UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23494

| T. Rowe Price Exchange-Traded Funds, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2022

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1.

ANNUAL REPORT

May 31, 2022

| | T. ROWE PRICE |

| TBUX | Ultra Short-Term Bond ETF |

| | For more insights from T. Rowe Price investment professionals, go to troweprice.com. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

HIGHLIGHTS

| ■ | The fund underperformed its benchmark and its Lipper peer group average from its inception through May 31, 2022. |

| ■ | A rise in front-end interest rates was detrimental to performance, as the fund invests primarily in bonds with prices that are sensitive to shorter-maturity Treasury yields. |

| ■ | Credit risk exposure has been managed toward the low end since the fund’s inception, reflecting credit spreads that did not appropriately compensate for fundamental and market risks. |

| ■ | The economic recovery in the wake of the pandemic-induced drawdown has become more tenuous with inflation impacting earnings growth while central banks globally began shifting to a more hawkish sentiment. |

Sign up for e-delivery of your statements, confirmations, and prospectuses or shareholder reports.

If you invest directly with T. Rowe Price, go to troweprice.com/paperless.

If you invest through an investment advisor, a bank, or a brokerage firm, please contact that organization and ask if it can provide electronic documentation.

It’s fast—receive your statements and

confirmations faster than U.S. mail.

It’s convenient—access your important account documents whenever you need them.

It’s secure—we protect your online accounts using “True Identity” to confirm new accounts and make verification faster and more secure.

It can save you money—where applicable,

T. Rowe Price passes on the cost savings to

fund holders.*

Log in to your account at troweprice.com for more information.

*Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Market Commentary

Dear Shareholders

Global stock markets produced mostly negative returns during your fund’s fiscal year, the 12-month period ended May 31, 2022, while rising bond yields weighed on returns for fixed income investors. Positive sentiment surrounding the recovering economy and corporate earnings growth in the first half of the period gave way to fears about new coronavirus variants, rising interest rates, soaring inflation, and geopolitical turmoil in the second half.

Nearly all major global and regional equity benchmarks receded during the period. Value shares outperformed growth stocks as equity investors turned risk averse and rising rates put downward pressure on growth stock valuations. Sector performance diverged widely, with communication services and consumer discretionary companies suffering amid the value rotation. Meanwhile, energy stocks registered exceptional returns as oil prices jumped in response to Russia’s invasion of Ukraine and the ensuing commodity supply crunch.

Financial markets entered the period on an upbeat note as an improving labor market and renewed stimulus efforts were reflected in higher consumer spending. A robust increase in corporate earnings growth also drove markets for much of 2021. However, earnings tailwinds showed signs of fading heading into 2022, as certain high-profile companies issued weaker-than-expected earnings reports or financial projections.

In November 2021, the emergence of the omicron variant of the coronavirus prompted worries about the economic outlook and the potential that a resurgence in cases could lead to further supply chain disruptions. While omicron variant trends and restrictions eased in most regions early in 2022, China continued to pursue a “zero COVID” policy, resulting in large-scale lockdowns and industrial production disruptions.

In February 2022, markets were caught further by surprise when Russia launched a large-scale military offensive into Ukraine. The strong sanctions on Russia that followed raised concerns about supply chains already stressed by the coronavirus. In March, the White House announced that the U.S. was cutting off all oil imports from Russia. As a result, oil prices surged to their highest level in over a decade.

Concerns about inflation intensified over much of the period, driven in part by events in Ukraine and China. Along with supply chain problems, the impact of the fiscal and monetary stimulus enacted during the pandemic and the release of pent-up demand for travel, recreation, and other services also pushed prices higher. In the U.S., consumer prices rose 8.2% in April versus the year before,

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

near multi-decade highs, driven by accelerating energy and food prices. In March, the U.S. Federal Reserve approved its first interest rate hike in more than three years and signaled an accelerating pace of rate increases ahead to combat inflation. In addition, the Fed ended its purchases of Treasuries and agency mortgage-backed securities during the period and announced plans to begin reducing its balance sheet.

Bond indexes were broadly negative as yields rose across the U.S. Treasury yield curve amid surging inflation and expectations of aggressive monetary tightening. (Bond yields and prices move in opposite directions.) Investment-grade corporate bonds fared particularly poorly, experiencing significant losses as concerns over a potential slowdown in economic growth took hold.

The challenges global markets face are complex and could drive market volatility as we enter the second half of the year. Our investment teams will be closely monitoring the Fed’s actions as the central bank attempts to use interest rate hikes to tame inflation without stifling economic growth. Meanwhile, we remain focused on the ongoing geopolitical and humanitarian crisis in Ukraine, which continues to disrupt supply chains, increase inflationary pressures, and dampen consumer confidence.

During challenging times like these, I am heartened by our firm’s long-term focus and time-tested investment approach. I also recognize that market volatility and sector rotation historically have presented attractive opportunities for active investors. I remain confident in the ability of our global research organization to uncover compelling investment ideas that can help deliver strong long-term risk-adjusted performance as market conditions normalize.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

CEO and President

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Management’s Discussion of Fund Performance

INVESTMENT OBJECTIVE

The fund seeks a high level of income consistent with low volatility of principal value.

FUND COMMENTARY

How did the fund perform since inception?

The fund returned -1.31% from its inception on September 28, 2021, through May 31, 2022, underperforming its benchmark, the Bloomberg Short-Term Government/Corporate Index, as well as its Lipper peer group average. (Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

After a period of stability and low rates, shorter-maturity bond markets saw the

PERFORMANCE COMPARISON

| | Total Return |

| Periods Ended 5/31/22 | Six Months | Since

Inception

9/28/21 |

| | | |

| Ultra Short-Term Bond ETF (Based on Net Asset Value) | -1.01% | -1.31% |

| Ultra Short-Term Bond ETF (At Market Price)* | -1.07 | -1.27 |

| Bloomberg Short-Term Government/Corporate Index | -0.16 | -0.18 |

| Lipper Ultra-Short Obligations Funds Average | -0.85 | -1.01 |

*Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would have received if shares were traded at other times.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

return of volatility, which ramped up in the fourth quarter of 2021 and continued through the end of the reporting period. Treasury yields rose and corporate credit spreads widened as the market assessed an increasingly hawkish Fed that found itself chasing stubbornly high inflation. The positive correlation between rates and credit spreads created an especially challenging environment for fixed income portfolios, with the trailing 12-month total return on one- to three-year corporate bonds falling to levels not seen since the global financial crisis. (Credit spreads are a measure of the additional yield offered by bonds that have credit risk compared with Treasuries.)

While U.S. economic fundamentals have remained reasonably healthy in the aggregate, inflation has become a more persistent challenge for growth. These elevated price pressures, combined with global central banks reversing supportive policies adopted after the pandemic-induced downturn, created a difficult environment for risk assets and placed pressure on credit spreads.

Yield curve positioning detracted from the fund’s performance. A rise in front-end interest rates was detrimental to performance, as the fund invests primarily in bonds with prices that are sensitive to shorter-maturity Treasury yields. An overweight within the front end of the curve also hindered relative performance as yield increases were most pronounced on shorter-maturity Treasury notes.

Security selection within corporate bonds was a modest drag on performance. Bonds issued by global banks underperformed amid concerns that slowing global growth and higher inflation may reduce lending margins.

Sector allocation detracted from the fund’s relative performance in aggregate. Out-of-benchmark allocations to securitized sectors, including residential mortgage-backed securities (RMBS), asset-backed securities (ABS), and commercial mortgage-backed securities, hindered relative results amid interest rate volatility and heavy new issuance. Our allocation to RMBS was a prominent detractor, as the interest rate-sensitive sector was dragged lower by concerns about the ramifications of tighter Fed policy, rising rates, and declining housing affordability.

In addition, while we are primarily a cash bond manager, we occasionally employ the limited use of derivatives in our strategy for hedging purposes. Derivatives may include futures and options, as well as credit default and interest rate swaps. During the reporting period, our use of derivatives, particularly currency forwards and Treasury futures, contributed to absolute performance.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

How is the fund positioned?

