopen, we think the change in the investment environment is likely to be both significant and swift. We believe this vintage of new deals will be attractive and that taking advantage of new issuances across private credit and public credit will lead to differentiated outcomes, particularly if lenders are able to expand the new issue premium with call protection or call premiums. This is most evident in high yield bonds, private junior debt, and other subordinated capital solutions. In short, we think it will remain a good time to be a lender.

As for the capital markets, we see some green shoots emerging. U.S. initial public offering, or IPO, activity has ticked up. Our debt capital markets team has seen a ramp-up in syndicated public debt markets and expects this trend to continue in the remaining months of 2023, and we have noticed that our clients have more appetite for allocating to credit in both liquid and private markets. We think that the interest rate outlook is a tad bit clearer, and that while credit fundamentals have not yet bottomed, they may be closer to doing so. Though there will no doubt be bumps in the road from here, we note that at this point in the calendar, there is pressure to get invested and to do deals. Fear of missing out is a powerful motivator.

Overall, as we look prospectively, the fragility, uncertainty, and volatility that have become consistent features of the market environment make it hard to interpret signals: Is a pipeline of new capital markets activity the sign we’ve been waiting for? Or are bank failures and credit downgrades the alarm we’ve been anticipating? We tend to lean toward the former, but those questions are only going to be perfectly clear in hindsight. We continue to believe waiting is the wrong approach. It takes time to deploy into private credit, but commitments need to be made now to access future deal flow. Meanwhile, liquid credit offers an opportunity to put money to work immediately. We believe that factors such as rate stabilization, increased market activity and demand for capital should provide a clearer view to how the short term will play out. Our idea is: Just start.

Traded Credit Markets

In the earlier part of this year, liquid credit markets offered a rare opportunity to take advantage of high yields, wide spreads, and prices ticking back up on the strength of rising market confidence across public markets. We saw public credit markets perform well and investor sentiment improved following the large valuation reset we saw in 2022. On a year-to-date basis, by the end of October 2023, the S&P 500 was up +10.7%, but the U.S. leveraged loan market was up +10.2% and U.S. high yield bond market was up +4.7% with far less risk. In hindsight, adding publicly traded assets to a private credit allocation would have not only helped those on the sidelines get capital deployed quickly, it would have also been accretive to a portfolio in terms of both returns and diversification.

That said, opportunity has not disappeared from public markets. While timing the ideal entry point is very difficult, we think the relatively high yield available can be good buffers against price volatility. To our team’s way of thinking, a downward move in rates will trigger an upward price movement in high yield and make the floating nature of loans less attractive. So long as one has capital to deploy and the flexibility to act when a move is imminent and fixed-rate debt becomes more attractive, we think it makes sense to take advantage of the income available today.

We’re excited about the opportunity ahead of us in traded credit. Given risks on the horizon (slowing growth, margin pressures, increasing cost of capital, etc.), we do see potential for spread volatility in the coming months. However, we think a few factors are important to consider when evaluating spreads. High yield market spreads as of October 31, 2023 are 442 basis points. To put into context, on a historical basis, spreads have been tighter than that level 62% of the time over the last 10 years. Spreads are attractive, but not outright “cheap”. One factor that we believe is often

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

overlooked is the composition of the market over time – there has been a noticeable shift in the high yield market over the last ten years towards a much “cleaner” high yield market – from a ratings perspective, more of the market is BB rated than ever before (~50% BB in the US and ~60% in Europe) and more high yield issuance has been secured than ever before (vs. unsecured). If you adjust for these quality factors, spread today is incrementally more attractive versus history. We also think it’s worth considering both the entry price and overall yields available in the market, both of which are historically quite attractive. Both US bank loans and high yield bond yields are in the top 1% of where they have been over the past 10-years (more return available than 99% of days over the past 10 years). The average dollar price in the high yield market of 86 cents as of October 31, 2023 is similarly attractive (top 4% price entry point). We are positioning the portfolio to take advantage of the returns on offer in the market doing the “simple” things and are ready with dry powder to take advantage of any volatility that may (or may not) come.

Private Credit Markets

Credit markets have changed in fundamental ways over the last 15 years—shifting corporate borrowing away from syndicated markets and towards private credit. Banks began shrinking the scope of their lending activity after the Global Financial Crisis, and the pullback has continued post-COVID and in the face of the U.S. regional banking scare in March 2023. As a result of the most recent retrenchment, the loan syndication machine broke down, conditions for high yield issuance became unpredictable, and the IPO well ran dry. What was left? Private credit, which has steadily taken share from syndicated markets and moved out of the realm of the middle-market to become a viable means for financing larger deals. Meanwhile, more recently, private asset-based finance strategies have seen a growing number of attractive opportunities to lend against portfolios of high-quality assets as regional banks have started to look to shed portfolios of loans or exit from lending against certain assets. On the other side of the transaction, we think private credit is also a permanent option for sponsors and borrowers. A growing number of large financings that would have almost certainly taken place in syndicated markets in the past have instead been executed in private credit markets. A negotiation with one lender or, in a bigger transaction, a small group of like-minded lenders, offers a level of certainty and flexibility that syndicated markets often can’t, and the potential benefits of that became obvious with syndicated markets shut.

On the demand side, we see a trend in which private credit is becoming a more permanent allocation for investors. Typically, we have seen the core allocations within private credit take on the role of an income strategy that can be supplemented by opportunistic, higher-yielding corporate lending strategies or private strategies that are uncorrelated to developed market corporate risk, such as asset-based. It’s also important to consider that private equity funds hold more than $2 trillion of dry powder and will need both public and private credit to finance deals. Indeed, we believe the pace of growth in private credit is sustainable, but it need not usurp liquid credit’s traditional role. We see them working more in tandem, even in the same deal at different points in the capital structure.

Private Corporate Direct Lending

The dislocation in the syndicated loan and bond market and the rising rate environment that persisted in the trailing 12-months has been supportive of KKR’s private direct lending initiatives. A few areas of focus have included: 1) larger borrowers, which generally have less customer and supplier concentration risk, better, more experienced management teams and stronger balance sheets, 2) defensive and non-cyclical sectors while being selective and diligent about maintaining portfolio diversification, 3) avoiding sectors where raw materials comprise a large percentage cost and those with weak pricing power and 4) deploying capital into incumbent investments to support a company’s continued growth. We have invested heavily into our team and platform over the last few years and are confident in our ability to maintain our origination volume and network in an increasingly competitive market.

Private Asset-Based Finance

Private asset-based finance is a large asset class that reaches across many different segments of the economy. Disintermediation in the banking sector has been expansionary for the asset class since the financial crisis, and more recently the regional banking dislocation in the U.S. has provided unique opportunities to be a private provider of capital as they look to sell portfolios of assets to shore up liquidity. While there is an increasing opportunity for private asset-based finance as a result, our underwriting standards remain high and we are picking our spots carefully, with an eye towards downside protection. We have sought to diligence funding originators with long track records and in sectors where we are more favorably biased – namely, lending to more prime borrower segments and on a collateralized basis. We also prefer secured risk over unsecured and have found opportunities across diverse collateral such as auto loans, mortgages, and equipment leasing. Finally, we also favor real assets which can provide a natural hedge in today’s high inflationary environment.

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

Fund Description & Performance

KKR Credit Opportunities Portfolio (“KCOP” or, the “Fund”) is a diversified, closed-end management investment company that continuously offers its shares and is operated as an “interval fund.” The Fund’s investment objective is to seek to provide attractive risk-adjusted returns and high current income. The Fund seeks to achieve its investment objectives by investing in a select portfolio with exposure to two primary credit strategies:

a.Opportunistic Credit, a conviction-based approach investing in a portfolio consisting primarily of publicly traded high yield bonds, first and second lien secured bank loans and structured credit (e.g., collateralized loan obligations (“CLOs”) and mezzanine debt); and

b.Private Credit, which includes directly originated hard and financial asset-based lending, corporate mezzanine debt, as well as directly originated first lien, second lien and unitranche senior loans to primarily upper middle-market companies.

The Fund expects, under normal circumstances, to invest 70-80% of its Managed Assets in the Opportunistic Credit strategy and 20-30% of its Managed Assets in the Private Credit strategy, though the Fund’s allocation in investments could vary from these guidelines at any time in the Fund’s discretion. “Managed Assets” means the total assets of the Fund (including any assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes).

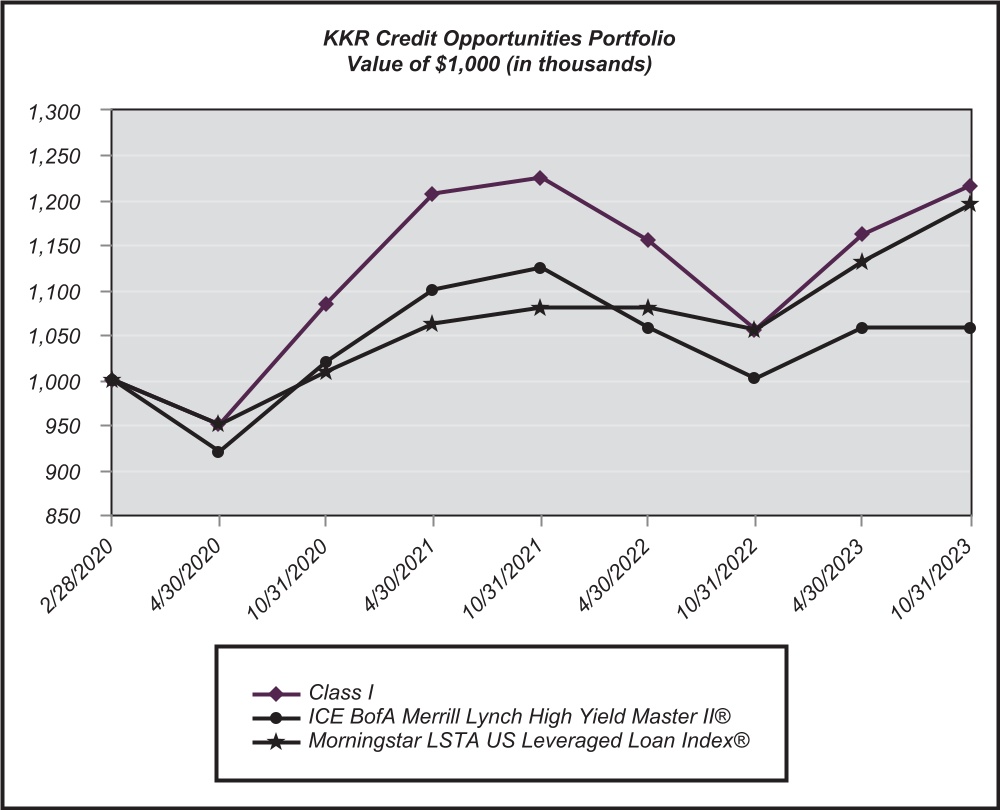

With respect to performance, following a challenging year, the Fund has recovered both on an absolute basis and relative to broader leveraged credit markets. For the 12-month period ended October 31, 2023, the Fund’s total return, net of fees and inclusive of dividends, was as follows for each share class: 14.88% (Class I), 14.72% (Class D), 14.10% (Class U), 14.08% (Class T – No Sales Load) and 11.79% (Class T – With Sales Load). By comparison, high yield (as measured by the Bank of America Merrill Lynch High Yield Master II Index) returned 5.90% and leveraged loans (as measured by the Morningstar LSTA US Leveraged Loan Index) returned 11.92%.

