UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23499

Goldman Sachs Real Estate Diversified Income Fund

(Exact name of registrant as specified in charter)

200 West Street,

New York, New York 10282

(Address of principal executive offices) (Zip code)

Copies to:

| | |

Robert Griffith, Esq. Goldman Sachs & Co. LLC 200 West Street New York, NY 10282 | | Stephen H. Bier, Esq. William J. Bielefeld, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders is filed herewith.

Goldman Sachs Interval Fund Annual Report September 30, 2024 Real Estate Diversified Income Fund

Goldman Sachs Real Estate Diversified Income Fund

| | | | | | |

| | | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee | | |

PORTFOLIO RESULTS

Goldman Sachs Real Estate Diversified Income Fund

Investment Objective

The Fund seeks to produce income and achieve capital appreciation with low to moderate volatility and low to moderate correlation to the broader equity markets.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Real Estate Securities Investment Team discusses the Goldman Sachs Real Estate Diversified Income Fund’s (the “Fund”) performance and positioning for the 12-month period ended September 30, 2024 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Class I, Class L, Class W, and Class P Shares generated average annual total returns, without sales charges, of 1.97%, 1.23%, 2.22%, 1.72%, 1.93% and 2.22%, respectively. |

| A | As of September 30, 2024, the Fund’s net asset value (“NAV”) for Class A, Class C, Class I, Class L Class W and Class P Shares was $8.36, $8.36, $8.84, $8.37, $8.53 and $8.84, respectively. |

| Q | What distributions did the Fund make during the Reporting Period? |

| A | The Fund’s Class A Shares distributed $0.60 per unit. The Fund’s Class C Shares distributed $0.54 per unit. The Fund’s Class I Shares distributed $0.62 per unit. The Fund’s Class L Shares distributed $0.58 per unit. The Fund’s Class W Shares distributed $0.60 per unit. The Fund’s Class P Shares distributed $0.62 per unit. |

| Q | What economic and market factors most influenced the U.S. real estate securities market as a whole during the Reporting Period? |

| A | For the Reporting Period overall, the U.S. real estate securities market posted positive returns that only modestly underperformed the broader U.S. equity market and significantly outpaced the U.S. fixed income market. The slightly weaker performance of the U.S. real estate securities market compared to the broad U.S. equity market was driven primarily by concerns around when the Federal Reserve (“Fed”) would begin to cut interest rates, refinancing worries within the commercial real estate market, and transaction volumes, which remained subdued but were picking up across the commercial real estate market. These concerns were, however, partially offset with a more optimistic view that the Fed rate hike cycle had concluded, which drove the public real estate securities market to rebound in the last months of the Reporting Period. These factors, combined, also revealed the |

disparities across real estate sectors and property types and highlighted the importance of identifying companies with strong underlying fundamentals, attractive growth prospects and healthy balance sheets.

As the Reporting Period began in the fourth quarter of 2023, the U.S. real estate securities market performed well and outperformed the broader U.S. equity market. Equities began the quarter with negative momentum, as investors digested a more resilient U.S. economy than consensus expected and a higher-for-longer Fed interest rate regime. Momentum then shifted in November and December to end the calendar year with positive performance. November 2023 saw the most significant easing in financial conditions of any month in more than four decades. Market sentiment also took a positive turn on the back of an overall shift in tonality from Fed officials signaling potential easing of monetary policy in the new year due to broader disinflation traction themes, with a gradual cooldown in economic activity while the labor market remained resilient. This produced a rally across U.S. real estate investment trusts (“REITs”) that marked one of the best monthly performances on record in November, all driven by renewed optimism about a soft economic landing and the end of interest rate hikes.

During the first quarter of 2024, the U.S. real estate securities market was generally flat and underperformed the broader U.S. equity market. The U.S. real estate securities market reacted early in the quarter to the news that property charge-offs could potentially be higher in 2024, which was negative but anticipated, specifically in the office sector. (A property charge-off is when a lender or creditor has written off a property loan as a loss and closed the account to future charges.) This led to almost all real estate sub-sectors posting negative returns early in the quarter and only a few posting positive returns at the end of the quarter. In addition, renewed concerns about potential spillover effects to commercial

PORTFOLIO RESULTS

real estate from the individual regional bank struggles had a compounding effect on the already negative sentiment. That said, while financing remained limited and expensive across the real estate sector, transaction markets started to show further re-opening, with the general consensus being that commercial real estate was nearing a bottom.

During the second quarter of 2024, the U.S. real estate securities market underperformed the broader U.S. equity market. Weak performance was driven by still-elevated interest rates, which made borrowing expensive for companies and, as a result, reduced profitability and lowered overall property demand. Market consensus was then predicting only one or two interest rate cuts in 2024, which was notably lower than anticipated when entering the calendar year. Consequently, the real estate securities market showed hesitation to rebound, as higher rates had led to a slower transaction market in commercial real estate and higher mortgages for consumers.

During the third quarter of 2024, the U.S. real estate securities market rebounded and outperformed the broader U.S. equity market by a wide margin. Following data releases in July, which indicated a cooling of inflation, real estate securities generally rebounded on the back of optimism the Fed would begin to cut interest rates at its September meeting. The U.S. real estate securities market also stood out as a comparatively defensive sector given lease-based revenues and a defensive cash flow base. The real estate securities market had come under pressure when interest rates were first hiked approximately two years earlier and then due to the uncertainty that dominated around the timing for the Fed’s first rate cut. In our view, the 50 basis point Fed rate cut that materialized in September 2024 showed promising signs for a recovery in the real estate market with the sector widely expected to deliver positive returns as interest rates started to move down. (A basis point is 1/100th of a percentage point.)

For the Reporting Period overall, all property types in the listed real estate securities market generated positive returns. Health care was the best performing property type, with senior housing REITs performing especially well on the back of strong trends, with increases in both occupancy and market rents. Senior housing also performed well relative to other forms of health care real estate as the aging population drove increased demand. Triple net was the property type that contributed least during the Reporting Period. The triple net sub-sector performed more weakly as the market took a more positive outlook for a soft landing and gravitated to more cyclical areas of the market. Historically, the triple net sub-sector has been viewed as the most defensive within the real estate sector, and thus it underperformed.

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | The listed, or public, equity sleeve of the Fund, which accounted for approximately 32% of the Fund’s net assets across both equity and credit at the end of the Reporting Period, contributed positively to the Fund’s performance. The optimism that surrounded the potential for and actual interest rate cuts in the fourth quarter of 2023 and third quarter of 2024, respectively, helped buoy listed real estate securities’ performance. Conversely, private equity investments, which accounted for approximately 68% of the Fund’s net assets at the end of the Reporting Period, detracted the most from the Fund’s performance, as the private market continued to reprice as transaction markets picked up. |

Preferred REIT stocks overall performed roughly in line with the broader REIT market during the Reporting Period, reacting similarly to the optimism facing interest rate cuts. Preferred stocks continued to play an important role in the Fund’s portfolio, with the goal of providing investors with a level of comparatively higher investment stability and yield sustainability, and thus helping us deliver on the Fund’s investment objective.

| Q | What were some of the Fund’s best-performing individual holdings during the Reporting Period? |

| A | The top individual contributors to the Fund’s performance during the Reporting Period were each in the listed, or public, equity space—Extra Space Storage, Inc. (“Extra Space Storage”), American Tower Corp. (“American Tower”) and AvalonBay Communities, Inc. (“AvalonBay Communities”). |

Extra Space Storage is in the self-storage sub-sector, providing storage and reinsurance services to tenants. During the Reporting Period, the REIT was a beneficiary of declining mortgage rates improving housing velocity, which is a key driver of storage demand. (Housing velocity is a term used to describe the rate at which homes are sold or rental units are leased in a real estate market.) With an improving supply backdrop, the second derivative improved after a multi-year correction in rates from COVID-era highs. (In real estate, a second derivative is a concept used to analyze the acceleration or deceleration of a business’s revenue growth.) At the end of the Reporting Period, we continued to like the sub-sector long term given what we saw as its attractive, longer-term fundamentals and limited capital expenditure requirements.

American Tower is one of the world’s leading telecommunication infrastructure providers. It owns and operates cellphone towers across several regions. The REIT performed well during the Reporting Period given that towers are considered critical infrastructure and because the company benefited from long lease terms with contractual uplifts that

PORTFOLIO RESULTS

drive income growth. These attributes were further supported by new investment by telecommunications providers to keep up with mobile traffic growth. At the end of the Reporting Period, we believed American Tower should be able to drive compelling earnings growth with limited capital investment required, generating attractive returns on capital.