The fund remained defensively positioned in a rising yield environment with more bonds maturing in less than a year than we would have in a more stable rate environment. Duration declined to below the low end of the fund’s half- to one-year target range before rising modestly given our view that the range of outcomes for rates has increased moving forward after rates and spreads rose to current levels. We have also managed credit risk exposure toward the low end since the fund’s inception, reflecting credit spreads that did not appropriately compensate for fundamental and market risks. (Duration measures a bond’s or a bond fund’s sensitivity to changes in interest rates.)

The portfolio has maintained exposure to a variety of fixed income credit sectors but has gradually shifted away from securitized sectors such as RMBS and ABS in favor of investment-grade corporate bonds. While economic growth is

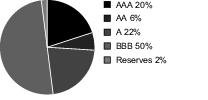

CREDIT QUALITY DIVERSIFICATION

Based on net assets as of 5/31/22.

Sources: Credit ratings for the securities held in the fund are provided by Moody’s, Standard & Poor’s and Fitch and are converted to the Standard & Poor’s nomenclature. If the rating agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated (NR). T. Rowe Price uses the rating of the underlying investment vehicle to determine the creditworthiness of credit default swaps. The fund is not rated by any agency. Securities that have not been rated by any rating agency totaled 0.12% of the portfolio at the end of the reporting period.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

trending lower, many corporations retain the healthy balance sheets that were built following the economic downturn of 2020, which makes the corporate bond sector relatively attractive.

Corporate debt represented just over 65% of the fund’s holdings as of May 31, 2022. Global banking continues to be our largest sector allocation within investment-grade corporates. While market stresses have increased, our research team remains confident in the increased resilience of balance sheets and responsible capital allocation decisions from management teams. The energy sector also continues to be an overweight exposure with the majority of the fund’s allocation coming from midstream companies. These companies benefit from contracted cash flows that reduce commodity price risk relative to their peers in other parts of the energy sector.

After rising initially amid tight spreads and valuations across the investment-grade fixed income market, our allocations to securitized sectors moved lower over the period. That said, securitized sectors still represent an important part of the fund’s positioning and continue to provide steady income and diversification benefits. Within these sectors, our analyst team continues to identify opportunities in short-maturity ABS that retain credit ratings of AA or higher and trade below par.

What is portfolio management’s outlook?

The economic recovery in the wake of the pandemic-induced drawdown has become more tenuous with inflation impacting corporate and consumer earnings growth while central banks globally began shifting to a more hawkish sentiment. The tighter financial conditions introduced in the first quarter of 2022 will continue to be a headwind for economic growth at the same time the Fed begins to reduce the size of its balance sheet. This tightening of financial conditions by central banks, coupled with slowing economic growth, creates a challenging environment for credit spreads.

The outlook for interest rates has grown more complex. Typically, the Fed would take a cautious approach in the face of declining growth rates. However, the Fed’s path has become less clear with inflation so far above its stated target. In our view, the range of outcomes for interest rates has increased since the beginning of the year.

In the current environment of heightened volatility, active management can play an even more instrumental part in achieving investor objectives. Credit spreads are more attractive than earlier in the year but still not much wider than long-term averages. Against this backdrop, the fund continues to be selective in

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

adding credit risk and maintains an elevated liquidity position. Using the breadth and depth of our global research platform, we will aim to selectively add to high-conviction positions as volatility creates attractive entry points.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

RISK OF BOND INVESTING

The value of the fund’s investments may decrease, sometimes rapidly or unexpectedly, due to factors affecting an issuer held by the fund, particular industries, or the overall securities markets. The prices of, and the income generated by, debt instruments held by the fund may be affected by changes in interest rates. The fund is subject to prepayment risks because the principal on mortgage-backed securities, other asset-backed securities, or any debt instrument with an embedded call option may be prepaid at any time, which could reduce the security’s yield and market value. An issuer of a debt instrument could suffer an adverse change in financial condition that results in a payment default (failure to make scheduled interest or principal payments), rating downgrade, or inability to meet a financial obligation.

BENCHMARK INFORMATION

Note: Bloomberg® and Bloomberg Short-Term Government/Corporate Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

Note: Portions of the mutual fund information contained in this report were supplied by Lipper, a Refinitiv Company, subject to the following: Copyright 2022 © Refinitiv. All rights reserved. Any copying, republication, or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

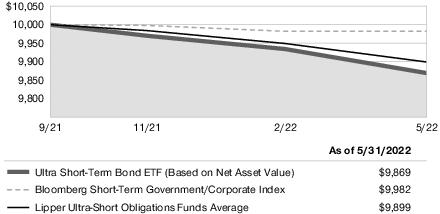

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

Ultra Short-Term Bond ETF

Note: See the Average Annual Compound Total Return table.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

AVERAGE ANNUAL COMPOUND TOTAL RETURN

| Period Ended 5/31/22 | Since

Inception

9/28/21 |

| Ultra Short-Term Bond ETF (Based on Net Asset Value) | -1.31%* |

| Ultra Short-Term Bond ETF (At Market Price) | -1.27* |

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. When assessing performance, investors should consider both short- and long-term returns. Past performance cannot guarantee future results. Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would have received if shares were traded at other times.

*Returns for periods of less than one year are not annualized.

PREMIUM/DISCOUNT INFORMATION

The frequency at which the daily market prices were at a discount or premium to the fund’s net asset value is available on the fund’s website (troweprice.com).

EXPENSE RATIO

| Ultra Short-Term Bond ETF | 0.17% |

The expense ratio shown is as of the fund’s most recent prospectus. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, includes acquired fund fees and expenses but does not include fee or expense waivers.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

FUND EXPENSE EXAMPLE

As a shareholder, you may incur two types of costs: (1) transaction costs, such as brokerage commissions on purchases and sales, and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as brokerage commissions paid on purchases and sales of shares. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

FUND EXPENSE EXAMPLE (continued)

T. Rowe Price Ultra Short-Term Bond ETF

| | Beginning

Account Value

12/1/22 | Ending

Account Value

5/31/22 | Expenses Paid

During Period*

12/1/22 to 5/31/22 |

| Actual | $1,000.00 | $989.90 | $0.84 |

| Hypothetical (assumes 5% return before expenses) | 1,000.00 | 1,024.08 | 0.86 |

| * | Expenses are equal to the fund’s annualized expense ratio for the 6-month period (0.17%), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), and divided by the days in the year (365) to reflect the half-year period. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

QUARTER-END RETURNS

| Period Ended 3/31/22 | Since

Inception

9/28/21 |

| Ultra Short-Term Bond ETF (Based on Net Asset Value) | -1.16%* |

| Ultra Short-Term Bond ETF (At Market Price) | -1.08* |

The fund’s performance information represents only past performance and is not necessarily an indication of future results. Current performance may be lower or higher than the performance data cited. Share price, principal value, and return will vary, and you may have a gain or loss when you sell your shares. Market returns are based on the midpoint of the bid/ask spread at market close (typically, 4 p.m. ET) and do not represent returns an investor would receive if shares were traded at other times. For the most recent month-end performance, please visit our website (troweprice.com) or contact a T. Rowe Price representative at 1-800-225-5132.

This table provides returns through the most recent calendar quarter-end rather than through the end of the fund’s fiscal period. It shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. When assessing performance, investors should consider both short- and long-term returns.