Looking at the trailing 12-month period, a component of this performance is derived from the underlying markets in which the Fund invests in, which were volatile and have faced headwinds amid rising rates, inflation concerns, recessionary fears, and even geopolitics. Importantly, risk assets and notably the leveraged credit markets, have seen a recovery following its lows of 2022. We also note the Fund’s use of leverage which has amplified returns in periods of positive performance and diluted returns in periods of negative performance. Over longer horizons, we believe leverage adds substantial value to the Fund, as reflected in the portfolio’s yield profile.

Diving into the Fund’s performance drivers, positions within the leisure, services and retail sectors were the top contributors during the period. On an asset class basis, leveraged loans and high yield bond positions were the strongest performers followed by structured credit, convertible bonds, and finally private credit. Performance was positive across all rating cohorts including non-rated positions. Notably strong was the selection of lower-rated names in the CCC- and B-rated cohort of the market which, in aggregate, comprised CCC-rated names followed by B-rated names which, in aggregate, comprised ~61.4% of the portfolio on average.

KCOP’s investments represented obligations and equity interests in 424 positions across a diverse group of industries. The top ten issuers represented 21.9% of the Fund’s total assets while the top five industries represented 29.9% of the Fund’s total assets. The Fund’s portfolio is comprised of the following:

| | | | | | | | |

| Investments in securities | % of net assets as of October 31, 2023 |

| | |

| Leveraged Loans | 61.2 | % |

| High Yield Securities | 52.6 | % |

| Asset Backed Securities | 7.8 | % |

| Equity and Other Investments | 5.5 | % |

| Total investments in securities | 127.1 | % |

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

Business Updates

We thank you for your partnership and continued investment in KCOP. We look forward to continued communications and will keep you apprised of the progress of KCOP specifically and the leveraged finance marketplace generally. Fund information is available on our website at kkrfunds.com/kcop.

Disclosures

The Bank of America Merrill Lynch High Yield Master II Index is a market-value weighted index of below investment grade US dollar-denominated corporate bonds publicly issued in the US domestic market. “Yankee” bonds (debt of foreign issuers issued in the US domestic market) are included in the Bank of America Merrill Lynch High Yield Master II Index provided that the issuer is domiciled in a country having investment grade foreign currency long-term debt rating. Qualifying bonds must have maturities of one year or more, a fixed coupon schedule and minimum outstanding of US$100.0 million. In addition, issues having a credit rating lower than BBB3, but not in default, are also included.

The Morningstar LSTA US Leveraged Loan Index is a market value-weighted index designed to measure the performance of the US leveraged loan market based upon market weightings, spreads and interest payments. The index was rolled out in 2000, and it was backloaded with four years of data dating to 1997.

It is not possible to invest directly in an index.

Past performance is not an indication of future results. Returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, expense limitations and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when sold, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. An investment in the Fund involves risk, including the risk of loss of principal. For a discussion of the Fund’s risks, see Risk Considerations, Note 3 to the financial statements. Call 855-330-3927 or visit www.kkrfunds.com/kcop for performance results current to the most recent calendar quarter-end.

Must be preceded or accompanied by a prospectus.

An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non–payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Borrowing to increase investments (leverage) will exaggerate the effect of any increase or decrease in the value of Fund investments. Investments rated below investment grade (typically referred to as “junk”) are generally subject to greater price volatility and illiquidity than higher rated investments. As interest rates rise, the value of certain income investments is likely to decline. Senior loans are subject to prepayment risk. Investments in foreign instruments or currencies can involve greater risk and volatility than US investments because of adverse market economic, political, regulatory, geopolitical or other conditions. Changes in the value of investments entered for hedging purposes may not match those of the position being hedged. The Fund may engage in other investment practices that may involve additional risks.

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns Year Ended October 31, 2023 | | One Year | | Since Inception | | Value of $1,000,000 investment at the time of inception as of 10/31/2023 |

| | | | | | |

| KKR Credit Opportunities Portfolio | | | | | | in thousands |

| Class I (commenced operations on 2/28/2020) | | 14.88 | % | | 5.46 | % | | $ | 1,216 | |

| Class T (commenced operations on 6/1/2020) | | 14.08 | % | | 4.34 | % | | $ | 1,156 | |

| Class U (commenced operations on 9/1/2020) | | 14.10 | % | | 2.77 | % | | $ | 1,090 | |

| Class D (commenced operations on 1/31/2022) | | 14.72 | % | | -0.83 | % | | $ | 986 | |

ICE BofA Merrill Lynch High Yield Master II Index® | | 5.90 | % | | 1.53 | % | | $ | 1,127 | |

| Morningstar LSTA US Leveraged Loan Index | | 11.92 | % | | 4.97 | % | | $ | 1,080 | |

Past performance is not an indication of future results. The above graph and average annual total returns table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

Schedule of Investments

(Stated in United States Dollars, unless otherwise noted)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| | | | | | | | |

| Leveraged Loans - 61.21% | | | | | | | | |

| Aerospace & Defense - 0.85% | | | | | | | | |

| Altitude II IRL WH Borrower DAC | Revolver 1L 05/23 | SOFR + 10.00% | 5.44% | 1/12/2030 | USD | 40,906 | | $ | 20,051 | | (b) (e) |

| Amentum Services Inc | TL 2L B 12/21 | SOFR + 7.60% | 12.93% | 2/15/2030 | USD | 2,767,140 | | 2,630,167 | | (b) |

| Arcfield Acquisition Corp | Revolver 1L 03/22 | SOFR + 5.75% | 0.50% | 8/4/2028 | USD | 143,583 | | — | | (a) (b) (e) |

| Arcfield Acquisition Corp | TL 1L 03/22 | LIBOR + 5.75% | 11.62% | 8/4/2029 | USD | 976,766 | | 980,087 | | (a) (b) |

| Ultra Electronics Holdings Ltd | TL 1L B 11/21 | LIBOR + 3.75% | 9.36% | 8/6/2029 | USD | 131,863 | | 128,270 | | |

| Ultra Electronics Holdings Ltd | TL 1L B 11/21 | EURIBOR + 3.25% | 7.19% | 8/6/2029 | EUR | 104,000 | | 106,853 | | |

| Vertex Aerospace Services Corp | TL 1L B 12/21 | SOFR + 3.35% | 8.67% | 12/6/2028 | USD | 1,535,227 | | 1,534,651 | | |

| | | | | | | | |

| Agricultural Products & Services - 0.05% | | | | | | | | |

| Fruits Bidco | TL 1L B1 08/23 | SOFR + 5.75% | 11.09% | 8/9/2030 | USD | 275,319 | | 269,179 | | (b) |

| Fruits Bidco | TL 1L B2 08/23 | EURIBOR + 5.75% | 9.55% | 8/9/2030 | EUR | 61,259 | | 63,335 | | (b) |

| | | | | | | | |

| Air Freight & Logistics - 1.13% | | | | | | | | |

| Envirotainer Ltd | TL 1L B1 07/22 | EURIBOR + 5.75% | 9.72% | 7/30/2029 | EUR | 4,739,642 | | 4,887,748 | | (a) (b) |

| Envirotainer Ltd | TL 1L B2 07/22 | SOFR + 5.75% | 11.14% | 7/30/2029 | USD | 2,411,934 | | 2,352,118 | | (a) (b) |

| Envirotainer Ltd | TL 1L DD 07/22 | EURIBOR + 5.75% | 1.15% | 7/30/2029 | EUR | 865,234 | | (22,691) | | (a) (b) (e) |

| | | | | | | | |

| Alternative Carriers - 1.61% | | | | | | | | |

| Level 3 Financing Inc | TL 1L 11/19 | SOFR + 1.75% | 7.19% | 3/1/2027 | USD | 10,940,710 | | 10,246,248 | | (a) |

| | | | | | | | |

| Apparel, Accessories & Luxury Goods - 3.18% | | | | | | | |

| Varsity Brands Inc | TL 1L 02/23 | SOFR + 5.11% | 10.44% | 12/15/2026 | USD | 21,176,519 | | 20,303,094 | | |

| | | | | | | | |

| Application Software - 5.35% | | | | | | | | |

| Community Brands Inc | Revolver 1L 02/22 | SOFR + 5.50% | 0.50% | 2/24/2028 | USD | 60,610 | | (1,182) | | (a) (b) (e) |

| Community Brands Inc | TL 1L 02/22 | SOFR + 5.65% | 10.92% | 2/24/2028 | USD | 1,014,846 | | 995,056 | | (a) (b) |

| Community Brands Inc | TL 1L DD 02/22 | SOFR + 5.50% | 1.00% | 2/24/2028 | USD | 121,212 | | (2,364) | | (a) (b) (e) |

| Follett Software Co | Revolver 1L 08/21 | SOFR + 5.75% | 0.50% | 8/31/2027 | USD | 136,050 | | (816) | | (a) (b) (e) |

| Follett Software Co | TL 1L 08/21 | LIBOR + 5.75% | 11.17% | 8/31/2028 | USD | 1,522,529 | | 1,513,394 | | (a) (b) |

| Med-Metrix | Revolver 1L 09/21 | SOFR + 6.00% | 0.50% | 9/15/2027 | USD | 158,828 | | — | | (a) (b) (e) |

| Med-Metrix | TL 1L 09/21 | LIBOR + 6.00% | 11.53% | 9/15/2027 | USD | 1,245,211 | | 1,245,211 | | (a) (b) |

| Med-Metrix | TL 1L DD 09/21 | LIBOR + 6.00% | 11.53% | 9/15/2027 | USD | 632,310 | | 400,421 | | (a) (b) (e) |

| SAMBA Safety Inc | Revolver 1L 09/21 | SOFR + 5.25% | 4.50% | 9/1/2027 | USD | 41,810 | | 20,545 | | (a) (b) (e) |

| SAMBA Safety Inc | TL 1L 09/21 | LIBOR + 5.25% | 10.95% | 9/1/2027 | USD | 565,564 | | 560,700 | | (a) (b) |

| Solera LLC | TL 2L 06/21 PIK Toggle | SOFR + 9.10% | 14.52% | 6/4/2029 | USD | 17,314,785 | | 17,364,577 | | (b) |

| TIBCO Software Inc | TL 1L B 09/22 | SOFR + 4.60% | 9.99% | 3/30/2029 | USD | 12,657,355 | | 12,054,675 | | |

See accompanying notes to financial statements.

