The sale or availability for sale of substantial amounts of ADSs could adversely affect their market price.

Sales of substantial amounts of ADSs in the public market, or the perception that these sales could occur, could adversely affect the market price of ADSs in the U.S. or U.K. and could impair our ability to raise capital through equity offerings in the future. As of March 31, 2024, we had 102,587,260 ordinary shares issued and outstanding, comprising (i) 85,262,412 Class A ordinary shares (excluding (i) 708,828 Class A ordinary shares issued to our depositary bank for bulk issuance of ADSs reserved for future issuances upon the exercise or vesting of awards granted under our share incentive plans, and (ii) 3,023,138 Class A Ordinary Shares as treasury stock), and (ii) 17,324,848 Class B ordinary shares. Among these shares, 59,779,446 Class A ordinary shares are in the form ADSs (including the 3,023,138 Class A Ordinary Shares treated as treasury stock), which are freely transferable without restriction or additional registration under Securities Act. The remaining outstanding ordinary shares may also be sold in public market, subject to volume and other restrictions as applicable under Rules 144 and 701 under the Securities Act and the applicable lock-up agreements, if any. To the extent shares are released before the expiration of the applicable lock-up period and sold into the market, the market price of the ADSs in the U.S. or U.K. could decline.

If a large number of our ordinary shares or securities convertible into our ordinary shares are sold in the public market after they become eligible for sale, the sales could adversely affect the trading price of the ADSs in the U.S. or U.K. and impede our ability to raise future capital. In addition, any ordinary shares that we issue under our share incentive plan or pursuant to any award agreements would dilute the percentage ownership held by ADS holders.

Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of the ADSs for return on your investment.

We currently intend to retain most, if not all, of our available funds and any future earnings to fund the development and growth of our business. As a result, we do not expect to pay any cash dividends in the foreseeable future. Therefore, you should not rely on an investment in the ADSs as a source for any future dividend income.

Our board of directors has complete discretion as to whether to distribute dividends, subject to our memorandum and articles of association and certain requirements of Cayman Islands law. Even if our board of directors decides to declare and pay dividends, the timing, amount and form of future dividends, if any, will depend on, among other things, our future results of operations and cash flow, our capital requirements and surplus, the amount of distributions, if any, received by us from our subsidiary, our financial condition, contractual restrictions and other factors deemed relevant by our board of directors. Accordingly, the return on your investment in the ADSs will likely depend entirely upon any future price appreciation of the ADSs. You may not realize a return on your investment in our ADSs and you may even lose your entire investment in the ADSs.

Our directors, officers and principal shareholders have substantial influence over our company and their interests may not be aligned with the interests of our other shareholders.

As of March 31, 2024, our directors and officers collectively own an aggregate of 61.6% of the total voting power of our outstanding ordinary shares. As a result, they have substantial influence over our business, including significant corporate actions such as change of directors, mergers, change of control transactions and other significant corporate actions.

Our directors, offices, and principal shareholders may take actions that are not in the best interest of us or our other shareholders. The concentration of ownership may discourage, delay or prevent a change in control of our company, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and may reduce the price of the ADSs in the U.S. or U.K. These actions may be taken even if they are opposed by shareholders, including ADS holders. In addition, the significant concentration of share ownership may adversely affect the trading price of the ADSs in the U.S. or U.K. due to investors’ perception that conflicts of interest may exist or arise.

We believe we were a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for our prior taxable year and there is significant risk that we will be a PFIC for our current taxable year and in future taxable years, which could result in significant adverse U.S. federal income tax consequences to U.S. Holders of ADSs or Class A ordinary shares.

A non-U.S. corporation will be a passive foreign investment company, or PFIC, for any taxable year if either (i) at least 75% of its gross income for such year consists of certain types of “passive” income; or (ii) at least 50% of the value of its assets (generally based on a quarterly average) during such year is attributable to assets that produce passive income or are held for the production of passive income.

Based on our financial statements, the manner in which we conduct our business, the trading price of our Class A ordinary shares and ADSs, the value and nature of our assets, and the sources and nature of our income we believe we were a PFIC for our prior taxable year. Additionally, there is a significant risk that we will be a PFIC for our current taxable year and in future taxable years. The determination of whether we are a PFIC must be made annually based on the facts and circumstances at that time.

46

”, “BURNING ROCK DX”, “

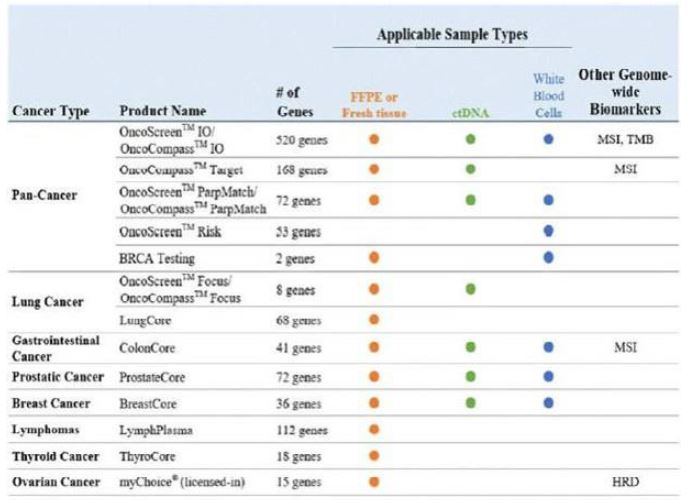

”, “BURNING ROCK DX”, “  ” and product and service names, and 37 trademark applications pending in China. We had registered 20 trademarks, including “BURNING ROCK DX”, “ONCOSCREEN” , “CanCatch” , “OverC” AND “ONCOCOMPASS” in European Union, the U.K, United States, Japan. and Australia, and twelve trademark applications pending in the US, Canada, Japan,and Brazil. We also own four registered domain names, including our official website.

” and product and service names, and 37 trademark applications pending in China. We had registered 20 trademarks, including “BURNING ROCK DX”, “ONCOSCREEN” , “CanCatch” , “OverC” AND “ONCOCOMPASS” in European Union, the U.K, United States, Japan. and Australia, and twelve trademark applications pending in the US, Canada, Japan,and Brazil. We also own four registered domain names, including our official website.