*Returns for periods of less than one year are not annualized.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

For a share outstanding throughout the period

| | 9/28/21(1)

Through |

| | 5/31/22 |

| NET ASSET VALUE | |

| Beginning of period | $ 50.00 |

| Investment activities | |

| Net investment income(2) (3) | 0.31 |

| Net realized and unrealized gain/loss | (0.94) |

| Total from investment activities | (0.63) |

| Distributions | |

| Net investment income | (0.27) |

| Net realized gain | (0.03) |

| Total distributions to shareholders | (0.30) |

| NET ASSET VALUE | |

| End of period | $ 49.07 |

| Ratios/Supplemental Data |

| Total return, based on NAV(3) (4) | (1.31)% |

Ratios to average net

assets:(3) | |

Gross expenses before

waivers/payments by

Price Associates | 0.17%(5) |

Net expenses after

waivers/payments by

Price Associates | 0.17%(5) |

| Net investment income | 0.94%(5) |

| Portfolio turnover rate(6) | 12.5% |

Net assets, end of period

(in thousands) | $ 36,801 |

| (1) | Inception date |

| (2) | Per share amounts calculated using average shares outstanding method. |

| (3) | See Note 6 for details to expense-related arrangements with Price Associates. |

| (4) | Total return reflects the rate that an investor would have earned on an investment in the fund during the period, assuming reinvestment of all distributions. Total return is not annualized for periods less than one year. |

| (5) | Annualized |

| (6) | Portfolio turnover excludes securities received or delivered through in-kind share transactions. |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

May 31, 2022

| PORTFOLIO OF INVESTMENTS‡ | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| ASSET-BACKED SECURITIES 12.4% |

| Auto Backed 5.2% | | |

| AmeriCredit Automobile Receivables Trust, Series 2020-3, Class C, 1.06%, 8/18/26 | 100 | 96 |

| Avis Budget Rental Car Funding AESOP, Series 2017-2A, Class D, 4.56%, 3/20/24 (1) | 100 | 100 |

| Avis Budget Rental Car Funding AESOP, Series 2018-1A, Class D, 5.25%, 9/20/24 (1) | 100 | 100 |

| Carvana Auto Receivables Trust, Series 2021-N4, Class B, 1.24%, 9/11/28 | 65 | 64 |

| Carvana Auto Receivables Trust, Series 2022-N1, Class A1, 2.31%, 12/11/28 (1) | 166 | 164 |

| Exeter Automobile Receivables Trust, Series 2021-2A, Class B, 0.57%, 9/15/25 | 200 | 197 |

| Exeter Automobile Receivables Trust, Series 2021-3A, Class B, 0.69%, 1/15/26 | 200 | 196 |

| Exeter Automobile Receivables Trust, Series 2022-2A, Class A3, 2.80%, 11/17/25 | 200 | 199 |

| GMF Floorplan Owner Revolving Trust, Series 2020-1, Class B, 1.03%, 8/15/25 (1) | 100 | 97 |

| Hyundai Auto Lease Securitization Trust, Series 2021-A, Class B, 0.61%, 10/15/25 (1) | 300 | 291 |

| Santander Consumer Auto Receivables Trust, Series 2021-CA, Class B, 1.44%, 4/17/28 (1) | 8 | 8 |

| Santander Consumer Auto Receivables Trust, Series 2021-BA, Class B, 1.45%, 10/16/28 (1) | 16 | 16 |

| Santander Drive Auto Receivables Trust, Series 2020-3, Class C, 1.12%, 1/15/26 | 25 | 25 |

| World Omni Auto Receivables Trust, Series 2021-A, Class B, 0.64%, 12/15/26 | 25 | 23 |

| World Omni Automobile Lease Securitization Trust, Series 2022-A, Class A2, 2.63%, 10/15/24 | 200 | 200 |

| World Omni Select Auto Trust, Series 2019-A, Class A3, 2.00%, 8/15/24 | 24 | 24 |

| World Omni Select Auto Trust, Series 2020-A, Class B, 0.84%, 6/15/26 | 100 | 98 |

| | | 1,898 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Collaterized Debt Obligations 1.3% | | |

| BlueMountain, Series 2015-3A, Class A1R, CLO, FRN, 3M USD LIBOR + 1%, 2.063%, 4/20/31 (1) | 250 | 245 |

| Symphony Static, Series 2021-1A, Class A, CLO, FRN, 3M USD LIBOR + 0.83%, 2.014%, 10/25/29 (1) | 237 | 234 |

| | | 479 |

| Other Asset-Backed Securities 3.3% | | |

| Amur Equipment Finance Receivables, Series 2022-1A, Class A2, 1.64%, 10/20/27 (1) | 200 | 193 |

| Elara HGV Timeshare Issuer, Series 2017-A, Class A, 2.69%, 3/25/30 (1) | 22 | 21 |

| Hilton Grand Vacations Trust, Series 2017-AA, Class A, 2.66%, 12/26/28 (1) | 147 | 145 |

| MVW, Series 2021-1WA, Class A, 1.14%, 1/22/41 (1) | 80 | 74 |

| MVW, Series 2020-1A, Class A, 1.74%, 10/20/37 (1) | 142 | 135 |

| Navient Private Education Refi Loan Trust, Series 2021-CA, Class A, 1.06%, 10/15/69 (1) | 79 | 74 |

| Nelnet Student Loan Trust, Series 2021-DA, Class AFL, FRN, 1M USD LIBOR + 0.69%, 1.617%, 4/20/62 (1) | 85 | 84 |

| Octane Receivables Trust, Series 2021-1A, Class A, 0.93%, 3/22/27 (1) | 71 | 69 |

| Octane Receivables Trust, Series 2021-2A, Class A, 1.21%, 9/20/28 (1) | 76 | 74 |

| Octane Receivables Trust, Series 2022-1A, Class A2, 4.18%, 3/20/28 (1) | 100 | 100 |

| Santander Bank NA, Series 2021-1A, Class B, 1.833%, 12/15/31 (1) | 193 | 188 |

| Sierra Timeshare Receivables Funding, Series 2020-2A, Class A, 1.33%, 7/20/37 (1) | 72 | 69 |

| | | 1,226 |

| Student Loan 2.6% | | |

| Navient Private Education Refi Loan Trust, Series 2020-HA, Class A, 1.31%, 1/15/69 (1) | 143 | 138 |

| Navient Private Education Refi Loan Trust, Series 2020-IA, Class A1A, 1.33%, 4/15/69 (1) | 134 | 123 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Navient Private Education Refi Loan Trust, Series 2020-GA, Class A, 1.17%, 9/16/69 (1) | 101 | 96 |

| Navient Private Education Refi Loan Trust, Series 2020-FA, Class A, 1.22%, 7/15/69 (1) | 86 | 83 |

| Navient Private Education Refi Loan Trust, Series 2021-A, Class A, 0.84%, 5/15/69 (1) | 74 | 68 |

| Navient Private Education Refi Loan Trust, Series 2021-EA, Class A, 0.97%, 12/16/69 (1) | 82 | 74 |

| Navient Private Education Refi Loan Trust, Series 2021-BA, Class A, 0.94%, 7/15/69 (1) | 79 | 74 |

| Navient Private Education Refi Loan Trust, Series 2021-GA, Class A, 1.58%, 4/15/70 (1) | 93 | 87 |

| Navient Private Education Refi Loan Trust, Series 2022-A, Class A, 2.23%, 7/15/70 (1) | 145 | 138 |

| SMB Private Education Loan Trust, Series 2016-B, Class A2B, FRN, 1M USD LIBOR + 1.45%, 2.325%, 2/17/32 (1) | 88 | 88 |

| | | 969 |

Total Asset-Backed Securities

(Cost $4,698) | | 4,572 |

| CORPORATE BONDS 60.8% |

| Airlines 1.2% | | |

| SMBC Aviation Capital Finance, 4.125%, 7/15/23 (1) | 200 | 200 |

| Southwest Airlines, 4.75%, 5/4/23 | 220 | 223 |

| | | 423 |

| Automotive 3.5% | | |

| Daimler Trucks Finance North America, FRN, SOFR + 0.75%, 1.242%, 12/13/24 (1) | 300 | 298 |

| General Motors, 4.875%, 10/2/23 | 130 | 133 |

| Hyundai Capital America, 2.375%, 2/10/23 (1) | 165 | 164 |

| Hyundai Capital America, 1.00%, 9/17/24 (1) | 60 | 56 |

| LeasePlan, 2.875%, 10/24/24 (1) | 200 | 194 |

| Nissan Motor Acceptance, 3.875%, 9/21/23 (1) | 100 | 100 |

| Nissan Motor Acceptance, 3.45%, 3/15/23 (1) | 155 | 156 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Stellantis NV, 5.25%, 4/15/23 | 200 | 203 |