AvalonBay Communities is an apartment REIT with a coastal focus. The company tends to concentrate more in first ring suburbs of major metropolitan areas versus downtown areas. (A first ring suburb, also known as an inner suburb, is a densely populated community that is located near the center of a metropolitan area.) During the Reporting Period, AvalonBay Communities performed well, delivering superior operating results compared to its peers, benefiting from favorable supply-constrained coastal exposure and a sub-sector-leading development pipeline. At the end of the Reporting Period, we continued to favor AvalonBay Communities over other U.S. apartment REITs given its mix of both high quality urban and suburban assets and given its development pipeline that will, in our view, augment its growth as it comes online.

| Q | Which positions detracted significantly from the Fund’s performance during the Reporting Period? |

| A | The positions that detracted most from the Fund’s performance during the Reporting Period were Oaktree Real Estate Income Fund; TA Realty Core Property Fund, LP; and Manulife US REIT. |

Oaktree Real Estate Income Fund is a private real estate investment fund that invests primarily in multi-family and industrial properties. The fund’s investments detracted from its return in the second quarter of 2024—and during the Reporting Period overall—largely driven by appraisers adjusting values lower due to a) the impact of higher interest rates; b) decreases in market rents and net operating income; c) elevated new supply across select multi-family and industrial markets; and d) limited transaction activity. This caused exit cap and discount rate assumptions across multi-family, industrial and office properties to remain flat or slightly increase during the Reporting Period. (In real estate, the exit cap rate is the anticipated rate of return on an investment property at the time of sale. In real estate, the discount rate is the annual rate of return an investor expects to earn on an investment.) While real estate values were impacted by higher operating expenses, these expenses came in below budget year-to-date through September 2024 due to cost savings across property insurance, taxes and labor.

TA Realty Core Property Fund, LP is a private real estate investment fund that invests in industrial, multi-family, retail and office properties. Its negative appreciation since the second quarter of 2022 continued during the Reporting Period,

driven by increases in valuation metrics used to value core real estate, such as discount rates and exit cap rates, which lower the value of properties. At the end of the Reporting Period, our long-term view was that the fund’s portfolio weightings and its respective emphasis on industrial and multi-family properties and lower allocations to office properties continued to position it well for relative performance going forward.

Manulife US REIT is a private REIT that invests across the core real estate sub-sectors, with approximately 80% of its portfolio in industrial and multi-family properties. It weakened during the Reporting Period driven by uncertainty and rising costs in the capital markets, expanding exit cap and discount rates, softening asset-level fundamentals in the office sub-sector, and, to a lesser extent, poor market selection for industrial and multi-family properties.

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, the Fund did not use any derivatives or similar instruments. |

| Q | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | During the Reporting Period, we re-initiated a Fund position in Public Storage, a self-storage operator, as we liked what we saw as its long-term demand dynamics and attractive valuation. |

Conversely, we sold the Fund’s position in CubeSmart, another self-storage REIT. We sold the position, as we believed it faces pressure on ongoing concerns around housing turnover and higher supply that would impact it more so than its storage peers. We decided to take advantage of other investment opportunities within the sub-sector that we saw as more attractive.

| Q | Were there any changes made in the Fund’s investment strategy during the Reporting Period? |

| A | Early in the Reporting Period, we trimmed some of the Fund’s higher beta, or more volatile, positions after they had performed well and also received proceeds from redemptions of underlying private funds. Additionally, we funded a modest amount of capital calls. (A capital call is a legal right of an investment firm to demand a portion of the money promised to it by an investor. A capital call fund would be the money that had been committed to the fund. Capital calls are often used to secure short-term funding on projects within private equity funds in order to cover the time between the financing agreement and the money received.) |

During the first quarter of 2024, we placed redemption requests in select private funds and invested capital in public real estate securities where we saw compelling valuations.

PORTFOLIO RESULTS

During the second quarter of 2024, we focused on liquidity to meet upcoming capital calls and redemption requests. In the third quarter of 2024, the Fund had limited activity in both its private and public portfolios.

Overall, during the Reporting Period, we increased the Fund’s allocation to private equity funds and modestly decreased its exposures to equity REITs, private credit funds, mortgage REITs and preferred securities.

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | Portfolio manager Timothy Ryan left Goldman Sachs Asset Management at the end of July 2024 to pursue another opportunity. Tim’s portfolio management responsibilities for the Fund were assumed by Kristin Kuney and Abhinav Zutshi, who continue to work closely with existing portfolio managers Sean Brenan and John Papadoulias. With these portfolio management team changes, there were no changes to the Fund’s investment philosophy, objective or strategy. |

| Q | How was the Fund positioned at the end of the Reporting Period? |

| A | At the end of the Reporting Period, the Fund was invested with approximately 62% of its total net assets in private equity, approximately 24% of its total net assets in public equity, approximately 6% of its total net assets in private credit, approximately 3% of its total net assets in public credit, approximately 2% of its total net assets in preferred securities and approximately 2% of its total net assets in cash and cash equivalents. |

Approximately 89% of Fund assets was invested in equities representing property types that we believe benefit from strong demographic tailwinds or revenues protected by long-term lease obligations. Approximately 12% of assets was invested in credit instruments diversified across property types and focused on seeking relatively consistent and reliable streams of cash flows and low loan-to-value ratios. (Loan-to-value (“LTV”) ratio equals the loan amount divided by the purchase price or appraised property value. The LTV ratio is one way lenders and financial institutions can assess lending risk before approving a mortgage. Generally, loans that have high LTV ratios are considered more risky and as a result carry higher interest rates—and vice versa.) Even though higher on the capital structure, we believed the Fund’s credit sleeve could generate equity-like returns with lower volatility. The private portion of the Fund was diversified at the end of the Reporting Period across institutional General Partners and strategies.

Within the Fund’s equity sleeve, approximately 30% of assets was invested in the industrial sub-sector, 20% in the multi-family sub-sector, 6% in the student housing sub-sector, 5%

in the lab office sub-sector, 5% in the single family rental sub-sector, 4% in the self-storage sub-sector, 4% in the towers sub-sector, 4% in the senior housing sub-sector, 3% in the lodging sub-sector, 3% in the manufactured housing sub-sector, 2% in the office sub-sector and the remainder across the retail, medical office buildings, data centers and mixed use sub-sectors.

| Q | How did the Fund use leverage during the Reporting Period? |

| A | The lines of credit established by the Fund under our management are bilateral, fully committed, revolving credit facilities. The Fund used leverage intermittently during the Reporting Period as a short-term cash flow management tool. More specifically, the credit agreements maintained by the Fund were typically utilized during quarterly repurchase periods and to dynamically allocate between private and public securities when other sources of capital were not immediately available. Using leverage in this way enables quick market entry to ensure those opportunities were not otherwise missed. The Fund did not use leverage habitually during the Reporting Period, meaning the Fund did not maintain a balance on any credit facility on a recurring basis. |

| Q | What is the Fund’s tactical view and strategy for the months ahead? |

| A | At the end of the Reporting Period, we believed there remained ample opportunity to leverage the differences between private and public real estate to create a complementary value above the sum of the parts. We also believed our ability to arbitrage between the two has helped the Fund’s performance and highlighted the strengths of each—the diversification, liquidity, transparency and market-driven valuations of the public market with the lower volatility and higher income stream the private market can provide. |

Further, at the end of the Reporting Period, we viewed real estate as increasingly attractive based on the sector historically offering strong performance after a period of interest rate hikes. We believed REITs were well positioned to benefit from a normalization of the interest rate environment. The vast majority of public REITs had, in our view, robust balance sheets at the end of the third quarter of 2024, which can be deployed for additional growth. We believed the valuation discount between public and private real estate, while being tighter than it was six and 12 months prior, should normalize further (historically, the public market has traded at a slight premium to the private market) and may provide additional potential upside for public real estate.

More specifically for the Fund, we believed several factors may contribute positively to its performance going forward. First, the Fund may potentially benefit from private and credit exposure. Public markets demonstrated strong performance

PORTFOLIO RESULTS

during the third quarter of 2024, with the FTSE NAREIT All Equity REIT Index up approximately 16% for the quarter, a trend we expect may accrue to private markets in the coming quarters. We have historically observed that private pricing lags public markets by 12 to 18 months. We also highlight that the Fund’s actively managed private/public exposure positions, in our view, should continue to offer potential additional upside.

Second, the Fund may benefit from valuation arbitrage in the months to come. While at the industry level, private and public valuations were relatively in line at the end of the third calendar quarter, there were dispersions at the sub-sector level, providing potential opportunities for the Fund to take advantage of pricing discrepancies across public and private markets. For example, we observed public markets trading at a discount to private in residential real estate, including apartments and single-family rentals.

Third, the Fund may benefit going forward from an interest rate tailwind. Lower interest rates will likely benefit, in our view, the entire real estate industry, but we believe there could be a more acute uplift in private markets and in real estate credit. In our view, private market valuations were bottoming at the end of the Reporting Period and did not yet reflect the upside from lower interest rates and stabilizing fundamentals. As we enter the last quarter of 2024, we believe this stabilization in interest rates may well continue to be a catalyst for a re-rating of real estate and for a recovery in equity prices.

