UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23474)

KKR Credit Opportunities Portfolio

(Exact name of registrant as specified in charter)

555 California Street, 50th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Annette O’Donnell-Butner

KKR Credit Advisors (US) LLC

555 California Street, 50th Floor

San Francisco, CA 94104

(Name and address of agent for service)

(415) 315-3620

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2021

Date of reporting period: April 30, 2021

Item 1. Reports to Stockholders.

KKR Credit Opportunities Portfolio

Semi-Annual Report

April 30, 2021

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary or, if you are a direct investor, by calling the Fund at 1-855-862-6092.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call the Fund at 1-855-862-6092. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary.

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Table of Contents

The KKR Credit Opportunities Portfolio (the “Fund”) files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT within sixty days after the end of the period. The Fund’s Form N-PORT is available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent period ended June 30 will be available (i) without charge, upon request, by calling 855- 862-6092; and (ii) on the Commission’s website at http://www.sec.gov.

INFORMATION ABOUT THE FUND’S TRUSTEES

The proxy statements and annual reports include information about the Fund’s Trustees and are available without charge, upon request, by calling 855-862-6092 and by visiting the Commission’s website at www.sec.gov.

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Management Discussion of Fund Performance

Looking Back on the Markets — April 30, 2021

The first quarter was characterized by a risk on rally with record amounts of debt issuance, unrelenting yearn for yield, an anticipated movement in rates, and spreads continuing to inch tighter. In terms of performance, loans had a strong quarter returning +1.8% and outperforming high yield, which returned +0.9% as of March 31, 2021.

Looking back on the market one year ago: high yield spreads spiked to +1,000bps amidst a global shut down as the world succumbed to a new unknown virus and investors flocked to the exits in pursuit of instant liquidity, while the world tried to grapple with the day-to-day news developments of COVID-19. In contrast to where we stand today: high yield spreads are near their historical tights at 336bps(1) as of March 31, 2021, the vaccine roll out in the U.S. has been robust, and the re-opening rally has shown no signs of slowing down. It is remarkable to see the powers of fiscal and monetary policy at work, and the vigor and speed in which a market can snap back. With the record amounts of dry powder, fiscal stimulus, and historically low borrowing costs, both leveraged loans and high yield performance and issuance to date continue to be strong.

In the first quarter, we witnessed a flurry of activity back into floating rate assets on the heels of rising Treasury rates in the first quarter in both the retail and institutional channels. Global leveraged loan new issue volume reached a record total of $263.92 billion between institutional new issuance and pro-rata activity as of March 31, 2021. The U.S. loan market experienced more than 2x the volume it saw in Q4 2020. The movement in rates coupled with the growing optimism around vaccine roll-out spurred strong technical tailwinds setting U.S. leveraged loans up for a record quarter of issuance at $180.8 billion, which exceeded the prior record of $171.4 billion back in Q1 of 2017.

The high yield market also showed no signs of slowing down printing $149.1 billion in issuance in the U.S. market and a total combined volume of $198.4 billion globally for the first quarter of 2021. The market has grown in size by 21% since January 2020 and is now sitting at $1.47 trillion. As borrowing costs remain suppressed and liquidity runways now extended, even rising Treasury rates could not completely deter the high yield market. Many issuers were prompted by the prospect of a rising interest rate environment and “rang the bell” to term out maturity profiles at low costs. As such, 2021 refinancing activity is higher than total high yield issuance volume for any pre March 2020 quarter at a staggering 79% of total volume this year.

Default activity in the first quarter trended lower as the $3.4bn of distressed volume was the lowest quarter since Q3 of 2018. The J.P Morgan U.S. high yield default rate decreased by 129bps to 5.37% and the loan default rate decreased by 33bps to 3.66%.

From a fund flows perspective, U.S. high yield net fund outflows exceeded more than $11.8 billion in the first quarter, which is a stark reversal from the 2020 trend where high yield fund flows totaled over $38 billion for the year. Flows for floating rate funds continued to respond favorably to strong momentum in global growth and rising rates, as loan funds saw a fourth consecutive inflow in March, which totaled +2.7bn. March’s inflow followed February and January’s inflows of +$4.2n and $4.bn, respectively. Year-to-date, inflows for loan funds total $11.1bn, which compares to outflows of -$16.0bn over the first three months of 2020.

The Market in Numbers1

For the period of November 1, 2020 – April 30, 2021: update for last 6 months:

| | • | | Returns: Over the six month period ending April 30, 2021, the high yield and leveraged loan markets returned 8.12% and 5.99% (as measured by the Bank of America Merrill Lynch High Yield Index and the S&P LSTA Leveraged Loan Index), respectively. |

1

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | • | | Spreads: The option adjusted spread on the Bank of America Merrill Lynch High Yield Index ended the period at 328bps (April 30, 2021). The 3-year discounted spread on the S&P LSTA Leveraged Loan Index ended the period at LIBOR plus 427bps. (April 30, 2021). |

| | • | | Volatility: As measured by the VIX index, over the last six months, the VIX peaked at 38.89 in early November and ended the period at 18.61 (April 30, 2021) |

Fund Background and Performance

KKR Credit Opportunities Portfolio (“KCOP” or, the “Fund”) is a newly organized, diversified, closed-end management investment company that continuously offers its shares (the “Shares”) and is operated as an “interval fund.” The Fund’s investment objective is to seek to provide attractive risk-adjusted returns and high current income.

The Fund seeks to achieve its investment objectives by investing in a select portfolio with exposure to two primary credit strategies:

| | 1. | Opportunistic Credit, a conviction-based approach investing in a portfolio consisting primarily of publicly traded high yield bonds, first- and second-lien secured bank loans and structured credit (e.g., collateralized loan obligation (“CLO”) and mezzanine debt) and |

| | 2. | Private Credit, which includes directly originated hard and financial asset-based lending, corporate mezzanine debt, as well as directly originated first-lien, second-lien and unitranche senior loans to upper middle-market companies. |

Under normal market conditions, the Fund will invest at least 80% of its Managed Assets (as defined below) in senior and subordinated corporate debt and debt related instruments, including bonds, secured bank loans, convertible securities, structured products, convertible debt securities, repurchase agreements, and municipal securities.

During an initial ramp period of approximately 6-18 months following the Fund’s commencement of operations, the Fund will invest substantially all of its assets in the Opportunistic Credit Strategy. Following that initial period, the Fund expects, under normal circumstances, to invest 70-80% of its Managed Assets in the Opportunistic Credit strategy and 20-30% of its Managed Assets in the Private Credit Strategy, though the Fund’s allocation in investments could vary from these guidelines at any time in the Fund’s discretion. Investment in the Private Credit Strategy is contingent upon the Fund first achieving sufficient scale to acquire such positions, and there can be no assurance that the Fund will ever raise sufficient assets to invest in the Private Credit Strategy. On at least a quarterly basis, the Fund’s Investment Committee will meet to, among other things, review and establish the allocation percentage between the Opportunistic Credit Strategy and Private Credit Strategy for the ensuing period. The Investment Committee will consider factors such as KKR’s macro-economic and market outlooks, assessment of the relative risk and return of each strategy, and other factors in making its determination. “Managed Assets” means the total assets of the Fund (including any assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes).

As of April 30, 2021, the Fund held 54.4% of its net assets in first and second-lien leveraged loans, 55.9% of its net assets in high-yield corporate debt, 0.2% of its net assets in collateralized loan obligations, 0.7% of its net assets in common stock, and 2.1% of its net assets in exchange traded funds. KCOP’s investments represented obligations and equity interests in 193 positions across a diverse group of industries. The top ten issuers represented 32.3% of the Fund’s net assets while the top five industry groups represented 41.9% of the Fund’s net assets. The Fund’s Securities and Exchange Commission 30-day yield was 4.42%.

| 1 | Source: Bloomberg, S&P LSTA and ICE BofAML data as of April 30, 2021. |

2

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Business Updates

We thank you for your partnership and continued investment in KCOP. We look forward to continued communications and will keep you apprised of the progress of KCOP specifically and the leveraged finance market place generally. Fund information is available on our website at kkrfunds.com/KCOP.

Disclosures

The Bank of America Merrill Lynch High Yield Master II Index is a market-value weighted index of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. “Yankee” bonds (debt of foreign issuers issued in the U.S. domestic market) are included in the Bank of America Merrill Lynch High Yield Master II Index provided that the issuer is domiciled in a country having investment grade foreign currency long-term debt rating. Qualifying bonds must have maturities of one year or more, a fixed coupon schedule and minimum outstanding of US$100 million. In addition, issues having a credit rating lower than BBB3, but not in default, are also included.

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX) reflects the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. The VIX reflects the market’s estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes. The first and second month expirations are used until 8 days from expiration, then the second and third are used.

The S&P/LSTA Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. The Index was rolled out in 2000 and it was back-loaded with four years of data dating to 1997.

It is not possible to invest directly in an index.

Past performance is not an indication of future results. Returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, expense limitations and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when sold, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. An investment in the Fund involves risk, including the risk of loss of principal. For a discussion of the Fund’s risks, see Risk Considerations, Note 3 to the financial statements. Call 855-330-3927 for performance results current to the most recent calendar quarter-end.

Must be preceded or accompanied by a prospectus.

An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non–payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Borrowing to increase investments (leverage) will exaggerate the effect of any increase or decrease in the value of Fund investments. Investments rated below investment grade (typically referred to as “junk”) are generally subject to greater price volatility and illiquidity than higher rated investments. As interest rates rise, the value of certain income investments is likely to decline. Senior loans are subject to prepayment risk. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market economic, political, regulatory, geopolitical or other conditions. Changes in the value of investments entered for hedging purposes may not match those of the position being hedged. The Fund may engage in other investment practices that may involve additional risks.