| | | 1,304 |

| Banking 15.2% | | |

| AIB Group, 4.75%, 10/12/23 (1) | 200 | 202 |

| Bank of America, VR, 0.523%, 6/14/24 (2) | 150 | 146 |

| Bank of America, FRN, SOFR + 0.66%, 1.437%, 2/4/25 | 100 | 99 |

| Bank of Nova Scotia, FRN, SOFR + 0.38%, 1.119%, 7/31/24 | 125 | 124 |

| Barclays, 4.375%, 9/11/24 | 200 | 202 |

| BPCE SA, 5.70%, 10/22/23 (1) | 250 | 256 |

| Candian Imperial Bank of Commerce, FRN, SOFR + 0.40%, 0.863%, 12/14/23 | 150 | 149 |

| Capital One Financial, 2.132%, 5/9/25 | 100 | 100 |

| Citigroup, VR, SOFR + 0.669%, 1.435%, 5/1/25 | 150 | 148 |

| Credit Suisse Group, VR, 4.207%, 6/12/24 (1)(2) | 250 | 250 |

| Danske Bank , 3.875%, 9/12/23 (1) | 200 | 201 |

| Deutsche Bank, 3.95%, 2/27/23 | 100 | 100 |

| Goldman Sachs Group, VR, 0.627%, 11/17/23 (2) | 150 | 148 |

| Goldman Sachs Group, FRN, SOFR + 0.58%, 1.003%, 3/8/24 | 65 | 65 |

| Goldman Sachs Group, FRN, SOFR + 0.7%, 1.405%, 1/24/25 | 50 | 49 |

| Goldman Sachs Group, FRN, SOFR + 1.39%, 1.868%, 3/15/24 | 50 | 50 |

| Hana Bank, 4.625%, 10/24/23 | 250 | 254 |

| HSBC Holdings, 4.25%, 3/14/24 | 200 | 202 |

| ING Bank NV, 5.80%, 9/25/23 (1) | 200 | 206 |

| Intesa Sanpaolo SpA, 3.375%, 1/12/23 (1) | 200 | 200 |

| JPMorgan Chase, FRN, SOFR + 0.54%, 1.316%, 6/1/25 | 150 | 148 |

| JPMorgan Chase, 2.03%, 4/26/26 | 150 | 150 |

| Mizuho Financial Group Cayman, 4.20%, 7/18/22 | 200 | 200 |

| Morgan Stanley, 4.10%, 5/22/23 | 190 | 192 |

| Morgan Stanley, FRN, SOFR + 0.95%, 1.731%, 2/18/26 | 75 | 74 |

| Nationwide Building Society, VR, 3.766%, 3/8/24 (1)(2) | 250 | 250 |

| Natwest Group, 6.125%, 12/15/22 | 200 | 203 |

| NatWest Group, 6.10%, 6/10/23 | 100 | 102 |

| Santander U.K. Group Holdings, VR, 1.089%, 3/15/25 (2) | 200 | 189 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Societe Generale, 5.00%, 1/17/24 (1) | 200 | 203 |

| Standard Chartered, 3.95%, 1/11/23 (1) | 200 | 201 |

| Truist Financial, FRN, SOFR + 0.40%, 0.839%, 6/9/25 | 245 | 241 |

| UBS, FRN, SOFR + 0.36%, 1.142%, 2/9/24 (1) | 200 | 199 |

| Wells Fargo, 2.025%, 4/25/26 | 100 | 100 |

| | | 5,603 |

| Building & Real Estate 0.5% | | |

| Longfor Group Holdings, 3.875%, 7/13/22 | 200 | 200 |

| | | 200 |

| Cable Operators 0.6% | | |

| Charter Communications Operating, 4.908%, 7/23/25 | 100 | 102 |

| Cox Communications, 3.15%, 8/15/24 (1) | 100 | 99 |

| | | 201 |

| Chemicals 1.8% | | |

| Celanese US Holdings, 4.625%, 11/15/22 | 200 | 202 |

| Cytec Industries, 3.50%, 4/1/23 | 200 | 200 |

| International Flavors & Fragrances, 3.20%, 5/1/23 | 250 | 250 |

| | | 652 |

| Consumer Products 0.3% | | |

| Ralph Lauren, 1.70%, 6/15/22 | 125 | 125 |

| | | 125 |

| Drugs 0.4% | | |

| AbbVie, 2.80%, 3/15/23 | 145 | 145 |

| | | 145 |

| Energy 7.9% | | |

| Boardwalk Pipelines, 3.375%, 2/1/23 | 225 | 228 |

| Cheniere Corpus Christi Holdings, 5.875%, 3/31/25 | 100 | 104 |

| Continental Resources, 4.50%, 4/15/23 | 300 | 303 |

| Devon Energy, 8.25%, 8/1/23 | 250 | 263 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Gray Oak Pipeline, 2.00%, 9/15/23 (1) | 325 | 319 |

| Kinder Morgan, 5.625%, 11/15/23 (1) | 250 | 256 |

| MPLX, 4.50%, 7/15/23 | 100 | 101 |

| MPLX, 4.875%, 6/1/25 | 100 | 102 |

| MPLX, 3.50%, 12/1/22 | 115 | 115 |

| Plains All American Pipeline, 2.85%, 1/31/23 | 275 | 275 |

| Reliance Industries, 4.125%, 1/28/25 | 250 | 252 |

| Sabine Pass Liquefaction, 5.625%, 4/15/23 | 150 | 152 |

| Thaioil Treasury Center, 3.625%, 1/23/23 | 200 | 200 |

| Williams, 3.70%, 1/15/23 | 100 | 101 |

| Williams, 4.50%, 11/15/23 | 150 | 152 |

| | | 2,923 |

| Exploration & Production 0.7% | | |

| Eni, 4.00%, 9/12/23 (1) | 250 | 252 |

| | | 252 |

| Financial 5.8% | | |

| AerCap Ireland Capital, 3.15%, 2/15/24 | 150 | 146 |

| Air Lease, 4.25%, 2/1/24 | 100 | 100 |

| Air Lease, 2.25%, 1/15/23 | 100 | 99 |

| Ally Financial, 5.125%, 9/30/24 | 100 | 103 |

| Ally Financial, 4.625%, 3/30/25 | 100 | 102 |

| Avolon Holdings Funding, 5.50%, 1/15/23 (1) | 100 | 101 |

| Equitable Holdings, 3.90%, 4/20/23 | 315 | 317 |

| General Motors Financial, 4.15%, 6/19/23 | 50 | 50 |

| General Motors Financial, FRN, SOFR + 0.76%, 1.183%, 3/8/24 | 90 | 89 |

| Global Payments, 3.75%, 6/1/23 | 200 | 201 |

| Jackson Financial, 1.125%, 11/22/23 (1) | 250 | 242 |

| Nasdaq, 0.445%, 12/21/22 | 150 | 149 |

| QNB Finance, 3.50%, 3/28/24 | 200 | 200 |

| Synchrony Financial, 2.85%, 7/25/22 | 145 | 145 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Western Union, 4.25%, 6/9/23 | 100 | 101 |

| | | 2,145 |

| Food/Tobacco 0.5% | | |

| Imperial Brands Finance, 3.50%, 2/11/23 (1) | 200 | 200 |

| | | 200 |

| Health Care 2.0% | | |

| Baxter International, FRN, SOFR + 0.44%, 1.221%, 11/29/24 (1) | 250 | 246 |

| Mylan, 4.20%, 11/29/23 | 200 | 202 |

| Mylan, 3.125%, 1/15/23 (1) | 100 | 100 |

| PerkinElmer, 0.85%, 9/15/24 | 90 | 85 |

| Thermo Fisher Scientific, FRN, SOFR + 0.53%, 1.192%, 10/18/24 | 85 | 85 |

| | | 718 |

| Industrial - Other 0.5% | | |

| GC Treasury Center, 4.25%, 9/19/22 | 200 | 201 |

| | | 201 |

| Information Technology 2.5% | | |

| Baidu, 3.875%, 9/29/23 | 200 | 202 |

| Equifax, 3.95%, 6/15/23 | 200 | 202 |

| Marvell Technology, 4.20%, 6/22/23 | 265 | 267 |

| Microchip Technology, 4.333%, 6/1/23 | 100 | 101 |

| Microchip Technology, 0.972%, 2/15/24 | 150 | 144 |

| | | 916 |

| Insurance 3.4% | | |

| Aon Global, 4.00%, 11/27/23 | 50 | 51 |

| Athene Global Funding, FRN, SOFR + 0.72%, 1.334%, 1/7/25 (1) | 200 | 195 |

| Athene Global Funding, 1.20%, 10/13/23 (1) | 60 | 58 |

| Brighthouse Financial Global Funding, FRN, SOFR + 0.76%, 1.395%, 4/12/24 (1) | 245 | 245 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Cigna, FRN, 3M USD LIBOR + 0.89%, 1.934%, 7/15/23 | 250 | 251 |