We are watching to see the magnitude of demand increases due to artificial intelligence developments, which could positively impact communication infrastructure. We are also watching the impact global elections may have on both supply-chain reconfiguration and near-shoring. Additionally, we are watching the substantial fiscal stimulus from the Inflation Reduction Act and the Infrastructure and Chips Act may have on certain regions and metropolitan areas in the U.S. Lastly, we are watching the effects the Fed’s easing cycle may have on real assets equities and how it may impact the financing environment. As it stood at the end of the Reporting Period, the financing market remained selectively available for high quality assets and strong sponsors, but the marginal cost of funding remained relatively expensive compared to the average cost of in-place debt, creating some headwinds to overall cash flows. As rates have come down—and may further decline, the potential refinancing headwinds should lessen, in our opinion.

As we move forward, we intend to maintain our active and integrated approach that aims to balance the need for attractive income and capital appreciation, with low to

moderate volatility relative to equity and public real estate markets, by investing primarily in income-producing real estate equity and debt securities. Through this actively managed, closed-end interval Fund, we will continue seeking to provide access to both private and public real estate diversified across property types, geography and asset class (equity and debt).

Sector, sub-sector and property type designations throughout this shareholder report are defined by Goldman Sachs Asset Management.

FUND BASICS

Real Estate Diversified Income Fund

as of September 30, 2024

|

|

TOP TEN HOLDINGS AS OF 9/30/241 |

| | | | |

| | |

Holding | | % of Net

Assets | | Asset Class |

| | |

Oaktree Global Credito FIC FIM | | 9.4% | | Private REIT & Private Investment Funds |

| | |

TA Realty Core Property Fund, LP | | 7.6 | | Private REIT & Private Investment Funds |

| | |

RealTerm Logistics Income Fund | | 5.7 | | Private REIT & Private Investment Funds |

| | |

CBRE U.S. Core Partners, LP | | 5.4 | | Private REIT & Private Investment Funds |

| | |

Wheelock Street Real Estate Long Term Value Fund | | 5.0 | | Private REIT & Private Investment Funds |

| | |

Greystar Student Housing Growth and Income Fund | | 4.9 | | Private REIT & Private Investment Funds |

| | |

Ares Industrial Real Estate Fund, LP | | 4.5 | | Private REIT & Private Investment Funds |

| | |

Harrison Street Core Property Fund, LP | | 4.0 | | Private REIT & Private Investment Funds |

| | |

Sentinel Real Estate Fund | | 3.9 | | Private REIT & Private Investment Funds |

| | |

AvalonBay Communities, Inc. REIT | | 3.2 | | Real Estate Investment Trust (REIT) |

| | 1 | The top 10 holdings may not be representative of the Fund’s future investments. |

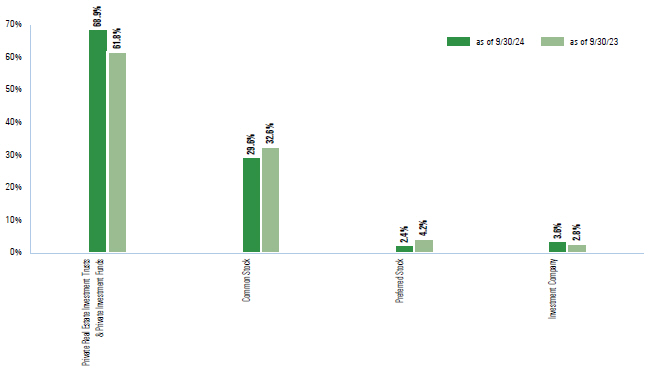

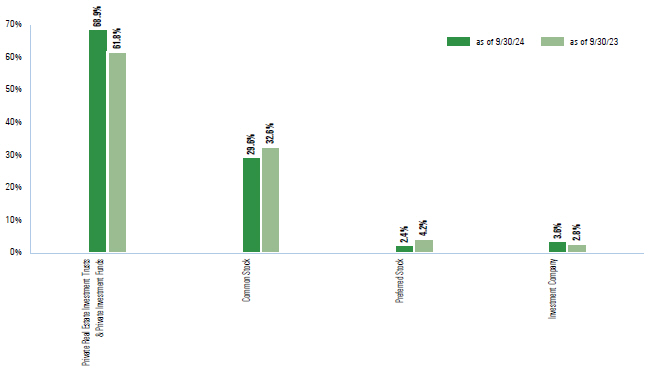

Percentage of Net Assets

| | 2 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall allocations may differ from percentages contained in the graph above. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. |

For more information about the Fund, please refer to am.gs.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Performance Summary

September 30, 2024

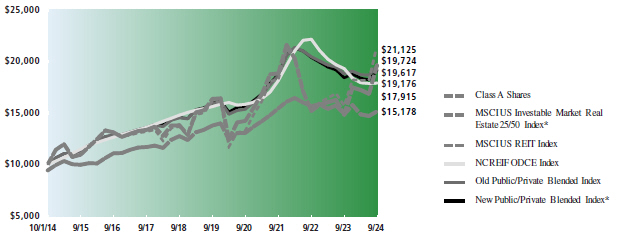

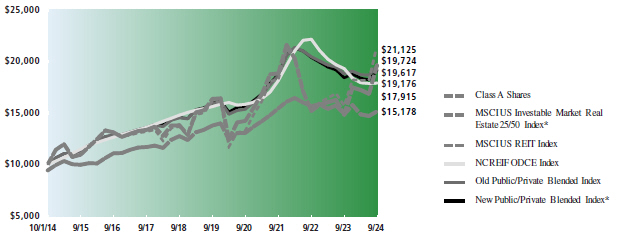

The following graph shows the value, as of September 30, 2024, of a $10,000 investment made on October 1, 2014 in Class A Shares at NAV (with a maximum sales charge of 5.75%). For comparative purposes, the performance of a private/public blended index (70% NCREIF ODCE Index & 30% MSCI US Investable Market Real Estate 25/50 Index, with dividends reinvested) (“New Public/Private Blended Index”), is shown. Prior to April 1, 2024, the performance of a private/public blended index (70% NCREIF ODCE Index & 30% MSCI US REIT Index, with dividends reinvested) (“Old Public/Private Blended Index”), was leveraged for comparison. The Investment Adviser believes that the New Public/Private Blended Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at am.gs.com to obtain the most recent month-end returns.

|

|

Real Estate Diversified Income Fund’s 10 Year Performance |

Performance of a $10,000 Investment, including any applicable sales charges, with distributions reinvested, from October 1, 2014 through September 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Average Annual Total Returns through September 30, 2024 **, *** | | One Year | | Five Years | | Ten Years | | Since Inception |

| | | | | |

| | Class A | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Excluding sales charges | | | | 1.97 | % | | | | 1.93 | % | | | | 4.88 | % | | | | — | |

| | | | | |

| | | Including sales charges | | | | (4.41 | )% | | | | 0.73 | % | | | | 4.26 | % | | | | — | |

| | | | | |

| | Class C | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Excluding contingent deferred sales charges | | | | 1.23 | % | | | | 1.17 | % | | | | 4.10 | % | | | | — | |

| | | | | |

| | | Including contingent deferred sales charges | | | | 0.22 | % | | | | 1.17 | % | | | | 4.10 | % | | | | — | |

| | | | | |

| | | Class I | | | | 2.22 | % | | | | 2.19 | % | | | | 4.90 | % | | | | — | |

| | | | | |

| | Class L (Commenced on July 10, 2017) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Excluding sales charges | | | | 1.72 | % | | | | 1.67 | % | | | | — | | | | | 3.52 | % |

| | | | | |

| | | Including sales charges | | | | (2.59 | )% | | | | 0.80 | % | | | | — | | | | | 2.90 | % |

| | | | | |

| | | Class W (Commenced on November 21, 2014) | | | | 1.93 | % | | | | 1.92 | % | | | | — | | | | | 4.44 | % |

| | | | | |

| | | Class P (Commenced on June 29, 2021) | | | | 2.22 | % | | | | — | | | | | — | | | | | 0.99 | % |

| * | The MSCI US Investable Market Real Estate 25/50 Index was incepted on September 1, 2016 and therefore no performance information is available prior to this date. For the period between October 1, 2014 and September 1, 2016, the performance of the Old Public/Private Blended Index is shown for the New Public/Private Blended Index. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| ** | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.75% for Class A, 4.25% for Class L, and the assumed contingent deferred sales charge of 1% for Class A and C Shares, if repurchased within 18 months and 12 months of purchase, respectively. Because Class P, Class I and Class W Shares do not involve sales charge, such a charge is not applied to their Average Annual Total Returns. |

| *** | After the close of business on May 15, 2020, the Resource Real Estate Diversified Income Fund (the “Predecessor Fund”) was reorganized into the Fund. The Fund has assumed the historical performance of the Predecessor Fund, which was managed by another investment adviser. Therefore, the performance information reported above for the Fund is the combined performance of the Fund and the Predecessor Fund. The performance information shown in this report for periods through May 15, 2020 reflects the performance of the Predecessor Fund. As a result, the Fund’s performance may differ substantially from what is shown for periods through May 15, 2020. |

