UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23499

Goldman Sachs Real Estate Diversified Income Fund

(Exact name of registrant as specified in charter)

200 West Street, New York, New York 10282

(Address of principal executive offices) (Zip code)

Copies to:

| | | | | | | | |

| | Caroline Kraus, Esq. Goldman Sachs & Co. LLC 200 West Street New York, New York 10282 | | | | Stephen H. Bier, Esq. William J. Bielefeld, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 | | |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Interval Fund

| | | | |

| | |

| Annual Report | | | | September 30, 2022 |

| | |

| | | | Real Estate Diversified Income Fund |

Goldman Sachs Real Estate Diversified Income Fund

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

PORTFOLIO RESULTS

Goldman Sachs Real Estate Diversified Income Fund

Investment Objective

The Fund seeks to produce income and achieve capital appreciation with low to moderate volatility and low to moderate correlation to the broader equity markets.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Real Estate Securities Investment Team discusses the Goldman Sachs Real Estate Diversified Income Fund’s (the “Fund”) performance and positioning for the 12-month period ended September 30, 2022 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, Class L, Class C, Class W, Class I and Class P Shares generated average annual total returns, without sales charges, of 1.43%, 1.17%, 0.67%, 1.40%, 1.70% and 1.79%, respectively. |

| | | As of September 30, 2022, the Fund’s net asset value (“NAV”) for Class A, Class L, Class C, Class W, Class I and Class P Shares was $9.91, $9.92, $9.91, $10.08, $10.40 and $10.41, respectively. |

| Q | | What distributions did the Fund make during the Reporting Period? |

| A | | The Fund’s Class A Shares declared dividends totaling $0.71 per share. The Fund’s Class L Shares declared dividends totaling $0.68 per share. The Fund’s Class C Shares declared dividends totaling $0.63 per share. The Fund’s Class W Shares declared dividends totaling $0.71 per share. The Fund’s Class I Shares declared dividends totaling $0.74 per share. The Fund’s Class P Shares declared dividends totaling $0.74 per share. |

| Q | | What economic and market factors most influenced the U.S. real estate securities market as a whole during the Reporting Period? |

| A | | For the Reporting Period overall, the U.S. real estate securities market posted negative returns similar to those of both the broader U.S. equity market and the U.S. fixed income market. The negative performance of the real estate sector was driven by the broader financial markets sell-off stemming from rising interest rates, recession concerns and geopolitical tensions, which combined to cause persistent volatility. U.S. real estate securities were particularly affected by rising interest rate concerns. |

| | | As the Reporting Period began in October 2021, the U.S. real estate securities market was volatile, owing to political uncertainty and fear of poor corporate earnings due to the resurgence of the COVID-19 Delta variant. However, the resilience of the corporate sector, evidenced by a strong third quarter 2021 earnings season and easing fears around Chinese equities, partly due to the real estate sector, propelled the equity market rally in October. Still, supply-chain disruptions, input cost pressures and tight labor markets were highlighted in many companies’ earnings reports. As the fourth quarter of 2021 progressed, persistently high inflation weighed on market sentiment. Then, the announcement by U.S. Federal Reserve (“Fed”) Chair Powell of the potential for interest rates to climb sooner than previously thought led to a sell-off. The U.S. equity markets broadly bounced back in December as some of these fears subsided. Despite record COVID-19 cases across the globe, studies showed the Delta variant was accompanied by milder symptoms compared to previous variants. Also, the Fed announced in December it would accelerate its pace of tapering and might increase interest rates three times in 2022. Consumer confidence and some other inflation indicators showed signs of improvement. For the fourth quarter of 2021 overall, the U.S. real estate securities market outperformed the broader U.S. equity market. |

| | | During the first quarter of 2022, the U.S. real estate securities market continued to outperform the broader U.S. equity market even as the quarter was marked by widespread volatility and low equity returns. In the initial part of the quarter, equity prices were weighed upon by global concerns around rising inflationary pressures and subsequent planned interest rate hikes by the Fed. The accompanying rise in bond yields and valuation concerns also remained prevalent, hurting riskier assets in the market. However, as the quarter progressed, market focus shifted to the hostilities developing |

1

PORTFOLIO RESULTS

| | at the Russia/Ukraine border. The actual invasion of Ukraine by Russia in late February caused a market rout. Major countries around the world took a public stance condemning Russia’s actions and imposed various economic sanctions. Such sanctions boosted crude oil prices, with several countries taking the opportunity to expedite goals to shift to renewable energy sources. Driven by the increased market volatility, the Fed signaled a slower than previously anticipated pace of monetary policy tightening while retaining a cautionary focus on rising inflation. Hopes around the success of diplomatic talks between Russia and Ukraine led to some market recovery toward the end of the quarter. |

| | | The U.S. real estate securities market posted negative returns in the second quarter of 2022 but continued to outperform the broader U.S. equity market. In general, U.S. equity markets continued to be volatile and under pressure from macroeconomic headwinds, including inflationary pressures and interest rate hikes, along with the ongoing spread of COVID-19 in China. The Fed raised interest rates in both May and June 2022, the latter of which represented the biggest single interest rate increase since 1994. At the same time, the Fed reiterated its belief in the resilience of the U.S. economy, a view bolstered by better than consensus expected U.S. non-farm payroll data. On the other hand, inflation levels rose. All told, increasing monetary pressures, declining corporate earnings growth and falling industrial production together increased investor concerns around a potential global economic slowdown. |

| | | In the third quarter of 2022, the U.S. real estate securities market significantly underperformed the broader U.S. equity market. Investor sentiment generally turned negative, driven by the rampant spread of COVID-19 in China, U.S.-China-Taiwan tensions and Fed Chair Powell’s speech at Jackson Hole. Corporate earnings for the second quarter of 2022 proved stronger than consensus expected at the aggregate level, fueling a short-lived market rally early in July. However, investor concerns around the progression of earnings and the bottom-line impact of rising prices and persistent inflation remained high. U.S. non-farm payrolls continued to be on the uptick, which along with the release of inflation data, stoked market expectations around the peaking of inflation. However, Fed Chair Powell’s remarks in August extinguished these hopes. Further, U.S. House Speaker Pelosi’s visit to Taiwan gave birth to new geopolitical tensions. |

| | | Amid this backdrop, private real estate values remained strong during the Reporting Period, but public real estate fundamentals softened. More specifically, public real estate, including real estate investment trusts (“REITs”), were priced by the end of the Reporting Period at a substantial discount to their private counterparts, a dispersion that has historically led to strong subsequent outperformance for public REITs. This valuation disconnect between public and private real estate was seen among virtually all property types, providing, in our view, an unprecedented opportunity to gain exposure to property types tied to secular growth at notable discounts. For example, at the end of the Reporting Period, investors could buy multi-family rental properties at a 20% discount to private market values, a discount that has happened only 2% of the time relative to history.* |

| | | For the Reporting Period overall, self-storage was the best performing property type. Self-storage properties generally reported strong second quarter 2022 earnings and raised their full-year earnings guidance. The strong performance was primarily driven by appreciation in storage operating fundamentals, as occupancies and pricing power remained at strong levels. Demand, fueled by COVID-19-related drivers and a strong housing market, came up against supply that was leveling off. Triple-net was the only other property type to post positive absolute returns during the Reporting Period. As costs passed to the tenant, retailers were able to pass higher input costs on to customers. Conversely, office and technology were the worst performing property types during the Reporting Period. Overall office leasing volume accelerated but still trailed 2019 levels amid a tougher economy. Also, the office sub-sector is on the “wrong” side of work-from-home trends, facing not only significant demand challenges but also supply challenges given higher construction costs. The technology sub-sector performed poorly largely due to its growth tilt. However, data centers, which are a component of the technology sub-sector, experienced unprecedented global demand as well as vacancies near all-time lows. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Private equity investments contributed most positively to the Fund’s performance during the Reporting Period and also dampened portfolio volatility. Private real estate outperformed public real estate during the Reporting Period. That said, within the public equity sleeve of the Fund, exposure to hotel equities contributed to returns most. Hotels |

| | * | | Source: Goldman Sachs Asset Management, Greenstreet Advisors. As of July 26, 2022. Note: The number of percentile occurrence is the frequency of premium the property type is below or equal to the July 26, 2022 premium to asset data during the time period of April 1, 1997 to July 26, 2022. For illustrative purposes only. |