| CNO Global Funding, 1.65%, 1/6/25 (1) | 150 | 142 |

| First American Financial, 4.30%, 2/1/23 | 100 | 100 |

| Liberty Mutual Group, 4.25%, 6/15/23 (1) | 200 | 202 |

| | | 1,244 |

| Lodging 0.3% | | |

| Hyatt Hotels, FRN, SOFR + 1.05%, 1.637%, 10/1/23 | 100 | 100 |

| | | 100 |

| Media & Communications 1.4% | | |

| Magallanes, 3.428%, 3/15/24 (1) | 35 | 35 |

| Magallanes, 3.638%, 3/15/25 (1) | 145 | 143 |

| Magallanes, FRN, SOFR + 1.78%, 2.258%, 3/15/24 (1) | 75 | 75 |

| SES, 3.60%, 4/4/23 (1) | 247 | 247 |

| | | 500 |

| Oil Field Services 0.4% | | |

| Energy Transfer, 4.20%, 9/15/23 | 50 | 51 |

| Energy Transfer, 5.875%, 1/15/24 | 50 | 51 |

| Energy Transfer, 4.25%, 3/15/23 | 55 | 55 |

| | | 157 |

| Other Telecommunications 0.6% | | |

| British Telecommunications, 4.50%, 12/4/23 | 200 | 204 |

| | | 204 |

| Petroleum 1.1% | | |

| Enbridge, FRN, SOFR + 0.40%, 1.182%, 2/17/23 | 55 | 55 |

| Enbridge, FRN, SOFR +0.63%, 1.412%, 2/16/24 | 100 | 99 |

| Energy Transfer, 3.45%, 1/15/23 | 100 | 100 |

| Suncor Energy, 2.80%, 5/15/23 | 145 | 145 |

| | | 399 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Railroads 0.3% | | |

| Kansas City Southern, 3.00%, 5/15/23 | 100 | 100 |

| | | 100 |

| Real Estate Investment Trust Securities 2.2% | | |

| Essex Portfolio, 3.25%, 5/1/23 | 300 | 301 |

| Highwoods Realty, 3.625%, 1/15/23 | 175 | 175 |

| Kimco Realty, 3.125%, 6/1/23 | 150 | 150 |

| Public Storage, FRN, SOFR + 0.47%, 1.175%, 4/23/24 | 65 | 65 |

| Weingarten Realty Investors, 3.50%, 4/15/23 | 100 | 100 |

| | | 791 |

| Retail 1.1% | | |

| 7-Eleven, 0.80%, 2/10/24 (1) | 95 | 91 |

| Nordstrom, 2.30%, 4/8/24 | 85 | 82 |

| QVC, 4.375%, 3/15/23 | 150 | 149 |

| QVC, 4.85%, 4/1/24 | 100 | 99 |

| | | 421 |

| Telephones 0.5% | | |

| Ooredoo International Finance, 3.25%, 2/21/23 | 200 | 201 |

| | | 201 |

| Transportation 0.8% | | |

| Penske Truck Leasing, 4.125%, 8/1/23 (1) | 200 | 202 |

| Triton Container International, 0.80%, 8/1/23 (1) | 100 | 96 |

| | | 298 |

| Transportation (Excluding Railroads) 1.2% | | |

| HPHT Finance, 2.75%, 9/11/22 | 200 | 200 |

| Sydney Airport Finance, 3.90%, 3/22/23 (1) | 245 | 246 |

| | | 446 |

| Utilities 3.6% | | |

| Edison International, 2.40%, 9/15/22 | 100 | 100 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Edison International, 3.125%, 11/15/22 | 60 | 60 |

| NextEra Energy Capital Holdings, FRN, SOFR + 0.40%, 1.15%, 11/3/23 | 200 | 198 |

| NRG Energy, 3.75%, 6/15/24 (1) | 200 | 198 |

| Pacific Gas and Electric, 4.25%, 8/1/23 | 110 | 111 |

| Saudi Electricity Global Sukuk, 3.473%, 4/8/23 | 200 | 201 |

| Southern, 4.475%, 8/1/24 | 145 | 148 |

| Southern California Edison, FRN, SOFR + 0.83%, 1.417%, 4/1/24 | 25 | 25 |

| Vistra Operations, 3.55%, 7/15/24 (1) | 245 | 240 |

| Vistra Operations, 5.125%, 5/13/25 (1) | 35 | 35 |

| | | 1,316 |

| Wireless Communications 0.5% | | |

| Rogers Communications Inc, 3.00%, 3/15/23 | 200 | 200 |

| | | 200 |

Total Corporate Bonds

(Cost $22,721) | | 22,385 |

| FOREIGN GOVERNMENT OBLIGATIONS & MUNICIPALITIES 2.3% |

| Foreign Government Obligations & Municipalities 2.3% | | |

| Japan Treasury Discount Bill, (0.127)%, 8/10/22 (JPY) | 17,850 | 139 |

| Japan Treasury Discount Bill, (0.10)%, 7/4/22 (JPY) | 44,650 | 347 |

| Japan Treasury Discount Bill, (0.114)%, 7/11/22 (JPY) | 44,400 | 345 |

| | | 831 |

Total Foreign Government Obligations & Municipalities

(Cost $858) | | 831 |

| MUNICIPAL SECURITIES 0.8% |

| California 0.8% | | |

| California Municipal Fin. Auth., National Univ., Series B, 3.323%, 4/1/23 | 100 | 101 |

| Golden St Tobacco Securitization, Series B, 0.502%, 6/1/22 | 100 | 100 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Golden St Tobacco Securitization, Series B, 0.672%, 6/1/23 | 100 | 98 |

| | | 299 |

Total Municipal Securities

(Cost $302) | | 299 |

| NON-U.S. GOVERNMENT MORTGAGE-BACKED SECURITIES 12.8% |

| Commercial Mortgage-Backed Securities 1.4% | | |

| BX Trust, Series 2021-ARIA, Class A, ARM, 1M USD LIBOR + 0.90%, 1.774%, 10/15/36 (1) | 65 | 62 |

| Great Wolf Trust, Series 2019-WOLF, Class A, ARM, 1M USD LIBOR + 1.034%, 1.909%, 12/15/36 (1) | 225 | 220 |

| ONE Mortgage Trust, Series 2021-PARK, Class A, ARM, 1M USD LIBOR + 0.70%, 1.575%, 3/15/36 (1) | 115 | 111 |

| SLIDE, Series 2018-FUN, Class A, ARM, 1M USD LIBOR + 1.15%, 2.025%, 6/15/31 (1) | 147 | 145 |

| | | 538 |

| Whole Loans Backed 11.4% | | |

| Angel Oak Mortgage Trust, Series 2019-5, Class A1, CMO, ARM, 2.593%, 10/25/49 (1) | 105 | 103 |

| Angel Oak Mortgage Trust, Series 2018-3, Class A1, CMO, ARM, 3.649%, 9/25/48 (1) | 33 | 33 |

| Angel Oak Mortgage Trust, Series 2021-2, Class A1, CMO, ARM, 0.985%, 4/25/66 (1) | 126 | 116 |

| Angel Oak Mortgage Trust, Series 2021-5, Class A1, CMO, ARM, 0.951%, 7/25/66 (1) | 157 | 144 |

| Angel Oak Mortgage Trust, Series 2021-6, Class A1, CMO, ARM, 1.458%, 9/25/66 (1) | 81 | 74 |

| Angel Oak Mortgage Trust, Series 2022-1, Class A1, CMO, ARM, 2.881%, 12/25/66 (1) | 111 | 106 |