For more information about the Fund, please refer to am.gs.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Schedule of Investments September 30, 2024 |

| | | | | | |

| | | Description | | Value | |

| |

| | Private Real Estate Investment Trusts & Private Investment Funds – 68.9%(a) | |

| | |

| | Ares Industrial Real Estate Fund, LP | | | $ 17,610,790 | |

| | Ares US Real Estate Fund IX, LP | | | 5,682,906 | |

| | Bain Capital Real Estate Fund I-B, LP | | | 8,526,144 | |

| | Brookfield Premier Real Estate Partners, LP | | | 1,456,427 | |

| | Brookfield Real Estate Finance Fund V, LP | | | 6,185,079 | |

| | Carlyle Property Investors, LP | | | 9,479,841 | |

| | CBRE U.S. Core Partners, LP | | | 21,140,397 | |

| | Clarion Partners Debt Investment Fund, LP | | | 3,043,644 | |

| | Clarion Ventures 4, LP | | | 2,646,288 | |

| | Greystar Student Housing Growth and Income Fund | | | 19,387,006 | |

| | Harrison Street Core Property Fund, LP | | | 15,891,479 | |

| | Heitman Core Real Estate Debt Income Trust, LP | | | 5,226,497 | |

| | Manulife US REIT | | | 8,421,015 | |

| | Nuveen U.S. Core-Plus Real Estate Debt Fund, LP | | | 7,835,822 | |

| | Oaktree Global Credito FIC FIM | | | 36,872,427 | |

| | Prologis Targeted U.S. Logistics Holdings II, LP | | | 9,293,925 | |

| | RealTerm Logistics Income Fund | | | 22,448,379 | |

| | Sculptor Real Estate Credit Fund, LP | | | 733,768 | |

| | Sentinel Real Estate Fund | | | 15,383,244 | |

| | TA Realty Core Property Fund, LP | | | 30,006,756 | |

| | The Trumbull Property Fund, LP | | | 3,743,635 | |

| | Wheelock Street Real Estate Long Term Value Fund | | | 19,794,738 | |

| | | |

| | TOTAL PRIVATE REAL ESTATE INVESTMENT TRUSTS & PRIVATE INVESTMENT FUNDS | |

| | (Cost $311,045,522) | | | 270,810,207 | |

| | | |

| | | | | | | | |

| | Shares | | | | | | |

| |

| | Common Stocks – 29.6% | |

| |

| | Health Care REITs – 1.3% | |

| | 42,621 | | Alexandria Real Estate Equities, Inc. REIT | | | 5,061,244 | |

| | | |

| |

| | Industrial REITs – 4.7% | |

| | 344,064 | | Americold Realty Trust, Inc. REIT | | | 9,726,689 | |

| | 69,504 | | Prologis, Inc. REIT | | | 8,776,965 | |

| | | | | | | | |

| | | | | | | 18,503,654 | |

| | | |

| |

| | Mortgage Real Estate Investment Trusts (REITs) – 3.6% | |

| | 817,708 | | Ladder Capital Corp. REIT | | | 9,485,413 | |

| | 559,472 | | TPG RE Finance Trust, Inc. REIT | | | 4,772,296 | |

| | | | | | | | |

| | | | | | | 14,257,709 | |

| | | |

| |

| | Residential REITs – 9.5% | |

| | 115,842 | | American Homes 4 Rent, Class A REIT | | | 4,447,174 | |

| | 56,304 | | AvalonBay Communities, Inc. REIT | | | 12,682,476 | |

| | 140,899 | | Equity LifeStyle Properties, Inc. REIT | | | 10,051,735 | |

| | 285,131 | | Invitation Homes, Inc. REIT | | | 10,053,719 | |

| | | | | | | | |

| | | | | | | 37,235,104 | |

| | | |

| | | | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Specialized REITs – 10.5% | |

| | 30,676 | | American Tower Corp. REIT | | | $ 7,134,011 | |

| | 4,849 | | Equinix, Inc. REIT | | | 4,304,118 | |

| | 31,674 | | Extra Space Storage, Inc. REIT | | | 5,707,338 | |

| | 15,688 | | Public Storage REIT | | | 5,708,392 | |

| | 33,884 | | SBA Communications Corp. REIT | | | 8,155,879 | |

| | 308,285 | | VICI Properties, Inc. REIT | | | 10,268,973 | |

| | | | | | | | | | |

| | | | | | | 41,278,711 | |

| | | |

| | TOTAL COMMON STOCKS (Cost $100,188,467) | | | 116,336,422 | |

| | | |

| | | | |

| | | Shares | | Description | | Dividend Rate | | Value | |

| |

| | Preferred Stocks – 2.4% | |

| | |

| | Hotel & Resort REITs – 0.4% | | | | |

| | 66,218 | | Pebblebrook Hotel Trust, Series E | | 6.38% | | | 1,450,836 | |

| | | |

| |

| | Mortgage Real Estate Investment Trusts (REITs) – 2.0% | |

| | 77,545 | | MFA Financial, Inc., Series C | | 6.50% | | | 1,837,817 | |

| | 49,554 | | PennyMac Mortgage Investment Trust, Series B | | 8.00 | | | 1,227,948 | |

| | 73,559 | | Two Harbors Investment Corp., Series B | | 7.63 | | | 1,831,619 | |

| | 128,562 | | Two Harbors Investment Corp., Series A | | 8.13 | | | 3,196,051 | |

| | | | | | | | | | |

| | | | | | | | | 8,093,435 | |

| | | |

| | TOTAL PREFERRED STOCKS (Cost $9,659,717) | | | 9,544,271 | |

| | | |

| | | |

| | | Shares | | Dividend Rate | | Value | |

| |

| | Investment Company – 3.6%(b) | |

| | Goldman Sachs Financial Square Government Fund - Institutional Shares | |

| | 14,195,121 | | 4.854% | | | 14,195,121 | |

| | (Cost $14,195,121) | | | | |

| | TOTAL INVESTMENTS – 104.5% (Cost $435,088,827) | | | $ 410,886,021 | |

| | LIABILITIES IN EXCESS OF OTHER ASSETS – (4.5)% | | | (17,524,452 | ) |

| | NET ASSETS – 100.0% | | | $ 393,361,569 | |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets.

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 11 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Schedule of Investments (continued) September 30, 2024 |

| (a) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on sale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered and the registration statement is effective. Disposal of these securities may involve time consuming negotiations and prompt sale at an acceptable price may be difficult. Total market value of restricted securities amounts to $270,810,207, which represents approximately 68.9% of net assets as of September 30, 2024. See additional details below: |

| | | | | | | | |

| Security | |

| Date(s) of

Purchase |

| | | Cost | |

Ares Industrial Real Estate Fund, LP | | | 12/21/22-01/19/23 | | | | $19,512,709 | |

Ares US Real Estate Fund IX, LP | | | 09/19/19-09/12/24 | | | | 6,379,662 | |

Bain Capital Real Estate Fund I-B, LP | | | 12/18/19-08/12/24 | | | | 6,222,362 | |

Brookfield Premier Real Estate Partners, LP | | | 10/01/19-12/20/21 | | | | 1,615,754 | |

Brookfield Real Estate Finance Fund V, LP | | | 10/03/19-09/12/24 | | | | 10,001,159 | |

Carlyle Property Investors, LP | | | 10/01/19-03/28/24 | | | | 10,052,448 | |

CBRE U.S. Core Partners, LP | | | 03/30/22-01/19/24 | | | | 26,489,411 | |

Clarion Partners Debt Investment Fund, LP | | | 02/14/17-08/01/22 | | | | 2,531,142 | |

Clarion Ventures 4, LP | | | 07/01/16-07/10/19 | | | | 6,923,743 | |

Greystar Student Housing Growth and Income Fund | | | 01/04/22-10/24/23 | | | | 20,921,738 | |

Harrison Street Core Property Fund, LP | | | 09/15/21-10/26/23 | | | | 18,051,478 | |

Heitman Core Real Estate Debt Income Trust, LP | | | 07/27/17-01/26/23 | | | | 6,465,322 | |

Manulife US REIT | | | 04/08/22-07/23/24 | | | | 13,044,354 | |

Nuveen U.S. Core-Plus Real Estate Debt Fund, LP | | | 10/01/19-10/31/23 | | | | 11,213,608 | |

Oaktree Global Credito FIC FIM | | | 10/07/21-12/27/23 | | | | 41,194,702 | |

Prologis Targeted U.S. Logistics Holdings II, LP | | | 01/03/20-06/20/23 | | | | 7,938,955 | |

RealTerm Logistics Income Fund | | | 04/18/22-11/06/23 | | | | 25,534,303 | |

Sculptor Real Estate Credit Fund, LP | | | 01/21/20-09/25/24 | | | | 1,588,330 | |

Sentinel Real Estate Fund | | | 05/04/22-01/16/24 | | | | 18,375,953 | |

TA Realty Core Property Fund, LP | | | 01/04/22-11/07/23 | | | | 32,522,875 | |

The Trumbull Property Fund, LP | | | 01/04/16-10/01/18 | | | | 4,629,525 | |

Wheelock Street Real Estate Long Term Value Fund | | | 04/23/24-09/10/24 | | | | 19,835,989 | |

Total | | | | | | | $311,045,522 | |

| (b) | Represents an affiliated issuer. |

| | |

| Investment Abbreviations: |

| LP | | —Limited Partnership |

| REIT | | —Real Estate Investment Trust |

|

|

ADDITIONAL INVESTMENT INFORMATION |

Additional information on investments in private real estate investment funds:

| | | | | | | | | | | | | | | | |

| Security | | Value | | | Redemption Frequency | | | Redemption Notice (Days) | | | Unfunded Commitments as of September 30, 2024 | |

|

| |

| | | | |

Ares Industrial Real Estate Fund, LP | | $ | 17,610,790 | | | | Quarterly | | | | 90 | | | | $ – | |

|

| |

| | | | |

Ares US Real Estate Fund IX, LP | | | 5,682,906 | | | | N/R | | | | N/R | | | | 846,045 | |

|

| |

| | | | |

Bain Capital Real Estate Fund I-B, LP | | | 8,526,144 | | | | N/R | | | | N/R | | | | 2,263,827 | |

|

| |

| | |

| 12 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| | | | | | | | | | | | | | | | |

| | | | |

Brookfield Premier Real Estate Partners, LP | | $ | 1,456,427 | | | | Quarterly | | | | 90 | | | | $ – | |

|

| |

| | | | |

Brookfield Real Estate Finance Fund V, LP | | | 6,185,079 | | | | N/R | | | | N/R | | | | 8,012,495 | |

|

| |

| | | | |

Carlyle Property Investors, LP | | | 9,479,841 | | | | Quarterly | | | | 90 | | | | – | |

|

| |

| | | | |

CBRE U.S. Core Partners, LP | | | 21,140,397 | | | | Quarterly | | | | 60 | | | | – | |

|

| |

| | | | |

Clarion Partners Debt Investment Fund, LP | | | 3,043,644 | | | | N/R | | | | N/R | | | | 4,652,799 | |

|

| |

| | | | |

Clarion Ventures 4, LP | | | 2,646,288 | | | | N/R | | | | N/R | | | | 963,242 | |

|

| |

| | | | |

Greystar Student Housing Growth and Income Fund | | | 19,387,006 | | | | Quarterly | | | | 90 | | | | – | |

|

| |

| | | | |

Harrison Street Core Property Fund, LP | | | 15,891,479 | | | | Quarterly | | | | 45 | | | | – | |

|

| |

| | | | |

Heitman Core Real Estate Debt Income Trust, LP | | | 5,226,497 | | | | Quarterly | | | | 90 | | | | – | |

|

| |

| | | | |

Manulife US REIT | | | 8,421,015 | | | | Quarterly | | | | 60 | | | | – | |

|

| |

| | | | |

Nuveen U.S. Core-Plus Real Estate Debt Fund, LP | | | 7,835,822 | | | | Quarterly | | | | 45 | | | | – | |

|

| |

| | | | |

Oaktree Global Credito FIC FIM | | | 36,872,427 | | | | N/R | | | | N/R | | | | – | |

|

| |

| | | | |

Prologis Targeted U.S. Logistics Holdings II, LP | | | 9,293,925 | | | | Quarterly | | | | 90 | | | | – | |

|

| |

| | | | |

RealTerm Logistics Income Fund | | | 22,448,379 | | | | Quarterly | | | | 90 | | | | – | |

|

| |

| | | | |

Sculptor Real Estate Credit Fund, LP | | | 733,768 | | | | N/R | | | | N/R | | | | 3,306,250 | |

|

| |

| | | | |

Sentinel Real Estate Fund | | | 15,383,244 | | | | Quarterly | | | | 90 | | | | – | |

|

| |

| | | | |

TA Realty Core Property Fund, LP | | | 30,006,756 | | | | Quarterly | | | | 45 | | | | – | |

|

| |

| | | | |

The Trumbull Property Fund, LP | | | 3,743,635 | | | | Quarterly | | | | 60 | | | | – | |

|

| |

| | | | |

Wheelock Street Real Estate Long Term Value Fund | | | 19,794,738 | | | | Annually | | | | 90 | | | | 5,164,011 | |

|

| |

N/R - Not Redeemable

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 13 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Statement of Assets and Liabilities September 30, 2024 |

| | | | | | | | |

| | | | | Real Estate Diversified Income Fund(a) | | |

| | | |

| | | Assets: | | | | | | |

| | | |

| | Investments in unaffiliated issuers, at value (cost $420,893,706) | | $ | 396,690,900 | | | |

| | Investments in affiliated issuers, at value (cost $14,195,121) | | | 14,195,121 | | | |

| | Receivables: | | | | | | |

| | Dividends | | | 1,998,480 | | | |

| | Fund shares sold | | | 492,564 | | | |

| | Reimbursement from investment adviser | | | 48,166 | | | |

| | Other assets | | | 260,000 | | | |

| | Total assets | | | 413,685,231 | | | |

| | | |

| | Liabilities: | | | | | | |

| | | |

| | Payables: | | | | | | |

| | Investments purchased | | | 18,406,947 | | | |

| | Due to custodian | | | 1,360,073 | | | |

| | Management fees | | | 203,906 | | | |

| | Distribution and Service fees and Transfer Agency fees | | | 40,649 | | | |

| | Accrued expenses | | | 312,087 | | | |

| | Total liabilities | | | 20,323,662 | | | |

| | Commitments and contingencies | | | | | | |

| | | |

| | Net Assets: | | | | | | |

| | | |

| | Paid-in capital | | | 407,637,421 | | | |

| | Total distributable loss | | | (14,275,852 | ) | | |

| | NET ASSETS | | $ | 393,361,569 | | | |

| | | | | | | | |

| | | Net Assets: | | | | | | |

| | | Class A | | $ | 61,073,121 | | | |

| | | Class C | | | 19,905,607 | | | |

| | | Class I | | | 93,750,471 | | | |

| | | Class L | | | 3,792,801 | | | |

| | | Class W | | | 20,742,463 | | | |

| | | Class P | | | 194,097,106 | | | |

| | | Total Net Assets | | $ | 393,361,569 | | | |

| | | Shares Outstanding $0.001 par value (unlimited number of shares authorized): | | | | | | |

| | | Class A | | | 7,305,485 | | | |

| | | Class C | | | 2,381,098 | | | |

| | | Class I | | | 10,610,434 | | | |

| | | Class L | | | 453,207 | | | |

| | | Class W | | | 2,432,310 | | | |

| | | Class P | | | 21,946,133 | | | |

| | | Net asset value, offering and repurchase price per share:(b) | | | | | | |

| | | Class A | | $ | 8.36 | | | |

| | | Class C | | | 8.36 | | | |

| | | Class I | | | 8.84 | | | |

| | | Class L | | | 8.37 | | | |

| | | Class W | | | 8.53 | | | |

| | | Class P | | | 8.84 | | | |

| (a) | Statement of Assets and Liabilities for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| (b) | Maximum public offering price per share for Class A is $8.87 and Class L is $8.74. Upon repurchase, Class C Shares may be subject to a contingent deferred sales charge, assessed on the amount equal to the lesser of the current net asset value (“NAV”) or the original purchase price of the shares. |

| | |

| 14 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Statement of Operations For the Fiscal Year Ended September 30, 2024 |

| | | | | | | | |

| | | | | Real Estate

Diversified Income

Fund(a) | | | |

| | | |

| | | Investment income: | | | | | | |

| | | |

| | Dividends — unaffiliated issuers | | $ | 11,994,909 | | | |

| | | |

| | Dividends — affiliated issuers | | | 595,074 | | | |

| | |

| | Total Investment Income | | | 12,589,983 | | | |

| | |

| | | | | | | | |

| | | |

| | Expenses: | | | | | | |

| | | |

| | Management fees | | | 5,320,143 | | | |

| | | |

| | Professional fees | | | 879,912 | | | |

| | | |

| | Transfer Agency fees | | | 595,856 | | | |

| | | |

| | Distribution and/or Service (12b-1) fees(b) | | | 443,035 | | | |

| | | |

| | Interest on borrowing | | | 404,523 | | | |

| | | |

| | Custody, accounting and administrative services | | | 302,874 | | | |

| | | |

| | Printing and mailing costs | | | 196,383 | | | |

| | | |

| | Registration fees | | | 131,773 | | | |

| | | |

| | Shareholder Service fees(b) | | | 82,169 | | | |

| | | |

| | Trustee fees | | | 32,412 | | | |

| | | |

| | Other | | | 120,044 | | | |

| | |

| | Total expenses | | | 8,509,124 | | | |

| | |

| | Less — expense reductions | | | (175,517 | ) | | |

| | |

| | Net expenses | | | 8,333,607 | | | |

| | |

| | NET INVESTMENT INCOME | | | 4,256,376 | | | |

| | |

| | | | | | | | |

| | | |

| | Realized and Unrealized gain (loss): | | | | | | |

| | | |

| | Net realized gain (loss) from: | | | | | | |

| | | |

| | Investments — unaffiliated issuers | | | (9,494,048 | ) | | |

| | | |

| | Net change in unrealized gain (loss) on: | | | | | | |

| | | |

| | Investments — unaffiliated issuers | | | 13,461,813 | | | |

| | |

| | Net realized and unrealized gain | | | 3,967,765 | | | |

| | |

| | NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 8,224,141 | | | |

| | |

| | (a) | Statement of Operations for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| | (b) | Class specific Distribution and/or Service and Shareholder Service fees were as follows: |

| | | | | | | | | | | | | | | | | | | | |

| Distribution and/or Service (12b-1) Fees | | Shareholder Service Fees |

| | | Class A | | Class C | | Class L | | Class W | | | | | | Class C | | | | Class L | | |

| | $157,974 | | $215,384 | | $10,373 | | $59,304 | | | | | | $71,796 | | | | $10,373 | | |

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 15 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Statements of Changes in Net Assets |

| | | | | | | | | | | | |

| | | | | Real Estate Diversified Income Fund(a) | | | |

| | | | | For the Fiscal Year Ended

September 30, 2024 | | | For the Fiscal Year Ended

September 30, 2023 | | | |

| | | | |

| | | From operations: | | | | | | | | | | |

| | | | |

| | Net investment income | | $ | 4,256,376 | | | $ | 8,383,466 | | | |

| | | | |

| | Net realized loss | | | (9,494,048 | ) | | | (2,225,711 | ) | | |

| | | | |

| | Net change in unrealized gain (loss) | | | 13,461,813 | | | | (31,441,684 | ) | | |

| | |

| | Net increase (decrease) in net assets resulting from operations | | | 8,224,141 | | | | (25,283,929 | ) | | |

| | |

| | | | | | | | | | | | |

| | | | |

| | Distributions to shareholders: | | | | | | | | | | |

| | | | |

| | From distributable earnings: | | | | | | | | | | |

| | | | |

| | Class A Shares | | | (114,477 | ) | | | (1,293,136 | ) | | |

| | | | |

| | Class C Shares | | | (41,719 | ) | | | (661,185 | ) | | |

| | | | |

| | Class I Shares | | | (172,534 | ) | | | (2,053,655 | ) | | |

| | | | |

| | Class L Shares | | | (7,078 | ) | | | (79,939 | ) | | |

| | | | |

| | Class W Shares | | | (40,771 | ) | | | (588,504 | ) | | |

| | | | |

| | Class P Shares | | | (360,104 | ) | | | (4,180,466 | ) | | |

| | | | |

| | From return of capital: | | | | | | | | | | |

| | | | |

| | Class A Shares | | | (4,353,499 | ) | | | (4,004,725 | ) | | |

| | | | |

| | Class C Shares | | | (1,586,568 | ) | | | (2,047,630 | ) | | |

| | | | |

| | Class I Shares | | | (6,561,415 | ) | | | (6,359,977 | ) | | |

| | | | |

| | Class L Shares | | | (269,175 | ) | | | (247,564 | ) | | |

| | | | |

| | Class W Shares | | | (1,550,521 | ) | | | (1,822,544 | ) | | |

| | | | |

| | Class P Shares | | | (13,694,601 | ) | | | (12,946,520 | ) | | |

| | |

| | Total distributions to shareholders | | | (28,752,462 | ) | | | (36,285,845 | ) | | |

| | |

| | | | | | | | | | | | |

| | | | |

| | From share transactions: | | | | | | | | | | |

| | | | |

| | Proceeds from sales of shares | | | 32,578,542 | | | | 73,256,595 | | | |

| | | | |

| | Reinvestment of distributions | | | 14,309,375 | | | | 20,210,490 | | | |

| | | | |

| | Cost of shares repurchased | | | (119,383,121 | ) | | | (124,541,428 | ) | | |

| | |

| | Net decrease in net assets resulting from share transactions | | | (72,495,204 | ) | | | (31,074,343 | ) | | |

| | |

| | TOTAL DECREASE | | | (93,023,525 | ) | | | (92,644,117 | ) | | |

| | |

| | | | | | | | | | | | |

| | | | |

| | Net Assets: | | | | | | | | | | |

| | Beginning of year | | $ | 486,385,094 | | | $ | 579,029,211 | | | |

| | |

| | End of year | | $ | 393,361,569 | | | $ | 486,385,094 | | | |

| | |

| | (a) | The Statements of Changes in Net Assets for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| | |

| 16 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Statement of Cash Flows(a) For the Fiscal Year Ended September 30, 2024 |

| | | | | | | | |

| | | |

| | | Increase (Decrease) in cash – Cash flows provided by operating activities: | | | | | | |

| | | |

| | Net increase in net assets from operations | | $ | 8,224,141 | | | |

| | | |

| | Adjustments to reconcile net increase in net assets from operations to net cash provided by (used in) operating activities: | | | | | | |

| | | |

| | Payments for purchases of investments | | | (61,641,144 | ) | | |

| | | |

| | Proceeds from sales of investments | | | 156,943,367 | | | |

| | | |

| | Net (payments for purchase) proceeds from sales of short-term investment securities | | | (788,286 | ) | | |

| | | |

| | (Increase) Decrease in assets: | | | | | | |

| | | |

| | Receivable for dividends | | | 1,010,410 | | | |

| | | |

| | Collateral for credit facility | | | 46,148 | | | |

| | | |

| | Reimbursement from investment adviser | | | 182,075 | | | |

| | | |

| | Other assets | | | (13,397 | ) | | |

| | | |

| | Increase (Decrease) in liabilities: | | | | | | |

| | | |

| | Distribution and Service fees and Transfer Agency fees | | | (161,595 | ) | | |

| | | |

| | Management fees | | | (313,671 | ) | | |

| | | |

| | Accrued expenses | | | (290,857 | ) | | |

| | | |

| | Net realized (gain) loss on: | | | | | | |

| | | |

| | Investments | | | 9,494,048 | | | |

| | | |

| | Net change in unrealized (gain) loss on: | | | | | | |

| | | |

| | Investments | | | (13,461,813 | ) | | |

| | |

| | Net cash provided by operating activities | | | 99,229,426 | | | |

| | |

| | | | | | | | |

| | | |

| | Cash flows used in financing activities: | | | | | | |

| | | |

| | Proceeds from sale of shares | | | 32,947,814 | | | |

| | | |

| | Cost of shares repurchased | | | (119,383,121 | ) | | |

| | | |

| | Increase in payable to custodian | | | 1,360,073 | | | |

| | | |

| | Distributions paid | | | (14,443,087 | ) | | |

| | | |

| | Drawdowns from line of credit | | | 35,000,000 | | | |

| | | |

| | Repayment of line of credit | | | (35,000,000 | ) | | |

| | |

| | Net cash used in financing activities | | | (99,518,321 | ) | | |

| | |

| | | | | | | | |

| | |

| | NET DECREASE IN CASH | | $ | (288,895 | ) | | |

| | |

| | | | | | | | |

| | | |

| | Cash (restricted and unrestricted): | | | | | | |

| | Beginning of year | | $ | 288,895 | | | |

| | |

| | End of year | | $ | — | | | |

| | |

| | | |

| | Supplemental disclosure: | | | | | | |

| | | |

| | Cash paid for interest and related fees | | | 404,523 | | | |

| | | |

| | Reinvestment of distributions | | | 14,309,375 | | | |

| | |

(a) Statement of Cash Flows for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated.

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 17 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Financial Highlights Selected Data for a Share Outstanding Throughout Each Year |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Real Estate Diversified Income Fund | | |

| | | |

| | | | | Class A Shares | | |

| | | |

| | | | | Year Ended September 30, | | |

| | | | | | | |

| | | | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | |

| | | | | | | |

| | Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Net asset value, beginning of year | | | $ | 8.79 | | | | $ | 9.91 | | | | $ | 10.45 | | | | $ | 9.38 | | | | $ | 10.69 | | | |

| | |

| | | | | | | |

| | Net investment income(a) | | | | 0.08 | | | | | 0.14 | | | | | 0.21 | | | | | 0.20 | | | | | 0.29 | | | |

| | | | | | | |

| | Net realized and unrealized gain (loss) | | | | 0.09 | | | | | (0.61 | ) | | | | (0.04 | ) | | | | 1.47 | | | | | (0.89 | ) | | |

| | |

| | | | | | | |

| | Total from investment operations | | | | 0.17 | | | | | (0.47 | ) | | | | 0.17 | | | | | 1.67 | | | | | (0.60 | ) | | |

| | |

| | | | | | | |

| | Distributions to shareholders from net investment income | | | | (0.01 | ) | | | | – | | | | | (0.19 | ) | | | | (0.34 | ) | | | | (0.23 | ) | | |

| | | | | | | |

| | Distributions to shareholders from net realized gains | | | | – | | | | | (0.15 | ) | | | | (0.11 | ) | | | | (0.26 | ) | | | | (0.30 | ) | | |

| | | | | | | |

| | Distributions to shareholders from return of capital | | | | (0.59 | ) | | | | (0.50 | ) | | | | (0.41 | ) | | | | – | | | | | (0.18 | ) | | |

| | |

| | | | | | | |

| | Total distributions | | | | (0.60 | ) | | | | (0.65 | ) | | | | (0.71 | ) | | | | (0.60 | ) | | | | (0.71 | ) | | |

| | |

| | | | | | | |

| | Net asset value, end of year | | | $ | 8.36 | | | | $ | 8.79 | | | | $ | 9.91 | | | | $ | 10.45 | | | | $ | 9.38 | | | |

| | |

| | | | | | | |

| | Total Return(b) | | | | 1.97 | % | | | | (5.05 | )% | | | | 1.43 | % | | | | 18.24 | % | | | | (5.20 | )% | | |

| | |

| | | | | | | |

| | Net assets, end of year (in 000’s) | | | $ | 61,073 | | | | $ | 69,953 | | | | $ | 80,263 | | | | $ | 83,054 | | | | $ | 87,520 | | | |

| | | | | | | |

| | Ratio of net expense to average net assets after interest expenses | | | | 2.09 | % | | | | 2.17 | % | | | | 2.05 | % | | | | 2.10 | % | | | | 2.19 | % | | |

| | | | | | | |

| | Ratio of net investment income to average net assets | | | | 0.89 | % | | | | 1.42 | % | | | | 1.97 | % | | | | 2.02 | % | | | | 2.88 | % | | |

| | | | | | | |

| | Ratio of net expense to average net assets before interest expenses | | | | 1.99 | % | | | | 1.99 | % | | | | 1.98 | % | | | | 1.99 | % | | | | 1.99 | % | | |

| | | | | | | |

| | Ratio of total expense to average net assets after interest expenses | | | | 2.13 | % | | | | 2.22 | % | | | | 2.06 | % | | | | 2.34 | % | | | | 2.28 | % | | |

| | | | | | | |

| | Portfolio turnover rate(c) | | | | 17 | % | | | | 46 | % | | | | 56 | % | | | | 73 | % | | | | 53 | % | | |

| | |

| | (a) | Calculated based on the average shares outstanding methodology. |

| | (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| | (c) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| 18 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Financial Highlights (continued) Selected Data for a Share Outstanding Throughout Each Year |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Real Estate Diversified Income Fund | | |

| | | |

| | | | | Class C Shares | | |

| | | |

| | | | | Year Ended September 30, | | |

| | | | | | | |

| | | | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | |

| | | | | | | |

| | Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Net asset value, beginning of year | | | $ | 8.79 | | | | $ | 9.91 | | | | $ | 10.45 | | | | $ | 9.38 | | | | $ | 10.68 | | | |

| | |

| | | | | | | |

| | Net investment income(a) | | | | 0.01 | | | | | 0.06 | | | | | 0.12 | | | | | 0.13 | | | | | 0.20 | | | |

| | | | | | | |

| | Net realized and unrealized gain (loss) | | | | 0.10 | | | | | (0.60 | ) | | | | (0.03 | ) | | | | 1.46 | | | | | (0.87 | ) | | |

| | |

| | | | | | | |

| | Total from investment operations | | | | 0.11 | | | | | (0.54 | ) | | | | 0.09 | | | | | 1.59 | | | | | (0.67 | ) | | |

| | |

| | | | | | | |

| | Distributions to shareholders from net investment income | | | | (0.06 | ) | | | | – | | | | | (0.16 | ) | | | | (0.26 | ) | | | | (0.16 | ) | | |

| | | | | | | |

| | Distributions to shareholders from net realized gains | | | | – | | | | | (0.16 | ) | | | | (0.11 | ) | | | | (0.26 | ) | | | | (0.29 | ) | | |

| | | | | | | |

| | Distributions to shareholders from return of capital | | | | (0.48 | ) | | | | (0.42 | ) | | | | (0.36 | ) | | | | – | | | | | (0.18 | ) | | |

| | |

| | | | | | | |

| | Total distributions | | | | (0.54 | ) | | | | (0.58 | ) | | | | (0.63 | ) | | | | (0.52 | ) | | | | (0.63 | ) | | |

| | |

| | | | | | | |

| | Net asset value, end of year | | | $ | 8.36 | | | | $ | 8.79 | | | | $ | 9.91 | | | | $ | 10.45 | | | | $ | 9.38 | | | |

| | |

| | | | | | | |

| | Total Return(b) | | | | 1.23 | % | | | | (5.77 | )% | | | | 0.67 | % | | | | 17.37 | % | | | | (5.94 | )% | | |

| | |

| | | | | | | |

| | Net assets, end of year (in 000’s) | | | $ | 19,906 | | | | $ | 37,064 | | | | $ | 54,094 | | | | $ | 69,360 | | | | $ | 72,826 | | | |

| | | | | | | |

| | Ratio of net expense to average net assets after interest expenses | | | | 2.83 | % | | | | 2.91 | % | | | | 2.81 | % | | | | 2.84 | % | | | | 2.94 | % | | |

| | | | | | | |

| | Ratio of net investment income to average net assets | | | | 0.07 | % | | | | 0.63 | % | | | | 1.18 | % | | | | 1.27 | % | | | | 2.04 | % | | |

| | | | | | | |

| | Ratio of net expense to average net assets before interest expenses | | | | 2.74 | % | | | | 2.73 | % | | | | 2.74 | % | | | | 2.74 | % | | | | 2.74 | % | | |

| | | | | | | |

| | Ratio of total expense to average net assets after interest expenses | | | | 2.87 | % | | | | 2.95 | % | | | | 2.82 | % | | | | 3.09 | % | | | | 3.04 | % | | |

| | | | | | | |

| | Portfolio turnover rate(c) | | | | 17 | % | | | | 46 | % | | | | 56 | % | | | | 73 | % | | | | 53 | % | | |

| | |

| | (a) | Calculated based on the average shares outstanding methodology. |

| | (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| | (c) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 19 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Financial Highlights (continued) Selected Data for a Share Outstanding Throughout Each Year |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Real Estate Diversified Income Fund | | |

| | | |

| | | | | Class I Shares | | |

| | | |

| | | | | Year Ended September 30, | | |

| | | | | | | |

| | | | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | |

| | | | | | | |

| | Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Net asset value, beginning of year | | | $ | 9.26 | | | | $ | 10.40 | | | | $ | 10.93 | | | | $ | 9.78 | | | | $ | 11.13 | | | |

| | |

| | | | | | | |

| | Net investment income(a) | | | | 0.10 | | | | | 0.17 | | | | | 0.26 | | | | | 0.24 | | | | | 0.33 | | | |

| | | | | | | |

| | Net realized and unrealized gain (loss) | | | | 0.10 | | | | | (0.64 | ) | | | | (0.05 | ) | | | | 1.54 | | | | | (0.93 | ) | | |

| | |

| | | | | | | |

| | Total from investment operations | | | | 0.20 | | | | | (0.47 | ) | | | | 0.21 | | | | | 1.78 | | | | | (0.60 | ) | | |

| | |

| | | | | | | |

| | Distributions to shareholders from net investment income | | | | (0.02 | ) | | | | – | | | | | (0.19 | ) | | | | (0.37 | ) | | | | (0.26 | ) | | |

| | | | | | | |

| | Distributions to shareholders from net realized gains | | | | – | | | | | (0.16 | ) | | | | (0.11 | ) | | | | (0.26 | ) | | | | (0.31 | ) | | |

| | | | | | | |

| | Distributions to shareholders from return of capital | | | | (0.60 | ) | | | | (0.51 | ) | | | | (0.44 | ) | | | | – | | | | | (0.18 | ) | | |

| | |

| | | | | | | |

| | Total distributions | | | | (0.62 | ) | | | | (0.67 | ) | | | | (0.74 | ) | | | | (0.63 | ) | | | | (0.75 | ) | | |

| | |

| | | | | | | |

| | Net asset value, end of year | | | $ | 8.84 | | | | $ | 9.26 | | | | $ | 10.40 | | | | $ | 10.93 | | | | $ | 9.78 | | | |

| | |

| | | | | | | |

| | Total Return(b) | | | | 2.22 | % | | | | (4.77 | )% | | | | 1.70 | % | | | | 18.59 | % | | | | (5.05 | )% | | |

| | |

| | | | | | | |

| | Net assets, end of year (in 000’s) | | | $ | 93,750 | | | | $ | 114,738 | | | | $ | 145,519 | | | | $ | 98,018 | | | | $ | 74,220 | | | |

| | | | | | | |

| | Ratio of net expense to average net assets after interest expenses | | | | 1.84 | % | | | | 1.92 | % | | | | 1.76 | % | | | | 1.84 | % | | | | 1.94 | % | | |

| | | | | | | |

| | Ratio of net investment income to average net assets | | | | 1.13 | % | | | | 1.66 | % | | | | 2.31 | % | | | | 2.33 | % | | | | 3.16 | % | | |

| | | | | | | |

| | Ratio of net expense to average net assets before interest expenses | | | | 1.74 | % | | | | 1.74 | % | | | | 1.70 | % | | | | 1.74 | % | | | | 1.74 | % | | |

| | | | | | | |

| | Ratio of total expense to average net assets after interest expenses | | | | 1.88 | % | | | | 1.96 | % | | | | 1.77 | % | | | | 2.12 | % | | | | 2.03 | % | | |

| | | | | | | |

| | Portfolio turnover rate(c) | | | | 17 | % | | | | 46 | % | | | | 56 | % | | | | 73 | % | | | | 53 | % | | |

| | |

| | (a) | Calculated based on the average shares outstanding methodology. |

| | (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| | (c) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| 20 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Financial Highlights (continued) Selected Data for a Share Outstanding Throughout Each Year |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Real Estate Diversified Income Fund | | |

| | | |

| | | | | Class L Shares | | |

| | | |

| | | | | Year Ended September 30, | | |

| | | | | | | |

| | | | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | |

| | | | | | | |

| | Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Net asset value, beginning of year | | | $ | 8.80 | | | | $ | 9.92 | | | | $ | 10.46 | | | | $ | 9.39 | | | | $ | 10.69 | | | |

| | |

| | | | | | | |

| | Net investment income(a) | | | | 0.05 | | | | | 0.11 | | | | | 0.18 | | | | | 0.18 | | | | | 0.27 | | | |

| | | | | | | |

| | Net realized and unrealized gain (loss) | | | | 0.10 | | | | | (0.61 | ) | | | | (0.04 | ) | | | | 1.46 | | | | | (0.89 | ) | | |

| | |

| | | | | | | |

| | Total from investment operations | | | | 0.15 | | | | | (0.50 | ) | | | | 0.14 | | | | | 1.64 | | | | | (0.62 | ) | | |

| | |

| | | | | | | |

| | Distributions to shareholders from net investment income | | | | (0.02 | ) | | | | – | | | | | (0.18 | ) | | | | (0.31 | ) | | | | (0.20 | ) | | |

| | | | | | | |

| | Distributions to shareholders from net realized gains | | | | – | | | | | (0.15 | ) | | | | (0.11 | ) | | | | (0.26 | ) | | | | (0.30 | ) | | |

| | | | | | | |

| | Distributions to shareholders from return of capital | | | | (0.56 | ) | | | | (0.47 | ) | | | | (0.39 | ) | | | | – | | | | | (0.18 | ) | | |

| | |

| | | | | | | |

| | Total distributions | | | | (0.58 | ) | | | | (0.62 | ) | | | | (0.68 | ) | | | | (0.57 | ) | | | | (0.68 | ) | | |

| | |

| | | | | | | |

| | Net asset value, end of year | | | $ | 8.37 | | | | $ | 8.80 | | | | $ | 9.92 | | | | $ | 10.46 | | | | $ | 9.39 | | | |

| | |

| | | | | | | |

| | Total Return(b) | | | | 1.72 | % | | | | (5.28 | )% | | | | 1.17 | % | | | | 17.93 | % | | | | (5.46 | )% | | |

| | |

| | | | | | | |

| | Net assets, end of year (in 000’s) | | | $ | 3,793 | | | | $ | 4,569 | | | | $ | 5,323 | | | | $ | 5,919 | | | | $ | 5,538 | | | |

| | | | | | | |

| | Ratio of net expense to average net assets after interest expenses | | | | 2.34 | % | | | | 2.42 | % | | | | 2.30 | % | | | | 2.34 | % | | | | 2.44 | % | | |

| | | | | | | |

| | Ratio of net investment income to average net assets | | | | 0.62 | % | | | | 1.15 | % | | | | 1.70 | % | | | | 1.76 | % | | | | 2.71 | % | | |

| | | | | | | |

| | Ratio of net expense to average net assets before interest expenses | | | | 2.24 | % | | | | 2.24 | % | | | | 2.23 | % | | | | 2.24 | % | | | | 2.24 | % | | |

| | | | | | | |

| | Ratio of total expense to average net assets after interest expenses | | | | 2.38 | % | | | | 2.46 | % | | | | 2.31 | % | | | | 2.59 | % | | | | 2.54 | % | | |

| | | | | | | |

| | Portfolio turnover rate(c) | | | | 17 | % | | | | 46 | % | | | | 56 | % | | | | 73 | % | | | | 53 | % | | |

| | |

| | (a) | Calculated based on the average shares outstanding methodology. |

| | (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| | (c) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 21 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

Consolidated Financial Highlights (continued) Selected Data for a Share Outstanding Throughout Each Year |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Real Estate Diversified Income Fund | | |

| | | |

| | | | | Class W Shares | | |

| | | |

| | | | | Year Ended September 30, | | |

| | | | | | | |

| | | | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | |

| | | | | | | |

| | Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Net asset value, beginning of year | | | $ | 8.96 | | | | $ | 10.08 | | | | $ | 10.62 | | | | $ | 9.52 | | | | $ | 10.85 | | | |

| | |

| | | | | | | |

| | Net investment income(a) | | | | 0.08 | | | | | 0.14 | | | | | 0.21 | | | | | 0.21 | | | | | 0.31 | | | |

| | | | | | | |

| | Net realized and unrealized gain (loss) | | | | 0.09 | | | | | (0.61 | ) | | | | (0.04 | ) | | | | 1.49 | | | | | (0.92 | ) | | |

| | |

| | | | | | | |

| | Total from investment operations | | | | 0.17 | | | | | (0.47 | ) | | | | 0.17 | | | | | 1.70 | | | | | (0.61 | ) | | |

| | |

| | | | | | | |

| | Distributions to shareholders from net investment income | | | | (0.03 | ) | | | | – | | | | | (0.18 | ) | | | | (0.34 | ) | | | | (0.24 | ) | | |

| | | | | | | |

| | Distributions to shareholders from net realized gains | | | | – | | | | | (0.16 | ) | | | | (0.11 | ) | | | | (0.26 | ) | | | | (0.30 | ) | | |

| | | | | | | |

| | Distributions to shareholders from return of capital | | | | (0.57 | ) | | | | (0.49 | ) | | | | (0.42 | ) | | | | – | | | | | (0.18 | ) | | |

| | |

| | | | | | | |

| | Total distributions | | | | (0.60 | ) | | | | (0.65 | ) | | | | (0.71 | ) | | | | (0.60 | ) | | | | (0.72 | ) | | |

| | |

| | | | | | | |

| | Net asset value, end of year | | | $ | 8.53 | | | | $ | 8.96 | | | | $ | 10.08 | | | | $ | 10.62 | | | | $ | 9.52 | | | |

| | |

| | | | | | | |

| | Total Return(b) | | | | 1.93 | % | | | | (4.96 | )% | | | | 1.40 | % | | | | 18.28 | % | | | | (5.31 | )% | | |

| | |

| | | | | | | |

| | Net assets, end of year (in 000’s) | | | $ | 20,742 | | | | $ | 29,307 | | | | $ | 39,873 | | | | $ | 40,617 | | | | $ | 47,709 | | | |

| | | | | | | |

| | Ratio of net expense to average net assets after interest expenses | | | | 2.08 | % | | | | 2.16 | % | | | | 2.04 | % | | | | 2.10 | % | | | | 2.19 | % | | |

| | | | | | | |

| | Ratio of net investment income to average net assets | | | | 0.88 | % | | | | 1.42 | % | | | | 1.98 | % | | | | 2.02 | % | | | | 2.99 | % | | |

| | | | | | | |

| | Ratio of net expense to average net assets before interest expenses | | | | 1.99 | % | | | | 1.98 | % | | | | 1.98 | % | | | | 1.99 | % | | | | 1.99 | % | | |

| | | | | | | |

| | Ratio of total expense to average net assets after interest expenses | | | | 2.12 | % | | | | 2.20 | % | | | | 2.05 | % | | | | 2.33 | % | | | | 2.23 | % | | |

| | | | | | | |

| | Portfolio turnover rate(c) | | | | 17 | % | | | | 46 | % | | | | 56 | % | | | | 73 | % | | | | 53 | % | | |

| | |

| | (a) | Calculated based on the average shares outstanding methodology. |