2

PORTFOLIO RESULTS

| | are relatively insulated from inflation, as they are able to pass through inflation costs to customers. Hotels are also among those property types that have benefited from the secular trend toward experiences over things. |

| | | Mortgage REITs detracted the most from the Fund’s performance during the Reporting Period. Mortgage REITs’ weak performance was driven by interest rate increases, which, in turn, led to volatility in capital markets as well as concerns about a potential recession. However, at the end of the Reporting Period, we believed we were still able to find attractive investment opportunities among mortgage REITs and maintained an allocation to these securities. |

| | | Real estate preferred stocks performed approximately in line with the broader REIT market during the Reporting Period, facing the same interest rate and inflation concerns, and thus had a rather neutral effect on Fund performance during the Reporting Period. However, with the goal of providing investors a level of investment stability and yield sustainability, preferred stocks continued to play an important role in the portfolio, providing comparatively higher yields and lower volatility, and thus helping the portfolio management team deliver on the Fund’s investment objective. |

| Q | | What were some of the Fund’s best-performing individual holdings during the Reporting Period? |

| A | | The top individual contributors to the Fund’s performance during the Reporting Period were Prologis Targeted U.S. Logistics Holdings II, LP; Carlyle Property Investors, LP; and Oaktree Real Estate Income Fund. |

| | | Prologis Targeted US Logistics Holdings II, LP is a private equity fund that seeks to provide attractive current income with long-term capital growth by investing in and operating logistics real estate assets in key markets in the U.S. The fund targets core stabilized assets where there may also be an opportunity to enhance returns by actively managing, repositioning and renovating the assets. During the Reporting Period, the fund’s strong performance was driven by its portfolio’s allocation to high density coastal industrial markets. The portfolio gained occupancy and was more than 97% occupied at the end of the Reporting Period. Market rent growth was the largest driver of valuation gains, as robust demand for logistics space, combined with constrained supply in the fund’s target market, led to strong net operating income growth. Further, its tenant retention was strong, at 62.6% of rolling leases re-signed at net rents 51.7% above in-place rents. |

| | | Carlyle Property Investors, L.P. is a private equity fund, whose focus on demographically-driven sub-sectors contributed to its strong performance during the Reporting Period. The fund actively increased its holdings in manufactured housing and single-family rentals, becoming the two largest sub-sector exposures in the fund, both of which experienced double-digit rent/net operating income growth during the Reporting Period. Medical offices and industrial were also high conviction sectors for the fund, both of which experienced strong growth during the Reporting Period as well. |

| | | Oaktree Real Estate Income Fund is a public real estate mutual fund, wherein multi-family properties represent approximately two-thirds of its portfolio and industrial properties represent about one-fifth of its portfolio. Rent growth in both property types was significantly in excess of inflation during the Reporting Period. Its rent growth was especially strong in supply-constrained coastal markets. |

| Q | | Which positions detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | The positions that detracted most from the Fund’s performance during the Reporting Period were TPG Real Estate Finance Trust, Inc; Apollo Commercial Real Estate Finance, Inc.; and Angel Oak Mortgage, Inc. Each is a mortgage REIT, which overall suffered as the Fed increased interest rates. Concerns about a potential recession also weighed on mortgage REITs during the Reporting Period. However, at the end of the Reporting Period, we considered each of these three stocks to be undervalued and continued to like them as long-term prospects. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund used equity index options, written options and purchased options to gain short-term broad-based exposure to the publicly-traded real estate market as well as to hedge potential near-term downside in the portfolio. The use of these derivatives had a neutral effect on the Fund’s results during the Reporting Period. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, we sold the Fund’s position in Prologis Targeted U.S. Logistics Holdings II, L.P., mentioned earlier, and established a position in Prologis, Inc. We sold the Fund’s position in the private equity fund at a premium to net asset value in the secondary market to reallocate capital to |

3

PORTFOLIO RESULTS

| | publicly-listed lab office, industrial and mortgage REITs as we sought to take advantage of the private/public price dislocation that existed during the Reporting Period. Among these purchases was Prologis, Inc., a global leader in logistics. We are favorable on the logistics industry and believe concerns around Amazon.com on this front were overstated. |

| | | We initiated a Fund position in Extra Space Storage, Inc., a self-storage facility REIT, which performed well during the Reporting Period, as self-storage was seen by investors as a defensive sub-sector that has the potential to outperform in down equity markets. We are constructive on the company given its strong occupancy levels as well as its strong same-store net operating income growth. We are also favorable on the self-storage sub-sector broadly, as it historically is rather recession resilient with high operating margins and low capital expenditure requirements. |

| | | We eliminated the Fund’s position in Ares US Real Estate Fund IX, LP, a private equity closed-end fund managed by Ares Real Estate with diversified exposure in the office, industrial and multi-family sub-sectors. The Fund received capital from its investment in the closed-end fund. |

| Q | | Were there any changes made in the Fund’s investment strategy during the Reporting Period? |

| A | | Early in the Reporting Period, we increased the Fund’s allocation to public real estate securities, primarily mortgage REITs given what we considered to be their attractive yield and valuations and given they were trading at discounts to their book value. We trimmed the Fund’s exposure to the multi-family sub-sector and incrementally added to then-recent underperformers such as towers and hotel REITs. We adjusted the Fund’s positioning within the data centers sub-sector. |

| | | During the first quarter of 2022, we added to the Fund’s private holdings in industrial, multi-family and student housing names as we sought to take advantage of what we saw as their strong long-term fundamentals. We increased listed credit positions to seek to take advantage of arbitrage opportunities, as floating rate residential and commercial exposures were trading at significant discounts to book values. We trimmed the Fund’s positions in select listed names where we felt the risk/reward scenario had become less favorable. |

| | | We redeemed the Fund’s largest private office exposure during the second quarter of 2022 and sold a private industrial position at a premium to net asset value. We also trimmed select listed names that had had strong performance, especially in the lab office, self-storage, multi-family and tower sub-sectors, and added exposure to credit names where we believed the risk/reward opportunity to be favorable. |

| | | In the third quarter of 2022, we used proceeds from asset raising to pay off borrowings that were taken out during periods of market weakness. On the listed side, we trimmed a triple-net lease hotel name after strong appreciation and put those proceeds into an industrial name trading at a significant discount to net asset value. We reduced the Fund’s private industrial exposure through the sale of a portion of Prologis Targeted U.S. Logistics Holdings II, L.P. at a premium to its second quarter 2022 net asset value. The capital from this redemption was reinvested into a number of listed lab office, industrial and mortgage REITs. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | Effective August 3, 2022, Collin Bell no longer served as a portfolio manager for the Fund. Effective at the close of business on August 17, 2022, Alicia Li no longer served as a portfolio manager for the Fund, and Abhinav Zutshi and John Papadoulias began serving as portfolio managers for the Fund. Mr. Zutshi, vice president on the Fundamental Equity team, joined Goldman Sachs Asset Management in 2009 and has worked with existing portfolio managers Kristin Kuney and Timothy Ryan on the firm’s liquid real assets strategies for more than 10 years. Mr. Papadoulias, vice president on the Real Estate Investment team within the Alternative Investments & Manager Selection group, joined Goldman Sachs Asset Management in April 2019 and has 16 years of industry experience, most recently as a partner at Rocaton Investment Advisors. At the end of the Reporting Period, the Fund was managed by Timothy Ryan, Kristin Kuney, Sean Brenan, Abhinav Zutshi and John Papadoulias. By design, all investment decisions for the Fund are performed within a co-lead or team structure, with multiple subject matter experts. This strategic decision making has been a cornerstone of our approach and helps to ensure continuity in the Fund. |

| Q | | How was the Fund positioned at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund was invested with approximately 49.0% of its total net assets in private equity, approximately 26.1% of its total net assets in public equity, approximately 11.3% of its total net assets in private credit, approximately 7.7% of its total net assets in public |

4

PORTFOLIO RESULTS

| | credit, approximately 4.0% of its total net assets in preferred securities and approximately 1.9% of its total net assets in cash and cash equivalents. |

| | | Approximately three-fourths of Fund assets was invested in equities representing property types that we believe benefit from strong demographic tailwinds or revenues protected by long-term lease obligations. Approximately one-fourth of assets was invested in credit instruments diversified across property types and focused on seeking relatively consistent and reliable streams of cash flows and low loan-to-value ratios. (Loan-to-value (“LTV”) ratio equals the mortgage amount divided by the purchase price or appraised property value. The LTV ratio is one way lenders and financial institutions can assess lending risk before approving a mortgage. Generally, loans that have high LTV ratios are considered more risky and as a result carry higher interest rates — and vice versa.) Even though higher on the capital structure, we believed the Fund’s credit sleeve could generate equity-like returns with lower volatility. The private portion of the Fund was diversified at the end of the Reporting Period across institutional General Partners and strategies. |

| | | Within the Fund’s equity sleeve, approximately 19.8% of assets was invested in the industrial sub-sector, 17.4% in the multi-family sub-sector, 7.4% in the self-storage sub-sector, 4.9% in the office sub-sector, 4.8% in the manufactured housing sub-sector, 4.7% in the student housing sub-sector, 4.1% in the single family rental sub-sector and the remainder across the lab office, lodging, data center, retail, senior housing, medical office buildings and towers sub-sectors. |