| Barclays Mortgage Loan Trust, Series 2021-NQM1, Class A1, CMO, ARM, 1.747%, 9/25/51 (1) | 133 | 124 |

| Bellemeade Re, Series 2022-1, Class M1A, CMO, ARM, SOFR30A + 1.75%, 2.335%, 1/26/32 (1) | 150 | 149 |

| BINOM Securitization Trust, Series 2021-INV1, Class A1, CMO, ARM, 2.034%, 6/25/56 (1) | 84 | 78 |

| BRAVO Residential Funding Trust, Series 2021-NQM3, Class A1, CMO, ARM, 1.699%, 4/25/60 (1) | 139 | 135 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| COLT Funding, Series 2021-4, Class A1, CMO, ARM, 1.397%, 10/25/66 (1) | 92 | 80 |

| Connecticut Avenue Securities Trust, Series 2021-R01, Class 1M1, CMO, ARM, SOFR30A + 0.75%, 1.334%, 10/25/41 (1) | 8 | 8 |

| Connecticut Avenue Securities Trust, Series 2021-R03, Class 1M1, CMO, ARM, SOFR30A + 0.85%, 1.434%, 12/25/41 (1) | 100 | 98 |

| Connecticut Avenue Securities Trust, Series 2022-R02, Class 2M1, CMO, ARM, SOFR30A + 1.20%, 1.785%, 1/25/42 (1) | 130 | 127 |

| Connecticut Avenue Securities Trust, Series 2022-R01, Class 1M1, CMO, ARM, SOFR30A + 1.00%, 1.585%, 12/25/41 (1) | 78 | 76 |

| Deephaven Residential Mortgage Trust, Series 2021-4, Class A1, CMO, ARM, 1.931%, 11/25/66 (1) | 88 | 82 |

| Eagle RE, Series 2021-2, Class M1A, CMO, ARM, SOFR30A + 1.55%, 2.135%, 4/25/34 (1) | 150 | 149 |

| Ellington Financial Mortgage Trust, Series 2020-2, Class A1, CMO, ARM, 1.178%, 10/25/65 (1) | 65 | 63 |

| Ellington Financial Mortgage Trust, Series 2021-1, Class A1, CMO, ARM, 0.797%, 2/25/66 (1) | 90 | 83 |

| Ellington Financial Mortgage Trust, Series 2021-3, Class A1, CMO, ARM, 1.241%, 9/25/66 (1) | 117 | 104 |

| Fannie Mae Connecticut Avenue Securities, Series 2021-R02, Class 2M1, CMO, ARM, SOFR30A + 0.90%, 1.484%, 11/25/41 (1) | 72 | 71 |

| Freddie Mac STACR REMIC Trust, Series 2021-HQA3, Class M1, CMO, ARM, SOFR30A + 0.85%, 1.434%, 9/25/41 (1) | 200 | 194 |

| Freddie Mac STACR REMIC Trust, Series 2021-DNA6, Class M1, CMO, ARM, SOFR30A + 0.80%, 1.384%, 10/25/41 (1) | 200 | 196 |

| Freddie Mac STACR REMIC Trust, Series 2021-HQA4, Class M1, CMO, ARM, SOFR30A + 0.95%, 1.534%, 12/25/41 (1) | 175 | 170 |

| Freddie Mac STACR REMIC Trust, Series 2022-DNA1, Class M1A, CMO, ARM, SOFR30A + 1.00%, 1.585%, 1/25/42 (1) | 200 | 195 |

| Freddie Mac Structured Agency Credit Risk Debt Notes, Series 2021-DNA7, Class M1, CMO, ARM, SOFR30A + 0.85%, 1.434%, 11/25/41 (1) | 215 | 209 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| GCAT, Series 2021-NQM5, Class A1, CMO, ARM, 1.262%, 7/25/66 (1) | 164 | 146 |

| New Residential Mortgage Loan Trust, Series 2021-NQ1R, Class A1, CMO, ARM, 0.943%, 7/25/55 (1) | 127 | 121 |

| OBX Trust, Series 2022-NQM1, Class A1, CMO, ARM, 2.305%, 11/25/61 (1) | 182 | 172 |

| Verus Securitization Trust, Series 2019-INV3, Class A1, CMO, ARM, 2.692%, 11/25/59 (1) | 187 | 184 |

| Verus Securitization Trust, Series 2021-R3, Class A1, CMO, ARM, 1.02%, 4/25/64 (1) | 108 | 104 |

| Verus Securitization Trust, Series 2021-2, Class A1, CMO, ARM, 1.031%, 2/25/66 (1) | 136 | 127 |

| Verus Securitization Trust, Series 2021-4, Class A1, CMO, ARM, 0.938%, 7/25/66 (1) | 122 | 108 |

| Verus Securitization Trust, Series 2021-5, Class A1, CMO, ARM, 1.013%, 9/25/66 (1) | 168 | 150 |

| Vista Point Securitization Trust, Series 2020-2, Class A1, CMO, ARM, 1.475%, 4/25/65 (1) | 112 | 109 |

| | | 4,188 |

Total Non-U.S. Government Mortgage-Backed Securities

(Cost $4,959) | | 4,726 |

| U.S. GOVERNMENT AGENCY OBLIGATIONS (EXCLUDING MORTGAGE-BACKED) 2.5% |

| U.S. Treasury Obligations 2.5% | | |

| U.S. Treasury Bill, 0.628%, 6/28/22 | 350 | 350 |

| U.S. Treasury Bill, 0.644%, 6/14/22 (3) | 334 | 334 |

| U.S. Treasury Bill, 0.873%, 8/11/22 | 225 | 224 |

| | | 908 |

Total U.S. Government Agency Obligations (Excluding Mortgage-Backed)

(Cost $908) | | 908 |

| SHORT-TERM INVESTMENTS 11.3% |

| Commercial Paper 8.1% | | |

| Arrow Electronics, 1.501%, 6/2/22 (4) | 300 | 300 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Conagra Brands, 1.451%, 6/14/22 (4) | 300 | 300 |

| Crown Castle International, 1.572%, 6/7/22 (4) | 300 | 300 |

| Enel Finance America, 3.289%, 4/21/23 (4) | 250 | 243 |

| Fidelity National Information Services, 1.301%, 6/22/22 (4) | 325 | 325 |

| Harley-Davidson Financial Services, 4.544%, 7/6/22 (4) | 250 | 249 |

| Humana, 1.351%, 6/13/22 (4) | 325 | 325 |

| Jabil, 1.745%, 7/1/22 (4) | 350 | 349 |

| Molson Coors Beverage, 1.853%, 6/22/22 (4) | 300 | 300 |

| Syngenta Wilmington, 1.701%, 6/1/22 (4) | 300 | 300 |

| | | 2,991 |

| Money Market Funds 3.2% | | |

| T. Rowe Price Government Reserve Fund, 0.66%, (5)(6) | 1,170 | 1,170 |

Total Short-Term Investments

(Cost $4,161) | | 4,161 |

Total Investments in Securities

102.9% of Net Assets (Cost $38,607) | | $37,882 |

| ‡ | Par/Shares and Notional Amount are denominated in U.S. dollars unless otherwise noted. |

| (1) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be resold in transactions exempt from registration only to qualified institutional buyers. Total value of such securities at period-end amounts to $15,777 and represents 42.9% of net assets. |

| (2) | Security is a fix-to-float security, which carries a fixed coupon until a certain date, upon which it switches to a floating rate. Reference rate and spread are provided if the rate is currently floating. |

| (3) | At May 31, 2022, all or a portion of this security is pledged as collateral and/or margin deposit to cover future funding obligations. |

| (4) | Commercial paper exempt from registration under Section 4(2) of the Securities Act of 1933 and may be resold in transactions exempt from registration only to dealers in that program or other "accredited investors" -- total value of such securities at period-end amounts to $2,991 and represents 8.1% of net assets. |

| (5) | Seven-day yield |

| (6) | Affiliated Companies |

| 1M USD LIBOR | One month USD LIBOR (London interbank offered rate) |

| 3M USD LIBOR | Three month USD LIBOR (London interbank offered rate) |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| ARM | Adjustable Rate Mortgage (ARM); rate shown is effective rate at period-end. The rates for certain ARMs are not based on a published reference rate and spread but may be determined using a formula based on the rates of the underlying loans. |

| CLO | Collateralized Loan Obligation |

| CMO | Collateralized Mortgage Obligation |

| FRN | Floating Rate Note |

| JPY | Japanese Yen |

| SOFR | Secured overnight financing rate |

| SOFR30A | 30-day Average SOFR (Secured Overnight Financing Rate) |

| USD | U.S. Dollar |

| VR | Variable Rate; rate shown is effective rate at period-end. The rates for certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and based on current market conditions. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| Description | Notional