3

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | | | | | | | |

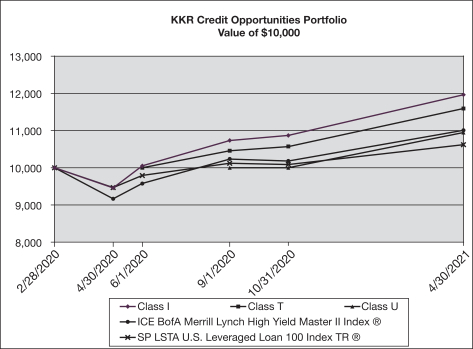

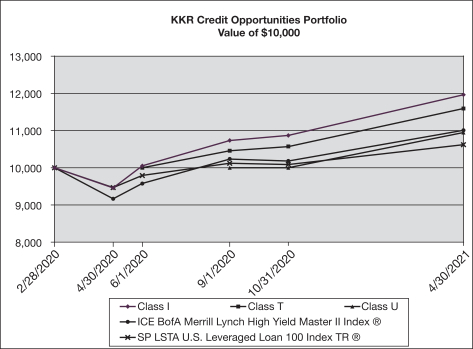

Average Annual Total Returns Period Ended April 30, 2021 | | Six Months | | | One Year | | | Since Inception | | | Value of

$10,000

4/30/2021 | |

KKR Credit Opportunities Portfolio | | | | | | | | | | | | | | | | |

Class I (02/28/2020) | | | 10.06% | | | | 26.50% | | | | 16.56% | | | $ | 11,964 | |

Class T (06/01/2020) | | | 9.72% | | | | N/A | | | | 15.94% | | | $ | 11,594 | |

Class U (09/01/2020) | | | 9.41% | | | | N/A | | | | 9.46% | | | $ | 10,946 | |

ICE BofA Merrill Lynch High Yield Master II Index® | | | 8.12% | | | | 20.10% | | | | 8.52% | | | $ | 11,004 | |

SP LSTA U.S. Leveraged Loan 100 Index TR | | | 5.31% | | | | 12.13% | | | | 5.28% | | | $ | 10,620 | |

4

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Schedule of Investments

| | | | | | | | | | |

| | | | | Par† | | | Value | |

Leveraged Loans - 54.4% | | | | | | | | | | |

| | | |

Aerospace & Defense - 3.4% | | | | | | | | | | |

| | | |

EaglePicher Technologies, LLC, TL 2L 02/18 | | | | | | | | | | |

| | | |

7.363% (1 Month US LIBOR + 7.250%), 03/08/2026 (a) | | | | | 1,142,419 | | | $ | 1,118,617 | |

| | | |

Ontic Engineering & Manufacturing, Inc, TL 1L B 02/21 | | | | | | | | | | |

| | | |

4.203% (3 Month US LIBOR + 4.000%), 10/30/2026 (a) | | | | | 83,479 | | | | 83,258 | |

| | | |

Sequa Corp., TL 2L 07/20 | | | | | | | | | | |

| | | |

11.750% (3 Month US LIBOR + 10.750%), 04/28/2024 (a) | | | | | 931,985 | | | | 886,938 | |

| | | |

Sequa Corp., TL 1L B 06/20 Add-on | | | | | | | | | | |

| | | |

10.000% (3 Month US LIBOR + 9.000%), 07/31/2025 (a)(d)(e) | | | | | 396,887 | | | | 417,771 | |

| | | |

Sequa Corp., TL 1L 07/20 | | | | | | | | | | |

| | | |

7.750% (3 Month US LIBOR + 6.750%), 11/28/2023 (a) | | | | | 5,453,435 | | | | 5,481,574 | |

| | | |

Standard Aero Ltd., TL 1L 04/19 | | | | | | | | | | |

| | | |

3.703% (3 Month US LIBOR + 3.500%), 04/06/2026 (a) | | | | | 4,673 | | | | 4,555 | |

| | | |

Standard Aero Ltd., TL 1L 02/20 | | | | | | | | | | |

| | | |

3.703% (3 Month US LIBOR + 3.500%), 04/06/2026 (a) | | | | | 2,512 | | | | 2,449 | |

| | | |

TransDigm Group, Inc., TL 1L F 01/20 | | | | | | | | | | |

| | | |

2.363% (1 Month US LIBOR + 2.250%), 12/09/2025 (a) | | | | | 2,668,217 | | | | 2,638,546 | |

| | | | | | | | | | |

| | | | | | | | | 10,633,708 | |

| | | | | | | | | | |

| | | |

Airlines - 0.3% | | | | | | | | | | |

| | | |

American Airlines Group, Inc., TL 1L 03/21 | | | | | | | | | | |

| | | |

5.500% (3 Month US LIBOR + 4.750%), 03/10/2028 (a) | | | | | 985,230 | | | | 1,014,521 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Auto Components - 4.1% | | | | | | | | | | |

| | | |

American Tire Distributors, Inc., TL 1L 04/15 | | | | | | | | | | |

| | | |

8.500% (1 Month US LIBOR + 7.500%), 09/02/2024 (a)(g) | | | | | 4,187,833 | | | | 4,126,753 | |

| | | |

BBB Industries, LLC, TL 1L 06/18 | | | | | | | | | | |

| | | |

4.613% (1 Month US LIBOR + 4.500%), 08/01/2025 (a) | | | | | 4,981,128 | | | | 4,956,222 | |

| | | |

Innovative XCessories & Services LLC, TL 1L 02/20 | | | | | | | | | | |

| | | |

5.000% (3 Month US LIBOR + 5.000%), 03/05/2027 (a) | | | | | 1,248,650 | | | | 1,252,296 | |

| | | |

Truck Hero, Inc., TL 1L 01/21 | | | | | | | | | | |

| | | |

4.500% (1 Month US LIBOR + 3.750%), 01/20/2028 (a) | | | | | 1,165,050 | | | | 1,164,590 | |

| | | |

Wheel Pros, Inc., TL 1L B 11/20 | | | | | | | | | | |

| | | |

6.250% (1 Month US LIBOR + 5.250%), 11/10/2027 (a)(c)(d) | | | | | 1,198,413 | | | | 1,199,162 | |

| | | | | | | | | | |

| | | | | | | | | 12,699,023 | |

| | | | | | | | | | |

| | | |

Chemicals - 5.8% | | | | | | | | | | |

| | | |

Aruba Investments, Inc., TL 2L 10/20 | | | | | | | | | | |

| | | |

8.500% (6 Month US LIBOR + 7.750%), 11/24/2028 (a) | | | | | 465,220 | | | | 470,261 | |

| | | |

Flint Group GmbH, TL 1L B4 11/15 | | | | | | | | | | |

| | | |

0.750% (3 Month EURIBOR + 7.250%), 09/21/2023 (a)(b)(h) | | EUR | | | 908,283 | | | | 1,069,635 | |

| | | |

Flint Group GmbH, TL 1L B5 02/17 | | | | | | | | | | |

| | | |

0.750% (3 mon EURIBOR +4.250%), 09/21/2023 (a)(b)(h) | | EUR | | | 666,416 | | | | 784,802 | |

See accompanying notes to financial statements.

5

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Flint Group GmbH, TL 1L B 04/14 | | | | | | | | | | |

| | | |

0.750% (3 Month EURIBOR + 3.000%), 09/21/2023 (a)(b)(h) | | EUR | | | 5,115,553 | | | $ | 6,024,307 | |

| | | |

Flint Group GmbH, TL 1L B3 05/15 | | | | | | | | | | |

| | | |

0.750% (3 Month EURIBOR + 0.000%), 09/21/2023 (a)(b) | | EUR | | | 104,724 | | | | 123,328 | |

| | | |

Flint Group GmbH, TL 1L B6 03/17 | | | | | | | | | | |

| | | |

0.750% (3 mon EURIBOR +4.250%), 09/21/2023 (a)(b)(h) | | EUR | | | 52,368 | | | | 61,671 | |

| | | |

Flint Group GmbH, TL 1L B7 04/14 | | | | | | | | | | |

| | | |

0.750% (3 Month EURIBOR + 3.000%), 09/21/2023 (a)(b)(h) | | EUR | | | 116,174 | | | | 136,811 | |

| | | |

Flint Group GmbH, TL 1L 01/17 | | | | | | | | | | |

| | | |

0.750% (3 Month US LIBOR + 3.000%), 09/21/2023 (a)(b)(h) | | | | | 1,707,650 | | | | 1,672,644 | |

| | | |

Flint Group GmbH, TL 1L C 04/14 | | | | | | | | | | |

| | | |

0.750% (3 Month US LIBOR + 3.000%), 09/21/2023 (a)(b)(h) | | | | | 283,499 | | | | 277,687 | |

| | | |

Invictus, TL 2L 01/18 | | | | | | | | | | |

| | | |

6.863% (1 Month US LIBOR + 6.750%), 03/30/2026 (a) | | | | | 35,559 | | | | 35,537 | |

| | | |

Vantage Specialty Chemicals, Inc., TL 2L 10/17 | | | | | | | | | | |

| | | |

9.250% (3 Month US LIBOR + 8.250%), 10/27/2025 (a) | | | | | 561,410 | | | | 536,615 | |

| | | |

Vantage Specialty Chemicals, Inc., TL 1L B 10/17 | | | | | | | | | | |

| | | |

4.500% (3 Month US LIBOR + 3.500%), 10/26/2024 (a) | | | | | 6,859,346 | | | | 6,651,712 | |

| | | | | | | | | | |

| | | | | | | | | 17,845,010 | |

| | | | | | | | | | |

| | | |

Commercial Services & Supplies - 1.6% | | | | | | | | | | |

| | | |

Access CIG, LLC, TL 2L 02/18 | | | | | | | | | | |

| | | |

7.865% (1 Month US LIBOR + 7.750%), 02/27/2026 (a) | | | | | 143,000 | | | | 143,179 | |

| | | |

Access CIG, LLC, TL 1L 02/18 | | | | | | | | | | |

| | | |

3.861% (1 Month US LIBOR + 3.750%), 02/27/2025 (a) | | | | | 38,504 | | | | 38,363 | |