| Q | | How did the Fund use leverage during the Reporting Period? |

| A | | Each line of credit established by the Fund under our management is a bilateral, fully committed, revolving credit facility. The Fund used leverage during the Reporting Period as a short-term cash flow management tool to reallocate capital from its private portfolio and reinvest it into its public portfolio to exploit the current market dislocation between private and public real estate. During the Reporting Period, the Fund did not use leverage habitually, meaning the Fund did not maintain a balance on any credit facility on a recurring basis. The intent of the credit agreements maintained by the Fund was primarily for short term cash flow management, typically utilized during quarterly repurchase periods. The secondary purpose was to exploit what we saw as attractive valuation opportunities in the public market when other sources of capital were not immediately available. This allowed the Fund to reallocate capital from its private portfolio and reinvest it into its public portfolio to exploit market dislocations between private and public real estate. Using leverage in this way enable quick market entry to ensure those opportunities were not otherwise missed. |

| | | On April 1, 2022, the Fund entered into an amendment (the “Amendment”) to its margin loan agreement by and between the Fund and the Bank of Nova Scotia that had established a revolving credit facility with a commitment of up to $35 million. The Amendment increased the commitment under the revolving credit facility to $75 million. (A revolving credit facility is a line of credit arranged between a bank and a business. It comes with an established maximum amount, and the business can access the funds at any time when needed.) |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, we maintained a constructive view ahead for the real estate sector. First, we believed the sector was offering relatively attractive yield potential, with a large portion of those yields considered return of capital. Second, unlike bonds, we believed real estate was offering defensive cash flow growth potential given long-term leases and largely secular growth drivers, such as digitization, e-commerce, biotech innovation and aging demographics. Third, unlike bonds, real estate may benefit from inflation, in our view. Some leases are linked to inflation and, if not, can typically be re-set in line with inflation. Further, incumbent asset values tend to increase as it becomes more difficult to develop new ones given increasing land, labor and material costs. Finally, we believed the real estate sector was attractively valued at the end of the Reporting Period compared to both bonds and equities. |

| | | Within the equity portion of the Fund, we believed several sub-sectors may be beneficiaries of secular growth drivers, including innovation, the desire for experiences over things and demographic shifts. For instance, within the innovation driver, we believed towers and digital storage may be the beneficiary of digitization; logistics and cold storage the beneficiary of e-commerce and e-grocery; life science offices the beneficiary of biotech advances; and studio offices the beneficiary of content creation. Within the experiences over things driver, leisure hotels may be the beneficiary of increased travel. Casinos, manufactured housing, recreational vehicle parks and marinas may be the beneficiary of increased leisure. Health care real estate may be the |

5

PORTFOLIO RESULTS

| | beneficiary of an aging population. Among demographic shifts, select multi-family properties may be the beneficiary of a movement from high tax to low tax states. Single-family rentals may be the beneficiary of a move from urban to suburban locales. Self-storage may be the beneficiary of increased transiency. |

| | | Within the credit sleeve of the Fund, we believed real estate offers attractive current yields, providing the potential for equity-like returns with lower risk, given their more senior position in the capital stack. We further believed real estate credit offers a hedge against rising interest rates. The commercial loans the Fund owns are floating rate and therefore may benefit from an increase in interest rates. Additionally, real estate credit, in our view, offers low loan-to-value ratios, creating a significant buffer to withstand volatility. Finally, we felt real estate credit offers attractive valuations in the public market, with a number of publicly-treaded mortgage REITs trading at significant discounts to loan value at the end of the Reporting Period. |

| | | All that said, given the fluid backdrop and accelerated disruption trends resulting in a wide dispersion of returns within the real estate sector, we maintained our view that the best way to manage the Fund going forward is via a highly active approach — one that requires casting a wide net across both private and public real estate investments and across equity and credit asset classes — to best take advantage of the opportunities in the full real estate investment universe. We also maintained our belief that an integrated approach can help garner the complementary aspects of public and private markets, specifically the ability to gain both more diversified and complementary property type exposures and exploit short-term pricing dislocations between public and private real estate. |

| | | As we move forward, we intend to maintain our active and integrated approach that aims to balance the need for attractive income and capital appreciation with low to moderate volatility relative to equity and public real estate markets by investing primarily in income-producing real estate equity and debt securities. Through this actively managed closed-end interval Fund, we will continue seeking to provide access to both private and public real estate diversified across property types, geography and asset class (equity and debt). |

| | | Sector, sub-sector and property type designations throughout this shareholder report are defined by Goldman Sachs Asset Management. |

6

FUND BASICS

Real Estate Diversified Income Fund

as of September 30, 2022

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 9/30/221 |

| | | |

| | | Holding | | % of Net Assets | | | Asset Class |

| | Oaktree Global Credito FIC FIM | | | 8.2 | % | | Private REIT & Private Investment Funds |

| | TA Realty Core Property Fund, LP | | | 7.4 | % | | Private REIT & Private Investment Funds |

| | RealTerm Logistics Income Fund | | | 4.6 | % | | Private REIT & Private Investment Funds |

| | CBRE U.S. Core Partners, LP | | | 4.6 | % | | Private REIT & Private Investment Funds |

| | Carlyle Property Investors, LP | | | 4.3 | % | | Private REIT & Private Investment Funds |

| | Public Storage | | | 4.1 | % | | Real Estate Investment Trust (REIT) |

| | Greystar Student Housing Growth and Income Fund | | | 3.9 | % | | Private REIT & Private Investment Funds |

| | Equity LifeStyle Properties, Inc. | | | 3.7 | % | | Real Estate Investment Trust (REIT) |

| | Prologis, Inc. | | | 3.6 | % | | Real Estate Investment Trust (REIT) |

| | | Harrison Street Core Property Fund, LP | | | 3.1 | % | | Private REIT & Private Investment Funds |

| 1 | | The top 10 holdings may not be representative of the Fund’s future investments. |

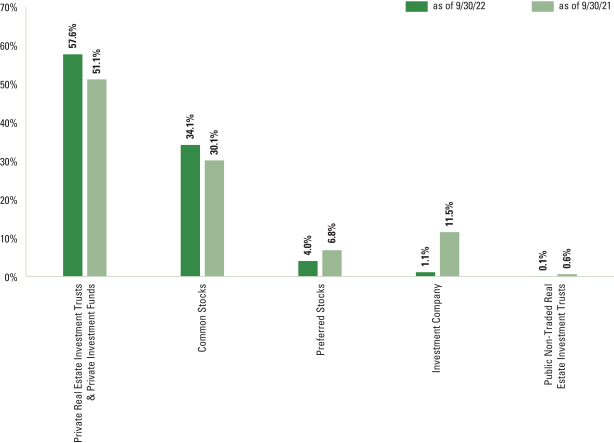

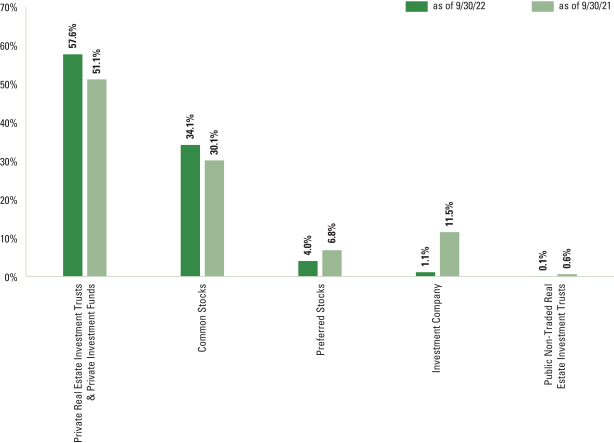

| 2 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall allocations may differ from percentages contained in the graph above. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

7

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Performance Summary

September 30, 2022

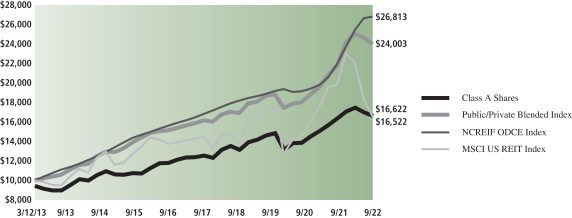

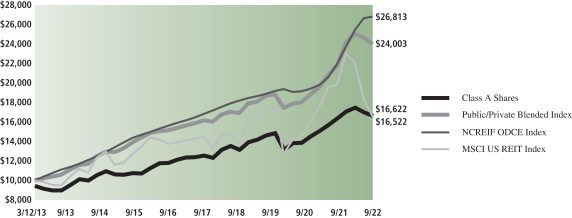

The following graph shows the value, as of September 30, 2022, of a $10,000 investment made on March 12, 2013 in Class A Shares at NAV (with a maximum sales charge of 5.75%). For comparative purposes, the performance of a private/public blended Index (70% NCREIF ODCE Index & 30% MSCI US REIT Index, with dividends reinvested), is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| | |

| Real Estate Diversified Income Fund’s Lifetime Performance | | |

Performance of a $10,000 Investment, including any applicable sales charges, with distributions reinvested, from March 12, 2013 through September 30, 2022.

| | | | | | | | | | |

| Average Annual Total Return through September 30, 2022*,** | | | One Year | | | | Five Years | | | Since Inception |

Class A (Commenced March 12, 2013) | | | | | | | | | | |

Excluding sales charges | | | 1.43% | | | | 6.03% | | | 6.26% |

Including sales charges | | | -4.90% | | | | 4.78% | | | 5.60% |

|

Class C (Commenced August 1, 2014) | | | | | | | | | | |

Excluding sales charges | | | 0.67% | | | | 5.23% | | | 5.49% |

Including sales charges | | | -0.33% | | | | 5.23% | | | 5.49% |

|

Class l (Commenced August 1, 2014) | | | 1.70% | | | | 6.29% | | | 6.24% |

|

Class L (Commenced July 10, 2017) | | | | | | | | | | |

Excluding sales charges | | | 1.17% | | | | 5.76% | | | 5.65% |

Including sales charges | | | -3.09% | | | | 4.84% | | | 4.78% |

|

Class W (Commenced November 21, 2014) | | | 1.40% | | | | 6.03% | | | 6.03% |

|

Class P (Commenced June 29, 2021) | | | 1.79% | | | | N/A | | | 4.90% |

|

| * | | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.75% for Class A and 4.25% for Class L and the assumed contingent deferred sales charge for C Shares (1% if repurchased within 12 months of purchase). Because Class I, Class W and Class P Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

| ** | | After the close of business on May 15, 2020, the Resource Real Estate Diversified Income Fund (the “Predecessor Fund”) was reorganized into the Fund. The Fund has assumed the historical performance of the Predecessor Fund, which was managed by another investment adviser. Therefore, the performance information reported above for the Fund is the combined performance of the Fund and the Predecessor Fund. The performance information shown in this report for periods through May 15, 2020 reflects the performance of the Predecessor Fund. As a result, the Fund’s performance may differ substantially from what is shown for periods through May 15, 2020. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

8

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Schedule of Investments

September 30, 2022

| | | | | | | | |

| | | | Description | |

Value | |

| | | | | | | | |

| |

| | | | Private Real Estate Investment Trusts & Private Investment

Funds – 57.6%(a) | |

| | | | Ares Real Estate Enhanced Income Fund, LP | | $ | 7,123,664 | |

| | | | Ares US Real Estate Fund IX, LP | | | 6,548,749 | |

| | | | Bain Capital Real Estate Fund I-B, LP | | | 7,657,376 | |

| | | | Brookfield Premier Real Estate Partners, LP | | | 7,265,828 | |

| | | | Brookfield Real Estate Finance Fund V, LP | | | 10,030,939 | |

| | | | Carlyle Property Investors, LP | | | 24,728,755 | |

| | | | CBRE U.S. Core Partners, LP | | | 26,534,832 | |

| | | | Clarion Partners Debt Investment Fund, LP | | | 6,766,437 | |

| | | | Clarion Ventures 4, LP | | | 4,760,823 | |

| | | | Greystar Student Housing Growth and Income Fund | | | 22,504,429 | |

| | | | Harrison Street Core Property Fund, LP | | | 17,756,189 | |

| | | | Heitman Core Real Estate Debt Income Trust, LP | | | 16,569,726 | |

| | | | Manulife US REIT | | | 12,498,455 | |

| | | | Nuveen U.S. Core-Plus Real Estate Debt Fund, LP | | | 10,353,101 | |

| | | | Oaktree Global Credito FIC FIM | | | 47,456,126 | |

| | | | Prologis Targeted U.S. Logistics Holdings II, LP | | | 4,744,811 | |

| | | | RealTerm Logistics Income Fund | | | 26,782,772 | |

| | | | Sculptor Real Estate Credit Fund, LP | | | 9,786,665 | |

| | | | Sentinel Real Estate Fund | | | 9,631,614 | |

| | | | TA Realty Core Property Fund, LP | | | 42,923,639 | |

| | | | The Trumbull Property Fund, LP | | | 5,583,601 | |

| | | | Truman 2016 SC5, LLC | | | 146,128 | |

| | | | Voya Commercial Mortgage Lending Fund, LP | | | 5,441,843 | |

| | | | | |

| TOTAL PRIVATE REAL ESTATE INVESTMENT TRUSTS &

PRIVATE INVESTMENT FUNDS |

|

| | (Cost $305,986,904) | | $ | 333,596,502 | |

| | | | | |

| | | | | | | | |

| Shares | | | Description | | Value | |

|

| Common Stocks – 34.1% | |

| Equity Real Estate Investment Trusts (REITs) – 26.3% | |

| | 61,962 | | | Alexandria Real Estate Equities, Inc. REIT | | $ | 8,686,453 | |

| | 135,191 | | | American Homes 4 Rent, Class A REIT | | | 4,435,616 | |

| | 13,657 | | | American Tower Corp. REIT | | | 2,932,158 | |

| | 233,330 | | | Americold Realty Trust, Inc. REIT | | | 5,739,918 | |

| | 111,777 | | | Digital Realty Trust, Inc. REIT | | | 11,086,043 | |

| | 342,118 | | | Equity LifeStyle Properties, Inc. REIT | | | 21,498,695 | |

| | 38,813 | | | Essex Property Trust, Inc. REIT | | | 9,401,673 | |

| | 86,411 | | | Extra Space Storage, Inc. REIT | | | 14,924,044 | |

| | 403,334 | | | Invitation Homes, Inc. REIT | | | 13,620,589 | |

| | 205,046 | | | Prologis, Inc. REIT | | | 20,832,673 | |

| | 80,374 | | | Public Storage REIT | | | 23,534,311 | |

| | 115,724 | | | Ryman Hospitality Properties, Inc. REIT | | | 8,516,129 | |

| | 6,092 | | | SBA Communications Corp. REIT | | | 1,734,088 | |

| | 182,454 | | | VICI Properties, Inc. REIT | | | 5,446,252 | |

| | | | | | | | |

| | | | | | | 152,388,642 | |

| | |

| Mortgage Real Estate Investment Trusts (REITs) – 7.8% | |

| | 667,262 | | | Angel Oak Mortgage, Inc. REIT | | | 7,993,799 | |

| | 724,584 | | | Apollo Commercial Real Estate Finance, Inc. REIT | | | 6,014,047 | |

| | 75,000 | | | Ares Commercial Real Estate Corp. REIT | | | 783,750 | |

| | |

|

| Common Stocks – (continued) | |

| Mortgage Real Estate Investment Trusts (REITs) – (continued) | |

| | 65,604 | | | Blackstone Mortgage Trust, Inc., Class A REIT | | | 1,531,197 | |

| | 174,446 | | | KKR Real Estate Finance Trust, Inc. REIT | | | 2,834,748 | |

| | 723,717 | | | Ladder Capital Corp. REIT | | | 6,484,504 | |

| | 364,531 | | | PennyMac Mortgage Investment Trust REIT | | | 4,294,175 | |

| | 995,969 | | | Redwood Trust, Inc. REIT | | | 5,716,862 | |

| | 284,911 | | | Starwood Property Trust, Inc. REIT | | | 5,191,079 | |

| | 580,966 | | | TPG RE Finance Trust, Inc. REIT | | | 4,066,762 | |

| | | | | | | | |

| | | | | | | 44,910,923 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $226,054,305) | | $ | 197,299,565 | |

| | |

| | | | | | | | | | | | |

| Shares | | | Description | | Dividend

Rate | | | Value | |

|

| Preferred Stocks – 4.0% | |

| Equity Real Estate Investment Trusts (REITs) – 0.0% | |

| | 10,015 | | | PS Business Parks, Inc., Series Z | | | 4.88 | % | | $ | 136,705 | |

| | 5,743 | | | PS Business Parks, Inc., Series Y | | | 5.20 | | | | 85,283 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 221,988 | |

| | |

| Mortgage Real Estate Investment Trusts (REITs) – 2.1% | |

| | 72,971 | | | Annaly Capital Management, Inc., Series F | | | 8.67 | | | | 1,738,899 | |

| | 77,545 | | | MFA Financial, Inc., Series C | | | 6.50 | | | | 1,370,996 | |

| | 73,444 | | | PennyMac Mortgage Investment Trust, Series B | | | 8.00 | | | | 1,402,780 | |

| | 70,804 | | | PennyMac Mortgage Investment Trust, Series A | | | 8.13 | | | | 1,362,977 | |

| | 76,398 | | | Rithm Capital Corp., Series B | | | 7.13 | | | | 1,442,394 | |

| | 69,110 | | | Rithm Capital Corp., Series A | | | 7.50 | | | | 1,329,676 | |

| | 73,559 | | | Two Harbors Investment Corp., Series B | | | 7.63 | | | | 1,297,581 | |

| | 128,562 | | | Two Harbors Investment Corp., Series A | | | 8.13 | | | | 2,314,116 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 12,259,419 | |

| | |

| Real Estate Management & Development – 1.9% | |

| | 200,776 | | | DigitalBridge Group, Inc., Series J | | | 7.13 | | | | 4,549,584 | |

| | 147,147 | | | DigitalBridge Group, Inc., Series H | | | 7.13 | | | | 3,300,508 | |

| | 130,381 | | | DigitalBridge Group, Inc., Series I | | | 7.15 | | | | 2,915,319 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,765,411 | |

| | |

| | TOTAL PREFERRED STOCKS | |

| | (Cost $27,220,723) | | | $ | 23,246,818 | |

| | |

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 9 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Schedule of Investments (continued)

September 30, 2022

| | | | | | | | |

| Shares | | | Description | | Value | |

|

| Public Non-Traded Real Estate Investment Trusts – 0.1%(a)(b) | |

| | 168,566 | | | NorthStar Healthcare Income, Inc. | | | | |

| | (Cost $1,592,486) | | $ | 488,598 | |

| | |

| | | | | | | | |

| Shares | | Dividend

Rate | | | Value | |

|

| Investment Company – 1.1%(c) | |

Goldman Sachs Financial Square Government Fund – Institutional Shares | |

6,603,112 | | | 2.911 | % | | $ | 6,603,112 | |

| (Cost $6,603,112) | |

| |

| TOTAL INVESTMENTS – 96.9% | |

| (Cost $567,457,530) | | | $ | 561,234,595 | |

| |

| OTHER ASSETS IN EXCESS OF LIABILITIES – 3.1% | | | | 17,794,616 | |

| |

| NET ASSETS – 100.0% | | | $ | 579,029,211 | |

| |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

(a) | | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on sale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered and the registration statement is effective. Disposal of these securities may involve time consuming negotiations and prompt sale at an acceptable price may be difficult. Total market value of restricted securities amounts to $334,085,100, which represents approximately 57.7% of net assets as of September 30, 2022. See additional details below: |

| | | | | | | | | | |

| | | Security | | Date(s) of

Purchase | | | Cost | |

| | Ares Real Estate Enhanced Income Fund, LP | | | 10/31/19-08/09/22 | | | $ | 7,253,293 | |

| | Ares US Real Estate Fund IX, LP | | | 09/19/19-12/01/21 | | | | 6,450,742 | |

| | Bain Capital Real Estate Fund I-B, LP | | | 12/18/19-12/09/21 | | | | 4,441,057 | |

| | Brookfield Premier Real Estate Partners, LP | | | 10/01/19-12/20/21 | | | | 5,227,076 | |

| | Brookfield Real Estate Finance Fund V, LP | | | 10/03/19-06/23/22 | | | | 11,068,189 | |

| | Carlyle Property Investors, LP | | | 10/01/19-09/28/22 | | | | 17,606,511 | |

| | CBRE U.S. Core Partners, LP | | | 03/30/22-07/20/22 | | | | 25,243,060 | |

| | Clarion Partners Debt Investment Fund, LP | | | 02/14/17-08/01/22 | | | | 6,264,185 | |

| | Clarion Ventures 4, LP | | | 07/01/16-07/10/19 | | | | 8,321,568 | |

| | Greystar Student Housing Growth and Income Fund | | | 01/04/22-09/15/22 | | | | 20,341,572 | |

| | Harrison Street Core Property Fund, LP | | | 09/15/21-08/02/22 | | | | 17,500,000 | |

| | Heitman Core Real Estate Debt Income Trust, LP | | | 07/27/17-11/13/17 | | | | 16,702,937 | |

| | Manulife US REIT | | | 04/08/22-07/25/22 | | | | 12,576,039 | |

| | NorthStar Healthcare Income, Inc. | | | 11/27/13-03/12/15 | | | $ | 1,592,486 | |

| | Nuveen U.S. Core-Plus Real Estate Debt Fund, LP | | | 10/01/19-07/22/22 | | | | 10,158,039 | |

| | Oaktree Global Credito FIC FIM | | | 10/07/21-07/29/22 | | | | 40,000,000 | |

| | Prologis Targeted U.S. Logistics Holdings II, LP | | | 01/03/20-08/16/22 | | | | 2,233,562 | |

| | RealTerm Logistics Income Fund | | | 04/18/22-09/30/22 | | | | 25,256,903 | |

| | Sculptor Real Estate Credit Fund, LP | | | 01/21/20-08/02/22 | | | | 10,048,684 | |

| | Sentinel Real Estate Fund | | | 05/04/22-08/22/22 | | | | 8,970,122 | |

| | TA Realty Core Property Fund, LP | | | 01/04/22-08/08/22 | | | | 39,902,674 | |

| | The Trumbull Property Fund, LP | | | 01/04/16-10/01/18 | | | | 4,986,192 | |

| | Truman 2016 SC5, LLC | | | 10/21/19 | | | | — | |

| | Voya Commercial Mortgage Lending Fund, LP | | | 10/11/19-08/09/22 | | | | 5,434,499 | |

| | Total | | | | | | $ | 307,579,390 | |

| | |

| |

(b) | | Significant unobservable inputs were used in the valuation of this portfolio security; i.e. Level 3. |

| |

(c) | | Represents an affiliated issuer. |

| | |

|

Investment Abbreviations: |

LP | | —Limited Partnership |

REIT | | —Real Estate Investment Trust |

|

| | |

| 10 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

|

| ADDITIONAL INVESTMENT INFORMATION |

Additional information on investments in private real estate investment funds:

| | | | | | | | | | | | | | | | |

| Security | | Value | | | Redemption

Frequency | | | Redemption

Notice

(Days) | | | Unfunded

Commitments

as of

September 30,

2022 | |

| | | | |

Ares Real Estate Enhanced Income Fund, LP | | $ | 7,123,664 | | | | Quarterly | | | | 90 | | | $ | 9,891,427 | |

| | | | |

Ares US Real Estate Fund IX, LP | | | 6,548,749 | | | | N/R | | | | N/R | | | | 1,363,069 | |

| | | | |

Bain Capital Real Estate Fund I-B, LP | | | 7,657,376 | | | | N/R | | | | N/R | | | | 4,413,827 | |

| | | | |

Brookfield Premier Real Estate Partners, LP | | | 7,265,828 | | | | Quarterly | | | | 90 | | | | — | |

| | | | |

Brookfield Real Estate Finance Fund V, LP | | | 10,030,939 | | | | N/R | | �� | | N/R | | | | 9,873,715 | |

| | | | |

Carlyle Property Investors, LP | | | 24,728,755 | | | | Quarterly | | | | 90 | | | | — | |

| | | | |

CBRE U.S. Core Partners, LP | | | 26,534,832 | | | | Quarterly | | | | 60 | | | | — | |

| | | | |

Clarion Partners Debt Investment Fund, LP | | | 6,766,437 | | | | N/R | | | | N/R | | | | 5,953,491 | |

| | | | |

Clarion Ventures 4, LP | | | 4,760,823 | | | | N/R | | | | N/R | | | | 963,242 | |

| | | | |

Greystar Student Housing Growth and Income Fund | | | 22,504,429 | | | | Quarterly | | | | 90 | | | | — | |

| | | | |

Harrison Street Core Property Fund, LP | | | 17,756,189 | | | | Quarterly | | | | 45 | | | | — | |

| | | | |

Heitman Core Real Estate Debt Income Trust, LP | | | 16,569,726 | | | | Quarterly | | | | 90 | | | | — | |

| | | | |

Manulife US REIT | | | 12,498,455 | | | | Quarterly | | | | 60 | | | | — | |

| | | | |

NorthStar Healthcare Income, Inc. | | | 488,598 | | | | N/R | | | | N/R | | | | — | |

| | | | |

Nuveen U.S. Core-Plus Real Estate Debt Fund, LP | | | 10,353,101 | | | | Quarterly | | | | 45 | | | | — | |

| | | | |

Oaktree Global Credito FIC FIM | | | 47,456,126 | | | | N/R | | | | N/R | | | | — | |

| | | | |

Prologis Targeted U.S. Logistics Holdings II, LP | | | 4,744,811 | | | | Quarterly | | | | 90 | | | | 10,000,000 | |

| | | | |

RealTerm Logistics Income Fund | | | 26,782,772 | | | | Quarterly | | | | 90 | | | | — | |

| | | | |

Sculptor Real Estate Credit Fund, LP | | | 9,786,665 | | | | N/R | | | | N/R | | | | 5,007,285 | |

| | | | |

Sentinel Real Estate Fund | | | 9,631,614 | | | | Quarterly | | | | 90 | | | | 16,029,878 | |

| | | | |

TA Realty Core Property Fund, LP | | | 42,923,639 | | | | Quarterly | | | | 45 | | | | — | |

| | | | |

The Trumbull Property Fund, LP | | | 5,583,601 | | | | Quarterly | | | | 60 | | | | — | |

| | | | |

Truman 2016 SC5, LLC | | | 146,128 | | | | N/R | | | | N/R | | | | — | |

Voya Commercial Mortgage Lending Fund, LP | | | 5,441,843 | | | | Quarterly | | | | 90 | | | | — | |

N/R – Not Redeemable

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 11 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Statement of Assets and Liabilities

September 30, 2022

| | | | | | |

| | | | | Real Estate

Diversified

Income Fund(a) | |

| | Assets: | |

| | Investments in unaffiliated issuers, at value (cost $560,854,418) | | $ | 554,631,483 | |

| | Investments in affiliated issuers, at value (cost $6,603,112) | | | 6,603,112 | |

| | Receivables: | | | | |

| | Investments sold | | | 35,628,216 | |

| | Dividends | | | 2,336,139 | |

| | Collateral for credit facility | | | 1,938,267 | |

| | Fund shares sold | | | 958,536 | |

| | Other assets | | | 1,610 | |

| | Total assets | | | 602,097,363 | |

| | | | | | |

| | Liabilities: | | | | |

| | Payables: | | | | |

| | Investments purchased | | | 21,466,882 | |

| | Management fees | | | 619,523 | |

| | Due to custodian-Overdraft | | | 434,660 | |

| | Distribution and Service fees and Transfer Agency fees | | | 222,268 | |

| | Accrued expenses | | | 324,819 | |

| | Total liabilities | | | 23,068,152 | |

| | | | | | |

| | Net Assets: | | | | |

| | Paid-in capital | | | 567,428,491 | |

| | Total distributable earnings | | | 11,600,720 | |

| | | NET ASSETS | | $ | 579,029,211 | |

| | | Net Assets: | | | | |

| | | Class A | | $ | 80,263,179 | |

| | | Class C | | | 54,093,908 | |

| | | Class I | | | 145,519,159 | |

| | | Class L | | | 5,322,982 | |

| | | Class W | | | 39,873,232 | |

| | | Class P | | | 253,956,751 | |

| | | Total Net Assets | | $ | 579,029,211 | |

| | | Shares outstanding $0.001 par value (unlimited number of shares authorized): | | | | |

| | | Class A | | | 8,098,691 | |

| | | Class C | | | 5,459,754 | |

| | | Class I | | | 13,990,847 | |

| | | Class L | | | 536,608 | |

| | | Class W | | | 3,954,433 | |

| | | Class P | | | 24,399,794 | |

| | | Net asset value and offering price per share:(b) | | | | |

| | | Class A | | | $9.91 | |

| | | Class C | | | 9.91 | |

| | | Class I | | | 10.40 | |

| | | Class L | | | 9.92 | |

| | | Class W | | | 10.08 | |

| | | Class P | | | 10.41 | |

| | (a) | | Statement of Assets and Liabilities for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| | (b) | | Maximum public offering price per share for Class A Shares is $10.51 and for Class L is $10.36. Upon repurchase, Class C Shares may be subject to a contingent deferred sales charge, assessed on the amount equal to the lesser of the current net asset value ("NAV") or the original purchase price of the shares. |

| | |

| 12 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Statement of Operations

For the Fiscal Year Ended September 30, 2022

| | | | | | |

| | | | | Real Estate

Diversified

Income Fund(a) | |

| | Investment income: | |

| | |

| | Dividends — unaffiliated issuers | | $ | 20,643,401 | |

| | |

| | Dividends — affiliated issuers | | | 181,172 | |

| | |

| | Total investment income | | | 20,824,573 | |

| | | | | | |

| | Expenses: | |

| | |

| | Management fees | | | 6,389,046 | |

| | |

| | Transfer Agency fees | | | 715,570 | |

| | |

| | Distribution and/or Service (12b-1) fees(b) | | | 652,634 | |

| | |

| | Professional fees | | | 643,601 | |

| | |

| | Interest on borrowing | | | 342,015 | |

| | |

| | Shareholder Services fees(b) | | | 329,542 | |

| | |

| | Printing and mailing costs | | | 325,779 | |

| | |

| | Custody, accounting and administrative services | | | 316,732 | |

| | |

| | Registration fees | | | 162,317 | |

| | |

| | Trustee fees | | | 22,552 | |

| | |

| | Other | | | 22,699 | |

| | |

| | Total expenses | | | 9,922,487 | |

| | |

| | Less — expense reductions | | | (54,510 | ) |

| | |

| | Net expenses | | | 9,867,977 | |

| | |

| | NET INVESTMENT INCOME | | | 10,956,596 | |

| | | | | | |

| | Realized and unrealized gain (loss): | |

| | |

| | Net realized gain (loss) from: | | | | |

| | |

| | Investments — unaffiliated issuers | | | 14,287,291 | |

| | |

| | Purchased options | | | (605,863 | ) |

| | |

| | Net change in unrealized gain (loss) on: | | | | |

| | |

| | Investments — unaffiliated issuers | | | (23,732,164 | ) |

| | |

| | Net realized and unrealized loss | | | (10,050,736 | ) |

| | |

| | NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 905,860 | |

| | (a) | | Statement of Operations for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| | (b) | | Class specific Distribution Service and Shareholder Services fees were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distribution Service Fees | | | Shareholder Services Fees | |

Class A | | | Class C | | | Class W | | | Class L | | | Class A | | | Class C | | | Class W | | | Class L | |

| $ | 101,327 | | | $ | 484,638 | | | $ | 52,132 | | | $ | 14,537 | | | $ | 101,327 | | | $ | 161,546 | | | $ | 52,132 | | | $ | 14,537 | |

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 13 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Statements of Changes in Net Assets

| | | | | | | | | | |

| | | | | Real Estate Diversified Income Fund(a) | |

| | | | | For the Fiscal

Year Ended

September 30, 2022 | | | For the Fiscal

Year Ended

September 30, 2021 | |

| | From operations: | |

| | | |

| | Net investment income | | $ | 10,956,596 | | | $ | 5,396,385 | |

| | | |

| | Net realized gain | | | 13,681,428 | | | | 23,895,785 | |

| | | |

| | Net change in unrealized gain (loss) | | | (23,732,164 | ) | | | 17,329,194 | |

| | Net increase in net assets resulting from operations | | | 905,860 | | | | 46,621,364 | |

| | | | | | | | | | |

| | Distributions to shareholders: | |

| | | |

| | From distributable earnings: | | | | | | | | |

| | | |

| | Class A Shares | | | (2,313,451 | ) | | | (5,083,770 | ) |

| | | |

| | Class C Shares | | | (1,610,006 | ) | | | (3,687,066 | ) |

| | | |

| | Class I Shares | | | (3,850,656 | ) | | | (4,677,645 | ) |

| | | |

| | Class L Shares | | | (157,568 | ) | | | (328,823 | ) |

| | | |

| | Class W Shares | | | (1,179,564 | ) | | | (2,502,130 | ) |

| | | |

| | Class P Shares | | | (5,454,080 | ) | | | (758,935 | ) |

| | | |

| | From return of capital: | | | | | | | | |

| | | |

| | Class A Shares | | | (3,165,131 | ) | | | — | |

| | | |

| | Class C Shares | | | (2,202,718 | ) | | | — | |

| | | |

| | Class I Shares | | | (5,268,243 | ) | | | — | |

| | | |

| | Class L Shares | | | (215,575 | ) | | | — | |

| | | |

| | Class W Shares | | | (1,613,812 | ) | | | — | |

| | | |

| | Class P Shares | | | (7,461,959 | ) | | | — | |

| | Total distributions to shareholders | | | (34,492,763 | ) | | | (17,038,369 | ) |

| | | | | | | | | | |

| | From share transactions: | |

| | | |

| | Proceeds from sales of shares | | | 301,496,257 | | | | 95,004,152 | |

| | | |

| | Reinvestment of distributions | | | 19,154,584 | | | | 7,645,452 | |

| | | |

| | Cost of shares repurchased | | | (59,214,251 | ) | | | (68,865,886 | ) |

| | | |

| | Net increase in net assets resulting from share transactions | | | 261,436,590 | | | | 33,783,718 | |

| | | |

| | TOTAL INCREASE | | | 227,849,687 | | | | 63,366,713 | |

| | | | | | | | | | |

| | Net Assets: | | | | | | | | |

| | | |

| | Beginning of year | | $ | 351,179,524 | | | $ | 287,812,811 | |

| | | |

| | End of year | | $ | 579,029,211 | | | $ | 351,179,524 | |

| | (a) | | The Statements of Changes in Net Assets for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| | |

| 14 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Statement of Cash Flows(a)

For the Fiscal Year Ended September 30, 2022

| | | | | | |

| | | | | | |

| | Increase/(Decrease) in cash – Cash flows used in operating activities: | | | | |

| | |

| | Net increase in net assets resulting from operations | | $ | 905,860 | |

| | |

| | Adjustments to reconcile net increase in net assets from operations to net cash provided by/(used in) operating activities: | | | | |

| | |

| | Payments for purchases of investments | | | (544,308,032 | ) |

| | |

| | Proceeds from sales of investments | | | 271,123,733 | |

| | |

| | Payment for purchases of option contracts | | | (2,839,397 | ) |

| | |

| | Proceeds from sale of option contracts | | | 2,233,534 | |

| | Net (purchase) proceeds from sales of short-term investment securities | | | 33,941,657 | |

| | |

| | (Increase) Decrease in Assets: | | | | |

| | |

| | Receivable for dividends | | | (440,297 | ) |

| | |

| | Collateral for credit facility | | | (1,938,267 | ) |

| | Reimbursement from investment adviser | | | 267,005 | |

| | Other assets | | | (8 | ) |

| | |

| | Increase (Decrease) in Liabilities: | | | | |

| | |

| | Management fees | | | 249,998 | |

| | |

| | Distribution, Service and Transfer Agency fees | | | 37,160 | |

| | Accrued expenses | | | 225,202 | |

| | |

| | Net realized (gain) loss on: | | | | |

| | |

| | Investments | | | (14,287,291 | ) |

| | |

| | Purchased options | | | 605,863 | |

| | |

| | Net change in unrealized (gain) loss on: | | | | |

| | |

| | Investments | | | 23,732,164 | |

| | |

| | Net cash used in operating activities | | | (230,491,116 | ) |

| | | | | | |

| | Cash flows provided by financing activities: | | | | |

| | |

| | Proceeds from sale of shares | | | 300,958,045 | |

| | |

| | Cost of shares repurchased | | | (59,214,251 | ) |

| | |

| | Overdraft payable to custodian | | | 434,660 | |

| | |

| | Distributions paid | | | (15,338,179 | ) |

| | |

| | Drawdowns from line of credit | | | 25,000,000 | |

| | |

| | Repayment of line of credit | | | (25,000,000 | ) |

| | |

| | Net cash provided by financing activities | | | 226,840,275 | |

| | |

| | NET DECREASE IN CASH | | $ | (3,650,841 | ) |

| | | | | | |

| | Cash (restricted and unrestricted): | | | | |

| | |

| | Beginning of year | | $ | 3,650,841 | |

| | |

| | End of year | | $ | — | |

| | |

| | Supplemental disclosure: | | | | |

| | |

| | Cash paid for interest and related fees | | | 342,015 | |

| | |

| | Reinvestment of distributions | | | 19,154,584 | |

| | (a) | | Statement of Cash Flows for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 15 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Financial Highlights

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Goldman Sachs Real Estate Diversified Income Fund | |

| | | | | Class A Shares | |

| | | | | Year Ended September 30, | |

| | | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | Per Share Data | |

| | | | | | |

| | Net asset value, beginning of year | | $ | 10.45 | | | $ | 9.38 | | | $ | 10.69 | | | $ | 10.47 | | | $ | 10.19 | |

| | | | | | |

| | Net investment income(a) | | | 0.21 | | | | 0.20 | | | | 0.29 | | | | 0.40 | | | | 0.30 | |

| | | | | | |

| | Net realized and unrealized gain (loss) | | | (0.04 | ) | | | 1.47 | | | | (0.89 | ) | | | 0.42 | | | | 0.58 | |

| | | | | | |

| | Total from investment operations | | | 0.17 | | | | 1.67 | | | | (0.60 | ) | | | 0.82 | | | | 0.88 | |

| | | | | | |

| | Distributions to shareholders from net investment income | | | (0.19 | ) | | | (0.34 | ) | | | (0.23 | ) | | | (0.26 | ) | | | (0.24 | ) |

| | | | | | |

| | Distributions to shareholders from net realized gains | | | (0.11 | ) | | | (0.26 | ) | | | (0.30 | ) | | | (0.21 | ) | | | (0.15 | ) |

| | | | | | |

| | Distributions to shareholders from return of capital | | | (0.41 | ) | | | — | | | | (0.18 | ) | | | (0.13 | ) | | | (0.21 | ) |

| | | | | | |

| | Total distributions | | | (0.71 | ) | | | (0.60 | ) | | | (0.71 | ) | | | (0.60 | ) | | | (0.60 | ) |

| | | | | | |

| | Net asset value, end of year | | $ | 9.91 | | | $ | 10.45 | | | $ | 9.38 | | | $ | 10.69 | | | $ | 10.47 | |

| | | | | | |

| | Total Return(b) | | | 1.43 | % | | | 18.24 | % | | | (5.20 | )% | | | 8.17 | % | | | 9.00 | % |

| | | | | | |

| | Net assets, end of year (in 000’s) | | $ | 80,263 | | | $ | 83,054 | | | $ | 87,520 | | | $ | 96,114 | | | $ | 86,965 | |

| | | | | | |

| | Ratio of net expenses to average net assets before interest expense | | | 1.98 | % | | | 1.99 | % | | | 1.99 | % | | | 1.99 | % | | | 1.99 | % |

| | | | | | |

| | Ratio of net expenses to average net assets after interest expense | | | 2.05 | % | | | 2.10 | % | | | 2.19 | % | | | 2.83 | % | | | 2.76 | % |

| | | | | | |

| | Ratio of total expenses to average net assets after interest expense | | | 2.06 | % | | | 2.34 | % | | | 2.28 | % | | | 2.90 | % | | | 2.97 | % |

| | | | | | |

| | Ratio of net investment income to average net assets | | | 1.97 | % | | | 2.02 | % | | | 2.88 | % | | | 3.83 | % | | | 2.97 | % |

| | | | | | |

| | Portfolio turnover rate(c) | | | 56 | % | | | 73 | % | | | 53 | % | | | 65 | % | | | 78 | % |

| | (a) | | Calculated based on the average shares outstanding methodology. |

| | (b) | | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| | (c) | | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| 16 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Goldman Sachs Real Estate Diversified Income Fund | |

| | | | | Class C Shares | |

| | | | | Year Ended September 30, | |

| | | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | Per Share Data | |

| | | | | | |

| | Net asset value, beginning of year | | $ | 10.45 | | | $ | 9.38 | | | $ | 10.68 | | | $ | 10.47 | | | $ | 10.19 | |

| | | | | | |

| | Net investment income(a) | | | 0.12 | | | | 0.13 | | | | 0.20 | | | | 0.32 | | | | 0.23 | |

| | | | | | |

| | Net realized and unrealized gain (loss) | | | (0.03 | ) | | | 1.46 | | | | (0.87 | ) | | | 0.41 | | | | 0.57 | |

| | | | | | |

| | Total from investment operations | | | 0.09 | | | | 1.59 | | | | (0.67 | ) | | | 0.73 | | | | 0.80 | |

| | | | | | |

| | Distributions to shareholders from net investment income | | | (0.16 | ) | | | (0.26 | ) | | | (0.16 | ) | | | (0.22 | ) | | | (0.20 | ) |

| | | | | | |

| | Distributions to shareholders from net realized gains | | | (0.11 | ) | | | (0.26 | ) | | | (0.29 | ) | | | (0.18 | ) | | | (0.14 | ) |

| | | | | | |

| | Distributions to shareholders from return of capital | | | (0.36 | ) | | | — | | | | (0.18 | ) | | | (0.12 | ) | | | (0.18 | ) |

| | | | | | |

| | Total distributions | | | (0.63 | ) | | | (0.52 | ) | | | (0.63 | ) | | | (0.52 | ) | | | (0.52 | ) |

| | | | | | |

| | Net asset value, end of year | | $ | 9.91 | | | $ | 10.45 | | | $ | 9.38 | | | $ | 10.68 | | | $ | 10.47 | |

| | | | | | |

| | Total Return(b) | | | 0.67 | % | | | 17.37 | % | | | (5.94 | )% | | | 7.24 | % | | | 8.17 | % |

| | | | | | |

| | Net assets, end of year (in 000’s) | | $ | 54,094 | | | $ | 69,360 | | | $ | 72,826 | | | $ | 74,609 | | | $ | 62,367 | |

| | | | | | |

| | Ratio of net expenses to average net assets before interest expense | | | 2.74 | % | | | 2.74 | % | | | 2.74 | % | | | 2.74 | % | | | 2.74 | % |

| | | | | | |

| | Ratio of net expenses to average net assets after interest expense | | | 2.81 | % | | | 2.84 | % | | | 2.94 | % | | | 3.58 | % | | | 3.51 | % |

| | | | | | |

| | Ratio of total expenses to average net assets after interest expense | | | 2.82 | % | | | 3.09 | % | | | 3.04 | % | | | 3.64 | % | | | 3.73 | % |

| | | | | | |

| | Ratio of net investment income to average net assets | | | 1.18 | % | | | 1.27 | % | | | 2.04 | % | | | 3.08 | % | | | 2.24 | % |

| | | | | | |

| | Portfolio turnover rate(c) | | | 56 | % | | | 73 | % | | | 53 | % | | | 65 | % | | | 78 | % |

| | (a) | | Calculated based on the average shares outstanding methodology. |

| | (b) | | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| | (c) | | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 17 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Goldman Sachs Real Estate Diversified Income Fund | |

| | | | | Class I Shares | |

| | | | | Year Ended September 30, | |

| | | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | Per Share Data | |

| | | | | | |

| | Net asset value, beginning of year | | $ | 10.93 | | | $ | 9.78 | | | $ | 11.13 | | | $ | 10.91 | | | $ | 10.62 | |

| | | | | | |

| | Net investment income(a) | | | 0.26 | | | | 0.24 | | | | 0.33 | | | | 0.45 | | | | 0.36 | |

| | | | | | |

| | Net realized and unrealized gain (loss) | | | (0.05 | ) | | | 1.54 | | | | (0.93 | ) | | | 0.42 | | | | 0.59 | |

| | | | | | |

| | Total from investment operations | | | 0.21 | | | | 1.78 | | | | (0.60 | ) | | | 0.87 | | | | 0.95 | |

| | | | | | |

| | Distributions to shareholders from net investment income | | | (0.19 | ) | | | (0.37 | ) | | | (0.26 | ) | | | (0.27 | ) | | | (0.26 | ) |

| | | | | | |

| | Distributions to shareholders from net realized gains | | | (0.11 | ) | | | (0.26 | ) | | | (0.31 | ) | | | (0.23 | ) | | | (0.16 | ) |

| | | | | | |

| | Distributions to shareholders from return of capital | | | (0.44 | ) | | | — | | | | (0.18 | ) | | | (0.15 | ) | | | (0.24 | ) |

| | | | | | |

| | Total distributions | | | (0.74 | ) | | | (0.63 | ) | | | (0.75 | ) | | | (0.65 | ) | | | (0.66 | ) |

| | | | | | |

| | Net asset value, end of year | | $ | 10.40 | | | $ | 10.93 | | | $ | 9.78 | | | $ | 11.13 | | | $ | 10.91 | |

| | | | | | |

| | Total Return(b) | | | 1.70 | % | | | 18.59 | % | | | (5.05 | )% | | | 8.35 | % | | | 9.25 | % |

| | | | | | |

| | Net assets, end of year (in 000’s) | | $ | 145,519 | | | $ | 98,018 | | | $ | 74,220 | | | $ | 55,138 | | | $ | 22,273 | |

| | | | | | |

| | Ratio of net expenses to average net assets before interest expense | | | 1.70 | % | | | 1.74 | % | | | 1.74 | % | | | 1.74 | % | | | 1.74 | % |

| | | | | | |

| | Ratio of net expenses to average net assets after interest expense | | | 1.76 | % | | | 1.84 | % | | | 1.94 | % | | | 2.63 | % | | | 2.49 | % |

| | | | | | |

| | Ratio of total expenses to average net assets after interest expense | | | 1.77 | % | | | 2.12 | % | | | 2.03 | % | | | 2.68 | % | | | 2.75 | % |

| | | | | | |

| | Ratio of net investment income to average net assets | | | 2.31 | % | | | 2.33 | % | | | 3.16 | % | | | 4.10 | % | | | 3.35 | % |

| | | | | | |

| | Portfolio turnover rate(c) | | | 56 | % | | | 73 | % | | | 53 | % | | | 65 | % | | | 78 | % |

| | (a) | | Calculated based on the average shares outstanding methodology. |

| | (b) | | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| | (c) | | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| 18 | | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Goldman Sachs Real Estate Diversified Income Fund | |

| | | | | Class L Shares | |

| | | | | Year Ended September 30, | |

| | | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | Per Share Data | |

| | | | | | |

| | Net asset value, beginning of year | | $ | 10.46 | | | $ | 9.39 | | | $ | 10.69 | | | $ | 10.48 | | | $ | 10.20 | |

| | | | | | |

| | Net investment income(a) | | | 0.18 | | | | 0.18 | | | | 0.27 | | | | 0.38 | | | | 0.30 | |

| | | | | | |

| | Net realized and unrealized gain (loss) | | | (0.04 | ) | | | 1.46 | | | | (0.89 | ) | | | 0.40 | | | | 0.55 | |

| | | | | | |

| | Total from investment operations | | | 0.14 | | | | 1.64 | | | | (0.62 | ) | | | 0.78 | | | | 0.85 | |

| | | | | | |

| | Distributions to shareholders from net investment income | | | (0.18 | ) | | | (0.31 | ) | | | (0.20 | ) | | | (0.24 | ) | | | (0.22 | ) |

| | | | | | |

| | Distributions to shareholders from net realized gains | | | (0.11 | ) | | | (0.26 | ) | | | (0.30 | ) | | | (0.20 | ) | | | (0.15 | ) |

| | | | | | |

| | Distributions to shareholders from return of capital | | | (0.39 | ) | | | — | | | | (0.18 | ) | | | (0.13 | ) | | | (0.20 | ) |

| | | | | | |

| | Total distributions | | | (0.68 | ) | | | (0.57 | ) | | | (0.68 | ) | | | (0.57 | ) | | | (0.57 | ) |

| | | | | | |

| | Net asset value, end of year | | $ | 9.92 | | | $ | 10.46 | | | $ | 9.39 | | | $ | 10.69 | | | $ | 10.48 | |

| | | | | | |

| | Total Return(b) | | | 1.17 | % | | | 17.93 | % | | | (5.46 | )% | | | 7.79 | % | | | 8.72 | % |

| | | | | | |

| | Net assets, end of year (in 000’s) | | $ | 5,323 | | | $ | 5,919 | | | $ | 5,538 | | | $ | 10,402 | | | $ | 4,613 | |

| | | | | | |

| | Ratio of net expenses to average net assets before interest expense | | | 2.23 | % | | | 2.24 | % | | | 2.24 | % | | | 2.24 | % | | | 2.24 | % |

| | | | | | |

| | Ratio of net expenses to average net assets after interest expense | | | 2.30 | % | | | 2.34 | % | | | 2.44 | % | | | 3.13 | % | | | 2.99 | % |

| | | | | | |

| | Ratio of total expenses to average net assets after interest expense | | | 2.31 | % | | | 2.59 | % | | | 2.54 | % | | | 3.17 | % | | | 3.22 | % |

| | | | | | |

| | Ratio of net investment income to average net assets | | | 1.70 | % | | | 1.76 | % | | | 2.71 | % | | | 3.60 | % | | | 2.91 | % |

| | | | | | |

| | Portfolio turnover rate(c) | | | 56 | % | | | 73 | % | | | 53 | % | | | 65 | % | | | 78 | % |

| | (a) | | Calculated based on the average shares outstanding methodology. |

| | (b) | | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| | (c) | | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| The accompanying notes are an integral part of these consolidated financial statements. | | 19 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Goldman Sachs Real Estate Diversified Income Fund | |

| | | | | Class W Shares | |

| | | | | Year Ended September 30, | |

| | | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | Per Share Data | |

| | | | | | |

| | Net asset value, beginning of year | | $ | 10.62 | | | $ | 9.52 | | | $ | 10.85 | | | $ | 10.63 | | | $ | 10.35 | |

| | | | | | |

| | Net investment income(a) | | | 0.21 | | | | 0.21 | | | | 0.31 | | | | 0.41 | | | | 0.31 | |

| | | | | | |

| | Net realized and unrealized gain (loss) | | | (0.04 | ) | | | 1.49 | | | | (0.92 | ) | | | 0.42 | | | | 0.58 | |

| | | | | | |

| | Total from investment operations | | | 0.17 | | | | 1.70 | | | | (0.61 | ) | | | 0.83 | | | | 0.89 | |

| | | | | | |

| | Distributions to shareholders from net investment income | | | (0.18 | ) | | | (0.34 | ) | | | (0.24 | ) | | | (0.26 | ) | | | (0.23 | ) |

| | | | | | |

| | Distributions to shareholders from net realized gains | | | (0.11 | ) | | | (0.26 | ) | | | (0.30 | ) | | | (0.21 | ) | | | (0.16 | ) |

| | | | | | |

| | Distributions to shareholders from return of capital | | | (0.42 | ) | | | — | | | | (0.18 | ) | | | (0.14 | ) | | | (0.22 | ) |

| | | | | | |

| | Total distributions | | | (0.71 | ) | | | (0.60 | ) | | | (0.72 | ) | | | (0.61 | ) | | | (0.61 | ) |

| | | | | | |

| | Net asset value, end of year | | $ | 10.08 | | | $ | 10.62 | | | $ | 9.52 | | | $ | 10.85 | | | $ | 10.63 | |

| | | | | | |

| | Total Return(b) | | | 1.40 | % | | | 18.28 | % | | | (5.31 | )% | | | 8.13 | % | | | 8.95 | % |

| | | | | | |

| | Net assets, end of year (in 000’s) | | $ | 39,873 | | | $ | 40,617 | | | $ | 47,709 | | | $ | 92,006 | | | $ | 69,400 | |

| | | | | | |