Amount | $ Value | Upfront

Payments/

$ (Receipts) | Unrealized

$ Gain/(Loss) |

| BILATERAL SWAPS 0.0% |

| Bilateral Credit Default Swaps, Protection Sold 0.0% |

| Goldman Sachs, Protection Sold (Relevant Credit: Pioneer Natural Resources, BBB*), Receive 1.00% Quarterly, Pay upon credit default 12/20/22 | 60 | — | — | — |

| Total Bilateral Swaps | | — | — |

| Description | Notional

Amount | $ Value | Initial

$ Value | Unrealized

$ Gain/(Loss) |

| CENTRALLY CLEARED SWAPS 0.0% |

| Credit Default Swaps, Protection Sold 0.0% |

| Protection Sold (Relevant Credit: AT&T, Baa2*), Receive 1.00% Quarterly, Pay upon credit default 12/20/22 | 125 | — | — | — |

| Protection Sold (Relevant Credit: AT&T, Baa2*), Receive 1.00% Quarterly, Pay upon credit default 12/20/23 | 125 | — | 1 | (1) |

| Protection Sold (Relevant Credit: Citigroup, A3*), Receive 1.00% Quarterly, Pay upon credit default 12/20/23 | 60 | — | — | — |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| Description | Notional

Amount | $ Value | Initial

$ Value | Unrealized

$ Gain/(Loss) |

| Protection Sold (Relevant Credit: Bank of America, A2*), Receive 1.00% Quarterly, Pay upon credit default 12/20/23 | 60 | — | — | — |

| Protection Sold (Relevant Credit: Verizon Communications, Baa1*), Receive 1.00% Quarterly, Pay upon credit default 12/20/23 | 125 | — | 1 | (1) |

| Protection Sold (Relevant Credit: T-Mobile USA, BBB*), Receive 5.00% Quarterly, Pay upon credit default 6/20/23 | 100 | 4 | 4 | — |

| Protection Sold (Relevant Credit: Lennar, BBB*), Receive 5.00% Quarterly, Pay upon credit default 6/20/23 | 100 | 5 | 5 | — |

| Protection Sold (Relevant Credit: Devon Energy, BBB*), Receive 1.00% Quarterly, Pay upon credit default 6/20/24 | 100 | — | — | — |

| Protection Sold (Relevant Credit: Freeport-McMoran, BBB*), Receive 1.00% Quarterly, Pay upon credit default 6/20/24 | 200 | 2 | 1 | 1 |

| Protection Sold (Relevant Credit: Hess, Baa3*), Receive 1.00% Quarterly, Pay upon credit default 6/20/24 | 100 | 1 | 1 | — |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| Description | Notional

Amount | $ Value | Initial

$ Value | Unrealized

$ Gain/(Loss) |

| Protection Sold (Relevant Credit: Devon Energy, BBB*), Receive 1.00% Quarterly, Pay upon credit default 6/20/23 | 100 | — | — | — |

| Total Centrally Cleared Credit Default Swaps, Protection Sold | (1) |

| Net payments (receipts) of variation margin to date | $ — |

| Variation margin receivable (payable) on centrally cleared swaps | $ — |

| * | Credit ratings as of May 31, 2022. Ratings shown are from Moody’s Investors Service and if Moody’s does not rate a security, then Standard & Poor’s (S&P) is used. Fitch is used for securities that are not rated by either Moody’s or S&P. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| FORWARD CURRENCY EXCHANGE CONTRACTS |

| Counterparty | Settlement | Receive | | Deliver | | Unrealized

Gain/(Loss) |

| HSBC Bank | 7/5/22 | USD | 365 | JPY | 44,650 | $18 |

| HSBC Bank | 7/11/22 | USD | 360 | JPY | 44,400 | 14 |

| UBS AG | 8/10/22 | USD | 137 | JPY | 17,850 | (2) |

Net unrealized gain (loss) on open forward

currency exchange contracts | $30 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Expiration

Date | Notional

Amount | Value and

Unrealized

Gain (Loss) |

| Short, 2 U.S. Treasury Notes ten year contracts | 09/22 | (238) | $— |

| Short, 5 U.S. Treasury Notes five year contracts | 09/22 | (563) | (2) |

| Short, 8 U.S. Treasury Notes two year contracts | 09/22 | (1,690) | 1 |

| Net payments (receipts) of variation margin to date | 6 |

| Variation margin receivable (payable) on open futures contracts | $5 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

AFFILIATED COMPANIES

($000s)

The fund may invest in certain securities that are considered affiliated companies. As defined by the 1940 Act, an affiliated company is one in which the fund owns 5% or more of the outstanding voting securities, or a company that is under common ownership or control. The following securities were considered affiliated companies for all or some portion of the period ended May 31, 2022. Net realized gain (loss), investment income, change in net unrealized gain/loss, and purchase and sales cost reflect all activity for the period then ended.

| Affiliate | Net Realized Gain

(Loss) | Changes in Net

Unrealized

Gain/Loss | Investment

Income |

| T. Rowe Price Government Reserve Fund | $—# | $— | $1+ |

| Supplementary Investment Schedule |

| Affiliate | Value

5/31/21 | Purchase

Cost | Sales

Cost | Value

5/31/22 |

| T. Rowe Price Government Reserve Fund | $— | ¤ | ¤ | $1,170^ |

| # | Capital gain distributions from mutual funds represented $0 of the net realized gain (loss). |

| + | Investment income comprised $1 of dividend income and $0 of interest income. |

| ¤ | Purchase and sale information not shown for cash management funds. |

| ^ | The cost basis of investments in affiliated companies was $1,170. |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

May 31, 2022

STATEMENT OF ASSETS AND LIABILITIES

($000s, except shares and per share amounts)

| Assets | |

| Investments in securities, at value (cost $38,607) | $37,882 |

| Interest and dividends receivable | 197 |

| Receivable for investment securities sold | 66 |

| Unrealized gain on forward currency exchange contracts | 32 |

| Cash | 8 |

| Variation margin receivable on futures contracts | 5 |

| Total assets | 38,190 |

| Liabilities | |

| Payable for investment securities purchased | 1,382 |

| Investment management and administrative fees payable | 5 |

| Unrealized loss on forward currency exchange contracts | 2 |

| Total liabilities | 1,389 |

| NET ASSETS | $36,801 |

| Net assets consists of: | |

| Total distributable earnings (loss) | $(556) |

Paid-in capital applicable to 750,000 shares of $0.0001 par value

capital stock outstanding; 4,000,000,000 shares authorized | 37,357 |

| NET ASSETS | $36,801 |

| NET ASSET VALUE PER SHARE | $49.07 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

STATEMENT OF OPERATIONS

($000s)

| | 9/28/21

Through

5/31/22 |

| Investment Income (Loss) | |

| Income | |

| Interest | $208 |

| Dividend | 1 |

| Total income | 209 |

| Investment management and administrative expense | 32 |

| Net investment income | 177 |

| Realized and Unrealized Gain / Loss | |

| Net realized gain (loss) | |

| Securities | (120) |

| Futures | 167 |

| Swaps | (2) |

| Forward currency exchange contracts | 97 |

| Foreign currency transactions | (4) |

| Net realized gain | 138 |

| Change in net unrealized gain / loss | |

| Securities | (725) |

| Futures | (1) |

| Swaps | (1) |

| Forward currency exchange contracts | 30 |

| Change in unrealized gain / loss | (697) |

| Net realized and unrealized gain / loss | (559) |

| DECREASE IN NET ASSETS FROM OPERATIONS | $(382) |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

STATEMENT OF CHANGES IN NET ASSETS

($000s)

| | 9/28/21

Through

5/31/22 |

| Increase (Decrease) in Net Assets | |

| Operations | |

| Net investment income | $177 |

| Net realized gain | 138 |

| Change in net unrealized gain / loss | (697) |

| Decrease in net assets from operations | (382) |

| Distributions to shareholders | |

| Net earnings | (174) |

| Capital share transactions* | |

| Shares sold | 37,357 |

| Increase in net assets from capital share transactions | 37,357 |

| Net Assets | |

| Increase during period | 36,801 |

| Beginning of period | - |

| End of period | $36,801 |

| *Share information | |

| Shares sold | 750 |

| Increase in shares outstanding | 750 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

NOTES TO FINANCIAL STATEMENTS

T. Rowe Price Exchange-Traded Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Ultra Short-Term Bond ETF (the fund) is a diversified, open-end management investment company established by the corporation. The fund incepted on September 28, 2021. The fund seeks a high level of income consistent with low volatility of principal value.