| | | |

Monitronics International, Inc., TL 1L EXIT 08/19 | | | | | | | | | | |

| | | |

7.750% (1 Month US LIBOR + 6.500%), 03/29/2024 (a)(c)(d) | | | | | 536,196 | | | | 527,386 | |

| | | |

VFS Global Services Pvt, Ltd., TL 1L B 06/17 | | | | | | | | | | |

| | | |

4.114% (3 Month LIBOR GBP + 4.000%), 07/29/2024 (a)(b) | | GBP | | | 1,360,050 | | | | 1,793,765 | |

| | | |

VFS Global Services Pvt, Ltd., TL 1L B 06/17 | | | | | | | | | | |

| | | |

3.250% (3 Month EURIBOR + 3.250%), 07/29/2024 (a)(b) | | EUR | | | 2,147,630 | | | | 2,475,493 | |

| | | | | | | | | | |

| | | | | | | | | 4,978,186 | |

| | | | | | | | | | |

| | | |

Construction & Engineering - 1.9% | | | | | | | | | | |

| | | |

Brand Energy & Infrastructure Services, Inc., TL 1L 05/17 | | | | | | | | | | |

| | | |

5.250% (3 Month US LIBOR + 4.250%), 06/21/2024 (a) | | | | | 1,072,620 | | | | 1,045,037 | |

| | | |

Total Safety US, Inc., TL 1L B 07/19 | | | | | | | | | | |

| | | |

7.000% (3 Month US LIBOR + 6.000%), 08/16/2025 (a) | | | | | 3,157,637 | | | | 3,170,804 | |

| | | |

Yak Access, LLC, TL 1L B 05/18 | | | | | | | | | | |

| | | |

5.113% (1 Month US LIBOR + 5.000%), 07/11/2025 (a) | | | | | 1,710,477 | | | | 1,565,087 | |

| | | | | | | | | | |

| | | | | | | | | 5,780,928 | |

| | | | | | | | | | |

| | | |

Distributors - 0.1% | | | | | | | | | | |

| | | |

Distribution International, Inc., TL 1L 06/19 | | | | | | | | | | |

| | | |

6.750% (3 Month US LIBOR + 5.750%), 12/15/2023 (a) | | | | | 449,284 | | | | 435,244 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

6

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Diversified Consumer Services - 3.5% | | | | | | | | | | |

| | | |

Conservice, LLC, TL 1L B 05/20 | | | | | | | | | | |

| | | |

4.453% (3 Month US LIBOR + 4.250%), 05/13/2027 (a) | | | | | 25,489 | | | $ | 25,524 | |

| | | |

Jostens, Inc., TL 1L 12/18 | | | | | | | | | | |

| | | |

5.730% (3 Month US LIBOR + 5.500%), 12/19/2025 (a) | | | | | 6,998,750 | | | | 6,999,380 | |

| | | |

KinderCare Education, LLC, TL 1L B 09/18 | | | | | | | | | | |

| | | |

4.750% (3 Month US LIBOR + 3.750%), 02/21/2025 (a) | | | | | 2,641,220 | | | | 2,612,682 | |

| | | |

Learning Care Group, Inc., TL 1L B 05/20 | | | | | | | | | | |

| | | |

9.500% (6 Month US LIBOR + 8.500%), 03/13/2025 (a)(d) | | | | | 279,746 | | | | 282,544 | |

| | | |

Learning Care Group, Inc., TL 2L 03/18 | | | | | | | | | | |

| | | |

8.500% (6 Month US LIBOR + 7.500%), 03/13/2026 (a) | | | | | 194,997 | | | | 188,050 | |

| | | |

Learning Care Group, Inc., TL 1L B 02/18 | | | | | | | | | | |

| | | |

4.250% (3 Month US LIBOR + 3.250%), 03/13/2025 (a) | | | | | 811,259 | | | | 799,236 | |

| | | | | | | | | | |

| | | | | | | | | 10,907,416 | |

| | | | | | | | | | |

| | | |

Electronic Equipment, Instruments & Components - 1.0% | | | | | | | | | | |

| | | |

Excelitas Technologies Corp., TL 2L 10/17 | | | | | | | | | | |

| | | |

8.500% (3 Month US LIBOR + 7.500%), 12/01/2025 (a) | | | | | 3,088,755 | | | | 3,092,616 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Energy Equipment & Services - 0.8% | | | | | | | | | | |

| | | |

Caprock Midstream, LLC, TL 1L B 10/18 | | | | | | | | | | |

| | | |

4.863% (3 Month US LIBOR + 4.750%), 11/03/2025 (a) | | | | | 2,435,629 | | | | 2,390,729 | |

| | | |

ChampionX Corp., TL 1L B 05/20 | | | | | | | | | | |

| | | |

6.000% (6 Month US LIBOR + 5.000%), 06/03/2027 (a) | | | | | 79,772 | | | | 81,567 | |

| | | | | | | | | | |

| | | | | | | | | 2,472,296 | |

| | | | | | | | | | |

| | | |

Food & Staples Retailing - 0.5% | | | | | | | | | | |

| | | |

Froneri Ltd., TL 2L 01/20 | | | | | | | | | | |

| | | |

5.863% (1 Month US LIBOR + 5.750%), 01/31/2028 (a)(b) | | | | | 60,000 | | | | 60,750 | |

| | | |

Froneri Ltd., TL 2L 01/20 | | | | | | | | | | |

| | | |

5.750% (6 Month EURIBOR + 5.750%), 01/31/2028 (a)(b) | | EUR | | | 1,046,740 | | | | 1,271,034 | |

| | | |

Smart & Final Stores, LLC, TL 1L B 05/19 | | | | | | | | | | |

| | | |

6.926% (1 Month US LIBOR + 6.750%), 06/20/2025 (a) | | | | | 191,322 | | | | 191,800 | |

| | | | | | | | | | |

| | | | | | | | | 1,523,584 | |

| | | | | | | | | | |

| | | |

Food Products - 0.3% | | | | | | | | | | |

| | | |

CSM Bakery Products, TL 2L 07/13 | | | | | | | | | | |

| | | |

11.000% (3 Month US LIBOR + 10.000%), 02/04/2022 (a)(c)(d) | | | | | 786,923 | | | | 780,203 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Health Care Equipment & Supplies - 2.1% | | | | | | | | | | |

| | | |

Drive DeVilbiss Healthcare, LLC, TL 1L 03/21 | | | | | | | | | | |

| | | |

10.500% (3 month US LIBOR +9.500%), 06/01/2025 (a)(h) | | | | | 3,477,621 | | | | 3,292,160 | |

| | | |

Orchid Orthopedic Solutions, LLC, TL 1L 02/19 | | | | | | | | | | |

| | | |

4.676% (3 Month US LIBOR + 4.500%), 03/05/2026 (a) | | | | | 3,437,719 | | | | 3,267,947 | |

| | | | | | | | | | |

| | | | | | | | | 6,560,107 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

7

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Health Care Providers & Services - 1.6% | | | | | | | | | | |

| | | |

Affordable Care Inc., TL 1L 10/15 | | | | | | | | | | |

| | | |

5.750% (3 Month US LIBOR + 4.750%), 10/24/2022 (a) | | | | | 4,995,494 | | | $ | 4,926,806 | |

| | | |

Paradigm Acquisition Corp., TL 2L 10/18 LC | | | | | | | | | | |

| | | |

7.703% (3 Month US LIBOR + 7.500%), 10/26/2026 (a) | | | | | 11,538 | | | | 11,272 | |

| | | | | | | | | | |

| | | | | | | | | 4,938,078 | |

| | | | | | | | | | |

| | | |

Hotels, Restaurants & Leisure - 4.8% | | | | | | | | | | |

| | | |

Aimbridge Acquisition Co, Inc., TL 1L B 09/20 | | | | | | | | | | |

| | | |

6.750% (1 Month US LIBOR + 6.000%), 02/02/2026 (a) | | | | | 411,811 | | | | 413,355 | |

| | | |

Aimbridge Acquisition Co, Inc., TL 1L B 10/19 | | | | | | | | | | |

| | | |

3.863% (1 Month US LIBOR + 3.750%), 02/02/2026 (a) | | | | | 4,233,475 | | | | 4,127,637 | |

| | | |

ASM Global, TL 1L 01/20 | | | | | | | | | | |

| | | |

2.613% (1 Month US LIBOR + 2.500%), 01/23/2025 (a) | | | | | 82,652 | | | | 78,919 | |

| | | |

B&B Hotels SAS, TL 1L B3A 01/20 | | | | | | | | | | |

| | | |

3.875% (6 Month EURIBOR + 3.875%), 07/31/2026 (a)(b) | | EUR | | | 1,886,660 | | | | 2,144,299 | |

| | | |

B&B Hotels SAS, TL 1L B4 03/21 | | | | | | | | | | |

| | | |

5.500%, 07/30/2026 (a)(b) | | EUR | | | 337,480 | | | | 400,158 | |

| | | |

ClubCorp Club Operations, Inc., TL 1L B 08/17 | | | | | | | | | | |

| | | |

2.953% (3 Month US LIBOR + 2.750%), 09/18/2024 (a) | | | | | 1,018,309 | | | | 982,032 | |

| | | |

Life Time Fitness, Inc., TL 1L 01/21 | | | | | | | | | | |

| | | |

5.750% (1 Month US LIBOR + 4.750%), 12/10/2024 (a) | | | | | 1,054,407 | | | | 1,059,516 | |

| | | |

Piolin BidCo SAU, TL 1L B 05/20 | | | | | | | | | | |

| | | |

7.500% (3 Month EURIBOR + 7.500%), 09/16/2026 (a)(b) | | EUR | | | 539,891 | | | | 648,276 | |

| | | |

United PF Holdings LLC, TL 1L 01/20 | | | | | | | | | | |

| | | |

4.176% (3 Month US LIBOR + 4.000%), 12/30/2026 (a) | | | | | 5,108,680 | | | | 4,959,684 | |

| | | | | | | | | | |

| | | | | | | | | 14,813,876 | |

| | | | | | | | | | |

| | | |

Household Products - 3.4% | | | | | | | | | | |

| | | |

Polyconcept North America, Inc., TL 1L B 08/16 | | | | | | | | | | |

| | | |

5.500% (6 Month US LIBOR + 4.500%), 08/16/2023 (a) | | | | | 10,171,856 | | | | 9,881,551 | |

| | | |

Steinhoff, TL 1L 07/19 (SFH Super Senior) | | | | | | | | | | |

| | | |

10.000%, 12/31/2021 (b)(c)(d)(h) | | EUR | | | 9,938 | | | | 12,207 | |

| | | |

Steinhoff, TL 1L 08/19 (SFH A1) | | | | | | | | | | |

| | | |

0.000% (3 Month EURIBOR + 0.000%), 12/31/2021 (b)(c)(d)(g)(h) | | EUR | | | 668,072 | | | | 631,309 | |

| | | | | | | | | | |

| | | | | | | | | 10,525,067 | |

| | | | | | | | | | |

| | | |

Industrial Conglomerates - 0.2% | | | | | | | | | | |

| | | |

Unifrax I LLC / Unifrax Holding Co., TL 1L B 10/18 | | | | | | | | | | |

| | | |

3.926% (3 Month US LIBOR + 3.750%), 12/12/2025 (a) | | | | | 741,572 | | | | 706,614 | |

| | | |

Unifrax I LLC / Unifrax Holding Co., TL 1L B 11/18 | | | | | | | | | | |

| | | |

3.750% (3 Month EURIBOR + 3.750%), 12/12/2025 (a) | | EUR | | | 25,000 | | | | 28,723 | |

| | | | | | | | | | |

| | | | | | | | | 735,337 | |

| | | | | | | | | | |

| | | |

IT Services - 0.4% | | | | | | | | | | |

| | | |

CoreLogic Inc/United States, TL 2L 03/21 | | | | | | | | | | |

| | | |

7.000%, 04/13/2029 (a) | | | | | 449,190 | | | | 451,997 | |

See accompanying notes to financial statements.

8

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

PSAV, Inc., TL 1L B3 12/20 | | | | | | | | | | |

| | | |

15.000%, 10/15/2026 (h) | | | | | 553,930 | | | $ | 652,715 | |

| | | |

PSAV, Inc., TL 2L 02/18 | | | | | | | | | | |

| | | |

8.250% (3 Month US LIBOR + 7.250%), 09/01/2025 (a)(d) | | | | | 189,000 | | | | 137,025 | |

| | | | | | | | | | |

| | | | | | | | | 1,241,737 | |

| | | | | | | | | | |

| | | |

Leisure Products - 1.6% | | | | | | | | | | |

| | | |

Areas Worldwide SASU, TL 1L B1 06/19 | | | | | | | | | | |

| | | |

4.750% (6 Month EURIBOR + 4.750%), 07/01/2026 (a)(b) | | EUR | | | 4,473,094 | | | | 4,822,382 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Machinery - 1.6% | | | | | | | | | | |

| | | |

Accuride Corp., TL 1L B 10/17 | | | | | | | | | | |

| | | |

6.250% (3 Month US LIBOR + 5.250%), 11/17/2023 (a) | | | | | 4,012,289 | | | | 3,813,098 | |

| | | |

CPM Holdings, Inc., TL 2L 10/18 | | | | | | | | | | |

| | | |

8.365% (1 Month US LIBOR + 8.250%), 11/16/2026 (a) | | | | | 371,172 | | | | 367,646 | |

| | | |

Welbilt, Inc. (Manitowoc Foodservice, Inc.), TL 1L B 10/18 | | | | | | | | | | |

| | | |

2.611% (1 Month US LIBOR + 2.500%), 10/23/2025 (a) | | | | | 583,820 | | | | 578,712 | |

| | | |

WireCo WorldGroup, Inc., TL 1L 07/16 | | | | | | | | | | |

| | | |

6.000% (6 Month US LIBOR + 5.000%), 09/29/2023 (a) | | | | | 85,157 | | | | 83,922 | |

| | | | | | | | | | |

| | | | | | | | | 4,843,378 | |

| | | | | | | | | | |

| | | |

Media - 2.8% | | | | | | | | | | |

| | | |

Emerald Expositions Holding, Inc., TL 1L B 11/17 | | | | | | | | | | |

| | | |

2.613% (1 Month US LIBOR + 2.750%), 05/22/2024 (a) | | | | | 8,325 | | | | 8,080 | |

| | | |

NEP Broadcasting, LLC, TL 1L 05/20 | | | | | | | | | | |

| | | |

9.250% (3 Month US LIBOR + 8.250%), 06/01/2025 (a)(d)(e) | | | | | 153,075 | | | | 157,667 | |

| | | |

NEP Broadcasting, LLC, TL 2L 09/18 | | | | | | | | | | |

| | | |

7.113% (1 Month US LIBOR + 7.000%), 10/19/2026 (a) | | | | | 393,000 | | | | 363,525 | |

| | | |

NEP Broadcasting, LLC, TL 1L B 09/18 | | | | | | | | | | |

| | | |

3.500% (3 Month EURIBOR + 3.500%), 10/20/2025 (a) | | EUR | | | 2,131,164 | | | | 2,477,331 | |

| | | |

NEP Broadcasting, LLC, TL 1L B 09/18 | | | | | | | | | | |

| | | |

3.363% (1 Month US LIBOR + 3.250%), 10/20/2025 (a) | | | | | 5,849,518 | | | | 5,698,893 | |

| | | | | | | | | | |

| | | | | | | | | 8,705,496 | |

| | | | | | | | | | |

| | | |

Metals & Mining - 0.0% | | | | | | | | | | |

| | | |

Foresight Energy LLC, TL 1L A 06/20 (Exit) | | | | | | | | | | |

| | | |

9.500% (1 Month US LIBOR + 8.000%), 06/30/2027 (a)(c)(d)(e) | | | | | 149,655 | | | | 149,655 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Multiline Retail - 0.2% | | | | | | | | | | |

| | | |

Belk, Inc., TL 1L EXIT 02/21 PIK Toggle (FLSO) | | | | | | | | | | |

| | | |

10.000%, 07/31/2025 (c)(d)(g) | | | | | 893,545 | | | | 581,921 | |

| | | |

Belk, Inc., TL 1L 02/21 (FLFO) | | | | | | | | | | |

| | | |

8.500%, (3 Month US LIBOR + 7.500%), 07/31/2025 (a)(c)(d) | | | | | 53,180 | | | | 53,357 | |

| | | | | | | | | | |

| | | | | | | | | 635,278 | |

| | | | | | | | | | |

| | | |

Oil, Gas & Consumable Fuels - 1.8% | | | | | | | | | | |

| | | |

Eagleclaw Midstream Ventures, LLC, TL 1L 05/17 | | | | | | | | | | |

| | | |

5.250% (1 Month US LIBOR + 4.250%), 06/24/2024 (a) | | | | | 219,152 | | | | 217,392 | |

See accompanying notes to financial statements.

9

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Lucid Energy Group II Borrower LLC, TL 1L 01/18 | | | | | | | | | | |

| | | |

4.000% (1 Month US LIBOR + 3.000%), 02/17/2025 (a) | | | | | 2,602,289 | | | $ | 2,569,760 | |

| | | |

Navitas Midstream Midland Basin LLC, TL 1L B 12/17 | | | | | | | | | | |

| | | |

5.500% (1 Month US LIBOR + 4.500%), 12/13/2024 (a) | | | | | 2,827,527 | | | | 2,819,864 | |

| | | |

Oryx Midstream Services, LLC, TL 1L B 04/19 | | | | | | | | | | |

| | | |

4.113% (1 Month US LIBOR + 4.000%), 05/08/2026 (a) | | | | | 10,862 | | | | 10,712 | |

| | | | | | | | | | |

| | | | | | | | | 5,617,728 | |

| | | | | | | | | | |

| | | |

Personal Products - 0.3% | | | | | | | | | | |

| | | |

Coty Inc., TL 1L B 03/18 | | | | | | | | | | |

| | | |

2.500% (1 Month EURIBOR + 2.500%), 04/05/2025 (a)(c) | | EUR | | | 30,508 | | | | 35,468 | |

| | | |

Coty Inc., TL 1L B 04/18 | | | | | | | | | | |

| | | |

2.360% (1 Month US LIBOR + 2.250%), 04/07/2025 (a)(c) | | | | | 715,844 | | | | 688,441 | |

| | | |

Coty Inc., TL 1L 04/18 | | | | | | | | | | |

| | | |

1.500% (1 Month EURIBOR +1.500%), 04/05/2023 (a)(c) | | EUR | | | 45,703 | | | | 54,158 | |

| | | | | | | | | | |

| | | | | | | | | 778,067 | |

| | | | | | | | | | |

| | | |

Professional Services - 0.4% | | | | | | | | | | |

| | | |

SIRVA Worldwide, Inc., TL 2L 07/18 | | | | | | | | | | |

| | | |

9.693% (3 Month US LIBOR + 9.500%), 08/03/2026 (a)(d) | | | | | 59,000 | | | | 52,314 | |

| | | |

SIRVA Worldwide, Inc., TL 1L 07/18 | | | | | | | | | | |

| | | |

5.638% (3 Month US LIBOR + 5.500%), 08/04/2025 (a) | | | | | 424,707 | | | | 400,685 | |

| | | |

TMF Group Holding BV, TL 2L 12/17 | | | | | | | | | | |

| | | |

6.875% (3 Month EURIBOR + 6.875%), 06/08/2026 (a)(b) | | EUR | | | 693,210 | | | | 833,415 | |

| | | | | | | | | | |

| | | | | | | | | 1,286,414 | |

| | | | | | | | | | |

| | | |

Road & Rail - 0.1% | | | | | | | | | | |

| | | |

Transplace, TL 2L 09/17 | | | | | | | | | | |

| | | |

9.750% (6 Month US LIBOR + 8.750%), 10/06/2025 (a) | | | | | 180,000 | | | | 176,700 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Software - 4.7% | | | | | | | | | | |

| | | |

Applied Systems, Inc., TL 2L 02/21 (Reprice) | | | | | | | | | | |

| | | |

6.250% (1 Month US LIBOR + 5.500%), 09/19/2025 (a) | | | | | 1,533,408 | | | | 1,550,337 | |

| | | |

Misys Ltd., TL 2L 04/17 | | | | | | | | | | |

| | | |

8.250% (6 Month US LIBOR + 7.250%), 06/13/2025 (a) | | | | | 3,169,669 | | | | 3,196,833 | |

| | | |

Misys Ltd., TL 1L 04/17 | | | | | | | | | | |

| | | |

4.500% (6 Month US LIBOR + 3.500%), 06/13/2024 (a) | | | | | 4,910,491 | | | | 4,834,869 | |

| | | |

TIBCO Software, Inc., TL 2L 02/20 | | | | | | | | | | |

| | | |

7.370% (1 Month US LIBOR + 7.750%), 03/03/2028 (a) | | | | | 3,698,372 | | | | 3,751,073 | |

| | | |

TIBCO Software, Inc., TL 1L B2 02/20 | | | | | | | | | | |

| | | |

3.870% (1 Month US LIBOR + 3.750%), 06/30/2026 (a) | | | | | 1,117,844 | | | | 1,113,133 | |

| | | | | | | | | | |

| | | | | | | | | 14,446,245 | |

| | | | | | | | | | |

| | | |

Specialty Retail - 0.2% | | | | | | | | | | |

| | | |

Douglas Holding AG, TL 1L B 03/21 | | | | | | | | | | |

| | | |

5.500%, 03/26/2026 (a)(b)(c)(d) | | EUR | | | 280,240 | | | | 334,696 | |

| | | |

Talbots, Inc., TL 1L B 11/18 | | | | | | | | | | |

| | | |

8.000% (3 Month US LIBOR + 7.000%), 11/28/2022 (a) | | | | | 212,000 | | | | 179,140 | |

| | | | | | | | | | |

| | | | | | | | | 513,836 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

10

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Textiles, Apparel & Luxury Goods - 3.2% | | | | | | | | | | |

| | | |

Varsity Brands, Inc., TL 1L 11/17 | | | | | | | | | | |

| | | |

4.500% (1 Month US LIBOR + 3.500%), 12/16/2024 (a) | | | | | 10,158,032 | | | $ | 9,794,070 | |

| | | | | | | | | | |

| | | |

Trading Companies & Distributors - 0.2% | | | | | | | | | | |

| | | |

FleetPride Corporation, TL 1L 12/18 | | | | | | | | | | |

| | | |

4.613% (1 Month US LIBOR + 4.500%), 02/04/2026 (a) | | | | | 726,227 | | | | 721,837 | |

| | | | | | | | | | |

| | | |

Transportation Infrastructure - 1.5% | | | | | | | | | | |

| | | |

Direct ChassisLink, Inc., TL 2L 04/19 | | | | | | | | | | |

| | | |

8.438% (3 Month US LIBOR + 8.250%), 04/10/2026 (a) | | | | | 2,442,190 | | | | 2,475,318 | |

| | | |

Direct ChassisLink, Inc., TL 2L 04/21 | | | | | | | | | | |

| | | |

7.176%, 04/30/2026 (a) | | | | | 2,000,000 | | | | 2,020,000 | |

| | | | | | | | | | |

| | | | | | | | | 4,495,318 | |

| | | | | | | | | | |

TOTAL LEVERAGED LOANS (amortized cost $164,178,606) | | | | | | | | | 167,963,341 | |

| | | | | | | | | | |

| | | |

High Yield Securities - 55.9% | | | | | | | | | | |

| | | |

Airlines - 2.1% | | | | | | | | | | |

| | | |

0.000%, 04/20/2026 (f) | | | | | 924,000 | | | | 971,355 | |

| | | |

American Airlines Group, Inc | | | | | | | | | | |

| | | |

5.750%, 04/20/2029 (f) | | | | | 542,000 | | | | 581,431 | |

| | | |

Delta Air Lines, Inc. | | | | | | | | | | |

| | | |

4.375%, 04/19/2028 | | | | | 2,378,000 | | | | 2,528,424 | |

| | | |

3.750%, 10/28/2029 | | | | | 2,408,000 | | | | 2,400,815 | |

| | | | | | | | | | |

| | | | | | | | | 6,482,025 | |

| | | | | | | | | | |

| | | |

Auto Components - 1.7% | | | | | | | | | | |

| | | |

BBB Industries, LLC | | | | | | | | | | |

| | | |

9.250%, 08/01/2025 (f) | | | | | 3,456,000 | | | | 3,758,400 | |

| | | |

Truck Hero, Inc. | | | | | | | | | | |

| | | |

6.250%, 02/01/2029 (f) | | | | | 341,000 | | | | 353,283 | |

| | | |

Wheel Pros, Inc. | | | | | | | | | | |

| | | |

6.500%, 05/15/2029 (c)(d)(f) | | | | | 1,197,000 | | | | 1,201,620 | |

| | | | | | | | | | |

| | | | | | | | | 5,313,303 | |

| | | | | | | | | | |

| | | |

Biotechnology - 1.2% | | | | | | | | | | |

| | | |

Intercept Pharmaceuticals, Inc. | | | | | | | | | | |

| | | |

3.250%, 07/01/2023 | | | | | 1,941,000 | | | | 1,613,456 | |

| | | |

2.000%, 05/15/2026 | | | | | 2,531,000 | | | | 1,663,155 | |

| | | |

Radius Health, Inc. | | | | | | | | | | |

| | | |

3.000%, 09/01/2024 (c)(d) | | | | | 326,000 | | | | 313,922 | |

| | | | | | | | | | |

| | | | | | | | | 3,590,533 | |

| | | | | | | | | | |

| | | |

Building Products - 4.8% | | | | | | | | | | |

| | | |

Cornerstone (Ply Gem Holdings, Inc.) | | | | | | | | | | |

| | | |

6.125%, 01/15/2029 (f) | | | | | 143,000 | | | | 152,837 | |

| | | |

LBM Borrower, LLC | | | | | | | | | | |

| | | |

7.750%, 04/01/2027 (f) | | | | | 6,455,000 | | | | 6,661,399 | |

| | | |

6.250%, 01/15/2029 (f) | | | | | 7,153,000 | | | | 7,352,783 | |

See accompanying notes to financial statements.

11

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | �� | |

SRS Distribution, Inc. | | | | | | | | | | |

| | | |

8.250%, 07/01/2026 (f) | | | | | 687,000 | | | $ | 720,491 | |

| | | | | | | | | | |

| | | | | | | | | 14,887,510 | |

| | | | | | | | | | |

| | | |

Chemicals - 2.7% | | | | | | | | | | |

| | | |

Consolidated Energy Finance SA | | | | | | | | | | |

| | | |

6.875%, 06/15/2025 (b)(f) | | | | | 911,000 | | | | 916,124 | |

| | | |

6.500%, 05/15/2026 (b)(f) | | | | | 1,646,000 | | | | 1,637,770 | |

| | | |

Cornerstone Chemical Co. | | | | | | | | | | |

| | | |

6.750%, 08/15/2024 (f) | | | | | 6,000,000 | | | | 5,780,070 | |

| | | | | | | | | | |

| | | | | | | | | 8,333,964 | |

| | | | | | | | | | |

| | | |

Commercial Services & Supplies - 0.8% | | | | | | | | | | |

| | | |

Multi-Color Corp | | | | | | | | | | |

| | | |

10.500%, 07/15/2027 (f) | | | | | 2,183,000 | | | | 2,410,447 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Construction & Engineering - 0.8% | | | | | | | | | | |

| | | |

Maxim Crane Works LP / Maxim Finance Corp. | | | | | | | | | | |

| | | |

10.125%, 08/01/2024 (f) | | | | | 2,484,000 | | | | 2,594,612 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Construction Materials - 0.2% | | | | | | | | | | |

| | | |

Cemex Materials LLC | | | | | | | | | | |

| | | |

7.700%, 07/21/2025 (f) | | | | | 554,000 | | | | 638,485 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Containers & Packaging - 0.1% | | | | | | | | | | |

| | | |

Plastipak Holdings, Inc. | | | | | | | | | | |

| | | |

6.250%, 10/15/2025 (f) | | | | | 207,000 | | | | 213,081 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Diversified Telecommunication Services - 1.2% | | | | | | | | | | |

| | | |

Zayo Group LLC | | | | | | | | | | |

| | | |

6.125%, 03/01/2028 (f) | | | | | 3,507,000 | | | | 3,612,526 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Electronic Equipment, Instruments & Components - 2.5% | | | | | | | | | | |

| | | |

CommScope, Inc. | | | | | | | | | | |

| | | |

6.000%, 06/15/2025 (f) | | | | | 890,000 | | | | 906,688 | |

| | | |

8.250%, 03/01/2027 (f) | | | | | 6,153,000 | | | | 6,599,092 | |

| | | |

7.125%, 07/01/2028 (f) | | | | | 310,000 | | | | 335,876 | |

| | | | | | | | | | |

| | | | | | | | | 7,841,656 | |

| | | | | | | | | | |

| | | |

Energy Equipment & Services - 0.1% | | | | | | | | | | |

| | | |

Archrock Partners LP / Archrock Partners Finance Corp | | | | | | | | | | |

| | | |

6.875%, 04/01/2027 (f) | | | | | 324,000 | | | | 345,617 | |

| | | | | | | | | | |

| | | | | | | | | | |

See accompanying notes to financial statements.

12

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Health Care Providers & Services - 2.9% | | | | | | | | | | |

| | | |

CHS/Community Health Systems, Inc. | | | | | | | | | | |

| | | |

8.000%, 03/15/2026 (f) | | | | | 986,000 | | | $ | 1,063,648 | |

| | | |

5.625%, 03/15/2027 (f) | | | | | 124,000 | | | | 131,661 | |

| | | |

6.875%, 04/01/2028 (f) | | | | | 882,000 | | | | 834,752 | |

| | | |

6.875%, 04/15/2029 (f) | | | | | 599,000 | | | | 626,827 | |

| | | |

6.000%, 01/15/2029 (f) | | | | | 67,000 | | | | 70,618 | |

| | | |

LifePoint Hospitals, Inc. | | | | | | | | | | |

| | | |

9.750%, 12/01/2026 (f) | | | | | 234,000 | | | | 253,013 | |

| | | |

5.375%, 01/15/2029 (f) | | | | | 518,000 | | | | 518,751 | |

| | | |

Molina Healthcare, Inc. | | | | | | | | | | |

| | | |

3.875%, 11/15/2030 (f) | | | | | 625,000 | | | | 644,531 | |

| | | |

Radiology Partners Inc. | | | | | | | | | | |

| | | |

9.250%, 02/01/2028 (f) | | | | | 4,269,000 | | | | 4,698,227 | |

| | | | | | | | | | |

| | | | | | | | | 8,842,028 | |

| | | | | | | | | | |

| | | |

Health Care Technology - 0.1% | | | | | | | | | | |

| | | |

Verscend Holding Corp. | | | | | | | | | | |

| | | |

9.750%, 08/15/2026 (f) | | | | | 314,000 | | | | 334,806 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Hotels, Restaurants & Leisure - 9.7% | | | | | | | | | | |

| | | |

Carnival Corp. | | | | | | | | | | |

| | | |

5.750%, 03/01/2027 (f) | | | | | 6,416,000 | | | | 6,772,922 | |

| | | |

ClubCorp Club Operations, Inc. | | | | | | | | | | |

| | | |

8.500%, 09/15/2025 (f) | | | | | 881,000 | | | | 853,376 | |

| | | |

Diamond Resorts International, Inc. | | | | | | | | | | |

| | | |

10.750%, 09/01/2024 (f) | | | | | 5,613,000 | | | | 5,961,540 | |

| | | |

Life Time Fitness, Inc. | | | | | | | | | | |

| | | |

5.750%, 01/15/2026 (f) | | | | | 3,526,000 | | | | 3,645,602 | |

| | | |

Merlin Entertainments PLC | | | | | | | | | | |

| | | |

6.625%, 11/15/2027 (b)(f) | | | | | 1,267,000 | | | | 1,286,005 | |

| | | |

5.750%, 06/15/2026 (b)(f) | | | | | 690,000 | | | | 730,406 | |

| | | |

NCL Corp, Ltd. | | | | | | | | | | |

| | | |

6.125%, 03/15/2028 (f) | | | | | 1,927,000 | | | | 2,032,388 | |

| | | |

Royal Caribbean Cruises Ltd. | | | | | | | | | | |

| | | |

5.500%, 04/01/2028 (f) | | | | | 4,731,000 | | | | 4,967,313 | |

| | | |

Viking Cruises, Ltd. | | | | | | | | | | |

| | | |

13.000%, 05/15/2025 (f) | | | | | 237,000 | | | | 277,969 | |

| | | |

7.000%, 02/15/2029 (f) | | | | | 3,183,000 | | | | 3,306,341 | |

| | | | | | | | | | |

| | | | | | | | | 29,833,862 | |

| | | | | | | | | | |

| | | |

Independent Power and Renewable Electricity Producers - 0.4% | | | | | | | | | | |

| | | |

NRG Energy, Inc. | | | | | | | | | | |

| | | |

3.625%, 02/15/2031 (f) | | | | | 1,325,000 | | | | 1,299,823 | |

| | | | | | | | | | |

| | | | | | | | | | |

See accompanying notes to financial statements.

13

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Insurance - 3.6% | | | | | | | | | | |

| | | |

Alliant Holdings I, Inc. | | | | | | | | | | |

| | | |

6.750%, 10/15/2027 (f) | | | | | 1,739,000 | | | $ | 1,829,428 | |

| | | |

Aspen Insurance Holdings Ltd | | | | | | | | | | |

| | | |

7.625%, 10/15/2025 (f) | | | | | 1,875,000 | | | | 2,005,688 | |

| | | |

National Financial Partners Corp | | | | | | | | | | |

| | | |

6.875%, 08/15/2028 (f) | | | | | 6,963,000 | | | | 7,316,302 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 11,151,418 | |

| | | | | | | | | | |

| | | |

IT Services - 1.1% | | | | | | | | | | |

| | | |

West Corp. | | | | | | | | | | |

| | | |

8.500%, 10/15/2025 (f) | | | | | 3,251,000 | | | | 3,309,924 | |

| | | |

Xerox Business Services /Conduent | | | | | | | | | | |

| | | |

10.500%, 12/15/2024 (f) | | | | | 121,000 | | | | 127,353 | |

| | | | | | | | | | |

| | | | | | | | | 3,437,277 | |

| | | | | | | | | | |

| | | |

Machinery - 0.8% | | | | | | | | | | |

| | | |

Welbilt, Inc. (Manitowoc Foodservice, Inc.) | | | | | | | | | | |

| | | |

9.500%, 02/15/2024 | | | | | 2,380,000 | | | | 2,506,438 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Media - 0.6% | | | | | | | | | | |

| | | |

Intelsat Jackson Holdings SA | | | | | | | | | | |

| | | |

0.000%, 08/01/2023 (b)(g) | | | | | 207,000 | | | | 127,305 | |

| | | |

Outfront Media Capital LLC / Outfront Media Capital Corp. | | | | | | | | | | |

| | | |

4.625%, 03/15/2030 (f) | | | | | 620,000 | | | | 614,575 | |

| | | |

Spotify USA, Inc. | | | | | | | | | | |

| | | |

0.000%, 03/15/2026 (f) | | | | | 1,303,000 | | | | 1,204,624 | |

| | | | | | | | | | |

| | | | | | | | | 1,946,504 | |

| | | | | | | | | | |

| | | |

Multiline Retail - 0.0% | | | | | | | | | | |

| | | |

JC Penney Corp, Inc. | | | | | | | | | | |

| | | |

0.000%, 03/15/2025 (d)(e)(f)(g) | | | | | 98,000 | | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Oil, Gas & Consumable Fuels - 4.1% | | | | | | | | | | |

| | | |

Genesis Energy | | | | | | | | | | |

| | | |

5.625%, 06/15/2024 | | | | | 1,902,000 | | | | 1,905,566 | |

| | | |

8.000%, 01/15/2027 | | | | | 431,000 | | | | 444,574 | |

| | | |

Global Partners LP / GLP Finance Corp. | | | | | | | | | | |

| | | |

7.000%, 08/01/2027 | | | | | 519,000 | | | | 555,810 | |

| | | |

6.875%, 01/15/2029 | | | | | 364,000 | | | | 394,258 | |

| | | |

Sunoco LP | | | | | | | | | | |

| | | |

4.500%, 05/15/2029 (f) | | | | | 933,000 | | | | 943,496 | |

| | | |

Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp. | | | | | | | | | | |

| | | |

6.000%, 03/01/2027 (f) | | | | | 211,000 | | | | 214,629 | |

| | | |

6.000%, 12/31/2030 (f) | | | | | 273,000 | | | | 274,024 | |

See accompanying notes to financial statements.

14

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Targa Resources Partners LP / Targa Resources Partners Finance Corp. | | | | | | | | | | |

| | | |

5.000%, 01/15/2028 | | | | | 458,000 | | | $ | 482,755 | |

| | | |

4.000%, 01/15/2032 (f) | | | | | 3,304,000 | | | | 3,250,309 | |

| | | |

Vine Oil & Gas LP / Vine Oil & Gas Finance Corp. | | | | | | | | | | |

| | | |

6.750%, 04/15/2029 (f) | | | | | 4,115,000 | | | | 4,121,913 | |

| | | | | | | | | | |

| | | | | | | | | 12,587,334 | |

| | | | | | | | | | |

| | | |

Road & Rail - 2.1% | | | | | | | | | | |

| | | |

Kenan Advantage Group, Inc./The | | | | | | | | | | |

| | | |

7.875%, 07/31/2023 (f) | | | | | 6,488,000 | | | | 6,504,220 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Software - 1.1% | | | | | | | | | | |

| | | |

Solera, LLC | | | | | | | | | | |

| | | |

10.500%, 03/01/2024 (c)(d)(f) | | | | | 3,196,000 | | | | 3,297,888 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Specialty Retail - 4.2% | | | | | | | | | | |

| | | |

Douglas Holding AG | | | | | | | | | | |

| | | |

6.000%, 04/08/2026 (b)(c)(d)(f) | | EUR | | | 6,393,000 | | | | 7,741,089 | |

| | | |

8.250%, 10/01/2026 (b)(c)(d)(f) | | EUR | | | 4,260,000 | | | | 5,131,518 | |

| | | | | | | | | | |

| | | | | | | | | 12,872,607 | |

| | | | | | | | | | |

| | | |

Textiles, Apparel & Luxury Goods - 0.7% | | | | | | | | | | |

| | | |

Varsity Brands, Inc. | | | | | | | | | | |

| | | |

9.000% (3 Month LIBOR USD + 8.000%), 12/22/2024 (a)(f) | | | | | 2,076,000 | | | | 2,101,950 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Trading Companies & Distributors - 6.3% | | | | | | | | | | |

| | | |

AerCap Holdings | | | | | | | | | | |

| | | |

6.500% (3 Month LIBOR USD + 4.300%), 06/15/2045 (b)(f) | | | | | 994,000 | | | | 1,059,853 | |

| | | |

4.625%, 10/15/2027 (b) | | | | | 3,714,000 | | | | 4,140,884 | |

| | | |

Neon Holdings, Inc. | | | | | | | | | | |

| | | |

10.125%, 04/01/2026 (f) | | | | | 4,721,000 | | | | 5,163,594 | |

| | | |

TruckPro LLC | | | | | | | | | | |

| | | |

11.000%, 10/15/2024 (f) | | | | | 3,669,000 | | | | 4,054,245 | |

| | | |

White Cap Construction Supply, Inc. | | | | | | | | | | |

| | | |

8.250%, 03/15/2026 (f) | | | | | 2,452,000 | | | | 2,551,268 | |

| | | |

6.875%, 10/15/2028 (f) | | | | | 2,443,000 | | | | 2,595,712 | |

| | | | | | | | | | |

| | | | | | | | | 19,565,556 | |

| | | | | | | | | | |

TOTAL HIGH YIELD SECURITIES (amortized cost $168,751,771) | | | | | | | | | 172,545,470 | |

| | | | | | | | | | |

| | | |

Collateralized Loan Obligations - 0.2% | | | | | | | | | | |

| | | |

Diversified Financial Services - 0.2% | | | | | | | | | | |

| | | |

Octagon Investment Partners Ltd. | | | | | | | | | | |

| | | |

7.848% (3 Month LIBOR USD + 7.660%), 10/20/2031 (a)(d)(e)(f) | | | | | 53,100 | | | | 53,948 | |

| | | |

TICP CLO Ltd. | | | | | | | | | | |

| | | |

5.788% (3 Month LIBOR USD + 5.600%), 01/20/2031 (a)(d)(e)(f) | | | | | 738,460 | | | | 707,346 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 761,294 | |

| | | | | | | | | | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS (amortized cost $679,311) | | | | | | | | | 761,294 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

15

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

| | | | | | | | | | |

Common Stocks - 0.7% | | | | | | | | | | |

| | | |

Health Care Providers & Services - 0.0% | | | | | | | | | | |

| | | |

Quorum Health Corp. (d)(e) | | | | | 212,000 | | | $ | 19,800 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Hotels, Restaurants & Leisure - 0.6% | | | | | | | | | | |

| | | |

Hilton Grand Vacations, Inc. | | | | | 40,347 | | | | 1,797,863 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Metals & Mining - 0.1% | | | | | | | | | | |

| | | |

Foresight Energy LLC (c)(d)(e) | | | | | 17,979 | | | | 258,511 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS (cost $1,917,067) | | | | | | | | | 2,076,174 | |

| | | | | | | | | | |

| | | |

Exchange Traded Funds - 2.1% | | | | | | | | | | |

| | | |

Diversified Financial Services - 2.1% | | | | | | | | | | |

| | | |

BlackRock Floating Rate Income Strategies Fund, Inc. | | | | | 23,250 | | | | 299,925 | |

| | | |

Nuveen Credit Strategies Income Fund | | | | | 53,690 | | | | 356,502 | |

| | | |

Nuveen Floating Rate Income Opportunity Fund | | | | | 94,645 | | | | 897,235 | |

| | | |

PowerShares Senior Loan Portfolio | | | | | 207,630 | | | | 4,599,004 | |

| | | |

Voya Prime Rate Trust | | | | | 42,211 | | | | 192,904 | |

| | | | | | | | | | |

| | | | | | | | | 6,345,570 | |

| | | | | | | | | | |

TOTAL EXCHANGE TRADED FUNDS (cost $6,360,945) | | | | | | | | | 6,345,570 | |

| | | | | | | | | | |

| | | |

TOTAL INVESTMENTS (cost $341,887,700) (i) - 113.2% | | | | | | | | | 349,691,849 | |

| | | | | | | | | | |

LIABILITIES EXCEEDING OTHER ASSETS, NET - (13.2)% | | | | | | | | | (40,895,545 | ) |

| | | | | | | | | | |

NET ASSETS - 100.0% | | | | | | | | $ | 308,796,304 | |

| | | | | | | | | | |

| † | | In U.S. Dollars unless otherwise indicated. | |

| (a) | | Variable rate security, the coupon rate shown is the effective rate as of April 30, 2021. | |

| (c) | | Security considered restricted due to the Adviser’s knowledge of material non-public information. The total value of these securities as of April 30, 2021 was $22,992,511 and represented 7.4% of net assets. | |

| (d) | | Security considered illiquid, as defined by the Securities and Exchange Commission. The total value of these securities as of April 30, 2021 was $24,042,859 and represented 7.8% of net assets. | |

| (e) | | Value determined using significant unobservable inputs. | |

| (f) | | Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold to qualified institutional buyers in transactions exempt from registration. The total value of these securities as of April 30, 2021 was $154,229,403, which represent 49.9% of net assets. | |

| (g) | | Non-income producing security. | |

| (h) | | Represents a payment-in-kind (“PIK”) security which may pay interest/dividend in additional par/shares. | |

| (i) | | All investments are held as collateral for the Fund’s credit facility. | |

See accompanying notes to financial statements.

16

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

The following table represents the Fund’s investments categorized by country of risk as of April 30, 2021:

| | | | | | |

| | | Country: | | % of Net Assets | |

| | |

| | United States | | | 97.5% | |

| | |

| | Germany | | | 7.6% | |

| | |

| | France | | | 2.4% | |

| | |

| | Netherlands | | | 2.0% | |

| | |

| | Sweden | | | 1.4% | |

| | |

| | United Kingdom | | | 1.1% | |

| | |

| | Switzerland | | | 0.8% | |

| | |

| | Luxembourg | | | 0.2% | |

| | |

| | Spain | | | 0.2% | |

| | | | | | |

| | | | | 113.2% | |

| | | | | | |

| | Liabilities Exceeding Other Assets, Net | | | (13.2)% | |

| | | | | | |

| | | | | 100.0% | |

| | | | | | |

See accompanying notes to financial statements.

17

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Statement of Assets and Liabilities

As of April 30, 2021 (Unaudited)

| | | | |

Assets | | | | |

| |

Investments, at value (amortized cost $341,887,700) | | $ | 349,691,849 | |

| |

Cash and cash equivalents | | | 21,233,517 | |

| |

Receivable for shares issued | | | 32,726,875 | |

| |

Dividends and interest receivable | | | 2,982,186 | |

| |

Due from Adviser | | | 14,549 | |

| |

Receivable for investments sold | | | 250,926 | |

| |

Prepaid expenses | | | 143,012 | |

| | | | |

Total assets | | | 407,042,914 | |

| | | | |

| |

Liabilities | | | | |

| |

Credit Facility (net of deferred financing costs of $51,392) | | | 57,229,835 | |

| |

Payable for investments purchased | | | 39,199,072 | |

| |

Distribution payable | | | 1,154,433 | |

| |

Investment advisory fees | | | 202,552 | |

| |

Distribution fees | | | 83,091 | |

| |

Shareholder service fees | | | 40,768 | |

| |

Trustees’ fees | | | 156,919 | |

| |

Other accrued expenses | | | 179,940 | |

| | | | |

Total liabilities | | | 98,246,610 | |

| | | | |

Net assets | | $ | 308,796,304 | |

| | | | |

| |

Net Assets | | | | |

| |

Paid-in capital — (unlimited shares authorized — $0.001 par value) | | $ | 293,973,218 | |

| |

Retained earnings | | | 14,823,086 | |

| | | | |

Net assets | | $ | 308,796,304 | |

| | | | |

| |

Class I: | | | | |

| |

Net asset value | | $ | 163,264,678 | |

| | | | |

Price per share (5,843,237 shares) | | $ | 27.94 | |

| | | | |

| |

Class T: | | | | |

| |

Net asset value | | $ | 21,446,747 | |

| | | | |

Price per share (774,564 shares) | | $ | 27.69 | |

| | | | |

| |

Class U: | | | | |

| |

Net asset value | | $ | 124,084,879 | |

| | | | |

Price per share (4,647,697 shares) | | $ | 26.70 | |

| | | | |

See accompanying notes to financial statements.

18

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Statement of Operations

For the Period Ended April 30, 2021 (Unaudited)

| | | | |

Investment income | | | | |

| |

Interest income | | $ | 6,660,346 | |

| |

Dividend income | | | 67,297 | |

| |

Other income | | | 281,583 | |

| | | | |

Total investment income | | | 7,009,226 | |

| | | | |

Expenses | | | | |

| |

Investment advisory fees | | | 737,273 | |

| |

Credit facility interest expense | | | 457,090 | |

| |

Offering Costs | | | 277,544 | |

| |

Legal fees | | | 179,106 | |

| |

Administration fees | | | 90,568 | |

| |

Term loan expense | | | 50,057 | |

| |

Audit and tax fees | | | 47,224 | |

| |

Trustees’ fees | | | 59,351 | |

| |

Transfer agent fees | | | 54,460 | |

| |

Shareholder service fees | | | 78,565 | |

| |

Distribution fees | | | 157,130 | |

| |

Shareholder reporting expense | | | 35,419 | |

| |

Custodian fees | | | 12,012 | |

| |

Other expenses | | | 107,021 | |

| | | | |

Total expenses prior to expense reimbursement | | | 2,342,820 | |

| |

Expense reimbursement | | | (536,415 | ) |

| | | | |

Net expenses | | | 1,806,405 | |

| | | | |

| |

Net investment income | | | 5,202,821 | |

| | | | |

| |

Realized and unrealized gain (loss) | | | | |

| |

Net realized gain (loss) on | | | | |

| |

Investments | | | 5,097,941 | |

| |

Foreign currency transactions | | | (51,782 | ) |

| | | | |

Net realized gain | | | 5,046,159 | |

| |

Net change in unrealized appreciation (depreciation) on | | | | |

| |

Investments | | | 5,300,146 | |

| |

Foreign currency translation | | | 95,468 | |

| |

Deferred Trustees’ fees | | | (27,488 | ) |

| | | | |

Net change in unrealized appreciation | | | 5,368,125 | |

| |

Net realized and unrealized gain | | | 10,414,285 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 15,617,105 | |

| | | | |

See accompanying notes to financial statements.

19

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Statements of Changes in Net Assets

| | | | | | | | |

| | | Period Ended

April 30, 2021

(Unaudited) | | | Period Ended

October 31, 2020(1) | |

Increase (decrease) in net assets resulting from operations | | | | | | | | |

| | |

Net investment income | | $ | 5,202,821 | | | $ | 4,080,569 | |

| | |

Net realized gain | | | 5,046,159 | | | | 2,282,066 | |

| | |

Net change in unrealized appreciation | | | 5,368,125 | | | | 2,151,030 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 15,617,105 | | | | 8,513,665 | |

| | | | | | | | |

| | |

Dividends to shareholders from | | | | | | | | |

| | |

Net dividend and distributions — Class I | | | (3,565,374 | ) | | | (4,076,334 | ) |

| | |

Net dividend and distributions — Class T | | | (380,378 | ) | | | (70,458 | ) |

| | |

Net dividend and distributions — Class U | | | (1,215,141 | ) | | | — | |

| | | | | | | | |

Total distributions | | | (5,160,893 | ) | | | (4,146,792 | ) |

| | | | | | | | |

| | |

Shareholder transactions | | | | | | | | |

Class I | | | | | | | | |

| | |

Subscriptions | | | 48,041,799 | | | | 102,640,250 | |

| | |

Issued to shareholder in reinvestment of distributions | | | 318,207 | | | | 769 | |

| | |

Shares redeemed | | | (130,979 | ) | | | — | |

| | | | | | | | |

| | | 48,229,027 | | | | 102,641,019 | |

| | | | | | | | |

Class T | | | | | | | | |

| | |

Subscriptions | | | 12,172,234 | | | | 8,164,260 | |

| | |

Issued to shareholder in reinvestment of distributions | | | 257,360 | | | | 32,833 | |

| | |

Shares redeemed | | | — | | | | — | |

| | | | | | | | |

| | | 12,429,594 | | | | 8,197,093 | |

| | | | | | | | |

Class U | | | | | | | | |

| | |

Subscriptions | | | 114,394,162 | | | | 7,421,000 | |

| | |

Issued to shareholder in reinvestment of distributions | | | 716,574 | | | | — | |

| | |

Shares redeemed | | | (55,250 | ) | | | — | |

| | | | | | | | |

| | | 115,055,486 | | | | 7,421,000 | |

| | | | | | | | |

Net increase in net assets | | | 186,170,319 | | | | 122,625,985 | |

| | |

Net assets | | | | | | | | |

| | |

Beginning of period | | | 122,625,985 | | | | — | |

| | | | | | | | |

End of period | | $ | 308,796,304 | | | $ | 122,625,985 | |

| | | | | | | | |

| (1) | The Fund commenced operations on February 28, 2020. |

See accompanying notes to financial statements.

20

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Statement of Cash Flows

| | | | |

| | | Period Ended

April 30, 2021

(Unaudited) | |

Cash Flows from Operating Activities: | | | | |

| |

Net increase in net assets resulting from operations | | $ | 15,617,106 | |

| |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| |

Purchases of investments | | | (309,121,784 | ) |

| |

Proceeds from sales of investments | | | 91,923,645 | |

| |

Net amortization (accretion) of premiums/discounts | | | (449,583 | ) |

| |

Net change in unrealized depreciation of investments | | | (5,300,146 | ) |

| |

Net change in unrealized appreciation on foreign currency translation | | | (95,468 | ) |

| |

Net change in unrealized appreciation on deferred Trustees’ fees | | | 27,488 | |

| |

Net realized gain from investments | | | (5,097,941 | ) |

| |

Net realized gain on investments (foreign currency related) | | | (198,464 | ) |

| |

Amortization of deferred financing costs | | | 86,215 | |

| |

Changes in assets and liabilities: | | | | |

| |

Increase in prepaid expenses | | | (143,012 | ) |

| |

Increase in receivable for investments sold | | | (223,456 | ) |

| |

Increase in dividends and interest receivable | | | (1,507,485 | ) |

| |

Decrease in due from Adviser | | | 93,693 | |

| |

Decrease in deferred offering costs | | | 277,543 | |

| |

Increase in investment advisory fees payable | | | 138,046 | |

| |

Increase in payable for investments purchased | | | 32,244,465 | |

| |

Increase in shareholder service fees | | | 40,768 | |

| |

Increase in distribution fees | | | 83,091 | |

| |

Increase in Trustees’ fees payable | | | 48,101 | |

| |

Decrease in accrued expenses and other liabilities | | | (299,946 | ) |

| | | | |

Net cash used in operating activities | | | (181,857,125 | ) |

| | | | |

Cash Flows from Financing Activities | | | | |

| |

Subscriptions for shares | | | 151,863,320 | |

| |

Cash dividends paid to shareholders, net of reinvestments | | | (3,368,917 | ) |

| |

Shares repurchased | | | (186,229 | ) |

| |

Proceeds from credit facility | | | 68,438,602 | |

| |

Paydown of credit facility | | | (17,000,000 | ) |

| | | | |

Net cash provided by financing activities | | | 199,746,776 | |

| | | | |

| |

Effect of exchange rate changes on cash | | | 9,953 | |

| | | | |

Net increase in cash and cash equivalents | | | 17,899,604 | |

| | | | |

| |

Cash and Cash Equivalents | | | | |

| |

Beginning balance | | | 3,333,913 | |

| | | | |

Ending balance | | $ | 21,233,517 | |

| | | | |

| |

Supplemental Disclosure of cash flow information and non-cash financing activities: | | | | |

| |

Cash paid for interest expense | | $ | 345,654 | |

| | | | |

See accompanying notes to financial statements.

21

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Financial Highlights

| | | | | | | | |

| | | Six Months

Ended

April 30, 2021

(Unaudited) | | | Period from

Commencement of

Operations to

October 31, 2020*** | |

Class I | | | | | | | | |

| | |

Per share operating performance | | | | | | | | |

| | |

Net asset value, beginning of period | | $ | 26.08 | | | $ | 25.00 | |

| | |

Income from operations | | | | | | | | |

| | |

Net investment income(1) | | | 0.77 | | | | 1.01 | |

| | |

Net realized and unrealized gain on investments, forward foreign currency contracts, foreign currency transactions and deferred Trustees’ fees | | | 1.86 | | | | 1.10 | |

| | | | | | | | |

Total income from operations | | | 2.63 | | | | 2.11 | |

| | |

Dividends from | | | | | | | | |

| | |

Net investment income | | | (0.77 | ) | | | (1.03 | ) |

| | | | | | | | |

Total dividends | | | (0.77 | ) | | | (1.03 | ) |

| | | | | | | | |

Net Asset Value, end of period | | $ | 27.94 | | | $ | 26.08 | |

| | | | | | | | |

Total return†(2) | | | 10.06% | | | | 8.71% | |

| | | | | | | | |

| | |

Ratios to average net assets** | | | | | | | | |

| | |

Expenses, before waiver | | | 2.27% | | | | 3.84% | |

| | |

Expenses, after waiver | | | 1.65% | | | | 1.68% | |

| | |

Net investment income, before waiver | | | 5.02% | | | | 3.91% | |

| | |

Net investment income, after waiver | | | 5.64% | | | | 6.06% | |

| | |

Supplemental data | | | | | | | | |

| | |

Net assets, end of period (000’s) | | $ | 163,265 | | | $ | 106,962 | |

| | |

Portfolio turnover rate(2)* | | | 38.88% | | | | 66.19% | |

| (1) | Per share calculations were performed using average shares. |

| (2) | Total return and Portfolio turnover rate are for the period indicated and have not been annualized. |

| † | Total return assumes a purchase of common stock at the net asset value on the first day and a sale at the net asset value on the last day of each period reported on the table. Total return assumes reinvestment of dividends and distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan |

| * | Portfolio turnover is calculated on the basis of the Fund as a whole. |

| *** | The date of commencement of operations for Class I shares was February 28, 2020. |

See accompanying notes to financial statements.

22

| | | | |

| |

Credit Opportunities Portfolio | | April 30, 2021 (Unaudited) |

| | | | |

Financial Highlights

| | | | | | | | |

| | | Six Months

Ended

April 30, 2021

(Unaudited) | | | Period from

Commencement of

Operations to

October 31, 2020*** | |

Class T | | | | | | | | |

| | |

Per share operating performance | | | | | | | | |

| | |

Net asset value, beginning of period | | $ | 25.83 | | | $ | 25.00 | |

| | |

Income from operations | | | | | | | | |

| | |

Net investment income(1) | | | 0.66 | | | | 0.61 | |

| | |

Net realized and unrealized gain on investments, forward foreign currency contracts, foreign currency transactions and deferred Trustees’ fees | | | 1.85 | | | | 0.83 | |

| | | | | | | | |

Total income from operations | | | 2.51 | | | | 1.44 | |

| | |

Dividends from | | | | | | | | |

| | |

Net investment income | | | (0.65 | ) | | | (0.61 | ) |

| | | | | | | | |

Total dividends | | | (0.65 | ) | | | (0.61 | ) |

| | | | | | | | |

Net Asset Value, end of period | | $ | 27.69 | | | $ | 25.83 | |

| | | | | | | | |

Total return†(2) | | | 9.72% | | | | 6.65% | |

| | | | | | | | |

| | |

Ratios to average net assets** | | | | | | | | |

| | |

Expenses, before waiver | | | 2.96% | | | | 3.54% | |

| | |

Expenses, after waiver | | | 2.38% | | | | 2.49% | |

| | |

Net investment income, before waiver | | | 4.29% | | | | 4.65% | |

| | |

Net investment income, after waiver | | | 4.86% | | | | 5.70% | |

| | |