6

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| | | | | | | | |

| Automotive Parts & Equipment - 2.28% | | | | | | | | |

| Innovative XCessories & Services LLC | TL 1L 02/20 | SOFR + 4.35% | 9.85% | 3/5/2027 | USD | 6,686,174 | | $ | 5,495,199 | | |

| Parts Authority Inc | TL 1L 10/20 | SOFR + 4.01% | 9.39% | 10/28/2027 | USD | 1,536,285 | | 1,460,753 | | |

| Rough Country LLC | TL 2L 07/21 | SOFR + 6.35% | 11.73% | 7/30/2029 | USD | 861,230 | | 813,862 | | |

| Truck Hero Inc | TL 1L 01/21 | SOFR + 3.86% | 9.19% | 1/31/2028 | USD | 5,007,369 | | 4,792,478 | | |

| Wheel Pros Inc | TL 1L 09/23 | SOFR + 8.88% | 14.31% | 5/11/2028 | USD | 902,052 | | 974,591 | | |

| Wheel Pros Inc | TL 1L 09/23 | SOFR + 4.50% | 9.95% | 5/11/2028 | USD | 1,218,733 | | 990,220 | | |

| | | | | | | | |

| Broadcasting - 2.47% | | | | | | | | |

| NEP Broadcasting LLC | TL 1L 05/20 | SOFR + 8.36% | 13.69% | 6/1/2025 | USD | 149,239 | | 149,239 | | (a) (b) |

| NEP Broadcasting LLC | TL 1L B 09/18 | SOFR + 3.36% | 8.69% | 10/20/2025 | USD | 4,482,478 | | 4,074,662 | | (a) |

| NEP Broadcasting LLC | TL 2L 09/18 | SOFR + 7.11% | 12.44% | 10/19/2026 | USD | 14,697,782 | | 11,545,108 | | (a) |

| | | | | | | | |

| Broadline Retail - 0.21% | | | | | | | | |

| AutoScout24 GmbH | TL 1L B 02/20 | EURIBOR + 2.75% | 6.91% | 3/31/2027 | EUR | 192,932 | | 192,444 | | |

| AutoScout24 GmbH | TL 2L 01/20 | EURIBOR + 6.00% | 10.14% | 3/31/2028 | EUR | 894,208 | | 905,560 | | |

| Belk Inc | TL 1L 02/21 | PRIME + 6.50% | 15.00% | 7/31/2025 | USD | 53,180 | | 45,895 | | (a) |

| Belk Inc | TL 1L EXIT 02/21 PIK Toggle | | | 7/31/2025 | USD | 1,000,844 | | 191,827 | | (a) (c) (f) |

| | | | | | | | |

| Building Products - 0.87% | | | | | | | | |

| DiversiTech Holdings Inc | TL 2L B 12/21 | SOFR + 7.01% | 12.40% | 12/21/2029 | USD | 1,945,020 | | 1,760,243 | | |

| VC GB Holdings Inc (Visual Comfort) | TL 2L 06/21 | SOFR + 7.01% | 12.40% | 7/23/2029 | USD | 4,110,401 | | 3,781,569 | | |

| | | | | | | | |

| Cable & Satellite - 0.97% | | | | | | | | |

| Astound Broadband (RCN/Radiate) | TL 1L B 10/21 | SOFR + 3.36% | 8.69% | 9/25/2026 | USD | 5,602,484 | | 4,651,126 | | |

| Virgin Media Inc | TL 1L 09/19 | SOFR + 2.61% | 7.95% | 1/31/2028 | USD | 1,564,478 | | 1,522,441 | | |

| | | | | | | | |

| Cargo Ground Transportation - 0.03% | | | | | | | | |

| Lazer Logistics Inc | Revolver 1L 05/23 | SOFR + 6.25% | 1.82% | 5/4/2029 | USD | 24,046 | | 2,966 | | (a) (b) (e) |

| Lazer Logistics Inc | TL 1L B 05/23 | SOFR + 6.25% | 11.72% | 5/6/2030 | USD | 198,377 | | 196,393 | | (a) (b) |

| Lazer Logistics Inc | TL 1L DD 05/23 | SOFR + 6.25% | 1.00% | 5/6/2030 | USD | 30,057 | | (301) | | (a) (b) (e) |

| | | | | | | | |

| Casinos & Gaming - 0.10% | | | | | | | | |

| Entain PLC | TL 1L B2 10/22 | SOFR + 3.60% | 8.99% | 10/31/2029 | USD | 634,704 | | 635,630 | | |

| | | | | | | | |

| Construction & Engineering - 2.09% | | | | | | | | |

| Brand Energy & Infrastructure Services Inc | TL 1L B 07/23 | SOFR + 5.50% | 10.87% | 8/1/2030 | USD | 1,533,282 | | 1,482,385 | | |

| Total Safety US Inc | TL 1L B 07/19 | SOFR + 6.26% | 11.50% | 8/16/2025 | USD | 6,129,043 | | 5,845,575 | | (a) |

| USIC Holdings Inc | TL 2L 05/21 | SOFR + 6.61% | 11.94% | 5/14/2029 | USD | 2,682,939 | | 2,475,011 | | |

| Yak Access LLC | TL 1L 03/23 | SOFR + 6.50% | 11.98% | 3/10/2028 | USD | 3,988,412 | | 3,545,698 | | |

| | | | | | | | |

See accompanying notes to financial statements.

7

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Construction Machinery & Heavy Transportation Equipment - 1.59% | | | | | | |

| Accuride Corp | TL 1L B 07/23 | 1.62% PIK, SOFR + 5.25% | 12.19% | 5/18/2026 | USD | 7,514,153 | | $ | 6,621,847 | | (f) |

| American Trailer Works Inc | TL 1L 02/21 | SOFR + 3.85% | 9.17% | 3/3/2028 | USD | 3,601,190 | | 3,397,129 | | |

| Shaw Development LLC | TL 1L 10/23 | SOFR + 6.00% | 6.25% | 10/30/2029 | USD | 148,613 | | 147,127 | | (a) (b) |

| Shaw Development LLC | TL 1L DD 10/23 | SOFR + 6.00% | 0.50% | 10/30/2029 | USD | 17,692 | | (177) | | (a) (b) (e) |

| | | | | | | | |

| Data Processing & Outsourced Services - 1.46% | | | | | | | |

| Encora Digital LLC | TL 1L 12/21 PIK Toggle | LIBOR + 5.18% | 10.47% | 12/20/2028 | USD | 1,652,370 | | 1,649,065 | | (a) (b) |

| Encora Digital LLC | TL 1L 12/21 | 9.75% PIK | 9.75% | 12/13/2029 | USD | 506,251 | | 482,052 | | (a) (b) (f) |

| Encora Digital LLC | TL 1L DD 12/21 | SOFR + 5.18% | 10.47% | 12/20/2028 | USD | 398,160 | | 397,364 | | (a) (b) |

| West Corp | TL 1L B3 01/23 | SOFR + 4.25% | 9.63% | 4/10/2027 | USD | 7,258,448 | | 6,815,356 | | |

| | | | | | | | |

| Distributors - 1.48% | | | | | | | | |

| Caldic BV | TL 1L B 01/22 | SOFR + 3.75% | 9.13% | 2/26/2029 | USD | 107,030 | | 106,183 | | |

| Caldic BV | TL 1L B 02/22 | EURIBOR + 3.50% | 7.45% | 2/26/2029 | EUR | 61,831 | | 63,791 | | |

| Caldic BV | TL 2L 03/22 | SOFR + 7.25% | 12.63% | 2/25/2030 | USD | 6,499,085 | | 6,297,613 | | (b) |

| Parts Town LLC | TL 1L 11/21 | LIBOR + 5.50% | 11.52% | 11/1/2028 | USD | 831,724 | | 823,157 | | (a) (b) |

| Parts Town LLC | TL 1L B 11/21 | LIBOR + 5.50% | 11.52% | 11/1/2028 | USD | 913,219 | | 903,813 | | (a) (b) |

| Parts Town LLC | TL 1L DD 11/21 | SOFR + 6.13% | 11.52% | 11/1/2028 | USD | 1,274,864 | | 1,261,733 | | (a) (b) |

| | | | | | | | |

| Diversified Metals & Mining - 0.02% | | | | | | | | |

| Foresight Energy LLC | TL 1L A 06/20 | SOFR + 8.10% | 13.49% | 6/30/2027 | USD | 120,754 | | 120,754 | | (a) (b) |

| | | | | | | | |

| Diversified Support Services - 0.18% | | | | | | | | |

| Access CIG LLC | TL 2L 02/18 | SOFR + 7.75% | 13.41% | 2/27/2026 | USD | 93,173 | | 91,310 | | |

| Apex Service Partners LLC | Revolver 1L 10/23 | SOFR + 6.50% | 0.95% | 10/24/2029 | USD | 25,732 | | 858 | | (a) (b) (e) |

| Apex Service Partners LLC | TL 1L 10/23 | 2% PIK, SOFR + 7.00% | 12.40% | 10/24/2030 | USD | 298,351 | | 294,622 | | (a) (b) (f) |

| Apex Service Partners LLC | TL 1L 10/23 PIK | 14.25% PIK | 14.25% | 4/23/2031 | USD | 64,914 | | 63,376 | | (a) (b) (f) |

| Apex Service Partners LLC | TL 1L DD 10/23 | SOFR + 6.50% | 1.00% | 10/24/2030 | USD | 77,197 | | (965) | | (a) (b) (e) |

| Apex Service Partners LLC | TL 1L DD 10/23 PIK | 14.25% PIK | 14.25% | 4/23/2031 | USD | 32,458 | | (769) | | (a) (b) (e) (f) |

| Magna Legal Services LLC | Revolver 1L 11/22 | SOFR + 6.63% | 0.50% | 11/22/2028 | USD | 26,940 | | — | | (a) (b) (e) |

| Magna Legal Services LLC | TL 1L 11/22 | SOFR + 6.60% | 12.02% | 11/22/2029 | USD | 229,952 | | 231,309 | | (a) (b) |

| Magna Legal Services LLC | TL 1L DD 11/22 | SOFR + 6.60% | 6.56% | 11/22/2029 | USD | 64,374 | | 61,548 | | (a) (b) (e) |

| Trescal SA | TL 1L B1 05/23 | EURIBOR + 6.50% | 10.12% | 5/2/2030 | EUR | 197,463 | | 203,571 | | (a) (b) |

| Trescal SA | TL 1L B2 04/23 | SOFR + 6.50% | 11.86% | 5/2/2030 | USD | 215,855 | | 210,437 | | (a) (b) |

| Trescal SA | TL 1L DD 05/23 | EURIBOR + 6.50% | 1.30% | 5/2/2030 | EUR | 113,999 | | (3,026) | | (a) (b) (e) |

| | | | | | | | |

See accompanying notes to financial statements.

8

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Electronic Equipment & Instruments - 0.73% | | | | | | | |

| Excelitas Technologies Corp | Revolver 1L 08/22 | SOFR + 5.75% | 5.03% | 8/12/2028 | USD | 351,770 | | $ | 228,615 | | (b) (e) |

| Excelitas Technologies Corp | TL 1L 08/22 | SOFR + 5.85% | 11.21% | 8/12/2029 | USD | 3,863,723 | | 3,824,700 | | (b) |

| Excelitas Technologies Corp | TL 1L 08/22 | EURIBOR + 5.75% | 9.54% | 8/12/2029 | EUR | 598,179 | | 626,169 | | (b) |

| Excelitas Technologies Corp | TL 1L DD 08/22 | SOFR + 5.75% | 1.00% | 8/12/2029 | USD | 457,301 | | (4,619) | | (b) (e) |

| | | | | | | | |

| Environmental & Facilities Services - 1.21% | | | | | | | |

| 48Forty Solutions LLC | Revolver 1L 03/22 | SOFR + 5.85% | 3.62% | 11/30/2026 | USD | 610,068 | | 219,869 | | (a) (b) (e) |

| 48Forty Solutions LLC | TL 1L 02/22 | SOFR + 5.85% | 11.41% | 11/30/2026 | USD | 4,688,090 | | 4,502,441 | | (a) (b) |

| 48Forty Solutions LLC | TL 1L 03/22 | SOFR + 5.85% | 11.41% | 11/30/2026 | USD | 3,133,346 | | 3,009,266 | | (a) (b) |

| | | | | | | | |

| Financial Exchanges & Data - 0.11% | | | | | | | | |

| IntraFi Network LLC | TL 2L 11/21 | SOFR + 6.35% | 11.67% | 11/5/2029 | USD | 751,420 | | 721,363 | | (a) |

| | | | | | | | |

| Food Distributors - 0.14% | | | | | | | | |

| Lipari Foods LLC | TL 1L 10/22 | SOFR + 6.65% | 12.03% | 10/31/2028 | USD | 766,939 | | 773,535 | | (b) |

| Lipari Foods LLC | TL 1L DD 10/22 | SOFR + 6.65% | 4.42% | 10/31/2028 | USD | 219,389 | | 100,484 | | (b) (e) |

| | | | | | | | |

| Health Care Equipment - 4.22% | | | | | | | | |

| Drive DeVilbiss Healthcare LLC | TL 1L 03/21 | 4.00% PIK, SOFR + 9.50% | 14.89% | 6/1/2025 | USD | 20,497,321 | | 16,295,370 | | (f) |

| Drive DeVilbiss Healthcare LLC | TL 1L 09/22 | 9.00% PIK, SOFR + 10.00% | 15.39% | 6/1/2025 | USD | 2,836,741 | | 2,836,741 | | (b) (f) |

| Orchid Orthopedic Solutions LLC | TL 1L 02/19 | SOFR + 4.76% | 10.15% | 3/5/2026 | USD | 6,866,086 | | 6,440,389 | | |

| PartsSource Inc | Revolver 1L 10/21 | SOFR + 5.86% | 1.41% | 8/23/2026 | USD | 87,104 | | 12,644 | | (a) (b) (e) |

| PartsSource Inc | TL 1L 10/21 | LIBOR + 5.75% | 11.39% | 8/23/2028 | USD | 1,312,243 | | 1,298,595 | | (a) (b) |

| PartsSource Inc | TL 1L DD 08/21 | SOFR + 5.75% | 3.58% | 8/23/2028 | USD | 464,562 | | 91,565 | | (a) (b) (e) |

| | | | | | | | |

| Health Care Facilities - 1.77% | | | | | | | | |

| Lakefield Veterinary Group | TL 1L 11/21 | LIBOR + 5.50% | 10.92% | 11/23/2028 | USD | 2,182,852 | | 2,123,478 | | (b) |

| Lakefield Veterinary Group | TL 1L DD 11/21 | LIBOR + 5.50% | 4.16% | 11/23/2028 | USD | 1,260,468 | | 647,518 | | (b) (e) |

| ScionHealth | TL 1L B 12/21 | SOFR + 5.36% | 10.69% | 12/23/2028 | USD | 2,415,260 | | 607,836 | | |

| VetCor Professional Practices LLC | Revolver 1L 08/22 | SOFR + 5.75% | 0.50% | 8/31/2029 | USD | 573,499 | | (2,581) | | (b) (e) |

| VetCor Professional Practices LLC | TL 1L B 08/22 | SOFR + 5.75% | 11.17% | 8/31/2029 | USD | 7,926,501 | | 7,890,832 | | (b) |

| | | | | | | | |

| Health Care Services - 1.74% | | | | | | | | |

| Affordable Care Inc | Revolver 1L 08/21 | SOFR + 5.50% | 0.50% | 8/2/2027 | USD | 177,081 | | (1,594) | | (a) (b) (e) |

| Affordable Care Inc | TL 1L 08/21 PIK | 1.25% PIK, SOFR + 5.50% | 10.92% | 8/2/2028 | USD | 1,583,764 | | 1,569,509 | | (a) (b) |

| Affordable Care Inc | TL 1L DD 08/21 | 1.25% PIK, SOFR + 5.50% | 10.92% | 8/2/2028 | USD | 284,754 | | 282,191 | | (a) (b) |

| Affordable Care Inc | TL 1L DD 08/23 | SOFR + 5.50% | 3.22% | 8/2/2028 | USD | 313,609 | | 81,792 | | (a) (b) (e) |

| American Vision Partners | Revolver 1L 09/21 | SOFR + 5.90% | 4.97% | 9/30/2026 | USD | 158,140 | | 84,779 | | (a) (b) (e) |

| American Vision Partners | TL 1L 09/21 | SOFR + 5.90% | 11.48% | 9/30/2027 | USD | 1,890,704 | | 1,845,516 | | (a) (b) |

| American Vision Partners | TL 1L DD 09/21 | SOFR + 5.90% | 11.49% | 9/30/2027 | USD | 780,806 | | 762,145 | | (a) (b) |

See accompanying notes to financial statements.

9

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Amerivet Partners Management Inc | Revolver 1L 02/22 | SOFR + 5.50% | 0.75% | 2/25/2028 | USD | 197,240 | | $ | (1,598) | | (a) (b) (e) |

| Amerivet Partners Management Inc | TL 1L 02/22 | SOFR + 5.65% | 11.04% | 2/25/2028 | USD | 2,218,703 | | 2,156,357 | | (a) (b) |

| Amerivet Partners Management Inc | TL 1L DD 02/22 | SOFR + 5.65% | 1.00% | 2/25/2028 | USD | 877,718 | | (24,664) | | (a) (b) (e) |

| Amerivet Partners Management Inc | TL 1L DD 11/22 | SOFR + 5.50% | 6.25% | 2/25/2028 | USD | 694,453 | | 674,939 | | (a) (b) |

| CHG Healthcare Services Inc | TL 1L 09/21 | SOFR+ 3.36% | 8.69% | 9/29/2028 | USD | 1,502,534 | | 1,488,733 | | |

| Novotech Pty Ltd | TL 1L B1 07/23 | SOFR + 5.57% | 10.92% | 1/13/2028 | USD | 1,088,942 | | 1,080,993 | | (a) (b) |

| Novotech Pty Ltd | TL 1L B2 01/22 | SOFR + 6.01% | 10.71% | 1/13/2028 | USD | 1,144,851 | | 1,136,494 | | (a) (b) |

| Novotech Pty Ltd | TL 1L DD 01/22 | SOFR + 5.25% | 1.00% | 1/13/2028 | USD | 266,244 | | (1,944) | | (a) (b) (e) |

| | | | | | | | |

| Health Care Technology - 0.36% | | | | | | | | |

| athenahealth Inc | TL 1L 01/22 | SOFR + 3.50% | 8.58% | 2/15/2029 | USD | 330,701 | | 321,253 | | |

| GoodRx Inc | TL 1L 10/18 | SOFR + 2.85% | 8.17% | 10/10/2025 | USD | 1,953,191 | | 1,953,796 | | |

| | | | | | | | |

| Hotels, Resorts & Cruise Lines - 0.44% | | | | | | | | |

| Playa Resorts Holding BV | TL 1L B 11/22 | SOFR + 4.25% | 9.58% | 1/5/2029 | USD | 1,956,118 | | 1,951,541 | | |

| Travel + Leisure Co | TL 1L 12/22 | SOFR + 4.10% | 9.49% | 12/14/2029 | USD | 879,474 | | 881,814 | | |

| | | | | | | | |

| Human Resource & Employment Services - 2.51% | | | | | | | |

| Insight Global LLC | Revolver 1L 09/21 | SOFR + 6.00% | 0.50% | 9/22/2027 | USD | 427,591 | | (4,618) | | (a) (b) (e) |

| Insight Global LLC | TL 1L 02/22 | LIBOR + 6.00% | 11.48% | 9/22/2028 | USD | 1,035,019 | | 1,023,841 | | (a) (b) |

| Insight Global LLC | TL 1L 09/21 | LIBOR + 6.00% | 11.48% | 9/22/2028 | USD | 5,346,863 | | 5,289,117 | | (a) (b) |

| Oxford Global Resources LLC | Revolver 1L 08/21 | SOFR + 6.25% | 0.38% | 8/17/2027 | USD | 128,823 | | — | | (a) (b) (e) |

| Oxford Global Resources LLC | TL 1L 06/22 | SOFR + 6.15% | 11.55% | 8/17/2027 | USD | 6,561,057 | | 6,626,667 | | (a) (b) |

| Oxford Global Resources LLC | TL 1L 08/21 | SOFR + 6.25% | 11.56% | 8/17/2027 | USD | 1,464,454 | | 1,479,099 | | (a) (b) |

| Oxford Global Resources LLC | TL 1L DD 08/21 | SOFR + 6.15% | 4.32% | 8/17/2027 | USD | 256,737 | | 124,813 | | (a) (b) (e) |

| SIRVA Worldwide Inc | TL 1L 07/18 | SOFR + 5.76% | 11.00% | 8/4/2025 | USD | 1,581,969 | | 1,430,694 | | |

| SIRVA Worldwide Inc | TL 2L 07/18 | SOFR + 9.76% | 15.16% | 8/3/2026 | USD | 59,000 | | 51,035 | | |

| | | | | | | | |

| Industrial Machinery & Supplies & Components - 1.55% | | | | | | | |

| Chart Industries Inc | TL 1L B 09/23 | SOFR + 3.35% | 8.66% | 3/15/2030 | USD | 2,364,494 | | 2,363,512 | | |

| Engineered Machinery Holdings Inc | TL 2L 08/21 | SOFR + 6.26% | 11.65% | 5/21/2029 | USD | 297,640 | | 291,687 | | |

| ProMach Group Inc | TL 1L B 08/21 | SOFR + 4.11% | 9.44% | 8/31/2028 | USD | 904,250 | | 903,580 | | |

| SPX FLOW Inc | TL 1L B 03/22 | SOFR + 4.60% | 9.92% | 4/5/2029 | USD | 3,140,864 | | 3,117,511 | | (a) |

| Time Manufacturing Co | Revolver 1L 12/21 | LIBOR + 6.65% | 4.58% | 12/1/2027 | USD | 153,560 | | 74,531 | | (a) (b) (e) |

| Time Manufacturing Co | TL 1L 06/22 | EURIBOR + 6.50% | 10.28% | 12/1/2027 | EUR | 370,457 | | 368,204 | | (a) (b) |

| Time Manufacturing Co | TL 1L 12/21 | LIBOR + 6.50% | 12.07% | 12/1/2027 | USD | 916,772 | | 861,674 | | (a) (b) |

| Time Manufacturing Co | TL 1L 12/21 | EURIBOR + 6.50% | 10.28% | 12/1/2027 | EUR | 591,000 | | 587,407 | | (a) (b) |

| WireCo WorldGroup Inc | TL 1L B 10/21 | SOFR + 4.36% | 9.70% | 11/13/2028 | USD | 1,317,989 | | 1,310,575 | | |

| | | | | | | | |

See accompanying notes to financial statements.

10

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Insurance Brokers - 3.57% | | | | | | | | |

| Alera Group Intermediate Holdings Inc | TL 1L 09/21 | SOFR + 6.10% | 11.42% | 10/2/2028 | USD | 650,259 | | $ | 643,887 | | (a) (b) |

| Alera Group Intermediate Holdings Inc | TL 1L DD 09/21 | SOFR + 6.10% | 11.42% | 10/2/2028 | USD | 184,794 | | 182,983 | | (a) (b) |

| Alera Group Intermediate Holdings Inc | TL 1L DD 12/21 | SOFR + 6.10% | 11.42% | 10/2/2028 | USD | 534,429 | | 529,192 | | (a) (b) |

| CFC Underwriting Ltd | TL 1L B 05/22 | SOFR + 5.00% | 10.30% | 5/16/2029 | USD | 5,343,384 | | 5,396,818 | | (a) (b) |

| CFC Underwriting Ltd | TL 1L DD 05/22 | SONIA + 5.00% | 1.00% | 5/16/2029 | GBP | 630,571 | | 7,659 | | (a) (b) (e) |

| Foundation Risk Partners Corp | Revolver 1L 10/21 | SOFR + 6.00% | 0.38% | 10/29/2027 | USD | 141,750 | | (1,984) | | (a) (b) (e) |

| Foundation Risk Partners Corp | TL 1L 03/22 | SOFR + 6.35% | 11.49% | 10/30/2028 | USD | 827,526 | | 815,941 | | (a) (b) |

| Foundation Risk Partners Corp | TL 1L 10/21 | SOFR + 6.25% | 11.49% | 10/29/2028 | USD | 1,322,284 | | 1,303,772 | | (a) (b) |

| Foundation Risk Partners Corp | TL 1L DD 03/22 | SOFR + 6.35% | 5.39% | 10/29/2028 | USD | 3,340,374 | | 2,359,387 | | (a) (b) (e) |

| Foundation Risk Partners Corp | TL 1L DD 10/21 | SOFR + 6.35% | 11.49% | 10/29/2028 | USD | 287,584 | | 283,558 | | (a) (b) |

| Galway Partners Holdings LLC | Revolver 1L 09/21 | SOFR + 5.25% | 0.50% | 9/30/2027 | USD | 205,492 | | (2,651) | | (a) (b) (e) |

| Galway Partners Holdings LLC | TL 1L 09/21 | SOFR + 5.35% | 10.74% | 9/29/2028 | USD | 2,885,988 | | 2,848,759 | | (a) (b) |

| Integrity Marketing Group LLC | TL 1L DD 08/23 | SOFR + 6.02% | 11.54% | 8/27/2026 | USD | 2,908,787 | | 2,895,116 | | (a) (b) |

| Integrity Marketing Group LLC | TL 1L DD 08/23 | SOFR + 6.02% | 11.44% | 8/27/2026 | USD | 5,534,103 | | 5,508,093 | | (a) (b) |

| | | | | | | | |

| Integrated Oil & Gas - 0.09% | | | | | | | | |

| CEPSA Holdco (Matador Bidco) | TL 1L B 10/19 | SOFR + 4.60% | 9.92% | 10/15/2026 | USD | 547,443 | | 548,618 | | |

| | | | | | | | |

| IT Consulting & Other Services - 3.07% | | | | | | | | |

| 3Pillar Global Inc | Revolver 1L 11/21 | SOFR + 6.00% | 1.75% | 11/23/2026 | USD | 186,240 | | 15,552 | | (a) (b) (e) |

| 3Pillar Global Inc | TL 1L 11/21 | SOFR + 6.10% | 11.43% | 11/23/2027 | USD | 1,921,292 | | 1,871,338 | | (a) (b) |

| 3Pillar Global Inc | TL 1L DD 11/21 | SOFR + 6.16% | 11.54% | 11/23/2027 | USD | 618,335 | | 602,259 | | (a) (b) |

| PSAV Inc (aka Encore) | TL 1L B1 12/20 | 0.25% PIK, SOFR + 3.60% | 8.92% | 3/3/2025 | USD | 10,224,780 | | 9,636,241 | | (f) |

| PSAV Inc (aka Encore) | TL 1L B3 12/20 | 10.00% PIK, 5.00% | 15.00% | 10/15/2026 | USD | 675,824 | | 677,936 | | (f) |

| PSAV Inc (aka Encore) | TL 2L 02/18 | SOFR + 7.36% | 12.69% | 9/1/2025 | USD | 7,628,543 | | 6,789,404 | | |

| | | | | | | | |

| Leisure Facilities - 1.70% | | | | | | | | |

| Aimbridge Acquisition Co Inc | TL 1L B 09/20 | SOFR + 4.86% | 10.19% | 2/2/2026 | USD | 21,395 | | 20,699 | | |

| Aimbridge Acquisition Co Inc | TL 1L B 10/19 | SOFR + 3.86% | 9.19% | 2/2/2026 | USD | 7,788,417 | | 7,476,880 | | |

| ClubCorp Club Operations Inc | TL 1L B 08/17 | LIBOR + 2.75% | 8.18% | 9/18/2024 | USD | 3,168,710 | | 3,083,567 | | |

| Life Time Fitness Inc | TL 1L B 05/23 | SOFR + 5.18% | 10.61% | 1/15/2026 | USD | 300,810 | | 301,449 | | |

| | | | | | | | |

| Leisure Products - 0.12% | | | | | | | | |

| Areas Worldwide SASU | TL 1L B1 06/19 | EURIBOR + 4.75% | 8.49% | 7/1/2026 | EUR | 30,687 | | 30,592 | | |

| Topgolf Callaway Brands Corp | TL 1L B 03/23 | SOFR + 3.60% | 8.92% | 3/15/2030 | USD | 706,052 | | 703,701 | | |

| | | | | | | | |

See accompanying notes to financial statements.

11

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Life & Health Insurance - 0.45% | | | | | | | | |

| Luxembourg Life Fund - Absolute Return Fund II | TL 1L 02/22 | SOFR + 7.50% | 12.89% | 2/10/2027 | USD | 2,907,025 | | $ | 2,871,850 | | (b) |

| | | | | | | | |

| Life Sciences Tools & Services - 0.89% | | | | | | | | |

| PAREXEL International Corp | TL 2L 07/21 | SOFR + 6.61% | 11.94% | 11/15/2029 | USD | 5,766,010 | | 5,697,394 | | (b) |

| | | | | | | | |

| Oil & Gas Storage & Transportation - 0.76% | | | | | | | |

| Brazos Midstream Holdings LLC | TL 1L B 01/23 | SOFR + 3.75% | 9.08% | 2/11/2030 | USD | 533,618 | | 532,327 | | |

| Oryx Midstream Services LLC | TL 1L B 01/23 | SOFR + 3.36% | 8.69% | 10/5/2028 | USD | 2,794,302 | | 2,793,534 | | |

| UGI Energy Services LLC | TL 1L B 02/23 | SOFR + 3.35% | 8.67% | 2/22/2030 | USD | 1,548,797 | | 1,549,402 | | |

| | | | | | | | |

| Other Specialized REITs - 0.50% | | | | | | | | |

| Pretium Partners LLC P2 | TL 1L 12/21 | 11.00% | 11.00% | 12/16/2029 | USD | 3,270,612 | | 3,205,200 | | (a) (b) |

| | | | | | | | |

| Packaged Foods & Meats - 0.14% | | | | | | | | |

| NovaTaste Austria GmbH | TL 1L B 05/23 | EURIBOR + 7.00% | 10.60% | 5/30/2030 | EUR | 372,095 | | 382,857 | | (b) |

| NovaTaste Austria GmbH | TL 1L DD CAR 05/23 | EURIBOR + 7.00% | 1.50% | 5/30/2030 | EUR | 116,280 | | (3,320) | | (b) (e) |

| Solina France SASU | TL 1L 10/22 | SOFR + 6.50% | 12.23% | 7/31/2028 | USD | 500,000 | | 500,950 | | (b) |

| | | | | | | | |

| Paper & Plastic Packaging Products & Materials - 0.10% | | | | | | | |

| Pretium Packaging LLC | TL 1L A 10/23 | 2.50% PIK, SOFR + 5.00% | 5.00% | 10/2/2028 | USD | 50,184 | | 48,332 | | (a) (b) (f) |

| Pretium Packaging LLC | TL 1L A1 10/23 | SOFR + 4.60% | 9.99% | 10/2/2028 | USD | 60,575 | | 46,542 | | (a) |

| Pretium Packaging LLC | TL 2L 09/21 | LIBOR + 6.75% | 12.20% | 10/1/2029 | USD | 810,470 | | 522,510 | | (a) (b) |

| | | | | | | | |

| Pharmaceuticals - 0.33% | | | | | | | | |

| Arrotex Australia Group Pty Ltd | TL 1L B1 06/23 | BBSY + 6.75% | 10.96% | 6/30/2028 | AUD | 588,281 | | 366,329 | | (b) |

| Arrotex Australia Group Pty Ltd | TL 1L B2 06/23 | BBSY + 6.75% | 10.96% | 6/30/2028 | AUD | 149,455 | | 93,067 | | (b) |

| iNova Pharmaceuticals (Australia) Pty Limited | TL 1L B 10/22 | BBSY + 6.50% | 10.68% | 10/30/2028 | AUD | 1,317,795 | | 833,966 | | (b) |

| iNova Pharmaceuticals (Australia) Pty Limited | TL 1L DD - C 10/22 | BBSY + 6.50% | 2.60% | 10/30/2028 | AUD | 133,689 | | (110) | | (b) (e) |

| Laboratoires Vivacy SAS | TL 1L B 03/23 | EURIBOR + 6.75% | 10.72% | 9/30/2030 | EUR | 780,884 | | 804,212 | | (a) (b) |

| Laboratoires Vivacy SAS | TL 1L DD 03/23 | EURIBOR + 6.75% | 2.03% | 9/30/2030 | EUR | 62,974 | | (1,738) | | (a) (b) (e) |

| | | | | | | | |

| Property & Casualty Insurance - 0.99% | | | | | | | | |

| Alacrity Solutions Group LLC | Revolver 1L 12/21 | SOFR + 5.25% | 4.53% | 12/22/2027 | USD | 505,280 | | 250,568 | | (b) (e) |

| Alacrity Solutions Group LLC | TL 1L 12/21 | SOFR + 5.35% | 10.67% | 12/22/2028 | USD | 5,512,494 | | 5,434,767 | | (b) |

| Alacrity Solutions Group LLC | TL 1L DD 06/22 | SOFR + 5.35% | 3.07% | 12/22/2028 | USD | 2,467,864 | | 637,793 | | (b) (e) |

| | | | | | | | |

| Publishing - 0.18% | | | | | | | | |

| Emerald Expositions Holding Inc | TL 1L B 05/17 | SOFR + 5.10% | 10.42% | 5/22/2026 | USD | 1,127,829 | | 1,129,949 | | |

| | | | | | | | |

See accompanying notes to financial statements.

12

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Real Estate Operating Companies - 0.44% | | | | | | | |

| Opendoor Labs Inc | TL 2L DD 10/21 | 10.00% | 10.00% | 4/1/2026 | USD | 2,931,835 | | $ | 2,832,152 | | (a) (b) |

| | | | | | | | |

| Real Estate Services - 0.33% | | | | | | | | |

| SitusAMC Holdings Corp | TL 1L 12/21 | SOFR + 5.60% | 10.99% | 12/22/2027 | USD | 2,078,245 | | 2,076,790 | | (a) (b) |

| | | | | | | | |

| Research & Consulting Services - 2.14% | | | | | | | |

| BDO USA PA | TL 1L 08/23 | SOFR + 6.00% | 11.32% | 8/31/2028 | USD | 146,901 | | 144,286 | | (a) (b) |

| Element Materials Technology Group US Holdings Inc | TL 1L B 03/22 | EURIBOR + 4.25% | 8.22% | 7/6/2029 | EUR | 51,387 | | 53,593 | | |

| Element Materials Technology Group US Holdings Inc | TL 1L B 04/22 | SOFR + 4.35% | 9.74% | 6/22/2029 | USD | 142,632 | | 138,472 | | |

| Element Materials Technology Group US Holdings Inc | TL 1L DD - B 04/22 | SOFR + 4.35% | 9.74% | 6/22/2029 | USD | 65,830 | | 63,910 | | |

| Element Materials Technology Group US Holdings Inc | TL 2L 07/22 | SONIA + 7.25% | 12.44% | 6/24/2030 | GBP | 1,336,815 | | 1,583,038 | | (b) |

| Element Materials Technology Group US Holdings Inc | TL 2L DD 06/22 | SONIA + 7.25% | 12.44% | 6/24/2030 | GBP | 413,113 | | 489,203 | | (b) |

| Element Materials Technology Group US Holdings Inc | TL Unsec DD 07/22 | 13.89% | 13.89% | 7/9/2031 | USD | 6,243,663 | | 5,887,774 | | (b) (f) |

| HKA | TL 1L B 08/22 | SOFR + 5.75% | 11.12% | 8/9/2029 | USD | 4,176,369 | | 4,000,961 | | (b) |

| HKA | TL 1L DD (CAR) 08/22 | SOFR + 5.75% | 11.12% | 8/9/2029 | USD | 1,318,854 | | 1,263,462 | | (b) |

| | | | | | | | |

| Specialized Consumer Services - 0.33% | | | | | | | |

| Circana Group (f.k.a. NPD Group) | Revolver 1L 08/22 | SOFR + 5.75% | 0.68% | 12/1/2027 | USD | 51,095 | | 1,022 | | (a) (b) (e) |

| Circana Group (f.k.a. NPD Group) | TL 1L 08/22 | 2.75% PIK, SOFR + 6.25% | 14.34% | 12/1/2028 | USD | 973,829 | | 983,567 | | (a) (b) (f) |

| SavATree LLC | Revolver 1L 10/21 | SOFR + 5.25% | 0.25% | 10/12/2028 | USD | 128,932 | | (1,238) | | (a) (b) (e) |

| SavATree LLC | TL 1L 10/21 | SOFR + 5.25% | 10.79% | 10/12/2028 | USD | 990,104 | | 980,598 | | (a) (b) |

| Spotless Brands LLC | TL 1L 02/23 | SOFR + 6.65% | 12.03% | 7/25/2028 | USD | 155,238 | | 155,579 | | (a) (b) |

| Spotless Brands LLC | TL 1L DD 02/23 | SOFR + 6.75% | 1.00% | 7/25/2028 | USD | 234,626 | | 2,651 | | (a) (b) (e) |

| | | | | | | | |

| Specialized Finance - 0.02% | | | | | | | | |

| BHG FUNDING 05 LLC | TL 1L DD 11/22 | Variable | 20.23% | 11/8/2027 | USD | 140,740 | | 140,726 | | (b) |

| | | | | | | | |

| Specialty Chemicals - 3.78% | | | | | | | | |

| Aruba Investments Inc | TL 2L 10/20 | SOFR + 7.85% | 13.17% | 11/24/2028 | USD | 465,220 | | 434,748 | | |

| Champion/DSM engg | TL 1L B1 03/23 | EURIBOR + 5.50% | 9.45% | 3/29/2030 | EUR | 1,839,940 | | 1,804,635 | | |

| Champion/DSM engg | TL 1L B1 03/23 | SOFR + 5.50% | 10.88% | 3/29/2030 | USD | 8,192,670 | | 7,552,659 | | |

| Flint Group GmbH | TL 1L 03/23 Super Senior | EURIBOR + 8.00% | 11.97% | 6/30/2026 | EUR | 427,556 | | 458,911 | | (a) |

| Flint Group GmbH | TL 1L 09/23 PIK | 6.90% PIK, SOFR + 7.00% | 12.67% | 12/31/2027 | USD | 339,123 | | 244,169 | | (a) (f) |

| Flint Group GmbH | TL 1L 09/23 PIK (HoldCo) EUR | 6.90% PIK, EURIBOR + 7.00% | 10.97% | 12/31/2027 | EUR | 1,168,952 | | 882,292 | | (a) (f) |

| Flint Group GmbH | TL 1L B 09/23 | 0.75% PIK, SOFR + 4.25% | 5.00% | 12/31/2026 | USD | 695,471 | | 652,585 | | (a) (f) |

See accompanying notes to financial statements.

13

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Flint Group GmbH | TL 1L B 09/23 (OpCo) EUR | 0.75% PIK, EURIBOR + 4.25% | 9.00% | 12/31/2026 | EUR | 2,408,567 | | $ | 2,377,200 | | (a) (f) |

| Flint Group GmbH | TL 2L 09/23 PIK | 6.90% PIK, LIBOR + 7.00% | 7.00% | 12/31/2027 | USD | 452,238 | | 81,780 | | (a) (f) |

| Flint Group GmbH | TL 2L 09/23 PIK (HoldCo) EUR | 6.90% PIK, EURIBOR + 7.00% | 10.97% | 12/31/2027 | EUR | 1,558,860 | | 269,250 | | (a) (f) |

| Vantage Specialty Chemicals Inc | TL 1L B 02/23 | SOFR + 4.75% | 10.08% | 10/26/2026 | USD | 9,747,197 | | 9,397,906 | | |

| | | | | | | | |

| Systems Software - 0.33% | | | | | | | | |

| Aareon AG | TL 1L 08/23 | EURIBOR + 6.25% | 7.00% | 8/19/2030 | EUR | 296,880 | | 306,251 | | (a) (b) |

| Aareon AG | TL 1L DD CAR 08/23 | EURIBOR + 6.25% | 1.50% | 8/19/2030 | EUR | 74,220 | | (1,923) | | (a) (b) (e) |

| Aareon AG | TL Unsec DD 08/23 | 10.25% PIK | 10.25% | 8/8/2031 | EUR | 45,357 | | (1,295) | | (a) (b) (e) (f) |

| Civica Group Ltd | TL 1L 08/23 | BBSW + 6.25% | 10.31% | 8/30/2030 | AUD | 12,272 | | 7,545 | | (a) (b) |

| Civica Group Ltd | TL 1L 08/23 | SONIA + 6.25% | 6.25% | 6/30/2030 | GBP | 221,717 | | 261,262 | | (a) (b) |

| Civica Group Ltd | TL 1L DD 08/23 | SONIA + 6.25% | 1.00% | 6/30/2030 | GBP | 94,171 | | (3,408) | | (a) (b) (e) |

| SolarWinds Holdings Inc | TL 1L B 11/22 | SOFR + 3.75% | 9.07% | 2/17/2027 | USD | 1,536,260 | | 1,533,057 | | |

| | | | | | | | |

| Trading Companies & Distributors - 0.27% | | | | | | | |

| Radwell International LLC/PA | Revolver 1L 04/22 | SOFR + 6.75% | 0.77% | 4/1/2028 | USD | 68,154 | | 2,726 | | (a) (b) (e) |

| Radwell International LLC/PA | TL 1L 04/22 | SOFR + 5.85% | 12.02% | 4/1/2029 | USD | 24,115 | | 24,356 | | (a) (b) |

| Radwell International LLC/PA | TL 1L 12/22 | SOFR + 6.75% | 12.14% | 4/1/2029 | USD | 901,911 | | 919,949 | | (a) (b) |

| Univar Inc | TL 1L B 06/23 | SOFR + 4.50% | 9.81% | 8/1/2030 | USD | 794,781 | | 793,434 | | |

| TOTAL LEVERAGED LOANS (Amortized cost $404,624,336) | | | | | | $ | 390,824,352 | | |

See accompanying notes to financial statements.

14

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| | | | | | |

| High Yield Securities - 52.48% | | | | | | |

| | | | | | |

| Advertising - 0.09% | | | | | | |

| Outfront Media Capital LLC / Outfront Media Capital Corp | 5.000% 08/2027 | 8/15/2027 | USD | 648,000 | | $ | 576,162 | | (h) |

| | | | | | |

| Aerospace & Defense - 0.83% | | | | | | |

| Aviation Capital Group LLC | 5.500% 12/2024 | 12/15/2024 | USD | 485,000 | | 477,370 | | (h) |

| Rolls-Royce PLC | 4.625% 02/2026 | 2/16/2026 | EUR | 491,000 | | 513,327 | | (h) |

| Ultra Electronics Holdings Ltd | 7.25% 01/2030 | 1/31/2030 | USD | 2,162,000 | | 2,112,923 | | (a) (b) |

| Ultra Electronics Holdings Ltd | 9.0% PIK 01/2031 | 1/31/2031 | USD | 2,272,448 | | 2,166,325 | | (a) (b) (f) |

| | | | | | |

| Alternative Carriers - 0.60% | | | | | | |

| Level 3 Financing Inc | 3.750% 07/2029 | 7/15/2029 | USD | 48,000 | | 24,461 | | (a) (h) |

| Zayo Group LLC | 4.000% 03/2027 | 3/1/2027 | USD | 5,034,000 | | 3,794,667 | | (h) |

| | | | | | |

| Apparel, Accessories & Luxury Goods - 0.26% | | | | | | |

| Hanesbrands Inc | 4.875% 05/2026 | 5/15/2026 | USD | 952,000 | | 875,736 | | (h) |

| Varsity Brands Inc | S+8.000% 12/2024 | 12/22/2024 | USD | 783,000 | | 783,000 | | (b) (h) |

| | | | | | |

| Application Software - 1.21% | | | | | | |

| Cision Ltd | 9.500% 02/2028 | 2/15/2028 | USD | 10,042,000 | | 5,298,661 | | (h) |

| Cvent Holding Corp | 8.000% 06/2030 | 6/15/2030 | USD | 1,411,000 | | 1,370,469 | | (h) |

| TeamSystem SpA | 3.500% 02/2028 | 2/15/2028 | EUR | 567,000 | | 513,410 | | (h) |

| TeamSystem SpA | 6.250% 02/2028 144A | 2/15/2028 | EUR | 496,000 | | 524,507 | | (b) (h) |

| | | | | | |

| Automotive Parts & Equipment - 1.74% | | | | | | |

| Forvia SE | 2.625% 06/2025 | 6/15/2025 | EUR | 505,000 | | 516,568 | | (h) |

| IHO Verwaltungs GmbH | 3.750% 09/2026 | 9/15/2026 | EUR | 516,000 | | 514,054 | | (f) (h) |

| Patrick Industries Inc | 1.750% 12/2028 | 12/1/2028 | USD | 603,000 | | 570,136 | | |

| Power Solutions | 4.375% 05/2026 | 5/15/2026 | EUR | 505,000 | | 512,354 | | (h) |

| Truck Hero Inc | 6.250% 02/2029 | 2/1/2029 | USD | 3,356,000 | | 2,673,004 | | (h) |

| Wheel Pros Inc | 6.500% 05/2028 | 5/11/2028 | USD | 10,121,000 | | 5,807,430 | | (b) (h) |

| ZF Finance GmbH | 3.000% 09/2025 | 9/21/2025 | EUR | 500,000 | | 507,958 | | (h) |

| | | | | | |

| Automotive Retail - 1.28% | | | | | | |

| Mavis Discount Tire Inc | 6.500% 05/2029 | 5/15/2029 | USD | 9,975,000 | | 8,161,362 | | (h) |

| | | | | | |

| Biotechnology - 0.17% | | | | | | |

| Grifols SA | 1.625% 02/2025 | 2/15/2025 | EUR | 532,000 | | 541,550 | | (h) |

| Grifols SA | 3.200% 05/2025 | 5/1/2025 | EUR | 503,000 | | 510,904 | | (h) |

| | | | | | |

| Broadline Retail - 0.00% | | | | | | |

| JC Penney Corp Inc | 8.625% 03/2025 | 3/15/2025 | USD | 97,819 | | — | | (b) (c) (h) |

| | | | | | |

See accompanying notes to financial statements.

15

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Building Products - 7.87% | | | | | | |

| Acproducts Inc (aka Cabinetworks) | 6.375% 05/2029 | 5/15/2029 | USD | 17,269,000 | | $ | 10,560,425 | | (h) |

| LBM Borrower LLC | 6.250% 01/2029 | 1/15/2029 | USD | 4,952,000 | | 3,917,255 | | (h) |

| Oldcastle Buildingenvelope Inc | 9.500% 04/2030 | 4/15/2030 | USD | 14,457,000 | | 12,768,684 | | (h) |

| PrimeSource Building Products Inc | 5.625% 02/2029 | 2/1/2029 | USD | 7,169,000 | | 5,255,097 | | (h) |

| PrimeSource Building Products Inc | 6.750% 08/2029 | 8/1/2029 | USD | 4,981,000 | | 3,804,282 | | (h) |

| Specialty Building Products Holdings LLC | 6.375% 09/2026 | 9/30/2026 | USD | 537,000 | | 500,109 | | (h) |

| SRS Distribution Inc | 6.000% 12/2029 | 12/1/2029 | USD | 8,573,000 | | 7,146,196 | | (h) |

| SRS Distribution Inc | 6.125% 07/2029 | 7/1/2029 | USD | 7,529,000 | | 6,312,427 | | (h) |

| | | | | | |

| Cable & Satellite - 2.10% | | | | | | |

| Astound Broadband (RCN/Radiate) | 6.500% 09/2028 | 9/15/2028 | USD | 6,272,000 | | 3,111,163 | | (h) |

| Block Communications Inc | 4.875% 03/2028 | 3/1/2028 | USD | 6,358,000 | | 5,226,435 | | (h) |

| Cable One Inc | 0.000% 03/2026 | 3/15/2026 | USD | 487,000 | | 399,584 | | (g) |

| Cablevision Lightpath LLC | 5.625% 09/2028 | 9/15/2028 | USD | 811,000 | | 607,709 | | (h) |

| CSC Holdings LLC (Altice USA) | 5.000% 11/2031 | 11/15/2031 | USD | 2,754,000 | | 1,410,405 | | (h) |

| CSC Holdings LLC (Altice USA) | 5.750% 01/2030 | 1/15/2030 | USD | 5,101,000 | | 2,676,748 | | (h) |

| | | | | | |

| Casinos & Gaming - 0.18% | | | | | | |

| Cirsa Funding Luxembourg SA | 5.000% 03/2027 | 3/15/2027 | EUR | 532,000 | | 512,383 | | (h) |

| Scientific Games International Inc | 7.500% 09/2031 | 9/1/2031 | USD | 677,000 | | 661,804 | | (h) |

| | | | | | |

| Commercial Printing - 0.87% | | | | | | |

| Multi-Color Corp | 10.500% 07/2027 | 7/15/2027 | USD | 4,432,000 | | 3,841,530 | | (h) |

| Multi-Color Corp | 8.250% 11/2029 | 11/1/2029 | USD | 515,000 | | 383,353 | | (h) |

| Multi-Color Corp | 9.500% 11/2028 | 11/1/2028 | USD | 1,388,000 | | 1,343,185 | | (h) |

| | | | | | |

| Commodity Chemicals - 0.43% | | | | | | |

| Ineos Quattro Holdings Ltd | 2.500% 01/2026 | 1/15/2026 | EUR | 538,000 | | 531,217 | | (h) |

| SI Group Inc | 6.750% 05/2026 | 5/15/2026 | USD | 4,943,000 | | 2,204,158 | | (h) |

| | | | | | |

| Construction & Engineering - 3.03% | | | | | | |

| Brand Energy & Infrastructure Services Inc | 10.375% 06/2029 | 8/1/2030 | USD | 7,344,000 | | 7,298,100 | | (h) |

| Maxim Crane Works LP / Maxim Finance Corp | 11.500% 09/2028 | 9/1/2028 | USD | 11,780,000 | | 11,510,827 | | (h) |

| thyssenkrupp Elevator AG | 4.375% 07/2027 | 7/15/2027 | EUR | 539,000 | | 517,831 | | (h) |

| | | | | | |

| Consumer Electronics - 0.10% | | | | | | |

| Energizer Holdings Inc | 6.500% 12/2027 | 12/31/2027 | USD | 670,000 | | 625,273 | | (h) |

| | | | | | |

| Consumer Finance - 0.08% | | | | | | |

| Navient Corp | 5.875% 10/2024 | 10/25/2024 | USD | 489,000 | | 477,995 | | |

| | | | | | |

See accompanying notes to financial statements.

16

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Data Processing & Outsourced Services - 0.05% | | | | | | |

| Xerox Business Services /Conduent | 6.000% 11/2029 | 11/1/2029 | USD | 414,000 | | $ | 341,762 | | (h) |

| | | | | | |

| Diversified Chemicals - 0.19% | | | | | | |

| Chemours Co/The | 4.000% 05/2026 | 5/15/2026 | EUR | 529,000 | | 517,795 | | |

| Chemours Co/The | 5.375% 05/2027 | 5/15/2027 | USD | 745,000 | | 673,771 | | |

| | | | | | |

| Diversified Support Services - 0.12% | | | | | | |

| Allied Universal Holdco LLC | 6.625% 07/2026 | 7/15/2026 | USD | 364,000 | | 341,186 | | (h) |

| Techem Energy Services GmbH/Germany | 6.000% 07/2026 | 7/30/2026 | EUR | 439,599 | | 452,313 | | (h) |

| | | | | | |

| Electric Utilities - 0.08% | | | | | | |

| Electricite de France SA | 4.000% SUN REGS | | EUR | 500,000 | | 516,074 | | (h) |

| | | | | | |

| Electronic Components - 1.06% | | | | | | |

| CommScope Inc | 6.000% 03/2026 | 3/1/2026 | USD | 310,000 | | 260,812 | | (h) |

| CommScope Inc | 6.000% 06/2025 | 6/15/2025 | USD | 10,798,000 | | 6,495,051 | | (h) |

| | | | | | |

| Food Retail - 0.08% | | | | | | |

| Burger King France SAS | 7.750% 11/2027 | 11/1/2027 | EUR | 506,000 | | 505,828 | | (f) (h) |

| | | | | | |

| Health Care Facilities - 0.21% | | | | | | |

| AHP Health Partners Inc | 5.750% 07/2029 | 7/15/2029 | USD | 109,000 | | 89,482 | | (h) |

| CHS/Community Health Systems, Inc. | 6.875% 04/2028 | 4/1/2028 | USD | 2,824,000 | | 1,227,423 | | (h) |

| | | | | | |

| Health Care Technology - 0.03% | | | | | | |

| athenahealth Inc | 6.500% 02/2030 | 2/15/2030 | USD | 260,000 | | 212,698 | | (h) |

| | | | | | |

| Hotels, Resorts & Cruise Lines - 7.80% | | | | | | |

| Carnival Corp | 6.000% 05/2029 | 5/1/2029 | USD | 6,033,000 | | 5,101,604 | | (h) |

| Marriott Ownership Resorts Inc | 0.000% 01/2026 | 1/15/2026 | USD | 6,863,000 | | 5,915,906 | | (g) |

| NCL Corp Ltd | 1.125% 02/2027 | 2/15/2027 | USD | 11,602,000 | | 9,047,646 | | |

| NCL Corp Ltd | 3.625% 12/2024 | 12/15/2024 | USD | 14,811,000 | | 14,021,892 | | (h) |

| Viking Cruises Ltd | 6.250% 05/2025 | 5/15/2025 | USD | 490,000 | | 479,272 | | (h) |

| Viking Cruises Ltd | 7.000% 02/2029 | 2/15/2029 | USD | 5,473,000 | | 4,957,690 | | (h) |

| Viking Cruises Ltd | 9.125% 07/2031 | 7/15/2031 | USD | 10,424,000 | | 10,250,962 | | (h) |

| | | | | | |

| Industrial Conglomerates - 0.51% | | | | | | |

| Unifrax I LLC / Unifrax Holding Co | 5.250% 09/2028 | 9/30/2028 | USD | 3,573,000 | | 2,417,516 | | (h) |

| Unifrax I LLC / Unifrax Holding Co | 7.500% 09/2029 | 9/30/2029 | USD | 1,509,000 | | 808,937 | | (h) |

| | | | | | |

| Industrial Machinery & Supplies & Components - 1.95% | | | | | |

| Renk AG/Frankfurt am Main | 5.750% 07/2025 | 7/15/2025 | EUR | 490,000 | | 511,963 | | (h) |

| SPX FLOW Inc | 8.750% 04/2030 | 4/1/2030 | USD | 13,032,000 | | 11,961,747 | | (a) (h) |

| | | | | | |

See accompanying notes to financial statements.

17

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Insurance Brokers - 2.12% | | | | | | |

| National Financial Partners Corp | 6.875% 08/2028 | 8/15/2028 | USD | 15,791,000 | | $ | 13,505,329 | | (h) |

| | | | | | |

| Integrated Telecommunication Services - 0.08% | | | | | | |

| Eircom Holdings Ireland Ltd | 2.625% 02/2027 | 2/15/2027 | EUR | 552,000 | | 518,027 | | (h) |

| | | | | | |

| Leisure Facilities - 3.54% | | | | | | |

| Cedar Fair LP | 5.375% 04/2027 | 4/15/2027 | USD | 513,000 | | 475,478 | | |

| Merlin Entertainments PLC | 4.500% 11/2027 | 11/15/2027 | EUR | 7,572,000 | | 6,868,168 | | (h) |

| Merlin Entertainments PLC | 6.625% 11/2027 | 11/15/2027 | USD | 7,389,000 | | 6,619,325 | | (h) |

| Six Flags Entertainment Corp | 7.250% 05/2031 | 5/15/2031 | USD | 9,407,000 | | 8,664,929 | | (h) |

| | | | | | |

| Metal, Glass & Plastic Containers - 0.08% | | | | | | |

| Trivium Packaging Finance BV | 3.750% 08/2026 | 8/15/2026 | EUR | 532,000 | | 510,690 | | (h) |

| | | | | | |

| Oil & Gas Equipment & Services - 0.15% | | | | | | |

| Archrock Partners LP / Archrock Partners Finance Corp | 6.875% 04/2027 | 4/1/2027 | USD | 488,000 | | 469,620 | | (h) |

| Solaris Midstream Holdings LLC | 7.625% 04/2026 | 4/1/2026 | USD | 498,000 | | 475,502 | | (h) |

| | | | | | |

| Oil & Gas Exploration & Production - 0.39% | | | | | | |

| Matador Resources Co | 5.875% 09/2026 | 9/15/2026 | USD | 471,000 | | 454,286 | | |

| Sitio Royalties Corp | 7.875% 11/2028 | 11/1/2028 | USD | 2,047,000 | | 2,021,239 | | (h) |

| | | | | | |

| Oil & Gas Storage & Transportation - 4.31% | | | | | | |

| Genesis Energy | 6.500% 10/2025 | 10/1/2025 | USD | 8,199,000 | | 8,017,376 | | |

| Genesis Energy | 8.000% 01/2027 | 1/15/2027 | USD | 436,000 | | 419,067 | | |

| Genesis Energy | 8.875% 04/2030 | 4/15/2030 | USD | 1,739,000 | | 1,682,536 | | |

| Global Partners LP / GLP Finance Corp | 7.000% 08/2027 | 8/1/2027 | USD | 497,000 | | 468,873 | | |

| NGL Energy Partners LP / NGL Energy Finance Corp | 7.500% 02/2026 | 2/1/2026 | USD | 16,254,000 | | 15,881,150 | | (h) |

| Rockies Express Pipeline LLC | 3.600% 05/2025 | 5/15/2025 | USD | 364,000 | | 344,834 | | (h) |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp | 6.000% 03/2027 | 3/1/2027 | USD | 365,000 | | 334,313 | | (h) |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp | 7.500% 10/2025 | 10/1/2025 | USD | 345,000 | | 340,231 | | (h) |

| | | | | | |

| Other Specialty Retail - 2.13% | | | | | | |

| Alain Afflelou SA | 4.250% 05/2026 | 5/19/2026 | EUR | 520,000 | | 518,367 | | (h) |

| Douglas Holding AG | 6.000% 04/2026 | 4/8/2026 | EUR | 6,512,000 | | 6,589,009 | | (h) |

| Douglas Holding AG | 8.250% 10/2026 | 10/1/2026 | EUR | 6,621,107 | | 6,483,525 | | (h) |

| | | | | | |

| Passenger Airlines - 2.58% | | | | | | |

| Air France-KLM | 3.875% 07/2026 | 7/1/2026 | EUR | 600,000 | | 605,718 | | (h) |

| American Airlines Group Inc | 3.750% 03/2025 | 3/1/2025 | USD | 11,901,000 | | 11,114,841 | | (h) |

| JetBlue Airways Corp | 0.500% 04/2026 | 4/1/2026 | USD | 7,651,000 | | 4,772,253 | | |

| | | | | | |

See accompanying notes to financial statements.

18

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Pharmaceuticals - 0.08% | | | | | | |

| Nidda Healthcare Holding AG | 7.500% 08/2026 | 8/21/2026 | EUR | 484,000 | | $ | 514,508 | | (h) |

| | | | | | |

| Real Estate Services - 1.42% | | | | | | |

| Anywhere Real Estate Group LLC | 0.250% 06/2026 | 6/15/2026 | USD | 4,790,000 | | 3,575,021 | | |

| Redfin Corp | 0.000% 10/2025 | 10/15/2025 | USD | 6,764,000 | | 5,512,631 | | (g) |

| | | | | | |

| Restaurants - 1.19% | | | | | | |

| Golden Nugget Inc. | 6.750% 07/2030 | 1/15/2030 | USD | 9,527,000 | | 7,579,881 | | (h) |

| | | | | | |

| Security & Alarm Services - 0.08% | | | | | | |

| Verisure Holding AB | 3.875% 07/2026 | 7/15/2026 | EUR | 534,000 | | 535,810 | | (h) |

| | | | | | |

| Trading Companies & Distributors - 1.43% | | | | | | |

| AerCap Holdings | 6.500% 06/2045 | 6/15/2045 | USD | 4,959,000 | | 4,870,018 | | (h) |

| Neon Holdings Inc (GPD Cos Inc) | 10.125% 04/2026 | 4/1/2026 | USD | 906,000 | | 816,997 | | (h) |

| White Cap Construction Supply Inc | 8.250% 03/2026 PIK Toggle | 3/15/2026 | USD | 3,647,000 | | 3,426,122 | | (h) |

| TOTAL HIGH YIELD SECURITIES (Amortized cost $388,089,284) | | | | $ | 335,045,517 | | |

See accompanying notes to financial statements.

19

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| | | | | | | | |

| Asset Backed Securities - 7.84% | | | | | | | | |

| | | | | | | | |

| Diversified Real Estate Activities - 0.01% | | | | | | | | |

| SG Residential Mortgage Trust 2022-2 | SGR 2022-2 B1 | | 5.31% | 8/25/2062 | USD | 57,502 | | $ | 45,831 | | (h) |

| | | | | | | | |

| Specialized Finance - 7.83% | | | | | | | | |

| AB BSL CLO 4 Ltd | ABBSL 2023-4A E | SOFR + 8.16% | 13.58% | 4/20/2036 | USD | 1,685,504 | | 1,699,040 | | (b) (h) |

| Adagio X Eur Clo DAC | Adagio X EUR CLO D | EURIBOR + 0.00% | 0.00% | 10/20/2037 | EUR | 509,000 | | 538,254 | | (b) (d) (h) |

| AGL CLO 7 Ltd | AGL 2020-7A ER | SOFR + 6.35% | 12.01% | 7/15/2034 | USD | 1,187,688 | | 1,149,906 | | (b) (h) |

| Aimco CDO | AIMCO 2021-16A E | SOFR + 6.20% | 11.86% | 1/17/2035 | USD | 1,075,210 | | 1,051,299 | | (b) (h) |

| ALM Loan Funding Ltd | ALM 2020-1A D | SOFR + 6.00% | 11.66% | 10/15/2029 | USD | 865,360 | | 836,063 | | (b) (h) |

| AMMC CLO 26 Ltd | AMMC 2023-26A D | SOFR + 5.75% | 11.14% | 4/15/2036 | USD | 459,840 | | 469,434 | | (b) (h) |

| Apidos CLO XLVI Ltd | APID 2023-46A D | SOFR + 5.00% | 10.42% | 10/24/2036 | USD | 353,364 | | 353,480 | | (b) (h) |

| Arbour CLO III DAC | ARBR 3A DRR | EURIBOR + 3.10% | 7.07% | 7/15/2034 | EUR | 779,000 | | 762,626 | | (b) (h) |

| Ares LXV CLO Ltd | ARES 2022-65A E | SOFR + 7.10% | 12.48% | 7/25/2034 | USD | 1,078,040 | | 1,000,499 | | (b) (h) |

| Aurium CLO I DAC | ACLO 1A DRR | EURIBOR + 3.90% | 7.86% | 3/23/2032 | EUR | 917,000 | | 935,051 | | (b) (h) |

| Ballyrock CLO 14 Ltd | BALLY 2020-14A D | SOFR + 7.00% | 12.68% | 1/20/2034 | USD | 250,000 | | 249,691 | | (b) (h) |

| Ballyrock CLO Ltd | BALLY 2019-1A DR | SOFR + 6.75% | 12.41% | 7/15/2032 | USD | 431,180 | | 418,501 | | (b) (h) |

| Bbam US Clo I Ltd | BBAM 2022-1A D | SOFR + 6.80% | 12.19% | 4/15/2035 | USD | 1,285,000 | | 1,214,672 | | (b) (h) |

| Bbam US Clo III Ltdbbb | BBAM 2023-3A D | SOFR + 8.60% | 8.45% | 10/15/2038 | USD | 1,466,876 | | 1,436,300 | | (b) (h) |

| Birch Grove CLO Ltd | BGCLO 2023-7A D | SOFR + 5.50% | 5.50% | 10/20/2036 | USD | 282,683 | | 282,683 | | (b) (d) (h) |

| Bluemountain Euro 2021-2 CLO DAC | BLUME 2021-2A D | EURIBOR + 3.10% | 7.07% | 10/15/2035 | EUR | 403,282 | | 396,119 | | (b) (h) |

| BlueMountain Fuji Eur CLO V DAC | BLUME 5A D | EURIBOR + 3.85% | 7.82% | 1/15/2033 | EUR | 1,501,000 | | 1,532,355 | | (b) (h) |

| Bridgepoint Clo V DAC | BRGPT 5A D | EURIBOR + 5.00% | 5.15% | 4/15/2036 | EUR | 688,000 | | 727,329 | | (b) (h) |

| Broad River BSL Funding CLO | BDRVR 2020-1A ER | SOFR + 6.50% | 12.18% | 7/20/2034 | USD | 1,500,000 | | 1,435,226 | | (b) (h) |

| Cairn Clo XVII DAC | CRNCL 2023-17A D | EURIBOR + 5.30% | 9.20% | 10/18/2036 | EUR | 387,000 | | 409,083 | | (b) (h) |

| Capital Four US CLO Ltd | C4US 2022-1A D | SOFR + 5.36% | 10.78% | 10/20/2030 | USD | 363,664 | | 365,977 | | (b) (h) |

| Carlyle Global Market Strategies | CGMS 2020-2A DR | SOFR + 6.70% | 12.34% | 1/25/2035 | USD | 640,460 | | 611,339 | | (b) (h) |

| Carlyle Global Market Strategies | CGMS 2021-8A E | SOFR + 6.50% | 12.16% | 10/15/2034 | USD | 370,690 | | 356,735 | | (b) (h) |

| Carlyle Global Market Strategies | CGMS 2021-9A E | SOFR + 6.63% | 12.31% | 10/20/2034 | USD | 819,560 | | 774,928 | | (b) (h) |

| CarVal CLO | CARVL 2021-1A E | SOFR + 6.60% | 12.28% | 7/20/2034 | USD | 2,000,000 | | 1,868,844 | | (b) (h) |

| CarVal CLO | CARVL 2021-2A E | SOFR + 6.75% | 12.41% | 10/15/2034 | USD | 446,919 | | 435,619 | | (b) (h) |

| CIFC Funding Ltd | CIFC 2021-7A E | SOFR + 6.35% | 12.02% | 1/23/2035 | USD | 644,186 | | 619,020 | | (b) (h) |

| CVC Cordatus Loan Fund XVIII DAC | CORDA 18A ER | EURIBOR + 6.06% | 10.03% | 7/29/2034 | EUR | 1,198,000 | | 1,149,136 | | (b) (h) |

| Dillon's Park CLO DAC | DILPK 1A D | EURIBOR + 3.00% | 6.97% | 10/15/2034 | EUR | 430,000 | | 417,620 | | (b) (h) |

| Eaton Vance CDO Ltd | EATON 2020-2A ER | SOFR + 6.50% | 12.16% | 1/15/2035 | USD | 510,460 | | 495,607 | | (b) (h) |

| Elmwood CLO | ELMW5 2020-2A ER | SOFR + 6.10% | 11.78% | 10/20/2034 | USD | 1,500,000 | | 1,450,225 | | (b) (h) |

| Elmwood CLO VI Ltd | ELMW6 2020-3A ER | SOFR + 6.50% | 12.18% | 10/20/2034 | USD | 558,701 | | 550,924 | | (b) (h) |

See accompanying notes to financial statements.

20

| | | | | | | | |

| Credit Opportunities Portfolio | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Empower CLO Ltd | EMPWR 2023-2A D | SOFR + 5.40% | 10.74% | 7/15/2036 | USD | 379,870 | | $ | 381,775 | | (b) (h) |

| Goldentree Loan Management US Clo 12 Ltd | GLM 2022-12A E | SOFR + 7.25% | 12.67% | 4/20/2034 | USD | 291,777 | | 290,967 | | (b) (h) |

| Golub Capital Partners CLO Ltd | GCBSL 2021-58A E | SOFR + 6.81% | 12.45% | 1/25/2035 | USD | 549,013 | | 519,320 | | (b) (h) |

| Guardia 1 Ltd | GUARD 2019-1A D | 7.11% | 7.11% | 10/20/2037 | USD | 1,550,000 | | 1,282,818 | | (b) (h) |

| Harvest CLO XXI DAC | HARVT 21A DR | EURIBOR + 3.40% | 7.37% | 7/15/2031 | EUR | 602,000 | | 608,139 | | (b) (h) |