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation

The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions

Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and losses are recorded as an adjustment to interest income. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Dividends received from other investment companies are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the asset received. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid monthly. A capital gain distribution may also be declared and paid by the fund annually. Dividends and distributions cannot be automatically reinvested in additional shares of the fund.

Currency Translation

Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars are provided by an

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

outside pricing service. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the respective date of such transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is not bifurcated from the portion attributable to changes in market prices.

Capital Share Transactions

The fund issues and redeems shares at its net asset value (NAV) only with Authorized Participants and only in large blocks of 25,000 shares (each, a “Creation Unit”). The fund’s NAV per share is computed at the close of the New York Stock Exchange (NYSE). However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Individual fund shares may not be purchased or redeemed directly with the fund. An Authorized Participant may purchase or redeem a Creation Unit of the fund each business day that the fund is open in exchange for the delivery of a designated portfolio of in-kind securities and/or cash. When purchasing or redeeming Creation Units, Authorized Participants are also required to pay a fixed and/or variable purchase or redemption transaction fee as well as any applicable additional variable charge to defray the transaction cost to a fund.

Individual fund shares may be purchased and sold only on a national securities exchange through brokers. Shares are listed for trading on NYSE Arca, Inc. (NYSE Arca) and because the shares will trade at market prices rather than NAV, shares may trade at prices greater than NAV (at a premium), at NAV, or less than NAV (at a discount). The fund’s shares are ordinarily valued as of the close of regular trading (normally 4:00 p.m. Eastern time) on each day that the NYSE Arca is open.

Indemnification

In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 – VALUATION

Security Valuation

The fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) is

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes policies and procedures used in valuing financial instruments, including those which cannot be valued in accordance with normal procedures or using pricing vendors; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; evaluates the services and performance of the pricing vendors; oversees the pricing process to ensure policies and procedures are being followed; and provides guidance on internal controls and valuation-related matters. The Valuation Committee provides periodic reporting to the Board on valuation matters.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs (including the fund’s own assumptions in determining fair value)

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Valuation Techniques

Debt securities generally are traded in the over-the-counter (OTC) market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by independent pricing services or broker dealers who make markets in such securities. When valuing securities, the independent pricing services consider the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Debt securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation. Swaps are valued at prices furnished by an independent pricing service or independent swap dealers. Forward currency exchange contracts are valued using the prevailing forward exchange rate. Futures contracts are valued at closing settlement prices. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Investments for which market quotations or market-based valuations are not readily available or deemed unreliable are valued at fair value as determined in good faith by the Valuation Committee, in accordance with fair valuation policies and procedures. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded. Factors used in determining fair value vary by type of investment and may include market or investment specific considerations. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the investment. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Valuation Inputs

The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on May 31, 2022 (for further detail by category, please refer to the accompanying Portfolio of Investments):

| ($000s) | Level 1 | Level 2 | Level 3 | Total Value |

| Assets | | | | |

| Fixed Income1 | $— | $33,721 | $— | $33,721 |

| Short-Term Investments | 1,170 | 2,991 | — | 4,161 |

| Total Securities | 1,170 | 36,712 | — | 37,882 |

| Swaps* | — | 1 | — | 1 |

| Forward Currency Exchange Contracts | — | 32 | — | 32 |

| Futures Contracts* | 1 | — | — | 1 |

| Total | $1,171 | $36,745 | $

— | $37,916 |

| Liabilities | | | | |

| Swaps* | $— | $2 | $— | $2 |

| Foreign Forward Currency Exchange Contracts | — | 2 | — | 2 |

| Futures Contracts* | 2 | — | — | 2 |

| Total | $2 | $4 | $

— | $6 |

| 1 | Includes Asset-Backed Securities, Corporate Bonds, Foreign Government Obligations & Municipalities, Municipal Securities, Non-U.S. Government Mortgage-Backed Securities and U.S. Government Agency Obligations (Excluding Mortgage-Backed). |

| * | The fair value presented includes cumulative gain (loss) on open futures contracts and centrally cleared swaps; however, the net value reflected on the accompanying Portfolio of Investments is only the unsettled variation margin receivable (payable) at that date. |

NOTE 3 – DERIVATIVE INSTRUMENTS

During the period ended May 31, 2022, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, and may use them to establish both long and short positions within the fund’s portfolio. Potential uses include to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, to enhance return, or to adjust portfolio duration and credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. The fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover its settlement obligations under open derivative contracts.

The fund values its derivatives at fair value and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. Generally, the fund accounts for its derivatives on a gross basis. It does not offset the fair value of derivative liabilities against the fair value of derivative assets on its financial statements, nor does it offset the fair value of derivative instruments against the right to reclaim or obligation to return collateral. The following table summarizes the fair value of the fund’s derivative instruments held as of May 31, 2022, and the related location on the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

| ($000s) | Location on Statement of

Assets and Liabilities | Fair Value |

| Assets | | |

| Interest rate derivatives | Futures* | $1 |

| Foreign exchange derivatives | Forwards | 32 |

| Credit derivatives | Centrally Cleared Swaps* | 1 |

| Total | | $34 |

| Liabilities | | |

| Interest rate derivatives | Futures* | $2 |

| Foreign exchange derivatives | Forwards | 2 |

| Credit derivatives | Centrally Cleared Swaps* | 2 |

| Total | | $6 |

| | |

| * | The fair value presented includes cumulative gain (loss) on open futures contracts and centrally cleared swaps; however, the value reflected on the accompanying Statement of Assets and Liabilities is only the unsettled variation margin receivable (payable) at that date. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Additionally, the amount of gains and losses on derivative instruments recognized in fund earnings during the period ended May 31, 2022, and the related location on the accompanying Statement of Operations is summarized in the following table by primary underlying risk exposure:

| ($000s) | Location of Gain (Loss) on Statement of Operations |

| | Securities^ | Futures | Forward

Currency

Exchange

Contracts | Swaps | Total |

| Realized Gain (Loss) | | | | | |

| Interest rate derivatives | $1 | $167 | $— | $— | $168 |

| Foreign exchange derivatives | — | — | 97 | — | 97 |

| Credit derivatives | — | — | — | (2) | (2) |

| Total | $1 | $167 | $97 | $(2) | $263 |

| Change in Unrealized Gain (Loss) | | | | | |

| Interest rate derivative | $— | $(1) | $— | $— | $(1) |

| Foreign exchange derivatives | — | — | 30 | — | 30 |

| Credit derivatives | — | — | — | (1) | (1) |

| Total | $

— | $(1) | $30 | $(1) | $28 |

| | |

| ^ | Options purchased are reported as securities. |

Counterparty Risk and Collateral

The fund invests in derivatives in various markets, which expose it to differing levels of counterparty risk. Counterparty risk on exchange-traded and centrally cleared derivative contracts, such as futures, exchange-traded options, and centrally cleared swaps, is minimal because the clearinghouse provides protection against counterparty defaults. For futures and centrally cleared swaps, the fund is required to deposit collateral in an amount specified by the clearinghouse and the clearing firm (margin requirement), and the margin requirement must be maintained over the life of the contract. Each clearinghouse and clearing firm, in its sole discretion, may adjust the margin requirements applicable to the fund.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF